#Tally course in kolkata

Explore tagged Tumblr posts

Text

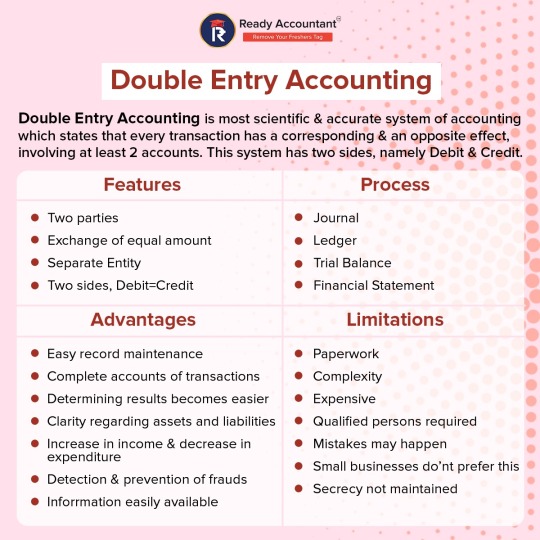

Mastering double-entry accounting is essential to optimum financial management and record-keeping. Check out these tips to help you master and excel in double-entry accounting. Ready Accountant Your one-stop shop for on-the-job experience in Live Projects related to Accounting, GST, Taxation and ROC.

For more details visit: https://readyaccountant.com/

#accounting course#taxation course#gst course#tally course in kolkata#tally course#gst course in kolkata

0 notes

Text

A Step-by-Step Guide to Become a Tax Accountant in India

Understand What a Tax Accountant Does:

A tax accountant will take charge of the taxation load for both private and government institutions. What differentiates a tax accountant from an accountant is the scope, for the general accountant is expected to account for several activities while dealing with finance; he or she handles issues on savings and income in relation to both parties- government and people- at various levels, though at one level at time. Besides the two above points, the accountant is required to comply with all the tax requirements from federal down to state level.

Some of the major differences between tax preparers and tax accountants include preparation of tax returns, planning, and consulting. Basically, a tax accountant acts as a consultant to collaborate with clients in their current tax liabilities and assist in designing long-term financial goals through continuous tax planning. This article explains the process of becoming a tax accountant in India, including qualifications, skills, and available training options, such as Tally, accounting, and Taxation courses in Kolkata.

The Most Vital Functions of a Tax Accountant are:

Effective planning for clients

Preparation of State and Federal Tax Returns.

The client consultancy about his demand to decrease the tax liabilities.

Deadline adherence while maintaining the tax compliance of laws.

Annual plan of Integrated Tax benefits

Effect on taxation through law

How to Become a Tax Accounting Professional in India?

Become a Tax Accounting Professional by a blend of study, experience, and acquiring new skills. Here's your step-by-step career way:

Step 1: Building a Sound Academic Foundation

Undergraduate degree: Bachelor's in Commerce (B.Com), or equivalent: This will ensure some conceptual knowledge in elements of accounting, finance, and taxation.

Professional Certification: Get your professional certification after acquiring your undergraduate degree. Useful ones are as follows:

⦁ CHARACTERED ACCOUNTANT (CA) : Will give a strong holistic view in taxation, auditing, and Financial Accounting. ⦁ Cost and Management Accountant (CMA): Its focus lies on management accounting, cost analysis, and tax planning. ⦁ Certified Public Accountant (CPA): This certification is helpful especially in jobs with an international firm or a niche industry finance sector.

Step 2: Practical Experience

Aside from formal education, hands-on experience is a must. Here's how one goes about it:

Internships: This includes taking up intern positions within accounting firms or companies that have financial departments where tasks of taxation are undertaken or implemented in real life situations.

Entry-Level Jobs: Tax assistant or junior accountant role that will practically allow one to apply the knowledge learned as well as gather the skills necessary.

Networking: Several professional societies that one can join to create a network of contacts, seek mentors, and also seek employment opportunities .

Phase 3: Key Skills

One needs to acquire these core skills to become a successful tax accountant: ⦁ Analytical Skills: The ability to interpret financial data and tax codes to ensure sound financial planning. ⦁ Communication: Simplify complicated tax laws to your clients. ⦁ Attention to detail: One should ensure that accuracy is an important aspect so that tax return preparation will not turn out wrong. ⦁ Ethics and integrity: The call for high ethics for all forms of financial reports and tax practices.

Step 4: Become a Continuing Student

Tax laws change every year. How to be up to date?

⦁ Advanced certifications: Enroll in a certification course on tax specialisation, which may add depth to your work as a professional and eventually open better avenue for advancement also. Accounting Course in kolkata is a Great choice to gain some knowledge on this field. ⦁ Conferences and Seminars: Discuss topics dealing with the tax laws of the day and accounting trends

Step 5: Know Your Accounting Software

Getting better at accounting software can become progressively important. Consider programs like a Tally course in Kolkata, and find digital accounting training helpful. This can assist in ensuring accuracy and productivity for your accounting and taxation-related tasks. Tally is an application used mostly by people in India. It has become an application that cannot be avoided in dealing with accounting or in the preparation of tax returns, thus making it a necessary component in a tax professional's career.

Step 6: Deep Insight into Tax Laws and Compliances

Basic of tax accounting are about the understanding of the tax laws of India. Key areas to be discussed below:

⦁ Income Tax Act: In terms of personal as well as corporate tax compliances. ⦁ Goods and Services Tax (GST): GST compliances, very critical. And that's particularly for individuals if they have undertaken a GST Course in Kolkata niche area. ⦁ Tax Planning Strategies: For what strategy will the consultant is using with a client, in order to minimize or reduce the payment towards tax to a greatest possible degree.

Step 7: Specialized Certification and Specialization]

A bit of experience under one's belt and it would not be a bad idea to get some specialized certifications that impart some extra skills in such areas as the following:

⦁ Tax Planning and Management There are lots of institutes offering strategic tax planning programs. This should really extend your capabilities. ⦁ International Taxation Any one who has worked with clients engaging in cross-border transactions can vouch for me. Knowing international tax is very, very plus.

Step 8: Increase Your Client Base

Building a client base is crucial when you get more expertise. Here's how to grow your network:

Freelance services: You can offer help on tax accounting to small businesses and individuals as a freelancer.

Industry networking: You have to attend industry events and conferences, which will allow you to meet more potential clients and build the network.

Online presence: You can get a professional online profile, where you attract clients with a need for tax accounting.

Conclusion

A career in tax accounting in India calls for an excellent balance of education, practical experience, and keeping abreast of changes in the industry. These steps can serve you in setting up a fulfilling profession by guiding your clients through the maze of tax regulations.

#accounting course#gst course in kolkata#tally course#gst course#taxation course in kolkata#Taxation Course#Tally Course in Kolkata#Accounting Course in Kolkata

0 notes

Text

Best Tally Institute Near Me: How to find Top Tally Training in Kolkata

In a present business scenario, the accounting skills play a very important role. In this scenario, Tally is one of the most used packages for finance management. Sometimes career enhancement through best Tally institute near you is possible in accounting or finance. Even in the city like Kolkata, there are many reputed institutes giving excellent training in Tally. This post will guide you to pick the best Tally course in Kolkata and explain why learning Tally can be a smart move for your career growth.

Why should you Learn Tally?

Tally is one of the most demanded accounting software, taking care of the most frequently faced tasks like payroll, inventory management, invoicing, and financial transaction management. Not only this, but companies all across India require professionals who have skills in Tally, and if you are choosing the best Tally institute for your learning, you will get massive job opportunities.

Choosing the Right Tally Institute

While making the right choice of suitable Tally institute, remember the following points:

Accreditation and Certification: Choose the institute which is accredited by recognized bodies. A good certificate issued by a reputed training center will give an edge to individuals in the job market.

Qualified Trainer: Choose institutes that have qualified trainers with practical exposure towards Accounting course in kolkata, GST, and Tally.

Comprehensive Syllabus: A full-fledged Tally course must comprise both basic and advanced features, like GST, payroll, and inventory management.

Practical Training: The training needs to be practical. An institution that provides you with actual hands-on exercises and case studies will make sure you are job-ready after the course.

Job Placement Support: Quite a few institutes offer job placement support, which can ultimately result in your job right after the completion of the course.

Flexibility of Learning: Working professionals will be attracted to institutes that offer flexible classes like weekend or online classes.

Skills Acquired after Tally Course

After you complete a Tally course, you'll acquire numerous key skills that will be so essential for your financial and accounting career. Here are some of the significant skills you will gain:

Analytical Skills: You will be able to interpret and analyze financial data.

Learning adaptability: Quick ability to learn new financial concepts and changes in software.

Accounting knowledge: Thorough knowledge of accounting principles and practices.

Computer application knowledge: Ability to effectively use Tally software, and other computer tools and applications.

Numerical aptitude: Safe and accurate figures and financial transaction handling.

Effective communication: Ability to communicate financial information clearly and effectively.

How to choose the best Tally Institute

In a good Tally institute look for the following features:

Full Course Curriculum: It should cover all Tally modules, ranging from the basic to the advanced level, like GST and payroll.

GST and Taxation Training: Institutes with GST and taxation training are particularly beneficial. A Taxation Course in kolkata associated with Tally will build your profile.

Practical Assignments: Institutes that provide practical projects make you apply the things you learn, making you industry-ready.

Certifications and Exams: Institutes offering certifications in Tally and conducting mock exams increase your employability.

Career Scope after Tally Course Completion

You can look into opportunities for accounting and finance as follows once you complete the Tally course:

Accountant: Take care of bookkeeping accounts and your financial accounts

GST Consultant: With training both in Tally and GST course in kolkata, assist the companies to maintain tax compliance

Tax Analyst: Prepare for returns and maintain compliance over taxation

Payroll Manager: Maintain payroll by using Tally Payroll features.

Tally Trainer: If you are mastering Tally, train others.

Avg Salary after completion of Tally course :

Average salary a person can expect to gain after becoming a graduate in Tally ranges between INR 5 Lakhs to INR 10 Lakhs as an annual level. The salary varies based on the skills and knowledge acquired by the candidate. A good example would be that candidates who have Intermediate-level Tally certification may be paid within the range of INR 2,00,000 to 4,00,000 annually while anyone who completes the advanced certification in Tally is expected to get a yearly salary between INR 5,00,000 and 7,00,000.

Courses That Develop Your Accounting Skills

In case you want to learn more about accounting, you can take more of these courses.

Taxation Course: This course includes GST, income tax, and other tax laws. With Tally being integrated into it, it will keep you ready for tax compliance management.

Accounting Course: It teaches a good foundation in the management of finances, and the skills learned in Tally complement each other.

Conclusion

Find the Best Institute offering courses in Tally by searching for an institute that offers trainers with experience, full course, and hands-on training with guaranteed support in getting jobs. This will equip you with the ability to do almost every role in finances and unlock very exciting career opportunities in your future.

#accounting course#tally course#taxation course in kolkata#gst course#tally course in kolkata#accounting course in kolkata#gst course in kolkata

0 notes

Text

Ready Accountant offers a future-ready certified corporate accounting course, providing hands-on experience with practical live projects. The course covers essential topics like Accounting, Income Tax, GST, Tally Prime, ROC Compliance, and Advanced Excel, ensuring students are equipped with real-world skills. With branches in Kolkata, Howrah, and Bangalore, Ready Accountant is accessible to students across India. After completing the course, 100% placement assistance is provided, helping graduates secure their future in the corporate accounting world. Join Ready Accountant today and take the first step toward a successful career.

0 notes

Text

Top Online Tally Course with Certificate | Leading Tally Training Institute

Explore the top online Tally course with a certificate from a leading Tally training institute. Learn Tally, Tally GST, and Tally Prime. Check Tally Prime course fees today!

#tally course#tally course fees#tally course near me#tally training#tally gst course#tally course kolkata#learn tally online#tally course in kolkata#tally prime course#tally prime course near me#online tally course#tally centre near me#tally training institute#tally course duration#tally gst course near me#best tally institute in kolkata#tally course online with certificate#tally accounting course#tally prime course fees#tally training online

0 notes

Text

Best Tally Training Institute in Kolkata

Kolkata's Top Tally course online in Kolkata - Students learn precisely how to manage and maintain accounts, inventory, and payroll at Tally in our TallyPrime Certificate Course with gst.

#certificate course in tally 9 erp#tally erp 9 certificate course#tally course near me#tally erp course near me#tally course#tally certificate course#tally with gst course in kolkata#tally gst course fees in kolkata#tally course online#learn tally online#online tally course with gst with certificate#online tally course with gst#tally course in kolkata#online tally course#tally prime course

0 notes

Text

Push Yourself to Success!

Your journey to greatness begins with a single step of determination, and nobody else will do it for you; take charge of your dreams and make them reality.

For more details visit: Ready Accountant

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course#success

0 notes

Text

Master the concepts of Double Entry Accounting: Learn its features, processes, advantages, and limitations to enhance your financial expertise and keep track of all the transactions accurately. Excellent for aspiring accountants and finance professionals! For more details visit: Ready Accountant

1 note

·

View note

Text

Understand the simple rules of Debit and Credit:

Understand easily the Simple Rules of Debit and Credit to go about managing Assets, Expenses, Liabilities, and Capital efficiently. Improve your accounting skills now!

For more details visit: https://readyaccountant.com/

#accounting course#accounting course in kolkata#taxation course#taxation course in kolkata#gst course#tally course

0 notes

Text

Mastering Accounting and Bookkeeping in 2024:

Accounting and bookkeeping are must-haves for organizations in this very volatile financial environment. The year 2024 provides a bundle of technological advantages and regulatory changes. In this context, businesses and professionals must update with modern Accounting and Bookkeeping Rules. This book covers new trends and emphasizes the need for professional training under courses such as Tally Course, Taxation Course, Accounting Course in Kolkata, and GST Course in order to outshine them.

Accounting and Bookkeeping :

The Bedrock of Financial Management Accounting and bookkeeping constitute the bedrock of accounting for recording and interpreting financial performance. While bookkeeping deals with the precise calculation of transactions through a daily ledger, accounting further translates data into action.

Important factors to watch out for in 2024 are:

Automation: Software like Tally Prime streamlines processes and cuts down on errors. Regulatory Changes: Relating to GST, income tax, and international standards requires vigilance. Globalization: Companies having an international vision must implement IFRS for themselves.

To face such problems, professionals can take up specific courses like accounting courses or Tally course to build hands-on experience.

TOOLS TO BE EMPLOYED

Basic Accounting and Bookkeeping Practices in 2024

A. Accuracy True records are the root of proper book keeping. Training platforms like Tally Prime under a Tally Course in Kolkata assist one in developing a method of minimal error handling and maximizes efficiency for one .

B. Tax Compliance Knowing and keeping up to date with the changes in tax laws, such as GST, is crucial. Training through a GST Course or Taxation Course makes it abreast of knowledge and ensures continued compliance on an err-free basis.

C. Entity Separation Separation of personal and business finances is one characteristic that makes all transactions transparent and legally clear. It is one of the most basic accounting rules that a business should follow.

D. Comply with International Standards If your business is international, then compliance with IFRS will increase credibility and attract easy entry into global markets. Specialized accounting courses offer extensive knowledge of these worldwide standards.

E. Reconcile Periodically Audits and reconciliations are done frequently, which prove useful for them to detect discrepancies in time and prevent fraud. Training on tools like Tally Prime allows one to work proficiently in conducting such tasks.

3. Technological Innovation that Transforms Accounting

A. Automation and AI AI-driven tools change the face of predictive analytics and the detection of fraud. Courses like this Tally Course introduce trainees to integrating AI in accounting workflow.

B. Cloud-Based Solutions Cloud accounting provides access to financial information from anywhere while being secure. Most modern accountants have to learn how to use these tools.

C. Blockchain Blockchain technology enables tamper-proof records, which increases the level of transparency and trust in financial reporting.

D. Digital Tax Filing Digitized tax-filing platforms for taxes assist in making compliance easy. A GST Course equips one with hands-on experience on how to prepare GST returns effectively.

Overcoming Compliance Issues A. Coping with Change

Tax laws are changing all the time, and the process may sometimes be overwhelming. Courses, such as the Taxation Course in Kolkata or GST Course, help one keep in the times.

B. Securing Digital Accounting

Digital accounting requires strong cybersecurity. Secure practices training is needed in order to secure sensitive data.

C. Skills Gap Modern skills require modern techniques. The Tally Course or Accounting Course equips one to fulfill the industrial needs.

Benefits of Updated Rules

Proper Planning: The correct set of data helps in appropriate budgeting and forecasting. Strict Control: Laws should be followed without punitive measures and to gain authenticity Professional Training: Professional training leads towards high-value career prospects. Improved Transparency: Transparent financials are a source of stakeholder confidence. This is all about the steps to implement modern accounting rules.

6. Steps to Implement Modern Accounting Rules

Adoption of Advanced Tools The adoption of Tally Prime helps the firm operate efficiently and become more accountable.

Upskilling Teams Instruct the employees to take courses related to Tally Course and GST Course.

Periodical Audits It is essential to check for compliance and at the same time pick any kind of anomaly through regular review.

Be Updated: You have to sign up for an Accounting Course such that you are updated with the new and recent trends.

Use Expert Support: You can seek support from those experts who are professionalized in this domain or undergo advanced training courses for guarantee. Different Methods by which You will Follow the New Accounting and Bookkeeping Standard for 2024

How to be in Compliance With New Accounting and Bookkeeping Regulations of 2024

The new accounting and bookkeeping rules of 2024 overwhelm businesses, but there is a proper way to ensure that compliance with them becomes seamless. Here's how you can adapt to changes well:

Track the Regulatory Changes Stay updated on the latest changes in rules for accounting and book-keeping. You could read credible newsletters, participate in webinars, and follow some reliable financial blogs for this purpose. Education means that you will be equipped with the latest requirements on compliance at all times. End

Use Accounting Software Modern accounting software makes the difference. Automation helps save time and reduces human error. Update frequency should be a choice-criterion of the software as it shall help follow the changes made in regulations. Accuracy would also be enhanced through automation, and so will be the possibility of compliance.

Consultant Expertise While managing compliance proves relatively challenging in the absence of particularized skills, the employment of a professional accountant ensures that books are quite accurate and up to date. An experienced accountant can provide insights into the financial health of a business while ensuring one is in compliance with the latest rules.

Regular audit of financial records Provide frequent checks of your financial statements so you can detect any errors or mismatches before such inconsistencies become serious issues. Regular audits also ensure that your operations are within the new regulatory regime, thus not facing penalized consequences for non-compliance.

Capitalize on Improved Information and Communication Technology Facilities Cloud application and document management technologies make it more efficient to store and retrieve your records. These systems ensure secure storage and recording, efficient tracking, and fulfillment of newly promulgated regulations on data management.

Steps can thus be taken by the various businesses to not only keep up with new rules but also make accounting stream line and easier for better financial management 2024.

Conclusion

Accuracy, adherence, and utilization of technology in playing accounting and bookkeeping games will be at the center of learning in 2024. Any business or professional who specializes in these most important disciplines can thrive in competitive markets. Expanding knowledge by taking a Tally Course, Accounting Course, and GST Course in kolkata can help one keep better abreast of industry requirements and guaranteed financial success. Follow these strategies confidently as you negotiate this rapidly changing world of accounting.

0 notes

Text

Which Certificate Course Is Best For Accounting And Finance?

In today's competitive job market, having specialized skills and qualifications is essential for career advancement, particularly in fields like accounting and finance.

#tally prime advanced course#certificate courses in accounting and finance#accounts and taxation courses in kolkata#top financial accounting training college in kolkata#diploma course in financial accounting#certificate course in tally prime with gst

0 notes

Text

Golden Rules of Debit and Credit Accounting:

Accounting forms the back-bone of the financial management of an organization; it accounts for and records correctly all business transactions. It is also the debit-credit concept that forms the foundation of the double entry bookkeeping system. These concepts have to be understood properly since they are vital in ascertaining correct financial records are kept; and this career can be pursued once a candidate enrolls for an Accounting Course in Kolkata.

In this discussion, we shall explore what are called the Golden Rules of Debit and Credit Accounting, the types of accounts involved, and just how these rules maintain financial recording integrity.

Basics of Debit and Credit

Every transaction in accounting affects at least two accounts, of course. One is increased with a debit; another is increased with a credit, though increases and decreases are not involved, but rather it is on the effect on the type of account involved.

Debit Entries That increase assets and expense accounts and decrease liability, equity, or income.

Credit Entries These are entries which raise liabilities, equity or revenue and decrease assets or expense.

For instance: Suppose a company buys stock in cash. In the account, it will credit the Inventory account (assets) and debit the Cash account (another asset). These are both weapons in the arsenal of an accountant trying to balance financial statements and both are used in that purpose.

Golden Rules for Debit and Credit Accounting

These Golden Rules of Debit and Credit Accounting can actually be divided into three key categories each of which can apply to specific types of accounts. Let's break them down:

Personal Accounts

Personal accounts are those involving individuals, companies, or organizations with whom the business has financial transactions such as with creditors and debtors.

Debit the Receiver: That is to say, when a person or entity receives something cash, goods, etc, that individual or entity's account is debited.

Credit the Giver: On the other hand, when something is given the account of the giver is credited.

For example: A business buys goods on credit from a supplier. Then, the supplier's account is credited and the purchase account is debited

Real Accounts Real accounts refer to physical assets. They include money, land, buildings, and machinery and other tangible property.

Debit What Comes In: If an asset comes to the business then it goes to the debit side of the account

Credit What Goes Out: And if it goes out then it will go to the credit side of the account

Example: This is in relation to when an entity buys machinery. In a bank sale or cash sale, this will credit the Cash or Bank real account and debit the Machinery real account.

Nominal Accounts

The nominal accounts are expenses and losses, incomes, and gains. Examples are: rent, salaries, income from sales, and interest received. All expenses and losses are debited since an expense or loss reduces the profit. Credit All Incomes and Gains: Income and gains increase profits, so they are always credited.

Example: When rent is paid, the Rent Expense account (nominal account) is debited and Cash account (real account) is credited.

Types of Accounts in Accounting

Being aware of the different types of accounts and how debits and credits affect them is an important step to mastering accounting principles. Let's go through each type in more detail.

Asset Accounts

All asset accounts account for everything owned or controlled, which the business might utilize to generate future economic benefits. These would include cash, accounts receivable, inventory, buildings, machinery, and investments.

Debit: In an asset, the account will be increased by debiting the account.

Credit: An asset is decreased by crediting the account.

Examples Buying equipment increases assets so that the Equipment account would be debited and Cash or Bank account would be credited.

Liability Accounts

Liability accounts consist of the business's loans and other duties that a company will settle in the near future. Liabilities embrace loans, account payable, mortgages, amongst others. Debit; When there is a reduction in the liabilities, credit the concerned account. Credit; A liability increases so credit this account.

The following examples A Business taking up a loan in the current period. When a Business takes up the loan and it goes down to record, then you credit a liability account loan payable and debit either cash or the bank.

Equity accounts are those which represent ownership interests in the firm, like common stock, retained earnings, and dividends.

Debit: An account is debited when equity decreases. Credit: An account is credited when equity increases.

Example

When the company issues stock, Share Capital account (equity account) is credited and Cash account (asset account) is debited.

Income and Expense Accounts

Income accounts are those that record revenues realized from business operations, while expense accounts are those that record costs incurred in conducting the business.

Debit: Expenses and losses are debited to decrease profit. Credit: Income and gains are credited to increase profit.

For example: When the company realizes revenue from sales, the Sales Revenue account, which is an income account, is credited, and the Cash or Accounts Receivable account, which is an asset account, is debited.

How Debit and Credit Accounting Reflect in the Balance Sheet

Basic accounting equation by debit and credit application must be on the balance

Assets = Liabilities + Equity

Therefore, this balance must forever be true. For all debit entries there must equally be a corresponding credit to keep the check on a balance sheet.

Practical Application: Tally Course, Taxation Course and GST Course

Courses such as GST or courses like Tally, Taxation, etc are also very helpful if one wants to understand and practically apply the Golden Rules of Debit and Credit Accounting.

Tally Course: Tally is the accounting software that does the majority of the work about accounting. Students are provided with the opportunity to utilize debit and credit principles quite efficiently in a computerized atmosphere.

Taxation Course: Because taxation deals with the concept of understanding tax-related transactions, their effects on the financial statements, and the accounting entries, the taxation course is also necessary for accountants.

GST Course: In any revisions to the rules of Goods and Services Tax, accountants learn how to make accounting entries to get into compliance and understand how this will change business transactions. GST Course can guied you to learn.

Conclusion Mastery of the Golden Rules of Debit and Credit Accounting is necessary for a career in accounting. The Golden Rules ensure double-entry bookkeeping, and thus, the correctness of the financial transactions involved. It will be easy for accountants to make reliable financial reports that are reflective of the true financial position of a business through the different types of accounts with their respective debit and credit rules.

#accounting course#gst course#taxation course#gst course in kolkata#accounting course in kolkata#tally course#tally course in kolkata

0 notes

Text

Unlock the true potential of your career by learning corporate accounting:

In the competitive world of professionalism, knowledge in the field of corporate accounting will help you take that extra competitive edge. Whether it is a fresh start or development of expertise at the practitioner level, it is always a must to join a top-course program in corporate accounting in order to achieve success. Besides providing comprehensive insight into financial practices, it will equip you with hands-on experience in using the latest tools like Tally and GST during the latest corporate trends.

This article is going to talk about some of the major reasons why it is a must join the corporate accounting course or Accounting Course in Kolkata and how this may be the right step for each career plan.

Why Corporate Accounting?

Corporate accounting is the most significant element for any organization. It works as an activity and helps in maintaining proper records of the financial state in an organization. This would then ensure the sustainability of businesses to their organizations as they control all the financial management. This level of professionalism within accountancy helps one build more fulfilling careers related to the finance domain as a financial analyst, corporate accountant, or an auditor and even the leading positions such as CFO.

Here's why it may all pay off to invest in the course of corporate accounting:

Enormous Demand: Any business, small or large, requires efficient accountants to manage all its accounts books. Such constant demand generates heavy enough job opportunities for corporate accountants, more in the larger organizations.

Good Remunerations: Professionals who specialize in corporate accountancy, and who have extra finance skills, are often compensated better than others.

Career Opportunities: Corporate accounting provides great career opportunities in terms of advancement up the ranks. Many accountants, as time progresses, take on senior levels, even executive ones.

International Applicability: Corporate accounting concepts are very broad and widely applied across various industries and economies across the globe. This means that your skillset will have great transferability and international applicability.

Important Features of an Excellent Corporate Accounting Course

A suitable program for mastering the best course in corporate accounting should encompass a broad scope of knowledge content and practical training to be applied in the real world. To this extent, the following could be the key qualities to watch out for:

Basic understanding of corporate accounting A balanced course will begin with the basics-the detailed exposition of key critical financial statements, including the balance sheet, income statement, and cash flow statement. Learn how to read and understand these documents: it forms the groundwork for the corporate accountant.

Accounting Software Tally Accounting software proficiency has become inevitable in the corporate environment today. Tally is one of the most widely used accounting software applications in India and is also being adopted by large and medium-sized businesses to ensure effective management of financial data in business firms. Masters working on ledgers, account reconciliations, and reports after getting actual practice in a Tally Course in Kolkata.

A course that teaches you Tally will enable you to navigate transactions fairly easily within organizations, which is a thing to cherish being part of the organizational team.

To be an expert in GST is the Taxation Must-Know Learners would become well verse in the GST nuances with a GST Course in Kolkata. They will learn everything about the filing of a GST return, and they will reconcile their accounts and prepare them for total compliance with the laws of GST. The skills that a person learns with such a course will be extremely valuable for a company when navigating the tax landscape of India.

Advanced Accounting Techniques Apart from the fundamentals, high-level courses teach more complex accounting practices in terms of cost accounting, management accounting, and financial analysis. All this enables you to evaluate the financial health of a company, prepare budgets, and even give strategic financial guidance.

Depth of Taxation Knowledge Understanding taxation is a main aspect of corporate accounting. A Taxation Course in Kolkata will see to it that you are well equipped with issues pertaining to corporate tax, income tax, and indirect taxes. You'll be taught ways of saving tax, preparation and filing of corporate tax returns, audit management, and many more, hence becoming a valuable asset in managing a company's tax affairs.

Case Studies of Real Life Businesses Best corporate accounting courses will infuse case studies that reflect real-world scenarios so you could also address the same types of financial challenges corporate accountants face. Such scenarios build hands-on skills in whatever from fraud detection to complex tax situations.

Building Necessary Soft Skills Apart from technical competencies, the corporate accountants should also be adept at communication and problem-solving skills. A balanced course will teach you communication skills based on how one can convey financial knowledge to other not so financially-oriented people and the collaboration ability of how individuals can work together in a team.

Selecting the Right Corporate Accounting Course in Kolkata

Some of the foremost corporate accounting institutes exist in Kolkata. These institutes provide both classroom and online classes, which makes them more suitable for working professionals as well as students.

Some essential factors that should be considered while determining a course:

Accreditation: The programme should be accredited by some governing body. This will add value to your certificate when applied at work.

Faculty: Find courses taught by professionals who have a good amount of real-world experience.

Hands-on Training: Select courses with practical sessions on accounting software such as Tally and real-life application cases using knowledge of GST.

Flexible Learning: Being a working professional or student, arrangements of flexible learning - perhaps over the weekends or in part-time classes - might facilitate pursuing the studies.

Conclusion Joining the best corporate accountancy course can be a watershed moment for your career. The course will make you learn the main skill and practical knowledge to survive in the corporate accounting world with so much confidence. Besides corporate accountancy, learning courses on Tally, GST, and taxation, you can learn all aspects of financial management, and you can become an ideal employee of any organization.

Getting all this learning opportunity in Kolkata will surely take you on the right track for a successful and fulfilling corporate accounting career.

#accounting course#gst course#taxation course in kolkata#tally course#accounting course in kolkata#gst course in kolkata

0 notes

Text

The key differences between Assets and Liabilities: From ownership and revenue generation to obligations and financial calculations, this guide breaks down the essentials for financial clarity.

If you want to know more visit: Ready Accountant

#accounting course#gst course#taxation course in kolkata#gst course in kolkata#tally course#taxation course

0 notes

Text

#Tally Course#taxation course#accounting course#corporate accounting training in kolkata#GST Course#Taxation Course

0 notes

Text

Get The Best Career Oriented Tally ERP 9 Certificate Course

Best Tally Training Institute in Kolkata - Our TallyPrime Certificate Course teaches students in detail that how to manage and maintain accounts, inventory and payroll at Tally.

#account tally course#tally course#tally course fees#tally course near me#tally prime course#tally gst course#tally training#tally course in kolkata#tally erp 9 certificate course#tally erp course near me#tally certificate course#tally with gst course in kolkata#tally gst course fees in kolkata#learn tally online#online tally course with gst with certificate#online tally course with gst

0 notes