#Tally GST Accounting

Explore tagged Tumblr posts

Text

Tally GST Accounting Classes In Raipur

Nirankari Education & Taxation Services offers comprehensive Tally GST Accounting Classes in Raipur. Our courses provide high-quality education and training in Tally erp9 software and GST accounting, empowering individuals to acquire the skills and knowledge needed to excel in the field of finance and taxation. Our classes are well designed to cater both beginners and professionals who are seeking a job in this field. For the job seekers we provide 10 days of practical training courses on Tally ERP software and GST accounting services. You will have the opportunity to work on simulated scenarios and gain confidence after learning our courses you will get 100% job support.

Tally GST Accounting Classes In Raipur

For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Tilda-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Tagore-Nagar-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Panchsheel-Nagar-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Dhamtari-Road-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Gudiyari-Road-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-GE-Road-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Tatibandh-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Golbazar-Raipur

#Tally GST Accounting#Classes In Raipur#Nirankari Education#& Taxation Services#Dhamtari-Road-Raipur

0 notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

Be a Master of Advance GST - Tally Prime Advance GST Course

Be a Master of Advance GST

Weekend special 2 Days Fast-track batch

Tally Prime Advance GST Course

GST Information & Definition

Advance GST

GST Sales & Purchase

GST R1,R2,R3 Reports

Export tally to Excel

Discussion Session

Benefits:

Highly Experienced Trainers

Extensive Detailed Course

One to One Interaction

Date:

Batch 1 - 28,29 January 2023

Batch 2 - 4,5 February 2023

Time:

11:00 AM - 5:00 PM : Sat-Sun

High Tea and Lunch Included

"Hurry Up!! Join Now, Limited Seats Available"

Place:

Ascent Software Solutions

Office No- 103, Kapil Sankalp, next to Perugate Police Station, Sadashiv Peth, Pune, Maharashtra 411030

Join Now:

Call: 9075056050 / 9822604098

WhatsApp: https://wa.me/message/GLMPPGZUIONVD1

#ascentsoftwaresolutions#Ascent Software Solutions#Tally Mobile#Tally Prime#Advance GST#gst registration#accounting services in dubai#accountant

3 notes

·

View notes

Text

A Comprehensive Guide to the GST Registration Process

GST registration process is an important milestone in India for business. It marks a crucial juncture under the Goods and Services Tax, or GST framework, that unifies a variety of indirect taxes. It has thus brought down a plethora of indirect taxes in a unified form all over the country. Therefore, be you an aspiring entrepreneur or a successful businessman, understanding this process becomes crucial.

This guide discusses the concept, importance, and process of GST registration and how training programs like Taxation, Tally, and GST Courses in Kolkata can enhance your financial acumen.

What is GST Registration?

GST registration is the process that recognizes a business as a taxable entity under the GST regime. It is mandatory for:

All businesses with more than ₹20 lakhs per annum turnover if the same turnover exceeds ₹10 lakhs per annum for any special category of states.

Inter-state supply

E-commerce businesses

Casual taxable person and non-resident taxable persons under GST

Aggrieved party in reverse charge mechanism

For GST registration after the completion, a GST identification number is received by the concern business and permits to collect taxes, input credit and return through GST. This article discusses reasons why GST is an important phenomenon.

Why Is GST Registration Required?

Here are the major reasons why registering for GST is important:

Legal Recognition: That business will be recognized as a legal supplier of goods or services.

Input Tax Credit: Will make the claiming of input tax credits possible without any hassle, with consequent reduction in tax.

Competitive Advantage: That compliance gains credibility with customers and partners.

Operational Ease: It helps to make interstate trading easy and also supports e-commerce. Failure to register when required can result in heavy penalties and legal repercussions, making compliance non-negotiable.

Step-by-Step Guide to GST Registration

Step 1: Prepare Required Documents Gather the following documents before initiating the registration:

PAN card of the business or proprietor.

Business registration proof (e.g., partnership deed, incorporation certificate).

Address proof of business premises (e.g., utility bill, rental agreement).

Bank account details (cancelled cheque, bank statement).

Proof of identity and address of the authorized signatory (Aadhaar, passport).

Digital signature for companies and LLPs (Class 2 or Class 3).

Step 2: Log on to the GST Portal

Go to the official GST portal at www.gst.gov.in and click on Services > Registration > New Registration.

Step 3: Fill Part A of the Application

Provide details such as:

Legal name and PAN of the business.

Email and mobile number for OTP verification.

A Temporary Reference Number (TRN) will be generated and sent through email and SMS.

Step 4: Log in Using TRN

Login with the TRN to fill up Part B of the application, which contains:

Business details such as trade name, type, and date of commencement.

Head and branch/branches. Details of goods or services supplied. Authorized signatory details.

Step 5: Upload Necessary Documents Ensuring scanned copies of all the documents are clean and correct will avoid delay in processing.

Step 6: Verification and Submission Submit application through EVC or digital signature.

Step 7: Processing of Application The application will be vetted by GST officials. After approval, they will give a GSTIN and a copy of the registration certificate. In case of any discrepancies, clarification will be sought.

An Accounting course in Kolkata also Beneficial.

Common Challenges in GST Registration

Despite how easy the process is, some common areas of common challenges are found as:

Incorrect or incomplete documents.

Key entry errors.

Slowly verification process. To overcome these challenges, consider enrolling in specialized courses like GST or a Taxation Courses in Kolkata, which provide comprehensive insights into GST compliance and related practices.

Tips for a Hassle-Free GST Registration

Ensure Document Accuracy: Double-check all details and ensure consistency.

Maintain Clear Records: Accurate records simplify compliance and audits.

Contact a tax consultant or GST consultant for some professional guidance.

Make the Best Use of Technology: Make use of Tally, thereby automating GST procedures. Take up a course in Tally and become proficient in using the tool.

Conclusion

Understanding the GST registration process is very important for any business that operates within the GST framework of India. Thorough preparation and resource utilization, such as professional training courses, will ensure smooth compliance and avoid pitfalls.

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

GST Compliance Made Easy!

Upgrade to TallyPrime 5.1 for:

Flexible data migration

Bulk invoice conversion

Error-free GST filing

Streamline your workflow today!

We Provide Best Tally Prime Software Services and give many facility and features to tally prime software . Tally on Cloud it’s a solution for easy, economical, efficient and with securely to use Tally from anywhere, anytime and from any devices with the help on just an internet connection.

Tally Prime is a rearranged arrangement that runs the unpredictable parts of your business, for example, bookkeeping, busy software team chat messaging apps accounting marg accounting software consistence and procedures out of sight. Count is anything but difficult to learn and can with least assets.

#tallyprime#accountingsoftware#gst reconciliation#tally on cloud#tally customization#cloud accounting software#tallysoftware

0 notes

Text

Why Tally, Discover Career Opportunities at DICS Innovatives.

DICS INNOVATIVES Pitampura Rohini , recognized among the top Tally Prime training institute in Pitampura Rohini, has training module for beginners, intermediates, and experts. Whether you are a college student, I.T professional or a project manager; the best Tally training institute in Pitampura Rohini offers best training environment, veteran Tally trainers, and flexible training schedules for entire modules. Also, the best training institute for Tally training asks for a value to money fee from the students.

Why Tally?

Tally is more than just accounting software; it’s a robust financial management tool that has transformed how businesses handle their accounts. The Best Tallly Institute In Pitampura Here are some compelling reasons to learn Tally:

1. User-Friendly Interface

Tally is designed with usability in mind. Its straightforward interface allows users to navigate easily, making it suitable for both beginners and experienced accountants. This accessibility reduces the learning curve, allowing businesses to adopt Tally quickly.

2. Comprehensive Features

Tally offers a wide array of features that cater to different aspects of accounting:

Inventory Management: Track stock levels, manage inventory, and generate reports effortlessly.

Payroll Management: Streamline employee payments, tax calculations, and compliance with labor laws.

Financial Reporting: Generate detailed financial statements, including balance sheets and profit & loss accounts, with just a few clicks.

3. Real-Time Data Processing

Tally provides real-time updates to financial data, ensuring that businesses have the most current information at their fingertips. This feature is particularly beneficial for decision-makers who rely on up-to-date financial insights to drive their strategies.

4. GST Compliance

As India transitioned to the Goods and Services Tax (GST), Tally adapted to facilitate compliance. It simplifies the GST filing process, generates necessary reports, and ensures that businesses meet regulatory requirements effortlessly.

Career in Tally

The demand for Tally professionals is skyrocketing as businesses increasingly rely on this software for their accounting needs. Here are some promising career paths you can pursue:

1. Accountant

As an accountant, you'll be responsible for maintaining financial records, preparing reports, and ensuring compliance with accounting standards. Proficiency in Tally is a valuable asset in this role.

2. Finance Manager

Finance managers play a critical role in strategic decision-making. They analyze financial data, manage budgets, and oversee financial planning. A solid understanding of Tally can enhance your ability to provide insightful financial forecasts.

3. Tax Consultant

Tax consultants assist businesses in navigating the complex landscape of tax regulations. With Tally’s GST features, you can offer valuable insights to clients, ensuring they remain compliant while maximizing their tax benefits.

4. Business Analyst

In this role, you'll analyze financial data and trends to provide actionable insights for businesses. Understanding Tally can help you interpret data more effectively and recommend strategies for growth.

5. Entrepreneur

If you aspire to start your own business, knowledge of Tally will be invaluable. You’ll be equipped to manage your finances, track expenses, and maintain compliance from day one.

What you'll learn

Company Creation

Accounting & Inventory Masters

Accounting & Inventory Vouchers

Bank Reconciliation

Outstanding Report

GST Implement & Return Preparation Also Include TDS, ESIC, PF

Job Costing

Cost Center Advance Level

Complete Payroll (Salary) Processing

Advance Topics : Budget, Voucher Numbering, Voucher Class, Sales / Purchase Order Processing, BOM, ManufactingVoucher,Price List etc

Conclusion

Tally has become an indispensable tool for businesses. By choosing DICS Innovatives in Pitampura, you’re investing in your future. tally accounting institute in Pitampura With expert instructors, a robust curriculum, hands-on training, and dedicated placement assistance join DICS Innovatives today and take the first step toward a rewarding accounting career.

0 notes

Text

Tally prime with advance gst

Tally Prime with Advanced GST is a powerful business management software that fully integrates GST compliance features, automating complex tasks like tax calculations, return filing, and data reconciliation. This ensures businesses meet all GST requirements without hassle. It simplifies the process of creating GST-compliant invoices, allowing automatic calculation of CGST, SGST, and IGST based on transaction types, and generates detailed sales and purchase reports. The software supports multiple GSTNs, helping businesses manage GST filings across different states, and also handles Reverse Charge Mechanism (RCM) transactions seamlessly.

#Tally prime with advance gst course in India#Account with tally prime with advance gst course in Punjab#Tally prime with advance gst#Online account with tally prime course in india#Account course online with certificate#Online account course with certificate#Online learning platform

1 note

·

View note

Text

Top 5 Accounting and Taxation Courses in Delhi

If you want to advance your career in the fast-growing field of business accounting and taxation, it`s important to undertake a short course or diploma course. These specialized courses will give you the practical knowledge and skills you need to navigate a fast-paced, ever-evolving industry.

https://www.nifm.in/blog-details/419/top-5-business-accounting-and-taxation-courses-in-delhi.php

0 notes

Text

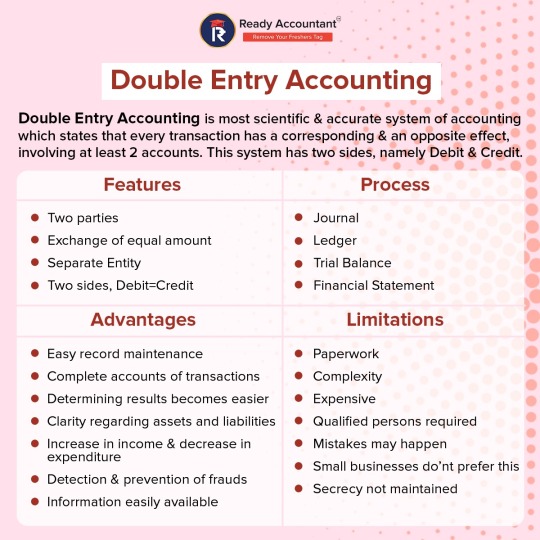

Master the concepts of Double Entry Accounting: Learn its features, processes, advantages, and limitations to enhance your financial expertise and keep track of all the transactions accurately. Excellent for aspiring accountants and finance professionals! For more details visit: Ready Accountant

1 note

·

View note

Text

The key differences between Assets and Liabilities: From ownership and revenue generation to obligations and financial calculations, this guide breaks down the essentials for financial clarity.

If you want to know more visit: Ready Accountant

#accounting course#gst course#taxation course in kolkata#gst course in kolkata#tally course#taxation course

0 notes

Text

Understand the simple rules of Debit and Credit:

Understand easily the Simple Rules of Debit and Credit to go about managing Assets, Expenses, Liabilities, and Capital efficiently. Improve your accounting skills now!

For more details visit: https://readyaccountant.com/

#accounting course#accounting course in kolkata#taxation course#taxation course in kolkata#gst course#tally course

0 notes

Text

Tally GST Accounting Classes In Raipur

Nirankari Education & Taxation Services offers comprehensive Tally GST Accounting Classes in Raipur. Our courses provide high-quality education and training in Tally erp9 software and GST accounting, empowering individuals to acquire the skills and knowledge needed to excel in the field of finance and taxation.Our classes are well designed to cater both beginners and professionals who are seeking a job in this field. For the job seekers we provide 10 days of practical training courses on Tally ERP software and GST accounting services. You will have the opportunity to work on simulated scenarios and gain confidence after learning our courses you will get 100% job support.

Tally GST Accounting Classes In Raipur

For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Tilda-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Tagore-Nagar-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Panchsheel-Nagar-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Dhamtari-Road-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Gudiyari-Road-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-GE-Road-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Tatibandh-Raipur For more info.:- https://www.nirankarieducation.com/tally-gst-accounting-classes-in-Golbazar-Raipur

#Tally GST Accounting#Classes In Raipur#Nirankari Education#& Taxation Services#Panchsheel-Nagar-Raipur

0 notes

Text

Mastering double-entry accounting is essential to optimum financial management and record-keeping. Check out these tips to help you master and excel in double-entry accounting. Ready Accountant Your one-stop shop for on-the-job experience in Live Projects related to Accounting, GST, Taxation and ROC.

For more details visit: https://readyaccountant.com/

#accounting course#taxation course#gst course#tally course in kolkata#tally course#gst course in kolkata

0 notes

Text

Mastering Accounting and Bookkeeping in 2024:

Accounting and bookkeeping are must-haves for organizations in this very volatile financial environment. The year 2024 provides a bundle of technological advantages and regulatory changes. In this context, businesses and professionals must update with modern Accounting and Bookkeeping Rules. This book covers new trends and emphasizes the need for professional training under courses such as Tally Course, Taxation Course, Accounting Course in Kolkata, and GST Course in order to outshine them.

Accounting and Bookkeeping :

The Bedrock of Financial Management Accounting and bookkeeping constitute the bedrock of accounting for recording and interpreting financial performance. While bookkeeping deals with the precise calculation of transactions through a daily ledger, accounting further translates data into action.

Important factors to watch out for in 2024 are:

Automation: Software like Tally Prime streamlines processes and cuts down on errors. Regulatory Changes: Relating to GST, income tax, and international standards requires vigilance. Globalization: Companies having an international vision must implement IFRS for themselves.

To face such problems, professionals can take up specific courses like accounting courses or Tally course to build hands-on experience.

TOOLS TO BE EMPLOYED

Basic Accounting and Bookkeeping Practices in 2024

A. Accuracy True records are the root of proper book keeping. Training platforms like Tally Prime under a Tally Course in Kolkata assist one in developing a method of minimal error handling and maximizes efficiency for one .

B. Tax Compliance Knowing and keeping up to date with the changes in tax laws, such as GST, is crucial. Training through a GST Course or Taxation Course makes it abreast of knowledge and ensures continued compliance on an err-free basis.

C. Entity Separation Separation of personal and business finances is one characteristic that makes all transactions transparent and legally clear. It is one of the most basic accounting rules that a business should follow.

D. Comply with International Standards If your business is international, then compliance with IFRS will increase credibility and attract easy entry into global markets. Specialized accounting courses offer extensive knowledge of these worldwide standards.

E. Reconcile Periodically Audits and reconciliations are done frequently, which prove useful for them to detect discrepancies in time and prevent fraud. Training on tools like Tally Prime allows one to work proficiently in conducting such tasks.

3. Technological Innovation that Transforms Accounting

A. Automation and AI AI-driven tools change the face of predictive analytics and the detection of fraud. Courses like this Tally Course introduce trainees to integrating AI in accounting workflow.

B. Cloud-Based Solutions Cloud accounting provides access to financial information from anywhere while being secure. Most modern accountants have to learn how to use these tools.

C. Blockchain Blockchain technology enables tamper-proof records, which increases the level of transparency and trust in financial reporting.

D. Digital Tax Filing Digitized tax-filing platforms for taxes assist in making compliance easy. A GST Course equips one with hands-on experience on how to prepare GST returns effectively.

Overcoming Compliance Issues A. Coping with Change

Tax laws are changing all the time, and the process may sometimes be overwhelming. Courses, such as the Taxation Course in Kolkata or GST Course, help one keep in the times.

B. Securing Digital Accounting

Digital accounting requires strong cybersecurity. Secure practices training is needed in order to secure sensitive data.

C. Skills Gap Modern skills require modern techniques. The Tally Course or Accounting Course equips one to fulfill the industrial needs.

Benefits of Updated Rules

Proper Planning: The correct set of data helps in appropriate budgeting and forecasting. Strict Control: Laws should be followed without punitive measures and to gain authenticity Professional Training: Professional training leads towards high-value career prospects. Improved Transparency: Transparent financials are a source of stakeholder confidence. This is all about the steps to implement modern accounting rules.

6. Steps to Implement Modern Accounting Rules

Adoption of Advanced Tools The adoption of Tally Prime helps the firm operate efficiently and become more accountable.

Upskilling Teams Instruct the employees to take courses related to Tally Course and GST Course.

Periodical Audits It is essential to check for compliance and at the same time pick any kind of anomaly through regular review.

Be Updated: You have to sign up for an Accounting Course such that you are updated with the new and recent trends.

Use Expert Support: You can seek support from those experts who are professionalized in this domain or undergo advanced training courses for guarantee. Different Methods by which You will Follow the New Accounting and Bookkeeping Standard for 2024

How to be in Compliance With New Accounting and Bookkeeping Regulations of 2024

The new accounting and bookkeeping rules of 2024 overwhelm businesses, but there is a proper way to ensure that compliance with them becomes seamless. Here's how you can adapt to changes well:

Track the Regulatory Changes Stay updated on the latest changes in rules for accounting and book-keeping. You could read credible newsletters, participate in webinars, and follow some reliable financial blogs for this purpose. Education means that you will be equipped with the latest requirements on compliance at all times. End

Use Accounting Software Modern accounting software makes the difference. Automation helps save time and reduces human error. Update frequency should be a choice-criterion of the software as it shall help follow the changes made in regulations. Accuracy would also be enhanced through automation, and so will be the possibility of compliance.

Consultant Expertise While managing compliance proves relatively challenging in the absence of particularized skills, the employment of a professional accountant ensures that books are quite accurate and up to date. An experienced accountant can provide insights into the financial health of a business while ensuring one is in compliance with the latest rules.

Regular audit of financial records Provide frequent checks of your financial statements so you can detect any errors or mismatches before such inconsistencies become serious issues. Regular audits also ensure that your operations are within the new regulatory regime, thus not facing penalized consequences for non-compliance.

Capitalize on Improved Information and Communication Technology Facilities Cloud application and document management technologies make it more efficient to store and retrieve your records. These systems ensure secure storage and recording, efficient tracking, and fulfillment of newly promulgated regulations on data management.

Steps can thus be taken by the various businesses to not only keep up with new rules but also make accounting stream line and easier for better financial management 2024.

Conclusion

Accuracy, adherence, and utilization of technology in playing accounting and bookkeeping games will be at the center of learning in 2024. Any business or professional who specializes in these most important disciplines can thrive in competitive markets. Expanding knowledge by taking a Tally Course, Accounting Course, and GST Course in kolkata can help one keep better abreast of industry requirements and guaranteed financial success. Follow these strategies confidently as you negotiate this rapidly changing world of accounting.

0 notes

Text

Top Benefits of Taking an Accounting and Taxation Course for Business Organizations

Today, in the fast-paced world, managing finances is the backbone of any business. Mastering accounting principles and tax regulations forms a significant part of this. An accounting and taxation course provides individuals with the necessary money management skills but equips businesses with the tools to enhance growth, ensure compliance, and streamline operations.

Better Financial Management

It would be important for a business to have a good foundation in accounting. Accounting and taxation course in Kolkata help entrepreneurs and professionals build a comprehensive knowledge of accounting principles, tax laws, and regulatory frameworks. This knowledge enables businesses to:

Manage financial transactions accurately.

Prepare detailed financial reports and statements.

Create and forecast budgets to support strategic decision-making.

For businesses operating in metro cities like Kolkata, enrolling in a taxation course offers region-specific insights into local tax laws and compliance practices, giving them a competitive edge.

Ensuring Tax Compliance

Tax compliance with any business is out of the question. Failure to comply will attract punitive measures and legal hassle. A taxation and accounting course gives businesses headway over their tax responsibility by learning about:

GST filling procedures and time limits.

Direct and indirect tax compliance: corporate taxes, VAT, customs duties, etc.

Specific GST course in Kolkata instruct businesses on how to register for GST, how to file returns, and reconcile tax data accurately so that businesses are fully compliant and do not pay fines that could have been avoided.

Strategic Planning

Financial information is an integral part of strategy. When armed with good knowledge of accounting and taxation, the business leader will be able to:

Analyze financial reports to assess profitability.

Identify cost-saving opportunities and optimize budgets.

Plan for future growth based on reliable financial forecasts.

Courses like advanced accounting programs equip professionals with tools to interpret financial statements and key performance indicators, enabling data-driven decision-making.

Reducing Costs Through In-House Expertise

Normally, small and medium enterprises outsource financial management as it is costly to hire external consultants. In-house skills can be developed by teaching the employees accounting applications like Tally ERP or Tally Prime that can help them perform routine items within an organization and reduce dependency on external services and hence save in the long term.

Accurate GST Reconciliation

GST is a pillar of the Indian taxation system and accurate reconciliation of returns is an essential part of it. The accounting and taxation courses give detailed step-by-step instructions to follow:

File GSTR-1 and GSTR-3B correctly. Do GST reconciliation in Tally Prime for the correct match of purchase and sales data Find out discrepancies and rectify to avoid penalties

Career Advancement

For individuals, accounting and taxation can help them gain entry into high-paying jobs like tax consultants, accountants, and finance managers. Businesses can also benefit by having in-house professionals who manage finances, hence reducing the use of external consultants and ensuring that finances are managed on time.

Streamlined Payroll Management Payroll is one of the most demanding functions in a business, regardless of the business's size. Knowledge of accounting and taxation leads professionals to handle payroll processes with utmost ease. Such examples include computing salaries, deductions, and tax obligations, ensuring compliance with TDS, PF, and other statutory contributions, as well as generating payslips and maintaining accurate records.

Why an Accounting and Taxation Course is Necessary

An accounting and taxation course benefits more than just compliance and financial control. It is invaluable for the following reason:

Deeper understanding of tax laws and procedures for an effective meeting of legal obligations

Open new avenues such as tax consultant, GST practitioner, or financial analyst with a well-known certification

Gain practical skills to file GST returns, compute TDS, and handle income tax filings with utmost confidence

Improve decisions on financial planning, budgeting, and cost optimization.

Global Relevance: Taxation principles are universally applicable, enabling professionals to work with multinational companies.

Technological Proficiency: Learn to use tools like Tally ERP and SAP, ensuring readiness for tech-driven roles.

Professional Credibility: Certification showcases your expertise and boosts your reputation in the field.

Support for Entrepreneur: Gain insights into tax structures and compliance to optimize financial strategies for your business.

Conclusion

This is a strategic decision to invest in an accounting and taxation course, both for businesses and individuals alike. Be it mastering payroll, exploiting accounting software, or achieving perfect tax compliance, the skills one gains are priceless in the current financial context. With these courses amalgamating theoretical knowledge with practical application, it equips businesses and professionals to face the complexities of finance as a part of daily life without any challenges.

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Unlock your Career Potential with Certified Accounting Courses

Get Certified: Accounting Course for Career Growth. A must-attain set of certifications that make the accounting skills and career better. From the core knowledge in accounting principles and tax rules to getting hands-on with the Digital Accounting Course With Articleship that preps you for jobs. Along with this, the Tally Prime Course Online And Job Placements offer job placement assistance as well as connect you with possible employers.

Table Of Content: -

Get Certified: Accounting Course for Career Growth

Master Tally Prime: Online Course With Certificate

Join Now: GST Online Course with Certification

Digital Accounting Course with Articleship Options

Tally Prime Online Course: Job Placement Support

Frequently Asked Questions (FAQs)

Get Certified: Accounting Course for Career Growth

Relevant certification in the modern competitive market can help you grow immensely in your career. Such a Certified Accounting Course, therefore, will be a qualification booster to set you apart from different employers. These courses include skills and knowledge required in accounting.

Benefits of Taking Certified Accounting Courses:

In-depth Knowledge: This helps understand accounting principles, financial reporting, and tax laws.

Professional Development: These certifications tell the employer that you respect your profession and are not willing to compromise on such things.

In addition to these regular courses in accountancy, specializations include online Tally Prime Course With Certificate. This course is based on the software package Tally Prime. As known, this is being largely used by the business fraternity in the country for their needs and purposes of accountancy as well as inventory management. This will improve your technical know-how and thereby enhance the prospects of job opportunities available to you in the marketplace.

Another worth offering is the GST Online Course With a Certificate. An accounting professional in India should know about the Goods and Services Tax, or GST because it has been a game changer in taxation.

Digital Accounting Course With Articleship is an excellent opportunity to learn while working. Here, the theoretical concept will not only be studied but articles, which will include practical hand training.

Tally Prime online course also has Tally Prime Job Placement. Here, you will be connected with the providers of the job opportunity.

Master Tally Prime: Online Course With Certificate

Mastering software tools in accounting is a compulsive requirement and not a choice. Any aspirant accounting professional who is desirous of increasing prospects for his career and aims at higher positions should take up the course designed specifically for mastering Tally Prime, the robust, advanced accounting software. Online Tally Prime Course with certificate provides in-depth Tally Prime knowledge with significant prospects of employability improvement by certification.

Advantages of Online Tally Prime Training

Comprehensive Curriculum: Everything, from basic functions to all the possible features of Tally Prime, will be learned in this online training on Tally Prime to get proper knowledge of the software in totality.

Flexibility: The online training system enables you to study at a flexible pace according to one's convenience. This feature benefits working professionals as the availability of time for work could be flexible and comfortable at the same time.

Certification: Get certified after completion, indicating validation of skills and knowledge gained through Tally Prime.

With all these, it would also be helpful to be able to apply for an accounting course that is qualified such that I will get some better principle knowledge about accountancy. The two courses combined with a GST course which is online results in getting a certificate, so I will be able to fully appreciate the Indian Taxation system.

The Digital Accounting Course With Articleship will then provide you with the on-the-job experience to be completed. Some programs add the Tally Prime Course Online And Job Placements, where you get an opportunity to face employers that are actively in search of the right employee.

Join Now: GST Online Course with Certification

Accountancy professionals have no option other than being updated regarding GST regulations and compliance in a rapidly changing finance world. Our GST Online Course With Certificate will be a comprehensive learning session on the regulation, compliance, and the impact of GST on businesses. This will add much value to your professional profile and enrich your knowledge.

Key Features of GST Online Course

Expert Trainers: Learn from industry experts about the real-life application of GST.

Flexibility: This online program is flexible, and you study at your own pace, very suitable for busy professionals, and

Certification: On completion, you can get a recognized certificate about your expertise in GST.

The additional course can be the GST course, and then support it with a Certified Accounting Course that will enhance building up basic accounting skills. An online Tally Prime Course With a Certificate further will bolster your skills especially since accountancy software is globally utilized in most businesses.

Besides, for the hands-on experience enthusiasts, a digital accounting course with articles is also available. Many of these programs also provide online Tally Prime courses along with job placements, and you'd directly be connected with the employers looking for the right candidates.

Digital Accounting Course with Articleship Options

As the digital world is evolving day by day, there is an exponential growth of demand for skilled accountants. Our Digital Accounting Course With Articleship gives the much-needed accounting skills accompanied by practical experience through articles, making you totally job-ready upon completion of the course.

Benefits of the Digital Accounting Course

The curriculum would focus on digital accounting tools, financial reports, and compliance regulations.

Articleship Experience: Articleship provides practical insight into industry professionals; therefore, you experience in your learning.

Certification: Certification is provided that confirms your digital accounting skill, thus making you a highly competitive one in the job market.

Apart from that, you may choose a certified accounting course that will make your base sound in accounting principles. Then, there is the GST Online Course With Certificate which gives you the necessary knowledge regarding tax regulations, if you wish to go deeper into specialization.

This great Online Tally Prime Course With a Certificate coming to you is one that takes much concern with the mastery of software much in demand anywhere, today. Thousands of these institutes present you with an opportunity like this so that you get complete assurance that no problem may arise at any time before, during, or after your transition from education to employment.

Tally Prime Online Course: Job Placement Support

If you are serious about a career in accounting, then there is no alternative but mastering Tally Prime. We offer Tally Prime online course along with the certificate course with job placement support from us to give that initial boost towards a better career.

What are the advantages of this Tally Prime online course?

Complete Training: Tally Prime training provides all the functionalities from simple to complex so that you are completely prepared for the work field.

Certification: A completion certificate is also included which makes you an impressive candidate in the eyes of the employers.

Job Placement Assistance: Job placement assistance helps students find job placements with organizations that are actively seeking skilled professionals in Tally Prime.

Apart from the Tally Prime course, one can further qualify by doing a Certified Accounting Course that would cover the most basic accounting principles. If there is interest in taxation, then the GST Online Course With Certificate is a very good add-on that would give critical insights into the regulations of GST.

Practical experience can be received through a Digital Accounting Course With Articleship. You will not only become theoretical but also prepared to face the practical world.

Frequently Asked Questions (FAQs)

1. Benefits of doing a Certified Accounting Course

A Certified Accounting Course trains in accounting principles, reporting financial statements, and other tax laws, therefore assuring professional growth. Moreover, it shows that a person is dedicated to this field, and it makes him an excellent candidate for any company.

2. How does the Tally Prime Online Course with Certificate help with placement?

An All-inclusive Tally Prime Training from Basic to Advanced. After you complete the courses, you will be entitled to the recognized certificate you will gain, and it will further make you eligible for acquiring the Tally Prime Course Online And Job Placements with the help of which you will get tied up to the employers on the lookout for adequate professionals.

3. What on-the-job experience do I get through the Digital Accounting Course with Articleship?

The Digital Accounting Course With Articleship merges the article's practical skills training and the theory knowledge so you enjoy practical insight from such people who are in the industry. Prepared Experience: You would have some real-life challenges going on in regard to the accounting profession itself, and making the workforce even more absorptive.

Source url: https://ajmalhabib.com/unlock-your-career-potential-with-certified-accounting-courses-2/

#Certified Accounting Course#Online Tally Prime Course With Certificate#Gst Online Course With Certificate#Digital Accounting Course With Articleship#Tally Prime Course Online And Job Placements#digi schema

0 notes