#Suze Orman

Explore tagged Tumblr posts

Text

I refuse to eat out. I think that eating out on any level is one of the biggest wastes of money out there.

--"Why Suze Orman Never Goes Out to Dinner" @wsj by Lane Florsheim, 1 January 2024

1 note

·

View note

Text

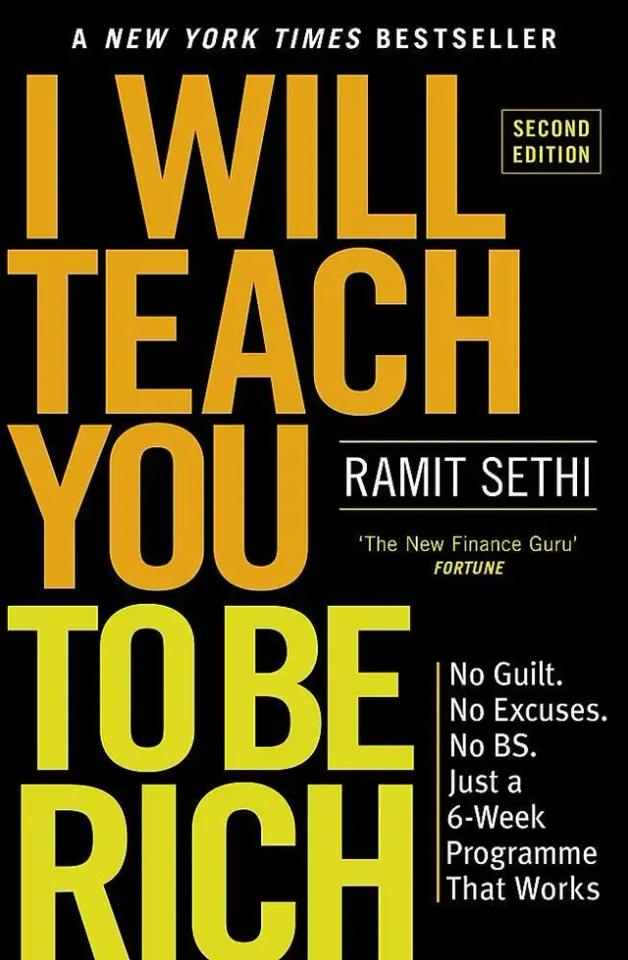

The gist of “I Will Teach You to Be Rich” from Ramit Sethi (vol.39)

Why do rich people tend to be conservative? One of the conservative financial investments is bonds. Bonds are safe and low-risk investments guaranteeing a rate of return. In several statistics, the bond proportion of a portfolio increases with age.

Bonds Why do rich people tend to be conservative? One of the conservative financial investments is bonds. Bonds are safe and low-risk investments guaranteeing a rate of return. In several statistics, the bond proportion of a portfolio increases with age. As much as you get money, you will prefer to preserve the capital rather than be involved in aggressive investing like stocks, including…

View On WordPress

1 note

·

View note

Text

A Big part of Financial Freedom.... 🤑 'Suze Orman' #financequotes #suzeorman #money #investing

#Personal Finance#Financial freedom#Simple Finance#Rules of Investing#How do the rich think?#Financial book summary#Warren Buffett#personal finance tips#personal finance 101#personal finance management#investing#warrenbuffett#financequotes#money#warrenbuffetadvice#warrenbuffettinvesting#warrenbuffetquotes#warrenbuffet#financever#Suze Orman#suzeorman

1 note

·

View note

Text

we all got that one uncle

#doodles#ocs#kiru#not gonna tag him since i really do not think i will ever be using him but thats uncle taichi as VERY briefly mentioned in ftbc chapter 2#he also happens to be the NEETZAP employee from season 2 but thats neither here nor there#he and kiru have an. intriguing dynamic in that while things were testy between him and mayumi/kenny he always tried to be nice to kiru#but he also never really knew how to interact with her so it was very 'how do you do fellow kids'#especially since i feel like hes the kind of guy who cant really turn off the whole 'salesman' act even in his personal life#hes just always walking around serving suze orman

12 notes

·

View notes

Text

you do have to laugh that while many fictional vampires and other immortals are v wealthy bc of their long lives and investments blah blah, there is zero indication that any of the btvs vampires have any money at all. like spike is out here squatting in crypts and mausoleums, angel investigations is always broke until angel goes into wolfram and hart, like did y'all really just never rob anyone for more than a few clothes. they need suze orman giving them advice

179 notes

·

View notes

Note

Hi! I was wondering if you have a one-stop place to learn financial literacy you recommend?

Yep! Our grand list of all articles is a good place to start. Or you could go through our master posts:

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

{ MASTERPOST } Everything You Need to Know about Getting a Job, Raise, or Promotion

{ MASTERPOST } Everything You Need to Know about Self-Care

{ MASTERPOST } Everything You Need to Know about Repairing Our Busted-Ass World

{ MASTERPOST } Everything You Need To Know About Living Independently for the First Time

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

{ MASTERPOST } Everything You Need to Know about Investing for Beginners

{ MASTERPOST } Everything You Need to Know about Credit and Credit Cards

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

When it comes to financial literacy, you have to keep in mind that a lot of it is a trap to get you to buy something. Beware the Dave Ramsey/Suze Orman/Robert Kiyosaki industrial complex.

That's literally why we do what we do: we don't think people should have to pay a ton of money to eek out a tiny bit of understanding of the rules of our patriarchal capitalist hellscape. That's why BGR runs primarily on donations. We could make a lot more money if we charged fat bucks for our information or kept upselling folks to our next ~*~wealth-building seminar~*~.

Instead, we humbly ask that if we've helped you out, you tip us here on Tumblr, join our Patreon, or throw a few dollars our way on PayPal.

148 notes

·

View notes

Text

she is so cute. tiktok can be so great for women. I 100% believe financial literacy should only be by/for other women. I love how girly millennial women aren't beholden to strict male defined ideas of seriousness... she's GOING to be a pink suze orman excited to help girls learn about money and you're going to LIKE it

15 notes

·

View notes

Text

Abundance is about being rich, with or without money. ~Suze Orman

Abundance is not a number or acquisition. It is the simple recognition of enoughness. ~Alan Cohen

Abundance is not something we acquire. It is something we tune into. ~Wayne Dyer

All misfortune is but a stepping stone to fortune. ~Henry David Thoreau

Be content with what you have, rejoice in the way things are. When you realize there is nothing lacking, the whole world belongs to you. ~Lao Tzu

Padma Bhadra

50 notes

·

View notes

Text

Owning a home is a keystone of wealth – both financial affluence and emotional security.

Suze Orman

63 notes

·

View notes

Text

youtube

Why was that Suze Orman hair EVERYTHING?!?!?

#katya zamolodchikova#drag#drag show#drag queen#Perestroika#Miley Cyrus#Wrecking Ball#live#live drag#the hair mawma#the wiglet#Youtube

11 notes

·

View notes

Text

Suze Orman suggests collecting your pennies from around the house, finding a gullible child and trading individual pennies for dollar bills — because pennies are heavier and therefore more valuable (wink) — and using the dollars to buy underpants for the underpants gnomes she manages.

3 notes

·

View notes

Text

Don't think you are depression-proof. Plan ahead for hard times and practice. You won't be disappointed. Living hand to mouth eventually gives you a can-do attitude that can be a lifesaver. Even if you have to give up your home, you will still have one.

Whether by choice or necessity, living in a car (other than an RV) will be even more challenging than living in an RV; space and basic amenities being the main factors. First on the list of preparations is to prepare it for an Emergency as any good prepper would do. Then consider things like, efficient use of available space, locations to park/rest, camping/cooking/sleeping setup/equipment, personal care products and staying clean, seasonal clothing, food and drink, privacy from prying eyes, communications (cell phone, WiFi/hotspot), staying warm and keeping cool.

Related Resources: How to Live Out of Your Car Being Prepared to Live in Your Car Successfully Surviving in Your Car Why Living in an RV is better than living in a House Living With Nothing; When Life Throws a Curve Ball The Suze Orman Story 6x10 Cargo Trailer Conversion Preparing Your Vehicle for an Emergency Staying Safe While Driving or a Vehicle Breakdown

[Author's Reference Link]

[11-Cs Basic Emergency Kit] [14-Point Emergency Preps Checklist] [Immediate Steps to Take When Disaster Strikes] [Learn to be More Self-Sufficient] [The Ultimate Preparation] [P4T Main Menu]

This blog is partially funded by Affiliate Program Links and Private Donations. Thank you for your support.

#live in your car#shelter#vehicle#car#rv#prepare4tomorrow#prepper#survival#shtf#cargo trailer bugout#prepping#prepared#survivor#survivalist#survivalism

28 notes

·

View notes

Text

Nearly two-thirds of millennials say spending $7 on their daily cup of coffee brings them ‘joy’ — but Suze Orman has compared it to ‘peeing $1M down the drain.’ Who’s right?

3 notes

·

View notes

Text

The Verge: Pushy checkout screens are helping ‘tipflation’

Tipping is an age-old American debate. How much do you pay and when? Is it a choice or an obligation? Generally, tech has at least made it easier over the years. Smartphones made it a breeze for friends to whip out a calculator to figure out tip and split the bill. And now, checkout screens everywhere, from in-person stores to delivery apps, have added buttons designed to make it easier for you to tip.

That’s convenient, until it’s not. According to a new Pew Research Center report, tipping culture in America has seen a shift in recent years. Seventy-two percent of Americans say tipping is expected in more places than five years ago. Not all of that is tech-related, but it’s hard to deny the role checkout screens have in tipflation. Even the Pew Research report notes the practice of tipping “is undergoing significant structural and technological changes,” including “the expansion of digital payment platforms and devices that encourage tipping.”

On days I go to the office, I occasionally treat myself to a latte at a local coffee shop. It’s all good, until I’m paying. A part of me dies at the fact a small latte is now around $9 in Manhattan. The anxiety seeps in when, after I’ve tapped my card against the terminal, it asks me how much I want to tip — 20 percent, 25 percent, and a higher number that I’ve blocked from my memory. There’s an option to not tip or to enter a custom tip, but those are smaller, and pressing those buttons fills me with anxiety that I’m a bad person.

Most recently, a finance bro behind me sighed because I was taking too long to figure out the custom tip interface. I ended up pressing the 25 percent button in a social anxiety-induced panic. Or $11.25. At that price, I regretted the latte, and in my head, I heard Suze Orman’s specter haranguing me for having my millennial treat.

Self-service kiosks occasionally ask me if I want to tip, too. The audacity to even ask is staggering. And even if most people pick “no tip” in that scenario, muscle memory and social programming may mean someone accidentally does tip.

How much of these tip prompts actually goes to the people you intended to tip?

Screens make all this easy partly because it cuts out the math. You just press a button that automatically adds on a percentage or, sometimes, a dollar amount. It’s all built into the regular flow of checking out, and you don’t have to rummage through your wallet to add to the tip jar. The thinking — whether it’s about how much you can afford or how it affects your total — is meant to go out the window. It’s similar to online or in-app shopping — just press the button and move on.

It’s common knowledge that service workers generally prefer direct tips — either handed to them or sent via Venmo. But where does that fit now that cashless payment options and checkout tip prompts are more commonplace? It’s very easy for a business to add these checkout screens to their systems and to set the lowest “easy” option at a price that may be higher than you want to give. They also often make it harder for you to choose an alternative to the preset options.On these screens, the “no tip” or custom options are either smaller or lower down on the menu. And while no one is forcing you to do anything, there’s a gentle persuasion happening that doesn’t always feel right. With DoorDash, if you don’t pre-tip, you now get a warning that your food may be delayed. That makes sense if you view tipping to be an obligation rather than a choice — but for those who view tipping as a reward for good service, it can feel like extortion, too.

Wherever possible, I still try to tip in cash. At my local ice cream shop, it warmed my heart this past summer to stick my dollar in a jar labeled “Help me fund my study abroad to Italy.” It felt a lot better than a digital prompt.

2 notes

·

View notes

Text

Hi I make $5

Suze Orman: You're SLACKING! YOU SHOULD BE SAVING TWO OF THOSE DOLLARS EVERY DAY!

Jim Kramer: Oh my God guys it's a buy on Tesla (hits buttons that play bull and car crash sounds) at only $212 a share it's a complete steal. I KNOW everyone complains that all my stock predictions are wrong, but this CEO could literally be the smartest guy in history (plays foghorn sound).

Me: I haven't left the house in two weeks because everything costs money.

Mom: I can't believe you bought a coffee for $5 !!!! You could have just sat in the park!

31K notes

·

View notes

Video

youtube

💥 5 Retirement Account Mistakes That Could Cost You Big | The Suze Orman...

0 notes