#Stock market course fees

Explore tagged Tumblr posts

Text

शेयर बाजार में धाक जमाएं: NSE और BSE के स्टॉक मार्केट कोर्स से रहस्य खोलें!

NSE और BSE के स्टॉक मार्केट कोर्स: निवेश के इच्छुक लोगों, खुशखबरी! आप चाहे अनुभवी पेशेवर हों या बिल्कुल नए, भारतीय शेयर बाजारों की गतिशील दुनिया में नेविगेट करना कठिन हो सकता है। लेकिन घबराएं नहीं, स्टॉक मार्केट कोर्स की भरमार आपको एक आत्मविश्वासपूर्ण निवेशक बनने के लिए ज्ञान और कौशल से लैस करती है। यह व्यापक गाइड NSE और BSE कोर्स की पेचीदगियों को उजागर करता है, जिससे आपको अपने वित्तीय…

View On WordPress

#best stock market course in india#bse stock market course#nse stock market course#Stock market course fees

0 notes

Text

Best Trading Institute In Delhi

ISM is the best trading institute in Delhi is a highly reputable institution that provides comprehensive and top-quality training in various trading disciplines. It offers a range of courses and programs designed to equip individuals with the necessary knowledge and skills to succeed in the financial markets.

This institute stands out due to its experienced faculty, who are industry experts and practitioners with a deep understanding of trading strategies and market dynamics. They provide practical insights and real-world examples to enhance the learning experience.

The institute utilizes state-of-the-art infrastructure and advanced trading tools to facilitate hands-on training. Students have access to live trading terminals, simulated trading environments, and data analytics software, allowing them to gain practical experience and develop trading strategies in a risk-free setting.

Furthermore, ISM the best trading institute in Delhi focuses on a personalized approach to education. They offer small class sizes or one-on-one mentorship, enabling instructors to provide individual attention and customized guidance to each student. This personalized approach ensures that students can grasp complex concepts, address their specific challenges, and progress at their own pace.

In addition to theoretical knowledge, the institute emphasizes practical application. They provide opportunities for students to engage in live trading sessions, participate in simulated trading competitions, and analyze real-time market data. This hands-on experience enhances students' decision-making abilities, risk management skills, and confidence in executing trades.

Moreover, the best trading institute in Delhi offers comprehensive support services to its students. This may include career counseling, job placement assistance, and ongoing mentorship even after course completion. They have a strong network of industry connections and collaborations, allowing students to access internships or job opportunities in reputed financial firms.

Overall, the best trading institute in Delhi distinguishes itself through its expert faculty, practical training approach, advanced infrastructure, personalized attention, and robust support services. It provides a solid foundation for individuals aspiring to build a successful career in trading and financial markets.

#trading courses in delhi#which college is best for mba in delhi#target institute delhi fee structure#stock market courses in delhi fees#stock trading courses in delhi#stock market institute courses delhi (dicc)#stock market courses in delhi#best stock trading institute in delhi

0 notes

Note

so, I know you've been vending at a lot of different craft fairs and witch markets for awhile now (sadly, too far away for me to attend!). would you happen to have any tips for someone looking to do the same at their local fairs? thanks!!!!!! ❤️

Sure! To start, brush up on three things - networking, recordkeeping, and people skills. Get an idea of what's going in on your area, talk to the organizers, see what the particulars are for the events. Here are some questions to ask:

What's the venue like? (indoors, outdoors, parking, accessibility)

Do I need to bring my own table and chairs?

Is there electricity / wifi available?

What is the table fee?

When is the event and how long does it run?

Is there a theme or target audience?

Is there advertising being done for the event? (Signal boost!)

Based on the answers you get, you can start putting your stock and setup together.

Do as much as you can WAY ahead of time. If you need to make things, start now. If you need to buy things, give yourself at least a month before an event to make sure everything arrives in time. Get yourself a 6-foot folding table and a comfortable folding chair or camp chair for events where they're not provided by the venue. Sign for Paypal, Venmo, and Cashapp as well as a card payment processing service like Square to give your customers the most payment options possible. And of course, plan to carry some small bills for cash patrons. (You don't need a register or cashbox, a simple bag of appropriate size will do. I literally use a pencil case that says Resting Witch Face. Works great.)

You'll want to get some displays for your merchandise. The type will vary depending on what you have, but it should be simply and sturdy and preferably easy to pack in and out. Vertical visibility is important at these events, so if you can find some kind of stand or tiered display, that will help you get noticed. I'd also suggest some simple clear plastic standups that you can put a printout price list and a basic sign in. A table banner helps people notice your table from afar and you should definitely have business cards to hand out with your shop info and socials. (I use Vistaprint for both.) Decorations are nice, but don't overload the table with them. They should augment your setup, not overwhelm it.

You may also want to get an 8x8 or 10x10 popup canopy and canopy weights if you plan to do outdoor events. Also, GET A COLLAPSIBLE WAGON. Best investment I ever made was a $45 collapsible wagon. It fits in my backseat and makes hauling things in and out of venues SO much easier.

Keep track of everything you spend related to your endeavors, including event fees, supplies, stock, setup items, displays, signage, business cards, and gas and food on the day. Keep those receipts - you can deduct them on your taxes later to offset your earnings. (Because registering as a business can be a pain and comes with fees, but if you don't do it, you may owe money for not collecting sales tax. Put aside some money for that tax bill, just in case.)

Prep your setup and stock the night before an event. Check your merch, charge your card reader (and bring a fully-charged auxiliary power pack and cord, just in case), make any updates to your inventory or pricing that you need to. It really cuts down on stress when you're loading up if you know you've already get everything set. I suggest reusable shopping bags or clear plastic bins to make things easy to haul, plus they can double as storage.

Plan to leave as early as you need to in order to account for traffic and pit stops. Pick an outfit ahead of time so you don't have to dither over clothes. It should be something appropriate for the event and the weather that looks neat and clean and is easy to move around in, including comfortable shoes. (Look to other vendors for examples.)

Make sure you bring water, snacks, and anything you'll need to get through the day, i.e. medicine (headache pills and stomach medicine at minimum), energy drinks, a fan for hot days, an extra layer for cold ones, etc. Get to the venue as early as the organizers allow. The more time you have to park, load in, and set up, the less stressed you'll be. Make sure things are arranged in a way that's accessible and makes sense. Place signage where necessary to explain items and pricing.

GO TO THE BATHROOM BEFORE THE EVENT BEGINS. TRUST ME.

During the event, you're gonna have to do a LOT of socializing, so prepare for that as best you can. Try to stand if possible when there's a lot of foot traffic so you're more noticeable. Be personable - you don't have to grin constantly, just try to keep a pleasant expression and greet people as they pass, especially if they look in your direction. Don't be afraid to invite passersby over if they pause to check out your setup. Welcome them in, invite them to check out your stuff, and let them know you're happy to answer questions. (And ALL questions are good questions. There are no dumb questions. Even if the question is the dumbest thing you've ever heard or it's the fifteenth time you've been asked that day.) Chat and banter a bit where possible. If you can get people smiling or laughing, they're more likely to stick around and possibly purchase your wares. Make sure as many people as possible take your card when they leave.

Yes, you will be exhausted when the event is over, even if you're a naturally outgoing person, and you'll still have to break everything down, haul it out, load your vehicle, and drive home. If you happen to have somebody who can help you out, that really comes in handy.

In any case, know your own capabilities and personal limits and plan for that when you're deciding where to vend. If a venue is too far away for your comfort or doesn't have what you need or the table fee is too high (be wary of any thing over $75 for a single day event), don't sign up. If an event is too long or too far outside your target audience, don't sign up. If you don't have an appropriate setup or don't have the stock / can't get it in time, don't sign up. If something about the event or the venue or the organizers rubs you the wrong way, DON'T SIGN UP. Talk to other local vendors to get an idea of where to go and what to expect. Most will tell you right away what works, what's good, and what to steer clear of.

This is all just the basics. You'll learn a lot more when you start to vend, as far as what your individual needs are, where to go to find reliable business, and how best to connect with local venues and customers. Keep records of everything you do (spreadsheets are your friend!), network with organizers and other vendors, and practice that sociable game face.

And trust me - if a disorganized introvert with social anxiety and ADHD and absolutely NO sales experience can figure out to do this, I think pretty much anyone has a chance.

Good luck!!!! 😁

#A. Nonymousse#witch market#vendors#practical advice#witch tips#life hacks#Bree answers your inquiries

37 notes

·

View notes

Text

How To Get Started Investing In The Stock Market

Educate yourself: Before investing in the stock market, it's important to educate yourself about the basics of investing, including the different types of investments, the risks involved, and how to build a diversified portfolio. There are many resources available, including books, online courses, and investment blogs.

Determine your investment goals: It's important to have clear investment goals before investing in the stock market. Are you investing for retirement, a down payment on a house, or to generate passive income? Your investment goals will help determine the types of investments that are appropriate for you.

Open a brokerage account: To invest in the stock market, you'll need to open a brokerage account with a reputable brokerage firm. Some popular options include Fidelity, TD Ameritrade, and Charles Schwab. When choosing a brokerage firm, consider factors such as fees, investment options, and customer service.

Build a diversified portfolio: Diversification is key to successful investing. By investing in a mix of stocks, bonds, and other assets, you can reduce your risk and increase your chances of long-term success. Consider investing in a mix of large-cap and small-cap stocks, domestic and international investments, and bonds with varying maturities.

Start investing: Once you have a brokerage account and have determined your investment strategy, it's time to start investing. Consider starting with a small amount of money and gradually increasing your investments over time.

WAYS TO INVEST

There are several ways to invest in the stock market, including:

Individual Stocks: This involves buying shares of individual companies on the stock market. You can buy shares through a broker or an online trading platform.

Mutual Funds: Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks. This allows you to invest in a variety of companies with a single investment.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they trade like individual stocks on an exchange. This allows you to buy and sell ETFs throughout the trading day.

Index Funds: Index funds track the performance of a specific index, such as the S&P 500. This provides exposure to a broad range of companies and can be a good option for long-term investors.

TOOLS TO START INVESTING

Online Trading Platforms: Many brokers offer online trading platforms that allow you to buy and sell stocks and funds. These platforms typically provide research tools and stock charts to help you make informed investment decisions.

Robo-Advisors: Robo-advisors are digital platforms that use algorithms to create and manage investment portfolios for you. They can be a good option for beginner investors who want a hands-off approach.

Investment Apps: There are several investment apps available that allow you to buy and sell stocks and funds from your mobile device. These apps are often designed for beginner investors and offer low fees and user-friendly interfaces.

PLATFORMS

A few popular options:

Robinhood: Robinhood is a commission-free trading app that offers stocks, ETFs, and cryptocurrency trading. It’s designed for beginner investors and offers a user-friendly interface.

Acorns: Acorns is an investment app that automatically invests your spare change. It rounds up your purchases to the nearest dollar and invests the difference in a diversified portfolio of ETFs.

TD Ameritrade: TD Ameritrade is a popular trading platform that offers stocks, ETFs, mutual funds, options, futures, and forex trading. It offers a variety of trading tools and research resources.

ETRADE: ETRADE is a popular online broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of trading tools and resources, including a mobile app.

Fidelity: Fidelity is a full-service broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of investment tools and research resources, including a mobile app.

INVESTMENT STRATEGIES

Value Investing: Value investing involves buying stocks that are undervalued by the market and holding them for the long term. This approach requires patience and a thorough analysis of a company’s financial statements and growth potential.

Growth Investing: Growth investing involves buying stocks in companies that are expected to grow faster than the market average. This approach often involves investing in companies that are at the cutting edge of technology or have innovative business models.

Dividend Investing: Dividend investing involves buying stocks in companies that pay a dividend. This can provide a steady stream of income for investors and can be a good option for those looking for more conservative investments.

Passive Investing: Passive investing involves investing in a diversified portfolio of low-cost index funds or ETFs. This approach is designed to match the performance of the overall market and requires minimal effort on the part of the investor.

Real Estate Investing: Real estate investing involves buying and holding real estate assets for the purpose of generating income or appreciation. This can include investing in rental properties, real estate investment trusts (REITs), or crowdfunding platforms.

Options trading: is a type of trading strategy that involves buying and selling options contracts, which are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as stocks, at a specific price within a certain time frame. Options trading can be used to generate income, hedge against risk, or speculate on market movements.

Swing trading is a type of trading strategy that aims to capture short- to medium-term gains in a financial asset, such as stocks, currencies, or commodities. Swing traders typically hold their positions for a few days to several weeks, taking advantage of price swings or "swings" in the market. Swing traders use technical analysis to identify trends and patterns in the market, and they often employ a combination of charting tools and indicators to help them make trading decisions. They look for stocks or other assets that have a clear trend, either up or down, and then try to enter and exit positions at opportune times to capture profits.

TECHNICAL ANALYSIS TOOLS

There are many technical analysis resources available for traders to use in their analysis of financial markets. Here are some popular options:

TradingView: TradingView is a web-based charting and technical analysis platform that provides users with real-time data, customizable charts, and a variety of technical indicators and drawing tools.

StockCharts: StockCharts is another web-based platform that provides a wide range of technical analysis tools, including charting capabilities, technical indicators, and scanning tools to help traders identify potential trading opportunities.

Thinkorswim: Thinkorswim is a trading platform provided by TD Ameritrade that offers advanced charting and technical analysis tools, as well as a wide range of other features for traders, including paper trading, news and research, and risk management tools.

MetaTrader 4/5: MetaTrader is a popular trading platform used by many traders around the world. It provides a range of technical analysis tools, including customizable charts, indicators, and automated trading strategies.

Investing.com: Investing.com is a website that provides real-time quotes, charts, news, and analysis for a wide range of financial markets, including stocks, currencies, commodities, and cryptocurrencies.

Yahoo Finance: Yahoo Finance is a website that provides real-time stock quotes, news, and analysis, as well as customizable charts and a variety of other tools for traders and investors.

Finviz: is a popular web-based platform for traders and investors that provides a wide range of tools and information to help them analyze financial markets. The platform offers real-time quotes, customizable charts, news and analysis, and a variety of other features.

438 notes

·

View notes

Text

there's a new way to feed your favorite little terrarium pet (me)!

so first of all thank you tremendously to everyone who's donated to support me so far. i'm really amazed and grateful because it's been just enough to keep me afloat and away from the worst conditions of homelessness. yall are really, truly making a difference <3

i've made a patreon to open up another door for donations. this isn't really any different than ko-fi, except the tiers have a set price of course. i've set them to $1, $5, $10, $25 and $100 for anyone actually obsessed with me enough to drop 100 bucks a month. the main reason for this is eventually, i will likely doing video content of some kind, at which point i can actually give patrons rewards!

i believe patreon will end up being cheaper for me in terms of transfer fees, but the best way to donate is through cashapp as anything i get there actually goes into the stock market, where i've been able to make a few bucks extra here and there. thats been enough to cover the transfer fees and then some.

and of course there's still my ko-fi! the vast majority of my donations come through ko-fi, so once again thank you so much to all my subscribers there and anyone else who's helped me out!!

please keep donating and boosting 🙏

49 notes

·

View notes

Text

All Cash and No Credit

Let's talk about HYBE's strategy for Jimin's MUSE. It's pretty simple

Maximize Profit - Minimize Success

Let's break down how they're doing it.

Goal #1 is to get as many customers as possible to buy from Weverse instead of regular retailers like chains (Target, Walmart, Barnes & Noble) and online sellers like Amazon. When fans buy on Weverse, a HYBE subsidiary, the company keeps not only the wholesale portion of the album sale, but the retail portion as well. This is obvious, right? If not, I'm happy to explain. The company likely makes twice the profit (give or take) on albums purchased via Weverse. AND, they can control when those albums are shipped, and how, when, or if the sales are reported to the music charting agencies.

The fact that Target pre-sales of MUSE is sold out within hours is suspect. This indicates limited stock, just like the strategy used for Like Crazy CD singles. Meanwhile, Geffen is very slow to release the pre-sale links for other retailers. The Walmart presale just went up. Where are B&N and Amazon? Will they have limited inventory, too?

Putting Jimin's Production Diary on Weverse only was a conscious choice. The cost of the documentary was expensive - more than the monthly fee for streaming services, the company kept all the profit (didn't have to share the costs with Netflix or Disney+), and limited his exposure to the general public. I suspect they will operate the same way with MUSE.

Goal #2 Keep Jimin as low as possible on the charts. We've seen this over and over. First, by splitting Like Crazy versions and disappearing sales, no CD restocks. Then we saw the same behavior from BH/HYBE again with Closer Than This being released on the worst possible day of the year and almost zero promotion. You know the details.

HYBE will limit stock. They will likely not report all sales.

MUSE physical albums will not be eligible for UK charts because of a random inclusion. The previous four solo album releases have had specific UK versions with no inclusions. UK fans will have to rely on digital sales for charting purposes unless BH provides a new version. Dirty.

Goal #3 Promote the album just enough to garner sales from fans while minimizing advertising to the greater public. The announcement of the new album is also strange. The teaser video was only on Instagram and only on the BigHit/BTS channel (this didn't stop anyone, though, as far as I can tell) as well as Weverse (I'm getting tired of that platform). TikTok is a far more effective advertising tool when it comes to targeting young people. Why wasn't the teaser posted to TikTok? Either way, "Jimin Jimin" was trending on X/Twitter with over 1.7 million mentions many hours after the announcement of the new album. There's only so much BH can do to suppress Jimin now that fans have taken marketing him into their own hands.

Let's keep an eye on this.

What's different this time around? This time the fandom knows who is behind thwarting Jimin's success. Precious time was lost during the FACE era when everyone was blaming Jimin's sabotage on Billboard and Spotify, rather than the rightful villain - HYBE/Big Hit. This time the fandom knows to watch their every move and call them out on their shady and unequal treatment. That said, tagging Geffen, Big Hit, and HYBE on X is pretty much useless. They have shown they won't change their behavior when fans complain. Instead, fans must start tagging Billboard, Spotify, and media outlets. Media outlets are the most important. HYBE does not care about the fandom, but they do care about their public image, especially after all the damage that's been done to the company and the stock price due to the ADOR controversy and court case.

I think Jimin is going to a different label for his solo work. That's my hunch. The company is going to squeeze as much profit out of him as possible before he goes, but it's a balancing act because they don't want him to outshine Jungkook. Of course, I could be completely wrong.

25 notes

·

View notes

Text

Light Of Day - Part II - Tess/Fem!Reader

This chapter is explicit! MDNI! In which Tess' actions come back to haunt her. This work contains drinking, oral sex, and general criminality. ~3.3k words. Part I

She wallows for a while after that.

Well, not all that much changes. She’s hesitant to leave her apartment even without the humiliation of being caught—even though nobody was around to see what had happened, it was bad enough for just her to see. She doesn’t even consider whatever punk tried to attack that night—if he knows who she is, he knows not to fuck with her. No, he doesn’t matter, but her girl saw what happened. Damn it all. She’ll probably have to stop calling her that, too.

She switches to the small stock of instant coffee she keeps for special occasions, just for the week. There’s still a healthy splash of booze in the mug, naturally. Some things just don’t change.

There’s a chance what happened hasn’t been spread. Her girl doesn’t have much in the way of friends, after all—she knows that much. There’s a chance her dignity is more or less intact, her reputation untouched. Still, she can’t quite bring herself to check.

The kid across the hallway takes her cards and brings back rations. He skims a little off the top every time, butshe doesn’t kick up a fuss about it. Just writes it off as a delivery fee, or a tip, or even charity from what she knows of the kid’s family. She has enough to spare anyway. If she wanted, Tess could hide away for at least a year without selling a damn thing.

He should be back in an hour or so, as she thinks of it. Time kind of blends together when she does this- hides away from the world, watches through her little window. She’s seen her girl enter and exit the market a few times now, glancing around nervously as she should, but never looking up. Never up, thank god.

There’s a knock at her door.

She didn’t think the kid would be back with groceries so soon. He usually takes his time to avoid drawing attention. She doesn’t care one way or another, of course. As long as she gets what she paid for. “Give me a second, kiddo.”

She sets her coffee down on the countertop and reaches for a pair of basketball shorts on the couch, tugging them on before she gets the door. As much as she loves lounging around in her underwear, the poor kid doesn’t need to see that.

Clutching a lead pipe in her free hand just in case, she opens the door with a blank expression.

It’s frozen on her face when she sees her girl standing before her, shuffling her feet and pressing her lips together.

Neither of them speak, for a moment.Tess blinks, mouth falling just slightly open as she processes what’s before her. The girl looked up when the door opened, watching Tess from under her eyelashes as they took in each other’s presence.

It’s tempting to just close the door- just walk away from this situation with what’s left of her dignity, avoid confronting her childish bullshit for as long as possible.

That’s exactly what it is, isn’t it? Childish. She grimaces as the situation sets in, eyes darting around looking for some way to escape without making an even bigger mess of the situation.

“Took a lot of cards to find you,” the girl mutters after a long moment, mouth twisted up to the side as she watches the floor, like she knows exactly what Tess is thinking. If Tess manages to get out of this and they had nothing else to discuss, she would at least have to find out who talked.

“...that’s intentional.” She’s gone to great lengths to hide away from the world, to make herself a hard woman to find. Anyone looking to find her would have to look pretty damn hard, especially with the mere strands of information the girl would have had.

Before she can think about it, she steps back and holds the door open, eyes glued to the ground. The girl steps inside, glancing around, anywhere but at Tess. Once the door shuts, she doesn’t immediately lunge or reach for a weapon. It’s not much, but it’s slightly reassuring. Tess leans the pipe up against the doorframe and crosses her arms.

“...you’re Tess.”

It’s not a question, but Tess nods anyway.

“I guess I should thank you for saving me. And for all the, ah…” she trails off as she turns to face Tess, carefully looking up to meet her eye. Tess nods.

Now that the secret’s out, she realizes how creepy this probably is. It started out innocent enough; she just wanted to offer something to add a little light to the girl’s day, let her know someone…

“I can stop.”

She doesn’t get a response to that, only silence as she looks around the apartment. The sun is in her chair by now—if she didn’t have a guest, she’d be sitting there, sans shorts, finishing off her coffee, basking in the sun. She doesn’t stop the girl from meandering over to the window, leaning over the chair and catching a glimpse of the market view. Looking back up to Tess, she scuffs the ground with her boot.

“...what do you want from me?”

“What do you want from me?” Tess can’t help herself from snapping just a bit, crossing her arms. “You haven’t humiliated me enough?”

“Humiliated you?” She raises an eyebrow, glancing up at the ceiling as she thinks. “If I remember right, all I did was open the door. If you’re embarrassed, that’s not on me.”

They’re both silent again, each of them back to avoiding eye contact.

“What do you want from me? If you’re trying to pay me for something, I don’t know what it is. I can’t offer you anything.” Her eyes widen, hands raised.

Oh.

She hasn’t made her intentions clear. Here’s a chance to correct that—or a chance to back out. Before she can decide what to do with the misunderstanding, she can’t help herself.

“You think I’m trying to pay you?”

The girl looks lost and exasperated as her theory falls apart, and goes back to looking around once again. Still, she doesn’t try to attack. Tess stays rooted to the ground.

“...why else would you give me shit?”

She stares at the girl, taking in the first real look at her face. It’s not obscured by a window, a hood, weather, or the corner of her own eye as she tries to be coy. Her usual silence, easily mistaken for shyness, has been replaced with distress. Tess should have known the anomaly of a random gift would have set her on edge. But those thoughts are far off, on the back burner of her mind. Christ, she’s a vision.

The look on her face must betray her as realization dawns.

“I’ll stop.” Tess mumbles, gritting her teeth.

“You-”

Tess jerks open the door beside her, stepping aside and watching the ground, furious with herself as her face heats up. “I’ll stop.”

That would be the end of it, then. Tess would sell off her box of gifts, respectfully look away when the girl entered the market, and never know her middle name or how she liked her coffee. She would likely never know those things anyway, but it was a nice fantasy to hold on to while she had it. It felt ridiculous, sure, but it was easy enough to justify- everyone needs a thought to fall asleep to, right? Some small comfort in a world of terrors? There was no harm in it. And now it’s over.

A soft hand rests on the wooden door, pushing it shut. Tess can’t bring herself to look up.

“Is it Tessa?”

Tess looks up, eyebrow raised. She’s watching, lips pressed together as she waits for an answer.

“Theresa.” The few girlfriends she’s had over the years called her Tessa on occasion, but that doesn’t feel like what she’s asking.

“Theresa,” the girl repeats, giving her a slow once-over. She doesn’t look nearly as confused as she did just moments ago. Meanwhile, Tess is sure she’s lost the plot. Her brow knits together, lip slightly curled, as she tries to figure out what exactly the girl is getting at. “From what I’ve heard, you’re not exactly shy. Did you just…not want to talk to me?”

“I…” She’s not sure how to explain herself. She never really questioned what she was doing or felt the need to justify herself. She thought nobody would ever ask why. Why would they? Her head shakes vacantly, still denying the situation. “I’ll stop.”

“I didn’t ask you to stop.” She steps forward, silently coercing Tess away from the door. Tess lets the girl herd her a few feet back into the apartment, curious to see where this is going. “Asked why you didn’t just talk to me.”

One hand comes up to Tess’ shoulder, guiding her up against the wall. She lets it happen.

“Didn’t want to scare you off.”

“You think you’re scary?”

Her immediate instinct is of course. It feels like a stupid question—she fucking runs Boston on reputation alone by now, men twice her size have nightmares about her, even Joel caves to her.

But her girl might not know about all of that.

To her, Tess is just a mystery. Some random, anonymous older woman with a very strange way of flirting. Some part of her demands a rabid correction—I think I’m fucking terrifying. You should too. But if this goes her way, if she really has a shot with this girl… that might not be the first impression she wants to make. The whole reason she put herself through these hoops was to avoid scaring her. Why come all this way just to blow it when she’s so close? So close to…something.

“I think people are scared of me.”

The girl tilts her head, reaching up to push a few strands of hair out of Tess’ face. Her cool fingers skim over the freckles on Tess’ cheek, the first kind touch she’s received since her last fling wanted more than she could give. She melts at it more than she’ll admit, looking down at the hand in the corner of her eye. The feeling in her chest is almost forgotten, but not fully lost. Defrosting.

She takes Tess’ hands in her own, running her thumbs over the marred skin, and pulls them forward. Tess stays stubbornly pressed against the wall as her hands are brought to rest on the girl’s waist, flesh giving way as she curls her fingers on instinct.

“I think you’re scared.” She’s close to a whisper as her arms loop around Tess’ neck, pulling them together. As though she didn’t just throw out an accusation that could easily get Tess killed.

Maybe she meant it as a challenge, maybe she didn’t. Regardless of what she hoped to accomplish, all it does is make something coil tight in Tess’ chest.

She breaks.

The girl’s lips are so soft. She’s pictured this many times, while falling asleep, zoning out on a shift, listening to the rain on her window. Despite the corner she’s backed Tess into, she’s modest with her affection, both of them getting a sense of the other before they move forward. As the girl sinks into her, her hesitations fizzle out as if they never existed at all. Tess’ arms wrap around the girl’s waist, one supporting her upper back as she pushes off from the wall. Her girl arches the small of her back, hips pressing into Tess as they stumble together to the couch.

Her girl isn’t exactly shy, but Tess doesn’t hold back. It’s not long before they’re kissing like this isn’t their first time—like they’ve been together for months, years even, like this is just one of many nights with each other. Like they’ll have all the time in the world to do it again, and again, and again.

A hand teases at the edge of Tess’ tank top- she lets the girl wander, lets her explore the skin beneath with a mild hand, but she pulls away for only a moment to mutter, “Leave it on.” If this is her only shot, she’s not about to waste it on her own pleasure.

Once Tess has laid her on the futon, she raises her arms, spread out for Tess like she’s not scared in the slightest. Like she carries no regard for the cross of a reputation Tess bears—like she’s trustworthy.

“My name-”

“I know your name.”

Tess cuts her off, kissing across her collarbones as she chuckles. “Bit of a stalker, huh?”

Looking up from under her eyelashes, Tess shrugs impassively, tugging the girl’s shirt off and onto the floor. The fabric is worn and thin, soft under Tess’ hands.

“Just… took an interest.”

“Should I be nervous?” The girl smirks, undoing the button on her jeans with one hand, stroking Tess’ hair with the other.

“Oh, very.” Tess nips at the supple skin of her breast, leaving behind a barely noticeable mark. Her knee nestles up between the girl’s legs, something firm for her to grind down on. She takes advantage, eyes flickering shut as she exhales. It’s the first visible sign of pleasure Tess has pulled from her, and she quickly remembers how enticing the feeling of success is. So quickly it grows on her, sidles up alongside her veins, making itself at home with her desire. It’s almost parasitic, something new and demanding inside her that will never part.

Her girl pulls away before long, giving Tess the chance to tug her jeans off and push them aside. She takes a moment to admire what she sees before moving on; gray cotton panties, worn thin with loosening elastic along the waistband, dewy wetness gathering in the defined notch Tess can trace with her fingers. She does, roughened fingertips testing the slight give of her flesh, how it yields to her touch. All motion has stopped, her girl now frozen on the couch, barely breathing at the touch. When Tess notices, her fingers stop, forcing a breath out of the girl.

“You’re a fucking tease.” She whispers as her chest falls, tucking her thumbs into the waistband of her underwear. “Do something or I’m going home and getting myself off.”

“No, you won’t.” She pushes the girl’s hands away and begins the slow tug to remove her underwear, world narrowing to the sight. Thin, faded stretch marks adorn the skin she runs over, the swell of her thighs resisting the drag of the fabric ever so slightly. It’s mesmerizing, especially the stretched seconds of the gusset pulling off her already soaked cunt. “I don’t think you’re going anywhere,” Tess whispers, the girl’s panties hanging off her finger before she sets them down on the coffee table. She won’t be getting them back, whether she likes it or not. “You didn’t come all this way to just go home and get yourself off.”

She backs up on the couch, positioning the girl’s legs over her shoulders and adjusting until she’s comfortable. It’s familiar, muscle memory by now, even if she hasn’t taken anyone to bed in some time now. It doesn’t matter—she couldn’t forget this if she tried. Tess kisses the skin of her thighs before licking up her slit, gathering the wetness on her lips before pushing forward.

Tess has to hold her hips tight to keep her stable on the couch, the girl’s back arching as Tess buries herself between her legs. She sounds like she can’t quite catch her breath, fighting to exhale as Tess refuses to let up. One leg kicks at the air behind Tess’ head before curling into her back, pressing her closer; she finally breathes out a broken moan as Tess circles around the girl’s clit. She feels fingers on her hairline, cautiously pushing up until her girl has a bit of control over Tess’ head. She doesn’t take advantage of it, just keeps both of them steady, keeps Tess where she wants to be.

“Tess—” the girl mewls, shuddering as tension builds. Her muscles threaten to cramp under Tess’ fingers, legs held out of the way. She pushes her tongue inside as she mindlessly works out the kinks and knots in the girl’s thighs. She responds with a harsh tug on Tess’ hair, one she’s tempted to punish, but she’s willing to let it slide for the wail she lets out. No sense in getting too… depraved. Not when it’s the first time really has the girl’s attention.

The girl audibly chokes and squeezes her legs around Tess when she cums, ankles locking behind her. Tess buries her tongue further inside, not daring to change a thing. If this is the last time she gets to speak to her, the last episode of this weird little situation they’ve made for themselves, she’s not going to ruin it. She exhales in relief as she feels the grip on her hair tighten, then ease. They sit there for a moment after she stops trembling, Tess’ head tilted against her thigh, watching her chest rise and fall. The hand on her head gently releases her hair, brushing through the bands of gray and pushing them out of her face. She’s not looking down at Tess, one arm tossed over her eyes as she recovers.

She almost wonders if her girl has dozed off—her breathing is rhythmic and steady, she makes no effort to move or address Tess. Still, she can’t complain. There’s a strong possibility that she’ll never see the girl again, neither of them will ever stoop to this low again. Tess, with her stupid crush, and her girl, fucking a borderline stalker. As much as she hates to admit that that’s what she is.

After a few minutes of silence, she starts to shift. Tess sits up to give her room to move. Looking over to the coffee table, she grabs a hair tie, pulling half of her hair back out of her face. She probably should have done this sooner, but she likes to give her partners something to grip on to—tt’s part of the fun. She also takes a cigarette off the table, lighting it up and taking a drag as the girl sorts through her clothes on the floor. Tess catches the moment when she sees her panties on the table, looks over to Tess in the corner of her eye, and stands to pull her jeans on. She’s glad she doesn’t say anything—those belong to Tess now, one way or another.

She fights with the breaking clasps of her bra before Tess stands and helps her, smoothing her hands over the straps and fixing a twist where she wouldn’t be able to reach. The girl lingers before picking up her shirt, looking at Tess over her shoulder and smiling before bending at the waist. It puts them in a suggestive position as Tess’ hand drags down her skin, settling on the small of her back, her other hand holding the cigarette off to the side. Tess tries to commit the sight to memory, just a few seconds to keep to herself when this fledgling affair dies quietly in the water.

When she stands and pulls her tank top back on, she turns and tucks two fingers into Tess’ waistband, pulling her in.

“Am I out of your system by now?”

Tess looks over her again, eyeing her with a starving gaze. “Not a chance.”

The girl gets up on her toes one more time to kiss Tess, wrapping an arm around her neck to pull her in. “You know where to find me. Next time, I might just let you in.”

With that, she turns and walks out the door, shutting it behind her before Tess can say a word.

At LAST, I finished it! Got this request MONTHS ago, but writer's block is a bitch. I'm technically open to a part III, but I have other projects in mind, so it's not super likely. Feel free to say hi or drop your thoughts in my askbox, check out my AO3 or my about me if you're interested!

#the last of us#fanfiction#tess servopoulos#tess x reader#tess servopoulos x reader#x reader#tlou tess#tess/reader#tess#tess servopoulos/reader#tess tlou#tlou#tess the last of us#the last of us hbo

26 notes

·

View notes

Note

“My sense is that Meghan's market is more of the TJ Maxx demographic.” Interesting assessment of Meghan’s market. From a business perspective, brands who end up at TJMaxx, Marshalls, etc. (owned by the same company TJX) are typically bought in due to 1) supplier has made too much (overstock) and it isn’t selling 2) it’s getting close to the end of its expiration dates (close out) and it sold in at a much cheaper cheaper price to TJX. She’d still need a regular place to sell before she tries to offload (usually at a much lower margin / maybe even a loss) to TJX. I’m basing this on my experience with working in food industry and resorting to these retailers for the same reasons.

Exactly my point. The TJX brand is the end of the line for so much product and merch these days (especially fast fashion) that it's inevitable Meghan's products will end up there if this turns into the deal she wants to be. The key thing is that she needs product first. That she launched without a real product is very telling.

To me, what I think it says is that she's not getting the investors or partners that she wants so she launched ASAP to use the media's hype as part of her negotiation or recruitment strategy. (In addition to taking advantage of Kate's absence, of course.)

I made a suggestion in an earlier post that Meghan's competitors are the socialite/influencers that are launching their own brands or already have brands. A great many of those brands use print-on-demand dropship merch. They save on overstock storage and production fees by only keeping a limited selection in stock and marking up their own prices to cover "demand."

I see Roop heading in that direction. If they can't find a distribution vendor (e.g., Kohls, Target, Macy's, etc.), they'll do dropshipping but at such low quantities they always sell out - which is the same tactic Meghan uses when she wants to be a fashion influencer (she wears something already heavily discounted and with so little stock that she can take credit for "selling out").

What is interesting, and why I think Roop has a good argument for exclusivity with TJX companies, is Rae Dunn. Most of her product is sold exclusively through TJX and she has a deal with a company called Magenta Inc., an online retailer that's thought to be behind Rae Dunn products in places like Amazon and Walmart.

So there's precedent for Meghan/Roop to sell exclusively with TJX, with perhaps a side deal for an online storefront like Magenta offers. But that's not the audience or market Meghan wants (even though she herself is the "wine mom" elder millennial motivational-quote-spouting stereotype that buys Rae Dunn and shops at TJX stores so it's a natural fit). She wants Roop in luxury marketplaces that prices out the very people who would actually buy Meghan's product.

She's stuck between a rock and a hard place. I think she realizes it now while watching the metrics on social media plateau from a total lack of engagement and total absence of content (hence throwing Mandana under the bus in Page Six). Which is surprising. Given the way she rolled out Sussex.com with the IG Vancouver kickoff - four or five days straight of new Sussex content and material - I expected the same thing with Roop; 1st day - social media launch, 2nd day - lunch papwalk, 3rd day - product launch, 4th day - "checking out my product" charity visit/papwalk, 5th day - Netflix cooking show promo, and so on.

I know, I know. Stop giving her ideas. I'm trying!

27 notes

·

View notes

Text

Privately judging and laughing at every first year event with the nerve to charge vendors $300+

Listen

To all you first-time event coordinators out there

Yes, okay, the vendor fee is, in a literal sense, meant to help pay for the space

BUT

It also a promise to all of your vendors that they will make at least that much money in sales during your event.

No matter what they sell, how niche, how small, how cheap. Whether they're selling $2 stickers of state birds, or fully framed fine art paintings.

Because here's the thing! Vending is a huge investment! Not just financially, but also an investment of time and energy. You have to make/buy stock, loading up their vehicle, traveling, unloading the vehicle, setting up displays and stock and sometimes tables and chairs (oh you better be providing a table and at least 2 chairs for $300), you have be in customer service/salesman mode for anywhere from 3 to 10 hours at a time, if it's a multi-day event depending on the venue you might have to pack up your stuff every night and set it up all over again in the morning, then of course there's the load out and traveling home.

It's a lot! And on top of that there's also just the financial cost of traveling, because even if you're local you still need food and are probably using gas to get to the venue with all your stuff. But if you're traveling from further away there's also tolls and hotel and parking fees!

Vendors just aren't gonna come if they can't be pretty confident that they're going to make those costs back. And $300 is also a lot for the kinds of self-employed, small businesses, individual makers who usually vend at these events!

So if you're charging $300+ you better have a solid idea, an experienced event organizer, a sure customer base, and a KILLER marketing strategy.

Because for a new event? Folks are only gonna give you one chance, and if they don't even break even? Especially if they're communicating with other vendors and hearing that a lot of vendors didn't break even? Not only are THEY not coming back? They're also warning folks in their circles away from your event. 'Cause none of us wants any other small business/maker essentially throwing that much time, energy, and money right down the drain.

7 notes

·

View notes

Note

Tips on becoming a freelance portfolio/ investment manager for private wealthy clients.

I’ve got a bit of experience as an assistant Portfolio manager, and I’ve been looking into starting my own business working with private wealthy individuals client.

There's so much to this, this is the shortest I could keep my answer:

Build Your Foundation:

Hone Your Skills: Sharpen your investment analysis, portfolio construction, and risk management knowledge as much as you can. Maybe consider courses or certifications to fill any gaps and boost your credibility more.

Define Your Niche: Are you drawn to specific asset classes (tech stocks, real estate, etc.) or client types (retirees, entrepreneurs)? Specializing adds value. This will boost referrals.

Get Regulatory Clarity: Depending on your location, there might be licensing or registration requirements for freelance advisors. Do your homework to stay compliant and track any changes.

Marketing and Client Acquisition:

Build Online Credibility: A polished LinkedIn profile and a basic website showcasing your expertise and background are essential. Network strategically!

Content is King: Share insightful market commentary through blog posts or a newsletter. You can try all the other social platforms as well. This establishes you as a thought leader and attracts potential clients.

Target the Right Audience: Where do your ideal clients hang out (online and offline)? Charity events, industry conferences, upscale networking groups – be where they are.

Leverage Your Existing Network: Don't underestimate the power of your current contacts. Let clients, colleagues, and friends know about your new venture(optional).

Operational:

Pricing Model: Will you charge hourly, flat fees, or a percentage of assets under management? Consider your services and market rates.

Tech Tools: Invest in the right software for portfolio management, reporting, and client communication to streamline your workflow.

Contracts and Compliance: Have a lawyer draft airtight client agreements that protect you both.

Bonus Tips:

Get a Mentor: Connect with a seasoned advisor who can offer guidance and share their experience.

Start Small and Scale: Begin with a few strategic clients, and as your expertise and reputation grow, expand your clientele.

Embrace the Freelance Mindset: Be prepared for the hustle; managing your own business requires discipline and adaptability.

Remember, building a successful freelance practice takes time, dedication, and top-notch client service. Stay passionate, stay focused, and let your expertise pave the way to becoming a trusted advisor for your wealthy clientele.

16 notes

·

View notes

Text

To save the news, shatter ad-tech

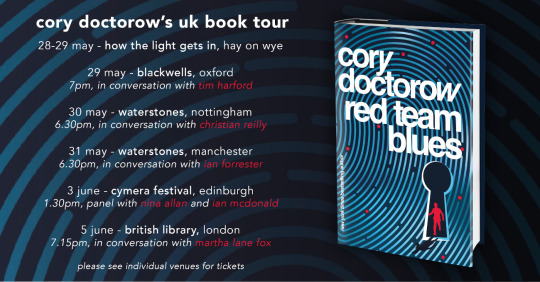

I’m coming to the HowTheLightGetsIn festival in HAY-ON-WYE with my novel Red Team Blues:

Sun (May 28), 1130h: The AI Enigma

Mon (May 29), 12h: Danger and Desire at the Frontier

I’m at OXFORD’s Blackwell’s on May 29 at 7:30PM with Tim Harford.

Then it’s Nottingham, Manchester, London, Edinburgh, and Berlin!

Big Tech steals from news, but what it steals isn’t content. Talking about the news isn’t theft, and neither is linking to it, or excerpting it. But stealing money? That’s definitely theft.

Big Tech steals money from the news media. 51% of every ad-dollar is claimed by a tech intermediary, a middleman that squats on a chokepoint between advertisers and publishers. Two companies — Google and Meta — dominate this sector, and both of these companies are “full-stack” — which is cutesy techspeak for “vertical monopoly.”

Here’s what that means: when an advertiser wants to place an ad, it contracts with the “demand-side platform” (DSP) to seek out a chance to put an ad in front of a user based on nonconsensually gathered surveillance data about a potential customer.

The DSP contacts an ad-exchange — a marketplace where advertisers bid against each other to cram their ads into the eyeballs of a user based on surveillance data matches.

The ad-exchange receives a constant stream of chances to place ads. This stream is generated by the “supply-side platform” (SSP), a service that represents publishers who want to sell ads.

Meta/Facebook and Google both the “full stack” of ads: they represent buyers and sellers, and they operate the marketplace. When the sale closes, Googbook collects a commission from the advertiser, another from the publisher, and a fee for running the market. And of course, Google and Facebook are both publishers and advertisers.

This is like a stock exchange where one company operates the exchange, while serving as broker and underwriter for every stock bought or sold, while owning huge amounts of stock in many of the listed companies as well as owning the largest companies on the exchange outright.

It’s like a realtor representing the buyer and the seller, while buying and selling millions of homes for its own purposes, bidding against its buyers and also undercutting its sellers, in an opaque auction that only it can see.

It’s a single lawyer representing both parties in a divorce, while serving as judge in divorce court, while trying to match one of the divorcing parties on Tinder.

It’s incredibly dirty. These companies gobble up the majority of every ad dollar in commissions and other junk fees, and they say it’s because they’re just really danged good at buying and selling ads. Forgive me if I sound cynical, but I think it’s a lot more likely that they’re good at cheating.

We could try to make them stop cheating with a bunch of rules about how a company with this kind of gross conflict of interest should conduct itself. But enforcing those rules would be hard — merely detecting cheating would be hard. A simpler — and more effective — approach is to simply remove the conflict of interest.

Writing on EFF’s Deeplinks blog this week, I explain how the AMERICA Act — introduced by Senator Mike Lee, with bipartisan cosponsors from Elizabeth Warren to Ted Cruz (!) — can do just that:

https://www.eff.org/deeplinks/2023/05/save-news-we-must-shatter-ad-tech

The AMERICA Act would require the largest ad-tech companies to sell off two of their three ad-tech divisions — they could be a buyer’s agent, a seller’s agent or a marketplace — but not all three (not even two!). This is in keeping with a well-established principle in antitrust law: “structural separation,” the idea that a company can be a platform owner, or a platform user, but not both.

In the heyday of structural separation, railroad companies were banned from running freight companies that competed with the firms that shipped freight on their rails. Likewise, banks were banned from owning companies that competed with the businesses they loaned money to. Basically, the rule said, “If you want to be the ref in this game, you can’t own one of the teams”:

https://www.eff.org/es/deeplinks/2021/02/what-att-breakup-teaches-us-about-big-tech-breakup

Structural separation acknowledges that some conflicts of interest are so consequential and so hard to police that they shouldn’t exist at all. A judge won’t hear a case if they know one of the litigants — and certainly not if they have a financial stake in the outcome of the case.

The ad-tech duopoly controls a massive slice of the ad market, and holds in its hands the destiny of much of the news and other media we enjoy and rely on. Under the AMERICA Act’s structural separation rule, the obvious, glaring conflicts of interest that dominate big ad-tech companies would be abolished.

The AMERICA Act also regulates smaller ad-tech platforms. Companies with $5–20b in turnover would have a duty to “act in the best interests of their customers, including by making the best execution for bids on ads,” and maintain transparent systems that are designed to facilitate third-party auditing. If a single company operated brokerages serving both buyers and sellers, it would need to create firewalls between both sides of the business, and would face stiff penalties for failures to uphold their customers’ interests.

EFF’s endorsement of the AMERICA Act is the first of four proposals we’re laying out in a series on saving news media from Big Tech. We introduced those proposals last week in a big “curtain raiser” post:

https://www.eff.org/deeplinks/2023/04/saving-news-big-tech

Next week, we’ll publish our proposal for using privacy law to kill surveillance ads, replacing them with “context ads” that let publishers — not ad-tech — control the market.

Catch me on tour with Red Team Blues in Hay-on-Wye, Oxford, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/25/structural-separation/#america-act

EFF's banner for the save news series; the word 'NEWS' appears in pixelated, gothic script in the style of a newspaper masthead. Beneath it in four entwined circles are logos for breaking up ad-tech, ending surveillance ads, opening app stores, and end-to-end delivery. All the icons except for 'break-up ad-tech' are greyed out.

Image: EFF https://www.eff.org/deeplinks/2023/05/save-news-we-must-shatter-ad-tech

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#how to save the news#money talks bullshit walks#googbook#ted cruz#news#big tech#eff#monopoly#structural separation#america act#link taxes#mike lee#elizabeth warren#ad-tech

75 notes

·

View notes

Text

Advanced Tips and Tricks for Global Market Trading

Trading in the global market can be both exciting and profitable if you employ the right strategies. Whether you're dealing with Forex, commodities, or other investments, these advanced tips will set you up for success.

Master Technical Analysis: Technical analysis is crucial for predicting market movements. Learn to read charts and use indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help you identify trends and make informed trading decisions.

Choose the Best Trading Platform: Selecting the right trading platform is essential. Look for platforms that offer real-time data, analytical tools, and a user-friendly interface. Good platforms also provide educational resources and excellent customer support.

Diversify Your Investments: Diversification reduces risk. Spread your investments across different asset classes like Forex, commodities, and stocks. This approach ensures that your portfolio is protected from market volatility.

Stay Updated with Market News: Keeping up with global news, economic events, and market trends is vital. Regularly read financial news and reports. Use economic calendars to track important events that might impact your trades.

Implement Risk Management Strategies: Effective risk management is key to long-term success. Use stop-loss orders to limit potential losses and ensure no single trade can hurt your portfolio too much. This way, you can trade with confidence.

Follow Expert Insights: Industry experts and analysts provide valuable insights. Platforms like TradingView and social media channels can offer advanced strategies and techniques. Learning from these experts can enhance your trading approach.

Use Automated Trading Systems: Automated trading systems can execute trades based on pre-set criteria, helping you take advantage of market opportunities without constant monitoring. Understand the algorithms and monitor their performance regularly.

Focus on Continuous Learning: The trading world is always changing. Participate in webinars, attend workshops, and take online courses to stay updated with the latest strategies and trends. Continuous learning helps you stay ahead.

Monitor Your Performance: Regularly review your trades and performance. Keep a trading journal to track your decisions, outcomes, and lessons learned. This practice helps you improve your strategies and avoid repeating mistakes.

Partner with Reliable Brokers: Choosing a reliable broker is crucial. Look for brokers with competitive spreads, low fees, and robust security measures. A good broker provides the tools and support you need for successful trading.

Trust APM for more expert insights and trading solutions.

5 notes

·

View notes

Text

Investing 101

Part 4 of ?

What to Buy

I've been procrastinating this post because I have a broker who provides buying/selling recommendations to me as I'm not an expert. Having said that, I can provide some information.

The first decision to make is whether to buy stocks or bonds. I explained the difference between the two in previous posts but I should add a caveat. Normally bonds are considered a safe but lower return investment to balance your portfolio and reduce risk. The moves by the Fed to control inflation however have raised interest rates on bonds to levels not seen in >40 years. For the first time in a long time, very safe bonds (ex. US Treasuries) are yielding more than equities and you can lock in those rates for a long time. Normally I'd advise a young person to avoid any bonds, but this is a strange time and some bonds would be a good investment for almost anyone. As with stocks, you can buy individual bonds or a bond fund.

What is a fund? Let's imagine that you want to own a basket of tech stocks (or bank stocks or consumer goods stocks, etc.). You could research various companies and make your purchases or you could buy a mutual fund. Mutual funds are actively managed investment pools with specific investment philosophies (ex. focused on tech stocks) - you purchase shares in the fund and the fund manager uses your money (and the $$ of other fund investors) to buy/sell shares in accordance with the philosophy/purpose of the fund. Actively managed means that there is a management team doing investment research and then buying and selling shares. Of course the management team costs money and they deduct their fee from the earnings pool prior to distributing the fund's earnings back to the owner/investors of the fund. Fund managers argue that their active management improves your earnings while lowering your risk. Detractors argue that management fees are too expensive and over the long run, investors can do better on their own (more on that later). Management fees aren't regulated (that I'm aware of) so investors have to be cautious - some funds have very expensive management fees while others are more frugal. Morningstar is a great resource for researching investments of all types, including funds.

An alternative to a Mutual Fund is an Index or Exchange Traded Fund. These funds are designed to mirror the composition and performance of an entire stock exchange (ex. NASDAQ). So if the NASDAQ goes up 10pts today, the related Index or Exchange traded fund will also go up 10pts. This is a low cost way to invest in the performance of the overall market. Many advisors recommend these investments for superior long term growth. These funds aren't actively managed by a human, but their low cost makes them a winner.

Speaking of humans, AI managed funds are increasingly a hot topic. I may own some of these funds and not even know it, but I'm not seeking AI management. In fact, automated trading can be problematic and cause 'flash crashes' for the market when every AI algorithm tries to sell at the time.

Target Date funds are another kind of mutual fund which is increasingly popular in 401Ks and 529 college savings plans. A target date fund is designed to manage risk and volatility with a specific life goal in mind. For example, you might establish a goal retirement date of 2040 and buy a Target Date fund for that year. The 2040 fund will automatically invest in higher risk/higher return equities in the first 20 years and gradually shift more of the portfolio to lower risk investments (like bonds) as your target date approaches.

Money market funds are a very low risk way to earn better returns on your emergency fund cash than allowing it to wallow in a bank savings account. A money market is a kind of mutual fund, but it owns very safe investments - the odds are very small that you'd lose money and instead you'll have a very liquid, safe investment that you can use in case of emergency.

What about individual stocks? Some investors follow the simple strategy of buying the stocks of companies whose products they know and admire. Ex, "I like my iPhone so I'm going to buy Apple stock." In >30 years of investing I have never purchased an individual stock. My rationale is that there is an entire industry of very smart people who do nothing but research and invest. The odds that I can outsmart them and pick a company which everyone else has undervalued are small. If I've read about it in the Wall Street Journal, so has everyone else and the opportunity to buy something cheap is long gone. In my opinion, buying individual stocks is like going to Vegas - of course you will hear stories of big winners, but in general the house (full time investment professionals) always wins. For a non-professional like me, the odds of selecting individual stocks and assembling a winning portfolio over the long term aren't in my favor.

17 notes

·

View notes

Text

Lili opens her first bank account

Lili keeps all of her money in socks in her locker at the club. With the increase of dancers being hired, it is time to secure the money. Lili heads to bank and discusses opening an account. The minimum amount of money needed to open the account is $100.

Lili: Thank you so much sir. Where do I sign?

Banker: Ok let me print out the documents and I will be right back. We are happy to have you as a client.

The night before Lili counted her money. She has managed to save $15,000. After a few moments the banker returns with the forms.

Banker: Alright, I just need your signature here. If you are interested, we can help you open an investment account.

Lili: What would that be?

Banker: Stocks and bonds. You have enough money here to invest in a few bonds. It would increase your money. It is all dependent on the wellness of the market. If you hire me, I can manage it for you.

Lili: Well, I don’t want to invest all of it. Can I do.... $2,000.

Banker: Of-course. You can always contribute whenever you want. I will just need your signature here. This is the website you can login to keep track from home. This is our number if you have any questions.

Lili: This is so exciting! Thank you so much. Oh, I do have one question. What is your charging fee to maintain my investment account?

Banker: 1% right now since you have a small account. As the account grows, my fees will as well.

Lili: Ok thank you.

Banker: One more thing, you can look at this pamphlet about investing. This includes the list of companies you can invest in.

Lili: Great. I will look into it. Have a great day!

BEGINNING OF STORY

Youtube

22 notes

·

View notes

Note

I think most americans look at a house as a primary store of wealth because there isn't really anything else available to store wealth in.

If you keep your money in a bank, you are losing single digit percentages of value every year (or double digit last year depending on how you do the math). Stock market investments are dubious on the best of days if you don't already possess the vast quantities of wealth needed to mitigate risk effectively, and most americans alive today have lived through multiple major recessions now, they know exactly how bad those can get. Motor vehicles don't typically last longer than a decade and a half even with the best maintenance possible, and other big ticket items that hold onto value well like businesses or resource rich property are inaccessible to someone who isn't interested in dedicating themselves to maintaining them.

By contrast, a house is something you benefit from very directly by owning, will maintain by virtue of needing to live in it, and are offered a variety of legal protections and insurance options to mitigate much of the risk of ownership. It may not make for an ideal society, but it does make sense from the perspective of someone who would like to try and actually accumulate wealth during their lifetime.

I do get the appeal of homeownership from a flexibility and personal benefit thing, not having to wait for some asshole to tell you you can't hang pictures is great, but I think for every person who values control over their home, there's someone else who just wants a place to live for the next two years.

The faulty instinct is that the house is the valuable part, as noted by that article. Buying a house as a store of value only works if the land it's on goes up in value. Buying land in bumfuck nowhere because you want to buy a house isn't a good idea, and buying land in a valuable area is probably beyond most people who are worried about where to direct their very limited funds.

I'm not as convinced as you about the idea that a modern diversified index fund is worse than landownership (especially for the non-ultra-wealthy) for your median American living in suburbs outside of high-demand city centers. I'm also not sure land is much less resilient to financial crashes, especially if you're still paying off your mortgage on pre-crash pricing.

Any idiot can invest in your basic Vanguard mutual fund without having to save up $25+k on a downpayment, versus what, like $2000 minimum initial investment for Vanguard? I don't know what S&P500 minimums are like. And they strongly tend to beat inflation year on year without the ongoing costs of home maintenance, bubble risk, and risk of just getting a crap location that doesn't improve.

That's to say nothing of significant transaction fees, land and property taxes, and overhead if you ever need to move homes. It's also much easier to continuously siphon off a little money to put into a mutual fund than it is to add money to a house.

Of course, stock prices crash, but that tends to coincide with housing price crashes, and it's harder to weather out a housing price crash with a huge mortgage to pay off than it is to weather leaving your investments to recover, especially if you're dealing with them in the long view. There's definitely certain situations where a house is a sensible investment but I think that's rarely the best reason to buy a house.

13 notes

·

View notes

Text

So I don't know nearly enough about MLMs (multi-level marketing not men-loving men) as I thought I did.

I just learned of an entire like stock market MLM, it's mainly directed at men.

Now I don't understand their entire downline system but they sell these courses you spend nearly 200+ dollars a MONTH. Not yearly A MONTH.

Also when you do get to the point of the actual stock exchange that 250+ a month doesn't actually cover broker fees.

Like if I'm paying 250 a month for a course on stock exchange I want the broker fees covered.

Also this heavily targets, of course, college students and usually POC and namely young black men.

4 notes

·

View notes