#Stellar Price Analysis

Explore tagged Tumblr posts

Note

Other than disco Elysium what games have you played that really touched you or left a mark?

Ico is the all-timer for me. The Last Guardian moved me immensely too, its bugs aside. Part of the Team Ico games' strength is in how much it leaves open for the player to transcribe meaning onto. I find it's very hard for me to be impressed by the writing of a game. Who's Lila is a recent one that has really burrowed into my brain (and I recommend Flawed Peacock's Youtube analysis of it as well) and allowed me to think about selfhood in a new way. Life is Strange gets knocked for crappy dialogue writing pretty often, but I found the relationships and atmospheres so compelling and recognizable that it meant a lot to me. (I have a lot in common with Chloe Price, and see so many of my friends in her, Max, and Rachel Amber). Soma is incredibly haunting and one of the few science fiction games that has real intellectual integrity with regard to its core premise. Immortality is a culmination of so many of the skills Sam Barlow has been honing for the past decade-plus, so it's best taken in after playing all his other games (Flawed Peacock's recent video on the game is also just stellar, god I love that guy). Hatoful Boyfriend is also far more deep than it gets credit for -- stick around for the end game. And of course, Metal Gear Solid gets me as the living embodiment of the gay hanged man / duplicitous bitch revolver ocelot (I especially love 3 and the better moments of 5).

52 notes

·

View notes

Text

‘Horrible’ Painting Found by a Junk Dealer Could Be a Picasso Worth $6 Million

An Italian family had long debated throwing away the unconventional portrait.

It’s not often you sit down to read a book about the greatest masterpieces of art history, then look up to find a stellar example hanging on your own wall. Yet this was apparently the experience of Andrea Lo Rosso, who began raising questions about a peculiar painting in his parents’ living room at their home on Capri in Italy. Could it possibly be by Picasso, the forefather of Modern art himself?

For years the man’s parents had argued over the unconventional portrait, which was discovered by his father Luigi Lo Rosso in the cellar of a villa in Capri 1962, given a cheap frame, and put on the wall. This did not please his wife, who despaired at the female sitter’s strangely contorted face. The scrawled name “Picasso” in the top left hand corner meant nothing to either of them.

“My father was from Capri and would collect junk to sell for next to nothing,” Lo Rosso told the Guardian. “He found the painting before I was even born and didn’t have a clue who Picasso was. He wasn’t a very cultured person.”

“My mother didn’t want to keep it—she kept saying it was horrible,” he added.

The family sought out the counsel of the Arcadia Foundation, which carries out art attributions and appraisals. A member of its scientific committee, Dr. Cinzia Altieri, a trained graphologist or handwriting specialist, studied the signature on the painting. The foundation also enrolled the help of famed art detective Maurizio Seracini, who led a chemical-scientific analysis of the work.

As a team, these experts have confirmed the attribution to Picasso. The painting has been identified as a portrait of Dora Maar, the French Surrealist photographer, painter, and poet who was at that time Picasso’s mistress.

It is believed to have been made some time between 1930 and 1936 during a trip to Capri, where Picasso often visited, although he first met Maar in late 1935 or early 1936. The pair had a relationship lasting nearly nine years and, though she was an artist in her own right, Maar’s work has only recently received the attention it deserves. In 2019, a landmark retrospective of over 250 works by Maar was presented at the Centre Pompidou in Paris and Tate Modern in London.

If the attribution turns out to be true, the Lo Rossos can expect a financial windfall. The Arcadia Foundation has valued the alleged Picasso at €6 million ($6.7 million).

The artist painted many portraits of Maar in their time together, and several reside in major museum collections today. The auction record for a painting of Maar by Picasso was set in 2006, when Sotheby’s New York sold Dora Maar au chat (1941) for $95.2 million, according to the Artnet Price Database.

Unfortunately for this team of Italian art sleuths, their rediscovered modernist masterpiece piece is unlikely to fetch in the millions until it has been legitimized by official Picasso authenticators.

Andrea Lo Rosso said that, so far, the Picasso Foundation in Malagá, Spain has refused to even assess the work, which it believes to be a fake. The foundation declined to comment publicly on the work when contacted. It reportedly receives hundreds of authentication requests every day.

The Picasso Administration in Paris has also been reached for comment but did not respond by publication time.

By Jo Lawson-Tancred.

#Pablo Picasso#‘Horrible’ Painting Found by a Junk Dealer Could Be a Picasso Worth $6 Million#Dora Maar#spanish artist#painter#painting#art#artist#art work#art world#art news#lost and found

17 notes

·

View notes

Text

But this is Donald Trump, and so it is all, as the wags like to say, “priced in.” It is priced in that he operates as the unreproachable head of a cult of personality. The fact that he grooves in his spare time to sexist anthems from the 1960s and racist hymns from the 1860s — priced in. Also priced in: Trump’s promise of expanded concentration camps in a second term. “Bloody” mass deportations. Stripping citizenship from people born in the United States. Ordering the U.S. military to shoot protesters opposed to him. All of these, and more, are now priced in. In short, America’s tastemakers and elite media have priced in the one fact that was at the center of every real debate since he came down that golden escalator nine years ago. They now all take for granted that Donald Trump, a man who is essentially a coin flip from retaking the presidency, is a fascist.

I’m sorry — that’s the bottom line? The most personally and officially corrupt man ever to sit in the Oval Office — a guy whose one term was defined by a) mismanaged crisis that left over a million Americans dead and pushed over ten million out of work, b) two impeachments, and c) a last-ditch effort to violently overthrow the U.S. government in a bid to remain in power indefinitely — is now literally promising to violently round up tens of millions of people including U.S. citizens, shove them into concentration camps without even pretending to follow due process, and deport them en masse at gunpoint. And all the paper of record can say is well, yeah, but Harris is kind of a flip-flopper who will have to work hard to get legislation through Congress. Great job. Stellar analysis.

3 notes

·

View notes

Text

5 Trade Ideas for Monday: Aflac, Amazon, Antero, Prudential and Tesla

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Aflac, Ticker: $AFL

Aflac, $AFL, comes into the week pulling back to the 50 day SMA. It has a RSI falling and a MACD dropping but positive. Look for a reversal to participate…..

Amazon, Ticker: $AMZN

Amazon, $AMZN, comes into the week breaking short term resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…..

Antero Resources, Ticker: $AR

Antero Resources, $AR, comes into the week rising off a low. It has a RSI moving higher with the MACD about to cross up. Look for continuation to participate…..

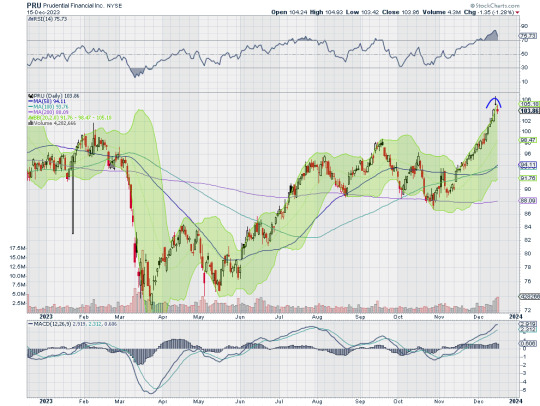

Prudential Financial, Ticker: $PRU

Prudential Financial, $PRU, comes into the week pulling back from a top. it has a RSI that is overbought with the MACD positive. look for continuation to participate…..

Tesla, Ticker: $TSLA

Tesla, $TSLA, comes into the week pressing at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a move higher to participate…..

Use this link to get special Holiday Sale Pricing!

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the December FOMC meeting and Quadruple Witching in the books, saw equity markets post another stellar week as they head into the last full week of the year.

Elsewhere look for Gold to continue higher while Crude Oil continues to trend lower. The US Dollar Index continues to drift to the downside while US Treasuries continue in their short term uptrend. The Shanghai Composite looks to continue the trend lower while Emerging Markets possibly break resistance to the upside.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong, especially the SPY and QQQ on the longer timeframe. On the shorter timeframe the IWM, QQQ and SPY could use a reset on momentum measures as all are extended. Use this information as you prepare for the coming week and trad’em well.

2 notes

·

View notes

Text

Daily Forex Signals Review for France

In the ever-evolving Forex trading market, traders in France are increasingly turning to Forex signal services to stay ahead. These services provide valuable trading insights, helping traders make informed decisions while reducing the time and effort needed for market analysis.

If you’re a trader in France looking for reliable daily Forex signals, this review highlights the top providers in 2024. Each service is evaluated based on its accuracy, pricing, delivery methods, and overall performance.

What Are Forex Signals?

Forex signals are trade recommendations generated by experts or automated systems. They guide traders on:

Which currency pairs to trade (e.g., EUR/USD)

Entry price and exit points

Stop-loss and take-profit levels

These signals help traders capitalize on market opportunities while managing risk effectively. For French traders, finding a trusted forex signal provider can make all the difference in achieving consistent profits.

Top Daily Forex Signal Providers for France

Here’s a detailed review of the best Forex signal services for French traders.

1. Forexbanksignal.pro – The #1 Choice for French Traders

Rating: ★★★★★ Website: Forexbanksignal.pro Features:

Accuracy Rate: Over 85%

Delivery: Telegram, WhatsApp, and Email

Frequency: 5-8 signals daily

Pricing: Starting at €50 per month

Forexbanksignal.pro stands out as the best choice for French traders. With a stellar accuracy rate and user-friendly interface, this service is perfect for beginners and seasoned traders alike. Their signals are well-researched, with detailed explanations and risk management advice.

What sets them apart is their commitment to transparency and customer support. French traders appreciate the free trial option, which allows users to evaluate the service before committing.

Pros:

High accuracy and reliability

Multi-channel delivery for convenience

Free trial available

2. Dailyforexsignals.pro – Consistent and Reliable

Rating: ★★★★☆ Website: Dailyforexsignals.pro Features:

Accuracy Rate: Around 80%

Delivery: Telegram and SMS

Frequency: Up to 6 signals per day

Pricing: From €45 per month

Dailyforexsignals.pro earns the second spot for its consistent performance and affordability. French traders value the platform's transparency, as it provides detailed performance reports. The signals are easy to follow, making them a great option for both beginners and advanced users.

Pros:

Affordable pricing plans

Transparent performance tracking

Responsive customer support

3. Goldsmartrisk.com – Best for Risk-Averse Traders

Rating: ★★★★☆ Website: Goldsmartrisk.com Features:

Accuracy Rate: 75%-80%

Delivery: Email and Telegram

Frequency: 2-3 signals daily

Pricing: Starting at €60 per month

Goldsmartrisk.com focuses on delivering high-probability trades with minimal risk. Their signals include detailed risk management strategies, making this service a favorite among cautious traders. Although the frequency of signals is lower, the quality and reliability are unmatched.

Pros:

Focus on risk management

High-quality signals

Ideal for conservative traders

4. FxDailyPips.com – A Budget-Friendly Option

Rating: ★★★★☆ Website: FxDailyPips.com Features:

Accuracy Rate: Around 78%

Delivery: Telegram and Email

Frequency: 3-4 signals per day

Pricing: Starting at €40 per month

FxDailyPips.com is an emerging player in the Forex signal market. French traders appreciate its affordability and straightforward signals, making it a great option for those just starting out or working with a smaller budget.

Pros:

Competitive pricing

Reliable performance

Growing popularity

Other Reputable Forex Signal Providers

In addition to the top four, several global providers offer excellent services for French traders:

5. 1000pipbuilder

1000pipbuilder is known for its exceptional track record and easy-to-follow signals, making it ideal for beginners in France.

6. Learn2Trade

Learn2Trade combines daily signals with educational resources, allowing traders to improve their market knowledge while trading profitably.

7. FXLeaders

FXLeaders offers free and premium Forex signals, providing flexibility for traders who want to test their strategies before committing to a paid plan.

FAQs About Forex Signals in France

1. Are Forex signals reliable?

Yes, Forex signals can be reliable if you choose a trusted provider like Forexbanksignal.pro or Dailyforexsignals.pro. Accuracy rates vary, so it’s essential to research before subscribing.

2. How do Forex signals work?

Forex signals provide recommendations for opening and closing trades based on market analysis. They include details like entry points, stop-loss levels, and take-profit targets.

3. Can beginners use Forex signals?

Absolutely. Forex signals are designed to simplify trading for both beginners and experienced traders. Services like Forexbanksignal.pro provide clear instructions that are easy to follow.

4. How much do Forex signals cost?

The cost of Forex signal services ranges from €40 to €100 per month, depending on the provider and features offered.

5. Are free Forex signals worth it?

Free Forex signals can be useful for testing purposes but often lack the accuracy and reliability of premium services. Paid services like Forexbanksignal.pro deliver better results.

6. How are signals delivered?

Forex signals are typically delivered via Telegram, Email, SMS, or WhatsApp. Choose a provider that uses a platform you’re comfortable with.

7. Is Forex trading legal in France?

Yes, Forex trading is legal in France, but it’s regulated by the AMF (Autorité des Marchés Financiers). Ensure you work with regulated brokers and signal providers.

Why Forex Signals Are Essential for French Traders

Forex signals simplify trading by providing actionable insights, allowing traders to save time on market analysis. For French traders, these services are particularly valuable for navigating volatile markets with precision.

Conclusion

If you’re a trader in France, choosing the right Forex signal service can significantly impact your success. Forexbanksignal.pro leads the pack with its high accuracy, excellent customer support, and transparent performance. Dailyforexsignals.pro offers a consistent and affordable alternative, while Goldsmartrisk.com is perfect for those who prioritize risk management. For budget-conscious traders, FxDailyPips.com provides reliable signals at a competitive price.

Other options like 1000pipbuilder, Learn2Trade, and FXLeaders also offer unique features to enhance your trading experience. By selecting the right signal provider, French traders can confidently navigate the Forex market and achieve consistent profitability.

#daily forex signals#best forex trading platforms#best forex brokers#best forex signals#forex expert advisor#forexsignals#forex market#forex#forextrading

0 notes

Text

Best IAS Coaching In Delhi

Best IAS Coaching in Delhi: Why Plutus IAS Stands Out

Preparing for the Indian Administrative Services (IAS) is a journey that demands exceptional guidance, strategic preparation, and unwavering dedication. For aspirants in Delhi, the hub of IAS coaching, the choice of the right institute can make all the difference. Among the plethora of coaching centers, Plutus IAS has emerged as a standout option for its unparalleled teaching methodology, state-of-the-art resources, and stellar track record.

Why Delhi is the Preferred Destination for IAS Aspirants

Delhi has long been the epicenter of IAS coaching in India, offering an ecosystem enriched by:

A vibrant peer group.

Access to renowned faculties.

Close proximity to national institutions like UPSC, libraries, and resources.

Amidst this competitive environment, selecting the right institute becomes a critical decision, and Plutus IAS has consistently proven its mettle.

What Makes Plutus IAS the Best Choice?

Experienced Faculty Plutus IAS boasts a panel of highly qualified educators who bring years of expertise to the table. Their personalized teaching approach ensures that every student receives the attention they need to excel.

Comprehensive Study Material The institute provides meticulously curated study materials, aligning with the latest UPSC syllabus and trends. These resources include detailed notes, updated current affairs, and test series that are integral to thorough preparation.

Interactive Online and Offline Classes Understanding the diverse needs of aspirants, Plutus IAS offers both online and offline classes. Their live sessions are interactive, ensuring an engaging learning experience. For offline students, the classroom infrastructure is modern and conducive to focused study.

Small Batch Size Unlike many coaching centers that overcrowd their classrooms, Plutus IAS ensures a small batch size to maintain a personalized teaching environment. This enables better faculty-student interaction.

Success Stories Over the years, Plutus IAS has nurtured countless success stories, with many of its students achieving top ranks in the IAS examination. The institute's commitment to excellence is evident in its remarkable results year after year.

Affordable Fee Structure Quality coaching often comes at a hefty price, but Plutus IAS strikes the perfect balance by offering top-notch guidance at a reasonable fee, making it accessible to aspirants from diverse backgrounds.

Additional Features

Regular Doubt Clearing Sessions: Dedicated sessions to address individual doubts and enhance conceptual clarity.

Mock Tests and Performance Analysis: Periodic tests to track progress and identify areas that need improvement.

Focus on Ethics and Essay Writing: Specialized training for often-overlooked yet crucial aspects of the IAS exam.

Conclusion

For those embarking on the challenging journey of IAS preparation, choosing the right coaching institute is vital. Plutus IAS, with its exceptional faculty, innovative teaching methods, and proven results, has rightfully earned its place as the best IAS coaching institute in Delhi. It not only equips aspirants with the knowledge they need but also instills the confidence and discipline required to succeed.

If you’re aiming for success in the IAS examination, Plutus IAS should be at the top of your list.

0 notes

Text

True Strength Index and AI Bots: The Hidden Gems in Modern Forex Trading Ever feel like the Forex market is out there like a mischievous genie—granting wishes to everyone but you? Well, it’s time to crack the code with a powerful duo that might just make the genie finally work in your favor: the True Strength Index (TSI) and Artificial Intelligence Bots. Sure, you've heard of indicators and bots, but this isn't just a ride on the hype train. Today, we're uncovering the underground tactics that savvy traders are using to squeeze every ounce of profit from the market. Buckle up (without clichés—I mean it), because it’s going to be a revelation. Let’s roll. TSI and AI Bots: An Unlikely but Powerful Tag-Team Imagine your trading strategy as a dinner party. You need a perfect mix of guests—ones that balance out each other's quirks. TSI is that friend who has an eye for the big picture, filtering out market noise and seeing genuine trends, while AI bots are those super-efficient servers who make sure your plates are cleared, drinks are topped up, and everyone is comfortable. When these two work together, they bring balance and execution, offering you the kind of harmony in trading that most people only dream of. But wait—what's the True Strength Index really? TSI is essentially a momentum-based indicator, but it’s also like the personal trainer of indicators—it cuts through the noise and focuses on real strength (not those inflated numbers from flexing in front of the mirror). It helps traders identify whether the market's movement has solid momentum behind it or if it’s just puffery, like those empty New Year’s gym memberships. And the AI bots? Well, they’re your tireless, caffeinated interns who work 24/7 without needing motivation. They take orders, process market data at lightning speeds, and execute trades based on your commands. Combining the insight of TSI with the efficiency of AI bots is like arming yourself with X-ray goggles and an octopus that knows how to trade. Why Most Traders Get It Wrong (And How You Can Avoid It) The biggest mistake traders make with indicators is treating them like crystal balls. News flash: no indicator has mystical powers (and if you’re looking for a crystal ball, this isn't Hogwarts). Traders often over-rely on one indicator or robot, thinking it can make them millionaires while they sleep. The reality is that indicators—even TSI—are like tools in a toolbox. If you use a hammer to paint a wall, you’re in for a mess. When using the TSI, you’re looking for confirmation of trends, not a full-fledged prediction. TSI does a stellar job of showing divergence—a sign that price action is saying one thing, but momentum might be hinting at something else. It’s like when a celebrity gives that awkward laugh on a talk show—sure, they’re smiling, but the TSI knows there's drama brewing underneath. Pair this with an AI bot, and you can automate your responses to these divergence signals. Bots can enter and exit positions faster than you can say "slippage." With AI-driven analysis, they’re also better equipped to adapt to a market environment than an outdated manual script. This is where hidden opportunities arise—combining a reliable human-designed indicator with the efficiency of machine learning. The Forgotten Strategy That Outsmarted the Pros When you think about Forex strategies, TSI probably isn’t the first thing that comes to mind. Most traders gravitate toward the RSI or MACD because they’re mainstream, and hey, nothing wrong with that—they’re like the Coca-Cola of indicators. But TSI? That’s your fine-aged whiskey. Few appreciate its potency. Take, for instance, the art of filtering "false breakouts." Ever experienced the frustration of seeing a breakout, going in big, and then realizing you got baited? It’s like falling for an "80% OFF" sale that ends up being on overpriced flip-flops—the frustration is real. TSI, with its two smooth moving averages, shows you when momentum is truly building. Using a crossover method, traders can identify a significant bullish or bearish moment and avoid those nasty head-fakes. And here’s the kicker: AI bots can step in and do the dirty work. They’re programmed to stay cold-hearted—which is something we all could use when the market gets emotional. Remember, the bots don’t get FOMO. They don’t see that second candle forming and decide to jump in "just in case." They stick to the strategy, executing with precision. How to Predict Market Moves with Precision TSI isn’t just a momentum indicator. It’s a mind reader—but one that’s been working out and has rock-solid biceps. Let’s talk about trend reversals. Traders have consistently missed the mark on detecting reversals because they’re either too early (cue the premature panic—like when you’re sure a horror movie character is dead only to be shocked by their next scene) or too late. When TSI diverges from price, it’s often a clue that the trend is on its last legs. It’s like your car’s fuel gauge—you can ignore it, but eventually, you’ll find yourself stranded. AI bots step in here by tracking these divergence patterns over multiple timeframes, backtesting, and even incorporating machine learning to learn from past market behaviors. It’s as if they’re taking all the notes you never got around to making, ensuring you’re one step ahead. AI Bots: Smarter Than Your Average Robot Gone are the days of "plug and pray" bots that scalp your account just because they think it’s a great day for random trades. AI bots now use deep learning, taking into account an array of variables, and yes—that includes TSI signals. They are leveraging Natural Language Processing (NLP) to analyze economic news and sentiment—something beyond our human coffee-fueled minds. Imagine, for a second, a bot that not only tracks your TSI signals but also cross-references live market sentiment. It can distinguish between a short-term hiccup and an opportunity that aligns with major market drivers—like deciding if that "sale" is for shoes you need or just more useless stuff. Bots now pick and choose, not based on the signals alone, but by weighing in context—and that’s ninja-level trading for you. The One Simple Trick That Can Change Your Trading Mindset Here’s the truth—trading isn’t about predicting every movement correctly; it’s about leveraging probabilities. TSI, in partnership with AI bots, lets you stack probabilities in your favor. The indicator helps spot the trend strength, while AI makes the real-time execution almost frictionless. Imagine setting your AI bot to monitor divergence alerts from TSI, confirming with news sentiment, and then executing a trade with a clearly defined risk profile. You've effectively outsourced everything but the decision-making framework. Let that sink in—you can be the one sipping on tea while the bots hustle. And isn't that the dream? Why You Shouldn't Ignore This Duo Most retail traders get stuck with analysis paralysis, jumping between too many indicators while over-analyzing every single chart. But simplicity is key. The power of TSI lies in its ability to filter out noise and focus on true market movements, while AI bots bring operational efficiency. AI bots integrated with TSI create an unbeatable formula that streamlines not just trade analysis but execution. It’s like having both the brains and the brawn—a perfect blend for staying ahead of the market's sneaky tricks. Wrap-Up: The True Strength of TSI and AI Bots So, there you have it—TSI and AI bots, the dynamic duo you didn’t know you needed. The True Strength Index helps you peek behind the market’s façade, revealing true momentum and potential turning points. On the other hand, AI bots do what they do best—act quickly, decisively, and without emotion. Try integrating TSI into your analysis and letting an AI bot execute when the conditions align. You’ll be surprised at how much more disciplined and efficient your trading becomes. Who knows? Maybe that mischievous Forex genie will finally start granting a few wishes your way. Got insights to share or questions bubbling up? Drop them in the comments below—let's demystify this journey together. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

The Trusted Real Estate Sales Reps in Milton

The real estate market in Milton is vibrant and competitive, requiring the expertise of skilled professionals to navigate successfully. Whether you’re buying your dream home, selling a cherished property, or investing in Milton’s growing market, having the right real estate sales representatives by your side is essential. Team Hilson is a name synonymous with trust, expertise, and exceptional service in Milton’s real estate industry.

Team Hilson is a group of dedicated serving real estate sales reps in Milton and the surrounding areas. Known for their client-focused approach and deep understanding of the local market, it has become a go-to resource for buyers, sellers, and investors seeking top-tier real estate services. Their commitment to excellence and personalized strategies has earned them a stellar reputation in the community.

What Sets Team Hilson Apart?

Deep Local Expertise: Milton is a dynamic community with a variety of neighborhoods, from historic homes in downtown Milton to modern developments in expanding suburbs. Team Hilson’s in-depth knowledge of these areas allows them to provide valuable insights into market trends, neighborhood features, and property values.

Client-First Philosophy: Their every client is treated as a priority. They take the time to understand your unique needs and goals, ensuring a customized approach that aligns with your real estate objectives.

Exceptional Marketing for Sellers: Selling a property in today’s market requires more than a simple listing. They uses professional photography, virtual tours, social media advertising, and targeted marketing campaigns to showcase your property’s best features and attract the right buyers.

Skilled Negotiators: In real estate transactions, negotiating is essential whether you're buying or selling. Expert negotiators, Team Hilson's representatives put in endless effort to get the greatest deal for their customers.

Streamlined Process: Real estate transactions can be complex, but Team Hilson is dedicated to making the process as smooth and stress-free as possible. From initial consultations to closing day, they guide you every step of the way.

Why Milton?

Milton is one of Ontario’s fastest-growing towns, offering an ideal blend of small-town charm and modern amenities. It boasts excellent schools, scenic parks, a thriving arts and culture scene, and a vibrant downtown area with shops and restaurants. With its proximity to Toronto and other major cities, Milton has become a popular choice for families, professionals, and retirees alike.

The town's attractiveness is reflected in its real estate market, which offers a variety of homes, from elegant detached homes to reasonably priced townhomes. Milton has something for everyone, whether you're searching for your forever home, a peaceful haven, or an investment opportunity.

How Team Hilson Can Help

For Buyers: Buyers can select residences that fit their budget, lifestyle, and interests with the help of Team Hilson. In addition to managing the logistics of home viewings and assisting clients with the purchasing process, they offer insights on the best neighborhoods.

For Sellers: Selling a home is a significant milestone, and they ensures you get the best value for your property. They offer market evaluations, expert staging advice, and comprehensive marketing plans to reach potential buyers effectively.

For Investors: Milton’s growing real estate market is a goldmine for investors. They offer market analysis and strategic advice to help investors identify lucrative opportunities and maximize returns.

Contact Team Hilson Today

The team you can rely on when it comes to real estate sales reps in Milton is Team Hilson. Their proficiency, commitment, and customer-focused methodology make them the best option for all of your real estate requirements. This is here to make sure your journey is profitable and successful, whether you're investing, selling, or buying.

Contact Team Hilson today and experience the difference of working with a team that puts your needs first. Your real estate dreams in Milton are just a call away!Bottom of Form

For more information

Contact us: +1 289-242-3342

Visit us: https://teamhilson.com/

Mail us : [email protected]

0 notes

Text

Brand Reputable Management Best Practices

In this modern day and age, it is evident that your brand reputation is more important now than any other time in recent memory. Having a positive brand reputation can immensely increase customer loyalty and build confidence in the market. Not to mention, it helps position you as a leader in your space in this way increasing your chances of attaining business success.

For your brand positioning strategy to deliver the results you expect, you must employ the correct measures. That is where the problem sets in since certain entrepreneurs don't have the foggiest idea what brand positioning is about. The good news is you can traverse this with a little help from a reputable brand consultant Singapore. Having said that, below are top brand reputation management best practices you should employ.

Gone are the days when product and price were the main point of focus by customers. Nowadays, many people factor in the customer experience prior to making a purchase decision. Ignore a stellar customer experience and prospects will settle for your competitors giving them an added advantage.

Thus, customer experience is an important part of your brand reputation strategy. Fortunately, there are numerous ways to deliver a remarkable customer experience. To maximize your brand strategy, you can reach out individually to every customer now and again to personally check in. Alternatively, try to deliver world-class customer support consistently.

While you probably won't have a clue about this, however content marketing is a vital element of effective brand reputation management. Content marketing involves producing informative content that hopes to solve the common problems faced by your audience. When people start noticing your content as it takes adjusts, they will certainly share it with their friends and colleagues. In what would seem like no time, your brand presence is expanding.

Making your brand voice stand out doesn't need to be the underlying reason why you are having sleepless nights. Given you understand your brand's purpose and mission while employing the right measures, you'll certainly make your business a force to be reckoned with.

To try not to commit expensive errors, make certain to perform a brand reputation analysis. Through this action, you can determine the things you are doing wrong while simultaneously coming up with the best brand name ideas. Fortunately, the best brand consultant Singapore can do this for you hassle-free.

0 notes

Text

Positive Analysis of Stellar Lumens Price Recovery

```html

Stellar Lumens Price Recovery: A Positive Outlook

In the ever-evolving world of cryptocurrency, one name that continues to resonate with investors and enthusiasts alike is Stellar Lumens (XLM). Following a period of fluctuations, Stellar Lumens is showing signs of a promising price recovery. In this article, we'll delve into the recent developments and market dynamics that underline this optimistic trend.

The Current Market Landscape

As of late, the cryptocurrency market has experienced significant volatility. However, despite these challenges, the Stellar Lumens ecosystem has been making positive strides. Analysts have noted a gradual increase in trading volume and market activity surrounding XLM, signaling growing investor confidence. This resurgence can largely be attributed to several key factors:

Technological Advancements: Stellar continues to enhance its platform, making it more user-friendly and accessible.

Increased Adoption: Partnerships with various financial institutions have further solidified Stellar's position in the industry.

Community Support: The dedication of the Stellar community plays a vital role in maintaining interest and investment.

Positive Technical Indicators

Technical analysis reveals several bullish patterns emerging for Stellar Lumens. Recent breakout levels suggest a potential upward trend that could benefit long-term investors. The RSI (Relative Strength Index) indicates that XLM is not overbought yet, which provides opportunities for new investors to enter the market without excessive risk. Additionally, key moving averages are aligning in a manner that historically precedes significant price increases.

The Role of Market Sentiment

Investor sentiment has a profound impact on the price trajectory of any cryptocurrency, and XLM is no exception. As news regarding regulatory clarity and institutional adoption continues to circulate, the market appears to be shifting towards a more positive outlook. This improved sentiment is not just restricted to Stellar but is reflective of a broader crypto recovery trend.

Social Media Buzz: Discussions on platforms like Twitter and Reddit indicate a growing hive of activity surrounding Stellar Lumens.

Influencer Endorsements: Prominent figures in the crypto space advocating for XLM have also contributed to the positive momentum.

The Future of Stellar Lumens

While no investment is without risks, the outlook for Stellar Lumens appears increasingly optimistic. Industry experts suggest that continued advancements and adoption could lead XLM towards new all-time highs. As the platform aims to bridge the gap between traditional finance and cryptocurrency, its relevance in a rapidly changing market cannot be understated.

In conclusion, the current recovery trends for Stellar Lumens indicate a strong potential for growth. Investors should remain vigilant, conduct thorough research, and consider the positive indicators before making any investment decisions. With the right approach, this could be an ideal time to capitalize on XLM's revival.

What Do You Think?

Are you bullish on Stellar Lumens? Share your thoughts and experiences in the comments below!

``` Positive Analysis of Stellar Lumens Price Recovery

0 notes

Text

DOGE Bull Run Possible as WIF Faces Key Resistance: Analyst

DOGE could be gearing up for a bull run after a 65% pullback, following historical patterns.

WIF faces strong resistance at $2.67, with a potential decline if it fails to break out.

Analysts predict major market shifts for both DOGE and WIF based on technical patterns.

Dogecoin ($DOGE) and dogwifhat ($WIF) are two tokens currently on the radar of enthusiasts and traders owing to their stellar performance in critical technical patterns. The recent posts from analysts have raised the hopes of potential price movements coming for both tokens in the near term. Several analysts perceive that Dogecoin will be in another bull run soon, and WIF is at an important resistance level.

Dogecoin’s Familiar Pattern Suggests a Potential Bull Run

Dogecoin has repeatedly shown a tendency to break out from long-term descending triangles, followed by a substantial surge in value. For instance, Dogecoin experienced a 200% price increase after a breakout from a multi-year triangle, after which the price was retracted by 60%. This pattern may be in the midst of forming again. Some analysts’ views are that it is just a matter of time before Dogecoin enters another bull run after retracing 65% in recent months. This pattern, which is observed across several cryptocurrencies, is usually followed by a rally in price as the selling pressure eases and buyers take over.

<embed>https://x.com/ali_charts/status/1842985818430062993</embed>

In a recent post by Ali, a crypto analyst, a multi-year descending triangle formation was highlighted for Dogecoin. The chart showcased key data points, reflecting how Dogecoin historically broke out from a downward trend, saw a surge, and then corrected before a longer-term rally took place. Ali emphasized that after the latest 65% pullback, Dogecoin might be on the verge of a significant breakout, similar to what occurred in the past.

Related:

WIF Faces Key Resistance Level

Meanwhile, CrediBULL Crypto shared an analysis of WIF ($WIFUSDT), highlighting a potential bearish reversal at a key resistance level. According to the chart, WIF has been consolidating around the $2.67 level after a recent rally. The analyst points out that the price has tested this resistance zone multiple times. The post mentions that WIF could "remove its hat" at this level, indicating a possible sharp decline if the resistance holds.

<embed>https://x.com/CredibleCrypto/status/1843117860820029826</embed>

The chart suggests that if WIF breaks down from its current price level, it could head toward its 100% retracement level at $1.075. Traders will be watching this resistance zone closely for signs of a reversal or a breakout. A failure to break through this level could lead to a significant correction in WIF’s price, as per the technical analysis.

Both Dogecoin and WIF traders are preparing for potential market shifts based on these technical patterns. Traders are advised to keep an eye on these levels as history may repeat itself in the volatile world of cryptocurrency.

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with just 3 weeks left in the year, equity markets continued to show strength with large cap and tech indexes approaching all-time highs. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) continued to drop. The US Dollar Index ($DXY) continued to bounce in the downtrend while US Treasuries ($TLT) did the same. The Shanghai Composite ($ASHR) looked to continue the downtrend while Emerging Markets ($EEM) dropped in broad consolidation.

The Volatility Index ($VXX) looked to remain very low and stable creating a positive environment for equity markets to move to the upside. Their charts looked strong, especially on the longer timeframe. On the shorter timeframe both the $QQQ and $SPY looked to continue to drift higher. The $IWM had taken the lead in the short term.

The week played out with Gold finding support and reversing to the upside while Crude Oil broke below $70/bbl before finding support and reversing. The US Dollar met resistance and fell back while Treasuries continued their move to the upside. The Shanghai Composite found support at a retest of the October low while Emerging Markets reversed and made a 4 month high.

Volatility continued little changed, holding just above the 2019 support level. This continued the breeze at the backs of equities and they marched higher all week. This resulted in the QQQ closing at a new all-time high and the SPY only 5 points away from a record with the IWM reaching the top of a 2 year channel. What does this mean for the coming week? Let’s look at some charts.

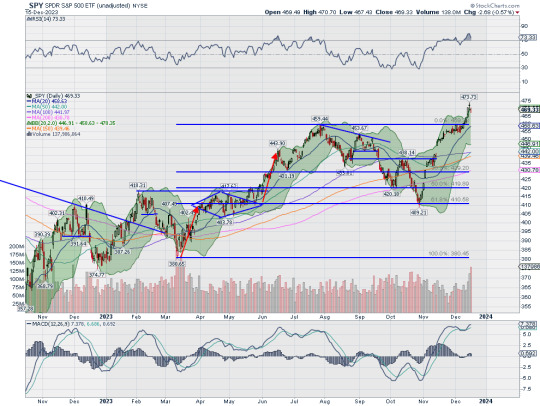

SPY Daily, $SPY

The SPY came into the week retesting the July high. It pushed through that Monday and continued to move higher through Thursday, closing at a nearly 24 month high and just off the all-time high. It printed an Evening Star reversal pattern though and confirmed with a move lower on the daily chart Friday. This saw the RSI rising into overbought territory and end the week pulling back with the MACD turning to flat near where prior peaks have occurred.

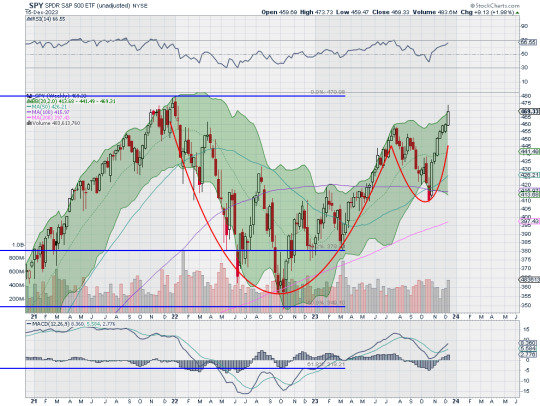

The weekly chart shows the longer term Cup and Handle pattern finally with a definitive trigger. It has a target to 570. The Bollinger Bands® on this timeframe are open higher with the RSI rising in the bullish zone and the MACD positive and climbing. There is resistance at 470 and 471 then 473 and 478.50. Support lower comes at 466 and 463.50 then 460 and 457 before 454 and 451. Uptrend.

SPY Weekly, $SPY

With the December FOMC meeting and Quadruple Witching in the books, equity markets posted another stellar week as they head into the last full week of the year. Elsewhere look for Gold to continue higher while Crude Oil continues to trend lower. The US Dollar Index continues to drift to the downside while US Treasuries continue in their short term uptrend. The Shanghai Composite looks to continue the trend lower while Emerging Markets possibly break resistance to the upside.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong, especially the SPY and QQQ on the longer timeframe. On the shorter timeframe the IWM, QQQ and SPY could use a reset on momentum measures as all are extended. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview December 15, 2023 with special Holiday Pricing

2 notes

·

View notes

Text

Who Are the Top 10 Real Estate Agents in Melbourne?

Top 10 Real Estate Agents in Melbourne

In the dynamic and competitive landscape of Melbourne’s real estate market, choosing the right agent can significantly influence your buying or selling experience.

Below, we delve into ten standout agents renowned for their exceptional service, expertise, and impressive track records.

Mario Tucci – Harcourts Rata & Co

With a perfect rating of 5.0 from 245 reviews, Mario Tucci stands out as a sales specialist at Harcourts Rata & Co.

His dedication is evident, having sold 133 properties with a median price of $325,000 over the last year.

Mario’s success is attributed not only to his sales figures but also to his strategic marketing and negotiation skills.

Clients frequently commend his ability to tailor marketing campaigns to fit the unique aspects of each property, enhancing visibility and buyer engagement.

In 2023, Mario successfully facilitated the sale of a high-demand family home in the suburbs, achieving a selling price 10% above the initial listing price, showcasing his prowess in negotiations.

His extensive knowledge of local market trends allows him to advise clients on optimal pricing strategies and the best times to enter the market.

With a focus on building long-term relationships, Mario’s commitment to excellence ensures that clients receive top-notch service from start to finish.

This dedication, combined with his track record, makes him a trusted choice for both buyers and sellers navigating Melbourne’s real estate landscape.

Annamaria Stella – Twig Real Estate

Annamaria Stella, a senior sales executive at Twig Real Estate, boasts an impeccable 5.0 rating from 241 reviews.

Over the past year, she has successfully sold 36 properties with a median sale price of $360,000.

Her reputation for thoroughness and professionalism is well-deserved; one client recently shared their appreciation for Annamaria’s comprehensive market analysis, which informed their selling strategy.

Annamaria specializes in inner-city properties and leverages cutting-edge digital marketing techniques to enhance property visibility.

In 2023, she achieved a remarkable 15% increase in sale prices for her clients through her effective negotiation skills and market expertise.

Her strong focus on client education and communication fosters trust and transparency throughout the buying or selling process.

Annamaria’s commitment to excellence ensures that every client feels valued and informed, making her a top choice for those looking to navigate the Melbourne real estate market with confidence.

Alex Ouwens – Ouwens Casserly Real Estate

Alex Ouwens, the director of Ouwens Casserly Real Estate, carries a 4.9 rating from 210 reviews.

He has sold 120 properties in the last year, with a median sale price of $520,000.

Known for his innovative marketing strategies, Alex employs a blend of traditional and digital marketing techniques to maximize property exposure.

His recent success includes selling a high-end apartment in Southbank for $1.2 million, 8% above the asking price.

Alex’s deep understanding of market dynamics enables him to provide tailored advice to clients, ensuring they make informed decisions.

His ability to connect with clients on a personal level fosters strong relationships, leading to repeat business and referrals.

With a proven track record and a commitment to delivering results, Alex Ouwens is a formidable player in the Melbourne real estate market.

Caitlin O’Connor – McGrath Estate Agents

Caitlin O’Connor, a prominent agent at McGrath Estate Agents, holds a stellar 4.8 rating from 180 reviews.

In the past year, she has sold 75 properties, achieving a median sale price of $450,000.

Caitlin is known for her comprehensive understanding of buyer psychology, which she leverages to create compelling marketing campaigns.

A recent project saw her successfully sell a historical home in Fitzroy for $2 million, which was $150,000 over the asking price.

Her exceptional communication skills ensure clients are kept informed throughout the process, building a sense of trust and reliability.

Caitlin’s proactive approach to problem-solving and her ability to navigate complex transactions set her apart in a competitive market.

With a dedication to excellence, she remains a top choice for both buyers and sellers in Melbourne.

James Tostevin – Marshall White

James Tostevin is a leading figure at Marshall White, with an impressive 4.9 rating from 200 reviews.

Over the last year, he has sold 140 properties, with a median sale price of $1.5 million.

James is particularly known for his strategic approach to luxury real estate, where he has developed a keen eye for market trends.

One of his notable achievements includes selling a luxury home in Toorak for $4 million, significantly above its initial listing price.

His extensive network of contacts and his reputation for professionalism enhance his clients’ experiences.

James is committed to providing personalized service, ensuring each client receives tailored advice based on their specific needs and goals.

His successful track record and dedication to client satisfaction solidify his status as one of Melbourne’s top agents.

Vanessa McGrath – Biggin & Scott

Vanessa McGrath, a leading agent at Biggin & Scott, boasts a commendable 4.8 rating from 160 reviews.

With 90 property sales in the past year and a median sale price of $400,000, Vanessa’s achievements speak volumes.

She is known for her approachable demeanor and in-depth knowledge of the local market, which allows her to connect with clients effortlessly.

In 2023, she sold a family home in the suburbs for $850,000, achieving a price that exceeded expectations by 5%.

Her attention to detail in marketing materials and open house events contributes to her success in showcasing properties effectively.

Vanessa’s commitment to building lasting relationships with clients is evident in her high rate of referrals and repeat business.

With a passion for real estate and a focus on delivering results, Vanessa McGrath remains a trusted name in Melbourne’s real estate sector.

Natasha D’Angelo – Barry Plant

Daniel D’Angelo of Barry Plant enjoys a strong 4.9 rating from 230 reviews.

Over the last year, he has sold 110 properties, with a median sale price of $375,000.

Known for his integrity and dedication, Daniel takes the time to understand his clients’ needs and objectives.

His recent sale of a commercial property in the CBD for $2.5 million highlighted his expertise in navigating complex transactions.

Daniel’s strong negotiation skills and proactive marketing strategies help ensure clients achieve the best possible outcomes.

He also places a strong emphasis on transparency, keeping clients informed at every stage of the buying or selling process.

With a commitment to excellence and a client-first approach, Daniel D’Angelo is highly regarded in Melbourne’s real estate community.

Liz Fong – Jellis Craig

Liz Fong, a top performer at Jellis Craig, boasts a 4.9 rating from 205 reviews.

In the past year, she has successfully sold 85 properties, achieving a median sale price of $450,000.

Liz is known for her creative marketing strategies and deep understanding of buyer behavior.

A recent highlight in her career was selling a prestigious home in Kew for $3 million, surpassing the asking price by 10%.

Her exceptional service and attention to detail have earned her a loyal client base, with many praising her for her professionalism and reliability.

Liz’s commitment to ongoing education and market research keeps her ahead of trends, ensuring she offers the best advice to her clients.

With a reputation for excellence, Liz Fong is a sought-after agent in Melbourne’s competitive market.

Tom Curnow – First National Real Estate

Tom Alexi, a seasoned agent at First National Real Estate, holds a strong 4.7 rating from 195 reviews.

Over the past year, he has sold 100 properties with a median sale price of $500,000.

Tom’s expertise lies in residential sales, where he utilizes data-driven strategies to optimize pricing and marketing efforts.

In 2023, he achieved notable success by selling a waterfront property for $1.8 million, well above the market average.

His clients appreciate his strong communication skills and his ability to simplify complex real estate processes.

Tom is committed to delivering outstanding results, consistently exceeding client expectations and building lasting relationships.

With a focus on integrity and transparency, Tom Alexi is a reliable choice for anyone looking to buy or sell in Melbourne.

Alistair Macmillan – Ray White

Sarah McMillan, an accomplished agent at Ray White, boasts an impressive 4.8 rating from 220 reviews.

In the last year, she has sold 95 properties, achieving a median sale price of $475,000.

Sarah is particularly skilled in digital marketing, utilizing social media and online platforms to reach a wider audience.

Her recent success includes selling a character home in Brunswick for $1.1 million, exceeding the client’s expectations.

Sarah’s focus on building relationships with her clients ensures a smooth and enjoyable experience.

Her proactive approach and extensive knowledge of the Melbourne market make her a valuable asset to both buyers and sellers.

With a commitment to excellence, Sarah McMillan continues to be a top performer in Melbourne’s real estate landscape.

FAQ (Frequently Asked Questions)

What Are the Best Suburbs to Invest in Melbourne Real Estate?

Melbourne’s property market is vast and diverse, making it essential to select the right suburb for investment.

Suburbs like Brunswick, Carlton, and Preston are gaining popularity for their proximity to the city and vibrant lifestyle.

For those looking for long-term capital growth, these areas have seen consistent annual price growth of over 5%. Brunswick, in particular, offers a mix of modern developments and heritage properties, with a median house price of around $1.4 million.

In Melbourne’s southeast, suburbs like Bentleigh East and Cheltenham are witnessing a surge in demand due to their accessibility to the city and improving infrastructure.

House prices in Bentleigh East have risen by approximately 10% over the past year, with a median price of $1.6 million.

Further out, suburbs like Tarneit and Cranbourne provide strong investment opportunities, particularly for first-time buyers and investors with smaller budgets.

With median house prices around $600,000, these growth corridors continue to attract young families and developers due to affordability and government incentives for new home builds.

How Is the Melbourne Real Estate Market Performing in 2024?

As of 2024, Melbourne’s real estate market remains resilient, following the post-pandemic recovery and ongoing demand for housing.

According to CoreLogic, the median house price in Melbourne has increased by 3.7% in the past year, now standing at $930,000.

Despite fluctuating interest rates, the market remains stable due to robust buyer activity, particularly in the outer suburbs where affordability is driving growth.

Popular growth areas such as Werribee, Tarneit, and Clyde North have seen prices rise between 5-8%, fueled by government infrastructure projects like the Suburban Rail Loop and planned transport upgrades.

Demand for apartments is also slowly rebounding, particularly in the inner city.

Vacancy rates, which peaked during the pandemic, have dropped significantly, stabilizing rental yields across the board.

Although the apartment market is still recovering, Melbourne’s housing sector shows long-term stability, with consistent demand from both local and international buyers, particularly as borders reopen and immigration increases.

What Is the Average House Price in Melbourne?

The average house price in Melbourne, as of mid-2024, sits at approximately $930,000.

This marks a slight increase from the previous year, driven by steady demand in both established suburbs and new growth areas.

In inner-city suburbs such as South Yarra and Fitzroy, house prices can exceed $1.5 million, reflecting the premium placed on proximity to the CBD, amenities, and lifestyle factors.

Conversely, in outer suburbs like Pakenham and Cranbourne, the median house price remains around $600,000, offering more affordable options for first-home buyers and investors.

Units and apartments in Melbourne have a lower median price of $580,000, though prices can vary significantly depending on the location and size of the property.

Luxury homes in prestigious suburbs such as Toorak and Brighton often surpass $4 million, attracting affluent buyers and investors.

Are There Any Upcoming Property Developments in Melbourne?

Melbourne is set to benefit from several high-profile property developments over the coming years, contributing to the city’s ongoing growth and expansion.

The Fishermans Bend project is one of the largest urban renewal initiatives, transforming former industrial land into a thriving residential and commercial hub.

This development aims to house over 80,000 residents by 2050, with construction well underway in areas such as Montague and Lorimer.

Other significant developments include Melbourne Quarter in Docklands, which combines residential towers with office spaces, retail outlets, and public parks.

The West Gate Tunnel Project, another large infrastructure development, is expected to unlock growth in western suburbs such as Altona North and Laverton by improving transport links to the CBD.

Smaller developments, such as apartment complexes in Richmond and Southbank, are also contributing to Melbourne’s housing supply, catering to growing demand for inner-city living.

These developments offer opportunities for investors to tap into Melbourne’s future growth potential.

How Do Melbourne House Prices Compare to Other Australian Cities?

Melbourne’s house prices sit just below Sydney’s but remain higher than most other Australian capitals.

As of 2024, the median house price in Melbourne is around $930,000, whereas Sydney’s median is approximately $1.2 million.

Melbourne remains more affordable than Sydney but significantly more expensive than cities like Brisbane and Adelaide, where median house prices hover around $750,000 and $700,000, respectively.

Melbourne’s stable market has historically provided solid capital growth, with an average annual increase of around 4-5% over the past decade.

Perth, with its median house price of $630,000, continues to offer more affordable property options compared to Melbourne, but lacks the same level of population growth and infrastructure development, factors that drive Melbourne’s sustained market performance.

Melbourne’s diverse housing market offers buyers options across various price points, but overall, it remains one of Australia’s more expensive cities to purchase property.

Is Now a Good Time to Buy Property in Melbourne?

With Melbourne’s real estate market showing steady growth in 2024, now may be a favorable time for buyers, particularly those looking for long-term investment opportunities.

The current median house price of $930,000 represents a relatively stable entry point into the market, following price corrections during the COVID-19 pandemic.

Interest rates, while higher than previous years, have stabilized, and many experts predict that the market will continue to grow, especially in emerging suburbs with strong infrastructure projects.

First-home buyers may benefit from government incentives like the First Home Owner Grant and stamp duty concessions on properties under $600,000, making it an opportune time to enter the market.

Investors can also take advantage of rising rental yields, particularly in Melbourne’s growth corridors where demand for housing remains high.

While the market is competitive, those with a clear strategy and focus on growth areas may find 2024 to be a promising year for purchasing property in Melbourne.

What Are the Best Schools in Melbourne’s Top Real Estate Suburbs?

Melbourne is home to some of Australia’s most prestigious schools, particularly in high-demand real estate suburbs.

Suburbs like Toorak, South Yarra, and Kew boast access to elite private schools, including Melbourne Grammar School, Scotch College, and Trinity Grammar School.

These institutions are known for their academic excellence, historical significance, and impressive facilities, often contributing to the higher property prices in these areas.

In Melbourne’s inner east, schools such as Camberwell Grammar School and MLC (Methodist Ladies’ College) attract families to suburbs like Hawthorn and Canterbury, pushing house prices above $2 million.

In more affordable suburbs, such as Altona North and Point Cook, high-quality public schools like Altona P-9 College and Point Cook Senior Secondary College provide excellent education options without the premium price tag.

For families prioritizing school zones, suburbs with access to highly-regarded public schools—such as Glen Waverley, which is zoned for Glen Waverley Secondary College—often experience increased property demand and price growth.

What Is the Process for Buying a House in Melbourne?

Buying a house in Melbourne typically begins with obtaining finance pre-approval, which allows buyers to determine their budget and confidently start house hunting.

Once pre-approved, the buyer can search for properties through real estate agents, online platforms, and auctions.

Upon finding a property, the buyer can make an offer or prepare for an auction if the property is listed for sale by auction.

If the offer is accepted or the auction is won, the buyer enters into a contract of sale and typically pays a deposit of 10%.

A conveyancer or solicitor then conducts legal checks, including title searches and contract reviews, before settlement occurs, usually within 30-90 days.

During settlement, the buyer’s mortgage lender transfers the funds to complete the purchase, and the property title is transferred to the buyer.

The buyer then takes possession of the property, completing the process.

How Can I Find Affordable Homes in Melbourne?

Finding affordable homes in Melbourne requires a focus on emerging suburbs, government incentives, and strategic property choices.

Suburbs in Melbourne’s outer north, west, and southeast offer more affordable house prices, with areas like Werribee, Tarneit, and Craigieburn featuring median house prices around $600,000.

Government schemes, such as the First Home Owner Grant, can provide eligible buyers with up to $10,000 toward purchasing a new home, while stamp duty concessions further reduce costs.

House-and-land packages in new developments, particularly in suburbs like Clyde North and Officer, also present affordable options for buyers seeking new builds.

Another strategy is purchasing smaller homes, townhouses, or apartments, which generally offer lower entry points into the market, especially in well-connected middle-ring suburbs like Coburg or Footscray.

With careful planning and a focus on growth areas, buyers can secure affordable homes in Melbourne’s competitive market.

What Are the Rental Yields Like in Melbourne?

Rental yields in Melbourne vary significantly depending on the suburb and property type.

As of 2024, gross rental yields for houses in Melbourne average around 3.1%, while units tend to offer slightly higher yields at 4%.

Suburbs like Point Cook and Werribee, where demand for rental properties remains high, offer yields of approximately 3.7% for houses and 4.5% for units.

Inner-city suburbs like Southbank and Docklands, known for their apartment buildings, have seen rental yields increase slightly to around 4.3%, driven by the return of international students and professionals post-pandemic.

While rental yields in high-end suburbs such as Toorak and Brighton are lower, averaging around 2.5% for houses, investors targeting Melbourne’s growth corridors or apartment markets can achieve solid returns, particularly in areas with ongoing population growth and infrastructure development.

What Are the Top Real Estate Agencies in Melbourne?

Melbourne’s competitive real estate market is serviced by several high-profile agencies that have earned strong reputations for their professionalism, local knowledge, and results.

Jellis Craig, an agency with a dominant presence in Melbourne’s inner east, is known for handling high-end properties in suburbs like Hawthorn and Kew. The agency has a large network of buyers and sellers and a track record of achieving premium sale prices.

Another leading agency is Marshall White, specializing in luxury homes across Melbourne’s blue-chip suburbs such as Toorak, Brighton, and South Yarra.

Biggin & Scott, with a wider footprint across Melbourne’s inner and outer suburbs, caters to a broad market of buyers and investors, handling both residential sales and property management. Their extensive reach allows them to dominate in high-growth areas like Point Cook and Craigieburn.

RT Edgar and Kay & Burton are also noteworthy agencies, particularly in Melbourne’s luxury market, focusing on prestigious homes and exclusive listings across affluent suburbs.

All of these agencies have adapted to the digital age with strong online platforms, providing potential buyers with the latest listings, virtual tours, and market insights.

How Do I Get a Mortgage for a Property in Melbourne?

Securing a mortgage for a property in Melbourne involves several steps and requires thorough preparation.

The first step is to assess your financial situation by calculating your income, expenses, and debt, ensuring you have a clear understanding of your borrowing capacity.

Next, it’s advisable to get pre-approval from a lender. This can be done by approaching a bank, credit union, or mortgage broker. Pre-approval provides an estimate of how much you can borrow, giving you confidence in your property search.

Once you have found a property, you will need to formally apply for a mortgage. The lender will conduct a valuation of the property, assess your credit history, and review your income and assets.

It’s essential to compare interest rates and mortgage features between different lenders. Fixed, variable, and split-rate options are available, each with different advantages depending on your financial situation and long-term plans.

Once the mortgage is approved, the loan documents are signed, and the funds are released at settlement to complete the purchase of the property.

Ensuring that you have a competitive mortgage with favorable terms can significantly impact your overall financial position, so taking the time to compare and negotiate is crucial.

What Are Melbourne’s Most Expensive Suburbs?

Melbourne is home to some of Australia’s most exclusive and expensive suburbs, where luxury homes and vast estates are nestled within tree-lined streets.

Toorak, consistently ranked as Melbourne’s most expensive suburb, boasts a median house price of over $4.3 million in 2024. Known for its palatial homes, Toorak attracts elite buyers, including business magnates and celebrities, seeking privacy and proximity to the city.

South Yarra and Brighton also feature prominently in the list of Melbourne’s priciest suburbs, with median house prices hovering around $2.7 million and $3.5 million, respectively. These areas are renowned for their stylish homes, vibrant culture, and access to premier schools.

Other exclusive suburbs include Hawthorn, where Victorian-era homes and modern mansions command prices in the vicinity of $2.6 million, and Armadale, where prices exceed $3 million, reflecting its desirability among affluent buyers.

The lifestyle offered by these suburbs, combined with proximity to Melbourne’s CBD, dining, and cultural precincts, ensures that prices remain at a premium, with demand consistently outstripping supply.

How Can I Find Real Estate Auctions in Melbourne?

Real estate auctions are a common method of sale in Melbourne, especially for properties in high-demand areas.

To find upcoming auctions, buyers can visit property listing platforms such as Domain and Realestate.com.au, where auction dates and times are displayed prominently on property listings.

Major real estate agencies like Jellis Craig, Marshall White, and Ray White also feature auction schedules on their websites, allowing buyers to browse available properties and auction dates.

Attending in-person auctions or observing live-streamed auctions online is an excellent way to get a feel for Melbourne’s competitive market dynamics.

For those serious about buying at auction, many agencies offer private inspections before the auction date, allowing prospective buyers to thoroughly assess the property.

Additionally, registering with a local real estate agent ensures that you receive notifications of upcoming auctions tailored to your preferences, keeping you informed of opportunities in your desired suburbs.

What Are the Property Taxes for Buying Real Estate in Melbourne?

When purchasing real estate in Melbourne, buyers must account for several taxes and fees that can add significant costs to the transaction.

Stamp duty, also known as land transfer duty, is the most significant tax, calculated based on the property’s value. As of 2024, buyers in Victoria pay around 5.5% of the purchase price in stamp duty for properties valued between $600,000 and $1 million.

First-home buyers may be eligible for stamp duty concessions or exemptions, particularly for properties under $600,000.

Foreign buyers are subject to an additional surcharge of 8%, applied to both residential and commercial properties. This surcharge reflects the Victorian government’s efforts to manage foreign investment in the property market.

Other taxes to consider include land tax for investment properties, which is calculated annually based on the property’s value, and the ongoing costs of council rates and owners’ corporation fees for apartments.

Ensuring that all tax obligations are met is essential for avoiding unexpected costs when purchasing real estate in Melbourne.

How Do I Find a Reliable Real Estate Agent in Melbourne?

Finding a reliable real estate agent in Melbourne requires research and referrals to ensure that the agent you select aligns with your property needs.

One approach is to ask for recommendations from friends or family who have recently bought or sold property in Melbourne. Personal experiences can provide insights into an agent’s professionalism and effectiveness.

Online platforms such as RateMyAgent and Google Reviews offer ratings and reviews for agents based on past client experiences, allowing you to assess their success rates and client satisfaction.

Real estate agencies such as Marshall White, Jellis Craig, and Barry Plant employ experienced agents who specialize in particular suburbs, providing valuable local knowledge and expertise.

Once you have shortlisted potential agents, meeting them in person can help you gauge their communication style and commitment to understanding your goals.

A reliable agent should be transparent, provide clear advice on pricing and market trends, and prioritize your needs, ensuring that you are fully supported throughout the buying or selling process.

What Are the Best Areas for First-Time Home Buyers in Melbourne?

Melbourne’s outer suburbs continue to offer the best opportunities for first-time home buyers seeking affordability and growth potential.

Suburbs like Werribee, Clyde North, and Cranbourne are increasingly popular due to their lower median house prices, which average around $600,000, and access to new infrastructure projects.

For those willing to venture further north, suburbs such as Craigieburn and Mickleham also provide affordable options, with prices typically below $700,000.

First-home buyers can also benefit from government incentives like the First Home Owner Grant, which offers up to $10,000 for new builds, and stamp duty concessions for properties valued under $600,000.

In Melbourne’s middle-ring suburbs, areas such as Coburg and Preston offer more affordable alternatives to the inner city while still being close enough to enjoy Melbourne’s amenities. These areas have experienced gentrification in recent years, providing first-time buyers with strong capital growth prospects.

By focusing on these emerging areas, first-time buyers can enter the property market without stretching their finances, while still enjoying long-term growth potential.

How Has COVID-19 Impacted Melbourne’s Real Estate Market?

The COVID-19 pandemic had a profound impact on Melbourne’s real estate market, particularly in 2020 and 2021, with prolonged lockdowns causing uncertainty and reducing buyer confidence.

During the height of the pandemic, Melbourne’s median house price fell by around 4%, and rental vacancy rates surged as international students and short-term renters vacated the city. The apartment market, in particular, was hit hard, with prices declining due to oversupply and reduced demand.

However, the market rebounded quickly in 2022 and 2023, driven by record-low interest rates and pent-up buyer demand.

House prices surged by approximately 18% in 2021 alone, particularly in suburban and regional areas, as remote work encouraged people to seek larger homes with more space.

While the market has since stabilized, the lasting impact of COVID-19 has shifted buyer preferences, with demand for larger homes, outdoor space, and suburban living continuing to drive growth in areas like the Mornington Peninsula and Melbourne’s outer north and west.

Melbourne’s rental market has also recovered, with vacancy rates dropping back to pre-pandemic levels as international migration and student arrivals resume.

The overall resilience of Melbourne’s property market highlights the strength of its long-term fundamentals, even in the face of global disruptions.

What Is the Outlook for Melbourne Real Estate Over the Next Five Years?

Melbourne’s real estate market is expected to experience moderate growth over the next five years, driven by continued population growth, infrastructure investment, and strong buyer demand.

With an annual population growth rate of around 1.8%, Melbourne is projected to become Australia’s largest city by 2026, fueling demand for housing in both established and emerging suburbs.

Areas in Melbourne’s west and southeast, such as Werribee and Clyde, are expected to see the most significant growth, benefiting from large-scale infrastructure projects such as the Suburban Rail Loop and the West Gate Tunnel.

While interest rates are likely to remain a key influence on buyer affordability, experts predict that Melbourne’s median house price could rise by 15-20% by 2028, depending on economic conditions.

What Are the Pros and Cons of Buying an Apartment Versus a House in Melbourne?

Aspect Buying an Apartment Buying a House

What Are the Pros and Cons of Buying an Apartment Versus a House in Melbourne?

Aspect

Buying an Apartment

Buying a House

Pros

Affordability

Typically lower entry prices, with an average apartment price of around $700,000 in inner Melbourne.

Higher upfront costs; average house price exceeds $1.2 million, making it less accessible for first-time buyers.

Location

Often located in vibrant urban centers, providing easy access to public transport, dining, and cultural amenities.

Houses may be in family-friendly suburbs, often farther from the city center.

Low Maintenance

Lower maintenance responsibilities due to body corporate fees covering communal areas and some repairs.

Homeowners bear all maintenance responsibilities, which can be time-consuming and costly.

Cons

Space Constraints

Generally less living space, which can be limiting for families or those needing extra room.

Larger living areas and backyards provide more space and privacy for families.

Limited Resale Potential

May not appreciate as much as houses in desirable suburbs, affecting long-term investment returns.

Historically strong capital growth, especially in suburbs like Mount Waverley and Glen Waverley.

Body Corporate Fees

Ongoing fees can add to overall costs, potentially deterring some buyers seeking long-term affordability.

Customization options are more extensive, allowing homeowners to renovate or extend their properties.

Originally Published: https://www.lakenarracan.com.au/who-are-the-top-10-real-estate-agents-melbourne/

0 notes

Text

Solar Panel Company Paradise Valley

Discovering Solar Solutions in Paradise Valley, AZ