#Soybean price

Explore tagged Tumblr posts

Text

Soybean Price: सोयाबीन भाव में 50 रुपये की तेजी, देखें आज 31 मई 2024 का ताजा रेट

Soybean Price 31 May 2024 – सोयाबीन भाव में आज मामूली बदलाव आया, लातूर मंडी में आज 50 रुपये की तेज़ी जबकि अकोला मंडी में 70 रुपये की गिरावट आई। देश की विभिन्न मंडियों में वर्तमान बाजार दरों के अनुसार आज का सोयाबीन का ताजा भाव और आवक की ताजा जानकारी यहाँ प्रकाशित की गई है । सोयाबीन का मंडी भाव अपडेट 31-05-2024 Aaj Ka Soyabean Ka Bhav: दिनांक 31 मई 2024 दिन शुक्रवार को सोयाबीन के भाव की लेटेस्ट…

View On WordPress

0 notes

Text

Ricancy Limited

Ricancy Limited is an international wholesaler and distributor of agro products ranging from cashew nuts, macadamia nuts, sisal fiber and much more from Kenya.

The leading supplier and exporter of agro-products like sisal fiber for sale, Chickpeas price ,cashew nuts for sale, almond nuts for sale, Soybean price ,walnuts for sale and many others.

We are leading Kenyan processor, manufacturer, exporter, trader, supplier of good quality agro products ranging from cashew nuts, macadamia nuts, sisal fiber and much more from Kenya.

#Robusta Coffee Beans price#Green Mung Beans price#Red Kidney Beans price#Cloves price#Chickpeas price#Soybean price#Pigeon Peas price#Yellow Maize price#Soybean Oil price#Raw Cashew Nuts price

0 notes

Text

Soybean Prices Today, Price Chart and Forecast Analysis Provided by Procurement Resource

Report Features Details Product Name Soybean Region/Countries Covered Asia Pacific: China , India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia,…

View On WordPress

0 notes

Text

आज का अनाज मंडी भाव (18 जनवरी 2025): जानिए किस मंडी में क्या हैं भाव

Aaj Ka Anaj Mandi Bhav 18 January 2025 : 18 जनवरी 2025 को देशभर की प्रमुख कृषि उपज मंडियों में अनाजों के भाव में कुछ उतार-चढ़ाव देखने को मिल रहे हैं। दिल्ली अनाज मंडी में गेहूं के भाव में 15 रुपये प्रति क्विंटल की तेजी आई है, जबकि सोयाबीन के भाव में भी 50 रुपये का इजाफा हुआ है। आइए जानते हैं आज के अनाज मंडी के ताजे भाव और खेती-बाड़ी से जुड़ी अहम जानकारी। दिल्ली मंडी के भाव (18 जनवरी 2025) गेहूं:…

#Anaj Mandi Rates#Delhi Mandi Prices#January 2025 mandi bhav#Mandi Bhav#Soybean Price Increase#Wheat Price Update

0 notes

Text

Soybean Oil Prices | Pricing | Price | News | Database | Chart | Forecast

Soybean oil prices have been a topic of considerable interest due to their significant impact on both the agricultural and food industries. The pricing dynamics of soybean oil are influenced by a complex interplay of factors, including global supply and demand, weather conditions, production costs, and international trade policies. In recent years, the prices of soybean oil have experienced fluctuations that have had far-reaching consequences for various stakeholders, from farmers and processors to consumers and policymakers.

One of the primary drivers of soybean oil prices is the global demand for vegetable oils, which includes soybean oil as a key component. As the world's population continues to grow and economies expand, the demand for food products, including cooking oils, has risen steadily. This increase in demand has put upward pressure on soybean oil prices, especially in regions where soybean oil is a staple in diets and a crucial ingredient in food processing. The growing popularity of plant-based diets and the push for healthier cooking alternatives have also contributed to the rising demand for soybean oil.

Another significant factor influencing soybean oil prices is the supply side, particularly the production levels of soybeans. Soybean oil is derived from soybeans, and thus, any disruption in soybean production can have a direct impact on oil prices. Weather conditions play a critical role in determining soybean yields, with droughts, floods, and other adverse weather events often leading to reduced crop output. For example, a drought in a major soybean-producing region can lead to a lower supply of soybeans, thereby increasing the cost of soybean oil. Additionally, the acreage devoted to soybean cultivation can fluctuate due to competing crops and market incentives, further influencing the availability and pricing of soybean oil.

International trade policies and geopolitical events are also crucial in shaping soybean oil prices. As a globally traded commodity, soybean oil is subject to tariffs, export restrictions, and trade agreements that can either facilitate or hinder its movement across borders. For instance, changes in trade relations between major soybean-producing and importing countries can lead to shifts in supply chains and price volatility. Trade disputes, such as those between the United States and China, have historically affected soybean markets, causing price fluctuations that reverberate throughout the supply chain, from farmers to end consumers.

Get Real Time Prices for Soybean oil: https://www.chemanalyst.com/Pricing-data/soybean-oil-1318

The cost of production is another essential factor that impacts soybean oil prices. This includes the cost of inputs such as seeds, fertilizers, and pesticides, as well as the expenses related to harvesting, processing, and transportation. When production costs rise, either due to higher input prices or increased labor costs, these additional expenses are often passed on to consumers in the form of higher soybean oil prices. Additionally, advances in agricultural technology and farming practices can influence production efficiency, thereby affecting the cost and availability of soybean oil.

Global economic conditions also play a role in determining soybean oil prices. Economic downturns can lead to reduced consumer spending, which in turn can lower demand for non-essential goods, including cooking oils. Conversely, periods of economic growth often lead to increased demand for food products, including soybean oil, as consumers have more disposable income to spend on higher-quality and processed foods. Inflation, currency exchange rates, and other macroeconomic factors can further complicate the pricing landscape for soybean oil, making it sensitive to broader economic trends.

The renewable energy sector has also emerged as a significant factor in the soybean oil market. Soybean oil is a key feedstock for biodiesel production, and the growing emphasis on renewable energy sources has increased demand for biodiesel, thereby boosting soybean oil prices. Government policies promoting the use of biofuels, such as subsidies and mandates, have further contributed to the rising demand for soybean oil in the energy sector. As countries strive to reduce their carbon footprints and transition to cleaner energy sources, the intersection of agriculture and energy markets has become increasingly important in determining soybean oil prices.

The impact of currency fluctuations on soybean oil prices cannot be overlooked, particularly in the context of international trade. Since soybean oil is traded globally, the strength or weakness of the US dollar, which is the primary currency used in global commodity markets, can influence its pricing. A stronger dollar generally makes US exports more expensive for foreign buyers, potentially reducing demand and putting downward pressure on prices. Conversely, a weaker dollar can make US soybean oil more competitive in international markets, driving up demand and prices.

Speculation in commodity markets also plays a role in the pricing of soybean oil. Traders and investors in commodity markets often engage in speculative activities based on their expectations of future price movements. These speculations can be driven by various factors, including anticipated changes in supply and demand, weather forecasts, and geopolitical events. When large amounts of capital flow into or out of the soybean oil market based on speculative trading, it can lead to significant price volatility. This volatility can create uncertainty for producers and consumers alike, making it more challenging to predict and manage costs.

In conclusion, soybean oil prices are influenced by a multitude of factors that interact in complex ways. From global demand and supply conditions to production costs, trade policies, economic trends, and speculative activities, the pricing dynamics of soybean oil are shaped by both short-term events and long-term trends. As the world continues to navigate economic uncertainties, environmental challenges, and evolving energy needs, the future of soybean oil prices will likely remain a topic of keen interest and careful monitoring by stakeholders across the agricultural, food, and energy sectors.

Get Real Time Prices for Soybean oil: https://www.chemanalyst.com/Pricing-data/soybean-oil-1318

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Soybean Oil#Soybean Oil Price#Soybean Oil Prices#Soybean Oil Pricing#Soybean Oil News#Soybean Oil Price Monitor#Soybean Oil Database

0 notes

Text

Filling Machines | Intelweigh Multi Head Weigher | Nichrome Bangladesh

Nichrome offers filler weighers for packaging with various filling capacities for solid, liquid & viscous food products like snacks, milk, oil

#vertical form fill seal machine#filling and packaging machine#packaging machine supplier in bangladesh#powder packaging machine#liquid filling machine in bangladesh#potato chip packaging machine#chub packaging machine#soybean oil packing machine#automatic sachet packing machine#silica gel packing machine#pouch packing machine#pouch sealing machine#table top blister packaging machine#powder bottle filling machine#small packaging machine#packaging machine price#shampoo filling machine#spices packing machine#liquid pouch packing machine#viscous liquid filling machine#ointment tube filling machine#ointment filling machine#airtight food packaging machine

0 notes

Text

Soybean Oil Prices Analysis, Tracking, Updates, Trends & Forecast | ChemAnalyst

Soybean oil prices, indicative of the cost of this vegetable oil extracted from soybeans, are subject to fluctuations influenced by various factors such as global market dynamics, agricultural output, and production costs. Understanding these price movements entails a comprehensive analysis of supply and demand dynamics, crop yields, and macroeconomic indicators.

The pricing of soybean oil is significantly influenced by the balance between supply and demand within the agricultural sector. Soybean oil, valued for its versatility and nutritional properties, finds extensive use in cooking, food processing, biodiesel production, and industrial applications. Fluctuations in soybean production due to factors such as weather conditions, pest infestations, and government policies can significantly impact the availability and cost of soybean oil, thereby influencing its market price.

Consumer demand plays a crucial role in determining soybean oil prices. Soybean oil is a staple ingredient in many households and food industries due to its neutral taste, high smoke point, and health benefits. Fluctuations in consumer preferences, dietary trends, and health awareness can lead to changes in demand for soybean oil, affecting its market price.

Get Real-Time Soybean Oil Prices: https://www.chemanalyst.com/Pricing-data/soybean-oil-1318

Raw material costs also significantly impact soybean oil prices. The price of soybeans, the primary raw material for soybean oil production, can fluctuate due to changes in agricultural yields, input costs, and global market dynamics. Any significant increase in soybean prices can translate into higher production costs for soybean oil manufacturers, thereby exerting upward pressure on prices.

Macroeconomic indicators, such as inflation rates, currency exchange rates, and income levels, can indirectly affect soybean oil prices by influencing overall consumer purchasing power and spending patterns. Economic expansions tend to drive up demand for edible oils, including soybean oil, as consumers have higher disposable incomes to spend on cooking oils and food products. Conversely, economic downturns may lead to reduced demand and downward pressure on soybean oil prices.

Government policies and regulations, such as import tariffs, export restrictions, and biofuel mandates, can also impact soybean oil prices. Trade policies that affect the import and export of soybeans and soybean oil can influence domestic supply and demand dynamics, thereby affecting prices. Biofuel mandates and renewable fuel standards can also influence the demand for soybean oil as a feedstock for biodiesel production, affecting its market price.

Looking ahead, several factors are expected to continue influencing soybean oil prices. Changes in agricultural practices, technological advancements in oil extraction processes, and shifts in consumer preferences for healthier cooking oils could lead to changes in market dynamics and price levels for soybean oil. Moreover, global trends in food consumption, dietary habits, and sustainability concerns may also influence the demand for soybean oil and its market price.

In conclusion, soybean oil prices are subject to a complex interplay of factors including agricultural output, consumer demand, raw material costs, macroeconomic indicators, and government policies. Stakeholders in the soybean oil industry, including farmers, manufacturers, retailers, and consumers, must closely monitor these factors to anticipate price movements and make informed decisions. As the culinary landscape evolves and consumer preferences change, navigating the dynamic market for soybean oil will remain a key challenge for industry participants.

Get Real-Time Soybean Oil Prices: https://www.chemanalyst.com/Pricing-data/soybean-oil-1318

ChemAnalyst

GmbH — S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49–221–6505–8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

First Quarter of 2023 in Asia- Pacific Soybean Oil Prices

North America

During the first quarter of 2023, the Soybean oil Prices in North America fluctuated due to conflicting market sentiments and erratic market dynamics. Prices dropped in the first half of Q1 as a result of the war's protracted settlement and the signing of various agreements between Russia and Ukraine. This, in turn, reduced the cost of edible oils, especially soybean oil. Because of the constant supply and low demand, the price remained low. All oils are now more affordable in the local US market as a result of the global decline in edible oil costs. Due to ample supplies on the domestic market, prices fell throughout the duration of the second half of the second month of Q1 2023. The third month of the quarter saw a price rise because the overall level of demand was high, and there was low availability of products available to meet customer needs.

Asia-Pacific region

Soybean oil prices fell in the Asia-Pacific region in Q1 2023. Importers raised their purchases at the beginning of the quarter, particularly in the first month, as a result of low global pricing and strong crush margins. China imported 6 MT of soybeans from Brazil in February, which was a record-high amount compared to a year earlier. Prices remained constant during the second month of the quarter as they continued to decline since there was sufficient demand from both domestic consumers and traders. Although during the last month of the quarter, market goods prices recovered to their typical range. The price of Soybean Oil was estimated to be USD 1377/MT at the end of Q4 for FOB Shanghai (China) in March 2023.

Europe

Soybean Oil prices fell in the European region in the first quarter of 2023, boosted by exporters who mostly fulfilled contracts that were already in place. While land logistics continued to run smoothly, there were more new contracts. Furthermore, because of efficient transportation and a sharp decline in fuel prices during the first half of the quarter, the product's price plummeted. Due to the availability of inventories on the domestic market and a drop in downstream demand, prices fell in the second part of Q1. Because there are no concerns about a limited supply, the product's price has decreased on the domestic market. The price of Soybean Oil was estimated to be USD 1385/MT for CFR Hamburg (Germany) in March, around the conclusion of Q1 2023.

ChemAnalyst addresses the key problematic areas and risks associated with chemical and petrochemical business globally and enables the decision-maker to make smart choices. It identifies and analyses factors such as geopolitical risks, environmental risks, raw material availability, supply chain functionality, disruption in technology and so on. It targets market volatility and ensures clients navigate through challenges and pitfalls in an efficient and agile manner. Timeliness and accuracy of data has been the core competency of ChemAnalyst, benefitting domestic as well as global industry in tuning in to the real-time data points to execute multi-billion-dollar projects globally.

0 notes

Text

The World's Forests Are Doing Much Better Than We Think

You might be surprised to discover... that many of the world’s woodlands are in a surprisingly good condition. The destruction of tropical forests gets so much (justified) attention that we’re at risk of missing how much progress we’re making in cooler climates.

That’s a mistake. The slow recovery of temperate and polar forests won’t be enough to offset global warming, without radical reductions in carbon emissions. Even so, it’s evidence that we’re capable of reversing the damage from the oldest form of human-induced climate change — and can do the same again.

Take England. Forest coverage now is greater than at any time since the Black Death nearly 700 years ago, with some 1.33 million hectares of the country covered in woodlands. The UK as a whole has nearly three times as much forest as it did at the start of the 20th century.

That’s not by a long way the most impressive performance. China’s forests have increased by about 607,000 square kilometers since 1992, a region the size of Ukraine. The European Union has added an area equivalent to Cambodia to its woodlands, while the US and India have together planted forests that would cover Bangladesh in an unbroken canopy of leaves.

Logging in the tropics means that the world as a whole is still losing trees. Brazil alone removed enough woodland since 1992 to counteract all the growth in China, the EU and US put together. Even so, the planet’s forests as a whole may no longer be contributing to the warming of the planet. On net, they probably sucked about 200 million metric tons of carbon dioxide from the atmosphere each year between 2011 and 2020, according to a 2021 study. The CO2 taken up by trees narrowly exceeded the amount released by deforestation. That’s a drop in the ocean next to the 53.8 billion tons of greenhouse gases emitted in 2022 — but it’s a sign that not every climate indicator is pointing toward doom...

More than a quarter of Japan is covered with planted forests that in many cases are so old they’re barely recognized as such. Forest cover reached its lowest extent during World War II, when trees were felled by the million to provide fuel for a resource-poor nation’s war machine. Akita prefecture in the north of Honshu island was so denuded in the early 19th century that it needed to import firewood. These days, its lush woodlands are a major draw for tourists.

It’s a similar picture in Scandinavia and Central Europe, where the spread of forests onto unproductive agricultural land, combined with the decline of wood-based industries and better management of remaining stands, has resulted in extensive regrowth since the mid-20th century. Forests cover about 15% of Denmark, compared to 2% to 3% at the start of the 19th century.

Even tropical deforestation has slowed drastically since the 1990s, possibly because the rise of plantation timber is cutting the need to clear primary forests. Still, political incentives to turn a blind eye to logging, combined with historically high prices for products grown and mined on cleared tropical woodlands such as soybeans, palm oil and nickel, mean that recent gains are fragile.

There’s no cause for complacency in any of this. The carbon benefits from forests aren’t sufficient to offset more than a sliver of our greenhouse pollution. The idea that they’ll be sufficient to cancel out gross emissions and get the world to net zero by the middle of this century depends on extraordinarily optimistic assumptions on both sides of the equation.

Still, we should celebrate our success in slowing a pattern of human deforestation that’s been going on for nearly 100,000 years. Nothing about the damage we do to our planet is inevitable. With effort, it may even be reversible.

-via Bloomburg, January 28, 2024

#deforestation#forest#woodland#tropical rainforest#trees#trees and forests#united states#china#india#denmark#eu#european union#uk#england#climate change#sustainability#logging#environment#ecology#conservation#ecosystem#greenhouse gasses#carbon emissions#climate crisis#climate action#good news#hope

3K notes

·

View notes

Video

youtube

green beans roasting machine price|soybean roaster for sale|Stir-fry chestnut machine

Raw material:all kinds of nuts, beans etc. Capacity:50-500kg/h Machine material: SUS304 Wechat/whatsapp:8613213203466

#green beans roasting machine price#soybean roaster for sale#Stir-fry chestnut machine#nuts roasting machine#peanuts roasting machine

0 notes

Text

AI-driven accurate forecasting for confident decision

Make informed and confident decisions about commodity investing with AI-Driven Accurate Forecasting Software. This innovative tool provides real-time commodity prices and gives accurate predictions for top commodities, including cotton prices, palm oil prices, sugar prices, and more.

Visit: https://pricevision.ai

#commodity market#commodity price forecasting#commodity futures prices#live commodity prices#Artificial intelligence#oil price forecast#wheat price#steel prices#palm oil price#sugar price#coffee price#ai techniques#oil forecast#soybean price today#commodity prices

0 notes

Text

Prepackaged instant noodles have their origins in the cheap price for wheat and fat (in the original case, soybean oil) dumped by the US on its East Asian protectorates, South Korea and Japan, as American aid after the Second World War and the Korean war. Since then, prepackaged instant noodles have become a staple of migrant workforces around the world. In China, the prepackaged instant noodle has become a fixture of life for the country’s poorest people and especially in the dormitories and cramped apartments of migrant workers. In this sense, it powered and continues to power the production of a huge proportion of the world’s material culture that flows outward from those factories. Nearly everything that surrounds me as I write to you emerged from or contains components built in coastal Chinese plants where palm oil-heavy instant noodles form a fixture of young migrant workers’ diets. Dozens of parts of the computer on which I type, the wax on the table on which it sits, the small plastic bottle of hand cream, the shoes I am wearing and so much more.

Max Haiven, Palm Oil: The Grease of Empire

278 notes

·

View notes

Text

Soybean Oil Price Chart, Historical and Forecast Analysis Provided by Procurement Resource

Report Features Details Product Name Soybean Oil Industrial Uses Vegetable oil, Biodiesel, Condiment for salads, Printing ink and oil paint formulations, Fixative Region/Countries Covered Asia Pacific: China , India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong,…

View On WordPress

0 notes

Text

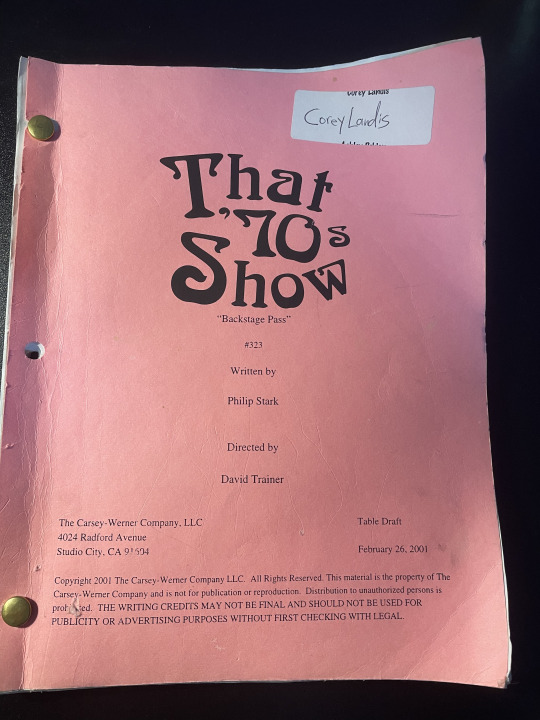

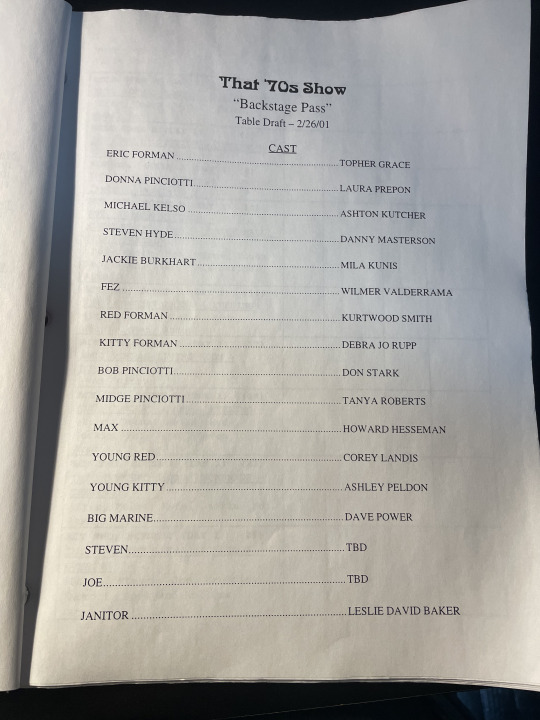

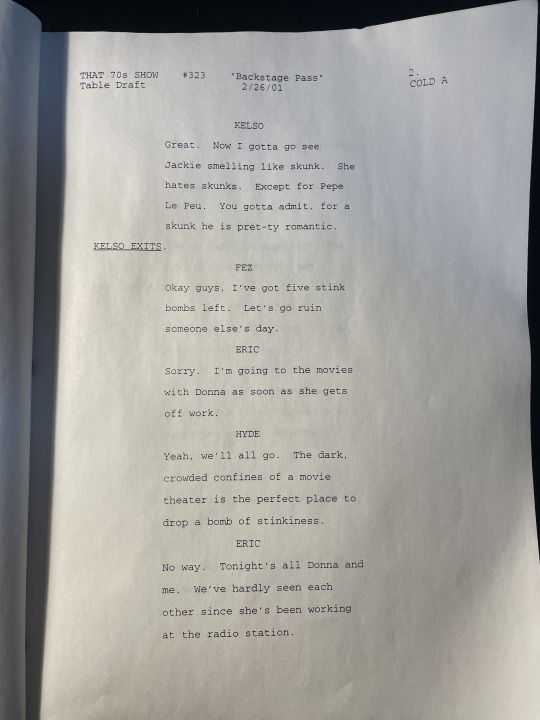

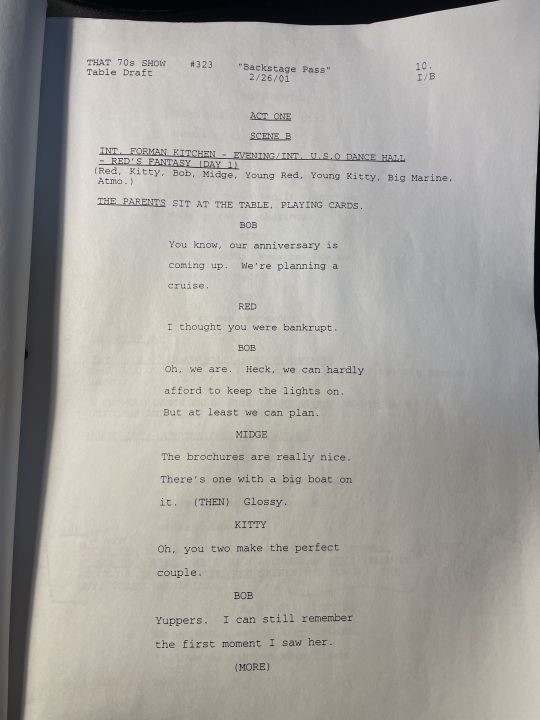

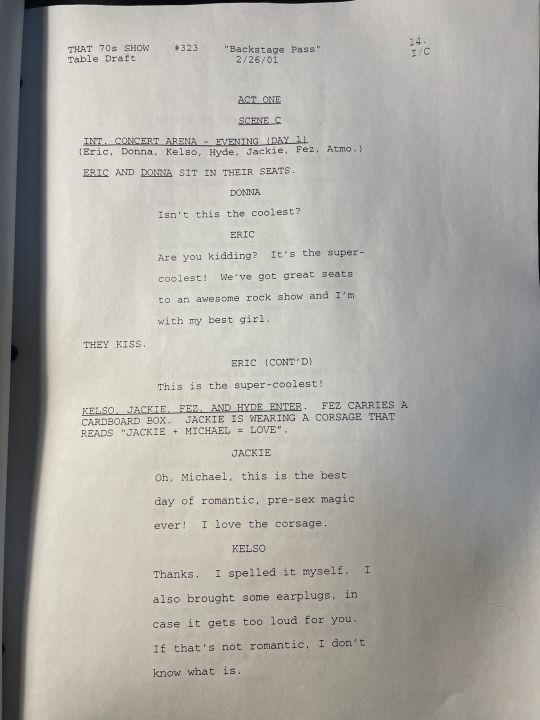

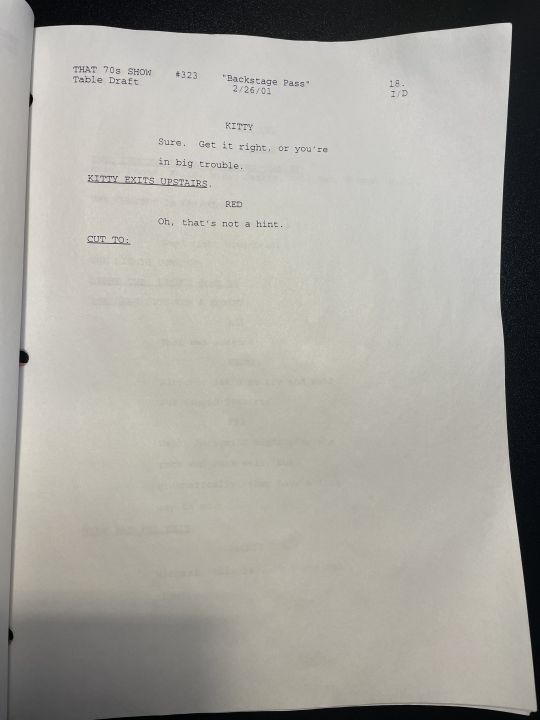

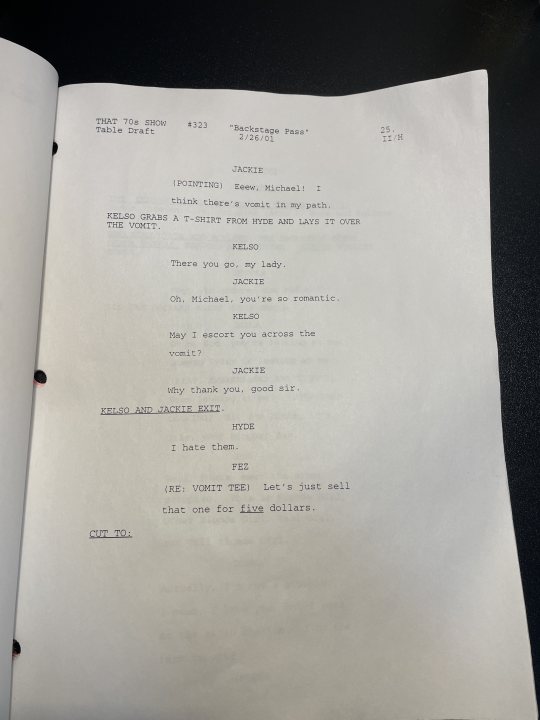

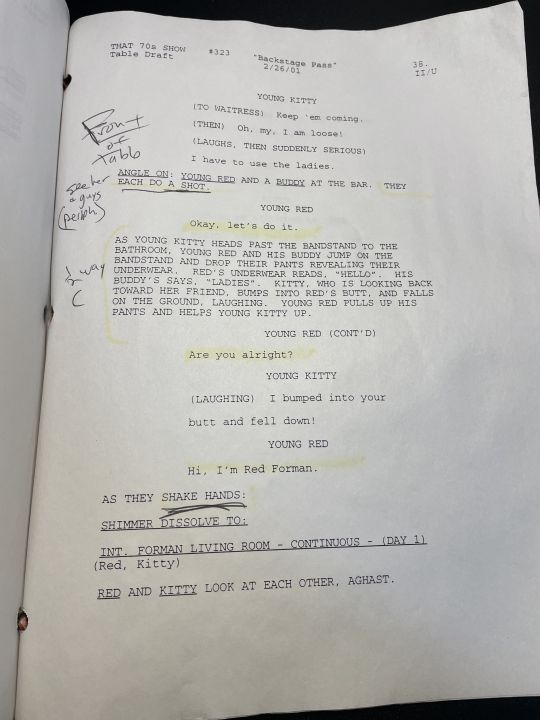

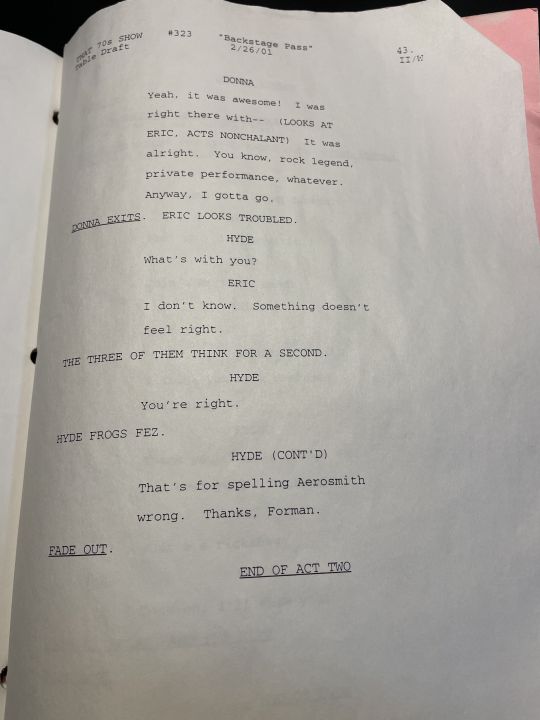

Hello again! I'm back with another That '70s Show original script. This time we'll be looking at S3xE23 "Backstage Pass"!

This one is extra special because of who it belonged to - one Corey Landis. And it's a table draft, which means there were quite a few changes (some of them significant!). Read on for my summary.

Who's Corey Landis? you may ask. Fair question.

He is the actor who plays a young Red Forman a few different times throughout the series! It's really cool to see the different notes he wrote to himself about how a scene should be staged or acted.

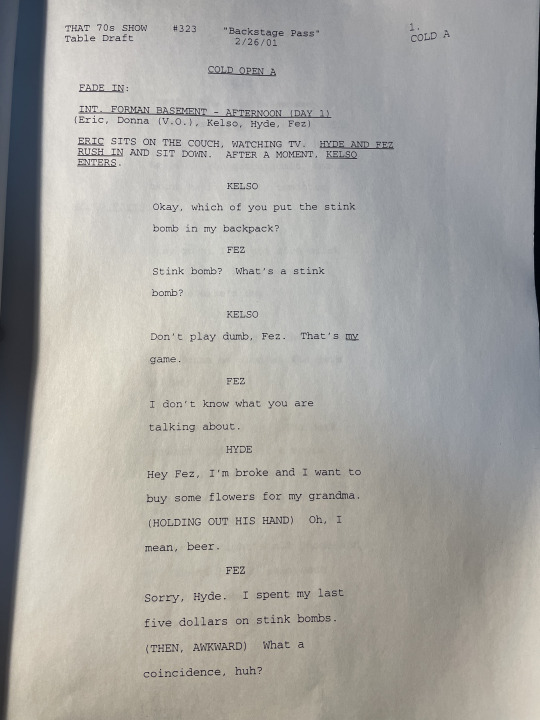

First up, right off the bat the cold open has some different lines.

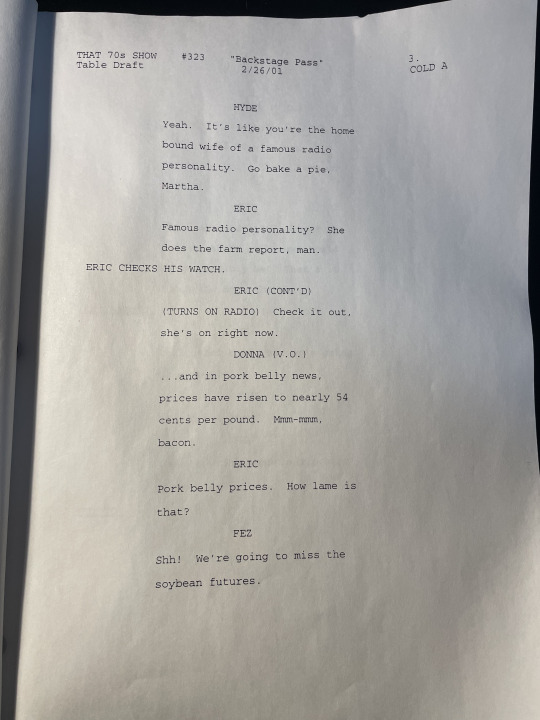

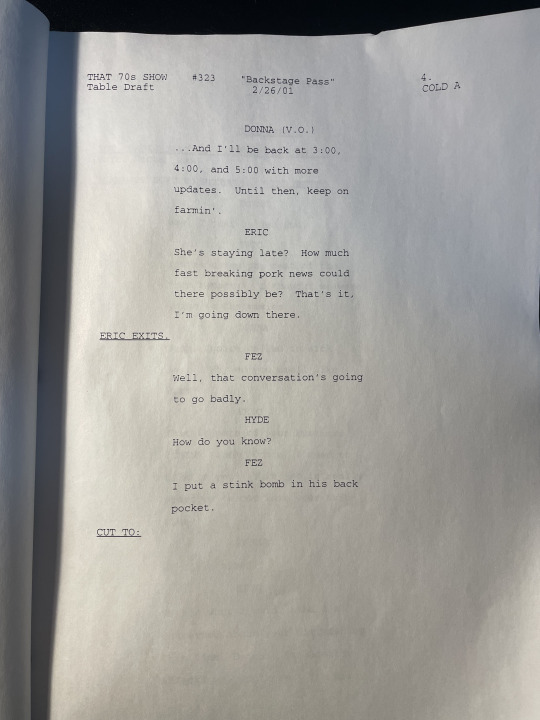

As you can see, the scene still ends in the same place and most of what the characters say is similar. You can see how they made it slightly shorter in the episode.

I like that Fez is interested in the soybean futures lol, that in the actual episode Eric's line was, "Pork belly prices. How cute is that?" instead, and that LP might've improvised her bit about forgetting to turn off the microphone (or it was added by a writer/producer in a later version of the script).

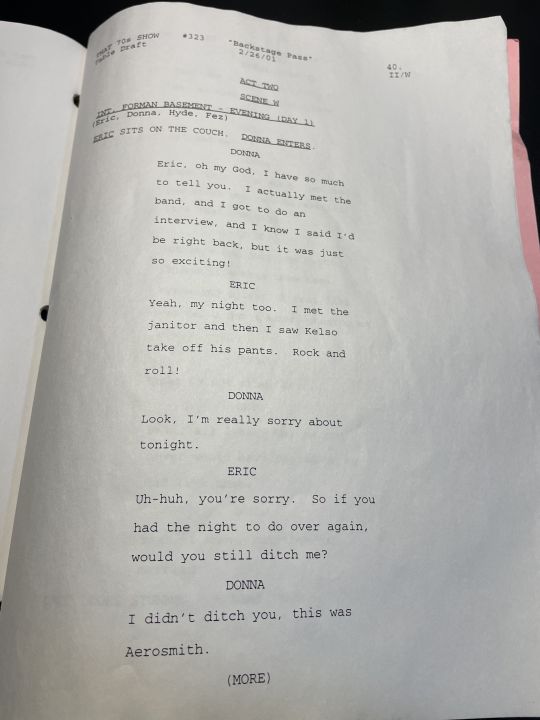

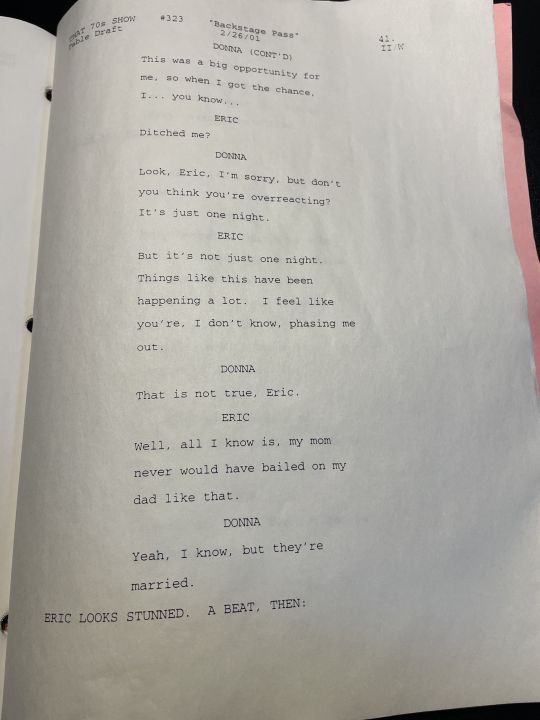

Eric and Donna's next scene is virtually the same, except for one major difference...

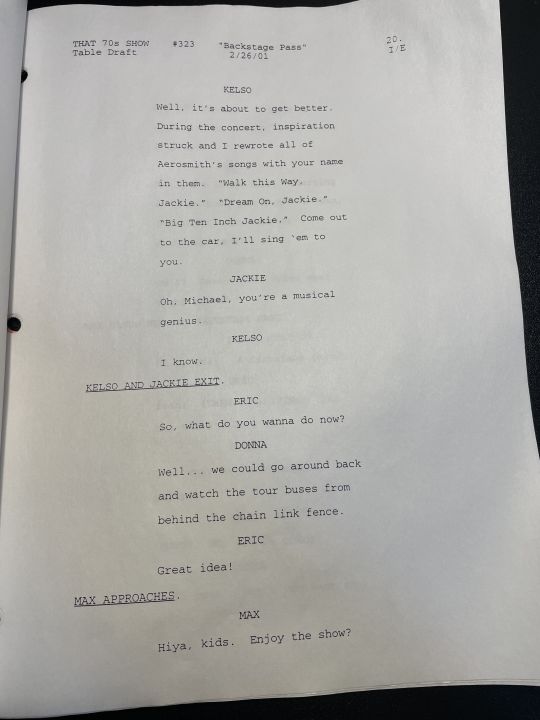

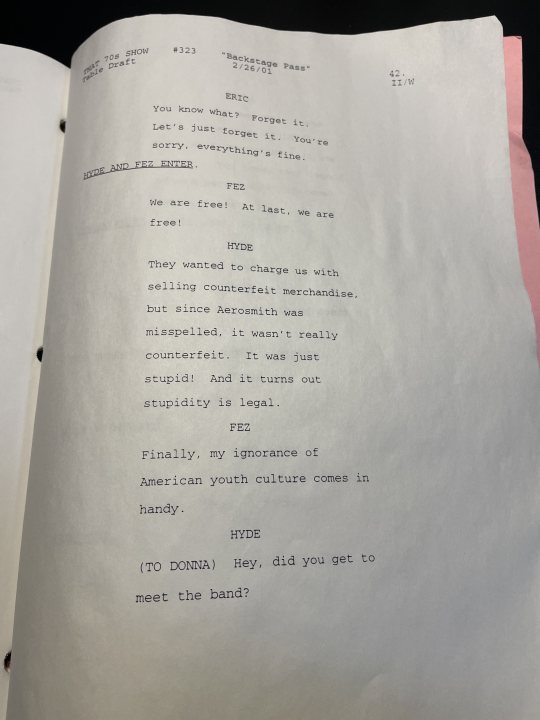

... the band they went to see was originally going to be Aerosmith! In the actual episode, they went to see Ted Nugent. There must have been some kind of licensing issue with being able to use Aerosmith. It's a significant difference, though, because this episode would've continued the characterization that Donna has a crush on Steven Tyler.

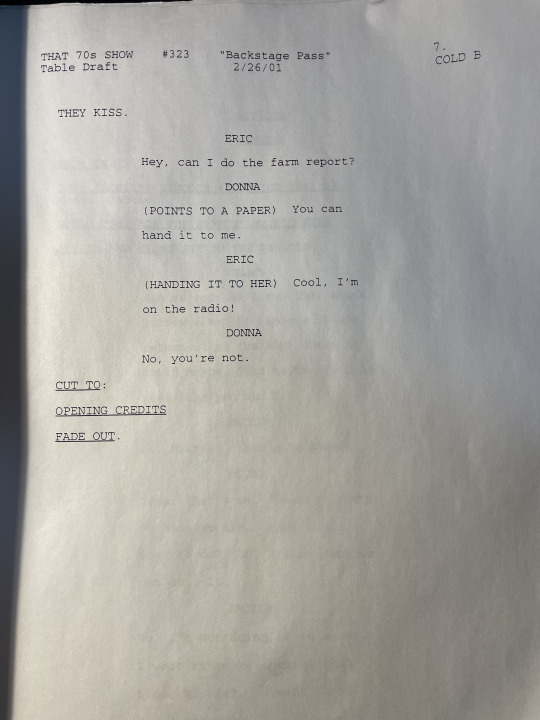

There's also this funny, cut moment at the end of Eric and Donna's scene at the radio station:

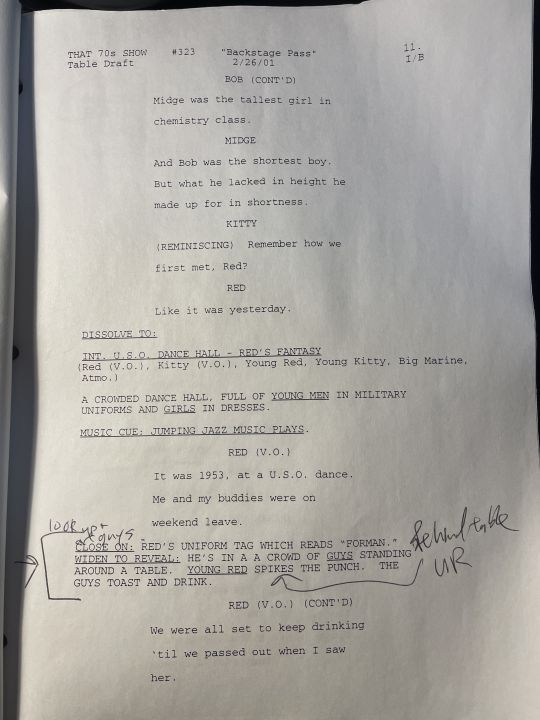

Now onto the parents.

Some more Bob and Midge lore:

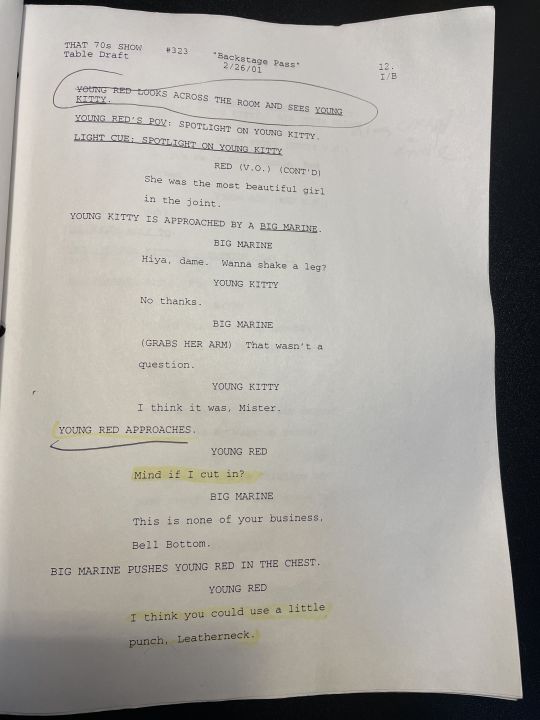

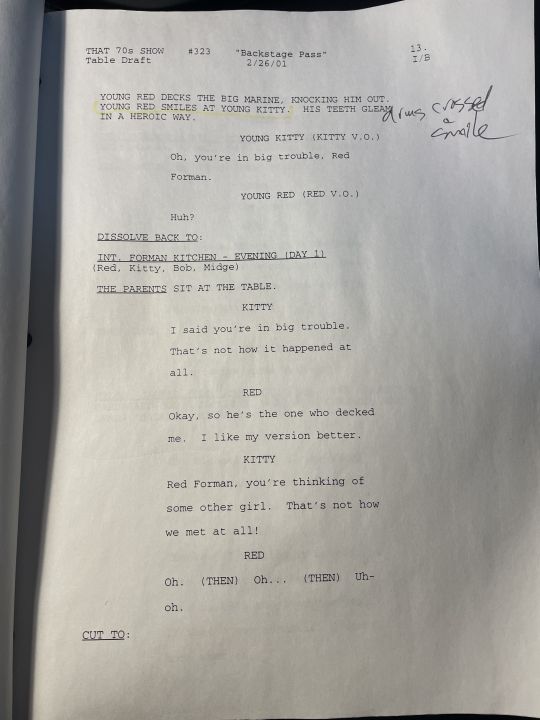

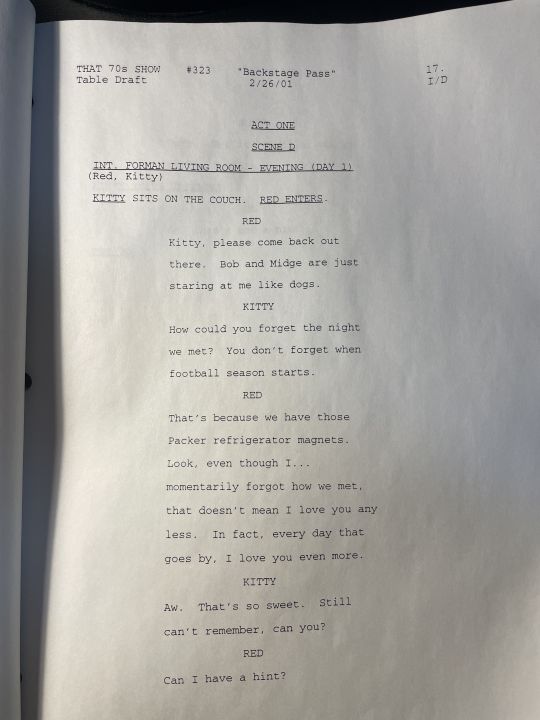

Red and Kitty's interaction is nearly word for word, but check out the actor's notes from the table read!! Pretty cool.

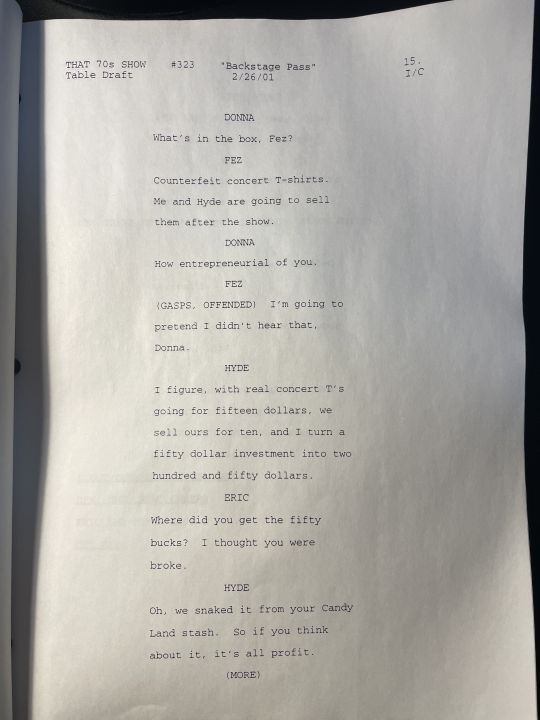

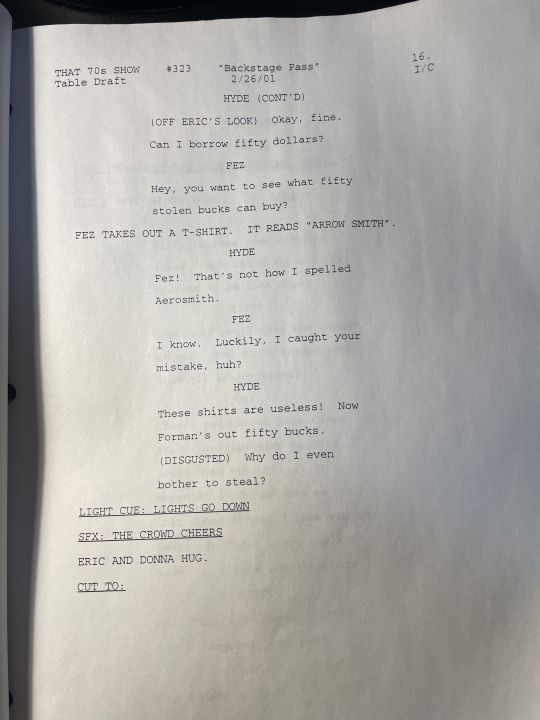

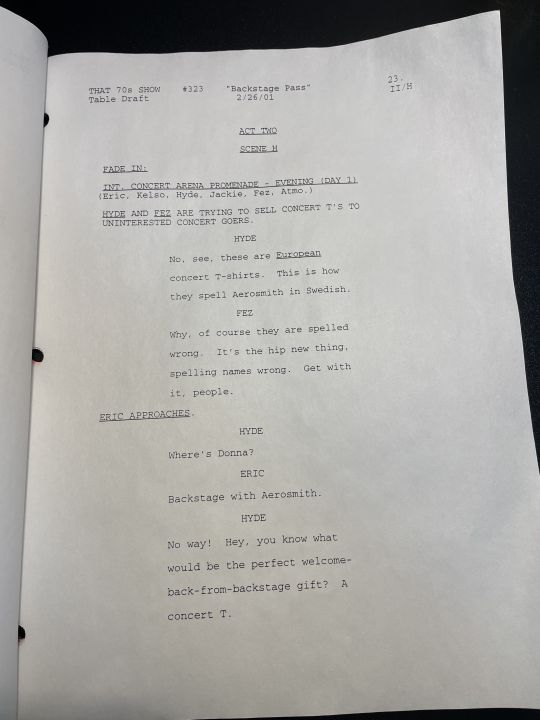

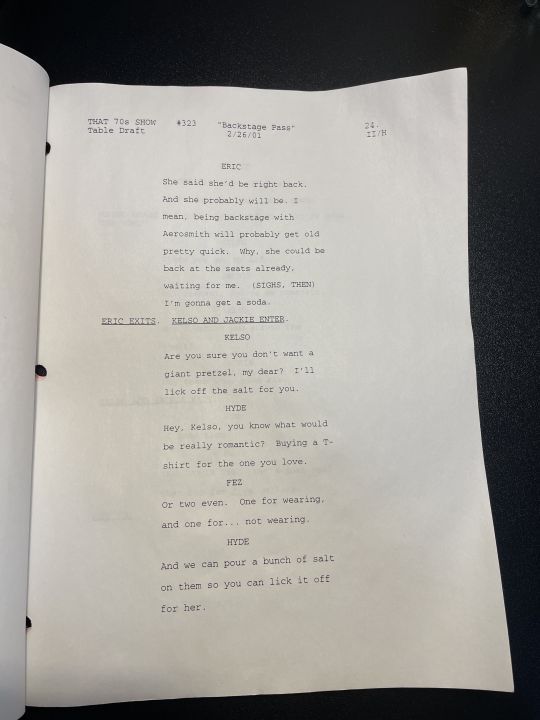

The next scene sees the gang waiting for the Aerosmith Ted Nugent concert to begin. And again it's similar, though not identical, to the scene that aired - Jackie and Kelso discuss their week of romance, Eric and Donna are eager for the concert to begin, and Fez and Hyde reveal their misspelled concert merch.

I was robbed of another Eric & Donna kiss (and a hug!), though 😡 + Eric calling her his "best girl". 🥹

Next we're back to the parents.

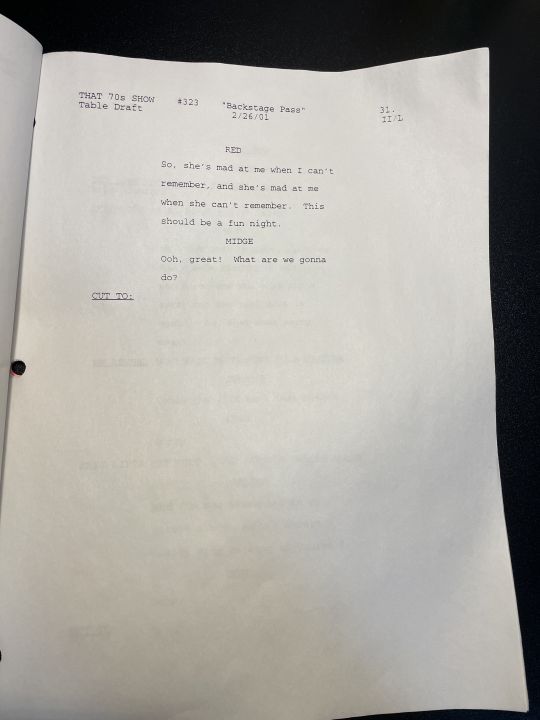

Red is still trying to remember how he and Kitty really met, and Kitty is becoming increasingly upset. In the episode she told him her version of events at this point, but in the script it is dragged out a little longer.

The Packer refrigerator magent line made me chuckle, ngl.

Back at the concert. This scene is again nearly identical to what really aired, but I enjoyed Kelso's Aerosmith versions of the songs he changed for Jackie. 😂

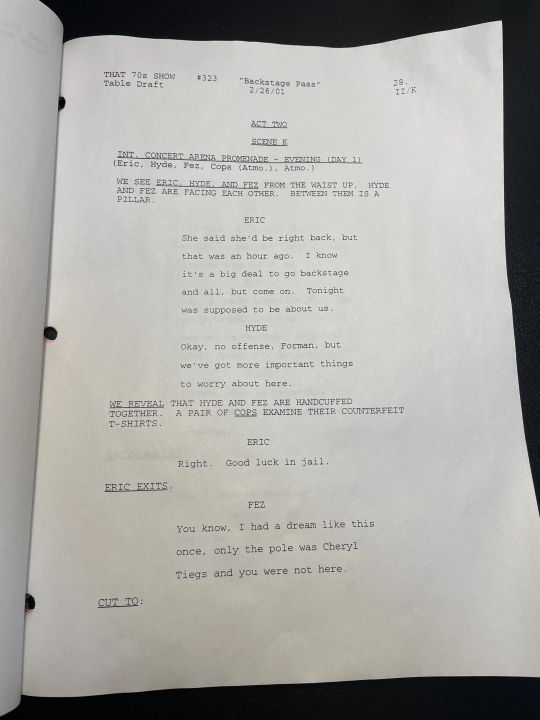

Then we check in on Fez and Hyde, who are struggling to sell their misprinted t-shirts just like in the episode.

Donna's scene backstage is word for word, except she's interviewing Steven Tyler instead of Ted Nugent.

In the next scene, Fez and Hyde get arrested. The scene is practically the same, except we get a little more insight into how upset Eric is with Donna. "Tonight was supposed to be about us," 😫. And I like Fez's Cheryl Tiegs line from the actual episode better.

Then the script cuts back to Red and Kitty. It's basically the same scene from the actual episode, but with a few added details. Horseface Lynn Taylor is mentioned again 🤣

Then Eric's scene with the janitor (Stanley!!), and Donna's scene backstage where Ted/Steven offers to let her touch the guitar are word for word.

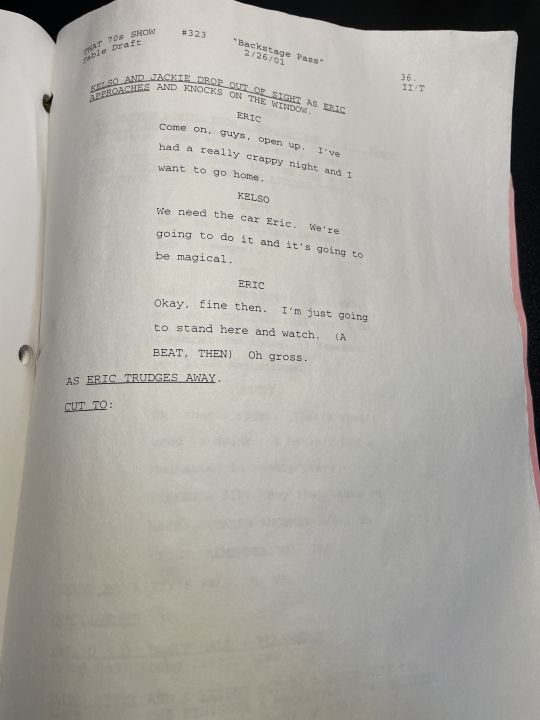

Kelso and Jackie's storyline and lines are mostly unchanged throughout, but this added line from Eric at the end of their final scene made me 😂🤣

Then we're back to Red and Kitty to conclude their storyline for the episode. The scene starts out the exact same, but ends with slightly different lines.

I just love getting to see the actor's notes!

And finally, the biggest difference of all: in the script, Eric and Donna's final scene takes place in the Forman basement, not outside of the concert venue. I'm glad they changed that, because all I can think is: how did Donna get home that night? Even though he was pissed, Eric really left her there? No no no no no. 😣 I think it's much more in character that he waited.

I do like that in the script Donna at least actually apologized - in the episode, she didn't. It's widely acknowledged within the fandom that this is one of Donna's worst moments on the show, regardless.

As one of the final episodes of season 3, this episode/storyline was integral to setting the stage for Eric and Donna's emerging break-up and it does the job. The original script even more so than the actual episode, in my opinion.

Well, that's all I've got for this one! Thanks for reading, and stay tuned for more in the series. I'm your *very* pregnant and uncomfortable host, @thatseventiesbitch 😄.

Other Scripts I've Posted:

S2xE20 "Kiss of Death" S2xE22 "Jackie Moves On" S2xE23 "Holy Crap!" S2xE26 "Moon Over Point Place" S5xE21 "Trampled Under Foot" S6xE20 "Squeezebox" S7xE8 "Angie"

#that 70s show#that '70s show#S3xE24#Backstage Pass#T70S Scripts#eric forman#donna pinciotti#steven hyde#jackie burkhart#michael kelso#fez#red forman#kitty forman#bob pinciotti#midge pinciotti#eric and donna#eric x donna#otp: mom and dad#red and kitty#red x kitty

35 notes

·

View notes

Text

Kota Mandi Bhav : कोटा मंडी भाव 5 जनवरी 2025; कृषि जिंसों और सर्राफा बाजार में उतार-चढ़ाव

Kota Mandi Bhav 5 January 2025 : शुक्रवार को भामाशाह मंडी में विभिन्न कृषि जिंसों की आवक करीब 1,40,000 कट्टे रही। धान और लहसुन में गिरावट देखी गई, जबकि सर्राफा बाजार में चांदी और सोने के भाव तेज रहे। मंडी में प्रमुख जिंसों के भाव (प्रति क्विंटल) फसल न्यूनतम मूल्य (₹) अधिकतम मूल्य (₹) गेहूं 2,850 3,091 धान (सुगंधा) 2,300 2,521 धान (1509) 2,600 2,821 धान…

#Agro Commodity#Bhamashah Mandi Kota#bullion market#gold silver price#Kota Mandi Bhav#Kota Mandi Bhav 5 January 2025#kota mandi news#Kota news#mustard price high#paddy#soybean | Kota News | News

0 notes

Text

Soybean Oil Prices Trend | Pricing | Database | Index | News| Chart

Soybean Oil Prices have been a focal point of the global commodity market, influenced by a multitude of factors ranging from agricultural trends to geopolitical developments. The price fluctuations of soybean oil are critical for various stakeholders, including farmers, food manufacturers, and consumers. One of the primary drivers of soybean oil prices is the supply and demand dynamic. As a product derived from soybeans, the availability of soybeans directly impacts the production of soybean oil. Agricultural productivity, affected by weather conditions, pest outbreaks, and technological advancements, plays a crucial role. For instance, droughts or excessive rainfall in major soybean-producing regions such as the United States, Brazil, and Argentina can significantly reduce crop yields, leading to a decrease in soybean supply and consequently pushing up soybean oil prices.

On the demand side, the diverse applications of soybean oil also influence its market price. Soybean oil is not only a staple in the food industry, used in cooking and food processing, but also a key ingredient in the production of biodiesel. The growing interest in renewable energy sources has bolstered the demand for biodiesel, thus increasing the consumption of soybean oil. Government policies and subsidies promoting biodiesel production can further amplify this demand, exerting upward pressure on prices. Additionally, consumer preferences and dietary trends, such as the rising demand for plant-based foods and health-conscious eating habits, contribute to the fluctuating demand for soybean oil.

Get Real Time Prices of Soybean Oil: https://www.chemanalyst.com/Pricing-data/soybean-oil-1318

International trade policies and tariffs also play a significant role in shaping soybean oil prices. Trade relations between major soybean-producing and importing countries can lead to volatility in the market. For instance, trade disputes or the imposition of tariffs between the United States and China, two of the largest players in the soybean market, can disrupt supply chains and affect prices. Such geopolitical tensions can lead to uncertainty, causing price spikes or drops depending on the nature of the trade restrictions imposed.

Currency exchange rates are another important factor impacting soybean oil prices. Since soybean oil is traded globally, the value of the US dollar, which is the dominant currency in commodity trading, can influence prices. A stronger dollar makes US soybean oil more expensive for foreign buyers, potentially reducing demand and lowering prices. Conversely, a weaker dollar makes it cheaper, boosting demand and driving up prices.

Technological advancements in agriculture and processing techniques can also affect soybean oil prices. Innovations that improve crop yields, enhance pest resistance, or increase the efficiency of oil extraction can lead to greater supply, thereby exerting downward pressure on prices. On the other hand, disruptions in these technologies, such as the emergence of resistant pests or diseases, can have the opposite effect.

The global economic environment and market speculation also play crucial roles. Economic growth in developing countries can lead to increased consumption of edible oils, including soybean oil, thus driving up demand and prices. Conversely, economic downturns can reduce consumer spending and demand for such commodities. Additionally, commodity traders and investors who speculate on future prices can cause short-term volatility. Speculative trading based on anticipated supply and demand changes, weather forecasts, or geopolitical events can lead to price swings independent of actual market fundamentals.

Environmental concerns and sustainability practices are increasingly influencing soybean oil prices as well. The push for sustainable agriculture and deforestation-free supply chains is gaining traction among consumers and regulatory bodies. Compliance with these practices can affect production costs and, consequently, prices. Companies that invest in sustainable practices may incur higher costs, which could be passed on to consumers in the form of higher prices. Conversely, failure to comply with sustainability standards can lead to reputational damage and reduced demand, potentially impacting prices negatively.

In summary, soybean oil prices are the result of a complex interplay of factors including supply and demand dynamics, agricultural productivity, international trade policies, currency exchange rates, technological advancements, economic conditions, market speculation, and sustainability practices. Understanding these factors is essential for stakeholders in the soybean oil market to make informed decisions and navigate the inherent volatility of this commodity. The interdependence of these factors means that changes in one area can have significant ripple effects throughout the market, making it crucial for participants to stay informed and adaptable in response to evolving market conditions.

Get Real Time Prices of Soybean Oil: https://www.chemanalyst.com/Pricing-data/soybean-oil-1318

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Soybean Oil#Soybean Oil Price#Soybean Oil Prices#Soybean Oil Pricing#Soybean Oil News#Soybean Oil Price Monitor#Soybean Oil Database

0 notes