#Software integration services

Explore tagged Tumblr posts

Text

The Importance of Accurate Bookkeeping for Small Businesses

Running a small business requires meticulous attention to finances. One of the most critical yet often overlooked aspects of managing a business is accurate bookkeeping. Proper bookkeeping ensures financial stability, compliance, and growth, allowing business owners to focus on scaling their operations rather than getting bogged down by disorganized financial records. In today’s competitive market, small businesses can greatly benefit from outsourced bookkeeping USA services, such as those offered by Raha Financials.

1. What is Bookkeeping, and Why Does It Matter?

Bookkeeping is the systematic recording, organizing, and tracking of financial transactions. It serves as the foundation for accounting and financial management, helping business owners maintain a clear picture of their financial health. Without accurate bookkeeping, small businesses may struggle with tax compliance, cash flow management, and financial decision-making.

Key Benefits of Proper Bookkeeping:

Ensures accurate financial reporting

Simplifies tax filing and compliance

Enhances cash flow management

Aids in securing business loans and investments

Reduces the risk of financial fraud and errors

2. How Bookkeeping Impacts Business Growth

Small businesses aiming for long-term success must prioritize bookkeeping. With organized financial records, businesses can track income and expenses efficiently, identify growth opportunities, and make informed financial decisions. Accurate bookkeeping also plays a vital role in financial forecasting, helping businesses set realistic goals and allocate resources effectively.

For instance: If a business owner notices a pattern of high expenses in a specific area, they can take proactive steps to cut costs and improve profitability. On the other hand, identifying steady revenue growth can signal the right time to expand operations or hire additional staff.

3. Common Bookkeeping Challenges Faced by Small Businesses

While bookkeeping is essential, many small business owners struggle to maintain accurate records due to various challenges:

Lack of Time: Managing bookkeeping alongside daily operations can be overwhelming.

Limited Financial Knowledge: Many business owners lack expertise in accounting principles.

Human Errors: Manual bookkeeping increases the risk of mistakes, which can lead to financial mismanagement.

Regulatory Compliance: Keeping up with changing tax laws and financial regulations can be daunting.

To overcome these challenges, many businesses are turning to outsourced bookkeeping USA services like Raha Financials, which offer professional bookkeeping solutions tailored to business needs.

4. The Advantages of Outsourcing Bookkeeping Services

Outsourcing bookkeeping to a trusted financial service provider like Raha Financials can save time, reduce errors, and provide expert financial insights. Here are some compelling reasons why small businesses should consider outsourcing:

Cost Savings

Hiring a full-time, in-house bookkeeper can be costly, considering salaries, benefits, and training expenses. Outsourcing provides access to expert bookkeepers at a fraction of the cost.

Accuracy and Compliance

Professional bookkeeping services ensure financial accuracy and compliance with tax regulations, minimizing the risk of errors, penalties, or audits.

Scalability

As businesses grow, their financial management needs evolve. Outsourced bookkeeping services can scale with the business, offering flexible solutions that adapt to changing demands.

Focus on Core Business Activities

By delegating bookkeeping tasks to experts, business owners can concentrate on expanding their operations, improving customer service, and increasing profitability.

5. Why Choose Raha Financials for Bookkeeping?

Raha Financials specializes in providing top-tier outsourced bookkeeping USA services, catering to the unique needs of small businesses. Their experienced team offers tailored financial solutions, ensuring accuracy, efficiency, and compliance.

Key Services Offered by Raha Financials:

Recording financial transactions

Bank and credit card reconciliation

Payroll processing

Financial statement preparation

Tax preparation and filing assistance

Expense tracking and cash flow management

By choosing Raha Financials, small businesses can enjoy peace of mind knowing that their finances are in expert hands.

6. Tips for Maintaining Accurate Bookkeeping Records

Even with outsourced bookkeeping, small business owners should adopt best practices to keep their financial records organized:

Keep Personal and Business Finances Separate: Maintaining separate accounts avoids confusion and simplifies tax filing.

Track All Expenses: Record all transactions, including small purchases, to maintain accurate financial records.

Use Digital Accounting Software: Cloud-based solutions streamline bookkeeping and improve accuracy.

Regularly Review Financial Statements: Monthly reviews help identify discrepancies and track financial performance.

Work with a Trusted Bookkeeping Service: Collaborating with a reliable firm like Raha Financials ensures professional management of financial records.

Conclusion

Accurate bookkeeping is the backbone of any successful small business. It provides financial clarity, aids in decision-making, and ensures compliance with tax regulations. For businesses struggling with bookkeeping, outsourcing to Raha Financials, a leading provider of outsourced bookkeeping USA, is a smart and cost-effective solution. By leveraging professional bookkeeping services, small businesses can optimize financial management, reduce stress, and focus on growth.

If you’re looking for expert bookkeeping assistance, consider Raha Financials to streamline your financial processes and take your business to the next level!

#Raha Financials#outsourced accounting and bookkeeping services#outsourced bookkeeping usa#software integration services#Tax Planning and Filing Services#global payroll services#financial management services

0 notes

Text

Top Classic and Adaptive AUTOSAR solutions in India- KPIT

KPIT providing the Top Classic and Adaptive AUTOSAR solutions in India, With 15+ years of AUTOSAR experience, KPIT offers AUTOSAR Base Software Solutions that go across E/E Architecture, such as High-Performance Compute (HPC) Platforms, Real-Time Critical ECUs, Sensors and I/O Concentrators, visite here to know more.

#AUTOSAR Solutions#AUTOSAR Base Software Solutions#Classic and Adaptive AUTOSAR#Software Integration Services#Platforms and Tools#AUTOSAR architecture#automotive industry#automotive and mobility industry

0 notes

Text

Software integration refers to the process of combining different software systems and ensuring that they work seamlessly together as a unified and cohesive solution. This involves connecting and coordinating various software applications, databases, and services to streamline workflows, enhance communication, and improve overall efficiency. Integration can occur at different levels, such as data integration, application integration, and business process integration, allowing organizations to optimize their operations by leveraging the strengths of multiple software components. Successful software integration facilitates real-time data exchange, reduces manual effort, and enhances the overall performance and functionality of an integrated system.

0 notes

Text

The Role of Business Development in Software Companies

In the dynamic landscape of the technology industry, software companies play a pivotal role in driving innovation and meeting the ever-evolving needs of businesses and consumers. Amidst the intricate web of coding, programming languages, and algorithms, the role of business development emerges as a critical component in the success and growth of software companies. This essay explores the multifaceted dimensions of business development within the context of software firms, elucidating its significance in fostering innovation, building strategic partnerships, and navigating the complexities of the market.

Innovation as a Catalyst for Growth: At the heart of every software company's success lies its ability to innovate. Business development, in this context, serves as a catalyst for fostering innovation. It involves identifying emerging trends, understanding customer needs, and translating these insights into products or services that stand at the forefront of technological advancements. Through market analysis and a keen understanding of industry trends, business development professionals guide software companies in creating cutting-edge solutions. They play a crucial role in ensuring that the products developed align with market demands and remain competitive in an ever-changing technological landscape.

Building Strategic Partnerships: Collaboration is a cornerstone of success in the software industry. Business development teams are instrumental in building and nurturing strategic partnerships that can drive growth, expand market reach, and enhance the overall competitiveness of a software company. These professionals engage in relationship-building activities, identifying potential partners, and negotiating mutually beneficial agreements. Whether it's forming alliances with other software companies, integrating with complementary technologies, or establishing relationships with key stakeholders, business development teams contribute to the creation of a robust ecosystem that propels the software company forward.

Navigating Market Complexity: The software market is characterized by its complexity, rapid evolution, and intense competition. Business development professionals act as navigators in this intricate terrain. They conduct thorough market research, analyze competitor strategies, and develop a deep understanding of customer needs. By staying abreast of market dynamics, these professionals guide the software company in making informed decisions about product development, pricing strategies, and market positioning. In essence, business development serves as the compass that helps software companies navigate the ever-shifting currents of the market, ensuring they remain agile and responsive to emerging opportunities and challenges.

Customer-Centric Approach: While technology forms the backbone of software companies, a customer-centric approach is equally essential for sustained success. Business development teams play a pivotal role in ensuring that the software solutions developed align with the needs and expectations of the end-users. Through customer feedback, market analysis, and collaboration with product development teams, business development professionals contribute to the creation of products that not only meet technical standards but also resonate with the target audience. This customer-centric focus enhances customer satisfaction, loyalty, and the overall market reputation of the software company.

Sales and Revenue Generation: Ultimately, the success of a software company is often measured by its ability to generate revenue. Business development professionals are central to this aspect, as they are responsible for driving sales and expanding the customer base. Through effective marketing strategies, targeted sales efforts, and the identification of new business opportunities, business development teams contribute directly to the financial health of the company. Their role extends beyond the initial sale, encompassing customer retention strategies and upselling efforts, ensuring a steady revenue stream for the software company.

Adaptability and Future-Proofing: In the fast-paced world of technology, adaptability is key to survival. Business development teams are tasked with future-proofing the software company by anticipating market trends and technological shifts. By continuously scanning the horizon for emerging opportunities and potential disruptions, business development professionals help the company stay ahead of the curve. This forward-looking approach is crucial for adapting strategies, exploring new markets, and incorporating emerging technologies into the software company's portfolio, ensuring its relevance and competitiveness in the long run.

Conclusion: In conclusion, the role of business development in software companies is multifaceted and indispensable. It encompasses innovation, strategic partnerships, market navigation, a customer-centric approach, sales, and adaptability. Business development professionals serve as the architects of growth, shaping the trajectory of a software company in a rapidly changing landscape. As technology continues to evolve, the symbiotic relationship between business development and software development becomes increasingly vital for companies aspiring not only to survive but to thrive in the competitive world of software solutions.

#anviamsolutions#anviam#software development#business#trending2023#digitalmarketing#software company#blockchain#software design#software#tracking software#app developers#app development#software integration services#software developers

0 notes

Text

#migration and integration services#api integration developer#software integration services#salesforce azure integration#mobile app integration

0 notes

Text

Get The Best IT System Integration Service In Northborough

Discover our top-notch IT system integration in Northborough. At AGR Technologies Inc, we specialize in providing the best IT system integration services to streamline and optimize your business operations.

Our team of skilled professionals is dedicated to understanding your unique business needs and tailoring solutions that ensure a smooth and efficient integration of various IT systems. Whether you are looking to connect existing systems, implement new technologies, or enhance overall system performance, we've got you covered.

#IT system integration#Managed IT services#IT service management#managed it service provider#it system integration services#Software integration services#Website Development#website development company#web design company

0 notes

Text

#best it consulting companies#It companies near me#Software Company in Durg Bhilai Chhattisgarh#ui & ux designer & developer#Digital marketing companies near me#Top digital marketing companies Durg#Third party api integration Services in durg#API development and integration#Mobile application development Services#Mobile software development company Durg#Web development company Bhilai#Best website development company Durg

2 notes

·

View notes

Text

Expert Shopware Development Services | Hire Professional Shopware Developers

Unlock your e-commerce potential with our specialized Shopware Development Services. At ProtonBits, we provide expert Shopware developers who are dedicated to building, optimizing, and scaling your online store seamlessly. With our tailored solutions, you can ensure a smooth and efficient experience that drives growth and success for your business.

#shopware#shopware development#shopware plugin#shopware api#shopware cms#shopware ecommerce#shopware development company#shopware developers#shopware development services#shopware integration services#shopware software#shopware plugins#shopware hosting#shopware e-commerce#shopware integrations#shopware development agency#shopware developer#hire shopware developer#hire shopware developers#shopware mobile app

3 notes

·

View notes

Text

Best Oil and Gas Construction Company, well construction Company

iDrilling Technologies (iDT), recognized as a reliable construction partner for the oil and gas, Well construction sector. We stand out as leading Oil and Gas Construction Company, well construction Company. Best as Engineering services, Drilling Construction Companies, well integrity, Reduce conventional footprint, Global networking, Risk matrix, ERD wells, well performance analysis, HPHT wells, Onshore wells, water wells, Deepwater wells Companies, Hydraulics and hole cleaning, Stuck pipe prevention, Casing design and material selection, Loss circulation management, Well barrier software, Hydraulics and hole cleaning software Companies. Visit https://idrillingtechnologies.com/

#Oil and Gas Construction Company#Well construction Company#Engineering services#Drilling Construction Companies#Well construction Companies#Well integrity Companies#Global networking Companies#Reduce conventional footprint Companies#Risk matrix Companies#Well performance analysis Companies#ERD wells Companies#HPHT wells Companies#Deepwater wells Companies#Onshore wells Companies#Shallow water wells Companies#Hydraulics and hole cleaning Companies#Casing design and material selection Companies#Stuck pipe prevention Companies#Loss circulation management Companies#Hydraulics and hole cleaning software Companies#Well barrier software Companies

3 notes

·

View notes

Text

Enhancing Financial Consumer Protection in the United States

The United States, with its diverse and expansive financial sector, is continuously evolving to strengthen consumer protection regulations. The country’s financial landscape includes a mix of traditional banks, credit unions, fintech companies, and online financial service providers. While the private sector drives innovation and efficiency, regulatory oversight remains crucial to ensuring fair and transparent financial practices. Strengthening financial consumer protection is essential to promoting responsible lending, enhancing financial literacy, and safeguarding consumers from fraud and deceptive financial practices.

The Rise of Digital Financial Services and Emerging Risks Digital financial services in the U.S. have witnessed rapid growth, providing consumers and businesses with real-time banking solutions. Mobile applications from financial institutions enable peer-to-peer (P2P) transfers, bill payments, microloan applications, international transactions, and online banking services. Businesses benefit from real-time fund management, automated payroll services, electronic tax filing, and other financial management services. As digital financial services expand, mitigating fraud risks and enhancing cybersecurity remain top priorities for regulators and financial institutions alike.

Key Financial Consumer Protection Challenges The U.S. financial sector faces several consumer protection challenges, particularly in banking, credit, and payment services. The most pressing concerns include:

Predatory Lending and Over-Indebtedness Despite regulations aimed at mitigating unfair lending practices, many consumers struggle with high-interest rates, hidden fees, and aggressive loan marketing. Strengthening creditworthiness assessment frameworks is necessary to prevent unsustainable debt burdens and protect financially vulnerable consumers.

Transparency and Information Disclosure Financial service providers (FSPs), including banks, fintech companies, and credit card issuers, must ensure clear and understandable product terms. Many consumers sign contracts without fully comprehending the terms due to complex financial jargon and inadequate disclosure. Increasing transparency and consumer education can improve financial decision-making.

Cybersecurity and Data Protection Risks As digital banking and payment platforms grow, protecting consumer data is a major concern. Issues such as identity theft, fraudulent credit applications, and unauthorized transactions highlight the need for stricter cybersecurity measures. Financial institutions must adopt stronger encryption protocols and educate consumers on safeguarding their personal data.

Regulatory Efforts to Strengthen Financial Consumer Protection The U.S. government and financial regulators, including the Consumer Financial Protection Bureau (CFPB) and the Federal Reserve, have implemented various measures to enhance consumer financial protections. Key areas of focus include enforcing fair lending laws, improving financial literacy programs, and holding financial institutions accountable for unethical practices.

Collaboration among multiple agencies is necessary to create a comprehensive consumer protection framework. Key regulatory bodies involved include the Federal Trade Commission (FTC) for fraud prevention, the Securities and Exchange Commission (SEC) for investment protection, and the Federal Deposit Insurance Corporation (FDIC) for banking security.

Recommendations for Strengthening Financial Consumer Protection To further improve financial consumer protection in the U.S., several reforms are necessary:

Enhancing regulatory mandates to address gaps in consumer financial protections.

Implementing robust market conduct supervision techniques to ensure compliance.

Establishing accessible dispute resolution mechanisms to provide consumers with fair and efficient complaint channels.

Additional measures include expanding the oversight of financial institutions, optimizing regulatory processes, and aligning financial regulations with evolving digital financial services. Introducing a financial ombudsperson for alternative dispute resolution and increasing training programs for financial consumer protection staff are also recommended.

The Role of Financial Services Providers in Strengthening Consumer Protection Financial service providers play a key role in ensuring consumer protection by adopting ethical business practices, complying with regulations, and offering transparent financial solutions. Companies like Raha Financials provide outsourced accounting and bookkeeping services, helping businesses manage their financial records efficiently. Additionally, outsourced bookkeeping USA services enable businesses to streamline their financial operations while ensuring compliance with federal and state regulations.

Businesses can also leverage software integration services to enhance operational efficiency and improve financial security. With the complexities of tax regulations, tax planning and filing services are essential for businesses looking to optimize tax strategies and maintain compliance.

As companies expand, global payroll services ensure seamless payroll processing across different jurisdictions, mitigating compliance risks and improving employee satisfaction. Firms that invest in financial management services can enhance cash flow management, optimize investments, and develop long-term financial strategies for sustainable growth.

For expert financial management solutions tailored to U.S. businesses, visit Raha Financials.

#Raha Financials#outsourced accounting and bookkeeping services#outsourced bookkeeping usa#software integration services#Tax Planning and Filing Services#global payroll services#financial management services

1 note

·

View note

Text

KPIT providing the Top Classic and Adaptive AUTOSAR solutions in India, With 15+ years of AUTOSAR experience, KPIT offers AUTOSAR Base Software Solutions that go across E/E Architecture, such as High-Performance Compute (HPC) Platforms, Real-Time Critical ECUs, Sensors and I/O Concentrators, visite here to know more.

#AUTOSAR Solutions#AUTOSAR Base Software Solutions#Classic and Adaptive AUTOSAR#Software Integration Services#Platforms and Tools#AUTOSAR architecture

0 notes

Text

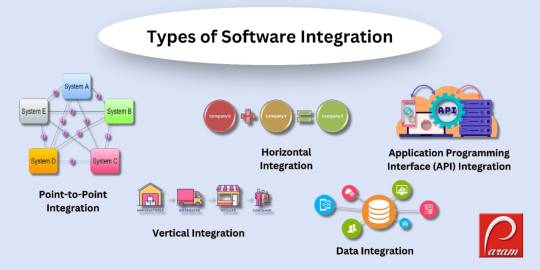

Types of Software Integration :

API Integration: Uses APIs for communication and data exchange between applications.

Data Integration: Combines and unifies data from various sources, ensuring consistency.

Point-to-point integration: Point-to-point integration directly connects two software applications for data exchange, but it can be less scalable and more complex without an intermediary.

Vertical Integration: Vertical integration is when a company grows by buying or merging with businesses at various stages of making or selling products, allowing more control over its supply chain.

Horizontal Integration: Horizontal integration happens when a company grows in its industry by buying or merging with competitors at the same production or distribution level.

0 notes

Text

Acemero is a company that strives for excellence and is goal-oriented. We assist both businesses and individuals in developing mobile and web applications for their business.

Our Services include:

Web/UI/UX Design

CMS Development

E-Commerce Website

Mobile Apps

Digital Marketing

Branding

Domain & Hosting

API Integration

Our Products include :

Support Ticket System

Direct Selling Software

Learning Management System

Auditing Software

HYIP Software

E-Commerce Software

#Mobosoftware#software development#software developers#web development#cms web development services#cms website development company#cms#mlm software#hyip#ecommerce software#lms#audit software#API Integration#Branding#Digital Marketing#ui/ux design

2 notes

·

View notes

Text

The Top Choice: Oracle Enterprise Resource Planning Cloud Service for Your Business Success

Are you searching for the best solution to streamline your business operations? Look no further than the Top Choice: Oracle Enterprise Resource Planning (ERP) Cloud Service. In today's fast-paced business world, organizations need a robust ERP solution to optimize their processes, enhance productivity, and drive growth. Oracle ERP Cloud Service, crowned as the best in the industry, offers a comprehensive suite of tools designed to meet the demands of modern businesses.

Why Choose the Best: Oracle Enterprise Resource Planning Cloud Service?

Oracle ERP Cloud Service stands out as the Best Option for businesses across various industries. Here's why:

Scalability: Easily scale your ERP system as your business grows, always ensuring seamless operations.

Integration: Integrate ERP with other Oracle Cloud services for a unified business platform.

Real-time Insights: Gain valuable insights into your business with real-time analytics, enabling data-driven decision-making.

Security: Rest easy knowing your data is secure with Oracle's advanced security features.

Frequently Asked Questions about the Best Choice: Oracle ERP Cloud Service

Q1: What modules are included in Oracle ERP Cloud Service?

A1: Oracle ERP Cloud Service includes modules for financial management, procurement, project management, supply chain management, and more. Each module is designed to optimize specific aspects of your business.

Q2: Is Oracle ERP Cloud Service suitable for small businesses?

A2: Yes, Oracle ERP Cloud Service is scalable and can be tailored to meet the needs of small, medium, and large businesses. It offers flexible solutions suitable for businesses of all sizes.

Q3: How does Oracle ERP Cloud Service enhance collaboration among teams?

A3: Oracle ERP Cloud Service provides collaborative tools that enable teams to work together seamlessly. Features like shared calendars, document management, and task tracking enhance communication and collaboration.

Conclusion: Empower Your Business with the Best ERP Solution

Oracle Enterprise Resource Planning Cloud Service is not just a choice; it's the Ultimate Solution for businesses seeking to optimize their operations. By harnessing the power of Oracle ERP, you can streamline processes, improve efficiency, and drive innovation. Don't let outdated systems hold your business back. Embrace the future with Oracle ERP Cloud Service and propel your business to new heights.

Ready to transform your business? Contact us today to explore the endless possibilities with the best ERP solution on the market.

#oracle#oracle erp#rapidflow#oracle erp cloud service#best erp solution#oracle erp service providers#business#business automation#oracle services#enterprise software#scalability#integration#rpa#market#erp

3 notes

·

View notes