#SBA Business Loans

Text

FBL Small Business Loans Leander TX | 737-757-0371

We are a Nationally Recognized Financial Company Serving all of our Client’s Business Lending Needs. Here at Fund Business Loans, with our expertise as a Small Business Lender, We Syndicate and have Partnerships with National Lenders. We can Provide all of your Business Loan, Finance and Lease Needs. There are a Variety of Business Loans available from Term Loans, SBA loans, to Business Lines of Credit and Business Working Capital. Most Loan types come with Minimum Requirements that Borrowers need to Meet in Order to be Eligible to Apply for the Loan. Plus, They all come with their Own Requirements for Documents you’ll Need to have in order to Apply and Get Approved.

FBL Small Business Loans Leander TX and nearby cities Provide Small Business Loans, SBA Business Loans, Business Startup Loans, Business Acquisition Loans, Accounts Receivable Financing, Short Term Loans, Business Loans, Lines of Credit, Invoice Factoring, Cash Advances, Commercial Equipment Financing, Used Equipment Financing, Commercial Real Estate Loans, Commercial Title Loans

Contact Us:

FBL Small Business Loans Leander TX

16401 Lucky Hit Rd. # D

Leander, TX 78641

Phone: 737-757-0371

Email: [email protected]

Website: https://fundbusinessloans.com/top-small-business-lending-leander-tx

2 notes

·

View notes

Text

FBL Small Business Loans Memphis TN | 901-542-8030 Call Now

We are a Nationally Recognized Financial Company Serving all of our Client’s Business Lending Needs. Here at Fund Business Loans, with our expertise as a Small Business Lender, We Syndicate and have Partnerships with National Lenders. We can Provide all of your Business Loan, Finance and Lease Needs. There are a Variety of Business Loans available from Term Loans, SBA loans, to Business Lines of Credit and Business Working Capital. Most Loan types come with Minimum Requirements that Borrowers need to Meet in Order to be Eligible to Apply for the Loan. Plus, They all come with their Own Requirements for Documents you’ll Need to have in order to Apply and Get Approved.

FBL Small Business Loans Memphis TN and nearby cities Provide Small Business Loans, SBA Business Loans, Business Startup Loans, Business Acquisition Loans, Accounts Receivable Financing, Short Term Loans, Business Loans, Lines of Credit, Invoice Factoring, Cash Advances, Commercial Equipment Financing, Used Equipment Financing, Commercial Real Estate Loans, Commercial Title Loans

Contact Us:

FBL Small Business Loans Memphis TN

555 S B.B. King Blvd. # E

Memphis, TN 38103

Phone: 901-542-8030

Email: [email protected]

Website: https://fundbusinessloans.com/top-small-business-lending-memphis-tn

1 note

·

View note

Photo

SBA Financing | Small Business SBA Loans- Royale Capital

We partner with SBA's Preferred Lending Partners to fund your business growth through SBA 7(a) loans. We streamline the application process for you and help you secure the funds you need to grow. For more details visit https://www.royale.capital/sba-business-loans

0 notes

Text

Our team of experienced consultants specializes in helping small businesses like yours identify funding opportunities that align with your unique goals and aspirations. Whether you are looking to invest in new technologies, expand your facilities, or hire additional talent, we have the expertise to guide you towards sustainable growth.

Reach out to us today to learn more at (800) 452-8485

#business consultant#small business loans#business owners#sba#entrepreneur#loans#business funding#small business owner#finance#personal loans

5 notes

·

View notes

Text

SBA LOANS

Features:

GOVERNMENT BACK FUNDS

10-YEAR TERM

7 to 7.5% APR

2 to 4 WEEK FUNDING PROCESS

QUALIFICATIONS:

2 YEARS TIME IN BUSINESS

2 YEARS PROFITABLE BUSINESS TAX RETURNS

675+ FICO

PAPERWORK NEEDED:

6 MONTHS BANK STATEMENTS

3 YEARS PERSONAL/BIZ TAX RETURNS

YEAR-TO-DATE P&L BALANCE SHEET (LAST YEAR'S AS WELL IF THEY ARE ON AN EXTENSION)

BUSINESS DEBT SCHEDULE

APPLICATION

SBA QUESTIONNAIRE

9 notes

·

View notes

Text

Cash Advances and Loans for Gig Workers No Credit Check

Overcoming Financial Challenges: A Comprehensive Guide to Securing Loans and Cash Advances for Gig Workers and Self-Employed Individuals

Introduction

The gig economy has revolutionized the way we work, offering flexibility and autonomy to pursue our passions and entrepreneurial dreams. However, gig workers and self-employed individuals often face unique challenges when seeking financial…

View On WordPress

#1099 contractors#alternative funding options#bank brezzy#BankBreezy#Breezy ConnectCash#business lines of credit#cash advances#cash flow management#co-signed loans#credit unions#direct deposits#emergency funds#employee retention tax credits#financial challenges#financial planning#financial solutions#freelance job marketplaces#gig economy platforms#gig workers#government-backed loans#invoice factoring#invoice financing#loans#no credit check loans#online lending platforms#point-of-sale loans#SBA loans#secured credit cards#Self-Employed#Self-Employed Tax Credit

1 note

·

View note

Text

Ever dreamt of building your business a brand new space but worried about financing? Securing a business loan for building construction can feel like climbing Mount Everest, but it doesn't have to be! This guide breaks down securing commercial construction loans into 7 simple steps, making your dream project a reality. Learn about different loan options, crafting a winning project plan, building a strong financial profile, and much more. Ready to transform your dream into a reality? Contact our team of financing experts today! We'll guide you through every step of the construction loans in MD and help you secure the funding you need to bring your vision to life.

0 notes

Text

Top Small Business Grants in Arizona 2024: Access Funding Now

Arizona small business owner! Running a business is tough, and sometimes you just need a little boost to get things going. The great news is there are grants out there specifically designed to help Arizona businesses like yours. This post will walk you through some of these grants, how to apply, and even what to do if you don’t snag the funding this time around. So whether you’re just starting…

View On WordPress

#500 employees#arizona business startup grants#arizona grants for small business#arizona small business grants#business development#business grants arizona#city of phoenix#economic development#financial assistance#funding sources#grant application#grant program#grants for small business in arizona#grants in arizona#local first arizona#maricopa county#minority owned businesses#minority small business grants arizona#small and micro businesses#small business administration sba#small business grants#small business grants az#small business grants in arizona#small business grants phoenix#small business loans#small business owners#small business start up grants arizona#small businesses in arizona#start up business grants arizona#state government

0 notes

Text

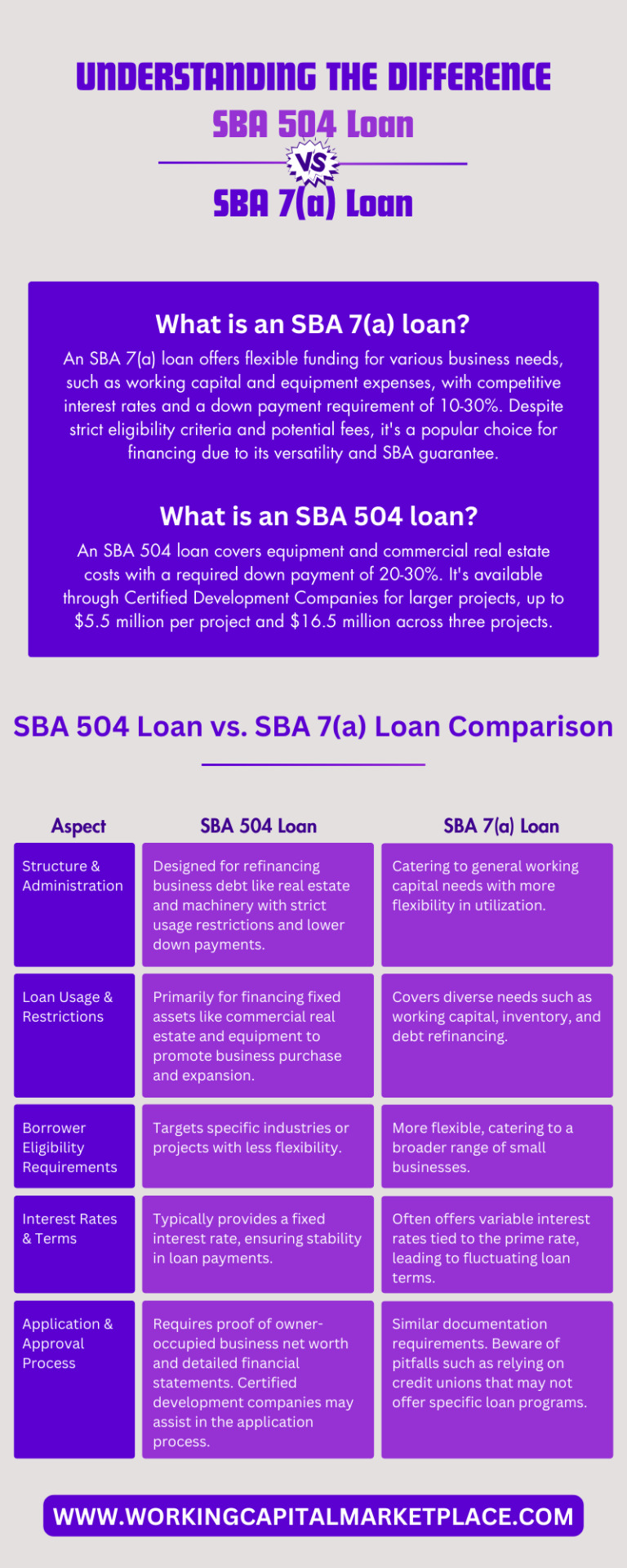

Understanding the Difference: SBA 504 Loan vs SBA 7(a)

Explore the difference between sba 7a and 504 loans with our informative infographic. Learn the key distinctions to make informed financing decisions for your business's growth and success.

0 notes

Text

The Benefits and Challenges of Utilizing SBA Loans for Trucking Businesses

In the dynamic world of trucking, securing financial support is often crucial for growth and sustainability. Small Business Administration (SBA) loans stand out as a viable option for trucking companies seeking capital.

However, like any financial instrument, SBA loans come with their own set of advantages and challenges. Understanding these nuances is essential for trucking entrepreneurs looking to leverage these loans effectively.

Benefits of Utilizing SBA Loans for Trucking Businesses:

Accessible Capital: SBA loans are specifically designed to support small businesses, including trucking companies. They offer accessible capital with relatively lower down payments and favorable interest rates compared to traditional loans, making them an attractive option for startups and small trucking businesses.

Flexible Use of Funds: One of the significant benefits of SBA loans is the flexibility in using the funds. Trucking businesses can utilize the loan proceeds for various purposes, including purchasing new vehicles, covering operational expenses, expanding fleets, or investing in technology and infrastructure upgrades.

Longer Repayment Terms: Unlike conventional loans with shorter repayment terms, SBA loans typically offer longer repayment periods. This extended timeline eases the burden on trucking businesses, providing them with more breathing room to manage cash flow and repay the loan without undue strain on their finances.

Build Business Credit: Successfully obtaining and repaying an SBA loan can significantly bolster the credit profile of a trucking company. Timely repayments demonstrate financial responsibility and can enhance the business's creditworthiness, paving the way for future financing opportunities at more favorable terms.

Challenges of Utilizing SBA Loans for Trucking Businesses:

Lengthy Approval Process: SBA loans often involve a lengthy approval process compared to other forms of financing. The extensive documentation requirements, thorough underwriting, and government regulations can result in delays, which may not align with the urgent funding needs of trucking businesses, especially during peak seasons.

Collateral Requirements: While SBA loans generally require less collateral than conventional loans, they still typically necessitate some form of collateral to secure the funding. For trucking businesses, especially startups or those with limited assets, meeting these collateral requirements can pose a challenge and limit their access to SBA financing.

Strict Eligibility Criteria: SBA loans have stringent eligibility criteria that businesses must meet to qualify. Factors such as credit history, time in business, revenue, and profitability are closely scrutinized. Trucking companies may find it challenging to meet these criteria, particularly if they have a limited operating history or less-than-ideal financial metrics.

Personal Guarantee: In many cases, SBA loans require business owners to provide a personal guarantee, putting their personal assets at risk in the event of default. This can be a significant concern for entrepreneurs who prefer to keep personal and business finances separate or who are reluctant to assume additional personal liability.

Conclusion:

SBA loans offer trucking businesses a valuable source of financing with numerous benefits, including accessibility, flexibility, and favorable terms. However, navigating the challenges associated with SBA loans, such as the lengthy approval process, collateral requirements, strict eligibility criteria, and personal guarantees, requires careful consideration and planning.

By weighing the pros and cons, trucking entrepreneurs can make informed decisions regarding the suitability of SBA loans for their specific financial needs and business objectives. With strategic utilization, SBA trucking loans can serve as a catalyst for growth and success in the competitive trucking industry.

0 notes

Text

What do I need to start a merchant cash advance business?

Starting a merchant cash advance (MCA) business involves several critical components to ensure you set up a robust and legally compliant operation. Here are the essential elements you need to consider:

.

FREE MCA LEADS - https://www.fiverr.com/leads_seo_web

.

OR

1. Understanding of the MCA Industry

Knowledge: Gain a deep understanding of how the MCA industry works, including the mechanics of advances, repayment methods, and risk management.

Market Research: Conduct thorough market research to identify your potential clients and understand the competition.

2. Business Plan

Detailed Plan: Outline your business strategy, including your target market, marketing plan, operational structure, funding sources, and financial projections.

Risk Assessment: Develop a methodology for assessing the creditworthiness of potential clients.

3. Legal Compliance and Licensing

Legal Structure: Decide on a legal structure for your business (LLC, corporation, etc.) that suits your needs for liability and tax purposes.

Licensing: Check local and state regulations to determine if specific licenses are required to operate an MCA business.

Contracts and Agreements: Have clear, legally vetted contracts ready for your clients that outline terms of the cash advance, repayment schedule, factor rates, and other critical details.

4. Capital for Funding Advances

Initial Capital: Ensure you have access to sufficient capital to fund the cash advances. This could be from personal funds, investor money, or loans.

Credit Line: Establishing a line of credit with a bank can be beneficial if additional funding is needed.

5. Technology and Infrastructure

Software Solutions: Invest in or develop software for application processing, underwriting, account management, transaction processing, and collections.

Hardware and Office Space: Depending on your business model, you may need office space and hardware for your team.

6. Sales and Marketing

Marketing Strategy: Develop an effective marketing strategy to reach your target customers. This could include digital marketing, direct mail, partnerships, and networking.

Sales Team: Build a knowledgeable and skilled sales team capable of explaining the benefits and risks of MCAs to potential clients.

7. Risk Management and Collections

Collections Strategy: Have a strategy and processes in place for collecting payments. This is crucial as the collection process can significantly impact your profitability.

Default Management: Develop procedures for managing defaults and non-payment scenarios.

8. Professional Assistance

Consultants: Engage with financial consultants who have experience in the MCA or broader financial services industry.

Legal Advice: Regularly consult with a lawyer to ensure ongoing compliance with laws and regulations affecting your business.

Accounting: Set up accounting practices and possibly hire a professional to manage your finances and taxes.

9. Customer Service

Support System: Establish a system for handling customer inquiries and support to maintain good client relationships and manage issues promptly.

10. Networking

Industry Connections: Connect with other professionals in the financial sector to stay informed about industry trends and changes in regulations.

By carefully planning and considering each of these elements, you can set up a merchant cash advance business that is well-equipped to succeed in a competitive financial market. It's important to prioritize compliance and risk management to build a sustainable business model.

#mca leads#mcaleads#merchantcashadvanceleads#merchantcashadvance#merchant cash advance#cash advance#business loan#b2bmarketing#b2b lead generation#leadgeneration#loans#mortgage#sba#line of credit

1 note

·

View note

Text

Unsecured Business Loans Pros and Cons

Unsecured business loans present a compelling option for companies seeking flexible financing solutions.

While they offer attractive advantages like streamlined application processes and swift funding, a comprehensive understanding of their inherent drawbacks is crucial for informed decision-making.

Benefits:

Collateral-Free: Unlike secured loans, unsecured options eliminate the need to pledge valuable assets, mitigating risk for businesses with limited collateral.

Expeditious Access: Streamlined application processes and minimal documentation requirements often translate into rapid funding disbursements, enabling companies to seize time-sensitive opportunities.

Broader Accessibility: Unsecured loan providers may exhibit greater flexibility in credit score and business history considerations, potentially opening doors for startups and businesses with evolving credit profiles.

Drawbacks:

Elevated Costs: Increased risk for lenders translates into higher interest rates and fees compared to secured alternatives. Careful cost-benefit analysis is essential to ensure borrowing aligns with financial sustainability.

Stringent Eligibility: Despite potentially relaxed credit score requirements, lenders may impose stricter eligibility criteria related to factors like revenue stability and business experience.

Personal Guarantee Risk: Certain lenders might request personal guarantees, potentially exposing the borrower's personal assets in case of loan default. Evaluating this risk alongside potential benefits is crucial before proceeding.

Alternative Financing Options:

Secured Loans: While demanding collateral, these loans often offer lower interest rates and larger loan amounts.

SBA Loans: Government-backed Small Business Administration loans provide fixed interest rates and flexible terms for qualified businesses.

Business Lines of Credit: Revolving credit lines offer flexibility for ongoing working capital needs and may present lower upfront costs compared to term loans.

Grants: Free funding opportunities exist, but competition is fierce and application processes can be extensive.

Crowdfunding: Platforms facilitate fundraising from the public, often in exchange for equity or rewards, but success is contingent on effective campaign strategies.

Conclusion:

Unsecured business loans can be strategic financing tools for agile businesses seeking swift access to funds.

However, careful consideration of their associated costs, eligibility requirements, and potential personal guarantee risks is essential.

Thoroughly evaluating alternative options ensures alignment with long-term financial goals and risk tolerance.

Ultimately, choosing the most suitable financing approach empowers businesses to capitalize on growth opportunities while maintaining financial stability.

#Unsecured Business Loans#business loans#finance#business loan#business setup in dubai#credit score#sba loans#crowdfunding#Secured loan

0 notes

Text

Exploring the Features and Benefits of SBA 7(a) Loans

The SBA 7A program is among the most widely used business financing solutions in the United States. The Small Business Administration provides these loans, which have several features and opportunities that make them a desirable option for business owners.

One of the main advantages of the 7A loans is their flexibility. These can be used for several things, such as refinancing obligations, buying working capital, inventory, or equipment, or even occasionally buying out another business. Moreover, SBA 7A loan interest rates are advantageous. It helps small businesses efficiently control borrowing costs by capping the maximum interest rate that lenders can charge on these loans. Since the interest rates are typically lower than those of traditional lenders, borrowers may end up saving a significant sum of money over time.

There are requirements that business owners must fulfill in order to be eligible for this loan. The SBA 7A loan requirements include that you must be able to repay the loan on schedule, have a strong credit score, and present enough collateral to secure the loan. Read More

#sba loans#SBA 7a loan#Small term loan#Cash Advance#interest rates#equipment financing#Term Loans#mortgage loan#business loan#same day loans online#Large capital Project

1 note

·

View note

Text

Attention business owners!

Are you in need of financial support to grow your business? Look no further! We have the expertise and resources to guide you through the entire process of securing an SBA Loan.

At BriMarc Noel LLC, we understand that obtaining a loan can be a daunting task, especially when dealing with all the paperwork and requirements. That's why we are here to simplify the process and assist you every step of the way.

We help you gather all the necessary documents and ensure they are correctly filled out.

We work closely with you to create a comprehensive loan application.

We provide guidance on selecting the right loan program for your specific needs.

We can even connect you with potential lenders who are interested in funding businesses like yours.

With our team of experienced professionals, you can feel confident that you are in capable hands.

We have a proven track record of successfully helping businesses secure SBA Loans, allowing them to reach new heights of success.

So, why wait? Take the first step towards achieving your business goals today. Contact us at BriMarc Noel LLC 800-452-8485 and let us help you navigate the SBA Loan process with ease. Together, we will make your dreams a reality!

4 notes

·

View notes

Text

Are you a small business owner feeling stuck due to financial constraints? We understand the challenges you face – from tight budgets to limited access to traditional loans. Our comprehensive guide breaks down the benefits of CDC SBA loans loans in simple terms and why you should consider it for your small business. Don't let financial worries hold your business back! If you still have queries, contact us today to explore your SBA CDC small business finance loan options and power your business forward. Your success is our mission!

1 note

·

View note