#Regulatory Environment

Explore tagged Tumblr posts

Text

Navigating the Indian Investment Landscape: A Comprehensive Guide for International Investors

India, with its vibrant economy, diverse market opportunities, and favorable regulatory environment, has emerged as an attractive destination for international investors seeking high returns and long-term growth prospects. From burgeoning sectors like technology and e-commerce to traditional industries such as manufacturing and agriculture, India offers a wealth of investment opportunities for savvy investors. In this comprehensive guide, we'll explore the Indian investment landscape, highlighting key sectors, regulatory considerations, investment strategies, and tips for international investors looking to capitalize on India's growth story.

Understanding the Indian Investment Landscape:

1. Economic Overview: India is the world's sixth-largest economy by nominal GDP and one of the fastest-growing major economies globally. With a young and dynamic population, a burgeoning middle class, and increasing urbanization, India offers a vast consumer market and a favorable demographic dividend for investors.

2. Key Investment Sector: India's economy is diverse and offers investment opportunities across various sectors. Some of the key sectors attracting international investors include:

- Information Technology (IT) and Software Services

- E-commerce and Digital Payments

- Healthcare and Pharmaceuticals

- Renewable Energy and Clean Technology

- Infrastructure and Real Estate

- Manufacturing and Automotive

- Agriculture and Agribusiness

3. Regulatory Environment: India has implemented several reforms to streamline its regulatory environment and improve the ease of doing business for investors. The government has introduced initiatives such as Make in India, Startup India, and Digital India to encourage investment, innovation, and entrepreneurship. Additionally, foreign direct investment (FDI) policies have been liberalized across various sectors, allowing greater foreign participation in the Indian economy.

4. Taxation and Legal Considerations: International investors should familiarize themselves with India's tax laws, regulations, and legal frameworks before making investment decisions. India has a progressive tax regime with corporate tax rates varying based on business structure, industry, and income levels. It's advisable to consult with tax advisors and legal experts to navigate the complexities of India's taxation and legal landscape.

Investment Strategies for International Investors:

1. Market Research and Due Diligence: Conduct thorough market research and due diligence to identify investment opportunities aligned with your investment objectives, risk tolerance, and sector preferences. Evaluate market trends, competitive dynamics, regulatory changes, and macroeconomic indicators to make informed investment decisions.

2. Diversification: Diversify your investment portfolio across different asset classes, sectors, and geographic regions to mitigate risks and maximize returns. Consider allocating capital to both high-growth sectors such as technology and healthcare, as well as stable sectors like infrastructure and consumer goods.

3. Long-Term Perspective: Adopt a long-term investment perspective when investing in India. While short-term market volatility and regulatory changes may occur, India's economic fundamentals remain strong, offering attractive growth prospects over the medium to long term. Patient investors can capitalize on India's demographic dividend and structural reforms to generate significant returns.

4. Partnering with Local Experts: Partnering with local investment advisors, financial institutions, and legal experts can provide valuable insights and guidance on navigating the Indian investment landscape. Local expertise can help international investors navigate regulatory hurdles, identify investment opportunities, and mitigate operational risks effectively.

5. Investment Vehicles: Evaluate different investment vehicles available for investing in India, including direct investments, private equity funds, venture capital funds, and mutual funds. Each investment vehicle offers unique benefits and risks, so it's essential to assess their suitability based on your investment goals and risk appetite.

Tips for International Investors:

1. Stay Informed: Stay updated on market developments, regulatory changes, and economic trends affecting the Indian investment landscape. Follow reputable financial news sources, attend industry conferences, and engage with local experts to stay informed and make timely investment decisions.

2. Network and Build Relationships: Networking with industry professionals, government officials, and fellow investors can provide valuable insights and access to investment opportunities in India. Join industry associations, attend networking events, and leverage social media platforms to expand your network and build relationships in the Indian business community.

3. Be Patient and Persistent: Investing in India requires patience, persistence, and a long-term commitment. Building relationships, navigating regulatory hurdles, and achieving investment success take time and effort. Stay focused on your investment goals, adapt to changing market conditions, and remain resilient in the face of challenges.

4. Seek Professional Advice: Consult with financial advisors, tax consultants, and legal experts specializing in India to seek professional advice tailored to your specific investment needs. Expert guidance can help you navigate regulatory complexities, optimize tax efficiency, and maximize returns on your investments in India.

5. Cultural Sensitivity: Recognize and respect cultural differences when conducting business in India. Building strong relationships and trust with local partners and stakeholders requires understanding and appreciating Indian customs, traditions, and business etiquette.

6. Risk Management: Assess and manage risks effectively by diversifying your investment portfolio, conducting thorough due diligence, and implementing risk mitigation strategies. Consider geopolitical risks, currency fluctuations, regulatory changes, and market volatility when making investment decisions.

7. Sustainability and ESG Factors: Consider environmental, social, and governance (ESG) factors when evaluating investment opportunities in India. Increasingly, investors are prioritizing sustainability and responsible investing practices to mitigate risks, enhance long-term value, and align investments with their values and principles.

8. Stay Flexible and Agile: Remain flexible and agile in adapting to changing market conditions, regulatory requirements, and investor preferences. India's business environment is dynamic and evolving, requiring investors to stay nimble and responsive to emerging opportunities and challenges.

India offers a wealth of investment opportunities for international investors seeking high growth potential and diversification benefits. With its robust economy, favorable demographic trends, and supportive regulatory environment, India continues to attract capital inflows across various sectors. By understanding the Indian investment landscape, adopting sound investment strategies, and leveraging local expertise, international investors can capitalize on India's growth story and unlock significant value for their investment portfolios. As India continues on its path of economic development and reform, it remains a compelling destination for investors looking to participate in one of the world's most dynamic and promising markets.

In conclusion, navigating the “Invest in India” landscape requires careful planning, strategic decision-making, and a long-term perspective. By understanding the key sectors, regulatory considerations, investment strategies, and tips outlined in this guide, international investors can position themselves to capitalize on the vast opportunities offered by India's vibrant economy and emerging market dynamics. With the right approach and guidance, investing in India can yield attractive returns and contribute to portfolio diversification and long-term wealth creation for investors around the globe.

This post was originally published on: Foxnangel

#regulatory environment#international investors#investment opportunities#investment ideas#india's economy#startup india#investing in India#investment opportunities in india#investments in india#foxnangel

3 notes

·

View notes

Text

Politics: Donald Trump Proposes Crypto Advisory Council

President-elect Donald Trump is moving forward with plans to establish a “crypto advisory council” aimed at reshaping U.S. cryptocurrency policy. Major industry players, including Ripple, Kraken, Circle, Paradigm, and Andreessen Horowitz’s crypto arm a16z, are actively seeking positions on this council, which is expected to operate under the National Economic Council or a similar White House…

#bitcoin reserve#Bitcoin treasury#crypto advisory council#crypto reserve#cryptocurrency policy#digital assets#Donald Trump#industry experts#investor optimism#politics#Politics: Donald Trump Proposes Crypto Advisory Council#regulatory environment#strategic policy development#U.S. Government

0 notes

Text

The New Cross-Cultural Playbook for Global Arbitration

Cross-cultural differences and the misunderstandings that often arise from them play a powerful role in how businesses build relationships and conduct their commercial and legal affairs. At a time of expansive growth in transnational business, trade, and investment, a lack of knowledge about local culture, values, and customs in business and legal dealings are leading to ever more complex and…

#Arbitration#B2B#business-to-business#businesses#Chameleon U.S.#Cross-culture#Global#Global Arbitration#International Chamber of Commerce#Jus Connect#legal dealings#McCann Truth Central#multi-cultural#regulatory environment#Social Media

0 notes

Text

Capitalism to Techno-Feudalism: The Evolution of Economic Systems

🌟 Dive into the intriguing world of economic evolution with our latest video "Capitalism to Techno-Feudalism: The Evolution of Economic Systems"! 🚀 Join us as we explore the rise of tech giants, wealth inequality, and strategies for navigating this digital landscape. Featuring insights from renowned economist Yanis Varoufakis.

Watch now:

youtube

#capitalism#techno-feudalism#economic systems#global financial crisis#tech giants#Yanis Varoufakis#wealth inequality#digital dominance#alternative infrastructure#regulatory environment#democratic norms#financialization#digital future#innovation#inequality#public discourse#cooperative models#societal challenges#Youtube

0 notes

Text

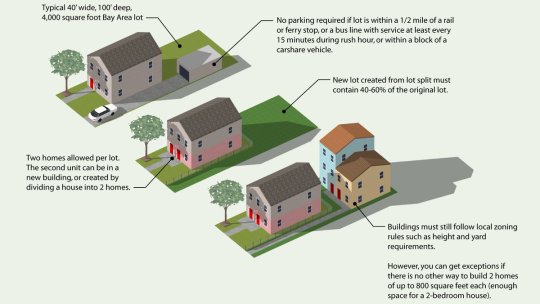

Senate Bill 9: A Game Changer in California's Housing Landscape

In the ever-evolving realm of California’s housing policies, one bill stands out as a potential game-changer: Senate Bill 9, also known as the California Housing Opportunity and More Efficiency (“HOME”) Act. This legislation, signed into law on September 16, 2021, aims to address the state’s housing crisis by providing homeowners with a streamlined process to subdivide their urban single-family…

View On WordPress

#affordable housing#design process#housing opportunities#regulatory environment#regulatory requirements#SB-9

0 notes

Link

Are you ready for the game-changer in fantasy sports betting? Dive deep into the transformative world of Florida Fantasy Sports Betting with our latest article! Learn how new regulations are reshaping the landscape and what it means for fans and participants. Don't miss out on becoming a pro in navigating these changes. Click to unlock the full story and stay ahead of the game! #FantasySports #NewRegulations #Florida

0 notes

Text

#propertyinvestment#property investment#Luxury housing#Pricing dynamics#Amenities preference#Market performance#Economic recovery#Regulatory environment#Investment outlook#Aspirational living

0 notes

Text

Animal Health Sector: Trends, Challenges, and Opportunities in 2023 and Beyond

View On WordPress

#animal health#digital health#disease prevention#global trends#innovation#livestock#London#One Health#pet care#regulatory environment#UK#veterinary medicine

0 notes

Note

oh ur an engineer. Disappointing ...........

^ this is where i work btw

#honest to god chemical engineering rant: i dont think there exists a branch of stem thats more pro capital honestly#like as a computer scientist or w/ever like you have to actively chose to be a cryptobro right? like it takes personal agency#but as a chemical engineer our work almost entirely revolves around mass production#and no matter how you spin it like maybe you find work in an environment lab or find yourself in regulatory bodies#you always end up working for the benefit of companies somehow#i have so many feelings abt this that i cant articulate rn#idek man :/ i never really had a choice either both my parents are engineers it was always like predetermined ig#i dont hate it mind i do like working as an engineer like day to day#but i was made to make art but i cant with how much engineering i have to do lmao#im sorry for venting im trying to graduate and its the hardest thing ive ever faced ever and i hate it and it makes me wanna die#asks#maplecaster

2 notes

·

View notes

Text

Sewage Treatment Plant (STP) Kolhapur |Renovation Services Near Me

Why Choose Ecocivic Solutions for STP in Kolhapur?

1. Expert STP Design and Installation Our team specializes in designing and installing customized STPs that meet local environmental standards and effectively treat wastewater. We ensure that the system operates efficiently, reducing the environmental impact and improving water quality.

2. STP Renovation Services If your existing STP is outdated or underperforming, Ecocivic Solutions offers expert renovation services. We modernize old systems, replace faulty components, and ensure that the plant meets current regulatory standards, improving efficiency and reducing operational costs.

3. Sustainable Practices At Ecocivic Solutions, we focus on sustainability. Our STP systems are designed to minimize waste, reduce energy consumption, and optimize the use of resources, contributing to a cleaner environment in Kolhapur.

Benefits of Our Sewage Treatment Plants

Improved Water Quality: Reduces pollution and enhances water safety.

Environmental Protection: Minimizes harmful wastewater discharge into local water bodies.

Cost Efficiency: Our systems are designed to be low-maintenance and cost-effective.

Renovation Services Near You

For existing STPs that require upgrades or repairs, Ecocivic Solutions provides timely and cost-effective renovation services. We enhance the performance of outdated treatment plants, ensuring they continue to operate efficiently and comply with environmental standards.

Serving Kolhapur and Beyond As a trusted name in Kolhapur for sewage treatment and environmental engineering, Ecocivic Solutions is committed to providing high-quality STP services, whether you’re building a new system or renovating an old one.

Get in Touch If you need expert STP installation or renovation services, contact Ecocivic Solutions today. We’re here to help you achieve a cleaner, greener future with sustainable wastewater management solutions.

Get in touch with : https://ecocivicsolutions.com/

#EnvironmentalEngineering #ConsultancyServices #SustainableSolutions #EcoFriendly #GreenConsulting #EnvironmentalImpact #WasteManagement #Sustainability #CleanTech #ClimateAction #ResourceConservation #InnovationInEngineering #ProfessionalConsultants #EnvironmentalAwareness #EngineeringSolutions #EcosystemHealth #RenewableEnergy #ConsultingExperts #FutureOfEngineering

#sustainable solutions tailored to your needs.#Sewage Treatment Plant (STP) Kolhapur |Renovation Services Near Me#Why Choose Ecocivic Solutions for STP in Kolhapur?#1. Expert STP Design and Installation#reducing the environmental impact and improving water quality.#2. STP Renovation Services#If your existing STP is outdated or underperforming#replace faulty components#and ensure that the plant meets current regulatory standards#improving efficiency and reducing operational costs.#3. Sustainable Practices#At Ecocivic Solutions#reduce energy consumption#and optimize the use of resources#contributing to a cleaner environment in Kolhapur.#Benefits of Our Sewage Treatment Plants#Renovation Services Near You#For existing STPs that require upgrades or repairs#Serving Kolhapur and Beyond#Get in Touch#If you need expert STP installation or renovation services#Get in touch with : https://ecocivicsolutions.com/#EnvironmentalEngineering#ConsultancyServices#SustainableSolutions#EcoFriendly#GreenConsulting#EnvironmentalImpact#WasteManagement#Sustainability

0 notes

Text

Navigating Opportunity: The Dynamic Business Environment of India

Navigating Opportunity: The Dynamic Business Environment of India Business Environment in India The business environment in India is a complex and dynamic landscape characterized by rapid economic growth, diverse consumer behavior, regulatory frameworks, and unique cultural factors. Understanding this environment is crucial for businesses seeking to enter or expand in this vibrant market. 1.…

0 notes

Text

STRATEGIES FOR EFFECTIVE PROJECT MANAGEMENT IN COMPLEX HEALTHCARE ENVIRONMENTS

STRATEGIES FOR EFFECTIVE PROJECT MANAGEMENT IN COMPLEX HEALTHCARE ENVIRONMENTS 1.1 Introduction Project management is critical in healthcare environments, where the complexity of operations, regulations, and patient care makes effective oversight essential. Healthcare projects often involve multiple stakeholders, extensive resources, and high-stakes outcomes, necessitating precise coordination…

#Agile methodologies#Complex Environments#CONTINUOUS TRAINING#Data-Driven Decision Making#healthcare#Healthcare Projects#interdisciplinary teams.#Operational efficiency#Patient outcomes#Project Management#regulatory compliance#RISK MANAGEMENT#Stakeholder engagement#STRATEGIES FOR EFFECTIVE PROJECT MANAGEMENT IN COMPLEX HEALTHCARE ENVIRONMENTS

0 notes

Text

A Comprehensive Guide to Business Setup with Creative Business Solutions

In today's rapidly evolving global business landscape, establishing an offshore company has become a strategic choice for entrepreneurs and corporations looking to optimize operations, minimize tax liabilities, and leverage favorable regulatory environments. Ras Al Khaimah (RAK) in the United Arab Emirates (UAE) is a premier destination for such initiatives. With its business-friendly climate, strategic location, and robust legal framework, forming a company in RAK Mainland Company Formation offers significant advantages for businesses of all sizes.

#Offshore Company Formation#Global Business Environment#Tax Optimization#Regulatory Framework#Ras Al Khaimah#UAE Business#RAK Mainland Company Formation#Business-Friendly Environment#Strategic Location#Legal Framework

0 notes

Text

Legal Environment of Business

Unlock the door to business success by understanding the dynamic landscape of the legal environment. From the foundational pillars of business formation to the intricate web of contracts and intellectual property rights, every aspect demands attention in this intricate ecosystem. Navigate confidently through the maze of regulations, safeguard your interests, and mitigate risks effectively. Whether you're a sole proprietor charting your own course, a partnership sharing the load, or a corporation enjoying the benefits of limited liability, grasp the nuances to thrive in the global marketplace. It's not just about compliance; it's about leveraging the legal framework to propel your business towards excellence. Welcome to the forefront of business legality – where strategic understanding meets unparalleled opportunity. Read Full article.

0 notes

Text

Understanding the Landscape of China Compressor Industry

The advancing automotive as well as construction sectors in China have boosted the need for compressors in this nation, aiding these advancements. Moreover, compressors also play a key role across different sectors in this nation. In this blog, we’ll be exploring the reasons for the increasing demand for compressors in China: Increasing Industrialization It is no secret that China’s extremely…

View On WordPress

#China Compressor Market#competitive environments#Construction#industrial processes#Manufacturing#Market dynamics#market trends#regulatory landscapes#strategic decisions#Technological advancements

0 notes

Text

Safety in Maritime Construction Projects

Safety in maritime construction projects is a critical concern that encompasses unique environmental, logistical, and operational challenges. This article aims to shed light on the specific safety measures required in maritime construction, highlighting why it’s crucial to address these distinct aspects for the successful completion of projects. Unique Risks in Maritime Construction In maritime…

View On WordPress

#construction project success#emergency response#equipment safety audits#GPS tracking#marine project risks#Maritime construction safety#maritime environment#personal flotation devices#regulatory compliance#remote-operated vehicles#Safety Culture#safety protocols#Safety Training#weather monitoring#worker empowerment

0 notes