#Polymer Coated Fabrics market

Text

Polymer Coated Fabrics Market See Incredible Growth 2022-2032 | Industrial Sedo S.L., Saint-Gobain SA, OMNOVO Solutions Inc., Continental AG

Polymer Coated Fabrics Market See Incredible Growth 2022-2032 | Industrial Sedo S.L., Saint-Gobain SA, OMNOVO Solutions Inc., Continental AG

insightSLICE has recently updated the Global Polymer Coated Fabrics Market research report inclusive of recent trends. The report is authored by seasoned researchers. To put marketplace clearly into the focus, up to date market insights and analysis has been offered via this report. The industry data presented in the report helps to recognize different domain opportunities present…

View On WordPress

#Chemical & Advanced Materials industry#Polymer Coated Fabrics#Polymer Coated Fabrics industrial manufacturers#Polymer Coated Fabrics market#Polymer Coated Fabrics market size#Polymer Coated Fabrics use#Scope of Polymer Coated Fabrics industry

0 notes

Text

The coated fabrics market is estimated to reach a value of USD 36.96 billion by 2028 and is expected to grow at a compound annual growth rate of 4.65% for the forecast period of 2021 to 2028.

#coated fabrics market#coated fabrics market size#elastomer coated fabrics market#global polymer coated fabrics market size

0 notes

Text

Application of bitumen in building

Bitumen has numerous applications in the construction industry, primarily serving as an adhesive and waterproofing material. Its versatile properties make it indispensable in various building-related functions. Here are some key applications of bitumen in construction:

1. Roofing and Waterproofing:

Bitumen 60/70 is extensively used in roofing systems to provide waterproof membranes for flat roofs. Traditional bitumen roofing membranes consist of layers of bitumen sprayed with aggregate, with a carrier fabric made of polyester or glass in between. Polymer-modified bitumen sheets have become the standard for flat roof waterproofing. Bituminous roofing membranes can also be recycled easily, enhancing their sustainability.

2. Wall Sealing:

Bitumen 60/70 plays a crucial role in sealing walls, providing protection against water and moisture intrusion. It is applied to substrates such as bathrooms and toilets, which are constantly exposed to moisture, to prevent water penetration and safeguard the underlying structures.

3. Floor and Wall Insulation:

Bitumen 80/100 insulation is widely employed for building waterproofing, both horizontally and vertically. It effectively prevents water penetration into floorboards and walls, offering reliable protection. Bitumen's chemical and physical properties make it easy to work with and highly durable.

4. Sound Insulation:

Bitumen's sound-absorbing properties find applications beyond construction. It helps reduce noise transmission, such as the sound of footsteps under floor coverings. Special tar mats in cars and elevators utilize Bitumen 80/100 for sound insulation.

5. Electrical Cable Insulation:

Bitumen's low electrical conductivity makes it suitable for use as an insulating material for electrical cables. It helps protect the cables and prevent electrical hazards.

6. Other Uses:

Bitumen 80/100 & bitumen 60/70 finds application in various other areas, such as the paper industry and the manufacturing of paints and varnishes. Its thermal insulation properties are beneficial in different contexts.

From an ecological standpoint, bitumen is highly regarded for its long lifespan. It remains a popular construction material, with significant demand both domestically and in international markets. The producer of bitumen in Iran exports a large percentage of its production to other countries such as Singapore, Dubai, Panama.

In residential construction, plastic-modified bitumen (KMB) coatings are commonly used for insulation. They compete with bitumen-free FPD (Flexible Polymer Disc) seals, which are easier to apply and offer faster repair options.

Overall, the applications of bitumen in the construction industry are extensive, ranging from roofing and waterproofing to sound insulation and electrical cable insulation. Its versatility and durability make it a valuable material in various building-related functions.

Important Considerations Before Using Bitumen:

1. Surface Preparation:

Before applying bitumen, it is crucial to ensure that the surface is clean, dry, and free from any contaminants. Even the presence of dust, dirt, or grease can hinder the adhesion of the bitumen coating and compromise the effectiveness of the seal. Additionally, the surface should be free from frost. If there are old incompatible coatings, they must be removed. In the case of older buildings, previous applications of bituminous paints may not provide a suitable surface for polymer-modified bitumen (PMB) coatings.

2. Repairing Cracks and Unevenness:

Prior to applying bitumen, any cracks or unevenness on the surface should be repaired using appropriate materials like repair mortar or leveling compounds. This ensures a smooth and uniform surface, promoting better adhesion and a more effective seal.

3. Additional Preparatory Measures:

In some cases, additional preparatory measures may be necessary. One option is to use a layer of synthetic resin on the coarse-pored bed or to apply a sealing slurry. A sealing slurry is a waterproof mixture of cement and plastic that allows water vapor to pass through. The advantage of using a sealing slurry is that it can adhere well to old bituminous coatings, providing an ideal substrate for applying a thick new bituminous coating.

By following these steps and ensuring proper surface preparation, you can optimize the adhesion and effectiveness of bitumen coatings in various applications.

What are the suitable means for repairing cracks and unevenness on the surface before applying bitumen?

There are several suitable means for repairing cracks and unevenness on the surface before applying bitumen. The choice of repair method depends on the severity of the damage and the specific requirements of the project. Here are some common methods for repairing cracks and unevenness:

1. Crack Fillers and Sealants:

For smaller cracks, crack fillers or sealants can be used. These materials, such as asphalt-based crack fillers or specialized concrete crack sealants, are designed to fill and seal cracks, preventing water infiltration and further damage. They are typically applied using a caulk gun or trowel.

2. Repair Mortar:

Repair mortars are suitable for filling larger cracks, holes, or areas of unevenness. These mortars are made from a blend of cement, sand, and additives to enhance adhesion and strength. They can be mixed with water to create a workable paste and then applied to the damaged areas using a trowel or other appropriate tools. Repair mortars are commonly used for repairing concrete surfaces.

3. Leveling Compounds:

Leveling compounds, also known as self-leveling underlayments or floor levelers, are used to create a smooth and level surface. These compounds are typically made from a blend of cement, fine aggregates, and additives. They have a fluid consistency that allows them to flow and self-level over uneven areas. Leveling compounds are commonly used to repair uneven concrete or subfloor surfaces before applying flooring materials.

4. Patching Mixtures:

Patching mixtures, such as asphalt patching compounds or repair mixes, are specifically designed for repairing asphalt surfaces. They typically contain a combination of asphalt binder, aggregates, and additives. These mixtures can be applied to fill potholes, repair damaged areas, or smooth out unevenness in asphalt surfaces.

5. Resurfacing:

In cases where the damage or unevenness is more extensive, resurfacing the entire surface may be necessary. This involves applying a new layer of bitumen or asphalt mixture over the existing surface to create a smooth and uniform finish. Resurfacing can help address multiple issues, including cracks, potholes, and unevenness.

It's important to follow the manufacturer's instructions and best practices when using any repair materials. Additionally, proper surface preparation, including cleaning and removing loose debris, is essential before applying any repair method.

ATDM CO is a manufacturer and exporter of Bitumen 60/70, offering three different quality grades available in drums, bags, and bulk quantities. Our products are classified into premium, second, and third types, each with varying production costs and facilities. We provide a wide range of options to accommodate different customer needs and volume requirements.

#bitumen#bitumen 60/70#bitumen 80/100#bitumen 60/70 specs#bitumen penetration grade 60/70#bitumen 60/70 specification#bitumen 60 70#atdm co llc.

2 notes

·

View notes

Text

Fabric Based Laminates Market - Gowth Industry&Forecast, 2023–2030.

Fabric Based Laminates Market Overview:

The global Fabric Based Laminates Market size is estimated to reach $5.15 billion by 2030, growing at a CAGR of 4.1% during the forecast period 2023–2030. The fabric-based laminates market has experienced significant growth in recent years, driven by the increasing demand for lightweight, durable, and high-performance materials in various industries. Fabric-based laminates combine the strength and flexibility of fabrics with the added benefits of laminated structures, making them suitable for a wide range of applications.

Moreover, the fabric-based laminates market presents immense growth potential, fueled by the demand for lightweight, durable, and high-performance materials across various industries. While challenges related to cost and material availability exist, technological advancements and increasing awareness regarding the benefits of fabric-based laminates are expected to propel market growth.

Sample Report:

Fabric Based Laminates market — Report Coverage:

The “Fabric Based Laminates market — Forecast (2023–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Fabric Based Laminates Market.

COVID-19 / Ukraine Crisis — Impact Analysis:

● The laminated fabric market is expected to experience a significant decrease in demand due to the pandemic. This is due to the fact that stakeholders are heavily reliant on the supply chain, and the countries most affected by the pandemic, India, China and the United States, are expected to be at the forefront of the pandemic’s spread. Additionally, the closure of physical retail outlets around the world has had a significant effect on the industry, with labor constraints and an export-oriented focus. As a result, workers have returned to their countries of origin, resulting in a decrease in exports.

● The supply chain disruption due to the Russia-Ukraine war has impeded the Fabric Based Laminates Market growth. The disruption has increased freight charges, created container shortages and lowered the availability of warehousing space. This has resulted in inflationary issues in the aftermarket.

Inquiry Before Buying:

● Fastest Growth of Asia Pacific Region

The global market breakdown by regions is as follows: North America Asia-Pacific Europe South America Middle East & Africa Asia Pacific The construction sector is the main driver of the global market, with Asia Pacific accounting for the largest market share during the forecast period China is the world’s largest manufacturer of motor vehicles Upholstered Furniture Apparel & Accessories The coated fabrics market in China is driven by the industrialization of China and India Many manufacturing firms in Asia Pacific are expected to increase their demand for polymer coated cloth.

Schedule A Call :

● Market growth is expected to be driven by the growth of the automotive industry.

The automotive industry has a wide range of applications that rely on laminated / coated fabric and clothing, such as airbags, tyres cables, vehicle grab handles, windscreen wipers, radiator covers, and more. Plastic materials, particularly thermoplastic materials, are more commonly used in the vehicle sector. PA6 has a range of characteristics that make it an ideal material for automotive applications, such as corrosion resistance, high temperature resistance, chemical and electrical conductivity. Additionally, the use of laminated / coated fabrics and apparel has enabled the weight of spinning spares to be reduced while maintaining rigidity and carrying capacity, making them an ideal choice for automotive applications. In the coming decade, the demand for PA6 is expected to increase due to the expansion of the automotive market and the shift towards lighter vehicles with higher strength ratings.

● Growing Supply of Protective Garments to Meet Market Needs

Selecting appropriate attire plays a crucial role in safeguarding individuals against the prevalent biological and chemical hazards encountered in daily life. The protective clothing sector is poised for rapid expansion due to the substantial production expenses within the manufacturing industry and stringent government regulations, such as those mandated by OSHA and NIOSH, which mandate the use of protective attire. Polyurethane emerges as an exceptional material for crafting protective garments designed for high-altitude, fire-resistant, and chemical defense purposes. Its notable attributes include flexibility in frigid conditions, resilience against substantial impacts, and exceptional weather resistance. These qualities collectively contribute to the promising growth of the protective clothing industry.

● Concerns about the environment may impede market expansion

Laminating fabrics often involves the use of adhesives, coatings, and chemicals to bond layers together. Some of these chemicals can be harmful to the environment. For example, solvent-based adhesives can release volatile organic compounds (VOCs) into the atmosphere, contributing to air pollution and potentially harming human health. The production of laminated fabrics can generate waste materials, including excess adhesive, trimmings, and defective laminated fabrics. Disposing of these waste materials can have negative environmental impacts, especially if they are not managed or disposed of properly.

Buy Now:

Fabric Based Laminates Market Share (%) By Region, 2022

For More Details on This Report — Request for Sample

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in Fabric Based Laminates Market. The top 10 companies in this industry are listed below:

Serge Ferrari Group

Spradling International, Inc.

OMNOVO Solutions, Inc

Saint-Gobain SA

Sioen Industries NV

Robert Kaufman

Continental AG

Lamcotec

Trelleborg AB

Seaman Corporation

For More Chemicals and Materials Market Reports, Please Click Here

0 notes

Text

Hospital PP Non Woven Fabric Price | Favourite Fab

PP (Polypropylene) non-woven fabric is essential in the healthcare industry, particularly for making medical disposables such as surgical gowns, masks, drapes, and protective covers. Its lightweight, breathable, and cost-effective nature makes it an ideal material for hospital use. In this blog, we’ll discuss the pricing and factors that affect the cost of hospital-grade PP non-woven fabric.

1. What is PP Non-Woven Fabric?

PP non-woven fabric is made from polypropylene, a thermoplastic polymer. It is commonly used in medical settings because it’s:

Breathable and soft for comfort

Liquid-resistant, offering protection from fluids

Disposable, ensuring hygiene and minimizing contamination

2. Price of Hospital PP Non-Woven Fabric

The cost of hospital-grade PP non-woven fabric can vary based on factors such as:

GSM (Grams per Square Meter): Higher GSM fabrics offer better strength and durability, which can slightly raise the price.

Quantity: Bulk purchasing often leads to reduced costs per unit.

Customization: Adding special coatings, colors, or printing may influence the price.

On average, the price of hospital PP non-woven fabric ranges from ₹110 to ₹200 per kg, depending on the above factors.

3. Factors Influencing Price

Raw Material Costs: Fluctuations in polypropylene prices due to market conditions can impact fabric pricing.

Fabric Type: Laminated or treated PP fabrics that offer additional protection (e.g., fluid repellent) may cost more.

Manufacturing Costs: Custom production processes, especially for healthcare-grade materials, can slightly increase costs.

4. Why Choose Favourite Fab?

At Favourite Fab, we offer high-quality PP non-woven fabric specifically designed for hospital use. Our fabrics meet industry standards, ensuring safety, comfort, and reliability at competitive prices.

Conclusion

Hospital PP non-woven fabric is a vital material in medical environments, offering a balance of affordability, protection, and comfort. Understanding the factors influencing its price helps in better budgeting and planning for healthcare supplies.

0 notes

Text

0 notes

Text

Adhesives & Sealants Market - Forecast(2024 - 2030)

Adhesives & Sealants Market Overview

Global Adhesives & Sealants market size is estimated to reach US$ 89.1 billion by 2027, after growing at a CAGR of 5.7% during the forecast period 2022-2027. Adhesives and sealants are the chemical products which are used to create a mechanical seal between components. Adhesives are the non-metallic materials used to hold two substances together, while sealants are material used to fill space between these substances and to provide a protective coating. Adhesives are of various types like polyurethane adhesives, cyanoacrylate adhesive and epoxy adhesives, while sealants consist of resin like silicon, acrylic and butyl. These materials are chemically made with the help of rheology modifiers which are used to improve their viscosity. Adhesives and sealants have high applicability in sectors like construction, automotive, paper, textile, electronics and wood. Their major applicability is in construction sector where adhesives are used in polycarboxylate for concrete production. Factors like growing construction activities, increase in production volume of automotive, increase in aircraft production and high consumption of clothing & apparel items are driving the growth of global adhesives & sealants market. However, adhesives and sealants manufacturing produce volatile organic compounds which can cause environment problems like pollution. The regulation imposed by government to restrict VOC emission can hamper the growth of global adhesives & sealants industry.

COVID-19 Impact

The wide spread of COVID-19 left a negative impact on the activities of various industrial sectors, as the necessary measures taken by countries like consequential lockdown led to lack of availability of labors and raw materials. This disrupted the functionality of various end users of adhesives and sealants like construction, automotive, textile, and aerospace. For instance, as per, International Construction and Infrastructure Surveys, the construction and infrastructure activities across all regions went down in Q1 of 2020 with China in the Asia-Pacific region having the sharpest workload contraction. Also, as per the International Organization of Motor Vehicle Manufacturing, in 2020 there was a 16% global decline in vehicles production. Further, as per the 2021 report of the General Aviation Manufacturers Association, the Global business jet deliveries declined 20.4% to 644 aircraft in 2020 due to the COVID-19 pandemic. Polycarboxylate is used in cement concrete application, cyanoacrylate adhesive is used in automotive interiors while acrylic sealants are used in aircraft to prevent corrosion and fuel leak. Hence, the decrease in productivity of such sector led to decrease in usage of adhesives and sealants in them.

Request Sample

Report Coverage

The report: “Adhesives & Sealants Market Report – Forecast (2022 – 2027)”, by IndustryARC, covers an in-depth analysis of the following segments of the Global Adhesives & Sealants Industry

By Type – Water Based Latex, Acrylic, Polysulfide, Silicone, Polyurethane, Epoxies, Polyamides, Cyanoacrylate, Polyethylene Glycol, and Others (Polyisobutylene, Dextrin, Butyl)

By Form – Water based (Solution, Polymer Dispersion), Solvent based (Wet Bonding, Contact Adhesives), Hot Melt, and Reactive

By Application – Bonding (Paper Bonding, Wood Bonding), Concrete Production, Countertop Lamination, Drywall Lamination, Transportation (Automotive Module Sealant, Anti-Fuel Leaking Agent, Anti-Corrosive Agent, Clothing & Apparel (Apparel Laminate, Fabric Combining) and Others (Self-Adhesives Bandages, Circuit Boards Encapsulants)

By End User – Automotive (Passengers Cars, Heavy Commercial Vehicles, Light Commercial Vehicles, Others (Three-Wheeler, Two-Wheeler)), Construction (Residential, Commercial), Aerospace, Wood Industry, Paper, Textiles (Woven, Non-woven), Electronic, Medical and Others (Marine, Plastics)

By Geography - North America (USA, Canada, Mexico), Europe (UK, Germany, France, Italy, Netherland, Spain, Russia, Belgium, Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and New Zealand, Indonesia, Taiwan, Malaysia, Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, Rest of South America), Rest of the World (Middle East, Africa)

Key Takeaways

Asia-Pacific dominates the global adhesives & sealants industry as the region consist of major end users of adhesives and sealants like plastic, construction, automotive, electrical in major economies like China, South Korea, and Australia.

Rheology Modifier is used in water borne, solvent borne adhesives and sealants of all types, to control viscosity, provide coating performance and build thick adhesion between components.

In dentistry filed, polycarboxylate cement is used in the fixation of dental crowns, inlays, and along with cavity linings which provide a good adhesion to the tooth structure.

Inquiry Before Buying

Adhesives & Sealants Market Segment Analysis – By Type

Polyurethane held a significant share in global adhesives & sealants market in 2021, with a share of over 22.0%. Polyurethane adhesives are UV, water, and chemical resistant while polyurethane sealants provide long term elasticity and durable adhesion. Polyurethane adhesives are majorly used in automotive windshield while polyurethane sealants are used in sealing gaps and joints in components and structures. The rapid development in automotive and construction sectors has increased their scale of productivity which has positively impacted the usage of adhesives and sealants. For instance, as per European Automobile Manufacturers Association, the production and registration of passenger cars in the EU increased by 53.4% in 2021 with strong volume seen in Spain, France, and Germany. Further, as per US Census Bureau, in 2021, construction activities steadily increased in US, with residential construction showing an increase of 4.1% in November, up by 1% from 2020 same month. Such increase in productivity of these sectors will lead to more usage adhesives and sealants in the, which will positively impact the growth of global adhesives & sealants industry.

Adhesives & Sealants Market Segment Analysis – By End User

Construction sector held a significant share in global adhesives & sealants market in 2021, with a share of over 19.0%. Adhesives & sealants based of resins like polyamide, epoxy resin and plastisol are majorly used in construction sector as they have resistance to excessive sun, rainfall, provide good steel bonding, and act as cement dispersant. The rapid development in the construction sector in countries has increased the scale of construction activities and the undertaking of new infrastructure projects. For instance, as per European Union, in December 2021, construction of building increased by 4.6% and civil engineering by 3.3% compared to 2020. Also, in 2019 a total of US$ 102.3 billion worth of projects were processed across all GCC countries, compared to US$ 101.8 billion in 2018. Hence, such increase in the construction and infrastructure development activities will lead to more usage of adhesives in cement application while sealants will be used in blocking dust and heat transmission. This will have a positive impact on the growth of global adhesives & sealants industry.

Schedule a Call

Adhesives & Sealants Market Segment Analysis – By Geography

Asia-Pacific held the largest share in global adhesives & sealants market in 2021, with a share of over 27.0%. The region consists of major end-users of adhesives and sealants like construction, automotive, textiles, in major economies like China, India, Japan, and Australia with China having the largest automotive and construction sector. The economic development in these nations has led to increase in the industrial output of these sectors. For instance, as per the 2021 report of the European Automobile Manufacturers Association on global vehicle production, China produced 32% of 74 million cars manufactured worldwide with Japan & Korea producing 16%. Also, as per the State Council for the People’s Republic of China, in July 2021 China has approved projects related to the development of affordable rental homes. Further, as per October reports of Infrastructure Australia 2021, the major infrastructure activity relating to commercial buildings, civil infrastructure, and residential will double in the next three years. Cyanoacrylate adhesives are used in automotive roof pads, engine hose protectors and flex boards while acrylic and polyurethane based sealants are used to seal joints between components like concrete, steel, and masonry wall. Hence, the growing productivity of construction and automotive will lead to more usage of such adhesives and sealants in them, resulting in more growth of global adhesives & sealant industry.

Adhesives & Sealants Market Drivers

Growing Construction Activities

Emerging economies, rapid urbanization, and various infrastructural developments undertaken by countries have increased the scale of construction activity. For instance, in preparation for the 2021 Expo, Dubai awarded about 47 construction contracts with a total value of US$ 3 billion to local and foreign companies. In 2019 National Development and Reform Commission of China approved 26 infrastructure projects estimated to be completed by 2023. Also, in 2021, Oman’s Ministry of Housing and Urban Planning five new integrated projects that would provide 4800 housing units. Adhesives and sealants in building construction are used as the bonding layer for floor fixing, countertop lamination and wall covering. Hence, the increase in construction activities and infrastructure development projects will lead to more usage of adhesives and sealants, which will have a positive impact on the growth of the global adhesives & sealants industry.

Growing Production of Automotive

Automotive adhesives and sealants are used by automotive original equipment manufacturers (OEMs) to bond different substrate of metal, eliminating the need for welding and mechanical bolts, welds and rivets. The increase in purchase capacity, improvement in living standards, and rapid urbanization have led to an increase in the demand for new automotive vehicles, thereby increasing their production volume. For instance, as per the International Organization of Motor Vehicle Manufacturing, the global production volume of vehicles increased to 57 million in 2021 from 52 million in 2020. Also, as per the November 2021 report of the Europe Automobile Manufacturer Association, the new passenger car registration in the first ten months of 2021 increased up to 2.2% with an increase shown in European Union markets like Italy showed 12.7%, Spain showed 5.6% and France showed 3.1%. Such an increase in automobile production on account of high demand will increase the usage of adhesives and sealants like cyanoacrylate adhesives, which will have positive impact on growth of global adhesives & sealants industry.

Buy Now

Adhesives & Sealants Market Challenges

Stringent Government Regulation

One of the significant issues related to adhesives and sealants is that, their formation causes VOC emission which can lead to serious problems like skin irritation, sour throat and long-term damage to lungs & kidneys. Hence, in order prevent such problems various government organization have imposed certain regulation relating to VOC emission. For instance, Title 40, Code of Federal Regulations of US, Environment Protection Agency deals with EPA’s mission of protecting human health and the environment from VOC emission. Such regulation can restrict the production volume of adhesives and sealants, which can hamper the growth of global adhesives & sealants industry.

Adhesives & Sealants Industry Outlook

The companies to develop a strong regional presence and strengthen their market position, continuously engage in mergers and acquisitions. The global adhesives & sealants top 10 companies include:

Henkel Corporation

Sika AG

Arkema SA

Evonik Industries

Ashland Inc.

PPG Industries

RPM International Inc.

Wacker Chemie AG

Avery Dennison

Pidilite Industries

Recent Developments

In 2021, Creative Materials introduced 129-06 temperature-sensing conductive adhesive, coating in either one-component or two-component versions, and the product has high reliability due to low hysteresis, high flexibility and strong adhesion.

In 2020, Arkema acquired Fixatti, a manufacturer of thermos-bonding adhesives powder and such acquisition will strengthen the global offering of hot melt adhesives solution for niche industrial applications.

In 2019, Sika AG acquired China based Crevo-Hengxin a manufacturer of silicone sealants and adhesives, and such acquisition will expand the adhesives & sealant market share of Sika in China

#Adhesives & Sealants Market#Adhesives & Sealants Market Share#Adhesives & Sealants Market Size#Adhesives & Sealants Market Forecast#Adhesives & Sealants Market Report#Adhesives & Sealants Market Growth

0 notes

Text

Epoxy Resin Market Dynamics, Top Manufacturers Analysis, Trend And Demand, Forecast To 2030

Epoxy Resin Industry Overview

The global epoxy resin market size was estimated at USD 11.25 billion in 2023 and is expected to grow at a CAGR of 6.3% from 2024 to 2030.

Increasing demand for paints and coatings is anticipated to drive market growth significantly during the forecast period. Increasing demand for epoxy resins is attributed to growing spending on construction, particularly residential construction, especially in North America and Western Europe. The rapid growth in global manufacturing activities is expected to fuel the demand for paints & coatings used in the production of motor vehicles and other durable goods, as well as industrial maintenance applications. This is expected to boost the demand for epoxy resins globally.

Gather more insights about the market drivers, restrains and growth of the Epoxy Resin Market

Asia Pacific has been the leading consumer of epoxy resins, fueled by increasing demand from China and India. Infrastructure development, along with increasing automotive production, has fueled paints & coatings demand in the region. Increasing disposable income and willingness to spend are expected to drive the market over the coming years.

In the recent past, global automotive production increased rapidly due to growing demand from middle-class families and rising disposable income across emerging nations such as China, India, Brazil, Vietnam, and others. The rise in automotive demand propelled the consumption of paints & coatings across the automotive industry, thereby fueling the demand for epoxy resins. However, volatile raw material price of epoxy resin is expected to restrain the market growth during the forecast period.

In addition, the outbreak of COVID-19 negatively impacted the demand for epoxy resin in various applications, including paints & coatings, adhesives, wind turbines, and others, owing to the stalled manufacturing activities, restrictions in supply and transportation, and economic slowdown across the globe in 2020. Moreover, the recommencing industrial operation is projected to positively influence the market demand in the coming years.

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

• The global medical polyoxymethylene market size was estimated at USD 117.69 million in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030.

• The global multi-med adherence packaging market size was valued at USD 327.73 million in 2023 and is expected to expand at a CAGR of 6.0% from 2024 to 2030.

Market Concentration & Characteristics

The market space is moderately consolidated with the presence of key companies, such as 3M, Aditya Birla Management Corp. Pvt. Ltd, BASF SE, and Sika AG. These companies adopt various strategic initiatives, such as new product launches, partnerships, capacity expansions, and collaborations, to expand their presence in the market. For instance, in March 2024, Safic-Alcan announced its expansion by collaborating with BB Resins Srl. BB Resins Srl is a manufacturer of epoxy resin hardeners, which boasts an extensive range of products specifically designed for the coatings, construction, and adhesives sectors. With this collaboration, Safic-Alcan aims to expand its business across Poland.

The industry is characterized by a high degree of innovation. Technological advancement, upgradation of electronic products, and circuit assembly have propelled PCB fabrication technology toward micro via, fine-trace, high-density tracing, and multi-layers. The usage of epoxy resins enhances thermal dissipation, dimensional stability, and dielectric loss, therefore, propelling the demand for epoxy resins in the manufacture of CCL. In recent years, the electronic industry has grown rapidly, thereby increasing the demand for PCBs across the globe.

In addition, stringent regulations shape the market’s demand and supply dynamics. Stricter regulations on volatile organic compounds (VOCs) and hazardous substances can limit the use of certain raw materials and formulations. This can lead to a shift in market preferences towards eco-friendly and compliant products. For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation requires comprehensive data on the safety of chemical substances, pushing manufacturers to innovate and produce safer epoxy resin formulations

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

The following are the leading companies in the epoxy resin market. These companies collectively hold the largest market share and dictate industry trends:

3M

Aditya Birla Management Corporation Pvt. Ltd.

Atul Ltd

BASF SE

Solvay

Huntsman International LLC

KUKDO CHEMICAL CO., LTD.

Olin Corporation

Sika AG

NAN YA PLASTICS CORPORATION

Jiangsu Sanmu Group Co., Ltd.

Jubail Chemical Industries LLC

China Petrochemical & Chemical Corporation (SINOPEC)

Hexion

Kolon Industries, Inc.

Techstorm

NAGASE & CO., LTD

Order a free sample PDF of the Epoxy Resin Market Intelligence Study, published by Grand View Research.

0 notes

Text

PVA (alcool polyvinylique), Prévisions de la Taille du Marché Mondial, Classement et Part de Marché des 13 Premières Entreprises

Selon le nouveau rapport d'étude de marché “Rapport sur le marché mondial de PVA (alcool polyvinylique) 2024-2030”, publié par QYResearch, la taille du marché mondial de PVA (alcool polyvinylique) devrait atteindre 3903 millions de dollars d'ici 2030, à un TCAC de 2.5% au cours de la période de prévision.

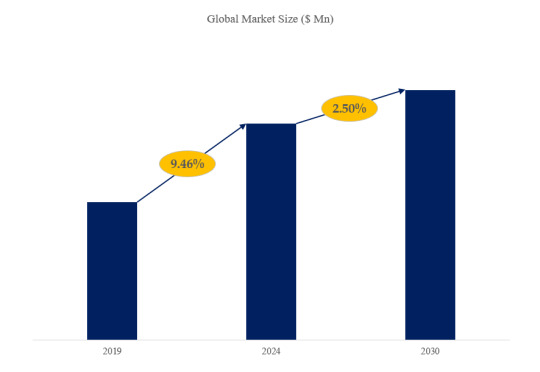

Figure 1. Taille du marché mondial de PVA (alcool polyvinylique) (en millions de dollars américains), 2019-2030

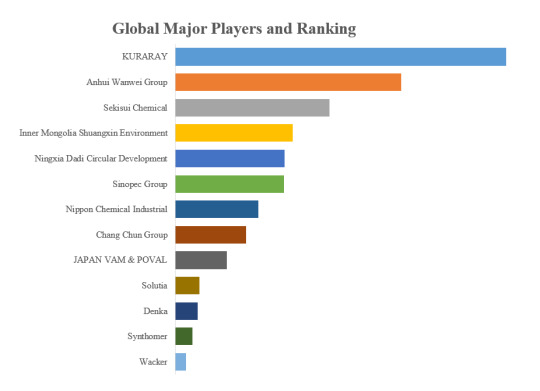

Selon QYResearch, les principaux fabricants mondiaux de PVA (alcool polyvinylique) comprennent KURARAY, Anhui Wanwei Group, Sekisui Chemical, Inner Mongolia Shuangxin Environment, Ningxia Dadi Circular Development, Sinopec Group, Nippon Chemical Industrial, Chang Chun Group, JAPAN VAM & POVAL, Solutia, etc. En 2023, les cinq premiers acteurs mondiaux détenaient une part d'environ 67.0% en termes de chiffre d'affaires.

Figure 2. Classement et part de marché des 13 premiers acteurs mondiaux de PVA (alcool polyvinylique) (Le classement est basé sur le chiffre d'affaires de 2023, continuellement mis à jour)

The key market drivers for the PVA (Polyvinyl Alcohol) market:

1. Increasing Demand for Eco-Friendly and Biodegradable Materials: The growing focus on sustainability and the shift towards environmentally-friendly products have driven the demand for PVA, a water-soluble and biodegradable polymer, as a replacement for traditional petroleum-based materials.

2. Expansion of the Packaging Industry: The increasing use of PVA in various packaging applications, such as water-soluble films, coatings, and adhesives, has been a significant driver for the market growth.

3. Rising Adoption in the Textile and Paper Industry: PVA's versatility in textile and paper applications, including as a sizing agent, binder, and coating material, has contributed to its widespread adoption in these industries.

4. Increasing Demand for Emulsifiers and Dispersants: PVA's ability to act as an effective emulsifier and dispersant in various industrial and consumer applications has driven its demand in the chemicals industry.

5. Expansion of the Construction and Building Materials Sector: The use of PVA in construction materials, such as cement and concrete admixtures, as well as in adhesives and sealants, has been a key driver for the market.

6. Growth of the Personal Care and Cosmetics Industry: PVA's applications in the personal care and cosmetics industry, including as a thickening agent, emulsifier, and film former, have contributed to the market's expansion.

7. Advancements in PVA Production and Processing Technologies: Improvements in PVA manufacturing processes and the development of new, high-performance PVA grades have made these products more accessible and appealing to a wider range of industries.

8. Increasing Demand for Water-Soluble and Dissolvable Products: The growing demand for water-soluble and dissolvable products, such as laundry detergent pods and medical devices, has fueled the need for PVA as a key ingredient.

9. Expansion of the Pharmaceutical and Medical Device Industry: The use of PVA in various pharmaceutical and medical applications, such as drug delivery systems, wound dressings, and medical implants, has been a significant driver for the market.

10. Rising Adoption in the Electronics and Semiconductor Industry: PVA's applications in the electronics and semiconductor industry, including as a protective coating and cleaning agent, have contributed to the growth of the PVA market.

À propos de QYResearch

QYResearch a été fondée en 2007 en Californie aux États-Unis. C'est une société de conseil et d'étude de marché de premier plan à l'échelle mondiale. Avec plus de 17 ans d'expérience et une équipe de recherche professionnelle dans différentes villes du monde, QYResearch se concentre sur le conseil en gestion, les services de base de données et de séminaires, le conseil en IPO, la recherche de la chaîne industrielle et la recherche personnalisée. Nous société a pour objectif d’aider nos clients à réussir en leur fournissant un modèle de revenus non linéaire. Nous sommes mondialement reconnus pour notre vaste portefeuille de services, notre bonne citoyenneté d'entreprise et notre fort engagement envers la durabilité. Jusqu'à présent, nous avons coopéré avec plus de 60 000 clients sur les cinq continents. Coopérons et bâtissons ensemble un avenir prometteur et meilleur.

QYResearch est une société de conseil de grande envergure de renommée mondiale. Elle couvre divers segments de marché de la chaîne industrielle de haute technologie, notamment la chaîne industrielle des semi-conducteurs (équipements et pièces de semi-conducteurs, matériaux semi-conducteurs, circuits intégrés, fonderie, emballage et test, dispositifs discrets, capteurs, dispositifs optoélectroniques), la chaîne industrielle photovoltaïque (équipements, cellules, modules, supports de matériaux auxiliaires, onduleurs, terminaux de centrales électriques), la chaîne industrielle des véhicules électriques à énergie nouvelle (batteries et matériaux, pièces automobiles, batteries, moteurs, commande électronique, semi-conducteurs automobiles, etc.), la chaîne industrielle des communications (équipements de système de communication, équipements terminaux, composants électroniques, frontaux RF, modules optiques, 4G/5G/6G, large bande, IoT, économie numérique, IA), la chaîne industrielle des matériaux avancés (matériaux métalliques, polymères, céramiques, nano matériaux, etc.), la chaîne industrielle de fabrication de machines (machines-outils CNC, machines de construction, machines électriques, automatisation 3C, robots industriels, lasers, contrôle industriel, drones), l'alimentation, les boissons et les produits pharmaceutiques, l'équipement médical, l'agriculture, etc.

0 notes

Text

0 notes

Text

#coated fabrics market#coated fabrics market size#elastomer coated fabrics market#global polymer coated fabrics market size#coated fabric examples#fabric coating companies#rubber coated fabrics market

0 notes

Text

The global demand for N-vinylformamide was valued at USD 384.9million in 2022 and is expected to reach USD 637.0 Million in 2030, growing at a CAGR of 6.50% between 2023 and 2030.The global N-vinylformamide (NVF) market has gained significant attention in recent years due to its unique properties and diverse applications across various industries. As a versatile monomer, NVF has opened new avenues in the specialty chemicals sector, leading to increased demand and research into its potential uses. This article provides an overview of the NVF market, its key applications, market dynamics, and future growth prospects.

Browse the full report at https://www.credenceresearch.com/report/n-vinylformamide-market

Introduction to N-Vinylformamide

N-vinylformamide is an organic compound that serves as a precursor to polyvinylformamide, a polymer that can be hydrolyzed to form polyvinylamine. This transformation gives NVF-based products their unique properties, making them useful in a variety of applications. NVF is typically produced through the reaction of formamide with acetylene, a process that results in a colorless liquid with a boiling point of 50-55°C. Its ability to polymerize easily makes it an essential component in the synthesis of various polymers and copolymers.

Key Applications of N-Vinylformamide

1. Water Treatment: One of the most significant applications of NVF is in water treatment processes. The polymeric derivatives of NVF, particularly polyvinylamine, are highly effective flocculants and coagulants. These compounds are used to remove suspended particles, heavy metals, and organic contaminants from wastewater, making them crucial in industrial and municipal water treatment facilities.

2. Paper Manufacturing: In the paper industry, NVF-based polymers are used as dry-strength resins. These resins improve the mechanical properties of paper products, such as tensile strength and burst resistance, without negatively impacting other qualities like printability. This makes NVF derivatives indispensable in the production of high-quality paper and packaging materials.

3. Adhesives and Coatings: NVF is also used in the formulation of adhesives and coatings. Its ability to form strong, durable bonds makes it ideal for use in high-performance adhesives. In coatings, NVF-based products enhance properties like adhesion, durability, and chemical resistance, making them suitable for a wide range of applications, including automotive, construction, and electronics industries.

4. Textile and Personal Care Products: In the textile industry, NVF-based polymers are used as fabric finishes to improve properties like softness, wrinkle resistance, and moisture absorption. In personal care products, NVF derivatives are employed as conditioning agents in shampoos and skin care formulations, where they provide moisture retention and film-forming properties.

Market Dynamics

The NVF market is influenced by several key factors, including the growing demand for water treatment solutions, the expansion of the paper and packaging industry, and the increasing use of high-performance adhesives and coatings. Additionally, the rising awareness of environmental sustainability has driven the adoption of NVF-based products in various industries, as they offer eco-friendly alternatives to traditional chemical agents.

1. Demand Drivers:

- Water Treatment: The global water crisis and stringent environmental regulations have led to an increased demand for efficient water treatment solutions, driving the use of NVF-based flocculants and coagulants.

- Packaging Industry: The growing e-commerce sector and the need for sustainable packaging solutions have boosted the demand for NVF in paper manufacturing.

- Construction and Automotive Sectors: The need for advanced adhesives and coatings in construction and automotive applications has further propelled the NVF market.

2. Restraints:

- High Production Costs: The production of NVF involves complex chemical processes, leading to relatively high costs compared to other monomers. This can be a limiting factor for its widespread adoption, especially in cost-sensitive markets.

- Health and Safety Concerns: NVF is classified as a hazardous substance, and its handling requires strict safety measures. These health and safety concerns can restrict its use in certain applications.

Future Growth Prospects

The future of the NVF market looks promising, with several factors contributing to its potential growth. Advances in polymer science and the development of new NVF-based products are expected to expand its application range. Moreover, the increasing focus on sustainability and the circular economy will likely drive the demand for eco-friendly materials, further boosting the NVF market.

Key Players

BASF

Dia-Nitrix

Eastman Chemical

Mitsubishi Rayon Company, Ltd.

TCI (Shanghai) Development Co., Ltd.

Santa Cruz Biotechnology, Inc.

Solenis LLC

Braskem

DowDuPont

Cargil

Royal DSM

Segmentation

By Application:

Polymerization

Adhesives and Sealants

Coatings

Textiles and Fibers

Paper and Packaging

Others

By End-Use Industry:

Chemical Industry

Adhesives and Sealants

Paints and Coatings

Textiles and Apparel

Paper and Packaging

Others

By Purity:

Standard Purity

High Purity

By Product Form:

Liquid

Solid

By Region

North America

US

Canada

Mexico

Europe

Germany

France

UK.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/n-vinylformamide-market

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

Synthetic Leather Market worth $88.0 billion by 2028

The report "Synthetic Leather Market by Type (PU-based, PVC-based, Bio-based), End-use Industry (Footwear, Furnishing, Automotive, Clothing, Bags, Purses & Wallets), and Region (North America, Europe, Asia Pacific, MEA, South America) - Global Forecast to 2028", size was USD 68.7 billion in 2023 to USD 88.0 billion by 2028, at a CAGR of 5.1% from 2023 to 2028.

Download pdf-https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=6616309

Synthetic leather, commonly referred to as artificial leather, is a man-made material that is meant to resemble the texture and, in some instances, the appearance of real leather. It is often made from various synthetic materials, such as polyurethane (PU) or polyvinyl chloride (PVC) and is used as an environmentally friendly and frequently more cost-effective substitute for genuine leather. Although it is not created from animal hides, synthetic leather has the same texture and appearance as genuine leather. A combination of polymers, fabric backing, and coatings were used in its engineering. Synthetic leathers are used in various industries such as footwear, furnishing, automotive, clothing, bags, purses & wallets, and others such as sports, electronics, and medical.

“Bio-based synthetic leather segment is estimated to be the fastest-growing type for synthetic leather market during the forecast period 2023 to 2028.”

The synthetic leather market is projected to be experiencing significant growth in the forecasted period. The bio-based synthetic leather segment is estimated to be the fastest-growing segment in the synthetic leather market due to a combination of environmental, consumer, and technological factors. As sustainability becomes a key component of both consumer preferences and business goals, the bio-based synthetic leather market is anticipated to maintain its growth trajectory. As continued research and development, it is expected that this industry will become even more cutting-edge, providing a greater range of superior, eco-friendly substitutes for conventional leather materials.

“Footwear segment is estimated to be the largest application in synthetic leather market in 2022, in terms of value.”

The footwear segment is estimated to be the largest application in synthetic leather market in the forecasted year due to several factors. The dominance of the footwear segment in the synthetic leather market is driven by a combination of economic, aesthetic, and ethical factors. Synthetic leather offers a cost-effective solution for footwear manufacturers without compromising on quality or style. Moreover, synthetic leather's durability is a pivotal factor. It can endure the rigors of daily wear, maintaining its appearance and shape over time. Furthermore, customization options further bolster the position of synthetic leather in the footwear industry. The synthetic leather market in the footwear segment is projected to rise in the forecast year.

Sample Request- https://www.marketsandmarkets.com/requestsampleNew.asp?id=6616309

“Asia Pacific was the largest region for the synthetic leather market in 2022, in terms of value.”

The Asia Pacific region's prominence as the largest market for synthetic leather can be attributed to a convergence of economic, industrial, and cultural factors. The fashion and footwear industries in the Asia Pacific region are among the largest globally, and they have embraced synthetic leather for its versatility and affordability. Moreover, the automotive industry's expansion in the region has led to increased use of synthetic leather in car interiors. Environmental concerns and animal welfare issues have also encouraged the shift toward synthetic leather, as it offers an ethical alternative to genuine leather. This combination of economic growth, industrial competence, and consumer preferences has firmly established Asia Pacific as the largest market for synthetic leather.

Key Players

The key market players identified in the report are Kuraray Co., Ltd. (Japan), San Fang Chemical Industry Co., Ltd. (Taiwan), Teijin Limited (Japan), NAN YA PLASTICS CORPORATION (Taiwan), Wanhua Chemical Group Co., Ltd. (China), Mayur Uniquoters Limited (India), FILWEL Co., Ltd. (Japan), Zhejiang Hexin Holdings Co., Ltd. (China), Alfatex Italia SRL (Italy), and H.R. Polycoats Private Limited (India).

#SyntheticLeather#LeatherAlternatives#VeganLeather#EcoFriendlyMaterials#SustainableFashion#FauxLeather#ArtificialLeather#PULeather#LeatherIndustry#EcoTextiles#FashionInnovation#CrueltyFreeFashion#SustainableMaterials#LeatherSubstitutes#GreenManufacturing

0 notes

Text

Global Top 15 Companies Accounted for 39% of total Waterproof Fabrics market (QYResearch, 2021)

Waterproof fabrics are fabrics that are inherently, or have been treated to become, resistant to penetration by water and wetting. They are usually natural or synthetic fabrics that are laminated to or coated with a waterproofing material such as rubber, polyvinyl chloride (PVC), polyurethane (PU), silicone elastomer, fluoropolymers, and wax.

In this report we focus on raw membrane material.

According to the new market research report “Global Waterproof Fabrics Market Report 2023-2029”, published by QYResearch, the global Waterproof Fabrics market size is projected to reach USD 2.12 billion by 2029, at a CAGR of 3.9% during the forecast period.

Figure. Global Waterproof Fabrics Market Size (US$ Million), 2018-2029

Figure. Global Waterproof Fabrics Top 15 Players Ranking and Market Share(Based on data of 2021, Continually updated)

The global key manufacturers of Waterproof Fabrics include Gore, Performax, Toray Industries, Polartec Neoshell, Swmintl, Sympatex, DSM, Carrington Textiles, Derekduck, Porelle Membranes, etc. In 2021, the global top five players had a share approximately 39.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

PP Woven Bags: The Durable, Versatile, and Eco-Friendly Packaging Solution

In today's fast-paced world, the demand for durable, versatile, and eco-friendly packaging solutions is higher than ever. Among the myriad of options available, Pp bags manufacturers in Delhi have emerged as a standout choice for various industries. These bags, made from polypropylene (PP), are known for their strength, durability, and versatility. In this comprehensive guide, we'll explore what PP woven bags are, their benefits, applications, and why they are becoming a preferred packaging solution across different sectors.

What Are PP Woven Bags?

PP woven bags are made from polypropylene, a type of thermoplastic polymer. The term "woven" refers to the method of weaving polypropylene tapes together to create a strong, lightweight, and durable material. These bags are widely used for packaging a variety of products, ranging from agricultural goods and building materials to chemicals and consumer goods.

The manufacturing process of Hdpe pp bags Exporter involves several steps, including the extrusion of polypropylene granules into tapes, weaving these tapes into fabric, laminating the fabric if necessary, and finally cutting and sewing the fabric into bags of various sizes and shapes.

Benefits of PP Woven Bags

Durability: One of the most significant advantages of PP woven bags is their durability. The woven structure of polypropylene tapes provides excellent tensile strength, making these bags resistant to tearing and stretching. This durability ensures that the bags can withstand heavy loads and rough handling, making them ideal for transporting and storing bulky and heavy items.

Versatility: PP woven bags are incredibly versatile and can be used in various industries. They can be customized in terms of size, shape, and design to meet specific packaging requirements. Additionally, they can be printed with branding and product information, making them an excellent choice for marketing and promotional purposes.

Eco-Friendliness: As the world moves towards more sustainable practices, the eco-friendly nature of PP woven bags is a significant advantage. These bags are reusable and recyclable, reducing the need for single-use plastics and minimizing environmental impact. Moreover, the production process of PP woven bags consumes less energy and generates fewer emissions compared to other types of plastic bags.

Cost-Effective: Despite their many benefits, PP woven bags are cost-effective. Their durability and reusability reduce the need for frequent replacements, leading to long-term cost savings. Additionally, the lightweight nature of these bags helps reduce transportation costs.

Moisture Resistance: PP woven bags can be laminated or coated to provide additional moisture resistance, protecting the contents from water damage. This feature is particularly beneficial for packaging agricultural products, chemicals, and other moisture-sensitive items.

Applications of PP Woven Bags

PP woven bags are used in a wide range of industries due to their versatility and durability. Here are some common applications:

Agriculture: PP woven bags are widely used in the agriculture industry for packaging products such as grains, seeds, fertilizers, and animal feed. Their strength and moisture resistance make them ideal for storing and transporting these products.

Construction: In the construction industry, PP woven bags are used for packaging materials such as cement, sand, and gravel. Their ability to withstand heavy loads and rough handling makes them suitable for this demanding environment.

Chemicals: The chemical industry uses PP woven bags for packaging a variety of chemicals, including powders and granules. The bags' durability and resistance to chemicals ensure safe and secure packaging.

Consumer Goods: PP woven bags are also used for packaging consumer goods such as food products, textiles, and household items. Their ability to be customized and printed with branding makes them an excellent choice for retail packaging.

Flood Control: In emergency situations, PP woven bags can be filled with sand and used as sandbags for flood control. Their strength and durability help protect against water damage during floods.

Manufacturing Process of PP Woven Bags

The manufacturing process of PP woven bags involves several key steps to ensure the production of high-quality, durable bags. Here is an overview of the process:

Extrusion: The process begins with the extrusion of polypropylene granules into flat tapes. These tapes are then stretched and heated to improve their strength and durability.

Weaving: The polypropylene tapes are woven together using circular looms to create a strong, lightweight fabric. This woven fabric forms the basis of the PP woven bags.

Lamination (Optional): Depending on the intended use, the woven fabric can be laminated with a layer of polyethylene or another material to provide additional moisture resistance and durability.

Cutting and Sewing: The laminated or non-laminated fabric is then cut into the desired size and shape. The pieces are sewn together to form the final bag, with handles or closures added as needed.

Printing: The finished bags can be printed with branding, logos, product information, and other designs using various printing techniques. This step enhances the bags' marketing potential and helps convey important information to consumers.

Maintenance and Reusability

One of the standout features of PP woven bags is their reusability. Proper maintenance and care can extend the lifespan of these bags, making them a sustainable packaging option. Here are some tips for maintaining and reusing PP woven bags:

Cleaning: PP woven bags can be easily cleaned with water and mild detergent. For heavily soiled bags, a brush can be used to remove dirt and debris. Ensure the bags are thoroughly dried before reuse to prevent mold and mildew growth.

Storage: When not in use, PP woven bags should be stored in a cool, dry place away from direct sunlight. Prolonged exposure to UV rays can weaken the polypropylene material over time.

Inspection: Regularly inspect the bags for any signs of wear and tear, such as holes, tears, or weakened seams. Damaged bags should be repaired or replaced to ensure the safety and security of the contents.

Conclusion

PP woven bags are a durable, versatile, and eco-friendly packaging solution that offers numerous benefits across various industries. Their strength, cost-effectiveness, and ability to be customized make them an ideal choice for packaging a wide range of products, from agricultural goods to consumer items. As the demand for sustainable packaging solutions continues to grow, PP woven bags stand out as a reliable and environmentally responsible option.

By understanding the benefits, applications, and proper maintenance of Pp woven bags price, businesses can make informed decisions about their packaging needs. Whether you're in agriculture, construction, or retail, PP woven bags from Singhal Industries can provide a durable and cost-effective solution that meets your specific requirements. Embrace the advantages of PP woven bags and contribute to a more sustainable future while ensuring the safe and secure packaging of your products.

Frequently Asked Questions (FAQs):

1. What makes PP woven bags from Singhal Industries a preferred packaging solution?

PP woven bags from Singhal Industries are preferred due to their exceptional durability, versatility, and eco-friendliness. These bags are made from strong polypropylene tapes woven together, providing excellent tensile strength and resistance to tearing and stretching. They can handle heavy loads and rough handling, making them suitable for various industries, including agriculture, construction, and chemicals. Additionally, these bags are cost-effective, reusable, and recyclable, contributing to environmental conservation. Their ability to be customized in size, shape, and design further enhances their appeal as a reliable and attractive packaging option.

2. What are some common applications of Singhal Industries' PP woven bags?

Singhal Industries' PP woven bags are used in a wide range of applications across different industries. In agriculture, they are ideal for packaging grains, seeds, fertilizers, and animal feed due to their strength and moisture resistance. The construction industry uses them for materials like cement, sand, and gravel, thanks to their durability and ability to withstand heavy loads. These bags are also utilized in the chemical industry for packaging powders and granules, ensuring safe and secure storage. Additionally, PP woven bags are popular in the consumer goods sector for packaging food products, textiles, and household items. Their versatility extends to emergency situations, where they can be filled with sand and used as sandbags for flood control.

3. How are PP woven bags from Singhal Industries manufactured and maintained?

The manufacturing process of PP woven bags from Singhal Industries involves several key steps. It starts with the extrusion of polypropylene granules into flat tapes, which are then woven together using circular looms to create a strong fabric. This fabric can be laminated for additional moisture resistance before being cut and sewn into bags. The finished bags can be printed with branding and product information for enhanced marketing potential. For maintenance, these bags are easy to clean with water and mild detergent and should be stored in a cool, dry place away from direct sunlight. Regular inspection for wear and tear is recommended to ensure the bags' longevity and continued effectiveness.

0 notes