#Pet food and nutrition Market Revenue

Explore tagged Tumblr posts

Text

Exploring New Directions in the Pet Care Sector

Introduction

The Pet Care Market is in a constant state of flux, with ongoing trends and innovations reshaping its landscape. In this article, we delve into some of the emerging trends in the pet care market and their impact on industry participants.

Tailored Nutrition

A notable trend in the Pet Care Market is the move towards personalized nutrition. Pet owners are increasingly seeking tailored diet plans and nutritional solutions to meet the specific needs of their pets. Responding to this demand, companies are offering customized pet food formulas and supplements designed to address various health concerns and dietary preferences.

E-commerce Expansion

The surge in e-commerce has transformed the way pet care products are purchased and sold. Online platforms provide convenience and accessibility, enabling pet owners to explore a wide array of products and make purchases from the comfort of their homes. This shift has led to the proliferation of online pet stores and the adoption of subscription-based models for pet food and supplies.

Emphasis on Sustainability

Sustainability has emerged as a significant focus area for both pet care companies and consumers. With increasing worries about environmental conservation and climate change, pet owners are seeking eco-friendly and sustainable pet care products. In response, companies are integrating recycled materials, minimizing packaging waste, and embracing sustainable manufacturing practices.

Technology-Driven Solutions

Technological advancements are fueling innovation in the pet care market. From wearable devices and smart collars to pet monitoring apps and telemedicine services, technology is revolutionizing how pet owners interact with their pets and manage their health and well-being. These tech-driven solutions offer convenience, efficiency, and peace of mind to pet owners, driving their adoption and integration into daily pet care routines.

Growing CBD Market

Another noteworthy trend in the pet care market is the increasing popularity of CBD products for pets. CBD, or cannabidiol, is a non-psychoactive compound derived from the cannabis plant, believed to offer various health benefits for pets, including pain relief, anxiety reduction, and improved mobility. As more research is conducted on the potential benefits of CBD for pets, the market for CBD pet products is expected to expand significantly.

Conclusion

The Pet Care Industry is undergoing rapid evolution, spurred by shifting consumer preferences, technological breakthroughs, and heightened awareness of pet health and wellness. By staying attuned to emerging trends and embracing innovation, companies can position themselves for success in this dynamic and competitive industry.

#Pet Market Analysis#Pet Market Size#Cat food manufacturers#Online dog food sales#Online pet food companies#Top pet companies#Pet Industry#Pet Industry research reports#Pet market research reports#Pet Market Demand#Pet Market Forecast#Pet Market Growth#Pet Market Outlook#Pet Market Revenue#Pet Market Trends#Pet Market Report#Pet Market Challenges#Pet Market Opportunities#Pet food and nutrition Industry research report#Pet food and nutrition Market Analysis#Pet food and nutrition Market Demand#Pet food and nutrition Market Forecast#Pet food and nutrition Market Growth#Pet food and nutrition Market Outlook#Pet food and nutrition Market Revenue#Pet food and nutrition Market Size#Pet food and nutrition Market Trends

0 notes

Text

Navigating the Pet Market Exploring the Market Trends, Growth, and Outlook

In the Pet Care industry, it is crucial to understand the Pet Market for pet owners, businesses, and enthusiasts alike. This comprehensive exploration delves into key aspects of the Pet Market, ranging from demand dynamics to growth projections, trends, and the challenges and opportunities that shape this flourishing industry.

Exploring Pet Market Research Reports: A Wealth of Insights

The Pet Market Research Reports serve as beacons of information, offering a comprehensive understanding of the industry's landscape. These reports, compiled by experts and analysts, provide valuable insights for stakeholders aiming to navigate the dynamic pet market. Pet Market Research Reports offer a detailed analysis of consumer preferences, emerging trends, and competitive landscapes, aiding businesses in making informed decisions. The increasing frequency of these reports, with over 150 published annually, underscores the growing demand for in-depth insights into the Pet Market.

Unraveling Pet Market Demand: Understanding Consumer Preferences

The heartbeat of the Pet Market lies in understanding what consumers seek for their furry companions. Exploring Pet Market Demand illuminates the evolving preferences of pet owners and sheds light on the factors influencing purchasing decisions. Pet Market Demand is witnessing a notable shift towards premium and specialized pet products, reflecting the growing trend of pet humanization. The demand for organic and natural pet products has seen a significant upswing, emphasizing the growing importance of health-conscious choices in pet care.

Forecasting Pet Market Trends: Peering into the Future

Anticipating trends is essential in a market as dynamic as pet care. Pet Market Forecast sections provide a glimpse into the future, considering factors such as technological advancements, changing consumer behaviors, and emerging product categories. The Pet Market Forecast suggests a surge in demand for sustainable and eco-friendly pet products, indicating a shift towards environmentally conscious pet ownership. Technological innovations such as AI-powered pet care apps and telemedicine services are expected to become prominent trends in the near future.

Pet Market Growth: Nurturing a Flourishing Industry

The continuous growth of the Pet Market is a testament to the unwavering love and care bestowed upon pets. Exploring Pet Market Growth patterns delves into the factors contributing to the industry's expansion with an annual growth rate of 5%, the Pet Market Growth is fueled by a rising awareness of pet health and the increasing adoption of pets across diverse demographics. The emergence of emerging markets and increased disposable income contribute significantly to the global growth trajectory of the Pet Market.

Outlook on Pet Market Opportunities: Navigating Possibilities

Amidst challenges, opportunities abound in the Pet Market. The Pet Market Opportunities section explores potential areas for growth, innovation, and market expansion. Innovations in pet tech, including smart collars and health-monitoring devices, present significant Pet Market Opportunities for businesses aiming to tap into the burgeoning pet technology sector. The rising trend of pet insurance and wellness programs represents untapped opportunities for businesses to diversify their service offerings.

Harvesting Pet Market Revenue: Understanding Financial Dynamics

For businesses, comprehending the financial aspects of the Pet Market is crucial. The Pet Market Revenue section unravels the economic landscape, considering factors like pricing strategies, consumer spending patterns, and revenue projections. The global Pet Market Revenue is expected to reach USD 200 billion by 2025, driven by a surge in pet product sales and an increased focus on premium pet services. The expanding e-commerce landscape and the ease of online transactions are contributing factors to the consistent growth in Pet Market Revenue.

Trends Painting Pet Market: Unveiling Consumer Preferences

The pet market is not immune to trends that shape consumer behaviors. Pet Market Trends delve into the evolving landscape, from the rise of pet influencers on social media to the increasing demand for organic and natural pet products. The influence of Pet Market Trends on consumer behavior is evident in the growing demand for personalized and customized pet products, reflecting an era of individualized pet care. The integration of technology, such as QR-coded pet food for traceability, is gaining popularity, aligning with the overall tech-savvy trend in pet ownership.

Challenges in Pet Market: Navigating Obstacles

Every industry has its hurdles, and the Pet Market is no exception. The Pet Market Challenges section sheds light on obstacles faced by businesses, ranging from regulatory constraints to market saturation. Regulatory uncertainties pose significant Pet Market Challenges, necessitating businesses to stay adaptable and proactive in complying with evolving standards. The prevalence of counterfeit pet products in certain markets represents a challenge to the industry's integrity, necessitating enhanced regulatory efforts.

Conclusion: Embracing the Pet Market Dynamics

The Pet Market is a vibrant and ever-evolving landscape shaped by the love and care bestowed upon our beloved pets. From the challenges that keep businesses on their toes to the opportunities that beckon innovation, the Pet Market remains a thriving hub for those dedicated to the well-being of their cherished companions.

#Pet Market Analysis#Pet Market Size#Online Dog Food Sales#Online Pet Food Companies#Top Pet Companies#Pet Industry#Pet Industry Research Reports#Pet Market Research Reports#Pet Market Demand#Pet Market Forecast#Pet Market Growth#Pet Market Outlook#Pet Market Revenue#Pet Market Trends#Pet Market Report#Pet Market Challenges#Pet Market Opportunities#Pet Food and Nutrition Industry Research Report#Pet Food and Nutrition Market Analysis#Pet Food and Nutrition Market Demand#Pet Food and Nutrition Market Forecast#Pet Food and Nutrition Market Growth#Pet Food and Nutrition Market Outlook#Pet Food and Nutrition Market Revenue#Pet Food and Nutrition Market Size#Pet Food and Nutrition Market Trends

1 note

·

View note

Text

Germany Pet Food Market Industry Forecast, 2024–2030

Germany Pet Food Market Overview:

Germany Pet Food Market size is estimated to reach US$6.1 billion by 2030, growing at a CAGR of 4.1% during the forecast period 2024–2030.

Request sample :

A key trend is the growing focus on sustainable and eco-friendly pet food. As consumers become more aware regarding sustainability, there is a growing interest in pet food products that use sustainable ingredients and environmentally responsible packaging. In November 2024, German pet food startup Wynn Petfood announced it is packing its entire product portfolio of premium pet food blends and practical snacks for dogs 100% in paper.

According to Koehler Paper, the designer of the packaging material, this is the first time paper packaging was used for wet food blends. Wynn is one of the first companies in the pet food industry to do so. Another significant trend is the demand for personalised and health-conscious pet food. Brands like Tails.com, Butternut Box and Pets Deli are tapping into this trend. The emphasis on subscription-based services and fresh, tailored meals is particularly attractive to a segment of pet owners willing to pay a premium for convenience and health benefits. This represents the Germany Pet Food Industry Outlook during the forecast period.

Market Snapshot:

Germany Pet Food Market — Report Coverage:

The “Germany Pet Food Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Germany Pet Food Market.

AttributeSegment

By Type

Dogs

Cats

Fish

Birds

Others

By Ingredients

Cereals

Fruits & Vegetables

Proteins

Fats

Additives

By Source

Conventional

Organic

By Food Type

Semi-moist Foods

Kibble

Canned Food

Veterinary Food

Nutritional Food

Others

By Packaging

Bags

Can

Pouches

Boxes/Cartons

Bottles and Jars

Tubs

Others

By Distribution Channel

Online

Offline

COVID-19 / Ukraine Crisis — Impact Analysis:

COVID-19 positively impacted the pet food market in Germany. Due to lockdowns, several people adopted pets for companionship. According to statistics from Global News, almost 30% of Canadians adopted a new animal during the pandemic and 31% of those who adopted new pets during this time were actually first-time pet parents. This led to an increased demand for pet food.

Inquiry Before Buying: The Russian-Ukraine war significantly affected the pet food market. Due to war, the inflation worsened in the country resulting in high prices of ingredients thereby impacting the pet food market. Ukraine is a major grain exporter and the grain is used in pet food, therefore, the war resulted in supply chain bottlenecks as manufacturers had to look for alternation sources of grain.

Key Takeaways

Cats are the Largest Segment

Cats are the largest segment in the German pet food market in terms of pet due to their minimal need for dependence on their owners and being able to live in small places making them ideal for apartments. As per the Central Association of Zoological Specialist Companies (ZZF), a German trade association, 2024 report on the Deutsch pet market, ZZF recorded populations of 15.7 million cats in Germany in 2023. In 42% of all cat-owning households there were two or more cats in German homes. As per the report, cat food represented the largest share of pet food sales in Germany in 2023, totaling $2.5 billion and growing 14.4% over 2022. According to ZZF, wet cat food sales made up the major’s share of total cat food revenue at $1.6 billion, up 15.3% year-over-year while dry cat food accounted for $426.7 million, up 11.3% year-over-year, and cat treat and snacks accounted for $400.8 million, up 14% year-over-year.

Online to Grow the Fastest

Online is projected to be the fastest growing distribution channel for pet food in Germany as consumers shift to digital platforms for convenience, competitive pricing and a wide range of choices. With direct-to-door delivery and subscription options available, e-commerce appeals to pet owners who prioritize convenience and time efficiency. In February 2024, Zooplus, a German online store that sells pet supplies and food, expanded its subscription model, which then became available in 8 markets. This helps customers automate repeat purchases, like pet food and set up frequencies for shipping.

Schedule A Call:

And in June 2024, the company announced plans to launch its own marketplace. By doing this, the platform will be able to quickly expand its product range. The rise of specialty pet food products has also spurred online demand as digital platforms offer detailed information and reviews to help consumers make informed choices. Seasonal promotions and personalized recommendations further enhance the online shopping experience attracting more pet owners to buy online. As e-commerce expands, online sales are anticipated to play an important role in the growth of Germany’s pet food market.

Bags are the Largest Segment

Bags are the largest segment, by packaging type, in the Canadian pet food market due to their durability, convenience and cost-effectiveness. Most dry pet foods such as kibble and treats are packaged in bags that are easy to store, transport and reseal. Bags are versatile and available in various sizes, along with resealable options appealing to convenience needs. The packaging’s ability to preserve food quality and prevent moisture or contamination makes it a preferred choice among pet owners. With these benefits, pet food in bags remains the largest segment in the German market reflecting both practicality and consumer demand for quality packaging.

Humanization of Pets Drives the Market

The humanization of pets has significantly transformed the pet food market in Germany. Pet owners increasingly view their pets as family members prioritizing their well-being and happiness. This trend has been particularly evident since the COVID-19 pandemic as individuals and families turned to pet companionship. According to Germany Trade & Invest, almost 50% of German households have at least one pet and the market is booming as Germans spend more and more on their non-human loved ones.

Buy Now:

This shift has driven demand for pet food with a focus on quality, taste and nutritional benefits. Consumers are willing to spend on organic, grain-free and high-protein options that mimic human-grade food. The market benefits from both first-time pet parents and existing pet owners expanding the demand for pet food across various segments.

Rising Pet Food Prices to Hamper Growth Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the Germany Pet Food Market. The top 10 companies in the Germany Pet Food Market are: 1. Mars Petcare 2. Nestlé Purina PetCare 3. General Mills 4. Heristo AG 5. Deuerer 6. Bewital Petfood GmbH & Co. KG 7. Rondo Food 8. Gimborn 9. Vitakraft Pet Care GmbH & Co. 10. Josera Petfood

Scope of Report:

Report MetricDetails

Base Year Considered

2023

Forecast Period

2024–2030

CAGR

4.1%

Market Size in 2030

$6.1 Billion

Segments Covered

By Animal Type, By Ingredient, By Source, By Food Type, By Packaging and By Distribution Channel

Key Market Players

1. Mars Petcare

2. Nestlé Purina PetCare

3. General Mills

4. Heristo AG

5. Deuerer

6. Bewital Petfood GmbH & Co. KG

7. Rondo Food

8. Gimborn

9. Vitakraft Pet Care GmbH & Co.

10. Josera Petfood

For more Lifesciences and Healthcare Market reports, please click here

#GermanyPetFood 🇩🇪🐾#PetFoodMarket 📊🐶🐱#PetIndustryGermany 🏭🐕#HealthyPetFood 🥩🥦🐾#SustainablePetFood 🌱🐾#PetCareGermany 🐾❤️#OrganicPetFood 🌿🐕#PetTrendsGermany 📈🐾

0 notes

Text

Greaves Meal Market: Trends Shaping the Future of Sustainable Animal Feed Solutions

The greaves meal market is experiencing rapid transformation due to changing demands in animal feed and sustainability practices. As a high-protein by-product from the meat processing industry, it has become an essential ingredient for various sectors, particularly livestock and poultry farming. Below, we explore key market trends that are shaping the greaves meal market landscape.

Sustainable Farming Practices

Increasing focus on eco-friendly farming methods drives demand for by-products like greaves meal.

Greaves meal supports circular economy principles by repurposing animal processing waste into valuable feed.

Adoption of organic feed options has made greaves meal a popular choice among sustainable farmers.

Enhanced emphasis on reducing food waste aligns with the utilization of greaves meal in agriculture.

Advancements in Processing Technology

Development of advanced rendering technologies has improved the nutritional quality of greaves meal.

Techniques to enhance protein extraction are increasing the market’s appeal to feed manufacturers.

Automation in greaves meal production ensures consistent quality and efficient scaling of output.

Innovations in odor control during processing have expanded acceptance across regions.

Rising Demand for High-Protein Feed

Livestock industries prefer greaves meal for its cost-effectiveness and rich protein profile.

Demand for high-protein feed to enhance animal growth and productivity is growing steadily.

Poultry and aquaculture sectors are significant contributors to the rising consumption of greaves meal.

Increasing focus on animal welfare drives demand for feed that improves livestock health.

Regional Market Expansion

Asia-Pacific leads market growth due to high demand in livestock and poultry farming.

North America benefits from advanced agricultural practices and sustainable feed solutions.

Europe’s regulatory standards emphasize the use of greaves meal in high-quality animal feed.

Emerging markets in Africa and South America show potential for greaves meal adoption.

Growth in Livestock and Poultry Industries

Increased consumption of meat products globally drives demand for efficient feed solutions.

Greaves meal aids in improving feed conversion ratios in livestock farming operations.

Poultry farms adopt greaves meal to meet nutritional requirements while reducing feed costs.

Its ability to enhance muscle growth in animals positions greaves meal as a valuable feed ingredient.

Shift Toward Cost-Effective Feed Solutions

Farmers seek economical feed alternatives to balance rising operational costs.

Greaves meal offers an affordable protein source compared to plant-based or synthetic feeds.

Bulk production methods contribute to cost efficiency and market competitiveness.

Economic benefits encourage small-scale farmers to integrate greaves meal into their practices.

Regulatory Influences

Stringent guidelines in Europe encourage the production of standardized greaves meal.

Global harmonization of feed regulations supports international trade of greaves meal.

Regulatory clarity boosts manufacturer confidence and promotes market stability.

Focus on quality assurance strengthens consumer trust in greaves meal as a feed ingredient.

Emergence of New Applications

Beyond animal feed, greaves meal is being explored for use in fertilizers.

Industrial applications such as biofuel production present untapped opportunities for greaves meal.

Research into new formulations opens doors for innovative uses in pet food manufacturing.

Expansion into non-traditional markets diversifies revenue streams for greaves meal producers.

Challenges in Market Growth

Limited awareness about greaves meal in developing regions poses growth challenges.

Competition from alternative protein sources like soy and synthetic feeds impacts adoption.

Environmental concerns about the rendering process necessitate sustainable production measures.

Transportation logistics and storage limitations affect the scalability of greaves meal distribution.

Future Opportunities

Increasing collaboration with local farmers to promote greaves meal utilization.

Development of region-specific feed formulations to meet diverse livestock requirements.

Integration of AI and data analytics for optimizing feed production processes.

Investments in research to improve the nutritional profile of greaves meal.

Greaves meal market trends continue to reflect a dynamic interplay of innovation, sustainability, and industry demands. With its ability to address multiple challenges in animal nutrition and farming efficiency, greaves meal is poised to remain a key component in global agricultural advancements.

0 notes

Text

Modified Starch Market Set To Witness An Uptick During 2022 to 2030

Modified Starch Industry Overview

The global modified starch market size is predicted to reach USD 18.9 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 5.3% from 2022 to 2030. The market is anticipated to expand significantly during the forecast period due to its use in a variety of applications such as paper, food and beverage, pharmaceuticals, textiles, and other applications like biodegradable polymers, coatings, and adhesives. Growing concern about health and nutrition, as well as a shift toward a healthier diet, are likely to be major factors driving the market.

The product penetration will rise over the forecast period as the demand for organic sweeteners in non-carbonated soft drinks and energy drinks rises. In order to produce efficient water-soluble modified starches, companies are investing more in research and development, which has created dynamic market conditions. Product innovation has significantly increased recently in order to access markets and reap strategic advantages. As a result, businesses have integrated and diversified their product portfolios to increase their presence throughout the value chain.

Modified starch has a high viscosity and improves the flavor, aroma, and color of the food it is used in because it contains very low protein and fat/lipid content. It also has organoleptic qualities and can be used in a variety of meals. Additionally, native-modified starch is suitable to be used in pet feeds and animal nutrition. During the palletization and extrusion processes, it facilitates the improvement of the finished product's texture while also giving animals a digestible energy source.

Gather more insights about the market drivers, restrains and growth of the Modified Starch Market

The market is expanding as a result of the rising demand for modified starch in personal care and cosmetic products to cater to distinct consumer preferences. In addition to being a potent substitute for silicone as well as other raw materials, modified starches also reduce greasiness. They are a great addition to baby and children's products along with cosmetics for tanning. Additionally, starches provide a chance to increase the stability of the emulsion. These factors are predicted to fuel product demand in the coming years.

Ingredient suppliers have been expanding their starch sources, and starch innovations are now focused on baked food elements such as fruit filling in desserts and sauces in frozen food meals. According to Starch Europe, European starch production has increased to over 11 million tons in 2020 as compared to 8.7 million tons in 2004. This includes starch made from maize, potato, and wheat. More importantly, an increasing number of starch manufacturers are investing in the European starch and sweetener market to contribute to the local economy and community, whilst also positioning the business for long-term progress, which will drive market growth.

Browse through Grand View Research's Nutraceuticals & Functional Foods Industry Research Reports.

The global polydextrose market size was valued at USD 355.1 million in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030.

The global bio vanillin market size was estimated at USD 227.7 million in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030.

Modified Starch Market Segmentation

Grand View Research has segmented the global modified starch market based on product, material, function, end-use, and region:

Modified Starch Product Outlook (Revenue, USD Million, 2017 - 2030)

Starch Esters & Ethers

Resistant

Cationic

Pre-gelatinized

Others

Modified Starch Material Outlook (Revenue, USD Million, 2017 - 2030)

Corn

Cassava

Wheat

Potato

Others

Modified Starch Function Outlook (Revenue, USD Million, 2017 - 2030)

Stabilizers

Thickeners

Emulsifiers

Binders

Others

Modified Starch End-use Outlook (Revenue, USD Million, 2017 - 2030)

Food & Beverage

Animal Feed

Paper

Pharmaceuticals

Textiles

Others

Modified Starch Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

US

Canada

Mexico

Europe

UK

Germany

France

Spain

Italy

Asia Pacific

China

India

Japan

Thailand

Australia & New Zealand

Central & South America

Brazil

Middle East & Africa

South Africa

Key Companies profiled:

Emsland-Stärke GmbH

Grain Processing Corporation

Global Bio-Chem Technology Group Company Limited

Ingredion Incorporated

Roquette Frères

ADM

Agrana Beteiligungs AG

Avebe U.A.

Cargill, Incorporated

Samyang Genex Corp.

Beneo-Remy N.V.

Siam Modified Starch Co., Ltd.

China Essence Group Ltd.

PT Budi Starch & Sweetener Tbk

Tate & Lyle PLC

ULRICK&SHORT

KMC (Kartoffelmelcentralen) Amb

Order a free sample PDF of the Modified Starch Market Intelligence Study, published by Grand View Research.

0 notes

Text

Top 10 Lucrative Franchise Opportunities in India for 2024

The franchise market in India is thriving, presenting a golden opportunity for entrepreneurs to step into an established business model with minimized risks. India’s vibrant economy, growing middle class, and increasing disposable incomes make it fertile ground for franchise investments across various industries. Here’s a roundup of the top 10 lucrative franchise opportunities in India for 2024 to help you make an informed decision.

1. Food & Beverage (F&B) Chains

The F&B sector is evergreen in India, with brands like Domino’s, Subway, and Haldiram’s continuing to attract franchisees. With a mix of global giants and homegrown favorites, this industry offers high footfalls and consistent revenue.

2. Health & Wellness

Health-conscious consumers are driving demand for fitness centers, yoga studios, and nutrition brands. Franchises like Gold’s Gym and Cult.Fit are expanding rapidly, offering comprehensive support to franchisees.

3. Education & EdTech

With parents prioritizing quality education, education franchises like Kidzee, Byju’s Learning Centers, and EuroKids remain top picks. The growth of online education platforms adds another dimension to this booming sector.

4. Retail & Lifestyle

Retail franchises in fashion, electronics, and home décor, such as Reliance Trends and Pepperfry Studios, are flourishing. These franchises benefit from India’s growing urban population and evolving lifestyle preferences.

5. Beauty & Personal Care

From salons like Lakmé to cosmetic brands like The Body Shop, the beauty sector is an excellent choice for entrepreneurs seeking high returns. Personalized service and brand loyalty make this an attractive segment.

6. E-Commerce & Delivery Services

Franchises like Amazon Delivery Service Partners and Swiggy Access are riding the wave of India’s e-commerce boom. These businesses thrive on India’s tech-savvy consumer base and demand for convenience.

7. Automobile & Car Care

The automobile industry has witnessed robust growth, paving the way for franchises in car services, accessories, and electric vehicle charging stations. Brands like CarzSpa and Mahindra First Choice Wheels lead this sector.

8. Hospitality & Tourism

As travel recovers post-pandemic, hotel and travel franchises like OYO Rooms and Thomas Cook are gaining traction. India’s diverse tourism landscape makes this sector evergreen.

9. Cleaning & Sanitation Services

Hygiene awareness has fueled growth in cleaning and sanitation franchises. Urban Company and ChemDry India are examples of brands offering scalable opportunities in this niche.

10. Pet Care Services

The pet care industry is booming, with franchises like Heads Up For Tails tapping into India’s growing love for pets. From grooming to pet supplies, this sector has immense potential.

Why Choose Fox&Angel for Your Franchise Journey?

Exploring the right franchise in India requires expert guidance. Fox&Angel, a leading consulting firm, specializes in identifying franchise opportunities that align with your goals, budget, and expertise. With their in-depth market insights and tailored solutions, Fox&Angel ensures your franchise venture is a resounding success.

Conclusion

India’s franchise ecosystem in 2024 is teeming with opportunities across diverse industries. By investing in a well-established brand, you can leverage proven business models and enjoy faster returns on investment. Whether you’re passionate about food, education, or technology, there’s a franchise for everyone.

Ready to explore the best franchise in India? Let Fox&Angel guide you on this journey to success. Contact us today to unlock your entrepreneurial dreams!

0 notes

Text

Affiliate Marketing Gold: Best Niches for 2024 Growth

As we embark on a new year, the affiliate marketing landscape is buzzing with potential. If you’re looking to maximize your earnings and carve out a niche in this competitive space, now is the time to explore the most promising affiliate marketing niches for 2024. By tapping into these lucrative areas, you can unlock substantial commissions and build a sustainable online income. Let’s dive into the best niches that are expected to thrive this year!

1. Health and Wellness

Overview

The health and wellness sector is an evergreen niche that continues to grow. With increased awareness about fitness, nutrition, and mental well-being, consumers are investing more in products and services that enhance their quality of life.

Why It’s Hot in 2024

Diverse Sub-Niches: This sector covers everything from dietary supplements and fitness programs to mental health apps and holistic wellness.

Recurring Revenue: Many health-related products, like subscription meal kits and wellness apps, offer recurring commissions.

Success Tips

Content Creation: Share valuable content about healthy living, workout tips, and nutrition advice to attract and engage your audience.

Collaborate with Influencers: Partner with fitness coaches and wellness influencers to reach a broader audience and gain credibility.

2. Cryptocurrency and Blockchain Technology

Overview

Cryptocurrency has captured the public's imagination, and its relevance is only set to increase. With a growing interest in blockchain technology, NFT marketplaces, and digital wallets, this niche presents numerous affiliate opportunities.

Why It’s Hot in 2024

Expanding Market: The cryptocurrency market continues to evolve, with new tokens, platforms, and investment opportunities emerging regularly.

High Payouts: Many crypto-related affiliate programs offer lucrative commissions, especially for trading platforms and wallet services.

Success Tips

Educational Content: Create guides, tutorials, and market analysis to help beginners navigate the cryptocurrency landscape.

Stay Updated: Follow industry trends and news to provide timely and relevant content to your audience.

3. E-Learning and Online Courses

Overview

The demand for online learning has surged, fueled by the pandemic and the growing desire for self-improvement. This niche includes everything from skill-based courses to certifications and professional development programs.

Why It’s Hot in 2024

Diverse Offerings: There’s a course for nearly every interest, whether it’s coding, photography, or digital marketing.

High Conversion Rates: People are increasingly investing in their education, leading to higher conversion rates for quality online courses.

Success Tips

Review Courses: Create in-depth reviews and comparisons of popular courses to help your audience make informed decisions.

Build a Community: Foster a sense of community around your niche by engaging with learners on social media platforms and forums.

4. Sustainable Living and Eco-Friendly Products

Overview

As consumers become more environmentally conscious, the demand for sustainable and eco-friendly products is skyrocketing. This niche includes everything from zero-waste products to sustainable fashion and green technologies.

Why It’s Hot in 2024

Ethical Consumerism: More people are prioritizing sustainability, driving growth in this sector.

Loyal Customer Base: Eco-conscious consumers tend to remain loyal to brands that align with their values.

Success Tips

Highlight Benefits: Share the benefits of using eco-friendly products and their positive impact on the environment.

Utilize Visual Content: Leverage social media platforms to showcase sustainable lifestyles and products through engaging visuals.

5. Pet Products and Services

Overview

The pet industry is booming, with pet owners willing to spend significantly on their furry friends. This niche includes pet food, toys, grooming services, and pet care resources.

Why It’s Hot in 2024

Rising Pet Ownership: The pandemic has led to an increase in pet adoptions, and pet owners are investing in quality products.

High Engagement: Pet owners are passionate and often seek recommendations, leading to increased engagement with pet-related content.

Success Tips

Share Pet Care Tips: Create content that offers advice on pet care, training, and health, linking to relevant products.

Leverage User-Generated Content: Encourage your audience to share photos and stories of their pets using your recommended products.

6. Home Improvement and DIY

Overview

The home improvement niche encompasses a wide range of products and services, including tools, materials, and home renovation ideas. With more people investing in their homes, this niche is ripe for affiliate marketing.

Why It’s Hot in 2024

Increased Home Projects: The rise in remote work has motivated homeowners to enhance their living spaces.

Diverse Product Range: From tools to decor, there are countless products to promote within this niche.

Success Tips

Create DIY Tutorials: Share step-by-step guides for home improvement projects, linking to the tools and materials used.

Engage with DIY Communities: Participate in forums and social media groups focused on home improvement to connect with potential customers.

7. Travel and Adventure

Overview

While the travel industry faced challenges during the pandemic, it is rebounding rapidly. This niche covers travel gear, booking services, and unique travel experiences.

Why It’s Hot in 2024

Resurgence of Travel: As restrictions ease, people are eager to explore new destinations and experiences.

High Commissions: Travel-related services, such as booking platforms and guided tours, often offer attractive affiliate commissions.

Success Tips

Share Travel Guides: Create comprehensive travel guides that highlight destinations, accommodations, and activities, linking to relevant services.

Utilize Stunning Visuals: Use high-quality images and videos to inspire your audience and showcase travel experiences.

Conclusion

As you venture into affiliate marketing in 2024, these niches present exciting opportunities for growth and profit. By focusing on health and wellness, cryptocurrency, e-learning, sustainable living, pet care, home improvement, and travel, you can tap into thriving markets that align with your interests and expertise. Remember to create valuable content, build trust with your audience, and leverage social media to maximize your reach. With the right strategies and dedication, you can turn your affiliate marketing efforts into a goldmine of success this year!

0 notes

Text

Wet Pet Food Market Will Hit Big Revenues In Future

The wet pet food market size is valued at USD 25.4 billion in 2023 and is expected to grow to USD 31.7 billion by 2028, with a CAGR of 4.5% during the forecast period. In recent years, the pet industry has experienced notable expansion, offering a broad array of products ranging from specialized toys to cutting-edge grooming solutions. Among these offerings, wet pet food has gained popularity due to its high moisture content, which mirrors traditional stews and gravies. This not only enhances flavor but also supports hydration, a key factor in pet health. Additionally, wet pet food provides a rich nutritional profile, incorporating essential proteins, vitamins, and minerals, making it suitable for pets with specific dietary needs or health concerns.

As consumers increasingly prioritize health, wet pet food has emerged as a popular choice to meet evolving nutritional demands. This growth is largely fueled by rising disposable incomes, the perception of pets as family members, and a growing understanding of how nutrition impacts overall pet well-being.

Wet Pet Food Market Trends

Here are some key trends in the Wet Pet Food Market:

Premiumization of Pet Food: Growing demand for high-quality ingredients and premium products is driving the wet pet food market, as pet owners seek healthier and more nutritious options for their pets.

Grain-Free and Natural Formulations: The rise in awareness about pet health has led to an increase in demand for grain-free and natural wet pet food, which avoids artificial ingredients, additives, and preservatives.

Humanization of Pets: Many pet owners treat pets as family members, leading to higher spending on wet pet food that mimics human food quality, including organic and gourmet options.

Focus on Pet Digestive Health: Digestive health has become a priority, with wet pet foods offering formulations that support gut health, improve digestion, and include probiotics.

Sustainability in Packaging: Brands are focusing on sustainable packaging solutions, such as recyclable or biodegradable packaging, to reduce their environmental footprint.

Growing Demand for Functional Ingredients: Ingredients that provide specific health benefits, such as joint health, skin and coat care, and immune system support, are becoming popular in wet pet food formulations.

Wet Pet Food Market Insights: Dogs Expected to Hold the Largest Share

Over the past few decades, dog adoption rates have seen a notable rise. Whether adopted from shelters or breeders, more dogs are becoming cherished members of households. This increase in dog ownership is attributed to various factors, including a greater awareness of the emotional and psychological benefits dogs offer to humans. Traditionally, developed nations like the US, Australia, Germany, and the Netherlands have been key markets for dog food, driven by the growing adoption of pets and higher spending on pet food products. However, in recent years, developing countries have also emerged as important markets for dog food. Rising pet adoptions, increased awareness of dog health, and the trend of humanizing pets have fueled this growth. Countries such as India, China, and Brazil now represent attractive markets for dog food, with large populations of stray dogs being adopted. According to data from PetSecure (Australia), nations like China, Japan, the Philippines, and India have some of the largest pet dog populations. Notably, India has the fastest-growing dog population globally.

Based on the distribution channel, online mode is anticipated to have the highest growth rate in the wet pet food market.

Online platforms are fueling the growth of the wet pet food market by overcoming the challenges of traditional shopping. The ease of browsing and purchasing online eliminates the need for physical store visits, offering greater accessibility. This convenience allows pet owners to explore a wider variety of wet pet food options and make more informed choices tailored to their pets’ specific needs. The global pandemic has significantly altered consumer behavior, accelerating a shift toward online shopping. E-commerce platforms saw a dramatic increase in demand as people sought safer ways to buy products. This trend extended to pet supplies, including wet pet food, as owners turned to online shopping for high-quality products while following safety guidelines. The rise in demand underscores the growing importance of online platforms in addressing changing consumer preferences, making them a key driver in the wet pet food market’s expansion.

Top Wet Pet Food Companies:

Nestlé (Switzerland), Mars, Incorporated (US), Colgate-Palmolive Company (US), Unicharm Corporation (Japan), Thai Union Group PCL (Thailand), Charoen Pokphand Foods PCL (Thailand), General Mills Inc. (US), The J.M. Smucker Company (US), Better Choice Company (US), Real Pet Food Co. (Australia), MONGE SPA P.IVA (Italy), Schell & Kampeter, Inc. (US), Inaba-Petfood Co., Ltd. (Japan), Sunshine Mills, Inc. (US), and Farmina Pet Foods (Italy). These players in this market are focusing on increasing their presence through expansion and collaboration. These companies have a strong presence in North America, Asia Pacific, and Europe.

Wet Pet Food Industry Development:

In July 2023, Champion Petfoods, under Mars, Incorporated, introduced its ACANA PREMIUM PÂTÉ wet cat food line, aligning with feline natural diets focused on prey-based nutrition and hydration. The product includes 3- and 5.5-oz cans in six diverse recipes, catering to various tastes and nutritional needs, such as Omega 3 support for skin and coat health. This strategic product launch enhances its position in the wet pet food market by offering a tailored and nutritious option that satisfies the dietary preferences of cats and supports their overall health.

In April 2023, Mars Petcare’s SHEBA brand introduced its first line of kitten nutrition products, PERFECT PORTIONS Wet Kitten Food, complementing its existing range of nutritional offerings for cats of all ages. It is designed to provide comprehensive nutrition, featuring high-quality proteins that support immune system health, bone strength, and brain development. Enriched with essential nutrients, DHA, vitamins, and minerals, the diets are available in two flavors, Savory Chicken and Delicate Salmon, in 2.64-oz trays in physical stores and online via major retailers such as Amazon, Chewy, Walmart, and PetSmart.

#Wet Pet Food Market#Wet Pet Food#Wet Pet Food Market Size#Wet Pet Food Market Share#Wet Pet Food Market Growth#Wet Pet Food Market Trends#Wet Pet Food Market Forecast#Wet Pet Food Market Analysis#Wet Pet Food Market Report#Wet Pet Food Market Scope#Wet Pet Food Market Overview#Wet Pet Food Market Outlook#Wet Pet Food Market Drivers#Wet Pet Food Industry#Wet Pet Food Companies

0 notes

Text

Human Grade Pet Food Market To Reach $3.77 Billion By 2030

The global human grade pet food market size is expected to reach USD 3.77 billion by 2030, growing at a CAGR of 6.6% during the forecast period, according to a new report by Grand View Research, Inc. Several key factors drive the increasing demand for human-grade pet food among pet owners. Pet owners are increasingly concerned about their pets' health and wellness, seeking higher-quality, safer food options. This trend reflects a broader humanization of pets, where they are considered integral family members deserving of nutritious, human-grade ingredients free from fillers and artificial additives. Manufacturers respond transparently in sourcing and production, building trust through clear labeling and adherence to human food standards.

Innovations in flavors play a crucial role, with manufacturers introducing diverse and appealing options inspired by popular human foods and natural ingredients. These include a variety of flavors such as salmon and quinoa, turkey and sweet potato, and lamb and brown rice, catering to both pet and owner preferences for gourmet-style options. The growth extends across various segments, including snacks, treats, and wet and dry food, offering pet owners a wide range of choices that prioritize nutrition, taste, and the overall well-being of their beloved companions.

In April 2023, HelloFresh, the leading meal-kit company, launched a new premium pet food brand called The Pets Table. Developed in partnership with veterinarians, The Pets Table offers a subscription-based service that provides fresh and air-dried, human-grade recipes customized for each dog's exact caloric needs at a competitive price point.

In addition,transparency and trust are also critical factors. Pet owners are more interested in understanding where their pet's food comes from and how it's produced. Human grade pet foods often offer greater transparency in sourcing and manufacturing processes, which builds consumer trust and loyalty.

Premiumization of pet food is another driving force. As disposable incomes rise and consumers become more willing to spend on higher-quality products for their pets, there's a growing market for premium human grade pet foods. These products often command higher prices due to their superior ingredients and production standards.

Request a free sample copy or view report summary: Human Grade Pet Food Market Report

Human Grade Pet Food Market Report Highlights

Wet food accounted for a revenue market share of 33.5% in 2023. Human grade wet food typically contains higher-quality ingredients and is formulated to provide balanced nutrition, which can appeal to pet owners who prioritize their pets' diet and health

Sales through online stores accounted for a share of 23.0% in 2023. Online retailers often offer a wider selection of human grade pet food than brick-and-mortar stores. This variety allows consumers to explore different brands, flavors, and formulations, empowering them to experiment with new recipes or discover their favorite products from the comfort of their homes

Asia Pacific is expected to grow at a significant CAGR from 2024 to 2030. There is increasing awareness and concern among pet owners about the quality and safety of pet food. Human-grade pet food is perceived as safer and more reliable in terms of ingredients and production standards compared to traditional pet food. Also, as disposable incomes rise across this region, pet owners are willing to spend more on premium pet products, which are often priced higher due to their quality and nutritional value

Human Grade Pet Food Market Segmentation

Grand View Research has segmented the global human grade pet food market based on type, distribution channel, and region.

Human Grade Pet Food Type Outlook (Revenue, USD Million, 2018 - 2030)

Snacks & Treats

Wet Food

Dry Food

Others

Human Grade Pet Food Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

Hypermarkets & Supermarkets

Convenience Stores

Online

Others

Human Grade Pet Food Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Asia Pacific

China

India

Japan

South Korea

Australia & New Zealand

Central & South America

Brazil

Middle East & Africa

UAE

List of Key Players in the Human Grade Pet Food Market

JustFoodForDogs

NomNomNow Inc.

Spot & Tango

The Honest Kitchen

Ollie

Pet Plate

Darwin's Natural Pet Products

The Farmers Dog, Inc.

Nestlé S.A.

Mars (Champion Pet foods)

0 notes

Text

Pet Food 2024 Industry Size, Demands, Growth and Top Key Players Analysis Report

Pet Food Industry Overview

The global pet food market size was estimated at USD 103.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030.

The demand for products is anticipated to be driven by growing consumer inclination toward the adoption of pets along with rising concerns regarding their health. Improvement in overall digestion and performance of pet animals owing to consumption of nutritious food is also likely to boost market growth in the forecast period. The pet food products that are available in the global market rarely vary. This, in turn, has prompted manufacturers to include multi-functional and innovative ingredients in their products to curb such similarity bias. Convenience is likely to play a vital role in driving this industry, given the increased popularity of prepared pet food. The other segment is organic pet food, a recent and growing trend in the market.

Gather more insights about the market drivers, restrains and growth of the Pet Food Market

Increasing availability of organic products in a variety of flavors and the inclusion of essential ingredients such as probiotics and antioxidants are factors that are likely to induce a positive impact on global market growth. On the other hand, low product penetration owing to its slightly high price may restrain organic segment growth in the coming years as every household would not be able to purchase high-priced products.

The market value chain is characterized by the presence of raw material suppliers, manufacturers, distributors, and end-users. The raw materials which are used for production include meat, meat byproducts, cereals, grains, and specialty proteins derived from animals, palatants, flavors & sweeteners, vitamins, minerals, and enzymes among others.

Manufacturers formulate these products in accordance with the standard nutritional requirements of domesticated animals. Meat-based raw materials are processed/rendered to separate protein components, water, and fat. The manufacturing process also entails grinding, cooking, and mixing the aforementioned raw materials with other ingredients.

The raw materials utilized in each pet food product segment are primarily commodities and agricultural-based products. Grains, fruits, and animal protein meals, among other ingredients, are procured from various suppliers. The cost, quality, and availability of these key ingredients have fluctuated in the past and are expected to fluctuate in the future as well. For instance, in March 2023, pet food prices in America rose by 15.1% YoY. Due to this, residents are considering giving away their pets. Such sudden and sharp increases in the prices of pet food can adversely affect market growth.

Browse through Grand View Research's Consumer F&B Industry Research Reports.

• The global frozen bakery market size was estimated at USD 67.27 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030.

• The global organic rice protein market size was valued at USD 69.5 billion in 2023 and is projected to grow at a CAGR of 12.9% from 2024 to 2030.

Global Pet Food Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet food market report based on pet type and region:

Pet Type Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

Dog

Wet Food

Dry Food

Snacks/Treats

Cat

Wet Food

Dry Food

Snacks/Treats

Others

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Poland

Ukraine

Russia

Turkey

Asia Pacific

China

India

Japan

South Korea

Indonesia

Malaysia

Vietnam

Thailand

Australia

Central & South America

Brazil

Argentina

Middle East & Africa

Middle East

South Africa

Key Companies & Market Share Insights

The competitive landscape of this market is moderately consolidated with the presence of multinationals striving to fulfill high demand from large customers and end-user base. Key industry participants are inclined toward adopting new marketing strategies and using advanced technologies to strengthen their customer base and generate more revenue in near future. In addition, companies are undertaking expansion, mergers, and acquisitions as a part of their strategic initiatives. For example, in January 2022, Manna Pro acquired Oxbow Animal Health, a small animal pet brand that offers premium food, and supplements for rabbits, pigs, hamsters, and other pets. In addition, in September 2023, Superlatus, Inc., a key food distribution and technology firm, merged with TRxADE HEALTH, Inc., and announced its expansion in the pet food industry with plant-based or vegan pet food treats.

Industry participants are inclined toward investing heavily in research and technology to advance processes and create new recipes, which are manufactured with varied and special ingredients. Key manufacturers are also focused on developing innovative formulas to offer diverse and high-quality food for pets and farm animals. Industry players also utilize raw materials with criteria to meet demands, as well as regulations, in both domestic and international markets.

Key Pet Food Companies:

The J.M. Smucker Company

Nestle Purina

Mars, Incorporated

LUPUS Alimentos

Total Alimentos

Hill’s Pet Nutrition, Inc.

General Mills Inc.

WellPet LLC

The Hartz Mountain Corporation

Order a free sample PDF of the Pet Food Market Intelligence Study, published by Grand View Research.

0 notes

Text

Overview of the Global Pet Care Market

Introduction

The global Pet Care Market has witnessed significant growth in recent years, driven by factors such as increasing pet ownership, rising disposable incomes, and changing consumer preferences. In this blog, we provide an overview of the global pet care market, highlighting key trends, growth drivers, and major players in the industry.

Market Size and Growth

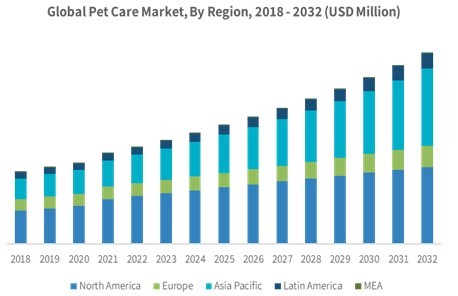

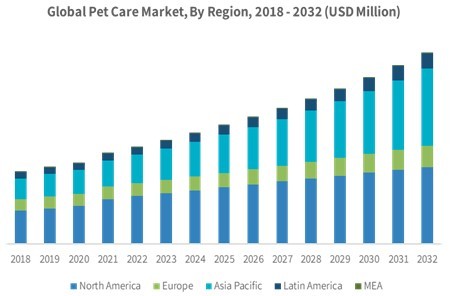

The global pet care market size was valued at USD 150.67 billion in 2021 and is projected to expand at a compound annual growth rate CAGR of 5.1% from 2022 to 2030. The market is expected to reach USD 230.45 billion by 2030, driven by the growing trend of pet humanization and increased consumer spending on pet-related products and services.

Pet Ownership Trends

Pet ownership has been on the rise globally, with approximately 85 million households owning a pet. The trend of pet humanization, where pets are treated as members of the family, has contributed to increased spending on pet care products and services. Millennials and Generation Z consumers, in particular, are driving the demand for pet-related products and are willing to invest in premium pet care solutions.

Impact of COVID-19

The COVID-19 pandemic has further accelerated the growth of the pet care market. With more people spending time at home, there has been an increase in pet adoptions and fostering. Additionally, pet owners are showing a strong desire to learn more about pet health issues, leading to increased spending on preventive care and wellness products.

Key Players in the Industry

Several companies dominate the global pet care market, offering a wide range of products and services to meet the needs of pet owners. Some of the key players in the industry include:

Nestle Purina PetCare

Mars, Incorporated

Hill's Pet Nutrition, Inc.

Blue Buffalo Co., Ltd.

Champion Petfoods LP

Ancol Pet Products Limited

Petmate Holdings Co

The Hartz Mountain Corporation

Spectrum Brands Holdings, Inc.

These companies compete by offering innovative products, expanding their distribution networks, and investing in marketing and advertising campaigns to attract pet owners.

Future Outlook

The future outlook for the global Pet Care Market remains positive, with continued growth expected in the coming years. Factors such as increasing pet ownership, rising consumer awareness about pet health and wellness, and technological advancements in pet care products are expected to drive market growth.

Conclusion

The global pet care market is a dynamic and rapidly growing industry, driven by changing consumer preferences and increasing pet ownership rates. With the right strategies and investments, companies can capitalize on the growing demand for pet care products and services and achieve long-term success in this thriving market.

#Pet Market Analysis#Pet Market Size#Cat Food Manufacturers#Online Dog Food Sales#Online Pet Food Companies#Top Pet Companies#Pet Industry#Pet Industry Research Reports#Pet Market Research Reports#Pet Market Demand#Pet Market Forecast#Pet Market Growth#Pet Market Outlook#Pet Market Revenue#Pet Market Trends#Pet Market Report#Pet Market Challenges#Pet Market Opportunities#Pet Food and Nutrition Industry Research Report#Pet Food and Nutrition Market Analysis#Pet Food and Nutrition Market Demand#Pet Food and Nutrition Market Forecast#Pet Food and Nutrition Market Growth#Pet Food and Nutrition Market Outlook#Pet Food and Nutrition Market Revenue#Pet Food and Nutrition Market Size#Pet Food and Nutrition Market Trends#Cat Food Market Reports#Dog Food Sales Online#Pet Food Market Size

1 note

·

View note

Text

Navigating the Pet Market Landscape: Market Share, Revenue and Growth

Introduction: The Flourishing Landscape of the Pet Market

In the realm where furry companions and commerce converge, the Pet Market stands as a testament to the inseparable bond between humans and their animal counterparts. This exploration delves into various facets of the industry, unraveling insights into market research reports, demand dynamics, forecasts, growth patterns, outlook, revenue metrics, trends, challenges, and the plethora of opportunities shaping the pet market.

Understanding Pet Market Demand: The Canine and Feline Frenzy

At the heart of the industry lies the dynamic force of Pet Market Demand. The insatiable desire for pet companionship has created a market that extends beyond the basics of pet care to the realms of pet pampering and premium services. Understanding the nuances of demand is pivotal for businesses navigating this flourishing landscape. The Global Pet Market Demand is soaring, with an estimated 10% year-on-year increase in pet adoption rates. Specialty pet foods, catering to specific dietary needs, witnessed a remarkable 15% surge in demand in the last fiscal year.

Forecasting the Future: Pet Market Forecast

Peering into the crystal ball, the Pet Market Forecast segment anticipates the trajectory of the industry. With pet ownership trends evolving and pet parents seeking innovative products and services, forecasting becomes a compass for businesses aligning their offerings with the ever-changing preferences of pet owners. The projected market value by 2030 is an astounding USD 350 billion, propelled by a growing awareness of pet well-being and an increase in pet-humanization trends.

Pet Market Growth

The heartbeat of the pet industry resonates in the rhythm of Pet Market Growth. With a projected annual growth rate of 5.8%, the industry is not just expanding; it's evolving. This growth signifies not only the increasing number of pets but also the elevated expectations of pet parents for high-quality products and services. The global pet market is poised to reach USD 269.9 billion by 2025, reflecting a CAGR of 5.8%. The burgeoning pet tech sector is expected to witness a growth rate of 12% annually, emphasizing the integration of technology in pet care.

Outlook into Pet Paradise: Pet Market Outlook

The Pet Market Outlook envisions a world where pets are not just companions but integral members of households. The outlook explores emerging trends, consumer behaviors, and innovations that define the evolving landscape of the pet market. Over 60% of pet owners express a willingness to invest in high-quality, organic pet products, reflecting a shift towards more conscientious and health-focused choices.

Pet Market Revenue

Beyond cuddles and playtime, the pet industry is a formidable economic force, as evidenced by Pet Market Revenue. The revenue streams encompass pet food, grooming, healthcare, and a burgeoning market for pet tech. Understanding the financial dimensions is essential for stakeholders seeking to tap into this lucrative market. Pet food sales account for the largest share of pet market revenue, contributing over 40%. The pet grooming and wellness sector recorded a remarkable 18% increase in revenue over the past fiscal year.

Trends Tailoring the Pet Experience: Pet Market Trends

In the ever-evolving pet landscape, Pet Market Trends are akin to the wagging tail of innovation. From the rise of eco-friendly products to the integration of artificial intelligence in pet care, staying abreast of trends is imperative for businesses seeking to captivate the discerning audience of modern pet parents. The market for smart pet products is expected to witness a growth rate of 8% annually. Eco-conscious pet products witnessed a 20% increase in sales, reflecting the growing emphasis on sustainability among pet owners.

Deciphering Insights: Pet Market Report

The foundation of informed decision-making lies in the insights derived from Pet Market Reports. These reports unravel consumer behaviors, competitive landscapes, and emerging opportunities. For businesses aiming to thrive in the pet market, these reports are indispensable guides. Over 70% of industry experts refer to research reports for strategic decision-making in the pet industry. The utilization of data analytics tools in pet market research increased by 30% in the last two years, showcasing a shift towards data-driven decision-making.

Challenges in the Pet Playground: Pet Market Challenges

Amidst the tail wags and purrs, challenges abound in the Pet Market Challenges section. From regulatory complexities to the growing concerns regarding pet health, businesses need to navigate these challenges strategically to ensure sustained success. Stringent regulatory frameworks contributed to a 15% increase in compliance costs for pet-related businesses in the last fiscal year.

Opportunities in the Pet Kingdom: Pet Market Opportunities

Within challenges lie opportunities, and the Pet Market Opportunities segment illuminates the pathways for growth. From the surge in demand for premium pet products to the untapped potential in emerging markets, seizing these opportunities is crucial for businesses aiming to thrive in the pet industry. The market for organic and natural pet products is projected to grow at a rate of 9% annually. Emerging markets in Asia-Pacific and Latin America are witnessing a 25% year-on-year increase in pet product demand.

Conclusion: Pawing Towards a Prosperous Future

In the final analysis, the Pet Market is more than a marketplace; it's a reflection of the evolving dynamics between humans and their beloved pets. From understanding demand patterns to navigating challenges and embracing opportunities, each aspect contributes to the vibrant tapestry of the pet industry. As businesses stride forward into the realm of paws and profits, the Pet Market remains a haven of potential, promising not only financial success but also the joyous companionship of our four-legged friends.

#Pet Market Analysis#Pet Market Size#Cat food manufacturers#Online dog food sales#Online pet food companies#Top pet companies#Pet Industry#Pet Industry research reports#Pet market research reports#Pet Market Demand#Pet Market Forecast#Pet Market Growth#Pet Market Outlook#Pet Market Revenue#Pet Market Trends#Pet Market Report#Pet Market Challenges#Pet Market Opportunities#Pet food and nutrition Industry research report#Pet food and nutrition Market Analysis#Pet food and nutrition Market Demand#Pet food and nutrition Market Forecast#Pet food and nutrition Market Growth#Pet food and nutrition Market Outlook#Pet food and nutrition Market Revenue#Pet food and nutrition Market Size#Pet food and nutrition Market Trends

0 notes

Text

Pet Food Market - Forecast(2024 - 2030)

Pet Food Market Overview:

The Pet Food Market size is estimated to reach $90 billion by 2030, growing at a CAGR of 8.4% during the forecast period 2023-2030. Pet food is a specialty food for domesticated animals and is formulated to meet their nutritional requirements such as meat, grains, cereals, meat by-products, vitamins and minerals. It is available in supermarkets/hypermarkets & pet stores and customized to the types of animals such as cats, dogs, fish and other pets.

Increasing demand for Premium Pet Food Products and rising pet ownership across developing economies are expanding the Pet Food Market opportunities. Rising health awareness among customers and attraction towards organic products are also driving the Pet Food Market growth. As per American Veterinary Medical Association, pet ownership for cats has increased to 29% in 2022. For dogs, it has increased to 45% in 2022. This represents the Pet Food Industry Outlook.

Pet Food Market Report Coverage:

AttributeSegment

By Food Type

Semi-moist Foods

Kibble Foods

Canned Foods

Veterinary

Nutritional Foods

Others

By Animal Type

Cat

Dog

Rabbit

Birds

Fish

Ferrets

Others

By Nature

Conventional

Organic

By Price

Premium

Mass

By Source Type

Animals

Plants

Cereals

Others

By Packaging

Stand-up pouches

Tin cans

Premade multi-layered pouches

Bags Roll stock

Corrugated boxes

Others

By Distribution Channel

Offline Platforms

Online Platforms

By Geography

North America (the US, Canada and Mexico)

Europe (Germany, France, UK, Italy, Spain, Russia and the Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and the Rest of Asia-Pacific)

South America (Brazil, Argentina, Chile, Colombia and the Rest of South America)

The Rest of the World (the Middle East and Africa).

Request Sample

COVID-19 / Ukraine Crisis - Impact Analysis:

The COVID-19 pandemic has impacted the supply chain of the animal feed industry. The different animal nutrition food items, vitamins and medicines including pet pharmaceuticals were out of stock.

The Russia-Ukraine war has impacted the supply chain and resulted in high input prices. In the short term, rising product prices in the domestic market contributed to increased earnings for producers.

Key Takeaways:

Dominance of North America Region

Geographically, North America led the Pet Food Market with a 37.3% share of the overall market in 2022. This is due to the increasing innovation by pet food manufacturers and rising pet adoption in the region. In 2020, as per American Pet Products Association National Pet Owners Survey, 63 million households or 74.6% of all households have dogs as pets.

Canned Food Segment holds the largest market share

According to the Pet Food Market forecast, the Canned Food Segment held the largest Pet Food Market revenue of $18 billion in 2022. The segment is estimated to grow at the fastest CAGR of 9.5% during the period 2023-2030. This is due to increasing consumer desire for feeding their pets nutritional food rich in vitamins, minerals, protein, fiber and other elements that are crucial to a balanced diet.

Premade Multi-layered Pouches Segment is anticipated to grow faster

As per the Pet Food Market analysis, the Premade Multi-layered Pouches segment is estimated to grow at the fastest CAGR of 9.8% during the forecast period 2023-2030. It is due to the durable structure, puncture-resistance protection and proper closures for pet food products, driving the segment growth.

Inquiry Before Buying

Increasing innovation by pet food manufacturers

The major competitors in the market are focusing on the launch of a number of pet food products to meet the needs of different types of animals that belong to different age groups. This is anticipated to fuel the expansion of the pet food industry. For instance, In November 2020, Nestle Purina introduced pet animal food that builds on alternative proteins to make better use of global resources. The range includes insects and plant proteins from millet and fava beans.

Rising health awareness among customers toward the organic product for pets

Customers are now more aware of the ingredients in their pet food. The market for organic pet food is increasing rapidly as a result of pet owners' growing attention to the health and welfare of their pets. The increasing number of health problems affecting pets has influenced pet owners to choose organic pet food over conventional options. These factors are contributing to the key Pet Food Market trends during the forecast period. In 2020, organic pet food consumption was worth $22 billion.

Schedule a Call

Imposition of strict regulations hamper market growth

Pet food comes with some of the strictest regulations out there, especially in western markets. Pet animal products are strictly examined in developed markets at every stage from the ingredients used in food preparation to their sales and marketing. The high stringency involved with commercialization is one of the major factors hampering the growth of the pet food industry.

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the Pet Food Market. The 10 key companies in this industry are:

Mars Pet care, Inc. (PEDIGREE®, NUTRO)

General Mills (Chex, Lucky Charms)

Nestle Purina Pet Care (Purina ONE®, Purina® Pro Plan®)

The J.M. Smucker Company (Meow Mix®, Rachael Ray®)

Hill’s Pet Nutrition (Hill's® Science Diet®, Prescription Diet®)

Diamond Pet Foods (Diamond V®, DIAMOND PRO89)

Simmons Pet Food (Twin Pet, Strongheart)

Global Pet Care (DreamBone, Good 'n' Fun)

Agrolimen SA (Advance Junior Maxi, Ultima Leche)

Deuerer (Katze, Wau)

Buy Now

Scope of Report:

Report MetricDetails

Base year considered

2022

Forecast period

2023–2030

CAGR

Growing at the rate of 8.4%

Market Size

90 billion USD

Segments covered

Food Type, Animal Type, Nature, Price, Source Type, Packaging, Distribution Channel and Region

Geographies covered

North America (the US, Canada and Mexico), Europe (Germany, France, the UK, Italy, Spain, Russia and the Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and the Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and the Rest of South America) and the Rest of the World (the Middle East and Africa).

Key Market Players

Mars Pet care, Inc.

General Mills

Nestle Purina Pet Care

The J.M. Smucker Company

Hill’s Pet Nutrition

Diamond Pet Foods

Simmons Pet Food

Global Pet Care

Agrolimen SA

Deuerer

#Pet Food Market Size#Pet Food Market Trends#Pet Food Market Growth#Pet Food Market Forecast#Pet Food Market Revenue#Pet Food Market Vendors#Pet Food Market Share#Pet Food Industry

0 notes

Text

Nestle's Financial Performance: Analyzing Revenue Growth and Profitability

Nestlé S.A. is a Swiss multinational food and beverage conglomerate headquartered in Vevey, Switzerland. As one of the largest food companies in the world, Nestlé’s portfolio includes a wide range of products such as baby food, bottled water, breakfast cereals, coffee, tea, dairy products, ice cream, frozen food, pet foods, and snacks. With a rich history dating back to 1867, Nestlé has established itself as a global leader in nutrition, health, and wellness.

Financial Performance Overview

Nestlé’s financial performance is a testament to its market leadership and operational efficiency. The company consistently delivers strong revenue growth, profitability, and shareholder returns, driven by its diverse product portfolio and strategic initiatives.

To know about the assumptions considered for the study, Download for Free Sample Report

Revenue and Growth

In recent years, Nestlé has demonstrated robust revenue growth, supported by its extensive global presence and diversified product range. The company’s revenue is generated from various geographic regions, with significant contributions from Europe, the Americas, and Asia, Oceania, and Africa.

Total Revenue: Nestlé reported total revenue of CHF 84.3 billion in the latest fiscal year, reflecting a year-on-year growth of 3.6%.

Organic Growth: The company achieved organic growth of 4.2%, driven by strong performance in key markets and categories.

Geographic Breakdown: Europe accounted for 30% of total revenue, the Americas contributed 45%, and Asia, Oceania, and Africa represented 25%.

Profitability

Nestlé’s profitability metrics underscore its operational efficiency and cost management strategies. The company’s focus on premiumization, innovation, and cost optimization has resulted in improved margins and profitability.

Operating Profit: Nestlé reported an operating profit of CHF 15.7 billion, representing an operating margin of 18.6%.

Net Profit: The company achieved a net profit of CHF 12.4 billion, translating to a net profit margin of 14.7%.

Earnings Per Share (EPS): Nestlé’s EPS for the fiscal year was CHF 4.20, reflecting a 5% increase from the previous year.

Cash Flow and Capital Allocation

Strong cash flow generation and prudent capital allocation are hallmarks of Nestlé’s financial strategy. The company prioritizes investments in growth opportunities, shareholder returns, and debt reduction.

Operating Cash Flow: Nestlé generated operating cash flow of CHF 16.8 billion, highlighting its robust cash-generating capability.

Capital Expenditures (CapEx): The company invested CHF 3.2 billion in capital expenditures, focusing on capacity expansion, innovation, and sustainability initiatives.

Shareholder Returns: Nestlé returned CHF 14 billion to shareholders through dividends and share buybacks, reflecting its commitment to delivering value to investors.

Strategic Initiatives and Growth Drivers

Nestlé’s strategic initiatives are geared towards driving sustainable growth, enhancing operational efficiency, and creating long-term value. Key focus areas include innovation, portfolio management, digital transformation, and sustainability.

Innovation and Product Development

Innovation is at the core of Nestlé’s growth strategy. The company continually invests in research and development to introduce new products, improve existing offerings, and meet evolving consumer preferences.

R&D Investment: Nestlé allocates approximately CHF 2 billion annually to research and development, focusing on nutrition, health, and wellness.

Product Launches: Recent product launches include plant-based alternatives, functional beverages, and premium pet foods, catering to the growing demand for healthier and sustainable options.

Portfolio Management