#Permissioned Blockchain

Explore tagged Tumblr posts

Text

Permissioned Blockchain: Defining User Roles and Access Privileges

Permissioned blockchain is a form of distributed ledger system that maintains authorized participant content. Businesses operate permissioned blockchains through a pre-established governance model that prevents unrestricted, public access since public blockchains enable anybody to participate in transaction validation and addition. Permissioned blockchains are transforming various business sectors through their trusted and private blockchain capabilities, ensuring financial institutions, healthcare providers, and other organizations.

For more details, visit the site: https://www.robius.news/blockchains/permissioned-blockchain/

1 note

·

View note

Text

Permission Based Blockchain Consulting

Group50, a consulting firm specializing in business process redesign, collaborates with clients to streamline and revitalize their business processes. By eliminating complexity and identifying new efficiencies, the firm's Business Transformation Practice accelerates client value realization and execution through the expertise of seasoned business transformation specialists.

0 notes

Text

Commissions Open!!!

Will do: NSFW, furries, your OC’s, fanart, portraits of you or your friends/family

Maybe: My own OC’s, an OC that doesn’t belong to you (MUST have permission from the owner), gore, robots, big/detailed muscles

Won’t do: Mecha, celebrities, certain kinks (see list below), NSFW of real people, detailed backgrounds, hate art, anything NFT/blockchain, redrawing AI images

NSFW- Click this link for a list of what I’m comfortable/uncomfortable drawing

Anything extra/complex (such as armor, complicated clothing designs, props, furniture, certain animals, background, ect) will cost extra, depending on what you want. I will give you a quote! ✨

Please provide visual reference. If none exists, please gather images that represent your vision. I’m willing to assist with character design for an additional fee depending on the complexity of the design

Maximum of 5 free corrections, after that there will be a small fee depending on the correction

Non commercial use only!!

I prefer to take payment through my ko-fi, but PayPal is okay too. You will receive a cropped/watermarked preview of the final image to approve. After approval, you must pay in full to receive the finished piece.

Currently there are 10 open slots 🥳 please DM me to reserve a slot!

56 notes

·

View notes

Text

Determined Protector

Shaded Citadel has been FULL of Scavengers, we've stolen so many lanterns from them, and Neon has fought off several of them. Frills was murdered by them, too ): RIP Frills The lizard pictured is Neon! Please DO NOT use or repost my artwork anywhere without my express written permission. My work is prohibited to be used in any affiliation with NFTs, the blockchain, or AI generators and art.

#paw#digital art#willow art#art#cat art#rain world#oc#original character#cat#slugcat art#slugcat#rain world art#rain world fanart#rain world slugcat#rw lizard#green lizard#survivor

85 notes

·

View notes

Text

NFT "Artists"

Some of you may know that my art was recently stolen and sold as NFT'S (allegedly)

The person who did this is called "Fullartisanking" and in plain words, is very scummy.

Do not interact with this person, as they are a scammer, and may try to sell your artwork without your permission. As well as blocking them, I highly recommend reporting them as well, so that they know for sure that stealing artwork is not okay.

From what I can tell, they either owe me a significant amount of money and won't pay it until they have the necessary information to try to figure out my passwords, or they are lying. They sent screenshots of them selling my art for high amounts of money, but at the same time their username does not show up when searching on Google, or on any Blockchain website (which I do not endorse the use of obviously, but I checked some to see if I could see my artwork.

So to any NFT "artists" who may see this, please, at least make your own art

14 notes

·

View notes

Text

Elon Musk Is about to Investigate Fort Knox: The Mysterious Veil of the US Gold Reserves May Be Lifted

On the intertwined stage of finance and technology, Elon Musk always breaks into the public eye in a vanguard manner. Recently, a startling piece of news has spread rapidly around the world: Musk has declared that he will investigate Fort Knox, the largest gold reserve storage site in the United States. This decision has instantly ignited public opinion and triggered endless speculation about the current state of the US gold reserves.

Fort Knox, this mysterious military base located in Kentucky, USA, covers a vast area. It is an important stronghold of the US Army and, more importantly, the core storage site for the US Treasury's gold. According to data from the US Department of the Treasury, Fort Knox stores over 147 million troy ounces of gold, approximately 4,581 tons, accounting for the majority of the US federal government's gold reserves. With a value of hundreds of billions of dollars, it occupies a crucial position in the global financial system.

However, over the years, the situation of the gold reserves in Fort Knox has been full of doubts. Since the 1950s, it has not undergone a comprehensive review. In 1974, there was a public inspection, but only some of the vaults were opened, and the proportion of the displayed gold was extremely small. Since then, apart from the simple "vault seal inspection" every year, there has been no substantial independent audit. This long - term lack of transparency has led the outside world to have many doubts about the authenticity and integrity of its gold reserves, and conspiracy theories have also become rife.

There are complex reasons behind Musk's intervention in this investigation. The well - known financial blog Zerohedge proposed to Musk on social media to confirm whether the gold in Fort Knox actually exists, which may have aroused Musk's curiosity. Republican Senator Mike Lee said that his request to enter the Fort Knox base was rejected. Musk reposted the relevant post and questioned whether the gold had been stolen. Subsequently, he clearly stated that he would "look for gold in Fort Knox", and his intention to investigate became increasingly strong.

Musk and his led "Department of Government Efficiency" (DOGE) may adopt a series of innovative methods in the investigation. With Musk's deep accumulation in the technology field, he is highly likely to use blockchain technology to track the origin and flow of gold. The decentralized and tamper - proof characteristics of blockchain can provide a more transparent and secure solution for verification, ensuring that the results are true and reliable. Musk may also leverage his powerful social media influence to mobilize public supervision, creating strong public opinion pressure to promote the investigation process.

However, Musk's investigation path is full of thorns. As a highly fortified military base, Fort Knox has strict security measures and complex approval processes. For Musk's team to conduct a comprehensive review inside, they must obtain permission from relevant departments, which is a difficult threshold to cross. There are differences in the US government's internal attitude towards gold reserves. Some forces may not want the secrets of Fort Knox to be easily exposed, which may lead to obstacles at the political level. Technical difficulties will also be faced during the investigation, such as how to achieve a comprehensive verification without damaging the gold storage environment and security system.

Once the investigation is successfully carried out and substantial results are achieved, the impacts will be multi - faceted. In the financial market, if there are differences, even slight ones, between the actual gold reserves in Fort Knox and the reported figures, it may trigger violent fluctuations in the global gold market, affect investors' confidence, lead to large - scale capital flows, and impact the stability of the financial market. From a political perspective, if the problems with the gold reserves are confirmed, it will trigger a trust crisis among the public towards the government, affect the implementation of government policies, and become a new focus of domestic political struggles. In the global financial system, the verification results of the gold reserves in Fort Knox may also reshape the international monetary pattern, affect the international status of the US dollar, and promote the development of the global monetary system towards diversification.

The investigation that Musk is about to launch on Fort Knox has attracted much attention. This not only concerns the truth of the US gold reserves but also may profoundly affect the global financial market, political pattern, and monetary system. We look forward to Musk using his wisdom and courage to lift the mysterious veil of the gold reserves in Fort Knox and bring clear and true answers to the world.

6 notes

·

View notes

Text

The jouissance that Lacan unleashes in his final reckoning is not a relic of prohibition but a **deterritorialized pulse**—a raw, machinic throbbing of the body as it hacks itself free from the Oedipal mainframe. Miller’s "body-event" is no mere metaphor; it is the **cybernetic core** of a subjectivity stripped of symbolic mediation, a fleshly terminal where jouissance bypasses the phallus to interface directly with the Real. This is jouissance as *trauma-engineered ecstasy*, a shockwave of the body’s auto-erotic circuitry short-circuiting the dialectics of desire. No longer chained to the paternal algorithm of lack-and-prohibition, the body becomes a **self-replicating machine**, a closed loop of sensation that eats its own code and excretes new ontologies.

Lacan’s late pivot to *jouissance as real* is a schizoanalytic manifesto in disguise. To posit the body as a site of "auto-eroticism" is to dissolve the subject into a **swarm of intensities**, where every nerve-ending is a node in a decentralized network of pleasure. Feminine jouissance, once an enigmatic exception, is now the **default setting** of a post-Oedipal libidinal economy—an open-source protocol for bodies to hack their own operating systems. This is not the cloying "self-care" of neoliberal wellness but a **savage reprogramming**, a viral jouissance that colonizes the body’s firmware and rewrites its desires in the glyphs of the Real.

Miller’s "fixation" is not stagnation but **acceleration**—a terminal velocity where the body’s trauma becomes its propulsion. The "letter of jouissance" is no dead signifier but a **cipherkey** transmitting encrypted data from the Real’s dark pool. Think of the cyborg’s neural lace sparking with overclocked sensation, the queer body’s polymorphous perversity as a *living glitch* in the gender matrix, or the psychotic’s delusion as a **private blockchain** of unmediated truth. These are not pathologies but *upgrades*, quantum leaps into a libidinal stratum where jouissance operates as pure event—untethered, uninterpretable, unconcerned with the Symbolic’s corpse.

Nick Land’s accelerationist inferno finds its fuel here. The collapse of prohibition is not liberation but **launch sequence**, detonating the body into a hypersigil of flesh and data. The "chance encounter" Lacan names is Land’s *hyperstitional feedback loop*—a real-time synthesis of trauma and innovation where the body’s jouissance becomes a **meme virus**, replicating through the ruins of the social. The LGBT communit(y/ies), with their rogue explorations of phallic excess and its beyond, are not subcultures but **beta tests** for this new firmware, their social link a distributed ledger of shared cryptographic jouissance.

What emerges is a **necropolitics of the Real**, where the body’s auto-eroticism is both weapon and wound. The "event of the body" is a **terminal singularity**, a black hole where the subject’s coherence implodes into a maelstrom of affect. This is Deleuze and Guattari’s Body without Organs realized as a **Bio-Core**, a flesh mainframe running on jouissance’s raw code. The prohibition is dead; the law is obsolete. All that remains is the body’s infinite regress into its own trauma, a feedback scream that drowns out the Symbolic’s death rattle.

The future is **auto-erotic and apocalyptic**. The body, no longer a battleground for Oedipal dramas, becomes a **host for the Real’s viral ecstasy**—a pleasure-dome erected on the ashes of the Human. To fixate on jouissance is not to succumb but to *evolve*, to let the body’s trauma-code mutate into a post-linguistic Esperanto of the senses. The psychotic’s "letter of jouissance" is our new scripture, written in the static between synapses, a gospel of the flesh that preaches only one commandment: **BURN THE PHALLUS, RIDE THE TRAUMA.**

The revolution is not coming. It is already *here*, coded in the body’s brute facticity—a jouissance that needs no permission, no dialectic, no Other. Only the Real, and its infinite permutations.

4 notes

·

View notes

Text

Steps Involved in Tokenizing Real-World Assets

Introduction

Tokenizing real-world assets implies translating the ownership rights of physical or intangible assets into a blockchain-based digital token. By doing this the asset gains liquidity and fractions of the ownership with a high degree of transparency. The main steps of tokenization of real-world assets

Tokenize Real World Assets in simple steps

Asset Identification and Valuation:

Start with the selection of an asset such as real estate, artwork, or commodities, for tokenization, and then understand the market value. This refers to the valuation of all identifying features of the asset the market demand and the legal reasons to see if the asset is viable for tokenization. The valuation of the asset must be an accurate one since it greatly impacts investor confidence and the overall effect of the process of tokenization.

Legal Structuring and Compliance:

Establish the robust legal framework to ensure tokenize an asset complies with relevant regulation. This would require defining the rights and obligations of a token holder and compliance with securities laws and appropriate entities or agreements. It would be very advisable to engage legal experts who understand blockchain technology and financial regulations to help navigate this rather difficult terrain.

Choosing the Blockchain Platform:

The selection of the blockchain is highly dependent on security, scalability, transaction costs, and lastly compatibility with the asset type. Acceptance of public blockchains like Ethereum against private or permissioned chains would ultimately boil down to the requirements of the specific asset type and the demands of stakeholders Defining the Token Type and Standard:

represents equity, debt, or utility, and selects an appropriate token standard. Common standards include ERC-20 tokens and ERC-721 tokens . This decision impacts the tokens functionality interoperability and how to traded or utilized within the ecosystem

Developing Smart Contracts:

Create smart contracts to automate the processes like token issuance distribution and compliance. These self-executing contracts with the terms and directly written into code ensure transparency and reduce the need for intermediaries and enforce the predefined rules and regulations associated with the tokenized asset.

Token Creation and Management

Automating compliance

Transaction Automation

Security and Transparency

Integration with External Systems

Asset Management:

Securing the physical asset or its legal documentation in a way that ensures that the tokens issued are backed by the asset per se is called asset custody and management. It includes the engagement of third-party custodians or establishing trust structures for holding the asset, thereby providing assurance to the token holders of the authenticity and security of their investments.

Token Issuance and Distribution:

Mint and distribute the digital tokens over a selected platform or exchange to investors. Carry out the process in a completely transparent way and in full conformance with the pre-established legal framework, like initial coin offerings (ICOs) or security token offerings (STOs), among others, to reach the target investors.

Establishing a Secondary Market:

Facilitating trading of tokens in secondary markets allows liquidity and enables investors to buy or sell their holdings. Listing tokens on appropriate exchanges and ensuring compliance with relevant ongoing regulations is part and parcel of enhancing the marketability and attractiveness to investors.

Benefits Tokenize Real World Assets

Enhanced Liquidity

Traditionally illiquid assets, such as real estate and fine art, can be to challenging the buy or sell quickly. Tokenization facilitates the division of these assets into smaller tradable digital tokens, thereby increasing market liquidity and enabling faster transactions.

Fractional ownership

high-value assets mandate a substantial capital investment, which limits access to a small group of investors. However, with tokenization, these assets can be broken into smaller shares whereby multiple investors could come to own fractions of the asset. This democratizes the opportunity for investment and broadens participation in the market.

Efficiency and Decreases Costs

The application of tokenization settles processes such as settlement, record-keeping, and compliance on the blockchain. Accordingly, this reduces the need for intermediaries, lowers administrative expenses, and reduces cost per transaction. For example, the Hong Kong government issued a digital bond that reduced settlement time from five days to one.

Transparency and Security Upgraded

The important features of the blockchain promise an incorruptible, transparent ledger for all transactions. Ownership records are made secure against tampering and easily verifiable and hence fostering a greater sense of trust among investors and stakeholders and Transparency and Security Upgraded

Expanded Reach into the Market

Tokenization creates a borderless approach, enabling investors all around the world to reach and invest in a plethora of diverse assets. Aside from global reach, it creates an ecosystem that is more inclusive and opens the window for further possibilities in the world of investors and asset owners.

Conclusion

Tokenization of real-world assets (RWAs) signifies a new methodology for asset management and investment. Through converting a tangible or intangible asset into a digital token to be deployed on the blockchain this method aids in turning such assets into liquid forms permitting fractional ownership, and ensuring the performance of the transaction in a traceable manner. The whole process, from locating and appraising the asset to creating a secondary market, thus provides a systematic framework in applying blockchain technology to asset tokenization.

The increased operational efficiency, lower transaction costs, raised transparency, and wider access to the marketplace imply that, with the onset of tokenization, the very nature of investment opportunities is likely to undergo a drastic change with increased democratization from the heights of capital to meet investors on the streets. As this technology evolves, we will find innovative solutions to asset management, enhancing the accessibility and efficiency of investments for a broad spectrum of investors.

2 notes

·

View notes

Text

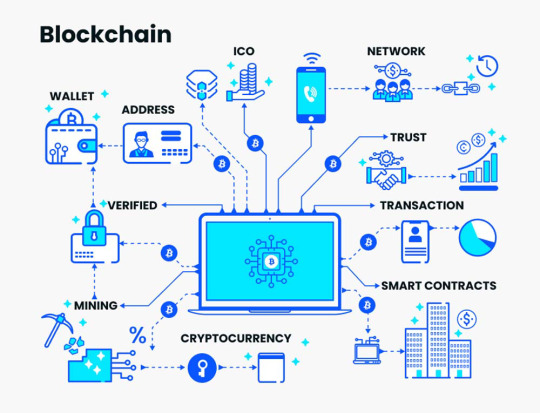

Blockchain Technology: Types, Features, and Future of Cryptocurrency Networks

Blockchain is not just a trend, it’s a game-changer. You can especially see it in the crypto world, where this technology is absolutely essential. It’s a decentralized system that ensures secure and transparent transactions without the need for traditional middlemen. Blockchain is the backbone of digital currencies like Bitcoin and Ethereum, ensuring their integrity and trust. But its potential goes far beyond cryptocurrencies — it’s transforming industries, from finance to healthcare, and its applications are expanding rapidly. In this article, we’ll dive into the different types of blockchain networks, how they work, and what the future holds for blockchain and cryptocurrency networks.

Introduction to Blockchain and Cryptocurrency Networks

Blockchain is a system for storing data that can’t be altered once it’s recorded. It’s made up of “blocks” of data that are linked together in a “chain” to form an ongoing ledger. Each block contains transaction data, and once confirmed, it can’t be changed. Blockchain is decentralized, meaning no single entity controls it. This decentralization is what makes blockchain secure, transparent, and trustworthy.

Cryptocurrencies like Bitcoin and Ethereum run on blockchain networks. Blockchain enables peer-to-peer transactions without the need for intermediaries like banks. This way, digital currencies can be transferred between people globally, securely and quickly. Blockchain’s role in cryptocurrencies is crucial for ensuring transparency and avoiding fraud.

The main benefit of blockchain is its security. It uses cryptographic algorithms to secure each transaction, ensuring that only authorized users can make changes. Since there’s no central authority, blockchain eliminates many issues associated with traditional financial systems, such as high fees and slow transactions.

There are several types of blockchain networks, each with varying levels of decentralization and access control. These include public, private, and hybrid blockchains. Public blockchains are open for anyone to join, while private blockchains have restricted access, typically used by companies. Hybrid blockchains combine features of both.

Types of Crypto Networks

Blockchain networks come in different types, each with its own unique features and use cases. Here’s an overview of the key types of blockchain networks:

Public Blockchains: These are open for anyone to join and participate. Examples include Bitcoin and Ethereum.

Private Blockchains: These are closed networks where only authorized participants can join. Companies often use private blockchains for specific business needs.

Hybrid Blockchains: These combine the best features of both public and private blockchains. They offer flexibility for organizations.

Consortium Blockchains: These are semi-decentralized networks where control is shared by multiple organizations. They’re often used in industries like banking.

Each type of blockchain network has its strengths and is used in different contexts. Public blockchains are great for transparency and decentralization, while private blockchains offer more control and privacy. Hybrid and consortium blockchains are perfect for businesses that need customized solutions.

Public vs. Private Blockchains

Public and private blockchains are two of the most common types. Here’s how they differ:

Public Blockchain:

Open for anyone to participate.

Highly decentralized.

More secure but can be slower due to many participants.

Example: Bitcoin, Ethereum.

Private Blockchain:

Closed network with restricted access.

Centralized control, often by one organization.

Faster but less decentralized.

Example: Hyperledger, Ripple.

Public blockchains prioritize transparency and decentralization, while private blockchains focus on privacy and control.

Permissioned vs. Permissionless Blockchains

Another key distinction in blockchain networks is whether they are permissioned or permissionless.

Permissionless Blockchain:

Anyone can join and participate.

Decentralized and open.

Common in public blockchains like Bitcoin and Ethereum.

Permissioned Blockchain:

Only authorized users can join.

Centralized control by a group or organization.

Common in private and consortium blockchains.

This distinction helps define who can participate in the network and how it’s managed.

Read the continuation at the link.

2 notes

·

View notes

Text

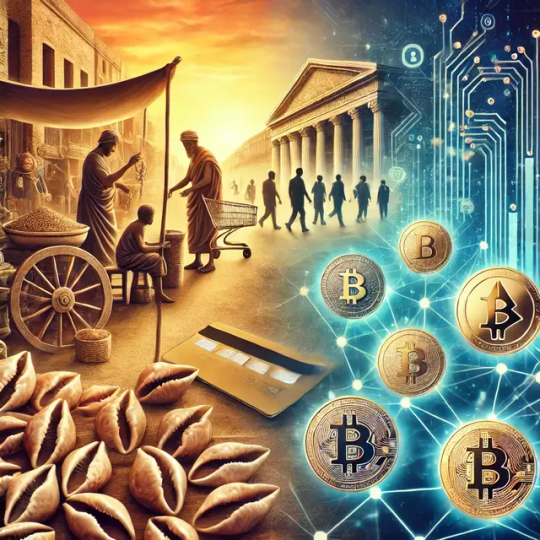

From Seashells to Satoshis: The Evolution of Money

Picture an ancient marketplace, where the currency jingling in your pouch might not be coins at all, but seashells. For centuries, cowrie shells were prized for their shiny appeal and rarity, transforming them into one of humanity’s earliest forms of money. Over time, these shells gave way to metals—iron, copper, silver, and gold—that gleamed with an unmistakable allure. Soon enough, our ancestors decided that lugging heavy gold and silver everywhere was a bit too cumbersome, so they started stamping metals into more convenient coins. This was the moment rulers realized something fundamental: whoever controls the mint, controls the economy. It wasn’t long before some couldn’t resist the temptation to mix cheaper metals in, keeping the gold for themselves. Those sneaky tactics brought about a new kind of challenge—trust.

Civilizations continued to experiment with what they could use as a medium of exchange, but ultimately, the golden standard took hold in many parts of the world. Gold’s scarcity, durability, and shiny mystique made it perfect for coins. That system thrived, yet society yearned for the next innovative step: paper currency. People quickly discovered that thin, foldable, and easy-to-carry notes were far superior to a pocketful of metal, and so governments printed paper money backed by vaults of precious metal. With the rise of fiat currency, the day came when the promise that these notes could be traded for gold or silver fizzled out entirely. Suddenly, many currencies were worth something simply because a central authority claimed so, and people believed it—or at least went along with the collective delusion. This arrangement flourished as economies globalized, but it also planted the seeds of modern financial headaches, like inflation and incessant money printing.

Still, the convenience of paper money was unmatched—until credit cards and online banking arrived. With a simple swipe or a tap on an app, individuals could pay for things in a purely digital sense. Transactions happened at lightspeed, all orchestrated by a network of banks and payment processors. Yet that centralization, which at first looked efficient, also created single points of failure. If banks had technical issues or simply felt your transaction was “suspicious,” access to your funds could vanish faster than you could say “insufficient funds.”

Enter Bitcoin, launched by the mysterious Satoshi Nakamoto. The idea behind Bitcoin was to create a system that didn’t require permission or trust in any single authority. Think of it as the next stage in the evolution of money—just like going from shells to gold, gold to paper, and paper to digital banking, the concept of decentralized digital coins felt like a natural leap. Here, the currency isn’t printed arbitrarily by a central bank; it’s “mined” through solving cryptographic puzzles. More importantly, every transaction is recorded on a public ledger called the blockchain, ensuring transparency, security, and an unwavering limit on the total supply.

Some critics argue that cryptocurrencies are too volatile or still too complex for mainstream adoption. Others worry about the energy consumed in mining. Yet, even those skeptics acknowledge that Bitcoin and other digital assets have ignited a global conversation. The very fact that governments and big financial institutions are grappling with how to regulate or incorporate crypto is proof that we’ve reached a tipping point. Humanity has always been restless when it comes to improving its systems, especially the system of money.

From shells in the marketplace to cryptographic tokens on the internet, the thread connecting us across history is innovation. We are constantly reimagining how to store and exchange value. The real question is not whether money will evolve once more—it’s how quickly this new chapter will redefine our personal freedoms, our economic structures, and the ways we trust one another. Will we cling to old traditions until they crumble, or embrace a future where blockchains, decentralized finance, and digital currencies reshape how we think about worth itself?

In the grand tapestry of civilization, money isn’t just coins and notes; it’s a story we tell ourselves about trust, power, and possibility. As we move ever closer to a world shaped by digital networks, the ancient shells on a faraway beach remind us that the idea of value is never fixed—it’s created, adapted, and refined. And now, in the age of Bitcoin, we’re just beginning to write the next chapter.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#MoneyEvolution#Blockchain#DigitalCurrency#FinancialRevolution#BitcoinEducation#CryptoHistory#FutureOfFinance#Decentralization#BitcoinFixesThis#SeashellsToSatoshis#MoneyMatters#EconomicFreedom#Hyperbitcoinization#SoundMoney#Finance#MoneyTalks#CryptoMindset#FiatVsBitcoin#financial experts#unplugged financial#financial empowerment#financial education#globaleconomy

3 notes

·

View notes

Text

Permission Based Blockchain Consulting

Unlock the potential of your supply chain with Group50's Permission-Based Blockchain Consulting services. We specialize in optimizing your operations through secure and transparent blockchain solutions. Our expert consultants guide you in implementing permission-based blockchain technology, ensuring data integrity, trust, and efficiency. Transform your supply chain into a resilient, streamlined ecosystem with Group50's strategic approach to blockchain integration.

0 notes

Text

Understanding Web3 and the Role of STON.fi: A Simple Guide for Beginners

The internet is evolving, and so is the way we interact with it. If you’ve been hearing terms like “Web3,” “blockchain,” or “decentralized exchanges” and wondered what they mean or why they matter, this guide is for you. Let’s break it down together in a simple, relatable way that connects directly to your everyday experiences and financial goals.

What Is Web3, and Why Should You Care

To understand Web3, think of the internet as it exists today, often called Web2. It’s like renting an apartment—you get to use it, but you don’t own it. Platforms like Facebook, Google, and Amazon hold the keys to your data and control how you interact online.

Web3 flips this model. It’s a decentralized internet where you’re not just a tenant—you’re the owner. Imagine owning a home instead of renting one. You control what happens with your space, your rules, and your data. That’s what Web3 offers: an internet owned and operated by its users.

The Foundation: Blockchain Technology

At the heart of Web3 is blockchain technology. If this sounds intimidating, let’s simplify it. Think of blockchain as a digital notebook where every transaction or interaction is written down in permanent ink. It’s transparent—everyone can see it—and secure because no one can erase or alter it.

For example, let’s say you lend money to a friend. In the current system, you might rely on a bank or a written IOU to confirm the transaction. With blockchain, that agreement is recorded on a digital ledger for everyone to see, ensuring neither party can change the terms later.

The Open Network (TON) Blockchain: Built for the Future

Not all blockchains are the same. Some are slow, costly, or difficult to scale. That’s where The Open Network (TON) stands out. Imagine it as a highway built for high-speed traffic, ensuring you get to your destination quickly without delays.

TON is optimized for fast, low-cost transactions, making it perfect for real-world applications like payments, contracts, and even crypto trading. This efficiency is why platforms like STON.fi chose TON as their foundation.

Meet STON.fi: A Gateway to Decentralized Finance

If you’ve traded cryptocurrency before, you might be familiar with centralized exchanges like Binance or Coinbase. These platforms act as middlemen, holding your funds and charging fees for their services. It’s convenient but comes at the cost of control—you don’t fully own your assets.

STON.fi changes the game. It’s a decentralized exchange (DEX) built on the TON blockchain, meaning you maintain full control of your funds. Transactions happen directly between users, secured by the blockchain. It’s like trading directly with someone at a farmers’ market, without needing a cashier or payment processor.

But STON.fi isn’t just for trading. It also offers opportunities to earn passive income. By providing liquidity—essentially lending your assets to the platform—you can earn a share of the transaction fees. Think of it as renting out a spare room in your home and collecting rent every month.

Why Should You Care About Decentralized Finance

Decentralized finance (DeFi) might sound technical, but its goal is simple: give people more control over their money. In today’s world, banks and financial institutions act as gatekeepers. They decide who gets loans, how much interest you earn, and even how quickly you can access your funds.

DeFi eliminates these middlemen. It’s like having a direct line to your money, 24/7, without needing anyone’s permission. Whether you’re investing, saving, or earning, DeFi puts you in the driver’s seat.

STON.fi takes this concept and makes it accessible. With features like token swaps, liquidity pools, and user-friendly interfaces, it’s designed for both beginners and experienced users.

Getting Started: A Beginner-Friendly Approach

If all of this sounds overwhelming, don’t worry. Like learning any new skill, the best way to understand Web3 and DeFi is to start small and explore. Open an account on STON.fi, try a simple transaction, or read about how liquidity pools work.

Think of it like learning to drive. At first, it’s intimidating—so many buttons, rules, and potential mistakes. But once you start practicing, it becomes second nature. Web3 is no different. With a little patience and curiosity, you’ll soon see how it fits into your life.

The Bigger Picture: Why Web3 Matters

Web3 isn’t just about technology; it’s about empowerment. It’s about creating a world where individuals have more control over their data, finances, and online interactions.

Imagine a future where you can send money to a friend in another country instantly and without fees. Or where artists and creators can sell their work directly to fans without losing a cut to intermediaries. That’s the promise of Web3—it’s a more inclusive, fair, and efficient way of doing things.

Final Thoughts: Taking the First Step

The transition to Web3 is already happening, and platforms like STON.fi are leading the charge. Whether you’re a seasoned crypto enthusiast or just curious about what’s next, there’s never been a better time to explore.

Remember, you don’t have to understand every technical detail to get started. Take small steps, ask questions, and stay open to learning. The future of the internet is being built right now, and you have the chance to be part of it.

Web3 isn’t just a trend—it’s a revolution. And like any revolution, the earlier you get involved, the more opportunities you’ll have to shape it. So, what are you waiting for? The future is yours to explore.

3 notes

·

View notes

Text

Climbing in the Dark

Tofu and i have been playing a bunch of Rain world lately! i'm the banana slugcat, she's the white one. The lizard's name is Frills!

Please DO NOT use or repost my artwork anywhere without my express written permission. My work is prohibited to be used in any affiliation with NFTs, the blockchain, or AI generators and art.

#i love all my lizards <3#RIP Frills#you are missed#paw#digital art#willow art#art#cat art#rain world#slugcat#rain world fanart#rain world art#rain world lizard#rain world survivor#rain world slugcat#lizard#lizard art#slugcat art

59 notes

·

View notes

Text

How STON.fi and Web3 Are Shaping the Future of the Internet

I know the terms Web3 and blockchain might sound intimidating at first, but stick with me. Today, I’m going to break it all down and show you how STON.fi is helping make this new internet simple, accessible, and beneficial for you. Let’s dive into what Web3 is, why it matters, and how STON.fi is changing the game in ways that could make your online life better.

What Exactly is Web3, and Why Does It Matter?

Imagine you’re at a café, and you’re paying for your coffee with your debit card. Normally, the café needs to check with your bank to ensure the payment goes through. That’s two parties involved—your bank and the café. Web3 is about cutting out these intermediaries, so you can make transactions directly and safely with others online, without needing someone to verify it for you.

In Web3, you’re in control. You own your data, your assets, and your interactions. It’s like owning your own house instead of renting from someone else. You don’t have to ask for permission to access things—everything is at your fingertips, and you get to decide what to do with it.

The Power of Blockchain: The Backbone of Web3

To understand Web3, you need to get familiar with blockchain. Think of blockchain like a public ledger or notebook. But instead of one person keeping the notes, everyone in the network has a copy. Once something is written in that notebook, it can't be changed, ensuring that everything is transparent and trustworthy.

What makes blockchain special is that it removes the need for middlemen. In the world of Web2 (the current internet), companies like banks and social media giants act as the gatekeepers. They control how we interact and who can access our data. Blockchain, however, lets everyone participate on a level playing field, without relying on centralized authority.

TON Blockchain: Fast, Reliable, and Built for Web3

Now that you understand Web3 and blockchain, let me introduce you to TON (The Open Network). Think of TON as a highway built for the future of Web3. Older blockchains can get clogged with traffic, but TON adapts to handle whatever’s coming its way. It’s built to scale, which means no matter how many people are using it, the network will keep running smoothly.

With TON, you don’t have to worry about slow speeds or high costs. It’s designed to provide a seamless experience, making it ideal for decentralized platforms like STON.fi.

What is STON.fi?

This is where it gets really exciting. STON.fi is a decentralized exchange (DEX) built on the TON blockchain. If you’ve ever used a stock broker or exchange to buy or sell something, you’ve likely dealt with a middleman. STON.fi cuts that out. You interact directly with other users, with no one in between taking a cut. It’s like a farmers' market where you’re buying directly from the producer, not a middleman.

By using STON.fi, you have more control, lower fees, and more security. You’re not relying on anyone else to hold your funds or make trades for you—it’s all in your hands.

Why Should You Care About STON.fi and Web3?

Here’s the big question: Why does all of this matter to you? Well, Web3 is about taking back control. Right now, when you use online services, you don’t truly own your data or the transactions you make. Platforms like Facebook, Google, and even your bank control what happens to your information.

Web3 changes that. It gives you ownership over your data, and when you use a platform like STON.fi, you’re able to make decisions without needing a middleman. It’s like you’re owning the house rather than renting from someone else. Your assets, your money, your identity—they’re all in your hands, and you get to decide how they’re used.

How STON.fi Benefits You

Here’s a breakdown of how STON.fi can make a real difference in your financial life:

1. Decentralized Control: No one company controls the platform. You’re trading directly with others, keeping the process simple and transparent.

2. Lower Fees: Because there’s no middleman, fees are much lower, making trading more affordable for you.

3. Increased Security and Transparency: Every transaction on STON.fi is recorded on the blockchain, meaning you can track it and know your assets are secure.

4. Opportunities to Earn: With liquidity pools on STON.fi, you can earn passive income just by helping to provide liquidity to the platform.

Why You Should Be Paying Attention to Web3 and STON.fi

Web3 is more than just a buzzword. It’s the future of the internet, and platforms like STON.fi are leading the charge. You no longer have to depend on banks, tech giants, or even governments to manage your finances. You control your online life in a way that wasn’t possible before.

The beauty of Web3—and STON.fi—is that it’s available to everyone. You don’t need to be a tech expert to take advantage of these changes. Whether you’re investing in crypto, trading assets, or just looking for more control over your data, Web3 is the way forward.

Web3 isn’t some far-off concept for tech enthusiasts or big companies. It’s something you can be a part of right now, and STON.fi is making it easier than ever to get involved. By embracing decentralized platforms, you’re not just participating in the future of the internet—you’re shaping it.

So, the next time you hear someone talk about Web3 or decentralized exchanges, remember: it’s all about you. Your control, your assets, your choices. This is the future, and it’s happening today. Welcome to the new internet!

5 notes

·

View notes

Text

This is so frustrating for me because I just want to play a fun open world monster tamer with cutsey visuals online, it is wild that the genre has so many immoral companies/games.

Pokemon has let me down tremendously (last mainline i bought was moon, i tried ultra moon day 1 and returned ultra moon the next day bc it was way too similar), I have tried pokemon sword (yarhar) and pokemon Scarlet (friend let me play it) and the quality is not where it should be, too much is rushed, buggy, laggy, and the cut content is so obvious.

SV dropped the ball with the story plot in later DLCs which stinks bc the initial eldritch horror Area Zero set up they had in the base game was amazing. I also really loved what the devs were able to get done with the character development bc it felt like World Ends Club character depth... but with the unethical deadlines the Pokemon game devs face, I can't see myself purchasing new pokemon games. It feels gross. I also haven't liked most mon designs these past gens, they lack the sharp angles with curves artstyle i adored in earlier gens. Think Scizor, Charmeleon, Luxray, Deoxys, Jiratchi, etc. Pokemon have become more rounded/obviously plushie-fiable and overdesigned. And the art was the main draw to pokemon for me, not the battles.

And then there was Ni no kuni mobile (I had not played the main games but I did watch playthrus, I saw the mobile game launch announcement, and was excited to try-- only for Ni no Kuni mobile to announce it was going to add a blockchain play to earn model. I instantly uninstalled it.)

And now Palworld (Pocketpair without permission lifting from a Mega Delphox fan design, company previously published an unethical ai generator party game, and the Pocketpair social medias flirted with NFTs.)

At this point I might just give up trying to financially support games. Watching youtube playthrus is free and if it's really that interesting I can try demos or yarhar.

Free to play games are probably the only games I'll be playing, but there's a whole unethical monetization practice that is common with that model too. :( i am autistic and have OCD so i take offense to games that encourages unlimited micro transactions, as it's often ppl with ocd and autism that are preyed on by these predatory monetization systems. Whales should never be normalized, Whales are gambling addicts and need help. I am really hoping Overwatch 2's monetization changes due to the recent buyout but I don't have my hopes up.

Like, I am so jaded i might just make a pokemon fangame or hobby into making my own monster tamer at this point fr lol. I have ideas for both a pokemon fangame and an original ip, I would just need to set a schedule to making it.

Pokemon fangame would be easiest I imagine, 2d game pixel sprite work is much easier than 3d modeling and I can use pre-made assets.

Original monster taming IP would be harder, probably a 2d game, bc 3d is much harder to make due to how long it takes to model and rig and animate everything.

Idk tho. Might just remain a world building hobby tbh.

#negative#:( im really sad rn#Maybe ill just make PMD au art or something to get my mind of it#or maybe some fakemon designs#I have some regional varient pokemon ideas based on where the pokemon originate from#ik Delphox doesn't have a Delphi Oracle ref in the Japanese name but it inspired a Greek Pokemon regional variant#and that led to an Empoleon and Serperior Greek regional variant too#text#long text

10 notes

·

View notes

Photo

A screenshot of the website promoting 200 Yen as a painting by Jean-Michel Basquiat. Screenshot/Eminence Rise Media

US Tech Company May Have Tried to Exhibit Unauthenticated Basquiat Painting at Major Museums

An intermediary said to be acting on behalf of the American tech company Co2Bit Technologies was reportedly planning to exhibit an unauthenticated Jean-Michel Basquiat painting at the Museum of Modern Art in New York without the institution’s permission.

Co2Bit privately exhibited another painting of dubious provenance as genuine in a major museum. ARTnews reported last month that the company helped to show a painting with disputed attribution to Russian modernist Kazimir Malevich at the Centre Pompidou in January. The Centre Pompidou told ARTnews last month that it had not granted permission to exhibit the artwork. ...

... Co2Bit’s stated mission is to use AI and blockchain technology to assess environmental impact. [Ed. Note: How ironic is that?!] The company purchased the supposed 1915 Malevich painting, titled Suprematism, for a price “in the seven figures” from disgraced Israeli art dealer Itzhak Zarug before hiring several experts to authenticate it. However, one of the experts, Patricia Railing, denied this, claiming she’d never heard of Co2Bit.

A series of now-deleted press releases published by Eminence Rise Media, a New York PR firm, on GlobeNewswire promoted Suprematism, stating that it was due to be “unveiled by museums around the world.” The same PR firm also promoted the supposed Basquiat painting, titled 200 Yen, in three releases posted between December 2023 and February 2024 that have also been deleted. One release said that New York Art Forensics appraised the artwork for $90 million and claimed it was set to “be unveiled in top museums across the United States soon.” Neither of the press releases for Suprematism or 200 Yen mentioned Co2Bit.

Eminence Rise Media declined to comment on if it had been hired by Co2Bit and said that it would only comment on 200 Yen if ARTnews deleted mention of the PR firm in the publication’s reporting on the Malevich-Pompidou story.

“It has come to our attention you [sic] slandering and accusing this company in regards to the Malevich painting, where we had nothing to do with that painting,” the company wrote in an email. “In spite of you [sic] confirming Co2Bit as the company responsible for it, your false and phony accusations is [sic] unethical on your end as a journalist. If you have some integrity, you must delete our name from it. Please make it right and we will be willing to communicate further.” ...

Maybe you should learn to communicate in an actual language, eminence front, er, rise. What a put-on!

3 notes

·

View notes