#Part-time workers personal loan options

Explore tagged Tumblr posts

Text

Do Part-Time Employees Qualify for Personal Loans?

Personal loans are an accessible financial solution for many individuals who need immediate funds for various reasons, such as medical expenses, home renovations, education, or emergencies. But a common question that arises is whether part-time employees qualify for personal loans, considering they have lower or irregular incomes compared to full-time employees.

In this article, we will explore whether part-time employees can get personal loans, the factors that lenders consider in these cases, and how part-time workers can increase their chances of approval. We will also provide tips for part-time employees on how to maximize their chances of securing a personal loan with favorable terms.

What Is a Personal Loan?

A personal loan is an unsecured loan that can be used for various personal purposes. Unlike home loans or car loans, which are tied to the asset being purchased, personal loans offer flexibility and can be used for anything from paying medical bills to financing vacations. These loans usually have fixed interest rates and fixed repayment terms, which makes them easy to manage. Personal loans are typically offered by banks, Non-Banking Financial Companies (NBFCs), and online lending platforms.

Can Part-Time Employees Qualify for Personal Loans?

The short answer is: Yes, part-time employees can qualify for personal loans. However, the approval process may differ compared to that of full-time employees. Lenders assess several factors before approving any loan application, and part-time employees need to meet these requirements to qualify. Let’s break down the essential factors that lenders consider when evaluating part-time employees for personal loans.

1. Income Stability

One of the main concerns that lenders have when assessing part-time employees is the stability of their income. Personal loan lenders want assurance that borrowers will be able to repay the loan amount without difficulty. Since part-time workers often have lower or irregular incomes, lenders may scrutinize their income patterns more closely.

That said, if a part-time employee can demonstrate a steady income over a long period of time, they are more likely to get approved for a personal loan. Lenders will assess your average monthly income, how long you have been working part-time, and whether you have any secondary sources of income.

2. Credit Score

A good credit score is a key factor that determines whether you qualify for a personal loan, regardless of your employment type. A high credit score (typically 750 or above) signals to lenders that you have a history of managing credit responsibly. Part-time employees with high credit scores are more likely to get approved for a personal loan, even with lower incomes.

If your credit score is below 750, you may still be able to get a loan, but you may face higher interest rates or more stringent eligibility criteria. In such cases, it’s essential to work on improving your credit score before applying for a loan to increase your chances of getting favorable terms.

3. Debt-to-Income (DTI) Ratio

The debt-to-income ratio (DTI) is another key factor that lenders consider when evaluating loan applications. Your DTI ratio is the percentage of your monthly income that goes toward paying off debt. Lenders use this ratio to assess whether you can afford additional debt, such as a personal loan.

For part-time employees, a lower DTI ratio is crucial. If a part-time worker has a high DTI ratio (indicating that a large portion of their income is already committed to paying off other debts), they may struggle to repay the loan, making lenders less likely to approve the loan.

4. Employment Duration

Lenders also want to ensure that you have a certain amount of job stability. For full-time employees, this requirement is usually more lenient. However, for part-time employees, lenders may want to see a longer employment history or proof that the part-time work is consistent and stable. Generally, part-time employees should aim to have at least six months to a year of employment history with their current employer to improve their chances of getting approved.

5. Additional Income Sources

Having secondary sources of income can significantly increase a part-time employee’s chances of qualifying for a personal loan. This could include freelance work, rental income, investments, or other part-time jobs. If part-time employees can show that they have additional income sources that supplement their primary part-time job, they may be able to qualify for a larger loan amount.

6. Loan Amount and Tenure

Part-time employees may be eligible for smaller loan amounts due to their lower incomes. However, the amount you can borrow also depends on your ability to repay the loan. Lenders generally offer smaller loan amounts with more flexible repayment terms to part-time workers, which means that you may be able to get approved for a loan, but with a lower principal amount.

Additionally, lenders may offer part-time employees longer loan tenures to reduce the monthly EMI (Equated Monthly Installment) burden. Opting for a longer loan tenure means lower EMIs but may result in paying more interest over the life of the loan.

How Part-Time Employees Can Increase Their Chances of Getting a Personal Loan

If you are a part-time employee and want to improve your chances of getting approved for a personal loan, here are some tips to consider:

1. Improve Your Credit Score

A higher credit score can increase your chances of getting approved for a loan. Pay your bills on time, reduce your credit card balances, and avoid taking on too much debt. If necessary, request a copy of your credit report to check for any errors that may be affecting your score and work to resolve them.

2. Demonstrate Stable Income

If you have been employed part-time for a while, make sure to provide proof of stable income. Lenders will often ask for bank statements, pay slips, and tax returns to verify your income. If you have been working part-time for a short period, consider waiting until you can show a consistent income pattern before applying for a loan.

3. Provide Proof of Additional Income

If you have other sources of income, such as freelance work, side businesses, or investments, provide proof of this additional income to increase your chances of approval. Lenders appreciate applicants who can demonstrate multiple streams of income, as this indicates financial stability.

4. Apply for a Smaller Loan Amount

If you are unsure about your eligibility, consider applying for a smaller loan amount. Lenders are more likely to approve personal loans for part-time employees with lower loan amounts, especially if they have stable income and a good credit score.

5. Choose a Longer Loan Tenure

Opting for a longer loan tenure can help lower your EMIs, making the loan more manageable. While this means you will pay more interest over time, it can make the loan more affordable in the short term.

6. Consider a Co-Applicant

If your income is not sufficient to qualify for a loan on your own, consider applying with a co-applicant. A co-applicant with a steady full-time job and a good credit score can increase your chances of loan approval.

How to Apply for a Personal Loan as a Part-Time Employee

Once you have ensured that you meet the eligibility requirements, the next step is to apply for a personal loan. Here’s a general process for applying:

Check Your Eligibility: Use online eligibility calculators offered by various lenders to check if you qualify for a personal loan based on your income and credit score.

Compare Lenders: Research various lenders, such as banks and NBFCs, to compare their interest rates, loan amounts, and repayment terms. Some popular lenders offering personal loans include:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

Incred Personal Loan

Fill Out the Application: Complete the online or offline application form, providing all necessary information about your income, employment, and financial obligations.

Submit Documents: Submit the required documents, including proof of identity, address, income, and employment.

Wait for Approval: After reviewing your application and documents, the lender will decide whether to approve your loan. If approved, the funds will be disbursed to your account.

Part-time employees can indeed qualify for personal loans, but the approval process may involve a more detailed review of their income and financial stability. By demonstrating a steady income, maintaining a good credit score, and providing additional income proof, part-time workers can increase their chances of securing a personal loan with favorable terms.

If you’re a part-time employee looking for a personal loan, consider comparing offers from trusted lenders like IDFC First Bank, Bajaj Finserv, Tata Capital, and others to find the best loan option for your needs.

#Part-time employee personal loan eligibility#Can part-time employees get personal loans#Personal loans for part-time workers#Eligibility for personal loan for part-time employees#Personal loan approval for part-time employees#Personal loan for part-time workers in India#How to get a personal loan as a part-time employee#Personal loan for part-time employees with low income#Credit score for part-time employees personal loan#Income proof for part-time employees personal loan#Personal loan requirements for part-time jobs#Part-time job personal loan eligibility criteria#Debt-to-income ratio for part-time employees#Part-time employee personal loan approval process#Best personal loans for part-time employees#Part-time workers personal loan options#Personal loan eligibility for freelance and part-time workers#Applying for a personal loan as a part-time employee#Documents needed for part-time employee personal loan#Can part-time employees qualify for loans without full-time employment#finance#bank#personal loans#loan services#nbfc personal loan#personal loan#personal loan online#loan apps#fincrif#personal laon

0 notes

Text

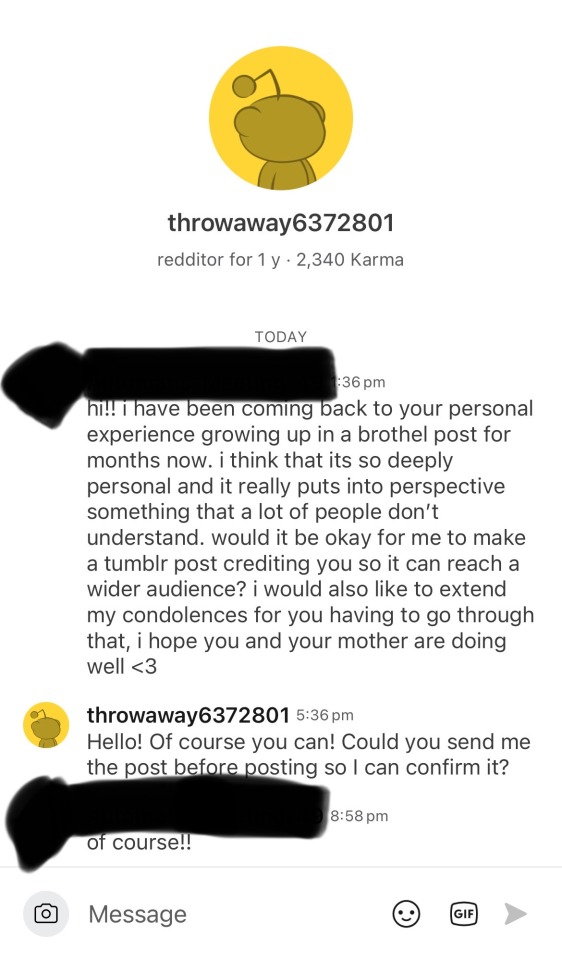

this post is a repost of an amazing reddit post by u/throwaway6372801 on the r/MoDaoZuShi subreddit.

https://www.reddit.com/r/MoDaoZuShi/s/GeHsDKCFON

Growing up in a Chinese brothel and how it may relate to Jin Guangyao/Meng Yao as a character

Just to start off I would like to preface that I’m not excusing his crimes, only putting in perspective parts of his character that I personally resonate with based on similarities. I will start off discussing how brothels and debts tend to work, especially involving children.

I will not be releasing where I grew up nor my name due to privacy reasons as I have somewhat personal information about myself on this account, despite its name.

But in short, I grew up in a brothel in China with my mother. She worked as a prostitute out of desperation and debt, which I ended up also helping with.

Debt was accumulated through food, housing, water, electricity, makeup, clothes, anything that we were unable to pay for ourselves and had to ‘take out a loan’ for. Things necessary for my mother to work, such as makeup, also fell into this category. This is not to mention baby items which were even more expensive and often times couldn’t be stretched out to last as long as other items.

Your co-workers are not your friends. You may both be in this situation, you may both have children, but if you cannot afford it, kindness is not an option. You have to be callous to survive.

On the same subject, politeness is a sought after commodity. If you can have a convincing smile, laugh, anything of the sort. Lying as well, if you can’t convince the man about to rape your child that they can’t because you would be ‘jealous’, you and your child are cooked.

Selling a child isn’t uncommon either. If someone has a particularly low-paying client who happens to be ugly or undesirable, they may offer the nearest person to them, not uncommonly a child that’s either their or one of their co-workers’.

Being a woman in a brothel is not a ‘women supporting women’ place. It is survival. And yes, some people are just evil, and will try and sell the child of a better paid co-worker than work themselves.

It doesn’t matter how pitiful you look, though it can help, you cannot stop it.

Onto Meng Yao. I will be calling him that since at this point in his life, he was indeed called Meng Yao.

We see when Wei Wuxian performs Empathy, that he goes into the body of Anxin. We as the readers get a glimpse into Meng Yao’s childhood at the brothel. It’s brief, and mostly focuses on the event of his mother, Meng Shi, being dragged naked into the streets, with himself after (fully dressed). Sisi comes to their defence.

But what I think that most people forget is that earlier, Anxin tries to sell Meng Yao to a customer. Not an uncommon thing to see in a brothel sadly.

We as the readers also are aware of Meng Yao’s signature ‘customer service smile’. This is pretty common with people in the customer service industry. Where you have to keep people happy to keep them from screaming at you. I have no doubt that this is likely a learned behaviour from his childhood at the brothel. All my fellow brothel brats, as well as myself, default to it as well.

Another response is possibly immediate lying/not taking fault in a situation where you are obviously at fault or have been caught red-handed. Think the scene of Meng Yao stabbing the Jin Captain and being caught be Nie Mingjue. Reading this scene, it always felt more like when a child drops a plate and immediately points to the dog to avoid punishment. While the child was clearly at fault, they took the blame off of themselves in an act of self-preservation. I’m not claiming that he was right here, just that his response makes sense to me. I have found myself and many others with a similar background doing it as well.

Well, that was definitely long. I don’t want to come off like I’m ridding Meng Yao of all his faults. I’m only trying to shed light on how some of his responses to things make sense given his upbringing, as well as maybe give people an insight as to how horrible brothels can be, especially to children.

If your mother is the only kind person to you, she is your whole world.

In addition, prostitution is often called ‘the first profession’ or ‘the oldest job’. I think this rings very true. Much of the practices mentioned have been practiced for centuries and likely will continue to be practiced for centuries to come.

If anyone decided to sit through and read everything, thank you. I would also like to apologise in advance for any grammatical or spelling mistakes, English is not my first language. I’m pretty all over the place here so apologies for that as well.

Edit: I forgot to mention the disgust and prejudice that people hold to this day. Meng Yao serving tea and it being seen as ‘tainted’ is a sentiment still somewhat held to this day. Same with him not being allowed to hold Jin Ling due to his perceived ‘dirtiness’. It’s something that is sad but true, and follows people for their entire lives. You will never be clean, due only to the circumstances of your birth and childhood, as well as a desperate attempt to survive. Prostitution is not something people aspire to achieve generally. If they do, they likely don’t understand the long term effects and social stigma that isn’t just limited to you.

Edit 2: Safety is another huge thing, especially for formal brothel brats. Safety comes with power. I’m not excusing Meng Yao’s use of getting power, he definitely used certain means that I don’t agree with. But especially growing up in that setting safety = power. I was given the advice many times growing up to cling to a powerful man in hopes that I become his wife, as that would grant me safety and stability. Many of the children I grew up with ended up working alongside their mothers or turning to drug dealing and criminal activity, which in turn gave them power. I think that what we learn growing up has a huge impact on people as adults. It can be very difficult to unlearn these associations.

Last edit, more of an update: I would like to thank everyone and extend that thanks on behalf of my mother. We are both doing well now. We have both come to America and I have started my own family in the past few months. She has a new job and recently moved. She’s very happy and has many friends here. Thank you all for your kindness and well wishes. Have a lovely day!

screenshots of the original post as well as my messages. cut off, but she did approve this post.

83 notes

·

View notes

Text

[aging userbase alert]

i got my W-2 today & i was like 'yaaay i will file my taxes while i am thinking of it, i now live in a direct file state! it will be easy & not involve handing my information over to some third-party company that might have terrible data handling practices,' because i like to file taxes as early as possible a) so i do not have time to misplace my W-2 and b) because my employer withheld tax for me, so i have functionally been giving the government a free loan & can i just say i do NOT like what uncle sam has been doing with that money, give it back you fucker!!! unfortunately you cannot direct file in my state if you contributed to an IRA (i know this sounds bougie but it is a very common & widely encouraged form of retirement savings, even if you've only got a little bit to sock away), or if you have cash tips, or if you worked as an independent contractor (so, like, gig work; the only 1099 it can handle is a 1099-INT, for interest on bank deposits).

& i hate that! i hate that a lot. the IRA thing is annoying for me but the part where it can't handle cash tips or independent contractor income is actually really bad in my opinion because this excludes a pretty big number of lower income american workers, who are more likely to be taken advantage of by tax preparation companies that will not protect their data & will often attempt to shunt them into confusing paid filing options. or they end up going with scummy irl tax preparers, who make a killing on low income people's tax returns! the IRS desperately wants everyone to e-file because it is much faster & more efficient & in many ways less error-prone, but the free file program has enriched tax preparation companies at the expense of american workers who were underserved & misled, and now direct file leaves out a bunch of basic stuff & excludes people who need it. if you want to e-file for free, supposing you cannot direct file (if you are reading my tumblr blog & need to file taxes in the united states i am sure you fall beneath the income threshold for the free file program), you must go to the IRS's page of free file partners, then shop around to find one that can handle your tax situation & hopefully doesn't have too terrible a track record with customer data. it's stupid & i'm mad about it! there should not be a united states & there absolutely should not be any government of human persons which comports itself with such ridiculous stupidity

8 notes

·

View notes

Text

folks I am curious, if you have the time please answer !

I need to know something : do you guys who live outside of France also have exams to become official workers of the State or not ?

In France there's a public exam system, basically if you want to work in a public institution without one you're forced to do short term contracts for at least 6 years (generally the first one is for 1 year, next one for 2 years, next one for 3) and then after 6 years they can choose to not offer you a long term contract* at which point you have to find another job in another place even if you were excellent at what you were doing.

These exams are divided according to categories (administration, culture, etc) and ranks (A+, A, B, C). A+ is for the highest functions of big institutions, A is to become manager of a service, B is to be an expert working under a manager, C is to be a technician - the lowest grade. Obviously salaries depend on that rank, from A to C they all start at minimum wage or near it basically but the A increases much much faster than the C, which is really poorly paid.

The advantage of getting the exam is Job Security bc in the french system if you get your exam it gives you access to an unlimited-in-time working contract without the 6 years delay* and you become almost impossible to fire (and also you get access to advantages like better housing options, financial helps for moving, and lots of other stuff etc.). These types of contracts are also the only thing that can secure a big bank loan to buy property for exemple.

The main problem is that these exams tend to be insanely difficult, at least for rank A and above, with several 4 hours long written sessions and several oral sessions to go through just to validate one exam, and basically very few people get it compared to the amount of people who attempt it. Even the B category is pretty difficult if you did not get into the right master's programs or selective schools to prepare it. The C category is atteignable but as mentionned above it's not paid well and does not give access to very good jobs.

So...

*these parts were edited after I was provided with additional information

#upthebaguette#france#exams#academia#THIS is dark academia actually. there's nothing darker than attempting a cat. A exam when you're still a student#polls#please im curious#bee tries to talk

28 notes

·

View notes

Text

The Beginning

It's been about a month.

If you couldn't guess by my URL, I am a trans person (FTM) who is entering the HVAC trade. This is for a few reasons.

As the economic crisis rapidly sends us streaming forward toward poverty, my entry level job was not making us (my partner and I) enough money anymore.

Gifted kid burnout caught up to me a long time ago, and with the affordability of college being completely impossible without loans I would never have a hope of paying back, I turned to trades as an option of higher education without the ridiculous price tag.

I am more of a hands on person. Sitting down at an office desk was never for me, and I'm not sure why I ever thought it would be. I want to get my hands dirty, and have a new adventure every day.

Why HVAC specifically? Good question. I was interested in trades in general, how things work has always fascinated me. HVAC was a matter of elimination. Medical was not for me, blood and high stakes stress me out and the cost of those courses are very high. I've already flunked out of engineering classes in high school so anything related to it was a no go. Welding was another good option, but with loud sounds and bright lights my autism and bad hearing were not going to have a good time. The last two I was considering were HVAC and electrical. Each excellent fields and I had high interest in both, so I applied for EMT which is a combination of both (electrical mechanical technician, not the medical worker).

Now a new issue arose, one I have dealt with my whole life.

I am transgender.

The current trans panic, living in the bible belt, not passing well, and the already intimidating trades were a lot to take in a navigate, but I believe I have been very fortunate.

The first step was shopping around for a school and being very up front with how I identify and the situation. Emailing schools made it easier to imagine the school as an entity rather than a collection of people each with their own political views that make them view me very differently. I was ghosted by a couple schools, I am unsure if this is because of my identity or if they thought I was a spammer, but for my sake I'd like to think it was the ladder.

I managed to get pell grants, a few scholarships, loans that are far smaller than they would be for a four year degree, and finally an approved application.

The first couple of months were intimidating, there is a lot to learn in a small amount of time and a recent head injury was not helping. However, I do not give up easily. I found that passing had never been more important to me than ever, and I'm not entirely sure why. Perhaps the far more masculine men around me make me feel more inadequate. Perhaps the trans panic has indeed instilled a terror in me of being clocked as trans far more than I originally thought. Perhaps it is simply paranoia and the unknown. Whatever the case, I've found myself taking more steps than I usually do to pass, including binding. I never really did befores since having covid binding has restricted my breathing when any strenuous activity is involved, my chest is not large to begin with, and the mentioned current economic crisis has made it impossible to save for top.

There have been a couple instances when I was misidentified as female, thankfully my voice saved me in that regard, but when I am stopped up due to the weather, it is not as convincing.

In one instance the wrong name was called (since I have been unable to change it) so I had to pretend like my name was simply not on the roster until I could correct the person in private, embarrassing everyone involved. My existence is very alien, so there is no system in place to change my name or inform staff other than by email or word of mouth. It is all very overwhelming.

Other than all of these moving parts, day to day has been very smooth. I can update in the future if there are any incidents or new challenges come up. Thank you for reading.

2 notes

·

View notes

Text

Revolutionizing Veterinary Relief with Roo: A New Opportunity for Veterinarians

The veterinary profession often demands long hours and heavy workloads, making it difficult for practitioners to achieve a balanced lifestyle. Enter Roo vet, an innovative platform designed to empower veterinarians by offering them the flexibility to choose relief shifts at their convenience. Whether you're looking for a side gig or a complete career shift, Roo allows veterinarians to earn significantly more while maintaining full control over their schedules.

What is Roo and How Does It Work?

Roo is a platform that connects veterinarians with animal hospitals in need of freelance relief workers. The concept behind Roo is simple yet transformative: it provides veterinarians with the freedom to choose their shifts, offering a unique alternative to the conventional full-time work model. After creating a free profile on Roo, veterinarians can easily browse available shifts across over 7,000 hospitals. Whether it’s urgent care, general practice, or emergency shifts, Roo ensures that there’s a variety of options for every vet.

The best part? There is no minimum requirement for hours or shifts. Veterinarians can work as little or as much as they want, making it a perfect option for those seeking flexibility. The platform also offers competitive pay, with relief veterinarians often earning nearly double the hourly rate of a full-time associate. This opportunity enables vets to achieve their financial goals faster, whether it's saving for a down payment on a house, paying off student loans, or simply earning more money on their own terms.

Benefits of Becoming a Roo Relief Veterinarian

Flexible Scheduling Roo gives veterinarians the power to create their own schedules. Whether you’re working full-time elsewhere or pursuing a more flexible career path, Roo lets you pick shifts that fit into your lifestyle. You can take time off whenever you want and come back when it suits you. This flexibility allows for a perfect work-life balance, which many full-time positions in the veterinary field lack.

Increased Earning Potential One of the major draws of using Roo is the opportunity to earn more. Veterinarians can set their rates, and relief veterinarians can often earn nearly twice as much as full-time associates. This higher hourly wage is ideal for those looking to boost their income without committing to long-term positions. The fast payment system ensures that veterinarians are paid promptly, with funds deposited within two business days after completing a shift.

Wide Variety of Shifts With over 7,000 hospitals in the Roo network, there are a wide variety of shifts to choose from. This includes urgent care, general practice, surgery, and even specialty practices. This broad spectrum allows veterinarians to explore new types of veterinary medicine, gain valuable experience, and increase their skill set.

No Membership Fees Signing up with Roo is completely free for veterinarians. There are no hidden fees or membership costs. Roo operates on a simple model where veterinarians only earn money when they work shifts, making it an attractive option for those looking to supplement their income.

Fast Payments and Tax Help After completing a shift, veterinarians are paid quickly—usually within two business days. Roo also offers support in tracking income and mileage, helping independent contractors file taxes with ease. This feature ensures that veterinarians don’t have to worry about complex paperwork, leaving them to focus on what they do best: providing excellent care to animals.

A Career with Flexibility and Purpose

Roo offers much more than just financial benefits. It allows veterinarians to take control of their careers and create a work-life balance that suits their personal needs. Whether you’re seeking more time with family, traveling, or simply enjoying more free time, Roo allows you to shape your veterinary career in a way that works best for you.

Roo also provides veterinarians with opportunities to work with different practices and specialties, broadening their experience and expanding their professional networks. This gives relief veterinarians the chance to learn from a variety of settings, which can be a valuable part of their professional development.

Conclusion

Roo is reshaping the veterinary profession by offering veterinarians the flexibility and financial freedom they deserve. Whether you're looking for additional income, a change in work environment, or greater work-life balance, Roo provides a platform that empowers veterinarians to take control of their careers. With its competitive pay, flexible scheduling, and variety of available shifts, Roo is quickly becoming the go-to choice for veterinarians seeking relief work opportunities.

0 notes

Text

Open Your Future: Top Grants for CNA Training You Need to Know About

Unlock Your Future: Top Grants for CNA Training you Need to Know About

Unlock Your Future: Top Grants for CNA Training You Need to Know About

Becoming a Certified Nursing Assistant (CNA) is an excellent career choice for those passionate about healthcare. With a growing demand for healthcare services, the need for skilled CNAs is increasing, making now the perfect time to pursue this rewarding path. However, one of the most significant hurdles potential CNAs face is the cost of training. Fortunately, various grants can make this journey more attainable. In this article, we will explore the top grants for CNA training that you need to know about to unlock your future.

Understanding CNA Training Costs

The cost of CNA training can vary widely, typically ranging from $500 to $3,000, depending on the program and institution. This cost frequently enough includes:

Tuition fees

Textbooks and learning materials

Uniforms and supplies

Certification fees

Given the financial burden, many students look for grants, which do not need to be repaid, unlike loans. Here’s a look at the most accessible grants available for CNA training programs.

Top Grants for CNA Training

1. Federal Pell Grant

The Federal Pell Grant is a government-funded grant designed for low-income undergraduate students. As a CNA student, you can qualify based on financial need, and it’s worth up to $6,495 per academic year.

Eligibility: Must demonstrate financial need, be enrolled in a qualifying program.

How to apply: Complete the Free Application for Federal Student Aid (FAFSA).

2. Workforce Investment Prospect Act (WIOA)

The WIOA grant provides funding for job training programs, including CNA training, to help individuals secure employment.This grant is notably helpful for unemployed and underemployed individuals.

Eligibility: Must be a Dislocated Worker or meet certain income criteria.

How to apply: Reach out to your local American Job Center.

3. State-Specific Grants

Many states have specific grants for CNA students. For example, California offers the california Community College Chancellors Office grants to students pursuing health careers. Research your state’s options for additional support.

4. Scholarships from Healthcare Organizations

Various healthcare organizations and associations offer scholarships and grants for individuals pursuing careers in nursing and healthcare. Some notable organizations include:

American Red Cross

Nurses Educational Funds

National Black Nurses Association

National Association of Hispanic Nurses

5.Employer Sponsored Training Programs

Many healthcare facilities offer financial assistance for CNA training as part of their commitment to workforce development. Programs may include:

Tuition reimbursement upon employment

Paid training programs

Benefits of Pursuing CNA Grants

Receiving a grant can significantly ease the financial burden of education.Here are key benefits of pursuing CNA grants:

No repayment required: Unlike loans,grants do not need to be repaid,giving you financial freedom post-graduation.

Expanded opportunities: Grants can open doors to higher-quality training programs that might have been financially out of reach.

Less financial stress: Fewer student debts allow you to focus on your education and training rather than financial woes.

Practical Tips for applying for CNA Grants

Applying for grants can feel daunting, but it doesn’t have to be. Here are some practical tips to enhance your application process:

Research Options: Thoroughly research all grant options available to you. tailor your search based on state, financial need, and specific programs.

Stay Organized: Keep track of deadlines and required documentation. A checklist can be very beneficial.

Write a Strong Personal Statement: Many grants require a personal statement. Be honest about your motivations for becoming a CNA and your future career goals.

Seek Help: Don’t hesitate to ask for assistance from educators or professionals who can review your applications.

Case Studies: success Stories

Real-life examples can shed light on the benefits of pursuing CNA grants. here are two inspiring stories:

Maria’s Journey

Maria, a single mother of two, struggled to find a way to finance her CNA training. After applying for the Federal Pell Grant and receiving assistance from her local workforce agency through WIOA, she was able to enroll in her local community college. Today, Maria works as a CNA and is pursuing further nursing education.

John’s Transformation

John was unemployed and looking for a meaningful career when he discovered CNA programs.With a grant from a local healthcare organization, he completed his training without financial stress. John is now proudly serving his community as a CNA and is grateful for the support he received.

First-Hand Experience from Current CNAs

What do current CNAs say about the value of financial aid during their training? We gathered insights from several CNAs who benefited from grants:

“I never woudl have been able to afford the training if it weren’t for the Pell Grant. It changed my life!” - Sarah, CNA.

“The support from my employer allowed me to start my CNA journey with confidence. I’m grateful every day!” – Michael,CNA.

Conclusion

Pursuing a career as a CNA is a rewarding endeavor, especially in today’s healthcare landscape. Funding your education through grants is not onyl feasible but also a smart financial decision. With many options available, it’s essential to research each grant thoroughly and prepare a compelling application. By taking advantage of these opportunities, you’re not just unlocking your future—you’re paving the way for a fulfilling career in healthcare.

youtube

https://cnatrainingprogram.net/open-your-future-top-grants-for-cna-training-you-need-to-know-about/

0 notes

Text

Open Your Career Potential: A Comprehensive Guide to CNA Course Costs and Financing Options

Unlock Your Career Potential: A complete Guide to CNA Course Costs and Financing Options

are you ready to take the first step toward a rewarding career in healthcare? Becoming a Certified Nursing Assistant (CNA) offers numerous opportunities for personal and professional growth. But before you plunge into this vibrant field,it’s crucial to understand the costs associated with CNA courses and the various financing options available to you. This comprehensive guide will help illuminate your path to becoming a CNA.

Understanding CNA Course Costs

The cost of CNA training can vary significantly based on several factors, including location, type of programme, and duration. Here’s a breakdown of average costs:

Type of Program

Average Cost

Community College

$1,200 – $2,500

Vocational Schools

$1,500 – $3,000

Online Courses

$300 – $1,500

On-the-Job Training

Varies (often free)

Key Factors Affecting CNA Course Costs

When evaluating the costs, consider the following factors:

Location: Costs can vary widely depending on the stateS demand for healthcare workers.

Institution Type: Community colleges might offer cheaper programs compared to private vocational schools.

Course Length: Shorter courses can be less expensive as they may not include extensive clinical training.

Additional fees: Textbooks, exam fees, and certification may add to overall costs.

Financing Options for CNA Courses

Don’t let a tight budget deter you from pursuing your CNA certification.Here are several financing options to consider:

1. Government Grants and Scholarships

Many organizations and local governments provide scholarships specifically for healthcare training. Check the following options:

Pell Grants: Federal funding for low-income students.

State Grants: Various states offer their own financial aid programs.

Institution-specific Scholarships: Many schools offer scholarships to prospective students.

2. Financial Aid Programs

Filling out the Free Submission for Federal Student Aid (FAFSA) can open doors to federal financial aid programs, including:

Loans: Low-interest loans that you pay back over time.

Work-Study programs: Part-time jobs to help cover expenses while studying.

3. Employer Sponsorship

Some healthcare employers offer to cover tuition costs in exchange for a commitment to work for them post-certification. This can be a fantastic way to get the training you need.

4. Payment Plans

Most training institutions offer payment plans that allow you to pay your tuition in installments, making it more manageable.

Benefits of Becoming a CNA

investing in your CNA training has numerous benefits, including:

Job security: The healthcare field is growing, and CNAs are in high demand.

Flexible Work Hours: Many healthcare facilities offer flexible scheduling.

Gateway to Further Opportunities: Becoming a CNA can open doors for higher education and advanced nursing roles.

Fulfillment: Help individuals live healthier lives and provide essential care.

Practical Tips for CNA Training Success

To maximize your investment in CNA training, consider these handy tips:

Research programs thoroughly to find one that suits your schedule and budget.

Connect with current CNAs for feedback on their training experiences.

Utilize online resources and study groups to enhance your learning.

Stay organized and manage your time efficiently to balance study and practical training.

Case Studies: Real-Life Experiences

Understanding the experiences of others may help in your decision-making. Here are a couple of stories:

Case Study 1: Sarah’s Journey

Sarah,a single mother,pursued CNA training at a local community college. She utilized a pell Grant and a payment plan, which allowed her to study while managing family responsibilities. Today, she works at a nursing home and is considering furthering her education.

Case Study 2: John’s Employer Sponsorship

John was lucky to secure a position as a part-time aide in a hospital while taking his CNA course. The hospital covered his tuition, and now he is a dedicated CNA with aspirations to become a licensed practical nurse (LPN).

Conclusion

becoming a Certified Nursing Assistant is a meaningful step toward a fulfilling career in healthcare.Despite the various costs associated with CNA courses, there are numerous financing options available to help you launch your career without financial burden.By understanding these costs, exploring financing options, and leveraging the benefits of this profession, you can effectively unlock your career potential. Start your journey today and become a vital part of the healthcare community!

youtube

https://cnaclassesonline.net/open-your-career-potential-a-comprehensive-guide-to-cna-course-costs-and-financing-options/

0 notes

Text

Best Loan Options for Part-Time Workers: Smart Picks

The best loan options for part-time workers include personal loans and specialized part-time worker loans. Credit unions often provide flexible terms tailored to irregular income patterns. Securing a loan as a part-time worker can be challenging due to fluctuating income and potentially limited work history. Nevertheless, there are financial institutions that cater to those with less…

View On WordPress

0 notes

Text

Leading CNA Training Programs in NY: Your Guide to a Rewarding Healthcare Career

Top CNA Training Programs in NY: Your Guide to a Rewarding Healthcare Career

Top CNA Training Programs in NY: Your Guide to a Rewarding Healthcare Career

Are you considering a career in healthcare? Becoming a Certified Nursing Assistant (CNA) can be a rewarding pathway. With a growing demand for healthcare workers, especially in New York, CNA training programs are more relevant than ever. This article provides a comprehensive overview of the best CNA training programs in New York, benefits of becoming a CNA, and practical tips to succeed in your new career.

Why Choose a CNA Career?

Choosing a career as a CNA offers numerous benefits:

Job Stability: The healthcare industry is rapidly growing, ensuring numerous job opportunities.

Flexible Hours: CNA jobs often provide flexible schedules, accommodating various lifestyles.

Personal Fulfillment: Helping patients improve their quality of life is an immensely rewarding experience.

Career Advancement: Many CNAs choose to continue their education in nursing or other medical fields.

Key Requirements for Becoming a CNA in New York

Before enrolling in a CNA training program, it’s essential to meet the following requirements:

You must be at least 16 years old.

A high school diploma or GED is typically required.

Pass a background check.

Complete a state-approved training program and pass the CNA exam.

Top CNA Training Programs in New York

Here are some of the leading CNA training programs across New York that equip students with the necessary skills and knowledge:

Training Program

Location

Duration

Cost

The City University of New York (CUNY)

New York City

6-8 weeks

$1,200

Western New York Institute of Technology

Buffalo

4-6 weeks

$900

New York Institute of Technology (NYIT)

Old Westbury

8 weeks

$1,500

Herkimer College

Herkimer

6 weeks

$800

Long Island School of Nursing

Hempstead

4 weeks

$1,300

1. The City University of New York (CUNY)

CUNY offers a comprehensive CNA program that covers essential skills through classroom instruction and hands-on training. With several campuses throughout the city, students have various options to choose from.

2. Western New York Institute of Technology

This institute provides an accelerated program that allows students to finish quickly while maintaining a high standard of education. With experienced instructors, students gain valuable knowledge and training.

3. New York Institute of Technology (NYIT)

NYIT’s program emphasizes patient care and practical skills in a supportive environment. Students benefit from state-of-the-art facilities and access to experienced healthcare professionals.

4. Herkimer College

Herkimer College offers an affordable CNA program with flexible scheduling options, catering primarily to adult learners and those seeking part-time training.

5. Long Island School of Nursing

This program is known for its quick completion time and extensive curriculum, preparing students effectively for the certification exam and future employment.

Financial Aid Options for CNA Training

Investing in CNA training can be financially challenging, but various programs offer financial aid options:

Federal Financial Aid: Fill out the FAFSA application to determine eligibility for grants and low-interest loans.

Workforce Development Programs: Local and state programs may provide funding to help with training costs for eligible individuals.

Scholarships: Look for scholarships specifically for healthcare training, offered by schools, organizations, and foundations.

First-Hand Experiences: Success Stories of CNAs in New York

Many CNAs in New York have shared their success stories that highlight the rewarding nature of the profession:

“As a CNA, I have developed strong relationships with my patients, which makes my job every day worth it. The training I received prepared me well, and I now aim to further my education in nursing.” – Emily Richards

“I started as a CNA to support my family. The skills I acquired and the experiences I’ve had were life-changing. I’ve now advanced to a nursing position at the same facility!” – John Doe

Practical Tips for Success in Your CNA Career

Once you’ve completed your CNA training, consider these practical tips to thrive in your career:

Stay Organized: Maintain a detailed schedule and documentation for patient care.

Communicate Effectively: Build strong communication skills to interact effectively with your team and patients.

Continue Learning: Pursue continuing education courses to enhance your skills and advance your career prospects.

Practice Compassion: Caring for patients is at the heart of being a CNA. Always approach your work with empathy.

Conclusion

Choosing to become a CNA in New York is not just about embarking on a job; it’s about starting a career filled with opportunities to make a meaningful impact. With various training programs available, financial aid options, and the chance to advance your education, the journey to becoming a Certified Nursing Assistant has never been more accessible. If you’re passionate about helping others and are looking for stability in your career, a CNA program could be the perfect fit for you. Take the leap today and begin your rewarding journey in healthcare!

youtube

https://trainingcna.org/leading-cna-training-programs-in-ny-your-guide-to-a-rewarding-healthcare-career/

0 notes

Text

The Future of Employee Benefits and Compensation

In the ever-evolving world of work, employee benefits and compensation have seen significant changes in recent years, with the future promising even more transformation. As organizations strive to meet the expectations of an increasingly diverse workforce, the future of employee benefits and compensation is becoming more complex and individualized. Technological advancements, shifting employee expectations, demographic changes, and the rise of new business models are driving these changes. The future of compensation and benefits will likely emphasize flexibility, inclusivity, personalization, and a stronger focus on employee well-being.

1. Personalization and Flexibility

As employees increasingly seek tailored experiences, organizations are recognizing that a one-size-fits-all approach to benefits and compensation is no longer sufficient. Future benefits packages will offer employees more control and flexibility in how they structure their benefits, enabling them to select the perks that best align with their individual needs.

This flexibility can take many forms. For example, employees may choose between different types of healthcare plans based on their personal or family needs, or opt for various retirement savings options that better suit their financial goals. Beyond traditional benefits like health insurance and retirement contributions, flexible benefits packages may also include options for wellness programs, professional development, and even sabbaticals or extended leave. The rise of flexible spending accounts (FSAs) and health savings accounts (HSAs) allows employees to allocate funds for medical expenses in a way that works best for them.

With personalization at the forefront, employers will increasingly provide platforms and tools that allow employees to customize their benefits. These digital platforms can give employees the ability to adjust their benefits year-round, rather than during an annual open enrollment period. In doing so, employees can adapt their benefits to life changes such as marriage, childbirth, or even pursuing further education.

2. Holistic Well-Being: Mental Health and Beyond

The future of employee benefits is increasingly focused on holistic well-being, going beyond traditional physical health benefits to address mental, emotional, and financial health. The COVID-19 pandemic accelerated the recognition of mental health challenges in the workplace, and employers are responding with programs aimed at providing support for mental health, stress management, and emotional resilience.

Organizations are offering mental health days, counseling services, and access to apps or platforms for meditation and stress relief. Flexible schedules and remote work policies also contribute to reducing workplace stress, giving employees more control over their work-life balance. Furthermore, mental health benefits are no longer seen as a luxury; they are becoming an essential part of employee well-being and are increasingly expected by workers, especially among younger generations.

Financial wellness is another growing trend. Employers are beginning to offer benefits like financial counseling, student loan repayment assistance, and budgeting tools. With the rising costs of living and student debt, these benefits are particularly valuable to younger employees. Employers are recognizing that employees who feel financially secure are more likely to be productive and satisfied with their jobs.

3. Technology Integration and Data-Driven Decision Making

Advancements in technology are reshaping the landscape of employee benefits and compensation. Human Resource (HR) software and digital platforms allow organizations to track employee preferences, performance, and engagement in real-time. This data is being used to design more effective and targeted benefits packages that align with the needs and preferences of employees.

For example, data analytics can help companies identify trends in employee behavior, such as the types of benefits that lead to higher retention or engagement. HR platforms that integrate artificial intelligence (AI) and machine learning can predict which benefits will appeal to different demographic groups, from younger workers who prioritize student loan assistance to older employees interested in retirement planning tools.

Moreover, technology facilitates the administration of compensation and benefits programs. Automation can simplify processes such as payroll, performance evaluations, and benefits enrollment, making these systems more efficient and less prone to errors. As companies collect more data on employee satisfaction, they can continuously fine-tune benefits and compensation offerings to ensure they meet the evolving needs of their workforce.

4. Equity and Inclusivity in Compensation

Another key trend in the future of employee benefits and compensation is the focus on equity and inclusivity. As organizations place more emphasis on diversity and inclusion, compensation practices will reflect a more equitable approach. Employers are increasingly looking at pay equity and taking steps to ensure that there is no discrimination based on gender, race, or other factors.

Pay transparency is likely to become more common, with employers sharing salary ranges and benefits information upfront, making it easier for employees to compare compensation packages and understand how their pay is determined. This transparency helps to build trust between employers and employees and reduce disparities in compensation across different groups.

Inclusive benefits packages will also become the norm. Companies will be expected to provide benefits that cater to diverse populations, including LGBTQ+ employees, employees with disabilities, and those from different cultural backgrounds. For instance, offering parental leave that includes both maternity and paternity leave, or providing health coverage for fertility treatments and gender-affirming care, is becoming a standard expectation. Flexibility in work arrangements will also be increasingly important for employees with caregiving responsibilities, whether for children, aging parents, or other loved ones.

5. Sustainability and Corporate Social Responsibility (CSR)

As environmental consciousness grows, employees are increasingly interested in working for companies that align with their values. In response, employers are incorporating sustainability into their benefits offerings. For example, companies might offer benefits such as subsidized public transportation passes, electric vehicle charging stations at the workplace, or contributions to green initiatives that allow employees to contribute to sustainability goals.

Additionally, many companies are adopting corporate social responsibility (CSR) programs that allow employees to volunteer for causes they care about. Paid volunteer time off (VTO) or company-sponsored charity events may become standard components of benefits packages in the future. By aligning their compensation and benefits packages with sustainability and social responsibility goals, employers are demonstrating their commitment to ethical practices and attracting socially conscious employees.

Conclusion

The future of employee benefits and compensation will be shaped by the growing demand for flexibility, inclusivity, and holistic well-being. Employers will need to rethink traditional benefit models and embrace new approaches that reflect the changing needs and values of the workforce. Personalization and technology will play a critical role in offering tailored benefits, while mental health and financial wellness will become increasingly prioritized. Equity, inclusivity, and sustainability will define compensation practices, ensuring that organizations can attract and retain a diverse, engaged, and satisfied workforce.

As the workforce continues to evolve, companies must remain agile and responsive to these changes. The future of employee benefits and compensation is not just about staying competitive in the marketplace; it’s about creating an environment where employees feel valued, supported, and empowered to thrive both professionally and personally.

0 notes

Text

How to support employee financial wellness before 2024 ends?

Supporting employee financial wellness is essential for enhancing job satisfaction, reducing stress, and improving overall productivity. With the year nearing its end, employers can take several steps to help employees improve their financial well-being. Here are some practical ways to support employee financial wellness before 2024 ends:

1. Offer Financial Education Programs

Workshops and Webinars: Provide educational workshops on financial literacy topics such as budgeting, saving, investing, debt management, and retirement planning. These can be virtual or in-person.

Access to Financial Advisors: Partner with financial advisors to offer free or subsidized sessions where employees can discuss their personal financial situations and get expert advice.

uKnowva HRMS Integration: Utilize uKnowva HRMS to organize and track participation in financial wellness programs, making it easy for employees to access learning materials and register for sessions.

2. Provide Access to Retirement Plans and Financial Tools

Retirement Planning: If you haven’t done so already, ensure employees are enrolled in a retirement savings plan like a 401(k) or pension scheme, and offer employer matching contributions where possible.

Financial Planning Tools: Offer employees access to digital tools or apps for budgeting, saving, or managing personal finances. uKnowva HRMS can integrate financial planning tools to help employees track and plan for their future goals.

Year-End Retirement Check: Encourage employees to review their retirement plans before the year ends, ensuring that they’re on track with their goals and taking full advantage of employer contributions.

3. Introduce Flexible Payment Options

On-Demand Pay: Offer employees the option to access earned wages before payday. This can reduce financial stress by allowing workers to manage emergencies without relying on expensive short-term loans.

Bonus and Incentives: Consider providing year-end bonuses, profit-sharing, or performance incentives to reward employees and boost their financial stability.

uKnowva HRMS: Through uKnowva HRMS, automate payroll management and give employees visibility into their earnings, allowing them to manage their financial needs better.

4. Expand Benefits to Include Financial Wellness Perks

Emergency Savings Plans: Help employees build an emergency savings fund by offering payroll deductions into a dedicated account. Matching contributions or small employer contributions can incentivize savings.

Debt Assistance Programs: Introduce student loan repayment programs or debt consolidation support. Employees facing debt challenges will appreciate this additional financial relief.

Financial Wellness as a Benefit: Consider including financial wellness tools, such as access to financial coaching or subscription services, as part of your overall benefits package.

5. Promote Healthcare and Insurance Benefits

Health Savings Accounts (HSA): Encourage employees to contribute to HSAs to save for future medical expenses in a tax-advantaged way.

Review Insurance Coverage: Ensure employees understand and are using health, dental, and life insurance benefits, which can help protect them from unexpected medical costs.

Year-End Benefit Reminders: As 2024 approaches, send reminders through uKnowva HRMS about deadlines for benefits enrollment and FSA/HSA contributions.

6. Provide Support for Managing Holiday Expenses

Holiday Budgeting: Offer tips and tools for managing holiday expenses, including creating a budget, using rewards points, or buying within limits.

Employee Discounts: Provide discounts or partnerships with retailers for holiday shopping. Employers can also offer coupons or cashback programs to help employees manage costs during the holiday season.

Gifts and Recognition: Consider giving thoughtful gifts or extra paid time off (PTO) as a non-monetary way of recognizing employees during the holiday period.

7. Encourage Open Communication About Financial Concerns

Anonymous Feedback Channels: Create anonymous channels for employees to express financial concerns or request assistance. This can help you tailor future financial wellness initiatives.

Financial Wellness Surveys: Use uKnowva HRMS to conduct surveys assessing employee financial health and needs. Based on survey results, adjust or introduce new financial wellness programs for 2024.

8. Support Mental Health and Financial Well-Being

Stress Management Programs: Financial stress can lead to mental health issues, so offer mental health resources such as employee assistance programs (EAPs) and stress management workshops.

Work-Life Balance: Encourage employees to take paid time off and maintain a work-life balance, which can reduce burnout and give them time to manage personal financial matters.

Mindfulness and Financial Planning: Include mindfulness practices and wellness programs that help employees manage stress, including financial-related stress.

9. Create a Year-End Financial Wellness Checklist

Encourage employees to review the following before the year ends:

Retirement contributions and potential adjustments

Tax planning and deductions

Health insurance enrollment or changes

End-of-year spending and savings goals

uKnowva HRMS can be used to send reminders or checklist templates to employees to help them stay on top of their financial planning.

By implementing these strategies before the end of 2024, companies can support their employees’ financial well-being, reduce stress, and boost morale. Tools like uKnowva HRMS make it easier to deliver these initiatives efficiently and track employee engagement in financial wellness programs.

#hr services#hr management#employee financial benefits#learning and development#employee expectations

0 notes

Text

How to Set Up a New Business in Saudi Arabia: A Comprehensive Guide

Starting a business in Saudi Arabia has become an attractive option for entrepreneurs and companies due to the Kingdom's growing economy and business-friendly reforms. Whether you're a seasoned businessperson or a first-time entrepreneur, setting up a new business in Saudi Arabia is now easier than ever with the right guidance. In this blog, we’ll guide you through the steps of launching your new venture and how Capital International Group can assist you every step of the way.

Why Start a Business in Saudi Arabia?

Saudi Arabia, the largest economy in the Middle East, has undergone significant reforms in recent years to attract foreign investors and boost entrepreneurship. The country’s Vision 2030 initiative is aimed at diversifying the economy, reducing dependence on oil, and promoting sectors like technology, healthcare, manufacturing, and tourism. Some benefits of starting a business in Saudi Arabia include:

Tax Incentives: Favorable corporate tax rates and no personal income tax.

Strategic Location: Gateway to the MENA (Middle East and North Africa) region.

Growing Market: An expanding population with rising purchasing power.

Business-Friendly Environment: Simplified procedures for business incorporation and investor protection.

Steps to Start a Business in Saudi Arabia

1. Choose the Right Business Structure

The first step is to decide on the legal structure of your business. Saudi Arabia offers several options, including:

Sole Proprietorship

Limited Liability Company (LLC)

Branch of a Foreign Company

Joint Stock Company

Each business structure has its pros and cons, depending on your long-term goals, capital, and the level of liability you are willing to take on. For most new businesses, an LLC is a popular choice due to its flexibility and protection of personal assets.

2. Obtain a Commercial Registration (CR)

A Commercial Registration (CR) is a mandatory step to legally operate in Saudi Arabia. You will need to submit your business name, industry type, and relevant documents to the Ministry of Commerce and Investment (MCI) to get the CR. This step can be done online through the ministry’s portal.

3. Secure Necessary Licenses and Permits

Depending on the nature of your business, specific licenses or permits may be required. For example, if you are in the food industry, you’ll need health and safety permits. Capital International Group can help you identify the right permits for your business and assist in the application process.

4. Open a Saudi Bank Account

To conduct business in Saudi Arabia, you must open a corporate bank account. Several major banks in Saudi Arabia, such as Al Rajhi Bank and Saudi National Bank (SNB), offer tailored services for businesses. To open an account, you’ll need your CR and other legal documentation.

5. Hire Employees and Register with GOSI

Once you’ve set up your company, you can begin hiring employees. Saudi labor law encourages hiring local talent, but you can also recruit foreign employees. As part of the hiring process, you’ll need to register your employees with the General Organization for Social Insurance (GOSI), which handles workers' benefits and compensation.

6. Understand Taxation and Zakat

Saudi Arabia has a corporate tax rate of 20% for foreign-owned companies and Zakat, a form of almsgiving required from Muslim-owned businesses. Understanding your tax obligations and ensuring compliance is crucial to avoid penalties. At Capital International Group, we offer expert tax advisory services to keep your business compliant.

7. Create a Business Plan and Seek Financing

Before launching your business, develop a detailed business plan outlining your objectives, target market, revenue model, and growth strategies. If you require additional capital, consider exploring Saudi Arabia’s numerous financing options, including government-backed loans for SMEs.

Why Choose Capital International Group for Business Setup?

At Capital International Group, we specialize in helping entrepreneurs and foreign investors successfully launch their businesses in Saudi Arabia. Our services include:

Business structure consultation

License and permit acquisition

Taxation and Zakat advisory

Employee recruitment and GOSI registration

Local market insights and growth strategies

We simplify the entire process, allowing you to focus on building your business while we handle the regulatory and legal aspects.

Conclusion

Starting a new business in Saudi Arabia presents a wealth of opportunities, but it requires careful planning and knowledge of local regulations. With the right guidance from Capital International Group, you can navigate the setup process smoothly and position your business for long-term success.

Ready to start your business in Saudi Arabia? Contact Capital International Group today and let us make your entrepreneurial journey seamless.

#saudi#business#business setup services in dubai#capital international group saudi#saudi business setup#business setup#startup

0 notes

Text

Prudential 401k: A Comprehensive Guide to Optimal Retirement

This easy-to-understand guide takes a close look at Prudential 401k plans, with the goal of helping you grow your retirement savings.

The article has a simple structure, including an introduction, body, and conclusion, and is written in a way that makes it easy for readers to learn about their plan. We've also used a lot of transition words to make the article flow smoothly.

I. Learning About Prudential 401k Plans

- First, what are Prudential 401k Plans? We'll start by talking about the basics of Prudential 401k plans, why they're important for retirement savings, and how they work. - Next, different types of plans offered by Prudential:

In this part, we'll discuss the various plans provided by Prudential, explain what makes them different, and help you choose the right plan for you. - Finally, the pros and cons of Plans: Here, we'll go over the benefits and possible downsides of using plans for your retirement savings.

II. Starting Your Prudential Retirement Plan

- First, signing up for your employer's Prudential 401k plan: We'll cover how to enroll in your company's plan, including key dates, what you'll need, and setting up your account.

- Then, looking at investment options: In this section, we'll help you understand the different investment choices within your plan, such as risk levels and how to diversify your investments.

- Lastly, contribution limits, extra savings for older workers, and employer match: We'll explain how much you can contribute, how older employees can save more, and ways to get the most from your employer's matching contributions.

III. Managing Your Savings Plan

- First, keeping track of your investments and making changes: In this part, we'll talk about how to keep an eye on your investments and change your plan as your financial goals change. - After that, moving money between plans: Here, we'll discuss how to transfer money from an old 401k or an IRA to your Prudential 401k, including the rules and tax issues involved.

- Finally, choosing who gets your account if something happens to you: We'll end by discussing why it's important to name a beneficiary for your 401k account and keep it updated so your retirement money goes where you want it to.

IV. Getting Ready for Retirement: Prudential 401k Tips

- First, when to retire and withdrawal rules:

We'll look at the rules for when you can retire and how to take money out of your 401k plan. - Next, how to make your retirement money last: We'll offer tips for making the most of your retirement savings, such as when to withdraw funds, managing required withdrawals, and other ways to save for retirement. - Lastly, thinking about other ways to get retirement income: Finally, we'll discuss the pros and cons of using annuities and other products to get more income after you retire.

V. Dealing with Emergencies: Accessing Your 401k Savings

- First, loans and emergency withdrawals: We'll review how you can borrow from your 401k plan or make withdrawals in an emergency, and what rules you need to follow.

- Then, taxes, penalties, and paying back loans: We'll explain possible taxes and penalties for using your 401k money early, and how to pay back loans you've taken. - At the end, the long-term effects on your retirement savings: To finish the guide, we'll consider how using your retirement money too soon might affect your future financial security and offer ways to stay on track even when times are tough. `Learn more about Prudential 401k plans and investment options on Prudential's official website` With this easy-to-read guide, you'll be prepared to make smart choices about your Prudential 401k plan and enjoy a more secure retirement. "Find useful tips on managing your personal finances here." Read the full article

#prudential401k#Prudential401kSavingsPlan#PrudentialEmployeeRetirementPlan#PrudentialPensionPlan#PrudentialRetirementPlan

0 notes

Text

Four Must-Have Insurance Coverage An Individual Needs

Accidents and unexpected life-events usually can’t be prevented from happening, but we can get protection from them.

Insurance is specially designed to shield us or at least safeguard us financially when certain things happen. As you know insurance has numerous options you can choose from, but it doesn’t mean you need to have them all.

Purchasing the right amount of coverage and type of plans are always determined by the specific situations. It is difficult to determine the insurance coverage you really need.

Many kinds of insurance, like auto insurance if you own a car or liability insurance if you run a business, are needed by law. If you don't have the needed insurance, you could get fines, face legal consequences, or even lose your license or business license.

However, according to financial experts, these types of insurance are the most recommended. Everyone should all have life, health, auto, and long-term disability. This article will help you determine what insurance is a must-have. We’re going to explain to you why these four are the essentials coverage everyone needs.

4 Types Of Insurance Everyone Must Have

Life Insurance. One of the greatest benefits of life insurance is the ability to cover the final expenses, which are funeral expenses, and provide a death benefit for those loved ones you leave behind. It is must-have insurance especially if you have a family that relies only on your income. Experts say that get a policy that covers ten times your yearly income, but that’s a number not everyone can afford. When calculating the amount of life insurance you need, remember to add daily living expenses on your estimation, not just the funeral expenses. These daily expenses include mortgage payments, outstanding loans, taxes, child care, and future college expenses. There are two types of life insurance you can choose from traditional whole life and short-term life. If you consider having life insurance, you can seek advice from financial experts or insurance agents to determine which is the best coverage for you.

Health Insurance. According to a study by the American Journal of Public Health in 2019, the majority of Americans who filed for personal bankruptcy are because of medical problems, due to bills, income loss due to illness, or both. Health insurance has become expensive these days, fewer and fewer people can afford it. If you are one of the people who can’t afford it, the best and least expensive option is by participating in your employer’s insurance program. But sometimes, smaller businesses do not offer this kind of benefit. You can check with trade organizations or associations for possible group health plans if your employer doesn’t offer health insurance benefits. If also this is not an option, You’ll be needing to buy health insurance on your own.

Long-Term Disability. This is the type of insurance everyone thinks they don’t need. The least coverage everyone will acquire. But according to a statistic from the Social Security Administration, 1 out 4 workers entering the workforce will most likely become disable and will be unable to continue to work before they reach the retirement age. Sometimes, even those workers who have the best insurance life and health policy don’t prepare for that day. 95% of the number of disability accidents illnesses that are not work-related. Meaning, while your health insurance covers most of your medical expenses, you’re still left with those daily living expenses that your paycheck normally covers. Most employers offer both short and long-term disability as part of the benefits package.

Auto Insurance. The number one cause of death for Americans between the age of 5 and 24 was car accidents. There are 38,000 people estimated who died in car crashes in 2019 alone. While not all states require drivers to have auto insurance, most do have regulations regarding financial responsibility in the event of accidents.

How To Save On Insurance Premiums

Insurance premiums can be a big cost, but there are ways to save money without giving up security. Here are some ways to save money on your insurance:

Shop around. The first step to saving money on insurance rates is to get quotes from more than one company and compare them. Make sure to look at both the coverage and the price, and don't be afraid to talk with insurers to get a better deal.

Increase deductibles. By reducing some of the risk to you, raising your deductibles can help lower your rates. Just make sure you can pay the higher out-of-pocket costs if you need to make a claim.

Bundle your policies. When you buy home and car insurance from the same company, for example, you may get a discount. By putting all of your insurance with one company, you can save money on your premiums.

Maintain a good credit score. Your credit score can affect how much you pay for insurance because insurers use it to figure out how risky you are. Keeping your credit score high can help you get better rates.

Ask about discounts. Insurance companies often give discounts to people who do things like drive safely, put safety features in their home or car, or join to certain professional groups. When shopping for insurance, be sure to ask if there are any savings you can get.

Consider usage-based insurance. Usage-based insurance plans, like those for auto insurance, use information about how you drive to figure out how much you pay for insurance. If you sign up for a usage-based program, you could save a lot on your rates if you are a safe driver.

Review your policy regularly. Your insurance needs change as your life does. By reviewing your coverage often, you can make sure you're not over- or under-insured, both of which can cause your premiums to go up.

The bottom line is most financial experts agree that these four insurance coverage are the four types of insurance everyone must have. If you are one of the people who cannot afford any of this, check your employer’s available coverage. If not, the last option is to get your own coverage.

But at Boise Health & Life Insurance Agency , we recommend obtaining quotes from several insurance carriers to compare them and give you the best plans for you with the right amount. While insuranc e is expensive, not having it could be more costly.

Thank You For Reading!

Originally published here: https://www.goidahoinsurance.com/four-must-have-insurance-coverage-an-individual-needs

0 notes

Text

Different Types of Personal Insurance

Personal insurance Sydney provides protection against the risks of illness, accidents and loss of income. There are different kinds of cover based on your needs and preferences.

There are some quick and easy plans available but you should be sure they meet your needs and are worth the cost. You might be able to get some discounts and rebates from health funds.

Life cover