#Online Electronic Payments

Explore tagged Tumblr posts

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

As your trusted merchant services provider, Your Merchant Services Rep is committed to delivering reliable and flexible payment solutions that meet the unique needs of your business. With NMI Payment Gateway, you can streamline your payment processing, enhance your customer experience, and grow your business with confidence. Visit Us;

#nmi payment gateway#merchant account fees#electronic merchant solutions#online payment gateway integration#merchant account for car dealership

4 notes

·

View notes

Text

How to Make EFTPS Payments Using TaxBandits: A Step-by-Step Guide

For businesses responsible for paying federal taxes, the Electronic Federal Tax Payment System (EFTPS) offers a convenient way to submit payments electronically. While the IRS provides its own EFTPS system, using a comprehensive tax solution like TaxBandits can simplify the process even further. In this article, we’ll walk you through how to make EFTPS payments using TaxBandits, ensuring that your tax payments are submitted accurately and on time.

Why Use TaxBandits for EFTPS Payments?

TaxBandits offers a seamless and integrated platform to manage your tax obligations, including EFTPS Online payments. By using TaxBandits, you can:

Save Time: Automate payment submissions without the need to re-enter data each time.

Minimize Errors: Integration with your payroll and accounting systems reduces the chances of manual errors.

Stay Compliant: TaxBandits keeps you up-to-date with tax laws and deadlines, so you never miss a payment.

With these benefits in mind, let’s dive into how you can make your EFTPS payments using TaxBandits.

Step 1: Log in to Your TaxBandits Account

Before you can make EFTPS payments, you’ll need to have a registered TaxBandits account. Once logged in:

Go to the Dashboard: The dashboard provides a summary of your account, including any upcoming tax deadlines.

Access the EFTPS Section: Navigate to the EFTPS payment section from the main menu to begin the payment process.

Step 2: Set Up Your EFTPS Account in TaxBandits

If this is your first time making an EFTPS payment through TaxBandits, you’ll need to set up your EFTPS account. This includes:

Employer Identification Number (EIN): Provide your business’s EIN, which is required for making federal tax payments.

Banking Information: Input the bank account details from which the payments will be debited. Ensure that the account has sufficient funds for the tax payment.

PIN and Password: If you already have an EFTPS account registered with the IRS, you’ll need to enter your unique PIN and password to authorize payments through TaxBandits.

Once your account is set up, it will be securely stored for future payments, so you don’t have to re-enter these details again.

Step 3: Select the Tax Form and Payment Type

TaxBandits simplifies the process by automatically populating tax payment information based on your payroll data. Here’s how:

Select the Type of Tax: Choose from the list of federal taxes you need to pay. Common payment types include:

Income tax withholding (Form 941)

Social Security and Medicare taxes (Form 941)

Unemployment tax (Form 940)

Estimated tax payments (Form 1040-ES)

Enter the Payment Amount: TaxBandits will automatically calculate the payment amount based on the data in your account. However, you can manually adjust the amount if necessary.

Verify Payment Codes: Each tax payment type requires a specific payment code, which is automatically assigned by TaxBandits. This ensures that your payment is applied to the correct tax type and period.

Step 4: Schedule Your Payment

With TaxBandits, you have the flexibility to schedule your payments in advance, ensuring that you meet all IRS deadlines without hassle:

Choose a Payment Date: You can select the date you want your payment to be processed. TaxBandits allows you to schedule payments up to 365 days in advance.

Set Up Recurring Payments: For businesses with regular tax obligations, such as payroll taxes, you can set up recurring payments to avoid the risk of missing a deadline.

Step 5: Review and Submit

Before submitting your payment, it’s essential to review all details to ensure accuracy:

Payment Summary: TaxBandits will display a summary of your payment details, including the tax type, amount, and scheduled date.

Verify Bank Information: Double-check your bank account details to ensure the payment will be debited from the correct account.

Submit the Payment: Once you’re satisfied with the details, click “Submit” to process the payment. TaxBandits will securely transmit your payment to the IRS via EFTPS.

Step 6: Receive Confirmation

After submitting your payment, you’ll receive an instant confirmation:

Email Notification: TaxBandits will send you a confirmation email with a unique reference number for the transaction. This serves as proof of payment.

Payment Tracking: You can track the status of your payment in the TaxBandits dashboard to ensure it has been processed by the IRS.

Step 7: Access Payment History and Reports

One of the advantages of using TaxBandits is its comprehensive reporting tools. After making your EFTPS payment, you can:

View Payment History: Access a detailed history of all past EFTPS payments made through TaxBandits, including dates, amounts, and payment types.

Generate Reports: Download reports that can be integrated with your accounting system, making it easier to reconcile your payments and file accurate tax returns.

Why Choose TaxBandits for EFTPS Payments?

By using TaxBandits for EFTPS payments, businesses can streamline the federal tax payment process while minimizing the risk of errors and missed deadlines. Some additional reasons to consider TaxBandits include:

Seamless Integration: TaxBandits integrates with popular payroll systems, allowing for accurate tax calculations and automated payments.

User-Friendly Interface: The platform is easy to navigate, with guided steps for each part of the payment process.

Security: TaxBandits uses advanced encryption and security measures to ensure your financial and tax information is always safe.

Conclusion

Managing federal tax payments doesn’t have to be a time-consuming or error-prone task. By leveraging TaxBandits’ EFTPS payment system, businesses can ensure timely, accurate, and secure tax payments with minimal effort.

Ready to simplify your tax payments? Start using TaxBandits for EFTPS today and take the stress out of managing federal taxes.

#EFTPS#EFTPS Tax Payment#EFTPS Online#EFTPS Federal Tax Payment#EFTPS Payment Online#EFTPS Payment#IRS Electronic Federal Tax Payment System EFTPS#EFTPS Federal Payments#EFTPS Online Payment#EFTPS IRS Payment#IRS Electronic Federal Tax Payment System

1 note

·

View note

Text

Common Challenges Faced by Businesses When Implementing Electronic Merchant Systems

In today's fast-paced, technology-driven world, the implementation of electronic merchant systems (EMS) has become crucial for businesses of all sizes. These systems streamline payment processes, enhance customer experiences, and improve overall operational efficiency. However, despite their numerous advantages, businesses often face several challenges during the implementation of electronic merchant systems. Understanding these challenges is the first step towards mitigating them effectively.

1. Integration with Existing Systems

Integrating an electronic merchant system with existing business infrastructure can be a complex task. Many businesses operate with legacy systems that might not be compatible with modern EMS. This incompatibility can lead to disruptions in business operations and data inconsistencies. To overcome this, businesses need to invest in comprehensive integration solutions that ensure seamless connectivity between old and new systems.

2. Data Security and Compliance

Data security is a paramount concern for businesses implementing electronic merchant systems. With increasing incidents of cyberattacks and data breaches, ensuring the security of sensitive customer information is critical. Compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) adds another layer of complexity. Businesses must adopt robust security measures, including encryption, secure authentication, and regular security audits, to protect against data breaches and comply with regulatory requirements.

3. User Training and Adaptation

The successful implementation of an EMS requires that all users, including employees and customers, are adequately trained. Employees need to understand how to use the system efficiently, and customers need to feel comfortable using it. Resistance to change and a lack of proper training can lead to underutilization of the system and operational inefficiencies. Comprehensive training programs and user-friendly interfaces can help overcome these challenges.

4. Cost Considerations

Implementing an electronic merchant system involves significant upfront and ongoing costs. These include the costs of purchasing the system, integration, training, and maintenance. Small businesses, in particular, might find these expenses burdensome. To address this challenge, businesses should conduct a thorough cost-benefit analysis to ensure that the long-term benefits of the system justify the initial investment. Additionally, exploring flexible pricing models and financing options can help manage costs effectively.

5. Technical Support and Maintenance

Once an EMS is implemented, ongoing technical support and maintenance are essential to ensure its smooth operation. Businesses might face challenges in accessing timely support, especially if the system is complex or the vendor is unresponsive. Partnering with a reliable vendor that offers robust support and maintenance services can mitigate these issues. Additionally, having an in-house technical team trained to handle minor issues can reduce dependency on external support.

6. Scalability and Flexibility

As businesses grow, their needs evolve. An electronic merchant system must be scalable and flexible enough to accommodate changing business requirements. Many businesses face challenges when their EMS cannot scale with their growth or adapt to new market trends. Choosing a system with scalable architecture and customizable features can help businesses stay agile and responsive to market changes.

7. Customer Experience

The primary goal of implementing an EMS is to enhance the customer experience. However, if the system is not user-friendly or fails to meet customer expectations, it can negatively impact customer satisfaction. Ensuring that the system offers a seamless, intuitive, and secure experience for customers is crucial. Regular feedback from customers can provide valuable insights into areas that need improvement.

Conclusion

Implementing an electronic merchant system can significantly benefit businesses by streamlining payment processes and improving operational efficiency. However, it is essential to be aware of the common challenges that may arise during implementation. By addressing issues related to system integration, data security, user training, costs, technical support, scalability, and customer experience, businesses can successfully implement an EMS and reap its full benefits.

Navigating these challenges requires careful planning, strategic investment, and continuous improvement. With the right approach, businesses can turn potential obstacles into opportunities for growth and enhanced customer satisfaction.

1 note

·

View note

Text

Get Paid Faster & Easier: Top Electronic Payment Solutions for Law Firms

Law firms, ditch the paper checks! Discover the best electronic payment processing solutions to streamline your workflow, boost client satisfaction, and get paid faster. Learn about features, security, and compatibility.

#Law Firm Electronic Payment#Electronic Payment Processing Solutions#best law firm payment processing platform#law firm payment processing solutions#best payment processing#payment processing solutions#payment processing solution for law firms#law office payment processing#law office credit card processing#law firm realization rate#payment processing solution#online payment options#lawyer payment methods#online lawyer payments#accept payments online#type of lawyer payment methods

1 note

·

View note

Text

E-invoicing works by creating invoices electronically in a structured format, transmitting them to the recipient through a secure network, EDI, or dedicated portal, and processing them automatically with the help of e-invoice approval software. Read More: https://teem-app.com/en/what-is-electronic-invoicing-e-invoicing/

#Online Invoicing Systems#Invoice Tracking#Electronic Invoice Approval Software#Payment Methods for Freelancers

0 notes

Text

How to Use Electronic Fund Transfer Payments to Enhance Financial Operations

In the online payment era, small businesses have no option but to improve their financial operations by adopting digital technologies. Electronic Fund Transfer (EFT) is becoming a very common method for faster and more efficient transactions. It is easier to transfer funds digitally than depending on traditional payment methods. The electronic fund transfer process is made simple by online payment platforms that offer new features like e-checks. So if you are a business owner looking to effortlessly carry out your payment operations, you must surely consider the advantages of EFT.

Adopt New Technologies: One of the major benefits of using new technology like EFT is that it will allow you to reduce your costs. The processing costs associated with traditional payments are high for large amounts. EFT transactions on the other hand do not cost as much. Firms can save money and invest it for expansion or other growth initiatives. Moreover, digital payment methods are much faster which will improve the overall efficiency of all business operations.

Reduce Risk: Traditional payment methods result in problems like errors and delays. Manual processing of financial transactions can lead to mistakes. If you enter the bank details or other relevant information incorrectly, you could end up transferring money to a different account, which can cause losses and delays. This will certainly affect your relationship with vendors and other partners. By adopting EFT payments, firms can reduce the risks associated with handling money physically.

New Features: Online payment platforms offer different payment methods like e-checks and digital wallets to help firms increase their flexibility. For example, e-checks or electronic checks can be sent to payees via email and they can cash them with their smartphones. This is a convenient solution to avoid the hassle of using physical checks. Digital wallets and direct bank transfers are also useful payment methods that allow firms to carry out financial processes more securely. The processing time can be reduced by using direct bank transfers and digital wallets can be used to make purchases online.

Improve Your Operations: Businesses can use EFT processes more easily with the help of useful tools that online payment sites offer. These systems let companies set up automatic payments for things like monthly bills or subscription fees. You don't have to start these payments by hand every time; the platform can be set up to move money instantly on a set plan. Businesses can also use these tools to plan when to pay for different activities. This lets them plan ahead and set up payments ahead of time, making sure they have money when they need it.

Integration: A great feature of online payment platforms is that they can be linked to other software available on the market. For example you can integrate your ACH payments with accounting or payroll software to make the whole process easier and smoother. Instead of having to calculate employee salaries every month, this lets you relax as payments will be worked out and sent to payee accounts automatically.

EFT payments are a great way to improve your financial management as they will reduce costs and make your transactions faster. You can also reduce risks, make use of new features and use your money more effectively by adopting EFT. Small businesses should certainly consider using online payment platforms that offer various EFT solutions.

1 note

·

View note

Text

An Insight into eCheck Payments and How They Work - Technology Org

New Post has been published on https://thedigitalinsider.com/an-insight-into-echeck-payments-and-how-they-work-technology-org/

An Insight into eCheck Payments and How They Work - Technology Org

eChecks are otherwise known as electronic checks. They are made from your checking account and they work similarly to regular checks. Instead of having a piece of paper, you will provide your information, including your routing number, payment authorization and bank account details through an online form. This allows your payment to be processed electronically.

Using a credit card for an electronic payment. Image credit: energepic.com via Pexels, free license

How Are eCheck Payments Processed?

eCheck payments are processed via the Automated Clearing House network. This central infrastructure works as a highway to move money electronically. eChecks can be sent faster than paper checks because you don’t need to pay any logistical overheads. Because you don’t have to deal with slips of paper, which can be lost, stolen or damaged, eChecks are seen as more secure.

Security measures are in place to prevent eCheck fraud, ranging from encryption to digital signatures and a solid authentication process. eChecks are particularly suited to online businesses; eCheck online casinos, for example, allow players to use eCheck to make deposits and withdrawals while protecting their bank details.

With casinos handling thousands of online payments per day, eChecks are a fast and efficient way to facilitate payments. Other sectors that use eCheck payments include membership businesses that require a monthly fee, or online retailers. As eChecks are so efficient and easy to adopt, it makes sense for businesses that need to accept lots of payments regularly.

For customers who want to pay via paper check, it’s sometimes possible to take a photo and upload it to the payment portal. The bank can initiate the ACH after “reading” the check digitally. Even by moving to eChecks, traditional payment methods are not overlooked.

E-shopping – illustrative photo. Image credit: Leeloo The First via Pexels, free license

How to Pay via eCheck

There are three main steps involved with sending eCheck payments. First of all, you have customer authorization. In addition to signing an online form, customers can also authorize the payment over the phone. Businesses can then set up either a one-time payment or a recurring payment, which is usually done through a payment processing system.

When the payment information has been received, businesses can submit the details through the ACH network so that the funds can be withdrawn and then deposited in the business’ account. The whole payment processing procedure usually takes between three and five days.

For businesses, there are many advantages to electronic checks. Electronic checks are far cheaper to process when compared to paper checks, not to mention that they are faster. You also have more options for back-office automation and more convenient payment experiences for customers. It’s also an easier process to carry out on a mass scale.

With the right software, businesses can arrange for customer’s direct debits to come out on the same day each month. The account authorization only has to be captured once as well. Cash application software can take the remittance files from the bank, using AI to match the payment manually with the correct invoice within the system.

With the world rapidly moving towards automation, accepting eChecks can help to reduce the manual labor involved with processing payments.

#ai#authentication#automation#Business#credit card#deal#details#easy#eCheck#electronic#encryption#fintech#Fintech news#form#fraud#how#how to#Infrastructure#InSight#invoice#it#mass#money#network#One#online payments#Other#Other posts#paper#phone

0 notes

Text

#Card Payment Solutions#payment processing#payments#card payment solutions#payment solutions#payment solution#payment gateway#chase payment solutions#bevel payment solutions#best payment solution#us merchant payment solutions#credit card payments#cardpayment solutions#payment#online payments#payment technology#payment depot#electronic payments#bancard solutions#card payment#payment innovation#credit cards#issuing solutions#accept card payment

1 note

·

View note

Text

Introducing Shop Now Pay Later in Qatar: Making Online Shopping More Accessible and Affordable

Shopping online has become increasingly popular in Qatar, as more and more people discover the convenience and affordability of buying products online. However, one of the biggest challenges of online shopping is often the payment process. Many shoppers are unable to pay the full amount upfront, which can be a barrier to making a purchase.

To address this issue, Jazp.com has introduced "Shop Now Pay Later" in Qatar. This is a convenient and affordable payment solution that allows shoppers to buy now and pay later in instalments, with no interest or additional fees.

Through our partnership with Tabby Qatar, we are now able to offer a range of flexible payment options that make online shopping even more accessible to everyone. Whether you're looking for electronics on instalments, or simply want to shop on finance, our monthly instalment plans offer a convenient and affordable way to spread the cost of your purchases over time.

One of the biggest advantages of Shop Now Pay Later is that it enables credit-free shopping. Unlike traditional credit cards, there are no interest charges or hidden fees, making it a more transparent and affordable way to pay for your purchases.

In addition to being a more affordable payment solution, Shop Now Pay Later is also a more flexible one. It allows you to choose a payment plan that suits your budget and schedule, so you can make payments at your own pace without any pressure.

At Jazp.com, we believe that shopping should be a hassle-free and enjoyable experience for everyone. That's why we're constantly looking for ways to make online shopping more convenient and accessible to all. With the introduction of Shop Now Pay Later in Qatar, we're taking a big step towards that goal.

So if you're looking for a more convenient and affordable way to pay for your online purchases, look no further than Jazp.com. Our partnership with Tabby Qatar offers a range of flexible payment options, making it easier than ever to buy now and pay later.

#Shop now pay later#Buy now pay later#Instalment plans#Tabby Qatar#Online shopping Qatar#Electronics on instalments#Monthly instalment plans#Shopping on finance#Interest-free instalments#Credit-free shopping#Flexible payment options

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

#E-tailers#Internet shopping#Mobile commerce#Electronic payments#Online shopping#Product catalog#Sales analytics#Social media commerce

0 notes

Text

Once upon a time, everything came with an instruction manual. You'd open the box and immediately chuck that manual into the trash, because recycling wasn't popular back then, and you could still make a living cutting down trees to print more manuals with. Nowadays, the humble instruction manual is gone altogether, replaced with – at best – an interactive electronic instruction manual. I still don't read them, but now it's because I can't.

You see, "having a working computer" is a lifestyle that is simply incompatible with my existence. Despite the fact that our civilization has produced approximately 171.3 computers per person, I somehow have no ability to make them work. So I'm at the public library, where they get really mad if you take a transmission apart over their keyboard. Look, people, the keyboard catches the spring clips when they go flying out. Would you rather have this or me crawling around on the carpet?

When I'm on the side of the road because my futuristic garbage exploded, I can't always use my dumpster-dove flip phone to look up the manual, either. That would require me to buy cellular service, instead of just calling 911 and asking the firefighters to transfer my call every time (don't ask the cops to do it.) The only way forward is to assume there was no manual at all. Doing so also prevents me from receiving additional frustration, when I jump through all these hoops to find out that the fancy online manual does not have a chapter for "this product is now 37 years old and has corroded its entire wiring harness, here's your diagram on where 'purple' goes." Why even bother writing one, assholes?

Sometimes I call up the Haynes service manual people, and yell at them, telling them to make a print manual again. Then I tell them what I had to go through because of the eternal obsolescence cycle of all things electronic. Then they make me a job offer, which I refuse because it would mess with my unemployment payments. I'm holding out for an offer from Chilton. If it was good enough for Frank Herbert, it's good enough for me.

154 notes

·

View notes

Text

@wikwalker hi sure yes anything to give me an excuse to procrastinate the post i should be writing right now. here are all teh drugs and how to manage them. you can trust me, a drug addict

first of all: https://www.erowid.org/ , erowid always

don't be afraid of drugs, if they're the right drugs, you should do them since they will be a blast regardless and overcoming fear is also good (but outside the scope here)

OK to do as much as you want: alcohol - social benefit greatly outweighs health effects, no reason to avoid if predisposed to abuse since that'll happen sooner or later. what can i say? don't be a fucking dork. when you start drinking, really overdo it as much as possible without dying and get a few real nasty hangovers under your belt so you know how much is the right amount to drink.

weed - innocuous enough to be fine but will make you stupid in the long term. make sure to only buy from a real drug dealer and never some legal institution. cut it out when you're a "real adult". don't smoke weed and watch TV routinely, go out and do things so you naturally grow to hate it. good to go through this as early as possible to minimize the time you spend as a cringe weed enthusiast

i guess those are the only two.

ok to do infrequently (annually): "lsd" - or whatever it is, probably not lsd, blah blah blah, if it works and is sold on blotter its fine and won't make you go nuts or whatever. opt for a better psychadelic imo. see psych rule at bottom of section

mushrooms - better than acid since you know what they are. rule of thumb is to always do more than you think you want. minimum 1/8oz. see psych rule at bottom of post

dmt - if you somehow have a dmt hookup you don't need to be reading any of this. lasts 10 minutes which leads to tendency to way overdo it, don't do this, my favorite webcomic artist is permanently crazy from exactly that. using a crack pipe is also not the uhhhh most dignifying-feeling thing to do either. it's harder than you think.

mdma - for use at electronic music event or rave. overuse causes brain lesions or something.

coke - wait until you're in your 20s, have maxed out your roth IRA for a couple of years in a row, and havent missed a car payment in a similar timeframe. better still if you've worked a very shitty low paying job and know the value of a dollar. if you still find yourself buying candy you're not ready. too expensive to be worth it to get hooked on. know that you are VERY ANNOYING to anyone who also isn't high. don't fuck around with the guy selling it to you. avoid discussing or thinking about business ideas. you can't afford to make it a habit + kinda turns you into a piece of shit after a while, but at least a very interesting one

ketamine - another sick drug that rules, but save it for a special occasion. don't try and go into the k-hole your first time

rule for psychedelics - you get one good strong trip a year and that's it, make it count, always opt for doing a bit more than a bit less. but don't make it a habit, otherwise you turn into a very stupid very annoying "hippy" style cliché and believe in ghosts, aliens, crap like that.

ok to try once prescription opiates/benzodiazepine (xanax), valium, this kind of shit - worth trying so you can go "holy shit, this stuff is way way way too good to ever use responsibly" and then never do again. especially if you're white. for some reason we just can't handle this shit. if a doctor prescribes it to you, idk, that's your call to make.

ayhuasca - this is just dmt in a different form. do some other psychadelics a number of times before you do this. once you realize the whole "substantial visual hallucinations" thing is made up, its time. do exactly this: -buy root online (legal). receive box of dirt -boil dirt into "tea" (read erowid for exact recipe) -take over-the-counter anti nausea medicine or anything that will give you a stronger stomach -drink tea (its nasty as fuck, get it down quick) -have someone bigger than you keep an eye on you for the next five hours. -have the experience, which is absurdly intense, has no bearing to the real world, etc etc. don't be a bitch and throw up, if you do it'll only last an hour or so. again there is no way to provide a consistent description of the experience except that you will meet god. you only ever need to do this once and never again. trust me

peyote/salvia/etc - try em if you want, you'll never ever want to again afterwords. these are drugs for idiot teenagers too lame to get real drugs. imagine being very very sick from poison and utterly terrified at the same time. No good

whippets/nitrous oxide - just find a dentist that uses it and don't bother creating hundreds of pounds of trash on your floor for this crap that lasts ten seconds. you have to understand the extremely short timeframe coupled with the cost makes zero sense. go to a phish concert parking lot and do some people watching -- you do not want to be these people. only use is as a motivator to get routine dental exam. also if you somehow manage to make it a heavy habit your fucking legs stop working, no shit, but they start working again once you quit.

don't ever do heroin/meth/pcp - is is truly a mystery why you should never do these 🙄

synthetic weed/k2/shit from the gas station - it is so funny that they sell this as "weed that won't pop you on a drug test". its not weed. it is some dubious chemical sprayed on yard waste. smoke it to have a terrible time and go nuts. only buy drugs from legitimate drug dealers!

kratom - anyone's guess as to why this is legal but it's heroin for pussies. its still heroin

dxm/cough syrup - do you ever wonder why it is exclusively teenagers robotripping? it's because it sucks ass. is like a cheesegrater on your brain in terms of health effects with repeated usage. you're better than this king

inhalants - these are at the bottom of the list for a reason. do not huff gas. don't huff paint. do not consume computer duster. not fun + fastest way to make yourself a complete, uh, (word i can't say anymore) and then dead

not listed quaaludes- unavailable due to no longer being manufactured. these ruled apparantly

sincis2c - unavailable due to not existing, i just made this up

amphetamines - cannot provide objective take here. they're my albatross, lifelong (posted 4:55am natch)

445 notes

·

View notes

Text

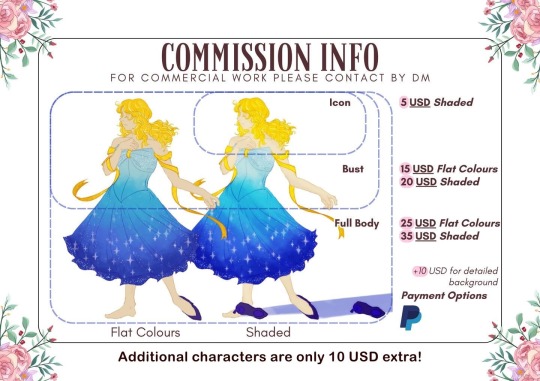

EMERGENCY COMMISSIONS

Hi, due to literal unforeseen circumstances, a huge strike of lightning hit my house and promptly destroyed a bunch of electronics. LEDs, Wi-Fi router and more. Those have been fixed but the lightning somehow burned my motherboard and lost my ENTIRE HARDDISK FULL OF MY ART FROM THE LAST 7 YEARS

To say I was devastated would be an understatement. My art is part of me and having lost it has made my depression relapse. But I've found out, that but using Data Recovery services online I can get my files back. So, to pay for it I'll be opening emergency commissions.

ICON aka HEAD SHOT

5 USD (Coloured & Shaded)

HALF BODY aka BUST

15 USD (Flat Colours)

20 USD (Coloured & Shaded)

FULL BODY

25 USD (Flat Colours)

35 USD (Coloured & Shaded)

MISC

Background (simple) $5

Background (detailed) $10

Extra Chara $10

WILL DO:

18+ Artwork

Furry/Anthro

Ships from all fandoms!

Self ship

Suggestive

Gore/Guro

Fanart and OCs

Object Heads

WILL NOT DO:

Mecha

Hate speech

Payment will be done through Paypal

Further details can be discussed through a DM or Discord if preferred

Please boost if you can!

p.s free sketch of your choice if you get a commission worth more than 20 USD! but you didnt hear it from me hehehe

#commissions#commissions open#DMs open#emergency commissions#emergency commisions open#my art#kaigaku#kimetsu no yaiba#rengoku kyojuro#kyojuro rengoku#demon slayer rengoku#muichiro tokito#honkai star rail#hsr blade#luka alien stage#alien stage#demon slayer memes#dungeon meshi#mcytblr#mcyt#ivorycello#ivory cello#ivory#ivorycello fanart#whitepine#mcrp#demon slayer#ao3#self ship#xxninjacatboyxx

83 notes

·

View notes