#New construction sales and leasing

Explore tagged Tumblr posts

Text

Hi there, my name is Maria and I am a lifelong resident of Austin, TX. As a real estate professional with years of experience in the local market, I use my unique insights to facilitate informed investment decisions for my clients, ensuring a personalized experience. Whether you are looking to buy, sell, or invest in Austin real estate, I am the expert you can trust to help you achieve your goals and provide a personalized experience every step of the way. You can trust that you will have a trusted advisor by your side throughout the entire process. So, let's work together to make your real estate dreams a reality!

Contact Us:

13785 Research Blvd Suite 125, AUSTIN TX 78750, USA

(512) 270-0878 [email protected] www.mariagovea.com

Facebook / Instagram

#buying agent services#real estate agent#seller's agent services#real estate broker#First-time home buyer services#Luxury property buying and sales#New construction sales and leasing#New construction services#Property rentals#Relocation assistance#Seller's agent services

0 notes

Text

Top Reasons to Invest in Real Estate on Magarpatta Road, Pune

Magarpatta Road in Pune is one of the city's most dynamic and sought-after locations for real estate investment. With its strategic positioning, growing infrastructure, and proximity to commercial hubs, it's an area that promises substantial returns for investors. Whether you're looking for a home or a commercial property, here are the top reasons why investing in real estate on Magarpatta Road is a smart move, with contributions from renowned developers like Goel Ganga Developments.

1. Strategic Location & Connectivity

Magarpatta Road enjoys a prime location in Pune, connecting some of the city's key areas. It offers seamless access to major locales like Hadapsar, Kharadi, Koregaon Park, and Pune Station. The area is well-connected by public transport, including buses and the upcoming metro line, making it highly accessible for residents and businesses alike.

For professionals working in the nearby IT hubs like Magarpatta City, EON IT Park, and Kharadi, Magarpatta Road offers the convenience of living close to work. This strategic location makes it an ideal investment choice, as both homebuyers and businesses are always on the lookout for properties in well-connected areas.

2. Booming IT and Commercial Infrastructure

Magarpatta Road has witnessed rapid development in the past few years, thanks to the booming IT and commercial sectors. The proximity to IT parks, corporate offices, and business centers ensures consistent demand for both residential and commercial real estate.

This area has become a hotspot for professionals, and with the growing number of businesses setting up shop here, there is a high demand for quality homes and office spaces. Developers like Goel Ganga Developments have taken note of this demand, delivering properties that cater to modern lifestyles and businesses looking for a strategic address in the city.

3. High Rental Yields

Given its proximity to business hubs, educational institutions, and entertainment options, properties on Magarpatta Road are highly sought after by tenants. Whether you're looking to rent out a residential flat or a commercial space, you can expect attractive rental returns due to the continuous demand for properties in this location.

The combination of growing infrastructure and a large working population ensures that rental yields remain strong, making Magarpatta Road a lucrative investment option.

4. World-Class Amenities and Infrastructure

Magarpatta Road offers a range of amenities, from well-maintained roads and green spaces to retail outlets and entertainment hubs. The area is home to some of Pune’s top educational institutions, hospitals, shopping malls, and restaurants, providing a comprehensive living experience.

Real estate projects by companies like Goel Ganga Developments are equipped with modern amenities like gyms, swimming pools, landscaped gardens, and community centers, offering a comfortable and luxurious lifestyle for residents. These features make it an attractive option for both investors and homebuyers looking for long-term value.

5. Growth Potential and Future Developments

The real estate market on Magarpatta Road is expected to continue growing in the coming years, thanks to ongoing infrastructure projects such as the Pune metro and expansion of road networks. These developments will further enhance the area’s connectivity and livability, boosting property values.

Additionally, with the establishment of more commercial and residential properties, there is a growing trend of mixed-use developments that cater to the needs of both businesses and families. This diversification of offerings ensures sustained growth and appreciation of property values in the region.

6. A Safe and Vibrant Community

Magarpatta Road is known for its vibrant and secure environment. The area is well-planned and has a mix of residential, commercial, and recreational spaces, making it a sought-after locality for families and professionals. Additionally, the presence of high-quality infrastructure and well-maintained neighborhoods ensures a safe and pleasant living experience.

Conclusion

With its ideal location, robust infrastructure, booming commercial ecosystem, and ongoing development, Magarpatta Road stands out as one of Pune's most promising real estate destinations. Whether you're looking for residential or commercial property, investing in Magarpatta Road offers great potential for high returns and capital appreciation.

For those interested in premium real estate options in the area, Goel Ganga Developments is one of the top developers offering quality residential and commercial projects, designed to cater to the growing demand for modern living and working spaces. By investing in this region, you can ensure a secure and prosperous future for your real estate portfolio.

If you’re considering real estate investment in Pune, don’t miss out on Magarpatta Road – it’s a decision that promises to pay off for years to come.

#goel ganga developments pune#best builders in pune#goel ganga developments#new residential projects in pune#pune builders and developers#premium residential projects in pune#commercial property in pune#ganga platino kharadi#commercial property for sale in pune#3 bhk flats in pune kharadi#budget 2024#union budget 2024#goel ganga ishanya satara#ganga acropolis baner#commercial property in koregaon park#best residential projects in pune#residential projects in kharadi#commercial construction projects#real estate projects in kharadi#real estate developer#realestate#lease agreement#ganga aria dhanori#commercial projects in koregaon park#kharadi residential projects#commercial shops for sale in pune#2 bhk for sale in kharadi#2 bhk flats in kharadi pune#3 bhk in dhanori#3 bhk flats in dhanori pune

2 notes

·

View notes

Text

"Faced with declining membership, aging buildings and large, underutilized properties, many U.S. houses of worship have closed their doors in recent years. Presbyterian minister Eileen Linder has argued that 100,000 churches may close in the next few decades.

But some congregations are using their land in new ways that reflect their faith – a focus of my urban planning research. Some are repurposing their property to provide affordable housing, as the housing crisis intensifies across the country.

Take Arlington Presbyterian Church in Arlington, Virginia. In 2016, the church sold its historic stone building to the Arlington Partnership for Affordable Housing to construct a 6-story complex with 173 apartments, known as “Gilliam Place.” The building still houses space for the congregation, as well as La Cocina, a bilingual culinary job training facility and cafe. In Austin, Texas, St. Austin Catholic Parish is partnering with a developer to build a 29-story tower providing 200 beds of affordable student housing, in addition to new spaces for ministry.

Other houses of worship are pursuing similar projects today.

Same mission, new projects

Faith-based organizations have been building housing for many years, but generally by purchasing additional property. In recent years, however, more houses of worship are building affordable housing on the same property as the sanctuary.

This can be done in a variety of ways. Some congregations adapt the existing sanctuary and other faith-owned buildings, while others demolish existing buildings to construct a new development, which may or may not have space for the congregation. Another option is to build on excess property, like a parking lot.

Depending on how a development deal is structured, a faith-based organization may receive proceeds from the sale of its land, or from leasing their property to a developer – funds which they can then spend on ministry or on a new space for worship. If a new development includes space for the congregation, sometimes they rent out those spaces when the space is not being used for worship, which can also financially benefit the congregation.

Faith-based organizations often see these projects as a way to do “God’s work.” In some instances, they include community services beyond the housing itself.

Near Los Angeles, the Episcopal Church of the Blessed Sacrament in Placentia partnered with a nonprofit affordable housing developer – National Community Renaissance, also called National CORE – to develop 65 units for older people. The complex also includes a 1,500 square foot (140 square meter) community center. The city’s diocese has a goal of building affordable housing on 25% of its 133 properties.

For some congregations, these are mission-driven projects rooted in social justice.

In Washington, D.C., Emory United Methodist Church redeveloped its property and constructed The Beacon Center – which has 99 affordable housing units, community spaces, and a commercial kitchen that provides job training for recently incarcerated people – while preserving the sanctuary. In Seattle, the Nehemiah Initiative is working with Black churches in the Central District, a historically African American neighborhood, to redevelop its properties into affordable housing to keep residents from being displaced."

Potential to evolve

As states and cities struggle to provide affordable housing, studies have been conducted from Nashville to New York City on the amount of land faith organizations own, and their potential as housing partners.

In the D.C. metro area, for example, the Urban Institute found almost 800 vacant parcels owned by religious organizations. In California, a report from the Terner Center at University of California, Berkeley found approximately 170,000 “potentially developable” acres of land owned by religious organizations and nonprofit colleges and universities...

When thinking about the redevelopment process, Arlington Presbyterian member Jon Etherton told me, “the call from God to create, do something about affordable housing was bigger than the building itself.”"

-via The Conversation, July 19, 2024

#church#christianity#washington state#california#washington dc#presbyterian#affordable housing#housing crisis#good news#hope

190 notes

·

View notes

Text

Tally Ho / Aladdin / Planet Hollywood

Aladdin opened in 1966 with one of the Strip's first neon-enhanced porte-cochéres, a freestanding sign featuring a revolving, three-sided marquee, topped with an "Aladdin's Lamp," designed and fabricated by YESCO.

Tally Ho ('62-'65)

'61: Edwin S. Lowe announces plans for Tally Ho non-gaming hotel. In the 40s the land was owned by locals Salton, Rose, and Goldberg. (Alexander & Rebecca Salton, founding members of the Las Vegas Jewish community.)

'62: Dec. 24, Opening of Tally-Ho, hotel and country club with 9-hole golf course. 322 of the 450 rooms open during “preview opening” in Dec. The hotel was alternately spelled Tally Ho, Tally-Ho, and Tallyho.

'63: Oct. 11, Tally Ho closed. “Ed Lowe made no excuses … admits he was dead wrong about a no gambling luxury hotel.” (Hertz, RJ 10/13/63)

'63: Oct., Norman Kaye and Frank Windsor operate the Tally Ho golf course.

'63: Oct.-Dec., The hotel is sold to Kings Crown Inns of America, represented by Floyd and Beryl Cook, Donald Bolinger (Cooks Brothers Trusts, Indiana). Under lease to operators Edward Nealis, Charles Luftig, and partners, Kings Crown Tally Ho's hotel, lounge, and restaurants reopen in Dec. (Duke, RJ 12/20/63)

'64: Construction of a showroom and casino begins in Fall, misses New Year's Eve opening deadline. The showroom and casino are completed in '65, ultimately never opened. (RJ 4/8/64, RJ 5/18/65)

'65: Nealis heads 18 casino applicants of Tallyho Operating Co. who are unable to get approval from Nevada Gaming Control Board (GCB). In later years Jimmy "the Weasel" Fratianno of the Los Angeles crime family claimed he owned a piece of the Tally Ho and was to run the casino. (AP, 2/17/65, RJ 11/25/84)

'65: Apr. 1, Tally Ho closed for the second time after King's Crown files suit against Tallyho Operating Co. for unpaid rent. Tenants are evicted, property put in control of the owners.

'65: Dec., Tally Ho bought by Milton Prell (Prell Hotel Corp.) from The Cooks Brothers Trusts.

Aladdin ('66-'97)

'66: Aladdin announced. Drawings for redesigned casino and proposed hotel tower unveiled early in the year. Martin Stern, architect. (RJ 1/2/66, RJ 1/17/66)

'66: Mar. 31, Aladdin opened. Freestanding sign and the Strip's first neon-enhanced porte-cochère by YESCO. Primary owners M. Prell, G. Gilbert, and S. Krystal, all former members of Sahara-Nevada Corp. Comedian Jackie Mason opens the 500-seat Baghdad Theatre.

'66: Dec., Prell stops $75k/month payments on the Aladdin and asks that the price be cut. The trustees agree to reduce the sale price to $5.5M. (Dayton, 4/20/72)

'67: Sep. 26, Milton Prell suffers a debilitating stroke which removes him from Aladdin management. (Dayton, 4/20/72)

'68: Apr., Stockholders of Prell Hotel Corp. vote to merge with Parvin-Dohrmann Co., leading to Parvin-Dohrmann take-over the Aladdin.

'68: Jun., Parvin-Dohrmann operation of Aladdin’s casino approved by GCB. (RJ 6/20/68)

'68: Sep., 28, "after the stock trade was finalized, Milton Prell, by this time paralyzed, was told by the new management he had two weeks to get out of the Aladdin." (McKnight, Alexander. Journal Herald, 4/20/72)

'70: Parvin-Dohrmann adopts the new name Recrion, and strips the firm of all its holdings except for its three Las Vegas hotel-casinos: Aladdin, Fremont, and Stardust.

'71: Oct.-Dec., Recrion announces sale to Sam Diamond, P. Webbe, R. Daly, D. Aikin as Aladdin Hotel Corp. Diamond announces plans for hotel tower.

'71: Entertainment director James Tamer is involved in secretly managing the casino and directing the skim, according to later conviction.

'74: Aladdin investigated by GCB for issuing comps to organized crime figures.

'74: Groundbreaking for the “Tower of Majesty” high-rise, and theater. Lee Linton, architect. Years later in '83, Linton and Aladdin attorney Sorkis Webbe are each convicted of tax fraud in relating to a kickback scheme during the '74 expansion.

'76: Jul., Tower and Theatre for the Performing Arts opened; new porte-cochère by Charles Barnard, Ad-Art; original sign replaced; all financed by Teamsters Central States Pension Fund loan.

'76: Mae Ellen George buys 24% of the hotel, relying on advice of Tamer.

'78: Aug. 3, Detroit federal grand jury indicts Tamer, Aladdin GM James Abraham, Aladdin casino manager Edward Monazym, and Charles Goldfarb (denied a license in ’71) of conspiring to allow hidden owners to exert control over the resort. Owners of the Aladdin at this time are Webbe (34%), Diamond (23%), Mae George (19%), Daly (14%), John Jenkins (8%), and George Morse (2%). (RJ 8/3/78)

'79: Mar. 13, Tamer, Abraham, Monazym, and Goldfarb convicted.

'79: Aug., GCB closes the resort; U.S. District Judge Claiborne opens it hours later, “until a mob-free buyer could be found.” (German, RJ 9/20/2021.)

'80: Jan., Ed Nigro gains a court-sanctioned takeover of the Aladdin after he and Johnny Carson sign an agreement to buy the property for $105M. The deal falls through.

'80: Jul. 10, GCB revokes Aladdin's license and the casino is closed; hotel remains open.

'80: Oct. 1, Casino is reopened after Ed Torres and Wayne Newton buy the Aladdin for $85M.

'82: Jul, Torres buys Newton's shares of the Aladdin.

'84: Feb., Aladdin placed under bankruptcy protection after a Teamsters Pension Fund forces foreclosure.

'85: Jan. 22, Ginji Yasuda buys the Aladdin for $54M; casino closed during Yasuda licensing.

'87: Apr. 1, gaming reopens.

'89: Aug., Yasuda, failing to reveal the source of millions in loans, loses his gaming license; Aladdin forced into bankruptcy.

'90: Aladdin spends the year in bankruptcy, operated by William Dougall.

'91: Jun., Property title transferred to Bell Atlantic Tricon Leasing Corp when no buyers meet the minimum bid.

'92: Jun., Aladdin emerges from 3-year bankruptcy, control is given to Joe Burt and his JMJ management team on a 12-year lease with Bell Atlantic Tricon.

'94: Dec., Jack Sommer, Signman Sommer Family Trust, buys the Aladdin for $80M. "When the family trust sold a major New York property in '94, Sommer needed to find a real estate investment for the proceeds to avoid substantial capital-gains taxes. The Aladdin was on the market at the time." (Simpson. RJ 8/13/2000.) Other potential buyers included Donald Trump.

'97, Nov 25: Aladdin closed. A new hotel-casino to be built on the 35-acre parcel.

'98, Apr 28: Aladdin tower demolished. Former Tally Ho rooms later demolished; Theater remains.

Aladdin (2000-2007) Planet Hollywood (2007-)

2000: New build of the Aladdin. Mall opens 8/17/00, hotel and casino delayed, opening 8/18/00. Cost: $1.1B.

2001: Sep., Aladdin files for bankruptcy.

2003: Aladdin sold for $635M to OpBiz investment group led by Planet Hollywood CEO Robert Earl. Sale finalized 9/1/2004.

2007: Apr. 17, renamed Planet Hollywood.

2009: Harrah’s Ent. purchases part of the $860M mortgage, takes full ownership in Feb. 2010. Harrah’s later rebranded as Caesars Entertainment.

Photos of Tally Ho | Photos of the Aladdin

Headline photo: Undated, circa '68, from The Magic Sign by Charles Barnard.

Circa Feb.-Mar. 1966: The hotel was open before the casino. Installation of the sign is beginning. Photo: Las Vegas News Bureau.

Mar. 1966: Sequence of photographs showing YESCO’s revolving, three-sided Aladdin pylon structure being pieced together by dual cranes ahead of their opening on the 31st. Ad-Art collection, from Charles Barnard’s The Magic Sign.

Undated, Las Vegas News Bureau.

Timeline sources. Previous landowners: C.D. Baker Map of Las Vegas Valley ’40; Alexander Salton. UNLV Special Collections & Archives.

Tally Ho: Tallyho Preview Attracts 3500. Review-Journal, 12/28/62; Tallyho Hotel Closes. Review-Journal, 10/11/63 p1; Murray Hertz. Future of Tallyho Raises Questions. Review-Journal, 10/13/63; Gordon Kent. Tally-Ho Hotel Sold. Review-Journal, 11/1/63; Forrest Duke. New Tallyho Sale Deal. Review-Journal, 12/20/63; Tallyho Plans $1 Million Show. Review-Journal, 4/8/64; Associated Press. Gaming Board Refuses Tallyho Casino License. Review-Journal, 2/17/65 p1; G. Kent, F. Duke. Strip Hotel Closes. Review-Journal, 4/1/65 p1; Tallyho Sues Owners. Review-Journal, 5/18/65 p1.

Tally Ho and Aladdin sales covered in a series by Keith McKnight and Andrew Alexander for The Journal Herald, Dayton OH. Welsh confirmed with crime figures. Journal Herald, 4/20/72; Firm with crime ties linked to casino deal. Journal Herald, 4/21/72.

Aladdin: Associated Press. Gamers Approve. Review-Journal, 6/20/68 p1; Associated Press. Firm adopts new name: Recrion Corp. Reno Gazette Journal, 12/14/70; Lou Miller. Aladdin Hotel sold. Review-Journal, 11/8/71; Jerry Ralya. New Aladdin Corporation seeks license. Review-Journal, 12/29/71; Aladdin execs indicted. Review-Journal, 8/3/78; AP. Las Vegas architect sentenced to prison. Review-Journal, 3/8/83; AP. Webbe convicted. Review-Journal, 6/19/83; Jane Ann Morrison. LV Casinos Targeted in Money Laundering. Review-Journal, 11/25/84; Aladdin Hotel's history spans 30 years. Review-Journal, 1/5/94 p3; Dave Palermo. Aladdin Hotel finally sells. Review-Journal, 12/9/94 p1; History. Review-Journal, 11/23/97 p14; Jeff Simpson. Aladdin owner faces music. Review-Journal, 8/13/2000; Chronology of the Aladdin hotel-casino. Las Vegas Sun, 8/18/2000. John L. Smith. Sharks in the Desert. Barricade Books, 2005; Jeff German. The Genie in the Lamp, and Close the Place Down. Review-Journal, 9/20/2021.

85 notes

·

View notes

Text

The federal government has added 56 properties to a new public lands bank of locations that are suitable for long-term leases so developers can build housing, a move the Housing Minister says will help boost the supply of homes Canadians can afford. Sean Fraser made the announcement Sunday in Halifax just ahead of a three-day cabinet retreat intended to prepare for the upcoming fall sitting of Parliament. "Making public lands available for home construction is going to reduce the cost of construction and in turn reduce the cost of living," Fraser said. Former military bases, Canada Post sites and federal office buildings are among the properties currently included in the public lands bank, many of which were previously set aside for sale as they are no longer in use.

Continue Reading

Tagging: @newsfromstolenland

#affordable housing#housing crisis#cost of living#public lands#cdnpoli#canadian politics#canadian news#canada

65 notes

·

View notes

Note

Why did Runningbrook get shot? That’s a pretty horrifying way to die, especially if any other cat was nearby to see it happen :(

It was!

So this time, the Suburban Expansion of TNP is getting overhauled. I've actually sat down and worked out a couple human factions; the

Land Owners (Windovers)

Unnamed Development Company (Devco)

The Scientists.

The cats won't be able to notice that there isn't just one group of humans at play here, but you will be able to notice them if you pay close attention to what's happening during the first part of TNP. The three groups interact very differently with Clan cats.

The FIRST group at play here, and the one that isn't a player for very long, is the Windovers. It's openly known by the locals that the cats in the woods are 'a bit strange', especially the farmers near WindClan. The Windovers own that land, and lease it out to various hunters and visitors and such.

But they've been approached by Devco, who want to expand Chelford by purchasing their land.

Problem that the Windovers have: If it gets out there are sapient cats, complete with religion, war, and possibly even tool use (rumored but unconfirmed) there's going to be a HUGE problem in selling it.

SO they're trying to 'quietly' deal with the pests. First they poisoned the rabbits, knowing that they eat those. That worked a bit. Next, they tried to scare them off by actively setting deadly animal traps, and taking shots as if they're pest rabbits. That was how Runningbrook died.

(If I end up moving away from gun, she will end up dying to some sort of snare. The point here though is that it's a, "Wait! They're trying to hurt us!" moment)

Around this point, the sale goes through and suddenly Windover persecution stops. NOT their problem anymore, THANK god, Windovers Exit Stage Right.

But at this point, the Clan cats are well aware that they are being actively targeted. Several cats were poisoned, injured, or outright killed. Devco begins development, first cutting through the trees near the Thunderpath, and eventually bringing in the Bulldozer

Which, Speckletail deals with! Buying them just a bit more time. Suddenly, it's calm for a bit, like they're "mourning their monster."

But THIS is actually the moment where Millie's Radio Collar begins; a cat attacking a construction worker is not something that can be ignored, it's all over the news, "CAT ATTACKS BULLDOZER, CLAIMS LABOURER."

(The Windovers got out just in time, they KNEW something like this was going to happen but now it's Devco's problem)

So this is where the Scientists come in. There's a huge clamor over this, Locals saying, "THE CATS ARE SPECIAL," others saying they need to be removed and rehomed, in any case, it's agreed that the White Hart west of the road needs to be de-catted before construction continues (though construction continues to the west, where ShadowClan is)

And this is when the "round-up" efforts come in, where there are live traps, a big white tent set up, and the cats are going to get weighed, tagged, and studied.

These guys are peaceful and DO NOT want to hurt the cats; but the Clans don't know that. To them, humans are a monolith and they're now terrified of them.

From here, the story returns to normal. A coordinated effort from the Clan cats frees the cats they've captured. Graystripe is the only one the scientists are able to hold onto, by slamming the door of the van just before he can leap out. Millie is later released with him, wearing a radio collar accurate to the tracking tech of the time.

And that brings us to the way humans interact with Clan cats now! The team tries to keep their distance to not stress them out any more, using trail cams and staying several hundred feet away while observing them.

114 notes

·

View notes

Text

The Lessing and Lessing Annex, Chicago

The Lessing (now The Commodore), 550 W. Surf St., Lake View, Chicago

The Lessing Annex (Now The Green Brier or Green Briar), 559 W. Surf St., Lake View, Chicago

The Commodore, view at Broadway and Surf St. Source: apartments.com

The Lessing (The Commodore) archival photo. Source: Chicago History, Spring 1985, p.30

I've always admired The Commodore, its severe facade of Roman brick with minimal ornament contrasting with its deep recesses and complicated footprint. I used to fantasize about living there; data about recent condominium sales put prices at $250,000-$300,000 for a two-bedroom unit.

Originally called The Lessing, the residential building was completed in 1897 at the northeast corner of Surf and Broadway, and designed by Edmund Krause.

New Yorker Herbert Croly observed in 1907 that while New Yorkers turned to Paris for models, Chicagoans favored simple, even modest exteriors. Chicago History, Spring 1985, p. 30

According to Carroll William Westfall, in "Home at the Top: Domesticating Chicago's Tall Apartment Buildings," Chicago History, Spring 1985, p. 21:

Multi-family dwellings, apartment and flat buildings, did not conform to nineteenth-century Chicagoan's cherished view of their town as a community of freestanding, single-family residences surrounded by fences protecting trees, gardens, and outbuildings. This image persisted long after Chicago had become a thriving commercial city and had ceased being merely a town.

Chicago History, Spring 1985, p.30

The story of The Lessing and Annex began with German immigrant Ernst Johann Lehmann, who began his career in Chicago by opening a small jewelry store on Clark Street. By 1874, he had been so successful that he moved his business to the prestigious corner of State and Adams. He called the new store "The Fair," a name that assured customers that they would be treated fairly. By 1882 The Fair store occupied every building along the north side of Adams between State and Dearborn Streets.

A short time later, the entire south half of the block bounded by Dearborn, State, Monroe, and Adams streets had been leased to The Fair in a deal amounting to a little over three million dollars. A great emporium would be constructed on the site, twelve stories high, costing two million bucks. The building would be the largest in the city and, in fact, the largest in the world devoted to merchandising.

Lehmann died in 1900 at age 50, 10 years after he suffered a mental breakdown, spending the remainder of his life in a mental institution. His wife, Augusta, via a male relative, gained control of the business. She also received the bulk of his wealth, estimated $10 miliion (about $331 million today). Augusta and the Lehmann clan had become interested in real estate before Ernst died. In 1897, the upscale Lessing Apartment building, designed by Edmund Krause, was completed at Surf and Evanston Street, now Broadway.

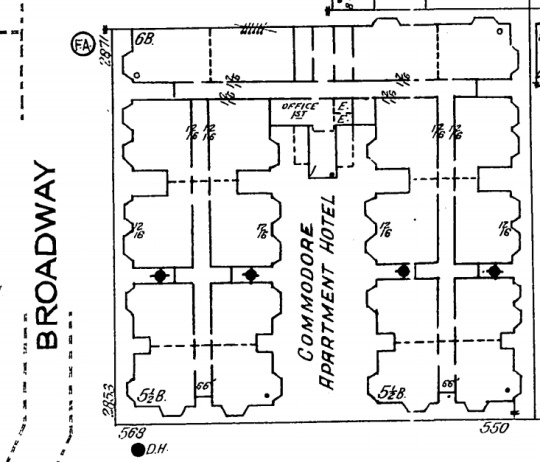

The Commodore, floor plan published in 1923

The Lessing was marketed to an upscale clientele and had 86 apartments, some of them with as many as eight rooms. Architect Edmund R. Krause broke the huge six-and-one-half-story complex into a series of projecting units with deep but narrow courts between them to provide light and ventilation. The Roman brick façade is organized into the classic three-part design of the Chicago School. Although there is a nifty oculus (a circular opening, especially one at the apex of a dome or structure), it is minimally decorated, centered at the top of each projecting bay. Digital Research Library of Illinois History

Oculus in the attic story

Entrance hall

Stairway

Interior views of The Commodore are available here

The quiet apartment building was disturbed in 1917 when a lurid tale of deceit and betrayal led to a murder that reads like a novel (see story below).

MURDER AT THE COMMODORE IN 1917.

Shoots When She Learns He is Married.

Dr. Louis H. Quitman Wounded by Cabaret Singer, May Die.

A video tour of The Commodore by sales agents is available on Instagram here

The Virginia Hotel, Chicago, was quite similar in design and simplicity to The Lessing.

Seven years later, the Lessing Annex was completed just to the south, facing The Lessing from across Surf.

The Lessing Annex

Apparently, the term "hotel" was sometimes applied to residential buildings that were not intended for short-term stays. "Fire proof construction, built 1902, steel and tile interior, brick exterior. The Green Briar was constructed of a different color of Roman brick than its neighbor across the street.

My photographs of the buildings:

Edmund R. Krause, architect

Edmund R. Krause was born in Thorn, Germany, on August 15, 1859, the son of William and Wilhelmina Krause. He studied architecture in Germany and came to the United States in 1880 at the age of 21. He began his architectural practice in Chicago in 1885 at the age of 25 or 26. For a brief time, he was in partnership with Frederick W. Perkins (1896) but, for most of his working years, he was a sole practitioner.... The American Contractor database that covers the period 1898 through and including 1912 shows that he designed 61 buildings. Of these, 25 (or 41 percent) were for either E.J. Lehman, the estate of E.J. Lehman or another Lehman family member. It is a great example of the importance of a major client to an architect. Another major client was the Fair Department Store. He designed six buildings for them – mainly warehouses or delivery stations – between 1904 and 1909. It appears that the large apartment building was his specialty, for he designed several. Most of them have been demolished, but one prominent commission still stands at the intersection of Surf and Broadway. Originally known as the Lessing Apartments, it was later renamed the Commodore and is now a condominium building. Designed in 1897 and completed in 1898, it originally had 75 apartments, 15 to a floor around a “U”-shaped central courtyard. Later, an Annex was constructed to the north using the same style yellow Roman brick. The Lessing Apartment Complex was one of the first, if not the first, large apartment building constructed north of Diversey. He also designed the 20-story Majestic Theatre building, at what is now 22 W. Monroe. It was subsequently renamed the Schubert Theater and, in 2005, was renamed the LaSalle National Bank Theater. George Rapp of the later firm of Rapp and Rapp designed the interior theater while working as an assistant to Mr. Krause. The building itself was recommended for Chicago Landmark status in 2005. To our knowledge, Edmund Krause designed only three structures in Edgewater: two houses and one commercial building. The first house he designed was at 1189-91 (now 6212) Winthrop. Cook County Recorder of Deeds records show his wife purchasing the lot on August 25, 1898. The permit for the house was issued the next month and he is shown as living in the house in the 1899 and 1900 city directories. It was a rather substantial frame house at 2,800 square feet. The Krauses sold the improved property on January 1, 1902. It was obviously a short stay. Edgewater Historical Society

Majestic Theater, Chicago, Edmund R. Krause, architect

#Krause#Edmund R. Krause#Lessing#Lessing Annex#apartment#condominium#Lake View East#Chicago#architecture#buildings#photography#history#Ernst Johann Lehmann#Lehmann#The Fair Store

6 notes

·

View notes

Text

have you guys ever tried to sell things? commerce nation every weekend my neighbor sets up the most involved racks of clothes and tent canopy yardsale i've never seen anyone attend and on every corner there are popup mountain of junk sales everything must go and it's like who even buys a lawnmower from the empty lot across from the perpetual mixed use five above one condo construction down the street from the bridge that's been closed all year? how are they even getting any foot traffic in that location location location? i don't know

take a box of books to half price but they open an hour late on weekends for some reason so you buy a coffee but the drive thru's full and you need (ground) coffee anyway so in you go and there goes $20. the pickled garlic at menards has in fact been on your grocery list for over a month and aldi is right there so now you've got half-frozen raw chicken too, and while-u-wait you check the one shelf that houses the $6 books you sold last time and at this point you don't even remember what all of them were but they've got 5 priced for $53, a "whopping" $15 for the youtuber who turned into a transphobe, probably by virtue of unfortunate research practices in order to pick up her video production turnaround, because it was hardcover, and $9 for the second book in paperback by the new york times bestselling harvard professor who went out of style because all her theories turned out to be undetectable at experimental regimes

and despite the capital outlay required to buy community college textbooks at the outset, they're able to make you an offer of a "whopping" $2, apologizing for it while they say it out loud, because it was obviously the wrong place to sell textbooks and you knew that. and resignedly you're like well it is an everything must go sale but i know i can do better for this one and you pull out kroenke database processing 14th edition even though it's realistically less useful than mcconnell code complete, because you found the receipt when you unshelved it and it was $200. not a price you paid because it was a certification -- to which you're considering setting fire -- that was paid by a federal program

and it's like what are we even really doing here. commerce nation but unless you have the capital outlay to establish a network of bricks and mortars, where you can just ship books in between each, anytime anyone at your convenience in the commerce nation asks for one of them (they've got brazilian portuguese in mississippi), you're not going to get a fair price for resale without patience and possibly a warehouse lease. deck stacked against the consumer at every turn, buck sure does stop here by which i mean the end user is buried in a mountain of junk they can't resell. anyway they had lauryn hill so i think all told it cost me $53 to get $2 back. but it's fine. i paid credit

10 notes

·

View notes

Text

Good morning TUMBLR - March 7th - 2024

''Mr. Plant has owed me a shoe since July 5, 1971."

Ch. VIII - 1985- 1989 - Bahrain - Part 1

The 25 km King Fahd causeway that links Saudi Arabia to Bahrain.

Manama, the modern capital of Bahrain.

Bahrain desert - the Tree of Life

Bahrain life

GPIC - Gulf Petrochemical Complex - Sitra Island, Bahrain

The winter between December 1984 and January 1985 was particularly harsh in Italy, characterized by increasingly lower temperatures. Between 13 and 17 January 1985, a depression centered on the Corsican Sea caused what is still remembered in Milan today as the snowfall of the century or the snowfall of '85, constituting the heaviest snowfall recorded in Milan in the 20th century. The snowfall caused serious damage. After four days of real storm, January 17th 1985 the Sports Hall collapsed in Milan due to the excessive weight of the snow that had accumulated on the roof. In this certainly not festive atmosphere, I received a call from an engineering company in Milan, INTECH, an already a supplier of services to SNAMPROGETTI, with whom I soon agreed to leave for Bahrain.

From the SNAMPROGETTI office in San Donato, the Head of HR office Mr. Cincotta reassured me: ''It's a temporary destination, just a few months, waiting that construction of new Agadir International Airport will start … don't worry…'' I stayed there for 4 years…….

Mind you, not that I minded: Bahrain was a liveable place (drinkable, in the language of shipbuilders) especially because it also allowed families to reach the employees involved in the project. I then left at the beginning of March 1984, with a flight via Kuwait. I arrived at Manama airport and believe it or not there was someone waiting for me! A local guy holding a board with my name written on it almost correctly: Brino Sirino….

Bahrain is a small Emirate in the Persian Gulf (Kaleejj el Arabi) made up of a main island and a myriad of uninhabited islets. It is the ''poorest'' Gulf state, relative to its surrounding neighbors. Above all, Saudi Arabia provides the Emirate with considerable economic aid as the ruling house of Bahrain, like the Al Saud, is of the Sunni faith, in spite to a majority Shiite population The Saudis would never allow a Shiite regime to be established 25 km from the Saudi coast with the approval of the ''Great Enemy'' Iran. And then Bahrain was a sort of ''playground'' for Saudis looking for entertainment just outside their front door. This therefore explains the reason for the economic support to Bahrain by the Saudis. For instance, one of the largest oil well in Saudi waters has always been exploited for free by the Bahraini oil industry. The construction of the 23 km long bridge that connects Saudi Arabia to the island of Bahrain was financed by the Saudis. The free sale of alcohol in Manama by shops managed by a company belonging to the ruling Bahraini family is another concession aimed at helping the Emir Al Khalifa's coffers. In 1986, shortly before the opening of the Dahran – Manama bridge to traffic, King Fahad proposed to the Emir Sheik Eissa the prohibition of alcohol sale, promising to compensate the Emir for the lost earnings: an offer returned to the sender. On top of all this, about 50% of the Southern territory of the island of Bahrain is off limits, due to the largest naval base leased to the US in the Gulf. However, Manama has since then been a modern city, full of skyscrapers, luxury hotels and shopping centres.

AWALI I was housed in Awali, a village of wooden houses built by the Americans of Caltex in 1939, when the first refinery in Bahrain (and the entire Persian Gulf) was built. Someone later told me that around 1942 some Italian planes departing from a base in Egypt tried to bomb the refinery, which produced fuel for the English army. Not having enough fuel to guarantee the return, the planes dropped their bombs into the sea just before the island of Bahrain, and aborted the mission. The village of Awali is located almost in the center of the main island of Bahrain, and its wooden houses are reminiscent of those from the Lassie TV series in every way, including anti-mosquito doors. The houses are 2 and 4 bedrooms, with a large living-dining room, kitchen and two bathrooms. I was assigned to a small 4 bedroom house, but when I got there I was the only occupant. The village also had a club with a partially covered swimming pool (to prevent the summer sun from making the water too hot) and tennis courts, to which we had free access.

RONCI ATHOS A few days after my arrival, around 3.00 AM, I heard some noises: the sound of a car stopping, doors slamming, and than someone throwing something (I than saw that it was suitcases…) inside the house. , on the wooden floor. Then the door of my room suddenly open, and someone said: Are you asleep? Before you arrived I was asleep……. However...... - says the guy - I'm not going to stay here…….tomorrow I'll talk to the HR and then I'll see ..... Okay…. I say…. do as you like but let me sleep now….

For the record, Mr. Ronci Athos – Umbrian from Narni – was still there in 1993, in the place that 8 years earlier he had said he would leave as soon as possible….

THE PROJECT Our client was called GPIC - Gulf Petrochemical Industries Company - a mixed Bahraini, Saudi and Kuwaiti capital company - and was part of the economic aid package from the rich Gulf countries to the ''poor'' relative of Bahrain. Later, at the time of the commissioning and start up of the plants - we would have transformed the acronym into Gruppo Pensionati Italiani Comerint, given the average age of the people that the then company 'ENI had sent to proceed with the commissioning of the plants. The project was in its final phase, and was directed by none other than the P.I. Manoli Benito Italo. Bahrain would be his last construction site personally managing, before becoming Director of the CSO Service of SNAMPROGETTI. The works were even ahead of schedule, so SNAMPROGETTI enjoyed a lot of credit with the Client. Upon delivery of the plant, the Client gifted an extra bonus of 4 million dollars to SNAMPROGETTI for its performance. The credit was than canceled in 1990, during the first Gulf War. GPIC invited SNAMPROGETTI, BECHTEL and UHUDE to provide an initial feasibility study for a urea plant to be built alongside the existing ammonia and methanol plants. BECHTEL replied that she was not interested, SNAMPROGETTI sent a fax requesting an advance of 11,000 USD for the preliminary study. The Germans from HUDE, sensing the deal, in the midst of the Gulf War, sent a representative to Bahrain to discuss the possibility of building the urea plant. In 1992 the belated SANMPROGETTI envoy to Manama was detained at the entrance gate of the plant for a couple of hours, only to be informed that GPIC had officially commissioned UHUDE with the preliminary study.

COMMISSIONING & START UP The long phase of pre-commissioning, commissioning and start-up of the plants soon began. Which were built on a so-called reclaimed land (an artificial island) created by dredging the shallow seabed, characteristic of the Bahraini island. The artificial island - equipped for safety reasons with an outer gate and an inner gate - was connected to the mainland by a causeaway approximately 3 kilometers long, and a second causeaway joined the island to the loading arms of the products, 10 kilometers further into the sea. This is to allow ships to carry out loading operations in complete safety, without the risk of running aground in the shallow seabed. There were many wrecks of ships stranded along the channel dug by the open sea up to the port of Manama - this much to the happiness of the divers, given that the wrecks had been transformed into sanctuaries of Persian Gulf tropical fish. However, I must say a word to describe the characters who are part of the commissioning – start up. These particular people, who believe they are a sort of ''NASA scientists'' intent on launching the SPACE SHUTTLE into space. As soon as they arrived at site their aim was: ''Okay, get rid of Construction people, we're here now''. The fact is that, apart from 3 or 4 of them who really knew what they were doing and were experts in the difficult process of putting the plants into operation (very dangerous indeed) all the others followed suit: ''they claimed to know'' and the less they knew, the more they pretended they were knewing. I met someone who, as soon as they heard someone approaching, started to talk about chemical formulas, operating pressures, and so on, just to put on airs. In any case, within 3 months the start up team had managed to get the two plants up and running, even if the (rhetorical) question that was circulating was - Did you make the methanol?'' ''no…I didn't…So who did it?? No one knows.... ''

Tawfeeq Mohammed Rasul Almansoor - GPIC President The President of GPIC, however, did not seem entirely satisfied, and he demonstrated it with a series of actions that were surprising to say the least. One day Mr. Tawfiq arrived at high speed at the outer gate driving his metallic blue Rolls Royce. The presence of smat guy on the guard post prevented him from ending up against the bars at the outer check point.

Mr Tawfiq continued on the causeway at full speed and the inner gate guard, warned by radio by his colleague at the outer gate, promptly raised the bars. The President's Rolls entered the area of the Administrative offices, where he finally stopped. Tawfiq got out of the car in a rage, and ordered the Security Chief who met him to organize a meeting within 15 minutes. Participants in addition to him were the Security Chef, the Director of COMERINT and the Security Advisor. We mortals later learned that the Security Chef – an British guy, former officer in Hes Majesty's army, had been fired on the spot – Reason given by Mr. Tawifiq:

''Two gates were opened for me and I was able to drive my car into the plant – and this was because at the sight of my Rolls Royce the guards thought I was driving the car. What if he was a terrorist? What if I suddenly went crazy and wanted to attack the plant? What if I had been kidnapped by terrorists who were hiding in the car filled with explosives??'' (I remember that the Rolls Royce was equipped with tinted mirror windows which did not allow anyone to see who was driving the car.) A few days later, a second episode, again with Mr. Tawifiq as absolute protagonist. He had gone between the Main Control Room and Plant Laboratory, in a fairly hidden corner of the plant, and had broken the glass of one of the fire alarms that send a signal to the Fire Department control room. He than set off the stopwatch on his Rolex Platinum Diamond Pearlmaster to see how long it would take for the firefighters to arrive. After 11 interminable minutes - I would like to point out that the Fire Station was about 700 meters from the place where Mr. Tawfiq was stationed - the firefighters arrived to find that it was a false alarm. Again an urgent meeting was called, where this time the HSE manager lost his job. The reason for such a delay – which according to Tawfiq could have led to a disaster in the event of a real fire – was that on the synoptic panel of the fire brigade control room it was not possible to identify precisely where the alarm had went off. Just a week after the episode of the false fire, the start-up of the plants had been successfuly done. The plant was even proding more ammonia and methanol than expected, around 1,200 tons per day per product, instead of the 1,000 tons expected. But many of the ''COMERINT Pensioners'' who had participated in the commissioning were still circulating in the plant. As they say in Southern Italy, ''they were mugging''. Obviously COMERINT was looking for all the plausible excuses to keep them in service, given the daily rates with which they were invoiced to the Customer. (an average of $1,200/day per person). The situation between COMERINT and GPIC had become very tense, with daily requests from the latter to demobilize the technicians. One day Tawfiq lost patience, and went to the Main Control Room - still dressed in the traditional white disdasha, ghutra on his head, he surprised a swarm of Italians having coffee, talking about football, playing on the computer. Tawfiq, who had been taken like an ordinary local, turned to the bystanders waving his arms in the Arab manner and said: ''What is this? Coffee shop''? The shift manager, at that moment sitting on the desk with a cup of coffee in his hand and his legs dangling, stood up and in a benevolent manner, took Tawfiq by the arm (a very serious mistake as per Arab habits) pointed to a door at the end of the corridor and told him : Shouff (look) coffee shop for Arab is there, at the end of corridor – accompanying it all with a laugh. Tawifiq, according to bystanders, didn't show any sign of upset - he left the Control Room, called the Italian Director on the phone. Mr Fiorentino, COMERINT top manager. Mr Tawfiq ordered that all those present at the unfortunate episode were boarded on the first plane to Italy. The offices in the North wing of the Control Room were closed until further notice. But where the President of GPIC gave his best was at the final meeting with Construction Director Benito Italo Manoli and the entire SAMPROGETTI staff present. During the meeting, numbers of questions were raised which mainly concerned the safety of the systems. At a certain point Mr. Tawfiq turned directly to the Italian Doctor Mr. Busonero asking : Doctor, in case of explosion of one or more tanks of ammonia or methanol, either due to a terrorist attack, or due to an accident, what could be the consequences?

Dead silence in the meeting room… gazes of all those present frantically crossing each other… Mr. Manoli trying to communicate via brain waves with Doct. Busonero, while coughs and noises of chairs moving rang out in the room…. ..and finally the Doctor, red in the face and with drops of sweat running down his forehead (despite the air conditioning being set to 19 degrees C – Tawfiq's favorite temperature) Doct. Busonero replied: - Well…Mr. Tawifiq…with a prevailing wind from the South-East to the North-West, the inhabitants of Manama would have from 7 to 10 minutes to recommend each one's soul to God…''

It was freezing in the meeting room, no one said a word, everyone was waiting for the President's counter-reply. Tawfiq stood up and nodded to Mr. Manoli who followed him into President's private office. The next day there was no trace of Doct. Busonero. We learned that he had been put on a plane to Rome before midnight, the deadline that Tawfiq had indicated to Mr. Manoli. Contrary, Doct. Busonero would have been arrested for telling the truth.

5 notes

·

View notes

Text

County Fair Potatoes, Inc. - Revolutionizing the Potato Industry

Welcome to County Fair Potatoes, Inc., a start-up featuring the unique combination of a multi-generational Idaho potato farmer, real estate, development, and potato processing experts, with the goal of capitalizing on the strong demand for French fries and frozen potato products in the U.S. and abroad. CFP will occupy 74,000 square feet in a new 280,000-square-foot facility that will be constructed by Fall 2025. This deal is unique because of vertical integration (food processing, lease income, cold storage services, etc.); the idea of adding various types of income into the financial model, thus increasing the value of the company, real estate footprint, and mitigating the risk of failure.

Why County Fair Potatoes?

Rapid Growth: The demand for French Fries is skyrocketing both in the US and internationally. Industry experts highlight that current production levels are not meeting this increasing demand.

Vertical Integration: Our company encompasses food manufacturing, sales, transportation, and facilities management. This approach minimizes costs, enhances efficiency, reduces food waste, and maximizes profitability.

Global Reach: By implementing a unique online B2B e-commerce strategy, we enable customers worldwide to sell genuine Idaho-certified potato products at reduced costs, with white-label capacity.

Eco-Friendly Products: Our potatoes are organic, non-GMO, low in salt, sugar, and preservatives, and incredibly tasty!

Investor Benefits

High Returns: Enjoy an impressive IRR of 167.7% and a real estate exit multiple of 2.5X.

Join Us: Interested in becoming an owner? Visit our crowdfunding site for more information: https://www.invown.com/app/pitch/cfp

Join us in transforming the potato industry and bringing the best Idaho potatoes to tables around the world!

Don't forget to like, comment, and subscribe for more updates on County Fair Brands!

www.countyfairbrands.com

https://www.invown.com/app/pitch/cfp

2 notes

·

View notes

Text

How Foreigners Can Easily Own a House in Vietnam?

How Foreigners Can Easily Own a House in Vietnam?

Because making an overseas property investment is a significant decision, it is recommended that the investors consult with real estate dispute lawyers in Vietnam for assistance in determining the developer's eligibility, construction permits, and other project-related legal documents. To ensure the protection of rights, reduce risks, and ensure compliance, it is essential to review the transaction documents in relation to the deposit agreement, sales agreement, and any other agreements the developer might propose.

On November 25th, 2014, the National Assembly of the Socialist Republic of Vietnam has approved the Housing Act 2014. The fact that a foreigner can buy a house in Vietnam is one of the most notable new changes.

Houses can be owned by foreign organizations and individuals in Vietnam:

-Overseas organizations and individuals putting resources into lodging development under projects in Vietnam as per the arrangements of the Housing Law and related authoritative archives;

-In Vietnam, businesses with foreign investment capital are operating, as are foreign investment funds, foreign bank branches, branch or representative offices of foreign businesses, and foreign investment funds.

-Foreign citizens are allowed to enter Vietnam.

What are forms of ownership housing foreigner in Vietnam?

-investment in the construction of housing in Vietnam as part of the project, in accordance with the Housing Law and related legislation;

-Apartments and single-family homes are included in the investment projects of housing construction. Commercial housing can be purchased, leased, donated, or passed down. (With the exception of housing projects aimed at safeguarding Vietnam's national defense and security, as mandated by the Government of Vietnam).

What are conditions, rights and obligations of foreigner when buy house in Vietnam?

For people or associations putting resources into lodging development under a project in Vietnam while seeking to possess houses in Vietnam they should fulfill the accompanying circumstances:

-Have an investment certificate

- Have housing developments constructed within the project in accordance with housing law.

When looking to buy a house in Vietnam, foreign businesses with foreign investment capital, branch or representative offices of foreign businesses, foreign investment funds, and foreign bank branches must meet the following conditions:

-Have investment certificates or documents relating with the license to operate in Vietnam gave by the skillful State offices of Vietnam.

Foreign individuals buying a house in Vietnam

-Allowed entry into Vietnam, but do not entitled to diplomatic and consular privileges and immunity.

Foreign businesses with foreign investment capital, branch or representative offices of foreign businesses, foreign investment funds, and foreign bank branches in Vietnam, as well as individual foreign buyers of homes in Vietnam, are eligible to own homes in Vietnam when:

-Rent, buy, donate, inherit, or own no more than 30% of an apartment building's units; Foreigners are not permitted to buy, lease, donate, inherit, or own more than two hundred fifty individual houses, including villas and semi-detached houses, in areas with a population equivalent to that of ward-level administrative;

-In accordance with the terms of the contract of sale, lease, donation, or inheritance, foreign individuals are entitled to own a home for a maximum of 50 years from the date of issuance of the certificate of ownership, which may be extended as required by the government. The certificate must also specify the period of ownership of the property;

-In the case of foreign individuals married to a citizen of Vietnam or hitched to a Vietnam resident got an outside country, they can possess the houses for a long and stable term. Additionally, like Vietnamese citizens, they enjoy owner rights;

Foreign organizations shall have the right to own a house in accordance with the contract of sale, lease, donation, or inheritance, but not longer than the period outlined in the certificate of ownership, which may include an extended period. The time it takes to own a house starts on the date the certificate of ownership is received and is listed on the certificate.

2 notes

·

View notes

Text

Important Clauses to Include in a Lease Agreement

When renting a property, whether residential or commercial, a well-drafted lease agreement is crucial. It serves as a legal document that protects the interests of both the landlord and the tenant. At Goel Ganga Developments, we understand the importance of a comprehensive lease agreement. Here are some essential clauses to consider when drafting or reviewing a lease.

1. Parties Involved

Clearly identify all parties involved in the lease agreement, including the landlord (lessor) and tenant (lessee). This section should include full names, addresses, and any relevant identification details to ensure that both parties are accurately represented.

2. Property Description

Provide a detailed description of the property being leased. This should include the address, type of property (residential or commercial), and specific features that are part of the lease (e.g., parking spaces, storage areas). Goel Ganga Developments offers a variety of properties, so ensuring clarity in this clause is vital.

3. Lease Term

Specify the duration of the lease, including the start and end dates. This clause should also outline any options for renewal or extension of the lease, along with the process for doing so.

4. Rent Payment Terms

Clearly state the rent amount, payment due date, acceptable payment methods, and any late fees for delayed payments. It’s also beneficial to include details about rent increases and the conditions under which they may occur.

5. Security Deposit

Detail the amount of the security deposit required, the conditions for its return, and any circumstances that may lead to deductions from it. This protects both parties in case of damages or unpaid rent.

6. Maintenance and Repairs

Outline the responsibilities of both the landlord and tenant regarding maintenance and repairs. Specify who is responsible for regular upkeep, emergency repairs, and any associated costs. At Goel Ganga Developments, we emphasize maintaining our properties to ensure tenant satisfaction.

7. Use of Premises

Define the permitted use of the property, including any restrictions. For commercial leases, specify what activities can take place on the premises to avoid conflicts or zoning issues.

8. Alterations and Improvements

Include clauses regarding any alterations or improvements the tenant wishes to make. This section should specify whether the tenant needs prior approval from the landlord and what happens to any modifications at the end of the lease term.

9. Termination Clause

Detail the conditions under which either party can terminate the lease early, including notice periods and grounds for termination. This ensures both parties are aware of their rights and obligations if they need to end the lease prematurely.

10. Governing Law

Specify the governing law that will apply to the lease agreement. This is especially important for commercial leases, as laws can vary significantly between jurisdictions.

11. Dispute Resolution

Include a clause outlining how disputes will be resolved, whether through mediation, arbitration, or court proceedings. This can save time and resources in case of disagreements.

Conclusion

Having a well-structured lease agreement is essential for a smooth landlord-tenant relationship. At Goel Ganga Developments, we prioritize transparency and fairness in all our dealings, ensuring that our lease agreements protect the interests of both parties. If you’re considering leasing a property, make sure to consult a legal expert to help draft an agreement that meets your specific needs.

#goel ganga developments pune#best builders in pune#goel ganga developments#new residential projects in pune#pune builders and developers#premium residential projects in pune#commercial property in pune#ganga platino kharadi#commercial property for sale in pune#3 bhk flats in pune kharadi#budget 2024#union budget 2024#goel ganga ishanya satara#ganga acropolis baner#commercial property in koregaon park#best residential projects in pune#residential projects in kharadi#commercial construction projects#real estate projects in kharadi#real estate developer#realestate#lease agreement#ganga aria dhanori#commercial projects in koregaon park#kharadi residential projects#commercial shops for sale in pune#2 bhk for sale in kharadi#2 bhk flats in kharadi pune#3 bhk in dhanori#3 bhk flats in dhanori pune

1 note

·

View note

Text

#Buying agent services London#ON#First-time home buyer services in London#Luxury property buying and sales London#New construction sales and leasing in London#Ontario#Property sales management London

0 notes

Text

Advantages of Multifamily Real Estate Investing

Investing in multi-family real estate is a favored asset class among both seasoned and novice commercial real estate investors. This category of real estate comprises properties specifically developed to accommodate multiple families, including apartment buildings and townhouses. These properties are typically owned by a single entity and rented out to multiple tenants. Multifamily investment properties for sale in New York can be a lucrative investment opportunity for individuals and companies looking to generate income from rental properties. Here are the many benefits of multifamily investing:

Help Pay Mortgage

One of the key advantages of investing in multi-family real estate is the ability to lease out multiple units, generating rental income that can be used to offset or even pay off your mortgage. With this strategy, you can enjoy the financial benefits of property ownership while maximizing your returns. This can significantly reduce your monthly housing costs and help you build equity in your property faster.

Easy to Finance

When considering obtaining a mortgage, multi-family loans are comparatively simpler to qualify for than single-family homes. This is because rental income can be considered as a source of income, enabling you to secure a larger loan. Nonetheless, it is crucial to meticulously examine your credit report and make enhancements to your credit score to secure the most favorable mortgage interest rate. By doing so, you can ensure that your mortgage application is successful and you receive the best possible terms.

Scope of Real Estate Portfolio Construction

Investing in multi-family properties presents an excellent opportunity for creating a rental property portfolio. By acquiring more multi-family units, you can generate sufficient rental income to offset your mortgage payments, thereby freeing up funds to acquire additional properties. This approach enables you to grow your real estate investment empire steadily. Over time, you can build a portfolio of properties that generates significant monthly income.

Easier Control

When you own Multifamily buildings for sale in Yonkers New York, you have greater control over your investment. You can handle the day-to-day issues that arise, collect the rent, and save on property management costs. Additionally, many renters treat multi-family units better because they know the owner is nearby.

Tax Benefits

Another significant benefit of multifamily real estate investing is tax benefits. You can write off the costs of maintenance and repairs on your rental unit, deduct insurance premiums and property/facility management fees, and reduce the value of your home over time. All these tax incentives lead to many tax savings.

Simplicity

Multi-family real estate investing is also a much easier way to become a real estate investor. You only need one mortgage and one insurance policy to cover your building, which makes it simpler to manage and reduces the need for property managers.

Reduce the Risk

Owning multiple units reduces risk. If one unit is vacant, you still have rental income from the other units to cover your expenses. Additionally, owning multi-family properties can help you weather economic downturns and other challenges that can impact the real estate market.

Conclusion

Multifamily investments offer compelling risk-adjusted return profiles. Different financing options are available for family offices and property trusts for individuals and partnerships. However, the complexity and diversity of the structural features of each loan create opportunities for failure in the financing process. Investigate not only the financing options but also the structural characteristics of the loan and be aware of the limiting factors early in the process. This creates the foundation for a successful path that increases cash flow. It is advisable to rely on seasoned brokers specializing in multifamily real estate investment to assist you in navigating the intricacies and pinpointing suitable prospects. Investing in multi-family properties can potentially yield substantial rental income, enhance equity, and foster financial security.

3 notes

·

View notes

Text

Thunderbird / Silverbird / El Rancho

Thunderbird Hotel, 1948

Thunderbird, '48-'76

'46: Marion Hicks and Lt. Gov. Cliff Jones purchase property for a planned Nevada Ambassador hotel on 3/11/46. The property was bought from Guy McAfee, Art Ham, and J.K. Houssels who had planned a hotel called Casa de Oro. Sale price is rumored $85,000.

'47: Officers of Thunderbird are a Las Vegas and Los Angeles group, Hicks, Jones, V. Sayer, J. Lane, P. Wagoner, J. Wells (Reno), and J. Kozloff. Hicks as builder. Construction begins on 46 acre lot in Oct.

'48: Thunderbird opens 9/2/48. 107 rooms, 75-foot observation tower. Signs by Graham Sign Co (RJ 8/18/48).

'53: Hicks builds the spin-off Algiers Hotel.

'58: renovation, adding new second floor over casino framed in rectangular box, new porte-cochère. New signs by Western Neon (RJ 11/24/58, RJ 12/24/58).

'59: “Thunderbird” logo changed, road sign replaced in Fall.

'61: road sign moved to the front-center of the hotel, fire-shooting stick added to both birds.

'62: new road sign and pylon.

'63: Thunderbird Downs quarter horse track opened, Oct. 5 (RJ 9/24/63).

'64: Sold to Del Webb Corp in Sep.

'65: 700-ft horizontal “Thunderbird” sign by Bill Clarke/Ad Art installed over the south rooms in Jun. (RJ 6/10/65); road sign & pylon replaced with one road sign and new neon bird.

'72: Sold to Caesars World Inc.

'73: Blue/green sign painted zigzag red/orange in summer.

'76: Sold to Tiger Investment Co (Thomas, Mack, K. Sullivan, et al), leased to Major Riddle in Dec.

Silverbird, '77-'81

'77: Reopened as Silverbird in Jan.

'78: Thunderbird signs replaced by the 190-ft sign/porte-cochère designed by Raul Rodriguez for Heath, built by AdArt. (RJ 3/29/78)

'81: Closed in 12/3/81.

El Rancho, '82-'92

'82: Sold at auction to Ed Torres in Feb; renamed El Rancho in Apr (RJ 3/18/82, 4/7/82). Opens at El Rancho 8/31/82.

'87: Tower addition.

'92: Closed Jul. 6.

2000: Tower demolished, Oct. 3. After the site was cleared the El Rancho sign remained, covered with advertised for Turnberry Place until '04 or '05.

Other sources include: “New Hotel To Be Built.” Las Vegas Review-Journal, 3/13/46 p1; Vegas as Playground. Review-Journal, 7/31/46 p5; Construction Started. Review-Journal, 10/28/47; Thunderbird Hotel. Review-Journal, 8/29/48; Martin Stern Jr. profile by P. Michel. UNLV Libraries, archived 3/10/2004.

Photos: (1) Postcard c. 1948. (2-3) Undated aerial photo of construction, by Las Vegas News Bureau. Radio station KENO west of the Thunderbird site. (4) Undated, during construction. Photo taken from the observation tower, by Las Vegas News Bureau. (5) Same models as the color postcard, from Union Pacific Railroad Photographs (PH-00043), UNLV Special Collections & Archives.

164 notes

·

View notes

Text

New Homes For Sale In Albuquerque, Nm

The Albuquerque Public Schools school district caters to over ninety,000 students’ instructional needs and is praised for its diversity. To see all the homes you’ve saved, visit the My Favorites section of your account. Zillow Group is dedicated to ensuring digital accessibility for individuals with disabilities. We are repeatedly working to improve the accessibility of our net expertise for everybody, and we welcome suggestions and accommodation requests. If you want to report a difficulty or search an lodging, please tell us.

To really appreciate your new hometown’s place in historical past, discover an apartment close to Albuquerque’s historic Old Town district, the place many homes are on the National Register of Historic Places. There’s stay weekend entertainment throughout the summer in Old Town Plaza, and a few of the city’s best buying too. Albuquerque was established in 1706 as a Spanish colonial outpost, with a village constructed up around a central plaza .

The self-proclaimed “outdoor enthusiast’s paradise,” Albuquerque boasts 300-plus days of sunshine every year. Albuquerque can be highly-regarded as a cultural center of the Southwest thanks to museums like the Maxwell Museum of Anthropology, Indian Pueblo Cultural Center and New Mexico Museum of Natural History. Active homebuilders within the area embrace Pulte Homes, Twilight Homes, RayLee Homes, Abrazo Homes, and Tiara Homes contributing their expertise and prime quality customer support to the house new home builders in albuquerque process. Situated on the middle of the New Mexico Technology Corridor, Albuquerque boasts a concentration of high-tech private firms and authorities establishments alongside the Rio Grande. Many know-how fields operate here and account for almost half of the state's economic activity. Other financial drivers embody authorities, agriculture, tourism, manufacturing, and analysis & improvement.

The info is for client's private, non-commercial use and is most likely not used for any objective other than figuring out properties which customers may be thinking about buying. So if you are ready to take advantage of each alternative that this market has to supply. In addition, share our technique for serving to you reach them without pulling your hair out in the process. As your actual property agent, we promise you'll at all times have a clear understanding of the entire image. When it comes to buying and selling real property in a market as unique as Albuquerque you know you can’t afford to place your belief and hard-earned cash in the palms of any Realtor®.

ABQnews Seeker Albuquerque Publishing Co. is looking for ... Albuquerque Publishing Co. is searching for a substitute for Journal Editor and Senior Vice President Karen Moses, who will retire this yr. The technical storage or entry is required to create consumer profiles to ship promoting, or to track the person on a internet site or across a quantity of websites for related advertising purposes. The New Mexico Regulation and Licensing Department regulates more new homes albuquerque than 500,000 people and companies in 35 industries, professions, and trades across the state. Our aim is to assure that New Mexicans receive quality companies from qualified people and businesses whereas additionally ensuring a fair and immediate administrative course of. The West Berry Senior Apartments, an reasonably priced housing improvement supported largely by The New Mexico Mortgage Finance Authorities , broke ground earlier this month.

Visit our News & Advice part to learn extra about buying and leasing commercial actual estate, from calculating the appropriate amount of space to the terms you need to perceive. Marco Santarelli is an investor, writer, Inc. 5000 entrepreneur, and the founder new homes for sale albuquerque of Norada Real Estate Investments – a nationwide provider of turnkey cash-flow investment property. His mission is to help 1 million folks create wealth and passive earnings and put them on the trail to monetary freedom with real property. He’s also the host of the top-rated podcast – Passive Real Estate Investing.

At Sivage Homes we imagine your home and its location must be an extension of your Lifestyle. All Sivage Communities are strategically situated to grant entry to native facilities and actions, all within close proximity of your home. Whether you're homes for sale in albuquerque new mexico on the lookout for climbing trails, dining, or a fast commute, every community offers a novel advantage for a way our clients stay. See the present MLS listings of homes for sale in Albuquerque.

Look for Albuquerque apartments near top-ranking excessive colleges like La Cueva High, Nex Gen Academy, and Sandia High. The average lease for a studio condo in Albuquerque, NM is $860 per thirty days. When you hire an house in Albuquerque, you'll find a way to count on to pay as little as $860 or as much as $1,886, depending on the situation and the scale of the condo. For extra adventurous outings, large homes for sale in albuquerque nm nature preserves sit simply exterior town limits. Albuquerque borders the Sandia Mountains to the east, with the Manzano vary and Valles Caldera National protect close by offering infinite opportunities to discover New Mexico’s rugged and beautiful pure landscape. Just like the town itself, Albuquerque’s delicacies is a medley of tons of of years of Mexican, European, and Native American influences.

2 notes

·

View notes