#New company registration UK

Explore tagged Tumblr posts

Text

A UK Expansion Worker visa allows you to come to the UK to set up a branch of an overseas business that has not started trading in the UK yet. Call Our UK Expansion Worker Visa Lawyers to start your journey to open a branch in the UK. To know more you can BOOK A CONSULTATION on +91 98191 27002 or email us at [email protected]

#UK Expansion Worker visa Consultant in India#Start a business in the UK#Register a company in the UK#Open A Branch In The UK#Set Up a UK Company#Starting your own business UK#Starting up a company In the UK#Registering a branch in the UK of an overseas company#Setting up a limited company the UK#Open a company in the UK#Register a business in the UK#Setting up a business in the UK#Register limited company in the UK#Starting a company in the UK#New company registration in the UK#Online company registration in the UK#Register your company in the UK

0 notes

Text

Keir Starmer appoints Jeff Bezos as his “first buddy”

Picks and Shovels is a new, standalone technothriller starring Marty Hench, my two-fisted, hard-fighting, tech-scam-busting forensic accountant. You can pre-order it on my latest Kickstarter, which features a brilliant audiobook read by Wil Wheaton.

Turns out Donald Trump isn't the only world leader with a tech billionaire "first buddy" who gets to serve as an unaccountable, self-interested de facto business regulator. UK PM Keir Starmer has just handed the keys to the British economy over to Jeff Bezos.

Oh, not literally. But here's what's happened: the UK's Competitions and Markets Authority, an organisation charged with investigating and punishing tech monopolists (like Amazon) has just been turned over to Doug Gurr, the guy who used to run Amazon UK.

This is – incredibly – even worse than it sounds. Marcus Bokkerink, the outgoing head of the CMA, was amazing, and he had charge over the CMA's Digital Markets Unit, the largest, best-staffed technical body of any competition regulator, anywhere in the world. The DMU uses its investigatory powers to dig deep into complex monopolistic businesses like Amazon, and just last year, the DMU was given new enforcement powers that would let it custom-craft regulations to address tech monopolization (again, like Amazon's).

But it's even worse. The CMA and DMU are the headwaters of a global system of super-effective Big Tech regulation. The CMA's deeply investigated reports on tech monopolists are used as the basis for EU regulations and enforcement actions, and these actions are then re-run by other world governments, like South Korea and Japan:

https://pluralistic.net/2024/04/10/an-injury-to-one/#is-an-injury-to-all

The CMA is the global convener and ringleader in tech antitrust, in other words. Smaller and/or poorer countries that lack the resources to investigate and build a case against US Big Tech companies have been able to copy-paste the work of the CMA and hold these companies to account. The CMA invites (or used to invite) all of these competition regulators to its HQ in Canary Wharf for conferences where they plan global strategy against these monopolists:

https://www.eventbrite.co.uk/e/cma-data-technology-and-analytics-conference-2022-registration-308678625077

Firing the guy who is making all this happening and replacing him with Amazon's UK boss is a breathtaking display of regulatory capture by Starmer, his business secretary Jonathan Reynolds, and his exchequer, Rachel Reeves.

But it gets even worse, because Amazon isn't just any tech monopolist. Amazon is a many-tentacled kraken built around an e-commerce empire. Antitrust regulators elsewhere have laid bare how Amazon uses that retail monopoly to take control over whole economies, while raising prices and crushing small businesses.

To understand Amazon's market power, first you have to understand "monopsonies" – markets dominated by buyers (monopolies are markets dominated by sellers – Amazon is both a monopolist and a monopsonist). Monopsonies are far more dangerous than monopolies, because they are easier to establish and easier to defend against competitors. Say a single retailer accounts for 30% of your sales: there isn't a business in the world that can survive an overnight 30% drop in sales, so that 30% market share might as well be 100%. Once your order is big enough that canceling it would bankrupt your supplier, you have near-total control over that supplier.

Amazon boasts about this. They call it "the flywheel": Amazon locks in shoppers (by getting them to prepay for a year's worth of shipping in advance, via Prime). The fact that a business can't sell to a large proportion of households if it's not on Amazon gives Amazon near-total power over that business. Amazon uses that power to demand discounts and charge junk fees to the businesses that rely on it. This allows it to lower prices, which brings in more customers, which means that even more businesses have to do business with Amazon to stay afloat:

https://vimeo.com/739486256/00a0a7379a

That's Amazon's version, anyway. In reality, it's a lot scuzzier. Amazon doesn't just demand deep discounts from its suppliers – it demand unsustainable discounts from them. For example, Amazon targeted small publishers with a program called the "Gazelle Project." Jeff Bezos told his negotiators to bring down these publishers "the way a cheetah would pursue a sickly gazelle":

https://archive.nytimes.com/bits.blogs.nytimes.com/2013/10/22/a-new-book-portrays-amazon-as-bully/

The idea was to get a bunch of cheap books for the Kindle to help it achieve critical mass, at the expense of driving these publishers out of business. They were a kind of disposable rocket stage for Amazon.

Deep discounts aren't the only way that Amazon feeds off its suppliers: it also lards junk-fee atop junk-fee. For every pound Amazon makes from its customers, it rakes in 45-51p in fees:

https://pluralistic.net/2023/11/29/aethelred-the-unready/#not-one-penny-for-tribute

Now, just like there's no business that can survive losing 30% of its sales overnight, there's also no business that can afford to hand 45-51% of its gross margin to a retailer. For businesses to survive at all on Amazon, they have to jack their prices up – way up. However, Amazon has an anticompetitive deal called "most favoured nation status" that forces suppliers to sell their goods on Amazon at the same price as they sell them elsewhere (even from their own stores). So when companies raise their prices in order to pay ransom to Amazon, they have to raise their prices everywhere. Far from being a force for low prices, Amazon makes prices go up everywhere, from the big Tesco's to the corner shop:

https://pluralistic.net/2023/04/25/greedflation/#commissar-bezos

Amazon makes so much money off of this scam that it doesn't have to pay anything to ship its own goods – the profits from overcharging merchants for "fulfillment by Amazon" pay for all the shipping, on everything Amazon sells:

https://cdn.ilsr.org/wp-content/uploads/2023/03/AmazonMonopolyTollbooth-2023.pdf

Amazon competes with its own sellers, but unlike those sellers, it doesn't have to pay a 45-51% rake – and it can make its competitor-customers cover the full cost of its own shipping! On top of that, Amazon maintains the pretense that its headquarters are in Luxembourg, the tax- and crime-haven, and pays a fraction of the taxes that British businesses pay to HMRC (and that's not counting the 45-51% tax they pay to Jeff Bezos's monoposony).

That's not the only way that Amazon unfairly competes with British businesses, though: Amazon uses its position as a middleman between buyers and sellers to identify the most successful products sold by its own customers. Then it copies those products and sells them below the original inventor's costs (because it gets free shipping, pays no tax, and doesn't have to pay its own junk fees), and drives those businesses into the ground. Even Jeff "Project Gazelle" Bezos seems to understand that this is a bad look, which is why he perjured himself to the American Congress when he was questioned under oath about it:

https://www.bbc.com/news/business-58961836

Amazon then places its knockoff products above the original goods on its search results page. Amazon makes $38b selling off placement on these search pages, and the top results for an Amazon search aren't the best matches for your query – they're the ones that pay the most. On average, Amazon's top result for a search is 29% more expensive than the best match on the site. On average, the top row of results is 25% more expensive than the best match on the site. On average, Amazon buries the best result for your search 17 places down the results page:

https://pluralistic.net/2023/11/03/subprime-attention-rent-crisis/#euthanize-rentiers

Amazon, in other words, acts like the business regulator for the economies it dominates. It decides what can be sold, and at what prices. It decides whose products come up when you search, and thus which businesses deserve to live and which ones deserve to die. An economy dominated by Amazon isn't a market economy – it's a planned economy, run by Party Secretary Bezos for the benefit of Amazon's shareholders.

Now, there is a role for a business regulator, because some businesses really don't deserve to live (because they sell harmful products, engage in deceptive practices, etc). The UK has a regulator that's in charge of this stuff: the Competition and Markets Authority, which is now going to be run by Jeff Bezos's hand-picked UK Amazon boss. That means that Amazon is now both the official and the unofficial central planner of the UK economy, with a free hand to raise prices, lower quality, and destroy British businesses, while hiding its profits in Luxemourg and starving the exchequer of taxes.

The "first buddy" role that Keir Starmer just handed over to Jeff Bezos is, in every way, more generous than the first buddy deal Trump gave Elon Musk.

Starmer's government claims they're doing this for "growth" but Amazon isn't a force for growth, it's force for extraction. It is a notorious underpayer of its labour force, a notorious tax-cheat, and a world-beating destroyer of local economies, local jobs, and local tax bases. Contrary to Amazon's own self-mythologizing, it doesn't deliver lower prices – it raises prices throughout the economy. It doesn't improve quality – this is a company whose algorithmic recommendation system failed to recognize that an "energy drink" was actually its own drivers' bottled piss, which it then promoted until it was the best-selling energy drink on the platform:

https://pluralistic.net/2023/10/20/release-energy/#the-bitterest-lemon

There's a reason that the UK, the EU, Japan and South Korea found it so easy to collaborate on antitrust cases against American companies: these are all countries whose competition law was rewritten by American technocrats during the Marshall Plan, modeled on the US's own laws. The bedrock of US competition law is 1890's Sherman Act, whose author, Senator John Sherman, declared that:

If we will not endure a King as a political power we should not endure a King over the production, transportation, and sale of the necessaries of life. If we would not submit to an emperor we should not submit to an autocrat of trade with power to prevent competition and to fix the price of any commodity.

https://pluralistic.net/2022/02/20/we-should-not-endure-a-king/

Jeff Bezos is the autocrat of trade that John Sherman warned us about, 135 years ago. And Keir Starmer just abdicated in his favour.

Check out my Kickstarter to pre-order copies of my next novel, Picks and Shovels!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/01/22/autocrats-of-trade/#dingo-babysitter

Image: UK Parliament/Maria Unger (modified) https://commons.wikimedia.org/wiki/File:Keir_Starmer_2024.jpg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

Steve Jurvetson (modified) https://commons.wikimedia.org/wiki/File:Jeff_Bezos%27_iconic_laugh.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#cma#competition and markets authority#dmu#digital markets unit#guillotine watch#silicon roundabout#Marcus Bokkerink#doug gurr#industrial policy henhouse foxes#dingo babysitters#ukpoli#labour#competition#antitrust#trustbusting#marshall plan#Jonathan Reynolds#regulatory capture#keir starmer

274 notes

·

View notes

Note

Europe VAT laws not changing any time soon, recent. If understand FAQ well, mean shipping to Europe impossible for several years minimum?

That's correct, I won't be shipping to the EU for the foreseeable future due to some import packaging regulations that either have already been implemented or are planning to be implemented in the future.

Note that this is for EU countries only—I can ship to all other non-EU countries like Switzerland, except for the UK due to the UK's own convoluted VAT system.

The only workaround I can offer for EU folks is that you can have a friend or family that lives in a non-EU country place an order to deliver to their address, and then they are able to ship that order to you marked as a gift. Not an option for everyone, I know.

Longer explanation under the readmore for those curious:

As it stands now, each EU country has its own system and fees that I can't keep up with (for example, France would cost me 80 euros per year), I'd need to individually register and report to each country, some require reporting and tracking of what sources of packaging I use, I believe? It's all very complicated, and it makes my head spin just trying to figure out what the requirements actually are, so that's why I stopped shipping to the EU entirely out of an abundance of caution. I also just don't get enough sales to the EU to justify the headache, I'd probably actually lose money paying all the fees. Actually, while I was looking up details while writing this post, apparently there's a new PPWR that's going to replace the old EU Packaging Directive? This is why I can't handle this (ಥ﹏ಥ)

As for why this doesn't seem to be affecting all companies—corporations can obviously afford their own professionals whose entire job is to handle this stuff, and the requirements are also different for large vs small volumes. Meanwhile, a lot of other small or 1-person businesses straight up don't know about these requirements, because it's not like there's a memo passed around about updates to international shipping law. It's also even more confusing because some packages are slipping by without any issue, probably in part due to how the regulations are still new and still being implemented, so I assume it's kind of a mess.

I know of a few people who are willingly taking the risk and shipping to the EU anyway and have had no consequences (for now at least), but I'm not risking the fines ¯\_(ツ)_/¯

Now for the UK, their VAT system doesn't have anything to do with packaging, but what it does require is similar registration with the government, and I'm required to collect and pay the VAT myself. No thanks!

TLDR; laws hard. laws also expensive. too stupid to figure out and too fearful of fines. no ship to countries

fun story: someone also once emailed me this long diatribe about how they think I'm shit at research and that I'm just making all this up (specifically just to screw with europeans or something, I guess?), so I sent them a few links to the literal official government websites where I got my info (like that UK one), and they never responded. lol

378 notes

·

View notes

Text

1963 AC SHELBY COBRA

1963 AC SHELBY COBRA 4.7-LITRE MARK II ROADSTER REGISTRATION NO. OYM 28A CHASSIS NO. CSK2116 ENGINE NO. CSX2116

Footnotes

Rightly regarded as one of the all-time great classic sports cars, the muscular, fire-breathing Cobra succeeded in capturing the hearts of enthusiasts like few of its contemporaries. Only 1,000-or-so Cobras of all types were built between 1962 and 1967, but such was the model's enduring popularity that production was resumed in 1982 under the auspices of Brooklands-based Autokraft.

Convinced that a market existed for an inexpensive sports car combining European chassis engineering and American V8 power, Le Mans-winning Texan racing driver Carroll Shelby concocted an unlikely alliance between AC Cars and the Ford Motor Company. The former's Ace provided the simple twin-tube chassis frame - designed by John Tojeiro - into which was persuaded one of Ford's lightweight, small-block V8s. It was discovered that the latter was lighter than the six-cylinder Ford Zephyr unit that AC was using, yet with vastly greater potential. To cope with the projected power increase, the Ace chassis was strengthened with heavier gauge tubing and supplied fitted with four-wheel disc brakes. Weighing a mere 1.5cwt more than a Bristol-engined Ace yet endowed with double the power and torque, the Cobra turned in a breathtaking performance, racing to 60mph in 4.4 seconds and reaching the 'ton' in under 12, exceptional figures by early 1960s standards and none too shabby even today.

The 260ci (4.2-litre) prototype first ran in January 1962, with production commencing later that year. Exclusively for the USA initially, Cobras - minus engines - were sent from England to be finished off by Shelby in California, and it was not until late in 1963 that AC Cars in Thames Ditton got around to building the first fully finished cars to European specification.

After 75 Cobras had been built with the 260ci engine, the more powerful 289ci (4.7-litre) unit was standardised in 1963. Rack-and-pinion steering was the major MkII up-date; then in 1965 a new, stronger, coil-suspended MkIII chassis was introduced to accommodate Ford's 427ci (7.0-litre) V8, an engine that in race trim was capable of producing well in excess of 400bhp. Wider bodywork, extended wheelarch flares and a bigger radiator intake combined to create the definitive - and much copied - Cobra MkIII look. Keeping ahead of the competition on the racetrack had been the spur behind Shelby's adoption of the 427 engine, but some MkIIIs to 'street' specification came with Ford's less powerful 428ci hydraulic-lifter V8.

But for Brian Angliss, the Cobra story would have ended in 1967. The Autokraft boss had built up a business restoring Cobras and supplying parts, and in the early 1980s acquired the rights to the AC name plus a quantity of jigs and tooling from the old Thames Ditton factory. Keeping the overall style of the MkIII, Autokraft produced the MkIV, which was appropriately updated to meet current legislation and powered by a 'Federalised' Ford 5.0-litre V8 engine. Around 480 were built.

Chassis number 'CSX2116' was invoiced to Shelby American on 16th April 1963 and shipped to Los Angeles three days later aboard the 'SS Loch Gowan'. Invoiced on 18th June 1963 to Burton Motors of Sacramento, California, the Cobra was sold new to a local doctor who used it for a few years before giving it to his daughter. She used the car as daily transport for several years before the clutch failed, at which time it was sold to Steve Dangremond of Santa Rosa, California. The Cobra was advertised for sale by Mr Dangremond in late 1977 and bought by Dr Grant Hill of Chotoka, Alberta. Dr Hill fitted Weber carburettors and raced 'CSX2116', eventually trading it to Fred Yule in Portland, Oregon. At that time, the car was still finished in its original colour scheme of dark blue and retained its original black leather interior.

'CSX2116' returned to the UK in the late 1980s and was advertised through Hampson's Ltd, by which time it had been refinished in red and fitted with a full-width roll bar. Subsequent owners in England were Dr Carlos Barbot, Trojan boss Peter Agg and Formula 1 racing driver Rupert Keegan. 'CSX2116' was last restored in 1988, records on file indicating that an extensive mechanical restoration was undertaken at this time. The car still retains its original black leather interior though the Weber carburettors have gone, replaced by an easier to maintain four-barrel Holley. There is considerable additional accompanying documentation including correspondence between previous owners, a copy of the original bill of sale, Shelby American Automobile Club letter of authentication, FIA papers and Swansea V5 registration document. The car has belonged to the current owner since 2006. Early Cobras are offered for sale only rarely and this example represents a wonderful opportunity to acquire a fine example of this classic of Anglo-American sports car design.

94 notes

·

View notes

Text

The Valley of Fear: Darkness

Here are some examples of tweed suits:

These suits were commonplace at the time as outerwear as they coped well with the British climate; remember this is January and it can be quite cold even though snow is pretty uncommon these days in Southern England.

Police tape did not come around until the 1960s. Until then, crime scene security involved police officers standing guard, a rather hard task in the countryside.

A mare is a female horse.

The Pennsylvania Small Arm Company is fictitious. T

he main firearms company out of the Keystone State today is the Kahr Firearms Group, who moved there from New York in 2014 when the latter state tightened up its firearms laws. It having bought up the Auto-Ordnance Company and Magnum Research, it is the company that sells the Desert Eagle for those who want oversized handguns and also semi-automatic versions of the Thompsons submachine gun, including the 50-round magazines. Individuals cannot purchase weapons from them directly though; you have to go through an authorised firearms dealer. They do not do shotguns, sawed-off or otherwise.

Aberdonian refers to Aberdeen, one of Scotland's eight cities. It is known as the Granite City due to the use of it there during the Victorian era and is the hometown of Annie Lennox.

A rampant lion or lion rampant is a heraldic lion standing upright with its paws raised:

They are common on coats of arms. As the symbol of the Kingdom of Scotland, they feature more than once on both the UK and Scottish royal coat of arms, including one wearing the Tudor and Scottish Crowns respectively:

It is possible to drown in an inch of water, but that generally requires losing consciousness first.

Anyway, blotting paper was widely used at the time:

Some information on splay foot can be found here:

There have been voluntary bike registration schemes set up in various countries to assist in theft recovery:

There is no requirement to pay road tax on pedal bikes - unlike motorbikes. However, taking them on holiday to France could lead to issues with Customs; it still can in some cases since Brexit.

12 notes

·

View notes

Text

Airbus A320neo EasyJet

Registration: G-UZHR Type: A320-251N Engines: 2 × CFMI LEAP-1A26 Serial Number: 8505 First flight: Nov 5, 2018

EasyJet, a British multinational budget airline group, is based at London Luton Airport. It offers both domestic and international flights on over 1,000 routes through its subsidiaries EasyJet UK, EasyJet Switzerland, and EasyJet Europe. Founded in 1995, EasyJet has grown by acquiring other companies and opening new bases, driven by the high demand for affordable air travel. The airline follows a business model similar to that of Southwest Airlines, focusing on maximizing aircraft usage, ensuring quick turnaround times, charging for additional services. The airline’s fleet is composed entirely of Airbus A320 family aircraft. This standardization helps reduce maintenance and training costs, contributing to overall efficiency.

Poster for Aviators aviaposter.com

4 notes

·

View notes

Text

Big taxes will be imposed on imports of electric vehicles from China to the EU after the majority of member states backed the plans.

The move to introduce tariffs aims to protect the European car industry from being undermined by what EU politicians believe are unfair Chinese-state subsidies on its own cars.

Tariffs on electric cars made in China are set to rise from 10% to up to 45% for the next five years, but there have been concerns such a move could raise electric vehicle (EV) prices for buyers.

The decision, which split EU member states such as France and Germany, risks sparking a trade war between Brussels and Beijing, which has condemned the tariffs as protectionist.

China has been counting on high-tech products to help revive its flagging economy and the EU is the largest overseas market for the country's electric car industry.

Its domestic car industry has grown rapidly over the past two decades and its brands, such as BYD, have begun moving into international markets, prompting fears from the likes of the EU that its own companies will be unable to compete with the cheaper prices.

The EU imposed import tariffs of varying levels on different Chinese manufacturers in the summer, but Friday's vote was to decide if they were implemented for the next five years.

The charges were calculated based on estimates of how much Chinese state aid each manufacturer has received following an EU investigation. The European Commission set individual duties on three major Chinese EV brands - SAIC, BYD and Geely.

EU members were divided on tariffs. Germany, whose car manufacturing industry is heavily dependent on exports to China, was against them. Many EU members abstained in the vote.

German carmakers have been vocal in opposition. Volkswagen says tariffs are "the wrong approach".

However, France, Italy, the Netherlands and Poland were reported to have backed the import taxes. The tariffs proposal could only have been blocked if a qualified majority of 15 members voted against it.

Germany's top industry association, BDI, called on the European Union and China to continue trade talks over tariffs to avoid an "escalating trade conflict".

The European Commission, which held the vote, said the EU and China would "work hard to explore an alternative solution" to the import taxes to address what it called "injurious subsidisation" of Chinese electric vehicles.

China's Commerce Ministry called the decision to impose tariffs "unfair" and "unreasonable", but added the issue could be resolved through negotiations.

The dispute has raised fears among industry groups outside the car sector that they could face retaliatory tariffs from China.

A trade body for the French cognac industry said the French authorities "have abandoned us".

"We do not understand why our sector is being sacrificed in this way."

It said a negotiated solution needed to be found that would "prevent our products from facing a surtax that could exclude them from the Chinese market".

'Serious concerns' over UK sales

Figures show that in August this year, EU registrations of battery-electric cars fell by 43.9% from a year earlier.

In the UK, demand for new electric vehicles hit a new record in September, but orders were mostly driven by commercial deals and by big manufacturer discounts, according to the industry trade body.

The Society of Motor Manufacturers and Traders (SMMT) said firms had "serious concerns as the market is not growing quickly enough to meet mandated targets".

The industry has warned that drivers need better incentives to buy electric to help manufacturers ahead of the planned ban on sales of new petrol and diesel vehicles. Under the Conservative government the deadline for this ban was pushed back to 2035 from 2030, but Labour has pledged to bring it back to 2030.

Car makers are required to meet electric vehicle sales targets. Under the Zero Emission Vehicle (ZEV) mandate, at least 22% of vehicles sold this year must be zero-emission, with the target expected to hit 80% by 2030 and 100% by 2035.

Manufacturers that fail to hit quotas could be fined £15,000 per car.

The bosses of several car companies, including BMW, Ford and Nissan, wrote to Chancellor Rachel Reeves on Friday saying the industry was likely to miss these targets.

They said economic factors such as higher energy and material costs and interest rates had meant electric cars remained "stubbornly more expensive and consumers are wary of investing". The average cost to buy an electric car in the UK is around £48,000.

They said a "lack of confidence" in the UK’s charging infrastructure was another barrier to encourage people to switch to electric.

4 notes

·

View notes

Text

COMEMİXGO - MEGA+

In today's fast-paced business environment, connecting with the right partners or clients can be a game-changer. Introducing ComeMixGo, an innovative online company directory designed to streamline your search for businesses across the UK and USA. Whether you're looking for industry leaders or niche startups, ComeMixGo’s comprehensive database offers intuitive navigation and robust filtering options to meet your specific needs. With our user-friendly platform, you can easily explore a multitude of companies, access vital information, and forge valuable connections.

UK Company Directory

The UK company directory is an essential tool for businesses and consumers alike, providing a comprehensive database of registered companies across the United Kingdom. This directory helps individuals and organizations easily find information about various companies, including their contact details, services, and operational statuses.

Key features of the UK company directory include:

Search Functionality: Users can easily search for companies by name, industry, or location, making it convenient to find specific businesses.

Company Information: Detailed profiles typically include company registration numbers, addresses, key personnel, and financial summaries.

Industry Classification: Companies are often categorized by industry, providing users with insights into market trends and competitive landscapes.

Verification Services: It ensures that the information listed is accurate and up-to-date, helping to build trust among users.

In addition to individual searches, the UK company directory supports larger-scale inquiries for market analysis, competitor research, and potential partnership exploration. Such resources are invaluable for both new startups and established firms looking to expand their networks.

Utilizing the UK company directory can streamline business operations, enhance marketing strategies, and drive informed decision-making across various sectors.

USA Company Directory

The USA company directory serves as a comprehensive resource for businesses looking to connect with various sectors across the United States. This directory is essential for anyone seeking to enhance their networking opportunities, find potential clients, or research competitors in the American market.

Many online company directories offer various features that make it easy for users to browse, search, and filter companies based on specific criteria. Some of these criteria include industry type, location, company size, and revenue, making it easier for businesses to find the exact contacts or services they need.

When utilizing a USA company directory, users can benefit from the following:

Accessibility: Most directories are available online, allowing users to access information from anywhere at any time.

Detailed Listings: Company profiles typically include essential information such as contact details, website links, and descriptions of services or products offered.

Search Functions: Advanced search capabilities enable users to narrow down results to find the most relevant companies quickly.

User Reviews: Many directories include reviews and ratings, giving insights into the company’s reputation and customer service.

In today’s digital age, leveraging the USA company directory can give businesses a competitive edge by facilitating better connections and enabling comprehensive market research. This is particularly important for those looking to expand their reach or establish partnerships across different states and industries.

As part of a larger global business strategy, combining resources from both the USA company directory and the UK company directory can provide robust opportunities for international collaboration and growth.

Company Directory

A company directory is an essential tool for businesses and consumers alike. It serves as a comprehensive list that allows individuals to easily find and connect with various enterprises across different regions, including the UK and USA. Utilizing a well-organized company directory can enhance networking opportunities, making it simpler for businesses to thrive in competitive markets.

One of the primary benefits of a company directory is the accessibility it provides to contact information, services offered, and company backgrounds. This information is invaluable for potential clients and partners looking to establish professional relationships. Additionally, the directory can promote businesses to a wider audience, increasing visibility and fostering growth.

In the context of both the UK company directory and the USA company directory, these platforms often include filters that allow users to search based on specific criteria, such as location or industry. This tailored approach enhances the user experience, ensuring that individuals can quickly find the relevant companies to meet their needs.

Moreover, an online company directory allows for real-time updates, ensuring that information remains accurate and current. This is crucial for maintaining professional relationships and ensuring smooth communication. Businesses listed in an online directory can also benefit from SEO advantages, as their websites are often linked directly from the directory pages, improving their search engine rankings.

Overall, a well-maintained company directory not only aids in quick information retrieval but also acts as a catalyst for economic interactions, benefiting both consumers and businesses in various sectors.

Online Company Directory

An online company directory serves as a comprehensive platform that enables users to easily search for and access information about businesses across various sectors. With the increasing need for digital resources, online directories have become essential for both consumers and businesses alike.

One of the key advantages of utilizing an online company directory is its ability to provide extensive details about companies, including their contact information, location, services offered, and even customer reviews. This readily available data assists users in making informed choices, whether they are seeking to partner with a firm or find a reliable supplier.

Furthermore, an online company directory typically categorizes businesses by industry, making it simpler for users to find a specific company, such as those listed in a UK company directory or a USA company directory. This not only enhances user experience but also boosts the visibility of businesses during online searches.

For businesses, being featured in an online directory can significantly increase their reach and visibility. It provides an opportunity to connect with potential customers who are actively searching for specific products or services online. In this digital age, maintaining a presence in an online company directory is crucial for growth and customer acquisition.

In summary, an online company directory is a vital resource that bridges the gap between businesses and consumers. Whether you're exploring a company directory for products or services in the UK or the USA, such platforms are invaluable for efficient and effective business interactions.

522 notes

·

View notes

Text

#3 Volvo EX30 — The China-made (but with a Swedish passport) crossover is starting to live up to the hype, jumping to the 3rd spot on the table in only its 3rd full month on the market. The model had 7,642 registrations in March. Note that its slightly bigger, but much older, sibling, the XC40 (recently renamed EX40), does not seem affected by this, with the Belgian-made SUV scoring its best result in 10 months (5,595 registrations in March). Expect the EX30’s sales to continue strong in the coming months, maybe even crossing the five-digit barrier (fingers crossed). Currently Volvo’s cheapest model(!), starting out at 39,000 euros vs. the 40,000 euros of the gasoline XC40, the EX30 is Volvo’s smallest model — the size of a VW ID.3. While it cannot be considered cheap (for that it would have to cost less than 35,000 euros), it can nevertheless be considered well priced, especially considering the premium standing it holds. Regarding the EX30’s March results, the distribution of deliveries show a push in three markets, with the UK (1,510 units), France (1,388 units), and the Netherlands (1,173 units) being the only ones above 1,000 deliveries, followed from afar by Sweden (652 units)(..)

P.S. The Volvo EX30 example well illustrates the mechanism of how American ICE vehicle manufacturers and the other companies that do not produce affordable electric cars will be kicked out of the European car market...! Tesla is too expensive and fails to offer a viable alternative to replace mass market ICE vehicles, but the Volvo EX30 is a completely different story: reasonable size perfect for Europe, acceptable range, good speed and quite reasonable price...! So, actually Tesla had lost affordable EV competition...

2 notes

·

View notes

Note

What’s-on-Netflix today is saying that White Stork is happening. Is this a legitimate source? Looks legit.

2) Saney have you seen this thing about White Stork? I'm not buying it

And you shouldn't. Whats-on-Netflix is nothing more than a clickbait site. It ran the same story (virtually word for word) 2 years ago.

It also literally has this in the 'article' (and I use that term loosely):

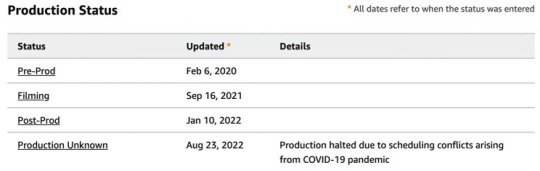

IMDb Pro has reported in the production status timeline of the series that filming had begun on September 16th, 2021, and ended on January 10th, 2022. However, as of August 23rd, 2022, the production status of White Stork was listed as unknown. Production updates listed by IMDb Pro should be taken with plenty of caution as there are no sources to verify the information.

Another one of our sources currently has White Stork listed for pre-production.

This is what is currently listed on IMDb Pro.

Except we know he didn't film anything in the fall of 2021, as he was spotted elsewhere, and was doing The Play What I Wrote. There was never any other cast announced for WS -- because it wasn't happening. And that's not the normal progression of production - it would go from post-production to released or have a release date, not back to Production Unknown... So that apparent change in status was nothing more than a random troll.

Because at the same time, this was happening with the actual production company:

July 2021 account statement filed with the UK government

They were planning to break up the production company due to not having the main cast member (that would be Tom). Note the words production abandoned - not 'on hold', but 'abandoned'.

And then the official filing to dissolve the production unit in March 2022.

Full dissolution - June 2022

You can't produce anything without a production company to pay the bills.

All information publicly available via Companies House, the UK Government's official listing of all company registrations.

Furthermore, the project is no longer listed on the Eleven Films website - at all. Not even the original news item from 2020. You can check for yourself, but there's no mention of it.

So 1) Don't believe clickbait sites like What's On Netflix; they're just regurgitating stuff they wrote years ago.

and 2) Don't always believe IMDb, since it's editable by trolls. IMDb Pro less so, because you generally have to provide proof for updates, but not 100% guaranteed.

Anyway, White Stork isn't happening. At least not with Tom or Eleven Films involved at this point.

8 notes

·

View notes

Text

I've been watching him enjoying Kitchin’s restaurants and their comments as much as He hopes his fans will. But KORA’s welcome got my attention.

Perhaps his first venture in Scotland is into food as well…..🤷

His visits to restaurants or distilleries were looking to copy ideas as tutored tasting of whiskies in Johnnie Walker Explorers' Bothy bar, Glenturret Distillery and The Glenturret Lalique Restaurant The Famous Grouse Experience with Alex last year was very well known.

Many ideas seem to be at the top of the speculation list about his venture, but this current record recognised by a memorandum of association + articles of association is recent (ten days). In the UK, every company is required to have a memorandum. They all have the same format and contain the same information.

Once he has registered his company (appointed on 31/01/2023), a certificate of incorporation will be sent to him, with the full name of the company and unique registration number. He can start trading through his new company as soon as he receives a notification that was approved his application. This can take up to 10 days. Therefore, he has the confirmation of arrival or still awaiting it. He must wait before deciding the next steps.

It's important to observe the rules....

LATHA ÙR nature of business in UK Standard Industrial Classification is Manufacture of beverages 11010 Distilling, rectifying and blending of spirits, It’s not in hospitality Trade Class.

A distillery’s not a brewery. The distillery makes hard alcohol like whisky, gin, vodka, rum, etc. The process of making distilled spirits starts much of the same as making beer but he’s not going to brew beer. He does not have a multidisciplinary farm distillery that experiences the entire process of making vodka, gin, and whisky. But a tasting tour ending with a complementary Gin cocktail at the bar would not be bad for the price he’ll charge for the tour.

3 notes

·

View notes

Text

Handbook for Foreign Entrepreneurs on Turkey Investment Strategies

I am very glad to inform you that my book is newly published. “Handbook for Foreign Entrepreneurs on Turkey Investment Strategies”is dedicated to identifying the key legal requirements for investing in Turkey through the franchising, agency and license agreement or the establishment and registration of the company. This work concludes in final recommendations for any alien investor regarding a long-term investment strategy: https://legal.com.tr/urun/handbook-for-foreign-entrepreneurs-on-turkey-investment-strategies/368884

Kutlay Telli, Ph.D.

Senior Lawyer| Consultant| Researcher|Certified Peer Reviewer

LLM Leicester University Faculty of Law, Leicester, UK

Visiting Scholar Fordham University Faculty of Law, New York, USA

After his graduation from the Faculty of Law in Ankara, he received his second master’s degree from the Leicester University Faculty of Law, UK in 2008. He delivered lectures in Fordham School of Law in the USA. He completed his dissertation research for an associate professor degree in New York. He speaks Turkish, French and English very fluently.

He has extensive experience in different branches of public and private international law. He has been engaging in legal matters within the framework of national and international firms and institutions such as the Turkish Council of State and the United Nations for 15+ years.

He wrote four books and numerous articles in journals with referees (mostly in English) dedicated to existing and emerging legal challenges and their effective solutions. Dr. Telli has a great capacity to produce legal documents, articles, reports and all related contents in particularly English and Turkish. He plays a considerable role in a number of leading international peer reviewed journals as referee. He also has extensive experience in negotiation techniques and diplomacy. Currently, Dr. Telli delivers legal and business consultation to foreign companies on their investment projects in Turkey. He is married with two children.

2 notes

·

View notes

Text

Business Registration in Surrey: A Step-by-Step Guide

Starting a business in Surrey? Congratulations! One of the first crucial steps in your entrepreneurial journey is registering your business. Whether you're a sole trader, a partnership, or a limited company, understanding the process of business registration is key to operating legally and successfully in the UK.

Why Register Your Business in Surrey?

Surrey, with its proximity to London and excellent transport links, is an ideal location for new businesses. Registering your business ensures compliance with the law, offers legal protection, and provides access to numerous opportunities.

How to Register Your Business in Surrey

Choose Your Business Structure The first step is deciding on your business structure:

Sole Trader: Simple and straightforward. You’ll be personally responsible for the business's finances.

Partnership: Two or more individuals share the responsibility and profits.

Limited Company: Offers limited liability protection, separating personal and business finances.

Register with HMRC Every business in the UK must be registered with HMRC for tax purposes. Sole traders and partnerships must register for self-assessment, while limited companies need to file with Companies House.

Get the Necessary Licenses Depending on your industry, you may need specific licenses or permits. For example, if you’re opening a food business, a food license is required. Check Surrey's local government website for specific business regulations.

Open a Business Bank Account Keeping your business finances separate from personal finances is crucial for tax purposes. A business bank account ensures transparency and helps streamline your operations.

Benefits of Registering Your Business in Surrey

Professional Image: A registered business is more credible to potential clients and partners.

Access to Grants and Funding: Many financial schemes require official business registration.

Tax Compliance: Stay on top of your obligations and avoid penalties with proper registration.

#WestViewAccounting#AccountingExperts#FinancialSolutions#TaxPlanning#BusinessGrowth#BookkeepingServices#FinancialSuccess#TaxPreparation#SmallBusinessSupport#AccountingMadeSimple

0 notes

Text

Unlock Global Opportunities with Isle of Man Offshore Company Formation

The Isle of Man is a premier jurisdiction for offshore company formation, offering a unique blend of financial stability, tax advantages, and a business-friendly environment. Whether you’re an entrepreneur, investor, or multinational corporation, establishing an offshore company in the Isle of Man can be the key to unlocking new opportunities and maximizing profitability.

Why Choose the Isle of Man for Offshore Company Formation?

Tax Advantages:

No capital gains tax, inheritance tax, or wealth tax.

Zero corporate tax for most companies, excluding specific regulated industries.

No withholding tax on dividends.

Economic and Political Stability:

The Isle of Man boasts a AAA credit rating and a solid reputation as a secure financial center.

Strong governance ensures a transparent and reliable business environment.

Strategic Location:

Situated in the Irish Sea, the Isle of Man provides easy access to the UK and European markets while maintaining its independence.

Efficient Business Setup:

Streamlined processes for incorporation and regulatory compliance.

Modern infrastructure and excellent digital connectivity make it easy to operate globally.

Privacy and Confidentiality:

The Isle of Man respects business privacy with minimal public disclosure of company ownership.

Types of Companies You Can Form

Private Limited Companies

Public Limited Companies

Limited Liability Companies (LLCs)

Limited Partnerships

Foundations and Trusts

Steps to Form an Offshore Company in the Isle of Man

Select a Company Name: Ensure the name is unique and complies with the naming guidelines.

Choose a Business Structure: Depending on your goals, select the most suitable type of entity.

Submit Required Documents: Provide identification and address proof for directors and shareholders, along with a Memorandum and Articles of Association.

Appoint a Registered Agent: A licensed agent in the Isle of Man is required for incorporation.

Open a Bank Account: Establish a corporate bank account to facilitate your financial transactions.

Obtain Necessary Licenses: For regulated industries, secure the appropriate approvals or licenses.

How Atrium Associates Can Help

Atrium Associates specializes in offshore company formation, offering comprehensive services tailored to your business needs:

Expert guidance on choosing the right structure.

Handling all incorporation and registration processes.

Assistance with opening corporate bank accounts.

Providing ongoing compliance, accounting, and tax advisory services.

Benefits of Partnering with Atrium Associates

Decades of expertise in offshore company formation.

Customized solutions to meet your unique requirements.

Transparent pricing and dedicated customer support.

Take the First Step Today

Establishing an offshore company in the Isle of Man provides the ideal platform for global expansion, financial efficiency, and business security. Let Atrium Associates guide you through every step of the process, ensuring a hassle-free and successful company formation.

Contact us now to start your journey to global success!

#Isle of Man Offshore Company Formation#offshore company isle of man#company formation isle of man#offshore company gibraltar

0 notes

Text

Professional Boiler Installation Services in Stratford: Ensuring Comfort and Efficiency

When it comes to ensuring comfort and warmth in your home, especially during the chilly winter months, a reliable boiler is essential. If you're a homeowner in Stratford looking to install a new boiler, you're likely seeking a service that is both professional and efficient, ensuring you stay warm without unnecessary disruptions. In this guest blog, we’ll delve into the importance of professional boiler installation, the best services available in Stratford, and why choosing a reputable company for this job is crucial for the safety, efficiency, and longevity of your system.

Why Professional Boiler Installation Matters

A boiler is a complex system that plays a critical role in your home's heating and hot water supply. Whether you are upgrading an old system or replacing a faulty one, professional installation is paramount. While DIY installation may seem like a cost-saving option, it comes with many risks, including voiding warranties, safety hazards, and inefficiency in operation. Here’s why professional boiler installation is essential:

Safety First: Boilers involve gas or electricity, and improper installation can lead to dangerous situations such as gas leaks, carbon monoxide poisoning, or even explosions. Professional boiler installers are trained to adhere to strict safety regulations and ensure that the installation process is done safely and up to code.

Maximized Efficiency: A professionally installed boiler operates more efficiently. Proper positioning, pipework, and connection ensure that the system runs optimally, which helps you save on energy bills. A skilled technician will ensure that your new boiler is installed in the most energy-efficient way possible, improving your home's overall heating efficiency.

Long-Term Performance: A quality installation ensures that your boiler will perform optimally for years to come. Professionals know how to avoid common pitfalls that can shorten the lifespan of the boiler, such as poor venting, incorrect setup, or inadequate maintenance.

Warranties and Guarantees: Most new boilers come with warranties that are only valid if the system is installed by a licensed professional. This means that if anything goes wrong, you're covered. A certified installer can provide you with the paperwork necessary for warranty purposes.

The Best Boiler Installation Services in Stratford

Stratford is home to a number of reputable boiler installation companies that provide top-notch services, but how do you choose the best one? Let’s explore some key features to look for when choosing a boiler installation service in Stratford.

1. Experienced and Certified Installers

Ensure that the company you choose employs experienced, Gas Safe registered engineers. Gas Safe registration is the UK’s official gas safety organization, ensuring that all gas engineers meet the required standards of safety and professionalism. Boiler installation can be a complicated process, so experienced professionals will provide peace of mind that your system will be correctly installed.

2. Comprehensive Services

From free consultations to post-installation support, the best companies will offer comprehensive services. Look for businesses that not only install your boiler but also offer boiler servicing, repairs, and maintenance. A full-service company will ensure your boiler remains in good working condition for years, avoiding costly breakdowns.

3. Energy-Efficient Solutions

An efficient boiler can save you hundreds of pounds on your heating bills over the course of a year. Reputable installers in Stratford will guide you toward energy-efficient models that suit your home’s needs. Whether you’re opting for a combi boiler, system boiler, or regular boiler, these professionals will recommend the best option based on your space, needs, and budget.

4. Prompt and Reliable Service

In an emergency, you need a boiler installation company that can respond quickly. Emergency boiler installation services in Stratford are available, and the best companies can offer a rapid response to ensure you’re not left without heating or hot water for long. Whether it's an urgent replacement or a new installation, these services ensure you get back to comfort swiftly.

5. Transparent Pricing

Transparency in pricing is essential when selecting a boiler installation service. Look for companies that provide clear, upfront quotes without hidden costs. The best boiler installers will provide a detailed breakdown of the installation cost, so you know exactly what you're paying for. Some companies may even offer financing options to make it easier to spread the cost of a new boiler.

Emergency Boiler Installation Services in Stratford

Emergencies can happen at any time, and a broken boiler in the middle of winter is one of the worst. If your boiler has broken down unexpectedly, emergency boiler installation services are a lifesaver. Here's why you should consider emergency services:

Quick Response: Emergency boiler services in Stratford are available 24/7. When your boiler breaks down, you can contact a professional who will arrive promptly, assess the situation, and provide you with a replacement or repair solution.

Temporary Solutions: In some cases, a temporary solution may be put in place to keep your home warm until the full installation is complete. Emergency boiler installation services aim to minimize disruption and ensure your home stays heated.

Peace of Mind: Knowing that an expert is on their way to fix your boiler can alleviate stress. Emergency services will not only install a new boiler if needed but will also check for any safety issues and ensure that your heating system is functioning correctly.

Conclusion

Installing a new boiler in Stratford is an important investment in your home’s comfort and energy efficiency. Whether you’re upgrading to a more efficient model or replacing an old unit, professional installation is vital for ensuring your new system operates safely, efficiently, and reliably. Stratford offers a range of top-rated boiler installation services, with experienced, certified installers available to provide you with the best possible service.

By opting for a professional service that offers transparent pricing, energy-efficient solutions, and emergency services, you can rest assured that your new boiler installation will provide you with warmth and peace of mind for years to come. Don't hesitate to consult with a local expert today to get the best possible boiler installation service in Stratford, ensuring you stay comfortable all year round.

#New Boiler Installation in Stratford#Professional Boiler Installation in Stratford#Best Boiler Installation Service in Stratford#Emergency Boiler Installation Services in Stratford#Professional boiler engineers Stratford

0 notes

Text

How to Register for a UTR Number: Step-by-Step Guide for Self-Employed and Businesses

Navigating the world of taxes can be challenging, especially when you’re self-employed or managing a business. One of the most important numbers you’ll need is your Unique Taxpayer Reference (UTR) number. This unique 10-digit code is issued by HM Revenue & Customs (HMRC) and is essential for individuals and businesses to manage their taxes properly. Whether you're starting a freelance career, a new business, or just want to ensure your tax records are in order, understanding how to register for your UTR number is crucial.

In this comprehensive guide, we'll walk you through the process of applying for a UTR number, explain the essential tools like the HMRC CGT calculator, and explore other useful tax calculators such as the P85 tax refund calculator and 60 tax trap calculator. Whether you're a freelancer or running a small business, registering for a UTR is the first step toward ensuring that your tax affairs are in order.

What Is a UTR Number?

Before we delve into how to register for your UTR number, let’s first understand what it is. A Unique Taxpayer Reference (UTR) number is a 10-digit identifier used by HMRC to track your tax records. It’s unique to you (or your business) and is required for various tax-related activities. You'll need it for:

Filing your Self-Assessment tax return (if you're self-employed, a business owner, or have other taxable income).

Paying your income tax.

Setting up a payment plan with HMRC.

Your UTR number is crucial for managing your taxes effectively, and having one allows you to submit your Self-Assessment forms or deal with other HMRC matters efficiently.

Who Needs a UTR Number?

There are several types of people who will need a UTR number, including:

Self-Employed Individuals: If you’re running your own business, whether as a freelancer, contractor, or small business owner, you’ll need to register for a UTR number for tax purposes.

Business Owners: If you own a business, whether you are a sole trader, a partner in a business, or a limited company director, having a UTR number is required for submitting your Self-Assessment tax return and managing corporate tax obligations.

Landlords: If you earn income from renting out properties, you will likely need a UTR number to report your rental income to HMRC.

Individuals with Other Sources of Income: If you have income outside your employment (such as from investments, dividends, or self-employment), a UTR number is necessary for your self assessment online chat.

How to Apply for a UTR Number: Step-by-Step Guide

Now that you understand what a UTR number is and who needs one, let’s break down how to apply for it. Here’s a step-by-step guide:

Step 1: Determine If You Need a UTR Number

First, confirm whether you need a UTR number. If you're self-employed or planning to be, or if you are managing a business, you will most likely need one. For employees who are solely on PAYE (Pay As You Earn), you generally don’t need a UTR unless you have other sources of taxable income.

Step 2: Register for Self-Assessment with HMRC

If you’re self-employed or need to file a Self-Assessment tax return, you must register for Self-Assessment. This is where your UTR number comes into play.

To register for Self-Assessment:

Go to the HMRC Website: Visit the official HMRC Self-Assessment Registration Page and follow the instructions to begin the process.

Create an Online Account: You will need a Government Gateway account if you don’t already have one. This account will allow you to manage your taxes online, submit returns, and pay taxes.

Provide Your Personal Information: You will need to provide your details, including your National Insurance number, address, and other relevant information.

Submit Your Application: After providing the necessary details, HMRC will process your application and issue your UTR number. This may take up to 10 days if you are applying online.

If you’re applying as a business, you will need to follow a similar process but provide additional business-related information.

Step 3: Wait for Your UTR Number

Once you’ve registered, HMRC will issue you a UTR number. You will receive this number by post at your registered address within 10 days. For businesses, it can take up to 21 days for HMRC to issue a UTR number.

Step 4: Use Your UTR Number for Your Tax Returns

Once you receive your UTR number, you can begin using it for your tax-related activities, such as filing your Self-Assessment tax returns, paying your income tax, and dealing with other matters related to your tax liabilities.

If you’re filing your tax return online through HMRC's portal, your UTR number will be required to access your tax records and submit your returns.

Step 5: Keep Your UTR Number Safe

Your UTR number is confidential, and it’s crucial to keep it safe. Do not share it unless necessary, as it’s used to identify your tax records with HMRC.

Useful Tools for Tax Calculation and Refunds

Once you’ve registered for your UTR number and have started the process of filing your taxes, you might need other tools to help you calculate your taxes. These tools can simplify the process of tax calculation and ensure you're not overpaying.

1. HMRC CGT Calculator

If you’re selling assets like property or stocks and have to deal with capital gains tax uk property calculator, you’ll need to calculate how much tax you owe on the profit. The HMRC CGT calculator can help you calculate your CGT liability. It’s a straightforward online tool that allows you to input the sale price, purchase price, and associated costs, providing an estimate of your capital gains tax.

Using the HMRC CGT calculator ensures that you're calculating the correct tax based on your sales, helping you avoid under-reporting your gains and facing penalties from HMRC.

2. P85 Tax Refund Calculator

If you've left the UK for work or personal reasons and are owed a tax refund, the P85 tax refund calculator can help you determine if you're eligible for a refund. The P85 form is used when someone leaves the UK to work abroad, and the calculator helps ensure you get a refund for the excess taxes you've paid while living in the UK.

Using the P85 tax refund calculator is essential for individuals who have worked in the UK but no longer reside there. It will provide a clearer understanding of your tax situation and help you claim back any overpaid tax.

3. 60 Tax Trap Calculator

The 60 Tax Trap refers to the situation where individuals earning between £100,000 and £125,000 face a reduction in their personal allowance, which can lead to significantly higher taxes. The 60 tax trap calculator helps you determine if you're falling into this trap, showing you how much your personal allowance is being reduced and what impact it has on your tax liability.

By using the 60 tax trap calculator, you can see if you're eligible for any reliefs or adjustments and make necessary financial decisions to reduce your tax burden.

Conclusion

Registering for your UTR number is an essential step for anyone who is self-employed or running a business in the UK. It is the foundation for submitting your Self-Assessment tax return and staying compliant with HMRC. By following the steps outlined above, you can easily apply for and receive your UTR number, ensuring that you’re on the right track for your tax obligations.

Additionally, using tools such as the HMRC CGT calculator, p85 tax refund calculator, and 60 tax trap calculator can help you manage your tax situation effectively, reduce your tax liability, and identify opportunities for refunds. These resources simplify complex calculations and provide clarity on your financial situation, making your journey through the tax season much smoother.

Remember, accurate and timely filing of taxes is key to avoiding fines and ensuring that you meet all legal requirements. Whether you're just starting your business or need help with your tax calculations, these tools and your UTR number will guide you every step of the way.

1 note

·

View note