#NNN properties

Explore tagged Tumblr posts

Text

0 notes

Text

Annoyed Series

Jimin

Pairing- Jimin x Named Reader

Word count- 971 Words

Includes- Everything is consensual, established relationship, teasing, brief fingering, missionary, squirting, fluff

Tag List- @mingtina @jaxminnie @yeosayang @delightfulmoonbanana @tannie13 @y00nzin0 @marsstarxhwa

@borntowalkaway @soulseobi05 @kpop-bambi @seokwoosmole @meowmeowminnie @realisticnotes @effielumiere @svnbangtansworld @pinkies-things @insomniacatiny @amyz78 @marvelfamily3000

Masterlists- check out for more fics

📝Annoyed Series Masterlist

📝Masterlists

📝BTS Masterlist

📝Jimin Masterlist

"Ha! Pay me", she giggles as my monopoly piece lands on her property

And she has freaking hotels so it's going to cost a lot

More than I have

"Three hundred Min"

"I only have one fifty left", I murmur

"You gotta borrow from the bank again"

I'm so over this game

I'm losing badly

"I'm tired baby", I tell her

She smirks, raising her eyebrow, "You liar. You're not tired. You're just tired of losing"

"Baby stop", I growl, standing up from the bed and getting the game box from my desk

"Aww poor Min, such a sore loser", she laughs

"Jo", I warn

"Such a big cry baby when you don't win"

That's it

I glare at her as I drop the box to the floor and walk right to her

Pushing her back on the game board, she yelps as I shove her night dress up and off

We just got out of the shower before we decided to play the game and she's already completely bare for me

And me, I'm just in boxers which is easy to take off

"Jimin", she squeals

"Shush", I snap, sliding two fingers in her soaked waiting cunt

She takes my fingers easily, sucking them in and clamping down on them

"You think it's funny", I growl, pulling my fingers out then slamming them back in

Her body arches as she moans, flooding my hand

"You like teasing me when you know losing is a sore spot for me?"

"I don't...I...I...", she babbles as I drive my fingers into her spot, her pussy so loud in the room

"What's the matter? Can't talk?", I tease meanly

With one last thrust, I pull my fingers out, her whining immediately

Pulling my boxers down, I move on top of her, holding her down on the bed as I push my hard cock into her hole

"Min", she moans, her pussy taking me and stretching so pleasurably for me

Thrusting in hard, I bottom out, her cunt clenching as I hit her spot, shouts of my name echoing off the walls

I slam my hands down on either side of her head, my right hand landing on top of the gameboard and some hotel pieces

Ignoring them, I pull my dick out then fuck back into her hard, impaling her pretty tight wet cunt on my cock

I move hard and fast, the sound of our skin smacking against each other's so pretty

Her hand moves under her, shoving game pieces away as her legs wrap tightly around my waist, her back lowering and resting on the gameboard, fake money spilling out from under her

Her boobs wiggle in my face as I drive my cock into her spot, game pieces flying off the bed and hitting the floor

"You know I hate losing baby but still you think it's a good idea to make fun of me?", I growl, both our bodies becoming sweaty and mixing together

"Nnn..no...I...I'm sorry", she whines, her hand slamming down on the bottom game board, holding onto the edge hard as I rail her into our bed

"Yeah you'll be sorry", I grunt, the pleasure out of this fucking world

She always feels so fucking good for me, always so tight, creaming my cock like a waterfall

I can fucking hear it, the squelching, it turning me on so much more knowing she's making a mess all over me

Her pussy throbs wonderfully, so tight as I drive both of us closer

Sitting up, I watch her stomach bulge with each thrust of my cock, the sight of that and of tears streaming down her face driving me crazy

"Fuck, look at your tummy baby", I murmur, mesmerized, "Bulging every time I fuck into you, I'm going that deeply"

She nods, sobbing, "Feels so good Jimin. Fuck, so good. Gonna cum"

I raise my eyebrow, "Oh are you?"

"Yyy..yes", she hiccups

Grabbing her chin, I make her look at me, "The only way I'll let you cum is if you promise you'll never make fun of me again when I lose a game"

"I promise!", she yells, "I swear!"

I nod, moving my hand to her clit and playing with it as I fuck her, "Good. You can cum"

"Fuck! Jimin!", she screams as her shaking body arches off the gameboard, her cunt squirting around my cock

My body is thrown into ecstasy and I shove my cock inside her, coming at the same time

"Joanne fuck! Yes baby!"

Her pussy is still squirting, a mixture of my cum and her squirt all over the game, the pieces, the fake money

And I don't give one shit

I rub her clit through it, her pussy milking my length at the same time she's squirting, her fingers holding onto the board so hard her knuckles are white

Her body relaxes into the bed bit by bit as the pleasure leaves us, her ragged breathing reaching my ears

I look down at her, into her beautiful fucked out brown eyes, smirking at her

Leaning down, I press my lips against hers, kissing her deeply

Her arms wrap around my neck, pulling me against her as we kiss

Moving us, I shove the game and as many pieces as I can off the bed, getting the blanket over us, our lips never separating

When the kiss ends, she lays her head on my chest, her body cuddling against mine

I hold her tightly, playing with her hair

"I love you", I tell her

"I love you", she whispers sleepy, making me smile at how sleepy she always is after sex

It's adorable

But I have one more thing to tell her before she sleeps

"Oh by the baby?"

"Yeah?"

"Looks like the game is ruined from your squirting so we can't play it anymore", I say gleefully

She sighs, "Ok Jimin"

#park jimin fanfic#bts jimin fanfic#jimin fanfic#bts jimin smut#jimin smut#park jimin smut#bts fanfic#bts smut

68 notes

·

View notes

Text

Written & Received Asks!

🐇.•°•.🐇.•°•.🐇.•°•.🐇.•°•.🐇.•°•.🐇.•°•.🐇.•°•.🐇.

If you sent me an ask, It's most definitely in this list. Asks are (usually) written from oldest to newest; so if you sent me an ask just recently it's not likely to be posted soon. However, there are other asks you can read while you wait for your own.

Hitachiin Twins - Devil Twins' Property

TWST First Years - Silly & Strong Male Reader

Genshin Handful - Mammon-Like Male Reader

Baizhu - Hawks-Like Geo Vision User Gender Neutral Reader

Zhongli - Gojo Satoru-Like Archon Reader

🫓Bonten - Debbie Jelinsky‐Like Male Reader

🫓Bonten - Debbie Jelinsky-Like Male Reader 2

TWST × Strong & Teasing Male Reader

Demiurge ‐ Fair & Just Seriphim Supreme Being Reader

Sebastian Michaelis & Company - Riddle Rosehearts‐Like Reader

Leviathan, Riddle Rosehearts, Idia Shroud - Past Cheat Reader

Dorm Heads - Collection Having Male Reader

🫓Bonten - Morticia Addams-Like Male Reader

🐀Demiurge - Sleeping on His Lap, Gn Supreme Being Reader

#0747 Shina - (Pre‐Arrest) Idol Male Reader

Guy Crimson & Diablo - Flirty Himbo Male Reader

Dorm Heads - Sinbad-Like Male Reader

Malleus Draconia - Cyno-Like Male Reader

Kalim Al Asim - Roughhousing, Male Reader

#0382 Honey - Teaching You How To Throw Darts, Male Reader

Demon Brothers - Flirty Male Reader

Dorm Heads - Zhongli-Like Male Reader

Fairy King Harlequin ‐ Touch Starved Reader

Ego Jinpachi ‐ Assistant Reader Makes Him Take a Nap

🌾Solomon ‐ Magic Blacksmith Male Reader

🦈Denji - Half Your Melon Bread 2

Leona Kingscholar & Ruggie Bucci - (Masc Leaning) Gender Fluid Reader Having Gender Envy

Samon Gokuu - Inmate Male Reader With A Mischievous Monkey Companion

Trey Clover, Ruggie Bucci, Jade Leech, Jamil Viper, Rook Hunt & Sebek Zigvolt - Sinbad-Like Male Reader

Gojo Satoru - Gn Reader Falls Asleep Mid Conversation (Next)

Sesshoumaru - Neuvillette-Like Male Reader

Terano 'South' Minami, Kurokawa Izana & Sano 'Mikey' Manjirou - Sweet & Gentle Gn Reader is Ruthless in Fights

Azul Ashengrotto - Sesshoumaru-Like Male Reader

(T) Sano 'Mikey' Manjirou - Chifuyu's Older Brother Male Reader

Arashi 'Benkei' Keizou - Cuddling With Male Reader

Haitani Ran - Attacked By Turkeys, Male Reader

Haitani Ran - "Bitch, What's For Dinner?" Tiktok, Male Reader

Samuel Seo, Sinu Han, Eli Jang, Jinguji Jakurai, Baizhu & Caelus - Bridal Carry, Male Reader

Suguru 'Bon' Ryuuji - Very Affectionate & Supportive Male Reader

Orochi Yamada, Sanzou Houzuki & #0689489 Hakushaku - Bubbly, Naive & Friendly Gn Reader

Sebek Zigvolt - Malleus' Younger Brother Male Reader

#0944 Sith - Male Reader

Joseph Joestar & Ceasar Zeppeli - Suzie Q's Brother Male Reader

Luka - Bottom Male Reader (Postponed)

Joakim "Welt Yang" Nokianvirtanen - Vidyadhara Male Reader

Al'haitham - Tartaglia-Like Matra Male Reader

Dazai Osamu - Jessica Rabbit-Like Male Reader

🎨Kirishima Ayato - With Ghoul Male Reader Who Can't Control His Kagune

Terano 'South' Minami, Haitani Ran, Kurokawa Izana - Male Reader Doing NNN

🍬Gaara of the Sand, Idia Shroud, #1325 Nico, Cyno, Kalim Al Asim & Suzuuya Juzou - Male Reader, Hanging Out/Snuggling

Demon Brothers - Wednesday Addams-Like Gn Reader

Albedo, Xiao, Baizhu, Kaedehara Kazuha, Tighnari & Cyno - General Fluff Headcannons, Male Reader

🕸Dorm Heads - Insecure, Flirty Male Reader

Enel - Raiden Shogun-Like Male Reader

🌾Argenti - Knight of Beauty Male Reader, General Fluff

Jack Howl - Gorou-Like Male Reader

🥕Any Demiurge × Male/Gn Reader Fic

Lilia Vanrouge - "Holding Hands Before Marriage" Prompt With Male Reader

🦊Kawasumi Itsuki, Amaki Ren & Iwatani Naofumi - General Fluff Headcanons + Kicking Kitamura Motoyasu Down a Well, Gn Reader in Mind

Julius Novachrono, William Vangeance, Nozel Silva, Fuegoleon Vermillion & Leopold Vermillion - Flare Corona-Like Crimsom Lions Male Reader

Leona Kingscholar - Being Spooked by a Cucumber, Gn Reader

Poly(?) #0737 Mina & #0727 Nina - Reacting to Their S/o Ending up in Nanba for Trespassing, Gn Reader

Jircniv Rune Farlord El Nix - With Celestial Supreme Being Male Reader

(WHB) Satan, Mammon, Beelzebub, Leviathan & Lucifer - Getting Matching Rings With Gn Reader

🍁(AFTERL!FE) Day - Calm & Supportive Boyfriend, Male Reader

(WHB) Satan, Mammon, Beelzebub, Leviathan & Lucifer - Kissing Headcanons With Gn Reader

Eli Jang (+ Yelena) - With Very Protective Male Reader, Leads to Smut

Dazai Osamu - Bottom Jessica Rabbit-Like Male Reader

🍁Demon Brothers - Reacting to Male Reader Who's Manipulative & Sadistic Towards Mammon

🥕Gazef Stronoff - Patron God Male Reader Who Used to be a Yggdrasil Player

(WHB) Minhyeok - Being Pampered During a Quiet Night in With Male Reader

Hatake Kakashi - Male Reader Teases Him by Reading His Erotic Novel Out Loud

(WHB) Belphegor, Asmodeus, Bimet, Astaroth, Ronove & Bael - Getting Matching Rings With Gn Reader

(WHB) Belphegor, Asmodeus, Bimet, Astaroth, Ronove & Bael - Kissing Headcanons With Gn Reader

(WHB) Valefor - Getting Matching Rings With Gn Reader

(WHB) Valefor - Kissing Headcanons With Gn Reader

(Secretary Anon) Wriothesely - With Seductive Secretary Male Reader

(Secretary Anon) (OM!)Uriel - Treating Male Reader Like a Pet

Diasomnia Dorm - With Chuunibyou Male Reader, Fluffy Headcannons

(WHB) Satan, Mammon, Beelzebub, Leviathan & Lucifer - Being Carried Bridal Style by Caring Tsundere Male Reader, Leads to Smut

🍁Eiden (+ Aster, Morvay, Quincy, & Kuya) - With a Cold Gemstone Dragon Clan Member Male Reader

(WHB & OM) Uriel Stalking Admiring Raphael & Other Angelic Shenanigans

Edmond - Overprotective Yushirou-Like Knight Marshal Male Reader Follows Him & The Other Clan Members

🫧Shigaraki Tomura - L.O.V. Member Gn Reader is His Infatuation

Lancelot (Saber) - Gn Reader Feels Insecure After Finding Out About His Past Relationship With Guinevere

👻Riddle Rosehearts, Leona Kingscholar, Azul Ashengrotto, Idia Shroud, Malleus Draconia & Dire Crowley - Cheating With a Friend Prank, Gn Reader

👻Sebek Zigvolt & Enma Yuuken - Cheating With a Friend Prank, Gn Reader

Mitsuba Kiji, Yozakura Kenshirou, Gokuu Samon & Suguroku Hajime - Shy & Antisocial Building 11 Supervisor Male Reader Who Shows His Kindness Through Small But Thoughtful Actions

Sawamura Daichi, Oikawa Tooru, Kuuro Tetsurou, Bokuto Koutarou, Ushijima Wakatoshi & Miya Osamu - Pretty Manager Male Reader Who Becomes Flustered Easily, Headcannons

Jircniv Rune Farlord El Nix - With a Gn Supreme Being Reader Who is Like Ashlesh (L.O.L.)

Demon Brothers - Tattooed Male Reader Coincedentally Has Tattoos of Their Figurative/Representative Animals

Mitsuba Kiji, Yozakura Kenshirou, Gokuu Samon & Suguroku Hajime - Anxious & Timid Vice Warden Male Reader Who's Filling in For Hyakushiki

Saitama/Caped Baldy - Monster HouseSpouse Male Reader (Might Become a Series in the Future)

🎨(OM!) Mammon, Karna, (God Eater) Soma Schicksal & Benimaru Shinmon - With Reader Who is Insecure About Themselves and Their Relationship

Sebek Zigvolt - Male Reader Who's Twisted From Tik-Tok Croc & Other Crocodile Best Fren Shenanigans

#hunn1e bunn1e's ask box#male reader#gender neutral reader#gn reader#answered asks#answered#ask box#received asks#ask#mystery anon#answered anon

14 notes

·

View notes

Text

Diabolik Lovers || Dark Waters - Kazemi Ecstasy Route [Ecstasy 02]

--Scene starts in a back alley

Girl: Fufufu where are we going, Kou-kun~?

Kou: It's a very special place. I'm sure you'll find it really nice~

Girl: I'm so lucky... I get to spend time alone with Kou-kun! This must be a dream~

Kou: A dream indeed~

Now... Be a good girl and close your eyes for me, ok~? Don't open until I tell you.

Girl: Ok~

Kou: ... *Quiet* Okay, now here's your chance! Just bite her!

Kazemi: Kou-kun, this is a bad idea...

Kou: Why? You feed and even get a chance to learn to control your hunger! It's a win-win for everybody~!

Isn't that what you want?

Kazemi: It is but... what if I kill her...?

Kou: Well… Then sucks to be her?

We'll just find someone else when we get the chance~

Kazemi: Kou!!

Kou: Geez, listen! All you need to focus on is drink her blood and just stop right before she ends up passing out and dying!

… Without chewing off her shoulder if you could...

Kazemi: ... Haah...

(He's right... I need to learn some self control at some point...)

Girl: Kou-kun? Who are you talking to?

Kou: No one, no one~!

I just got a sudden call, that's all~

Here, how about I hold you like this?

Girl: Kou-kun... It feels nice...!

Kou: Does it~?

Then... what if I do this~? Fufu

Girl: Ah~ Kou-kun... That's so bold~

Kazemi: ... ...

(He's kissing her neck... How typical.)

(... But... why am I getting angry...?)

Kou: Hmm... You smell so good~

Stand still for me now, ok~?

... Haah... Nn... n... Ah...

Girl: Ah!! K... Kou-kun... What are you doing!? It hurts!!

Kazemi: ...!

(The blood... I can smell it...!)

Kou: Hm... nn... Hah~

See, Kujira-chan~? This isn’t hard to do~

Come on now. Give it a go.

Kazemi: ... ...

(I have to do this...)

(I have to or else... we won’t make it...)

Girl: Who... Who are you...? Get away from me!!

Kazemi: ... I’m sorry...

... Ah... Hm... nn... Hah...

(Oh my God... This... This is amazing!!)

(I need more... More more more!!!)

Girl: AAAAAHH!!

Kou: Hehe You’re really into it, aren’t you~?

Kazemi: Nn... gulp... Hmph... Haah... Nnn...

Kou: ... Now, Kujira-chan... It’s time to stop.

Kazemi: ... Gulp...

Kou: Kujira-chan?

Kazemi: ... ...

Kou: ... Come on... If you don’t stop now, she will-

*Hiss*

Kou: WAAH!!?

--CG appears

Kazemi: ... ...

Kou: Kujira-chan! ... Oi! What the hell is wrong with you!?

Kazemi: ... ...

(The blood... I need it... It’s mine... My blood...)

... Get away...

Kou: What!? Have you lost your mind? If you kill that woman, there’s no way we’ll get out of this alive!

Kazemi: ... ... ...

Kou: ... Oi, stop already. You’re acting like a stupid animal. We gotta get going or we’ll never get to the others.

Kazemi: (The others...)

... ...

(That’s right... This is... Kou-kun...)

(What... am I doing...?)

...

--CG fades

*Thud*

Girl: Ugh!

Kou: Good... now all you need to do is lick the bite mark so that it heals faster!

Kazemi: ... I... can’t...

Kou: Huh? What do you mean you can’t!?

Kazemi: I can’t because... my saliva doesn’t have healing properties like vampire’s does...

My healing powers are in my tears... like mermaids...

Kou: Eeeh? Seriously?

...

Well, that can’t be helped then... I’ll just heal it myself then.

But we have to go as soon as I’m done, got it?

Kazemi: ... Yes...

--End of Ecstasy 2

5 notes

·

View notes

Text

What is a NNN Lease Investment?

First, what exactly is a triple-net lease? Well, it’s a type of commercial lease where the tenant takes on responsibility for not only the rent but also property taxes, insurance, and maintenance costs. So in an investment situation, essentially, the property owner gets a hassle-free income stream, making it an attractive option for investors. Here’s why I’m buzzing about triple net lease…

View On WordPress

#beilercampbellcommercial#commercialrealestate#commercialrealestatebroker#CRE#CREi#diversifyyourportfolio#investment#investmentincome#NNNleasing#passiveincome#realestate#realestateinvesting#triplenetlease

5 notes

·

View notes

Text

Top 5 Reasons your Business will benefit from Solar

Sustvest has seen businesses from all different industries and verticals invest in on-site solar. We are making the renewable energy asset class, which is only accessible to ultra-high net worth individuals, family offices, or funds, available for anyone to invest in starting as low as 5000 INR.

An Improved Via Tax Benefits

At least half of your original investment in solar is recouped through tax credits and deductions, allowing solar to deliver a double-digit internal rate of return (IRR) in many cases. Now, thanks to the Inflation Reduction Act of 2022, the federal Investment Tax Credit (ITC) is back up to 30%. You can also increase the tax credit through adders, including an additional 10% if the project meets domestic content.

Reduced Utility Expenses

On-site solar replaces an otherwise sunken expense with an asset. The money you typically pay to the utility company can be used to purchase a three-decade solar asset that provides long-term benefits.

To your company. Even owners of triple-net (NNN) leased properties where tenants pay the electrical bills can recoup their investment while offering their tenants energy savings.

Potential to be Cash Flow Positive Immediately

Colorado’s Commercial Property Assessed Clean Energy (C-PACE) program allows businesses to implement solar with little to no money out of pocket (100% loan-to-cost), enabling projects to be cash-flow positive.

From year one, after recouping the tax benefits. Additionally, building owners can bundle the cost of a new roof, solar PV system, LEDs, and heating, ventilation, and air-conditioning upgrades into one fixed-

Interest loan with terms up to 25 years. The loan structure removes all risk for property owners, as the non-recourse financing is tied to the property via a special tax assessment. As a result, C-PACE Financing can transfer to the next owner if the property is sold.

Brand Reputation and Differentiation

The Denver metro area is growing and increasingly competitive, attracting many national and international firms. Commercial solar sets these businesses apart from the competition and provides Real estate investors with access to a more sophisticated tenant class with internal sustainability committees or mandates. Solar helps increase occupancy and base rates, meet corporate sustainability goals, comply with regulations (such as Energize Denver), and retain quality employees and tenants. Companies that have installed solar know that few capital energy improvements offer such a holistic Range of benefits.

Increased Property Value

In addition to utility savings from solar, some utilities will purchase the renewable energy credits (RECs) generated by your system. For example, a 200kW system on a 30,000 square foot flat roof in Xcel Energy.

The territory will generate approximately $11,000 in annual income for 20 years. This income directly increases your property’s Net Operating Income (NOI).

To Sum It Up

On-site commercial solar electricity is cheaper than traditional, utility-based electricity over time. As utility rates continue to raise, so does the value of your solar system’s energy, and these savings are free.

Up capital to fund core business initiatives or investments. Solar brings impressive and quantifiable ecological benefits for those seeking to achieve environmental, social, and governance goals or mandates.

To the table. It also increases the marketability of your property, giving you an edge in today’s hyper-competitive market, all while generating an attractive return on investment.

4 notes

·

View notes

Text

Unlocking Passive Income Through Industrial Real Estate - Signal Ventures

Investing in industrial real estate is an increasingly attractive avenue for generating passive income. With the rise of e-commerce, logistics, and manufacturing, the demand for industrial properties has surged. This comprehensive guide will explore how you can unlock passive income through industrial real estate, covering key strategies, market trends, benefits, and practical steps to start your investment journey.

Understanding Industrial Real Estate

What is Industrial Real Estate?

Industrial real estate encompasses properties used for manufacturing, production, storage, and distribution of goods. This category includes warehouses, distribution centers, manufacturing plants, and flex spaces that can serve various industrial purposes.

Types of Industrial Properties

Warehouses: Large buildings designed for storing goods. They often serve as distribution centers for e-commerce companies.

Manufacturing Facilities: Properties specifically designed for the production of goods, often equipped with specialized machinery.

Distribution Centers: Facilities designed to efficiently receive, store, and distribute goods to retailers or directly to consumers.

Flex Spaces: Versatile properties that combine office and industrial spaces, accommodating businesses that require both functions.

The Demand for Industrial Real Estate

E-commerce Boom

The growth of e-commerce has dramatically increased the need for logistics and warehousing facilities. As consumers shift toward online shopping, companies are investing heavily in industrial properties to ensure efficient supply chains.

Supply Chain Resilience

Recent global events, including the COVID-19 pandemic, have highlighted the importance of resilient supply chains. Businesses are increasingly prioritizing industrial spaces that can support rapid response and adaptability to changing market conditions.

Manufacturing Resurgence

The trend of reshoring, or bringing manufacturing back to the home country, is gaining momentum. This resurgence creates demand for manufacturing facilities, particularly in regions with favorable labor markets and infrastructure.

Benefits of Investing in Industrial Real Estate

1. Strong Cash Flow

Industrial properties often generate higher rental yields compared to other real estate sectors. Long-term leases with stable tenants, such as logistics companies, manufacturers, and e-commerce giants, contribute to consistent cash flow.

2. Lower Vacancy Rates

Due to the increasing demand for industrial space, vacancy rates tend to be lower compared to residential and retail properties. This stability makes industrial real estate an attractive option for investors seeking reliable income.

3. Less Management Hassle

Industrial properties typically require less hands-on management compared to multifamily residential properties. Many leases are triple net (NNN), meaning tenants are responsible for property taxes, insurance, and maintenance, reducing the burden on the landlord.

4. Appreciation Potential

As demand for industrial space continues to grow, the value of well-located properties is likely to appreciate over time. This potential for capital appreciation adds to the overall return on investment.

5. Diversification

Adding industrial real estate to your investment portfolio can provide diversification benefits. Industrial properties often perform independently of traditional market fluctuations, offering a hedge against economic downturns.

Key Considerations for Industrial Real Estate Investment

1. Location, Location, Location

The location of an industrial property is paramount. Proximity to major transportation hubs, highways, and urban centers enhances accessibility, making the property more attractive to tenants. Consider areas with strong logistics networks and infrastructure.

2. Understand Tenant Needs

Different types of industrial tenants have varying requirements. For example, e-commerce companies may prioritize high ceilings and dock access, while manufacturing tenants may need specific power and ventilation systems. Understand these needs when evaluating properties.

3. Lease Structures

Familiarize yourself with various lease structures common in industrial real estate:

Triple Net Leases (NNN): Tenants pay for property taxes, insurance, and maintenance, providing landlords with stable cash flow.

Gross Leases: The landlord covers all expenses, making it essential to carefully analyze potential costs.

Modified Gross Leases: A hybrid approach where some expenses are shared between landlord and tenant.

4. Regulatory Considerations

Be aware of local zoning regulations and environmental requirements. Industrial properties may be subject to specific regulations, especially concerning emissions and waste management.

5. Due Diligence

Conduct thorough due diligence before purchasing industrial properties. This includes evaluating the condition of the building, reviewing financial records, and assessing the tenant’s creditworthiness.

Steps to Build Your Industrial Real Estate Portfolio

Step 1: Set Your Investment Goals

Define your investment objectives. Are you looking for long-term cash flow, capital appreciation, or a combination of both? Having clear goals will guide your property selection and investment strategy.

Step 2: Research the Market

Conduct extensive market research to identify emerging trends and opportunities. Look for regions experiencing economic growth, population influx, and increasing demand for industrial space.

Step 3: Network with Industry Professionals

Build relationships with real estate agents, brokers, and industry experts. Networking can provide valuable insights into market trends and potential investment opportunities.

Step 4: Identify Financing Options

Explore various financing options for your industrial real estate investments:

Conventional Loans: Traditional mortgages from banks or credit unions.

Commercial Real Estate Loans: Specific loans tailored for commercial properties, often with different terms than residential loans.

Partnerships: Consider pooling resources with other investors to acquire larger properties.

Step 5: Start with Smaller Investments

If you’re new to industrial real estate, consider starting with smaller properties. This allows you to gain experience and understand the nuances of the market without taking on excessive risk.

Step 6: Monitor and Optimize Your Portfolio

Regularly assess the performance of your investments. Monitor market trends, tenant satisfaction, and property values. Be proactive in addressing maintenance issues and tenant needs to maximize returns.

Strategies for Generating Passive Income

1. Long-Term Leases

Negotiate long-term leases with tenants to secure stable cash flow. Many industrial tenants prefer longer lease terms for stability, which can provide peace of mind for investors.

2. Value-Add Improvements

Consider making strategic improvements to your industrial properties. Upgrading facilities, enhancing security, or adding features can attract higher-quality tenants and justify increased rents.

3. Diversify Tenant Base

Aim for a diversified tenant base to reduce risk. Relying on a single tenant or industry can expose you to significant financial risk if that tenant vacates or faces economic challenges.

4. Explore Mixed-Use Opportunities

Consider properties that can accommodate mixed-use purposes, such as combining warehouse space with retail or office components. This can diversify income streams and increase property value.

5. Implement Sustainable Practices

Sustainable buildings often attract environmentally-conscious tenants. Investing in energy-efficient upgrades can reduce operating costs and enhance the property’s appeal.

Case Studies: Successful Industrial Real Estate Investments

Case Study 1: E-commerce Warehouse Investment

An investor identified a warehouse in a suburban area with a strong e-commerce presence. By negotiating a long-term lease with a growing online retailer, the investor secured a stable cash flow. The property’s value appreciated by 20% over five years, providing both rental income and capital gains.

Case Study 2: Manufacturing Facility Revitalization

A group of investors purchased an outdated manufacturing facility in an industrial park. They invested in renovations to modernize the space and attracted new tenants from the tech sector. The revitalized property achieved higher rental rates, significantly boosting cash flow and overall value.

Challenges in Industrial Real Estate Investment

1. Market Fluctuations

Industrial real estate, like any investment, is subject to market fluctuations. Economic downturns can impact demand for industrial properties, leading to potential vacancies or lower rental rates.

2. Maintenance Costs

While industrial properties often require less hands-on management, they still incur maintenance costs. Regular upkeep is essential to preserve property value and tenant satisfaction.

3. Tenant Risk

The financial stability of tenants is crucial. Conduct thorough credit checks and evaluate their business models to minimize the risk of defaults or vacancies.

4. Regulatory Compliance

Navigating regulatory requirements can be complex. Stay informed about local zoning laws and environmental regulations to avoid potential legal issues.

Conclusion

Unlocking passive income through industrial real estate presents a wealth of opportunities for savvy investors. By understanding market dynamics, leveraging strategic approaches, and conducting thorough due diligence, you can build a profitable industrial real estate portfolio. With the continued growth of e-commerce and the manufacturing sector, the demand for industrial properties is poised to increase, making this an opportune time to invest. Embrace the potential of industrial real estate, and embark on a journey to financial independence and lasting wealth.

0 notes

Text

A Brief Overview of Triple Net Lease Agreements

Commonly used for commercial real estate properties, including retail spaces, office buildings, and industrial facilities, triple net leases (NNN) are lease agreements in which a tenant agrees to pay a property's base rent plus its operating costs. The operating expenses usually include property maintenance costs, taxes, and building insurance.

Commercial property owners possessing real estate in desirable locations and large multinationals who can easily cover the additional rent costs use triple net leases. The leases offer long-term contracts that can reach 20+ years. Plus, they transfer management and financial responsibilities, like paying for maintenance costs, typically handled by the landlord, to the tenant. Therefore, the agreements can provide a consistent passive income stream with limited involvement in day-to-day property operations and higher returns due to low ongoing expenses.

For tenants, NNNs often guarantee lower base rent rates than other types of leases, but potential increases in taxes, insurance, and upkeep expenses over time could significantly increase their overall rent expenses.

0 notes

Text

Commercial Real Estate Renting in Toronto: A Comprehensive Guide

Toronto, Canada's largest city, is a hub of economic activity, making it a prime location for commercial real estate opportunities. Whether you’re a small business looking to expand or a multinational corporation seeking a foothold in one of the most dynamic cities in North America, understanding the ins and outs of commercial real estate renting in Toronto is crucial.

1. Why Rent Commercial Real Estate in Toronto?

Toronto’s thriving economy, diverse workforce, and strong infrastructure make it an attractive destination for businesses. Key industries include finance, technology, healthcare, and education, offering plenty of opportunities for commercial ventures. Renting commercial property in this city allows businesses to access a growing population and gain exposure to both local and international markets.

2. Types of Commercial Properties Available

Commercial real estate in Toronto offers a wide range of property types, including:

Office Spaces: Ideal for businesses in finance, legal services, consulting, and other professional sectors.

Retail Spaces: Prime retail locations are in high demand, particularly along popular streets like Queen Street West, Bloor Street, and the PATH, Toronto’s underground pedestrian network.

Industrial Properties: For logistics, warehousing, or manufacturing, the outskirts of Toronto, including areas like Etobicoke and Scarborough, provide ample industrial spaces.

Coworking Spaces: A growing trend, especially for startups, tech firms, and freelancers, these flexible office spaces allow for short-term leases and shared amenities.

3. Understanding Commercial Lease Agreements

Before renting a commercial space in Toronto, it’s essential to understand the key terms and conditions of commercial lease agreements:

Lease Term: Typically, commercial leases in Toronto range from 5 to 10 years. However, some landlords offer shorter or more flexible lease options, especially for smaller businesses.

Triple Net Lease (NNN): In this common lease type, tenants are responsible for paying rent along with additional expenses like property taxes, maintenance, and insurance.

Rent Escalation Clauses: Many commercial leases have provisions for annual rent increases, so businesses should budget for this when planning long-term occupancy.

Permitted Use Clause: This outlines the type of business operations allowed in the space. It’s crucial to ensure that the property’s zoning aligns with your business activities.

4. Cost of Renting Commercial Real Estate in Toronto

The cost of renting commercial real estate in Toronto varies significantly depending on the location, size, and type of property. Here’s a general breakdown:

Prime Office Locations: The Financial District and downtown areas like King Street and Bay Street can have rental prices ranging from $40 to $70 per square foot.

Retail Spaces: High-traffic retail areas like Yonge Street or Bloor Street may see rates upwards of $100 per square foot, depending on the visibility and foot traffic.

Industrial Spaces: Typically more affordable, industrial properties can range from $10 to $20 per square foot in areas like North York or Scarborough.

5. Finding the Right Commercial Space

Working with a commercial real estate agent or broker in Toronto is often the best way to find the right property for your needs. These professionals have a deep understanding of the local market and can help you navigate the complexities of lease agreements, zoning regulations, and negotiations. Additionally, they often have access to listings that may not be publicly advertised.

6. Zoning Laws and Regulations

Toronto has strict zoning regulations that dictate how different types of properties can be used. Before signing a lease, ensure that the property is zoned for your business activities. Toronto’s zoning by-laws categorize areas for residential, commercial, industrial, and mixed-use purposes, so understanding the zoning specifics is key to avoiding potential legal issues.

7. Emerging Trends in Commercial Real Estate

Toronto’s commercial real estate market is evolving with new trends that reflect shifts in work culture, technology, and consumer behavior:

Flexible Workspaces: Post-pandemic, the demand for coworking spaces and flexible office leases has surged, as businesses adopt hybrid work models.

Sustainable Buildings: Green certifications like LEED (Leadership in Energy and Environmental Design) are becoming more popular, with tenants seeking energy-efficient buildings to reduce operational costs and meet corporate sustainability goals.

Mixed-Use Developments: Many new commercial spaces are part of larger mixed-use developments that combine residential, retail, and office spaces, offering convenience for tenants and customers alike.

8. Tips for Renting Commercial Space in Toronto

Plan Ahead: Start your search early, especially if you’re looking for a prime location. Toronto’s commercial real estate market can be competitive, particularly in high-demand areas.

Negotiate Lease Terms: Don’t hesitate to negotiate rent, lease terms, or additional perks like free rent periods or reduced maintenance fees.

Consider Location Carefully: Proximity to public transportation, customer foot traffic, and other businesses are critical factors to consider when choosing a commercial space.

Work with a Professional: Engage a real estate lawyer to review the lease agreement to ensure that it aligns with your business needs and protects your interests.

Conclusion

Renting commercial real estate in Toronto offers businesses the chance to thrive in one of the most dynamic markets in the world. Whether you're a startup or an established company, understanding the types of properties available, the costs involved, and the legal aspects of leasing will help you make informed decisions for your business expansion. With the right strategy and expert guidance, you can find the perfect commercial space to grow your operations in Toronto.

0 notes

Text

Unlocking Opportunities: A Guide to Investing in Commercial Property

If you’re considering expanding your investment portfolio, investing in commercial property could be a strategic move. At Triple M Finance, we understand that diving into the commercial property market can be both exciting and daunting. This guide will provide you with essential insights and practical tips to help you make informed decisions and maximize your investment potential.

Why Invest in Commercial Property?

Investing in commercial property offers several advantages over residential investments. Here are some compelling reasons to consider:

1. Higher Rental Yields

Commercial properties typically offer higher rental yields compared to residential properties. This is largely due to the longer lease terms and higher rents that commercial tenants are willing to pay. Investors can benefit from a steady stream of income and potentially higher returns.

2. Longer Lease Agreements

Commercial leases often span longer periods—sometimes up to 10 years or more. This provides stability and predictability for your rental income, reducing the risk of frequent vacancies and turnover compared to residential properties.

3. Triple Net Leases

Many commercial properties operate under triple net (NNN) leases, where tenants are responsible for paying property taxes, insurance, and maintenance costs in addition to rent. This shifts some of the financial responsibilities away from the property owner and can enhance your investment’s profitability.

4. Diversification

Commercial property investment offers an excellent opportunity for portfolio diversification. By adding commercial assets to your investment mix, you can reduce your exposure to residential market fluctuations and potentially enhance overall returns.

Key Considerations for Investing in Commercial Property

Before diving into the commercial property market, there are several important factors to consider:

1. Market Research

Conduct thorough market research to understand the demand and supply dynamics in your target area. Analyze factors such as local economic conditions, business growth prospects, and vacancy rates. A well-researched location can significantly impact your investment’s success.

2. Property Type

Commercial properties come in various types, including office buildings, retail spaces, industrial properties, and warehouses. Each type has its own market dynamics, risks, and rewards. Assess your investment goals and expertise to choose the property type that aligns best with your strategy.

3. Financial Analysis

Evaluate the financial aspects of the investment, including purchase price, expected rental income, and operating expenses. Conduct a detailed cash flow analysis and consider factors like property management costs, maintenance expenses, and potential for property value appreciation.

4. Due Diligence

Perform comprehensive due diligence before making a purchase. This includes inspecting the property, reviewing lease agreements, and assessing the financial health of current tenants. Ensure the property complies with local regulations and zoning laws.

5. Financing Options

Explore various financing options available for commercial property investments. Commercial loans often have different terms and conditions compared to residential loans. Work with a financial advisor or mortgage broker to find the best financing solution for your investment.

6. Property Management

Effective property management is crucial for maintaining and enhancing the value of your commercial property. Consider whether you’ll manage the property yourself or hire a professional property management company. Good management practices can help attract and retain tenants, ensuring a steady income stream.

Tips for Success

Build a Strong Network: Connect with real estate agents, property managers, and other investors to gain insights and opportunities in the commercial property market.

Stay Informed: Keep up with market trends, economic indicators, and changes in commercial real estate laws. Staying informed will help you make timely and informed decisions.

Consult Professionals: Seek advice from financial advisors, tax professionals, and legal experts to navigate the complexities of commercial property investment and ensure compliance with all regulations.

Conclusion

Investing in commercial property can be a rewarding venture, offering attractive rental yields, long-term leases, and diversification opportunities. At Triple M Finance, we are dedicated to helping you navigate the commercial property market and achieve your investment goals. For personalized advice and support, contact us at 0422 331 130 or visit us at PO Box 327 Round Corner NSW 2158.

Explore the potential of commercial property investment with confidence and take the next step towards building a successful investment portfolio!

#investment property deductions#investment property purchase#investment property depreciation#investing in commercial property

0 notes

Text

Contact person name:

Chris Barnard

Address:

129 Teal St, Port Orange, FL 32127, United States

Phone number:

+1 904-325-9877

Business Email:

Website:

Description:

Welcome to Florida Commercial Building Inspectors, your trusted partner in ensuring the integrity of commercial properties. With a decade of dedicated experience, we take pride in offering comprehensive commercial building inspection and property condition assessment services.

Service Areas: Our reach extends far and wide, covering Jacksonville, Orlando/Winter Park, Melbourne, St Augustine, Daytona Beach, and surrounding areas. Wherever you are in Central Florida, we've got you covered!

Main Services: At Florida Commercial Building Inspections, we specialize in full commercial building inspections and property condition assessments. But that's not all—we go above and beyond with additional services like lease inspections, balcony inspections, and thermography inspections.

Certified Excellence: Our inspectors are certified by NACBI, the National Association of Commercial Building Inspectors and Thermography Inspectors. Rest assured, your property is in the hands of professionals committed to upholding the highest standards in the industry.

Who We Serve: Our main clientele includes buyers of commercial real estate, commercial real estate agents, real estate attorneys, commercial lenders, commercial real estate investors, landlords, and tenants of commercial real estate.

Building Diversity: Whether it's office centers, medical plazas, restaurants, retail stores, churches, or apartment buildings, we've got the expertise to assess and provide valuable insights into the condition of diverse commercial properties.

Choosing Florida Commercial Building Inspections means choosing thoroughness, reliability, and a decade of proven excellence. Let us be your eyes when it comes to commercial property - because your peace of mind is our top priority!

Services:

Commercial building inspections (primary), Property condition assessments (PCAs) (primary), Lease inspections or NNN lease inspections, Property maintenance inspections, Balcony inspections, Phase I environmental site assessments (ESA), Phase II environmental site assessments (ESA)

Employee count - 1-5

Year Established - 2013

Twitter:

Facebook:

Pinterest:

LinkedIn:

https://www.linkedin.com/company/fcbinspectors/

1 note

·

View note

Text

Understanding Commercial Leasing: What Every Business Should Know

Commercial leasing is a critical aspect of running a successful business. Whether you're starting a new venture or expanding your current operations, understanding the ins and outs of commercial leasing can save you time, money, and stress. This blog post will explore the essential aspects of commercial leasing, offering insights into common challenges, a step-by-step guide to leasing, a real-world case study, and a concluding overview.

The Basics of Commercial Leasing: A Vital Business Decision

What is Commercial Leasing?

Commercial leasing refers to renting a property for business purposes. This could be an office space, retail store, warehouse, or any other type of commercial property. Unlike residential leases, commercial leases are typically more complex and may involve long-term commitments and significant financial investments.

Types of Commercial Leases

Understanding the different types of commercial leases is crucial to making an informed decision. Here's a breakdown of the most common types:

Gross Lease: The tenant pays a fixed rent, and the landlord covers most operating expenses, such as taxes, insurance, and maintenance.

Net Lease: The tenant pays a base rent plus a portion of the property's operating expenses.

Percentage Lease: The tenant pays a base rent plus a percentage of their business's gross revenue.

Triple Net Lease (NNN): The tenant is responsible for base rent, property taxes, insurance, and maintenance costs.

Each lease type has its own advantages and disadvantages, so it's essential to understand what best suits your business needs.

Common Challenges in Commercial Leasing

1. Understanding the Lease Terms

One of the most significant challenges in commercial leasing is understanding the lease terms. Unlike residential leases, commercial leases often contain complex legal language and clauses that can be difficult to comprehend. This includes provisions related to rent increases, renewal options, and termination clauses.

2. Negotiating the Lease Agreement

Negotiating a commercial lease can be a daunting task, especially for small business owners. The terms of the lease can greatly impact your business's financial health, so it's vital to approach negotiations with a clear understanding of what you need and what you're willing to compromise on.

3. Hidden Costs

Commercial leases can come with hidden costs that may not be immediately apparent. These might include maintenance fees, property taxes, insurance, and utility expenses. Understanding these potential costs upfront can help you avoid unpleasant surprises down the road.

4. Location, Location, Location

Choosing the right location is critical to the success of your business. However, finding the perfect spot can be challenging, especially in competitive markets. The ideal location should balance affordability, visibility, and accessibility.

5. Long-Term Commitment

Commercial leases often involve long-term commitments, ranging from three to ten years or more. This can be a double-edged sword: while a long-term lease can provide stability, it can also be a significant risk if your business needs change over time.

A Step-by-Step Guide to Commercial Leasing

Step 1: Determine Your Business Needs

Before you start searching for a commercial property, it's essential to clearly define your business needs. Consider factors such as:

Space Requirements: How much space do you need?

Budget: What can you afford in terms of rent and additional costs?

Location: Where do you need to be to attract your target market?

Lease Term: How long do you plan to stay in the property?

Understanding these needs will help you narrow down your options and focus on properties that meet your criteria.

Step 2: Search for Suitable Properties

Once you've defined your needs, you can begin searching for properties that match your criteria. Consider working with a commercial real estate agent who has expertise in the local market and can help you find suitable options.

Step 3: Evaluate Potential Locations

As you evaluate potential locations, consider factors such as:

Foot Traffic: Is the area busy with potential customers?

Accessibility: Is the location easy to reach for both customers and employees?

Competition: Are there competing businesses nearby that could impact your success?

Step 4: Review the Lease Agreement

Once you've found a property that meets your needs, you'll need to review the lease agreement carefully. This is where understanding the lease terms becomes crucial. Consider consulting with a lawyer who specializes in commercial real estate to ensure that you fully understand the agreement.

Step 5: Negotiate the Terms

Negotiating the terms of the lease is a critical step in the process. This might include negotiating the rent, lease term, renewal options, and any other clauses that could impact your business. Don't be afraid to ask for changes to the lease agreement if something doesn't align with your business needs.

Step 6: Finalize the Lease and Move In

Once you've agreed on the terms, it's time to finalize the lease and move into your new space. Be sure to thoroughly inspect the property before moving in to ensure that everything is in order.

Case Study: A Successful Commercial Lease Negotiation

Background

Jane Doe, the owner of a small boutique clothing store, was looking to expand her business by opening a second location. After identifying her business needs and budget, she began searching for suitable properties in a high-traffic area.

The Challenge

Jane found a property that was perfect for her business, but the initial lease agreement presented several challenges:

High Base Rent: The base rent was higher than she had budgeted for.

Maintenance Costs: The lease included a clause that made her responsible for all maintenance costs, which could be unpredictable.

Short Lease Term: The lease term was only three years, but Jane wanted the stability of a longer commitment.

The Solution

Jane decided to negotiate the terms of the lease. Here's how she did it:

Negotiated a Lower Base Rent: Jane used market data to show that the initial rent was above average for the area. She successfully negotiated a lower rent that fit her budget.

Shared Maintenance Costs: Jane proposed a compromise on maintenance costs, where she would be responsible for minor repairs, and the landlord would cover major expenses. This was accepted.

Extended the Lease Term: Jane negotiated an option to renew the lease for an additional five years at a pre-agreed rate, providing her with the long-term stability she needed.

The Outcome

By successfully negotiating the lease terms, Jane was able to secure a prime location for her new store while staying within her budget. The new location quickly became profitable, contributing significantly to her business's growth.

Conclusion: Navigating the Complex World of Commercial Leasing

Commercial leasing is a complex process that requires careful consideration and strategic planning. From understanding lease terms to negotiating agreements and managing hidden costs, there are many factors to consider. However, by following a structured approach and seeking professional advice when needed, you can secure a commercial lease that aligns with your business goals and sets the stage for long-term success.

Remember, the key to successful commercial leasing is to be well-informed and proactive. Don't rush into a lease agreement without fully understanding the implications. Take the time to assess your needs, evaluate your options, and negotiate terms that work for your business. With the right approach, commercial leasing can be a powerful tool to help your business thrive.

This article has explored the various aspects of commercial leasing, providing insights into common challenges, a step-by-step guide, and a real-world case study. Whether you're a new business owner or an experienced entrepreneur, understanding these principles will help you navigate the complex world of commercial leasing with confidence.

By being aware of potential pitfalls and taking a strategic approach, you can secure a commercial lease that supports your business's growth and success. Happy leasing!

0 notes

Text

Introduction to Armstrong Number in Python

Summary: Discover the concept of Armstrong Numbers in Python, their unique properties, and how to implement a program to check them. Learn about basic and optimised approaches for efficient computation.

Introduction

In this article, we explore the concept of an Armstrong Number in Python. An Armstrong number, also known as a narcissistic number, is a number that equals the sum of its own digits, each raised to the power of the number of digits.

These numbers are significant in both programming and mathematical calculations for understanding number properties and algorithmic efficiency. Our objective is to explain what an Armstrong number is and demonstrate how to implement a program to check for Armstrong numbers using Python, providing clear examples and practical insights.

Read: Explaining Jupyter Notebook in Python.

What is an Armstrong Number?

An Armstrong number, also known as a narcissistic number, is a particular type of number in which the sum of its digits, each raised to the power of the number of digits, equals the number itself. This property makes Armstrong numbers unique and exciting in mathematics and programming.

Definition of an Armstrong Number

An Armstrong number is defined as a number equal to the sum of its digits; each raised to the power of the total number of digits. For example, if a number has 𝑛 digits, each digit d is raised to the 𝑛th power and the sum of these values results in the original number.

Explanation with a Simple Example

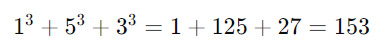

Consider the number 153. It has three digits, so we raise each digit to the third power and sum them:

Since the result equals the original number, 153 is an Armstrong number. Another example is 370:

Difference Between Armstrong Numbers and Other Numerical Concepts

Armstrong numbers are distinct because they involve the specific property of digit manipulation. Unlike prime numbers, which are based on divisibility, or perfect numbers, which relate to the sum of divisors, Armstrong numbers focus solely on digit power sums. This unique characteristic sets them apart from other numerical concepts in mathematics.

How to Determine an Armstrong Number?

To determine whether a number is an Armstrong number, we need to verify if the sum of its digits, each raised to the power of the number of digits, equals the number itself. This concept may seem complex at first, but with a clear understanding of the process, it becomes straightforward.

Let's break down the steps and explore the mathematical method used to identify Armstrong numbers.

Mathematical Formula

The formula to check if a number is an Armstrong number is:

Here, d1,d2,…,dm represent the digits of the number, and 𝑛 is the total number of digits.

Step-by-Step Breakdown

Determine the Number of Digits: First, find the total number of digits, nnn, in the given number. This is crucial as each digit will be raised to the power of nnn.

Extract Each Digit: Extract each digit of the number. This can be done using mathematical operations like modulus and division.

Raise Each Digit to the Power of nnn: For each digit, calculate its power by raising it to nnn.

Sum the Powered Digits: Add the results of the previous step together to get the sum.

Compare the Sum with the Original Number: Finally, compare the sum with the original number. If they are equal, the number is an Armstrong number.

Example Calculation

Let's determine if 153 is an Armstrong number:

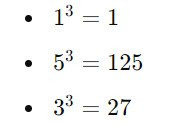

Number of digits (n): 3

Extracted digits: 1, 5, 3

Raised to the power of n:

Sum of powered digits: 1+125+27=1531

Comparison: The sum, 153, equals the original number, confirming that 153 is an Armstrong number.

This systematic approach helps in accurately identifying Armstrong numbers, making the concept both interesting and accessible.

Also Check: Data Abstraction and Encapsulation in Python Explained.

Armstrong Number Algorithm

An Armstrong number, also known as a narcissistic number, is a number that is equal to the sum of its own digits each raised to the power of the number of digits. To determine if a number is an Armstrong number, we follow a specific algorithm.

This section outlines the steps involved and discusses the efficiency and complexity of the algorithm.

Outline of the Algorithm

To check if a number is an Armstrong number, follow these steps:

Determine the Number of Digits:

First, calculate the number of digits (n) in the given number. This step helps in raising each digit to the appropriate power.

Calculate the Sum of Digits Raised to the Power of n:

For each digit in the number, raise it to the power of n and sum these values. This step involves iterating through each digit, performing the power operation, and accumulating the results.

Compare the Sum with the Original Number:

Finally, compare the calculated sum with the original number. If they are equal, the number is an Armstrong number.

Key Steps in the Algorithm

Extracting Digits: We extract each digit from the number, which can be done using modulus and division operations.

Power Calculation: Raise each extracted digit to the power of the total number of digits.

Summation: Accumulate the results of the power calculations to form the total sum.

Comparison: Compare the accumulated sum with the original number to determine if it is an Armstrong number.

Efficiency and Complexity

The Armstrong number algorithm is efficient for small to moderately sized numbers. The primary operations involve basic arithmetic, such as modulus, division, and exponentiation, making the algorithm computationally light. The time complexity is O(d), where d is the number of digits in the number.

This is because the algorithm processes each digit exactly once. For large numbers, the time complexity may increase, but it remains manageable due to the simplicity of the calculations involved.

Implementing Armstrong Number in Python

To determine whether a number is an Armstrong number, we need to implement a straightforward approach in Python. Armstrong numbers, also known as narcissistic numbers, are numbers that equal the sum of their own digits each raised to the power of the number of digits.

Here, we’ll explore a basic implementation in Python and discuss how to optimise it for better performance.

Basic Implementation

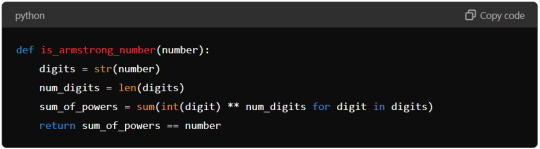

Let’s start with a simple Python program to check if a number is an Armstrong number:

Explanation of the Code:

Function Definition: The function is_armstrong_number takes an integer number as its parameter.

Convert Number to String: We convert the number to a string using str(number) to easily access each digit.

Count Digits: We determine the number of digits using len(digits).

Initialise Sum Variable: We initialise sum_of_powers to zero to accumulate the sum of each digit raised to the power of num_digits.

Calculate Sum of Powers: We loop through each digit in the string, convert it back to an integer, raise it to the power of num_digits, and add it to sum_of_powers.

Check Armstrong Condition: Finally, we compare sum_of_powers with the original number to determine if it is an Armstrong number.

Optimised Approach

While the basic implementation is easy to understand, it may not be the most efficient for larger numbers. Here are some optimisations:

Use List Comprehension: Python’s list comprehension can make the code more concise. Here’s an optimised version:

This version uses a single line to calculate sum_of_powers using list comprehension, making the code more compact and potentially faster.

2. Precompute Powers: For very large numbers, precomputing powers for digits (0 through 9) and reusing them can reduce computation time.

3. Avoid String Conversion: If working with extremely large numbers, you might want to avoid converting numbers to strings repeatedly. However, this is a trade-off between readability and performance.

By employing these optimisations, you can enhance the efficiency of the Armstrong number checking algorithm, especially for larger inputs.

Frequently Asked Questions

What is an Armstrong Number in Python?

An Armstrong Number in Python is a number that equals the sum of its digits each raised to the power of the number of digits. For example, 153 is an Armstrong Number because 1^3+5^3+3^3=153.

How can I check for an Armstrong Number in Python?

To check for an Armstrong Number in Python, calculate the sum of each digit raised to the power of the total number of digits. If this sum equals the original number, it’s an Armstrong Number.

What is the efficiency of the Armstrong Number algorithm in Python?

The Armstrong Number algorithm in Python is efficient for small to moderate numbers with a time complexity of O(d), where d is the number of digits. The primary operations include basic arithmetic and exponentiation.

Further See: Understanding NumPy Library in Python.

Conclusion

In this article, we've explored Armstrong Numbers in Python, highlighting their unique property of being equal to the sum of their digits raised to their respective powers. We demonstrated how to implement and optimise a Python program to check for Armstrong Numbers. Understanding this concept and its implementation enhances both mathematical knowledge and programming skills.

0 notes

Text

With our expertise in 1031 exchanges and DST investments, we'll help you invest smarter & create passive income from real estate.

1031 exchange wizards, 1031exchangewizards, https://www.1031exchangewizards.com, nnn 1031 exchange properties, 1031 dst listings, 1031 exchange dst properties, 1031 dst properties, 1031 exchange property listings, dst 1031 investments, delaware statutory trusts and 1031 exchanges, 1031 exchange dst investments, 1031 exchange properties available, dst properties for sale, 1031 exchange deals, delaware statutory trust properties, dst for 1031 exchange, best delaware statutory trust, dst 1031 returns, 1031 real estate investment trust, real estate investment trust 1031 exchange, 1031 exchange listings, 1031 commercial properties,

1031 commercial real estate, 1031 investment services, 1031 exchange online, dst delaware statutory trust 1031 , 1031 exchange expert, 1031 brokers, 1031 exchange firms, 1031 exchange investment options, 1031 investment options, 1031 agents near me, delaware statutory trust 1031, delaware trust 1031, 1031 exchange delaware statutory trust, 1031 exchange real estate for sale, 1031 exchange accommodator near me, 1031 exchange into real estate fund, delaware trust, 1031 exchange into delaware statutory trust, dst trust 1031, dst 1031 exchange, dst and 1031 exchange, 1031 exchange triple net properties, dst 1031, 1031 realty exchange, 1031 exchange into dst, delaware statutory trust companies,delaware statutory trust investments, dst properties 1031, delaware 1031 exchange, delaware statutory trust offerings, delaware statutory trust funds, dst exchange, 1031 into dst, reit 1031

, 1031 exchange company near me, 1031 exchange to buy primary residence, old republic 1031 exchange, 1031 companies near me, 1031 deals, 1031 exchange services near me, 1031 exchange realtor , delaware statutory trust real estate, 1031 dst, top 1031 exchange companies, 1031 exchange brokers, delaware statutory trust agreement, 1031 exchange companies, 1031 company, 1031 exchange nnn, nnn 1031 exchange, 1031 exchange experts near me, 1031 intermediary companies

0 notes

Text

NNN Leases in Commercial Real Estate: A Tenant's Guide to Triple Net Agreements

The world of commercial real estate can be full of unfamiliar terms and structures. If you're looking to lease a space for your business, you've likely encountered the concept of an NNN lease. But what exactly does "NNN" stand for, and how does it impact your bottom line in NNN leases in commercial real estate?

Understanding NNN Leases: The "Triple Net" Breakdown

NNN stands for "Triple Net Lease," a type of commercial lease agreement where the tenant shoulders a significant portion of the property's operating expenses, on top of the base rent and utilities. These expenses typically fall into three categories:

Taxes: This includes property taxes levied by the local government.

Insurance: The tenant is responsible for obtaining and paying for property insurance.

Common Area Maintenance (CAM): This covers expenses associated with maintaining the shared areas of the property, such as parking lots, landscaping, and hallways.

In simpler terms, with an NNN lease, you're essentially taking on the role of a partial owner when it comes to the property's upkeep in NNN leases in commercial real estate.

Benefits and Drawbacks of NNN Leases for Tenants

Advantages:

Lower Base Rent: NNN properties often come with lower base rents compared to traditional gross leases where the landlord covers most operating expenses. This can be attractive for businesses on a tight budget.

Predictable Expenses: The detailed breakdown of expenses in an NNN lease allows for more predictable budgeting compared to gross leases where operating costs can fluctuate.

Greater Control: NNN tenants have more control over how certain expenses are managed, potentially leading to cost savings through efficient maintenance practices.

Disadvantages:

Increased Financial Burden: The responsibility for taxes, insurance, and CAM can significantly add to your monthly costs in NNN leases in commercial real estate.

Fluctuating Costs: While some expenses may be predictable, factors like property taxes or unexpected repairs can lead to unforeseen cost increases.

Management Responsibilities: NNN tenants take on the burden of managing and budgeting for various operating expenses.

Is an NNN Lease Right for You?

The suitability of an NNN lease depends on your business's specific needs and financial situation. Here are some factors to consider:

Business Model: Businesses with a steady income stream and the ability to manage maintenance costs might benefit from NNN leases.

Financial Strength: Ensure your business has the financial resources to cover the additional expenses associated with NNN leases.

Lease Term: Longer lease terms in NNN agreements can offer more stability in terms of budgeting for operating costs.

Negotiating Your NNN Lease

If you decide to pursue an NNN lease, careful negotiation is crucial. Here are some key points to focus on:

Expense Caps: Negotiate for caps on certain expenses like CAM to limit unforeseen cost increases in NNN leases in commercial real estate.

Maintenance Responsibilities: Clearly define the responsibilities for repairs and replacements within the lease agreement.

Lease Term: A longer lease term can provide predictability in terms of rent and operating expenses.

Conclusion

NNN leases offer a unique option for tenants in the commercial real estate market. By understanding the implications and carefully negotiating the terms, you can leverage the benefits of NNN leases while mitigating the potential drawbacks. Remember, consulting with a qualified commercial real estate professional can be invaluable when navigating the complexities of NNN agreements.

0 notes

Text

Gaur World Smartstreet Commercial Real Estate Property

If we talk about the commercial Real Estate Noida Extension, then we think it is only made for that person who has a large portfolio. But have you checked is this right? You get a negative answer if you do some little research work. Thanks to the latest technology and obviously internet you get entire data anywhere and anytime. So anybody can invest in commercial real estate property that is ready for higher risk and higher revote. Basically, Commercial Real Estate is the attainment and management of commercial property. In the commercial property you can consider retail building, warehouses, office space and apartment of any filed. If you want to ready to take more risk to gain a higher return, then Commercial Real Estate provides you with better options. If you have a question in your mind that why I should invest in Commercial Real Estate, then know its benefits. Here we discuss some advantages of Commercial Real Estate which give you some idea. Let's check it. Gaur City 2 Greater Noida West / Gaur Siddhartham Resale Price / Gaur City Resale Price / Gaur World Smartstreet Resale Price

Have Great Profit Potential, When you hold commercial property in the number of size and tenants annually then definitely you get much more return of your investment in the form of stock dividends. If we compare other return which is between 25 to 3% annually and Commercial Real Estate provides you 5% to 15% return. So basically, if you desire more return, the Commercial Real Estate provides you with wider criteria for your investment. Noticeable Appreciation of Investment, If you check the track record of Commercial Real Estate, then you will find that it provides better (or consider as the best!) appreciation in terms of asset value on comparing to another investment type. In properties, values go up with two factors one is an internal factor, and the other one is an external factor. In the internal factor, proactive management comes which make cost-effective improvements which are directly connected with usability and attraction of asset.

Tax Benefits, To maintain Commercial Real Estate Noida Extension property is a very expensive and difficult task. So that as per rule it is liable from tax incentives to the owner. So, you can get higher expensive value and maintenance values to keep it safe. Have Small Risk, In the Commercial Real Estate there you invest in multiple buildings, so the risk will be reduced because when some are not present in the building, others cover their operating cost. On the other hand, you invest in residential property; you have only one vacancy so that if they left the house loses is 100%. In the Commercial Real Estate, tenants are connected with NNN that is Net taxes, net common area maintenance, and Net building expenses.

Few Competitions, One of the big disadvantages of residential property investment is it has lots of competition, so their chances of profit are less for you. On the other hand, Commercial Real Estate is big in structure as well as it has less in competition. So that you have a great opportunity to earn more and get more benefits from your investment and secure your future. Significant For Current Income, The main benefit of Commercial Real Estate investment is it is secured with leases so that you get regular income from your investment stream, and it usually is higher than your stock dividend. That's it! These are the benefits of commercial Real estate Greater Noida West investment. If you also need to earn more profits, then you should take a chance in Commercial Real Estate field also.

1 note

·

View note