#Multifamily homes for sale

Explore tagged Tumblr posts

Text

c.1970 Two Bedroom Louisiana Starter Home $50K

OHU50K Notes $50,000 Located on a corner lot opposite a field is this two-bedroom, one-bath Louisiana starter home with front porch, side carport, central air and heat, and community water and sewer. The home is located about 25 minutes south of Baton Rouge. Realtor Comments Great investment property, Needs some TLC has good bones and large rooms with hard wood floors and plenty potential.…

#acreage real estate#afforable home#affordable houses#countr ylife dreams#country house listing#country life dreamsus#country living#duplex for sale#house for sale#houses for sale#houses on acreage#Multifamily homes for sale#multifamilyhomes4sale#old house listing#old house living#old house lover#old housel ove#old houses#old houses under100k#old houses under50k#real estate

0 notes

Text

Commercial Real Estate

The Estate Montreal project focuses on developing premier commercial real estate properties in the heart of Montreal, Canada, designed to meet the needs of modern businesses. These properties will offer a variety of flexible, high-quality spaces, including office buildings, retail locations, and mixed-use developments, all strategically situated to maximize visibility and accessibility. By combining sustainable design with state-of-the-art infrastructure, Estate Montreal aims to create an environment where businesses can thrive, making it a key player in shaping Montreal's commercial real estate landscape. For More Details Visit Us-: https://estatemontreal.com/

#commercial real estate#capital markets#commercial property for sale#apartment buildings for sale#commercial buildings for sale#Investment property#investing in montreal real estate#multi family residential#multifamily for sale montreal#multi family homes for sale

1 note

·

View note

Text

12 CashFlow Units Rural & Gladstone

$290,000 & $490,000

Netting $97,000/yr

Www.Reioffer.net

#rentals #rentalproperty #rentalproperties #forsale #offmarket #MFR #MFH #SFR #SFH #multifamily #singlefamily #multifamilyhomesforsale #singlefamilyhomesforsale #cashflow #cashflowing #invest #investing #investments #opportunities #closingqueen #realty #indy #NOI #net #commercialdeals #commercialproperty #propertiesforsale #investor

#rentals forsale offmarket MFR MFH SFR SFH multifamily singlefamily cashflow cashflowing invest investing investments#REI#homes for sale#indiana#cash buy house#cash investor#entrepreneur#investing#real estate#cash buy indiana#off market#real estate investing#ROI#NOI#caprate#sfr#mfr#mfh#sfh#singlefamily#multifamily#real estate investors#real estate investment#investments#off-market#cash deals#sell house for cash#cash buyers#Closing Queen#REI Queen

0 notes

Text

Looking For Rental Properties In Toronto?

https://rickchohan.exprealty.com/ for all your rental needs in Toronto. We offer a wide variety of listings from condos to detached homes, as well as single family homes and townhouses. We also have access to an extensive network of lenders and settlement agents who can help with any financial requirements that may come up during the leasing process.

#Multifamily Property For Sale#Rental Homes In Toronto#Buy Land In Toronto#Houses For Sale In Toronto Canada#Multi Family Homes For Sale

0 notes

Text

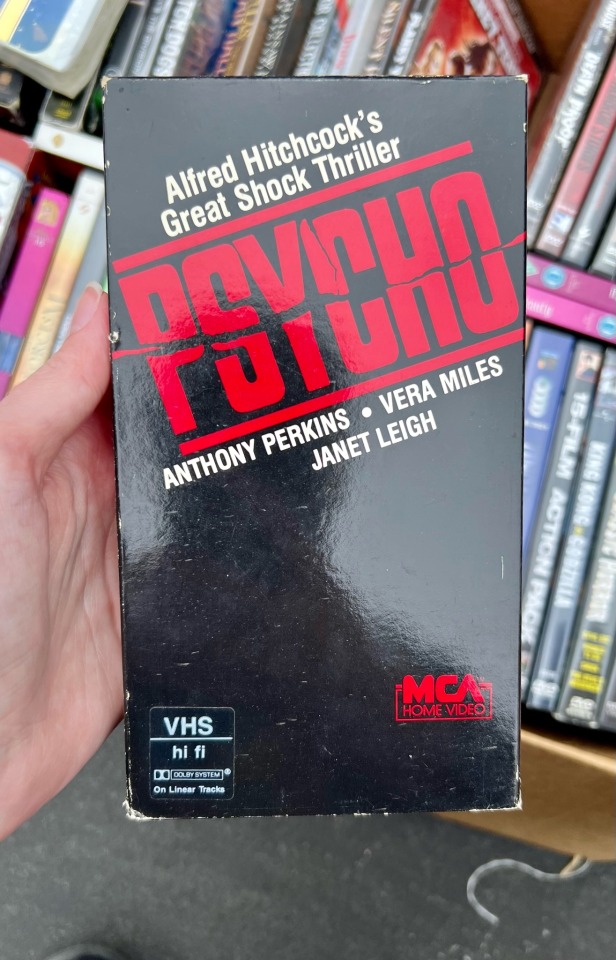

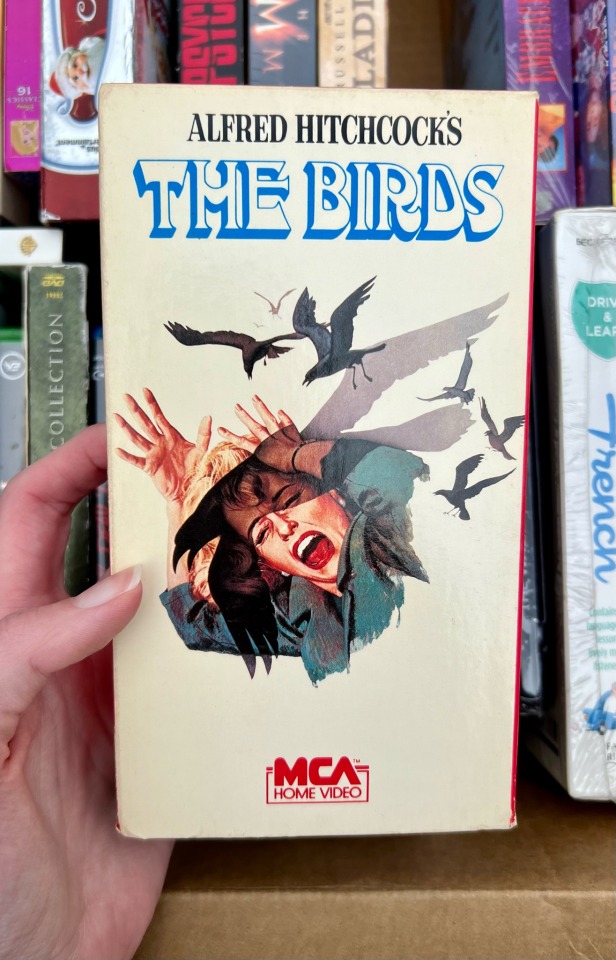

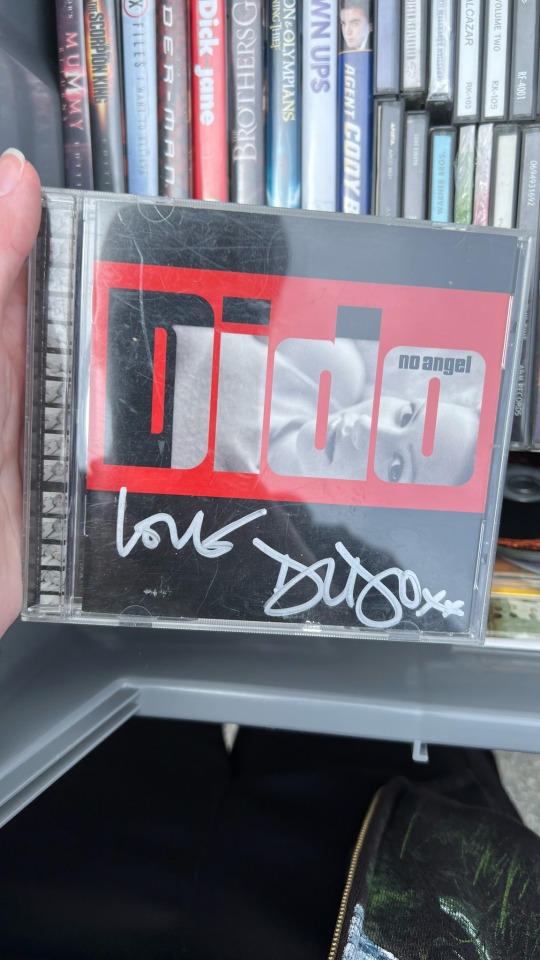

Just got home from a big multifamily yard sale! Wasn’t as good a haul as last year’s, but still got some neat things 😊

Chromecast, still sealed: $5

All the Pokemon stuff (not pictured: Japanese Marnie card that’s inside her tin) - $2

Puss in Boots: $0.50

Giant Toothless from How to Train Your Dragon: $1

Miniature doll house cabinet: $4

Not pictured: bottle of water and homemade brownie baked by a grandma: $1

Total: $13.50

And some cool stuff I saw but didn’t buy:

#thrifting#yard sale#the guy selling the Pokemon stuff was so nice he threw in that deck box with uh. I can’t remember her name. the electric gym leader on it#and didn’t even say anything or charge me for it#he did say he has way too many tins 🤣#and he had a ton of deck boxes too#one thing I was bummed about was that he said he’d had a Build a Bear Bulbasaur but it sold before the official start time of the sale 😭#I went to his table FIRST but I didn’t wanna be pushy before they were even set up#and so apparently I lost out 🤦 oh well#got no room for a plushie that big anyway tbh#very very nearly came home with that Cassie Dragontales but she had Suspicious Brown Smear Stains 🥴

16 notes

·

View notes

Text

Things to Know Before Buying a Multi-Unit Property

Buying a multi-unit property is a wise investment choice that can provide a steady return on investment and pave the way toward financial freedom. Whether you possess extensive experience in real estate investment or are a beginner seeking to acquire your initial multi-unit property, there are numerous vital elements to contemplate prior to reaching a conclusion.

Below are the five key things you should know before buying a multi-unit property.

Deep History: Before purchasing any property, it is crucial to gain a thorough understanding of its history and the surrounding area. Whether you are considering a house, a two-family home, a four-family home, an apartment complex, or a vacant lot, researching the area's history will provide valuable insights. By examining aspects such as neighborhood growth, crime rates, nearby amenities, and prospective infrastructure enhancements, you can obtain valuable insights to guide your decision-making process when choosing an investment location.

Follow the Builders: Keeping an eye on new home construction can give you valuable insights into the housing market. Builders often work tirelessly to meet the growing demand for housing, and they possess valuable knowledge about upcoming housing booms. By observing their activities and staying up to date with city development plans, you can identify areas that are likely to experience growth and increased property value. Relying on the top commercial real estate companies in New York can be a smart strategy to spot potential investment opportunities in multifamily properties.

Costs and Expenses: When considering the advantages and returns of owning multi-unit properties, it is crucial to factor in the expenses and costs linked to maintenance and operation. These include property taxes, insurance, repairs, upkeep, utilities, and fees for property management. Additionally, if you are considering purchasing a Multifamily building for sale in New Jersey or any other high-priced area, be prepared for higher expenses. Thoroughly calculate your anticipated expenses and create a detailed budget to ensure the investment aligns with your financial goals.

Choose the Right Tenants: Selecting suitable tenants is crucial when investing in a multi-unit property. Since you will be providing separate facilities for multiple tenants, it is essential to choose individuals who are responsible, reliable, and financially stable. Conduct thorough background checks to ensure they have no criminal records and verify their rental history to assess their reliability as tenants. Additionally, consider their compatibility with other tenants and their overall demeanor. Choosing the right tenants will minimize potential issues and maximize the rental income from your property.

Seek Professional Guidance: Navigating the multifamily property market can be complex, especially for first-time investors. Consider seeking the assistance of Multifamily investment real estate brokers in Yonkers specializing in multifamily properties. These professionals can help you identify suitable properties, negotiate favorable terms, and ensure a smooth transaction.

#multifamily#realestateagent#realestateinvesting#commercialrealestate#multifamilybuilding#buildingforsale#commercial#realestateinvestor#propertymanagement#investmentproperty#luxuryrealestate

3 notes

·

View notes

Text

Multifamily Property for Sale: How To Buy a Multigenerational Home

http://dlvr.it/TJfMFY

0 notes

Text

Why 2025 Is the Best Year to Invest in Multifamily Properties

Are you waiting for the right time to invest in multifamily properties? Well, there is a saying that says, " Do not wait; the time will never 'be just right.'

This 2025 seems to be a great opportunity for investors like you to invest in real estate. Connect with professionals from Platzner International Group, where we help investors like you find the best multi-family homes for sale.

In this blog, we are delving into why investing in multifamily properties in 2025 is a smart decision.

0 notes

Text

The Future of Houston’s Housing Market: Trends for 2025

As 2025 approaches, Houston’s housing market continues to evolve in response to economic shifts, demographic trends, and local developments. With strong job growth, a steady influx of new residents, and ongoing housing demand, Houston remains a key player in the Texas real estate landscape. However, market conditions are also influenced by interest rates, home inventory levels, and affordability concerns. For buyers, sellers, and investors, understanding the trends shaping Houston’s housing market in 2025 is crucial for making informed decisions.

1. Steady Population Growth Driving Housing Demand Houston’s population continues to expand, fueled by job opportunities in industries such as energy, healthcare, and technology. With Texas remaining a top destination for domestic migration, new residents will increase demand for both rental and for-sale properties. This ongoing growth is expected to put upward pressure on home prices, especially in desirable neighborhoods with good schools and amenities. Suburban areas such as Katy, Cypress, and Pearland will likely see continued development as homebuyers seek affordability outside the city center.

2. Interest Rates and Affordability Challenges One of the biggest factors affecting Houston’s housing market in 2025 will be interest rates. If mortgage rates remain elevated, affordability could become a significant challenge for first-time homebuyers. However, if rates stabilize or decrease, buyer activity is expected to increase as more people enter the market. Home prices in Houston have historically been more affordable than in cities like Austin or Dallas, but higher borrowing costs may push buyers toward smaller homes or less expensive suburbs.

3. Shift Toward New Construction and Suburban Expansion With demand for housing continuing to rise, homebuilders are expected to ramp up construction efforts, particularly in suburban areas. New developments in communities such as Richmond, The Woodlands, and League City will offer a mix of single-family homes and townhouses, catering to a diverse range of buyers. Additionally, builders may focus on affordable housing solutions, including smaller home designs and energy-efficient properties, to attract budget-conscious buyers.

4. The Rise of Smart and Sustainable Homes Technology and sustainability will play a more significant role in Houston’s housing market in 2025. Smart home features, including energy-efficient appliances, solar panels, and home automation systems, are becoming standard in new builds. Buyers are prioritizing properties with lower utility costs and eco-friendly features, driving developers to incorporate green building materials and smart home technology into their designs. Homes with these modern features may see increased demand and higher resale values.

5. Increased Competition in the Luxury Market Houston’s luxury home market is expected to remain competitive, particularly in sought-after neighborhoods like River Oaks, Memorial, and The Heights. As high-income professionals and international buyers seek high-end properties, demand for custom-built homes, gated communities, and luxury condos will continue to grow. While interest rates may impact some segments of the market, well-financed buyers will continue to invest in Houston’s prime real estate locations.

6. Strong Rental Market Growth The rental market in Houston will likely experience continued growth in 2025. With affordability challenges limiting some buyers, many individuals and families will turn to renting instead. This trend will drive demand for single-family rental homes and multifamily apartment complexes. Investors looking to capitalize on this demand may find opportunities in areas with high rental yields and strong tenant demand.

7. Real Estate Technology and Digital Transactions The way people buy and sell homes in Houston is evolving, with digital transactions, virtual home tours, and blockchain technology becoming more prevalent. Buyers and sellers are increasingly relying on online platforms, AI-driven property recommendations, and secure digital contracts to streamline transactions. This shift is making the home-buying process more efficient and accessible, reducing the need for in-person meetings and paperwork-heavy processes.

Final Thoughts

As we move into 2025, Houston’s housing market will continue to be shaped by economic conditions, population trends, and technological advancements. While challenges such as affordability and interest rates remain, strong demand and ongoing development will keep Houston’s real estate market dynamic. Whether you’re a buyer, seller, or investor, staying informed about these trends will help you navigate the market with confidence.

If you’re considering buying or selling a home in Houston, consulting with a local real estate professional can provide valuable insights and guidance. Staying ahead of market trends will ensure you make the best real estate decisions for the future.

Thinking of buying or selling? Contact Tili Capistran!

📞 713–875–3715 📧 [email protected]

#real estate investing#sellersagent#content seller#talktotili#daily blog#real estate#texas#buyers and sellers#houston#opportunities#property investment

0 notes

Text

Multifamily Real Estate: The Best Buying Opportunity in Years

The multifamily investment market is entering one of the best buying windows in years, fueled by strengthening fundamentals, falling new supply, and pent-up investor demand. Despite financing challenges due to higher interest rates, sales volume has been rising steadily, presenting a prime opportunity for savvy investors.

“Multifamily absorption topped 546,000 units last year, the second-highest level in over 40 years, while new apartment construction has fallen below 40,000 units per quarter—marking the lowest pipeline since the Great Recession.” – Gray Capital LLC Analysis

Now is one of the best times in years to invest in multifamily assets, as strong fundamentals and tightening supply create a prime buying window. According to Gray Capital LLC, multifamily absorption reached 546,000 units last year, the second-highest level in over four decades, demonstrating continued renter demand despite economic fluctuations. Meanwhile, new apartment construction has plummeted, with quarterly starts dropping below 40,000 units—the lowest since the Great Recession. At the same time, rent affordability has improved, making renting the more viable option for many as home prices remain 7.2 times the average annual income. With lease renewal rates rising, vacancy rates staying low, and institutional investors already making their move, those who act now can capitalize on market conditions before competition intensifies and asset prices climb.

At Kaufman Development, we’ve been capitalizing on this trend by sourcing and acquiring off-market multifamily assets, avoiding brokers, and going direct to sellers to secure the best deals before they hit the market. Want to learn how we do it? Reach out at [email protected] and we’ll show you how.

Let’s break down why now is the time to invest in multifamily and how to find the best deals before your competition does.

⸻

Why Multifamily is a Strong Investment in 2025

Despite financing hurdles, the fundamentals of the multifamily sector remain incredibly strong. Here’s why:

• Absorption is at historic highs – The market absorbed over 546,000 units last year, the second-highest in over 40 years.

• New supply is shrinking fast – Apartment construction has slowed dramatically, with quarterly starts dropping to below 40,000—a level not seen since the Great Recession.

• Rent growth is picking up – With demand staying high and supply tightening, rents are poised for growth in the near and medium term.

• Affordability keeps renters in the market – With home prices 7.2x the average annual income, homeownership is out of reach for many, keeping rental demand strong.

• Employment stability supports demand – With the unemployment rate holding below 5%, people continue moving for jobs, further increasing apartment demand.

This unique combination of factors is setting the stage for multifamily to outperform in the coming years. While other asset classes face volatility, multifamily remains resilient, making this a prime time to buy.

⸻

Why We’re Buying Off-Market – And You Should Too

While many investors wait for brokers to bring them deals, Kaufman Development is going directly to sellers—and it’s paying off.

Here’s why we recommend avoiding brokers and going direct:

✅ Better Pricing – Off-market deals typically close at a discount since sellers save on brokerage fees and buyers avoid bidding wars.

✅ Less Competition – Direct negotiations mean fewer competing buyers, allowing for better terms and deal structures.

✅ More Flexibility – Working directly with sellers allows for creative financing, seller carrybacks, and structured deals that wouldn’t be possible in a traditional brokered transaction.

✅ Faster Deals – Without a broker marketing the deal to hundreds of buyers, transactions move quickly and smoothly.

At Kaufman Development, we’ve built a network of direct-to-seller relationships that allow us to find and acquire multifamily properties before they ever hit the market.

Interested in learning our process? Email [email protected] and we’ll show you how to source your own off-market deals.

⸻

What to Expect in the Multifamily Market Ahead

With interest rates expected to settle by 2026, asset prices are adjusting, creating a prime buying window for investors who recognize the long-term value of multifamily.

🔹 Institutional investors are already back in the game – Large funds are buying aggressively, signaling strong confidence in the market’s future.

🔹 Retail investors are lagging behind – Many individual investors are still hesitant, creating less competition for those who act now.

🔹 Smart investors are locking in deals before the next boom – Once interest rates stabilize and new supply remains low, we expect valuations to surge, making today’s purchases highly profitable.

The window won’t stay open forever. Those who buy now will be ahead of the next wave.

⸻

Final Thoughts: The Time to Act is Now

Multifamily is one of the strongest real estate asset classes for 2025 and beyond, and the next 12-18 months will likely be one of the best buying opportunities in years.

At Kaufman Development, we’re actively acquiring off-market multifamily deals and helping investors skip the brokers, go direct, and find the best opportunities before they hit the market.

💡 Want to learn how to find and close off-market multifamily deals? Contact us at [email protected] and let’s talk.

#Multifamily #RealEstateInvesting #OffMarketDeals #CRE #Investing

#real estate#investment#danielkaufmanrealestate#economy#real estate investing#daniel kaufman#housing#construction#homes#housing forecast

0 notes

Text

c.1940 Oklahoma Farmhouse For Sale With In-Law Apartment on 3.85 Acres $185K

OHU50K Notes $185,000 Check out this Oklahoma farmhouse for sale with an in-law apartment and 3.85 acres. Property includes a three-bedroom, one-bath main house, and a one-bedroom, one-bath in-law apartment. Realtor Comments Income producing property. 2 rental units in one or can be used for a large family. The main house is a charming 3-bedroom, 1-bathroom home on 3.852 acres with a…

#acreage real estate#afforable home#affordable houses#countr ylife dreams#country house listing#country life dreamsus#country living#duplex for sale#house for sale#houses for sale#houses on acreage#Multifamily homes for sale#multifamilyhomes4sale#Oklahoma farmhouse for sale#old house listing#old house living#old house lover#old housel ove#old houses#old houses under100k#old houses under50k#real estate

0 notes

Text

Investing in Apartment Buildings for Sale in Montreal

Montreal is known for its vibrant culture, strong economy, and diverse real estate market. For investors looking to capitalize on multi-family properties, apartment buildings for sale in this city present a unique opportunity. With increasing rental demand, a stable economy, and promising appreciation potential, Montreal is an attractive location for those seeking a long-term investment property.

Why Invest in Apartment Buildings for Sale in Montreal?

Strong Rental Demand Montreal is home to professionals, families, and students who seek rental properties. With an increasing number of people looking for affordable housing options, apartment buildings benefit from a steady stream of tenants. The presence of major employers, such as tech companies, healthcare institutions, and universities, contributes to a stable rental market.

Growing Population & Infrastructure Development Montreal has experienced significant development in recent years, with new infrastructure projects enhancing its accessibility. The REM (Réseau express métropolitain) light rail system and other public transit improvements are making different areas of the city more desirable for renters. As more people move to Montreal, the demand for multi-family properties is expected to rise, making now a strategic time to invest.

Relatively Affordable Entry Costs Compared to Other Major Cities While property prices in cities like Toronto and Vancouver have soared, Montreal still offers relatively affordable investment opportunities. Investors can purchase apartment buildings for sale at a lower cost per unit than in other major metropolitan areas, making it easier to generate a positive cash flow. With careful property selection, investors can find deals that yield solid returns over time.

Favorable Investment Climate Montreal has a reputation for being a stable and safe city, making it attractive to long-term tenants. Additionally, property tax rates tend to be lower than in other Canadian cities, improving profit margins for investors. The city’s well-maintained neighborhoods and high quality of life contribute to consistent property appreciation.

Long-Term Benefits of Investing in Multifamily Properties

Investing in multifamily residential apartment buildings is a proven strategy for building wealth over time. Unlike single-family properties, apartment buildings provide multiple revenue streams through multiple units, reducing the risk of vacancies. As rental prices continue to rise in Montreal, landlords can expect increased rental income, further enhancing the return on investment.

Additionally, multifamily properties offer economies of scale when it comes to maintenance and management. Operating costs can be spread across multiple units, making it more cost-effective than maintaining multiple single-family homes. This efficiency is especially beneficial for investors looking to expand their portfolios and maximize profits.

Another key advantage is property appreciation. As demand for housing in Montreal grows, apartment buildings for sale tend to increase in value, leading to long-term equity gains. Investors can leverage this appreciation to refinance their properties, secure additional investment opportunities, or increase their net worth over time.

Final Thoughts

Investing in apartment buildings in Montreal can be a rewarding endeavor for all those looking to generate passive income and build long-term wealth. With strong rental demand, continued infrastructure development, and favorable market conditions, the city remains a promising location for real estate investors. Whether you are an experienced investor or new to the multifamily property market, now is the time to explore the opportunities available for real estate investing in Montreal.

Estate Montreal specializes in helping investors find lucrative apartment buildings for sale in the city. With in-depth market knowledge, expert negotiation skills, and access to exclusive listings, their team can guide you through the buying process and ensure you make informed decisions. Partnering with Estate Montreal gives you the advantage of working with professionals who understand the local real estate landscape and can help you maximize your investment potential.

#apartment buildings for sale#capital markets#commercial buildings for sale#commercial property for sale#commercial real estate#multi family homes for sale

0 notes

Text

Apartment buildings for sale Van Nuys Canoga Park

Apartment Buildings for Sale in Van Nuys & Canoga Park: A Prime Investment Opportunity

If you're looking for lucrative real estate investments in Los Angeles, Apartment buildings for sale Van Nuys Canoga Park present an excellent opportunity. These areas, located in the San Fernando Valley, offer a blend of affordability, strong rental demand, and long-term appreciation potential.

Why Invest in Van Nuys?

Van Nuys is a thriving neighborhood with a diverse population and a growing economy. The area benefits from its central location, providing easy access to major freeways like the 405 and 101. Additionally, the neighborhood has seen consistent rental demand due to its proximity to employment hubs, educational institutions, and public transportation. Investors can find multifamily properties ranging from small duplexes to large apartment complexes, making it a versatile market for different budgets.

Canoga Park: A Growing Rental Market

Canoga Park is another attractive location for multifamily investments. With a mix of suburban charm and urban amenities, this neighborhood attracts families, young professionals, and retirees alike. The area is home to Westfield Topanga & The Village, a major shopping and entertainment center, as well as parks and schools, making it a desirable location for renters. The continued development and revitalization projects in Canoga Park make it a promising market for long-term real estate appreciation.

Key Considerations for Buyers

Market Trends: Research rental demand, price appreciation, and occupancy rates.

Property Condition: Assess renovation needs and potential costs.

Financing Options: Explore mortgage rates, loan programs, and potential ROI.

Final Thoughts

Investing in Apartment buildings for sale Van Nuys Canoga Park offers solid returns and a steady rental market. Whether you're a seasoned investor or a first-time buyer, these neighborhoods provide excellent opportunities to build wealth through real estate.

#apartment buildings for sale north hollywood#apartment buildings for sale san fernando valley#unique apartment buildings for sale

0 notes

Text

Debt Markets, Credit Facilities Propel Commercial Real Estate Growth

Real estate provides a viable pathway for global investment growth in a volatile macroeconomic landscape. As detailed in the Commercial Observer in September 2024, senior debt markets center on debt and obligations prioritized for repayment should default or bankruptcy occur. Collateral backs them, which assures returns, even in insolvency. By contrast, subordinated debt typically has higher interest rates because it has higher risk related to its lower payback priority.

Senior debt markets are complex and evolving. Banks’ conservative approaches have avoided the pitfall of broad non-performing loan (NPL) portfolios, which were a major contributor to past financial crises. NPLs present high risks since they contain large amounts of collateralized debt, making them difficult to identify. Manageable single-asset loans often contain distressed assets. While traditional commercial mortgage-backed securities (CMBS) can pool 50 to 100 loans, single-asset, single-borrower (SASB) loans represent single large loans for one property, which investors can buy on the secondary market after securitization.

At the same time, lenders are taking a collaborative approach, flexibly working with sponsors to achieve refinancings and property sales rather than exacting harsh penalties such as foreclosure and bankruptcy.

Structured capital solutions (investments with debt and equity-like features) are a related way of combining debt and equity capital in ways that enable sponsors to bridge gaps across stretch senior loans and mezzanine loans. The latter represents business loans with tailored repayments to company cash flows. Professionals calculate existing loan balances against (often lower) permanent loan proceeds taken in, which helps ensure liquidity and mitigate rises in overall capital costs.

Real-world examples abound across Texas. In September 2024, Dallas-based Invitation Homes, Inc. announced it had closed a senior unsecured credit facility valued at $3.5 billion. It replaced the previous existing facility and reduced debt costs. The facility spans a fully funded $1.75 billion term loan and a $1.75 billion revolving line of credit (revolver), with the final maturity date set for September 2029. With the $1.75 billion revolver replacing an existing $1 billion revolving line of credit, this boosts balance sheet flexibility and liquidity as the real estate firm positions itself to take full advantage of emerging growth opportunities.

Debt financing’s rise also reflects trends of US interest rates peaking and positioned for a medium-term decline. This makes debt more attractive, as loans do not accumulate interest as quickly. This, in turn, generates renewed bank investments in the capital markets, as borrowers are less likely to accumulate unrepayable levels of debt.

For example, JLL Capital Markets successfully arranged an April 2024 construction loan of $290 million to support the 500,000-square-foot Class AA office tower Parkside Uptown. The project should reach completion in 2027, with funding involving a floating-rate four-year loan arranged through the Goldman Sachs Alternatives’ Real Estate Group. When the loan closed, Bank of America had already completed pre-leasing for nearly half of the available office space. It indicates a high demand for office space in uptown Dallas.

Another growth driver in US commercial real estate markets is inbound investment from regions such as Singapore and Japan. The Dallas-Fort Worth metroplex presents particularly robust opportunities in the multifamily, industrial, retail, and office categories. It is an advantageous location that attracts a growing and highly qualified workforce and proximity to infrastructure and supply chain elements such as multimodal transportation.

At the same time, Texas’ business-friendly environment gives corporations room to maneuver without severe regulatory oversight. With banks increasingly willing to take on major real estate financing deals, reduce payments, and extend maturity dates, real estate investment prospects are growing ever brighter.

0 notes

Text

Advantages of Multifamily Real Estate Investing

Investing in multi-family real estate is a favored asset class among both seasoned and novice commercial real estate investors. This category of real estate comprises properties specifically developed to accommodate multiple families, including apartment buildings and townhouses. These properties are typically owned by a single entity and rented out to multiple tenants. Multifamily investment properties for sale in New York can be a lucrative investment opportunity for individuals and companies looking to generate income from rental properties. Here are the many benefits of multifamily investing:

Help Pay Mortgage

One of the key advantages of investing in multi-family real estate is the ability to lease out multiple units, generating rental income that can be used to offset or even pay off your mortgage. With this strategy, you can enjoy the financial benefits of property ownership while maximizing your returns. This can significantly reduce your monthly housing costs and help you build equity in your property faster.

Easy to Finance

When considering obtaining a mortgage, multi-family loans are comparatively simpler to qualify for than single-family homes. This is because rental income can be considered as a source of income, enabling you to secure a larger loan. Nonetheless, it is crucial to meticulously examine your credit report and make enhancements to your credit score to secure the most favorable mortgage interest rate. By doing so, you can ensure that your mortgage application is successful and you receive the best possible terms.

Scope of Real Estate Portfolio Construction

Investing in multi-family properties presents an excellent opportunity for creating a rental property portfolio. By acquiring more multi-family units, you can generate sufficient rental income to offset your mortgage payments, thereby freeing up funds to acquire additional properties. This approach enables you to grow your real estate investment empire steadily. Over time, you can build a portfolio of properties that generates significant monthly income.

Easier Control

When you own Multifamily buildings for sale in Yonkers New York, you have greater control over your investment. You can handle the day-to-day issues that arise, collect the rent, and save on property management costs. Additionally, many renters treat multi-family units better because they know the owner is nearby.

Tax Benefits

Another significant benefit of multifamily real estate investing is tax benefits. You can write off the costs of maintenance and repairs on your rental unit, deduct insurance premiums and property/facility management fees, and reduce the value of your home over time. All these tax incentives lead to many tax savings.

Simplicity

Multi-family real estate investing is also a much easier way to become a real estate investor. You only need one mortgage and one insurance policy to cover your building, which makes it simpler to manage and reduces the need for property managers.

Reduce the Risk

Owning multiple units reduces risk. If one unit is vacant, you still have rental income from the other units to cover your expenses. Additionally, owning multi-family properties can help you weather economic downturns and other challenges that can impact the real estate market.

Conclusion

Multifamily investments offer compelling risk-adjusted return profiles. Different financing options are available for family offices and property trusts for individuals and partnerships. However, the complexity and diversity of the structural features of each loan create opportunities for failure in the financing process. Investigate not only the financing options but also the structural characteristics of the loan and be aware of the limiting factors early in the process. This creates the foundation for a successful path that increases cash flow. It is advisable to rely on seasoned brokers specializing in multifamily real estate investment to assist you in navigating the intricacies and pinpointing suitable prospects. Investing in multi-family properties can potentially yield substantial rental income, enhance equity, and foster financial security.

3 notes

·

View notes

Text

Apartments for Rent in Tampa

Novel Independence Park by Crescent Communities is the No.1. apartments for rent in Tampa. This is a serene retreat that combines high-end amenities with a casual atmosphere, making it an ideal home for those seeking a relaxing staycation. This apartment community features a saltwater pool, an outdoor grilling area, private offices, a fitness club, a pickleball court, and a dog park. Novel Independence Park includes amenities that are designed to help individuals navigate their own paths. Beyond the luxurious features, the community of Novel Independence Park fosters a sense of belonging and encourages social interaction, which creates a vibrant living environment. This apartment for rent in Tampa offers an exciting community. Call NOVEL Independence Park by Crescent Communitiesat (813) 501-7020 to know more about these apartment communities.

Weather in Tampa, FL

With moderate winters and very warm summers, Tampa has a lovely, sunny environment that people enjoy all year round. The residents' feeling of well-being and relaxation is enhanced by this lovely weather, which also encourages a dynamic and active lifestyle. The pleasant weather in Tampa makes it perfect for picnics in verdant parks and running along picturesque waterfronts, among other outdoor pursuits that families and people may enjoy. Also, the pleasant weather encourages people to get to know one another, as they often join forces for outdoor activities, sports leagues, and social gatherings. People live in communities where they can easily enjoy leisure activities all year round, which strengthens their social links and promotes a sense of unity.

The Tampa Riverwalk

Stunning views of both nature and the urban abound along the 2.6-mile Tampa Riverwalk, a lovely waterfront walkway running along the Hillsborough River. This is perfect for a relaxing walk or an energizing bike ride, the Riverwalk welcomes guests to interact with Tampa's vivid character. Along the road, the visitors may come across several waterfront eateries that offer a mouthwatering cuisine and cool beverages ideal for savoring the surroundings. Both locals and visitors will find the Riverwalk a meeting spot with its many parks, public art projects, and attractions like museums and playgrounds. The Riverwalk is a peaceful approach to interact with Tampa's core whether one is savoring the tranquilly of the river or the busy metropolis.

2024 Tampa Bay Real Estate Sales is $1.75 Billion

The 20 highest grossing sales in the Tampa Bay region generated over $1.75 billion in 2024, a slight decrease from 2023 but a significant cooling from 2022 due to low interest rates. Multifamily properties dominated the list, with several top-selling apartments clustered in suburban. Developers capitalized on the trend by building in these submarkets, where rent growth was outperforming. The No. 1 sale of 2024 was a well-known downtown office tower, with higher-tiered assets averaging above 90% occupancy. Tampa's tallest office tower, 100 N Tampa St., sold for $151.3 million in June to Brookdale Group, a real estate private equity firm. The building, which bears the Regions Bank logo, was 83% leased at the time of sale. In summary, the 20 highest-grossing sales in the Tampa Bay region generated over $1.75 billion this year, with multifamily properties dominating the list.

Link to map

Tampa Riverwalk Riverwalk, Tampa, FL 33602, United States Get on I-275 S 5 min (1.2 mi) Continue on I-275 S. Take FL-60 W/State Rd 60 W to Independence Pkwy. Take exit 2B from FL-589 N 7 min (6.7 mi) Continue on Independence Pkwy. Drive to George Rd 26 sec (0.2 mi) NOVEL Independence Park by Crescent Communities 4108 George Rd, Tampa, FL 33634, United States

0 notes