#MortgageDebt

Explore tagged Tumblr posts

Text

#HELOCs#Mortgages#MortgageDebt#Delinquencies#Foreclosures#Q2#RealEstate#Finance#Economy#HousingMarket#DebtCrisis#FinancialNews#HomeLoans#MortgageRates#EconomicTrends#renews

0 notes

Link

#BankDebt#banksandgovernment#Blockchain&CryptocurrencyRegulation2023#capsecurity#cryptoassets#cryptoregulation#CryptocurrencyRegulations#DollarstoCryptoCoins#MortgageDebt#SwitchfromDollarstoCryptoCoins

0 notes

Text

Personal Finance and the Role of Personal Finance Advisory Companies: How Real Estate Assist Can Help

Navigating the world of personal finance can be overwhelming, especially when dealing with mortgage payments, loan arrears, and other financial challenges. Personal finance advisory companies can help guide you through this complex landscape, offering valuable insights and tailored solutions. Real Estate Assist is one such company, specializing in helping homeowners overcome financial hurdles and regain control of their finances. In this comprehensive guide, we'll discuss personal finance, the role of personal finance advisory companies, and how Real Estate Assist can make a difference in your financial journey.

Understanding Personal Finance

Personal finance encompasses various aspects of managing your money, including budgeting, saving, investing, and managing debt. Having a firm grasp on your personal finances is essential for achieving your financial goals and securing a stable future. Some essential aspects of personal finance include:

a. Budgeting and Expense Tracking Creating and maintaining a budget is the cornerstone of personal finance.

A budget helps you understand your income and expenses, allowing you to make informed decisions about how to allocate your money. Tracking your expenses can also help you identify areas where you can cut back or find more cost-effective alternatives.

b. Saving and Investing

Saving money is crucial for building an emergency fund, financing big-ticket items, and planning for retirement. Investing, on the other hand, allows your money to grow over time, providing a potential source of passive income and long-term financial stability.

c. Managing Debt

Debt management is an integral part of personal finance. Ensuring that you can make regular payments on your debts, such as mortgages, credit cards, and personal loans, is essential to maintain a healthy credit score and avoid financial distress.

The Role of Personal Finance Advisory Companies

Personal finance advisory companies offer a range of services designed to help individuals manage their finances more effectively. These companies provide expert advice and guidance, helping clients make informed financial decisions and develop strategies to achieve their financial goals. Services offered by personal finance advisory companies may include:

a. Financial Planning

Financial planning involves creating a roadmap for achieving your financial goals, taking into account your current financial situation, risk tolerance, and future aspirations. A personal finance advisory company can help you develop a comprehensive financial plan that addresses various aspects of your financial life, including saving, investing, and managing debt.

b. Investment Advice

Investment advice is another service offered by personal finance advisory companies. These companies can help you develop an investment strategy tailored to your specific needs, risk tolerance, and financial goals. They can also provide guidance on selecting the right investment products and managing your investment portfolio.

c. Debt Management and Consolidation

Debt management and consolidation services help clients develop strategies for tackling their debt and improving their overall financial situation. Personal finance advisory companies can provide guidance on debt repayment strategies, negotiate with creditors on your behalf, and help you consolidate your debts into a single, more manageable payment.

How Real Estate Assist Can Help

Real Estate Assist is a personal finance advisory company with a focus on helping homeowners overcome financial challenges related to their mortgages and other debts. By partnering with Real Estate Assist, you can access a range of services and benefits that can help you regain control of your finances:

a. Tailored Financial Solutions Real Estate Assist understands that each client's financial situation is unique. They work closely with you to develop tailored financial solutions that address your specific needs and goals.

b. Expert Guidance The team at Real Estate Assist has extensive experience in the personal finance industry, providing expert guidance and advice to help you navigate the complex world of personal finance and make informed decisions.

c. Mortgage and Debt Assistance Real Estate Assist specializes in helping homeowners facing mortgage arrears and other debt-related challenges. They can help you explore options for

debt consolidation, loan restructuring, and alternative repayment plans, working with your lenders to find a solution that works for you.

d. Legal Support In some cases, you may need legal assistance to protect your rights and interests as a homeowner. Real Estate Assist can connect you with legal professionals who specialize in mortgage and debt-related issues, ensuring that you receive the support you need.

e. Ongoing Support and Education Real Estate Assist is committed to providing ongoing support and education to help you maintain a healthy financial future. They offer resources and tools to help you stay informed about personal finance topics and develop the skills needed to manage your finances effectively.

Frequently Asked Questions

Q: How much does it cost to work with Real Estate Assist? A: The cost of working with Real Estate Assist varies depending on your specific needs and the services you require. It's essential to discuss your situation with a representative from Real Estate Assist to get an accurate quote for their services.

Q: Can Real Estate Assist help me if I have bad credit? A: Yes, Real Estate Assist can work with clients who have poor credit histories. They can help you develop a plan for improving your credit score and provide guidance on managing your debts more effectively.

Q: How long does it take to see results from working with Real Estate Assist? A: The timeline for seeing results from working with Real Estate Assist will vary depending on your specific financial situation and the complexity of your case. However, with their expert guidance and support, you can expect to see improvements in your financial situation over time.

In today's complex financial landscape, having a trusted personal finance advisory company by your side can make all the difference. Real Estate Assist offers a range of services tailored to homeowners facing mortgage and debt-related challenges, providing expert guidance and support to help you regain control of your finances. With their help, you can develop a comprehensive plan for managing your personal finances and work towards a brighter, more secure financial future.

d. Legal Support In some cases, you may need legal assistance to protect your rights and interests as a homeowner. Real Estate Assist can connect you with legal professionals who specialize in mortgage and debt-related issues, ensuring that you receive the support you need.

e. Ongoing Support and Education Real Estate Assist is committed to providing ongoing support and education to help you maintain a healthy financial future. They offer resources and tools to help you stay informed about personal finance topics and develop the skills needed to manage your finances effectively.

Frequently Asked Questions

Q: How much does it cost to work with Real Estate Assist? A: The cost of working with Real Estate Assist varies depending on your specific needs and the services you require. It's essential to discuss your situation with a representative from Real Estate Assist to get an accurate quote for their services.

Q: Can Real Estate Assist help me if I have bad credit? A: Yes, Real Estate Assist can work with clients who have poor credit histories. They can help you develop a plan for improving your credit score and provide guidance on managing your debts more effectively.

Q: How long does it take to see results from working with Real Estate Assist? A: The timeline for seeing results from working with Real Estate Assist will vary depending on your specific financial situation and the complexity of your case. However, with their expert guidance and support, you can expect to see improvements in your financial situation over time.

In today's complex financial landscape, having a trusted personal finance advisory company by your side can make all the difference. Real Estate Assist offers a range of services tailored to homeowners facing mortgage and debt-related challenges, providing expert guidance and support to help you regain control of your finances. With their help, you can develop a comprehensive plan for managing your personal finances and work towards a brighter, more secure financial future.

#personal finance#Homeowners#Mortgagedebt#Debtassistance#debthelp#debt solution#Managing debt#Debt management

1 note

·

View note

Photo

More evidence of how stupid a credit score is. Those getting mortgage relief because they CAN’T PAY THEIR MORTGAGE have higher credit scores than those who didn’t take relief. This further proves what I always say: a credit score is nothing but HOW GREAT YOU ARE AT BORROWING MONEY AND TAKING YOUR HARD MONEY AND GIVING IT TO OTHER PEOPLE!!! https://www.bloomberg.com/news/articles/2021-05-19/the-almighty-credit-score-isn-t-as-reliable-post-covid-fed-says?utm_source=url_link&utm_medium=news_tab&utm_content=algorithm #creditscore #mortgages #debt #mortgagedebt #economy #recession #ridiculousness #debtfreegoals #debtfree #loanpayment #stimulusbill #moneymoves #buildwealth #wealthbuilding #debtscore #putmoneyinthebank #howtosavemoney #howtopayoffdebt https://www.instagram.com/p/CPGJqjmjxkR/?utm_medium=tumblr

#creditscore#mortgages#debt#mortgagedebt#economy#recession#ridiculousness#debtfreegoals#debtfree#loanpayment#stimulusbill#moneymoves#buildwealth#wealthbuilding#debtscore#putmoneyinthebank#howtosavemoney#howtopayoffdebt

0 notes

Text

Facing Up To The End Of Easy Money

Part 3 of the series on Australia’s looming debt danger

In the first part of this three-part series, we outlined why real wages were in decline, not just in Australia but across the world.

In part 2 we added the burden of rising bank interest rates, showing that together those factors are making it more difficult to service mortgage debt...

Read full article here: https://www.primecapital.com/facing-up-to-the-end-of-easy-money/

0 notes

Photo

Abhaile is a scheme to help homeowners find a resolution to home mortgage arrears. It provides free expert financial and legal advice from qualified and regulated professionals, which are available through MABS or a Personal Insolvency Practitioner (PIP). The aim of Abhaile is to help mortgage holders in arrears to find the best solutions and keep them wherever possible, in their own homes. A dedicated mortgage arrears adviser will work with you and your lender to find the best solution for your situation. #tallaght #mabs #mortgagedebt #mortgagearrears #weareheretohelp #callus (at Dublin South MABS - Tallaght) https://www.instagram.com/p/B8QuVEznknS/?igshid=1ap6xacsvholm

0 notes

Text

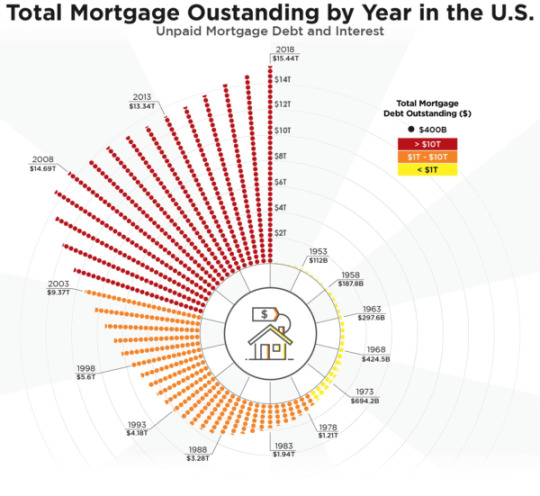

America's Mortgage Debt Spiral

America's Mortgage Debt Spiral Accelerates to All-Time High.

Since the 1940s, housing prices have soared to new levels. According to the U.S. Census Bureau, the median home value in the U.S. was $30,600 in 1940 (adjusted for inflation). By 2017, that number was $193,500. Not surprisingly, as housing prices increase, so does the amount of mortgage debt that a homebuyer must take on in order to afford a home. Our new visualization takes a closer look at how mortgage debt in the U.S. has changed over time. * Outstanding mortgage debt is 284 times greater in 2018 than it was in 1949. * Total mortgage debt first exceeded $1 trillion in 1977. * From 2008 to 2012, during the height of the Great Recession, total mortgage debt in the U.S. actually decreased every year. * As a percentage, the largest increase in mortgage debt year-over-year occurred from 1949 to 1950, when mortgage debt increased by more than 50%.

The visualization is based on data from the Federal Reserve, which lists the amount of outstanding mortgage debt in the U.S. since 1949. The chart above represents a timeline of mortgage debt, shown in circle form. The top of the circle starts with 1949, and the years progress in a clockwise direction until 2018, the most recent full year. For each year, the amount of outstanding mortgage debt is represented by smaller, stacked dots, with each dot representing $400 billion. To give a more complete picture of how much mortgage debt has been accruing over the years, the dots are color-coded. Years with yellow dots mean that the total mortgage debt is under $1 trillion, while orange dots represent $1 trillion to $10 trillion and the red dots represent more than $10 trillion in mortgage debt. Evolution of the Mortgage Debt - Every Five Years 1953 - $112 billion 1958 - $187.8 billion 1963 - $297.6 billion 1968 - $424.5 billion 1973 - $694.2 billion 1978 - $1.21 trillion 1983 - $1.94 trillion 1988 - $3.28 trillion 1993 - $4.18 trillion 1998 - $5.6 trillion 2003 - $9.37 trillion 2008 - $14.69 trillion 2013 - $13.34 trillion 2018 - $15.44 trillion Even though the mortgage debt is the highest in history, long-term interest rates are close to historical lows. Prominent economists, like Paul Krugman, have warned about the current real estate market status. Mortgage demand, despite record-low rates, seems unable to grow since home prices are still out of reach for many Americans. While mortgage rates in the U.S. are low, other countries like Denmark are giving homebuyers even more of a boost. A Danish bank is offering the world’s first negative interest rate, at -0.5% a year, meaning the mortgage holders will pay back a lower amount than they took out to purchase a home. It will be interesting to see how this affects the Danish real estate market in the long run. Information courtesy of HowMuch.net. Ed Bertha (941) 921.2117 [email protected] www.DiscoverSuncoastHomes.com Red Line Investors dba Burns & Bertha 2707 Barnard Road Bradenton, FL 34207 Burns & Bertha - Changing Lives - Red Line Investors - © 2019 www.DiscoverSuncoastHomes.com Read the full article

0 notes

Text

A Chapter 7 Bankruptcy Can Stop a Foreclosure

Karra L. Kingston Esq. has helped debtors file bankruptcy to save their homes. A Chapter 7 bankruptcy can stop a foreclosure. Many clients come to us after all other options have been exhausted. Our office has represented clients in bankruptcy Court against mortgage lenders and obtained successful modification outcomes. Call our office today to speak with a bankruptcy lawyer that can help you save your home before it's too late! A Chapter 7 bankruptcy, can stop foreclosure proceedings and may even save your home. Many times people who face foreclosure wait until the last minute to stop the auction of their home. In some jurisdictions filing a Chapter 7 bankruptcy can be useful to stopping the sale of the home, and trying to get a loan modification. Sometimes, Chapter 7 may not be the best option and a Chapter 13 bankruptcy may need to be filed to save your home.

How Can A Chapter 7 Bankruptcy Save My Home?

A Chapter 7 bankruptcy can stop a foreclosure and wipe out the amount that you owe on your mortgage. This means that if your house is foreclosed on and you file a Chapter 7 bankruptcy then you will not be liable for any deficiency that may be owed. It is important to understand that even though your mortgage gets wiped out in a Chapter 7 bankruptcy, this does not mean that the lien on the property goes away. A lien still stays on the property when you file a Chapter 7 bankruptcy. This means the mortgage company can continue to foreclose on your home even though you do not personally owe the remaining balance on the mortgage. If you are current on your mortgage then this should not be a concern, as most companies will allow you to keep paying your mortgage even after filing a Chapter 7 bankruptcy. Different States' have different rules as to what can be done to stop the sale of your home in a Chapter 7 bankruptcy. For example, in New York the Court will allow you to file a Chapter 7 bankruptcy, to stop the sale of your home and try to seek loss mitigation. Loss mitigation, is where the lender and the debtor work together to come up with some sort of repayment plan. Sometimes the lender will extend the terms of the loan and put the arrears in your monthly payment. Other times, the lender may put a balloon payment at the end of your mortgage. Unfortunately, not everyone can qualify for loss mitigation. In order to qualify, you will have to show the lender that you have enough income to be able to make payments on your loan. Why Chapter 7 May Not Be the Best Way To Save Your home Filing a Chapter 7 bankruptcy, may not be the best way to save your home. If you are not able to participate in loss mitigation, then you have no recourse. Unlike a Chapter 7 bankruptcy, a Chapter 13 bankruptcy allows you to become current on your arrears. This means that you will have to pay your regular monthly mortgage payment, on top of paying your arrears. If you can show the Court that you are able to pay both, your Chapter 13 bankruptcy plan will likely to be confirmed. Unfortunately, Chapter 7 bankruptcy does not have a mechanism to allow you to catch up on your arrears. Further, if you file a Chapter 7 bankruptcy the Court can not force the lender to give you a loan modification. This means that the lenders ultimately, have the upper hand. How Does the Automatic Stay Stop My Foreclosure? If your home is set for auction, filing a Chapter 7 can by you time. When you file bankruptcy an automatic stay becomes effective. This prevents creditors from coming after you including, the bank from foreclosing on your home. Creditors must cease all collection efforts. Therefore, if your home was scheduled for auction, the auction will be canceled. Filing a bankruptcy can help you stay in your home for a little while longer. This extra time can allow you to work out other foreclosure options with your lender such as a loan modification, or short sale. If you have a foreclosure auction date set, time is of the essence. The longer you wait the more difficult the process becomes. Make sure that you speak with a bankruptcy lawyer immediately to discuss your options. Read the full article

#BankruptcyAttorney#bankruptcycost#bankruptcylawyer#behindonmortgage#Chapter7bankruptcy#Filebankruptcytostopforeclosuresale#Foreclosure#foreclosureattorney#foreclosuresale#ForeclosureStatenIsland#howcanfilingchapter7stopforeclosure#loanmodification#mortgagedebt#NewJerseyforeclosure#savemyhome

0 notes

Photo

#buildCredit #creditscore #securedCreditCard #studentloandebt #taxdebt #taxes #thematrix #thedebtmatrix #fastcash #paychecktopaycheck #IRSdebt #financecar #bankruptcy #TEDtalk #PMI #mortgageDebt #mortgage #FHAmortgage #subprimemortgage #layoff #overdraftprotection #gapinsurance #paydayloan #creditcarddebt #studentloan #schooldebt #debt #highinterest #freefinancing https://www.instagram.com/whycryovermoney/p/BwFR30ihi9V/?utm_source=ig_tumblr_share&igshid=1qfnzlp5ym0ld

#buildcredit#creditscore#securedcreditcard#studentloandebt#taxdebt#taxes#thematrix#thedebtmatrix#fastcash#paychecktopaycheck#irsdebt#financecar#bankruptcy#tedtalk#pmi#mortgagedebt#mortgage#fhamortgage#subprimemortgage#layoff#overdraftprotection#gapinsurance#paydayloan#creditcarddebt#studentloan#schooldebt#debt#highinterest#freefinancing

0 notes

Link

#BANKRUPTCY & DEBT ATTY IN GREATER LOS ANGELES & OC;#ENGLISH/SPANISH SPEAKING#bankruptcy debt studentloans#bancarrota mortgagedebt hipoteca fairlending discrimination

0 notes

Photo

Where people excel at keeping to their budgets 1. San Jose San Jose might be in one of the most expensive states to buy a home (California ranks third in monthly mortgage #payments, behind Washington, D.C. and Hawaii), but residents here have the least amount of debt among residents in the 50 largest U.S. metro areas. The average millennial living in San Joseowes around $18,000 in non-mortgage debt, which is about $5,000 less than the average young person in the country. Among that debt, student loans — which typically accounts for 40 percent of young people's total credit and loan balances — were the lowest in San Jose at 24.1 percent. 2. San Francisco Thanks to the booming tech industry, San Francisco is easily one of the most expensive places to live. Yet, LendingTree's data shows its residents live within their means: San Francisco residents have a revolving credit utilization of 27.4 percent, compared with the 50-metro average of 32.6 percent, and a non-housing debt balance that's 27.7 percent, which is, again, well below the average of 43.7 percent of income. Still, sky-high home prices mean San Francisco residents endure a mortgage debt of 123.9 percent of their income. This is among the highest, only behind other #california cities — #sacramento (126.5 percent), San Diego (131.1 percent) and Riverside (131.1 percent). 3. Raleigh The capital of #northcarolina is known for being one of the largest technology and scholarly hubs, fueled by the well-educated population residing in the #collegetown . Surrounding colleges and universities include #dukeuniversity , the University of North Carolina at Chapel Hill, Wake Forest University, North Carolina State University and Shaw University. Here, residents have a revolving #credit utilization of 32.9 percent, a non-mortgage debt of 41.9 percent of income and a #mortgagedebt of 72.8 percent of income. 4. Minneapolis Earlier this year, #minneapolis , along with the state's capital, #stpaul , ranked ninth on U.S. News' list of the "Best Affordable Places to Live." The median annual #salary in the Twin Cities is $55,010, and the average home price is just over $237,000. https://www.instagram.com/p/Bpm90Z-gkvH/?utm_source=ig_tumblr_share&igshid=ecubd6jkmexb

#payments#california#sacramento#northcarolina#collegetown#dukeuniversity#credit#mortgagedebt#minneapolis#stpaul#salary

0 notes

Text

JumpmanBilly: #Mortgage Debt Has Advantages – #Tax Advantages https://t.co/7yOsXPHiXN #mortgagedebt #mortgages

JumpmanBilly: #Mortgage Debt Has Advantages – #Tax Advantages https://t.co/7yOsXPHiXN #mortgagedebt #mortgages

— LoveThePPL (@LovverOfall) April 14, 2018

0 notes

Text

Atarah Wright - February 02, 2017 at 08:21AM

LOOK! Learn how to Eliminate #MortgageDebt in appx 10 yrs with 1 of my REAL #Millionaire Super Friends/Mentor He is hosting a Private Webinar & I want you to be my guest! #Save #Money and STOP Allowing THE BANK to use your money without your knowledge! You will learn a #Wealth Strategy that when implemented will help you: 1. Pay off Your Mortgage, Car Loan & ANY Secured #Debt in 50 to 70 percent of the time. Watch, Share and Subscribe. #WealthFirstTV #WealthFirst #AskAtarah 2. Increase Your Financial IQ. Knowing IS half the battle. 3. Find the support from other #WealthBuilders who have been Financially AWAKENED! Inbox me for additional details to attend Thursday, Tonight @ 9pmEST A Private Webinar that is Invitation Only! *****WARNING WARNING WARNING WARNING WARNING WARNING **** You will NOT get this information from your Accountant, Tax Preparer, Mortgage Broker, Banker, typical Financial Planner. Only a few have access to these type of #WealthBuilding strategies. AND I'm ONE! THIS IS NOT THE PAY AN EXTRA PAYMENT METHOD. THE STRATEGY SHARED TONIGHT WILL STOP YOU IN YOUR TRACKS! BLOW YOUR MIND. AND MOST IMPORTANTLY #IncreaseYourCashflow & #SAVEYOUMONEY. Period. Point Blank. Inbox ME Now So I can help or keep paying your mortgage and giving away ALLLLLLL THAT MONEY TO THE BANKS. IJS it's time to #WAKEUP

0 notes

Text

The Chronicles of Debt

It is close to ten years since America’s housing bubble burst. It is six since Greece’s insolvency sparked the euro crisis. Linking these episodes was a rapid build-up of debt, followed by a bust.

A third installment in the chronicles of debt is now unfolding. This time the setting is emerging markets. Investors have already dumped assets in the developing world, but the full agony of the slowdown still lies ahead...

https://www.primecapital.com/the-chronicles-of-debt/

0 notes

Photo

Protections if your mortgage is sold to a third party. #tallaght #mabs #mortgagedebt #mortgagearrears #weareheretohelp #callus (at Dublin South MABS - Tallaght) https://www.instagram.com/p/B8QrmRKHty2/?igshid=69ci7qb645ng

0 notes

Photo

#buildCredit #creditscore #securedCreditCard #studentloandebt #taxdebt #taxes #thematrix #thedebtmatrix #fastcash #paychecktopaycheck #IRSdebt #financecar #bankruptcy #TEDtalk #PMI #mortgageDebt #mortgage #FHAmortgage #subprimemortgage #layoff #overdraftprotection #gapinsurance #paydayloan #creditcarddebt #studentloan #schooldebt #debt #highinterest #freefinancing https://www.instagram.com/whycryovermoney/p/BwE77IChOXo/?utm_source=ig_tumblr_share&igshid=10qjqcq2wtc0i

#buildcredit#creditscore#securedcreditcard#studentloandebt#taxdebt#taxes#thematrix#thedebtmatrix#fastcash#paychecktopaycheck#irsdebt#financecar#bankruptcy#tedtalk#pmi#mortgagedebt#mortgage#fhamortgage#subprimemortgage#layoff#overdraftprotection#gapinsurance#paydayloan#creditcarddebt#studentloan#schooldebt#debt#highinterest#freefinancing

0 notes