Paul Scanlon is CEO of Prime Capital in Syndey, Australia. Paul Scanlon has over 20 years experience in the funds management and the finance industry. Prime Capital specializes in commercial funding activities.

Don't wanna be here? Send us removal request.

Text

Investors Head For The Brexit, But Property May Gain

Any event that causes uncertainty and possible loss of money results in a ‘flight to safety’ from investors. And uncertainty has been supplied in bulk recently by the British people’s vote to leave the European Union, so investors are also looking for the door.

UK Prime Minister David Cameron has bailed out, as has most of the Opposition; Scotland and Ireland have had enough of the UK; and the EU is telling the lot of them to take their cricket bats and balls and get out.

https://www.primecapital.com/investors-head-for-the-brexit-but-property-may-gain/

2 notes

·

View notes

Text

What if the Interest Rate Lever Doesn’t Work?

The world is awash with debt and we’re running out of solutions…

Interest rates are central banks’ main economic control lever, but we just don’t know how effective they will be against the gathering global tsunami of debt.

“The world is now staggering under a record amount of debt,” Fidelity International’s Michael Collins says. “Household, corporate and government debt are at unmatched levels in absolute and relative [to GDP] terms.

“This unrivalled debt poses an unprecedented threat to the world economy.”

https://www.primecapital.com/what-if-the-interest-rate-lever-doesnt-work/

2 notes

·

View notes

Text

Time To Rethink Your Funding

More pressure on banks may make it harder for businesses to get loans…

The best banking brains in the world are keenly poring over spreadsheets trying to work out how to cope with the massive changes being forced on them by regulators the world over.

https://www.primecapital.com/time-to-rethink-your-funding/

2 notes

·

View notes

Text

People V Property – The Herd Is On The Move

Real estate prices are easing and that’s causing some concern…

“If enough people think the same way, that becomes a self-fulfilling prophecy,” is an axiom attributed to the shadowy BitCoin founder known as Satoshi Nakamoto.

In stockbroking and beyond it’s called the ‘herd mentality’, but does it also apply to the property market?

https://www.primecapital.com/people-v-property-the-herd-is-on-the-move/

1 note

·

View note

Text

Residential Land Costs Keep Rising

The high cost of housing in the capital cities remains a political hot potato and with a federal election imminent, there will be increased focus on how future generations are being priced out of the market.

This is highlighted by recent data showing that even vacant blocks are moving out of reach of market entrants, but equally, while there is limited supply, empty land is a solid investment.

https://www.primecapital.com/residential-land-costs-keep-rising/

1 note

·

View note

Text

Brisbane The Place To Invest

The property market is cooling and sellers no longer have the whip hand. It’s now becoming easier for buyers to find a bargain but value is an important consideration.

In our previous report, we pointed out that property values were falling, auction clearance rates were declining, rental growth was the lowest on record and general real estate sentiment was weakening.

https://www.primecapital.com/brisbane-the-place-to-invest/

0 notes

Text

Solutions For A Budget ‘Emergency’

Apparently we had a Federal Budget ‘emergency’ in 2014. Crisis was the narrative, and politicians from all parties revelled in the opportunity to push weird and wonderful agendas.

The government still appears keen to cut the deficit, if not return the budget to surplus, but with the failing of discussions around GST increases and changes to negative gearing, are there any good ideas left? Here’s a few interesting ones to consider.

https://www.primecapital.com/solutions-for-a-budget-emergency/

0 notes

Text

Property Hotspots Start Cooling

The long-expected cooling of the property markets appears to be under way, with values falling, auction clearance rates declining, rental growth the lowest on record and general real estate sentiment weakening.

National Australia Bank’s (NAB) residential property survey for the final quarter of 2015 shows real estate market participants have little optimism left, with the index at +1, down from +10 in the third quarter. The respondents to the survey expect house prices to increase by just 0.5% nationally this year and 1% over the next two years.

https://www.primecapital.com/property-hotspots-start-cooling/

0 notes

Text

The Banks Are Hurting And You Will Pay

The big four banks have suddenly found that money is getting more expensive and their customers – that’s you – will pay the price.

The cost of wholesale funding, or selling debt – which banks use to supplement deposits to help finance their operations and manage risk – is at a two-year high and showing no signs of decreasing as world markets, including the credit markets, switch to gloom mode.

https://www.primecapital.com/the-banks-are-hurting-and-you-will-pay/

0 notes

Text

The Warning Signs In Capex

When you look for signs of economic growth, there are a lot of signals to choose from but the one that stands out most is capital expenditure, or private business investment intentions.

This shows how much private businesses are spending or planning to spend on assets by type, such as new buildings and other structures/equipment, plant and machinery – and the news isn’t good. But there are ways to profit from a gloomy outlook.

https://www.primecapital.com/the-warning-signs-in-capex/

0 notes

Text

The World In 2016

“The future ain’t what it used to be,” said Yogi Berra, and if the unpredicted uneventfulness of 2015 is anything to go by, predictions for 2016 are expected to be difficult.

In conjunction with annual forecasting editions of the Economist magazine, we suggest the year coming will be able to be summed up in three words: woes, women and wins...

https://www.primecapital.com/the-world-in-2016/

0 notes

Text

Facing Up To The End Of Easy Money

Part 3 of the series on Australia’s looming debt danger

In the first part of this three-part series, we outlined why real wages were in decline, not just in Australia but across the world.

In part 2 we added the burden of rising bank interest rates, showing that together those factors are making it more difficult to service mortgage debt...

Read full article here: https://www.primecapital.com/facing-up-to-the-end-of-easy-money/

0 notes

Text

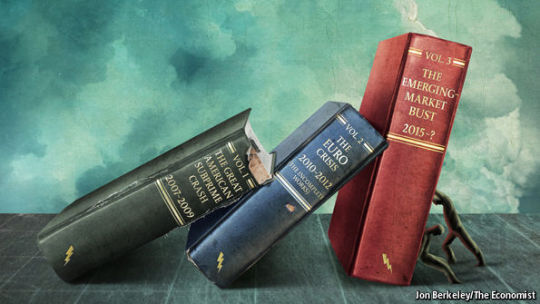

The Chronicles of Debt

It is close to ten years since America’s housing bubble burst. It is six since Greece’s insolvency sparked the euro crisis. Linking these episodes was a rapid build-up of debt, followed by a bust.

A third installment in the chronicles of debt is now unfolding. This time the setting is emerging markets. Investors have already dumped assets in the developing world, but the full agony of the slowdown still lies ahead...

https://www.primecapital.com/the-chronicles-of-debt/

0 notes

Text

Why Your Debt Is Our Concern

Part 2 of our series on Australia’s looming debt danger.

Australian mortgage holders are under pressure now that the four big banks and a host of smaller lenders have increased their variable loan rates...

https://www.primecapital.com/why-your-debt-is-our-concern-2/

0 notes

Photo

HERE'S WHY YOU WON'T GET A PAY RISE

It’s no surprise to anyone that real wages in Australia have been declining over the past 20-plus years. But what’s worth considering is why they are in decline and what the future may hold...

0 notes

Photo

Global economists and investors are not only worried about when the US Federal Reserve will start to push up interest rates.

Just as important is the scale and length of the tightening cycle – how much the Fed will need to tighten policy, and how long it will take to do so.

There have been 12 American tightening cycles since 1955, and they have lasted just under two years on average. In five of the past seven instances, however, the Fed has relented in a year or less, largely because inflation has been relatively subdued in recent decades.

http://www.primecapital.com.au/a-brief-history-of-rate-rises-tightening-pains/

0 notes

Photo

At its meeting today, the Board decided to leave the cash rate unchanged at 2.0 per cent. #cashrate #RBA #monetarypolicy

Read more here: http://www.rba.gov.au/media-releases/2015/mr-15-18.html

0 notes