#Money Transfer From UAE to India

Text

How to pay tuition fees abroad from india without breaking the bank?

How to Pay Tuition Fees Abroad from India? Users can send money abroad in 3 simple steps on DCB Remit: 1. Register online on www.dcbremit.com website 2. Register your beneficiary 3. Book a transaction and transfer money to DCB Bank pool account 4. Sit back and relax, as the money will reach your beneficiary within 48hrs! * Digital Money Transfer Services roviders offer exclusive exchange rates with seamless digital journey. Quick and paperless money transfer services.

#How to Pay Tuition Fees Abroad from India#india remit#remit money#Money Transfer Remit#How to Send Money from India to UAE#Transfer Money from India to UAE#Abroad Money Transfer#International Bank Transfer from India#International Money Transfer from India#International Money Transfer India#International Money Transfer Online#Money Transfer from India#Send Money Abroad#Send Money Abroad from India#Send Money from India#Send Money Overseas#Sending Money Abroad#Transfer Money Abroad#Transfer Money to Abroad

0 notes

Text

Transfer Money to UAE Online - Send Money from India to UAE

Use safe online international money transfer services to send money from India to the United Arab Emirates. Take advantage of choices for sending money from India to the UAE that are quick, dependable, and affordable with reasonable fees and favorable exchange rates.

0 notes

Text

Modus operandi unraveled: How over Rs 600 crore were siphoned out of country

The outward remittances were done illegally in the garb of third party payments against import of garments from Bangladesh.

Delhi Police's Special Cell registered an FIR in October 2021 regarding a syndicate that channeled money obtained through various criminal activities out of the country. This included Proceeds of Crime ( POC) obtained through illegal Chinese loan apps, illegal online gamings and also illegal bettings.

The wide network of this syndicate can be gauged from the fact that the case was first taken over by Delhi Police in October 2021. It was later transferred to the Enforcement Directorate ( ED) that is probing the matter and recently made an arrest on July 13.

From the documents that have been accessed by Republic Digital, it is mentioned categorically how accused persons, the fraudulent companies created by them on the pretext of forged documents were involved in opening of bank accounts both within and outside country and have taken out funds to the tune of Rs 338 crore.

To begin with, fake identities like Aadhaar, PAN cards and Voter ID cards were used for creating shell firms and opening multiple bank accounts.

In continuation to this, shell firms were also opened in Hong Kong, China, UAE, Singapore and Malaysia. The money that was deposited in Indian bank accounts was then successfully routed through RTGS/ NEFT.

The probe in this case by the agencies led them to get hold of Ashish Kumar Verma. It was found that Ashish along with the accomplices were able to create 18 shell firms and multiple accounts not only in private but also public banks.

Investigations have also revealed that Ashish is one among many in this huge syndicate that was successfully taking out hundreds of crores from the country.

As per law enforcement officials the other major characters involved in this crime of money laundering included Praveen Kumar based in Dubai who was involved in creating fake firms abroad, and Vipin Batra who used to be in touch with Ashish and gave him directions on how the modus operandi had to be implemented. Vipin Batra was recently arrested by the ED on July 13. He is being interrogated.

The mastermind of this syndicate is said to be Pawan Thakur, a Dubai-based bookie and an international Hawala operator. As per law enforcement officials, he is the mastermind in incorporating entities within India as well in foreign countries for remitting funds from India and receiving such funds in foreign bank accounts.

Thakur used to provide forged documents to Vipin Batra who in turn used to send these documents to Ashish Kumar Verma for executing outward remittances. Thakur used to incorporate entities in foreign countries on the backing of passports of several Indian individuals.

The modus operandi proved to be so successful that the syndicate acquired foreign exchange to the tune of Rs 271 crore and successfully sent this amount to the foreign bank account of shell companies abroad in the garb of purported imports of services giving false declarations in turn to banks.

In this, 90 percent of the amount was sent to Dubai while 10 percent was sent to Singapore.

It did not just end here. During the investigations, it was further found that Pawan Thakur was working on a similar modus operandi and in connivance with people that have been identified as Rohit Sharma, Jatin Chopra, Anmol Srivastava, Deepak Kaushal and others for illegal outward remittances.

The outward remittances were done illegally in the garb of third party payments against import of garments from Bangladesh.

From this, funds to the tune of Rs 338 crore were channeled out to Hong Kong and Singapore. Some of the fake firms that were created are Perfect Solutions, Omega Technologies, RP investment and consultancy, Flappose Trade PVT ltd, Uniwide innovations.

Fake directors of these firms were created. Bank accounts of office boys were created by giving them Rs 15,000. On their names, SIM cards used to be bought from where banking transactions used to be done.

With some arrests made in this case so far, investigations are still on to get hold of major masterminds in this Hawala racket that has resulted in more than Rs 608 crore being siphoned off the country.

1 note

·

View note

Text

Check The Azure VMware Solution’s Most Recent Features

AVS Azure VMware Solution

With Azure VMware Rapid Migration Plan, you can save a ton of money while moving or expanding VMware environments to Azure quickly and seamlessly. You can also access 200+ Azure services.

Get a quick migration for workloads on VMware.

Select a migration solution that combines the greatest features of Azure and VMware on fully managed infrastructure for ease of use.

Extend or migrate to the cloud more quickly without the need for re-platforming, reworking, or re-hosting.

Make use of your current abilities and workflow. NSX, vSAN, HCX, and VMware vSphere are all part of the Azure VMware Solution.

Customers of Windows and SQL Server can receive unrivaled cost savings with free Extended Security Updates.

Take care of a range of use cases, such as capex challenges, cyberthreats, license issues, datacenter exits, and capacity requirements.

Benefits

Examine switching to the Azure VMware Solution

Relocation according to your terms

Either transfer cloud-ready workloads to Azure infrastructure as a service (IaaS) or migrate everything exactly as is to Azure VMware Solution.

Effectiveness

By switching to Azure VMware Solution, you can avoid overprovisioning, hardware updates, and decommissioning infrastructure expenditures.

Regularity

Boost IT efficiency by making use of the VMware resources and expertise that already exist.

Value addition

Give IT personnel more time to work on value-adding projects rather than maintaining on-premises software and datacenters.

Dependable

With VMware technology that is completely managed and maintained by Microsoft, you can achieve business continuity, reduced downtime, and fewer disruptions.

Creativity

With access to native Azure services and tools and a highly productive cloud platform, move more quickly.

It gives me great pleasure to present some of the most recent changes Azure has made to the Azure VMware Solution.

Currently, 33 areas provide Azure VMware Solution: More than any other cloud provider, AVS is currently available in 33 Azure regions. Since its introduction four years ago, we have been striving to support customers worldwide through geographic expansion. India Central, UAE North, Italy North, and Switzerland North were the most recent additions. See which region is closest to you by visiting the Azure products by region webpage.

The DoD SRG Impact Level 4 Provisional Authorization (PA) in Azure Government has now authorized the addition of Azure VMware Solution as a service: Azure Government in Arizona and Virginia currently offers AVS.

Increased compatibility with VMware Cloud Foundation (VCF): Customers of NetApp and VMware by Broadcom may now use NetApp ONTAP software for all storage needs, including consolidated and standard architectures, to streamline their VCF hybrid cloud platforms. In order to give NetApp storage systems running VMware workloads symmetric active-active data replication capabilities, the most recent version of ONTAP Tools for VMware (OTV) will offer SnapMirror active sync. By removing data protection from their virtualized compute and enhancing data availability, SnapMirror active sync enables users to work more productively. Study up on it.

New features for Azure VMware Solution: Spot Eco by NetApp with AVS reserved instances may now be used by clients to maximize the value of their deployments when they are expanding or relocating their vSphere virtual machines (VMs). Compute expenses can be greatly decreased by offloading data storage to Azure NetApp Files and managing AVS reserved instances using Spot Eco. Find out more about Azure NetApp Files.

Use JetStream with Azure VMware Solution to Improve Disaster Recovery and Ransomware Protection: Azure’s customers require comprehensive choices to protect their essential workloads without sacrificing application performance. Disaster Recovery (DR) and ransomware protection are major concerns for enterprises today. AVS provides cutting-edge disaster recovery (DR) solutions with near-zero Recovery Point Objective (RPO) and instant Recovery Time Objective (RTO) through partnerships with top technology firms like JetStream. By continuously replicating data, the JetStream DR and Ransomware solution delivers Continuous Data Protection (CDP).

Using affordable and high-performance storage choices like Azure Blob Storage, Azure NetApp Files (ANF), and ESAN-based solutions, it uses heuristic algorithms to detect data tampering through VMware-certified VAIO APIs. Compared to other products on the market that guard against ransomware by taking irreversible photos, Azure’s strategy is distinct. JetStream and Microsoft have collaborated to create a special feature that rehydrates virtual machines (VMs) and their associated data from object storage, enabling them to be deployed to AVS nodes that are provisioned on-demand, either with or without a pilot light cluster. In the case of a disaster or ransomware attack, this guarantees a quick, affordable recovery with little downtime.

The VMware Rapid Migration Plan is a comprehensive suite of licensing perks and programs that Azure just introduced. It will safeguard your price and help you save money when you migrate to Azure VMware Solution. If your needs change, you can shift the value to other types of compute by using Reserved Instances to lock in pricing for one, three, or five years. With Azure Migrate and Modernize services, you may minimize migrating costs. You can also receive special Azure credits for purchasing Azure VMware Solutions. Additional savings on SQL Server and Windows Server licenses might be available to you.

Read more on govindhtech.com

#AzureVMwareSolution#MostRecentFeatures#VMwareRapidMigrationPlan#SQLServer#AzureNetApp#cyberthreats#VMware#Microsoft#cloudprovider#DisasterRecovery#dr#ransomwareattack#azure#sql#technology#technews#news#govindhtech

0 notes

Text

Send Money To India From UAE - Money Transfer From UAE

0 notes

Text

Digital Money Transfer Market Anaysis by Size And Growth to 2031 Shared in Latest Research

The Market report can help clients make business decisions and understand Industry Recent Trends, Share, Size, Growth, Opportunity, and Forecast 2024 to 2031” report by Report Ocean delivers a thorough industry evaluation, covering market trends, competitor analysis, regional insights, and the Recent market developments. Ideal for investors, researchers, consultants, and marketing strategists, it is a valuable resource for those looking to engage in the market. The study emphases on whole estimate of the value chain, technological progresses, prospects, future roadmaps and distributor study.

Get the complete sample, please click:

Key Regions & Countries

North America (United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

South America (Brazil, Argentina, Colombia etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa).

The Report Covers -

-Complete in-depth study of the market and Vital changes in market dynamics.

- Detailed considerate of market-particular drivers, Trends, constraints, Restraints, Opportunities and important micro markets.

- the report focus on Complete valuation of all prospects and risk.

- In depth study of business tactics for growth of the market core players.

- Market latest innovations and key procedures.

- the Research focus on Vital changes in market aspects, product development, current trends, Competitive Landscape.

- Conclusive study about the development conspiracy of market for forthcoming years.

Table Of Content:

Some Major TOC Points:

Chapter 1. Report Overview

Chapter 2. Global Growth Trends

Chapter 3. Market Share by Main Players

Chapter 4. Breakdown Data by Type and Application

Chapter 5. Market by End Users/Application

Chapter 6. COVID-19 Outbreak: Chair Lifts Sales Industry Impact

Chapter 7. Opportunity Analysis in Covid-19 Crisis

Chapter 8. Market Driving Force

To Be Continued…!

Reason To Buy:

Robust study methodology with important analysis including Porter's Five Investigation and SWOT analysis.

Extensive analysis of aggressive commerce regulations and rules of numerous government agencies both internationally and regionally from the report to incorporate a wide picture of this market's potential.

Supplying crucial opportunities for market expansion throughout the forecast period.

Study of a Huge historic Information about market behavior, functionality, and creation from companies.

True and factual statistics consisting of a succinct graphical representations, tables, and statistics of this market in the report.

Contact Us:

Proficient Market Insights

Phone:

US : +1 424 253 0807

UK : +44 203 239 8187

Email:

Web: https://proficientmarketinsights.com/

0 notes

Text

Mobile Remittance Service Market: Forthcoming Trends and Share Analysis by 2030

Global Mobile Remittance Service Market size is expected to grow from USD 22211.01 Million in 2023 to USD 85191.62 Million by 2032, at a CAGR of 16.11% during the forecast period (2024–2032)

You can use a mobile phone to send and receive money electronically with a mobile remittance service. It's an easy and accessible alternative to going in person to a bank or money transfer agency to transfer money. Bill payments and peer-to-peer transactions are made easier with the usage of mobile remittance services, which are available both domestically and internationally. They provide consumers with freedom in managing their finances by meeting the increasing demand for cross-border remittances and facilitating transactions between conventional bank accounts and mobile wallets. The market for conventional bank accounts is also present.

Financial inclusion, cost effectiveness, speed, and convenience are all provided by mobile remittance services. They enable customers to start transactions whenever and wherever they choose by doing away with the necessity for actual trips to banks or remittance centers. They are perfect for urgent financial situations because they offer transfers that happen almost instantly. Financial inclusion for individuals without simple access to traditional banking is further enhanced by the fact that digital transactions frequently have lower fees than traditional methods.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/4013

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Leading players involved in the Mobile Remittance Service Market include:

Mobetize Corp. (U.S.)

MoneyGram (U.S.)

Remitly (U.S.)

Regalii (U.S.)

Flywire (U.S.)

PayPal. (U.S.)

Ria Financial Services (U.S)

Western Union Holdings, Inc. (U.S)

Currency Cloud (UK)

Azimo (UK)

WorldRemit (UK)

TransferWise (UK)

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

If You Have Any Query Mobile Remittance Service Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/4013

Segmentation of Mobile Remittance Service Market:

By Type

Banks

Money Transfer Operators

By Application

Migrant Labor Workforce

Low-income Households

Small Businesses

An in-depth study of the Mobile Remittance Service industry for the years 2024–2032 is provided in the latest research. North America, Europe, Asia-Pacific, South America, the Middle East, and Africa are only some of the regions included in the report's segmented and regional analyses. The research also includes key insights including market trends and potential opportunities based on these major insights. All these quantitative data, such as market size and revenue forecasts, and qualitative data, such as customers' values, needs, and buying inclinations, are integral parts of any thorough market analysis.

Market Segment by Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Key Benefits of Mobile Remittance Service Market Research:

Research Report covers the Industry drivers, restraints, opportunities and challenges

Competitive landscape & strategies of leading key players

Potential & niche segments and regional analysis exhibiting promising growth covered in the study

Recent industry trends and market developments

Research provides historical, current, and projected market size & share, in terms of value

Market intelligence to enable effective decision making

Growth opportunities and trend analysis

Covid-19 Impact analysis and analysis to Mobile Remittance Service market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=4013

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1 773 382 1049

Email: [email protected]

#Mobile Remittance Service#Mobile Remittance Service Market#Mobile Remittance Service Market Size#Mobile Remittance Service Market Share#Mobile Remittance Service Market Growth#Mobile Remittance Service Market Trend#Mobile Remittance Service Market segment#Mobile Remittance Service Market Opportunity#Mobile Remittance Service Market Analysis 2023

0 notes

Text

Global Faster Payment Service (FPS) Market Size to Reach USD 3,067 Million by 2030, At Growth Rate (CAGR) of 21.20%

The global market for Faster Payment Service (FPS), estimated at USD 543.5 million in 2022, is projected to reach USD 3,067 million by 2030, with a CAGR of 21.20% during the forecast period from 2022 to 2030.

FPS allows individuals and businesses to transfer money between bank accounts almost instantly. This enables faster settlement of payments, making it suitable for various purposes such as bill payments, salary transfers, online purchases, and peer-to-peer transactions. FPS is often integrated into online and mobile banking platforms offered by banks and financial institutions. Users can conveniently initiate and manage payments through these channels, providing greater flexibility and convenience.

Major Market Players

Key players in the global Faster Payment Service (FPS) market include ACI Worldwide, FIS, Fiserv Inc., wirecard, Mastercard, Temenos Headquarters SA, Global Payments Inc., Capgemini, Icon Solutions Ltd, M & A Ventures LLC, PAYRIX, Nexi Payments SpA, Obopay, and Ripple, among others. Recent developments include Fiserv launching the EnteractSM, a cloud-based customer relationship management platform, and ACI Worldwide partnering with BI-FAST to extend their real-time payment services in Indonesia.

Get more Information About the Faster Payment Service (FPS) Market here & Take a Sample Copy:

https://introspectivemarketresearch.com/request/16608

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

Faster Payment Service Market Segmentation:

By Mode of Payment

Single Immediate Payments

Forward-Dated Payments

Direct Corporate Access Payments

Domestic P2P Payments

P2M Payments

B2B Payments

Others

By Component

Solutions

Payment gateway

Payment processing

Payment Security

Services

Others

By Deployment

Cloud

On-Premises

By End Use Industry

Retail and E-Commerce

Banking, Financial Services, & Insurance (BFSI)

IT & Telecom

Travel & Tourism

Others

Inquire or Share Your Questions If Any Before the Purchasing This Report @

https://introspectivemarketresearch.com/inquiry/16608

Regional Insights:

Regional Outlook (Revenue in USD Million; Volume in Units, 2023-2030)

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Acquire This Report:

https://introspectivemarketresearch.com/request/16608

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Email:[email protected]

#Faster Payment Service (FPS)#Faster Payment Service (FPS) Market#Faster Payment Service (FPS) Market Size#Faster Payment Service (FPS) Market Share#Faster Payment Service (FPS) Market Growth#Faster Payment Service (FPS) Market Trend#Faster Payment Service (FPS) Market segment#Faster Payment Service (FPS) Market Opportunity#Faster Payment Service (FPS) Market Analysis 2022#US Faster Payment Service (FPS) Market#Faster Payment Service (FPS) Market Forecast#Faster Payment Service (FPS) Industry#Faster Payment Service (FPS) Industry Size#china Faster Payment Service (FPS) Market#UK Faster Payment Service (FPS) Market

0 notes

Text

Guide on Money Transfer from India to UAE - IndusForex

Would you like to transfer money from India to the UAE? Find the necessary details on money transfer from India to UAE in a few easy steps. Click here to read more.

0 notes

Text

International bank transfer from india : Everything You Need to Know

International bank transfer from india at attractive exchange rates.There are multiple reasons that people may choose to send money abroad from India. One of the main reasons to transfer money abroad is the payment of tuition fees and maintenance of the students studying abroad. The most popular countries for Indian students studying abroad are US, UK, Canada, Australia, and Europe.Other reasons for transferring money abroad is money sent to New Immigrants, Medical Expenses, Property Purchases, Foreign Investments.

#International Bank Transfer from India#india remit#remit money#Money Transfer Remit#How to Send Money from India to UAE#Transfer Money from India to UAE#Abroad Money Transfer#How to Pay Tuition Fees Abroad from India#International Money Transfer from India#International Money Transfer India#International Money Transfer Online#Money Transfer from India#Send Money Abroad#Send Money Abroad from India#Send Money from India#Send Money Overseas#Sending Money Abroad#Transfer Money Abroad#Transfer Money to Abroad

0 notes

Text

Send money to UAE has become an integral part of modern life.

Individuals and businesses must exchange currencies for various

reasons, such as paying for travel expenses, importing and exporting goods and services, and investing in foreign countries.Unimoni provides a fast, easy, and affordable way to transfer money from India to UAE.

0 notes

Text

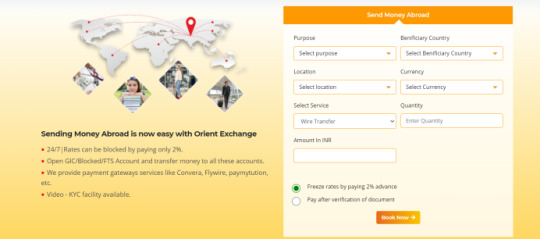

How Orient Exchange emerging as Student friendly Remittance agency

In recent years, Orient Exchange has emerged as a popular choice among students for remittance services. Indian based company has been making waves in the remittance industry for its low fees, attractive exchange rates, and user-friendly platform.

In this article, we will explore how Orient Exchange is emerging as a student-friendly remittance agency.

User-Friendly Platform

One of the key factors contributing to Orient Exchange's popularity among students is its user-friendly platform. The company offers a hassle free web portal that can be easily accessed and used to Send Money Abroad from India. The portal is easy to navigate, with clear instructions on how to initiate a transfer. Students can easily track their transfers and receive real-time updates on the status of their transactions. The portal also allows users to store their recipient's information for quick and easy future transactions.

Please refer the below image for Remittance Portal of Orient Exchange

Low Fees

Another reason why Orient Exchange is popular among students is its low fees. The company offers some of the lowest transfer fees in the market, making it an attractive option for students who are often on a tight budget. Students can save significant amounts of money by using Orient Exchange instead of traditional banks or other remittance agencies that charge higher fees. This allows them to have more funds available for their studies, travel, or other expenses.

Attractive Exchange Rates

In addition to low fees, Orient Exchange also offers attractive exchange rates, which is another reason why it is becoming a popular choice among students. The company's rates are competitive, and they are often better than what is offered by traditional banks. This means that students can get more value for their money when they transfer funds through Orient Exchange. This can make a significant difference, particularly for students who need to transfer large amounts of money.

Rate Blocking Facility:

Orient Exchange offers rate blocking facility I.e, Sender can block the exchange rate up-to 48 hours by paying 2% advance amount, which makes users to avoid to pay some extra money because of rate fluctuations.

Send Money to 100+ Countries:

Orient Exchange offers Students to send money to 100+ countries across the world, one can transfer money for various purposes mentioned in the portal.

Some of the below countries where students can transfer money through orient exchange are:

Transfer Money to USA

Transfer Money to Canada

Transfer Money to UK

Transfer Money to Europe

Transfer Money to Australia

Transfer Money to New Zealand

Transfer Money to UAE

Flexible Payment Options

Orient Exchange offers flexible payment options, which is another reason why it is becoming a popular choice among students. The company uses various payment such as Convera, paymytution, flywire, etc. . This makes it easy for students to transfer money regardless of their payment preferences. Additionally, the company allows for partial payments, which means that students can transfer smaller amounts of money over time, rather than having to transfer a lump sum at once.

24/7 Customer Support

Orient Exchange offers 24/7 customer support, which is a valuable feature for students who may need assistance outside of regular business hours. The company's support team is available around the clock to assist with any questions or concerns that students may have. This ensures that students can get help when they need it, rather than having to wait until regular business hours.

Tie ups with major banks

Inorder to help Indian students Orient Exchange has tied up with various foreign banks such as Bank of Montreal(BOM) and CIBC-Simplii in Canada, Fintiba and Expatrio in Germany and other major banks in New Zealand.

Orient Exchange helps students to open Account such as

GIC Account in Canada

Blocked Account in Germany

FTS Account in New Zealand

In conclusion, Orient Exchange is emerging as a popular choice among students for remittance services. The company's user-friendly platform, low fees, attractive exchange rates, flexible payment options, 24/7 customer support, and student-friendly policies make it an attractive option for students who need to transfer money overseas.

As more and more students choose Orient Exchange, it is likely that the company will continue to grow and expand its services to meet the needs of its customers.

#send money abroad#send money overseas#international money transfer#send money to canada from india#send money to abroad education#gic account#gic account opening#convera payment#money transfer from india to canada#transfer money from india to canada#send money internationally#money transfer

0 notes

Text

Buy IELTS,PTE,CELPIP Certificates Without Any Exams,Buy Passports,Licenses,ID cards,Erase Criminal Records,Buy Credit Card details and Credit Card Hack software.

We update and modify your poorly performed scores directly from the system-We control and change your scores from the system while you write the exam-We also provide leak questions and answers for upcoming exams-Provide certificates with online verification on the official website. We are an organization comprised of expert programmers and IT engineers, we give checked banks proclamation to our customers with online login subtleties and can be additionally confirmed through calls to any of these banks

Whatsapp: +1(707)701-3848

Wickr : powells1

Email: [email protected]

Website: https://globaldocz.com

Buy 100% Undetectable Bank Notes,Buy Counterfeit Bank Notes,Buy Money Online,Buy Fake Notes Online,Undetectable US Dollars For Sale,Euro Bank Notes For Sale,Dollars,Euros,Pounds Counterfeit Bank Notes For Sale,Available in Large Stock 99% Undetectable Euros/Dollars/Pounds Bank Notes For Sale.Counterfeit Bank Notes All Currency Available.Just place your order for other currencies,we have available in large stock euro,dollar and pound

Whatsapp: +1(707)701-3848

Wickr : powells1

Email: [email protected]

Website: https://globaldocz.com

Our services.

-Clear your criminal record from any Country database system

-Hack any phone from a distance without physical contact.

-Increase your credit score to your desired amount

-Buy fake drivers license, I’d, ssn, Passport

-Buy clone credit card ready to hit any atm machine, gift card amazon card, etc

-Hack any online banking account, PayPal account, bitcoin, flight tickets

-Buy any school certificate, diploma, degree all registered under the database system

-Fake bank account/verified bank account with login details for a loan

Contact us for more details:

Whatsapp: +1(707)701-3848

Wickr : powells1

Email: [email protected]

Website: https://globaldocz.com

— Our bank articulation is utilized to demonstrate your loan specialists or customers you possess the accurate offset on the announcement with a 6months exchange notable that can be checked through any strategy for their decision, yet you can't move or pull back any cash from this record, for more details click here

We provide Questions and answers for the upcoming exams Available Certification without exams Remote control assistance during your exams Upgrade your Previous scores

#IELTS Certification#PTE Certification#CELPIP Certification#TOEFL Certification#OET Certificate

All our services are verified for #Immigration, #Jobs and #Study abroad in Canada, Australia,USA,UK ETC 100% pass Guaranteed.#UKVI IELTS CERTIFICATE#UKVI IELTS CERTIFICATE,Obtain IELTS #Certificate in #oman#India, #UAE, #Qatar, ##saudiarabia#abudhabi#Riyadh ##amman#tehran#dohaqatar#lebanon#turkey.

* School Grade Changes hack

* Hack University grades and Transcripts

* University title hack

* Erase criminal records hack

* penetration of website and database

* Sales of Dumps cards of all kinds

* Individual computers hack

* Control devices remotely hack

* Burner Numbers hack

* Verified Paypal Accounts hack

* Any social media account hack

* Android & iPhone Hack

* increase your credit score

* Text message interception hack

* email interception hack

* unlocking of frozen crypto wallet

* Increase blog traffic

* Skype hack

* Bank accounts hack

* free loan

* email accounts hack

* Website crashed hack

* help Sign up for ILLUMINATI and get famous faster

* delete YouTube videos or increase views

* school transfer and certificate forgery

* server crashed hack

* Retrieval of lost file or documents

* Credit cards hacker

* loading of bitcoin.

Contact us for more details:

Whatsapp: +1(707)701-3848

Wickr : powells1

Email: [email protected]

Website: https://globaldocz.com

Erase Criminal Records

Buy Ielts Certificate Online

Buy CELPIP Certificate online

Buy PTE Certificate Online

Buy PMP Certificate online

Buy NCLEX Certificate online

Buy Euros Online

Buy Great Britain Pounds

Buy Canadian Dollars

Buy US Dollars

Buy Australian Dollars

Buy New Zealand Dollars

Buy Fake Passports Online

Buy Fake Drivers License Online

Credit Card Hack Software

Whatsapp at: +1(707)701-3848

Website: https://globaldocz.comOur services.

-Clear your criminal record from any Country database system

-Increase your credit score to your desired amount

-Buy fake drivers license, I’d, ssn, Passport

-Buy clone credit card ready to hit any atm machine, gift card amazon card, etc

-Hack any online banking account, PayPal account, bitcoin, flight tickets

-Buy any school certificate, diploma, degree all registered under the database system

Whatsapp: +1(707)701-3848

Website: https://globaldocz.com

0 notes

Text

NPCI to Permit NRIs with International Numbers from 10 Countries to Use UPI Payments

NPCI (National Payments Corporation of India) will allow Non-resident Indians (NRIs) from 10 countries to transfer funds easily through UPI (Unified Payments Interface) from an international mobile number. The countries that fall into consideration are the United Kingdom, United States, Australia, Canada, UAE, Singapore, Qatar, Hong Kong, Saudi Arabia, and Oman. But to use this facility, people have to use Non-Resident Ordinary (NRO) or Non-Resident (External) Rupee (NRE) account. However, without an Indian mobile number, they can enjoy making digital payments.

An NRO account allows NRIs to manage the earned income in India while an NRE account permits the NRIs to transfer to India their foreign earnings. The Payments Corporation has announced 30 April as the deadline for the partner banks to comply with the instructions. The UPI move will not just assist local businesses abroad, but even the family, individuals, and international students.

Earlier the NRIs were unable to operate the UPI network because the same is dependable on SIM. The feature was to date accessible to only Indian SIM card phones. However, non-resident Indians can now utilize international SIM linked to their NRO or NRE accounts and make transactions online from their mobile UPI interface. Also, no charges will apply for such transactions. In December 2022 alone, UPI transactions saw a record high of Rs. 12.82 lakh crore. With the current step, the transactional amount will soar higher.

So, the NPCI will enable UPI transactions from mobile numbers bearing the country codes of the mentioned 10 nations along with the existing domestic country code. In the future, the facility can extend to other countries as well. UPI helps to instantly transfer money through mobile phones in easy steps. The partner banks have to make sure that the NRE and NRO accounts comply with the guidelines of the RBI (Reserve Bank of India) and FEMA (Foreign Exchange Management Act).

The beneficiary and remitter banks will keep in check all the transactions to combat money laundering and any act of terrorism so that the UPI system remains transparent and risk-free. NPCI has been receiving several requests from NRIs and customers to include a facility for some time now, and finally, international numbers from the 10 countries will be able to benefit from the instant and seamless payment on UPI.

Visit: - https://www.jsbmarketresearch.com/news/news-npci-nri-upi-payment

Follow our social handles:-

Instagram: - https://www.instagram.com/p/CnT9GV1o6gV/

Twitter: - https://twitter.com/JSBMarket/status/1613485999639924736?s=20&t=dnIEdrzbB7aUrWnhNzbrgA

LinkedIn: - https://www.linkedin.com/posts/jsbmarketresearch_nrisupi-upipayments-upiinternational-activity-7019251859638923264-y0CX?utm_source=share&utm_medium=member_desktop

YouTube: - https://youtube.com/shorts/K9dyiSHxeLQ?feature=share

Pint: https://pin.it/6hZ60IY

#NRI UPI Payments#Banking#Transaction#Global 10 Countries#NRI#Non-resident Indian#International Transactions#10 Countries#Financial Inclusion#Digital Payments#Cross-border Payments#swotanalysis#jsbmarketresearch#marketresearchreports

0 notes