#MinistryofFinance

Explore tagged Tumblr posts

Text

Changes in Customs Act, 1962- Reshaping India's trade & compliance landscape

Changes in Customs Act, 1962- Reshaping India's trade & compliance landscape

“Indirect Tax I Indirect Tax Litigation I Customs & FTP I Central Licensing I Arbitration I Advisory” Dated: 04.02.2025 Changes in Customs Act, 1962- Reshaping India’s trade & compliance landscape The Finance Bill, 2025 introduces key amendments to the Customs Act, 1962, streamlining customs procedures, reducing assessment delays, and enhancing trade facilitation. Major changes include a time…

#BIS#BISAct#BISExempted#BISStandard#CBIC#Customs#CustomsAct#CustomsAct1962#DGFT#DPIIT#Exports#Facebook#GovtofIndia#ImportClearance#Importers#Imports#IndianCustoms#Instagram#Law#LawFirm#Lawyers#LegalAdvisory#LegalUpdates#LinkedIn#MinistryofFinance#SJEXIMServices#Telegram#TelegramChannel#Threads#Twitter

0 notes

Text

Government role in indian stock market?

The government plays a crucial role in monitoring the Indian stock market through various regulatory bodies, policies, and legislative frameworks. Here’s a detailed overview of how the government ensures the proper functioning and integrity of the stock market: Regulatory Bodies 1. Securities and Exchange Board of India (SEBI): Regulation and Supervision: SEBI is the primary regulator for the…

#ClearingAndSettlement#CorporateGovernance#FDIPolicies#FinancialStability#IndianStockMarket#InvestorProtection#MarketRegulation#MarketSurveillance#MinistryOfFinance#MonetaryPolicy#RBI#SEBI#StockExchanges#StockMarket#Taxation

0 notes

Text

The Ministry of Corporate Affairs has recently released an update that #ninenewforms (MSME, BEN-2, MGT-6, IEPF-1, IEPF-1A, IEPF-2, IEPF-4, IEPF-5, and IEPF-5 e-verification report) are shifting from V2 to V3 on July 15, 2024, at 12:00 a.m. Moreover, the company's e-fillings on the V2 portal will be disabled starting July 4, 2024. . Kindly note that the #V3portal is not available from July 13th, 2024 (12:00 a.m.) to July 14th, 2024 (11:59 p.m.). Excluding the above nine forms, the rest of the fillings can be done. . In case of any #legalguidance or clarification, feel free to contact us. #Globaljurix always ready to help you. . Contact us for More Details about MCA Update of the same. . 📩 [email protected] 📞+91-8800-100-284 🌏 www.globaljurix.com

0 notes

Link

The ongoing technological rivalry between the United States and China heats up as China establishes a third, and largest yet, state-backed investment fund dedicated to bolstering its domestic chip industry. This strategic move signifies China's unwavering commitment to achieving self-sufficiency in chip technology, a critical component in modern electronics and a point of contention with the US. China Steps Up Chip Game The Big Fund Gets Bigger: Unveiling the Third Phase China's newly launched fund, officially known as the third phase of the China Integrated Circuit Industry Investment Fund (IC Industry Investment Fund), carries the unofficial moniker "Big Fund." This latest iteration boasts a staggering war chest of 344 billion yuan (approximately $47.5 billion). Registered in Beijing, this phase dwarfs the previous two installments, solidifying the government's commitment to propelling China's chip industry forward. A Closer Look at the Big Fund's Investors The Big Fund isn't a solitary endeavor; it represents a collaborative effort by prominent Chinese entities. Here's a breakdown of the key players: Ministry of Finance: Leading the charge is China's Ministry of Finance, contributing a significant 17% stake (around 60 billion yuan) to the fund. China Development Bank Capital: Following closely behind is China Development Bank Capital, a subsidiary of the country's development bank, with a 10.5% stake. Major Chinese Banks: Demonstrating broad domestic support for the initiative, five major Chinese banks each contribute roughly 6% of the total capital. This collective effort highlights the national importance China assigns to achieving chip independence. Market Cheers the Big Fund Announcement The Chinese stock market reacted positively to the news of the Big Fund's expansion. The CES CN Semiconductor Index, a key indicator of China's chip sector performance, surged by over 3%. This surge marks the strongest single-day performance for the index in over a month, reflecting investor confidence in the Big Fund's ability to propel the domestic chip industry. It's worth noting that similar positive market reactions followed the launch of the Big Fund's first two phases in 2014 and 2019, respectively. A Track Record of Success and Future Focus The Big Fund isn't a novel venture. Its previous phases have demonstrably supported critical players within China's chip ecosystem. Some notable beneficiaries include: Semiconductor Manufacturing International Corporation (SMIC): China's leading chip foundry has received backing from the Big Fund. Hua Hong Semiconductor: Another major Chinese chip foundry has benefited from the fund's investments. Yangtze Memory Technologies: This prominent flash memory maker has also seen support from the Big Fund. Beyond these industry giants, numerous smaller chip-related companies and investment funds have received crucial funding through the Big Fund's initiatives. Looking towards the future, reports from Reuters suggest the third phase will prioritize investments in equipment specifically designed for chip manufacturing. Additionally, the Big Fund is exploring partnerships with various institutions to effectively manage the substantial capital injection. This collaborative approach could ensure the efficient allocation of resources and the successful execution of China's chip self-sufficiency goals. The US-China Tech Rivalry: A Complex Landscape The Big Fund's establishment can't be viewed in isolation. It's intricately linked to the ongoing US-China tech rivalry. The US has imposed export controls on certain chip-making technologies, a move viewed by China as an attempt to stifle its technological advancements. By establishing the Big Fund, China aims to lessen its dependence on US technology and foster domestic innovation in the chip sector. This strategic move seeks to position China as a self-sufficient leader in chip development and production. FAQs: Q: Why is China so focused on achieving chip self-sufficiency? A: Chip technology plays a critical role in modern electronics, from smartphones and computers to advanced weaponry. By achieving self-sufficiency, China aims to reduce its reliance on foreign technology and potentially gain a competitive edge in various sectors. Q: How has the US responded to the Big Fund's launch? A: The US government has yet to issue an official statement regarding the Big Fund's launch. However, the ongoing tensions surrounding technology transfer between the two countries suggest the US might view this move with concern.

#BigFund#CESCNSemiconductorIndex#ChinaChipIndustry#ChinaDevelopmentBankCapital#ChinaStepsUpChipGame#ChipInvestment#ChipSelfSufficiency#HuaHongSemiconductor#MinistryofFinance#SemiconductorManufacturing#SMIC#USChinaTechRivalry#YangtzeMemoryTechnologies

0 notes

Link

#budgettarget#CPSE#disinvestment#equityshare#exchequer#fiscal#floorprice#greenshoeoption#HAL#MinistryofFinance#non-retailportion#NSEwebsite#offerforsale#retailinvestors#revenueestimates#shares#subscribed

0 notes

Text

💸 India vs. the World: 2024 Medical Cost Comparison 🌍

Compared to developed countries like the United States, medical procedures in India are substantially more affordable, often priced 50-75% lower. This makes India a highly sought-after destination for medical tourism, with treatments such as orthopedic, cardiac, and cosmetic surgeries available at a fraction of the cost—sometimes as low as 25% of what they would cost in the US.

Looking for affordable, high-quality healthcare? India continues to lead the way in providing top-notch medical care at a fraction of the cost compared to the USA, UK, and other countries! From heart bypass surgeries to IVF treatments, India offers world-class services that cater to international patients' needs while saving you up to 80% of treatment costs.

👨⚕️ Whether it’s a knee replacement or a liver transplant, our team at Tour2Wellness connects you with the best hospitals and specialists, ensuring a seamless and comfortable journey.

✈️ Ready to explore affordable treatment options? Let’s talk today!

👉Book an appointment now and let us guide you towards a brighter, healthier tomorrow. 📞+91 7303561607 🌐 https://www.tour2wellness.com 📧 [email protected]

#medicaltourism#visafree#ministryoffinance#healthcareindia#tour2wellness#financeminister#patients#india#indiabudget2024#singapore#medicaltravel#2024#indiabudget#costcomparison#cost#budget#healthministry#usa#uk#hospitality#govermentofindia#surgeries#transplants#procedures#healthyhairjourney#booking#indiatravel#banglore#wellnessjourney

1 note

·

View note

Text

The Public Debt Management Office (PDMO)... #Applicationprocess #bond #Bonddenominations #Bondinvestment #Bondinvestmentoptions #Bondissuance #BondmarketNepal #Budgetdeficit #Budgetdeficitmanagement #Collateralbonds #Domesticdebt #Economicdevelopment #Economicdevelopmentinitiatives #EconomicDevelopmentStrategies #Economicgrowthinitiatives #EconomicGrowthNepal #Economicgrowthprospects #FinancialinclusionNepal #Financialinstitutions #Financialleverage #Financialliquidity #FinancialmarketNepal #Financialobligations #Financialplanning #FinancialplanningNepal #financialsecurity #FinancialsecurityNepal #FinancialstabilityNepal #ForeignEmploymentSavingBond #GovernmentbondsNepal #interest #Interestpayments #Investmentflexibility #InvestmentflexibilityNepal #Investmentopportunity #issue #Loancollateral #Migrant #MinistryofFinance #NepalRastraBank #Nepalieconomicpolicies #Nepalieconomy #nepalifinancenews #Nepalifinanceupdates #Nepaliinvestmentopportunities #Nepaliinvestmentoptions #Nepaliinvestmentstrategies #Nepalimigrantworkerbonds #Nepalimigrantworkers #NonResidentNepalis #offering #Onlineplatform #PDMO #PDMONepal #Secondarymarket #Taxregulations #workers

0 notes

Photo

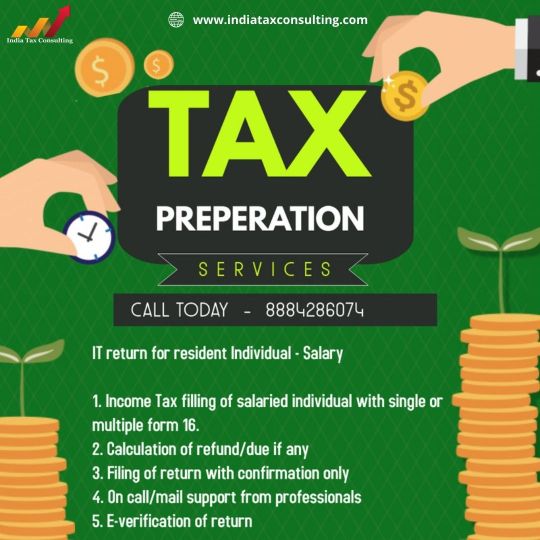

Want to plan and save taxes !! No need to read so many articles on google !! reach out to an expert !!

Feel free to Call us @ +91 88842 86074 or write to us - [email protected]

Visit our website : https://www.indiataxconsulting.com

#taxconsultant#taxconsulting#taxconsultants#taxation#tax#incometax#gst#gstindia#mca#ministryoffinance#india#taxconsultingfirm#service#consulting#taxiservice#TDS#TDSreturn#corporate#compliances#compnayregistrationservices#incometaxe#incometaxreturn#taxes#indiatax

1 note

·

View note

Photo

📸🇨🇦🇲🇶 . . The view from #fairmontchateaufrontenac #ministryoffinance #ministeredesfinances #architecture #architecturelovers #architecturephotography #travel #travelblogger #travelphotography #travellovers #holiday #quebec #canada #quebeccity #villedequebec #canadianblogger #summer #july #familytime #narcityquebec #vieuxquebec (at Quebec Vieux-Quebec) https://www.instagram.com/p/BzwxRY_Fov3/?igshid=m7krfs0py8tt

#fairmontchateaufrontenac#ministryoffinance#ministeredesfinances#architecture#architecturelovers#architecturephotography#travel#travelblogger#travelphotography#travellovers#holiday#quebec#canada#quebeccity#villedequebec#canadianblogger#summer#july#familytime#narcityquebec#vieuxquebec

1 note

·

View note

Text

India's Union Budget Highlights 2023, Change in New Tax Rates, Green Energy Boost, and More

Finance Minister Nirmala Sitharaman presented the Union Budget 2023 following the notion of Amrit Kaal, saying that the economic growth for the current year is estimated at 7%. For FY2024, the fiscal deficit will be at 5.9% from 6.4% in FY2023. The same may come down to 4.5% in 2025-26. New tax regime to become the default tax regime. It entails lower tax rates for Hindu Undivided Families and individuals if they do not avail of the specified deductions and exemptions such as interest on a home loan, house rent allowance, and investments as per Section 80C.

The new tax regime rates are nil for income up to Rs. 3 lakhs. 5%, 10%, 15%, 20%, and 30% is applicable for income bracket for Rs. 3 lakhs to Rs. 6 lakhs, Rs. 6 lakhs to Rs. 9 lakhs, Rs. 9 lakhs to Rs. 12 lakhs, Rs. 12 lakhs to Rs. 15 lakhs, and over Rs. 15 lakhs, respectively.

Individuals with income of Rs 15.5 lakh and beyond can benefit from a standard deduction of Rs 52,500 in the new tax regime.

But you can still choose to be under the old tax regime. The old tax regime will not apply taxes on income up to Rs. 2.5 lakhs. 5%, 15%, 20%, and 30% tax are applicable on the income bracket of Rs. 2.5 to Rs. 5 lakhs, Rs. 5 to Rs. 7.5 lakhs, and over Rs. 10 lakhs, respectively.

Visit: - https://www.jsbmarketresearch.com/news/news-union-budget-2023-announced-by-nirmala-sitharaman

Here are further updates announced in the Union Budget this year:

Relief for MSMEs by investing in green energy. An outlay of Rs. 35,000 crores for investment into energy transition.

A new scheme to supply food grains was implemented from 1 January 2023 to priority households and all Antaodaya for the next year. An agricultural accelerator fund for entrepreneurs in rural areas launching start-ups to develop innovative and affordable solutions for farmers.

16% hike in customs duty for cigarettes. Plan of 100 labs for 5G solutions for engineering colleges. Data embassies are to be set up in IFSC Gift City for digital continuity solutions. Government to set up a National Financial information repository.

Emergency Credit Line Guarantee Scheme (ECLGS) extended up to March 2023. Expansion in guarantee cover by Rs. 50,000 crores with a total of Rs. 5 lakh crores as cover. This added amount will be exclusively utilized for hospitality and related companies.

50 additional water aerodromes, airports, and landing grounds for regional air connectivity intended to push up the existing UDAAN scheme.

From April 2023, Rs. 9,000 crore corpus for Credit Guarantee for MSME.

Phase 3 of eCourts with an outlay of Rs. 7,000 crores, which will replicate the offline processes but on a digital platform.

To boost the tourism sector, 50 destinations are selected via challenge mode – virtual and physical connectivity, tourism guides, and security available on an application to improve the tourist experience.

Green credit program under the Environment Protection act. Green hydrogen production by 2030 to reach 5 million tonnes. The government will set up a battery storage capacity of 4,000 MWH.

5% compressed biogas mandate to every entity that markets natural gas in the country. It will facilitate the transportation segment with an increase in CBG production.

To access anonymized data, the government will build a national data governance framework.

Rs. 2.40 lakh crore for Indian Railways, a 9 times hike from the outlay stated in 2013-14.

Mission to eradicate sickle cell anemia by the year 2047. It will consist of universal screening of 7 crore people in the age group of 0 to 40 years in tribal areas.

Set up of Urban Infrastructure Development Fund to meet the shortfall in priority sector lending. Rs. 1000 crores annually allocated. National Housing Bank to manage this fund.

Replacement of vehicles by the central government in order to upscale sales of automobiles and electric vehicles.

PAN or Permanent Account Number will be a single business identifier across digital systems on an integrated system for state and central-level departments.

Preparation of a National Cooperative database for de-centralized storage capacity to facilitate the setting up of dairy cooperative societies, farms, and fisheries for the next 5 years in uncovered villages in order to promote allied agricultural activities.

National mission with Rs. 15,000 crore proposal for vulnerable tribes to help with clean water, health, basic infrastructure, sanitation, and sustainable livelihood opportunities.

National digital library to provide quality books to adolescents and children across the nation to make up for the losses in education because of the pandemic.

Compared to capital expenditure allocation in 2022-23 of Rs. 7.5 lakh crore, for 2023-24, the amount has been increased to Rs. 10 lakh crores to encourage investment activity. Outlay of Rs. 1.3 lakh crore for infrastructure investment by government and continuation of interest-free loans for 50 years to state governments in this respect.

Stay updated what’s happening in the world by visiting here: - https://www.jsbmarketresearch.com/news

Follow our social handles: -

Instagram: - https://www.instagram.com/p/CoHfSJmossK/?utm_source=ig_web_copy_link

YouTube: - https://youtube.com/shorts/rKO-Jm1PskA?feature=share

Pinterest: - https://pin.it/5RDVfbO

Twitter: - https://twitter.com/JSBMarket/status/1620736495274573824?s=20&t=Lja0sZWa_q0laUrKg5TxWg

#Unionbudget2023#Nirmalasitharaman#Incometaxproposals#Newincometaxslabs#Dailynews#Sitharamaneconomicreport#Governmentofindia#Economicaffairs#Ministryoffinance#Budgetforall#Sitharamanbudgetincometax#Indiaunionbudget2023#Budget

0 notes

Text

केेंद्रीय वित्तमंत्री निर्मला सीतारमण 8 जनवरी को कोटा आयेंगी

लोकसभा अध्यक्ष ओम बिरला की पहल पर कोटा में क्रेडिट आउटरीच प्रोग्राम में 1407 करोड के लोन वितरित करेंगी न्यूजवेव @कोटा केंद्रीय वित्तमंत्री निर्मला सीतारमण रविवार 8 जनवरी को कोटा आ रही हैं। वे लोकसभा अध्यक्ष एवं कोटा-बूंदी सांसद ओम बिरला के प्रयासों से कोटा में आयोजित क्रेडिट आउटरीच प्रोग्राम के तहत ऋण बांटने की शुरूआत करेंगी। याद दिला दें कि केंद्रीय वित्त मंत्रालय देशभर में क्रेडिट आउटरीच प्रोग्राम आयोजित करता है। राजस्थान में यह कार्यक्रम पहली बार हो रहा है, जिसमें सरकारी अधिकारी एवं राजस्थान से भाजपा नेता भी मौजूद रहेंगे। इस कार्यक्रम के लिये लोकसभा अध्यक्ष ओम बिरला ने तीन दिन कोटा में भ्रमण कर जिन्हें लोन देना है, उस वर्ग की स्थिति का जायजा लिया। छोटे व्यापारियों को विस्तार देने की कोशिश यह कार्यक्रम लघु उद्यमियों को सीधे तौर पर लाभ देने वाला है। इसमें राजस्थान के स्ट्रीट वेंडर्स, लघु उद्यमी, पशुपालक आदि को लोन दिये जाएंगे। इसके लिए पीएम स्वनिधि यो��ना और मुद्रा योजना के तहत सरकार बैंकों के माध्यम से लोगों को सस्ती ब्याज दरों पर लोन उपलब्ध करवाएंगे। इस कार्यक्रम के दौरान सभी बैंक कोटा के दशहरा मैदान में अपनी स्टॉल लगाएंगे। 1,407 करोड़ रू के ऋण दिए जाए��गे राज्यस्तरीय बैंकर्स समिति राजस्थान के संयोजक और बैंक ऑफ बड़ौदा राजस्थान के जीएम कमलेश कुमार चौधरी ने बताया कि 8 जनवरी को क्रेडिट आउटरीच के इस प्रोग्राम में 31,000 से ज्यादा लाभार्थियों को 1407 करोड़ से ज्यादा के लोन दिए जाएंगे। इसमें प्रधानमंत्री मुद्रा योजना, स्वयं सहायता समूह क्रेडिट लिंकेज, किसान क्रेडिट कार्ड, स्टेंडअप इंडिया योजना, प्रधानमंत्री रोजगार सृजन कार्यक्रम जैसी सरकारी योजनाओं के तहत लोन दिए जाएंगे। इस प्रोग्राम से लोन का फ्लो बढ़ेगा। Read the full article

#GoI#Loksabha-Speaker-Om-Birla#Creditoutreachprogramme#KotaRajasthan#MinistryofFinance#SmtNirmlaSitaRaman

0 notes

Text

CESTAT Hyderabad set aside the reclassification insisted by Revenue due to lack of evidence and assessment not challenged at the time of import

CESTAT Hyderabad set aside the reclassification insisted by Revenue due to lack of evidence and assessment not challenged at the time of import

“Indirect Tax I Indirect Tax Litigation I Customs & FTP I Central Licensing I Arbitration I Advisory” Dated: 03.02.2025 CESTAT Hyderabad set aside the reclassification insisted by Revenue due to lack of evidence and assessment not challenged at the time of import CESTAT Hyderabad, ruled in favor of Vijay Nirman Company Pvt Ltd in a customs classification dispute. The case involved the…

#BIS#BISAct#BISRegistration#BISStandard#CBIC#CESTAT#CESTATHyderabad#CESTATOrders#Classification#Customs#CustomsAct#CustomsAct1962#Exports#Facebook#GovtofIndia#Imports#IndianChamberofCommerce#IndianCustoms#IndirectTax#IndirectTaxIndia#IndirectTaxLitigations#Instagram#Law#LawFirm#Lawyers#Legal#LegalAdvisory#LegalUpdates#LinkedIn#MinistryofFinance

0 notes

Text

ADB disseminates $350 million loan for infra development in Maharashtra

The Asian Development Bank (ADB) has signed an agreement with the Government of India to disseminate $350 million loan to Maharashtra Government for the improvement of the connectivity of the key economic areas in the state. The agreement was signed between Rajat Kumar Mishra, Additional Secretary, Department of Economic Affairs in the Ministry of Finance and Hoe Yun Jeong, Officer-in-Charge of ADB’s India Resident Mission. Mishra said the project will improve connectivity and facilitate access to services and accelerate the inclusive economic growth of the districts lagging in the state. According to Jeong, the project will further support to the onging endeavour to upgrade major district roads and the highways in the state. Under this project, over 319 km of the highways and 149 km of district roads in the state will be upgraded across the 10 districts Hingoli, Ahmednagar, Jalna, Nagur, Kohalpur, Nashik, Nanded, Sangli, Satara and Pune. The project will help in connecting underdeveloped rural communities with markets and improve access to the healthcare and social services. It will also improve agricultural value chains. Read the full article

#ADB#ADBIndiaResidentMission.#AdditionalSecretary#AsianDevelopmentBank#DepartmentofEconomicAffairs#HoeYunJeong#MaharashtraGovernment#MinistryofFinance#RajatKumarMishra#RoadInfrastructure

0 notes

Link

If you’re currently in a financial pinch or want to know as much as possible about the EPF or Employees Provident Fund program, one thought that’s likely to have crossed your mind is finding out how the EPF withdrawal system works. Here, we’ll be breaking down all you need to know about the EPF, how it works, and everything involved in getting your money out of the program.

What Is EPF?

EPF is short for Employees Provident Fund and refers to a government program run by the Ministry of Finance. The primary goal is to ensure that employees have something saved for when they’re at a certain age or unable to work again for whatever reason.

How Does Yhe EPF Work?

This retirement savings scheme works differently, depending on the individuals involved. For example, in all cases, EPF automatically deducts 11% of your monthly salary at the end of each moment. However, if you earn less than RM 5 000, your employer should contribute 13% of your salary to this program. But, in cases where you make above the RM 5 000 benchmarks, your employer is required to contribute only 12% instead. Recently, EPF has worked for people in the gig economy and even stay-at-home moms!

Withdrawing From Your EPF

Under ideal circumstances, this retirement savings scheme allows withdrawals only when an individual is 55. The primary reason is that you should take the proceeds from this account and use them to support yourself in your golden years. There are a few instances where you’re legally allowed to tap into this account at an earlier age, as long as you meet specific requirements.

Requirements For Withdrawing From Your EPF Prematurely

Some provisions allow you to take out some or all of your savings before age 55 under certain circumstances. Before delving into these circumstances, it’s vital to mention that your EPF is into two different accounts. You can’t withdraw from either of these accounts unless;

You’ve saved above the required sum for your age and want to transfer the excess to a fund manager for further investment.

You’re a civil servant who started the EPF program before putting you on the government’s pension plan.

For any reason, you become mentally or physically disabled and cannot work anymore.

You intend to relocate from Malaysia finally.

You become deceased, and your beneficiary gets your savings.

You must cover housing loans, Hajj expenses, or medical bills.

What To Remember

No matter the reason, make sure you think long and hard before dipping into your Employees Provident Fund, as this can have far-reaching effects!

0 notes

Photo

A great honor to meet the Hon’ble Finance Minister Nirmala Sitharaman Ji and request and represent the collective voice of solar module manufacturers with regards to the implementation of Basic Custom Duty (BCD) on Solar Modules & Cells w.e.f. April 1, 2022 under the leadership of Sh. Ram Charan Bohra Ji, MP - Jaipur City. To read the entire story click on either of the below links https://www.energetica-india.net/news/finance-minister-sitharaman-assures-solar-industry-stakeholders-for-bcd-implementation-on-pv-modules-from-april-2022 https://www.saurenergy.com/solar-energy-news/fm-assures-manufacturer-associations-of-bcd-as-promised-from-april-1-2022 https://www.eqmagpro.com/finance-minister-sitharaman-promises-implementation-of-bcd-on-solar-modules-from-april-2022-during-a-meeting-with-solar-industry-associations-eq-mag-pro/ #INA #InsolationEnergy #NIMMA #ISMA #AISIA #BCD #BasicCustomDuty #SolarModules #Notification #Delegation #Meeting #MinistryOfFinance #GOI https://www.instagram.com/p/CYn9m6rPxNC/?utm_medium=tumblr

#ina#insolationenergy#nimma#isma#aisia#bcd#basiccustomduty#solarmodules#notification#delegation#meeting#ministryoffinance#goi

0 notes

Photo

Want to plan and save taxes !! No need to read so many articles on google !! reach out to an expert !! Feel free to Call us @ +91 88842 86074 or write to us - [email protected] Visit our website : https://www.indiataxconsulting.com

#taxconsultant#taxconsulting#taxconsultants#taxation#tax#incometax#gst#gstindia#mca#ministryoffinance#india#taxconsultingfirm#service#consulting#taxiservice#taxservice#TDS#TDSreturn#corporate#compliances#compnayregistrationservices#incometaxe#incometaxreturn#taxes#indiatax

0 notes