#Mega Millions results for November 29

Explore tagged Tumblr posts

Text

Mega Millions Jackpot Soars to $541 Million After Another Draw Without a Winner

The Mega Millions jackpot has surged to an astonishing $541 million after no player matched all six numbers in the latest drawing. With the next drawing scheduled for December 1, 2024, excitement is building nationwide as lottery enthusiasts dream of claiming this life-changing prize. The cash option for the jackpot is estimated at $241 million, making it one of the most significant jackpots of the year. Despite the long odds of 1 in 302.6 million, millions of players are hoping to beat the odds and make history as the next big winner.

Read more about this topic in Google trend topic 1

Read more about this topic in Google trend topic 2

Read more about this topic in Google trend topic 3

#Mega Millions#Mega Millions jackpot#Mega Millions lottery#Lottery grand prize#Mega Millions 2024#When is the next Mega Millions drawing?#How to win the Mega Millions lottery#Today's Mega Millions jackpot value#Mega Millions results for November 29#2024#Chances of winning the Mega Millions jackpot#U.S. lottery#$541 million grand prize#Odds of winning Mega Millions#Latest Mega Millions drawing numbers#Friday lottery drawing

0 notes

Photo

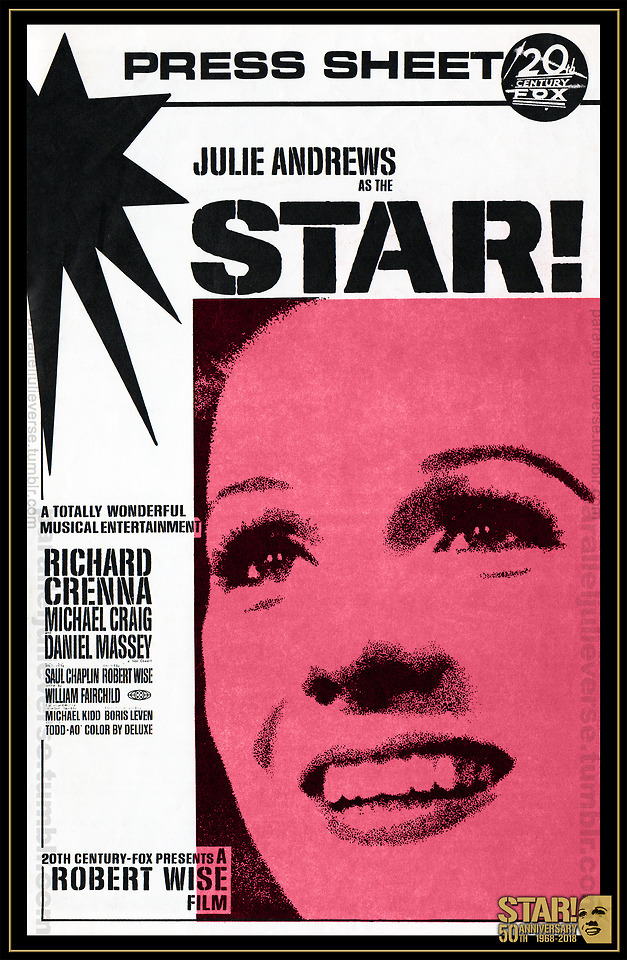

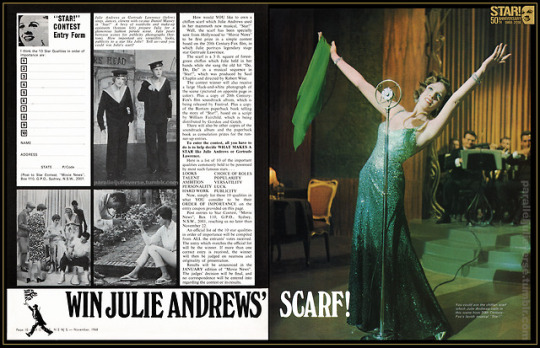

G’day Gertie: Star! debuts Down Under

After its global premiere in London and subsequent release to select international markets such as Japan, the Julie Andrews mega-musical Star! made its way to Australia in early-October 1968, fifty years ago this week. Release patterns for films in this era could be a little idiosyncratic, and the Australian release of Star! was no exception. The film was treated to two lavish “preview” premieres in Sydney and Melbourne on October 4 and 8, respectively, but didn’t open to the general public till October 24 with a premiere roadshow engagement at Melbourne’s Paris Theatre. Even more strangely, Melbourne was the only Australian city to screen Star! for the first six months. The film didn’t open in Sydney till 23 May 1969 with other Australian cities to follow.*

The three previous Julie Andrews film musicals –– Mary Poppins, The Sound of Music, and Thoroughly Modern Millie –– had all been major hits in Australia with Millie and Music still in theatrical release when Star! opened in late-1968. In point of fact, The Sound of Music enjoyed longer roadshow runs in Australia than anywhere else in the world: 181 weeks in Sydney (140 at the Mayfair before transferring to the Paris for a further 41 weeks), and 178 weeks in Melbourne (140 at the Paris, then transferring to the Esquire for a final 38 week run). By 1968, it was estimated that just under half the national population had seen The Sound of Music with more to come as the film entered suburban and regional release (Dale: 15; Keavney: 4-5).

As a result, Twentieth Century-Fox had high hopes Star! would do well in Australia and sent director Robert Wise on a special PR trip to the country to help launch the film. Accompanied by his wife, Patricia, Wise touched down in Sydney on 31 September 1968 where he was treated to a round of civic and industry receptions before officiating at a special gala invitation-only premiere of Star! on October 4 at Sydney’s Mayfair Theatre, home to The Sound of Music for so many years (“New Boom”: 18). The following week, Wise flew on to Melbourne for the second Australian premiere at the Paris Theatre, another Sound of Music alma mater, on October 8. While in Melbourne, Wise gave a host of press interviews and even helped the Lord Mayor lay a plaque for a new $4-million cinema complex in the city (Messer: 8; see also, Bennett: 14; Musgrove: 2; Veitch: 18).

As with the UK response, Australian critical reception of Star! was generally very positive. In Melbourne, Howard Palmer of The Sun wrote:

“Star! the Julie Andrews epic is indeed one of those films that a critic sees with relief, because he can let his his hair down and quite safely say it is wonderful in every way...Wise has put theatre on the screen better than anyone else before him...Julie Andrews gives the drama of the Lawrence love affairs so well...Add to this the many comic scenes of her early career....and you have a complete actress...It’s a wonderful film not to be missed” (27).

Alec Martin of the Melbourne Truth was equally enthusiastic:

“[I]f Gertrude Lawrence was alive today she would be the first to whistle and stamp her feet at...Miss Andrews’ brilliant performance in Star!...Miss Andrews sheds her wholesome Mary Poppins and Sound of Music image to play the glamorous, temperamental Gertrude Lawrence with perfection....Star! will be a box-office success, that’s for sure” (39).

Ronald Conway of Melbourne’s The Advocate declared Star! “[a]n agreeable, civilised musical...Julie Andrews sings and acts splendidly and it is a relief to see her in something other than Sound of Music which lasted at the Paris for ever so long...A handsome production to be enjoyed by patrons of all ages” (20). While Kay Mealun of The Australian Women’s Weekly gushed, “I found it rich and big and happy–– could have sat it through, three hours and all, all over again right away” (56).

Not all Australian reviews of Star! were as unreservedly laudatory, though even naysayers conceded the film had charm. Colin Bennett of The Age wrote that Star! “is well set in theatreland and reproduces...a series of splendid old favourites performed to perfection by Julie Andrews who looks fabulous and sings beautifully...But [she] lacks the bite of a Gertrude Lawrence. She is too fundamentally ‘nice’ and tasteful and efficient to be really insolent or bitchy” (6).

In a similar vein, Valda Marshall of The Sun Herald wrote:

“Star! is like an unrealised and long-forgotten musical script of the 30s...a conglomeration of vaudeville numbers, revue material and musical acts...It lacks a central sustaining interest [and] the star herself is without a unified character...Julie Andrews is...in top form. Her voice is as sure and strong as ever. Her acting still has the same unabashed directness and warmth. But the spark of mischievousness and spontaneity are missing” (87).

Charles Higham of the Sydney Morning Herald –– who summarily titled his mixed review, “Julie glitters but she isn’t Gertie Lawrence” –– declared Star! “a carefully made picture...with fine dramatic moments [but] there is something tame and bloodless about it...Julie Andrews in the title role...brings a brittle professionalism and impeccable coldness to a part that demanded vulnerability, anguish, a maddening neurotic edge. Impossible to imagine this athlete of the musical screen missing an appointment or failing to pay a bill, falling hopelessly and foolishly in love or singing out of tune” (6). Still, Higham mused in another column, “[o]ne hopes Sydney audiences will respond warmly to this very well-made film” (Higham: 19).

And, for the most part, Australian audiences did respond with comparative warmth to Star!. While the film didn’t score anywhere near the record-breaking success of The Sound of Music, it enjoyed respectable theatrical runs, playing in roadshow release in Melbourne for just under six months (23 weeks from 24 October 1968-26 March 1969) and in Sydney for five months (20 weeks from 23 May 1969-9 October 1969), two of the longest roadshow runs of Star! anywhere outside London (Davies: 198. 206; Louden: 6).

Star! also went on to a fairly solid theatrical after-life in Australia. The film avoided the debacle of post-release editing that occurred in North America and the full roadshow print screened in residual first release in suburban and regional Australian markets well into the early-70s. Star! even ran as a 70mm double-feature with Hello Dolly at Sydney’s Village Cinema City in late-1974. The film continued to pop up intermittently in subsequent years in repertory screenings. It played several times throughout the 1970s and 80s at Sydney’s Ritz and Mandarin cinemas. The National Library in Canberra hosted a special archival screening of Star! in March 1980, and the film was given a lavish one-week showcase season at Melbourne’s Astor Theatre in November 1998 to celebrate its 30th anniversary.

Star! was also a frequent feature on Australian TV screens. It made its national small screen debut as the Sunday Night Movie of the Week in October 1973 and was rebroadcast every few years thereafter: 1975, 1979, 1980, 1981, 1986 and 1989. As far as can be ascertained, the first two broadcasts were edited for running time, but most later broadcasts appear to have been the 176 min. roadshow release.

Notes:

* In a sign of the times, the delay of the Sydney release of Star! was due to the unexpected success of The Graduate which had been booked in to the Mayfair, Sydney’s “home” of Todd-AO roadshows. The theatre’s previous roadshow offering, Doctor Dolittle, closed earlier than anticipated and The Graduate was scheduled as a “filler” –– it ended up running at the Mayfair for 11 months (Louden, 6).

Sources:

Bennett, Colin. “Box Office Wisdom.” The Age Saturday Magazine. 5 October 1968: 14.

________. “New Films: Star.” The Age. 28 October 1968: 6.

Bishop, Barbara. “Julie Misses the Point.” The Sun. 25 October 1968: 14.

Conway, Ronald. “Star.” The Advocate. 31 October 1968: 20.

Dale, David. “The Tribal Mind: What Australians Love the Most.” The Sydney Morning Herald. 12 February 1999: 15.

Davies, Keith. 50 Years of Cinema and Movie’s in Melbourne’s CBD (1940 – 1989). Melbourne: (n.p.), 2016.

“Films on TV.” The Age Green Guide. 21 December 1978: 8.

Higham, Charles. “Star-Maker.” The Sydney Morning Herald. 5 October 1968: 18.

________. “Turmoil in Film City.” The Sydney Morning Herald. 24 May 1969: 19.

________. “Julie Glitters but she is not Gertrude Lawrence.” The Sydney Morning Herald. 26 May 1969: 6.

________. “Films like Mother Used to Cry Over.” The Sydney Morning Herald. 21 June 1969: 17.

Keavney, Kay. “‘The Sound of Music’ Greatest Film Bonanza.” The Australian Women’s Weekly. 36: 1, 5 June 1968: 4-5.

Louden, Doug. Sydney in 70mm. Sydney: (n.p.), 2016.

MacDonald, Dougal. “Julie Never Stops Being Julie.” The Canberra Times. 28 September 1969: 30.

Marshall, Valda. “It’s a Happening World: Star!” The Sun-Herald. 25 May 1969: 87.

Martin, Alec. “She is the True Star.” The Melbourne Truth. 2 November 1968: 39.

Melaun, Kay. “Julie as Gertrude.” The Australian Women’s Weekly. 36: 20, 4 December 1968: 56.

Messer, John. “From Horror to the Sound of Music––That’s Wise.” The Age. 8 October 1968: 8.

“Movies on TV.” The Sydney Morning Herald: TV Guide. 12 May 1975: 1.

“Movies on TV.” The Sydney Morning Herald: Monday Guide. 27 March 1978: 3.

“Movies on TV.” The Sydney Morning Herald: 7-Day Guide. 29 January 1979: 3.

“Movies on TV.” The Sun-Herald. 15 April 1984: 84.

Musgrove, Nan. “Two Women on His Mind.” The Australian Women’s Weekly. 36: 20, 16 October 1968: 2.

“New Boom for Star Musicals.” The Sydney Morning Herald. 1 October 1968: 18.

Palmer, Howard. “Julie Proves It.” The Sun Weekend Magazine. 26 October 1968: 27.

“Sunday TV.” The Age TV-Radio Guide. 30 March 1975: 8.

“Television.” The Age. 3 April 1980: 2.

“Television.” The Age. 28 August 1981: 2.

“Television.” The Age. 21 January 1989: 18.

“Today’s TV.” The Sun-Herald. 21 October 1973: 71.

Veitch, Jack. “Why Robert Wise Doesn’t Need to Work Again.” The Sun- Herald. 6 October 1968: 18.

“What Was the Name of that Film?” The Age. 8 October 1968: 16.

Copyright © Brett Farmer 2018

#julie andrews#Star!#star!50#gertrude lawrence#Robert Wise#Twentieth Century Fox#musical#old hollywood#fiftieth anniversary#classic film#australia#film poster#film advertising#hoyts

28 notes

·

View notes

Text

Mega Millions Winner:Win Friday’s $284 Million Jackpot?

The $284 million Mega Millions jackpot will continue to grow because no one correctly picked all six numbers in the drawing on Friday night, November 26, resulting in a rollover on Tuesday, November 29.. Read More

0 notes

Link

Bruno Mars comes home this week, but the pop music megastar’s welcome came five months ago, when his first two announced shows each sold out in a couple of hours. A third was added and sold out just as quickly, and now the moment his fans waited months for is finally here.

For the fourth time, the Roosevelt grad born here as Peter Hernandez is back, bringing his mega-successful 24K Magic World Tour to Honolulu for a little homestand.

This visit is his biggest yet, befitting of his ever-growing profile, as he revives Aloha Stadium as a viable concert facility with a venue-record three sold-out shows, capping a 213-concert tour that spanned six continents, 38 countries and nearly two years.

About 110,000 fans will attend the three shows, reinforcing the pop-music superstar’s description of his home state in a 2011 web documentary.

“They got love, man,” Mars said then. “Hawaii … this place is the best.”

Hawaii earns the nickname “The Aloha State” in many ways. From the lei we give out on special occasions to the way we always make sure our potlucks have too much food rather than too little. From the aloha shirts many businessmen favor over three-piece suits to the way we welcome guests — both into our state and into our homes.

But some of our greatest aloha is expressed in the way we support our own.

24K MAGIC WORLD TOUR >> Where: Aloha Stadium >> When: 7 p.m., Nov. 8, 10 and 11 (doors open at 5:30 p.m.) >> Tickets: $49.50 and up, available at Ticketmaster.com >> Guest acts: Charlie Wilson (Nov. 8); The Green and Common Kings (Nov. 10 and 11) Every Little League team that makes it to the World Series — which only seems to happen every other year — gets the full weight of the state behind it. When Mililani’s Jasmine Trias and Maui’s Camile Velasco were “American Idol” finalists, the show became appointment television from Kalapana to Kekaha, and our telephone votes carried Trias to a third-place finish.

So when one of our own becomes perhaps the biggest pop star in the world? Well, it’s like we ourselves are along for the ride — singing along to every No. 1 song, gushing over every Super Bowl halftime show, celebrating every Grammy Award win.

And when that pop star comes home for a visit? We throw the biggest party we can.

The hoolaulea for Hawaii’s own Bruno Mars begins Thursday at Aloha Stadium. It lasts for three concerts across four nights, with more than 100,000 of his closest friends having already RSVP’d, “Hell yes.”

BRUNO BY THE NUMBERS >> 19: Top 40 singles >> 11 million: Albums sold >> 79 million: Singles sold >> 7: No. 1 singles as a performer >> 8: No. 1 singles as a songwriter >> 32: Weeks spent at No. 1 on the Billboard Hot 100 >> 32: Countries where Mars has had a No. 1 single >> 11: Grammy Awards won >> 27: Grammy nominations >> 14.049 billion: Total YouTube views for Bruno Mars’ official music videos 24K MAGIC WORLD TOUR >> Miles traveled: 113,201 >> Days: 594 >> Shows: 213 >> Continents: 6 >> Countries: 38 >> States: 29 >> Cities: 123 >> Stops: 141

Take away something as simple as birthplace and Mars is still very much the kind of pop megastar Hawaii fans would love. Start with the fact that he’s half Filipino. So rare has it been for us to see Asians and Polynesians in the national limelight that we grab on for dear life when one — be it in music, movies or sports — rises to national or worldwide prominence, even if he’s not from Hawaii. A Steve Perry-less Journey would not sell out one concert here if it weren’t led by Arnel Pineda, a singer from the Philippines. In the world of sports, Ichiro Suzuki, Troy Polamalu and Jeremy Lin were local faves.

But the “half” in Mars’ ethnic makeup is as important as the “Filipino” to a state that has three times as many multiracial residents per capita as any other state, for we also pride ourselves on our multiculturalism. Sure, racial prejudice exists in Hawaii, but we’re still the state with the most ethnic variety, and Mars embodies that diversity — his father is most prominently Puerto Rican and Jewish and his late mother was Filipino, but he has flecks of other ethnicities laced in with those. For a state of “poi dogs,” one moving the most assuredly toward a true post-racial society, who better to identify with than a pop star who defies racial categorization?

And Mars is a big enough star that even if he wasn’t from Hawaii, the coming shows would be significant. That said, the fact that Mars is “one of us” certainly adds to the fervor surrounding his arrival on these shores this week. And let’s face it — he probably wouldn’t be coming here if he weren’t from here. Honolulu is on one of its greatest runs of concerts in many years, but while more and more stars are finding their way to our islands, the biggest are not visiting at their peak the way Mars is. We’re getting some great acts, but we’re not getting the Taylor Swifts, the Ed Sheerans, the Beyonces of contemporary pop music. Will that change? Mars’ three sellouts seem to have opened the door to more shows at the stadium, with the Eagles and Guns N’ Roses due in December, and there are rumblings that other stars could be on their way.

Whatever happens down the road, with Mars coming to town, Honolulu for once is included in a worldwide tour by an artist in the upper stratosphere. Mars’ 24K Magic Tour has sold well past 2 million tickets worldwide, with revenue surpassing $250 million. The album it was named after was the second-best seller of 2017. Overall, Mars has certified sales of more than 90 million records/downloads in the U.S. alone less than a decade after he put himself on the map with a smooth guest spot on rapper B.o.B.’s chart-topping “Nothin’ on You.”

All of which serves as a reminder of another reason Hawaii loves Bruno: He always remembers where he came from.

BACK TO WHERE IT ALL STARTED

ALBUMS

“Doo-Wops & Hooligans” (2010) >> Peak: No. 3 >> Sales: 5 million copies >> Singles: “Just the Way You Are” (No. 1 for 4 weeks, 9 million); “Grenade (No. 1 for 4 weeks; 7 million); “It Will Rain” (No. 3, 3 million); “The Lazy Song” (No. 4, 3 million)

“Unorthodox Jukebox” (2012) >> Peak: No. 1 >> Sales: 4 million copies >> Singles: “Locked Out of Heaven” (No. 1 for 6 weeks, 6 million); “When I Was Your Man” (No. 1 for 1 week, 6 million); “Treasure” (No. 5, 3 million)

“24K Magic” (2016) >> Peak: No. 2 >> Sales: 2 million copies >> Singles: “That’s What I Like” (No. 1 for 1 week, 7 million); “Finesse feat. Cardi B” (No. 3, 3 million); “24K Magic” (No. 4, 5 million)

Other singles >> “Uptown Funk” by Mark Ronson featuring Bruno Mars (2015, No. 1 for 14 weeks, 11 million) >> “Nothin’ on You” by B.o.B. featuring Bruno Mars (2010, No. 1 for 2 weeks, 3 million) >> “Billionaire” by Travie McCoy featuring Bruno Mars (2010, No. 4, 2 million) >> “Lighters” by Bad Meets Evil featuring Bruno Mars (2011, No. 4, 2 million) >> “Young, Wild & Free” by Snoop Dogg & Wiz Khalifa featuring Bruno Mars (2012, No. 7, 4 million)

Sources: Billboard Magazine, Recording Industry Association of America

The pop superstar born in Honolulu as Peter Hernandez has brought his show to town for the tours following all three of his albums, with each visit growing on pace with his skyrocketing career — from one sold-out show at Blaisdell Arena to three there and now three at Aloha Stadium, a venue with about four times the capacity of the arena. For his hometown fans, it was a long wait through a tour that has gone on for almost two years, but in the end he did not forget about us.

Mars’ backstory is well-known, and it both adds to the Bruno Mars mythology and makes him that much more likable.

He started his career as a 4-year-old Elvis impersonator in Waikiki and entertained at hotel shows throughout his youth. During a “60 Minutes” profile in November 2016, he also recollected, with no negativity or sense of self-pity, how he spent part of his childhood homeless, living with his father and brother in an abandoned shack in Manoa Valley.

Mars has credited his humble beginnings for his work ethic and his start in Waikiki for his broad appeal.

“Because of my upbringing performing for tourists, I had to entertain everyone. Not just black people, not just white people, not just Asian people, not just Latin people. I had to perform for anybody that came to Hawaii,” Mars told Rolling Stone for a November 2016 cover story. (Mars had not granted the Star-Advertiser an interview at press time.)

That requirement to entertain all comers has also resulted in a command of various musical styles. His latest album, 2016’s “24K Magic,” is pretty much a straight-up tribute to old-school R&B and funk, but his prior two albums showed off his versatility as a singer and his dexterity at crossing genres, with forays into belted balladry (the soaring yet somber “When I Was Your Man”); post-punk reggae-rock (the Police-inspired “Locked Out of Heaven”); folksy, island-inflected pop whimsy (“The Lazy Song”); and even an amalgam of styles including Motown and surf rock (“Runaway Baby”).

Those songs and those sounds all come from Bruno. In an era in which so many pop stars lean on hitmakers such as producers Max Martin and Benny Blanco, Mars has had a hand in writing and producing every song he’s appeared on. He works with outside producers at times — most notably Mark Ronson, with whom he recorded the megahit “Uptown Funk” — but compared with his peers, such collaborations are minimal. More commonly, Mars and his production teams — previously The Smeezingtons and now Shampoo Press & Curl — work in the opposite direction, shepherding hits for such artists as Adele (“All I Ask”) and CeeLo Green (“Forget You”), the former earning him one of his 11 Grammys.

SHOWMAN BRINGS THE MAGIC

Mars takes that same hands-on approach with his dancing, that extra something-something that takes him from star musician and singer to maybe the best showman currently working, a worthy successor to great entertainers such as James Brown and Michael Jackson.

Phil Tayag, one of the founding members of the renowned hip-hop dance crew the Jabbawockeez, works with Mars on many of his routines — peep him in the video for “Finesse,” among others — but won’t go so far as to call himself Mars’ choreographer.

“He’s not one of those artists that just wants somebody to prepare something for him,” Tayag told MTV.com in January. “We build everything together. He is very involved in all aspects of what he does when it comes to music production and everything. So it’s the same with dancing and creating and choreographing — super involved. … I was thinking in the beginning that he was just one of these artists that wants to be fed this choreography and all that, but he’s not. He’s super involved in everything, so we create together. He is a choreographer as well.”

The choreography is one part of translating powerfully sung songs to a live platform. Mars sees the brotherhood — in one case literal — he shares with his eight-piece band, the Hooligans, as an even more essential part.

“I think the best part of our show is that you can tell that we’re all friends up there,” Mars said in a documentary short posted to his YouTube page, “and you go in thinking, like, ‘Oh, OK, I’m gonna go see this guy sing these love songs,’ but then you kinda get a treat, you get … one of my best friends, (sideman and writing partner) Philip Lawrence, and me and him are just having the time of our life. You got my brother (Eric Hernandez) on drums, and I think that’s where the magic happens.”

BRUNO TIMELINE

>> Oct. 8, 1985 — Born Peter Hernandez in Honolulu.

>> Feb. 14, 1990 — Graces the cover of Midweek at a mere 4 years old, drawing attention for his gig as an Elvis impersonator at the Esprit Nightclub at the Sheraton Waikiki. Mars goes on to appear in costume in the Aloha Bowl halftime show in December and in the Nicolas Cage film “Honeymoon in Vegas” two years later.

>> June 7, 2003 — Graduates from Roosevelt High School. Soon after, he moved to Los Angeles to pursue a career in music.

>> Feb. 8, 2009 — “Right Round” by Flo Rida (featuring an uncredited Kesha) becomes Mars’ first No. 1 hit as a songwriter (six other writers and the band Dead or Alive share credit).

>> May 1, 2010 — “Nothin’ on You,” a collaboration with rapper B.o.B., becomes Mars’ first No. 1 single as a performer. Five months later, “Just the Way You Are” becomes Mars’ first fully solo chart-topper.

June 15, 2010 — Network TV debut on “The Tonight Show with Jay Leno.”

>> Oct. 4, 2010 — Debut album “Doo-Wops & Hooligans” is released.

>> Dec. 19, 2010 — Plays a sold-out show at the Blaisdell Arena.

>> Feb. 13, 2011 — Wins first Grammy Award, for best male pop vocal performance for “Just the Way You Are”

>> October 20, 2012 — Hosts “Saturday Night Live” and serves as musical guest, one of only 25 performers ever to do double-duty. (He also appears as a musical guest only on Oct. 9, 2010, Nov. 22, 2014 and Oct. 15, 2016.)

>> March 16, 2013 — “Unorthodox Jukebox” becomes Mars’ first (and so far only) U.S. No. 1 album.

>> June 1, 2013 — Mother, Bernadette Bayot, dies of a brain aneurysm at age 55. Mars told Latina magazine in 2017, “She’s more than my music. If I could trade music to have her back, I would.”

>> Feb. 2, 2014 — Wows the world as the lead Super Bowl XLVIII halftime performer, with a guest appearance by the Red Hot Chili Peppers. (He returned two years later at Super Bowl L as a guest with Beyonce at the request of main act Coldplay.

>> April 18-21, 2014 — Plays three sold-out shows at Blaisdell Arena.

>> Jan. 17, 2015 — “Uptown Funk,” a collaboration with British producer Mark Ronson, spends the first of 14 weeks at No. 1, tied for third-most in Billboard history.

>> July 4, 2015 — Performs at the White House as part of President Barack Obama’s Independence Day celebration.

>> Nov. 20, 2016 — CBS news program “60 Minutes” airs a segment on Mars, his roots in Hawaii and his rise to fame.

>> Dec. 13, 2016 — Appears on the “Carpool Karaoke” segment of “The Late Late Show with James Corden.” About 50 segments have aired and Mars’ is among the most viewed on the internet.

>> Nov. 29, 2017 — His special, “Bruno Mars: 24K Magic Live at the Apollo,” airs on CBS.

>> Jan. 28, 2018 — Wins six Grammys, including the big three of album, record and song of the year, bringing his career total to 11 Grammys.

>> June 9 and 16 and Aug. 3, 2018 — Three shows at Aloha Stadium this month sell out within hours.

2 notes

·

View notes

Text

Thursday, April 29, 2021

Biden to propose free preschool, as speech details emerge (AP) President Joe Biden will call for free preschool for all three- and four-year-old children, a $200 billion investment to be rolled out as part of his sweeping American Families Plan being unveiled Wednesday in an address to Congress. The administration said the historic investment would benefit 5 million children and save the average family $13,000. It calls for providing federal funds to help the states offer preschool, with teachers and other employees earning $15 an hour. The new details are part of Biden’s $1 trillion-plus package, an ambitious next phase of his massive infrastructure investment program, this one focused on so-called human infrastructure—child care, health care, education and other core aspects of the household architecture that undergird everyday life for countless Americans. Together with Biden’s American Jobs Plan, a $2.3 trillion infrastructure investment to be funded by a corporate tax hike, they add up a whopping $4 trillion effort to fulfill his campaign vow to Build Back Better.

Navy SEALs to shift from counterterrorism to global threats (AP) Ten years after they found and killed Osama bin Laden, U.S. Navy SEALs are undergoing a major transition to improve leadership and expand their commando capabilities to better battle threats from global powers like China and Russia. The new plan cuts the number of SEAL platoons by as much as 30% and increases their size to make the teams more lethal and able to counter sophisticated maritime and undersea adversaries. That decision reflects the broader Pentagon strategy to prioritize China and Russia, which are rapidly growing their militaries and trying to expand their influence around the globe. U.S. defense leaders believe that two decades of war against militants and extremists have drained resources, causing America to lose ground against Moscow and Beijing.

Scientist: Extent of DDT dumping in Pacific is ‘staggering’ (AP) Marine scientists say they have found what they believe to be more than 25,000 barrels that possibly contain DDT dumped off the Southern California coast near Catalina Island, where a massive underwater toxic waste site dating back to World War II has long been suspected. The 27,345 “barrel-like” objects were captured in high-resolution images as part of a study by researchers at the University of California San Diego’s Scripps Institution of Oceanography. They mapped more than 56 square miles (145 square kilometers) of seafloor between Santa Catalina Island and the Los Angeles coast in a region previously found to contain high levels of the toxic chemical in sediments and in the ecosystem. Historical shipping logs show that industrial companies in Southern California used the basin as a dumping ground until 1972, when the Marine Protection, Research and Sanctuaries Act, also known as the Ocean Dumping Act, was enacted. Disposing of industrial, military, nuclear and other hazardous waste was a pervasive global practice in the 20th century, according to researchers. The long-term impact on marine life and humans is still unknown, said Scripps chemical oceanographer and professor of geosciences Lihini Aluwihare, who in 2015 co-authored a study that found high amounts of DDT and other man-made chemicals in the blubber of bottlenose dolphins that died of natural causes.

Electric Vehicle Appeal Loses Steam (Nature.com/ArsTechnica) California is the largest market in the US for plug-in vehicles. But a new study in Nature Energy has found that about 20% of those early electric vehicle adopters have given up their EVs to return to fossil fuel-powered transport. Survey responders said what they liked most about their plug-ins were recharging costs, reliability, and safety. What they liked least were the driving range and convenience of charging. Not surprisingly, those who decided to keep their EVS had more access to level 2 charging (240 V AC) at home, as well as more access to charging generally.

The real crisis along the U.S.-Mexico border (Washington Post) There’s a crisis along the U.S.-Mexico border, but it isn’t the crisis that the media has been covering and that the Republican governors of Arizona and Texas recently blamed on President Biden. The crisis I’m talking about is the one that is eroding the livelihoods of U.S. citizens on the borderlands. Just ask Blanca Gallardo, 45, or her colleague Ivan Caballero, 39, two of the three workers left at La Familia, a mega-discount store in the border city of Nogales, Ariz. The store once employed 24 people. La Familia occupies a prime piece of real estate on Morley Avenue, Nogales’s Main Street. Like other retail businesses on and around this thoroughfare, La Familia depends almost entirely on shoppers who live on the other side of the border fence a short walk away—Mexicans who have not been allowed to enter the United States since March last year, when land ports of entry were closed to visa-carrying nonessential travelers in an effort to contain the coronavirus pandemic. The result has been devastating. Sheriff David Hathaway, a lifelong Nogales resident and the top law enforcement official in Santa Cruz County, one of four border counties in Arizona, said that 90 percent of local businesses have shut their doors and may never reopen. “There is no migrant crisis,” Hathaway told me. “What we have is a big economic crisis.” That’s not just a Nogales problem, though. One downtown merchant in the border city of El Paso told Border Report in November that his store had lost as much as 90 percent of its customers since last March.

López Obrador’s bid to alter Mexican Supreme Court seen as threat to judicial independence (Washington Post) He won the presidency in a landslide. His party dominates Congress. Now, Mexican President Andrés Manuel López Obrador is in a battle over the country’s judiciary, as opponents and legal analysts accuse him of making an unconstitutional power grab. Lawmakers from López Obrador’s party have triggered outrage by voting to add two years to the four-year term of the Supreme Court chief justice, Arturo Zaldívar. Zaldívar is generally regarded as sympathetic to the president. As in the United States, where some Democrats want to expand the U.S. Supreme Court, there are fears that the judiciary is becoming increasingly politicized. But the Mexican measure carries especially grave implications, analysts say, because it appears to violate a constitutional limit on the chief justice’s term. López Obrador is increasingly challenging institutions created as part of Mexico’s transition to democracy, including the national elections board and the freedom-of-information institute. Critics worry that the president, who came to power as a leftist political outsider, could use his popularity to reestablish elements of the one-party system that reigned here for seven decades.

With pools closed, Peruvians turn to open-water swimming (AP) The swimmers began gathering even before dawn glimmers on Pescadores beach, plunging into the Pacific surf for one of the few athletic endeavors permitted under Peru’s strict pandemic restrictions. Swimming pools have been closed for more than a year, but government has since Oct. 30 allowed open-water swimming, even if relaxing on the beach is banned to prevent mass gatherings. Forty-three-year-old Lorena Choy said swimming “relaxes me, unstresses me. ... It helps a lot psychologically.” Swimming coach Víctor Solís, 47, said he estimated that the number of swimmers out each morning has multiplied fivefold recently.

UK to come under scrutiny in Italy’s largest mafia trial in decades (The Guardian) In a high-security, 1,000-capacity courtroom converted from a call centre, Italy’s largest mafia trial in three decades is under way in Lamezia Terme, Calabria. About 900 witnesses are set to testify against more than 350 defendants, including politicians and officials charged with being members of the ‘Ndrangheta, Italy’s most powerful criminal group. Several of the defendants will be asked to respond to charges of money laundering over establishing companies in the UK with the alleged purpose of simulating legitimate economic activity. The ‘Ndrangheta—based in the southern region of Calabria, the toe of the Italian boot—is reputed to be one of the richest and most feared criminal organisations in the world. A study by the Demoskopita Research Institute in 2013 estimated its financial strength as more than that of Deutsche Bank and McDonald’s combined, with an annual turnover of €53bn (£44bn). Investigators say the secret of its success lies in its ability to connect the underworld with the upper world, where often the “upper world” stands for London. In the last decade, hundreds of investigations have asserted how the ‘Ndrangheta has laundered billions of euros in the City.

The U.S. Built the Afghan Military Over 20 Years. Will It Last One More? (NYT) President Biden’s decision to withdraw from Afghanistan by Sept. 11, the 20th anniversary of the terrorist attacks that first propelled the United States into conflict, has prompted deep fears about the Afghan security forces’ ability to defend what territory remains under government control. For nearly two decades, the United States and NATO have engaged in the nation-building pursuit of training, expanding and equipping Afghanistan’s police, army and air forces, spending tens of billions of dollars in an attempt to build government security forces that can safeguard their own country. But despite this enormous effort, the undertaking has only produced a troubled set of forces that are woefully unprepared for facing the Taliban, or any other threat, on their own. What comes next is anything but certain. The Taliban already control vast amounts of the country, even with American military power present. Afghan units are rife with corruption, have lost track of the weapons once showered on them by the Pentagon, and in many areas are under constant attack. Some soldiers have not been home in years because their villages have been overtaken by the Taliban. Prospects for improvement are slim, given slumping recruitment, high casualty rates and a Taliban insurgency that is savvy, experienced and well equipped—including with weapons originally provided to the Afghan government by the United States.

In India, Illness Is Everywhere (NYT) Crematories are so full of bodies, it’s as if a war just happened. Sickness and death are everywhere. Dozens of houses in my neighborhood have sick people. One of my son’s teachers is sick. The neighbor two doors down, to the right of us: sick. Two doors to the left: sick. I’m sitting in my apartment waiting to catch the disease. That’s what it feels like right now in New Delhi with the world’s worst coronavirus crisis advancing around us. India is now recording more infections per day—as many as 350,000—than any other country has since the pandemic began, and that’s just the official number, which most experts think is a vast underestimation. New Delhi, India’s sprawling capital of 20 million, is suffering a calamitous surge. A few days ago, the positivity rate hit a staggering 36 percent—meaning more than one out of three people tested were infected. A month ago, it was less than 3 percent. The infections have spread so fast that hospitals have been completely swamped. Although New Delhi is locked down, the disease is still rampaging.

US Navy fires warning shots in new tense encounter with Iran (AP) An American warship fired warning shots when vessels of Iran’s paramilitary Revolutionary Guard came too close to a patrol in the Persian Gulf, the U.S. Navy said Wednesday. The Navy said the USS Firebolt fired the warning shots after three fast-attack Guard vessels came within 68 yards (62 meters) of it and the U.S. Coast Guard patrol boat USCGC Baranoff. The incident Monday marked the second time the Navy accused the Guard of operating in an “unsafe and unprofessional” manner this month alone after tense encounters between the forces had dropped in recent years.

Hong Kong passes immigration bill, raising alarm over ‘exit bans’ (Reuters) Hong Kong’s legislature passed on Wednesday a controversial immigration bill, which lawyers, diplomats and right groups fear will give authorities unlimited powers to prevent residents and others from entering or leaving the Chinese-ruled city. The government has dismissed those fears as “complete nonsense,” saying the legislation, which will come into effect on Aug. 1, merely aims to screen illegal immigrants. The assurances, however, come in a climate of mistrust after the increasingly authoritarian path officials have taken the imposition of a sweeping national security law by Beijing last year. Lawyers say the new law will empower authorities to bar anyone, without a court order, from entering or leaving Hong Kong—essentially opening the door for mainland China-style exit bans—and fails to prevent indefinite detention for refugees. The Hong Kong Bar Association (HKBA) said in February the bill failed to explain why such powers were necessary, how they would be used and provided no limit on the duration of any travel ban, nor any safeguards against abuse.

0 notes

Text

Worm For Mac

The most threatening aspect of computer worms as a type of malware is that they are self-replicating. Where viruses sometimes need to hook up to a specific type of computer program or be actively controlled by a hacker in order to work, worms are so dangerous because they start cloning themselves pretty much the moment they hit your computer. The goal of worms is twofold: first, they seek to exploit known vulnerabilities in an operating system; second, they seek to spread as far as they can, using computer networks, email attachments, file sharing networks, and any number of other methods to move from one computer system to the next.

Mary Mac's Tea Room: 70 Years of Recipes from Atlanta's Favorite Dining Room. By John Ferrell Jul 13, 2010. 4.6 out of 5 stars 88. Hardcover $29.99 $ 29. FREE Shipping by Amazon. In stock on November 13, 2019. More Buying Choices $1.98 (40 used & new offers). Start quickly with the most recent versions of Word, Excel, PowerPoint, Outlook, OneNote and OneDrive —combining the familiarity of Office and the unique Mac features you love. Work online or offline, on your own or with others in real time—whatever works for what you’re doing.

Super Mega Worm is the Mac version of the retro-looking iOS arcade game of the same name, in which you control a giant bloodthirsty worm that's out to wreak some (cartoonishly) gory eco-vengeance. Download Malwarebytes for Mac (the free version) and you get a 14-day trial of the premium version with automatic (real-time) virus and malware protection. After 14 days, your trial reverts to a limited disinfection scanner. Buy the premium version now to prevent infection in the first place.

What Worms Are Used For: An Example

That’s not to say that worms are exactly the mindless cancer of the computer world. On the contrary, these malicious programs do send data back to a control server, and they can be controlled to help hackers achieve specific goals.

For instance, when a website goes down as part of a DDoS (Distributed Denial of Service) attack, the root cause is often a worm that has infected a large number of machines. The hacker who created the worm is then able to create a botnet army with these compromised computers, and can use them to flood a specific target site with huge amounts of traffic or data, essentially killing the bandwidth of the target and resulting in a denial of service for the site.

DDoS attacks are difficult to protect against for website administrators, simply because the attack is coming from so many different sources. All of the machines infected with the worm are essentially part of the attack, making it impossible to block specific IP addresses or even distinguish legitimate traffic from malicious traffic.

Worms in History

One of the most notorious computer worms in history was also one of the first. Written by a graduate student at Cornell University, the worm in question—called the Morris worm—was launched in November 1988, and quickly spread from computer to computer. Like other worms since, the Morris worm operated by exploiting known vulnerabilities in a specific operating system—in this case, Unix. Though originally intended as a harmless technology test, the worm was coded in such a way that it would infect some computer systems more than once, which resulted in computer crashes, denial of service attacks across the Internet, and potentially up to $10 million in damage.

The estimate is that the Morris worm infected about 10% of the computers connected to the Internet at the time. While it’s unlikely that a worm could ever have such a far-reaching impact today—thanks to our knowledge of worms and the cyber-security safeguards that are in place on most computers and networks—it’s still frightening to think of the kind of a damage that a worm could do if it infected 10% of the Internet in 2015.

Worms on Mac OS X

Luckily for Mac users, worms still haven’t really made their way to OS X. In the past few years, we’ve seen a huge increase in the number of trojan horses, keyloggers, and other types of malware that can infect machines running Mac OS X. However, a Google search for “Mac worms” should reveal that there are no major worm infections to worry about on Mac… yet.

According to a Wired article published in August 2015, researchers have created “the first firmware worm that attacks Macs.” What this article essentially proves is that there is nothing about Macs on either a hardware or software level that will prevent worms from infecting OS X computers or spreading from one Mac to the next. A firmware worm hell-bent on attacking Macs could be particularly damaging, since, as the Wired piece notes, fixing the issue would require users to open up their Macs and “electrically reprogram the chip.”

Worm Machine Stardew

Granted, not all worms would impact a Mac’s firmware. Firmware consists of programs or data that are installed to a system’s read-only memory (ROM), after which they cannot be removed. Many worms, while dangerous and destructive, do not have this level of permanence. Still, the point is that the potential is there for Macs to be hit with a catastrophic worm attack.

Machine Armyworm

So how can you protect yourself from worm infection? Since worms exploit known operating system vulnerabilities, always keeping your Mac fully up-to-date with all updates and security patches should reduce the likelihood of a worm being able to exploit your machine. Beyond updates, just use common sense in using the Internet: don’t open emails or attachments from people you don’t know or don’t trust, don’t use public file sharing networks, don’t click on links that look spammy, and always run firewall and antivirus software on your system.

0 notes

Text

$150 Billion Cryptocurrency Boom Is Here – Buy This ETF to Profit

$150 Billion Cryptocurrency Boom Is Here – Buy This ETF to Profit:

Story Highlights:

Bitcoin is on track to hit $50,000 as early as next year.

This exchange-traded fund is your best opportunity to buy into the cryptocurrency mega trend that is already trading 27% above the price of bitcoin.

Tesla’s new “Cybertruck” is giving the Ford F-150 pickup a run for its money.

How high will pot stocks rise, now that they’ve hit bottom?

Gold. Silver. Coins. Paper dollars.

If you could line your pockets with any of these valuables, which would be the best choice?

The surprising answer: None of the above.

In fact, blockchain-based cryptocurrencies are becoming the new-world digital money — with bitcoin on track to hit $50,000 to $100,000 by the end of next year.

In today’s Bold Profits video, Paul Mampilly joins me to explain why. And to tell you about the best way you can start investing in this mega trend today before bitcoin surges higher in 2020.

[embedded content]

Click Here to View Full Transcript

Bold Profits Daily November 29, 2019

Paul Mampilly: It’s Paul on the Iancast again. I’m hijacking this permanently.

Ian Dyer: Fine with me. We have good discussions.

Paul: With Market Talk I’m always trying to keep it tight down to three to five minutes. I have a lot of competition between Hudson and Amber. On this one, we’re going to do it long. How about that? Ian: Sounds good.

Paul: Let’s start with dramatic news. You and I never sleep. I know you were up watching Bitcoin hit $6,500.

Ian: The whole time, yes. It bounced. The Bakkt futures we talked about last week, the expiration date came into play there. Bitcoin fell to below $7,000, then it bounced and went a little lower.

Again, around these expiration dates in the futures, all these new Bitcoins are being sent out from the actual futures company to all the investors. It creates an immediate supply that can have an effect on price.

Paul: Long term, I don’t know anybody who would ever want to be short those futures. You’d have to deliver something of a fixed quantity. I remember seeing analysis that something like 30-40% of Bitcoin are being HODLed. Hold on for dear life, that’s what HODL means.

The crypto world has its own language. We have HODL. We have FUD.

Ian: That’s fear, uncertainty and doubt, right?

Paul: Time to lambo for time to move. So 40% of all Bitcoin approximately is being HODLed. I read analysis on The Block, which is a website where they do crypto analysis, that hedge funds are short Bitcoin. This sounds crazy to me.

Ian: Me too. There’s a lot of questions around it. When you look at all these hedge fund managers that are into traditional investments like 60% stock and 40% bonds. Bitcoin doesn’t fit anywhere in there and they don’t know what to do with it. They don’t’ think it will ever overtake gold as a safe haven asset.

There’s a lot of naysayers out there still which is surprising considering it’s survived for 10 years now — almost 11 — and it started out as a fraction of a penny and has grown into a $150 billion asset class all on its own with no promotion other than word of mouth. It’s amazing what it has done so far. It’s an alternative currency.

Paul: Exactly. Both Ian and I are on the record of seeing Bitcoin at much higher numbers. Ian has a $50,000 by end of 2020. Is that right?

Ian: Yes, $50,000 next year and somewhere around $100,000 in 2021.

Paul: I think that’s conservative. I think we might hit $100,000 maybe even by the end of 2020. Here’s why. To me, Bitcoin is the first exponential asset. It runs off a digital mechanism rather than a lineal mechanism which is the stock market, the bond market. In other words, it requires human intervention.

If you think about gold, you have to go dig it out of the ground. There’s a whole process. Bitcoin is completely digital. There’s no physical element to it. It can exponentially grow and it’s already done that. This is why it has so much skepticism because there’s never been an exponential asset in history — this is asset number one. It’s going to be the most valuable.

Ian: There’s never been something like these halving events in any asset before. When the supply is limited by this much on one specific day, that day has a lot of say in the future of Bitcoin. We’ve seen that because after the past few halving events, there’s a gigantic rally by thousands of percent after the supply is cut.

Paul: I went back and modeled the Litecoin halving event to Bitcoin. For sure, it’s setting up to be a minimum of $25,000 to $30,000 the way it models. Most of the people who believe in Bitcoin largely never bat an eye at the volatility. It’s the disbelievers who come to really give us a lot of grief about it.

Ian and I believe in Bitcoin. We think Bitcoin is going to the moon. Everyone can make their own judgment. There is that one indicator that we both track. We should tell people about it.

Ian: A company called Grayscale has their own Bitcoin trust. They own a lot of Bitcoin and sell it as a fraction on the stock market. You can buy shares of the trust backed by Bitcoin. It’s a way of buying Bitcoin on the stock market, which is really interesting and not a lot of people know it exists.

We’ve seen all these headlines and rumors of a Bitcoin ETF, but there already is one and it doesn’t get that much press. It gives us a good indicator because when there’s a lot of bullish or bearish sentiment on Bitcoin you will see the premium of this ETF start to go up or down. Right now it’s trading about 27% above the price of Bitcoin.

The stock market is giving Bitcoin a premium even though it fell 50% in just a few months. That’s a really bullish indicator to me. It’s been as low as 10% and then it bounced from there. Now, like I said, it’s up almost 30% and people are paying a lot more for Bitcoin in the stock market because as of right now more people have stock accounts than crypto accounts.

Paul: It’s a pain to get a crypto account. I have a coin-based account and you probably have one as well, but most people don’t want to deal with that. I can tell you from tracking the Grayscale Bitcoin Trust, at the peak in 2017 the premium was something like 130-140%. Ian: It was more than double.

Paul: At the low about this time last year I believe the premium was something like 3-4%. Right now it’s nowhere near as pessimistic as it was back then so there’s no reason to expect the premium to be as low. I don’t believe it has traded at a discount any time recently.

All signs point to Bitcoin going higher sooner rather than later. I feel like we can leave that one right there and move to the next one. I think we should name the Iancast, “Tesla, Bitcoin and Pot.” Ian: That’s what we talk about. It’s the fastest growing things out there.

Paul: It’s also what most millennials like to trade and are invested in. When I did a Tesla, Bitcoin and pot video for my Tuesday Bold Profits, I got 30 comments. I don’t think I’ve ever received 30 comments on anything before. That’s where people are at.

So let’s deal with Tesla. Cybertruck.

Ian: Yea. Cybertruck. Just to start off, Tesla has never had an advertisement before. They’ve never spent on marketing. It’s crazy the publicity this stuff is getting. Literally everybody was talking about the Cybertruck over the weekend. We both pre-ordered one.

I personally love it. I know a lot of people are really skeptical of the design. I think it’s going to grow on people. It’s a steel truck that’s supposedly bulletproof, although the window did break during the promo.

If you throw a steel ball at any other car window it’s going to go right through the car window. Bulletproof glass breaks. It doesn’t shatter but it breaks like that.

Paul: I follow Elon’s tweets. It turns out, when they hit the sledgehammer against the Cybertruck it cracked the window. That’s why when they threw the ball, it shattered the window. Elon said what they should have done is first throw the ball and then hit the Cybertruck with a sledgehammer.

Then the demo would have worked out fine. But, you know, that’s how it is in life. I think they got $100 million worth of free publicity as a result of the windows breaking because everybody felt like they had to show it.

Ian: Yes. And they have more than 200,000 orders already in the first few days for this truck. Paul: I feel like the truck makers depend on trucks and SUVs. Between the Model Y coming out and now with this, it’s really time. Those companies are going to struggle. Maybe some of the others will end up being a competitor, but for now there’s no competition of any kind for Tesla.

Ian: It even blows the gas-powered pickup trucks out of the water. I drive a pretty good truck and the Tesla can tow more, carry more, has a bigger truck bed and it faster. It’s a super powerful truck. I’ve heard a lot of people say it doesn’t appeal to the kind of market that drives pickup trucks.

They want more power. What doesn’t appeal? I guess the design? I think it will grow on people and I don’t see it as a reason not to buy it.

Paul: My reaction was pretty much what everyone else’s was. I didn’t stay up for the launch, but I woke up and looked at it and then I thought, “Whoa, that’s different.” Then about a minute later I thought, “I really like it.” Then five minutes later I thought, “I need to order one.”

Ian: Same here. I woke up and saw it and thought, “That’s weird. That’s actually what it looks like?” But then it grew on me. It’s going to take time. It’s what everyone imagined future cars would look like 20 years ago and now it’s finally here. I think it’s going to grow on people. It’s kind of iconic.

Paul: I’m watching the reaction on Twitter and people are having a slightly slower version of what we went through. It came out and now they think it’s kind of cool. I think this might be as fast selling as the Model 3. People say it’s only a $100 deposit and it doesn’t mean anything. But 200,000 is a lot of people.

Ian: Even if 90% of them cancel that’s more than $1 billion they’re getting from this already. Paul: You looked this up before we got on. What’s the short position in Tesla?

Ian: It’s down. It was just 25% a few weeks ago. It’s down to 16% now.

Paul: I have to tell you, in my entire 25 years of being on Wall Street I have never known a company as large as Tesla carry such a large short position. This is insane.

Ian: They’re different. Different doesn’t appeal on Wall Street. Everyone wants to think the same way, be safe, not get fired for liking some company that everyone else hates.

Paul: They talk about Tesla stock owners and car owners being a cult, but the people who hate Tesla are also a cult.

Ian: Pretty much. They do have a lot of haters — millions.

Paul: They do. I always keep my Sentry Mode on when I drive my car because I don’t want to run across someone who wants to do something to my car. We like Tesla at Bold Profits. You can also see we had a Tesla at our last franchise meeting and it was a super big hit. Amber gunned it and she loved it. We’re trying to persuade everyone to get one.

We’ve done Bitcoin, we’ve done Tesla, what about pot? I was on last week and the stocks all sold off. Then, boom.

Ian: They’re back. It’s going to be a ride, for sure. That’s how bottoms are. It goes up and down fast. Some of these stocks in the pot sector doubled from their bottom and went up 100% in a couple days. You don’t see that when there’s not some big buyer looming in the background.

There’s going to be buying in these stocks. They are bottoming out right now and they’re going to come back up. It’s going to be great. The market is so bearish on these stocks right now because they’ve gone down so much for months. It’s the classic selloff we’ve seen where the end is the worst part. It’s like that with anything in the stock market.

Paul: This is so true, Ian. You are absolutely right. Most people — I’m included in this, I’ve never had perfect timing — start buying probably a month too early. Then they underestimate how much that last drop is going to be. That’s where they get shaken out and they sell.

It’s also where they get emotionally blown out. They are not going to come back. Then they end up missing it.

Ian: They are the ones who push it up at the end toward the bubble phase.

Paul: That’s right. Then they come at the end and signal the very top. I’m going to guess just by the sharpness of the move in the ETF MJ, Canopy, Cronos and Aurora, that there’s a combination of short covering as well as actual long buying going on.

Ian: Yes. Some of these went up 100% in a couple days and a lot of them went up at least 40% in the first initial bounce.

Paul: In my experience, when you have the sharp, off-the-bottom jump of 40-50% it means there’s actually a big buyer. A strong hands buyer that is going to own and is signaling they are going to buy more. This is why market makers keep lifting the price up to find sellers who are willing to sell.

In my experience that’s a good sign. We’re bullish on pot and we have it across a ton of our services. Did you end up putting on that trade for the pot company?

Ian: We did. In Rebound Profit Trader we have a pot trade. We’re probably going to do another one very soon. We’re bullish on that. In Rebound Profit Trader the goal is to get stocks at the bottom and buy call options on them, which go up faster than the stock. You can make hundreds of percent in just a few days by doing that if you time it right.

Here at the bottom of the pot crash we think it’s a really good time to buy calls on these beaten down pot companies.

Paul: We were chatting before on Slack and you said we had eight 60% winners in Rebound Profit Trader? I forget the numbers.

Ian: We’ve had 10 winners in the past month.

Paul: 40%, 60%, something in that range?

Ian: Yes, a lot of them are more than 40%. Biotech has been very strong. We just closed our fourth biotech gain of more than 50% — all four have come within the past week. It’s been a good run. Biotech is looking like a good place to be too.

In our other options service — Rapid Profit Trader — we just closed a biotech gain of about 45%. We only held it for three days. You can make money really fast when you’re in the right place in the market.

Paul: They say biotech is the poor man’s lottery. It’s been true. I have traded a ton of biotech in my life because you can have incredible, fast gains. You put options on top of that and we’re talking about a 12-engine rocket that can zoom up instantly. 45% in three days is just wow.

If you’re interested in any of Ian’s services, he runs two phenomenal options services: Rebound Profit Trader and Rapid Profit Trader. They have slightly different strategies but they have a common goal to make you money really fast. Check into the description below.

A little market update. What are we seeing?

Ian: We’re recording this Monday. Today the market is making all-time highs. I saw the ETF we track for biotech — XBI — is up 4% today. Biotech is still moving higher. S&P 500 is making all-time highs. The Russell 2000, which is the small- and mid-cap stocks is breaking out. It’s at a 52-week high as well.

It’s looking really good right now. It’s looking really good to close the year out.

Paul: Remember, the way we look at the world 52-week highs are important because it shows confidence, it shows people are pushing money in and they’re willing to pay higher prices for it.

If you like the content you are seeing here on the Iancast, subscribe to the channel, give this video a thumbs up, share it with your friends and comment below on what you’ve been experiencing during this bull market. You can also follow me on Twitter @MampillyGuru.

What’s your Twitter, Ian?

Ian: It’s @IanDyerGuru. Give me a follow.

Paul: That’s what we have for this Iancast for today. Ian, we’ll have another one next week. Ian: Yeah. See everyone next week. Have a great weekend and hope you had a good Thanksgiving. Paul: Same here. This is Paul saying bye.

Regards,

Ian Dyer

Editor, Rapid Profit Trader

0 notes

Link

Story Highlights:

Bitcoin is on track to hit $50,000 as early as next year.

This exchange-traded fund is your best opportunity to buy into the cryptocurrency mega trend that is already trading 27% above the price of bitcoin.

Tesla’s new “Cybertruck” is giving the Ford F-150 pickup a run for its money.

How high will pot stocks rise, now that they’ve hit bottom?

Gold. Silver. Coins. Paper dollars.

If you could line your pockets with any of these valuables, which would be the best choice?

The surprising answer: None of the above.

In fact, blockchain-based cryptocurrencies are becoming the new-world digital money — with bitcoin on track to hit $50,000 to $100,000 by the end of next year.

In today’s Bold Profits video, Paul Mampilly joins me to explain why. And to tell you about the best way you can start investing in this mega trend today before bitcoin surges higher in 2020.

[embedded content]

Click Here to View Full Transcript

Bold Profits Daily November 29, 2019

Paul Mampilly: It’s Paul on the Iancast again. I’m hijacking this permanently.

Ian Dyer: Fine with me. We have good discussions.

Paul: With Market Talk I’m always trying to keep it tight down to three to five minutes. I have a lot of competition between Hudson and Amber. On this one, we’re going to do it long. How about that? Ian: Sounds good.

Paul: Let’s start with dramatic news. You and I never sleep. I know you were up watching Bitcoin hit $6,500.

Ian: The whole time, yes. It bounced. The Bakkt futures we talked about last week, the expiration date came into play there. Bitcoin fell to below $7,000, then it bounced and went a little lower.

Again, around these expiration dates in the futures, all these new Bitcoins are being sent out from the actual futures company to all the investors. It creates an immediate supply that can have an effect on price.

Paul: Long term, I don’t know anybody who would ever want to be short those futures. You’d have to deliver something of a fixed quantity. I remember seeing analysis that something like 30-40% of Bitcoin are being HODLed. Hold on for dear life, that’s what HODL means.

The crypto world has its own language. We have HODL. We have FUD.

Ian: That’s fear, uncertainty and doubt, right?

Paul: Time to lambo for time to move. So 40% of all Bitcoin approximately is being HODLed. I read analysis on The Block, which is a website where they do crypto analysis, that hedge funds are short Bitcoin. This sounds crazy to me.

Ian: Me too. There’s a lot of questions around it. When you look at all these hedge fund managers that are into traditional investments like 60% stock and 40% bonds. Bitcoin doesn’t fit anywhere in there and they don’t know what to do with it. They don’t’ think it will ever overtake gold as a safe haven asset.

There’s a lot of naysayers out there still which is surprising considering it’s survived for 10 years now — almost 11 — and it started out as a fraction of a penny and has grown into a $150 billion asset class all on its own with no promotion other than word of mouth. It’s amazing what it has done so far. It’s an alternative currency.

Paul: Exactly. Both Ian and I are on the record of seeing Bitcoin at much higher numbers. Ian has a $50,000 by end of 2020. Is that right?

Ian: Yes, $50,000 next year and somewhere around $100,000 in 2021.

Paul: I think that’s conservative. I think we might hit $100,000 maybe even by the end of 2020. Here’s why. To me, Bitcoin is the first exponential asset. It runs off a digital mechanism rather than a lineal mechanism which is the stock market, the bond market. In other words, it requires human intervention.

If you think about gold, you have to go dig it out of the ground. There’s a whole process. Bitcoin is completely digital. There’s no physical element to it. It can exponentially grow and it’s already done that. This is why it has so much skepticism because there’s never been an exponential asset in history — this is asset number one. It’s going to be the most valuable.

Ian: There’s never been something like these halving events in any asset before. When the supply is limited by this much on one specific day, that day has a lot of say in the future of Bitcoin. We’ve seen that because after the past few halving events, there’s a gigantic rally by thousands of percent after the supply is cut.

Paul: I went back and modeled the Litecoin halving event to Bitcoin. For sure, it’s setting up to be a minimum of $25,000 to $30,000 the way it models. Most of the people who believe in Bitcoin largely never bat an eye at the volatility. It’s the disbelievers who come to really give us a lot of grief about it.

Ian and I believe in Bitcoin. We think Bitcoin is going to the moon. Everyone can make their own judgment. There is that one indicator that we both track. We should tell people about it.

Ian: A company called Grayscale has their own Bitcoin trust. They own a lot of Bitcoin and sell it as a fraction on the stock market. You can buy shares of the trust backed by Bitcoin. It’s a way of buying Bitcoin on the stock market, which is really interesting and not a lot of people know it exists.

We’ve seen all these headlines and rumors of a Bitcoin ETF, but there already is one and it doesn’t get that much press. It gives us a good indicator because when there’s a lot of bullish or bearish sentiment on Bitcoin you will see the premium of this ETF start to go up or down. Right now it’s trading about 27% above the price of Bitcoin.

The stock market is giving Bitcoin a premium even though it fell 50% in just a few months. That’s a really bullish indicator to me. It’s been as low as 10% and then it bounced from there. Now, like I said, it’s up almost 30% and people are paying a lot more for Bitcoin in the stock market because as of right now more people have stock accounts than crypto accounts.

Paul: It’s a pain to get a crypto account. I have a coin-based account and you probably have one as well, but most people don’t want to deal with that. I can tell you from tracking the Grayscale Bitcoin Trust, at the peak in 2017 the premium was something like 130-140%. Ian: It was more than double.

Paul: At the low about this time last year I believe the premium was something like 3-4%. Right now it’s nowhere near as pessimistic as it was back then so there’s no reason to expect the premium to be as low. I don’t believe it has traded at a discount any time recently.

All signs point to Bitcoin going higher sooner rather than later. I feel like we can leave that one right there and move to the next one. I think we should name the Iancast, “Tesla, Bitcoin and Pot.” Ian: That’s what we talk about. It’s the fastest growing things out there.

Paul: It’s also what most millennials like to trade and are invested in. When I did a Tesla, Bitcoin and pot video for my Tuesday Bold Profits, I got 30 comments. I don’t think I’ve ever received 30 comments on anything before. That’s where people are at.

So let’s deal with Tesla. Cybertruck.

Ian: Yea. Cybertruck. Just to start off, Tesla has never had an advertisement before. They’ve never spent on marketing. It’s crazy the publicity this stuff is getting. Literally everybody was talking about the Cybertruck over the weekend. We both pre-ordered one.

I personally love it. I know a lot of people are really skeptical of the design. I think it’s going to grow on people. It’s a steel truck that’s supposedly bulletproof, although the window did break during the promo.

If you throw a steel ball at any other car window it’s going to go right through the car window. Bulletproof glass breaks. It doesn’t shatter but it breaks like that.

Paul: I follow Elon’s tweets. It turns out, when they hit the sledgehammer against the Cybertruck it cracked the window. That’s why when they threw the ball, it shattered the window. Elon said what they should have done is first throw the ball and then hit the Cybertruck with a sledgehammer.

Then the demo would have worked out fine. But, you know, that’s how it is in life. I think they got $100 million worth of free publicity as a result of the windows breaking because everybody felt like they had to show it.

Ian: Yes. And they have more than 200,000 orders already in the first few days for this truck. Paul: I feel like the truck makers depend on trucks and SUVs. Between the Model Y coming out and now with this, it’s really time. Those companies are going to struggle. Maybe some of the others will end up being a competitor, but for now there’s no competition of any kind for Tesla.

Ian: It even blows the gas-powered pickup trucks out of the water. I drive a pretty good truck and the Tesla can tow more, carry more, has a bigger truck bed and it faster. It’s a super powerful truck. I’ve heard a lot of people say it doesn’t appeal to the kind of market that drives pickup trucks.

They want more power. What doesn’t appeal? I guess the design? I think it will grow on people and I don’t see it as a reason not to buy it.

Paul: My reaction was pretty much what everyone else’s was. I didn’t stay up for the launch, but I woke up and looked at it and then I thought, “Whoa, that’s different.” Then about a minute later I thought, “I really like it.” Then five minutes later I thought, “I need to order one.”

Ian: Same here. I woke up and saw it and thought, “That’s weird. That’s actually what it looks like?” But then it grew on me. It’s going to take time. It’s what everyone imagined future cars would look like 20 years ago and now it’s finally here. I think it’s going to grow on people. It’s kind of iconic.

Paul: I’m watching the reaction on Twitter and people are having a slightly slower version of what we went through. It came out and now they think it’s kind of cool. I think this might be as fast selling as the Model 3. People say it’s only a $100 deposit and it doesn’t mean anything. But 200,000 is a lot of people.

Ian: Even if 90% of them cancel that’s more than $1 billion they’re getting from this already. Paul: You looked this up before we got on. What’s the short position in Tesla?

Ian: It’s down. It was just 25% a few weeks ago. It’s down to 16% now.

Paul: I have to tell you, in my entire 25 years of being on Wall Street I have never known a company as large as Tesla carry such a large short position. This is insane.

Ian: They’re different. Different doesn’t appeal on Wall Street. Everyone wants to think the same way, be safe, not get fired for liking some company that everyone else hates.

Paul: They talk about Tesla stock owners and car owners being a cult, but the people who hate Tesla are also a cult.

Ian: Pretty much. They do have a lot of haters — millions.

Paul: They do. I always keep my Sentry Mode on when I drive my car because I don’t want to run across someone who wants to do something to my car. We like Tesla at Bold Profits. You can also see we had a Tesla at our last franchise meeting and it was a super big hit. Amber gunned it and she loved it. We’re trying to persuade everyone to get one.

We’ve done Bitcoin, we’ve done Tesla, what about pot? I was on last week and the stocks all sold off. Then, boom.

Ian: They’re back. It’s going to be a ride, for sure. That’s how bottoms are. It goes up and down fast. Some of these stocks in the pot sector doubled from their bottom and went up 100% in a couple days. You don’t see that when there’s not some big buyer looming in the background.

There’s going to be buying in these stocks. They are bottoming out right now and they’re going to come back up. It’s going to be great. The market is so bearish on these stocks right now because they’ve gone down so much for months. It’s the classic selloff we’ve seen where the end is the worst part. It’s like that with anything in the stock market.

Paul: This is so true, Ian. You are absolutely right. Most people — I’m included in this, I’ve never had perfect timing — start buying probably a month too early. Then they underestimate how much that last drop is going to be. That’s where they get shaken out and they sell.

It’s also where they get emotionally blown out. They are not going to come back. Then they end up missing it.

Ian: They are the ones who push it up at the end toward the bubble phase.

Paul: That’s right. Then they come at the end and signal the very top. I’m going to guess just by the sharpness of the move in the ETF MJ, Canopy, Cronos and Aurora, that there’s a combination of short covering as well as actual long buying going on.

Ian: Yes. Some of these went up 100% in a couple days and a lot of them went up at least 40% in the first initial bounce.

Paul: In my experience, when you have the sharp, off-the-bottom jump of 40-50% it means there’s actually a big buyer. A strong hands buyer that is going to own and is signaling they are going to buy more. This is why market makers keep lifting the price up to find sellers who are willing to sell.

In my experience that’s a good sign. We’re bullish on pot and we have it across a ton of our services. Did you end up putting on that trade for the pot company?

Ian: We did. In Rebound Profit Trader we have a pot trade. We’re probably going to do another one very soon. We’re bullish on that. In Rebound Profit Trader the goal is to get stocks at the bottom and buy call options on them, which go up faster than the stock. You can make hundreds of percent in just a few days by doing that if you time it right.

Here at the bottom of the pot crash we think it’s a really good time to buy calls on these beaten down pot companies.

Paul: We were chatting before on Slack and you said we had eight 60% winners in Rebound Profit Trader? I forget the numbers.

Ian: We’ve had 10 winners in the past month.

Paul: 40%, 60%, something in that range?

Ian: Yes, a lot of them are more than 40%. Biotech has been very strong. We just closed our fourth biotech gain of more than 50% — all four have come within the past week. It’s been a good run. Biotech is looking like a good place to be too.

In our other options service — Rapid Profit Trader — we just closed a biotech gain of about 45%. We only held it for three days. You can make money really fast when you’re in the right place in the market.

Paul: They say biotech is the poor man’s lottery. It’s been true. I have traded a ton of biotech in my life because you can have incredible, fast gains. You put options on top of that and we’re talking about a 12-engine rocket that can zoom up instantly. 45% in three days is just wow.

If you’re interested in any of Ian’s services, he runs two phenomenal options services: Rebound Profit Trader and Rapid Profit Trader. They have slightly different strategies but they have a common goal to make you money really fast. Check into the description below.

A little market update. What are we seeing?

Ian: We’re recording this Monday. Today the market is making all-time highs. I saw the ETF we track for biotech — XBI — is up 4% today. Biotech is still moving higher. S&P 500 is making all-time highs. The Russell 2000, which is the small- and mid-cap stocks is breaking out. It’s at a 52-week high as well.

It’s looking really good right now. It’s looking really good to close the year out.

Paul: Remember, the way we look at the world 52-week highs are important because it shows confidence, it shows people are pushing money in and they’re willing to pay higher prices for it.

If you like the content you are seeing here on the Iancast, subscribe to the channel, give this video a thumbs up, share it with your friends and comment below on what you’ve been experiencing during this bull market. You can also follow me on Twitter @MampillyGuru.

What’s your Twitter, Ian?

Ian: It’s @IanDyerGuru. Give me a follow.

Paul: That’s what we have for this Iancast for today. Ian, we’ll have another one next week. Ian: Yeah. See everyone next week. Have a great weekend and hope you had a good Thanksgiving. Paul: Same here. This is Paul saying bye.

Regards,

Ian Dyer

Editor, Rapid Profit Trader

0 notes

Text

Why Louisville fired Bobby Petrino and should hire Jeff Brohm

Petrino’s Cardinals didn’t win enough when they had Lamar Jackson, and they cratered after he left. Fortunately, there’s an ideal replacement candidate out there.

To no surprise, Louisville is firing football coach Bobby Petrino, according to Yahoo Sports.

Breaking: Louisville has fired Bobby Petrino, effective immediately. Story to come on @YahooSports