#MarketShare

Explore tagged Tumblr posts

Text

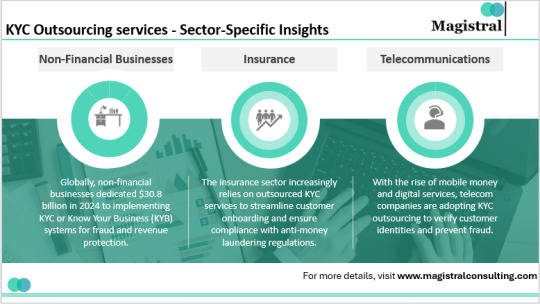

KYC Outsourcing Services: Boost Efficiency & Reduce Costs

#magistralconsulting#kyc#operationoutsourcing#financialservices#marketshare#sectorspecific#northamerica#europe

0 notes

Text

0 notes

Text

Intel Out of the Top 10? Ryzen 7 9800X3D Dominates CPU Sales

A new CPU sales report shows AMD's Ryzen 7 9800X3D in the top spot, with Intel processors conspicuously absent from the top 10 rankings.

0 notes

Text

Property and Casualty Insurance Market size at USD 1,845.5 billion in 2023. During the forecast period between 2024 and 2030, BlueWeave expects Global Property and Casualty Insurance Market size to grow at a significant CAGR of 8.29% reaching a value of USD 2,987.6 billion by 2030. Global Property and Casualty Insurance Market is propelled by various factors including increasing frequency and severity of natural disasters, expanding urbanization driving demand for coverage, regulations mandating insurance coverage, and technological advancements enhancing risk assessment. Also, growing awareness of the need for insurance, coupled with rising disposable incomes in emerging economies, fuels market expansion. The evolving threat landscape, including cyber risks, also contributes to the market's growth as businesses seek comprehensive protection. Further, innovations in insurance products and distribution channels, along with a focus on data analytics for improved underwriting, contribute to the market's dynamism and sustained development.

Sample: https://www.blueweaveconsulting.com/report/property-and-casualty-insurance-market/report-sample

Opportunity – Increasing Level of Disposable Incomes

The rise in disposable incomes among the thriving middle class across the world is a significant driver for Global Property and Casualty Insurance Market. As individuals experience increased earnings, their ability to invest in insurance products for financial security and asset protection improves. Higher incomes enable consumers to afford premiums for diverse insurance policies to cover their property. The trend is particularly pronounced in emerging markets, where economic growth fuels the demand for comprehensive insurance solutions to safeguard assets.

#Blueweave#Consulting#marketreserch#marketforrecast#marketshare#PCInsuranceMarket#InsuranceIndustry#RiskManagement#InsuranceMarketTrends#MarketResearch#InsuranceGrowth#FinancialServices

0 notes

Text

Bitcoin Dominance Hits 3.5-Year High as Altcoins Struggle Bitcoin's market dominance reaches 58.77%, its highest level since April 2021, as altcoins struggle.

#Bitcoin#BTC#MarketShare#CryptoDominance#AltcoinSeason#BlockchainNews#CryptoTrends#BitcoinUpdate#CryptoMarket#Altcoins

0 notes

Text

How Quick commerce affects Kiranas compared to e-commerce

Sahil Barua, CEO of Delhivery, a leading logistics firm, recently shared his insights on the company's performance and future strategies in an interview with ET’s Pranav Mukul and Samidha Sharma. Barua discussed various aspects of Delhivery’s operations, including the sustainability of rapid delivery models, revenue growth challenges, and market outlooks.

On Delivery Models and Sustainability:

Barua expressed skepticism about the long-term viability of ultra-fast delivery models, such as 10-15 minute deliveries, beyond groceries and fast-moving consumer goods. He predicts that as the costs of these expedited services become clearer, delivery timelines are likely to extend. Delhivery is responding by focusing on 2-4 hour deliveries through a new network of shared dark stores for brands and e-commerce players. Barua emphasized that Delhivery will steer clear of instant delivery services, opting instead for more feasible and sustainable delivery windows.

Revenue Growth and Market Conditions:

Delhivery has faced slow revenue growth recently. Barua pointed out that the company's e-commerce express parcel business is a reflection of current market conditions. The launch of Meesho’s logistics vertical, Valmo, has reduced the overall volume available to third-party logistics providers, although Delhivery has been less affected due to its limited reliance on Meesho. The company is also in the process of renegotiating contracts with clients, which is affecting the speed of volume growth.

Future Focus and Challenges:

Looking ahead, Delhivery’s primary focus remains on its part-truck load (PTL) business. As this segment grows and becomes more efficient, including express shipments, it has contributed to improved profitability. The company has successfully captured market share from both organized competitors and traditional, unorganized sectors. However, the truckload business has encountered challenges due to factors such as elections and adverse weather conditions.

Growth Outlook:

Barua anticipates a volatile but growth-oriented outlook for the next six to nine months. While the company’s performance in July and August has met expectations, predicting future trends in the e-commerce sector remains challenging.

Stock Performance and Market Perceptions:

Delhivery's stock has yet to recover to its IPO price of Rs 487. Barua noted that he cannot offer specific insights into stock price fluctuations but remains focused on guiding the company to serve its stakeholders effectively, regardless of market valuations.

IPO Market Trends:

Barua acknowledged the recent trend of startup IPOs being priced more moderately compared to the high valuations seen in 2021. He views the availability of public markets for startups as a positive development, crucial for fostering innovative enterprises, despite occasional setbacks. He believes that supporting businesses in their public offerings is a wise long-term strategy.

Holiday Season Outlook:

Barua does not expect a dramatic breakthrough in e-commerce growth for the holiday season. While a 23-24% growth rate is unlikely, he anticipates a more modest increase of 15-18%. He highlighted that cost-cutting measures have been critical to ensuring the sustainability of the company, emphasizing that maintaining low costs is essential for long-term viability.

READ MORE

#QuickCommerce#KiranaStores#MarketShare#EcommerceTrends#Delhivery#SahilBarua#RetailTrends#BusinessImpact#RetailMarket#CommerceInsight#news#business#marketing#ceo#entrepreneur

0 notes

Text

#innovation#management#technology#creativity#entrepreneurship#sustainability#inspiration#insights#outbreak#impact#business#businessgrowth#startup#marketsize#marketshare#markettrends#marketgrowth#marketanalysis#marketscopeandopportunity#marketchallenges#marketdynamicsandopportunities#marketcompetitorsanalysis

0 notes

Text

Thị phần là gì? 7 Phương pháp giúp gia tăng thị phần hiệu quả

Thị phần là một khái niệm quan trọng trong việc xây dựng các chiến lược, kế hoạch kinh doanh trong Doanh nghiệp. Xác định đúng thị phần sẽ giúp Doanh nghiệp xác định được vị thế hiện tại của thương hiệu trên thị trường, từ đó có các định hướng phù hợp nhằm củng cố hoặc cải thiện. Hãy cùng Fastdo tìm hiểu thị phần là gì và cách xác định thị phần hiệu quả qua bài viết sau!

0 notes

Text

1 note

·

View note

Link

The Indian subcompact SUV segment continues to be a battleground for automakers, with established players and new entrants vying for market share. May 2024 saw some interesting shifts in the sales landscape, with familiar names dominating the charts while a newcomer showed impressive growth. Let's delve deeper into the key takeaways from the latest sales figures. Maruti Brezza Retains Maruti Brezza Remains King (for Now) Maruti Suzuki's Brezza retained its position as the best-selling subcompact SUV in India for May 2024. However, it's important to note that this victory comes with a caveat. Despite selling over 14,000 units, the Brezza experienced a significant 17.1% decline in sales compared to April 2024. This dip could be attributed to various factors, such as production constraints, increased competition, or a shift in consumer preferences. Nonetheless, the Brezza continues to hold the highest market share (25.57%) within the segment, showcasing its enduring popularity among Indian car buyers. Tata Nexon Maintains Consistent Presence The Tata Nexon, a long-time rival of the Brezza, secured the second spot with over 11,457 units sold. Unlike the Brezza, the Nexon witnessed a slight positive MoM (Month-over-Month) growth of 2.58%. However, its YoY (Year-over-Year) market share dipped by 5.22%, suggesting a potential decline in overall sales compared to May 2023. It's important to note that these figures encompass both the regular Nexon and the electric variant, the Nexon EV. Newcomer XUV 3XO Makes a Splash May 2024 marked the arrival of a significant player – the Mahindra XUV 3XO. This compact SUV, essentially a facelift of the XUV300, witnessed a staggering 149.81% surge in sales compared to April 2024. Mahindra managed to dispatch a commendable 10,000 units of the XUV 3XO in its first month, immediately grabbing a sizable chunk (18.02%) of the subcompact SUV market share. This impressive performance indicates that the XUV 3XO has resonated well with Indian car buyers seeking a stylish and feature-packed option. Familiar Faces Round Out the Top 5 The Hyundai Venue, another established name in the segment, maintained a steady sales performance with over 9,300 units sold. While this figure is slightly lower than the Venue's average sales for the past six months, it still signifies continued consumer interest in this well-rounded option. Kia's Sonet also occupies a strong position, exceeding 7,000 units sold in May 2024. Although its MoM sales dipped by 5%, Sonet's performance remains consistent with its average sales figures from the past half year. Nissan Magnite and Renault Kiger: A Mixed Bag The Nissan Magnite witnessed a slight decline in MoM sales, managing to sell over 2,200 units in May 2024. However, it retains a decent market share of 3.98%. Renault's Kiger, on the other hand, continues to struggle, selling less than 1,000 units last month. This translates to a meager 1.53% market share, indicating the need for Renault to potentially reassess its strategy for the Kiger in the Indian market. Looking Ahead: A Dynamic Market The Indian subcompact SUV segment is a fiercely competitive space, with automakers constantly innovating and refining their offerings. While Maruti Brezza holds the crown for now, the significant MoM growth of the XUV 3XO suggests a potential shift in the balance of power. Additionally, consistent performers like Nexon, Venue, and Sonet demonstrate their enduring appeal among consumers. This dynamic landscape signifies that Indian car buyers have a wealth of options, and automakers must continually adapt to stay ahead of the curve. FAQs Q: Which subcompact SUV emerged as the top seller in May 2024? A: Maruti Brezza retained its position as the top-selling subcompact SUV in May 2024. Q: How did Tata Nexon perform in terms of sales? A: Tata Nexon secured the second position with consistent sales, although its YoY market share decreased. Q: What factors contributed to Mahindra XUV 3XO's success in its debut month? A: The Mahindra XUV 3XO witnessed a surge in sales due to consumer interest in the facelifted model. Q: Did Hyundai Venue experience any significant changes in sales? A: Hyundai Venue maintained steady sales performance, reflecting its brand reputation for quality and reliability. Q: Which subcompact SUV faced challenges in maintaining sales momentum? A: Nissan Magnite and Renault Kiger experienced declines in sales, indicating challenges in sustaining market traction.

#hyundaivenue#Indianautomotivemarket#kiasonet#MahindraXUV3XO#marketshare#markettrends#MarutiBrezza#MarutiBrezzaRetains#monthlysalesdata#NissanMagnite#RenaultKiger#salesperformanceanalysis.#subcompactSUVsales#tatanexon

0 notes

Text

Carrefour Takes Stand Against Price Hikes, Pulls Popular Snacks from Shelves #Carrefour #customerloyalty #distributionchannels #Doritostortillachips #Layspotatochips #marketshare #PepsiCoproducts #pricehikes #pricingissues #retailer #revenue #supplier

#Business#Carrefour#customerloyalty#distributionchannels#Doritostortillachips#Layspotatochips#marketshare#PepsiCoproducts#pricehikes#pricingissues#retailer#revenue#supplier

0 notes

Text

Mortgage Origination Outsourcing: Boost Operational Efficiency

0 notes

Text

0 notes

Text

The Financialization Of Essentials

During a cost of living crisis, which many in the world are now experiencing, it is easier to get in touch with the essentials necessary for living. Food, shelter, and energy are the essential ingredients for survival in our modern worlds. The financialization of essentials by capitalism is proving to be at cross purposes for those trying to survive in a cost of living crisis. What do I mean by this? The march toward a consumer society has meant that all these basic requirements of life are things you have to buy. Few of us go out and dig up or hunt for our food these days. Putting a roof over our head is an expensive purchase in the 21C. Plus, all of our devices and vehicles run on forms of energy which we have to buy. Neoliberalism promised to make things easier and cheaper for all in this regard but has manifestly failed to do so. We were told that if governments got out of the way and let private enterprise do what it’s best at we would all be much better off. Thirty years of this, ‘the market knows best’ ethos, has placed at least a third of working Australians in dire straits when it comes to affording the basics of life. Neoliberal economic policies have failed us in every essential market. Photo by Michael Burrows on Pexels.com

Food Prices In An Uncompetitive Grocery Sector Downunder

Let us begin with food. Australia has a celebrated duopoly in our grocery sector. Coles and Woolworths control some 65% of this market, which means most Aussies are buying their food from these two supermarket companies at their many stores around the nation. Prices have gone up, up, and up over the last 2 years in every category. High inflation globally has been the major cause of this, apparently. Shopping trolleys half full of food and groceries now cost hundreds of dollars at the checkout. Australia has no price controls, rather it leaves it to what the free market consumers are prepared to pay. However, in economics it is understood that if suppliers have a monopoly or duopoly, which means there is little or no competition in supplying that market, they can then set the price and the consumer just has to pay it. The power in that transactional relationship has shifted to the seller away from the buyer. Competition is an integral part of a functioning free market system. If most economists and people with a basic understanding of how free market economies work know this, why have we ended up with a non-competitive food and grocery sector in Australia?

The Free Market Economy Rigged In Favour Of Big Businesses

Power imbalances and louder voices closer to governments and decision makers within the system, is the simple answer. The supermarket sector is not the only non-competitive market we have in Australia. Oh no, it is, in fact, a common theme running through all of our markets and sectors. This is despite the fact that we have had something called the ACCC, the Australian Competition & Consumer Commission, specifically created to enforce and maintain competition in our business sectors. Complete and utter failure could be words employed to describe their efforts over the last 30 years. In all fairness to those appointed to run this agency it has been undermined and underfunded by successive governments in thrall to powerful business interests. It is but another toothless tiger amid many in the regulatory sphere in Australia. We like to establish such bodies and give them high falutin titles but ensure that they have no real power. This is the underhand card trick performed by those in government who want to be seen to be doing something without upsetting the established status quo. In reality, the big end of town, Corporate Australia, goes about its merry way merging and acquiring its competition to make ever more money for its investors. Coles in its latest half yearly profit is delivering 30% ROI and generating billions along the way. “The ACTU calls on Coles to reduce its prices following today's announcement of its half-yearly profit of $594 million. The profits generated on items increased, with underlying gross margins up by 7bps to 26.6% and its EBIT margins up since pre-pandemic.” - (https://www.actu.org.au/media-release/coles-should-drop-prices-after-594m-half-year-profit/#:~:text=TheACTUcallsonColes,marginsupsinceprepandemic.) Photo by Pixabay on Pexels.com Canada Has The Same Concentration Of Market Share In Grocery Sector Canada has exactly the same problem with an oligopoly of 3 giant supermarket chains controlling their grocery sector. This should not be a surprise because corporations regularly look beyond national borders for CEOs and growth strategies. The real issue is that the unregulated market does not look after everybody, especially when it comes to dealing with the essentials of life. Food is not just another product to be treated as an economic unit. If companies, like supermarket chains, become so dominant within their sector they have moral responsibilities beyond delivering ROIs for their shareholders. If they do not realise this themselves, then, governments have to step in. In Australia, we have some 6 official enquiries into this sector, due to what is happening in terms of ordinary citizens not being able to afford to buy food and groceries. However, what will these reviews be able to do? Will they just be more talk fests or can they actually effect positive change? We will have to wait and see. Is Housing Primarily About Shelter Or Wealth Creation In Australia? Shelter or housing is another essential of life and it is big business in Australia and Canada. Again, both countries are in the midst of housing rental crises. Again, the market did not take care of business in terms of providing enough low cost housing for the denizens of each nation. Governments stopped building social housing a couple of decades back and let the market do its stuff. Of course, the market was primarily interested in high returns from high cost housing and apartments. In fact, they were rapidly converting existing low cost housing into high cost housing. The market wasn’t interested in the group of people who required budget accommodation to fit their socioeconomic needs. Now, we have a real crisis on our hands with poor people and families living in tents on the fringes of cities here in Australia. Downunder we have a well patronised governmental blame game, where state governments and the federal government each blame the other for not fulfilling their responsibilities to the people. This has been going for decades and probably centuries. It is easy to be cynical about such things but the bitter truth is that another essential of life, another basic, is not being delivered by those in charge of the ship. Why is this happening? Photo by Josh Hild on Pexels.com Finance & Business Concerns Driving The Bus Governments listening to those solely motivated by making large amounts of money. Business people, often, go around thinking and acting as if their pursuits are the only really important thing in the world. We live in a capitalist free market economy and business turns the wheels that make everything work, according to many with an MBA. In actual fact, there are other considerations which need to be factored in to make a modern society function optimally. Economics has ruled the roost over the last 50 years to the detriment of other considerations. The neoliberal economic approach has had the ear of governments across the globe for much of that time. Prior to the 1970s and 1980s governments used to think that they had a moral duty to look after the poor and those unable to look after themselves. A shift happened, which came from the Rand organization during the JFK administration in the United States. Economic studies became the preferred way of looking at everything governments had to do. Everything had a dollar value and this slowly began to change the way we thought about helping others and seeing the world. This economic filter promised to provide dispassionate scientific truth rather than assumptions built on sentiment. In actual fact, economics is not a real science, no matter how hard economists wish it be otherwise, and it is predicated on plenty of assumptions of its own. The upshot of this is that economics became the lingua franca and didn’t the commercial world love that – now you’re talking my language! The financialization of essentials has occurred at pace over the last few decades. Photo by Binyamin Mellish on Pexels.com Property Price Inflation- Yeah We Love That! What is housing primarily for? Ask yourself this. In Australia, the property market has been out of control since former PM John Howard delivered the capital gains tax discount on the family home. Inflation in this sector has been running hot ever since at around 325% over the last 30 years. However, we don’t call it that when it comes to the property market. No, everybody wants the value of their property to go up, up and further up. Buying a house now costs near on average of a million dollars. My parents bought a house in an average suburb in Perth for $30k in the late 1970s and this same house with little done to it but a few licks of paint sold for just under that million mark 4 years ago. Many young home buyers can no longer afford the deposit to get a home loan from our heavily concentrated banking sector. The big 4 banks, they call them, have swallowed up all their competition. Indeed, ANZ knocked back by the ACCC initially, was just granted permission by a court to swallow Suncorp, one of the very few remaining smaller banks. It is hard to justify this decision in the highly concentrated Australian banking sector if anyone in charge was really serious about valuing competition. Is housing primarily about providing shelter or is that an outmoded idea in this day and age? Housing is the biggest financial element within the domestic Australian economy – “The total value of residential dwellings in Australia rose by $261.0 billion to $10,267.4 billion this quarter.” - (https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/total-value-dwellings/latest-release) Photo by David Peterson on Pexels.com Providing shelter from the storm for poor people and those in need seems a puny consideration amid such a large number of dollars in value for homes in Australia. It is like the game of life is a board game, but with real money, Monopoly, perhaps? A third of the nation already own at least one residential property and many within that cohort own multiple houses. Our members of parliament, in the majority, are home owners and many of them are landlords too. It seems to me that if you did not realise that you were supposed to be playing this board game you are now at a distinct disadvantage economically. Some pundits talk of a 2 speed economy in Australia, where the crucial divide is predicated on property ownership. This divide between rich and poor has accelerated immensely since the Howard capital gains tax discount effect came in to play. Alan Kohler, the ABC financial journalist penned an excellent essay on this topic just recently. “High-priced houses do not create wealth; they redistribute it. And the level of housing wealth is both meaningless and destructive. It’s meaningless because we can’t use the wealth to buy anything else – a yacht or a fast car. We can only buy other expensive houses: sell your house and you have to buy another one, cheaper if you’re downsizing, more expensive if you’re still growing a family. At the end of your life, your children get to use your housing wealth for their own housing, except we’re all living so much longer these days it’s usually too late to be useful. And much of this housing wealth is concentrated in Sydney, where the median house value is $1.1 million, double that of Perth and regional Australia.” - (https://www.quarterlyessay.com.au/essay/2023/11/the-great-divide/extract) Photo by Monstera Production on Pexels.com Banking Oligopoly In Australia So Profitable Our banks in Australia are among the most profitable in the world. The big 4 regularly make profits in the tens of billions of dollars. Large parts of this are down to lending money on home loans for investors. The financialization of shelter is an exceedingly profitable business in Australia. “AUSTRALIA - A record breaking year for Australia’s major banks saw cash earnings soar to an unprecedented $32.5bn, eclipsing the record last set in 2017 ($31.2bn). This was due to the combination of healthy balance sheet growth and Net Interest Margin (NIM) uplift, with net interest income rising by a never-before-seen $9bn. As notable expenses continue to fall, the result could have been higher, if it weren’t for normalising levels of credit expense and inflationary impacts on costs. “ - (https://www.pwc.com.au/media/2023/major-banks-deliver-record-profits.html) Our central bank, the Reserve Bank of Australia (RBA), has been steeply raising interest rates on the cash rate over the last 2 years in a bid to dampen demand within the economy and rein in inflation. This monetary policy lever is the preferred means of managing inflation within national economies globally. Of course, it also delivers much increased revenue to banks and the government during the period of higher interest rates. It seems in our system those closest to the controls never lose out no matter the fluctuations within the economy. It is a rigged game for those of us standing on the fringes or unaware we were playing the game in the first place. “Some businesses are using the “cover” of high inflation and a lack of competition to push up prices, Reserve Bank of Australia governor Michele Bullock has said. The so-called price-gouging asserted by the Greens and former head of the competition regulator Allan Fels meant it was important to reduce inflation to the RBA’s 2 to 3 per cent band, to make it harder for firms to push up prices, Ms Bullock said.” - (https://www.afr.com/policy/economy/inflation-is-cover-for-pricing-gouging-rba-boss-says-20240215-p5f58d#:~:text=Somebusinessesareusingthe,governorMicheleBullockhassaid.) The Governor of the RBA has finally come out and admitted price gouging has been going on under the cover of high inflation by Australian businesses amid the lack of competition within our markets. Neoliberal Privatization Promised Cheaper Prices Back in the 1990’s we were promised that the privatization of public utilities would deliver cheaper power prices via the neoliberal economic policies embraced by the LNP and Labor governments. Of course, this has not happened, although some Australian business people have become very wealthy through the privatization of public assets. We have wholesale energy markets setting prices for the generation of electricity in states around the nation. The energy sector is facing the demands of global warming and the need to transform, away from a dependency on fossil fuels like coal. Power stations are ageing and having to be phased out. Solar rooftop has been the runaway success story; after a late start thanks to politicians captured by the money and influence of the coal lobby. We still hear more about the doom and gloom of an uncertain future with renewables because the corporate media oligopoly is also controlled by vested fossil fuel interests via their advertising spend. The mineral lobby is a powerful entity in Australia, as we can see by the fact that they are so lightly taxed by our governments in comparison to other resource rich nations like Qatar and Norway. “And if you don’t believe those decisions make a difference, just consider the fact that in Norway, they tax the fossil fuel industry and give kids free university education, in Australia we subsidise the fossil fuel industry and charge kids a fortune to go to university. Indeed, the Commonwealth collects more revenue from HECS fees than it gets from the Petroleum Resource Rent Tax. Choices matter.” - (https://australiainstitute.org.au/post/richard-denniss-national-press-club-address/) Values matter and the decisions made by our leaders tell the story. Australia values those that dig up the rocks more than the minds of our children, who are our future. Rocks run out and we should derive as much revenue and taxes as possible whilst we have them. At the same time, we should provide the best education possible for our kids and make it as accessible as possible to all of them wherever they live around the nation. We need political leaders who are progressive rather than stuck in the past. The world is forever changing and we are challenged to keep up and meet the demands of that ever changing world. Read the full article

#ACCC#Australia#consumers#economics#financialization#highinflation#lackofcompetition#marketshare#neoliberalism#pricegouging#RBA

0 notes

Text

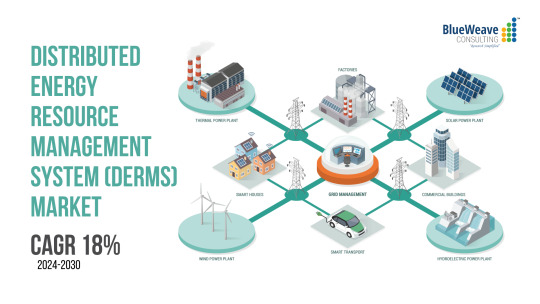

Distributed Energy Resource Management System (DERMS) Market size by value at USD 0.3 billion in 2023.During the forecast period between 2024 and 2030, BlueWeave expects Global Distributed Energy Resource Management System (DERMS) Market size to expand at a CAGR of 18% reaching a value of USD 1.0 billionby 2030. Global Distributed Energy Resource Management System (DERMS) Market is driven by the increasing adoption of renewable energy sources, the growing need for grid reliability and resilience, and advancements in energy storage technologies. Regulatory mandates for carbon emission reductions and incentives for distributed energy resources further fuel market growth. Rising electricity demand, coupled with the integration of smart grids and IoT technologies, supports efficient DER management. Additionally, the proliferation of electric vehicles (EVs) and microgrid solutions enhances DERMS adoption.

Sample: https://www.blueweaveconsulting.com/report/distributed-energy-resource-management-system-market/report-sample

Opportunity – Grid Modernization and Integration of DERs

Global Distributed Energy Resource Management System (DERMS) Market is driven by the modernization of electricity grids and the increasing adoption of distributed energy resources (DERs) like solar panels, wind turbines, and battery storage. Utilities and grid operators are deploying DERMS to optimize grid stability and efficiency amid the growing complexity of managing decentralized energy sources. The transition supports the integration of renewable energy, enhances grid resilience, and enables real-time monitoring, addressing the evolving needs of modern energy infrastructure.

#Blueweave#Consulting#marketreserch#marketforrecast#marketshare#DistributedEnergy#EnergyManagement#SmartEnergy#RenewableEnergy#SustainableEnergy#EnergyMarketTrends#MarketResearch#CleanEnergyFuture

0 notes

Text

A Tale Of Joy In Adversity: Fanta's Bubbling History

Fanta, with over 100 flavours and a vast fan base, stands as one of the world’s most popular soft drinks. However, were you aware that Fanta emerged out of necessity and innovation during World War II? And that it has a fascinating and controversial history that spans decades and continents? In this blog post, we will explore the origins, evolution, and impact of Fanta – A Tale of Joy! Pic:…

View On WordPress

#BeverageTrends#Blog#BlogPost#BrandAwareness#BussinessWars#CarbonatedDrinks#Cocacola#Colawars#ConsumerPreferences#Fanta#FantaFlavours#FantaHistory#GlobalBeverages#MarketShare#PersonalBlogs#ShareTheBlog#softdrinkindustry#StayInformed

0 notes