#Madoff

Explore tagged Tumblr posts

Text

A look behind the scenes at Bernie Madoff’s massive Ponzi scheme, how it was perpetrated on the public and the trail of destruction it left in its wake, both for the victims and Madoff’s family. Credits: TheMovieDb. Film Cast: Bernie Madoff: Robert De Niro Ruth Madoff: Michelle Pfeiffer Frank Dipascali: Hank Azaria Stephanie Madoff: Kristen Connolly Catherine Hooper: Lily Rabe Mark Madoff: Alessandro Nivola Eleanor Squillari: Kathrine Narducci Andrew Madoff: Nathan Darrow Martin London: Steve Coulter Dan Horwitz: Michael A. Goorjian Ostrow: Geoffrey Cantor Michael Schwartz: Jason Babinsky Waitress: Marta Milans Agent Ted Cacioppi: Kelly AuCoin SEC Investigator: Amanda Warren Peter Madoff: Michael Kostroff Reporter: Portland Helmich Upscale Gala Guest: Doris McCarthy David Sheehan: Hamilton Clancy News Reporter: Tommy Bayiokos Reed: Gary Wilmes Club Codette: Cece King Trader: Kelly Aaron Party Guest: Amelia Brain Pinks: Marion McCorry Nicole De Bello: Sophie von Haselberg Driver: Karen Goeller Emily Madoff: Sydney Gayle Photographer / Paparazzi: Vincent Chan Caterer: Adam Butterfield Mike: Razor Rizzotti FBI Agent Kane Partner: Derrick Simmons Visitor: James Brickhouse Kenneth Langone: Ray Iannicelli Florida Fisherman: Guy Sparks Carl Shapiro: Ben Hammer Pool Kid: Ethan Coskay Picard Reporter: Victor Joel Ortiz Federal Agent: Chris LaPanta Daughter: Nicole Scimeca Young Mom: Anthoula Katsimatides Irving Picard: David Little Pierre: Jean Brassard Robert Jaffe: Mark Axelowitz Audrey: Reagan Grella Girl in Pool: Giulia Cicciari Party Guest: Wayne J. Miller Tom FitzMaurice: Neil Brooks Cunningham Palm Beach Party Guest: Lori Burch Bartender: Christine J. Carlson Inmate Gonzales: Sammy Peralta 17th floor Office worker: Ralph Bracco Young Daniel: Eli Golden Ike Sorkin: Mark LaMura Pool Party Guest (uncredited): Robert Levey II BLM Employee: Geoffrey Dawe Film Crew: Producer: Joseph E. Iberti Screenplay: Sam Levinson Executive Producer: Barry Levinson Screenplay: Samuel Baum Screenplay: John Burnham Schwartz Book: Diana Henriques Co-Producer: Amy Herman Original Music Composer: Evgueni Galperine Casting: Ellen Chenoweth Director of Photography: Eigil Bryld Editor: Ron Patane Costume Design: Rita Ryack Art Direction: Ryan Palmer Executive Producer: Robert De Niro Executive Producer: Jane Rosenthal Set Decoration: Heather Loeffler Executive Producer: Berry Welsh Co-Executive Producer: Jason Sosnoff Original Music Composer: Sacha Galperine Production Design: Laurence Bennett Sound Re-Recording Mixer: Skip Lievsay Movie Reviews:

0 notes

Text

MADOFF: The Monster of Wall Street

It was such a good documentary. Not too long, not too short.

I would have liked to understand better the fraudulent operation behind that scheme.

Honestly, people are as guilty as Bernie Madoff, they are just so so greedy. How can someone even believe to have 100% return without any loses.

And the institutions are as guilty as him too.

I really felt sorry for the mathematician, Markopolos who knew that Madoff was a fraud and did everything to show it, but no one believed him, until it was too late.

Some people are just too stupid.

Worst JP Morgan Chase "acknowledged a lack of oversight in monitoring Bernie Madoff's bank transactions, but the company claimed that no employee knowingly assisted in the fraud."

Some quotes :

"- And the choice he made was, he could live with himself as a liar much more easily than he could live with himself as a failure." (Episode 1)

"- He's both Bernie's savior, if you will, and Bernie's deep, enraging enemy, because Bernie, as the ultimate control freak, has allowed somebody to basically control him." (Episode 2)

"- For what Madoff needed to reassure his investors. Even before Madoff himself knew what he needed." (Episode 2)

"- A white-collar crime is different than a blue-collar crime. A blue-collar crime, the bodies drop before you investigate. And a white-collar crime, they drop afterwards." (Episode 4)

"- He chose, the methodology of death that he did, a painful solution, to atone for his sins of omission." (Episode 4)

"- Why would anybody trust me to give me business? Turn their money over to me? But the first thing I learned: Whatever you do in this business, never break your word. Your word was your bond, literally, and that was it. You trusted everybody. But nothing in this industry is what it looks like." (Episode 4)

"- People knew not to ask too many questions. If you're getting good returns and you're getting lots of money, and you're not to as any questions, you don't ask any questions. And, you know, greed has a way of doing that to people." (Kotz - Episode 4)

"- JP Morgan Chase has pled guilty to five massive criminal conspiracies involving billions of dollars within the last six years. When they get caught, they're never required to disclose the profits they made on the scheme. They just pay a fine and they go on." (Episode 4)

"- You know, my dad's crime... it killed my brother quickly and it's killing me slowly." (Mark Madoff - Episode 4)

"- Noted psychiatrists that I talked with about Madoff's case hypothesized that what Bernie was grieving was the loss of his family's adoration. It was not so much that he loved them as that he loved having them love him. Which is, of course, pure narcissism and pure sociopath." (Episode 4)

"- And the price of trusting anyone is that they can betray you liked that." (Episode 4)

"- People want to believe in good returns without downside risk. Everybody wants that in their portfolio, but they're chasing the Holy Grail. The Holy Grail doesn't exist in real life, nor does it exist in finance." (Markopolos - Episode 4)

#madoff#bernie madoff#the monster of wall street#madoff the monster of wall street#documentary#netflix

0 notes

Text

I can feel a new autistic little special interest forming.

Bad news; it's an interest in corporate fraud.

#brieuc.txt#Crazy how much money people can get away with by using the simple tactic of lying#I've watched multiple FTX documentaries today and I am fascinated by it#I've been reading so many articles on Binance's recent struggles and now I'm going back to older frauds like Madoff and Enron

18 notes

·

View notes

Text

do you guys want to recommend me books. i'm currently being mildly bored by a popular history of the plantagenets + exhausted my reread of the miss marples i didn't remember that acutely rn + dnf'd a guy gavriel kay + temporarily oversaturated myself on nicola griffith

#unfortunately this kind of does comprehensively cover my taste except for the bit that thinks the tell-all memoir by the guy who#originally did a bunch of fiddly investigative math to identify the madoff ponzi scheme and then got mad because his boss was#trying to get him to replicate ponzi scheme returns with an actual financial algorithm#is one of the best books i've ever read.#so. you know. if that helps you triangulate.#box opener#i don't think this will help.#was the sequel to children of time good? were the human-focused parts less grindingly unfun by comparison than in CoT?#if so maybe i'll try that.

19 notes

·

View notes

Text

had a caption idea called “ring around the ponsie” but that….

…..that doesn’t sound quite right 🤔

#let’s all dance around bernie madoff woo hooooo~ 💀#ramblin but not a gamblin man#i might still use it tho cuz im /me/#ごめんなさい草彅さん#your nickname is too damn good at subbing into words 😔

2 notes

·

View notes

Text

@swankytigre is currently comparing me to bernie madoff and idk why??

2 notes

·

View notes

Text

YES! Start in Toronto...

#I ❤️ Francesca Albanese

#palestine#palestinians#israeli apartheid#israeli occupation#genocide#gaza#war crimes#justice#icj ruling#end the occupation#illegal settlements#illegal occupation#illegal annexation#securities fraud#arms dealing#swiss bankers#russian oligarchs#toronto#holy blossom temple#canadian madoff#lantzmen#decolonization#free palestine#free gaza#un report#bronfman#cija#mega group#sy jacobson

3 notes

·

View notes

Text

youtube

PEGA NA MENTIRA! CINCO FILMES QUE MOSTRAM QUE A MENTIRA TEM PERNA CURTA PRA VER NO STREAMING!

#april fool's day#dia da mentira#emma stone#easy a#helen mirren#jim carrey#liar liar#liar#lies#lie#mentiras#mentira#die flascher#the wizard of lies#robert de niro#bernie madoff#the good liar#ian mckellen#Youtube

2 notes

·

View notes

Photo

Midwest solidarity with eastern Europe.

From Kansas, moves to Boston for grad school, ended up at some dinner party at a profs house. A distinguished looking woman comes up to me and we start chatting. Turns out she is the one who funded my scholarship. Dope.

Then she asks me if it was hard reading where I grew up.

I, deeply confused, ask, "what do you mean?"

She responds, patiently, "well, with not having electricity it must have been difficult to make time to read for your classes during the day."

....and bc I am more Hob than I would like at times, I take her on a FUCKING RIDE.

I'm talking about saving up for candles and how supportive my family was letting me borrow the horse on the weekend to go to the library. I'm talking about breaking ice on the homestead for the cattle and to have water to make coffee. How tough it was during harvest having to work the fields all day, put down the horses at night, and then catch up on classes.

And she ate up every. Single. Word.

Like, she was in it.

She also told me at the end of the conversation that I "wasn't as stupid as your accent makes you sound."

Anyway, thanks for the money or whatever, I hope you choke on the tax write off, and just because you've never been to a place doesn't mean that the world doesn't exist there.

Ta da!

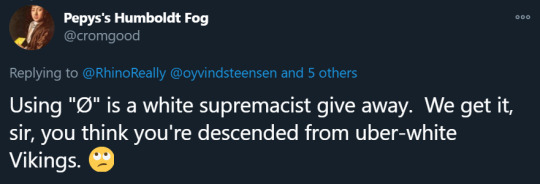

meanwhile on twitter

#so i am maybe still a bit bitter about that#i didnt have enough money for both food and rent and was teaching without getting paid#and she wanted me to lick her boots for the pittance she gave me#and then have the gall to call me the moron#jokes on her#i did nothing with the degree#donated nothing to the university#and she lost almost all her money to bernie madoff#WINNING

159K notes

·

View notes

Text

The “elites” are so much more sophisticated than the “peasants”. They deserve MORE freedom. Laws should not apply to them, only poor people and people who get rich off scamming rich people.

0 notes

Text

The love of money: Part 1

Bernie Madoff

#financialfreedom#financial services#financial crime#financial crisis#bernie Madoff#money#old money#wealth#wealth management#money in the bank#money transfer#skrilla#make money online#sean almond#fantasy books#fiction book#library aesthetic#library#kindle books#books and coffee#books and reading#books and literature#coffee aesthetic#stock market#stock trading#seedsofadream#seeds of a dream#sean almond author#seanalmondauthor#seanalmond

0 notes

Text

yeahhhhh pretty much, except the only thing is it's less individual investors and more Hedge Funds.

Hedge funds use algorithms to maximize profits by any means necessary, up to and including certain tactics that will deliberately tank a stock. If it's not performing well or if they just don't want it to, they can bet against it and whip out a variety of bullshit of varying legality to push the share price down, which causes other HFs to sell to stay ahead of the market, which leads portfolio managers and accountants and regular folks to sell, and then when the selloffs are done the original HFs make fucking bank off strangling the stock. (This also works in reverse: betting a stock will rise, baiting others to buy in, profit, then bet against it again)

So a "strong" company is one with lots of gains and very few/short losses (harder to break/less room to manipulate, generally Big Name stocks like Disney/Apple/etc) whereas a "weak" company with more losses than gains or lots of volatility is a prime target for the piranhas. The people running companies are terrified of stagnation, let alone losses, because it can very, very easily be taken advantage of and even outright kill the company in just a few weeks or months. Perpetual growth is virtually required to survive the market as it is today.

Individual, casual/hobbyist investors with at most a couple dozen shares in a handful of companies don't have the numbers/margins to seriously affect a stock price. Even hobbyist/semipro "traders" who obsess/hoard and attempt to imitate The Big Guys are comparitively few in number and just don't have the weight to affect much more than their own account balance. But hedge funds do have MASSIVE weight in the market, throwing around thousands of shares at a time, several times a day, for dozens of different tickers, in multiple markets and across multiple industries.

And then there are "market makers." These are giant companies whose SOLE purpose is to manipulate the market ensure "market liquidity," or, "a buy for every sell, a sell for every buy." What this means is that if demand is high but there aren't enough shares available to sell, they make more by "borrowing" them, potentially infinitely. If these market makers feel a stock is too "overvalued," they can dump loads of those borrowed shares to saturate the market and drive the price back down. There is extremely little regulation on this, which leads to situations where the same one share can have dozens or hundreds of "owners."

This can happen because regular everyday investors don't actually "own" stock at all. Like, very literally, their "shares" are 1) not real and 2) can be liquidated by their brokers at any time, because, as the go-between third party, their brokers own the shares "on their behalf," and brokers essentially just "deliver" digital IOUs. All Actual Real Shares are held in the DTCC by a company called Cede & Co, and everything else is traded on credit.

If you buy a "share" in a company through a broker, it's not your name on the company shareholder list, it's your broker's. If you're submitting paperwork to your broker for voting for that company's policies at their annual meeting, your broker is pooling aaaaall the votes and "proportionally" voting "on your behalf." And your broker can decide to lend out your shares without telling you (to their own profit) and you may or may not ever get them back -- this is called "failure to delivers" or FTDs and there is a massive backlog of them that just ... never get addressed.

this is hella over-summarized and sloppy but the tl;dr is that supply and demand economics are beyond broken, the entire stock market is more fake than you ever imagined, it's propped up entirely by computer programs trading IOUs-of-IOUs-of-IOUs, and is easily manipulated at the literal whim of bank-and-billionaire proxies.

companies really have got to be okay with stagnant profits. what is wrong with earning the same amount every year? why does it always have to be more? it's not sustainable. there are only so many people on the planet you can profit from 😭

#stock market#it was a hyperfixation i try to forget#but sometimes i ... cannot#it still makes me so ANGRY#its a bernie madoff wet dream#and there is just SO MUCH INFO to try and organize and communicate#like i could prob make a nice masterpost with a cpl days of prep#but i rly can't right now bc irl stuff#and i shouldn't#BUT IM SO TEMPTED#a great primer tho is Jon Stewart's episode on Dark Pools#anyways#rambles#FUCKING STOCK MARKET AAAAAAAA#financial law enforcement can take YEARS and fines are often LESS THAN 5% OF PROFITS FROM THE CRIME#and they reversed the last charges from the 2008 crisis#and they're still fuckin DOIN THE SAME SHIT#when it finally implodes its gonna be like. so ungodly bad#it was never supposed to be this#it was supposed to be regular ppl supporting good companies products and employers#until a handful of ppl figured out how to turn it into a terrifyingly efficient money printing game#with a 0% chance of legal consequences#and 'only' like a 5% chance of total economic annihilation via catastropic chain reactive system failure#aaaaaAAAAAAAAAA okay. okay im done#im done im good im... letting go now#going back to normal. i can be done. i can.#sorry

64K notes

·

View notes

Text

Funniest part about Bernie Madoff is that being a soulless bastard got him so far and the thing that ratted him out to his sons was that he was gonna use the last of the ponzi scheme money to give bonuses to all of his employees because he knew they were all gonna be out of a job very soon. I gotta respect him for that one it must be said.

#brieuc.txt#bernie madoff#Dunno why I'm tagging him there isnt a Bernie Madoff fanbase#Or maybe there is. What do I know

3 notes

·

View notes

Text

Building Lives on Lies

The Consequences of Self-DeceptionBuilding a life founded on lies and self-deception often leads to devastating consequences, both for individuals and society at large. A well-known example at the individual level is the story of Bernie Madoff. He built his financial empire on a massive Ponzi scheme involving lies and deception. For years, he maintained false narratives about the stability and…

#Bernie Madoff#Building Lives on Lies#Deception and Ruin#Financial Fraud#personal integrity#Self-Deception Consequences#Societal Impact of Lies#Trust and Honesty

0 notes

Text

De la Ponzi la Madoff și Caritas – O Istorie a Înșelăciunii

Materialul următor îți va oferi o privire detaliată asupra a două dintre cele mai notorii scheme Ponzi din istorie: cea a lui Bernard L. Madoff Investment Securities LLC și mult-discutata schemă Caritas din România.Rămâi până la finalul videoclipului pentru că vom explora cum au fost construite aceste fraude, ce promisiuni au făcut și cum au reușit să atragă milioane de oameni, de la investitori…

youtube

View On WordPress

#Acțiuni#administrare capital#brokeri#Caritas#clasele de active#Cătălin D. Iamandi#Cătălin Daniel Iamandi#dezvoltare personala#dividende#domeniu financiar#educatie financiara#ETF#Falimentul Madoff#Financial Education#Financial Success#finante personale#Fonduri mutuale#independență financiară#investiții#investiții în acțiuni#investiții în ETF#Investing#investitor#motivatie#R-type Evolution#risc-randament#România#română#Schema Ponzi#subtirare

1 note

·

View note

Text

Madoff: The Monster of Wall Street The Price of Trust Joe Berlinger USA, 2023

#Madoff: The Monster of Wall Street#The Price of Trust#Joe Berlinger#2023#2020s#netflix#documentary#docuseries#photoset#title card

0 notes