#Macd indicator

Explore tagged Tumblr posts

Link

Demystifying MACD: Mastering Momentum Analysis

"Mastering MACD Indicator for Informed Trading"

This article unveils the powerful MACD (Moving Average Convergence Divergence) indicator, an essential tool for traders and investors in deciphering market trends and momentum. Developed by Gerald Appel in the 1970s, MACD uses the difference between two Exponential Moving Averages (EMAs) to identify potential shifts in price trends and velocity. The article delves into the key components of MACD – the MACD Line, Signal Line, and Histogram – and provides their respective formulas and interpretations. By highlighting practical applications such as trend following, detecting overbought/oversold conditions, and utilizing various signal crossovers, the article equips readers with valuable insights into making informed investment decisions.

Whether for newcomers or experienced traders, the comprehensive understanding of MACD's components, usage scenarios, limitations, and tips for successful implementation enhances one's technical analysis toolkit, offering a robust foundation for strategic trading.

2 notes

·

View notes

Text

#stock market#stock trading#investing stocks#Macd indicator#earn money online#MACD#best indicator for option trading#option trading#option strategy

1 note

·

View note

Text

Sniper entry Scalper mode on #XAUUSD Gold Signal M1 Timeframe MT4. Non Repaint signals more info in official Website: wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#indicatorforex#forexindicator#forexsignals#cashpowerindicator#forex#forextradesystem#forexindicators#forexprofits#forexvolumeindicators#forexchartindicators#forex trading xauusd#forex indicators volume#forex indicators macd#forex bollinger bands#forex rsi#forex fibonacci

2 notes

·

View notes

Text

Momentum Trading: Forex Trading Strategy Explained

Momentum trading is a strategy that seeks to capitalize on the continuance of existing trends in the market. By focusing on the strength of price movements, traders can make informed decisions and optimize their profits. What is Momentum Trading? Momentum trading involves buying and selling currency pairs based on recent price trends. The core idea is that strong movements in the market tend to…

#Currency Pairs#Divergence#Economic Indicators#Forex#Forex Trading#Leverage#MACD#Market Conditions#Market News#Momentum Trading#Moving Average Convergence Divergence#Moving Averages#Price Movements#Relative Strength#Risk Management#RSI#Stochastic Oscillator#Stop-Loss#Stop-Loss Orders#Take-Profit#Trading Strategy

3 notes

·

View notes

Text

MACD, EMA & Moving Average Ribbon: Ghid Complet pentru Identificarea Trendurilor și Semnalelor de Tranzacționare

MACD, EMA & Moving Average Ribbon: Ghid Complet pentru Identificarea Trendurilor și Semnalelor de Tranzacționare Introducere Indicatorii tehnici sunt esențiali pentru a evalua evoluția pieței și a identifica oportunități de tranzacționare. Trei dintre cei mai utilizați indicatori sunt MACD (Moving Average Convergence Divergence), EMA (Moving Average Exponential) și Moving Average Ribbon. MACD…

#analiza tehnica#strategie de tranzacționare#MACD#semnale de tranzacționare#indicator tehnic#medii mobile#trend#EMA#Moving Average Ribbon

0 notes

Text

Aiming Higher: Uniswap's UNI Token Gathers Steam, Eyes 15% Price Increase

Uniswap's native cryptocurrency, UNI, has recently exhibited a robust bullish trend, surging past key resistance levels at $6.00 and $6.20. The token's ascent above $6.50, accompanied by a 5% growth, has ignited discussions among investors and traders regarding a potential rally toward the $8.00 mark.

The breakthrough of a critical bearish trend line, formerly a stronghold near $6.60, has injected optimism into UNI's market dynamics. The token's steady climb above the $6.75 resistance level signifies its strong upward momentum, with attention now turning to the next significant obstacle at the $7.25 resistance.

As of the latest update, UNI is valued at $6.82, reflecting a modest 0.51% increase in the past 24 hours and a weekly gain exceeding 10%. The ongoing battle between bears and bulls has shaped UNI's price action, with the bulls currently seeking to surpass the resistance at $6.90.

Detailed analysis of UNI's technical indicators adds further weight to its bullish stance. The 4-hour MACD signals a growing bullish momentum, complemented by an RSI firmly above 50, indicative of a robust market sentiment favoring the bulls. The token's consistent performance above the 100 simple moving average further strengthens the positive outlook for UNI's short-term trajectory.

Uniswap's dominance in the Ethereum ecosystem throughout 2023, marked by substantial transaction volume and efficient gas processing, has translated into UNI's notable price movement. A 28% increase following the launch of new initiatives and expansions underscores the platform's influence in the decentralized finance (DeFi) space, contributing to UNI's current upward trajectory.

#UNI token#Uniswap#cryptocurrency#DeFi space#bullish trend#resistance levels#technical indicators#price analysis#UNI/USD#CoinMarketCap#MACD#RSI#Cryptotale

0 notes

Text

Learn How To Combine RSI Reading With Other Indicators For Strong Confirmation

Throughout this article, we will explore how to combine RSI readings with other indicators, including Moving Averages, Bollinger Bands, and Fibonacci retracements.

0 notes

Video

youtube

MACD Trading Tutorial Step-by-Step Guide for Beginners 2023

0 notes

Text

Forex 1-Hour Trading Strategy

You can take advantage of the 60-minute time frame in this Forex strategy. The most suitable currency pairs to trade using this Forex strategy are the EUR/USD, USD/JPY, GBP/USD, and the AUD/USD. In regards to the Forex trading strategies resources used for this type of strategy, the MACD is the most suitable which is available on both MetaTrader 4 and MetaTrader 5.

Buy Trade Rules:

You can enter a long position when the MACD histogram goes above the zero line. The stop loss could be placed at a recent swing low.

Sell Trade Rules:

You can enter a short position when the MACD histogram goes below the zero line. The stop loss could be placed at a recent swing high.

#MACD#histogram#forex indicators#forex system#forextrading#forex strategy#stocks#daytrader#options#investing#bitcoin#cryptotrading#forexmarket#investor#forex#forexbroker#forexsignals#forexmentor#trader

1 note

·

View note

Link

Demystifying MACD: Mastering Momentum Analysis

"Mastering MACD Indicator for Informed Trading"

This article unveils the powerful MACD (Moving Average Convergence Divergence) indicator, an essential tool for traders and investors in deciphering market trends and momentum. Developed by Gerald Appel in the 1970s, MACD uses the difference between two Exponential Moving Averages (EMAs) to identify potential shifts in price trends and velocity. The article delves into the key components of MACD – the MACD Line, Signal Line, and Histogram – and provides their respective formulas and interpretations. By highlighting practical applications such as trend following, detecting overbought/oversold conditions, and utilizing various signal crossovers, the article equips readers with valuable insights into making informed investment decisions.

Whether for newcomers or experienced traders, the comprehensive understanding of MACD's components, usage scenarios, limitations, and tips for successful implementation enhances one's technical analysis toolkit, offering a robust foundation for strategic trading.

0 notes

Text

Here Is A List Of The Most Common Trading Indicators

In trading, an indicator is a statistical measure of market conditions used to forecast price changes. These are some of the most commonly used trading indicators, which are typically available on trading platforms like KuCoin: Simple Moving Average (SMA): An average of the price over a certain number of periods (like days or hours). The formula for SMA is (A1+A2+A3…+An)/n, where A is the asset…

View On WordPress

#ATR#Average True Range#Bollinger Bands#crypto trading#EMA#Exponential Moving Average#Fibonacci Retracement#MACD#Moving Average Convergence Divergence#Relative Strength Index#RSI#Simple Moving Average#SMA#Stochastic Oscillator#trading indicators#Volume Weighted Average Price#VWAP

1 note

·

View note

Text

Forex Trading MT4 0.40 Lots #Sell Trade running #USDCHF. Profits protected with SL. Official Website: wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#cashpowerindicator#forexindicator#forexsignals#indicatorforex#forexindicators#forextradesystem#forex#forexprofits#forexvolumeindicators#forexchartindicators#metatrader4 indicators#metatrader5 indicator#mt4 indicators#mt5 indicators#forex trading profits#forex macd#forex fibonacci#forex price action

3 notes

·

View notes

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we’ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk. 1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Text

What to expect from the stock market this week

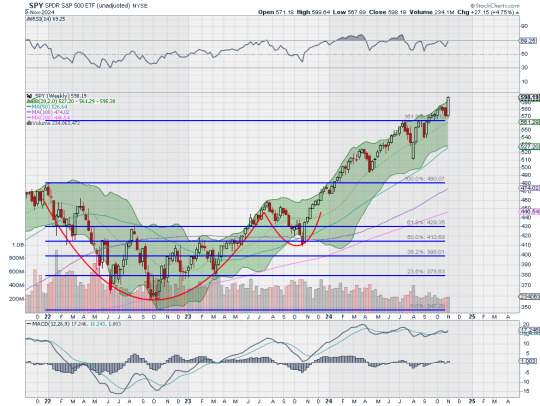

Last week, the review of the macro market indicators saw with October in the books and heading into the election and FOMC meeting, equity markets experienced a Halloween spooking. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) looked to consolidate in its uptrend while US Treasuries ($TLT) pulled back in their consolidation. The Shanghai Composite ($ASHR) looked to continue the short term move higher while Emerging Markets ($EEM) pulled back in their uptrend.

The Volatility Index ($VXX) looked to remain at a neutral level, above the base established this year, and was likely to stay there at least until after the election. This might make for choppy light trading for equity markets to start next week. Their charts looked strong on the longer timeframe though. On the shorter timeframe both the $QQQ and $SPY had reset momentum measures lower and could reverse or turn bearish, likely a couple of days’ time would tell. The $IWM did not seem concerned about an election or Fed policy, churning sideways.

The week saw major movements happen following the election. It played out with Gold pulling back from its high Wednesday before a partial recovery while Crude Oil found some strength and moved higher in a choppy range. The US Dollar jumped to a 4 month high while Treasuries fell back to a 5½ month low Wednesday before a recovery. The Shanghai Composite continued the move to the upside while Emerging Markets chopped in a wide range.

Volatility crashed down to the low end of the range since August. This put a stiff breeze at the backs of equities and they started to move up Tuesday and then accelerated Wednesday through the end of the week. This resulted in the SPY and QQQ printing a new all-time highs Wednesday, Thursday and Friday and the IWM gapping up to a 1 year high. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week at the 50 day SMA on the daily chart in a pullback from the top. It had a gap left open from the end of the week. It held there on Monday and then started higher Tuesday, into the gap. It gapped up Wednesday to finish at a new all-time high and leaving an island below. It followed that up with new all-time highs Thursday and Friday. The Bollinger Bands® are open to the upside. The RSI is rising deep in the bullish zone with the MACD positive and rising.

The weekly chart shows a strong, long bullish candle rising from the 161.8% extension of the retracement of the 2022 drop. The 200% extension is now within view at 614 above. The RSI is rising near overbought territory in the bullish zone with the MACD drifting up and positive. There is no resistance above 599.60. Support lower sits at 585 and 580 then 574.50 and 571.50 before 565.50 and 556.50. Uptrend.

With the Presidential Election and November FOMC meeting in the rearview mirror, equity markets showed jubilation as they vaulted higher. Elsewhere look for Gold to in its uptrend while Crude Oil consolidates in a broad range. The US Dollar Index continues to move to the upside while US Treasuries consolidate in their pullback. The Shanghai Composite looks to continue the move higher while Emerging Markets chop in their short term uptrend.

The Volatility Index looks to remain low and drifting lower following the election making it easier for equity markets to continue higher. Their charts look strong on both timeframes, especially the SPY and QQQ. The IWM has now joined the party, a stone’s throw away from making its first new all-time high in 2 years. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview November 8, 2024

44 notes

·

View notes

Text

Halloween Trading Strategy Treat Begins Next Week

Next week provides a special short-term seasonal opportunity, one of the most consistent of the year. The last 4 trading days of October and the first 3 trading days of November have a stellar record the last 30 years. From the tables below:

DJIA: Up 24 of last 30 years, average gain 1.95%, median gain 1.39%. S&P 500: Up 25 of last 30 years, average gain 1.96%, median gain 1.61%. NASDAQ: Up 25 of last 30 years, average gain 2.43%, median gain 2.29%. Russell 2000: Up 23 of last 30 years, average gain 2.34%, median gain 2.56%.

Many refer to our Best Six Months Tactical Seasonal Switching Strategy as the Halloween Indicator or Halloween Strategy and of course “Sell in May”. These catch phrases highlight our discovery that was first published in 1986 in the 1987 Stock Trader’s Almanac that most of the market’s gains have been made from October 31 to April 30, while the market, on average, tends to go sideways to down from May through October.

Since issuing our Seasonal MACD Buy signal for DJIA, S&P 500, NASDAQ, and Russell 2000, on October 11, 2024, we have been moving into new long trades targeting seasonal strength in various sectors of the market via ETFs and a basket of new stock ideas. The above 7-day span is one specific period of strength during the “Best Months.” Plenty of time remains to take advantage of seasonal strength.

24 notes

·

View notes

Text

GMX appears poised for a bullish breakout, targeting a potential surge to $90 as robust market signals align in its favor

GMX is currently drawing attention as a potential contender for a significant bullish trend. According to Ali, a prominent blockchain figure, GMX is on the verge of a breakout from a head-and-shoulders pattern, which signals a possible considerable increase in stock value. If the stock maintains a 3-day candlestick close above $59, it might initiate a bullish rally, reaching a target of $90.

The current trading volume and technical indicators like RSI and MACD offer further evidence of GMX's positive outlook. The stock is currently trading at $58.31, marking a 0.6% increase within an hour and a 1.9% rise since yesterday. Over the last week, the stock has achieved a notable 7.0% increase, indicating a consistent upward trend. The high trading volume of GMX is a positive indicator of investor engagement and can often precede notable shifts in price trends. Over the last 24 hours, GMX has recorded a remarkable trading volume of $36,792,611.

Additionally, several technical indicators offer insights into the stock's current and future performance. The 4-hour Relative Strength Index (RSI) for GMX is at 67.26, indicating a slightly overbought condition. The 4-hour Know Sure Thing (KST) indicator points to a very strong short-term momentum for GMX, often a sign of increasing buying pressure. The bullish signal from GMX's 4-hour MACD aligns with this trend, indicating a recent surge in buying activity.

Despite GMX's promising outlook, investors should remain cautious and informed due to the volatile nature of the stock market. While GMX offers an appealing investment prospect, investors must stay alert and well-informed about the stock's performance to maximize potential opportunities and adeptly manage associated risks.

#GMX#bullish breakout#market signals#upward trend#technical indicators#Relative Strength Index (RSI)#Moving Average Convergence Divergence (MACD)#trading volume#investor caution#risk management.#crypto market#cryptotale

0 notes