#Loan statement fraud

Explore tagged Tumblr posts

Text

Gang preparing fake financial documents busted

Just two days after the arrest of three persons involved in a fake C-form sale racket, the district police busted a gang involved in preparing fake financial documents here today.

City Police Commissioner Gaurav Yadav claimed that the gangsters were involved in preparing fake documents like bank statements and loan statements and were “facilitating” students for procuring study visa in different countries.

The racket was being run from the premise of Education Boutique, Prime Tower. On a tip-off, the police laid a trap and nabbed three persons, Atul Vashisht, resident of Panchkula, Kamal Sehgal of the local Wariana, and Naresh Kumar, resident of the local Preet Nagar, Ladowali Road, from the Prime Tower.

Yadav revealed that Atul Vashisht runs Daffodils Study Abroad, Sector 22-C, Chandigarh, Kamal Sehgal runs Taff Educations, Green Park, near Narinder Cinema, Jalandhar, while Naresh Kumar runs Worldwide Career Consultants, Badwal Complex, near Narinder Cinema, Jalandhar.

Their fourth accomplice Pavit Brar, a Director of Education Boutique, is yet to be arrested. The police had recovered fabricated documents, supposed to be issued by different banks, from the arrested persons.

The racketeers used to advertise through media and were offering “readymade” documents to students desirous of going abroad for higher studies in different foreign countries.

A case under sections 419, 420, 465, 467, 471 and 120-B of the IPC was registered at Navi Baradari police station.

#Fake financial documents#Study visa scam#Education Boutique racket#Prime Tower fraud#Gang arrest#Atul Vashisht#Kamal Sehgal#Naresh Kumar#Pavit Brar#Fake C-form sale#Indian police investigation#IPC fraud charges#Bank statement forgery#Loan statement fraud#Study abroad fraud

1 note

·

View note

Text

RBI’s New 15-Day Credit Reporting Rule: A Game-Changer for Borrowers and Lenders

India’s financial landscape is witnessing a pivotal transformation with the Reserve Bank of India (RBI) introducing a new mandate on credit reporting. Effective January 1, 2025, all lenders must update borrowers’ credit information with credit bureaus every 15 days instead of the current monthly reporting system. While this change seems procedural, its implications are far-reaching, impacting borrowers, lenders, and the entire credit underwriting process.

This blog explores the rationale behind the new rule, its implications for borrowers and lenders, the role of bank statement analysis and advanced tools in credit underwriting, and how it reshapes the financial ecosystem.

What’s Changing?

The new RBI directive reduces the credit reporting cycle to 15 days, requiring lenders - banks, NBFCs, and other financial institutions - to update borrowers’ repayment history, defaults, and other credit activities more frequently. This shift brings India closer to global best practices in credit reporting, ensuring that creditworthiness is evaluated based on the most current data.

Borrowers with timely repayments will benefit from faster improvements in their credit scores, while delays or defaults will now reflect on reports much sooner, influencing future loan prospects.

The Rationale Behind the New Rule

The RBI’s move addresses several key challenges in India’s lending ecosystem:

Accurate Credit Underwriting: Credit underwriting - the process by which lenders assess a borrower’s risk—relies heavily on up-to-date credit reports and bank statement analysis. The 15-day reporting rule ensures lenders access more recent financial data, enabling them to make informed decisions and minimize risks associated with outdated credit information.

Curbing Over-Leveraging: Borrowers sometimes exploit the lag in credit reporting to secure multiple loans from different institutions. With faster updates, lenders can identify over-leveraged borrowers earlier, preventing unsustainable debt accumulation.

Promoting Responsible Borrowing: A shorter reporting cycle encourages financial discipline among borrowers. Timely repayments are rewarded with faster improvements in credit scores, while defaults are penalized swiftly, discouraging risky financial behavior.

Mitigating ‘Evergreening’ of Loans: Faster credit updates allow lenders to detect borrowers taking out new loans to repay existing ones—an unsustainable practice known as loan ‘evergreening.’ Early identification of such patterns can prevent potential defaults.

Impact on Borrowers

For borrowers, the new rule offers both benefits and challenges:

Opportunities for Borrowers

Faster Credit Score Improvements: Borrowers making timely payments will see their credit scores improve more quickly, making them eligible for better loan terms, such as lower interest rates and higher limits.

Transparency in Financial Health: With frequent updates, borrowers gain a clearer picture of their financial standing, empowering them to make informed decisions.

Reward for Discipline: The system incentivizes disciplined borrowing and repayment habits, as the benefits are reflected more promptly in credit scores.

Challenges for Borrowers

Reduced Time to Rectify Errors: Defaults or missed payments will now be reflected in credit reports faster, leaving borrowers with less time to address issues before lenders take action.

Increased Scrutiny: Borrowers with high credit utilization or irregular payment histories will face tighter evaluations during bank statement analysis and other assessment processes.

Pressure to Maintain Financial Stability: The new system places greater responsibility on borrowers to balance their financial obligations, as any lapses will have immediate repercussions.

Impact on Lenders

Lenders stand to gain significantly from the new credit reporting norms, particularly in terms of improved risk assessment and portfolio quality.

Benefits for Lenders

Enhanced Credit Underwriting: Access to real-time credit data and detailed bank statement analysis enables lenders to refine their credit underwriting processes, resulting in more accurate risk assessments.

Early Detection of Risk: The shorter reporting cycle helps lenders identify red flags, such as over-leveraging or signs of financial distress, at an earlier stage.

Healthier Loan Portfolios: Lenders can maintain a healthier loan portfolio by preventing over-lending and reducing default rates, minimizing the risk of non-performing assets (NPAs).

Challenges for Lenders

Operational Adjustments: Implementing the new rule requires significant investment in technology and process upgrades to ensure timely and accurate reporting.

Increased Responsibility in Monitoring: With more frequent updates, lenders must closely monitor borrower behavior and act swiftly in case of defaults or other issues.

Role of Bank Statement Analysis in the New Era

Bank statement analysis will play a crucial role in adapting to the new reporting system. By reviewing borrowers’ transaction histories, spending patterns, and cash flow, lenders can gain deeper insights into their financial behavior.

For instance:

Identifying Risky Borrowing: Patterns of frequent loan applications or high credit utilization can signal potential over-leveraging.

Evaluating Repayment Capacity: Consistent inflows and prudent spending habits indicate a borrower’s ability to manage loan obligations.

Detecting Warning Signs: Irregular payments or insufficient balances can serve as early indicators of financial distress.

With advanced analytics tools, lenders can automate bank statement analysis, making the process faster and more accurate.

Statistical Insights: The Growing Importance of Credit Reporting

To understand the broader impact of this change, consider the following data:

Credit Demand on the Rise: As of March 2023, personal loans accounted for 28% of the total retail lending portfolio, with an annual growth rate of over 20%. This highlights the importance of accurate credit reporting in managing India’s growing credit demand. (Source: TransUnion CIBIL)

Credit Utilization Trends: Credit card usage has seen a sharp rise, with transactions crossing ₹1.5 trillion monthly as of December 2022. The new rule will ensure timely reflection of credit utilization, which is a key factor in credit scoring. (Source: RBI Reports)

NPA Challenges: Non-performing assets (NPAs) in India’s banking sector stood at ₹5.94 trillion in March 2023. The new framework aims to reduce this burden by enabling better risk management. (Source: Financial Express)

How Borrowers Can Prepare

Borrowers must adopt proactive strategies to adapt to the new rules:

Automate EMI Payments: Ensure timely repayments by setting up automatic payments for loans and credit cards.

Monitor Credit Scores Regularly: Use tools to track changes in your credit score and address issues promptly.

Practice Responsible Borrowing: Avoid taking multiple loans or exceeding your repayment capacity to maintain a healthy financial profile.

Maintain Low Credit Utilization: Keep your credit utilization ratio below 30% to avoid negative impacts on your score.

How Lenders Can Leverage the Change

Lenders can harness the new framework to strengthen their processes:

Upgrade Technology: Invest in systems that enable seamless credit reporting and bank statement analysis.

Enhance Credit Underwriting: Use advanced analytics and machine learning tools to improve risk assessment and decision-making.

Educate Borrowers: Create awareness about the new rules and encourage borrowers to adopt responsible financial habits.

Rewind-Up: A Transformative Shift

The RBI’s 15-day credit reporting rule marks a significant step towards creating a more transparent, efficient, and responsible lending environment. By ensuring that credit reports reflect real-time financial behavior, this change benefits both borrowers and lenders, fostering trust and stability in the financial system.

As India’s credit ecosystem evolves, the integration of tools like bank statement analysis and advancements in credit underwriting will play a pivotal role in adapting to this new era. For borrowers, the message is clear: financial discipline and timely repayment are more important than ever. For lenders, this is an opportunity to strengthen risk management and drive sustainable growth.

By embracing these changes, India’s financial sector is poised to achieve greater resilience and inclusivity, paving the way for a healthier economic future.

#cart#fintech#novel patterns#account aggregator#bfsi#myconcall#credit underwriting#finance#wealth management#genesis#bank statement analyser#bank statement analysis#credit assessment#financial inclusion#financial statement#financial statements#credit reporting#fraud detection#loan

1 note

·

View note

Text

When a company decides they want to take their business venture forward and have it publicly traded, the Securities and Exchange commission (SEC) mandates the heads or owner of the company file a S-4 registration statement. This gives possible investors a background on the owners of the stock in questions past business dealings. Did they exceed expectations for growth in their previous companies? Was there any litigation or leans? What were the profit margins? This enables investors to make an educated and thoughtful decision before investing.

Since the 80’s it has been Trump’s priority to portray wealth. The golden decor, the foreign model wife, huge 747s with his name plastered on them, his name plastered on buildings, hotels and skyscrapers worldwide. This giving the illusion of success. What’s lesser known is often the buildings that bare his name do not belong to him nor are they financially affiliated with him. Some are. Some are just a marketing stunt that the name, Trump, brings luxury to, or used to, mind.

When the idea of making Truth Social a publicly traded company was introduced it was mandated that a S-4 registration statement be made public before the SPAC, Digital World Acquisition Corp could move forward with the merger of Truth Social and Technology Group Corp. it reads as follows.

Entities associated with President Trump have filed for bankruptcy protection. The Trump Taj Mahal, which was built and owned by President Trump, filed for chapter 11 bankruptcy in 1991. The Trump plaza, the Trump Castle, The Plaza Hotel, all owned by President Trump at the time, filed for chapter 11 bankruptcy in 1992. THCR, which was founded by President Trump in 1995, filed for chapter 11 bankruptcy in 2004. Trump Entertainment Resorts, Inc, the new name given to Trump Hotels and Casino Resort after its 2004 bankruptcy, declared bankruptcy in 2009. While all the forgoing were different businesses than TMTG, there can be no guarantee that TMTG’s performance will exceed the performance of those entities.

It continues,

Trump Shuttle, Inc, launched by president Trump in 1989, defaulted on its loans in 1990 and ceased to exist by 1992. Trump University, founded by President Trump in 2005, ceased operations in 2011 amid lawsuits and investigations regarding the company’s business practices. Trump vodka, a brand of vodka produced by Drinks Americas under license from the Trump Organization, was introduced in 2005 and discontinued in 2011. Trump Mortgage,LLC a financial services company founded by President Trump in 2006, ceased operations in 2007. GoTrump.com, a travel site founded by President Trump in 2006, ceased operations in 2007. Trump Steaks, a brand of steak and other meats founded by President Trump in 2007, discontinued sales two months after its launch. While all these businesses were in different industries than TMTG, there can be no guarantee that TMTG’s performance will exceed the performance of these entities.

I couldn’t have said it better myself. It’s all a lie. An illusion. Smoke and mirrors. The fortune Trump’s father left to him, Trump squandered quicker than he could recover, leading to a lifetime of shady deals, loans from foreign banks, failed get rich schemes and grifting.

Oh my the grift is strong in that one. From digital trading cards, NFT’s, ugly sneakers, bobble head dolls, $100k watches, madeIn china, sold from a strip mall in Wyoming, there’s ornaments, a $60 Bible, also made in china for $4, where the gold edged pages stick together, heck! He’ll even sell you a piece of the suit he was wearing when he was shot at in PA.

Another financial stronghold of Trump is to simply screw over people. Whether it’s not paying contractors who worked on his properties, not paying employees at his hotels, confiscating their tips as well, suing models who worked at his agencies for defamation, a charity, The Trump Foundation, was found guilty of fraud, stealing from those in need to line his pockets, or trying to cut out the very people who created his TMTG company in the first place. Trump doesn’t seem to care who he stiffs, as long as it benefits him.

The new and most lucrative venture is campaign donations. Whether it’s billionaire oligarchs who are buying favor, or little old Mr and Mrs MAGAdonia, Trump will happily take your money.

Lord knows he needs it. Between owning his rape victim 90 some million dollars and counting. The over half a billion dollars he scammed from New York he has to pay back. The hundreds of millions of dollars in lawyer fees. Not to mention upcoming cases and his lavish lifestyle. Things might get tight.

As you can see it’s a fake. A failed businessman who couldn’t just take the money his father left him and sit on an investment. He wanted fame. He wanted power.

After a lifetime of pursuing fame and power, a lifetime of fraud, cheating, grifting, ripping people off, and skirting the system has come back to haunt him. Accountability is knocking. Eventually it will kick in the door.

#election 2024#traitor trump#politics#kamala harris#vote blue#donald trump#republicans#news#the left#gop#american people#america#independents#harris waltz#trump24#harris walz 2024#trump is a threat to democracy#trump 2024#money#maga 2024#maga cult#trump vance 2024#vote kamala#vote vote vote#women voters#liberty#love#joy#democracy#declaration of independence

27 notes

·

View notes

Text

By Luke Tress

The anti-Zionist activist group Jewish Voice for Peace will pay a penalty of $677,634 to the US government after allegations of fraud.

Jewish Voice for Peace received a loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act that was launched in March 2020, the US Attorney’s Office for the District of Columbia says in a statement.

Groups engaged in political or lobbying activities were not eligible for the loans, and Jewish Voice for Peace said it was not engaged in such activities in its loan application. An investigation determined that “Jewish Voice for Peace was primarily engaged in political activities,” however, the statement says.

The investigation came after a complaint filed by The Zionist Advocacy Center, a New York-based group.

Jewish Voice for Peace received a loan of $388,817, and, as part of a civil settlement, agreed to pay twice that amount in a penalty. The settlement does not include a “determination of liability,” the district attorney’s office says.

“Jewish Voice for Peace contends that any misstatements in this application were inadvertent,” the statement says.

Jewish Voice for Peace took in $3.3 million in revenue, mainly from donations and grants, between July 2022 and July 2023, according to its most recent tax filings.

14 notes

·

View notes

Text

Protests lay the groundwork for future progress

February 18, 2025

Robert B. Hubbell

On President’s Day 2025, hundreds of thousands of Americans marched in protest against Trump’s ongoing coup. From Manhattan to North Hollywood, from Denver to Springfield, Illinois, from Washington, D.C. to Seattle, Washington, Americans made their voices heard. Coverage in the major media was subdued (at best) and non-existent (at worst). See, e.g., NYTimes, Thousands Gather on Presidents’ Day to Call Trump a Tyrant. (Accessible to all.) Although the Times said that “thousands” attended the protests, one reader estimated that there were 50,000 protesters in Manhattan alone.

A dozen readers sent me photos of rallies they attended, but most photos were not suitable for publication because they prominently featured the faces of protesters. The photo below (with blurred faces) shows the protest in Springfield, Illinois:

The size of the rallies is less important than the number of protests across the nation, and the number of protests is less important than the fact that the protests took place at all. All resistance movements must begin somewhere. We will never know which protest—or protester—will serve as the spark to ignite the flame of a massive national movement.

For more than a century before Rosa Park’s courageous act of resistance brought the fight for equal rights to the attention of all Americans, Black men and women were refusing to comply with restrictions on “Whites Only” segregation in public transportation. See Because of Them We Can, Meet The Black Women Who Refused To Give Up Their Seats Before Rosa Parks. As described in the article,

While these women definitely sparked the bus boycott, there had been a century of resistance against segregated public transportation. More than 100 years prior, schoolteacher Elizabeth Jennings was also arrested for traveling in a whites only section of a streetcar in New York City. During her trial, she was defended by lawyer Chester A. Arthur, who would go on to become the future United States President. It was Jennings’ trial that led to the desegregation of New York’s street cars. Frederick Douglass had also protested a few years prior, being kicked out of a whites-only train car in 1841. Similarly, baseball legend Jackie Robinson also once refused to move to the back of the bus and was court-martialed as a result.

The key to achieving victory is not to give up, to persist, to endure, and to abide. We are on the right side of history and represent the majority of Americans. It is only a matter of time before the protests and boycotts reach critical mass and become self-sustaining reactions that will become unstoppable.

To everyone who turned out on Monday, thank you, thank you, thank you! Keep up the great work. You are heroes of democracy!

DOGE seeks access to Social Security and student loan borrower information

Musk and his team of government-sanctioned hackers have gained access to the Treasury Department’s payments system. Over the President’s Day Weekend, Musk demanded access to Social Security beneficiary information, causing the acting head of Social Security to resign. See HuffPo, Social Security Head Steps Down Over DOGE Access Of Recipient Information: AP Sources.

Musk and his team apparently secured sufficient access to begin posting misleading information about the recipients. Musk incorrectly asserted that tens of millions of recipients were engaged in fraud because they were marked as “deceased.” Musk misleadingly suggested that some beneficiaries of Social Security are listed as 150 years old.

There are two things wrong with Musk’s statement. First, it proves that Musk is mucking around in private information about our social security benefits. Second, it shows that he is monumentally ignorant. See Nancy Altman in The Hill, Opinion: Elon Musk is coming for your Social Security.

Altman writes,

Both Musk’s ignorance and his anti-Social Security playbook were on full display Tuesday, when the shadow president talked to reporters in the Oval Office. In trying to convince us that our extremely efficient Social Security system is rife with fraud, he unknowingly proved how economical its administration is, when he asserted, “just cursory examination of Social Security and we’ve got people in there that are 150 years old.” No one born 150 years ago is still receiving benefits. But here is where Musk is showing his ignorance: Let’s take the example of a person who is issued a Social Security card as an infant and dies at age 10, never having received a penny of benefits. Social Security doesn’t waste taxpayer dollars finding that information and cancelling their Social Security number — this would be prohibitively expensive and wasteful. Moreover, most adults who die leave behind spouses and children, including adult disabled children, who may be eligible for benefits for many years based on the decedent’s earnings record. Therefore, that record may remain active for a very long time. For example, the last person to receive a Civil War pension was a veteran’s disabled daughter, who died less than five years ago — in 2020.

The problem with Musk rifling through data he doesn’t understand is this: He can suggest he has discovered fraud in just a few words: “We’ve got people in there that are 150 years old.” That lie takes three paragraphs to refute. But that is our challenge, so we must educate ourselves to be effective messengers of the truth.

Musk is now training his sites on student loan borrowing data. Late Monday, a federal judge in DC refused to grant an emergency restraining order barring Musk from accessing information on borrowers of student loans. See University of California Student Association v. Acting Secretary of Education | Memorandum and Order. The judge ruled that the student association had failed to make a “clear showing of irreparable harm” because the DOGE staffers have an obligation to prevent disclosure of the borrowers’ information.

Of course, we have seen that once information is in the hands of Musk, he operates under no constraints in publishing information to create the false impression that his team has discovered fraud, waste, and abuse.

If Musk or his team discloses private information beyond the permitted uses, it will be too late for injunctive relief to be effective. The judge failed to recognize (or acknowledge) that Musk isn’t playing by the rule book—and has failed to protect innocent borrowers whose information is now a pawn in the hands of bad actors with a history of misusing private information to suggest fraud where none exists.

DOGE lays off FAA employees

Three weeks after the largest US commercial aviation disaster in decades, the Trump administration is laying off FAA personnel charged with maintaining air traffic safety and systems integrity. See Trump Begins Firing FAA Air Traffic Control Staff Weeks After Fatal DC Plane Crash | HuffPost Latest News.

Per HuffPo,

The firings hit the FAA when it faces a shortfall in controllers. Federal officials have been raising concerns about an overtaxed and understaffed air traffic control system for years, especially after a series of close calls between planes at U.S. airports. Among the reasons they have cited for staffing shortages are uncompetitive pay, long shifts, intensive training and mandatory retirements.

Trump administration claims Musk is not a DOGE employee

Several states have filed suit against Elon Musk alleging that he is operating in violation of the Appointments Clause in ordering budget cuts and layoffs. In a responsive court filing, the White House claims that Musk (a) is not an employee of DOGE and (b) has no authority to order any cuts or layoffs. See Reuters White House says Musk is not DOGE employee, has no authority to make decisions. The White House claims, instead, that Musk is merely communicating the president’s directives.

If the state Plaintiffs can obtain the communications between Musk and Trump, those communications will likely show that the White House court filing is filled with lies. Trump isn’t ordering Musk to do anything. Musk is a rogue agent doing what he wants and telling Trump after the fact.

The fact that the White House has resorted to lies to conceal the truth of Musk’s role indicates that the White House knows that Musk is operating in an illegal matter in violation of the Appointments Clause.

The complaint is here: New Mexico et. al. v. Musk et al., and the declaration asserting that Musk is not an employee of DOGE is here: Declaration of Joshua Fisher.

Concluding Thoughts

Do not create unnecessary pressure by imposing unrealistic expectations on yourself. Do what you can and trust that others will carry their fair share of the burden. Every action is significant, no matter how small it may seem in isolation. We are not fighting this battle alone but as a part of a mass resistance campaign. Contribute what you can, when you can, and be proud of your contribution.

Everyone who showed up at a protest on Monday should pat themselves on their back, as should everyone who wrote a postcard, posted truthful content on social media, wrote a letter to the editor, or encouraged a fellow activist who needed a boost. We are truly in this fight together. We each have our part to do. Let’s do it—without fear or guilt or second-guessing. Every act—successful or not—becomes part of the groundwork for our future progress.

Stay strong! Talk to you tomorrow!

[Robert B. Hubbell Newsletter]

#Robert B. Hubbell#Robert B. Hubbell Newsletter#protest#Presidents Day Protests#resist#DOGE#Social Security#Musk#FAA

15 notes

·

View notes

Text

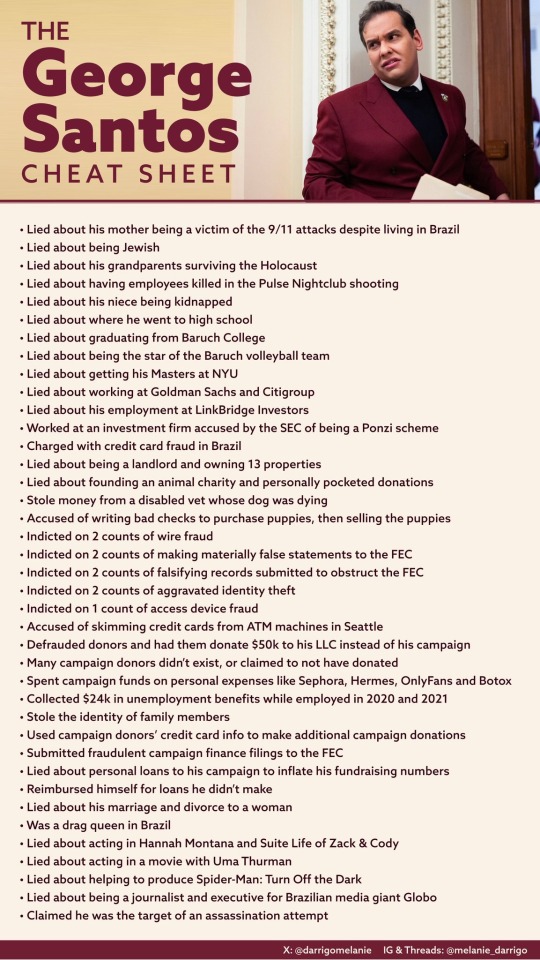

George Santos:

• Lied about his mother being a victim of the 9/11 attacks despite living in Brazil

• Lied about being Jewish

• Lied about his grandparents surviving the Holocaust

• Lied about having employees killed in the Pulse Nightclub shooting

• Lied about graduating from Baruch College

• Lied about being the star of the Baruch volleyball team

• Lied about getting his MBA at NYU

• Lied about working at Goldman Sachs and Citigroup

• Lied about his employment at LinkBridge Investors

• Worked at an investment firm accused by the SEC of being a Ponzi scheme

• Charged in Brazil with credit card fraud

• Lied about being a landlord and owning 13 properties

• Lied about founding an animal charity and personally pocketed donations

• Stole money from a disabled vet whose dog was dying

• Accused of writing bad checks to purchase puppies, then selling the puppies

• Indicted on 2 counts of wire fraud

• Indicted on 2 counts of making materially false statements to the FEC

• Indicted on 2 counts of falsifying records submitted to obstruct the FEC

• Indicted on 2 counts of aggravated identity theft

• Indicted on 1 count of access device fraud

• Accused of skimming credit cards from ATM machines in Seattle

• Defrauded donors and had them donate $50k to his LLC instead of his campaign

• Invented campaign donors, and some donors claimed to not have donated

• Spent campaign funds on personal expenses like Sephora, Hermes, OnlyFans and Botox

• Collected $24k in unemployment benefits while employed in 2020 and 2021

• Stole the identity of family members

• Used campaign donors’ credit card info to make additional campaign donations

• Submitted fraudulent campaign finance filings to the FEC

• Lied about personal loans to his campaign to inflate his fundraising numbers

• Reimbursed himself for loans he didn’t make

• Lied about his marriage and divorce to a woman

• Was a drag queen in Brazil

• Claimed he was the target of an assassination attempt

• Lied about acting in Hannah Montana and Suite Life of Zack & Cody

• Lied about acting in a movie with Uma Thurman

• Lied about helping to produce Spider-Man: Turn Off the Dark

• Lied about being a journalist and executive for Brazilian media giant Globo

After Santos himself, I I really put the bulk of the blame on the DNC + DCCC for not finding out about even a quarter of these huge ass lies until he was already in office. (Sorry, but the Republican Party ain’t gonna do it).

76 notes

·

View notes

Text

THIS MOTHERFUCKER !!!

"Supreme Court Justice Clarence Thomas has been accused of not disclosing a yacht trip to Russia and a private helicopter flight to a palace in President Vladimir Putin’s hometown, among a slew of other gifts and loans from businessman Harlan Crow.

Buried on page 14 of a letter that two Democratic senators sent to Attorney General Merrick Garland on Tuesday, in which they urged Garland to appoint a special counsel to probe Thomas, was an astonishing list of dozens of “likely undisclosed gifts and income” from Crow, Crow’s affiliated companies, and “other donors.”

In the letter, Sens. Sheldon Whitehouse (D-RI) and Ron Wyden (D-OR) said Thomas, one of the court’s staunchly conservative justices, even may have committed tax fraud and violated other federal laws by “secretly” accepting the gifts and income potentially worth millions.

“The Senate is not a prosecutorial body, and the Supreme Court has no fact-finding function of its own, making the executive role all the more important if there is ever to be any complete determination of the facts,” reads the letter requesting the appointment of a special prosecutor.

“We do not make this request lightly,” said the letter.

The list of potentially secret gifts also includes a loan of more than $267,000 provided by Thomas’ close friend Anthony Welters, the yacht trip to Russia from the Baltics, and the helicopter ride to Yusupov Palace in St. Petersburg. ProPublica first reported last year on the existence of extensive undisclosed gifts and lavish trips from Crow.

Additionally, Justice Thomas is accused of not disclosing tuitions for his grandnephew, free lodging, real estate transactions, and home renovations. The action escalates Democratic senators’ efforts to hold Thomas accountable for perceived ethics controversies.

According to the senators, Thomas’ conduct could violate the Ethics in Government Act, which requires officials like Supreme Court justices to file annual reports disclosing gifts and income accepted from outside sources.

“It is a crime,” reads the report, “To knowingly and willfully fail to file or report such information.”

Since 2023, two Senate committees have been looking into the 1991 loan from Welters that was connected to Thomas’ purchase of a luxury motor home. Welters previously responded to a New York Times request for comment on the loan only to say that it was “satisfied.”

Thomas, for his part, belatedly disclosed some—but not all—gifts from Crow this year and has defended the gifts as “personal hospitality” from some of his and his wife’s “dearest friends.”

“The evidence assembled thus far plainly suggests that Justice Thomas has committed numerous willful violations of federal ethics and false-statement laws and raises significant questions about whether he and his wealthy benefactors have,” Durban and Wyden wrote."

16 notes

·

View notes

Text

Brazil Police find fraud evidence against Jair Bolsonaro Jr

Jair Renan Bolsonaro, the youngest son of former Brazilian President Jair Messias Bolsonaro, is suspected together with a friend (and shooting instructor, Maciel Alves) of fraudulent misrepresentation, use of false documents, and money laundering in connection with an application for a bank loan, the Federal District Civil Police (PCDF) said in a statement Thursday. No further details were released, given the case's seal of secrecy.

Jair Bolsonaro Jr denied having committed anything illegal since a police raid in August last year during which some of his electronic devices were seized. According to the PCDF, it is now up to the Public Prosecutor's Office of the Federal District and Territories (MPDFT) to analyze the case and decide whether to file charges against both men.

Earlier this week, police searched the homes and offices of top aides to the former president as part of an investigation accusing them of plotting a coup to oust Luiz Inácio Lula da Silva on Jan. 8, 2023. Congressman Eduardo Bolsonaro, Senator Flávio Bolsonaro, and Carlos Bolsonaro, a Rio de Janeiro councilman - all sons of the former president - are also under investigation in separate cases.

Continue reading.

#brazil#brazilian politics#politics#jair renan bolsonaro#mod nise da silveira#image description in alt

20 notes

·

View notes

Text

Nihilus Rex 27: Mind Games

Nils and Lash have some nice, healthy communication. Also, more jokes about mind games and preparation to deal with their enemy, rival and possible ally. As a behind the scenes note, yes, Ottendorf, Altendorf, and Altdorf are all real variants of the same type of cipher, and me and @canyouhearthelight arguing about which one was most in character to use was actually part of the gag that just went into this chapter. Sometimes it's fun writing hopelessly OP characters where we just get to nod obliquely at all the shit our nerdy asses have picked up over the years.

You better be careful what you do

I wouldn't wanna be in your shoes

If they ever found you out

You better be careful what you say

It never really added up anyway

I got friends in this town

Miranda Lambert, “White Liar”

Nils

Class was boring - I mean, it would have been interesting, especially the political debate that came inherent in the macroeconomic discussion of regulation - but frankly with everything else going on and the plans Lash and I were hatching it felt almost beneath notice. Like a waste of time before we got to the real action.

Our weeb friend was a smarmy son of a bitch, I had to give him that, and trying to trace him took work - one of the other reasons that I was just as happy to use the challenge and draw him to us. If it worked, it let us keep flying under the radar and gave us a layer of plausible deniability, and if worst came to worst it handed us a convenient option for another patsy if he proved less than tractable. Lash and I would have to be careful in our eventual conversation with him in how we phrased everything to make sure statements could be read to assume that he was pissed that we were taking credit for his ideas to set it up properly, but it could be done with good planning. Recruit if we could, cash out the option to get the Feds off our backs if we couldn’t - because we were going to need to deal with the fibbie at some point either way.

I shared the thought with Lash to get her thoughts, and see if we could begin establishing how we wanted to lay in that contingency. “Hey, so it occurs to me, if we can’t recruit this guy, we may want to have some kind of setup to feed him to the feds when we encounter him, let them think we were just doing some dumb, edgy marketing for our totally-legal activism and the actual ‘economic terrorist’ got pissed at us for trying to take the credit. If we can’t get him on our side, better not to have him in the way, right?”

She looked thoughtful for a moment - or more accurately, like she was plotting - before asking slowly, “How likely would we be to frame him for some of the shit we’ve done? Even just stuff we did before we met?”

“I’d have to look at his profile a little more closely, but bear in mind that the hack itself doesn’t really match the profile of either of our usual patterns, and nothing we did before that rises to the level where the federal government cares enough to pay attention.”

“I took money from Microsoft and donated it to charity,” she pointed out. “Repeatedly. That would definitely land on the news, at least.”

“Right,” I said, taking a breath, trying to steady myself, “and let’s not get into my thefts from social media and various databombings on their harvested userdata, BUT that followed a very different profile than the bank job, which is what we knew drew their attention - they’re looking for the people who’d run the bank job, not people who are little more than thieving horseflies buzzing around the heads of corporate titans and taking a few drops here and there that said corporations never notice enough to report.” It was an unpleasant truth - we’d stolen probably tens of thousands between us, but not all at once, and in increments that the corporations we’d robbed could lose to rounding error.

“Hey, you said you wanted him fed to the Fed, not to go down for the loans,” she shrugged. “Wire fraud across state lines is still FBI-worthy. Not to mention that many counts.” Lash started silently ticking off on her fingers before staring at them and nodding. “Yeah, plenty of counts, for sure.”

“Fair. I’m worried they’re looking for the bank robbers and we have someone we can give them as a patsy. So when we meet with him, let’s feel him out and make sure any statements we have are set up so they can be misread as him trying to find out if we’re stealing credit for his work, yeah?”

“Can do.” She snapped off a sarcastic salute before grabbing my elbow and semi-forcing me to slow down. “Either way, our ‘viral marketing campaign’ is ready to go as soon as you set up the location for the final clue. So, make sure your sandbox is as secure as possible so we don’t get any bugs in there.”

I nodded. “Yeah. I’ll have it ready in an hour. Want me to order some pizza while I do it?” I had an extra tab open while I was getting the proxy networks set up and sketching out the ciphers for the clues.

“One meat lovers, one spinach and bacon, coming up,” she agreed, pulling out her phone. “Don’t forget to write down the address for me once it’s ready so I can translate it a couple times and hide it in the last clue.”

“Yeah, babe, I know, we’ve been picking at this for a minute.” I said, softly smiling. I wondered if she knew she talked to me the way her mom talked to her dad. I had almost finished the third cipher we were going to be doing it with. “Think three will be enough, or should we do four? At five it feels obnoxious, but if he wasn’t too paranoid to be hooked with fewer than three, he’d be a piece, not a player.”

“Forty five minutes until food,” Lash announced before looking up. “I’m going to translate it at least twice - once to hex and once to… I dunno, a sound frequency maybe? So four should be fine on your end for the ciphers.”

“You got it. Altdorf code it is.”

“Altendorf,” she corrected, scrunching her face at what she thought was a deliberate mistake on my part.

“Nope. Altdorf. Right wing computer nut, probably also a gamer. Altdorf code is a memetic variant on the classic Altendorf book cipher, named for a thing in a game franchise popular with that crowd.” I replied, smirking. Dating a girl who knew as much cryptography as I did was a blast, but it was occasionally fun to flex on each other. Loved it when she caught me out, as she often did, but it was sometimes fun to catch her off too.

“Freaking nerd,” she half-mumbled, knowing good and well I would hear her. “But if it works, it works. Provided he figures out all the clues I’m laying out.”

“And then we put all this effort into this to show off for each other for nothing…” I muttered, watching her work over what she did as I finished up selecting a handful of games, books, and comics to cipher off of, with arc numbers for each and internally contained clues within the cipher to hint at what the target should be using for the Altdorf code. Nonsensical to anyone who didn’t understand it, but comprehensible to anyone who did - if you understood the rest of the cyphers it was under, of course.

“Ew, eyewatering,” she grunted before adjusting something. It must have worked, because she was able to actually look at the screen when she was done. “And now for the clouds…”

“Those clouds look awful.” I said, idly thinking out loud. “Really bloated, data-wise.”

“That would be because they are compressed audio tracks,” she confirmed. “Which, when unzipped and played, give the hex code. But yeah, they’re ugly, aren’t they?” The door buzzed and she looked at her phone. “Pizza’s here.”

“Ah.” I stood up and got the pizza, tipping the guy. After he left I turned back to Lash. “So, now we wait. Trap is baited and set with a challenge for a new ally or an enemy we can get rid of quickly. Speaking of the question as to what we do if he is a new ally: thoughts on how we get rid of the fed? She’s poking around the white supremacist scene, and stirring them up harder might lead to more of them poking around if she gets shot.”

Lash rubbed her face before getting up to get plates. “My first instinct is to lay low and monitor. Right now, there’s no actual evidence tying us to the situation, so monitoring would be the most conservative and safest call in the immediate future. And it gives us time to plan something in the event we do need to intervene.”

I nodded as I poured drinks for both of us. “Yeah. Fair point. Give him about two days, then we’ll meet him together. Two options, either he thinks the whole made up names thing is actually bullshit, in which case he’ll want to meet both of the people he’s working with and we can establish a triumvirate, or he thinks it’s for real and is playing like he thinks it's dumb, then he’ll want to meet with the heads of both groups, which means we’ll need you there to rep one of them. What angles we play depends on what angle he hits us with.” I was still thinking about the way we could feel that out while also maintaining the option to sacrifice him and dispose of him to the feds if he wasn’t amicable to a team up, but honestly that was mostly just a matter of careful phrasing.

“If it comes to that, as long as I am repping the Icono-whatsits, I’m good.”

“No, I thought we’d have the brown, anarchic immigrant’s daughter represent the carefully crafted illusion of the violently traditionalist ones who want to restore ‘traditional values’ because that would totally make the con hold up. Tell you what, when we take it global, and we have to do this in India, THEN we swap roles and you have to play a Hindutava nationalist and pretend to be a Disciple chick. For today, the heel role is mine.”

She set her plate down with a loud clatter, glaring at me as she stood up. “And on that completely uncalled-for note, I think I need to head home for a few days. Let me know if he gets in contact, and we’ll go from there.”

I sighed, realizing what I’d done wrong, then felt a surprising flash of irritation - at her, at myself, at the fact that every time we started getting closer I said something obnoxious and that we never just got a few weeks without some shit happening. “You know what? Yeah. I’m sorry. That was unnecessarily rude. If you want to go home, I get it, but please eat first, or at least take some pizza with you. I shouldn’t have been that much of an asshole - I’ve been jittery since the Fed showed up, and I shouldn’t be taking it out on you. Know you can’t pass yourself off as a white supremacist, I mostly wanted to joke around about the fact that as this goes global, we may have to practice swapping roles for other countries. That’s all.”

Lash took a deep breath and picked up one of the pizza boxes. “I know it will eventually be necessary for me to be the bad guy, but seriously. What part of this,” she waved a hand over herself, stopping to gesture emphatically at her face, “in any way says I won’t just blow our entire ass cover if I try to be a white supremacist? It’s not like I’m shirking work or something.” The free hand shoved her hair back and she exhaled. “I think we just need a couple days to get actual sleep and calm down.”

“You aren’t shirking work, I know.” I said, trying to take a breath. “I’ve just been…I’ve been constantly trying to figure out every possible angle we can take this from, because I want to keep us out of trouble and keep the feds away, keep this prick away from your family, keep everything under control. I said something sarcastic that I thought was funny because yeah, obviously this,” I gestured at her, “was not going to be playing the white supremacist, this,” I gestured at my own face, “was. And I wasn’t looking forward to it. And it isn’t your fault I’ve been obsessively plotting, I haven’t been telling you all of it, but it’s been all of the babbling about contingencies I’ve been doing since the fed arrived. Because I’ve been afraid. And I shouldn’t have taken it out on you.” True, but I did also want her to see my perspective of how much effort I was putting into this whole thing. “And if you need me to give you a ride home tonight, I will, but seriously take a pizza. Because it’s too late for you to be walking home.”

The pizza box in her hand dropped back to the table and she growled in frustration. “UGH! And all the shit with Uber and taxis lately…” She fell back into what had become her seat on the couch. “Fine. But I’m sleeping out here. In clothes, so don’t get any ideas, buster.”

“We didn’t have time to go mattress topper shopping, so you’ll probably sleep better, and I’m insisting on plenty of blankets. And you’re eating your share of pizza.” I shrugged. “And even my Catholic ass won’t feel guilty about you being too damn stubborn to take a ride I’m offering.”

“No ride. I refuse to owe you,” she spat before biting viciously into a slice of pizza, shoving half of it into her mouth without a trace of grace.

“And thus, couch, blankets, and coping aplenty.” I said, sitting down. “You okay, Lash?”

“I am sleep deprived, stressed about the apartment being ready when my parents are discharged next week despite knowing that Mori has had it ready since the day after she got here, and I’m mad at you for being a jerk.”

“Mori took care of the apartment, you know it, you know you know it. You’re going to sleep better tonight, and I’m sorry for being a dick.” I said, coaxingly. “Things are going to be alright. Let’s eat, brush our teeth, then we can rack out, okay?”

“Fine,” she muttered, demolishing another slice of pizza.

I wasn’t certain what it said about my life - or life, in general - that “relationship issues” were causing me slightly more confusion and headaches than “FBI investigation” and “rival terrorist” combined. It definitely said something, but I wasn’t entirely certain what. Maybe it was a me problem. Maybe if I wasn’t dating someone who would do terrorism with me I wouldn’t have this problem.

But then it wouldn’t be worth it.

#original fiction#writers on tumblr#Nihilus Rex#Afterverse#cyberpunk#dystopia#modern dystopia#Arcadian inquisition prequel#miys prequel#traumatized characters

7 notes

·

View notes

Text

Leading Auditors in Dubai, UAE

Dubai, UAE, is a global business hub, attracting entrepreneurs and corporations from around the world. With a dynamic economy and evolving regulatory landscape, businesses in Dubai require top-tier auditing services to maintain financial transparency, comply with regulations, and build stakeholder confidence.

In this article, we explore the leading auditors in Dubai, the services they offer, and why choosing a reliable audit firm is crucial for your business success.

Why Auditing is Essential for Businesses in Dubai

Auditing is more than just a financial obligation—it is a critical process that ensures businesses operate efficiently, mitigate risks, and adhere to UAE regulations. Some key reasons why businesses in Dubai require auditing services include:

Regulatory Compliance – The UAE has stringent financial and tax regulations, including corporate tax and VAT compliance, requiring businesses to maintain proper financial records.

Fraud Prevention – Regular audits help detect and prevent financial mismanagement or fraudulent activities within an organization.

Investor & Stakeholder Confidence – A well-audited financial statement enhances credibility and builds trust with investors, banks, and regulatory bodies.

Business Growth & Expansion – Proper financial reporting helps businesses secure loans, attract investors, and plan for expansion with confidence.

Top Services Offered by Leading Audit Firms in Dubai

Reputable auditors in Dubai offer a wide range of services tailored to the needs of various industries. These include:

✅ External Audits – Independent examination of financial statements to ensure accuracy and compliance with International Financial Reporting Standards (IFRS).

✅ Internal Audits – Assessing internal controls, risk management, and operational efficiency to enhance business performance.

✅ VAT & Tax Compliance – Ensuring businesses comply with UAE tax laws, including VAT filing, corporate tax, and tax planning strategies.

✅ Accounting & Bookkeeping – Maintaining accurate financial records to help businesses track their finances and meet reporting requirements.

✅ Risk Advisory & Fraud Investigation – Identifying potential financial risks and providing solutions to mitigate them.

How to Choose the Right Auditor in Dubai

Selecting a trusted audit firm is crucial for business success. Here are some factors to consider:

🔹 Industry Experience – Choose a firm with expertise in your business sector to ensure they understand industry-specific regulations.

🔹 Reputation & Accreditation – Verify if the audit firm is approved by UAE regulatory bodies such as the Ministry of Economy and registered with the Dubai Financial Services Authority (DFSA).

🔹 Comprehensive Services – opt for a firm that offers a full range of auditing, tax, and advisory services to meet all your business needs.

🔹 Transparent Pricing – Ensure the firm provides clear and fair pricing without hidden fees.

Final Thoughts

Hiring a right auditor in Dubai is an investment in your business’s financial health and regulatory compliance. Whether you are a startup, SME, or multinational corporation, choosing the right auditing firm can help you navigate financial complexities and drive long-term success.

Are you looking for professional audit services in Dubai? Binjoy Auditors L.L.C. provides expert auditing, accounting, and tax advisory services tailored to your business needs. Contact us today to ensure financial transparency and compliance!

2 notes

·

View notes

Text

“Commitments must quickly become cash.” Well, of course: cash talks, B.S. walks. No wait. it’s ‘B.S. talks and cash walks.” The South has been plundered for decades, and this is just another scam. They will get pennies on the dollar as kleptocrats along the way make the cash disappear into their own pockets. ⁃ Patrick Wood, Editor.

After two weeks of negotiations at the 29th annual United Nations “climate” summit, the UN and its member governments agreed to rules for a global “carbon market” led by the global body. The scheme will put a price on emissions of the gas of life, carbon dioxide (CO2), and allow carbon credits to be traded. UN bosses called it a “base to build on.”

The final deal, inked over the weekend, also saw Western governments pledge $1.3 trillion per year in “climate” wealth transfers by 2035. The money for Third World kleptocracies and climate profiteers will come from what remains of the middle class in the West. These reparations are to compensate for “loss and damage” supposedly caused by Western CO2, the UN claims.

Of that sum, about $300 billion annually will be in the form of grants and low-interest loans for “climate reparations,” starting immediately. That represents a tripling of previous pledges. The rest of the funding will come from government-backed “investments” and potential new international taxes on fuels or aviation in the years ahead.

Trading Emissions of CO2

The most important part of the deal involves the UN’s “carbon market” schemes. “This will be a game-changing tool to direct resources to the developing world and help us save up to $250 billion a year when implementing our climate plans,” explained COP29 boss Yalchin Rafiyev, deputy foreign minister for the Islamo-Marxist regime of Azerbaijan.

“When operational, these carbon markets will help countries implement their climate plans faster and cheaper, driving down emissions,” he continued. “We are a long way from halving emissions this decade. But wins on carbon markets here at COP29 will help us get back in that race.”

Deal a “Base on Which to Build”

UN Secretary-General António Guterres, former leader of the Socialist International, also said the deal was a good start. “I had hoped for a more ambitious outcome — on both finance and mitigation — to meet the great challenge we face. But this agreement provides a base on which to build,” he said in a statement after the deal was signed.

“It must be honored in full and on time,” continued Guterres, touting “multilateralism” (better known to Americans as globalism). “Commitments must quickly become cash. All countries must come together to ensure the top-end of this new goal is met.… I appeal to governments to see this agreement as a foundation — and build on it.”

UN climate boss Simon Stiell emphasized that the agreement is merely the next step on the road to even more grandiose grabs for money and power. “This is no time for victory laps,” said Stiell. “We need to set our sights and redouble our efforts on the road to [COP30 in the Brazilian city of] Belém.”

In his final statement on the summit, Islamo-Marxist dictator Ilham Aliyev boasted of success. “I consider the ‘Baku breakthrough’ as a triumph of multilateralism,” he said, celebrating the confab’s approval of rules for the UN’s “carbon markets” and wealth redistribution. “The COP29 is a turning point in the climate diplomacy.”

Will Trump Pull Out?

With Donald Trump’s reelection, COP29 attendees despaired about the looming departure of the U.S. government and its taxpayers’ money from the UN climate process. The president-elect has repeatedly ridiculed the man-made global-warming hypothesis as a “fraud,” a “scam,” and a “hoax.” He recently said destroying the scam must be a priority.

Some of Trump’s Cabinet nominees, including Energy Secretary Chris Wright, have echoed the president-elect’s hostility to climate alarmism. However, a delegation of five GOP congressmen arrived at COP29 to assure the “climate” negotiators that they all support parts of Biden’s “climate” agenda, including emissions reductions.

Former Trump climate advisor Dr. William Happer, a physicist from Princeton, called efforts to tax and regulate CO2 dangerous and stupid. In an interview with The New American, he said CO2 emissions should be encouraged. “CO2 is actually good for the world, so people ought to be encouraged to make more of it,” he said.

3 notes

·

View notes

Text

Maximizing Best Credit Card In India Insider Tips and Tricks

What is a Credit Card?

Best Credit Card India is a economic tool issued through banks or economic institutions that permits cardholders to borrow budget to pay for items and offerings. It operates on a credit score limit, that's the maximum amount you may borrow, and is normally paid again monthly.

Types of Credit Cards

Rewards Credit Cards

Cash Back Cards

Offer a percentage of your spending lower back as coins. Ideal for ordinary purchases.

Travel Rewards Cards:

Earn factors or miles for travel-associated expenses, frequently with delivered tour advantages.

Low-Interest Credit Cards

Designed for folks that may also carry a balance from month to month. These cards generally have decrease annual percent prices (APRs).

Balance Transfer Credit Cards

Allow you to transfer high-interest debt from different playing cards, regularly with promotional low or 0% hobby charges for a certain period.

Secured Credit Cards

Require a coins deposit as collateral. They are beneficial for constructing or rebuilding credit score history.

Student Credit Cards

Tailored for college college students, these playing cards frequently have decrease credit limits and can offer rewards for responsible utilization.

Business Credit Cards

Designed for commercial enterprise fees, imparting capabilities like fee monitoring, higher limits, and rewards tailor-made for business spending.

Key Features

Credit Limit

The maximum amount you could charge for your card.

Interest Rate (APR)

The fee of borrowing cash, expressed as an annual percentage.

Annual Fee

A price charged every year for the use of the cardboard, which may vary based totally on the card kind.

Rewards Program

Points or cash back earned on purchases, which may be redeemed for diverse rewards.

Introductory Offers

Promotions like 0% APR for a certain period or bonus rewards for brand spanking new cardholders.

Benefits of Using Credit Cards

Building Credit History

Responsible use can improve your credit score, which is crucial for loans and mortgages.

Convenience

Easily make purchases on line and in-save without carrying coins.

Rewards and Discounts

Earn rewards on spending and access special offers.

Fraud Protection

Many credit score playing cards offer zero liability for unauthorized transactions.

Emergency Funds

Can function a backup in case of surprising costs.

Responsible Credit Card Use

Pay On Time

Always pay your payments by using the due date to keep away from late expenses and hobby costs.

Monitor Your Spending:

Keep song of your purchases to live inside your finances.

Keep Balances Low

Aim to use no greater than 30% of your credit restrict to preserve a healthy credit rating.

Read the Fine Print

Understand the terms, charges, and interest fees associated with your card.

Review Statements

Credit Card Apply Online regularly check your statements for accuracy and document any suspicious hobby.

Conclusion

It can be valuable financial tools when used responsibly. They offer flexibility, rewards, and the opportunity to build credit score, however it’s vital to manipulate them wisely to avoid debt and keep a wholesome financial profile. Before applying for a credit card, evaluate your spending behavior and pick out one which aligns together with your economic dreams.

2 notes

·

View notes

Text

Trump Cannot Participate in Closing Arguments in NY Civil Trial, Judge Engoron Says

This is wrong in so many ways!

NTD

5–7 minutes

New York Supreme Court Justice Arthur Engoron indicated to attorneys on Jan. 10 that former President Donald Trump likely won’t participate in closing arguments for his civil fraud trial.

Emails posted to the court docket show Justice Engoron telling Trump’s attorney Chris Kise: “Not having heard from you by the third extended deadline (noon today),” I assume that Mr. Trump will not agree to the reasonable, lawful limits I have imposed as a precondition to giving a closing statement above and beyond those given by his attorneys, and that, therefore, he will not be speaking in court tomorrow.”

President Trump’s lawyers, who have already appealed unsuccessfully for a directed verdict on the grounds of prosecutorial bias, will make their case on Jan. 11.

The email chain shows Justice Engoron telling Mr. Kise repeatedly that he needed to state whether the former president would abide by limitations he sought to impose.

“As I have already indicated to you, if Mr. Trump wishes to speak … you will have to tell me NOW that he will agree to the limitations I have imposed, which go without saying and apply to everyone, and he will have to agree to do so tomorrow, on the record,” Justice Engoron said in an earlier Jan. 10 email to Mr. Kise, the New York attorney general’s office, and other Trump attorneys.

Justice Engoron initially approved the unusual request, saying he was “including to let everyone have his or her say.”

But he said Trump would have to limit his remarks to the boundaries that cover attorneys’ closing arguments: “commentary on the relevant, material facts that are in evidence, and application of the relevant law to those facts.”

He would not be allowed to introduce new evidence, “comment on irrelevant matters” or “deliver a campaign speech”—or impugn the judge, his staff, the attorney general, her lawyers, or the court system, the judge wrote.

Trump attorney Christopher Kise responded that those limitations were “fraught with ambiguities, creating the substantial likelihood for misinterpretation or an unintended violation.

At 11:40 a.m. ET, Mr. Kise told Justice Engoron that he was being “very unfair.”

“You are not allowing President Trump, who has been wrongfully demeaned and belittled by an out of control, politically motivated Attorney General, to speak about the things that must be spoken about,” he said.

Justice Engoron responded: “I won’t debate this yet again. Take it or leave it. Now or never. You have until noon, seven minutes from now. I WILL NOT GRANT ANY FURTHER EXTENSIONS.”

Justice Engoron had denied Mr. Kise’s request to postpone closing arguments after President Trump’s mother died.

In their closing arguments, Trump’s legal team is expected to emphasize critical points from the direct examination of such witnesses as Rosemary Vrablic, a former Deutsche Bank managing director closely involved in efforts to grow business between the bank and the Trump Organization, and Eli Bartov, an expert on real estate accounting practices who spoke on the meaning of generally accepted accounting principles (GAAP) as applied to loans and insurance.

Since the trial began on Oct. 2, 2023, attorneys for New York Attorney General Letitia James’s office have attempted to build a case that in preparing SFCs to seek loans and insurance policies for Trump properties, members of the Trump Organization inflated the value of assets in a manner that involved conscious wrongdoing.

Throughout the government lawyers’ direct examination and cross-examination, they pulled up images on a courtroom screen of statements of financial conditions, emails, letters, contracts, and memoranda bearing the signatures of Mr. Donald Trump Jr., Mr. Eric Trump, Ivanka Trump, Mr. Weisselberg, Mr. McConney, and President Trump himself. The court heard witness after witness testify as to the content of conversations and email exchanges from as far back as 2012, and heard expert testimony about GAAP and whether the documents on the screen adhered to such norms and standards.

Ms. James, a Democrat, who had previously sought a $250 million settlement—almost one-tenth of President Trump’s estimated net worth of $2.6 billion—has announced that nothing less than $370 million will suffice as a penalty for inflated valuations of his assets.

Ms. James also seeks five-year bans on the former president’s sons, Eric Trump and Donald Trump Jr., taking part in any real estate deals.

President Trump blames the attorney general for what he sees as a politically motivated prosecution of the GOP’s 2024 front-runner.

He has also argued that Ms. James is going after him without real legal ground as crime surges on New York’s streets, and that her actions will drive businesses out of New York and deter others from operating in the city.

The Associated Press and Michael Washburn contributed to this report.

From The Epoch Times

5 notes

·

View notes

Text

Sam Bankman-Fried, once hailed as a genius in cryptocurrency, was found guilty Thursday of all fraud counts against him, a year after his exchange, FTX, imploded and practically wiped out thousands of customers.

The verdict was reached around 7:40 p.m. ET, about four hours after the federal jury in Manhattan began deliberations.

Bankman-Fried, a co-founder of the digital currency exchange FTX, was charged with seven counts of wire fraud, securities fraud and money laundering that swindled customers of FTX and lenders to its affiliated hedge fund, Alameda Research.

Bankman-Fried “perpetrated one of the biggest financial frauds in American history,” Damian Williams, the U.S. attorney for the Southern District of New York, said after the verdict.

“The cryptocurrency industry might be new; the players like Bankman-Fried might be new,” Williams said. “But this kind of fraud, this kind of corruption, is as old as time.”

Bankman-Fried faces up to 110 years in prison. His sentencing is scheduled for March 28.

FTX and Alameda quickly collapsed in November 2022 after some of their financial liabilities were exposed. The fact that Alameda had taken billions of dollars from FTX's customers and that much of Alameda's balance sheet comprised digital currency assets it had created, was central to the case against Bankman-Fried.

Unnerved by disclosures about the firm's financial position, many of FTX’s customers tried to get their money back. That set off the equivalent of a bank run.

The value of Alameda's investments crashed, and FTX couldn’t return much of that money because it had been given to Alameda. Some went to the fund’s lenders, and billions were spent on sponsorships, commercials and loans to top executives. That, too, was a major part of the case against Bankman-Fried.

Many of FTX and Alameda's leaders were also charged after the firms went under. Former Alameda CEO Caroline Ellison, FTX co-founder Gary Wang and FTX head of engineering Nishad Singh all pleaded guilty. They agreed to cooperate with the prosecution and testify against Bankman-Fried in exchange for lighter sentences.

While Bankman-Fried testified in his own defense, it didn’t appear to have the same weight as the insider testimony against him. The prosecution, in its closing argument, said Bankman-Fried had answered “I can’t recall” 140 times while he was being cross-examined.

Bankman-Fried’s lawyers contended that he did not intend to defraud anyone and that the government was looking for someone to blame after the failures of FTX and Alameda.

Bankman-Fried was asked to rise and face the jury as the verdicts were read Thursday, and he did so. He showed little emotion as each verdict was read.

His father slumped in his seat, hunched over as each guilty verdict came in. His mother was visibly emotional.

Mark S. Cohen, Bankman-Fried’s counsel, said in an emailed statement Thursday that Bankman-Fried’s legal team respects the jury’s decision but that they are disappointed.

“Mr. Bankman Fried maintains his innocence and will continue to vigorously fight the charges against him,” he said.

Forbes had once estimated that Bankman-Fried's stakes in Alameda and FTXwere worth $26 billion. He was 29 at the time. But after the bankruptcies, that was gone. Criminal charges followed weeks later.

He also faces another trial on charges of bribing foreign officials and other counts. That trial is scheduled to begin in March, and he has pleaded not guilty to all charges.

On Thursday, Bankman-Fried was found guilty of two counts of wire fraud conspiracy, two counts of wire fraud, one count of conspiracy to commit money laundering, one count of conspiracy to commit commodities fraud and one count of conspiracy to commit securities fraud.

Williams, the prosecutor, said Bankman-Fried’s conviction should send a message to others.

“It’s a warning, this case, to every single fraudster out there who thinks that they’re untouchable or that their crimes are too complex for us to catch or that they’re too powerful for us to prosecute or that they could try to talk their way out of it when they get caught,” he said. “Those folks should think again.”

11 notes

·

View notes

Text

Jeffrey McConney, former controller for the Trump Organization, is among the people who has testified in the bench trial for New York Attorney General Letitia James' civil fraud case against the company.

James alleges that former President Donald Trump and his company seriously exaggerated the value of its real estate assets — an allegation that Justice Arthur Engoron, assigned to the case, agreed with in a September 26 ruling. And McConney has offered testimony on the Trump Organization's operations.

Trump's legal team has claimed that McConney has insufficient knowledge where property valuations are concerned. But the Daily Beast's Jose Pagliery, in a report published on October 12, lays out some reasons why that claim is problematic.

POLL: Should Trump be allowed to hold office again?

In court, Trump lawyer Jesus Suarez told Engoron, "Objection, your honor. Mr. McConney is not a valuation expert. He's not offered as a valuation expert."

But Pagliery explains, "The idea that the Trump Organization's long-time bean counter would be oblivious to the inner workings of real estate valuations seemed implausible, given that documents presented at trial showed that he was the key conduit to getting those very valuations compiled into Trump's annual statements of financial condition. That paperwork, which was signed off by outside accountants at the firm Mazars USA, was the reason that financial institutions like Deutsche Bank and Ladder Capital extended hundreds of millions of dollars in loans to Trump."

Pagliery continues, "Those funds allowed his company to seal several marquee deals, including the purchase of the Doral golf course in South Florida and the acquisition of the Old Post Office in Downtown Washington, which briefly became a Trump hotel. The inherently contradictory nature of Trump lawyers' stance on McConney underscored the sharp contrast on display at the ongoing bank fraud trial, where James is trying to bolster a case the judge has already decided has merit while Trump lawyers combat the very premise of the investigation. When investigators point to spreadsheets, the defense either shrugs, appears confused, or claims vastly inflated values are mere differences of opinion."

7 notes

·

View notes

Text

Federal prosecutors hit Rep. George Santos, R-N.Y., with 23 additional charges Tuesday, including allegations of identity theft and that he charged a supporter's credit card in excess of their contribution and then transferred the money to his personal bank account. Prosecutors said Santos faces “one count of conspiracy to commit offenses against the United States, two counts of wire fraud, two counts of making materially false statements to the Federal Election Commission (FEC), two counts of falsifying records submitted to obstruct the FEC, two counts of aggravated identity theft, and one count of access device fraud” in a superseding indictment filed Tuesday. “As alleged, Santos is charged with stealing people’s identities and making charges on his own donors’ credit cards without their authorization, lying to the FEC and, by extension, the public about the financial state of his campaign. Santos falsely inflated the campaign’s reported receipts with non-existent loans and contributions that were either fabricated or stolen” Breon Peace, United States Attorney for the Eastern District of New York, said in a statement.

7 notes

·

View notes