#Jason Klarman

Explore tagged Tumblr posts

Text

What the Fox? “My Son Jeffrey: The Dahmer Family Tapes”

A new streaming series promises “never-before-heard” conversations between serial killer Jeffrey Dahmer, “The Milwaukee Cannibal”, and his father, Lionel. My Son Jeffrey: The Dahmer Family Tapes is streaming from Sept. 18 on Fox Nation, Fox News Channel’s subscription-based streaming service. The four-part documentary series replays conversations recorded with Dahmer while he was in Columbia…

View On WordPress

#Dahmer#Dahmer-mania#Emmy Awards#Fox Nation#Fox news#Jason Klarman#Jeffrey Dahmer#Lionel Dahmer#Milwaukee#Milwaukee Cannibal#My Son Jeffrey: The Dahmer Family Tapes#Netflix#Ronald Flowers#true crime#West Allis

8 notes

·

View notes

Text

Tim Dickinson and Asawin Suebsaeng at Rolling Stone:

Donald Trump was slamming his fist on the Resolute Desk and, once again, calling for blood. It was the second year of his presidency, and Trump was seething about gang members and drug lords. He wanted to see their bodies piled up in the streets. Specifically, he sought a series of mass executions — with firing squads and gallows, and certainly without the quaintness of an appeals process — to send a chilling message about the scope of his power. Trump, who’d taken office inveighing against “American carnage,” wanted to create some of his own. This violent fantasy became an obsession, according to former Trump administration officials. The 45th president brought up the topic so often during the early years of his presidency that one former White House official tells Rolling Stone they lost count. “Fucking kill them all,” Trump would say. “An eye for an eye.” Other times he’d snap at his staff: “You just got to kill these people.” Invoking the brutality of dictatorial regimes that Trump wanted to emulate, he’d add, “Other countries do it all the time.”

For Trump, the spectacle was crucial. “He had a particular affinity for the firing squad,” says one of the former White House officials. He’d say, “They need to be eradicated, not jailed.” Administration officials privately referred to this demand as Trump’s “American death-squads idea,” comparing it to the drug-war bloodbath carried out by Filipino strongman Rodrigo Duterte. (The sources, some still very much within Trump’s circle, requested anonymity in order to speak candidly about sensitive conversations.) That mass executions were not a feature of Trump’s term is a credit to the American justice system and the more sober-minded government officials who were unwilling to be complicit in his mad schemes. These aides and advisers typically put the president off, making vague promises to “look into” the idea, long enough to let Trump’s tyrannical tantrum blow over.

But if Trump defeats Vice President Kamala Harris this November, America will encounter a Trump unbound, a man whose darkest impulses will not be checked by “adults in the room” — creating potentially catastrophic consequences for the American experiment. “This election is about whether or not we remain a democratic society or we move to authoritarianism,” Sen. Bernie Sanders tells Rolling Stone, insisting that Trump “does not believe in the basic tenets and foundations of American democracy.” The safeguards that kept Trump in check during his first term have collapsed — starting with the MAGA-fication of the Republican Party. “We know from the first administration that Trump was an amateur and lots of people stopped his most radical actions,” says Jason Stanley, a Yale professor and author of How Fascism Works. He underscores that Trump’s darkest ambitions were present from the beginning — from the Muslim ban to the coup attempt of Jan. 6. “The only thing that stopped him from being a full-on dictator was other people,” Stanley says. “We know that that’s not going to happen anymore.”

Trump’s campaign to retain power after losing the 2020 election only collapsed because Vice President Mike Pence proved more loyal to the Constitution than to Trump’s cult of personality. But for 2024, Trump has a vice presidential candidate who appears even less committed to the democratic process than he is. J.D. Vance is a protégé and plaything of the billionaire venture capitalist Peter Thiel, who has written that “freedom and democracy” are not “compatible.” A second administration will not feature advisers in the mold of former Chief of Staff John Kelly, or Defense Secretary Mark Esper — establishment Republicans with a stake in keeping Trump constitutionally in bounds. “These are going to be all MAGA people,” says Michael Klarman, a Harvard law professor and an expert in executive power. “Some of them are much more ideologically committed to the agenda than Trump is,” he says, listing deputies like Stephen Miller and Russell Vought, as well as masterminds of the Heritage Foundation’s extreme policy agenda, Project 2025.

[...]

Dictatorship Threat

TRUMP HAS BEEN PUBLIC about his plans, vowing to be a “dictator” — though just for a day, he claims, so he could supercharge fossil-fuel production and seal off the border. How any of this would work is likely beyond Trump’s understanding, but he’s certainly going to pull every lever of power within his grasp. And the targets of his authoritarian ambition are not single-day, or even single-year, projects. Trump seeks autocratic power to implement his draconian immigration policies, including starting “the largest domestic deportation operation” in U.S. history and reinstating the Muslim travel ban. He’s called for ending the constitutional right of birthright citizenship with an “executive order” — a notion backed by Vance.

Trump also seeks to remake American energy policy to benefit the fossil-fuel industry, a plan he shorthands as “drill, drill, drill.” And he’s put criminal justice on the agenda, vowing to free the rioters who stormed the Capitol on Jan. 6, calling them “hostages” and vowing to “sign their pardons or commutations on Day One.” For those who have studied the rise of authoritarian leaders throughout history, the playbook of Trump and his allies dictates they will push through as many new laws, executive decrees, and emergency orders as possible before anyone understands what is happening. “They want to have a blitzkrieg — and then all you need to be is a dictator for a day,” says Ruth Ben-Ghiat, author of Strongmen: How They Rise, Why They Succeed, How They Fall and a professor at New York University. “It’s not just a change of methods, it’s a change of political system — a vast expansion of the powers of the executive, so that Trump will be able to rule as an autocrat.”

Get Out of Jail Free

TRUMP’S EFFORT TO REGAIN power is driven substantially by his desire to stay out of prison — part of a long pattern of putting his own interests ahead of the nation’s. He is a felon convicted on 34 counts stemming from the cover-up of a hush-money payout to a porn star at the height of the 2016 election. He also faces federal charges for election interference, as well as a Georgia indictment for his demand that GOP election officials “find 11,780 votes” to reverse his loss in that swing state. Regaining the White House would put a naked abuse of power at Trump’s fingertips. Trump has long been open about his desire to meddle in his criminal cases, having called on Congress to defund the Justice Department until it dropped charges against him. No one in MAGA world denies that Trump would begin a second term by ordering federal charges against himself and his cronies dismissed. In a more normal time, such a brazenly corrupt act might define a political era.

Trump’s tightrope walk to keep out of prison is a hallmark of autocrats. “Regular politicians wouldn’t even run for office if they had big legal problems. But strongmen are not normal politicians,” says Ben-Ghiat. “They have to run; they have to get back into power and make their legal troubles go away.” She points to the examples of Italy’s former Prime Minister Silvio Berlusconi, who faced dozens of criminal trials, and Russia’s Vladimir Putin. “This is how these guys think. And it’s why they all denigrate the press and the judiciary as corrupt, because that’s their enemy.”

Retribution Agenda

TRUMP HAS POSITIONED HIMSELF as an avatar of a collective revenge fantasy for his followers. During a 2023 speech in Waco, Texas, site of the fiery 1993 standoff between the anti-government Branch Davidian cult, led by David Koresh, and federal authorities, Trump told the audience: “I am your warrior, I am your justice.… For those who have been wronged and betrayed … I am your retribution.” The Waco setting was chilling — and no accident. The FBI’s deadly siege of the Koresh compound inspired the 1995 Oklahoma City bombing by militia member and anti-government extremist Timothy McVeigh, the deadliest domestic terror attack in U.S. history and a horrific act of vengeance. McVeigh and Koresh are seen as martyrs by the far right, and Trump was speaking directly to the most radical core of his base.

Trump has already threatened to turn the Justice Department into a vehicle for retribution for what he perceives as unjust political persecution — for election interference, hush-money payments, as well as his alleged mishandling of classified documents. He has posted on Truth Social, for example: “IF YOU GO AFTER ME, I’M COMING AFTER YOU!” Trump has long blamed Biden for all of his legal woes, despite the president’s hands-off approach to the various cases against him. Trump has vowed to appoint “a special prosecutor” to go after President Biden and his family over what Trump describes as “bribes, kickbacks, and other crimes,” insisting, “Justice will be done.” Trump associate and former counsel to the Senate Judiciary Committee Mike Davis, who has been talked up for a top post in a new Trump administration, said on a recent podcast that if he were selected as acting attorney general, he’d carry out a “three-week reign of terror” before getting “chased out of town with my Trump pardon,” pledging to “indict Joe Biden and Hunter Biden and James Biden and every other scumball, sleazeball Biden.”

[...]

Controlling Families

LIKE MANY ASPIRING AUTOCRATS, Trump is a threat to families, seeking to impose government power on personal choices about reproduction. He’s “proud” of his success in overturning Roe v. Wade, which led to state-level, near-total abortion bans affecting millions of women. Trump has said he’ll personally vote to preserve Florida’s six-week abortion ban, and has even endorsed the idea of states choosing to punish women for seeking abortion care. The GOP platform, moreover, includes a declaration of fetal personhood, asserting that fetuses are entitled to 14th Amendment protections — logic that could lead to a court-imposed nationwide abortion ban. Vance, meanwhile, has opposed abortion even in the case of rape and incest: “It’s not whether a woman should be forced to bring a child to term,” he said in a 2021 interview. “It’s whether a child should be allowed to live — even though the circumstances of that child’s birth are somehow inconvenient to society.” Vance has also accused people without children of lacking a “direct stake” in the country and proposed that those with kids be given greater voting power. (His mentor, Thiel, has blamed his loss of confidence in democracy, in part, on “the extension of the franchise to women.”) Controlling reproduction is yet another hallmark of fascism, says Ben-Ghiat, whose expertise is in Benito Mussolini’s rule in Italy. Il Duce equated population growth with national strength, and restricted birth control and outlawed abortion while providing loans to married couples that would be forgiven in stages with the birth of each child. “Vance may not know that he’s repeating Mussolini proposals, but it’s the same stuff,” Ben-Ghiat says. “You have women seen as an enemy if they’re not contributing to the state by having babies.” Ben-Ghiat points out that this type of rhetoric doesn’t just impact women: “Mussolini actually passed a measure that taxed bachelors because they weren’t doing their duty” to reproduce. “It’s never just one target,” she warns. “The number of targets always expands.”

[...]

‘Real Danger to the Rule of Law’

TRUMP’S AUTHORITARIANISM ISN’T going to look the same as Putin’s in Russia or Xi Jinping’s in China. Think more of a WWE-style circus mixed with former FBI director J. Edgar Hoover-style crackdowns and Newt Gingrich’s limited-government fantasies. Much of what Trump and his government-in-waiting are plotting — including invading and even bombing Mexico to supposedly send a message to drug cartels — is rooted in Trump’s impulse to wallow in the spectacle of cinematic violence. The sheer cartoonishness of Trump’s vision for America can make it hard to accept as real. But Klarman insists that Trump and Co. must be taken at face value: “There’s no reason to doubt it. They admire Viktor Orban; Trump meets with him at Mar-a-Lago. He admires Putin’s strength. He admires Xi. They are authoritarian. There’s no reason in the world to doubt this.” It is seductive to dismiss Trump’s darkest calls for revenge and bloodshed as red meat to rally his troops, and to doubt the likelihood of follow-through. “It’s a very common theme in the history of fascism that lots of people think that the fascist leader is joking,” Stanley warns. “People don’t want to believe what’s right in front of their eyes. Let’s take Trump seriously this time.” Trump allies like Davis call fears of an autocratic Trump term “silly.” He points to the fact that Trump never had Hillary Clinton arrested, despite the pervasive chants at his rallies to “Lock her up” — which he contends offers assurance that the former president’s most troubling rhetoric won’t translate into action: “Trump has already proven that he’s not going to be vindictive as president.” Others who have seen Trump operate up close, however, are strident in their warnings. Pence refused to endorse Trump on the grounds that “anyone who puts themselves over the Constitution should never be president of the United States.” John Kelly, Trump’s longest-serving chief of staff, has blasted Trump’s admiration for “autocrats and murderous dictators,” while insisting the former president has “nothing but contempt for our democratic institutions, our Constitution, and the rule of law.” But the surge of excitement and creative energy for the candidacy of Kamala Harris — and a Democratic agenda centered on Tim Walz’s call for Americans to both root for their neighbors and to “mind your own damn business” — provides hope of defending against Trump’s threat to democracy.

Rolling Stone had an insightful column about how America would be a nightmare if Donald Trump wins. If you want a safe, free, and prosperous America, vote Kamala Harris!

Read the full story at Rolling Stone.

#Donald Trump#Authoritarianism#Project 2025#2024 Presidential Election#2024 Elections#John Kelly#Mark Esper#Stephen Miller#Russ Vought#Mike Davis

4 notes

·

View notes

Text

Fox Nation is set to host a night of comedy featuring the talented Jimmy Failla. This event is generating excitement among fans and comedy lovers alike. Scheduled for August 12th, the evening promises to deliver laughter and entertainment to all attendees. Jason Klarman, the President of Fox Nation, has praised Failla, calling him “one of […]

0 notes

Text

0 notes

Text

Happy Friendsgiving Vintage, Friends Tv Show, The One With All The Thanksgivings Unisex T-Shirt

Get your Friendsgiving celebration off to a good start with this vintage Happy Friendsgiving design. Imagine yourself sitting around the Thanksgiving table with Rachel, Monica, Phoebe, Joey and Chandler as you're about to gobble down your first bite of turkey. We're not talking about just any old shirt though! This is an officially licensed Jason Klarman shirt from Production Onslaught Ink that'll be sure to have everyone asking where you got it!

buy now: https://frogtyshop.com/product/happy-friendsgiving-vintage-firends-tv-show-the-one-with-all-the-thanksgivings-unisex-tshirt-sweatshirt-hoodie/

0 notes

Text

Regresa a la pantalla la serie 'Cops', suspendida en EE.UU. tras la muerte de George Floyd

Regresa a la pantalla la serie ‘Cops’, suspendida en EE.UU. tras la muerte de George Floyd

El servicio de televisión a la carta FOX Nation, creado por la cadena FOX News, anunció este lunes que ha dado luz verde al regreso de la emblemática serie ‘Cops’ (‘Policías’) y puso fecha al estreno de la temporada 33 en la plataforma: el 1 de octubre. Esta serie es “una de las marcas más icónicas de la televisión con una base de fans increíblemente apasionada”, explicó Jason Klarman, presidente…

View On WordPress

0 notes

Text

"COPS" TV Show Revived on FOX Nation Streaming Service - Patrol

“COPS” TV Show Revived on FOX Nation Streaming Service – Patrol

FOX Nation has greenlit the return of the iconic series “COPS” and will premiere season 33 on Oct. 1, announced Jason Klarman, president of the subscription streaming service. The debut will include the first four episodes and each new installment of “COPS” thereafter will drop weekly on Friday nights. The deal also includes 15 episodes from season 32. Season 32 of “COPS“ was appearing on the…

View On WordPress

0 notes

Link

Exxon Mobil Faces Climate Change Battle at Annual Meeting: Live Updates Here’s what you need to know: Exxon Mobil storage tanks in Rotterdam. Shareholders say the oil giant should invest more heavily in renewables like wind and solar energy.Credit…Peter Dejong/Associated Press Exxon Mobil will face a big challenge over its climate change policies at an annual shareholder meeting on Wednesday as activists contest the election of one-third of the company’s board. A coalition of investors concerned about the environment has argued that Exxon has not invested enough in cleaner energy, which will hurt its profits in the future. These investors argue that the company should follow European oil companies like BP and Total that have begun investing heavily in renewables like wind and solar energy. The hedge fund leading this campaign, Engine No. 1, is seeking to defeat the election of four of the company’s director candidates and has proposed four of its own. A victory for even one of its nominees would be a sharp rebuke to Darren W. Woods, Exxon’s chairman and chief executive. Some big pension funds, including the New York State Common Retirement Fund and the California Public Employees’ Retirement System, have joined Engine No. 1, which was started last year. “We listen, and we hear,” Mr. Woods said in an interview in which he tried to take a conciliatory tone. “We don’t always agree, but we always understand there is an opportunity to improve.” Exxon has argued that its investments in carbon capture and storage, including a proposal to capture the emissions from industrial plants along the Houston Ship Channel, demonstrate that the company is changing in its approach to climate change. This week, it announced that it would add two new directors to the board, including a climate expert, but it has not committed to investing in renewable energy. Engine No. 1 dismissed the move, saying, “This vote is too important to be influenced by this type of cynical, last-minute maneuvering.” The final shareholder meeting for Jeff Bezos as Amazon’s chief executive could be eventful.Credit…Michael Nelson/EPA, via Shutterstock Amazon’s investors are gathering virtually on Wednesday for the company’s annual shareholder meeting. There is much to discuss, according to the DealBook newsletter: good, bad and ugly (from the perspective of Amazon’s management). The e-commerce giant’s bumper profits are likely to be overshadowed by three major developments: Reports that the company is about to make an expensive bet on the Hollywood studio MGM, a series of shareholder proposals that company directors don’t want to pass and an antitrust suit filed against the company that landed on Tuesday. Amazon is said to be considering spending $9 billion to acquire MGM, which would buy classic films like “Rocky” and “Singin’ in the Rain,” as well as the James Bond franchise. If a deal is reached, approval from regulators would rest on Amazon’s argument that it’s a small player in entertainment. (Lina Khan, a nominee for the F.T.C. who is awaiting Senate confirmation, made her name with a paper about Amazon’s alleged antitrust abuses.) The backers of several shareholder proposals, all opposed by Amazon’s management, say their aim is to make the company a better corporate citizen, reacting to accusations of labor and environmental abuses. New York State’s pension fund is calling on Amazon to conduct an independent racial equity audit of its practices related to civil rights, equity, diversity and inclusion. (Calls for racial audits have been a feature at many shareholder meetings recently.) Another proposal would bar Jeff Bezos from leading Amazon’s board after he steps down as chief executive this year. The District of Columbia sued Amazon on Tuesday, accusing the company of effectively prohibited sellers on its site from charging lower prices for the same products elsewhere, which raised prices on Amazon and beyond. “Amazon has used its dominant position in the online retail market to win at all costs,” said Karl Racine, the district’s attorney general. It is believed to be the first antitrust suit against Amazon by an American government authority, but because it is based on local rather than federal law, its effect could be limited even if successful. Nonetheless, Mr. Racine’s argument “is both old-school and novel, and it might become a blueprint for crimping Big Tech power,” wrote Shira Ovide, The Times’s On Tech columnist. Episodes of “Tucker Carlson Tonight” will be available the next day on Fox Nation, along with other prime-time Fox News shows.Credit…Richard Drew/Associated Press Fox News entered the streaming video market in November 2018 with Fox Nation, a digital subscription service that now encompasses hundreds of hours of original programming including political commentary, documentaries and travel specials like “Castles USA,” in which the host Jeanine Pirro tours castles around the country. Until now, the network had resisted rebroadcasting its marquee prime-time shows on the streaming service. That is set to change next week, in a significant shift in digital strategy for the Rupert Murdoch-owned channel. Starting June 2, episodes of “Tucker Carlson Tonight,” “Hannity” and “The Ingraham Angle” will be available on demand on Fox Nation the day after they are shown live on cable. The shift “will add incredible value for subscribers,” Fox Nation’s president, Jason Klarman, said in a statement on Tuesday. Fox News had reasons to initially avoid duplicating its traditional TV programming on Fox Nation. The channel earns significant revenue from cable distributors that pay to carry Fox News. And the network has the largest total weeknight audience in cable news; viewers who switch over to watch the programs on Fox Nation will not be counted by Nielsen. Other networks, though, have seen benefits from making their cable programs available in digital venues. The shows can attract new subscribers and widen their viewership to the younger audiences that prefer streaming services. A monthly subscription to Fox Nation costs $6. The network has declined to share its total number of subscribers. Lachlan Murdoch, the executive chairman of the Fox Corporation, said on a recent earnings call that the first quarter of 2021 had generated Fox Nation’s “highest number of customer acquisitions since launch.” The District of Columbia said in a lawsuit that Amazon had stopped merchants that use its platform from charging lower prices for the same products elsewhere online.Credit…Angela Weiss/Agence France-Presse — Getty Images The District of Columbia claimed in a complaint on Tuesday that the giant online marketplace is artificially raising prices for products by abusing its monopoly power. The legal action is believed to be the first government antitrust suit against Amazon in the United States, report The New York Times’s David McCabe, Karen Weise and Cecilia Kang. Here’s what you need to know: What D.C. says “Amazon has used its dominant position in the online retail market to win at all costs,” said Karl Racine, the attorney general for the District of Columbia. “It maximizes its profits at the expense of third-party sellers and consumers, while harming competition, stifling innovation and illegally tilting the playing field in its favor.” What Amazon says Mr. Racine “has it exactly backwards — sellers set their own prices for the products they offer in our store,” Jodi Seth, a spokeswoman for Amazon, said in a statement. She added that Amazon reserved the right “not to highlight offers to customers that are not priced competitively.” The big picture Amazon has attracted attention from critics because of the sweeping nature of its business. It operates a dominant web hosting operation and a streaming platform that competes with Netflix and Hulu, and it expanded into brick-and-mortar grocery stores with the 2017 acquisition of Whole Foods. But the lawsuit filed by Mr. Racine, a Democrat, concerns the core of its business: the online marketplace for outside merchants that accounts for more than half of the products it sells. Australians will have some of the best views of the “super blood moon” this week, but passengers on a one-time flight departing from Sydney had an even better one. The Australian airline Qantas operated a three-hour flight on Wednesday (Tuesday evening in the United States) for about 100 passengers to see the moon enter the Earth’s shadow and turn a blood red color during a total lunar eclipse. Tickets went on sale this month for 499 Australian dollars (about $386) for economy class and 1,499 Australian dollars (about $1,162) for business class. The tickets sold out in less than half an hour. Senator Sherrod Brown, Democrat of Ohio, is the chairman of the Senate Banking Committee.Credit…Andrew Harnik/Associated Press The chief executives of the six biggest American lenders will testify before the Senate Banking Committee on Wednesday, the first time the committee has summoned all the top bankers since the financial crisis of 2008. (They will also appear at the House Committee on Financial Services on Thursday, for the first time since 2019.) At the Senate hearing, Sherrod Brown, Democrat of Ohio and the committee’s chairman, has promised to press the bank chiefs on a range of subjects, sending them a list of questions on topics including the riskiness of their assets, the diversity of their work forces, actions on climate change, pledges on racial equity and more. It could make for a disjointed hearing as senators veer from issue to issue, trying to catch the chief executives off guard or unprepared. Their prepared testimonies address the committee’s questions in varying depth and detail, while all make the case that their institutions are healthier, safer and more law-abiding since 2008. Jamie Dimon of JPMorgan Chase turned in a nine-page paper urging business, government and society to address inequities and “unleash the extraordinary vibrancy of the American economy.” Jane Fraser of Citigroup prepared 11 pages (and a three-page addendum with data and tables) that note her bank’s approach to cryptocurrencies, saying that it is “focusing resources and efforts to understand changes in the digital asset space.” James Gorman of Morgan Stanley assembled a 20-page report with few frills that includes a short introduction and responses to each question in order. Charles Scharf of Wells Fargo and David Solomon of Goldman Sachs each submitted 15 pages heavy on environmental, social and governance issues. Brian Moynihan of Bank of America had the most to say, with 32 pages that devote a lot of space to the bank’s “responsible growth” principles. “We embrace our dual responsibility to drive both profits and purpose,” he wrote. Source link Orbem News #annual #Battle #Change #Climate #Exxon #Faces #Live #Meeting #Mobil #Updates

0 notes

Text

Jason Klarman Named as President of Fox Nation

Jason Klarman Named as President of Fox Nation... #JasonKlarman has been named President of #FoxNation, it was announced by Suzanne Scott, CEO of #FoxNews Media, to whom he will report.

Jason Klarman has been named President of Fox Nation, it was announced by Suzanne Scott, CEO of Fox News Media, to whom he will continue to report. Continue reading

View On WordPress

0 notes

Text

The Power of Visual Thinking

Value Investing Almanack (VIA) Special Offer: VIA, our premium newsletter that subscribers call “the best resource on Value Investing in India,” which was closed for new subscriptions for the past few months, is now accepting new members, and at a very special 55% discount, or Rs 9,000 off the base price! Click here to join now.

* * * Here is your latest Saturday newsletter, where I share the latest updates from the site, an idea worth thinking about, few stories you shouldn’t miss, and a question for you. Let’s get started.

Safal Niveshak Updates Just in case you missed, here are a couple of recent posts on the site –

30 Big Ideas from Seth Klarman’s Margin of Safety (Special Report) (Corrected and with new download links)

The Best Books: Recommended Reading List

Regret Missing the Rally in Stocks? Now What?

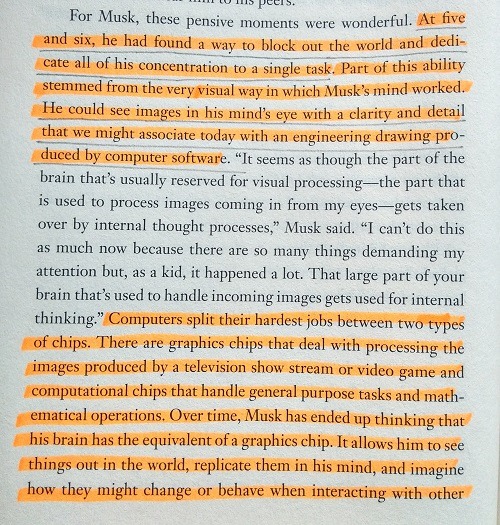

Imagine! Here’s a note from Ashlee Vance’s biography of Elon Musk –

Visual thinking is a great way to understand complex or potentially confusing information, and also a way to organize your thoughts and improve your ability to think and communicate.

Imagine someone talking to you, and starting with the word – “Imagine…”

You are completely hooked, isn’t it?

Consider this excerpt from Richard Feynman’s The Pleasure of Finding Things Out, where his father helps him visualize about dinosaurs –

We had the Encyclopedia Britannica at home and even when I was a small boy my father used to sit me on his lap and read to me from the Encyclopedia Britannica, and we would read, say, about dinosaurs and maybe it would be talking about the brontosaurus or something, or tyrannosaurus rex, and it would say something like, ‘This thing is twenty-five feet high and the head is six feet across,’ you see, and so he’d stop and say, ‘let’s see what that means. That would mean that if he stood in our front yard he would be high enough to put his head through the window but not quite because the head is a little bit too wide and it would break the window as it came by.’ Everything we’d read would be translated as best as we could into some reality and so I learned to do that ��� everything that I read I try to figure out what it really means, what it’s really saying by translating.

Then consider how Warren Buffett visually convinced me why gold was a bad investment…

I will say this about gold. If you took all the gold in the world, it would roughly make a cube 67 feet on a side… Now for that same cube of gold, it would be worth at today’s market prices about $7 trillion dollars – that’s probably about a third of the value of all the stocks in the United States… For $7 trillion dollars… you could have all the farmland in the United States, you could have about seven Exxon Mobils, and you could have a trillion dollars of walking-around money… And if you offered me the choice of looking at some 67-foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I’ll take the farmland and the Exxon Mobils.

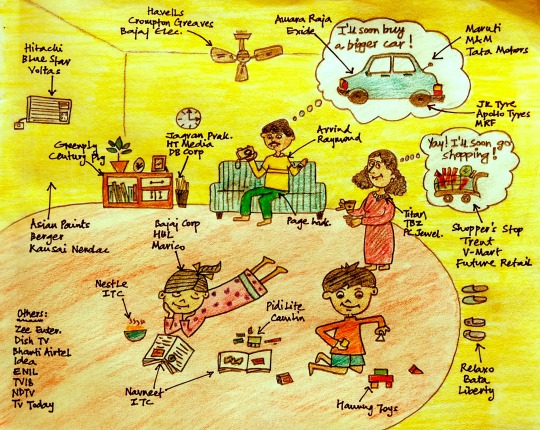

I’ve tried my hands at visual thinking this way –

You may want to check out my Wall of Ideas for more such examples of visual thinking.

Now, visual thinking is not a new lesson that I would attribute to Elon Musk. But imagine the kind of businesses he is building, to save the world, which he had originally visualized when he was under ten years of age.

When it comes to investing, you can avoid yourself a lot of pain by just visualizing your life after you’ve lost a lot of money trading and speculating in the stock market. If the visuals unnerve you, don’t do anything that would get you into such a situation. That’s also the concept of inversion.

I personally used visual thinking when I was deciding about quitting my job to start Safal Niveshak to help small investors become better at their investment decision making. Of course, when I had started planning my future after a job, the first visual was that of – not being successful in my future work, getting over my savings, and having to return to a job.

But another visual I saw was of helping people, enjoying the freedom of doing things my way, and spending a lot of time with my family. And I thank my stars that this was more powerful than the visual of losing everything.

A Few Stories You Shouldn’t Miss

We Begin Our Lives as Growth Stocks, But End Our Lives As Value Stocks (Of Dollars And Data)

The Bargain Hunter’s Dilemma (Barry Ritholtz)

What I Read, and Why (Jason Zweig)

Why I’m Losing Hope in India (Andy Mukherjee)

Last Refuge of License Raj (Anand Sridharan)

Here’s How to Give Thanks—Not Once a Year—but Every Day (Ryan Holiday)

Happiness Won’t Save You (NY Times)

Meditations

History may not repeat itself, but some of its lessons are inescapable. One is that in the world of high and confident finance little is ever really new. The controlling fact is not the tendency to brilliant invention; the controlling fact is the shortness of the public memory, especially when it contends with a euphoric desire to forget.

~ John Kenneth Gailbraith

On the surface it seems that the present moment is only one of many, many moments. Each day of your life appears to consist of thousands of moments where different things happen. Yet if you look more deeply, is there not only one moment, ever? Is life ever not “this moment?”

This one moment – Now – is the only thing you can never escape from, the one constant factor in your life. No matter what happens, no matter how much your life changes, one thing is certain: it’s always Now.

Since there is no escape from the Now, why not welcome it, become friendly with it?

~ Eckhart Tolle

A Question for You When you get better at what you do, you can make a bigger impact and solve bigger problems. That gives you more satisfaction. And also more income.

Ask yourself this question – How can I get better at what I do?

* * * That’s about it from me for today.

If you liked this post, please share with others on WhatsApp, Twitter, LinkedIn, or just email them the link to this post.

If you are seeing this newsletter for the first time, you may subscribe here.

Stay safe.

Regards, Vishal

* * * Value Investing Almanack (VIA) Special Offer: VIA, our premium newsletter that subscribers call “the best resource on Value Investing in India,” which was closed for new subscriptions for the past few months, is now accepting new members, and at a very special 55% discount, or Rs 9,000 off the base price! Click here to join now.

The post The Power of Visual Thinking appeared first on Safal Niveshak.

The Power of Visual Thinking published first on https://mbploans.tumblr.com/

0 notes

Text

1 note

·

View note

Link

DTC health tech startup Eargo announced the hiring of Shiv Singh as chief marketing officer today.

Shiv Singh Joins DTC Health Tech Startup As CMO

This week’s marketing shifts include former Visa and PepsiCo marketer Shiv Singh joining DTC health tech company Eargo as chief marketing officer, Fox News Media seeing the return of Jason Klarman as EVP of marketing, …

0 notes

Text

15 Quotes I Love About Value Investing

I recently read about 40 pages of quotes from value investors around the world. The quotes were compiled by Value Investor Insight and they’ve made the entire collection free for anyone to read — you can view them all here.

But for those who don’t want to read all 40 pages, I’ve highlighted 15 of my favorite quotes below. By journaling and sharing them here, I hope they help my investment process going forward and also yours.

1. It is one of the hardest things to do and that is to remain a disciplined, long-term investor at all times.

“If the entire country became securities analysts, memorized Benjamin Graham’s Intelligent Investor and regularly attend- ed Warren Buffett’s annual shareholder meetings, most people would, nevertheless, find themselves irresistibly drawn to hot initial public offerings, momentum strategies and investment fads. People would still find it tempting to day-trade and perform technical analysis of stock charts. A country of security analysts would still overreact. In short, even the best-trained investors would make the same mistakes that investors have been making forever, and for the same immutable reason — that they cannot help it.” Seth Klarman

2. Value investors need to harness time and use it tactically.

“Time arbitrage just means exploiting the fact that most investors — institutional, individual, mutual funds or hedge funds — tend to have very short-term time horizons, have rapid turnover or are trying to exploit very short-term anomalies in the market. So the market looks extremely efficient in the short run. In an environment with massive short-term data over- load and with people concerned about minute-to-minute performance, the inefficiencies are likely to be looking out beyond, say, 12 months.” Bill Miller

3. Great investment ideas are not necessarily complicated.

“There’s a clarity that comes with great ideas: You can explain why something’s a great business, how and why it’s cheap, why it’s cheap for temporary reasons and how, on a normal basis, it should be trad- ing at a much higher level. You’re never sitting there on the 40th page of your spreadsheet, as Buffett would say, agonizing over whether you should buy or not.” Joel Greenblatt

4. There’s a perception that numbers, quants, and algorithms rule the stock market, but it’s so much more than that.

“I think my background has helped me learn to think well conceptually. Investing is not just about numbers. It’s also about imagination and structure and narrative and characters — the types of things we liberal-arts majors should know something about.” John Burbank

5. You should be able to defend your highest conviction investments at all times.

“There’s a virtuous cycle when people have to defend challenges to their ideas. Any gaps in thinking or analysis become clear pretty quickly when smart people ask good, logical questions. You can’t be a good value investor without being an independent thinker — you’re seeing valuations that the market is not appreciating. But it’s critical that you understand why the market isn’t seeing the value you do. The back and forth that goes on in the investment process helps you get at that.” Joel Greenblatt

6. Your edge is not going to come from data or news, it’s going to come from something of your creativity.

“Everyone tends to see the same things, read the same newspapers and get the same data feeds. The only way to arrive at a different answer from everybody else is to organize the data in different ways, or bring to the analytic process things that are not typically present.” Bill Miller

7. A good investment is not entirely dependent on the balance sheet, it’s also about the management team.

“We tend to be more about the jockey than the horse. It’s important to under- stand how people are going to behave under stress. You don’t have to predict the future if you know the company has the assets and management to do well in difficult times. I believe that’s when the seeds for exceptional performance are planted.” Bruce Berkowitz

8. Every investment should have a price, and if it’s not there now, you will be rewarded greatly if it ends up there down the road.

“Our best ideas tend to come from what I call “old research, new events.” That’s typically the good company you’ve studied carefully and would love to own at the right price, that gets marked down after it trips or its industry goes out of favor.” Ricky Sandler

9. Always remember that a cheap investment is cheap for a reason and cheap does not automatically make it a value.

“One of the big mistakes value investors can make is to be too enamored with absolute cheapness. If you focus on statistical cheapness, you’re often driven to businesses serving shrinking markets or that have developed structural disadvantages that make it more likely they’re going to lose market share.” Bill Nygren

10. You must know your circle of competence and when you should or should not be investing.

“I’d always said that if a guy was long the best 50 companies he knew and short the 50 worst, if that didn’t work you were in the wrong business. But that strategy was literally a recipe for bankruptcy from 1998 to 2000. I said when I closed down that it was a market I didn’t understand, and I didn’t.” Julian Robertson

11. Change your outlook on life, it will spark the little things, which in turn will lead to the big things.

“People who are in a good mood are more inclined to try learning new skills, to see things in a broader context, to think of creative solutions to problems, to work well with other people, and to persist instead of giving up. If you were writing a recipe for how to make more money, those are among the first ingredients you would include.” Jason Zweig

12. Human psychology plays a massive role in the world of investing.

“To suppose that the value of a common stock is determined purely by a corporation’s earnings discounted by the relevant interest rates and adjusted for the marginal tax rate is to forget that people have burned witches, gone to war on a whim, risen to the defense of Joseph Stalin and believed Orson Wells when he told them over the radio that the Martians had landed.” Jim Grant

13. Durability is a trait you should never overlook.

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.” Warren E. Buffett

14. Avoid complacency and stay vigilant.

“One of the economists who has heavily influenced the way I think is Hyman Minsky, who always said, “Stability begets instability.” The very idea is that the more stable things appear, the more dangerous the ultimate outcome will be because people start to assume everything will be all right and end up doing stupid things.” James Montier

15. I am making this investment today because… You need to be able to answer that every single time.

“I never buy anything unless I can fill out on a piece of paper my reasons. I may be wrong, but I would know the answer to that. “I’m paying $32 billion today for the Coca Cola Company because.” If you can’t answer that question, you shouldn’t buy it. If you can answer that question, and you do it a few times, you’ll make a lot of money.” Warren Buffett

#Investing#$SPY#$BRK-A#$BRK-B#Stocks#WarrenBuffett#Quotes#Stock Market#Finance#Money#Charlie Munger#Investors

366 notes

·

View notes

Text

Fox shakes up advertising pitch as Tucker Carlson ad revolt continues

Fox News is planning a shake-up of its pitch to advertisers at the same time as multiple controversies over the tenor and content of its news coverage are sparking calls for a boycott that has already caused some advertisers to flee.

The changes, under a new marketing slogan, “America is watching”, are intended to highlight the channel’s news operations but come as advertisers are increasingly wary of repeated scandals around its opinion show hosts’ political bias.

In recent months, dozens of advertisers have pulled their ads from Fox shows, threatening to reduce Fox’s access to the lifeblood of advertising revenue, a trend that may accelerate in the wake of several recent, polarizing events.

Last week, a New Yorker story laid out how Fox’s close ties to the Trump administration had led some to accuse it of being a propaganda outlet for administration officials. That was followed by back-to-back incidents involving two of Fox’s most politically unyielding hosts, Jeanine Pirro and Tucker Carlson.

Pirro, a former New York prosecutor, accused Ilhan Omar, the Democratic representative from Minnesota, of placing Sharia law above recognition of constitutional rights, a clearly offensive overreach that Fox News itself publicly condemned in a statement.

Meanwhile, the Fox host Tucker Carlson has been forced to respond to radio recordings he made to the shock jock Bubba the Love Sponge 10 years ago in which he described women as “extremely primitive” and defended the now convicted polygamous child sexual abuser Warren Jeffs.

The recordings, released by the progressive media watchdog Media Matters for America, led to a social media campaign urging Fox to dismiss Carlson and calling on advertisers to drop their support of the show.

According to Business Insider as many as 33 have already stopped advertising on Carlson’s show in recent months, though probably not all were reacting to Carlson’s views now or in the past or the protests against him.

Since the weekend, #FireTuckerCarlson and #BoycottTuckerCarlson have trended on Twitter as users tagged advertisers still working with Carlson.

In a statement, the Trinity College, Connecticut-educated Carlson posted on Twitter that he would not “express the usual ritual contrition” for “saying something naughty on a radio show more than a decade ago”. He invited critics to come on his show and take it up with him directly.

On his Monday evening broadcast, Carlson maintained a defiant stance. “Fox News is behind us, as they have been since the very first day,” he added, noting: “But we will never bow to the mob. Ever. No matter what.”

Advertisers that have so far pulled their ads from Fox include the pharmaceutical giant AstraZeneca, which announced on Monday it would no longer advertise around Carlson’s evening program Tucker Carlson Tonight.

Pressure is mounting on Carlson’s remaining advertisers, including Mitsubishi and Allstate Insurance, to follow 33 others that have cut ties with the host since December, when he told viewers that immigrants make the country “poorer and dirtier”.

Those that have already walked include Takeda Pharmaceutical Company, CareerBuilder, TD Ameritrade, Just For Men, Outback Steakhouse and Peloton.

In some cases, advertisers have pulled their ads without announcing it, so Fox’s lost accounts could be greater.

On Monday evening, noted Variety, Carlson’s program featured longer commercials from the direct-response advertiser MyPillow, a regular Fox News client. Bayer AG, the pharmaceutical manufacturer, aired commercials for Claritin-D and One-a-Day vitamins.

However, Fox’s decision so far to stand by Pirro and Carlson follows a proven strategy for the station in which hosts must find a balance between stimulating and provoking the reactive political and social positions of Fox’s core viewership while not going so far as to alienate advertisers who seek them.

Advertisers began to walk away last summer after Laura Ingraham suggested detention facilities at the US-Mexico border were like “summer camps”.

Still, Fox News’ three top shows, hosted by Carlson, Sean Hannity and Ingraham, are among the most-watched programs in cable news. Carlson’s show averages 525,000 viewers a night aged between 25 and 54, figures that walk over ratings for CNN and MSNBC at the similar 8pm timeslot.

But the timing of the latest controversies is also critical for other reasons. In the coming months, 21st Century Fox will complete the sale of its studio and most cable assets to Disney.

At that point the company – known as Fox Corporation – will rely on Fox News, Fox Business Network, Fox Sports and Fox Broadcasting for revenue. Of those, Fox News accounted for $1.02bn in advertising revenue in 2018, a figure projected to climb to $1.07bn this year.

So far, despite the recent ad boycotts, 21st Century Fox says advertising revenue was up 6% over the last quarter. With TV entering its critical ad-selling sales session, Fox News will be certain to want to keep it that way – even if that means stirring controversy.

According to the Fox News consultant Jason Klarman, more than two-thirds of Fox’s audience is there for news itself, not opinion programming like Hannity and Carlson. “News is transcending its own genre and becoming popular culture, thanks in part to the Trump presidency,” Klarman told Variety.

0 notes

Text

Latticework of Mental Models: Risk Aversion Vs Loss Aversion

On April 10, 2003, Pepsi announced a contest called “The Pepsi Billion Dollar Sweepstakes”. It was scheduled to run for 5 months starting from May in the same year.

For the contest, Pepsi printed one billion special codes which could be redeemed either on their website or via postal mail. According to Pepsi’s estimate, about 200-300 million of these codes were redeemed. Out of these, 100 codes were chosen in a random draw to appear in a two-hour live gameshow-style television special. Each of these 100 people were assigned a random 6-digit number, and a chimpanzee (to ensure a truly random number and of course to rule out any monkey business) backstage rolled dice to determine the grand prize number. This number was kept secret and the 10 players whose numbers were closest to it were chosen for the final elimination. On the evening of September 14, the final day of the contest, the event, titled Play for a Billion, was aired live. If a player’s number matched the grand prize number, he would win US$ 1 billion. (Source: Wikipedia)

Given the scenario, it was highly unlikely that anyone would win a billion dollar. The chances were literally 1 in a billion. In spite of that, Pepsi was unwilling to bear the risk of the possible billion-dollar prize. So they arranged for an insurance company to insure the event. They paid US$ 10 million to Berkshire Hathaway to assume the risk. Yes, Warren Buffett’s Berkshire Hathaway. The same guy who is famous for his two iron rules –

1. Never lose money 2. Don’t forget rule number 1.

Then why would Buffett expose his company to such a big risk for a relatively paltry premium of US$ 10 million? Isn’t this akin to playing Russian roulette?

Remember Russian roulette? Here’s how a Russian roulette is played –

Imagine you are offered US$ 10 million to put a revolver, containing only one bullet in the six available chambers, to your head and pull the trigger. If you survive you win the US$ 10 million prize. The odds of winning are more than 80 percent. The upside is huge i.e. US$ 10 million. The downside – loss of life i.e., death – is even bigger.

Should you play this game? What if the prize money is US$ 1 billion and the revolver has thousand chambers instead of just 6 with a single bullet i.e., a minuscule probability of death and an enormous upside?

Warren Buffett once wrote that he would never play this kind of game, where the downside is unacceptable to him, no matter how low the probability of the outcome. Then why is he risking his US$1 billion?

Isn’t Buffett contradicting himself?

In his 2003 letter to shareholders, he wrote –

Ajit [Jain] writes some very unusual policies. Last year, for example, PepsiCo promoted a drawing that offered participants a chance to win a $ 1 billion prize. Understandably, Pepsi wished to lay off this risk, and we were the logical party to assume it. So we wrote a $ 1 billion policy, retaining the risk entirely for our own account. Because the prize, if won, was payable over time, our exposure in present-value terms was $ 250 million. (I helpfully suggested that any winner be paid $ 1 a year for a billion years, but that proposal didn’t fly.) The drawing was held on September 14. Ajit and I held our breath, as did the finalist in the contest, and we left happier than he. PepsiCo has renewed for a repeat contest in 2004.

These kind of cases are quite rare for most insurance operations. For one, unlike say the auto insurance business, here we don’t have sufficient past data to make reasonable calculations about odds of win/loss. We also don’t have the option to spread the risk of loss among millions of premium-paying customers, or the time between receiving the premium and paying the loss to invest the float.

Instead, here there are only two possible outcomes. Either Berkshire earns the US$ 10 million that will have absolutely no meaningful effect on Berkshire’s bottom line or Berkshire will lose the net present value of US$ 1 billion paid out over 40 years. That amount is still small but certainly not insignificant.

One clear benefit of Buffett’s willingness to make such a bet is that it establishes Berkshire’s reputation as an insurer which can cover such events. So the contest proved a publicity bonanza not only for Pepsi but also for Warren Buffett. I am sure there are many other companies (like Pepsi) who would love to exploit the publicity created by announcing such contests and delegating the risk to Berkshire. That creates another unique source of revenue for Buffett.

Still, the question remains –why would Buffett make such a bet when the upside is insignificant?

We all know that Buffett is super-smart. There’s something which he knows and understands about Risk that a common investor doesn’t. When he underwrites these unusual and risky looking policies, he is essentially willing to look foolish but not be foolish.

In other words, Buffett is not loss averse. He is risk averse. To understand this statement, we need to understand the difference between risk aversion and loss aversion.

Loss Aversion is Human Nature

We, humans, have a natural tendency to be loss averse. What do I mean by that?

Let me take an example from Jason Zweig’s book Your Money and Your Brain. He writes –

Imagine that you can choose between winning $3,000 for sure, on the one hand, or a gamble with an 80% chance of winning $4,000 and a 20% chance of winning nothing. If you’re like most people, you will pick the sure thing.

Next, imagine that you can choose between losing $3,000 for sure, or a gamble with 80% odds of losing $4,000 and 20% odds of losing nothing. What would you do now? In this case, people reject the sure thing and take the gamble 92% of the time.

You would be better off taking the gamble in the first example and the sure thing in the second one–the opposite of what you probably chose. On average, an 80% chance of winning $4,000 is worth $ 3,200 (.80 x 4,000 = 3,200). So, in the first example, the gamble has an “expected value” $200 higher than the sure thing. By the same rule, an 80% chance of losing $4,000 leaves you $3,200 poorer. And in the second case, you logically should favour the sure loss of $3,000; on average, it will leave you with $200 more. But it’s hard to be strictly logical in these choices because the idea of losing money triggers potential regret in your emotional brain. If you take the 80% gamble of winning $4,000 and win nothing instead, you will kick yourself for missing out on the $3,000 sure thing. And a 100% chance of losing everything feels a lot worse than the risk of an even bigger loss coupled with a small shot at losing nothing. Doing anything – or even thinking about doing anything– that could lead to an inescapable loss is extremely painful.

In simpler words, or rather in Charlie Munger’s words, “The quantity of a man’s pleasure from a ten-dollar gain does not exactly match the quantity of his displeasure from a ten-dollar loss.” And this is the foundation of Daniel Kahneman’s work on Prospect Theory.

Prospect Theory (Image Source: Thinking, Fast and Slow )

A typical outcome of loss aversion is the propensity to sell our stocks as soon as the price drops. This tendency results in most investors buying the stock when the market is rising and selling out when the prices collapse. It’s nothing but a severe distaste for possibility of loss. While there may be a persuasive evolutionary explanation for loss aversion, as we’ll see later, it is not good for money management.

What majority of the investors fail to realise is that possibility of loss doesn’t always translate to risk. To wrap our heads around this subtle distinction, let’s explore what exactly is a risk.

What is Risk?

The real risk associated with any stock (or for that matter, any investment) is the risk of ‘permanent loss of capital’. A permanent loss of capital occurs when a stock goes down because of worsening business operations and stays down for a very long time or even forever. For example, if a company goes bankrupt, or its earnings power drops permanently, then shareholder value will also become permanently diminished.

Risk is a perception in each investor’s mind that results from analysis of the probability and amount of potential loss from an investment, writes legendary investor Seth Klarman, “If an exploratory oil well proves to be a dry hole, it is called risky. If a bond defaults or a stock plunges in price, they are called risky.”

Another way to understand risk is to invert the question and see what is not a risk. Contrary to popular belief, volatility isn’t necessarily a risk. Many investors consider price fluctuations to be a significant risk i.e., if the price goes down, the investment is seen as risky regardless of the fundamentals.

Are short-term price movements really a risk? Perhaps yes but only for certain investors under specific conditions. So if you’re using debt (margins) to buy stocks, volatility is certainly a risk for you. Volatility alone isn’t a risk. However, debt plus volatility is a risk.

We just said that price volatility isn’t a source of risk. But there is one situation where price becomes a factor in risk. Not the market price, but the price at which an asset/stock is acquired. In fact, all other things being equal, the price of an asset is the principal determinant of its riskiness. In simpler words, overpaying for an asset increases the risk.

Howard Marks, in his 2013 letter to investors, wrote –

No asset is so good that it can’t be bid up to the point where it’s overpriced and thus dangerous. And few assets are so bad that they can’t become under-priced and thus safe (not to mention potentially lucrative).

An investor who doesn’t use leverage has enormous staying power because markets can stay irrational longer than one can stay solvent (and sane). So avoiding debt is one way to ensure that you don’t incur a permanent loss of capital because of margin calls or debtors forcing you to sell your positions.

Martin Whitman, in his book The Aggressive Conservative Investor, writes –

Macro data such as predictions about general stock market averages, interest rates, the economy, consumer spending, and so on are unimportant for safe and cheap investors as long as the environment is characterized by relative political stability and an absence of violence in the streets.

The concept of risk is meaningless unless it is preceded by a modifying adjective. There exist market risk, investment risk, credit risk, failure-to-match-maturities risk, commodity risk, terrorism risk, and many more types of risk. The idea of general risk is not helpful in a safe and cheap analysis. When financial academics and sell-side analysts refer to risk they almost always mean only market risk and usually very short-run market risk.

In fact, the most basic definition of risk is – not knowing what you’re getting into. You need to understand the business whose stock you are buying. Always remember, risk comes from not knowing what you are doing, in life and in stock market investing. Because when you don’t know what you are doing, you can lose it all…permanently.

Loss is Not Risk

Unlike the notion of loss, risk can’t be reduced to a single idea. Buffett’s rules of investing – “Don’t lose money,” and “Never forget the first rule.” – confuses a lot of new investors. After all, the surest way of not losing money is to put it in fixed deposits. Right?

While it’s true that shunning loss should be the primary goal of every investor, the dictum is incorrectly interpreted that one should never incur any loss at all. This is a sign of a typical loss averse mindset which, as we have seen above, is a behavioural bias.

“Don’t lose money” means that over several years an investment portfolio should not be exposed to appreciable loss of principal. It also means that any loss in your portfolio shouldn’t set you back so severely that you can’t continue investing.

In fact, being extremely loss-averse can increase the risk.

How? An extremely loss-averse investor would prefer putting all his money in safe bank deposits which over long term lose its value because of taxation and inflation. An apple that cost Rs 100 today will cost you Rs 108 next year because of an inflation rate of 8 percent. However, a bank deposit will fetch you only Rs 106 (after tax) in one year. Which means putting money in the bank for one year took away your ability to buy an apple.

What looks safe in short term is far riskier in the longer term.

Refer to the example from Jason Zweig’s book. By reframing the problem from a “gain frame” to “loss frame”, we nudged you from sure shot (conservative) option towards the riskier option (gambling). Loss aversion made you a risk-seeking person.

“As an investor,” writes Prof. Bakshi in his insightful post, “you should seek businesses which are risk averse but not loss averse. You should avoid businesses who don’t want to even experiment a bit because they are petrified of losses should the experiments fail.”

Another Billion Dollar Bet

Charlie Munger once wrote –

We will never play financial Russian roulette with the funds you’ve entrusted to us, even if the metaphorical gun has 100 chambers and only one bullet. In our view, it is madness to risk losing what you need in pursuing what you simply desire.

Notice the last sentence which I have highlighted. Risk is betting what you need in hope of getting what you desire. That’s what makes Warren Buffett’s billion-dollar bet not risky for him. He can afford to lose a billion dollar because a billion dollar is less than 1% of Berkshire’s net worth. Buffett is risking a large amount of money, but in terms of his expected loss, he’s not risking a whole lot. If $1 billion were going to ruin him, he wouldn’t. But it’s not going put Warren Buffett out of business. Not many insurance companies have the kind of financial strength Berkshire has. Berkshire’s bets would be very risky for other mom and pop insurance operations and that’s why the likes of Pepsi turn to Buffett, time and again.

Precisely because there aren’t many insurance companies willing to insure such events, Buffett is happy to take more such bets. Moreover, he’s getting paid disproportionately for the risk he’s assuming. The expected value of his bet is far-far less than US$ 10 million (the probability of someone winning the Pepsi’s challenge multiplied by prize money). If you calculate, it would probably be less than 100 dollars. So US$ 10 million is a pretty awesome deal for Buffett. I am sure he wouldn’t shy away from insuring a couple of dozens more such events.

No wonder Buffett goes out of his way to not just find but create such deals for Berkshire. After Pepsi event, Buffett suggested the US$ 1 billion contest to Quicken Loans founder Dan Gilbert in 2014. Gilbert and Buffett announced a billion dollar prize for anyone who could pick a perfect bracket in the annual men’s NCAA basketball tournament known as March Madness. According to one estimate, the odds of picking every winner correctly in a 64-team bracket are less than 1 in 9 quintillion. The odds of Buffett having to pay out reach about 1 in 10,000 in the Quicken Loans contest if all 10 million entrants have basketball knowledge. The odds of correctly forecasting 67 games are extraordinarily thin. (Source: Warren Buffett will pay you US $1-billion…)

Even a skilled handicapper would have about a 1-in-1-billion chance of completing a perfect bracket. “Millions of people play brackets every March, so why not take a shot at becoming $1 billion richer for doing so,” Buffett said in the statement. “While there is no simple path to success, it sure doesn’t get much easier than filling out a bracket online.”

And it’s not that Buffett will silently watch the winner take away his billion dollars. At any point, if he feels that odds are turning against him, he would make a move. “If you get to the Final Four with a perfect bracket, I may buy you out of your position,” Buffett said. “I’ll make you an offer you can’t refuse.” He’s ready to bear the losses but he’s also vigilant if the risk increases at any point, he’s ready to curb that risk.

And that’s another important lesson that every investor needs to learn from Warren Buffett. Be risk averse but don’t be afraid to make mistakes or take an occasional loss.

Conclusion

Every great investor intuitively understands this distinction between loss aversion and risk aversion. Seth Klarman says –

To maintain a truly long-term view, investors must be willing to experience significant short-term losses; without the possibility of near-term pain, there can be no long-term gain.

Great investors recognize another uncomfortable reality about probability, writes Michael Mauboussin, “the frequency of correctness does not really matter, what matters is how much money you make when you are right versus how much money you lose when you are wrong.”

In other words, we like to be right a lot more than to be wrong. This concept is very difficult to put into operation because of loss aversion.

Volatility is a friend of risk-averse investor and an enemy of loss averse investor. Someone who hasn’t made peace with short term notional losses, who hasn’t learnt to deal with daily price fluctuations because of market sentiments, is going to have an extremely tough time investing his or her money in stock market.

People who are risk averse get benefitted from people who are only loss averse.

Risk in investing, thus, comes not from the companies, institutions, or securities involved. It comes from the behaviour of investors. Their tendency to let the emotions of greed and fear control their actions.

The post Latticework of Mental Models: Risk Aversion Vs Loss Aversion appeared first on Safal Niveshak.

Latticework of Mental Models: Risk Aversion Vs Loss Aversion published first on http://ift.tt/2ljLF4B

0 notes

Text

0 notes