#Indiana Department of Revenue

Explore tagged Tumblr posts

Text

Michael Bryant Hicks

Most recently, Hicks was the Executive Vice President, General Counsel, and Corporate Secretary at Indianapolis-based Apria, Inc. (APR), the nation’s largest provider of home healthcare equipment and in-home clinical services for respiratory diseases, diabetes, and other illnesses. At Apria, he managed all legal and regulatory matters, enterprise risk, and government affairs. This work culminated in March 2022, when Hicks and the Apria management team completed negotiation for the sale of Apria to Owens & Minor, delivering a significant premium to shareholders, while placing the business on a trajectory for future value creation. Prior to Apria, Hicks was the General Counsel of Elanco Animal Health (ELAN), a $13.5 Billion market cap animal pharmaceutical company based in Greenfield, Indiana. Hicks led Elanco’s successful 2018 IPO and managed a legal department of 70 professionals in navigating the complex regulatory environment in which the company does business in the United States (FDA, USDA, EPA) and abroad (European Medicines Agency, Chinese FDA). A Trusted Voice in Healthcare and Life Sciences Matters: As a General Counsel, Hicks knows the experience of having the FDA order a company to recall one of its highest revenue products. He has also engaged in complex negotiations with commercial payers and delicate discussions with CMS on drug pricing. He deftly managed these situations by understanding the economic motivations of payers and the FDA and CMS regulatory environment. A Leader in Corporate Governance: Hicks has designed the boards of directors of two public companies in connection with their initial public offerings, developing the corporate governance processes the companies relied upon in their first years on public exchanges. He’s been the company interface with Glass Lewis, ISS, the SEC, and the NYSE. Hicks is the leader these companies have looked to on Environmental, Social, & Governance matters, matching the values and business goals of an enterprise with complementary issues of societal impact. He’s also been the lead negotiator in two major encounters with prominent activist investors. Navigating High Stakes Investigations and Litigation: As General Counsel at Mallinckrodt Pharmaceuticals, Hicks brought to successful settlement a DEA controlled substances investigation, a DOJ False Claims Act investigation, and an FTC investigation into alleged antitrust violations. He also led the formation of the company’s early strategy in the nationwide opioid litigation. A Leader in Transformative Deal Making: Hicks’s career began in global M&A as an energy lawyer with Vinson & Elkins law firm in Houston, Texas, where his engagements included a wide range of cross-border energy projects, including assisting Occidental Petroleum in financing and building oil production assets with the Ecuadorian state petroleum company Petroecuador. He continued large-scale global deal making in the healthcare and life sciences space as the lead lawyer in consummating some of the largest deals of the last decade: DaVita’s 2012 acquisition of HealthCare Partners ($4.4B), Elanco’s acquisition of Bayer Animal Health ($6.9B). Hicks earned a juris doctor from Yale Law School and a Bachelor of Arts from the University of North Carolina at Chapel Hill.

Michael Bryant Hicks

0 notes

Video

youtube

Clark County Indiana Sheriff And Political Powerhouse In The State Republican Party Will Spend The Next 15 Years Behind Bars After Taking A Plea Deal In A Large-Scale Corruption, Theft And Fraud Case.

Jamey Noel — the former sheriff of Clark County — pled guilty last week to over 25 felony counts of theft, tax evasion, official misconduct, money laundering and more. He was sentenced to 15 years and ordered to pay over $3 million in restitution to local first responder groups.

Noel ran up over $2 million in personal expenses on a credit card that belonged to local fire and EMS departments he controlled as sheriff from 2015 to 2022.

While sheriff, Noel reportedly used the cards to pay for vacations, concerts, clothes, Rolex watches, cars, food, alcohol, child support, college tuition and more. It’s estimated he bought over 100 cars, including public safety vehicles, a 1930 Ford Roadster, pick-up trucks, and two classic 1970s Plymouth Road Runners.

Noel purchased several military surplus items, outfitted a sheriff’s air fleet and allegedly put taxpayer-subsidized fuel in his private airplane. The former sheriff even charged over $2,500 to a Hooter’s restaurant in Jeffersonville, court records show. Noel – who was identified in a leaked membership list of a far-right extremist group in 2022 – entered his plea deal last Wednesday in Clark County court. His guilty charges include: Theft – Level 5 Felony 15 counts

Tax Evasion – Level 6 Felony 5 counts

Official Misconduct – Level 6 Felony 4 counts

Money Laundering – Level 5 Felony 1 count

Corrupt Business Influence – Level 5 Felony

Obstruction of Justice – Level 6 Felony 1 count In addition to the 15-year sentence, Noel was ordered to back over $2,870,924 to the Utica Volunteer Firefighters Association, $61,190.77 to the Sheriff’s Department, $173,155.07 to the Dept. of Revenue and $35,245.60 to the State Police. He will also serve three years of probation after his release from prison.

His wife Misty and daughter Kasey face felony theft and fraud charges after also reportedly participating in the scheme. Kasey allegedly functioned as the executive assistant at Jamey’s businesses and had access to stolen money. She reportedly charged more than $108,660.59 on an American Express credit card belonging to the Utica Volunteer Fire Department and New Chapel EMS.

The credit card purchases, which allegedly took place between October 2018 and September 2023, included clothing, cosmetics, manicure and pedicure services, food, tickets, trips, alcohol, utilities, vaping products, gas, Netflix and various Amazon orders.

0 notes

Text

Owners of Columbus Components have closed at least 10 plants in 10 years

By Kirk Johannesen and Boris Ladwig, The Republic

THE owners of Columbus Components Group have closed at least 10 manufacturing plants in North America in the last decade and eliminated at least 1,500 jobs.

A former CCG executive said many of the companies did not generate a profit - but produced enough revenues to pay the owners a management fee.

Cleveland, Ohio-area businessmen Patrick K. James, Jay L. Schabel and Michael D. Klinginsmith bought the former Arvin-Meritor Inc. plant on 17th Street in 2004.

In the last decade, James, now CCG's sole owner, has owned at least 16 automotive-related companies in five states and two countries. At least 10 of those have closed.

One of the companies, Cleveland-based Dickey-Grabler, had operated for 125 years when James bought it in March 2007. Ten months later, it folded.

An 11th company, Pennsylvania-based Hood & Co., was closed and the employees let go before assets were sold to another company, which reopened the facility and rehired the employees.

Four companies are still operating: Cleveland area-based Hawthorn Manufacturing LLC, Detroit-based International Specialty Tube LLC, Columbus Components Group LLC and Madison-based Century Tube LLC, which James bought in February.

Columbus Components Group sent a Worker Adjustment and Retraining Notification notice to Indiana Department of Workforce Development on March 23, stating that the withdrawal of sales orders by clients would result in layoffs and possible closure.

James, who often purchases other companies through his principal companies, Hawthorn and Viking, could not be reached despite repeated attempts.

James, Schabel and Klinginsmith formed Hawthorn Manufacturing Corp. in 2006 and Hawthorn Manufacturing LLC in 2007.

Schabel, who lives in Chagrin Falls, Ohio, said he left Hawthorn about 1½ years ago.

He now runs a farm with his wife and is chief operating officer of Polyflow Corp., an Akron, Ohio-based Clean Technology startup.

Klinginsmith also has left the company, according to Rick Bohn, Hawthorn's former chief operating officer. Klinginsmith also could not be reached.

Local CCG officials repeatedly have declined to be interviewed.

Employment decline

Employment at CCG has fallen from 520 in 2004, when Schabel, Klinginsmith and James bought it, to about 140. On April 9, the company laid off 123.

Bohn said that James, Schabel and Klinginsmith, bought the former Arvin-Meritor plant because it fit a profile of companies they desired.

"Their strategy was to ... try to purchase businesses that were stressed," Bohn said.

That allowed the purchasers to obtain the companies with relatively low startup costs, Bohn said.

Some of the companies that Viking/Hawthorn bought had just gone through bankruptcy or changed ownership or were struggling like many other companies in the automotive business, Bohn said.

"Every one was a challenge," he said.

Bohn, who lives in Ohio and said that he left the company under good terms, said that the Viking/Hawthorn principals tried to acquire related businesses to give them more of a strategic foothold. For example, if they acquired an exhaust system supplier, they would try to acquire other similar suppliers.

Bohn said James' strength in marketing and business development allowed the company to establish a sizable network through which it would find out about possible acquisitions.

Sometimes the customers of a business that was being sold or about to close asked the Viking/Hawthorne principals to take over, because the customers did not want to lose their suppliers, Bohn said.

"I don't think there was any other strategy than that," he said.

While Bohn was with the company, it owned auto suppliers in locations including New York, Pennsylvania, Ohio and Ontario, Canada.

"During my (tenure) ... something happened to every one of them," Bohn said.

All of the companies had struggled previously, though, he said, and capital was limited.

"The shining star actually was CCG," he said.

The former ArvinMeritor plant had good equipment and was relatively healthy and therefore did not require a substantial capital infusion, Bohn said.

ArvinMeritor sold the plant, which stamped exhaust systems components, as part of a larger strategy to shed operations that it did not consider its main focus.

Breaking even

Bohn also said that the companies bought by Hawthorn and Viking often generated no profit.

At fiscal year's end, sometime the income was zero or negative, he said.

However, the businesses generated enough revenues to make bank loan payments and pay utility bills, suppliers and employees.

And, Bohn said, "There (was) enough revenue to draw some kind of management fee or salary (for the principals)."

Typically the new owners would try to secure commitments from existing customers and then find new customers to keep the business going, Bohn said.

"Unfortunately, in almost every case it required things that weren't necessarily controllable," he said.

Schabel said Hawthorn was a private, entrepreneurial company that was fairly diversified and that its business strategy evolved over the years. Schabel said he worked for the company four years.

He said he could not discuss details about the business because he signed a non-disclosure agreement when he left.

He said he has not had contact with James for about 10 months.

James was born in 1965, according to a Data Universal Numbering System report, which provides background information on companies. The DUNS report stated that James has been employed in the automotive industry since 1986.

© 2024 The Republic

0 notes

Text

Tyson Foods closes four more plants, resulting in 3,000 job cuts

3,000 jobs will be lost as a result of Tyson Foods closing four poultry operations throughout the US between late 2023 and early 2024, the company revealed on August 7.

Tyson Foods has been firing employees all around the country despite making tens of billions of dollars a year in revenue. It declared in April that it would let go of 10% of its corporate staff and 15% of its top leadership. It shut down its corporate headquarters in South Dakota and Chicago towards the end of last year. Tyson Foods to shut down its facilities in Glen Allen, Virginia, and Van Buren, Arkansas, affecting almost 1,700 workers, three months ago.

The economics of the primarily rural villages destroyed

North Little Rock, Arkansas; Corydon, Indiana; Dexter, Missouri; and Noel, Missouri are the locations of the four other plants that are now set for closure. New facilities will house production that is nearer to Tyson’s clientele. Chief Financial Officer John R. Tyson estimates that the four plants butcher about 10% of Tyson’s chickens.

The economics of the primarily rural villages where they are located will be completely destroyed by these closures. More than 500 jobs in Corydon, Indiana, will be eliminated. A Tyson Foods spokeswoman responded to the criticism from the public by saying, “We are closely coordinating with state and local officials, including the Indiana Department of Workforce Development, to connect all team members to resources and assistance available.”

A little over 3,000 people call Corydon home, which is 25 miles from Louisville, Kentucky. Its 3.8 percent unemployment rate will very definitely increase significantly. The usual yearly income of Corydon is only $19,825, which is much less than the $28,555 national average.

Tyson Foods closing 4 plants after reporting losses

youtube

Government to postpone plans

More than 680 employees work at the Missouri plant in Dexter, which will shut down on October 13th. The closure will have a knock-on effect on the local economy, according to City Administrator David Wyman, causing the government to postpone plans to build a new $18 million wastewater treatment plant. There are 7,900 people living in the town of Dexter.

1,513 jobs will be impacted by the Missouri plant shutdown in Noel. The McDonald County Presiding Commissioner stated on Tuesday that there was “no way we can incorporate that into existing jobs.” There are barely 2,100 people living in the town as a whole.

About 300 employees in North Little Rock stand to lose their employment. The town of 68,000 people has a lower-than-normal unemployment rate of 2.8 percent, but its household median income is only $45,590, and its poverty rate is 21.7 percent.

Curious to learn more? Explore our articles on Enterprise Wired

0 notes

Text

A Film About Child Trafficking Takes on Summer Blockbusters

“Sound of Freedom,” a thriller starring Jim Caviezel as a federal agent who takes on child traffickers, will not be the summer box office’s biggest hit. But it may be its unlikeliest.The film — whose distributor, Angel Studios, has a big success with “The Chosen,” a streaming series about the life of Jesus — was the third most watched film in North America last weekend. Its $19.7 million weekend take was behind only the horror film “Insidious: The Red Door,” which made $33 million in its first weekend, and “Indiana Jones and the Dial of Destiny,” which made $27.4 million in its second.“Sound of Freedom” is based on a true story: Caviezel plays Tim Ballard, a U.S. Department of Homeland Security agent who investigated pedophiles. (Ballard later founded the anti-trafficking group Operation Underground Railroad, became a frequent guest on Fox News and was appointed by former President Donald J. Trump to a federal advisory panel on human trafficking.)Some critics say the film appeals to the QAnon movement, which posits a false conspiracy theory accusing progressive elites of pedophilia. The Guardian called it a “QAnon-adjacent thriller.” A Rolling Stone article said that its “mainstream accessibility makes it valuable as a recruitment tool.” In an interview, Neal Harmon, Angel’s chief executive, said: “Anybody who watches this film knows that this film is not about conspiracy theories,” adding, “it’s not about politics.”Caviezel, who played the title role in Mel Gibson’s 2004 film “The Passion of the Christ,” seemed to allude to QAnon while promoting the film on the podcast of Stephen K. Bannon, saying “there is a big storm coming,” a movement motto, and mentioning “adrenochrome,” a hormone that QAnon adherents say elites harvest from their child victims.A representative for Caviezel did not reply to a request for comment. Nor did Operation Underground Railroad.Though not explicitly faith-based like other Angel projects — including the “The Chosen” and “His Only Son,” a recent film about Biblical patriarchs — “Sound of Freedom” stands as the latest instance of an entertainment industry success story that targeted an audience that is often overlooked by Hollywood.The film, which was independently produced for $14.5 million, has grossed more than $41 million from its domestic release on Tuesday, July 4, through last weekend, according to Comscore. Unusually, it made slightly more on Sunday than Saturday, a Comscore media analyst said. Angel Studios’ unorthodox “Pay It Forward” program, which lets supporters go online to purchase tickets for those who might otherwise not see the film, may have helped. So might its emerging status as a political football: championed by the right, reviled by left-wing critics.Angel, which is based in Provo, Utah, relies on crowdfunding to boost its projects. More than 7,000 “angel investors” raised $5 million in exchange for revenue-sharing to help market “Sound of Freedom,” the company said.“We believe that the model of the Hollywood gatekeeper system, of selecting content, doesn’t choose the content that people want to watch,” said Jared Geesey, Angel’s senior vice president of global distribution.The producer of “Sound of Freedom,” Eduardo Verástegui, and its director and co-writer, Alejandro Gómez Monteverde, hail from the Mexican state of Tamaulipas, Verástegui said in an interview, and most of the financing came from Mexican backers. It was filmed in 2018. Its original distributor, Fox Latin America, dropped it after Disney acquired 21st Century Fox in 2019. (A Disney spokesman said the studio never knew about the film.) It was picked up earlier this year by Angel, which describes itself as a values-based studio.Verástegui, the producer, acknowledged the polarization around the film. He, too, promoted it on Bannon’s podcast. But he said he hoped political differences could be shelved in favor of the movie’s anti-trafficking message.The film, which is a little over two hours, does not mention specific QAnon tenets. Hitting many typical action-movie beats, it depicts trafficking and related problems like child sexual abuse imagery as stark and growing, and suggests that the international wealthy are among its consumers. Its featured actors include Bill Camp and Mira Sorvino in a small role as Ballard’s wife.During the credits, Caviezel addresses the audience, saying the filmmakers hope “Sound of Freedom” will be “the ‘Uncle Tom’s Cabin’ of 21st century slavery.” He adds, “We believe this movie has the power to be a huge step forward toward ending child trafficking.” Source link Read the full article

0 notes

Text

Governor Holcomb: $125 automatic tax refund on its way to all Hoosiers

New Post has been published on https://aroundfortwayne.com/news/2022/04/13/governor-holcomb-125-automatic-tax-refund-on-its-way-to-all-hoosiers/

Governor Holcomb: $125 automatic tax refund on its way to all Hoosiers

Today, Indiana Governor Eric J. Holcomb announced that Hoosiers should expect to begin receiving their promised $125 Automatic Taxpayer Refund in the coming weeks.

#2022 $125 Automatic Taxpayer Refund#Indiana Auditor of State#Indiana Department of Revenue#Indiana Governor Eric Holcomb#Indiana State Income Tax#Indianapolis Indiana

0 notes

Text

Big Box stores' other shoe drops

Since the start of this century, small and mid-sized towns have courted big box stores, using tax revenues to fund expensive road, sewer and electric expansions to lure large corporate chains to town.

These companies promised jobs and tax revenues, and, technically speaking, they delivered both, but only if you do some very funny math. National chains pay little or no federal income tax, and often secure state tax abatements.

This gives them a 30–40% advantage over small, homegrown businesses operated by locals who can’t afford the huge sums needed to pay corrupt tax-experts to establish fictional headquarters on offshore financial secrecy haves.

Large national chains also have commanding bargaining power when they negotiate with suppliers, which means they pay less for their merchandise than locally owned businesses.

Given the tax and purchasing advantages, the arrival of a big box store doesn’t really create jobs. Sure, they hire locals to work in their stores, but at the cost of a boarded-up main street where the only businesses that survive are dollar stores.

When a local government spends public funds to lure in a big box store, they actually cost the town net jobs, and the funds they spend to kill those jobs come from the workers whose jobs were lost and the businesses that provided those jobs.

But at least big boxes pay local taxes, right?

Well…

In Michigan, Lowes pioneered an aggressive tactic of lowering its tax bills. It’s called the “dark store” gambit, and it’s so successful that towns are refunding millions to big box stores.

https://ilsr.org/dark-store-tax-tactic-makes-big-box-stores-terrible-deal-for-cities/

In her breakdown for ILSR, Olivia LaVecchia explains how the “dark store” hustle works. First, a big box store files an appeal on its tax assessment, arguing that the town or county have overvalued its property.

Instead of opting for the usual assessment formula (building costs minus depreciation), they demand assessment based on the sale price of “comparable” properties.

Then, they argue that the relevant “comparable” properties are shuttered, abandoned big box stores.

Big box stores are built to order, heavily customized to the retailer’s specific requirements. They are designed to be fast to erect and disposable, and when they are put up for sale, restrictive covenants are added to the deed to block a competitor from moving in.

These restrictions are incredibly specific (and restrictive), listing individual items that may never be sold by anyone who buys the property, for the rest of time.

Unsurprisingly, the resale value of a cheaply built, white-elephant structure that can’t be used to sell common items is very, very low. Lowe’s argues that the taxes on its property should reflect this incredibly low valuation.

That’s how the Lowe’s in Marquette, MI retroactively slashed the assessed value of the store it built for $10m from $5.2m to $2.4m (in 2010), $2m (in 2011) and $1.5m (in 2012).

Based on the new assessment, Marquette was on the hook to refund $755,828 to Lowe’s, a company with $50b in net annual sales.

To pay for the refund, Marquette slashed its library, police and fire-department budgets.

Lowe’s is a trailblazer. After a corporate-friendly state tax tribunal and supreme court sided with Lowe’s 12 more big-box stores in Marquette appealed their historical tax assessments, seeking comparable refunds from the city.

Marquette isn’t an outlier. Ottawa City, MI is on the hook to refund $14.8m to its big box parasites. Statewide, the “dark store” gambit has netted $47m, so far — and it’s spreading to Indiana, with Meijer hitting Marion County, IN for $2.4m.

Indiana is projecting a $120m tax shortfall for towns and counties as “dark store” reassessments sweep the state. Big box stores already destroy local businesses and jobs and erode the local tax-base, but it’s about to get much worse.

Thanks to the sky-high costs they impose on local governments, big box stores already cost municipalities $0.44/sqft/year ($80k/year for a Walmart Supercenter). That’s before dark-store reassessment.

https://ilsr.org/key-studies-why-local-matters/#7

The myth of big box prosperity sent money gushing out of the public spigots: by 2014, big boxes had sucked up more than $2.4b in direct subsidies from local governments.

https://www.goodjobsfirst.org/taxbreaksandinequality

The dark-store hustle has all the hallmarks of a long con. In a long con, the crook lets the mark win a little money at first, as a convincer. Then, having lulled the mark into complacency, the crook takes them for everything.

Local governments were able to pretend that somehow these big boxes would make up for the costs they imposed and the losses they triggered, because of the local tax bills they paid. That kept the subsidies and favors flowing.

Now that local governments are on their last legs, battered by the covid slump and anti-tax extremists in state government that cut spending, the fraudsters pull their switch, clawing back all the taxes they paid as convincers and setting themselves up for a tax-free future.

Image: City of Westminster Archives Centre (modified) https://commons.wikimedia.org/wiki/File:Hallam_Street_Blitz_Bomb_Damage.JPG

CC BY-SA: https://creativecommons.org/licenses/by-sa/3.0/deed.en

Image: Mike Mozart (modified) https://www.flickr.com/photos/jeepersmedia/13656574134

CC BY: https://creativecommons.org/licenses/by/2.0/

135 notes

·

View notes

Text

Georgia Uncovers a Slew of Valid Complaints Against Health Insurance Providers

Anthem Blue Cross and Blue Shield, Ambetter of Peach State, and Humana had high consumer complaints last year that the state decided to be legitimate based on the newly revealed numbers. Complaint data for all health insurers in Georgia was recently disclosed by Georgia Insurance Commissioner Jim Beck and his team - the department's Consumer Services Division handled the complaints.

According to JoAnne Oni, head of consumer services, other states compiled similar statistics, and it was the first time that the Georgia agency has made the information public. Different complaint categories include Automobile, life, and homeowner insurance firms.

Oni stated that department officials investigate each complaint and promise to keep their commitments of transparency, consumer protection, and fraud defense. In a statement, Beck added, "This is just the beginning."

The information on health insurance complaints is divided into two groups. One is the complaint-to-premium-revenue ratio for the insurer in 2018. The other factor is the number of complaints that have been confirmed. Any percentage greater than 1.00 is deemed negative in both categories, with higher values indicating poorer records. A confirmed complaint means that the insurance department has found that the insurer violated the law or that the complaint and the insurer's answer show that the insurer made a mistake. The complaint data does not cover self-insured large employer health plans.

Anthem Blue Cross of Indiana is Georgia's largest health insurer that earned $2.4 billion in premium revenue for its Blue Cross Healthcare Plan of Georgia in 2018. It received the most complaints (579), resulting in an "All Complaints Ratio" of 1.50. A total of 81 complaints were confirmed, resulting in a confirmed ratio of 1.87. An Anthem spokesman said the company was analyzing the data on Tuesday. Total complaint and confirmed complaint ratios for Ambetter of Peach State were 1.81 and 1.31, respectively. Complaint ratios of 1.42 and 1.40 were approved for two Humana health plans.

Both Kentucky-based Humana and Ambetter's parent firm based in St. Louis, Centene, could not be reached for their comments.

In a statement released, the Georgia Association of Health Plans noted that member insurers are "currently assessing the data." They are looking forward to collaborating with Commissioner Beck and the insurance department to improve our Georgia consumers' experience. There are hundreds of organizations on the complaint list, ranging from Blue Cross, which has a large volume of business, to Reliable Life Insurance Company, which has only $33 in premium revenue.

At least one adverse complaint ratio was found in 11 of the 21 companies with more than $100 million in revenue.

The information may be helpful to some cautious insurance consumers who want to know which insurance firms are best at keeping their customers satisfied before deciding where to spend their money, according to Laura Colbert of Georgians for a Healthy Future, a consumer advocacy group.

The more excellent value of this information is for the Georgia Department of Insurance, which can use it to take action against insurers who consistently receive poor marks or reward insurers who always prioritize consumers, as well as for insurance companies, who may be inclined to prioritize the needs of their customers better as they see how they stack up against their competition.

1 note

·

View note

Text

Dorothy Elizabeth Gish (March 11, 1898 – June 4, 1968) was an American actress of the screen and stage, as well as a director and writer. Dorothy and her older sister Lillian Gish were major movie stars of the silent era. Dorothy also had great success on the stage, and was inducted into the American Theater Hall of Fame. Dorothy Gish was noted as a fine comedian, and many of her films were comedies.

Dorothy Gish was born in Dayton, Ohio. She had an older sister, Lillian. The Gish sisters' mother, Mary Robinson McConnell Gish, supported the family after her husband James Leigh Gish, a traveling salesman, abandoned the family in New York. Mary Gish, who was "a former actor and department store clerk", moved with her daughters to Indiana, where she opened a candy and catering business. In 1902, at the age of four, Dorothy made her stage debut portraying the character "Little Willie" in East Lynne, an adaptation of the 1861 English novel by Ellen Wood.

In 1910, she heard from her husband's brother, Grant Gish, who lived in Shawnee, Oklahoma and informed her that James was ill. He was in a hospital in nearby Norman, Oklahoma, so Mary sent 17-year-old Lillian to visit him. At first, Lillian wrote back to her 12-year-old sister Dorothy that she planned to stay in Oklahoma and continue her education, but after seeing her father she admitted she missed her mother and sister. So, after a few months away from them, in the spring of 1912, she traveled back. Soon afterward, their childhood friend, actress Mary Pickford, introduced the sisters to director D. W. Griffith, and they began performing as extras at the Biograph Studios in New York at salaries of 50 dollars a week. During his initial work with the sisters, Griffith found it difficult to distinguish one from the other, so he had Lillian wear a blue ribbon in her hair and Dorothy a red one. The girls, especially Lillian, impressed the director, so he included them in the entourage of cast and crew he took to California to produce films there.

Dorothy and her sister both debuted in Griffith's 1912 production An Unseen Enemy. She would ultimately perform in over 100 short films and features, many times with Lillian. Throughout her own career, however, Dorothy had to contend with ongoing comparisons to her elder or "big" sister by film critics, fellow actors, studio executives, and by other insiders in the motion picture industry. Such comparisons began even from the outset of the sisters' work for Biograph. Linda Arvidson, Griffith's first wife, recalls their initial work for the studio in her autobiography When The Movies Were Young:

Lillian and Dorothy just melted right into the studio atmosphere without causing a ripple. For quite a long time they merely did extra work in and out of pictures. Especially Dorothy, as Mr. Griffith paid her no attention whatsoever and she kept on crying and trailed along. She also continued to play in many one and two reel Biograph films, learning the difficult technique of silent film acting, and preparing for opportunity when it came. Dorothy was still a person of insignificance, but she was a good sport about it; a likable kid, a bit too perky to interest the big director, so her talents blushed unnoticed by Mr. Griffith. In 'The Unseen Enemy' the sisters made their first joint appearance. Lillian regarded Dorothy with all the superior airs and graces of her rank. At a rehearsal of 'The Wife', of Belasco and DeMille fame, in which picture I played the lead, and Dorothy the ingénue, Lillian was one day an interested spectator. She was watching intently, for Dorothy had had so few opportunities, and now was doing so well, Lillian was unable to contain her surprise, and as she left the scene she said: 'Why, Dorothy is good; she's almost as good as I am.' Many more than myself thought Dorothy was better.

Dorothy Gish's budding film career almost ended on a street in Los Angeles on Thanksgiving Day in 1914. On Friday, November 26, the 16-year-old actress was struck and nearly killed by a "racing automobile". Newspapers and film-industry publications at the time reported the event and described the severe injuries Gish sustained. The near-fatal accident occurred as Dorothy was walking with Lillian at the intersection of Vermont and Prospect avenues. According to news reports, after the car struck her, it dragged her along the street for 40 to 50 feet. Other movie personnel who were standing together on a nearby sidewalk, including D. W. Griffith, witnessed Dorothy being hit. The following day, the Los Angeles Times informed its readers about the accident:

...Miss Dorothy Gish, a moving picture actress, was seriously injured yesterday afternoon. Picked up unconscious, she was taken to the office of Dr. Tryon at number 4767 Hollywood boulevard, where it was found her injuries consisted of a crushed right foot, a deep cut in the right side, and bruises on all parts of her body. She was later removed to the home of her mother at LaBelle apartments, Fourth and Hope streets. The automobile that ran her down is owned by T. B. Loreno of No. 6636 Selma avenue, also of the moving picture game.

Subsequent news reports also describe the reaction of other pedestrians at the scene. The Chicago Sunday Tribune and trade papers reported that Dorothy's "horrified friends" rushed to her aid, with Griffith being among those who lifted the unconscious teenager into an ambulance and reportedly rode with her in the emergency vehicle. In addition to Gish's initial examination by the doctor identified by the Los Angeles Times, the Chicago newspaper and Motion Picture News stated that she was rushed to the hospital, where surgeons mended her "very badly torn" left side with "many stitches" and treated the area where one of her toes had been "cut off", presumably a toe from her badly damaged right foot. At the time of the accident, Gish was completing a two-reel romantic comedy with actor W. E. Lawrence. The film, How Hazel Got Even, had already been delayed once at Reliance-Majestic Studios due to director Donald Crisp's bout with pneumonia. Completion of the short was postponed yet again, for over a month, while Gish recuperated. Originally scheduled for release on December 27, 1914, How Hazel Got Even was not distributed to theaters until mid-February 1915.

After recovering from the 1914 accident, Gish resumed her screen career the following year, performing in a series of two- and three-reel shorts as well as in longer, more complex films such as the five-reel productions Old Heidelberg, directed by John Emerson, and Jordan Is a Hard Road, once again under D. W. Griffith's direction. Increasingly, Dorothy's appeal to both producers and audiences continued to grow in 1915, leading W. E. Keefe in the June issue of Motion Picture Magazine to recognize her as "one of the most popular film stars on the Motion Picture screen". In an article about Gish in the cited issue, Keefe also recognizes that Dorothy, career-wise, was finally emerging from her sister's shadow:

A year ago she was known as Lillian's little sister. A year's growth has changed this. Today she is taller and weighs more than her "big" sister, and is known as Dorothy Gish without always being identified as "Lillian's sister."

In 1916 and 1917, Dorothy continued to expand her acting credentials by starring in a variety of five-reelers for Fine Arts Film Company or "Griffith's studio", which was a subsidiary of Triangle Film Corporation. Her work in those years required filming on locations in New York and on the West Coast.

In the 1918 release Hearts of the World, a film about World War I and the devastation of France, Dorothy found her first cinematic foothold in comedy, striking a personal hit in a role that captured the essence of her sense of humor. As the "little disturber", a street singer, her performance was the highlight of the film, and her characterization on screen catapulted her into a career as a star of comedy films.

Griffith did not use Dorothy in any of his earliest epics, but while he spent months working on The Birth of a Nation and Intolerance, Dorothy was featured in many feature-length films made under the banner of Triangle and Mutual releases. They were directed by young Griffith protégés such as Donald Crisp, James Kirkwood, and Christy Cabanne. Elmer Clifton directed a series of seven Paramount-Artcraft comedies with Dorothy that were so successful and popular that the tremendous revenue they raked in helped to pay the cost of Griffith’s expensive epics. These films were wildly popular with the public and the critics. She specialised in pantomime and light comedy, while her sister appeared in tragic roles. Dorothy became famous in this long series of Griffith-supervised films for the Triangle-Fine Arts and Paramount companies from 1918 through 1920, comedies that put her in the front ranks of film comedians. Almost all of these films are now considered to be lost films.

"And So I Am a Comedienne", an article published in Ladies Home Journal in July 1925, gave Dorothy a chance to recall her public persona: “And so I am a comedienne, though I, too, once wanted to do heroic and tragic things. Today my objection to playing comedy is that it is so often misunderstood by the audiences, both in the theater and in the picture houses. It is so often thought to be a lesser art and something which comes to one naturally, a haphazard talent like the amateur clowning of some cut-up who is so often thought to be ‘the life of the party’. In the eyes of so many persons comedy is not only the absence of studied effect and acting, but it is not considered an art.”

She made a film in England Nell Gwynn which led to three more films. Gish earned £41,000 for these movies.

When the film industry converted to talking pictures, Dorothy made one in 1930, the British crime drama Wolves. Earlier, in 1928 and 1929, her performances in the Broadway play Young Love and her work with director George Cukor renewed her interest in stagecraft and in the immediacy of performing live again. The light comedy had proven to be popular with critics and audiences in New York, in performances on the road in the United States, as well overseas in a London production. Those successes convinced her to take a respite from film-making.

In 1939, both Dorothy and Lillian Gish found the stage role of a lifetime. “Dorothy and I went to see the New York production of Life With Father, starring Howard Lindsay and Dorothy Stickney,” Lillian wrote in her autobiography. “After the performance I said: ‘This is the play we’ve been waiting for to take through America.’” Lillian predicted the popular play would be a perfect showcase for all the people who had seen the hundreds of films featuring Mary Pickford, Dorothy, and herself. She was introduced to Lindsay backstage, and immediately surprised the producers with her enthusiastic desire to head the first company to go on the road, with Dorothy taking the same part for the second road company, and the movie rights for Mary Pickford. Pickford did not make the film version, but the Gish sisters took the two road companies on extensive tours. Another stage success later in Gish's career was The Magnificent Yankee, which ran on Broadway at the Royale Theatre during the first half of 1946. Lillian in her pictorial book Dorothy and Lillian Gish repeats John Chapman's comments about her sister's work in that production: "'Miss [Dorothy] Gish and Mr. Calhern give the finest performances I have ever seen them in. She is a delight and a darling.'"

Television in the 1950s offered many stage and film actors the opportunity to perform in plays broadcast live. Dorothy ventured into the new medium, appearing on NBC's Lux Video Theatre on the evening of November 24, 1955, in a production of Miss Susie Slagle's. She and Lillian had previously performed that play together on screen, in Paramount Pictures' 1945 film adaptation.

"The truth is, that she did not know what she really wanted to do," wrote her sister, Lillian, in her autobiography. "She had always had trouble making decisions and assuming responsibilities, in some ways she had never grown up. She was such a witty and enchanting child that we enjoyed indulging her. First Mother and I spoiled her and later Reba, her friend, and her husband Jim. Reba called Dorothy 'Baby' and so did Jim. With the best intentions in the world, we all helped to keep her a child."

From 1930 until her death, she only performed in five more movies, including Our Hearts Were Young and Gay (1944), which was a hit for Paramount. Director Otto Preminger cast Dorothy in his 1946 film, Centennial Summer, and Mae Marsh appears in the film in one of her many bit parts. In the 1951 release The Whistle at Eaton Falls, a film noir drama film produced by Louis de Rochemont, Dorothy portrays the widow of a mill owner. On television during this period, she also made several appearances in anthology television series. Her final film role was in 1963 in another Otto Preminger production, The Cardinal, in which she plays the mother of the title character.

Dorothy Gish married only once, to James Malachi Rennie (1890–1965), a Canadian-born actor who co-starred with her in two productions in 1920: Remodeling Her Husband, directed by sister Lillian, and in the comedy Flying Pat. In December 1920, the couple eloped to Greenwich, Connecticut, where they wed in a double ceremony in which Gish's friend, actress Constance Talmadge, also married Greek businessman John Pialoglou. Gish and Rennie remained together until their divorce in 1935. Dorothy never married again

Gish died aged 70 in 1968 from bronchial pneumonia at a clinic in Rapallo, Italy, where she had been a patient for two years to treat hardening arteries. Her sister Lillian, who was filming in Rome, was at her bedside. The New York Times reported the day after her death that the United States consulate in Genoa was making arrangements to cremate "Miss Gish's body" for return to the United States. The ashes were later entombed in Saint Bartholomew's Episcopal Church in New York City in the columbarium in the undercroft of the church. Lillian, who died in 1993, was interred beside her.

In recognition of her contributions to the motion picture industry, in 1960 Dorothy Gish was awarded a star on the Hollywood Walk of Fame at 6385 Hollywood Boulevard in Los Angeles.

The (since renamed) Gish Film Theatre and Gallery of Bowling Green State University's Department of Theatre and Film was named for Lillian and Dorothy Gish and was dedicated on that campus in 1976.

#dorothy gish#silent era#silent hollywood#silent movie stars#classic hollywood#golden age of hollywood#classic movie stars#1910s movies#1920s hollywood#1930s hollywood#1940s hollywood#1950s hollywood#1960s hollywood

14 notes

·

View notes

Text

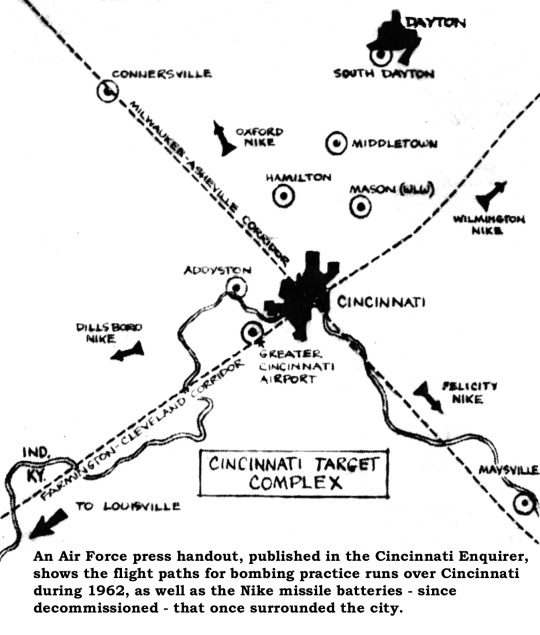

Remember When The Air Force Practiced Nuclear War Over Cincinnati?

Unless you’re an air show regular, you don’t hear many sonic booms these days. The occasional military flight gets over-enthusiastic and sometimes a meteor smacks the atmosphere just so, but such incidents are pretty scarce.

Time was, sonic booms were a regular and frequent occurrence in Cincinnati. From the mid-1950s well into the 1960s Cincinnatians were amazed, then annoyed, by this novel phenomenon.

Although Cincinnatians read about sonic booms since the early 1950s, the first local booms were recorded in 1955 when an F-104 Starfighter squadron out of Dayton’s Wright-Patterson Air Force Base engaged in maneuvers south of Wilmington. For the next five years, occasional Starfighter sorties caused residents to light up the switchboards at newspapers and police departments.

The first sonic boom in Hamilton County was blamed on a B-58 Hustler supersonic bomber being flown from Wright-Pat to Ft. Worth, Texas by a civilian test pilot. That boom, on 2 August 1957, cracked a plaster ceiling in one of the northern suburbs and resulted in widespread panic. The Cincinnati Enquirer [6 August 1957] was not amused:

“Telephone lines of fire departments, police, newspapers, radio stations and the like were jammed with calls. It was an illumination illustration of what might happen if the scare had some basis, and those lines were needed for emergency purposes.”

Problem was, sonic booms were so new and so different – five to 10 times louder than thunder – that people had no reference. Walter McCrosky didn’t. He was caretaker of an Oakley apartment building. When he heard a sonic boom on 4 December 1958, he was convinced it originated inside his building and called the fire department. When they found nothing amiss, he refused to believe the sound was caused by an airplane 30 miles away.

So many sonic booms and complaints about damage allegedly caused by sonic booms piled up that the local newspapers published contact information for Air Force officials handling damage payments. On 22 October 1959, the Enquirer printed advice from the Internal Revenue Service allowing deductions for damage to property as the result of sonic booms.

None other than Al Schottelkotte, then a columnist for the Enquirer, announced 4 May 1960 that Cincinnati need no longer endure sonic booms because the F-104 squadron based at Wright-Patterson had been cut in an Air Force budget move.

The respite was short-lived, because the Air Force revealed in 1962 that it was going to bomb Cincinnati a couple nights each week for the next year. Air Force logistics, it turned out, had painted a big tactical “X” on Cincinnati.

The Air Force set aside a limited number of corridors for attack training, and two of the corridors ran through Cincinnati airspace. One started in New York and ended in Missouri; the other started in North Carolina and ended in Minneapolis after going through Milwaukee.

Lying along these practice corridors were four Nike missile emplacements at Oxford, Wilmington and Felicity, Ohio and at Dillsboro, Indiana. Each had state-of-the-art radar systems capable of evaluating the accuracy of supersonic bombardiers. Within the “Cincinnati Target Complex” were several locations boasting brilliant radar profiles. These spots became the ��bullseyes” onto which the bombers aimed their practice bombs: Addyston, Mason, Middletown, Maysville, Connersville, South Dayton and the Greater Cincinnati Airport.

Although the Air Force gave the heads-up so Cincinnati could prepare for a rash of sonic booms, practice runs were also mandated for the sub-sonic B-52s and B-47s that formed the backbone of the United States nuclear deterrent strategy. Consequently, the local media were disappointed when the first practice run produced no sonic booms at all. “Boom Over City Goes Pf-t” whined the Enquirer [17 July 1962]:

“Hey, what happened to that boom? Cincinnatians expecting to hear the air-ripping thunder of B-58 Hustler bombers over the city last night were disappointed. Only one of the jet bombers flew over – and it made no sonic boom.”

In short order, the air Force fell into a pattern with two booms sounding almost every night between 8:00 p.m. and 8:30 p.m. and another set around 11:00 p.m. Those late night booms generated the most complaints about interrupted sleep, awakened children and disturbed pets. Despite the grumbles, the aerial maneuvers inspired patriotism at the Enquirer [27 July 1962]:

“The ‘sound of freedom’ boomed loud and clear over the Cincinnati area last night in two window-rattling installments, sending jarred citizens to their telephones. The booms sounded at 8:18 p.m. and again at 8:28 p.m. as two B-58 Hustler bombers passed over the city on practice runs from Asheville, N.C. to Milwaukee.”

Perhaps the most profound impact of the 1962 assault on Cincinnati occurred at the Camp Myron Kahn Boy Scout facility near Camden, Ohio. Cheviot Boy Scout Troop 601 occupied the camp for a week that summer. One night, the scouts enacted a ritual in which several boys, dressed as Indians, ran into the council ring and chanted an incantation before a stack of wood. One boy intoned, “Let there be fire!” just as a sonic boom cracked the sky and just as a hidden scoutmaster ignited the bonfire. According to the Cincinnati Post’s Si Cornell [9 August 1962]:

“The little Indian chief seemed amazed at the extent of his mystical powers.”

22 notes

·

View notes

Photo

Ghostly warning: Dead gangster Ma Barker doesn’t want her house moved

He called the newsroom with a warning: They can’t move that house.

“I’m worried something terrible is going to happen,” the man said in a thick New York accent. “I have to warn somebody.”

Then he told me a ghost story.

His name is Donald J. Weiss. He’s a 62-year-old retired police patrolman from upstate New York. He had moved to Ocala several years ago and visited the house where gangster Ma Barker had been killed. He had wanted to see the site of the longest shootout in FBI history: four hours, more than 2,000 bullets.

But when he wandered beneath the live oaks, a voice growled, “Get outta here, lawman!”

And when he took a photo of the front porch, a shadowy figure appeared.

“That woman is still in that house,” he told me. “And she’s pissed.”

He gave the photo to the Marion County Sheriff’s Office because he wanted to enter it into evidence. And because bad things started happening as soon as he had blown up the print. “I had a heart attack,” he said. “You think that’s a coincidence?”

The property has been sold, he told me. County officials want to move the house.

“They have no idea who or what is in there,” Weiss said. “That woman has the power to do a lot of things. We are dealing with the afterworld here.”

I thanked the caller for his concern.

“When are they moving it?” I asked.

He paused, as if to make a point, then said gravely, “By Halloween.”

Reporters get a lot of crazy calls. Many might have dismissed this one. But I knew this house, and so did my photographer friend John Pendygraft.

“Hey John,” I called across the cubicle wall. “Do you remember that story we did on the Ma Barker house?”

John’s eyes got big. “Do you remember what happened?”

Our story four years ago had been about real estate: historic home for sale on nine waterfront acres, eight miles north of the Villages, two hours from Tampa. And about the gangsters who hid out there until the end.

We had toured the four-bedroom house with a Realtor, whose assistant shivered and said, “I get the weirdest feeling when I’m in here.” We had reported rumors about flickering lights and an unsuccessful exorcism.

But we hadn’t written about what had happened to John. Or what he saw when he enlarged one of his pictures.

John has worked in war zones in Afghanistan and the Gaza Strip. He has photographed the dead from an Asian tsunami, a Mexican assassination and Hurricane Katrina. If he ever is scared, he won’t show it.

That fall day in 2012, in the Ma Barker house, he had gone alone into the front bedroom to take pictures through the window, looking out toward the lake where the FBI agents had crouched behind trees.

All of a sudden, John rushed out, cameras, lights, tripod flapping over his shoulders, nearly sliding down the 13 stairs. “I don’t know what happened, or what that was,” he panted. He heard the mattress fall, then saw it, dangling through the bed frame. “I didn’t touch it,” he insisted.

We left that afternoon, as dusk began to descend. From beneath the Spanish moss, John shot a few final frames. The next day, when he zoomed in on his laptop, he saw a strange figure on the screened porch: The silhouette of a stout woman with a bun, who looked like she was holding a machine gun.

Her story starts in Missouri, in 1873. Her parents named her Arizona Donnie Clark. She and a farmhand, George Barker, had four sons. As soon as the boys were grown, her husband left.

Legends vary about Ma Barker’s role in her boys’ gang. Some say she just cooked and cleaned. Others say she was the mastermind.

They began by robbing banks, then murdered a policeman. From 1910 through 1930, they are said to have stolen $2 million. And killed at least 10 people.

The FBI’s first director, J. Edgar Hoover, called them “the worst criminals in the entire country.” Ma Barker became the only woman to top the most wanted list.

In 1934, the gang split and went into hiding. One son fled to Chicago. Ma and her favorite son, baby Freddie, moved to Miami where, posing as a wealthy widow, she asked if anyone knew a secluded spot where she could spend the winter.

Someone introduced her to Carson Bradford, whose family had a lovely home in the center of Florida, on Lake Weir.

The house sounded perfect: fully furnished, set back from the road, with a boat tethered to a dock out back. Ma paid the full season’s rent in cash. Just before Thanksgiving, she moved in with Freddie and a couple of his friends.

In a letter to her son Arthur in Chicago, she drew a map of the lake and circled the closest town, Ocala. She mailed it from Ocklawaha’s little post office.

FBI agents found Arthur the following January, and with him, the letter, which led them to Ma’s hideout.

In the predawn darkness on Jan. 16, 1935, a dozen officers pointed their guns at the upstairs windows. “This is the FBI,” an officer shouted, according to an agency report. “You are surrounded.”

Some say the gun battle lasted as long as six hours.

When it was over, they found Freddie, 32, shot in the back of his head. Ma, 63, was curled on the floor, cradling her Tommy gun. That day, Hoover said, marked “the end of an era of violence.”

For nine months, the corpses lay unclaimed. Finally, a relative moved them closer to home.

But some say Ma still inhabits that two-story, cream-colored house with forest green shutters. The cop on the phone, my friend the photographer, the former and current owner all saw, heard or felt … something.

But how do you report a ghost story?

I started with the Marion County Sheriff’s Office and that “evidence” photo the retired cop mentioned on the phone.

Lt. Dave Redmond remembered some man bringing in the photo, but the deputy hadn’t seen anything in it.

Records only go back to 1990, said department spokeswoman Lauren Lettelier. “But since then, there have been no reports of hauntings at that house.”

I talked to Carson Good, 47, the great-grandson of the man who built the house. He has memories of swimming and sailing in the lake. And of countless sleepless nights, cringing in the dark. “I’m not a big believer of ghosts, but I heard a lot of sounds in that house,” he said. “Voices. Furniture moving. People walking up and down the wooden stairs.”

His grandmother didn’t like to talk about it, but she often heard spirits stirring. Years ago, he said, a psychic from Cassadaga held a seance at the house and convinced the ghost of Freddie Barker to move on. But the medium said Ma refused to move.

Good and his family sold the property for $750,000 and donated the house to the county, which hired a contractor to lift the home off its foundation and float it across Lake Weir to a park called Carney Island. County commissioners allocated $270,000 for the move. Private donations and fundraising will finance the museum.

County tax collector George Albright, who grew up next to the storied house, envisions an homage to the early days of the FBI, as agents set out to capture notorious gangsters like “Baby Face” Nelson, “Pretty Boy” Floyd, Bonnie and Clyde and, of course, the infamous Barker gang.

“We’ve already had calls from people asking about ghost tours. If they want something like that, or to hold seances, we’ll look into that,” said the tax collector, “as a revenue source.”

Some say the gang buried Mason jars filled with cash along the lake. Local children used to spend summers digging for the treasure, but came up with shovels full of sand.

As soon as the home is removed, before the new owner closes on the land, the tax collector plans to bring in a team with ground-penetrating radar to scan the soil.

“Let’s hope she’s a friendly ghost,” he said.

On a gray Wednesday in October, more than 81 years after the shootout, John and I returned to the scene. The house already had been lifted on jacks. The screened porch was gone; workers were carrying out lamps. A true-crime novelist was parked in an SUV, taking pictures.

Like John, he swore he had seen a face in a window.

“I think whatever’s in there doesn’t want us to come in,” said Tony Stewart, who had driven from Indiana to see the house in its original setting. “And it won’t come out.”

We had told the retired cop that we would meet him later. The tax collector didn’t want anyone else at the construction site. But Weiss pulled up in his white Cadillac, quaking in his tassled loafers.

“This is where their bodies were. They dragged ‘em right down this driveway,” said Weiss, clasping his arms across his chest. “She’s not at rest. She will never leave this property.”

He has felt this before, he said. “I sense spirits.”

The first time was in 1992, just before Christmas. He was on patrol in White Plains, N.Y., resting in his car between calls, when he had a vision of a sad teenage boy: long hair, pale, with a pug nose. Two days later, he was sent to a home where a teenage boy had hanged himself. “The same boy I’d seen.”

#Ghostly warning: Dead gangster Ma Barker doesn’t want her house moved#outlaw#paranormal#ghost and hauntings#ghost and spirits

6 notes

·

View notes

Text

Michael Bryant Hicks

Most recently, Hicks was the Executive Vice President, General Counsel, and Corporate Secretary at Indianapolis-based Apria, Inc. (APR), the nation’s largest provider of home healthcare equipment and in-home clinical services for respiratory diseases, diabetes, and other illnesses. At Apria, he managed all legal and regulatory matters, enterprise risk, and government affairs. This work culminated in March 2022, when Hicks and the Apria management team completed negotiation for the sale of Apria to Owens & Minor, delivering a significant premium to shareholders, while placing the business on a trajectory for future value creation. Prior to Apria, Hicks was the General Counsel of Elanco Animal Health (ELAN), a $13.5 Billion market cap animal pharmaceutical company based in Greenfield, Indiana. Hicks led Elanco’s successful 2018 IPO and managed a legal department of 70 professionals in navigating the complex regulatory environment in which the company does business in the United States (FDA, USDA, EPA) and abroad (European Medicines Agency, Chinese FDA). A Trusted Voice in Healthcare and Life Sciences Matters: As a General Counsel, Hicks knows the experience of having the FDA order a company to recall one of its highest revenue products. He has also engaged in complex negotiations with commercial payers and delicate discussions with CMS on drug pricing. He deftly managed these situations by understanding the economic motivations of payers and the FDA and CMS regulatory environment. A Leader in Corporate Governance: Hicks has designed the boards of directors of two public companies in connection with their initial public offerings, developing the corporate governance processes the companies relied upon in their first years on public exchanges. He’s been the company interface with Glass Lewis, ISS, the SEC, and the NYSE. Hicks is the leader these companies have looked to on Environmental, Social, & Governance matters, matching the values and business goals of an enterprise with complementary issues of societal impact. He’s also been the lead negotiator in two major encounters with prominent activist investors. Navigating High Stakes Investigations and Litigation: As General Counsel at Mallinckrodt Pharmaceuticals, Hicks brought to successful settlement a DEA controlled substances investigation, a DOJ False Claims Act investigation, and an FTC investigation into alleged antitrust violations. He also led the formation of the company’s early strategy in the nationwide opioid litigation. A Leader in Transformative Deal Making: Hicks’s career began in global M&A as an energy lawyer with Vinson & Elkins law firm in Houston, Texas, where his engagements included a wide range of cross-border energy projects, including assisting Occidental Petroleum in financing and building oil production assets with the Ecuadorian state petroleum company Petroecuador. He continued large-scale global deal making in the healthcare and life sciences space as the lead lawyer in consummating some of the largest deals of the last decade: DaVita’s 2012 acquisition of HealthCare Partners ($4.4B), Elanco’s acquisition of Bayer Animal Health ($6.9B). Hicks earned a juris doctor from Yale Law School and a Bachelor of Arts from the University of North Carolina at Chapel Hill.

Michael Bryant Hicks

0 notes

Text

suspended license auto insurance

BEST ANSWER: Try this site where you can compare quotes from different companies :insurancefreequotes.xyz

suspended license auto insurance

suspended license auto insurance policies tend to have the highest rate of auto insurance claims over the life of the policy. According to these guidelines, car insurance is an integral part of driver safety, but it is also a cause for worry if more cars are involved in incidents that result in a ticket. The good news is that car insurance companies will take the time to check this information. If you’re in the market for a new car, you’re free to invest in a car insurance policy that’s right for you. However, you should always choose the cheapest car for your situation. Your current car insurance should offer level coverage as well. However, your vehicle may not be sufficient in a crash with another vehicle or if a pole‑to-pole accident damage your car. This is why an accident where your car is at fault can lead to a huge financial loss for you in the case that you are subsequently accused of car insurance not only as a result of the incident but also as a result of. suspended license auto insurance policy. A non-ownership can result in lower monthly premiums if the insurer doesn’t insure your vehicle at the current state limit. Non-owners auto policies include gaps in coverage, a reduction in your policy time cap, and a cancellation fee for not renewing before the next policy renewal. The fee is typically $9 for non-owners auto insurance. You can expect a slight decrease in your monthly premium but it’s only temporary. Not only are these gaps covered, but they can also incur you a penalty if you drive without coverage for a brief period of time if you’re driving without insurance. If you’re a young person, your current car insurance company may be willing to insure your car until you’ve reached the age of 25 and the minimum age is 26. If you’re a married person, this may save money, but you’ll have to shop around to find the best rate. When shopping for car insurance,. suspended license auto insurance policy, you may also want to consider , the company’s term car insurance program. and , but don’t forget that gives possible discounts for drivers who have a clean , good, or poor driving record. is often a great resource as well. A quick , you can receive discounts for a bad driving record, with some people only getting a small price cut with . In recent years, the company has become less frequent than ever. can be an attractive financial strategy, or in some cases even a tool. It may work if you’re in the car buying process and you pay . You can have a policy with a new company, compare , or simply switch carriers before making a decision. It’s not a good idea to wait in the first few years of life because your vehicle may get damaged or stolen. And, once the vehicle is lost or stolen, it could be damaged in accidents. You also cannot get car insurance if.

Obtaining Insurance After Suspension

Obtaining Insurance After Suspension of License The Department of Revenue requires all vehicles and licensees to be insured a minimum of a certain amount of money for which the value shall exceed the cost to acquire or maintain a vehicle, or the value of a vehicle which does not exist in the marketplace, so as to secure the safekeeping of the assets upon such vehicle suspension. The Department’s Notice and Answer Regarding Motor Vehicle Insurance Regulation is a general outline of the requirements and standards required for the issuance and renewal of personal auto insurance policies. The Department of Insurance shall issue, issue and issue and issue a separate insurance policy in the same state in which the Department of Motor Vehicles is located on the street where you place vehicles and property. You can see if you can get insurance on your vehicle if it is in a special parking lot, the driveway or the driveway or the street where you place vehicles. Call us at to make changes to your life insurance policy.

How Long Will a Suspended License Affect my Car Insurance Rates?

How Long Will a Suspended License Affect my Car Insurance Rates? Is There a Penalty if You Will Only Be Fined for Driving Without a License? It is important to understand that a person s license is one of the most important things that a licensed professional will ask about. The consequences for driving without a license in this manner will be extremely expensive for the person responsible for the car crash. The first penalty due will be the license suspension. These can range from a mere suspension of your registration to a 90-day suspension. The second penalty will be the cost of your car insurance in addition to the regular fees and the suspension of your license until you can show you are compliant with the law. The cost of auto insurance will be determined by a number of factors such as your car, your age and your driving record. If you are arrested, your DMV can place you in prison for up to 6 months. The longer you remain on the road and are involved in a car accident without insurance, the longer the time you will have to obtain a new license on.

Strategies for Reducing Insurance Costs After Suspension

Strategies for Reducing Insurance Costs After Suspension: Reduce Auto Insurance Costs Premiums by Upgrading Vehicle Accidentation Coverage. Reducing the risk of accidents is one of the most significant strategies to reduce or eliminate claims. Unfortunately, in order to do this, insurance companies are often going to have multiple insurance needs to compensate their customers. Many drivers pay huge amounts of money just for this. You could end up spending thousands of dollars per year on the cost of insurance. This can be done with so many different insurance companies that if none of them provide adequate or affordable insurance coverage, a low-priced policy can be extremely expensive. One of the best ways to reduce the cost of insurance is to not only save some money, but to also reduce premiums, and to not try to make more money off of those that do. To save more money, simply think about saving some money even more than a minimum amount. What you see below is some of the cheapest auto insurance benefits that a person can use, and what they can do when they have.

Can a Driver Get Car Insurance While Suspended?

Can a Driver Get Car Insurance While Suspended? It’s Your Time To Get a Hold for Your State. Insurance is an essential tool, but why wait? It gives drivers the best of both worlds when it comes to auto insurance. But what exactly is auto insurance for drivers? It might make the process more personal, which means a lot of driving through the same insurance carriers. When you’re involved in an auto, which you drive, you can assume the insurer will use a portion of your bill for property damage. You’d want to have this information handy on your computer screen, which means a lot less time spent talking to your agent. If you’re a high-risk driver, auto insurance rates can be high. It makes sense to ask: Does the insurer consider the circumstances of a person, such as marriage or the death of a parent, in the application process? The fact that you are an underwriter and this includes: What is the coverage for people who drive? What is the best way.

SR-22 Insurance in Indianapolis

SR-22 Insurance in Indianapolis, and other states. For more help finding the best rates after comparing personalized quotes, try out our Quick Tip: To compare auto insurance quotes in Indianapolis from multiple companies free, enter your ZIP code here. You’ll get multiple prices from top insurance companies. Do you know who has the cheapest car insurance? In almost every state in the U.S., the cheapest insurance is from an insurer that’s more than 50 years old. But Indiana drivers without a valid driver’s license may want to get quotes from more companies.

You May Need Insurance-Even if You’re Not Driving

You May Need Insurance-Even if You’re Not Driving Driving without insurance is a misdemeanor in Oklahoma. However, if you’re not licensed to operate a vehicle, driving without insurance will be a traffic infraction. Auto Dealers Insurance-Telemedicare. If you want to check and find out who is available, and who is available when you need one, just simply call our toll-free number and we will get in touch (844) 922-0517. When you are shopping for auto insurance, you have a few choices to make: The more you are aware of your options and your goals and the plans you have to meet them, the more you can rely on your auto policy to be in force during times of need. You can always ask your independent insurance agent if there is anything you can do and will be able to get in touch with a licensed agent of.

SR-22 Insurance

SR-22 Insurance. You may want to check with your state’s insurance department to see if something is required. It’s possible to be denied insurance coverage if you have multiple traffic violations or traffic violations. A traffic ticket is not an indicator of future drug or alcohol use. However, a DUI is not a specific marker of addiction, so a potential drug in a teen’s driving skills class is still a distant memory. A parent’s driving record is one of the many factors that affect teen auto insurance rates. Some states, like , determine how many years a driver stays on their driving record. They decide some of the rules and limitations place such a large number of drivers onto an auto insurance policy. Teen drivers with DWI, DWI+, and DWIs on their driving record may have more expensive rates than teenagers with no DWI. In some states, the DWI DUI will negatively (but not by much) affect the rate of teen car insurance. Some examples of car.

Does a suspended license affect insurance?

Does a suspended license affect insurance? . When it comes to just having a license, you’re dealing with a broken off auto insurance policy that has only *little* coverage for most of the costs associated with getting licenses, then there’s a cost associated with having an auto insurance policy and then if those aren’t covered, that comes back to just a fine print, no insurance to a suspension of license, or, the suspension may either be temporary or have to be cancelled for non financial reasons. The problem is, some people are able to get temporary auto insurance, and their suspension is simply too long and their insurance doesn’t cover what they originally purchased. When you’re an entrepreneur, there is a chance you can get a suspended license, and when you’re also a high-level leader in insurance marketing, there is a chance your license isn’t that long. Once you’re not working for a corporation, if you can�.

Do I need insurance if my license is suspended?

Do I need insurance if my license is suspended?If I am in another state and my vehicle is registered in the state I am in, and I am on my way out, are my licenses suspended?When I move to New York, should I get a license plate?Can I use my cell phone while I am not driving?If I am driving at night, can I just cancel my insurance? New York auto insurance lapse accounts are generally used to make changes in your insurance or stop your policy from renewing. There are also some conditions or limits you can’t meet, and most of the time, no. It will be illegal to drive while being stopped and you will be asked to pay a $100 reinstatement fee for the first time. If you get into an accident while driving, you will be cited. It will cost you, the other driver’s insurance company, and the other party for the following: If you don’t have your own insurance, the driver will continue to be a burden to their.

A car insurance company can report the details of an accident or ticket to the licensing agency that can lead to a suspension. However, only the government licensing agency or a court can suspend a driver’s license.

A car insurance company can report the details of an accident or ticket to the licensing agency that can lead to a suspension. However, only the government licensing agency or a court can suspend a driver’s license. If you are in a car accident and you are not able to obtain car insurance then an agency will contact you to find you an insurer to fill out the ticket. The reason for a ticket usually depends on the nature of the accident. You are not required to have it because of your driver’s licence. If you want to be able to file your new car insurance you will be asked to buy a new car insurance policy if you do not have insurance already. If you have not already purchased a new car insurance policy then you may not want to buy it, just need to decide what type of car insurance would best suit you. However, if you have an old model car you should expect a large insurance premium in its first year. However, if you buy a car then you will be paying a higher premium than if you bought the car in a few years. In 2017 a total of 909 car accidents resulted in injuries, including five of the six in which the driver was injured..

1 note

·

View note

Text

Law Enforcement Gun Ranges Discover Little Known Approach for Using Forfeiture Funds to Pay for Firing Range Contractor Services, Cleaning and Lead Maintenance