#India digital payment growth

Explore tagged Tumblr posts

Text

India's Digital Payments Revolution: Redefining Financial Landscapes

The story of India’s digital payments revolution is nothing short of extraordinary. In a nation of 1.4 billion people, where cash once reigned supreme, technology has rewritten the rules of commerce. Seamlessly blending innovation, government policies, and mass adoption, India has emerged as a global leader in cashless transactions. This article dives deep into the remarkable growth, the impact on entrepreneurs, the role of regional banks, and India’s vision for leading the global digital payment landscape. Expand to read more

#India digital payment growth#UPI adoption in India#digital payments for startups#regional banks role in fintech#future of cashless India#digital economy India#global payment systems#India fintech innovation#cashless transactions in India#Insights on financial inclusion in India#Insightful take on digital payments.

0 notes

Video

youtube

India Is Becoming a GLOBAL TECH POWER Due to UPI? India is rapidly emerging as a global tech powerhouse, and it's all thanks to the revolutionary Unified Payments Interface (UPI)! In this video, we explore how UPI has transformed the country's digital payment landscape, making it an attractive destination for tech giants and startups alike. From increasing financial inclusion to boosting economic growth, we delve into the impact of UPI on India's tech ecosystem. Join us as we discuss the future of fintech in India and how UPI is playing a crucial role in shaping the country's digital destiny.

#Unified Payments Interface#Cashless Transactions#technology adoption#digital revolution#financial technology#cashless economy#will india become a superpower india#india today news#indian economy#india news in hindi#india economic growth#how india is becoming the global super power#india tech growtheconomics of india#why is india growing so fasteconomic growth india#economy india#indian economic growth

0 notes

Text

Accessing New Opportunities for Digital Payment Growth in India: By Jamel Derdour

India’s transition to a digital payment powerhouse has been remarkable, driven by the success of platforms like UPI, mobile wallets, and the e-commerce boom. Yet, the journey is far from over. Numerous untapped opportunities exist to further accelerate the growth of digital payments, paving the way for a more inclusive and efficient financial ecosystem. Expanding Digital Payments in Rural…

0 notes

Text

India's Global Role: Beyond the "Consumer Market" Tag

What are your thoughts on India's global role? Share your insights & join the conversation!

India, a land of vibrant colors, rich history, and a booming economy, is often perceived as just a massive consumer market. But is that all there is to India’s story? In this eye-opening exploration of India’s global role, we’ll uncover the country’s untapped potential, technological prowess, and cultural influence. Get ready to see India in a whole new light! And don’t forget to check out my…

#ayurveda#Bollywood#consumer market#culture#digital payments#economic growth#global role#India#Innovation#ISRO#Make in India#manufacturing#renewable energy#soft power#strategic partnerships#technology#Yoga

0 notes

Text

ICICI Bank & SCCI Host Cyber Fraud Prevention Seminar in Jamshedpur

Chamber event highlights digital payment safety and business growth strategies Jamshedpur entrepreneurs gain insights on cybersecurity, loan facilities, and supply chain management at ICICI Bank seminar, emphasizing vigilance in the evolving digital economy. JAMSHEDPUR – The Singhbhum Chamber of Commerce and Industry collaborated with ICICI Bank to host an educational seminar addressing critical…

View On WordPress

#बिजनेस#business#business growth strategies#cybersecurity awareness for entrepreneurs#digital payment safety India#financial education Jamshedpur#ICICI Bank business seminar#ICICI Bank cyber fraud prevention#Indian digital economy trends#Jamshedpur business seminar#Jamshedpur commerce event#Singhbhum Chamber of Commerce

0 notes

Text

Woxro: The Bright Head in the Lead of Ecommerce Development

Woxro is one of the highest level e-commerce development companies in the constantly changing digital economy. Woxro assures cutting-edge solutions for businesses with the sophisticated requirement of today's digital economy. Whether it's about B2B and B2C platforms or the most seamless integration, or simply a custom-built solution, the online business experiences get ignited through Woxro's services. Backed with the attitude of innovation and commitment towards making their clients successful, Woxro helps companies make strong digital platforms along with competitive markets. Check out these are the core e-commerce development services by which Woxro comes forward to be a preferred partner for businesses wanting to breathe new life into their online presence. Woxro is the leading ecommerce development company in India and is providing top notch services and solutions for you.

B2B Platform Development

The B2B interaction is at the heart of modern commerce; it has built B2B platforms that make such interactions easy and hassle-free. B2B marketplaces help a company reach its suppliers, shortlist potential partnerships, and make the transactions all from one centralized place. Woxro's B2B platforms are wide-ranging and ensure that customers experience security, reliability, and ease of use in all business operations in order to create confidence and efficient workflows. Woxro's B2B solutions are equipped with real-time inventory management, automated processes, and advanced analytics, meaning businesses can work efficiently and have valuable relationships that last long.

B2C Platform Development

Through ease-of-use, online shops to offer products for shopping, Woxro's B2C platform development services help businesses reach their customers and interact directly with them. Designed to convert visitors into loyal customers, Woxro's B2C platforms include all the comprehensive tools for managing products, processing secure payments, and engaging in more personalized experiences for shopping. Each is optimized to give an easy, enjoyable experience to the user as businesses stretch their reach to the customer, marketing being directed, and giving an enjoyable shopping experience that creates a sale and brand loyalty.

Platform Migration

Moving out from the outdated systems to modern scalable platforms often marks the beginning for businesses that want to remain competitive. Woxro professionals successfully migrate complexly numerous business operations from less than the minimum level of disruption. Woxro takes cautious control of data migration, system configuration, and testing processes while making the move to become more distant in terms of on-premise systems to cloud infrastructure, updating legacy technology, or changing platforms. When businesses engage with Woxro, they embrace the latest technologies, realize cost savings on operations, and boost the performance of the system with business continuity and efficiency intact.

Custom-Designed Platform Development

Woxro realises that every business is unique and has custom platform development services that provide bespoke solutions for a specific goal or workflow in place. These platforms are off-the-shelf by definition, designed from the ground up to meet a precise business need. Woxro's custom solutions are scalable and adaptive, allowing businesses to implement proprietary features, streamline workflows, and maximize flexibility. About Woxro's customization innovation integration: It ensures that the platforms continue to grow with the business and, thus, become an excellent basis for long-term growth as well as a competitive edge in the market.

CMS Integration

The integration of a content management system with your e-commerce platform has vast benefits within the operation, ranging from effective product management to advanced SEO capabilities. Woxro's content management system integration services enable businesses to access a single, easy-to-use interface for managing product descriptions, optimizing search content for better search engine rankings, and personalising shopping experiences. CMS integration, therefore, promotes ease of updates while bringing increased online visibility and engagement from customers. CMS integration helps companies create more engaging and dynamic experiences that talk to customers to convert them.

API Integration

API integration is a necessary concept for e-commerce platforms in an interlinked digital world, integrating with third-party applications, payment systems, and other services. Woxro's API integration services provide smoother interoperability between different software applications for easy information sharing and add-on features. Of course, payment gateway, CRM system, and APIs all resolve issues because their performance can grow without getting disconcerting of existing operations, Woxro ensures that. API integration makes the overall functionality and responsiveness of e-commerce platforms robust, flexible, and scalable enough to expand on further expectations.

Why Woxro for ECommerce Development?

At Woxro, you will find industry expertise, innovative technology and, above all, a client-centric approach that seeks tailored solutions for each business. Ecommerce development with Woxro's services is done to cater for the unique needs of every client so as to ensure robust, scalable solutions adapting to changing market demands. Whether it is a B2B, B2C platform, handling platform migrations, or integration with CMS and APIs, Woxro connects with technical pools of expertise in alignment with strategic insight to yield results. Businesses partner with Woxro to achieve advanced tools and custom solutions in enforcing the new path forward through their digital success.

Conclusion

Woxro e-commerce development solutions give businesses the possibility of a powerful and agile web presence. The products offered by Woxro for creating B2C growth strengthen customer engagement, streamline B2B relations, smooth migrates, and unlock API and CMS integrations that facilitate business clients' digital transformation with the platform. Equipping businesses with solutions that solve the challenges of the digital age, creating future-proof, impact-generating e-commerce, to drive business growth and success-all of these Woxro does.

#ecommerce#ecommerce development agency#ecommerce development services#ecommerce development company#ecommerce website development#ecommerce developers#web developers#web development#web graphics#web resources#shopify#woocommerce#online store#smallbusiness#websitedevelopmentcompany#search engine optimization#web design#website design#web hosting#website#social media#content creation#content creator#cms development services#cms#b2b#b2bmarketing#api integration

5 notes

·

View notes

Text

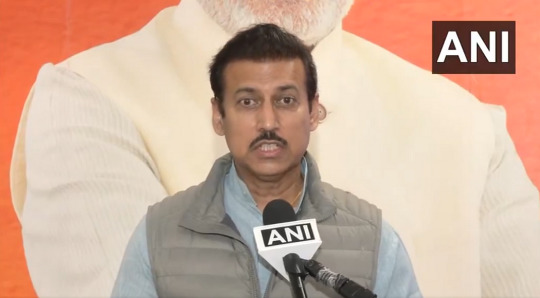

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

B2B ecommerce website development in Indore

B2B eCommerce website development in Indore presents a lucrative opportunity for businesses looking to establish a strong online presence. With its rich talent pool, cost-effective solutions, and innovative approach, Indore has become a preferred destination for digital transformation projects. Online transactions between companies, as opposed to between companies and customers, are referred to as business-to-business (B2B) eCommerce. Strong B2B eCommerce solutions are essential given the growing dependence on digital platforms for supplier relationships, inventory control, and procurement.

The Significance of B2B eCommerce

Streamlined Operations: Efficiency is increased by automating procedures including order placing, tracking, and payment. Global Reach: Companies are able to grow their clientele beyond national borders. Cost Efficiency: By reducing manual intervention, digital systems lower operating expenses. Improved Customer Experience: Self-service portals, bulk ordering, and customized pricing are examples of features that increase consumer pleasure.

Why Indore Is a Center for the Development of B2B eCommerce

Indore has established itself as one of the fastest-growing IT cities in India. Businesses might think about Indore for the creation of B2B eCommerce websites for the following main reasons: Skilled Talent Pool: Indore is home to a sizable population of web developers, designers, and IT specialists that are knowledgeable about cutting-edge technologies. Cost-Effective Solutions: Development services in Indore are exceptional value for money and are less expensive than in major cities. Successful Startup Ecosystem: The dynamic entrepreneurial climate in Indore encourages originality and inventiveness in web development. Robust Infrastructure: The city's cutting-edge IT infrastructure facilitates timely delivery and smooth project execution. Client Proximity: Because of its advantageous location, companies in Central India can work with developers situated in Indore with ease.

How to Create a Business-to-Business eCommerce Website in Indore ?

Building a strong B2B eCommerce platform requires careful preparation and implementation. Here’s a step-by-step guide:

1. Analysis of Requirements

Determine the target market and business goals.

Specify the essential features and integration requirements.

2. Selecting the Appropriate Platform Depending on your needs, choose bespoke development or platforms like Magento or Shopify Plus. 3. Design of UI/UX

Create prototypes and wireframes for approval.

Concentrate on producing a design that is neat, expert, and user-focused.

4. Growth and Assimilation

To create the website, write clear, optimal code.

Increase functionality by integrating third-party tools and APIs.

5. Quality Assurance and Testing

To get rid of bugs, do thorough testing.

Make sure it works on all devices and browsers.

6. Implementation and Upkeep

Use secure servers to launch the website.

Assure seamless operations by providing regular updates and support.

#website#website design#web design#seo services#digital marketing#web development#usa#usa news#india#web hosting#web developers

4 notes

·

View notes

Text

What Are the Key Trends Shaping Domestic Money Transfers?

Domestic Money Transfers have evolved significantly in recent years, driven by advancements in technology, changing consumer preferences, and increasing regulatory oversight. The emergence of Digital Solutions, coupled with the integration of innovative financial tools, has reshaped the way individuals and businesses transfer funds within a country. This article delves into the key trends shaping Domestic Money Transfers, highlighting the role of technology, accessibility, and efficiency in this transformation.

1. Digital Transformation in Money Transfers

One of the most significant trends in Domestic Money Transfers is the widespread adoption of Digital Solutions. Traditional methods, such as bank drafts and money orders, are being replaced by mobile apps, digital wallets, and online banking platforms. These technologies allow for faster, more secure, and convenient transactions, catering to the growing demand for real-time payments.

The rise of digital banking has made it easier for consumers to transfer money with just a few taps on their smartphones. Mobile apps, have become household names, enabling peer-to-peer transfers with minimal fees and instant confirmation. These platforms not only enhance user experience but also reduce the dependency on cash, making transactions more efficient and traceable.

2. The Role of Fintech Companies

Fintech companies play a pivotal role in revolutionizing Domestic Money Transfers. By leveraging cutting-edge technologies like artificial intelligence (AI) and blockchain, they are addressing common challenges such as high transaction costs, delays, and lack of transparency. Companies like Xettle Technologies, for instance, have developed innovative platforms that streamline domestic payments, offering features like instant transfers, robust security protocols, and user-friendly interfaces.

These fintech solutions are particularly valuable for small businesses, freelancers, and gig economy workers who rely on seamless and affordable payment methods to manage their finances. By integrating Digital Solutions into their operations, fintech companies ensure that users can access fast and reliable money transfer services without the limitations of traditional banking systems.

3. The Shift Toward Real-Time Payments

Real-time payments (RTP) have emerged as a game-changer in Domestic Money Transfers. Consumers and businesses increasingly expect instant fund availability, whether for payroll, bill payments, or peer-to-peer transfers. Real-time payment systems eliminate the delays associated with traditional methods, ensuring that funds are credited within seconds.

Governments and financial institutions worldwide are investing in RTP infrastructure to meet these demands. In the United States, for example, the Federal Reserve’s FedNow Service aims to provide a nationwide RTP platform by facilitating instant transfers between banks. Similarly, other countries have implemented systems like India’s Unified Payments Interface (UPI) and the United Kingdom’s Faster Payments Service, highlighting the global push for faster domestic transactions.

4. The Growth of Mobile Money and Digital Wallets

Mobile money and digital wallets are becoming integral to the domestic payments ecosystem. These Digital Solutions provide a secure and convenient way to store and transfer money, especially for unbanked or underbanked populations. Platforms like Apple Pay, Google Pay, and Cash App offer seamless integration with smartphones, enabling users to make transfers, pay bills, and shop online without the need for physical cash or cards.

This trend is particularly prominent in emerging markets, where mobile penetration is high but access to traditional banking infrastructure remains limited. By bridging this gap, digital wallets are fostering financial inclusion and empowering users to participate in the digital economy.

5. The Influence of Open Banking

Open banking is another trend shaping Domestic Money Transfers by fostering collaboration between traditional banks and fintech companies. Through secure APIs (Application Programming Interfaces), open banking allows third-party providers to access customer data (with consent) to create tailored financial services. This innovation promotes competition and encourages the development of more efficient and customer-centric money transfer solutions.

With open banking, users can link multiple accounts to a single platform, making it easier to manage funds and initiate transfers. For businesses, open banking streamlines payment processing, enhances cash flow management, and provides real-time insights into financial transactions.

6. Enhanced Security and Fraud Prevention

As Domestic Money Transfers become increasingly digital, ensuring security is paramount. Advanced fraud prevention measures, such as biometric authentication, tokenization, and encryption, are being integrated into money transfer platforms to protect user data and prevent unauthorized access.

AI and machine learning play a crucial role in detecting suspicious activities and mitigating risks. These technologies analyze transaction patterns in real time, flagging anomalies and preventing fraudulent transfers before they occur. For consumers and businesses alike, enhanced security builds trust and encourages wider adoption of digital money transfer solutions.

7. The Push for Financial Inclusion

Digital Solutions for Domestic Money Transfers are also driving financial inclusion by reaching underserved populations. In rural areas and low-income communities, mobile money platforms and agent networks provide access to basic financial services, allowing individuals to send and receive money with ease. This democratization of financial services helps reduce economic disparities and fosters greater participation in the formal economy.

8. Regulatory Support and Standardization

Supportive regulatory frameworks are facilitating the growth of Domestic Money Transfers. Governments and regulatory bodies are working to create standards for interoperability, data security, and compliance, ensuring that digital payment systems operate seamlessly and transparently. Initiatives like regulatory sandboxes allow fintech companies to innovate while adhering to legal requirements, creating a balanced ecosystem for growth and innovation.

Conclusion

The landscape of Domestic Money Transfers is undergoing a profound transformation, fueled by the adoption of Digital Solutions, technological advancements, and evolving consumer expectations. Trends such as real-time payments, mobile money, open banking, and enhanced security measures are redefining how individuals and businesses manage their financial transactions.

Fintech companies like Xettle Technologies are at the forefront of this revolution, delivering innovative tools that simplify domestic payments and enhance user experience. As these trends continue to shape the market, the future of Domestic Money Transfers promises to be faster, more inclusive, and more secure than ever before.

2 notes

·

View notes

Text

Digital Signature Certificate for Import-Export Code (IEC) Registration

The Import-Export Code (IEC) is a unique identification number required by businesses involved in the import or export of goods and services in India. One of the mandatory requirements for IEC registration is the submission of documents using a Digital Signature Certificate (DSC). This blog explains the importance of DSCs in the IEC registration process, how they are used, and why securing your DSC is crucial for your business’s growth in international trade.

What is the Import-Export Code (IEC)?

The Import-Export Code (IEC) is a key business identification number provided by the Directorate General of Foreign Trade (DGFT). It is mandatory for businesses wishing to engage in international trade activities. Whether you’re a manufacturer, wholesaler, or trader, an IEC is essential for clearing goods through customs, making payments for exports/imports, and availing other export benefits.

Why is a Digital Signature Certificate (DSC) Needed for IEC Registration?

E-Filing Requirement: The DGFT requires businesses to submit their IEC registration forms electronically via the DGFT portal. To sign and submit these online forms, you need a Digital Signature Certificate (DSC). This DSC ensures that the forms are validated and processed by the authorities without the risk of fraud.

Ensures Legal Validity: A DSC is recognized under the Information Technology Act, 2000, and serves as a legally valid electronic signature. This makes it possible for the IEC application to be processed legally, just like a traditional paper submission.

Prevents Tampering: The use of encryption technology in DSCs ensures that the information submitted for IEC registration cannot be altered once it’s been signed, thus preventing tampering or fraudulent modifications to the documents.

Faster Processing: Using a DSC speeds up the entire IEC registration process. Since the registration is done electronically, you can avoid delays associated with manual document submission and processing.

How to Apply for IEC Registration with a DSC

Obtain a Digital Signature Certificate (DSC): To apply for an IEC, you first need to obtain a DSC from a Certifying Authority (CA). You can choose between Class 2 and Class 3 DSCs, with Class 3 being the more secure option for business-related applications like IEC registration.

Prepare the Required Documents: The DGFT requires various documents for IEC registration, such as the PAN card, proof of address, bank certificate, and the identity of the applicant. Along with these documents, you will need your DSC to authenticate and sign the application.

Register on the DGFT Portal: Visit the DGFT’s official website and create an account. After registering, log in to complete the IEC application form online. During this process, you’ll be asked to upload your documents.

Attach the DSC: Once you’ve completed the form and uploaded all the necessary documents, you’ll need to sign the form using your DSC. This step ensures the authenticity of the registration application and validates your submission.

Submit the Application: After attaching your DSC, submit the application. The DGFT will process your application, and once it is approved, your IEC will be issued electronically.

Benefits of Using DSC for IEC Registration

Security: The encryption technology in DSCs secures your business’s data and ensures that sensitive information remains protected during the registration process.

Legitimacy: With a DSC, you can ensure that your IEC registration is legally valid, reducing the chances of rejection or delays due to discrepancies.

Efficiency: The use of DSC reduces the manual effort involved in IEC registration and ensures that your application is processed more quickly.

Reduced Fraud Risks: Since the DSC links your identity to the submitted documents, it prevents any fraudulent or unauthorized transactions, protecting your business from potential legal and financial issues.

Conclusion

A Digital Signature Certificate (DSC) plays an integral role in securing and facilitating the Import-Export Code (IEC) registration process. By ensuring the authenticity of your online submission and protecting your business’s sensitive data, a DSC is essential for those seeking to engage in international trade. For a smooth IEC registration experience, consult with the Best CA Firm in Delhi, which can help you obtain a DSC and guide you through the entire registration process, ensuring your business is ready for global expansion.

2 notes

·

View notes

Text

IT companies in Coimbatore :Hiring freshers role and benefit

Coimbatore has emerged as a preferred location for IT professionals due to its affordable cost of living, high-quality educational institutions, and the city’s well-developed infrastructure. Unlike metropolitan cities, IT companies in Coimbatore offers a balanced lifestyle with a lower cost of living, which appeals to many working professionals. With a pool of skilled talent graduating from nearby engineering and technical institutions, Coimbatore is an ideal place for IT companies to find qualified candidates for various roles, making it a hot spot for job seekers.

Who Are the Leading IT Companies in Coimbatore?

The city hosts several top IT companies, including Tata Consultancy Services (TCS), Cognizant, Wipro, and Robert Bosch, along with growing regional players like KGISL and Aspire Systems. These companies offer a variety of services from software development to business consulting and automation solutions. Working with such companies not only provides a chance to learn and grow but also adds credibility to one's career profile. Their well-established infrastructure and focus on training employees make them attractive employers in the region.

Best IT Companies in Coimbatore :

Coimbatore, one of Tamil Nadu's major industrial hubs, has seen significant growth in the IT sector. Known for its skilled workforce, affordable infrastructure, and a supportive business ecosystem, the city hosts many IT companies that offer a wide range of services from software development to digital transformation.

Here’s a look at some of the best IT company in Coimbatore :

Accenture :

Global consulting and technology services company providing full-fledged IT and business process services.

ThoughtWorks:

Leaders in software consultancy to get custom software developed through agile methodology and digital transformation

Payoda Technologies :

focuses primarily on aspects of digital transformation, analytics, cloud solution development and software development.

Sridhar Vembu Institute of Technology (Zoho Corp) :

It is based in Chennai; however, the innovation and research wing of Zoho is based in Coimbatore, where it works on software product development.

Softratech Info :

The company provides IT solutions, consultancy, software development, and support services.

Repute Network :

A technology-based company, focusing on digital payments, financial technologies, and blockchain solutions

Mindnotix Technologies :

A technology firm, developing web and mobile applications as well as AR/VR-based applications, and AI-driven applications.

Kumaraguru College of Technology :

Technology Business Incubator (KCT-TBI) - Incubates start-ups and tech innovation in IoT, AI, robotics, and software solutions.

Revature India :

Trains and develops software services and products, focusing on creating technical talent for the global market.

i2i Software Solutions :

Offers end-to-end software solutions and IT services, with a focus on custom development.

eQuadriga Software Pvt Ltd :

is an IT services company focusing on software development, mobile apps, and digital marketing.

Conclusion :

Coimbatore’s IT sector is full of opportunities for freshers, thanks to a supportive ecosystem of companies and a growing tech community. From MNCs like Cognizant and Bosch to dynamic startups, IT companies in Coimbatore provides ample options for fresh graduates eager to kickstart their careers. With a focus on learning, networking, and skill development, freshers can build a promising career in this thriving city.

#it company#IT companies in Coimbatore#internship#freshers it job#jobseekers#jobs#employment#careers#workplace#inside job

2 notes

·

View notes

Text

History of Finance in India

The Evolution of Financial Management in India and Its Impact on the Economy

India’s financial management history is a fascinating journey that has significantly shaped its economy. Let’s explore this evolution in simple terms.

Early Beginnings

Financial management in India has ancient roots. Historically, India was known for its rich in nature trade and commerce. Ancient texts like the Arthashastra, written by Chanakya, provide insights into early financial practices, including taxation and statecraft.

Colonial Era

The British colonial period brought significant changes. The establishment of the Reserve Bank of India (RBI) in Kolkata 1935 marked a pivotal moment. The RBI became the sole central authority for regulating the country’s currency and credit systems. However, the financial system was primarily designed to serve colonial interests, focusing on trade and revenue and tax collection.

Post-Independence Reforms

After gaining independence in 1947, India faced the challenge of building a robust financial system. The government nationalized 13 major banks in 1969 to ensure financial inclusion and support economic development. This move aimed to extend banking services to rural areas and promote savings and investments.

Liberalization in the 1990s

The 1991 marked a turning point with economic liberalization. The government introduced reforms to open up the economy, reduce state control, and encourage private sector participation. The Multi National Companies across the globe were invited, encouraged to set up their businesses in India for cheap labour. To initiate this government also provided tax benefits to these companies.

These reforms led to significant growth in the financial sector. The stock market expanded, and new financial instruments like mutual funds and insurance products became popular. The liberalization era also saw the establishment of regulatory bodies like the Securities and Exchange Board of India (SEBI) to oversee the capital markets.

Digital Revolution

In recent years, digital technology has revolutionized financial management in India. Initiatives like the Pradhan Mantri Jan Dhan Yojana aimed to provide banking services to every household. The introduction of UPI or Unified Interface payments made transaction so quick and safe that today India is the largest country with the most number of online P2P and P2M transactions.

Impact on the Economy

The evolution of financial management has had a profound impact on the Indian economy:

Economic Growth: Financial reforms have fueled economic growth by attracting investments and promoting entrepreneurship.

Financial Inclusion: Nationalization of banks and digital initiatives have improved financial inclusion. The number of users of credit cards, online payments, loans and Bank account holders has increased significantly.

Stability and Regulation: The establishment of regulatory bodies like the RBI and SEBI has ensured stability and transparency in the financial system.

Innovation: The digital revolution has spurred innovation in financial services. Mobile Banking, Digital loans and Online Serices has made the work easier and efficient.

Conclusion

The history of financial management in India is a story of transformation and resilience. From ancient practices to modern digital innovations, each phase has contributed to shaping the economy. As India continues to evolve, its financial system will play a crucial role in driving sustainable growth and development.

2 notes

·

View notes

Text

Brazil: 2024 analysis of payments and ecommerce trends

Brazil is Latin America's largest digital commerce market, with a transactional volume of USD 276.9 million in 20231. It will likely grow by 51% over the next couple of years, reaching USD 500 billion in 2026. Brazilians' growing digitisation and innovative payment industry support such growth.

For decades, we have heard that cash is king in Latin America, but this may soon no longer be true in Brazil. Over the last decade, the country has evolved from being majorly unbanked to becoming one of the leading financial innovation hubs in the world. According to Central Bank data, cash withdrawals decreased by around 27% in 2023.

Alongside India’s UPI, Brazil’s instant payment system, Pix, stands out as the world's real-time payments (RTP) disruptor. It has managed to digitise millions of transactions that were paid in cash before and create the basis for new solutions that can be built on top of it.

For the industry, expanding the customer’s digital footprint translates into leveraging data to offer a broader range of products and services, facilitating the monetisation of increasingly larger and more qualified datasets.

Continue reading.

4 notes

·

View notes

Text

Business Setup in India by MAS LLP: Your Partner for Growth

Setting up a business in India is a lucrative opportunity due to its growing economy, diverse market, and skilled workforce. However, navigating the legal and regulatory framework can be challenging. That’s where MAS LLP steps in, offering expert assistance to help you establish your business smoothly and efficiently.

Why Choose MAS LLP for Business Setup in India? MAS LLP is a leading consultancy that specializes in business formation and compliance services. With years of experience, MAS LLP has assisted numerous entrepreneurs and companies in setting up their businesses across India. Here’s why partnering with MAS LLP is a smart choice:

Comprehensive Services MAS LLP provides a full suite of services, from company registration and legal compliance to tax advisory and financial consulting. Their team of experts ensures that every step of the business setup process is handled professionally.

Expert Knowledge of Indian Regulations India's business environment is governed by complex laws and regulations, including the Companies Act, FDI norms, and various tax laws. MAS LLP has in-depth knowledge of these regulations, ensuring that your business complies with all legal requirements from the start.

Tailored Solutions for Different Business Structures Whether you are looking to establish a private limited company, a partnership, an LLP, or a sole proprietorship, MAS LLP can help you choose the right structure based on your business goals and operational needs.

Steps to Setting Up a Business in India with MAS LLP

Business Structure Selection Choosing the right business structure is crucial for long-term success. MAS LLP provides guidance on selecting the best structure, whether it's an LLP, private limited company, or branch office.

Company Registration MAS LLP will help you with the process of registering your business with the Ministry of Corporate Affairs (MCA). This includes obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and filing the required documents for incorporation.

Tax Registration Once your business is registered, MAS LLP assists in obtaining necessary tax registrations such as GST, PAN, and TAN, ensuring your company is compliant with India’s tax laws.

Legal Compliance Keeping up with regulatory requirements is essential for any business. MAS LLP provides ongoing legal compliance support, including annual filings, audit reports, and statutory compliance.

Banking and Financial Setup MAS LLP also assists with setting up business bank accounts, payment gateways, and financial structuring, helping you manage your financial operations efficiently.

Why Set Up a Business in India? India is a growing economy with a young, dynamic workforce and a vibrant consumer market. By setting up your business here, you tap into a diverse and large customer base, benefit from government incentives for startups, and gain access to various sectors like IT, manufacturing, and retail.

Additionally, India offers excellent opportunities for foreign investors with simplified FDI policies. With MAS LLP by your side, you can navigate the challenges of setting up a business in India with ease and focus on what really matters—growing your business.

Conclusion MAS LLP is your go-to partner for setting up a business in India. Their expertise in regulatory compliance, business formation, and financial consulting ensures that you can establish your business smoothly and start operating without any legal or financial hurdles.

Whether you are a local entrepreneur or a foreign investor, MAS LLP offers tailored solutions to meet your unique business needs. Get in touch with MAS LLP today and take the first step towards establishing a successful business in India!

6 notes

·

View notes

Text

Understanding GEM Registration: Meaning, Uses, and Benefits

GEM registration refers to the Government e-Marketplace, a digital platform established by the Government of India to facilitate efficient and transparent procurement of goods and services by government departments. The process allows businesses to register and sell directly to government entities, enhancing market access and visibility. Key benefits of GEM registration include creating a level playing field for all sellers, ensuring transparency, reducing costs and administrative time, and providing prompt payment mechanisms. It is particularly useful for businesses aiming to tap into government procurement opportunities, thus fostering growth and sustainability.

Understanding GEM Registration

We all live in a competitive marketplace where businesses and government entities constantly seek streamlined processes to connect and conduct transactions efficiently. One initiative that has gained significant prominence is GEM registration. This article will delve into the meaning of GEM registration, its full form, and its importance in the procurement ecosystem.

What is GEM Registration?

GEM, which stands for Government e-Marketplace, is an online platform established by the Government of India to facilitate the procurement of goods and services by various government departments and organizations. GEM registration allows businesses to sell their products and services directly to government entities, ensuring transparency, efficiency, and a hassle-free procurement process.

GEM Registration Meaning and Full Form

The full form of GEM is "Government e-Marketplace". It represents a digital marketplace where government buyers and sellers meet to conduct business transactions. The meaning of GEM registration is essentially the process through which sellers enlist themselves on this platform to offer their goods and services to government buyers.

GEM Registration Kya Hai?

In simpler terms, "GEM registration kya hai" translates to "what is GEM registration?" It is a crucial step for businesses aiming to expand their market reach to government sectors. Through GEM registration, vendors can access a wide range of procurement opportunities, making it a vital tool for growth and visibility in the public domain.

How GEM Registration is Used

GEM registration is primarily used to enroll sellers on the Government e-Marketplace, allowing them to list their products and services. Once registered, sellers can participate in bids and tenders posted by different government departments. The platform simplifies the procurement process by eliminating intermediaries, reducing paperwork, and ensuring prompt payment processes. Sellers benefit from a vast network of government buyers, leading to increased sales opportunities and potential business expansion.

Why GEM Registration is Useful

The utility of GEM registration lies in its ability to create a level playing field for all sellers, regardless of size. Here are some reasons why GEM registration is particularly useful:

Enhanced Market Access: It opens doors to a large and diverse market comprising various government departments, ministries, and public sector units.

Transparency and Efficiency: The platform ensures a transparent procurement process with clear guidelines and standardized practices, reducing the chances of corruption and favoritism.

Reduced Costs and Time: By digitizing the procurement process, GEM reduces administrative costs and time associated with traditional procurement methods.

Prompt Payments: The platform facilitates timely payments to sellers, improving cash flow and financial stability for businesses.

Growth Opportunities: With the government being a significant buyer, GEM offers substantial growth opportunities for businesses across various sectors.

Conclusion

GEM registration is a strategic move for businesses aiming to tap into the extensive network of government buyers. Understanding the meaning and benefits of GEM registration can empower businesses to leverage this platform effectively, ensuring growth and sustainability in the competitive market landscape. Whether you're a small enterprise or a large corporation, GEM registration offers a pathway to broaden your market reach and engage efficiently with government procurement processes.

2 notes

·

View notes

Text

Navigating the Indian Investment Landscape: A Comprehensive Guide for International Investors

India, with its vibrant economy, diverse market opportunities, and favorable regulatory environment, has emerged as an attractive destination for international investors seeking high returns and long-term growth prospects. From burgeoning sectors like technology and e-commerce to traditional industries such as manufacturing and agriculture, India offers a wealth of investment opportunities for savvy investors. In this comprehensive guide, we'll explore the Indian investment landscape, highlighting key sectors, regulatory considerations, investment strategies, and tips for international investors looking to capitalize on India's growth story.

Understanding the Indian Investment Landscape:

1. Economic Overview: India is the world's sixth-largest economy by nominal GDP and one of the fastest-growing major economies globally. With a young and dynamic population, a burgeoning middle class, and increasing urbanization, India offers a vast consumer market and a favorable demographic dividend for investors.

2. Key Investment Sector: India's economy is diverse and offers investment opportunities across various sectors. Some of the key sectors attracting international investors include:

- Information Technology (IT) and Software Services

- E-commerce and Digital Payments

- Healthcare and Pharmaceuticals

- Renewable Energy and Clean Technology

- Infrastructure and Real Estate

- Manufacturing and Automotive

- Agriculture and Agribusiness

3. Regulatory Environment: India has implemented several reforms to streamline its regulatory environment and improve the ease of doing business for investors. The government has introduced initiatives such as Make in India, Startup India, and Digital India to encourage investment, innovation, and entrepreneurship. Additionally, foreign direct investment (FDI) policies have been liberalized across various sectors, allowing greater foreign participation in the Indian economy.

4. Taxation and Legal Considerations: International investors should familiarize themselves with India's tax laws, regulations, and legal frameworks before making investment decisions. India has a progressive tax regime with corporate tax rates varying based on business structure, industry, and income levels. It's advisable to consult with tax advisors and legal experts to navigate the complexities of India's taxation and legal landscape.

Investment Strategies for International Investors:

1. Market Research and Due Diligence: Conduct thorough market research and due diligence to identify investment opportunities aligned with your investment objectives, risk tolerance, and sector preferences. Evaluate market trends, competitive dynamics, regulatory changes, and macroeconomic indicators to make informed investment decisions.

2. Diversification: Diversify your investment portfolio across different asset classes, sectors, and geographic regions to mitigate risks and maximize returns. Consider allocating capital to both high-growth sectors such as technology and healthcare, as well as stable sectors like infrastructure and consumer goods.

3. Long-Term Perspective: Adopt a long-term investment perspective when investing in India. While short-term market volatility and regulatory changes may occur, India's economic fundamentals remain strong, offering attractive growth prospects over the medium to long term. Patient investors can capitalize on India's demographic dividend and structural reforms to generate significant returns.

4. Partnering with Local Experts: Partnering with local investment advisors, financial institutions, and legal experts can provide valuable insights and guidance on navigating the Indian investment landscape. Local expertise can help international investors navigate regulatory hurdles, identify investment opportunities, and mitigate operational risks effectively.

5. Investment Vehicles: Evaluate different investment vehicles available for investing in India, including direct investments, private equity funds, venture capital funds, and mutual funds. Each investment vehicle offers unique benefits and risks, so it's essential to assess their suitability based on your investment goals and risk appetite.

Tips for International Investors:

1. Stay Informed: Stay updated on market developments, regulatory changes, and economic trends affecting the Indian investment landscape. Follow reputable financial news sources, attend industry conferences, and engage with local experts to stay informed and make timely investment decisions.

2. Network and Build Relationships: Networking with industry professionals, government officials, and fellow investors can provide valuable insights and access to investment opportunities in India. Join industry associations, attend networking events, and leverage social media platforms to expand your network and build relationships in the Indian business community.

3. Be Patient and Persistent: Investing in India requires patience, persistence, and a long-term commitment. Building relationships, navigating regulatory hurdles, and achieving investment success take time and effort. Stay focused on your investment goals, adapt to changing market conditions, and remain resilient in the face of challenges.

4. Seek Professional Advice: Consult with financial advisors, tax consultants, and legal experts specializing in India to seek professional advice tailored to your specific investment needs. Expert guidance can help you navigate regulatory complexities, optimize tax efficiency, and maximize returns on your investments in India.

5. Cultural Sensitivity: Recognize and respect cultural differences when conducting business in India. Building strong relationships and trust with local partners and stakeholders requires understanding and appreciating Indian customs, traditions, and business etiquette.

6. Risk Management: Assess and manage risks effectively by diversifying your investment portfolio, conducting thorough due diligence, and implementing risk mitigation strategies. Consider geopolitical risks, currency fluctuations, regulatory changes, and market volatility when making investment decisions.

7. Sustainability and ESG Factors: Consider environmental, social, and governance (ESG) factors when evaluating investment opportunities in India. Increasingly, investors are prioritizing sustainability and responsible investing practices to mitigate risks, enhance long-term value, and align investments with their values and principles.

8. Stay Flexible and Agile: Remain flexible and agile in adapting to changing market conditions, regulatory requirements, and investor preferences. India's business environment is dynamic and evolving, requiring investors to stay nimble and responsive to emerging opportunities and challenges.

India offers a wealth of investment opportunities for international investors seeking high growth potential and diversification benefits. With its robust economy, favorable demographic trends, and supportive regulatory environment, India continues to attract capital inflows across various sectors. By understanding the Indian investment landscape, adopting sound investment strategies, and leveraging local expertise, international investors can capitalize on India's growth story and unlock significant value for their investment portfolios. As India continues on its path of economic development and reform, it remains a compelling destination for investors looking to participate in one of the world's most dynamic and promising markets.

In conclusion, navigating the “Invest in India” landscape requires careful planning, strategic decision-making, and a long-term perspective. By understanding the key sectors, regulatory considerations, investment strategies, and tips outlined in this guide, international investors can position themselves to capitalize on the vast opportunities offered by India's vibrant economy and emerging market dynamics. With the right approach and guidance, investing in India can yield attractive returns and contribute to portfolio diversification and long-term wealth creation for investors around the globe.

This post was originally published on: Foxnangel

#regulatory environment#international investors#investment opportunities#investment ideas#india's economy#startup india#investing in India#investment opportunities in india#investments in india#foxnangel

3 notes

·

View notes