#Income Tax Course

Explore tagged Tumblr posts

Text

"Learn Income Tax with Expert-Led Courses for Career Growth"

1. Introduction to Income Tax Course

Income Tax Course is a specialized program that equips individuals with knowledge about taxation, laws, and the filing process. This course is designed for those who wish to pursue a career in taxation or need to understand tax-related matters for personal use. The course offers a comprehensive understanding of the country's income tax system, rules, and regulations.

2. Why Choose an Income Tax Course?

There are several reasons why an Income Tax Course is beneficial:

Career Growth: With the increasing complexity of tax laws, professionals trained in tax are in high demand.

Financial Knowledge: It helps individuals manage their personal and business finances efficiently.

Legal Awareness: The course increases understanding of legal tax obligations, reducing the chances of errors.

3. Eligibility Criteria for Income Tax Course

To enroll in an Income Tax Course, certain eligibility criteria must be met:

Basic Qualification: A candidate should have a minimum of 10+2 qualification. For advanced courses, graduation in commerce or related fields may be preferred.

Age Limit: Generally, there is no specific age limit, but certain institutions might prefer candidates under 35 years.

Knowledge of Basic Mathematics: Since tax calculation involves some mathematical understanding, a basic knowledge of numbers is necessary.

4. What Will You Learn in an Income Tax Course?

An Income Tax Course covers a wide range of topics related to taxation. Here are some key areas:

Basic Concepts of Income Tax

Income Tax Act: Overview of Indian Income Tax Law.

Taxable Income: What constitutes taxable income under various heads.

Deductions and Exemptions: Understanding deductions under sections like 80C, 80D, etc.

Tax Calculation and Filing

Tax Slabs: Calculation of tax based on income slabs.

Tax Returns: Step-by-step process to file income tax returns (ITR).

Tax Forms: Different ITR forms and their uses.

Tax Planning and Optimization

Tax Saving: Various legal ways to reduce tax liability.

Investment for Tax Benefits: Exploring investment options like PPF, ELSS, etc.

Advanced Tax Strategies: Managing tax liabilities for businesses and high-net-worth individuals (HNWI).

5. Career Opportunities After Income Tax Course

After completing an Income Tax Course, you can explore the following career paths:

Tax Consultant: Offering tax filing and consulting services to individuals and businesses.

Tax Manager: Managing tax matters for companies and corporations.

Finance and Accounting Roles: Work as an accountant or financial analyst specializing in tax.

Government Jobs: Apply for positions in government tax departments like Income Tax Officer or IRS.

6. Duration and Cost of Income Tax Course

The duration and cost of an Income Tax Course vary based on the institution and course level. On average:

Duration: A basic course lasts 1-3 months, while advanced courses can take up to 6 months or more.

Cost: Fees range from ₹5,000 to ₹30,000 depending on the course depth and institution.

7. Popular Institutions Offering Income Tax Course

Several reputed institutions offer Income Tax courses, both offline and online. Some of the popular ones include:

Institute of Chartered Accountants of India (ICAI)

National Institute of Taxation (NIT)

Udemy (for online courses)

NIIT (for professional courses)

8. Benefits of Pursuing an Income Tax Course

Here are some benefits that students can enjoy after completing the Income Tax Course:

Expertise in Taxation: Acquire deep knowledge of tax laws and regulations.

Career Prospects: Better job opportunities in the finance and accounting sectors.

Self-Improvement: Gain confidence in handling your own tax filing and saving money on professional fees.

Increased Credibility: Gain respect in the professional world as a certified taxation expert.

9. Conclusion

In conclusion, an Income Tax Course is an excellent way to enhance your understanding of taxes and financial planning. Whether you are looking to build a career in taxation or wish to manage your finances better, this course provides valuable skills. The knowledge you gain can open doors to various career opportunities and help you make informed decisions about tax planning and filing.

By choosing the right course and institution, you can lay a solid foundation for a successful career in the taxation field.

Accounting interview Question Answers

How to become an accountant

How to become Tax consultant

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs i India

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

Master 'Income from Other Sources' with Expert Guidance!

Join CA Abhinit Singh, with over 20 years of experience, as he makes this critical tax concept easy to understand in an exclusive video by Ready Accountant.

📌 What you'll learn:

✔️ The various types of income that fall under 'Other Sources'

✔️ Key exemptions and deductions you can claim

✔️ Pro tips to file your taxes with confidence

🎥 Watch our full video now: https://youtu.be/_cpKJH_k5kI

Ready to take control of your finances? Watch now and level up your tax knowledge!

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#income tax course#Accounting and Taxation

0 notes

Text

Mastering Tax Management: Unlocking Opportunities with Professional Diploma Courses

In the lively world of money staying abreast of tax obligation guidelines plus strategies is essential for experts looking for to be successful in their professions. With the raising ins and outs of tax obligation regulations along with the developing organization landscape acquiring specific understanding using a revenue tax obligation program is not simply valuable however frequently vital. Additionally recognizing devices like GST declaring with Tally can significantly boost one's effectiveness as well as performance in tax obligation management. This extensive overview discovers the relevance of specialist diploma programs in tax obligation monitoring highlighting their advantages, educational program as well as occupation leads.

Comprehending the Importance of Income Tax Courses:

An earnings tax obligation program functions as a foundation for people wanting to browse the information of tax obligation legislations together with guidelines effectively. These training courses provide an organized educational program developed to offer all natural understandings right into numerous elements of tax consisting of earnings tax obligation preparation, conformity and also submitting treatments. By registering in such training courses experts can enhance their understanding of tax obligation concepts remain upgraded on regulative adjustments, plus create the knowledge required to take on complicated tax obligation situations.

Discovering GST Filing with Tally:

In today's electronic age effectiveness in tax obligation software program is similarly crucial for tax obligation specialists. Among one of the most commonly made use of systems for GST declaring as well as bookkeeping is Tally. Combining GST declaring with Tally right into a revenue income tax course outfits students with functional abilities to enhance tax obligation conformity treatments. From tape-recording purchases to producing GST-compliant billings plus submitting returns perfectly, Tally streamlines the ins and outs of GST conformity making it a crucial device for tax obligation experts throughout sectors.

Advantages of Professional Diploma in Taxation Management:

i) Comprehensive Curriculum: Professional diploma programs in tax obligation administration supply a comprehensive educational program covering different tax obligation regulations, conformity needs plus innovative tax obligation preparation strategies. From recognizing the principles of revenue tax obligation to grasping GST declaring with Tally these programs supply a holistic understanding of tax concepts along with techniques. ii) Practical Training: Practical direct exposure is necessary for understanding tax obligation administration. Specialist diploma programs typically include hands-on training sessions, study plus real-world simulations to enable individuals to use theoretical understanding to sensible situations. By joining interactive discovering experiences people can establish the abilities along with self-confidence required to browse complicated tax obligation difficulties efficiently. iii) Industry-Relevant Insights: Taught by knowledgeable tax obligation experts as well as market specialists expert diploma programs supply useful understandings right into present tax obligation patterns, governing advancements as well as arising innovations. This industry-relevant expertise outfits participants with the knowledge to deal with modern tax obligation problems plus adjust to developing tax obligation landscapes. iv) Qualification together with Recognition: Completing an expert diploma in tax obligation monitoring improves reputation combined with opens a wide variety of job chance. Certified accreditations from reputed establishments verify one's knowledge in tax obligation monitoring improving employability along with gaining possible in the affordable work market. v) Networking Opportunities: Professional diploma programs supply a helpful atmosphere for networking with fellow tax obligation experts sector specialists, as well as subject debit. Joining conversations, however tasks and also collective tasks encourages purposeful links as well as helps with expertise sharing, boosting the discovering experience.

Task Prospects in Taxation Management:

The need for skilled tax obligation experts remains to expand throughout sectors driven by progressing governing needs as well as the boosting ins and outs of tax obligation regulations. Grads of specialist diploma programs in tax obligation administration are well-positioned to seek varied job courses in tax obligation, audit companies, company financing divisions, getting in touch with companies as well as federal government firms. Duties such as tax obligation expert, tax obligation professional, tax obligation accounting professional, conformity supervisor plus monetary coordinator are simply a couple of instances of the satisfying occupation chances offered to tax obligation administration experts.

Final thought:

To conclude expert diploma training courses in tax obligation administration comprehensive components on earnings tax obligation training course combined with GST filling with Tally supply a detailed path for people wanting to be successful in the area of tax obligation monitoring. By acquiring particular expertise, useful abilities along with industry-recognized qualifications specialists can open up a wide variety of chances plus add efficiently to their companies' economic success. Whether starting a brand-new job course or looking for to improve existing abilities purchasing tax obligation education and learning is a positive relocation that can produce lasting returns in today's vibrant service atmosphere.

0 notes

Text

Key Features to Look for in an Online Income Tax Course

Embarking on a journey to expand your comprehension of income tax in India through an online course is a judicious decision. However, with myriad options available, it becomes imperative to meticulously discern the unique attributes that distinguish one course from another. To aid you in this endeavor, here are several tips and pieces of advice to initiate your exploration:

Comprehensive Curriculum:

Look for the best income tax course online that covers the entire spectrum of Indian taxation, including income tax laws, filing procedures, and recent amendments.Ensure the curriculum is regularly updated to align with the dynamic nature of tax regulations in India.

Expert Instructors:

Opt for a course led by industry experts, experienced tax professionals, or educators with a deep understanding of Indian tax laws.Check for instructor profiles and reviews to ensure their credibility and effectiveness in delivering complex tax concepts.

Interactive Learning Materials:

Seek the best income tax course online that provide a variety of interactive learning materials such as video lectures, case studies, and quizzes to enhance engagement.Interactive elements can facilitate better comprehension and retention of complex tax principles.

Practical Applications and Case Studies:

The best income tax course online ought to integrate practical applications and real-world case studies, enabling you to apply theoretical knowledge to tangible scenarios. This aspect guarantees thorough preparation for addressing practical taxation challenges in real-life situations.

Flexibility and Accessibility:

Look for courses that offer flexibility in terms of study schedules, allowing you to learn at your own pace.Ensure the course is accessible on various devices to accommodate your lifestyle and learning preferences.

Certification and Recognition:

Check if the course provides a recognized certification upon completion, as this can add significant value to your resume.Look for affiliations with reputable organizations or institutions within the taxation field.

Student Support and Community:

Assess the extent of student support provided, encompassing access to instructors, participation in discussion forums, and assistance with inquiries. A lively online community can enrich your learning journey, offering chances for networking and collaborative learning.

Conclusion:

Choosing the optimal online income tax course is a pivotal stride in establishing a robust understanding of Indian taxation. By giving precedence to these essential features, you can make a knowledgeable choice that corresponds to your learning objectives, paving the way for success in navigating the intricate realm of income tax in India. Resource: https://rtsprofessionalstudyindia.wordpress.com/2023/11/24/key-features-to-look-for-in-an-online-income-tax-course/

0 notes

Text

Income Tax e - filing Online Course. Upgrade your Tax e filing Practice through tyariexamki.com. Job Oriented Course

For more information

Visit us:- https://www.tyariexamki.com/.../Income-Tax-Return-E...

2 notes

·

View notes

Text

Want to be a tax preparation professional? Our Step-by-Step Guide to Becoming a Tax Preparer in 2025 has you covered, from signing up for a tax preparation course to getting certified and real-world experience. Discover how a tax preparation course Canada can enable you to master key skills, locate personal income tax services near me, and remain current on tax legislation. Whether you are interested in personal income tax preparation or professional tax preparation courses, this guide will get you started on a prosperous career. Read on to discover your prospects!

#tax preparation course canada#tax preparation course#income tax preparation training#personal income tax course#tax preparation classes#tax preparation training#personal income tax services near me#personal income tax preparation near me

0 notes

Text

In the ever-evolving world of finance, staying ahead in the tax business can be challenging yet rewarding. Whether you’re just starting out or looking to expand your existing practice, the Tax Business Growth Academy provides invaluable insights to help you succeed. This comprehensive guide will walk you through essential strategies to elevate your tax business to new heights, offering a blend of foundational knowledge, marketing insights, and technology utilization.

0 notes

Text

Best Taxation Course in Kolkata: A Guide for Aspiring Tax Professionals

The tax department is a vital part of the economy of every country. At present, it basically serves as a principal source for the collection of revenues to finance public services and infrastructure. In this context, in today's scenario with increasing complexities in tax laws, the demand for trained tax professionals is mounting, and there's no exception for Kolkata too. Whether you are an experienced accountant or just entering this field, a course in specialized taxation will bring you an amazing view.

This article briefly explains why the taxation course is beneficial, what are some of the core subjects in these courses, and then introduces some of the best institutes offering both offline and online courses on Accounting and taxation Course in Kolkata.

The Importance of a Taxation Course

A taxation course puts you in the position of guiding various financial tasks, including tax planning, compliance, and risk management. Thus, for an individual desirous of advancing his or her expertise or for a business professional carrying out corporate tax roles, getting the right taxation course is very important.

Here are some of the major matters usually taught in taxation courses:

Law Relating to Income Tax: Understanding the individual and corporate income taxes and returns, as well as compliance.

Goods and Services Tax (GST): Understanding the detailed structure of GST, including its compliance and filing, as one of the biggest tax reforms under India's flag.

Corporate Tax Laws: Issues relating to corporate tax laws will highlight the types of taxes levied upon corporate enterprises and what is involved in corporate tax planning as well as auditing.

International Taxation: Useful for those who will be employed with multinational firms, for they will be expected to understand cross-border tax regulations which is considered indispensable.

Tax Auditing: Practice of how to conduct an audit. This includes knowledge about your own personal tax, compliance, and taxation-related risk management.

Tax Planning Strategies: A way by which the practitioner understands how to design tax-saving strategies both for business enterprises and individuals. Why take a Taxation Course?

Joining a taxation course in kolkata has many advantages. Here are some reasons why this professional course can be rewarding:

Widest Career Opportunities A specialization in taxation is sure to lead to opportunities in several sectors. Tax professionals are in great demand in corporate finance, auditing firms, government agencies, and consultancy services. You may also be a freelance tax consultant to offer advisory services for businesses and individuals alike. In Kolkata, the demand for tax professionals comes from all possible sectors, whether it's manufacturing, IT, or retail, among others.

Thorough Knowledge of Tax Laws The tax laws are many in number and ever-changing; thus, a taxation course is important in equipping one to stay up-to-date. A taxation course equips one with the expertise to understand and apply the rules laid down within the tax law. A person with such expertise is capable of ensuring compliance, liability diminution, and therefore, prevention of penalties for those clients and employers.

Intrepreneurial opporchunities A taxation course equips you with skills to establish your own consultancy or tax advisory service. As a taxation expert, you can offer businesses valuable services like tax planning, compliance, and audit management, increasing your revenue. With growing demand for expert tax advice, it's a lucrative career path for entrepreneurial professionals.

Best Institutions for Taxation Courses in Kolkata

For people interested in the taxation course in Kolkata, there are quite a number of reputed institutions which impart courses combining both theoretical and practical experiences. Here's some of the best institutes:

Ready Accountant Ready Accountant: It provides industrial training courses under Accounting and Taxation, and GST Course in kolkata. Its courses range from online learning, SAP FICO training, and placement support. Its combination of IT and tax will fit in any trainee who wants to perfect their skills in these fields. Their training equips students with knowledge relevant to today's job market.

Indian Institute of Taxation (IITax) One of the premier institutions situated at Kolkata is IITax, known for its specialized taxation courses that help professionals master the GST and corporate tax, indirect tax regulations. The training being highly practical means the students are job-ready out of the campus gates and try to bridge the gap between book knowledge and real-time applications.

Tally Education Pvt. Ltd. There are dedicated taxation courses for students who want to learn tax compliance on Tally Prime. With the said programme, it will very much be useful for those students who have an SME entity and use Tally Prime prevalently for account management.

Online courses offer flexibility in studying from anywhere and at any time, which makes them a brilliant preference for working professionals. Here's why online learning may be great for those to take up advanced courses in taxation:

Flexible Scheduling Online courses in Taxation let you learn according to your schedule. Be in the office, attending to your children, or doing whatever important thing in your hands, and you will still be able to learn without compromising quality education.

Interactive and Engaging Just like the traditional classroom teaching, most online courses on taxation allow for live sessions, recorded lectures, quizzes, and assignments, meaning you get to experience a very engaging learning environment. You can also reach out to instructors and peers- something that makes online learning as realistic as other classroom-style learning.

Accessibility of Learning Resources With online courses, you'll have access to materials being studied 24/7, in which you can review lectures and practice quizzes that are available all the time so you can finish your assignments at whatever time you please.

Conclusion

Taxation is a rewarding and diverse profession with many opportunities that range across various sectors. Be it managing corporate tax or working for government agencies, starting one's consultancy business, the taxation course gives you an extensive range of knowledge and relevant skill sets to achieve professional success.

1 note

·

View note

Text

"Unlock Career Opportunities With Income Tax Course

1. Introduction

In today’s fast-paced world, understanding income tax is crucial. The Income Tax Course helps individuals to gain knowledge about taxation, which is essential for personal financial planning and career growth. With the increase in financial literacy, the demand for professionals skilled in tax laws is also rising. This course provides practical and theoretical knowledge for better tax planning, filing, and management.

2. Income Tax Course: What is it?

An Income Tax Course is a specialized course that teaches individuals how to understand, manage, and file taxes. The course covers various topics such as tax laws, tax calculation, returns filing, and more. By enrolling in this course, students learn to apply the tax rules and regulations, ensuring that businesses and individuals comply with the tax system effectively.

3. Benefits of Income Tax Course

Knowledge Gain

Taking an Income Tax Course provides a comprehensive understanding of the tax system. Students gain the expertise required to calculate taxes accurately. They also learn about the latest updates in tax laws and government policies.

Career Opportunities

This course opens numerous career opportunities. With a qualification in income tax, individuals can work as tax consultants, financial advisors, or even start their own tax-related services.

Legal Expertise

Income tax laws are ever-changing. By completing this course, individuals gain legal expertise in taxation, which is crucial for business owners, professionals, and individuals planning for their financial future.

4. Who Should Take This Course?

Students: Those pursuing careers in finance or accounting.

Working Professionals: Accountants, financial advisors, and HR professionals who need to enhance their tax knowledge.

Business Owners: Entrepreneurs who want to understand taxation for better financial planning.

Anyone Interested in Tax Laws: Anyone curious about how the tax system works and how it impacts businesses and individuals.

5. Income Tax Course Curriculum

Basics of Taxation

The curriculum begins with basic concepts of taxation. Students learn about direct taxes, indirect taxes, personal income tax, and more. It’s important to understand the foundation of tax laws before moving on to advanced topics.

Advanced Taxation Concepts

Once students grasp the basics, they move to advanced concepts like GST, corporate tax, and transfer pricing. This helps professionals understand complex tax matters and apply them in real-world scenarios.

Filing Income Tax Returns

A critical part of the course is learning how to file income tax returns. This includes understanding tax deductions, exemptions, and how to fill out tax forms correctly. This skill is essential for personal and professional financial management.

6. Best Platforms for Learning Income Tax

Online Platforms: Platforms like Udemy, Coursera, and LinkedIn Learning offer flexible learning options.

Institutes: There are reputed institutes such as ICAI and NIIT that provide in-depth income tax courses.

Government-Recognized Institutes: These institutions offer certification programs that are recognized in the industry.

7. Duration and Fees of Income Tax Course

Duration

The duration of an Income Tax Course depends on the level of the course and the platform chosen. Typically, it can take anywhere from 1 month to 6 months to complete a comprehensive course.

Fees

The fees for an income tax course can vary greatly. On average, the course fee ranges from ₹5,000 to ₹50,000, depending on the course type and institute. Online courses are often more affordable.

8. Career Opportunities After Income Tax Course

After completing an income tax course, various career paths are available, including:

Tax Consultant: Providing expert advice to clients on tax-related matters.

Tax Auditor: Ensuring companies follow tax laws accurately.

Finance Manager: Handling corporate tax planning.

Taxation Officer: Working with government agencies to enforce tax laws.

With experience, professionals can also move up to managerial and leadership roles.

9. Conclusion

An Income Tax Course is a valuable investment for anyone seeking to understand tax laws and manage finances effectively. Whether you are a student, a working professional, or a business owner, this course can offer significant benefits. By gaining knowledge in tax planning, filing, and compliance, individuals can enhance their careers and make informed decisions about personal and business finances.

The Income Tax Course offers great potential for career growth and expertise in a critical field of finance. Make sure to choose the right platform and get started today to unlock numerous opportunities.

IPA OFFERS:-

Accounting interview Question Answers

How to become an accountant

How to become Tax consultant

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs i India

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

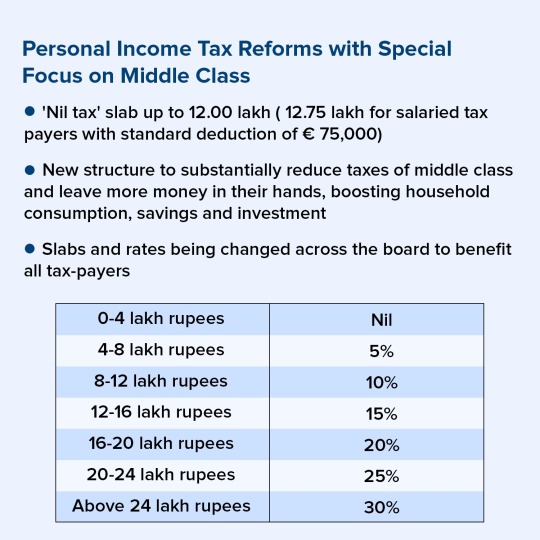

New Personal Income Tax Reforms: Major Relief for the Middle Class

The government has revised the earnings tax structure, reaping benefits middle-class taxpayers. Now, income up to ₹12 lakh is tax-unfastened, with lower tax rates for other brackets. those adjustments aim to boost savings, increase disposable income, and support economic boom. check out the new tax slabs!

A Taxation Course can help them who wants to know about Tax Laws

#accounting course in kolkata#taxation course#tally course#gst course in kolkata#taxation course in kolkata#gst course#union budget 2025#income tax

0 notes

Text

https://www.flipkart.com/ready-accountant-ra-incometax-digital/p/itm5caf967d5ef2a?pid=EDMH5HMP9ZHZR6JG&lid=LSTEDMH5HMP9ZHZR6JG7CFT9H&marketplace=FLIPKART&store=6bo%2F5hp%2Fvxa%2F6t0&srno=b_1_1&otracker=product_breadCrumbs_Ready%20Accountant%20Digital&fm=organic&iid=9fcdb853-b6b9-483a-ada9-232f2716517e.EDMH5HMP9ZHZR6JG.SEARCH&ppt=pp&ppn=pp&ssid=391jqbu84w0000001730713992304

0 notes

Text

Explore the largest online law book store with over 300,000 titles on Supreme Court law, business law, constitutional law, criminal law, civil law, tax law, marriage and divorce, eBooks, CLAT, and more. Enjoy low prices and easy payment options.

#Buy Law Books Online#Income Tax Act#GST Books#Law Courses Online#Law Courses#LLB Entrance Exam#Law Entrance Examination

1 note

·

View note

Text

Efficient Tax Filing Strategies: Maximizing Returns and Minimizing Stress

Discover efficient tax filing strategies in our course designed to minimize the stress and maximize the return. Learn time-saving tips , organization techniques , and best practices for a smooth tax filing experience .

0 notes

Text

Looking for the Best income tax course online? You have come to the right place. The certificate will be given to you after taking the online Exam/Test. Normal charges will be taken to sit in the online Exam/Test, which will be informed to you at the time of the Exam/Test. For more information, you can call us at 7530813450.

#best income tax course#gst filing training#partnership firm registration services#income tax certification course#basic gst course online#basic gst course#best income tax course online#gst registration service#gst basic course#GSTFilingTraining#OnlineGSTCourses#GSTCertification#LearnGST#GSTTrainingOnline#GSTReturns#GSTFilingCourse#GSTLearning#GSTExperts#GSTTrainingInstitute#GSTCourseOnline#GetCertified#GSTSkills#GSTKnowledge#FileGSTReturns

0 notes