#Income GDP

Explore tagged Tumblr posts

Text

What do GDP numbers and releases actually tell us?

This week has brought up some challenges and issues for the concept of Gross Domestic Product and even more so for the way that it is used. We can start with an update yesterday via the annual Blue Book in the UK from which the central message was this. The upward annual revision to volume GDP in 2022 follows directly from the changes to current price growth described earlier in this article, and…

#business#economy#education GDP#expenditure GDP#Finance#GDP#Germany#health GDP#Income GDP#Office for National Statistics#Output GDP#Recession#UK#US

0 notes

Text

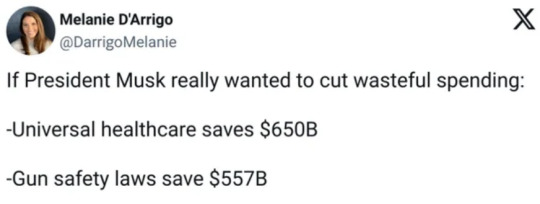

someone explain to me how gun safety laws save half a trillion dollars

2 notes

·

View notes

Text

The TikTok Ban will have a negative affect on the the economy, it adds millions to the GDP, not to mention small businesses grew and thrived with Tiktok and was a means of household income for millions of Americans.

5 notes

·

View notes

Text

"In the United States, happiness rates peaked in the 1950s, when GDP per capita was only about $15,000 (in today’s dollars). Since then the average real income of Americans has quadrupled, and yet happiness has plateaued and even declined for the past half-century. The same is true of Britain, where happiness has declined since the 1950s despite a tripling of income.19 Similar trends are playing out in country after country.

What explains this paradox? Researchers have found that – once again – it’s not income itself that matters, but how it’s distributed. Societies with unequal income distribution tend to be less happy. There are a number of reasons for this. Inequality creates a sense of unfairness; it erodes social trust, cohesion and solidarity. It’s also linked to poorer health, higher levels of crime and less social mobility. People who live in unequal societies tend to be more frustrated, anxious, insecure and discontent with their lives. They have higher rates of depression and addiction."

- from Less Is More by Jason Hickel

3 notes

·

View notes

Text

A vicious circle

I have written before of the damage to the economy caused by inequalities of wealth. Here I want to discuss both cause and effect. The Guardian sheds light on the burden on the NHS resulting from poverty. The article reports that forgotten diseases are back as a result of bad diet, bad housing and, dare I say, bad education. This is not only bad for those who suffer, it is expensive for the…

0 notes

Text

Funny how so many everyday Americans with easy access to all types of loans, because they have high credit scores, don’t seem to have the time, energy, or know how to utilize their high credit score for profit, and be able to live off of passive income, while the people who seem to know how to do this can’t seem to get the loans they’d need to accomplish this. It’s probably because the people with the cognitive capacity necessary to have the know how on how to accomplish this are the type of people to pay off loans as soon as possible, which lowers your credit score, lol. Just one more way that America’s endless bloated bureaucracy sabotages economic opportunities, stunts economic development, and negatively effects their own nation’s GDP.

#America#Americans#loans#credit#credit score#profit#passive income#cognition#bureaucracy#economic opportunities#economic development#economic growth#GDP

0 notes

Text

The Road to 2047: Can India Achieve High-Income Status?

For years, India has been celebrated as the world's fastest-growing major economy. But economic growth alone isn’t enough. The real question is: Can this growth be sustained at an ambitious 7.8% annually for the next two decades? According to a recent World Bank report, this is the magic number India must achieve to transition into a high-income country by 2047, just in time for its centenary as an independent nation. But is this an achievable goal, or is it just another lofty aspiration in a country where economic progress often collides with ground realities?

#India economic growth#high-income nation 2047#World Bank report India#GDP growth India#Indian economy reforms#investment in India#female labor force India#total factor productivity#Viksit Bharat 2047#India per capita income

0 notes

Text

Budget 2025: A Game Changer for Indian Real Estate? Key Expectations & Market Impact

Will This Budget Unlock Growth, Affordability, and Investment in Real Estate?

As India gears up for Union Budget 2025, the real estate sector is on high alert, anticipating policy shifts that could redefine housing affordability, taxation benefits, and infrastructure expansion. With the industry contributing nearly 7% to the GDP and projected to reach $1 trillion by 2030, real estate stakeholders—homebuyers, investors, and developers—are eyeing reforms that can boost demand, streamline regulations, and fuel long-term growth.

From tax breaks for homebuyers to incentives for green real estate, this year’s budget could be a make-or-break moment for the property market. Here’s what the industry is hoping for:

1. Affordable Housing: Bigger Incentives, Bigger Opportunities

One of the biggest expectations from Budget 2025 is an aggressive push for affordable housing, a segment that remains a key government priority. With the Pradhan Mantri Awas Yojana (PMAY) in full swing, developers and buyers alike are looking for:

✅ Extension of PMAY Benefits – Increased funding and subsidies for first-time homebuyers under Credit Linked Subsidy Scheme (CLSS). ✅ Higher Tax Deductions – Raising the Section 80EEA benefit (currently ₹1.5 lakh) to ₹2.5 lakh to help middle-income buyers. ✅ Lower GST on Under-Construction Properties – Reducing the current 5% GST (without ITC) to 3% or reinstating input tax credit (ITC) for builders to cut costs.

These moves could enhance affordability, improve sales volumes, and strengthen India’s housing demand.

2. Tax Benefits: More Savings for Homebuyers & Developers

Industry players have long demanded higher tax exemptions to boost liquidity and sales. Key tax-related expectations from Budget 2025 include:

📌 Increase in Home Loan Interest Deduction – Raising the Section 24(b) limit from ₹2 lakh to ₹5 lakh can make home loans more attractive. 📌 Relaxation in Capital Gains Tax – Expanding Section 54 exemptions to encourage reinvestment in real estate. 📌 GST Input Tax Credit (ITC) for Developers – Allowing builders to claim ITC can reduce project costs and make homes more affordable.

A well-balanced tax regime could encourage new home purchases, attract more investors, and drive fresh capital into the sector.

3. Infrastructure & Urban Expansion: Driving Real Estate Growth

Real estate thrives on strong infrastructure, and this budget is expected to boost metro expansions, smart city projects, and expressway networks. Experts are calling for:

🏗️ More Funding for Smart Cities & Urban Development – Expanding beyond metros to Tier 2 & Tier 3 cities. 🚆 Increased Connectivity Through Highways & Metro Rail – Unlocking new investment zones for real estate growth. 🏢 SEZ Reforms & Commercial Hubs – Making it easier to develop and sell properties in Special Economic Zones.

With India’s urbanization rate growing at 2.3% annually, these measures could expand real estate demand beyond metro cities.

4. REITs, Co-Living & Rental Housing: Unlocking the Next Big Market

The rental housing sector and Real Estate Investment Trusts (REITs) are emerging as game-changers, and Budget 2025 could further boost these markets with:

💼 Tax Incentives for REIT Investors – Offering capital gains tax exemptions or tax-free dividends to increase retail participation. 🏘️ Rental Housing & Co-Living Support – Special incentives for rental housing projects, student housing, and senior living. 📊 New Rental Housing Policy – Making it easier for private players to set up and manage large-scale rental properties.

With millennials and Gen Z preferring rental options, a structured rental housing framework could increase affordability and expand investment opportunities.

5. Stamp Duty & Registration Charges: A Much-Needed Rationalization

One of the biggest roadblocks in real estate transactions is high stamp duty and registration charges, which vary across states. The sector is hoping for:

📉 Reduction in Stamp Duty for First-Time Buyers – A centralized reduction policy to increase home sales. 🏡 Tax Deduction on Stamp Duty Costs – Making stamp duty partially deductible under income tax laws to improve affordability.

These measures could significantly lower property acquisition costs and encourage more real estate transactions.

6. Green Real Estate & Sustainable Development

Sustainability is the future, and Budget 2025 is expected to encourage eco-friendly real estate practices by:

🌱 Tax Benefits for Green Buildings – Reduced GST and subsidies for energy-efficient and sustainable real estate projects. ⚡ Incentives for Solar & Renewable Energy in Housing – Subsidies for solar power, rainwater harvesting, and energy-efficient homes. 🏗️ Higher Floor Space Index (FSI) for Green Certified Projects – Allowing eco-friendly buildings to have higher permissible construction limits.

With climate change concerns rising, incentivizing green real estate can attract global investors and ensure long-term sustainability.

Final Thoughts: Will Budget 2025 Be a Game Changer?

The Union Budget 2025 has the potential to revolutionize the real estate sector by focusing on affordability, infrastructure expansion, taxation benefits, and sustainable development.

For homebuyers, tax relaxations and lower interest rates could make homeownership easier. For developers, GST simplifications and incentives could reduce costs and increase profitability. For investors, REIT incentives and rental housing policies could unlock new income streams.

A progressive and real-estate-friendly budget could fuel industry growth, attract foreign investments, and make housing more accessible for millions of Indians. All eyes are now on the finance ministry—will Budget 2025 deliver the much-needed boost? Only time will tell. 🚀

#IndianEconomy (Context)#EconomicGrowth (Key concern)#FiscalPolicy (Government's approach)#FinancialPlanning (Impact on individuals)#BudgetAnalysis (For expert commentary)#BudgetUpdates (For news and announcements)#GDP (Gross Domestic Product - important metric)#Inflation (Major economic factor)#Sectors (Choose those relevant to your content):#AgricultureBudget (For farming and rural issues)#HealthcareBudget (For health and medical spending)#EducationBudget (For schools and universities)#InfrastructureBudget (For roads#railways#etc.)#DefenceBudget (For military spending)#RuralDevelopment (Focus on rural areas)#ITsector (For technology and related industries)#RealEstateBudget (For property and housing)#Manufacturing (For industrial sector)#EnergyBudget (For power and renewables)#Taxes & Reforms:#TaxReforms (Expected changes)#GST (Goods and Services Tax)#DirectTaxes (Income tax#corporate tax)#IndirectTaxes (Sales tax#excise duty)#Subsidies (Government support programs)#Expectations & Predictions:

0 notes

Text

President Marcos signs into law VAT refund for foreign tourists

In a move to boost the Philippines’ standing in international tourism, President Ferdinand “Bongbong” Marcos, Jr., signed into law the priority measure of providing Value Added Tax (VAT) refund for foreign tourists, according to a Philippine News Agency (PNA) news article. To put things in perspective, posted below is an excerpt from the PNA news article. Some parts in boldface… President…

#Asia#Bing#Blog#blogger#blogging#Bongbong Marcos#business#business news#Carlo Carrasco#economic dynamism#economic growth#economics#economy#Economy of the Philippines#Facebook#Ferdinand Marcos#finance#foreign tourists#geek#Google#Google Search#governance#gross domestic product (GDP)#holiday#income#Instagram#jobs#Marcos#news#Philippine News Agency (PNA)

1 note

·

View note

Text

Recently Union Budget of the Year 2024 was passed and announced by Finance Minister Nirmala Sitaraman. This time with the theme of Viksit Bharat, it has led an ambitious roadmap for our nation’s progress. With ample of changes being aimed at boosting the economy, to address the key factors, youth and addressing the stakeholders as well. The budget is aimed at making a developed India.

#Budget#Budget 2024#Union Budget 2024#Finance Minister Nirmala Sitaraman#GDP growth rate of 7.5%#Personal income tax and corporate tax

0 notes

Text

The "National Debt" isn't national and it isn't a debt. Eric Boehm remains clueless.

The problem with Libertarians like Eric Boehm . . . where do I begin? They have so many issues. First, they don’t understand this equation: Gross Domestic Product = Federal Spending + Non-federal Spending + Net Exports. Gross Domestic Product (GDP) is the most commonly used measure of the economy. The equation tells you that the more the federal government spends, the more the economy grows. But…

View On WordPress

0 notes

Text

Economic Issues

India has one of the world's fastest-developing economies. It belongs to the group of developing nations that continually seek to strengthen their economic conditions. The enormous population of India presents a lot of difficulties that must be resolved for it to keep expanding. Yet, India confronts several economic issues, which we will address in this blog post. We'll talk about the main issues and toughest obstacles the Indian economy faces.

What are economic issues?

Economic issues refer to any difficulty in the economy that is concerned with the production of goods and services to meet the economy's endless desires through the use of scarce resources. In other words, a choice-making issue brought on by a lack of resources is typically referred to as an economic difficulty. It develops because humans have limitless demands but only a few ways to satisfy them.

Central problems of an economy

The production, distribution, and exchange of goods and services are the three core issues of an economy. Let's look at these issues: what to produce, how to produce, and for whom to produce. Doing so will help us identify the demands of society.

(I) What to produce?

This issue entails deciding which products should be created as well as how much of each product should be produced.

A nation must choose what types of commodities and services to produce as it has limited resources and cannot produce all goods.

For instance, if a farmer only has one plot of land available for farming, he must decide between growing wheat or rice.

(II) How to produce?

This problem determines which production method to use in the creation of the chosen goods and services.

There are primarily two production methods. Which are:

1) Capital-intensive approach (more reliance on machines)

2) Labor-intensive approach (more labor is employed)

Capital-intensive techniques encourage efficiency and expansion, whereas labor-intensive techniques generate employment.

To enhance your knowledge, please visit Daily Booster Article| study24hr.com

(III) For whom to produce?

This topic is concerned with determining the types of people who will consume the goods, i.e., to produce goods for the rich or the poor.

Society is unable to fulfill everyone's needs. Hence, it must decide how much of the entire output of commodities and services should go to whom.

Furthermore, society must decide whether to produce luxury items or everyday goods. This distribution or ratio is closely related to the economy's purchasing power.

Causes of economic issues

Some of the primary causes of economic problems are listed below:

1. Endless human desires

Human beings have limitless wants and needs, so they can never be satisfied. A person will experience new cravings once their initial need has been met. Because of the limited resources available, the unending number of people's needs continues to grow.

2. Unavailability of resources

Resources like labor, land, and capital are not enough to meet demand. As a result, the economy is unable to satisfy everyone's needs.

3. Other uses

Due to a lack of resources, the same resources are employed for several reasons, and choosing among resources is consequently crucial. For instance, gasoline is used for running equipment, generators, and vehicles. Thus, the economy should now select one of the alternate applications.

Major challenges faced by the Indian economy

The Indian economy faces several ups and downs due to the following reasons:

1. Unemployment

Unemployment reflects the health of the economy. It is a condition in which an individual actively seeks employment but is unable to obtain work. Workers who are unemployed experience financial hardship, which harms their families, relationships, and communities. However, the level of poverty may rise as a result of little or no income, which would slow down economic development and progress.

2. Poor education

Many children in India are unable to receive a proper education because of poverty, unstable finances, or other resource shortages. Due to their lack of skills and intellectual capacity, these kids find it difficult to fit into social situations. As a result, they are unable to participate in the same activities as educated people due to the lack of resources that education generates.

Explore ”Study24hr.com” if you're looking for an online instructional resource. It is an incredible online learning environment that seeks to improve students' academic performance and understanding abilities. Learners can access a variety of study materials, such as mock test papers, daily boosters, academic notes, and tutorial videos, with the help of this wonderful site, making it easier for them to prepare for their exams. Additionally, ”Study24hr.com” allows educators to publish their notes on its website, generating qualified leads.

3. Population density

The population density of India is among the greatest in the world. The major issue that the Indian economy faces is this population density combined with an infrastructure that cannot keep up with the population expansion. Besides, congestion emerges as a problem with increased population densities as more people begin to dwell in an area. Problems such as packed roads and transit congestion make it difficult for people to commute by public transportation, leading to people buying more vehicles, which then leads to other problems such as traffic jams and pollution.

4. Corruption

Another significant issue that the Indian economy faces is corruption. The economy is greatly inefficient and wasteful as a result of corruption. It causes plenty of social issues. Moreover, corruption functions as an ineffective tax on businesses, ultimately driving up production costs and lowering investment returns.

Conclusion

It is acknowledged that India needs to solve several economic concerns quickly to improve its economic situation. We must acknowledge the importance of education in addressing these problems if we want to overcome them. Hence, assist India's underprivileged folks in receiving a quality education because it is the responsibility of the educated person to inform others of the value of education. Keep in mind that India can develop more as we learn more about it!

#economic issues#indian economy#poverty#challenges#unemployment#poor education#corruption#low income#job seekers#population density#society#demand#study24hr#economic growth#GDP

1 note

·

View note

Text

Purchasing power

In several discussions online and in person about money, credit, taxation, spending, and economic policy in general there is a common use of overloaded, not well defined terms like "money" in particular, but also the rest of the above.

As to topics like distribution of income and relatedly inflation, money, credit, I have found that they become a lot clearer if one talks of purchasing power instead, at least in a political economy where many or most goods and services are commodities traded in markets, instead of being self-produced.

Purchasing power is what after all most people care about: they want income, money, credit, wealth, etc. in order to buy things, that is they want purchasing power, whichever form it assumes.

When a Real American says something like "I wish to make money fast" or "I always hustle to make money" what they really mean is that they want more purchasing power, usually they don't want to just accumulate bigger numbers in a bank account or more banknotes or coin in a vault (even if some do because to them that is a way to keep score).

So a large part if not most or all of the study of the political economy is to figure purchasing power and there are two large subtopics:

How purchasing power per person increases, that is how productivity increases (the development problem).

Who gets which slice of existing purchasing power, and how they get it (the distribution question).

So when reading economic or political news or discussions, the two most prominent questions are:

In the long term how does this affect the amount of purchasing power per person?

In the short term how does affect whom gets more or less purchasing power?

Note: an often forgotten distinction is that between GDI ("Gross Domestic Income") and GDP ("Gross Domestic Product"): GDI (expressed usually in currency terms) is in effect the total purchasing power in a state, and GDP (which also for this reason should be expressed in physical terms) is what can be bought with that purchasing power (plus net imports).

0 notes

Text

Just saw a very dumb post

0 notes

Text

Yeah okay so like I said in the tags of the last post I’m rising from my tumblr grave to say that the ban on TikTok is symptomatic of a MUCH larger and more terrifying problem. Because yes, on its surface it’s silly dances and asmr and cooking videos and whatever, but in truth and at its core, TikTok single-handedly revolutionized the way 170 million Americans communicated with each other AND the rest of the world. Non-Americans love to point out how America-centric Americans are, but fail to realize that we are purposefully raised in an isolated, insulated environment where we are told from basically day 1 that America Is The Best and not to even bother taking a look around because it’s all downhill from outside of here. TikTok has, for MANY Americans, single-handedly destroyed that notion and allowed them (us!!) to broaden our world-view and realize that actually, things are better in other countries, and it did so in a kind, empathetic, and compassionate way.

And yeah most people wake up to the truth of that on their own as they get older, but holy shit!! The VAST majority of the Americans on TikTok are millennials and gen z (and even some older gen alpha)!! People who are becoming disillusioned with “The American Dream” (said with the HEAVIEST sarcasm) while they’re still school-aged or are just entering young-adulthood!! People who are entering - or TRYING to enter - the American workforce who suddenly have an unfiltered window into non-American lives and are wondering why tf we’re struggling and penny-pinching and toeing the line of poverty while our rich elected officials sit around and fight and argue over everything that actually matters to the citizens they supposedly represent and get richer all the while. THAT is why they’re banning the app, and that fact alone should terrify every single American citizen.

Not to mention the precedent it sets for other social media platforms!! You think some nebulous, unproven, and unfounded “threat to national security” will stop with TikTok?? They’ve already censored Adult Material on tumblr, who’s gonna stop them from coming back and doing it again or getting rid of it altogether for the exact same reason? It’s a blatant act of censorship and a direct attack on the American first amendment right to free speech.

NOTHING radicalized me the way tiktok did. I watched people in my life who were STAUNCH Trump supporters in 2016 AND 2020 wake up to the truth and vote blue for the first time in their lives BECAUSE OF TIKTOK, and did so with al the nuanced understanding that even Democrats are severely failing this country, but are at least better than the alternative. That level of awareness and presence in the average US citizen scares American politicians.

The fact that the vast majority of them - including the ones loudly opposing the ban!! - bought stock in Meta BEFORE the ban was legalized/upheld by the Supreme Court?? That Mark Zuckerberg and Elon Musk were legally allowed to lobby congress to ban TikTok when BOTH stood to DIRECTLY financially gain from their biggest competitor being banned in the US and are guilty of unethically gathering data and selling it to MULTIPLE third parties?? The fact that Trump is now teasing that he may or may not intervene to save TikTok when he was the one who talked about banning it in the first place AND ALSO OWNS HIS OWN COMPETING SOCIAL MEDIA PLATFORM??

It’s the burning of Alexandria. It’s the loss of a significant chunk of culture. It’s the sharp and sudden loss of contact with the rest of the world for more than half of all American citizens. It’s the loss of $240 BILLION dollars in the GDP when the country is already TRILLIONS of dollars in debt. And on an individualistic level, it’s the loss of millions of small businesses and primary income streams for so many individuals and families who found their primary audience on TikTok. Is the app perfect? HELL no. Are there significant changes needed to make it a safe environment for all users? ABSOLUTELY. But that can also be said of ANY social media platform. TikTok openly fostered connection and communication and creativity and compassion that is completely unique to that platform! It made so many people - myself included!! - feel less alone. I get the feeling I know what the general consensus is about TikTok on this site, but the ban on this app should scare the shit out of everyone.

#TikTok ban#TikTok#mark zuckerberg#elon musk#donald trump#I’ve been gone for like 3 years at this point but I can’t say quiet about this#and as this is the only sort-of platform I’ve got#if you want to do something to help#delete ALL meta apps off your phone#not your accounts just the apps themselves#Facebook#Instagram#facebook messenger#WhatsApp#all of them#this + the fact that I traveled outside the US for the first time in my life last year has really fundamentally changed who I am#I’m just honestly so infuriated#as are most people on TikTok#anyway back to tagging senators ro khana and ed markey in every tiktok I scroll past byeeeeeee

3K notes

·

View notes

Text

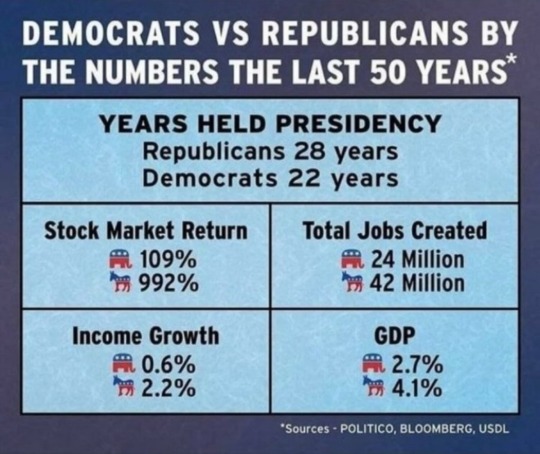

You think Republicans are better for the economy?

1 note

·

View note