#I feel like I’ve simplified his features a lot since December

Explore tagged Tumblr posts

Text

Mistah Maguire

#ihnmaims#i have no mouth and i must scream#allied mastercomputer#uh tagging his human AM au i guess#I feel like I’ve simplified his features a lot since December#And i can conclude his hairstyle is an odd mix of Harlan Ellison and Jeffrey dahmer#abner maguire

31 notes

·

View notes

Text

Puppetry Lost Media

In honour of reaching 50 followers last week (now 55 followers, as of writing this) I decided to cover two subjects of great interest to me: puppetry (of course) and lost media.

Everybody online loves a good old bit of lost media. Whether it be being a part of the many searches for the media in question, or watching documentaries about them on sites like YouTube. I’ve been mildly addicted to the latter kind of content for a while. From what I’ve seen, though, there aren’t many videos or articles out there specifically covering lost puppetry. So, in no particular order, here are a couple of pieces of lost puppetry I found while scrolling through the lost media wiki.

銀河少年隊 - Ginga shounen-tai AKA Galaxy Boy Troop (1963 - 1965)

Osamu Tezuka is one of the most pioneering figures in Japanese art and animation. Starting as a manga artist in the 1940s inspired by the animated works of American studios such as Walt Disney and the Fliecer Brothers, he adapted and simplified many of the stylistic techniques of both artists to create his own signature style of big shiny eyes, physics defying hair and limited animation. A style that would go on to heavily influence the world of anime and manga as a whole.

But animation and graphic art were not the only mediums Tezuka would dabble in. Ginga Shounen-Tai, or Galaxy Boy Troop in english, was a television series that aired on the public broadcast channel NHK from April 7th, 1963 to April 1st, 1965. Running for 2 seasons with a total of 92 episodes.

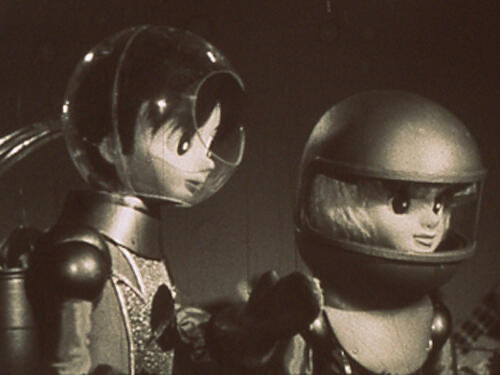

The series was a mixture of marionette characters that utilised the Supermarionation marionette technique, popularised by Jerry Anderson’s Thunderbirds, and limited traditional animation. The story revolves around a child genius named Roy who leads a rag-tag group of heros around the galaxy in a rocket ship in order to revive the earth’s sun and later protect it from alien invaders.

Out of the 92 episodes that aired, only episode 67 still exists in its entirety with French subtitles, and the full episode can be found on YouTube with English subtitles uploaded by user Rare TezukaVids. According to user F-Man on the Tezuka in English forums, footage of episode 28 exists but with no audio, and episode 87’s animated segments exist without the marionette segments. F-Man also claims the reason for Galaxy Boy Troop’s disappearance is due to Tezuka not being proud of the series and having all episodes of it destroyed.

Personally, I think it’s a shame that pretty much all of this series is gone. From what I’ve seen in episode 67, it looks really charming. Tezuka’s signature character design style was adapted suprisingly well to marionettes, and the puppetry itself isn’t that bad either. I love the little face mechanisms like the blinking eyes, flapping mouths and others. It gives the puppets a lot of personality and charm. Like, just look at this old mans eyebrow mechanism and tell me you wouldn’t want to watch 92 episodes of this show;

Tinseltown (2007)

Tinseltown was a 15 minute sitcom pilot created by the Jim Henson company under thier Henson Alternative banner. The pilot was commissioned by the Logo Network and aired as part of the Alien Boot Camp programming block in 2007.

The pilot (and likely the series, had it been picked up by the logo network) features a cast of both puppets and live actors as characters. The premise revolves around Samson Kight, an anthropomorphic bull preformed by Brian Henson and drew Massey, and his partner Bobby Vegan, an anthropomorphic pig prefomed by Bill Barretta and Michelan Sisti, as they attempt to balance thier lives working in Hollywood with life as parents to thier sullen 12-year-old foster son, Foster, played by Paul Butcher. Other human characters included Mia Sara as Samson’s ex-wife Lena and Francesco Quinn as the family’s manservant Arturo.

The Tinseltown pilot used to be available on the Logo Network’s YouTube channel, but was later removed for unknown reason. Since then, the pilot has not been made available online. However the characters Samson and Bobby have made appearances in other Henson related works, such as the improv stage show Stuffed and Unstrung, where they played the role as the shows producers, and in a 2011 video on the Jim Henson Company YouTube channel celebrating Jim Hensons 75th birthday.

I find Tinseltown pretty interesting as I feel like it should be more noateable or known, considering that this is (as far as my knowledge goes) the first Jim Henson Company project featureing openly lgbtq characters as its leads, and would have been the first Henson show to do so had it been picked up. As someone who’s interested in lgbtq+ representation in creative media such as animation, I realised that there’s not many examples of canon lgbt characters in puppetry. The only ones aside from Samson and Bobby I could think off the top of my head would be Deet’s Dads from The Dark Crystal: Age of Resistance and Rod from Avenue Q. Though, obviously, there could be more I’m not currently aware of. I don’t think the Tinseltown pilot was a masterpiece or anything. After all, there’s probably a couple of good reasons Logo didn’t pick it up for a full series. But I think it be cool if either Henson co. or Logo made this available online again, if just so we could appericate it as an interesting little footnote in the history of lgbtq rep in puppetry.

With that said, considering the pilot’s obscurity and the fact that it’s main couple haven’t been used in any Henson Related projects in almost ten years, as well as the possibility that there may be legalities preventing the Henson company from releasing it such as Logo still owning the rights, it’s unlikely we’ll see the Tinseltown pilot anytime soon.

Sonic Live in Sydney (1997 - 2000)

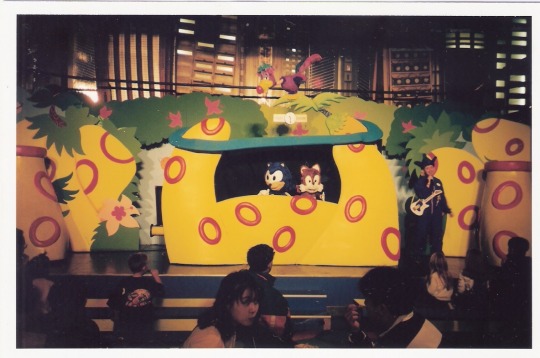

Sonic the Hedgehog is a fictional character no stranger to multiple interpretations of him and his universe across a diverse range of media. From the more light-hearted and comedic stylings of The Adventures of Sonic the Hedgehog and Cartoon Networks Sonic Boom cartoon series, to more serious faire such as the Sonic SatAM cartoon and the Sonic Adventure videogame duology. One of the more obscure and stranger adaptations of the character came in the form of Sonic Live in Sydney, a one an a half hour live show hosted at the former Sega World Sydney amusement park in Darling Harbor, Sydney, Australia. Originally beginning as a live show with actors in meet-and-greet style costumes, the show eventually was replaced with a puppet show during its last two years.

The shows plot was set in an alternate timeline whos continuity was a mix of the SatAM cartoon and Sonic the Hedgehog 3, where Doctor Robotnik’s Death Egg crash lands in Sydney, Australia instead of Angel Island and attempts to take over before being foiled by sonic and friends. According to Phillip Einfeld of Phillip Einfeld Puppetoons, the company that made the puppets, Sega felt the costumed actor version of the show wasn’t dynamic enough, and wished to replace it with a version featuring live puppets with animatronics. Both versions of the shows plot are identical.

While Sonic Live in Sydney’s soundtrack is available on YouTube, and some photos of the show are available on the Lost Media Wiki, no footage of either the costumed actors version or the puppet show version have resurfaced. The show was closed down in 1999, possibly due to cost, shortly before the Sega World park as a whole in 2000. So unless there is someone out there who viseted the show between 1998 or 1999 who recorded the show via a handheld camera, footage of both incarnations of the show are likely forever lost to time.

On a personal note, I don’t have much to say on this one other than how gloriously peek gaudy 90s Sonic the set/puppet design is. I have no doubt finding footage of these puppets in action would truly be a silly delight to behold...

Legend of Mary (year unknown)

This one is a little different from the other entries on this list as while the film itself in its entiraty is available on YouTube for anyone to view, the information surrounding Legend of Mary, specifically its year of release, remains a mystery as of writing this.

I have mentioned the film before on this blog so I’ll keep it brief here: in summary, Legend of Mary is a short film retelling of the Nativity featuring the Rod puppets of Austrian puppeteer Richard Teschner. the video was uploaded to YouTube by user canada 150 archive. I looked up the people credited in the film and was able to find most of them, but didn’t find Legend of Mary listed in thier credits, and was unable to find the film on sites like IMDB, tMDB or Letterboxd. I reached out to Canada 150 archive asking if they had any info regarding the Legend of Mary’s release date, and after a coupe of months, they replied saying they didn’t know.

And that’s as far as I got on my search for answers, if anyone of you guys has any information regarding Legend of Mary, then it be of huge help in finding the release date.

Sam and friends (1955 - 1961)

Sam and friends was the very first puppetry television series created by Jim Henson alongside his colabarator and future wife Jane Nebel. filmed in Washington, D.C. and airing twice daily on WRC-TV and the NBC affiliate in Washington, D.C. from May 9, 1955, to December 15, Sam and Friends would mark the first apperence of Kermit (though not yet as a frog) and paved the way for Henson’s iconic and revered legacy in the realm of puppetry on film and television.

With the impact this show had in mind, it may come as a shock to some that almost half of Sam and Friends, specifically, 42 of the 86 episodes, are considered lost. With 16 existing, 8 documented, 9 known from memory, plus 8 existing Esskay commercials and 1 memory-known Esskay commercial. Some taped episodes have been shown at venues such as the museum of the moving image while others have been erased. It’s unknown if copies of these erased episodes still exist.

This post would become far to long if I were too list every episode missing from Sam and Freinds, but if your curious, the lost media wiki article has a comprehensive list of all lost episodes.

Annnd that about it for this post. This type of content is pretty different from the stuff I usually post. So I’m egar to see what you guys think about it. If you enjoyed this article, want to see more like it or have ideas for what puppetry-related topics I should cover in the future. And again, thank you all so much for helping me reach 55 followers. Your support really does mean a lot to me, and I hope you enjoyed this as a follower milestone gift.

Anyways, hope you enjoyed this dip into lost puppetry, and have a happy holiday season!

#jim henson#sonic the hedgehog#osamu tezuka#lost media#lgbt#puppets#puppetry#richard teschner#lost tv series#failed pilots#failed pilot#lost puppetry#live show#theme parks#amusement parks#puppet show#performance#tv#television#film#short film#1950s#1960s#1990s#2000s

84 notes

·

View notes

Text

Why I think the actual Angel is Noelle Holiday

After nine months of research, procrastination, and working out the kinks, here’s a little theory of mine that’s been floating around in my head ever since the end of last November about Noelle Holiday and her potential role in the future of the series. It’s a bit of a long read, but I hope you’ll be willing to indulge me and give this crazy theory a chance.

As a forewarning, the following points I will be bringing up are simply too hefty to make a TLDR for, and it’s quite a long read, but trust me, you’re going to want to read through all of it for it to make sense in the end

Part 1: The Possible Evolution of the Delta Rune

First off, I’d like to look at the Delta Rune itself and a few easily overlooked key lines Gerson says about it:

That emblem actually predates written history.

The original meaning has been lost to time…

All we know is that the triangles symbolize us monsters below, and the winged circle above symbolizes…

Somethin' else.

The meaning and design of symbols can change over time, and it’s likely the same has happened to the way the Delta Rune is currently interpreted compared to when it first came into existence. For example, take a look at these variations of the Delta Rune:

Of these variations of the Delta Rune, these may be some of the oldest or closest iterations of the symbol to the original design, especially the ones from the intro cutscene and Gerson’s shop. The former is presumably from long before the Human-Monster War and thus the oldest version, and with Gerson’s apparent age and how he implies that he studies history, it is likely that the variation in his shop is also as close as can be to the original.

As for how these particular iterations of the Delta Rune fit into my theory, look at the design and positioning of the wings in these probably older iterations compared to likely more modern interpretations:

On the more recent interpretations, the base of the wings are placed around the same level as the center of the circle, and the wings themselves are mostly realistically designed. However, on the older interpretations, the wings are more simplified and stylized with more of an explicit arc to them, and the ‘feathers’ are more blocky with visible and sometimes significant spaces in between. Now keep that in mind when looking at these pictures:

Taking this into account, I think it is possible that - through the help of time and redesigns becoming successively more stylized - what was originally supposed to be a reindeer with antlers slowly got distorted and misremembered as a ‘winged circle.”

And maybe, something like this might even apply to Deltarune’s version of the Delta Rune as well given how several of the depictions of the Angel throughout the game look like the transition point between the older and newer designs, what with the ‘feathers’ being much rounder and closer together while still on an arc-based stylized design instead of a realistic wing-like design:

Part 2: The Origins of Modern Christmas

Now, with that established, let’s take a closer look at Noelle and her family.

Besides the obvious exception of Lancer, she has the most dialogue of all the NPCs, gets two entire scenes to herself in the hospital with her dad and outside her house to flesh out her character and crush on Susie compared to several other NPCs getting only a few lines of dialogue at most, and it is absolutely required to talk to her at the beginning of the game in order to even progress and end up in the Dark World.

As many other posts than mine have demonstrated, this suspicious level of detail has led a lot of people to theorize that Noelle will be an important character and that she might even be playable later on, a theory which has certainly been helped by Toby Fox’s original concept art of “THE FUN GANG” showing that her character has been in development for a LONG time - perhaps even from when work on Deltarune was just beginning - and that she may have been designed as a main character from the start.

However, much like how the potential origins of Undertale’s Delta Rune point towards the importance of reindeer in the series, I believe the deeper origins behind the names of the Holiday family similarly point towards Noelle’s true role in Deltarune.

Obviously, the name Rudy is a clear reference to the famous Rudolph the Red Nosed Reindeer, and Dess is most likely a reference to how Christmas is celebrated in the month of December. However, as Rudolph the Red Nosed Reindeer was created in 1939 for the Montgomery Ward department store chain, he is actually a relatively new addition to the list of Santa’s reindeer, whom in of themselves are early 19th Century additions to the image of Santa Claus - a figure tracing back to the 4th Century Christian bishop Saint Nicholas.

And on Jesus’ birth being on the 25th of December for Dess’ name, from what I’ve gathered with my google-fu, the event may have actually taken place less on December 25 and more during the fall or spring due to mentions of shepherds tending to their sheep in the scripture as well as from several attempts to connect the Star of Bethlehem with recorded astronomical events.

In fact, it seems likely that - in the 4th Century - the church might have actually chosen the date either because of coming to the conclusion that Jesus’ conception took place on the spring solstice - aka March 25, nine months before December 25 - or because they wanted to increase the popularity of Christianity through adopting and appropriating pagan winter solstice festivals like the Yule and Saturnalia holidays around the same time of year.

On the flipside, Noelle is a name that has a particularly distinct connection to Christmas; specifically, to the one for whom the holiday is named for in the first place rather than a recent secular addition or the general time in which said holiday is celebrated.

From what I’ve seen, Noelle as a name traces back to the French word ‘noel,’ which - alongside referring to Christmas carols - is a variant form of the word ‘Nael.’ This form comes from the noun use of the Latin adjective natalis, meaning of, or belonging to, one’s birth. The noun use (from natalis dies, day of birth) denoted a birthday, an anniversary, a commemorative festival, hence in ecclesiastical Latin the festival of the nativity of Christ, Christmas.

Basically, out of all the names of the Holiday family, Noelle’s is the one that most directly ties into the actual origins of Christmas in how the name’s origins heavily revolve around the birth of Jesus Christ, a major religious figure who was to be a sacrifice for humanity’s sins and to provide a way into heaven.

Considering Toby Fox’s attention to hidden details and deeper meanings and how angels are heavily associated with and are depicted in Christianity - particularly in relation to Jesus - there may be further significance to Toby picking a name that’s typically given to girls born around or on Christmas day. After all, even if it may or may not be the actual day of Jesus’ birth, it is widely celebrated and recognized as such.

However, as you’ll see at the end, I think there’s even another layer of meaning to Noelle Holiday’s name than just this one.

Part 3: Reindeer in Undertale

On a slightly different topic, while it’s hard to ignore how more prominently featured Christmas iconography and figures in the foreground of the series - what with the introduction of the Holiday family as well as several jokes about “Krismas” and Santa Claus in Deltarune, I believe it may also be important to pay attention to Undertale’s fair share of Christmas-themed details.

Namely, in how a significant amount of them owe their existence to one specific minor character; aka the rather unusually designed Gyftrot.

In contrast to the handful of implications that Asgore is the Underground’s Santa only being implicitly hinted at through extended dialogue and checking his bureau, Snowdin’s tradition of putting presents under decorated trees is blatantly and conspicuously out in the open.

And as Gift Bear explains if you talk to them, said tradition originated not with wherever Asgore’s Santa outfit and apparent moonlighting came from, but rather came about in the first place as a way to make Gyftrot feel better after some teens decorated his horns.

As to why I am calling Gyftrot unusually designed, it is because of his rounded head and sideways mouth - a trait only seen elsewhere in the DT Extraction Machine, Photoshop Flowey, and Sans’ Gaster Blasters.

Of all the conversations and theories I’ve seen about this strange detail, most people were only able to come up with the explanation that Toby simply liked the design and reused it for Gyftrot just for fun without any deeper meaning to it, or that Toby unintentionally gave it to Gyftrot while making Undertale.

However, a third explanation I found is that Gyftrot’s design may actually be foreshadowing for what Photoshop Flowey’s appearance looks like, what with how Gyftrot actually seems to have a second pair of eyes at the base of his antlers, and how one of the decorations he spawns with is a picture between his four eyes in a very similar position to the television screen on Photoshop Flowey.

To my knowledge, this explanation and comparison has only been made in conjunction by two people, with user u/Peridotthepie providing the explanation and and user u/pleasespellicup providing the following picture in the linked post.

While I can’t see any other possible parallels between the two to fully call this foreshadowing - especially with how the picture decoration isn’t guaranteed to show up on every playthrough and how obscure it is - I’d like to propose the idea that the DT Extraction Machine (and perhaps the Gaster Blasters by extension) may very well be based on Gyftrot or a relative with a similar design in-universe.

After all, not even boss monsters leave behind anything more than a pile of dust when they die, not even a goat-like skull that could be used as a reference, whereas Gyftrot is a living, walking example of such a design, complete with what even seems to be a SOUL-shaped hole in his mouth.

Not only that, but given how attentive to detail and deeper meanings Toby has shown himself to be as well as the increased prominence and importance of reindeer/Christmas themes in general for Deltarune, I find it incredibly unlikely that this design choice was made just for fun or as an accident.

On a bit of a side note, it is interesting that we first learned of the name “Rudy” in a post from September 17, 2017 on Undertale’s 2nd anniversary and alarm clock app.

Considering the apparent parallels between Undertale and Deltarune - for example, the potential connection between Susie and the ‘Suzy’ character mentioned by Clam Girl, who appears to have ties to Gaster - and the implications of the dialogue in that post, it’s likely that Undertale Rudy is also a reindeer just like his counterpart, and I would not be surprised if he was also related to Gyftrot as well.

As for what the exact deeper meaning or in-universe explanation behind Gyftrot could be, it’s too early to tell, but I have the feeling that it likely ties heavily into Noelle’s circumstances in Deltarune and some of the effects of the DT Extraction Machine on Undertale’s plot as detailed below.

Part 4: Determining Other Connections

To explain what I’m talking about, let’s take a closer look at a few key lab entries by Alphys, starting with this one:

ENTRY NUMBER 5: I've done it. Using the blueprints, I've extracted it from the human SOULs. I believe this is what gives their SOULs the strength to persist after death. The will to keep living... The resolve to change fate. Let's call this power... "Determination."*

While not explicitly confirmed, from the name and surrounding context, it is likely that the blueprints Alphys used were for the DT Extraction Machine and that DT stands for Determination, though it is unknown whether Alphys built the machine from the blueprints or if it was already constructed and she merely used the blueprints to operate it.

Either way, as we all know, things went horribly wrong from there. Alphys had accidentally turned those who had “fallen down” into the Amalgamates, created Flowey from the flower whose seeds Asriel had brought from the surface, and fell into a nervous downward spiral while wracked with guilt.

Now, I want to focus on just how the Amalgamates had been created, particularly with these entries:

ENTRY NUMBER 6: ASGORE asked everyone outside the city for monsters that had "fallen down." Their bodies came in today. They're still comatose... And soon, they'll all turn into dust. But what happens if I inject "determination" into them? If their SOULS persist after they perish, then... Freedom might be closer than we all thought.

ENTRY NUMBER 12: nothing is happening. i don't know what to do. i'll just keep injecting everything with "determination." i want this to work.

ENTRY NUMBER 17: monsters' physical forms can't handle "determination" like humans can. with too much determination, our bodies begin to break down. everyone's melted together…

Here, I’d like to draw your attention to a few things. Given the surrounding context, “falling down” seems to be a condition - one that potentially originates from age, injury, or some kind of illness - involving or causes monsters to enter a comatose state and eventually die.

And in Entry 17, there is the interesting wording of the line “with too much determination, our bodies begin to break down.” From how it’s phrased, it seems that, instead of melting from any amount of Determination in their systems whatsoever, monsters can handle Determination without having to fear of their bodies breaking down, though obviously there’s a cap to how much they are able to handle.

As for why I’m making this particular distinction, it’s because of Noelle’s situation with her father and how it may proceed beyond Chapter 1 in the future.

With the implication that Undertale Rudy had passed away a while ago, Deltarune Rudy’s conversations with and about Noelle, and Deltarune’s apparent theme of choices not mattering - or at least, not in the long run - it seems pretty likely that DR Rudy is suffering from a case of the foreboding coughs of death and that he may even “fall down” later on.

As such, it wouldn’t be surprising if his condition keeps worsening all the way until he ends up on his deathbed/in a coma/legitimately dead no matter what the doctors or Noelle and such do to help, and neither would it be surprising for her to be seriously affected and react in a severe way as a result.

I mean, Rudy openly talks about how everything scares her, even ironically Santa Claus, and as the classroom scene demonstrates, she has trouble mustering up the courage and confidence to assert herself to the point where even Alphys asks her to speak up.

Considering that her father openly talks about how defenseless she is and how he worries about not being able to protect her from his hospital bed, his death/apparently inevitable upcoming death would no doubt drastically impact her, especially if she attempted as much as she could to stop it to no avail.

Sometimes, one can be driven to desperation to do crazy things as a result of love and worry, and Noelle may very well do the same out of love for her father. If at least some of Undertale’s rules about SOULS and monsters also apply to the world of Deltarune, then there may only be one way - or at the very least, what she feels might be the only option left - in the end for Noelle to potentially give her father the strength to persist and the will to keep living, perhaps even after death.

Or in other words, potentially through extracting enough Determination from a human SOUL to inject into and potentially save her father/bring him back to life.

If the SOUL we the players control is or is close enough to a human SOUL to work, no other human characters/SOULS pop up later, and Noelle somehow finds out about the power of Determination and becomes resolved to use it, then there may be few - if any - things we will be able to do to dissuade her from going after Kris/wherever the SOUL we control goes.

Now, this is where what I think could be the second meaning behind Noelle’s name points would come into play, and in quite an important way.

For those that don’t know, if you enter Susie, Kris, or Noelle as the creator’s name in Deltarune’s introduction, you get the interesting following response:

“YOU ARE ABOUT TO MEET SOMEONE VERY, VERY WONDERFUL.”

With how anagrams appear to be a major theme of Deltarune in both a naming and worldbuilding sense, it's rather curious that of these three names, only two make any actually sensible anagrams. Kris and Susie can be turned into "risk" and "issue,” but Noelle oddly appears to buck the trend.

However, I think the answer for this ties back to Lab Entry 17. You see, in toxicology research terms, Alphys had injected more than “the highest dose at which there was not an observed toxic or adverse effect.”

Interestingly, this level of dosage is known as the No Observable Adverse Effect Level, or the term NOAEL for short. And sometimes, when describing and looking for an effect in general than just specifically adverse ones, the term used in toxicology reports is the No Observable Effect Level, or NOEL.

Basically, if Noelle hopes to save her father, she needs to make sure to not inject too much or too little Determination. Otherwise, she’d go below the NOEL, where Ruby would simply not have enough strength to keep living, or above the NOAEL, where Rudy would seem to be fine for a while at first before inevitably melting down.

And with that, Noelle’s strangely un-anagramable name can be reconciled with Kris and Susie’s, all three names relating to terms often used to describe something problematic in a scientific way.

In fact, one could even say that the terms their names correspond to sound like they would fit very well in a lab or experiment report, perhaps one involving interesting increases in darkness, like an imbalance in Dark Fountains…

Part 5: Conclusions

Of course, I do realize that that last bit is quite a stretch to suggest, even in comparison to the rest of my theory and particularly the latter half of the above section. As of now, there’s no real way of telling how these details actually connect in this way or if they really even connect to each other in the first place, let alone if they even operate on similar enough rules like my theory presumes.

Heck, with the shortage of clear definitive details about W.D. Gaster, the apparent differences between the worlds of Deltarune and Undertale, and how things may change or have already changed in development in between games and chapters, it’s entirely possible that the series will take a very different direction than the one laid out here.

Perhaps we haven’t even heard of the character who is the actual Angel and everything we’ve seen so far are just red herrings. Maybe Ralsei’s legend will be revealed to have been falsified and he and/or Asriel will turn out to be the Angel like commonly theorized. For all we know, the world of Deltarune might not even precede OR succeed Undertale’s, and it’ll turn out that both worlds are derived from a third, unaltered world/timeline.

But whatever it may be, at the point we currently are at now, I find that my most likely candidate for the Angel is Noelle Holiday. On their own, the details supporting my theory would be easy to disregard and aur tenuous at best when taken by themselves, but when taken together as a whole, it’s hard to deny that they VERY much look like they start to frame a pretty concerning picture about the exact role of reindeer across the entire series.

I mean, even if stuff like Determination turn out to not exist - or at least, don’t work the same way they do in Undertale at all - in Deltarune, the following general sequence of events seem likely to happen for me; that Rudy might get worse to the point of almost dying/actually dying, that Noelle might turn to something just as equally rather dangerous or desperate as extracting Determination in order to save/bring back her father, and that what she does may involve/cause her to somehow become the Angel.

Besides, like we can see from the introduction to Deltarune Chapter 1, it would be much like Toby to play with our expectations from Undertale and set us up to suspect that Ralsei or Asriel may be the Angel while he sets up the real Angel elsewhere.

After all, just about every good magic trick and literature twist relies on the art of misdirection at least in some part, subtly distracting the audience while the real clues are being built up in plain sight.

Like, for example, using the power of fluffy boys to deflect attention from the reindeer in the background.

#deltarune#undertale#deltarune theory#deltarune noelle#noelle holiday#delta rune#the angel#aka: toby’s bamboozled us again folks

99 notes

·

View notes

Text

Ambesi’s Winter Corner - Figure Skating

I’m a figure skating fan, I’ve been a casual one for some years now, and since last year, I’ve got more involved with groups and everything. I love learning new things, so I took the opportunity of being surrounded by so many people who know TONS about it and ran with it :D. I’m on an international fan group and one of the best commentators about the sport is the Italian Massimiliano Ambesi, who is really so interesting to read and listen. So sometimes, with other Italian fans, I help people in the international group by translating Ambesi’s commentary or articles. This is an extract from Winter Corner, where he talks about severl winter sports, and I translated the part about figure skating. I hope it’s useful somehow! This is the original article: LINK Q: Massimiliano, let’s start with one of our features in the feature. In your opinion, who was the ATHLETE OF THE WEEK? A: “Forever and ever Alena Kostornaia: in the Grand Prix final in Turin she was the clear-cut winner of the competition, with the highest technical level ever seen in the history of the sport, and she even allowed herself the luxury of establishing a new World Record. By the way, it is possible that in the sum of the components she could go even better, allowing her to get more than 250 points in a spotless competition, and all this without quadruple jumps. At the moment, she represents the best synthesis between technical skills and artistic quality. The only minor flaw in the final was that she was not the winner of every single segment of the competition, as she had been before. In the free skate her training companion Anna Shcherbakova preceded her by mere tenths of point. For this, it was determining the triple axel + triple toeloop combination although from a negative point of view, that she completed with less quality compared to the one at the NHK Trophy some weeks ago. In any case, Alena improved her personal records in every segment of the competition, both TES and PCS, and this, at the end of the game, is definitely resounding because, we can say it now, she competed with a problem of unknown gravity to one shinbone. The victory in the Grand Prix Final will probably guarantee her a place for the European and World championships regardless of what will happen at the Russian National Championship.”

Q: A question arises then, if you want a bit obvious. Who can beat her? A:“There are three skaters that can have the chance to compete with her at the same level, both in this moment and in the future. As for the future, it’s impossible not to mention the Japanese Rika Kihira, although she needs to recover her full physical health, and, consequently, the triple Lutz she had to forcibly put aside. In the short-term, instead, Anna Shcherbakova and Alexandra Trusova, who were preceded by Kostornaia at the Grand Prix Final and are ready to get their re-match in the imminent national Championship at the end of December. The other skaters, in a way or another, are several steps behind as demonstrated not only in the Grand Prix Final, but during the whole season, in which three of Eteri Tutberidze’s students have annihilated the competition in any context. Obviously, the staff directed by the coach with Georgian origins deserves a mention because they established a long series of records that, from now one, can only be matched.

Q: As we opened with Figure Skating, let’s keep it as a topic. I’d like to have your comment on the results of the other competitions on the other Grand Prix Finals that were held in Turin. A: “We witnessed four competitions with clear-cut results, besides the final leads. In the single competitions, the victory went to two skaters, Kostornaia and Chen, who completed every planned element, improving the world record. In the Ice Dance and even more in the Pair Skating, the indisputable favourites of the eve won, Papadakis/Cizeron and Sui/Han, although there was some minor mistake here and there. The most problematic segment of competition was the Rhythm Dance: during that you could feel the competitors’ tension, but everything got back to normal for the free dance.

Q: You haven’t mentioned it, but I'd like to know your opinion about the multiple complaints about the scores in the Men's single competition. What is your idea about it? A: "First things first, Nathan Chen is the worthy winner of the final, and he deserved his result on the field, but his skating isn’t worth the scores that he gets. Right now, there's a clear problem on the attribution of the GOE and on the evaluation of the program components. More quadruple jumps can't automatically mean more PCS, and especially when the necessary requirements are not present, over-scoring the jump elements should not be possible, but it's not just that. The current score system doesn't work well right now. It's not only a problem of lack of proportionality between the TES and the PCS, which is well known, I also think that the situation was way worsened when they changed the GOE attribution system at the beginning of this Olympic four-year period. In my opinion, the current rules are not applied correctly because no judge, and I challenge anyone to prove otherwise, is able to evaluate in real/almost real-time the many elements of the programs, with precise references to the six bullet points that are to be referenced in the rules, to the possible deductions that may happen, and don't forget that at the same time they also have to evaluate the five scores of the components. With this statement, I'm not saying that the judges are not competent to do that, but simply that the current GOE assignment system is not applicable in such a short time as what they have. The example, in this sense, can be represented by any segment of the competitions in this season. I invite everyone to compare the quad Salchows made by Hanyu and Chen in the free skate in Turin, jumps that, inexplicably, obtained the same GOE. Thus, if it is not possible, for reasons that I think are understandable, to apply the rules as they were thought, maybe it would be better to create something different, so that anyone can adjust accordingly, and they can avoid losing credibility. Obviously, my premise is that there's no deceit, although, after having seen some people at work, I might have a doubt about that. In any case, I'll ignore it for now, and go forward, even if I'm quite perplexed. We need corrective measures, and we need them as soon as possible, but I'm not convinced that those who are in charge of these decisions may be able to intervene."

Q: With an answer like this, I cannot help asking you if Yuzuru Hanyu can beat a Chen who, in fact, is able to carry out every planned element. A: "In a competition with spotless programs for both of them, the victory would go to the Japanese skater. I have no doubt about it, because he is one step ahead in every score entry. In the free skate in Turin, the base value planned by Hanyu, counting the highest GOE possible, was 0,8 points above Chen's. Thus, they are on basically even ground on this. It's clear that Chen is more at ease in completing five quadruple jumps. The American skater, in this sense, is favoured by his skating: he spends less energy because he clearly covers less ice and has more two-footed skating, and this advantage still remains even though Hanyu had to simplify his free skate, compared to the previous ones, to be able to put in five quadruple jumps as well. In any case, it needs stressing that the Japanese man's jumps are better in quality, which means more height (in the final, the height for every jump was measured and the difference was embarrassing), the width, the entrance, the exit position, and a lot of other elements. Chen demonstrated to be superior on the athletic point of view, and on this part Hanyu will have to work in order to overcome this situation. Besides, another important difference is where the jumps are placed. Chen starts with his three most difficult elements in the first half (not in bonus zone), and two of them are combination jumps, and has a second part that is lighter than Hanyu's, who instead wants to execute three difficult combinations as the last three jump elements. I think that in Toronto they'll need to think about this. In general, I still think that the comparison on the PCS is out of the question, because the Olympic champion has an advantage on every item, in particular on the less subjective ones, like skating skills and transitions. Especially in the short program, the difference is even higher. It is clear that it's still necessary for Hanyu to complete every planned jump. In Turin, for the first time in his career, he was able to complete five quadruple jumps, of four different kinds, Lutz included. Surely, this is an important starting point for the future. As for the rest, we can only wait for the next competition.

#figure skating#yuzuru hanyu#nathan chen#alena kostornaia#alexandra trusova#anna shcherbakova#english#translation#massimiliano ambesi#winter corner#ISU#ISU judging system#men's single#ladies' single#free skate#short program

22 notes

·

View notes

Text

Sketchbook Flipthrough: Dec 19 - Jun 20

One of the creative practices I have developed is to work in my sketchbook for one hour every day. It seems that the key to my personal creativity is consistency rather than quality. I have gone through so many sketchbooks in my developing career as an artist but this is the very first one that I have fully completed. I worked in this Seawhite of Brighton A5 sketchbook from December 2019 to June 2020.

This first page I was attempting to finish up my self-made Inktober prompts by drawing a Garden Chafer. I don't think I really did it justice but it got me past the dilemma of the first blank page. On the next page I've drawn a mandala - I love drawing mandalas to practice symmetry and linework.

This next drawing was for a Christmas present for my partner; it is one of his favourite Warhammer characters: The Green Knight. The composition of this piece was taken directly from the reference picture I had from a Warhammer book but I drew it in my style of ink illustration with a bold triangle frame. Next to this I tried my hand at some faux calligraphy by inking the words "lose hate not weight." This is a message that became a personal mantra in the post-Christmas and New Year diet culture frenzy that is so overwhelming and all-consuming.

This collection of small drawings is titled "Some things I found while walking the dog." It features some winter plants and a lot of litter as well as a turnip that had washed up with the recent floods, which my dog thought was the best ball ever.

This spread has a very simplified not-quite pattern of houses of different designs. I was just playing with different shapes and patterns to create the buildings and their features. Beside this we have a baby Yoda - can you tell we started the year watching the Mandalorian?

Next, I've drawn a very fine lined rendition of the Wallace Monument in Stirling - this one may become a print in the near future, I am as yet undecided. On the opposite page I've drawn another mandala, this time taking up the entire page. I love practicing my linework and incorporating more bold black elements is something I am going to work with more going forwards.

This is a random doodle page - I tend to have my sketchbook out on the counter while volunteering with Made In Stirling so I can doodle in between customers when it is quiet. I like to do these random shapes of lines to practice getting the flow and ease of specific line styles more natural. The drawing beside this is of Stirling Castle - this one is definitely going to become a print in my collection soon! I just love the combination of the semi circle and the trees.

On the next spread, I've done a simplified drawing of a local building - I use local estate agents pictures as reference images as they tend to take really good building pictures! The next drawing was another style I have really started to gravitate towards. It's a kind of line practice except in the style of a topographic map. I had great fun doing this and they'll definitely pop up in my sketchbook practices regularly in the future.

This drawing was one of the ones I did while idly watching TV to stop myself from fidgeting. It's just a collection of tiny leaves that look as though they are drifting slowly in the sky. On the opposite page is a weird lined abstract shape thing - I don't particularly like it, but bad art is just as important to the creative process as good art.

This next spread is another that I don't particularly like. On the left, I've drawn a group of tree shapes in a similar vein to the not-quite house pattern. On the right is an attempt at a more structured architectural drawing of a fancy modern style house. You can tell I got fed up of it by the time I got to the shading.

This next piece is actually my first ever drawing from life. I took a life drawing class at my local college at the start of the year to push my boundaries a bit. I just glued it into my sketchbook after class and folded it so it would fit properly. It was drawn in charcoal and I didn't use any setting spray on it so it has smudged a little bit. Beside this is a tiny collection of baby animals which I think I drew at one of the Community Creative Club meets. I will never not love baby hedgehogs - they are the cutest thing on this planet.

Next up, I've got a collection of the local birdlife. These are all birds that I have seen around my home and tried to identify as best as possible. The heron, which I had mentally named Herman and saw every morning, unfortunately died after being caught in the floods of the start of this year. I have since seen another heron take its place in the misty mornings. This spring it was a delight to watch the swan and duck families grow up - we saw the same goosander family almost every day and took great delight in witnessing the mum duck diving under the ducklings and teaching them how to swim and forage.

This drawing is another random linework practice piece - it's kind of noodly. On the right is a drawing of Mooncake from Final Space which we were watching at the time. Chookity Pok!

This is another simplified building drawing using local estate agents' pictures as reference images. Beside this, is another drawing from my life drawing class. In this activity I thouroughly misunderstood the instructions so everyone else in the class ended up with tiny drawings on the side of their bigger collaborative pieces.

Next, we have another topographic style line drawing but a lot more simplified, as well as one of the first of my portraiture practices for the 100 Heads Challenge.

This two page spread is another piece from my life drawing class - this time I drew with materials more familiar to me, using white ink to add highlights and make the figure pop out from the brown of the paper.

On the next pages I've drawn a leafy plant and a Totoro - this was when Netflix started adding Studio Ghibli to its catalogue.

This next drawing is another that I don't particularly like, I think I just got the composition not quite right. It's a kind of composite of a few different trees that formed the view out of our cabin window on our February holiday to Aviemore. Beside this I've drawn a collection of simple fine line mushrooms.

The next page is an attempt at illustrating a map of an imaginary town - I have mixed feelings about it. On the opposite page is an aimless doodle of tiny flowers, for no particular reason.

Next is a page of random tiny doodles which almost looks like a (really bad) tattoo flash sheet. On the right I've drawn a self-portrait.

Next is almost a cartoon board but made up of intricate food illustration. I wanted to really test my textures with ink in this piece to try and capture a sense of likeness of the food items. Also, a pine cone. I have a weird obsession with pine cones.

On the left is a kind of spiderweb doodle which was probably another line work practice. On the right is another piece from life drawing class which I've just glued in so as to keep a memento of my progress.

This drawing is yet another one from life drawing class where I used different colours of ink pens to create depth and shadows in the model. Beside this is a drawing of a monument in Edinburgh called the Dugald Stewart Monument.

Another piece from my life drawing class is followed by a rough sketch of the Falkirk Kelpies.

The next two pages are made up of another piece from life drawing class - I like the way I've used different shades of ink to add highlight and lowlight to the figure.

Here is a monument in my typical style, this one is a part of Glasgow University. And next to this is another very simplified topography style map.

This spread features more monuments of Glasgow - the Duke of Wellington Statue (complete with cone hat, obviously) and the Clyde Auditorium. Both of which will become prints before long.

These next drawings are of another topographic map and the Falkirk Kelpies. These Kelpies took me about two weeks to draw in total because there are just so many intricate details.

Up next is a couple more monuments, the Stirling Robert the Bruce statue, and Edinburgh's Greyfriars Bobby.

The next drawing is another in my usual style of Castle Stalker. I love how this one turned out and it will definitely be in my shop soon! Beside this is an attempt at drawing a building from the Royal Mile in Edinburgh - I don't think it turned out very well, I got some of the angles of walls a bit wrong.

This next page features a simple drawing of a piece of hawthorn blossom that I found earlier this year. Beside this is a cute little Japanese building which I've coloured in with pencils. I was inspired to draw this from watching Midnight Diner on Netflix.

This painting was one of the first that I did during lockdown - it's of some daffodils that smudged a wee bit. On the right is an ink illustration of St Andrew's Cathedral, which also has some smudged daffodil paint.

This spread includes a yin and yang mandala and another colour pencil Japanese style house.

This is some more linework practice. On the left is a drawing of some wintery cow parsley stalks. On the right is some simple lined circles - I really like how when they cross over each other it appears like cross hatching.

This next page was inspired by watching Chris Riddell's IGTV's during lockdown. Beside this is a fuzzy bumble butt grazing on a thistle.

These next two drawings are my first tentative steps into character design - when I'm learning something new I tend to take inspiration from artists that already work in a particular way so that I might pick up some of their tricks along the way.

The next spread features another tiny building and an adorable mouse peeking out of a tulip flower.

Next is another practice of character drawing and an attempt at a fairytale style house, I didn't get the proportions quite right unfortunately.

On the left is a drawing of a treehouse which looks like an amazing place to live. On the right is an illustration of Fenton Tower - you might recognise it as Archie's humble abode from Balamory.

Next is another couple of spaghetti like line practices. I love playing with flow and texture within linework.

This drawing is a local building, the reference picture came from estate agents’ images. Beside this is some triangular line practice with the crossing over crosshatching again.

This is an illustration in my usual style of Dunnottar Castle - it will soon be in my avaible print collection. Next to this is an ink and watercolour drawing of a building from Culross, Fife where they have very distinctive white washed walls and bright brick edging.

This is another spread of linework practice - this time with squares and another topographic map.

This is a funky building I found online and wanted to draw - it's wedged between two sheer cliff faces! Next to this is a random page of scraps really. I started trying to draw some fairytale buildings before abandoning that idea and splashing some watercolour over the page instead. I then added this small watercolour painting of Kate from @kateshappinessjourney, which I tried to paint with a colour palette similar to Fran Menses.

These are two paintings of tiny country cottages done in ink and watercolour. I really enjoyed doing these and will probably do more going forward. Beside this is another bumble butt on a flower.

This is another Studio Ghibli inspired drawing and some character design practice. On the right is a couple more tiny watercolour cottages.

This page is has a random drawing from a reference on Instagram of a person wrapped up in a blanket along with a quote that reads: "I have planted worth, beneath my skin, in all the places, you made me doubt." Beside this is a practice loose watercolour painting of some flowers and leaves in a vase. It's not my usual style but I like to practice using watercolour regularly so that I can continue to develop my skills.

Next up is a collection of tiny drawings taken from scrolling through Instagram - I do this particularly when I want to draw but don't have a specific subject in mind. On the right hand side is a little landscape painting in gouache. I'm still learning how to use this medium so I don't expect masterpieces any time soon!

This is another weird building drawing - it did not turn out how I had envisioned so I am quite disappointed with it. On the adjoining page is a Draw This In Your Style challenge from @moonylux on Instagram. Its a very dainty and glamourous looking mermaid that I quite enjoyed drawing.

Here are some more gouache painting practices of some Scottish landscapes. I really like how my use of brushstrokes makes the paintings more vibrant and alive. Beside this is a little line drawing practice of some ocean waves.

This next drawing is another bumble butt on a flower. I think I might turn these into a print. On the right is a tiny collection of watercolour snails being adorable and curious creatures. I'm low-key obsessed with snails - I always move them from the path after the rain so they don't get stood on. I think these paintings could do with another layer of paint to increase the saturation of the colours.

This is an ink drawing of a Jackalope. I wish I could have one as a pet because they are so freaking cute. On the other side of this spread is another gouache practice piece - this one of a pink flower on a dark blue background.

This is another in my series of mythological creature illustrations. It's a fairy based off of the flower fairy drawings by Cicely Mary Barker in her books. Next to this is my first attempt at creating a repeating pattern for Minnie Small's #minniemission. It did not go well but I like to keep the scraps of my ideas.

This is a series of sketches for a commission for The Kitchen at 44. I often test out ideas in my sketchbook - sometimes completing the whole commission in my sketchbook and other times, as in this case, transferring the drawings over to something more fit-for-purpose (like watercolour paper).

Here is another of the great Scottish mythological creatures - this one is a Kelpie which features in stories across the country. Beside this I've done another gouache practice, of yet another landscape... I miss my studio and my acrylic paints a lot, but I am having great fun learning to use a new medium!

This is an illustration of a bean-nighe, or washer woman, who foretells death when she is seen washing the bloodied clothes of the people who are about to die. She also has breasts so saggy and cumbersome that she throws them over her shoulders to keep them out the way while she works. Next to this is a drawing of a building inspired by Ian Mcque's incredibly intricate illustrations.

This next drawing is another mythological creature illustration - this one is an uilbheist of Orkney and Shetland legend. This three headed sea serpent protects the islands from danger. On the right, is a little gouache seascape study. I really like how this one turned out.

This is another gouache study - I don't like how this one turned out much but there are tiny elements of this piece that I like. Beside this is some portrait practices for the 100 Heads Challenge - the challenge is to do 100 Heads in 10 days but that is way too difficult for me to achieve, so I just practice some here and there when I want to draw something different.

This is an illustration of a Boobrie, another of Scotland's mythological creatures. Beside this is some more portrait practice. I don't think I did these ones very well - but that is exactly why it is called a practice.

Here is a random piece of paper that I was testing pens on when decluttering. Over the top of it I've just drawn a quick flower doodle. Next to this is a collection of some of the Black Lives Matter protestors from June. Please keep this movement alive, listen and learn as much as possible. Only we can make the future better.

This next drawing is a commission I did for a friend who is about to embark on her probation year as an English teacher and wanted some literary themed illustrations to make signposts for her classroom. They are Narnia, Desire St, and East Egg, since they are some of her favourite stories. Beside this, on the right, is a collection of random shapes drawn with a highlighter and then turned into cartoony people. This kind of drawing practice really pushes you to look at shapes in a different way.

Here is some more portrait practices. I'm quite pleased with these. Next to this is some random leafy doodles, just for the hell of it.

This is another simplified house using a reference image from local estate agents. Beside this is another topographic map style linework practice.

Here is a creature by Karolina Plutowska from the book 'Sketching from the Imagination: Creatures and Monsters.' Practicing drawing like this helps me learn new ways of approaching illustration that I might not have considered before. Of course, I would never seek to claim any kind of profit or credit for drawings like these since they are based on someone else's artwork. On the right, is some more portrait practices which I never got around to inking. The pencil lines are very faint but you can see that I use a lot of shapes and lines to get the proportions right and help map out the whole page before I ink.

And this very last spread consists of another creature drawing from the book 'Sketching from the Imagination.' It is an illustration by Ksenia Bakhareva which I am particularly fond of. On the very last page of this sketchbook I've stuck in the finished repeating pattern that I made for Minnie Small's #minniemission. I am really pleased with how this piece came out and I can't wait to turn it into something fun!

And there you have it! That is the entire contents of my last sketchbook - dated from December 2019 to June 2020. It was been a wild few months but I've grown a lot as a person and as an artist, as can be seen from my sketchbook progression.

I hope you enjoyed taking a look inside my sketchbook. I use it basically as a place to store all of my art and treat each page as a new opportunity to practice my skills and talents. Not everything you create has to be a masterpiece but the act of practicing your skills every day will get you so much more creative than you ever thought possible .

0 notes

Text

My Interview with Jason Zweig

Note: This interview was originally published in the December 2016 issue of our premium newsletter – Value Investing Almanack (VIA). To read more such interviews and other deep thoughts on value investing, business analysis and behavioral finance, click here to subscribe to VIA.

“I wish I could talk to this guy,” I told my wife when I read Ben Graham’s The Intelligent Investor first time sometime in 2005.

“But he is dead, right?” she said.

“Oh, not Graham,” I exclaimed, “But Jason Zweig who has edited this version of Graham’s book.”

“I am sure you would one day,” she said with an air of confidence. But I junked her thoughts saying, “Why would he even want to talk to me?”

Well, I had this discussion in mind when I wrote to Mr. Zweig in mid-October last year to request him for an interview for our Value Investing Almanack newsletter. I knew it was a shot in the dark, something I had not done for a long-long time after missing a few such shots in the dark on stocks I lost money owning.

But this shot worked, and worked well for me. Not only did Mr. Zweig agree immediately for the interview, he also made me comfortable by asking me to address him as, well, Jason.

It turned out to be a great interview for me as a learner, and I hope Jason also found it worth his time and effort. Before I begin, I remember this quote from Jason in his starting note for The Intelligent Investor –

In the same way, I envy you the excitement of reading Jason’s thoughts in this interview for the first time. So let’s start right here with a brief introduction.

Jason Zweig is the investing and personal-finance columnist for The Wall Street Journal. He is the author of The Devil’s Financial Dictionary, a satirical glossary of Wall Street (PublicAffairs Books, 2015), and Your Money and Your Brain, on the neuroscience of investing (Simon & Schuster, 2007).

Jason edited the revised edition of Benjamin Graham’s The Intelligent Investor (HarperCollins, 2003), the classic text that Warren Buffett has described as “by far the best book about investing ever written.” He also wrote The Little Book of Safe Money (Wiley, 2009); co-edited Benjamin Graham: Building a Profession, an anthology of Graham’s essays (McGraw Hill, 2010); and assisted the Nobel Prize-winning psychologist Daniel Kahneman in writing his book Thinking, Fast and Slow. From 1995 through 2008 Zweig was a senior writer for Money magazine; before joining Money, he was the mutual funds editor at Forbes.

Jason has also been a guest columnist for Time magazine and cnn.com. He has served as a trustee of the Museum of American Finance, an affiliate of the Smithsonian Institution, and sits on the editorial boards of Financial History magazine and The Journal of Behavioral Finance. A graduate of Columbia College, Jason lives in New York City.

Safal Niveshak (SN): What inspired you to write your latest book, The Devil’s Financial Dictionary? What’s the biggest lesson you wish the reader should take from the book?

Jason Zweig (JZ):

Ever since I was a college student, I’ve been an admirer of Ambrose Bierce, the 19th century American author who wrote The Devil’s Financial Dictionary, one of the greatest works of satire in the English language.

A few years ago, my teenage daughters were teasing me about how my personal website never featured anything new (at least in their opinion). I looked out the window of my home office and wondered: “What could I do that would be new every day without making readers feel that I’m encouraging them to respond to the market’s every move?”

To the left of my window, I glimpsed the paperback copy of The Devil’s Financial Dictionary that I’ve owned since 1979. I glanced to the right and there, on my other bookshelf, was my second, hardcover copy of the same beloved book. I suddenly realized that I could write and post one satirical financial definition per day on my website. I didn’t expect it to turn into a book; I wrote the entries for fun. Then several publishers stumbled on it, and suddenly it became a book.

Of course, Wall Street and the rest of the financial world provide such a wealth of absurdities that eventually it may turn into a multi-volume encyclopaedia.

The lesson readers should take from the book is that the language of finance is often used not to explain, but to obfuscate. Those who know what terms mean can make a lot of money. Those who think they know what terms mean will lose a lot of money.

SN: What do you think happens inside our brains when we hear the financial experts’ gibberish? We all want to simplify our lives, so why is it that many of us admire those in the financial markets who throw at us the most complex stuff?

JZ: Neuroeconomist Gregory Berns of Emory University and his colleagues have found that listening to financial experts triggers a neural response they call “offloading,” which is a lower level of activation in the posterior cingulate and other regions of the frontal cortex normally engaged in decisions about risk and return. Conformity and deference to authority are part of human nature; man is a social animal, and we evolved to learn that following the leader and staying inside the herd helps to keep us alive. That served our ancestors well on the plains of the Serengeti. It doesn’t serve us well in modern financial markets, where computers can outsmart us and many people are richly rewarded for giving advice that is better for their own bottom line than it is for ours.

I also feel that financial jargon is even more insidious than other professional dialects, like medical lingo or info-tech gobbledygook. When a financial advisor uses jargon, we want to pretend to understand it so we can feel like privileged insiders who are “in the know.” Pretending to comprehend financial gibberish confers an illusion of power on those who purport to know what the jargon means.

In truth, the ultimate power lies in understanding that you don’t know what it means – and that the person using those words probably doesn’t, either.

SN: That’s true! Anyways, in mid-October 2016 front-page article in The Wall Street Journal titled The Dying Business of Picking Stocks, you wrote about investors giving up on stock picking and moving into passive funds. Can you please elaborate more in that? Do you see it as a long-lasting trend?

JZ: Our article was primarily about the U.S. market, although I believe these trends will inevitably percolate worldwide. Active management will never disappear entirely; hope springs eternal, and most people never entirely abandon their belief in magic.

Furthermore, active management gives investors someone else to blame. If you buy an index-tracking fund that loses 30% in six months, you have no one to blame but yourself; if you buy an actively managed fund that does the same, you can tell your family or your boss or your pensioners that the fund manager “strayed from his mandate.” You get to sack him instead of being sacked yourself. Finally, at least in the U.S. (and I’m sure in many other places), institutional investors are often required to make periodic “due-diligence” visits to the asset-management firms they hire. Many such firms seem to have home offices near beautiful beaches or in historic cities that are delightful to visit. Perhaps that is some kind of coincidence, but it certainly gives their largest clients a lifelong incentive to ignore high fees and low performance.

Nevertheless, index-tracking funds will continue to grow worldwide, as they should and as they must. Research by Fama and French, among others, has shown that nearly all outperformance relative to a market index can be explained by such common dimensions of risk and return as value, size, “quality” (profitability), and momentum. These factors can be systematically packaged into a tracker fund at extraordinarily low cost. An active manager whose success has come from picking stocks one at a time that score high on one or more of these factors must charge high fees to cover the considerable research costs; a passive fund can algorithmically mimic what the active manager is doing for a fraction of the cost. In the U.S., such “factor ETFs” are available for annual fees of under 0.1%, or 10 basis points and less. Active managers charging 10 to 20 times as much are doomed to lose market share.

SN: You define ‘forecasting’ as “an attempt to predict the unknowable by measuring the irrelevant; a task that in one way or another, employs most people on Wall Street.” Let’s talk about financial journalists here, who are in the prediction mode all the time, whether it’s newspapers, television, or the Internet. What role has financial journalism to play in promoting the devilish financial jargon you have defined in your book?

JZ: The financial media can’t be dissociated from the prediction industry in general. We are all guilty of perpetrating the myth that someone, somewhere, knows what the markets are about to do. Decades ago, the psychologist Paul Andreeassen showed that people who get more frequent news updates on their investment portfolios earn lower returns than those with no access to the news at all. That doesn’t mean that financial journalism is useless: Ignorance won’t make you a better investor. But the financial media should focus investors’ attention on the elements that separate success from failure – how to be optimally diversified, how to minimize fees and taxation, how to increase one’s own self-control – rather than pretending to clairvoyance or trumpeting whichever investment has been hottest lately.

I try to write for my high-school English teacher’s wife, who tells me whenever I see her that she likes my columns even though she doesn’t understand them. My goal is eventually to write one she can understand; I think, after 20 years, I am getting closer.

SN: You’ve defined “News” as “noise; the sound of chaos.” Bombarded with such noise from all sides, how does an investor go about blocking it to be able to make sound investment decisions.

JZ: Whatever can be a matter of policy and procedure must be. You should have a checklist that you must follow before taking any action. The rules should be yours, not mine, but they must be rules, not wishes. A few possibilities:

Never buy a stock purely because its price has been going up, nor sell purely because it has been going down.

List, in writing, three detailed reasons why you are buying, in terms that – like a scientific hypothesis – can be falsified by subsequent findings.

Stipulate a price target, a time by which you expect the stock to reach that level, and an estimated probability that those forecasts are correct.

Set up, in advance, automated alerts to remind you when price changes significantly – for example, 25%, 50%, etc. At those thresholds, assess methodically whether the value of the underlying business has changed comparably.

Sign a contract with yourself, witnessed by family or friends, binding you to sell only when the value of the business, rather than the price of the stock, decays.

If that sounds like too much work, then owning individual stocks probably isn’t a good match for your temperament. Buy a passive fund instead – but don’t forget to sign a comparable contract with yourself.

SN: You recently quoted Keynes who said that courage is the key to investing. But showing courage when everyone is running for cover in a falling market is harder to do than to imagine. Given that such scenarios are playing out quite often in the current times, how does an investor build the necessary courage to combine with his/her capital when the opportunities come knocking?

JZ: Cash and courage go hand in hand, as Benjamin Graham wrote in 1932 after stocks had fallen more than 80%. Cash without courage will do you no good in a falling market, as you will be too afraid to invest it. Courage without cash is equally useless, as you can’t buy anything no matter how brave you feel if you have no money to buy it with. So husbanding some cash is the first step.

I am also great believer in what I call “financial fire drills.” Just as office-workers are periodically required to rehearse what to do if the building catches fire, investors should rehearse how they should behave if the stock market erupts in flames.

Build a watch-list of investments you would like to own at much lower prices than today’s, specifying the prices at which they will become bargains. Cultivate good mental hygiene now, before it is too late: Break bad habits like watching financial television, frequently checking the value of your brokerage accounts, or getting constant updates on the market. Go back and study your behavior during the last market crash: Did you sell? freeze? or buy more? (Don’t rely on your memory, which is likely to be illusory; consult your actual brokerage records, and be honest with yourself about what they show.) Then look at how those decisions worked out: Did your behavior rescue you from further losses, or preclude you from further gains?

Using what you learn about your past behavior, you should be able to structure rules to improve your future behavior.

SN: Your book basically mocks the outrageousness of the financial world which, in other words, is laying bare the truth of how the system works. In fact, you’ve defined “stock market” as a chaotic hive of millions of people who overpay for hope and underpay for value. Amidst all this, what advice do you have for a small, individual investor on how to safeguard his/her capital and grow his/her money?

JZ: The great investment philosopher Peter Bernstein liked to say that investors without much money should take small risks with most of their money and big risks with a little of it. Maximizing diversification should be your primary goal. If you put at least 90% of your investable assets into a small set of low-cost, widely diversified market-tracking funds, then there’s nothing wrong with trying to pick a few market-beating stocks with the rest of your money. You can’t lose much of your total wealth if you turn out to be incompetent at stock-picking, while you could enhance your wealth significantly if you turn out to be good at it. But you must be serious about it, willing to devote great amounts of time and effort and scholarship and emotional resolve. If you treat it as a game, you are certain to lose, sooner or later.

SN: How can an investor improve the quality of his/her decision making?

JZ: Study the markets. Study history. Study psychology. Above all, study yourself. Successful investing isn’t about picking the right stocks and avoiding the wrong ones. It is about making sure that you don’t let your own emotions deflect you from your strategy at the worst imaginable time. The best investors are those who think constantly about their own shortcomings and how to overcome them.

SN: What are the most important qualities an investor needs to survive the complexity of the financial markets?

JZ: Self-control. I don’t know what proportion of people who call themselves “investors” are, in fact, just speculators, but I wouldn’t be surprised if it is above 90%.

I find it remarkable that in India, the world’s wellspring of yoga, so many investors give themselves endless stress trying to chase short-term market performance.

Investing is not a 110-metre race. It is a marathon. If you want to finish the race, you shouldn’t try to go faster; you should slow down. And you need to learn how to resist investing in any asset or strategy you don’t understand.

SN: You talk about self-control. Can someone learn to have self-control or learn to behave well, if that attribute is not already ingrained in him/her? I’ve read this wonderful book called Sapiens, where the author talks about the gorging gene theory, which suggests that we carry the DNA from our ancestors of gorging on sugared or fatty food even when we have our refrigerators overstuffed with such foods. This is because our ancestors used to gorge on sugared fruits but that was purely out of scarcity and fear that if they did not eat them, the baboons would. So, with such a DNA, can we as investors really learn to behave well?

JZ: Genetics is predisposition, but it doesn’t have to be predestination. We’re all inclined to love sweet, salty, or fatty foods, but we aren’t all doomed to like them. With diligence and discipline, we can train ourselves to have higher resistance to them. And we can recognize that willpower is insufficient, in and of itself, to achieve that resistance. We must make our environment more hygienic. Think of alcoholics, for example. You might tell yourself, When someone offers me a drink, I will just say no. But, over time, you will learn that that doesn’t work, because of what psychologist George Lowenstein has called “the hot-cold empathy gap”: In a cold, or emotionally unengaged state, you will picture your future desires as much more manageable than they will, in fact, turn out to be in the heat of the moment. So eventually alcoholics learn to control their environmental hygiene: They avoid walking down the street where the tavern is, they ask their friends to tell the party host not to serve alcohol, they bring their own non-alcoholic beverages with them when they travel. All of those behaviors are intended to keep dangerous emotional cues at bay.

By the same token, investors need to avoid the cues that can trigger self-defeating behaviors. Use checklists and watchlists to prevent impulse from determining your behavior. Remove any trading apps from your smartphone. Don’t bookmark any websites that encourage you to update your account values in real time. Build a spreadsheet of all your holdings that you refresh only once every calendar quarter. Change the password on your brokerage account to a personalized variant of IWILLTRADEONLYWHENABSOLUTELYNECESSARY; there is evidence from psychological research that frequent subliminal repetition of such a message can change your behavior.

You should be under no delusion that these techniques will eliminate your genetic frailties. But they can help you exert at least some control over them.

SN: Are successful investors born, or made?

JZ: Both, of course. A great deal of investing success comes from temperament, which is (largely) inborn. But every good investor I’ve ever met is a learning machine – someone who eats information ravenously and who is obsessed not by how much he already knows but by how much he has yet to learn.