#Home Loan in los angeles

Explore tagged Tumblr posts

Text

#Mortgage Lending in Los Angeles#Los Angeles Loan Service#Mortgage Lender in Los Angeles#mortgage broker#Fixed Rate Mortgage los angeles#Refinance my home#Buy a House#Mortgage Loan in los angeles#30 Year Fixed Rate Mortgage#Home Loan in los angeles#Adjustable Rate Mortgage#Loan Service in los angeles#mortgage lender near me in los angeles#Mortgage Lending near me Los Angeles#Loan Service#Mortgage Lender#Fixed Rate Mortgage#Home Loan near me in los angeles#Home Loan#Mortgage Loan

0 notes

Text

Funding Solutions: Navigating the Financial Maze

Introduction

In the world of business, capital is the fuel that keeps the engine running. Whether you're a budding entrepreneur with a revolutionary idea or an established company looking to expand, securing the right Funding Solutions is vital. This article will guide you through the intricate web of funding options and provide insights to help you make informed decisions.

Traditional Funding Options

Bank Loans

Traditional bank loans have long been a go-to choice for many businesses. They provide reasonable interest rates and well-designed payback schedules. However, the approval process can be daunting, and collateral may be required.

Angel Investors

High-net-worth people known as angel investors contribute funds in return for stock. They often bring valuable expertise and connections to the table, making them an attractive option for startups.

Venture Capital

Venture capitalists are firms or individuals who invest in high-potential, high-risk businesses. They typically seek a significant equity share and expect rapid growth in return.

Small Business Grants

Government and private organizations offer grants to support specific industries and initiatives. These grants don't require repayment, but competition can be fierce.

Modern Alternatives

Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise funds from a large number of individuals. In exchange, backers often receive early access or special perks.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual lenders. These loans can be easier to secure and offer competitive interest rates.

Bootstrapping

Bootstrapping is a strategy where businesses use their own resources to fund operations. It provides full control but can limit growth potential.

Government Assistance Programs

Numerous government programs offer financial support to businesses, including tax incentives, low-interest loans, and grants. Investigating these options can yield substantial benefits.

Strategic Partnerships

Collaborating with established companies can provide access to their resources and networks. These partnerships can take various forms, from joint ventures to licensing agreements.

The Art of Pitching

Regardless of the funding source, a compelling pitch is crucial. It should clearly outline your business idea, its potential, and how the investor will benefit.

The Rise of Fintech

Financial technology, or fintech, has opened up new avenues for funding. Peer-to-peer lending platforms, mobile banking, and digital payment solutions offer flexibility and convenience.

Exploring Cryptocurrency

Cryptocurrency has gained traction as an alternative funding source. Initial Coin Offerings (ICOs) and blockchain technology have opened up new opportunities for entrepreneurs.

Building a Solid Financial Strategy

Creating a comprehensive financial strategy is essential. It should encompass budgeting, cash flow management, and contingency planning to ensure financial stability.

Challenges and Pitfalls

Funding is not without its challenges. High competition, stringent requirements, and financial risks are hurdles that every entrepreneur must overcome.

Success Stories

Learning from the successes of businesses that secured innovative funding can inspire and guide aspiring entrepreneurs.

Conclusion

In the vast landscape of Funding Solutions navigating the financial maze can be challenging but rewarding. Understanding your options, crafting a compelling pitch, and choosing the right funding solution can set you on the path to business success.

FAQ

What is the best funding solution for a startup?

The best funding solution for a startup depends on various factors, including the industry, growth potential, and the entrepreneur's goals. Explore traditional options like bank loans or consider modern alternatives like crowdfunding or peer-to-peer lending.

How can I prepare a winning pitch for investors?

To prepare a winning pitch, clearly communicate your business idea, its viability, and how the investor will benefit. Use data and storytelling to make your pitch compelling and memorable.

What is the role of fintech in modern funding solutions?

Fintech plays a significant role by providing digital solutions for fundraising, lending, and payment processing. It offers convenience, accessibility, and flexibility in the funding landscape.

Are government grants a reliable funding source for businesses?

Government grants can be a reliable funding source, but they often come with specific requirements and competition. Research and tailor your applications to increase your chances of success.

How do I navigate the challenges of securing funding?

Navigating funding challenges requires persistence and adaptability. Seek mentorship, improve your pitch, and consider a mix of funding sources to increase your chances of success.

#business loan#finacial loan#small business#welcome home#artists on tumblr#michael cera#usa#star wars#yellowjackets#loans#personal loan#home loan#financial planning#banking#california#los angeles#michigan#chicago#south carolina#virginia#utah

0 notes

Text

Empowering Commercial Ventures: Real Estate Loans in Orange County

Unlock growth with Commercial Real Estate Loans in Orange County. Our financial solutions empower businesses to acquire, develop, or refinance commercial properties. Trust our expertise in tailoring loans to your project's needs, ensuring favorable terms and flexible repayment options. With a commitment to supporting your ambitions, we offer reliable solutions that align with your business goals. Experience the advantage of securing your commercial real estate dreams with our exceptional services.

#private money lender orange county#private money lenders for real estate#home construction loans#fastfinancing#hard money loans san diego#hard money lenders orange county#orangecounty#best mortgage lenders los angeles#loansolutions#mortgage brokers orange county#commercial real estate loan

0 notes

Note

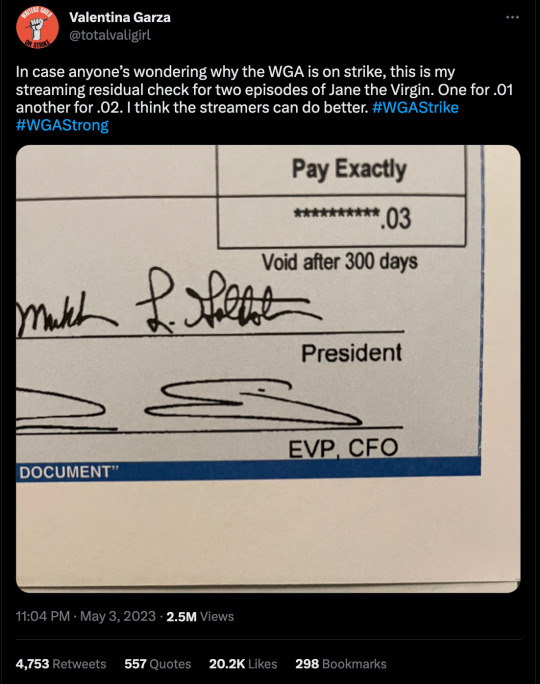

I'm totally in support of the writers in theory but I'm trying to understand more of what you're fighting for because I've seen some people on twitter claim writers make more money a week than most of us make in a month so I'm trying to understand what the issue is. Also if that info is accurate. This is a genuine question. Not trying to have a "gotcha moment". I really want to hear from a writer.

people have always had wild misconceptions about how much a writer earns because of their lack of understanding of how the industry actually works. there's so many posts about how "you guys make 5k a week. what more do you want?!" yeah...let's do some math on that.

5k a week for 14 weeks (and that's a long room. a lot of rooms these days are 8-10 weeks. those are the dreaded mini-rooms we're trying to kill) is $70,000. for roughly three months of work. you'd think we're cooking with gas...BUT HOLD UP. that's gross! let's see everything that has to come out of that check:

10% to our agent

10% to our manager

5% to our entertainment attorney

5% to our business manager (not everyone has one but a lot of us do. i do, so that's literally 30% immediately off the top of every check)

most of these breakdowns ive seen downplay taxes severely. someone made one that says writers pay 5% in taxes and i would like to ask them "in what universe?". that doesn't even cover state taxes. the way taxes work in the industry is really complicated, but the short of it is most of us have companies for tax reasons so we aren't taxed like people on w2s/1099. if we did we'd be even more fucked. basically every production hires a writer's company instead of the writer as an individual. so they engage our companies for our services and then at the end of the year we (the company) pay taxes as corporations or llcs (depending on what the writer chose to go with). my company is registered as a "corporation" so let's go with those rates. california's corporate rate is 9% and the federal corporate tax rate is 21%. there's other expenses with running a business like fees and other shit so my business managers/accountants/bookkeepers have recommended i save between 35-40% of everything i make for when tax season comes.

you see where the math is at already??? 25-30% in commissions and then 35-40% in taxes. on the lower end you're at THE VERY LEAST looking at 60% of that check gone. 70% worst case scenario. suddenly those $70,000 people claim we make are actually down to $28,000 as the take home pay. and that's if you're only losing 60%. it goes down to $21,000 if it's 70%.

lets pretend you worked a long 14 week room (that's the longest room ive ever worked btw) and let's also be generous and say you only have 60% in expenses so the take home is $28,000. average rent in los angeles is around $2,800-$3,000. if you're paying $2,800 in rent that means you need AT LEAST $4,000 a month to have a semi decent life since you need to also cover groceries, gas, medical expenses, toiletries, phone, internet, utilities, rental and car insurances, car payments, student loan payments, etc etc etc. and again, this is los angeles. everything is more expensive so you're living BARE BONES on 4k. and these are numbers as a single person. im not even taking having children into account. so those $28,000 you take home might cover your life for 6-7 months. 3 of which you're in the room working. the reality is that once that room ends, you might not work in a room again for 6-9-12 months (i have friends whose last jobs were over 18 months ago) and you now only have about 3 months left of savings to hold you over. we have to make that money stretch while we do all the endless free development we do for studios and until we get our next paying job. so...3 months left of enough money to cover your expenses -> possible 9 months of not having a job. this is how writers end up on food stamps or applying to work at target.

this is why we're fighting for better rates and better residuals. residuals were a thing writers used to rely on to get them through the unemployment periods. residual checks have gone down from 20k to $0.03 cents. im not joking.

they've decimated our regular pay and then destroyed residuals. we have nothing left. so don't believe it when they tell you writers are being greedy. writers are simply fighting to be able to make a middle class living. we're not asking them to become poor for our sake. we're asking for raises that amount to 2% of their profit. TWO PERCENT. this is a fight for writing even being a career in five years instead of something you do on the side while you work retail to pay your bills. if you think shows are bad now imagine when your writer has to do it as a hobby because they need a real job to pay their bills and support a family. (which none of us can currently afford to have btw)

support writers. stop being bootlickers for billion dollar corporations. stop caring about fictional people more than you care about the real people that write them. if we don't win this fight it truly is game over. the industry as you know it is gone.

7K notes

·

View notes

Text

Wow! 👏👏👏 JDEadonWriter on X, put this amazing post out today. Check this out!

Are Meghan Markle's kids FAKE? 🤔

Megnant

1 Size: Bump drastically altering in size, even in a single day 😯

2 Slip: Bump slipped down to her knees in Birkenhead, UK 😯

3 Wobble: Bump wobbled side-to-side as she crossed the street. 😯

4 Clutching: Supporting her bump with her hands overly often. 🤔

5 Popping: audibly popped in a video, and wafted her clothes😯

6 Shape: Bump unnaturally shaped on Netflix🤔

7 Straps: Moonbump straps outlines visible under clothing in several photos. And something snapped, impacting the clothing fabric (video of H&M in London)😯

8 Biology: An absence of swelling of ankles, and other subtle biological (non)signs.🤔

9 Holding: Carrying a (doll?) infant on her bump, instead of on her hip.🤔

10 Squats: Squatting, effortlessly, with her knees together in videos and photos. In heels.😯

Births

11 Announcements: Royal official birth announcements are indirect. One states they are delighted "by the news of the" (not by the actual) birth.🤔

12 Coverup? A medic who certified a birth closed down her practice shortly afterwards.😯

13 Certificates: Questions linger over the birth certificates signatures, etc.🤔

14 Leak: An official Royal twitter account tweet indicated that Meghan’s kids are fake, before being taken down. An innocent prank?😁

15 Recovery: Epidural (ouch!) birth in a bath description anomalies and arriving home too soon afterwards to be quite plausible.🤔

16 Born Of Body?: Meghan allegedly told a friend she was infertile, when at college, and there was a reported alleged hysterectomy before the births.

17 Silence: Meghan is silent on her claimed births, despite always flashing her bump; having a "Capacity for over sharing"; boasting about being a “Mom”, and always talking about herself (apparently) on her feminist podcast. 🤔

Rented Infants

18 Archie Model: The real parents of the infant predominantly shown in Archie photos are identified. 💥

19 Lilibet Model: Parents of the infant shown in Lilibet photos are identified.💥

20 Loan: Mother of “Lilibet” commented on Insta that she does not "loan" her daughter to Meghan any longer.😯

21 Shape-Shifting: Different infants used in photos of both Archie and Lilibet.😯

22 Photoshopping: A litany of incompetently-photoshopped “family” photos. (A huge topic in itself).🤔

Dolls

23 Reborn Doll: Seemingly cradling a doll (a product called Darren) in official photo of Archie 🪆

24 Party Doll: Meghan seemingly cradled a similar doll when gate-crashing a polo match party, begetting astonished looks.😯

25 Bumpy Ride: Meghan seemed to be lugging an inanimate doll on top of her bump through some woods in Canada. Whilst grinning at a hired pap.🪆

26 Twisted: In one photograph, Archie's head is twisted more than 90 degrees 🪆

27 Carrying: A high % of photographs show them carrying the “kids” 🪆

28 Backs-Turned: A high % of Photos are of kids facing away from the camera 🤔

Other Oddities

29 Website: A startling absence of updates of Royal website on Meghan’s offspring.🤔

30 Bishop: Los Angeles christening cleric was not the official Bishop the Harkles claimed he was.🤔

31 Implausible Platitudes: Claiming Archie’s first word was “Crocodile”, and that he demands a Leica camera for his birthday. As tots do...🤔

32 Merch: An uncharacteristic unwillingness to merchandise their kids, for $$$ or PR.🤔

33 Invisible: The Harkles are never seen with their kids. There are hints of "home schooling" (will they ever be allowed out?)😯

34 Family Holidays: Weirdly, the Harkles never take their kids on holiday, and, if they pretend they did, they incompetently photoshop them into pap snaps on Insta.🤔

35 Everything Else: All the stuff I overlooked in this hastily speed-typed list.🤔

🤔🤔🤔

Why does it matter? 🤔

Because rich Prince Harry wants we skint, long-suffering tax payers, to pay for his security expenses; he’s a traitor, and, well, it’s fraud, isn’t it? 💥

Feel free to leave evidence I missed out in the comments. 👍

#MeghanMarkleIsAGrifter

#MeghanMarkleExposed

#WhereAreTheKids

#sussexbabyscam

#fraud#move along meghan#meghan markle lies#meghan and harry#megxit#youtube#lilibet#spare me#fucking grifters#grifters gonna grift#worldwide privacy tour

189 notes

·

View notes

Text

Intuit: “Our fraud fights racism”

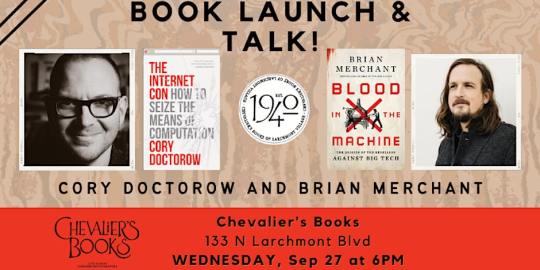

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

youtube

Hello all,

I am posting on behalf of the wolf and wolfdog sanctuary, Apex Protection Project. The work we do there is important for our current residents and we advocate for their wild counterparts. I’ve only been volunteering for about two months now and it is fulfilling work getting to know and bond with these animals.

I am writing to you now to ask for assistance. Apex has found a forever home but is still in need of assistance towards its purchase. For information, I am quoting the e-mail I received so you can hear it in Paula's (co-founder) own words under the read more.

Even if you cannot donate at this time, please tell others. It would mean the world to me and the rest of us to be able to secure this property. For additional information, please feel free to contact me or Apex.

Thank you for your time.

When epic YouTubers Yes Theory first visited us, we were on a two and a half acre rental property with a pack of 16 rescued wolves and wolfdogs. They're visit changed our lives, sharing our mission with the world and helping our community grow. Since then, we've added more members to the pack, saved many more lives, and even visited Washington D.C. to advocate for wolves in the wild and you've been here supporting us, believing in us, and helping us achieve our mission... Since then, we've been searching for a property Apex can call home that will allow us to continue growing and saving more lives and we've finally found the PERFECT Forever Home! - but it's not ours yet. We are in the process of raising enough finances to secure a down payment. Will you help us? By making a donation toward this new home for Apex, you are literally becoming an active part of a very important and major step in Apex's growth and success. We are so lucky and incredibly grateful to have such a supportive global community! You the real deal and when we come together, anything is possible. You have been here for us when we've needed you and now, we need you more than ever. A property like this doesn't come along often and may not be available very long. Matter of fact, we've found that there is another interested buyer so we are doing whatever we can as quickly as possible to have a fair shot at getting it. Let us share what's possible...

Imagine... A 60-acre ranch and permitted wild animal sanctuary nestled in the mountains only an hour and a half north of Los Angeles. The beauty of this property is that it comes with all of the amenities we need: perimeter fencing, two sprawling compounds with large enclosures as well as ample fencing and materials to build and expand - buildings that would serve as an on-site medical center, offices, and isolation areas for sick or injured animals to heal - and acres of forest, fields, and a stream for the pack to run and play - where the wolves will enjoy a cooler climate year round. There's a house for Steve and me to live on the property as well as a caretaker's house for our Pack Care Manager Bette so we can care for the pack 24/7. A small guest house and an event center for programs and presentations. There's unlimited possibilities including nature retreats, school field trips, our ongoing educational experiences and programing, and camping under the stars while listening to the pack howl. Our pack will have the security of a forever home and we will have the ability to grow, save more lives, and increase our efficacy in our fight to save wolves in the wild for decades to come. This is all possible with YOUR help! Please join us in making this dream a reality! DONATE NOW! Don't let this once-in-a-lifetime opportunity pass us by. Time is of the essence!

For more information on making a significant donation, donating stocks, providing a personal loan, and the tax benefits, please contact us at [email protected] as soon as possible.

11 notes

·

View notes

Note

So as we know Bakugou knows English a lot better than his peers right? So they'd send him to the UK with Shoto, Izuku, or Kirishima right? Just to kinda make sure they don't get lost or whatever. Cause even though they've been graduated form UA for a decade those three still can't get English down.

They're on a late night patrol as they're on loan for an agency there in order to hell with some mission or something.

Anyway here's you stumblin out of spoons quite drunk from your good night out, running right into a wall of muscle. Recognizing Bakugou right away and immediately going into your posh accent and brit slang.

Talking absolute filth to him, thanks to your many pints and shots, you've got insane confidence (and you run the biggest fan account on Twitter).

Bakugou has been to New York and Los Angeles and even some southern cities with thick accents but it's more than your slang or accent, he can't hear a single word you're fuckin saying because of how pretty you are.

Nevermind his ears getting a little pink because of how flustered your tone and the devilish look in your eye. How your hand rests on his pec clad under his skin tight hero costume. Got him so flustered that he's mumbling in Japanese about his fuckin pretty you are 👀

(This is bakujo btw hehe)

Kitten omg I’m gonna sob😭 even though he’s def the best at English he probably still can’t understand my accent when I’m talking a mile a minute straight out of the pub.

Kiri is probably asking him in Japanese what the fuck I’m saying, and he’s just trying to hold me upright😭 and then when I tell him I’m getting the tube home he’s worried because how the fuck am I getting home alone like this? And I gotta tell him I’m gonna be fine, and not to worry but he’s insisting on making sure I get home okay🥺

But the alcohol might make me brave enough to ask for his number, and maybe he’ll be shocked enough to give it to me. And we meet up the next morning for coffee ahhhh. And he teases me for it so much because I was so drunk and the only things he could understand me saying was that I wanna fuck him😭😂

58 notes

·

View notes

Text

MOVING AID REQUEST

Hi all <3 Britt here again! I'm really hoping this part of my life is over soon, but I'm in the home stretch. As you may know, I am being displaced from my current house and life due to an inability to find extraneous work during the writers and actors strike that has put a halt to the profession I studied and have been working in consistently for the past 4 years. At the moment I am looking for funds to aid in my move from Los Angeles back to my parents house in New York where I'll be free of my rent expenses and hopefully get my feet back under me. I am looking for general funds to aid in shipping some of my possessions back home, to fix my car for the drive (oil change, tire change), my student loan payments, and to pay various lingering expenses I have with my current apartment such as my power bill. Anything anyone has available to help would be so greatly appreciated. It's a difficult time and I'm just trying to make the best of it! I really appreciate all the help that people have given me so far and I feel so grateful to be a part of this community. So much love to you all <3

PAYPAL

VENMO

scrungly george for your troubles <3

#mutual aid#community aid#aid request#writers strike#sag aftra#wga#wga solidarity#sag aftra strike#iatse#fundraising#op

71 notes

·

View notes

Text

Mortgage Lending in Los Angeles

Welcome to Mortgage Dove lender service. We are a trusted American mortgage lender company. We are a quality mortgage lender in Los Angeles, California. Our goal at Mortgage Dove is to make it as easy as possible for every American to own a home without having to go through a complicated process on their own. We envision the home buying process to be a smooth transaction for people from different walks of life whether through online or physical mortgage lender experience to meet the needs of our clients. We are dedicated to promoting homeownership for everyone, regardless of their status under applicable law, including those who have exercised their right under the Consumer Credit Protection Act in good faith.

#Mortgage Lending in Los Angeles#Los Angeles Loan Service#Mortgage Lender in Los Angeles#mortgage broker#Fixed Rate Mortgage los angeles#Refinance my home#Buy a House#Mortgage Loan in los angeles#30 Year Fixed Rate Mortgage#Home Loan in los angeles#Adjustable Rate Mortgage#Loan Service in los angeles#mortgage lender near me in los angeles#Mortgage Lending near me Los Angeles#Loan Service#Mortgage Lender#Fixed Rate Mortgage#Home Loan near me in los angeles#Home Loan#Mortgage Loan

1 note

·

View note

Text

❝ there's a person that you must be, just trust me ❞

Age: 31

Gender & Pronouns: cis female & she/her

Neighborhood: Deer Park

Occupation: chef and owner of Tres Amigos

Positive traits: passionate, selfless, & dedicated

Negative traits: indecisive, hot-tempered, & cynical

Length of time in Blue Harbor: local

Faceclaim: Prscilla Quintana

smirking eyes that hold one too many secrets, a history of survival shining from dark eyes, postcards pinned to the wall from far away places, a record player spinning an extensive vinyl collection, empty wine bottles by the bathtub

death tw, parkinson's disease tw

Born and raised in Blue Harbor, Illinois meant that Antonella Ibarra was far removed from the places she wanted to be and the person she dreamed of being one day. The small town just wasn't where big life happened, at least in her opinion, no matter how short the drive may have been to bigger, thriving cities. So, Nell grew up a dreamer and little by little the older she got the more she saw each dream die off.

When she was 11 years old her mother passed away suddenly, the death was a mystery of what caused it but at least she went peacefully in her sleep, and that left Nell and her father all on their lonesome. He'd been out of work for some time by then, a back injury from a hard labor job, and tough times got even tougher when the family of two tried to live on a singular income. Nell's father received disability but it barely covered the bills. There was some help from family here and there when they could give a little but her father never liked being a burden and pride often got in the way of asking for assistance. For some time he tried to go back to work, taking on whatever jobs he could that wouldn’t completely destroy his weak back, in the end it was up to the young Nell to take care of them. The worry of keeping a roof over their heads and food in their stomachs, Nell had to take up a job at 13 years of age. She worked in a kitchen, just doing dishes and cleaning up after customers at the end of the day. It was tough but the tips the waitresses made were often shared with her. Which helped when it came to her father needing a home nurse to visit a few times a week.

As a teenager her distractions were boys and girls. Dating was fun and she felt carefree, it was an escape from the troubles of her day to day life. Especially when her father's health took an even further decline as Parkinson's began to set in. Oftentimes she would pretend to be someone else, lie to those she was seeing about her life and where she came from, it was the ultimate escape. Especially when being that poor meant Nell either had to bring leftovers home from the diner she worked at or make magic happen with the little groceries she could afford to buy. Thankfully the cooks at the diner showed her tricks and gave her tips over the years that propelled her into the career she possesses now as an adult.

It was a selfish move but for a couple of years Nell put her father into a nursing home and rented out their house so that she could attend culinary school. The promise was that she would come back and make everything right again. It was obvious to her that a big risk could eventually offer up great rewards, so with a heavy heart and shoulders heavily weighed with guilt she went to Los Angeles for culinary school. There were even two trips abroad, one to Italy and another to Spain, but Nell kept her word even if it was heartbreaking to leave Los Angeles and the thrill of those two years behind. With culinary school and experience under her belt she took the position of chef at a popular downtown restaurant. Years of success and good reviews took her career even further and just a few of years ago Nell accepted the position of head chef at one of Chicago’s finest establishments.

With some money saved and a loan from the bank Nell bought out the owners of Tres Amigos with a promise to keep it authentic while taking the casual restaurant to new heights. The big dreams she’d had as a child still waved somewhere in the back of her mind begging for attention, and with her father living back in his home and under her care, she’s pushing through the struggle to make those aspirations as much of a reality as possible. The hardest thing was leaving behind the top job at one of Chicago’s finest to make something of her own, but Nell wanted nothing more than to work with traditional Mexican cuisine and expand upon it. A touch into her roots and the things her mother and family had taught her would finally come to light and shine.

Nothing else in her life may go right but Nell Ibarra sure can cook.

potential connections:

ride or die — this person has been there through it all and likely from the beginning. nell and this person support and lean on each other through the highs and lows. they're platonically married and have often joked about actually marrying each other if they're both single at 40.

la friends — for 2 years nell was in los angeles for culinary school and definitely went out on the town and further south to mexico to live it up and enjoy herself. anyone that was there during this time that she could've had a good time with will always be memorable for nell.

frequent customers — maybe they just know each other from how often they come into tres amigos. or maybe they're familiar with nell's cooking from that big restaurant she used to be chef at in chicago?

the ex — for practically the last decade these two have been off and on. nell doesn't know how to do love and relationships properly, especially with so much of her life feeling out of her control. i imagine he has plenty going on in his own life as well, but they care for each other, probably really love each other, even if they come and go a lot in each other's lives. he helps out with her dad and nell doesn't really know how to live without him. i have a lot of fun headcanons!

ex-girlfriend — in my head (and heart) they were good friends in high school and maybe were flirtly never quite fully platonic with each other that entire time. when she came back from la and in the midst of life being super complicated for nell their hooking up only started off as a fun thing and a distraction, but feelings came up and that's when nell cut it off. i have lots of headcanons!

also down for the usuals! neighbors, childhood friends, friends from chicago, anyone involved in the culinary industry, one night stands, flings, bad dates, etc.

6 notes

·

View notes

Text

Eleanor Coppola

Chronicler of the making of her husband’s Apocalypse Now whose footage and recordings were the basis for a documentary and book

In March 1976, Eleanor Coppola arrived in the Philippines, her three young children in tow, to film behind-the-scenes footage on the set of her husband Francis Ford Coppola’s new movie Apocalypse Now, which transposed the plot of Joseph Conrad’s 1899 novella Heart of Darkness to late-1960s Vietnam.

No one could have known then that production on this war epic would stretch on for more than a year, delayed by catastrophic weather, medical emergencies, military conflict, an incomplete script and plain old creative differences, making it one of the most infamously turbulent shoots in cinema history. As it rumbled on, newspaper headlines plaintively asked: “Apocalypse When?”

Principal photography added up to a staggering 238 days in total. Eleanor, who has died aged 87, was there for every one of them. As well as documenting the chaos as it unfolded, she secretly recorded conversations with Francis for the purposes of her diary.

He can be heard confiding gravely: “The film will not be good … This film is a $20m disaster. Why won’t anyone believe me? I’m thinking of shooting myself … This is one crisis I can’t pull myself out of.” He nicknamed the project “The Idiodyssey”.

The material Eleanor gathered – amounting to 60 hours of film and 40 hours of audio – was put into storage after squabbles over the point of view that her film (originally shot for promotional purposes) should take. Fax Bahr and George Hickenlooper’s documentary Hearts of Darkness: A Filmmaker’s Apocalypse (1991) later drew heavily on her extraordinary footage and tape recordings. Highlights included Francis frantically typing new scenes moments before shooting; arguing with Dennis Hopper, who had not learned his lines; and conferring at length with Marlon Brando, who arrived on set hugely overweight, not having read Heart of Darkness and seemingly intent on dragging his heels in the hope of reaping multimillion-dollar overtime bonuses.

Hearts of Darkness showed belatedly that Eleanor was not merely an observer on set, but also a facilitator. It was she, for instance, who convinced Francis to watch the sacrificial culling of a carabao, a water buffalo, by the Ifugao tribespeople, a gruesome spectacle that he eventually incorporated into his film’s climax.

The documentary was also narrated by Eleanor, incorporating parts of her book Notes on the Making of Apocalypse Now (1979; updated in 1995). She is heard reflecting that “it’s scary to watch someone you love go into the centre of himself and confront his fears – fear of failure, fear of death, fear of going insane. You have to fail a little, die a little, go insane a little, to come out the other side.”

She was invested in Apocalypse Now in more ways than one: Francis had put up their home as collateral. A fortnight into production, he sacked his lead actor, Harvey Keitel, replacing him with Martin Sheen, who later suffered a near-fatal heart attack.

Actors would turn up to set with no idea what they were shooting; the phrase “scenes unknown” was a regular fixture on the daily call-sheets. Helicopters loaned to the production by Ferdinand Marcos, the country’s strongman president, were abruptly recalled for his war on communism. During a typhoon that destroyed sets and halted filming, Francis cooked pasta and played Puccini’s La Bohème at high volume.

He took what Eleanor later called “an Italian approach” to life: “Very theatrical, throwing stuff up in the air and screaming.” Through it all, she was undaunted, even sanguine, no matter how high the stakes. “What’s the worst that can happen?” she asks in Hearts of Darkness, looking back on the mounting threats to the family’s home and finances. “They take away your big house, they take away your car, so what? … I really wasn’t frightened by it.”

Born in Los Angeles, California, she was raised in Huntington Beach by her mother, Delphine (nee Lougheed); her father, Clifford Neil, a political cartoonist for the Los Angeles Examiner, died when Eleanor was 10. She was educated at Huntington Beach high school, and graduated from UCLA in 1959 with a degree in applied design, going on to do freelance work at architectural installations.

Eleanor and Francis met in Ireland in 1962 on the set of the Roger Corman-produced horror film Dementia 13, which Francis directed; Eleanor was the assistant art director. They married a year later and had three children: Gian-Carlo, who died in a speedboat accident in 1986 at the age of 22; and Roman and Sofia, who both became film-makers.

In 1971, Francis rushed from the set of The Godfather to film Eleanor giving birth to Sofia. Eleanor later used the footage as part of an art installation. She also created an artwork in response to Gian-Carlo’s death, Circle of Memory, a chamber of straw bales that she installed in several sites over the years.

Even after the children were born, it was rare for the family not to leave its Napa Valley estate (which the Coppolas had bought after the success in 1972 of The Godfather) to accompany Francis wherever he happened to be working. After the Philippines, Eleanor and the children moved to Los Angeles to be with him during production on his musical One from the Heart (1982). They then decamped to Tulsa, Oklahoma, while he directed his back-to-back teen movies The Outsiders and Rumble Fish (both 1983). On the set of The Godfather Part III (1990), Eleanor recalled how Francis claimed to “[hate] the process of making movies … he talked about his family and complained about me. I sat there while he ran it all out, not agreeing, and not yielding to the temptation to give my point of view. I just tried to be present and listen.”

Nevertheless, Eleanor confessed in her 2008 memoir Notes on a Life that she sometimes regretted not having pursued fully her own artistic ambitions. In 2023, she told the New Yorker that Francis “made it very clear that my role was to be the wife and mother”.

The Coppolas’ wine and hotel businesses occupied some of her time in later life. She also returned to textiles, one of her great passions, as well as designing costumes for the dance company ODC San Francisco.

She directed two narrative films – Paris Can Wait (2016), starring Diane Lane and Alec Baldwin, and Love is Love is Love (2020), with Rosanna Arquette and Cybill Shepherd – and filmed documentary footage on the set of some of Sofia’s movies, including the irreverent costume drama Marie Antoinette (2006). Sofia dedicated her most recent film, Priscilla (2023), to her mother.

Eleanor is survived by Francis, Roman and Sofia, six grandchildren, Gia, Romy, Cosima, Alessandro, Marcello and Pascal, and a brother, William.

🔔 Eleanor Jessie Coppola, writer and film-maker, born 4 May 1936; died 12 April 2024

Daily inspiration. Discover more photos at Just for Books…?

9 notes

·

View notes

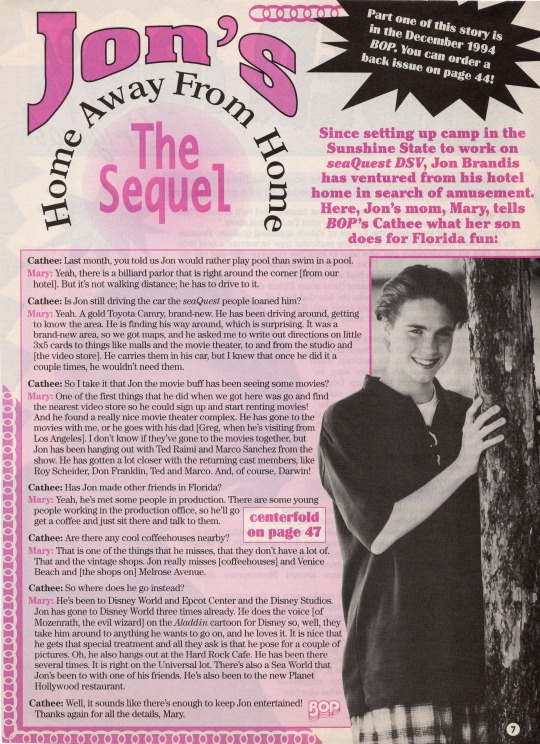

Text

jon's home away from home, the sequel since setting up camp in the sunshine state to work on seaquest dsv, jon brandis has ventured from his hotel home in search of amusement. here, jon’s mom, mary, tells bop’s cathee what her son does for florida fun:

cathee: last month, you told us jon would rather play pool than swim in a pool. mary: yeah, there is a billiard parlor that is right around the corner [from our hotel]. but it's not walking distance; he has to drive to it.

cathee: is jon still driving the car the seaquest people loaned him?mary: yeah. a gold toyota camry, brand-new. he has been driving around, getting to know the area. he is finding his way around, which is surprising. it was a brand-new area, so we got maps, and he asked me to write out directions on little 3x5 cards to things like malls and the movie theater, to and from the studio and [the video store]. he carries them in his car, but i knew that once he did it a couple times, he wouldn't need them.

cathee: so i take it that jon the movie buff has been seeing some movies? mary: one of the first things that he did when we got here was go and find the nearest video store so he could sign up and start renting movies! and he found a really nice movie theater complex. he has gone to the movies with me, or he goes with his dad [greg, when he's visiting from los angeles]. i don't know if they've gone to the movies together, but jon has been hanging out with ted raimi and marco sanchez from the show. he has gotten a lot closer with the returning cast members, like roy scheider, don franklin, ted and marco. and, of course, darwin!

cathee: has jon made other friends in florida? mary: yeah, he's met some people in production. there are some young people working in the production office, so he'll go get a coffee and just sit there and talk to them.

cathee: are there any cool coffeehouses nearby? mary: that is one of the things that he misses, that they don't have a lot of. that and the vintage shops. jon really misses [coffeehouses] and venice beach and the shops on] melrose avenue.

cathee: so where does he go instead? mary: he's been to disney world and epcot center and the disney studios. jon has gone to disney world three times already. he does the voice [of mozenrath, the evil wizard] on the aladdin cartoon for disney so, well, they take him around to anything he wants to go on, and he loves it. it is nice that he gets that special treatment and all they ask is that he pose for a couple of pictures. oh, he also hangs out at the hard rock cafe. he has been there several times. it is right on the universal lot. there's also a sea world that jon's been to with one of his friends. he's also been to the new planet hollywood restaurant.

cathee: well, it sounds like there's enough to keep jon entertained! thanks again for all the details, mary.

#jonathan brandis#bop magazine#1994#articles#interviews#mary brandis#seaquest dsv#disney's aladdin#aladdin the series#mozenrath#disney world#epcot center#disney studios#universal studios#90s#teen magazine#fan magazine#magazine scans#jonathanbrandisarchive

6 notes

·

View notes

Text

This story originally appeared on Grist and is part of the Climate Desk collaboration.

On a 20-acre parcel outside the tiny Southern California town of New Cuyama, a 1.5-megawatt solar farm uses the sun’s rays to slowly charge nearly 600 batteries in nearby cabinets. At night, when energy demand rises, that electricity is sent to the grid to power homes with clean energy.

To make renewable energy from intermittent sources like solar and wind available when it is most needed, it’s becoming more common to use batteries to store the power as it’s generated and transmit it later. But one thing about the Cuyama facility, which began operations this month, is less common: The batteries sending energy to the grid once powered electric vehicles.

The SEPV Cuyama facility, located about two hours northeast of Santa Barbara, is the second hybrid storage facility opened by B2U Storage Solutions. Its first facility, just outside Los Angeles, uses 1,300 retired batteries from Honda Clarity and Nissan Leaf EVs to store 28 megawatt-hours of power, enough to power about 9,500 homes.

The facilities are meant to prove the feasibility of giving EV batteries a second life as stationary storage before they are recycled. Doing so could increase the sustainability of the technology’s supply chain and reduce the need to mine critical minerals, while providing a cheaper way of building out grid-scale storage.

“This is what’s needed at massive scale,” said Freeman Hall, CEO of the Los Angeles-based large-scale storage system company.

Electric vehicle batteries are typically replaced when they reach 70 to 80 percent of their capacity, largely because the range they provide at that point begins to dwindle. Almost all of the critical materials inside them, including lithium, nickel, and cobalt, are reusable. A growing domestic recycling industry, supported by billions of dollars in loans from the Energy Department and incentives in the Inflation Reduction Act, is being built to prepare for what will one day be tens of millions of retired EV battery packs.

Before they are disassembled, however, studies show that around three-quarters of decommissioned packs are suitable for a second life as stationary storage. (Some packs may not have enough life left in them, are too damaged from a collision, or are otherwise faulty.)

“We were seeing the first generation of EVs end their time on the road, and 70 percent or more of those batteries have very strong residual value,” said Hall. “That should be utilized before all those batteries are recycled, and we’re just deferring recycling by three, four, or five years.”

Extending the useful life of EV batteries mitigates the impact of manufacturing them, said Maria Chavez, energy analyst at the Union of Concerned Scientists.

“The whole point of trying to deploy electric vehicles is to reduce emissions and reduce the negative impacts of things like manufacturing and extractive processes on our environment and our communities,” Chavez told Grist. “By extending the life of a battery, we reduce the need for further exploitation of our natural resources, we reduce the demand for raw materials, and we generally encourage a more sustainable process.”

Just as batteries have become crucial to reducing emissions from transportation, they’re also needed to fully realize the benefits of clean energy. Without stationary storage, wind and solar power can only feed the grid when the wind is blowing or the sun is shining.

“Being able to store it and use it when it’s most needed is a really important way to meet our energy needs,” Chavez said.

The use of utility-scale battery storage is expected to skyrocket, from 1.5 gigawatts of capacity in 2020 to 30 gigawatts by 2025. EV packs could provide a stockpile for that buildout. Hall said there are already at least 3 gigawatt-hours of decommissioned EV packs sitting around in the United States that could be deployed, and that the volume of them being removed from cars is doubling every two years.

“We’re going from a trickle when we started four years ago to a flood of batteries that are coming,” he said.

B2U says its technology allows batteries to be repurposed in a nearly “plug-and-play fashion.” They do not need to be disassembled, and units from multiple manufacturers—B2U has tested batteries from Honda, Nissan, Tesla, GM, and Ford—can be used in one system.

The packs are stored in large cabinets and managed with proprietary software, which monitors their safety and discharges and charges each battery based on its capacity. The batteries charge during the day from both the solar panels and the grid. Then B2U sells that power to utilities at night, when demand and prices are much higher.

Hall said using second-life batteries earns the same financial return as new grid-scale batteries at half the initial cost, and that for now, repurposing the packs is more lucrative for automakers than sending them straight to recyclers. Until the recycling industry grows, it’s still quite expensive to recycle them. By selling or leasing retired packs to a grid storage company, said Hall, manufacturers can squeeze more value out of them.

That could even help drive down the cost of electric vehicles, he added. “The actual cost of leasing a battery on wheels should go down if the full value of the battery is enhanced and reused,” he said. “Everybody wins when we do reuse in a smart fashion.”

B2U expects to add storage to a third solar facility near Palmdale next year. The facilities are meant to prove that the idea works, after which B2U plans to sell its hardware and software to other storage-project developers.

At the moment, though, planned deployment of the technology is limited. B2U predicts only about 6 percent of decommissioned EV batteries in the US will be used for grid-scale storage by 2027.

“People are skeptical, and they should be, because it’s hard to do reuse of batteries,” said Hall. “But we’ve got a robust data set that does prove reliability, performance, and profitability. We’re at a point where we really can scale this.”

14 notes

·

View notes

Note

Y'all can't handle this

Y'all don't know what's about to happen baby

Team 10

Los Angeles, Cali boy

But I'm from Ohio though, white boy

It's everyday bro, with the Disney Channel flow

5 mill on YouTube in 6 months, never done before

Passed all the competition man, PewDiePie is next

Man I'm poppin' all these checks, got a brand new Rolex

And I met a Lambo too and I'm coming with the crew

This is Team 10, bitch, who the hell are flippin' you?

And you know I kick them out if they ain't with the crew

Yeah, I'm talking about you, you beggin' for attention

Talking shit on Twitter too but you still hit my phone last night

It was 4:52 and I got the text to prove

And all the recordings too, don't make me tell them the truth

And I just dropped some new merch and it's selling like a god, church

Ohio's where I'm from, we chew 'em like it's gum

We shooting with a gun, the tattoo just for fun

I Usain Bolt and run, catch me at game one

I cannot be outdone, Jake Paul is number one

It's everyday bro

It's everyday bro

It's everyday bro

I said it is everyday bro!

You know it's Nick Crompton and my collar stay poppin'

Yes, I can rap and no, I am not from Compton

England is my city

And if it weren't for Team 10, then the US would be shitty

I'll pass it to Chance 'cause you know he stay litty

Two months ago you didn't know my name

And now you want my fame? Bitch I'm blowin' up

I'm only going up, now I'm going off, I'm never fallin' off

Like Mag, who? Digi who? Who are you?

All these beefs I just ran through, hit a milli in a month

Where were you? Hatin' on me back in West Fake

You need to get your shit straight

Jakey brought me to the top, now we're really poppin' off

Number one and number four, that's why these fans all at our door

It's lonely at the top so we all going

We left Ohio, now the trio is all rollin'

It's Team 10, bitch

We back again, always first, never last

We the future, we'll see you in the past

It's everyday bro

It's everyday bro

It's everyday bro

I said it is everyday bro!

Hold on, hold on, hold on, hold on (espera)

Can we switch the language? (Ha, ya tú sabes)

We 'bout to hit it (dale)

Sí, lo único que quiero es dinero

Trabajando en YouTube todo el día entero

Viviendo en U.S.A, el sueño de cualquiera

Enviando dólares a mi familia entera

Tenemos una persona por encima

Se llama Donald Trump y está en la cima

Desde aquí te cantamos can I get my VISA?

Martinez Twins, representando España

Desde la pobreza a la fama

It's everyday bro

It's everyday bro

It's everyday bro

I said it is everyday bro!

Yo, it's Tessa Brooks

The competition shook

These guys up on me

I got 'em with the hook

Lemme educate ya'

And I ain't talking book

Panera is your home?

So, stop calling my phone

I'm flyin' like a drone

They buying like a loan

Yeah, I smell good

Is that your boy's cologne?

Is that your boy's cologne?

Started balling', quicken Loans

Now I'm in my flippin' zone

Yes, they all copy me

But, that's some shitty clones

Stay in all designer clothes

And they ask me what I make

I said is 10 with six zeros

Always plug, merch link in bio

And I will see you tomorrow 'cause it's everyday bro

Peace

-🍇

Why, grape anon,

13 notes

·

View notes

Note

I've been really enjoying hearing you talk about your writing :) But I was a bit ?! to hear that you've never read the comics, for no reason other than I love them and think you would enjoy them.

If you have the opportunity, I would 8000% recommend Season of Mists to you and your lovely followers. It's so fun, and has so many wonderful character cameos from Egyptian, Norse, Japanese mythology, plus the Fae, plus Angels!, plus OCs, PLUS Hob. And it's a fucking lovely storyline.

And I do think it's Dream at his most, well, Dream. The premise is literally just:

Desire: Honestly sending Nada to Hell was a dick move.

Dream: Oh, fuck off.

Death: I mean. It was though.

Dream: ??? Like, actually...???

Dream:

Dream:

Dream: Shit, my bad. Okay fuck it, guess I'm going to free Nada from Hell.

Everyone: You know Lucifer & co. are LITERALLY going to try to kill / imprison you, right? And like, will probably succeed?

Dream: ??? Okay, and...???

Thank you :) And I know, I know! I'm not averse to reading them at all but it's mostly a time thing. Maybe after next season or in preparation for it? I adore mythology and I'm sure I'd love it. Also that's an incredible pitch haha!

I did, actually, almost get into The Sandman comics once. It was a near miss. Years ago, I went on this date with a guy. From OkCupid. Remember OkCupid?? Longform online dating, what an era! And we had this super charming banter over messages. We talk about authors including Neil Gaiman (foreshadowing music). He riffs off of a dumb Shakespeare pun I had on my profile about my love for potatoes.* We decide to have a picnic.

There's a thunderstorm that day. Appropriately inauspicious. He invites me to his place to wait for the weather to improve. I head over to hang out.

It was not great. In hindsight, it was one of the worst dates of my life. (So far! Always room for improvement.) His personality was WILDLY divergent from what I had expected, and also generally enjoy being around. But I'm really good at muscling through awkward dates and really bad at being like "I never plan on seeing you again!" on the spot, so when he insisted on loaning me his Sandman comics as I was trying to leave, I took them. I took them. I'm sorry. I was in my early twenties. It's my only defense.

I went home, marinated, decided yes, I really do not want to go on another date with this guy, sent him a message politely saying as much, and said I'd return his books. He said he was home all weekend so I could just come by whenever. So I trek back to his a day or so later with the carrier bag of Sandman comics. I am not looking forward to this interaction. If the vibe wasn't so bad there would've been a second date you know? The vibe, it was bad.

But lo and behold, as I walk toward his apartment complex, I see someone a ways ahead going up the steps. I see them stop to fish out their keys. I see an opportunity. I walk faster. They open the door and go inside. I break into a Business Casual Sprint. I grab the door juuuust before it closes again. I'm breathing heavily. I try to breathe quieter. I tip-toe down the stairs to his basement unit (it was a basement unit) and delicately hang the bag on his doorknob like I'm playing a game of Operation. No buzzers go off. I turn on my heel and flee. My heart is soaring. The air tastes sweeter. I have pulled off my reverse heist. I text him from the warm comfort of public transportation that I left them outside his door.

And I never thought about The Sandman again for six years.

*'Stars, hide your fries' (He replied Let not oven black my deep desires. I mean, you can see why I went.)

#asks#the sandman#the sandman comic spoilers#gloam storytime#haven't thought about that in ages#similarly i once had a one night stand that turned into a two night stand exclusively because I was returning Hermann Hesse's Steppenwolf#he was a classics student#of course#i could honestly run a whole sideblog of dating stories i used to be OUT on the town my god#funny that of all the fandoms to finally participate in it was Awful Date Guy's#wonder how he likes the show

39 notes

·

View notes