#Hall-Héroult

Explore tagged Tumblr posts

Text

Alluminio Green-Tech 2025: Ciclo Chiuso New EARS Revolution

#Aerospazio#Allumina#alluminio#Automotive#Bauxite#bayer#Ciclo chiuso#circolarità#Eco-friendly#elettronica#Energie rinnovabili#estrazione#fango rosso#grafene#Hall-Héroult#leghe alluminio#mercato 2025#Profitto#proiezioni 2050#raffninazione#Sostenibilità#sottoprodotti#tecnologie innovative#titanio

0 notes

Text

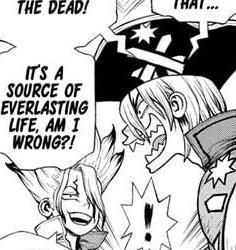

Chapter 210 Trivia

This is it everyone. We're going to get Ruri and the others back finally. I haven't been this excited for the next chapter since chapter 209.

Two people are using drills of some sort since they have wires leading away from them, but Yo is stuck using a pick-axe and hitting things wildly, spinning like the other fighters do when mining.

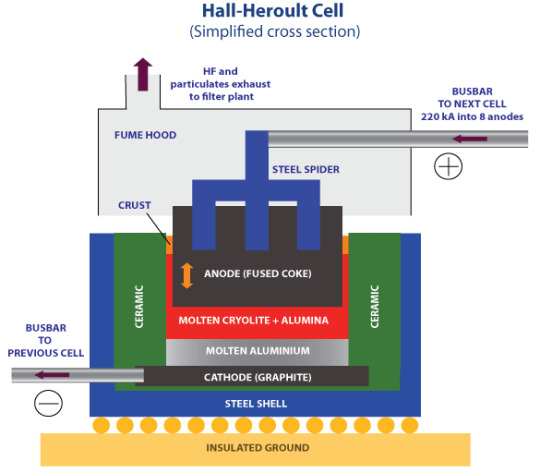

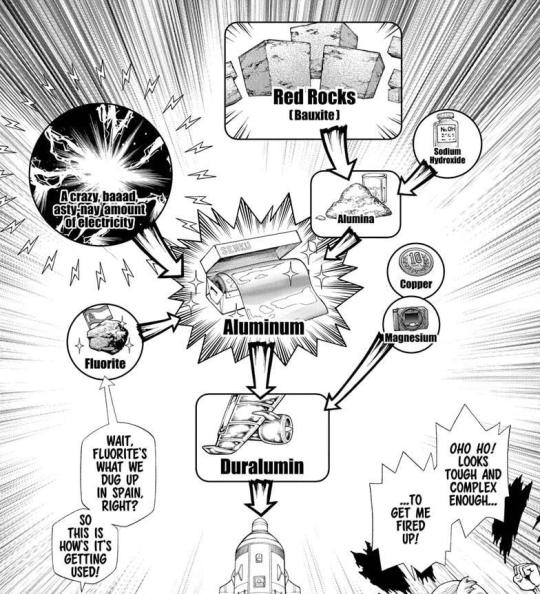

To make bauxite into aluminum, you need two processes: the Bayer process, to turn it into aluminum oxide, and the Hall–Héroult process to turn that into aluminum. Both are energy intensive, and even these days use hydroelectric power to reduce costs and carbon footprint.

The Hall-Héroult process involves dissolving the aluminum oxide in cryolite, which is a compound that contains the fluorite they acquired in Spain.

Duralumin (DURable ALUMINum) is an aluminum-copper alloy that has been age-hardened (heat treated) in such a way that gives it better strength at higher temperatures, perfect for the rocket. In addition to copper, it usually contains manganese and magnesium.

Once again we have proof of the big, happy family that is the Kingdom of Science: using each others' words.

I couldn't find where the power cost for Apollo's aluminum came from, (it's possible Kurare calculated it?) but I can convert 3 billion yen to USD: 27,309,975$ or about 27.3 million dollars.

Kaseki not reacting because he doesn't know the value of a yen is pretty funny too.

The timeline is still fairly vague at this point since we don't know how much time has passed after October 1st, but if this bird here is an eastern great egret, we can at least say it's not March yet, since the bird has a black beak during the breeding season (March-May).

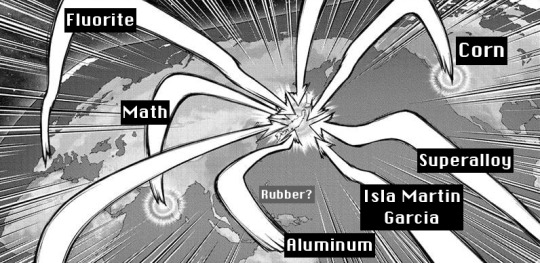

There's several cities with arrows here but there's also two extras, and the Rubber City one is still missing…

I'm wondering if the top unlabelled arrow is somehow for the moon, as that's possibly where the medusa came from?

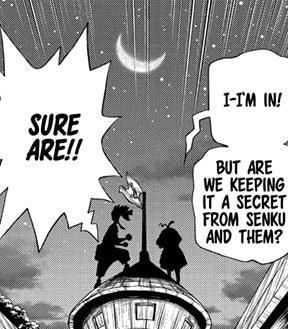

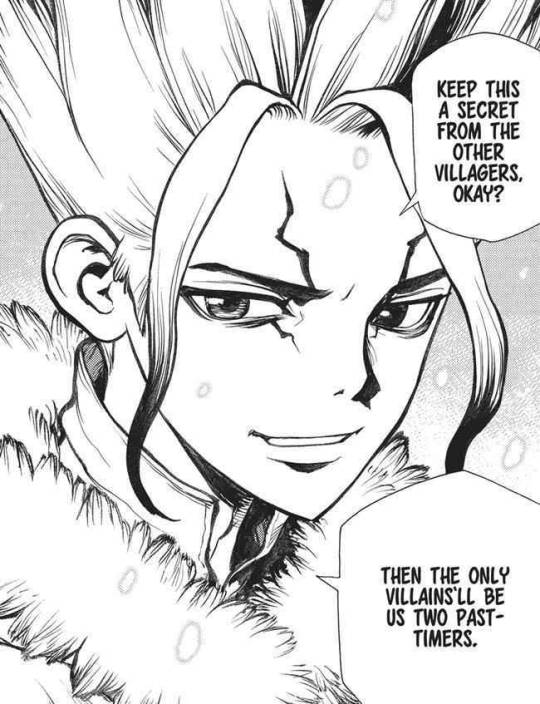

What a way to find out that you're immortal… Poor Ukyo. He's probably heard a lot of secret things this chapter because of people yelling…

I'm wondering how they got up there since there's no visible access hatch and I'd be concerned about falling from that height if they climbed up out the windows.

Rooftop bonding is always nice though :)

"You say 'amateur' as if it was a dirty word. 'Amateur' comes from the Latin word 'amare', which means to love. To do things for the love of it." - Mozart in the Jungle

(I know that's not really trivia, I simply think the quote suits Chrome and that he should hear it. Not that Chrome knows what Latin is, haha!)

Somehow I don't think this endeavor will be kept a secret for long, since he's yelling on top of a tower in the direction of the boat Ukyo is currently on.

Also he's known to not be able to keep secrets, yet can also keep them when needed?

We don't know Sai's age, but if we compare it to Ryusui's timeline (the racetrack flashback) and Senku's ages (the rocket flashback and petrification), he couldn't have been away from Nanami Corp. for longer than 5 years.

Assuming Sai hadn't already graduated high school, he wouldn't have really had enough time to become a professor, since that takes 6-8 years.

There's no age limit on being a professor, but Sai would need to have a Master's degree to be eligible, and then still need to take other tests and training. He may have been a tutor or a teaching assistant instead.

Chrome has written absolutely nothing down, but Suika has several pages full on her desk already. It's also amusing how Suika, the one who needs glasses and is significantly shorter, is sat behind Chrome.

I believe "Mathematics by Sai" may be the first properly bound, hardcover book in the Stone World too.

7 notes

·

View notes

Text

Aluminium Wire Prices, News, Trend, Graph, Chart, Monitor and Forecast

The aluminium wire market has experienced significant fluctuations in recent years, driven by a complex interplay of factors that influence supply, demand, and pricing dynamics. Aluminium wire, widely used across industries such as electrical transmission, construction, automotive, and telecommunications, remains a crucial commodity in the global economy. The pricing trends of aluminium wire are inherently linked to the performance of the broader aluminium market, which is influenced by global economic conditions, raw material availability, energy costs, and geopolitical factors. As a lightweight, corrosion-resistant, and highly conductive material, aluminium wire continues to see robust demand, particularly with the growing adoption of renewable energy infrastructure and electric vehicles.

The primary driver of aluminium wire prices is the cost of raw aluminium, which is derived from bauxite ore through energy-intensive processes like Bayer refining and Hall-Héroult smelting. The availability and price of bauxite, along with energy costs, significantly impact production expenses. Additionally, market prices are influenced by factors such as import-export policies, trade restrictions, and tariffs. In recent years, disruptions in bauxite supply chains, particularly from major producers like Australia, Guinea, and China, have led to price volatility. Political instability in resource-rich regions and policy changes in key markets have further added to the unpredictability in aluminium wire pricing.

Get Real time Prices for Aluminum Wire: https://www.chemanalyst.com/Pricing-data/stainless-steel-1502

Global economic growth plays a crucial role in determining aluminium wire prices. During periods of strong economic expansion, infrastructure projects and industrial activities increase, driving up the demand for aluminium wire. Conversely, economic slowdowns, like the one witnessed during the COVID-19 pandemic, lead to reduced demand and downward pressure on prices. The pandemic-induced disruptions to global supply chains caused significant fluctuations in aluminium prices, with initial declines followed by sharp recoveries as industries resumed operations and governments implemented stimulus packages to boost infrastructure development.

Energy costs are another critical factor in aluminium wire pricing. The aluminium production process requires substantial electricity, and any fluctuations in energy prices, particularly for fossil fuels and electricity, directly impact production costs. In regions where energy prices are high, aluminium wire producers face higher production costs, which are often passed on to consumers through increased prices. The global push toward cleaner energy sources and the associated costs of transitioning to renewable energy have also affected the aluminium market. As more aluminium producers adopt sustainable practices and invest in energy-efficient technologies, production costs may stabilize, potentially influencing aluminium wire prices.

The automotive industry, particularly the rapid growth of electric vehicles (EVs), has significantly influenced aluminium wire demand and pricing. Aluminium wire is essential for lightweight wiring systems in EVs, contributing to improved energy efficiency and vehicle performance. With major automakers committing to electrification and governments worldwide promoting EV adoption through incentives and regulatory measures, the demand for aluminium wire has surged. This growing demand has contributed to upward pressure on prices, especially as manufacturers compete for high-quality aluminium products.

In the construction sector, aluminium wire is extensively used in electrical wiring, structural components, and infrastructure projects. Urbanization, population growth, and infrastructure development, particularly in emerging economies like India, China, and Southeast Asia, have driven consistent demand for aluminium wire. Large-scale infrastructure projects, such as smart city initiatives, renewable energy installations, and high-speed rail networks, have further boosted market growth. However, fluctuations in construction activity, driven by factors like interest rate changes and economic policies, have led to periodic price variations in the aluminium wire market.

Geopolitical factors, including trade tensions, sanctions, and international agreements, have also played a significant role in aluminium wire pricing. The imposition of tariffs and sanctions on major aluminium producers, such as Russia and China, has led to supply chain disruptions and increased prices in certain regions. Trade policies implemented by the United States, the European Union, and other major economies have influenced the flow of aluminium products across borders, impacting regional price disparities. Additionally, currency fluctuations and changes in global trade dynamics contribute to the complexity of pricing in the aluminium wire market.

Technological advancements and innovations in aluminium wire manufacturing have introduced new market dynamics. The development of high-performance alloys, improved production techniques, and the integration of digital technologies into manufacturing processes have enhanced product quality and efficiency. As manufacturers invest in research and development to create aluminium wires with superior conductivity, strength, and durability, production costs and pricing strategies may evolve accordingly. Furthermore, the increasing focus on recycling and the circular economy has led to the growth of secondary aluminium production. Recycled aluminium requires significantly less energy compared to primary production, potentially mitigating price increases and contributing to more sustainable pricing trends.

Regional variations in aluminium wire prices reflect differences in supply chain structures, production capacities, and demand patterns. Asia-Pacific, led by China and India, remains a dominant player in the aluminium wire market due to its vast manufacturing base and ongoing infrastructure development. North America and Europe, while also significant markets, experience price variations influenced by energy costs, environmental regulations, and import policies. In Latin America and Africa, the availability of raw materials like bauxite and growing industrialization efforts contribute to regional price dynamics.

The outlook for aluminium wire prices remains subject to the interplay of these multifaceted factors. As the world transitions toward cleaner energy sources, the demand for aluminium wire in solar, wind, and electric grid applications is expected to rise. However, potential supply chain disruptions, energy price fluctuations, and geopolitical developments could lead to continued price volatility. Market participants, including manufacturers, traders, and consumers, must stay attuned to these dynamics to make informed decisions and navigate the complexities of the aluminium wire market effectively.

Get Real time Prices for Aluminum Wire: https://www.chemanalyst.com/Pricing-data/stainless-steel-1502

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Aluminium Wire#Aluminium Wire Price#Aluminium Wire Prices#Aluminium Wire Pricing#India#united kingdom#united states#Germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

알루미늄 잉곳 (Aluminium Ingot) 가격 추세, 시장 통찰력 및 예측 예측

알루미늄 잉곳 (Aluminium Ingot) 은 Hall-Héroult 전해 공정을 통��� 알루미나(산화 알루미늄)에서 직접 생산되는 주요 알루미늄 형태입니다. 다양한 하류 알루미늄 제품의 기본 원료로 사용됩니다. 알루미늄 잉곳 가격에 영향을 미치는 요인을 이해하는 것은 건설, 운송, 포장 및 기타 관련 부문에 종사하는 기업에 매우 중요합니다.

알루미늄 잉곳에 대한 글로벌 수요

알루미늄 잉곳에 대한 글로벌 수요는 다음에서의 사용에 의해 주도됩니다.

압출: 창문, 문, 건축 구성 요소 및 기타 다양한 구조 및 건축 응용 분야를 위한 알루미늄 프로파일을 생산하는 데 사용됩니다. 압연: 포장(캔, 호일), 자동차 차체 패널, 항공 우주 구성 요소 및 기타 응용 분야를 위한 알루미늄 시트 및 판을 생산하는 데 사용됩니다. 주조: 자동차 부품, 기계 구성 요소 및 기타 다양한 산업 및 소비자 제품을 위한 알루미늄 주조물을 생산하는 데 사용됩니다. 합금: 특정 속성을 가진 다양한 알루미늄 합금을 생산하는 기본 금속으로 사용됩니다. 알루미늄 잉곳 가격에 영향을 미치는 요인

여러 복잡한 요인이 알루미늄 잉곳 가격에 영향을 미칩니다.

원자재 비용(알루미나 및 알루미나 삼수화물(ATH)): 알루미늄 생산의 주요 원자재는 보크사이트 광석에서 추출한 알루미나(Al₂O₃)입니다. 알루미나 가격의 변동은 알루미늄 잉곳 가격에 직접적이고 상당한 영향을 미칩니다. ATH는 보크사이트와 알루미나의 중간 제품입니다. 보크사이트 시장 역학: 보크사이트 광석의 공급 및 수요 균형은 알루미나 가격에 영향을 미치므로 알루미늄 잉곳 가격에 간접적으로 영향을 미칩니다. 광산 작업, 보크사이트 생산 지역의 지정학적 요인, 환경 규정과 같은 보크사이트 가용성에 영향을 미치는 요인은 알루미늄 잉곳 공급 및 가격에 영향을 미칠 수 있습니다. 에너지 비용(특히 전기 분해용 전기): Hall-Héroult 공정은 매우 에너지 집약적이어서 많은 양의 전기가 필요합니다. 에너지 비용, 특히 전기 가격은 알루미늄 잉곳 가격에 상당한 역할을 합니다. 저렴한 전기(예: 수력 발전)를 이용할 수 있는 지역은 종종 알루미늄 생산에서 경쟁 우위를 점합니다.

リアルタイムで 알루미늄 잉곳 (Aluminium Ingot) 価格: https://www.analystjapan.com/Pricing-data/aluminium-ingot-1332 공급 및 수요 역학: 건설, 자동차, 포장, 항공우주 및 기타 관련 부문의 글로벌 경제 상황과 활동은 알루미늄 잉곳 수요에 영향을 미칩니다. 건설 활동, 자동차 생산, 포장재 수요, 항공우주 제조와 같은 특정 산업 동향도 알루미늄 잉곳 수요에 상당한 영향을 미칠 수 있습니다. 공급은 알루미나 가용성, 알루미늄 제련소 용량, 에너지 가용성, 공장 유지 관리 및 계획되지 않은 정전의 영향을 받을 수 있습니다. LME 알루미늄 가격: 런던 금속 거래소(LME)는 알루미늄의 주요 글로벌 거래 플랫폼입니다. LME 알루미늄 가격은 전 세계 물리적 알루미늄 잉곳 가격의 벤치마크 역할을 합니다. 재고 수준: 창고와 생산자 및 소비자가 보유한 글로벌 알루미늄 재고 수준은 시장 감정과 가격 변동에 영향을 미칠 수 있습니다. 높은 재고 수준은 가격에 하락 압력을 가할 수 있는 반면, ��은 재고 수준은 가격 상승으로 이어질 수 있습니다. 운송 및 물류 비용: 알루미늄 잉곳은 대량 상품이며 운송 비용은 특히 장거리의 경우 최종 가격에 상당히 영향을 미칠 수 있습니다. 환율: 알루미늄은 국제적으로 거래되기 때문에 환율 변동은 다양한 국가의 수입 및 수출 가격에 영향을 미칠 수 있습니다. 지정학적 요인: 보크사이트 생산 또는 알루미늄 생산 지역의 정치적 불안정, 국제 갈등, 무역 분쟁 및 제재와 같은 지정학적 사건은 공급망을 방해하고 알루미늄 잉곳 가격에 영향을 미칠 수 있습니다. 환경 규정: 보크사이트 채굴, 알루미나 정제 및 알루미늄 제련과 관련된 환경 규정은 생산 비용에 영향을 미치고 시장 역학에 영향을 미칠 수 있습니다. 탄소 배출권 거래 제도 또는 세금도 가격에 영향을 미칠 수 있습니다. 현재 시장 동향 및 가격 전망

알루미늄 잉곳 시장은 세계 경제 성장, 주요 최종 사용 부문의 동향, 에너지 가격 및 지정학적 요인의 영향을 받습니다.

ANALYST JAPAN

Call +1 (332) 258- 6602 1-2-3 Manpukuji, Asao-ku, Kawasaki 215-0004 Japan

Website: https://www.analystjapan.com

Email: [email protected]

0 notes

Text

Khám Phá Nguyên Liệu Sản Xuất Nhôm – Từ Bauxite Đến Quy Trình Điện Phân

Nhôm, với tính chất bền bỉ, chống ăn mòn và nhẹ, đã trở thành một kim loại thiết yếu trong nhiều ngành công nghiệp. Quá trình sản xuất nhôm đòi hỏi sự kết hợp của nhiều nguyên liệu và công nghệ phức tạp, bắt đầu từ quặng bauxite. Đây là nguồn cung cấp nhôm dồi dào với hàm lượng nhôm từ 40% đến 60%, được khai thác tại các mỏ lớn trên thế giới, đặc biệt là ở Úc và Guinea.

Để chuyển hóa bauxite thành nhôm tinh khiết, người ta sử dụng quy trình Bayer – một phương pháp tiên tiến với việc sử dụng natri hydroxit (NaOH) để loại bỏ tạp chất từ bauxite, thu được alumina (Al₂O₃) tinh khiết. Alumina này sau đó được đưa vào quy trình Hall-Héroult, phương pháp điện phân nóng chảy giúp biến đổi alumina thành nhôm. Các hóa chất như criolit và alumina fluoride được thêm vào để hạ thấp nhiệt độ nóng chảy, tối ưu hóa quá trình điện phân, từ đó nhôm đạt được độ tinh khiết cao và giảm chi phí sản xuất.

Nhưng không chỉ dừng ở đó, quy trình sản xuất nhôm còn đòi hỏi quản lý nghiêm ngặt về môi trường. Chất thải bùn đỏ và khí thải CO₂ phát sinh trong quá trình này cần được xử lý cẩn trọng để giảm thiểu tác động xấu đến môi trường. Phế liệu Hoàng Ngọc Diệp tự hào không chỉ cung cấp dịch vụ thu mua nhôm phế liệu mà còn hỗ trợ khách hàng trong việc hiểu rõ quy trình sản xuất, hướng đến việc bảo vệ tài nguyên và phát triển bền vững: https://hoangngocdiep.vn/nguyen-lieu-san-xuat-nhom/

0 notes

Text

Primary Aluminium Market: Trends and Insights

Introduction

The global primary aluminium market is a vital sector within the broader metals industry, characterized by its extensive applications across various sectors, including automotive, aerospace, construction, packaging, and electronics. Aluminium, renowned for its lightweight properties, durability, and corrosion resistance, has become indispensable in modern manufacturing processes.

According to a study conducted by Next Move Strategy Consulting, the Primary Aluminium Market is projected to witness significant growth, with an anticipated size of USD 141.50 billion and a compound annual growth rate (CAGR) of 3.6% by 2030.

Understanding the Primary Aluminium Market

Historical Overview: The history of aluminium dates back to the 19th century, marked by the development of cost-effective production methods such as the Hall-Héroult process. Over the years, aluminium has emerged as a versatile metal, finding applications in diverse industries due to its favourable properties.

Request for a sample, here: https://www.nextmsc.com/primary-aluminium-market/request-sample

Market Segmentation: The primary aluminium market can be segmented based on product type, end-user industry, and geography. Product types include ingots, billets, and slabs, while end-user industries encompass automotive, aerospace, construction, packaging, and electrical appliances.

Value Chain Analysis: The primary aluminium value chain involves several stages, including bauxite mining, alumina refining, primary aluminium smelting, downstream processing, and distribution. Each stage presents opportunities for value addition and optimization.

Trends Shaping the Primary Aluminium Market

Rising Demand in Automotive and Aerospace Industries: The automotive and aerospace sectors are significant consumers of primary aluminium, driven by the need for lightweight materials to improve fuel efficiency and reduce emissions. With the transition towards electric vehicles (EVs) and the emphasis on sustainable aviation, the demand for aluminium is expected to escalate further.

Focus on Sustainability and Recycling: Sustainability has become a central theme in the primary aluminium market, with stakeholders prioritizing eco-friendly practices and recycling initiatives. Aluminium recycling not only conserves natural resources but also requires significantly less energy compared to primary aluminium production, aligning with global sustainability goals.

Technological Advancements in Production Processes: Technological innovations play a crucial role in enhancing efficiency and reducing environmental impact in primary aluminium production. Advanced smelting technologies, such as inert anode technology and electrolysis optimization, are gaining traction for their potential to lower energy consumption and greenhouse gas emissions.

Geographical Shifts in Production and Consumption: The primary aluminium market is witnessing geographical shifts, with emerging economies in Asia-Pacific, particularly China, emerging as key players. Rapid industrialization, urbanization, and infrastructure development in these regions are driving robust demand for primary aluminium, reshaping the global market landscape.

Impact of Trade Dynamics and Tariffs: Trade dynamics and tariffs significantly influence the primary aluminium market, impacting supply chains and pricing structures. Trade disputes between major aluminium-producing nations can lead to price volatility and market uncertainties, affecting stakeholders across the value chain.

Insights into Market Dynamics

Market Drivers: Several factors drive growth in the primary aluminium market, including increasing urbanization, infrastructure development, technological advancements, and evolving consumer preferences towards lightweight and sustainable materials.

Market Restraints: Despite its promising outlook, the primary aluminium market faces certain challenges, including fluctuating raw material prices, regulatory constraints, geopolitical tensions, and competition from alternative materials.

Opportunities for Market Players: Market players can capitalize on emerging opportunities by investing in research and development (R&D) to innovate new alloys, expanding production capacities, forging strategic partnerships, and leveraging digitalization to optimize operations and supply chain management.

Challenges to Address: Addressing challenges such as energy efficiency improvements, carbon footprint reduction, waste management, and compliance with stringent environmental regulations are imperative for the sustainable growth of the primary aluminium market.

Regional Analysis

North America: North America remains a significant market for primary aluminium, driven by robust demand from the automotive, aerospace, and construction sectors. The region also boasts advanced manufacturing capabilities and a focus on technological innovation.

Europe: Europe is witnessing a transition towards sustainable practices, with stringent environmental regulations driving demand for recycled aluminium. The region's automotive industry is leading the adoption of lightweight materials to meet stringent emissions standards.

Asia-Pacific: Asia-Pacific, led by China, is the largest consumer and producer of primary aluminium globally. Rapid industrialization, urbanization, and infrastructure development in countries like China and India fuel demand for aluminium across various sectors.

Middle East and Africa: The Middle East and Africa region possess significant bauxite reserves, providing a competitive advantage in primary aluminium production. However, the region faces challenges related to infrastructure development and political instability.

Future Outlook and Predictions

Market Growth Prospects: The primary aluminium market is poised for steady growth, driven by expanding applications, technological advancements, and increasing focus on sustainability.

Emerging Trends: Emerging trends such as lightweight, electric mobility, circular economy initiatives, and Industry 4.0 integration are expected to shape the future trajectory of the primary aluminium market.

Key Challenges: Overcoming challenges related to energy efficiency, carbon emissions, regulatory compliance, and geopolitical uncertainties will be critical for sustaining growth in the primary aluminium market.

Strategic Imperatives: Market players need to adopt a proactive approach by investing in R&D, fostering innovation, enhancing operational efficiencies, and strengthening collaborations across the value chain to capitalize on emerging opportunities and mitigate risks effectively. Embrace Digital Transformation: The integration of digital technologies such as artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), and data analytics can revolutionize operations within the primary aluminium market. By harnessing data-driven insights, companies can optimize production processes, improve predictive maintenance, enhance supply chain visibility, and optimize resource utilization, thereby gaining a competitive edge in the market.

Inquire before buying, here: https://www.nextmsc.com/primary-aluminium-market/inquire-before-buying

Prioritize Talent Development and Training: Investing in talent development and training programs is essential for building a skilled workforce equipped to tackle the evolving challenges and opportunities within the primary aluminium industry. By fostering a culture of continuous learning and skill enhancement, companies can ensure that their employees possess the expertise and capabilities required to drive innovation, improve productivity, and adapt to changing market dynamics effectively.

Enhance Stakeholder Engagement and Communication: Effective stakeholder engagement and communication are crucial for fostering trust, transparency, and collaboration across the primary aluminium value chain. Companies should prioritize engaging with stakeholders, including customers, suppliers, regulators, local communities, and non-governmental organizations (NGOs), to understand their concerns, gather feedback, and address issues proactively. By fostering open dialogue and transparent communication, companies can build stronger relationships, mitigate risks, and enhance their reputation in the market.

Conclusion

In conclusion, the primary aluminium market presents lucrative opportunities for growth and innovation amid evolving consumer preferences, technological advancements, and regulatory shifts. Stakeholders across the value chain must adapt to changing market dynamics, embrace sustainability practices, and leverage technological innovations to secure their competitive positions and drive sustainable growth in the years to come. By staying abreast of market trends and insights, businesses can navigate challenges and capitalize on emerging opportunities in the dynamic landscape of the primary aluminium market.

0 notes

Text

The Craftsmanship Behind Aluminium Sheet Manufacturing Companies

A Closer Look at Aluminium Sheet Manufacturing

Aluminium sheet manufacturing companies play a vital role in producing the versatile material that has become a cornerstone of numerous industries. These companies are the unsung heroes behind the sheets that go on to serve as the foundation for various products. In this blog, we'll delve into the fascinating world of aluminium sheet manufacturing, exploring the process, applications, and the impact on different sectors.

The Art of Aluminium Sheet Production

Aluminium sheet manufacturing is a meticulous process that involves several intricate steps. It all begins with the extraction of bauxite, which is then refined to obtain alumina. The alumina is subjected to an electrolytic process known as the Hall-Héroult process to obtain pure aluminium. This primary aluminium is further processed, heated, and rolled into sheets of different thicknesses. The result is a versatile, lightweight, and corrosion-resistant material ready for applications.

Applications Across Industries

Aluminium sheets are the unsung heroes of multiple industries, owing to their versatility. They are indispensable in the construction sector, where they are used for roofing, cladding, and structural components. In the automotive industry, aluminium sheets contribute to lightweighting, enhancing fuel efficiency. Additionally, they play a pivotal role in aerospace, where every ounce saved is critical.

Sustainability and Aluminium Sheets

One of the most compelling aspects of aluminium sheet manufacturing is its sustainability. Aluminium is 100% recyclable, which means that the sheets produced today can be transformed into new products in the future. This closed-loop recycling process significantly reduces the environmental impact of aluminium sheet production, making it a responsible choice for eco-conscious industries and consumers.

Innovation and Future Prospects

Aluminium sheet manufacturing is not stagnant; it is marked by continuous innovation. Manufacturers are developing advanced alloys and techniques to create sheets with improved strength and performance characteristics. As industries continue to push the boundaries of what's possible, aluminium sheet manufacturers are poised to meet the demand for more efficient and sustainable materials.

Aluminium sheet manufacturing companies are at the forefront of producing a material that shapes our modern world. Their commitment to quality, sustainability, and innovation ensures that aluminium sheets remain a cornerstone of various industries, promising a brighter and more efficient future.

0 notes

Text

aluminium rod dealers in chennai

Aluminium Rods, Aluminium Round Bars and Their Use

Aluminum round bar or aluminum bar or aluminum rod is one of the most popular and versatile aluminum products due to its machinability, durability, and application in a wide variety of applications.

Aluminum bar products have an excellent strength-to-weight ratio and like other aluminum products, are widely used in mechanical, construction, automotive, and aerospace parts. All of our aluminum bars and products are manufactured from factory-grade 6082 aluminum. It is a medium-strength alloy with excellent machinability and corrosion resistance.

Aluminum Metal

Aluminum is derived from the mineral bauxite. Bauxite is converted to aluminum oxide (alumina) through the Bayer process. The alumina is then converted into metallic aluminum using electrolytic cells and the Hall-Héroult process.

Pure aluminum is soft, flexible, corrosion-resistant, and highly conductive. It is widely used as foil and conductor cables, but alloying with other elements is necessary to provide the higher strength needed for other applications. Aluminum is one of the lightest engineering metals and has a higher strength-to-weight ratio than steel. If you want quality range of aluminium rods, then contact the top aluminium rod dealers in Chennai.

Aluminium Rod Specifications and Best Aluminium Rod Dealers in Chennai

Metal & Alloy Industries, one of the best aluminium rod dealers in Chennai offers aluminum rods or bars that come in various sizes and specifications, particularly the 6000 series which is the most versatile in nature. Aluminum products have a higher thermal conductivity than steel and are also used for both cooling and heating applications.

Aluminum can be expanded into rod-shaped or circular pieces that can be used for all kinds of applications. Aluminum round bars are known for their lightweight, excellent rust resistance, and excellent thermal conductivity. It's also cheaper than many options. Aluminum bar or aluminum bar inventory includes 2011, 2024, 6060, 6061, 6063, 6262, and 7075.

FEATURES

Weighs about 1/3 the weight of stainless steel

good strength

Can be welded

Good machining quality

Suitable for anodizing

Suitable for powder coating

0 notes

Text

girl who plays dwarf fortress but uses real life wikipedia for all the geology information and yields for various ores

#dwarf fortress#the only thing this doesn't really work for is native aluminum/bauxite#because dwarf fortress is not going to implement the hall-héroult process until v0.75 at least

86 notes

·

View notes

Text

Dull Or Shiny?

Is there a right side to #aluminiumfoil? It seems there isn't unless it's #nonstick #tinfoil @Alcoa

The date of Charles and Julia Hall’s first production of aluminium by electrolysis, February 23, 1886, was significant because in France, Paul Héroult, using the same process to produce aluminium, was quicker off the mark in applying for a patent. When Hall applied for his patent on July 9, 1896, he was sued by Héroult for infringement of the patent granted him on April 23, 1886. Thanks in part…

View On WordPress

#Alcoa#Aluminium#aluminium foil#Charles and Julia Hall#Le Migron#Paul Héroult#Robert Victor Neher#Toblerone

0 notes

Text

يمكن أن يتم تخزين الهيدروجين من خلال العديد من الطرق الحالية للاحتفاظ بالهيدروجين لاستخدامه لاحقًا. وتشمل هذه الأساليب الميكانيكية مثل استخدام ضغوط عالية ودرجات حرارة منخفضة ، أو استخدام مركبات كيميائية تطلق غاز الهيدروجين عند الطلب. في حين يتم إنتاج كميات كبيرة من الهيدروجين من قبل الصناعات المختلفة ، فإنه يتم استهلاكه في الغالب في موقع الإنتاج ، لا سيما لتخليق الأمونيا . لسنوات عديدة ، تم تخزين الهيدروجين كغاز مضغوط أو سائل مبرد ، ونقله على هذا النحو في أسطوانات وأنابيب وخزانات مبردة لاستخدامها في الصناعة أو كوقود دافع في برامج الفضاء. يحفز الاهتمام باستخدام الهيدروجين لتخزين الطاقة على متن المركبات في المركبات عديمة الانبعاثات على تطوير طرق تخزين جديدة ، أكثر تكيفًا مع هذا التطبيق الجديد. يتمثل التحدي الأكبر في نقطة الغليان المنخفضة جدًا لـ H 2 : يغلي حوالي 20.268 كلفن (-252.882 درجة مئوية أو -423.188 درجة فهرنهايت). يتطلب تحقيق درجات الحرارة المنخفضة هذه إنفاق طاقة كبيرة.

تخزين الهيدروجين الهيدريد المعدني

هيدرات المعادن ، مثل MgH 2 ، NaAlH 4 ، LiAlH 4 ، LiH ، LaNi 5 H 6 ، TiFeH 2 ، أمونيا بوران ، وهيدريد البلاديوم تمثل مصادر للهيدروجين المخزن. ومرة أخرى ، فإن المشاكل المستمرة هي نسبة وزن H 2 التي تحملها وإمكانية عكس عملية التخزين. [13] بعضها سهل التزويد بالوقود في درجات الحرارة والضغط المحيطين ، في حين أن البعض الآخر عبارة عن مواد صلبة يمكن تحويلها إلى كريات. تتمتع هذه المواد بكثافة طاقة جيدة ، على الرغم من أن طاقتها النوعية غالبًا ما تكون أسوأ من الوقود الهيدروكربوني الرائد .

LiNH 2 و LiBH 4 و NaBH 4 . [14]

طريقة بديلة لخفض درجات حرارة التفكك هو تعاطي المنشطات. تم استخدام هذه الاستراتيجية لهيدريد الألومنيوم ، لكن التركيب المعقد يجعل هذا النهج غير جذاب. [15]

تشتمل الهيدريدات المقترحة للاستخدام في اقتصاد الهيدروجين على هيدرات بسيطة من المغنيسيوم [16] أو معادن انتقالية وهيدرات معدنية معقدة تحتوي عادةً الصوديوم أو الليثيوم أو الكالسيوم أو والألمنيوم على البورون . توفر الهيدريدات المختارة لتطبيقات التخزين تفاعلًا منخفضًا (أمانًا عاليًا) وكثافة تخزين هيدروجين عالية. المرشحون الرئيسيون هم هيدريد الليثيوم وبوروهيدريد وهيدريد الصوديوم والأمونيا الليثيوم ألومنيوم بوران . تقوم شركة فرنسية McPhy Energy بتطوير أول منتج صناعي ، يعتمد على هيدريد المغنيسيوم ، والذي تم بيعه بالفعل لبعض العملاء الرئيسيين مثل Iwatani و ENEL.

يمكن إنتاج الهيدروجين باستخدام الألمنيوم عن طريق تفاعله مع الماء. [20] كان يُعتقد سابقًا أنه للتفاعل مع الماء ، يجب تجريد الألومنيوم من طبقة أكسيده الطبيعية باستخدام مواد كاوية ، وسبائك ، [21] أو خلطه مع الغاليوم (الذي ينتج جزيئات الألمنيوم النانوية التي تسمح بتفاعل 90٪ من الألومنيوم. ). [22] ومنذ ذلك الحين تم إثبات أن التفاعل الفعال ممكن عن طريق زيادة درجة حرارة وضغط التفاعل. [23] الناتج الثانوي للتفاعل لتكوين الهيدروجين هو أكسيد الألومنيوم ، والذي يمكن إعادة تدويره مرة أخرى إلى الألومنيوم باستخدام عملية Hall-Héroult ، مما يجعل التفاعل متجددًا نظريًا. على الرغم من أن هذا يتطلب التحليل الكهربائي ، والذي يستهلك قدرًا كبيرًا من الطاقة ، يتم تخزين الطاقة بعد ذلك في الألومنيوم (ويتم إطلاقها عند تفاعل الألومنيوم مع الماء).

المغنيسيوم

يمكن تقسيم مواد تخزين الهيدروجين القائمة على Mg بشكل عام إلى ثلاث فئات ، على سبيل المثال ، سبائك Mg نقية ، وسبائك أساسها Mg ، ومركبات قائمة على Mg. على وجه الخصوص ، حظيت أكثر من 300 نوع من سبائك تخزين الهيدروجين القائمة على المغنيسيوم باهتمام واسع النطاق [24] بسبب الأداء العام الأفضل نسبيًا. ومع ذلك ، فإن حركية امتصاص / امتصاص الهيدروجين السفلية المتأصلة في الاستقرار الديناميكي الحراري المفرط للهيدريد المعدني تجعل سبائك تخزين الهيدروجين القائمة على المغنيسيوم غير مناسبة حاليًا للتطبيقات الحقيقية ، وبالتالي ، تم تكريس محاولات ضخمة للتغلب على هذا النقص. تم استخدام بعض طرق تحضير العينات ، مثل الصهر ، وتلبيد المسحوق ، والانتشار ، والسبائك الميكانيكية ، وطريقة تصنيع الاحتراق المائي ، والمعالجة السطحية ، والمعالجة الحرارية ، وما إلى ذلك ، على نطاق واسع لتغيير الأداء الديناميكي وعمر دورة تخزين الهيدروجين القائم على المغنيسيوم سبائك. بالإضافة إلى بعض استراتيجيات التعديل الجوهري ، بما في ذلك صناعة السبائك ، [25] [26] [27] [28] البنية النانوية ، [29] [30] [31] المنشطات عن طريق الإضافات التحفيزية ، [32] [33] واكتساب المركبات النانوية مع الهيدريدات الأخرى ، [34] [35] وما إلى ذلك ، تم استكشافها بشكل أساسي لتعزيز الأداء جوهريًا من سبائك تخزين الهيدروجين القائمة على المغنيسيوم. [36] مثل الألمنيوم ، يتفاعل المغنيسيوم أيضًا مع الماء لإنتاج الهيدروجين. [37]

من بين سبائك تخزين الهيدروجين الأولية التي تم تطويرها ��ابقًا ، يُعتقد أن مواد تخزين الهيدروجين القائمة على المغنيسيوم والمغنيسيوم توفر إمكانية رائعة للتطبيق العملي ، على حساب المزايا على النحو التالي: 1) مورد المغنيسيوم وفير واقتصادي. يوجد عنصر Mg بكثرة ويشكل حوالي 2.35 ٪ من قشرة الأرض مع المرتبة الثامنة ؛ 2) كثافة منخفضة فقط 1.74 جم سم 3 ؛ 3) قدرة تخزين الهيدروجين الفائقة. كميات تخزين الهيدروجين النظرية للمغنيسيوم النقي هي 7.6٪ بالوزن (نسبة الوزن) ، [38] [39] [40] و Mg2Ni 3.6٪ بالوزن ، على التوالي. [36]

0 notes

Photo

يمكن أن يتم تخزين الهيدروجين من خلال العديد من الطرق الحالية للاحتفاظ بالهيدروجين لاستخدامه لاحقًا. وتشمل هذه الأساليب الميكانيكية مثل استخدام ضغوط عالية ودرجات حرارة منخفضة ، أو استخدام مركبات كيميائية تطلق غاز الهيدروجين عند الطلب. في حين يتم إنتاج كميات كبيرة من الهيدروجين من قبل الصناعات المختلفة ، فإنه يتم استهلاكه في الغالب في موقع الإنتاج ، لا سيما لتخليق الأمونيا . لسنوات عديدة ، تم تخزين الهيدروجين كغاز مضغوط أو سائل مبرد ، ونقله على هذا النحو في أسطوانات وأنابيب وخزانات مبردة لاستخدامها في الصناعة أو كوقود دافع في برامج الفضاء. يحفز الاهتمام باستخدام الهيدروجين لتخزين الطاقة على متن المركبات في المركبات عديمة الانبعاثات على تطوير طرق تخزين جديدة ، أكثر تكيفًا مع هذا التطبيق الجديد. يتمثل التحدي الأكبر في نقطة الغليان المنخفضة جدًا لـ H 2 : يغلي حوالي 20.268 كلفن (-252.882 درجة مئوية أو -423.188 درجة فهرنهايت). يتطلب تحقيق درجات الحرارة المنخفضة هذه إنفاق طاقة كبيرة.

تخزين الهيدروجين الهيدريد المعدني

هيدرات المعادن ، مثل MgH 2 ، NaAlH 4 ، LiAlH 4 ، LiH ، LaNi 5 H 6 ، TiFeH 2 ، أمونيا بوران ، وهيدريد البلاديوم تمثل مصادر للهيدروجين المخزن. ومرة أخرى ، فإن المشاكل المستمرة هي نسبة وزن H 2 التي تحملها وإمكانية عكس عملية التخزين. [13] بعضها سهل التزويد بالوقود في درجات الحرارة والضغط المحيطين ، في حين أن البعض الآخر عبارة عن مواد صلبة يمكن تحويلها إلى كريات. تتمتع هذه المواد بكثافة طاقة جيدة ، على الرغم من أن طاقتها النوعية غالبًا ما تكون أسوأ من الوقود الهيدروكربوني الرائد .

LiNH 2 و LiBH 4 و NaBH 4 . [14]

طريقة بديلة لخفض درجات حرارة التفكك هو تعاطي المنشطات. تم استخدام هذه الاستراتيجية لهيدريد الألومنيوم ، لكن التركيب المعقد يجعل هذا النهج غير جذاب. [15]

تشتمل الهيدريدات المقترحة للاستخدام في اقتصاد الهيدروجين على هيدرات بسيطة من المغنيسيوم [16] أو معادن انتقالية وهيدرات معدنية معقدة تحتوي عادةً الصوديوم أو الليثيوم أو الكالسيوم أو والألمنيوم على البورون . توفر الهيدريدات المختارة لتطبيقات التخزين تفاعلًا منخفضًا (أمانًا عاليًا) وكثافة تخزين هيدروجين عالية. المرشحون الرئيسيون هم هيدريد الليثيوم وبوروهيدريد وهيدريد الصوديوم والأمونيا الليثيوم ألومنيوم بوران . تقوم شركة فرنسية McPhy Energy بتطوير أول منتج صناعي ، يعتمد على هيدريد المغنيسيوم ، والذي تم بيعه بالفعل لبعض العملاء الرئيسيين مثل Iwatani و ENEL.

يمكن إنتاج الهيدروجين باستخدام الألمنيوم عن طريق تفاعله مع الماء. [20] كان يُعتقد سابقًا أنه للتفاعل مع الماء ، يجب تجريد الألومنيوم من طبقة أكسيده الطبيعية باستخدام مواد كاوية ، وسبائك ، [21] أو خلطه مع الغاليوم (الذي ينتج جزيئات الألمنيوم النانوية التي تسمح بتفاعل 90٪ من الألومنيوم. ). [22] ومنذ ذلك الحين تم إثبات أن التفاعل الفعال ممكن عن طريق زيادة درجة حرارة وضغط التفاعل. [23] الناتج الثانوي للتفاعل لتكوين الهيدروجين هو أكسيد الألومنيوم ، والذي يمكن إعادة تدويره مرة أخرى إلى الألومنيوم باستخدام عملية Hall-Héroult ، مما يجعل التفاعل متجددًا نظريًا. على الرغم من أن هذا يتطلب التحليل الكهربائي ، والذي يستهلك قدرًا كبيرًا من الطاقة ، يتم تخزين الطاقة بعد ذلك في الألومنيوم (ويتم إطلاقها عند تفاعل الألومنيوم مع الماء).

المغنيسيوم

يمكن تقسيم مواد تخزين الهيدروجين القائمة على Mg بشكل عام إلى ثلاث فئات ، على سبيل المثال ، سبائك Mg نقية ، وسبائك أساسها Mg ، ومركبات قائمة على Mg. على وجه الخصوص ، حظيت أكثر من 300 نوع من سبائك تخزين الهيدروجين القائمة على المغنيسيوم باهتمام واسع النطاق [24] بسبب الأداء العام الأفضل نسبيًا. ومع ذلك ، فإن حركية امتصاص / امتصاص الهيدروجين السفلية المتأصلة في الاستقرار الديناميكي الحراري المفرط للهيدريد المعدني تجعل سبائك تخزين الهيدروجين القائمة على المغنيسيوم غير مناسبة حاليًا للتطبيقات الحقيقية ، وبالتالي ، تم تكريس محاولات ضخمة للتغلب على هذا النقص. تم استخدام بعض طرق تحضير العينات ، مثل الصهر ، وتلبيد المسحوق ، والانتشار ، والسبائك الميكانيكية ، وطريقة تصنيع الاحتراق المائي ، والمعالجة السطحية ، والمعالجة الحرارية ، وما إلى ذلك ، على نطاق واسع لتغيير الأداء الديناميكي وعمر دورة تخزين الهيدروجين القائم على المغنيسيوم سبائك. بالإضافة إلى بعض استراتيجيات التعديل الجوهري ، بما في ذلك صناعة السبائك ، [25] [26] [27] [28] البنية النانوية ، [29] [30] [31] المنشطات عن طريق الإضافات التحفيزية ، [32] [33] واكتساب المركبات النانوية مع الهيدريدات الأخرى ، [34] [35] وما إلى ذلك ، تم استكشافها بشكل أساسي لتعزيز الأداء جوهريًا من سبائك تخزين الهيدروجين القائمة على المغنيسيوم. [36] مثل الألمنيوم ، يتفاعل المغنيسيوم أيضًا مع الماء لإنتاج الهيدروجين. [37]

من بين سبائك تخزين الهيدروجين الأولية التي تم تطويرها سابقًا ، يُعتقد أن مواد تخزين الهيدروجين القائمة على المغنيسيوم والمغنيسيوم توفر إمكانية رائعة للتطبيق العملي ، على حساب المزايا على النحو التالي: 1) مورد المغنيسيوم وفير واقتصادي. يوجد عنصر Mg بكثرة ويشكل حوالي 2.35 ٪ من قشرة الأرض مع المرتبة الثامنة ؛ 2) كثافة منخفضة فقط 1.74 جم سم 3 ؛ 3) قدرة تخزين الهيدروجين الفائقة. كميات تخزين الهيدروجين النظرية للمغنيسيوم النقي هي 7.6٪ بالوزن (نسبة الوزن) ، [38] [39] [40] و Mg2Ni 3.6٪ بالوزن ، على التوالي. [36]

348 notes

·

View notes

Text

Rising Demand of Alumina for Varied Utility to Boost Sales

Introduction

Aluminum Oxide, or Alumina, is a white crystalline chemical substance made mostly from the mineral bauxite. It's utilized in a wide range of advanced applications, such as anti-corrosion materials, wear and abrasion-resistant parts, and the electronics industry. Alumina is a cost-effective material with high quality properties such as high durability, brightness, low heat radiation, and high temperature stability.

The increased usage of aluminum oxide in the manufacture of porous ceramics has had a significant impact on alumina growth. In accordance with this, the rising demand for dental cements as well as industrial manufacturing processes is also operating as a crucial element that will boost alumina growth.

Know More@ https://www.kingsresearch.com/post/global-alumina-market-size?utm_source=Atish

COVID-19 Impact

Alumina is made from bauxite, which is a raw material. The COVID-19 epidemic has hampered bauxite mining, which has been labeled a national emergency by governments around the world. The market has been severely impacted by disruptions in bauxite production and supply to alumina refineries.

Spikes in COVID-19 infection rates resulted in lockdowns and shutdown of mining activities. Moreover, several industries such as Alumina stopped production due to lockdown protocols. As governments across the world are relaxing restrictions, it is projected that the pre-pandemic sales levels would be surpassed.

Key Developments

Due to its improved safety and performance, advanced aluminum materials are overtaking the automotive industry. Since lightweight materials improve fuel efficiency, worldwide automakers are switching their preferences to lighter materials in lieu of iron and steel components.

For instance, in 2020 itself, International Aluminum Institute (IAI) recorded 10,943.0 thousand metric tons of alumina production amid the surging COVID-19.

Refractories, ceramics, polishing, and abrasive applications are the most common applications for speciality aluminum oxides. Aluminum hydroxide, from which alumina originates, is used to make zeolites, coat titania pigments, and as a fireplace retardant/smoke suppressant in large quantities. Over 90% of the alumina, commonly referred to as Smelter Grade Alumina (SGA), is used in the Hall–Héroult process, which is used to assemble aluminum.

Also, Aluminum oxide has a number of advantages, including the ability to be produced in a range of forms, such as powder, sputtering targets, and tablets. Aluminum oxide can also be obtained in the form of nanoparticles. Aluminum oxide nanoparticles have a high tensile strength. Additionally, the particles have electric conductivity, are ductile, and can be employed to improve the strength of a variety of metals and alloys.

Competitive Landscape

Although rising demand from the automotive, construction, and packaging industries is likely to drive up aluminum demand, the global market is expected to face several constraints due to changing raw material prices and the availability of alternative materials. Yet, the competitive landscape is experiencing constant acquisitions, mergers, and expansions.

· Aluminum Corporation of China Ltd. (Chalco) began development on the second alumina refinery production line at Huasheng, China, in November 2020.

· Gränges AB, a Swedish rolled aluminum company, and Alcoa Corp, an American aluminum pioneer, have launched a collaboration in June 2021, focused at lowering the environmental effect of the aluminum value chain.

· Kaiser Aluminum Corporation had concluded its $670 million acquisition of Alcoa Warrick LLC in April 2021, which included all of the assets of the Warrick Rolling Mill, from Alcoa Corporation ("Alcoa").

Some prominent players of the market include:

· Alcoa Corporation

· Hongqiao Group

· Vedanta

· Cabot Corporation

· Aluminum Corporation of China (Chalco)

· Worsley Alumina

· Sasol

· Almatis

· Rusal

· Xinfa Group

· Rio Tinto

About Us

Kings Research is a data proficient market research firm that specializes in fostering efficient insights that propels businesses. We specialize in providing business intelligence on product specific markets to gain insights on quantifiable data. And our aim is to be the development catalyst to our clients that deliver actionable insights.

0 notes

Photo

يمكن أن يتم تخزين الهيدروجين من خلال العديد من الطرق الحالية للاحتفاظ بالهيدروجين لاستخدامه لاحقًا. وتشمل هذه الأساليب الميكانيكية مثل استخدام ضغوط عالية ودرجات حرارة منخفضة ، أو استخدام مركبات كيميائية تطلق غاز الهيدروجين عند الطلب. في حين يتم إنتاج كميات كبيرة من الهيدروجين من قبل الصناعات المختلفة ، فإنه يتم استهلاكه في الغالب في موقع الإنتاج ، لا سيما لتخليق الأمونيا . لسنوات عديدة ، تم تخزين الهيدروجين كغاز مضغوط أو سائل مبرد ، ونقله على هذا النحو في أسطوانات وأنابيب وخزانات مبردة لاستخدامها في الصناعة أو كوقود دافع في برامج الفضاء. يحفز الاهتمام باستخدام الهيدروجين لتخزين الطاقة على متن المركبات في المركبات عديمة الانبعاثات على تطوير طرق تخزين جديدة ، أكثر تكيفًا مع هذا التطبيق الجديد. يتمثل التحدي الأكبر في نقطة الغليان المنخفضة جدًا لـ H 2 : يغلي حوالي 20.268 كلفن (-252.882 درجة مئوية أو -423.188 درجة فهرنهايت). يتطلب تحقيق درجات الحرارة المنخفضة هذه إنفاق طاقة كبيرة.

تخزين الهيدروجين الهيدريد المعدني

هيدرات المعادن ، مثل MgH 2 ، NaAlH 4 ، LiAlH 4 ، LiH ، LaNi 5 H 6 ، TiFeH 2 ، أمونيا بوران ، وهيدريد البلاديوم تمثل مصادر للهيدروجين المخزن. ومرة أخرى ، فإن المشاكل المستمرة هي نسبة وزن H 2 التي تحملها وإمكانية عكس عملية التخزين. [13] بعضها سهل التزويد بالوقود في درجات الحرارة والضغط المحيطين ، في حين أن البعض الآخر عبارة عن مواد صلبة يمكن تحويلها إلى كريات. تتمتع هذه المواد بكثافة طاقة جيدة ، على الرغم من أن طاقتها النوعية غالبًا ما تكون أسوأ من الوقود الهيدروكربوني الرائد .

LiNH 2 و LiBH 4 و NaBH 4 . [14]

طريقة بديلة لخفض درجات حرارة التفكك هو تعاطي المنشطات. تم استخدام هذه الاستراتيجية لهيدريد الألومنيوم ، لكن التركيب المعقد يجعل هذا النهج غير جذاب. [15]

تشتمل الهيدريدات المقترحة للاستخدام في اقتصاد الهيدروجين على هيدرات بسيطة من المغنيسيوم [16] أو معادن انتقالية وهيدرات معدنية معقدة تحتوي عادةً الصوديوم أو الليثيوم أو الكالسيوم أو والألمنيوم على البورون . توفر الهيدريدات المختارة لتطبيقات التخزين تفاعلًا منخفضًا (أمانًا عاليًا) وكثافة تخزين هيدروجين عالية. المرشحون الرئيسيون هم هيدريد الليثيوم وبوروهيدريد وهيدريد الصوديوم والأمونيا الليثيوم ألومنيوم بوران . تقوم شركة فرنسية McPhy Energy بتطوير أول منتج صناعي ، يعتمد على هيدريد المغنيسيوم ، والذي تم بيعه بالفعل لبعض العملاء الرئيسيين مثل Iwatani و ENEL.

يمكن إنتاج الهيدروجين باستخدام الألمنيوم عن طريق تفاعله مع الماء. [20] كان يُعتقد سابقًا أنه للتفاعل مع الماء ، يجب تجريد الألومنيوم من طبقة أكسيده الطبيعية باستخدام مواد كاوية ، وسبائك ، [21] أو خلطه مع الغاليوم (الذي ينتج جزيئات الألمنيوم النانوية التي تسمح بتفاعل 90٪ من الألومنيوم. ). [22] ومنذ ذلك الحين تم إثبات أن التفاعل الفعال ممكن عن طريق زيادة درجة حرارة وضغط التفاعل. [23] الناتج الثانوي للتفاعل لتكوين الهيدروجين هو أكسيد الألومنيوم ، والذي يمكن إعادة تدويره مرة أخرى إلى الألومنيوم باستخدام عملية Hall-Héroult ، مما يجعل التفاعل متجددًا نظريًا. على الرغم من أن هذا يتطلب التحلي�� الكهربائي ، والذي يستهلك قدرًا كبيرًا من الطاقة ، يتم تخزين الطاقة بعد ذلك في الألومنيوم (ويتم إطلاقها عند تفاعل الألومنيوم مع الماء).

المغنيسيوم

يمكن تقسيم مواد تخزين الهيدروجين القائمة على Mg بشكل عام إلى ثلاث فئات ، على سبيل المثال ، سبائك Mg نقية ، وسبائك أساسها Mg ، ومركبات قائمة على Mg. على وجه الخصوص ، حظيت أكثر من 300 نوع من سبائك تخزين الهيدروجين القائمة على المغنيسيوم باهتمام واسع النطاق [24] بسبب الأداء العام الأفضل نسبيًا. ومع ذلك ، فإن حركية امتصاص / امتصاص الهيدروجين السفلية المتأصلة في الاستقرار الديناميكي الحراري المفرط للهيدريد المعدني تجعل سبائك تخزين الهيدروجين القائمة على المغنيسيوم غير مناسبة حاليًا للتطبيقات الحقيقية ، وبالتالي ، تم تكريس محاولات ضخمة للتغلب على هذا النقص. تم استخدام بعض طرق تحضير العينات ، مثل الصهر ، وتلبيد المسحوق ، والانتشار ، والسبائك الميكانيكية ، وطريقة تصنيع الاحتراق المائي ، والمعالجة السطحية ، والمعالجة الحرارية ، وما إلى ذلك ، على نطاق واسع لتغيير الأداء الديناميكي وعمر دورة تخزين الهيدروجين القائم على المغنيسيوم سبائك. بالإضافة إلى بعض استراتيجيات التعديل الجوهري ، بما في ذلك صناعة السبائك ، [25] [26] [27] [28] البنية النانوية ، [29] [30] [31] المنشطات عن طريق الإضافات التحفيزية ، [32] [33] واكتساب المركبات النانوية مع الهيدريدات الأخرى ، [34] [35] وما إلى ذلك ، تم استكشافها بشكل أساسي لتعزيز الأداء جوهريًا من سبائك تخزين الهيدروجين القائمة على المغنيسيوم. [36] مثل الألمنيوم ، يتفاعل المغنيسيوم أيضًا مع الماء لإنتاج الهيدروجين. [37]

من بين سبائك تخزين الهيدروجين الأولية التي تم تطويرها سابقًا ، يُعتقد أن مواد تخزين الهيدروجين القائمة على المغنيسيوم والمغنيسيوم توفر إمكانية رائعة للتطبيق العملي ، على حساب المزايا على النحو التالي: 1) مورد المغنيسيوم وفير واقتصادي. يوجد عنصر Mg بكثرة ويشكل حوالي 2.35 ٪ من قشرة الأرض مع المرتبة الثامنة ؛ 2) كثافة منخفضة فقط 1.74 جم سم 3 ؛ 3) قدرة تخزين الهيدروجين الفائقة. كميات تخزين الهيدروجين النظرية للمغنيسيوم النقي هي 7.6٪ بالوزن (نسبة الوزن) ، [38] [39] [40] و Mg2Ni 3.6٪ بالوزن ، على التوالي. [36]

171 notes

·

View notes

Text

What Is Low-carbon Aluminium?

We are now faced with a target to reduce our global carbon emissions to zero by 2050, we have just less than 30 years to achieve this. If we can achieve this target, then we should be able to limit our world’s rise in temperature to just 2° compared to pre-industrial levels. Many scientific minds have been working on how we may achieve this target, but it eventually comes down to countries across the globe who need the determination and available investment to drastically cut carbon emissions. Will we achieve this goal? Well, there is still much work to be done and technology is rapidly evolving.

Construction is just one of the areas identified by the United Nations, claiming that 11% of our total carbon emissions are due to our global construction activities. Aluminium, used extensively in external envelope applications, sits alongside other materials and construction activities that are under review. Primary aluminium production (new aluminium extracted from bauxite ore) is an electricity-intensive raw material to produce. Chinese prime aluminium production emits 20kg of CO2 per single kg of aluminium production. On average, globally, this drops to 16.7kg of CO2 per kg of aluminium production. A typical low-carbon aluminium however can be produced at around 7kg of CO2 per single kg of aluminium production by using renewable energy and recycled content. It is important to remember that it is the aluminium material itself, the ‘billet’ or ‘logs’ used for extrusion that is sourced as low-carbon, not the production of the profile itself.

The production of prime aluminium has continued to take advantage of new technology to reduce energy consumption in its manufacture and its carbon emissions since aluminium became a commercially viable material in 1880 through the Hall–Héroult process. Energy consumption has been reducing on average by 1.2% per year over the last few decades, but in order to achieve a low-carbon aluminium product, much more is needed.

The quantity of recycled aluminium used globally, sometimes known as secondary production, has remained relatively constant at 31-33% since 2000, with 34% used in 2019 the highest share during this period. As aluminium has a high value, collection rates are typically high, in 2019, collection rates for aluminium were over 95% for all new scrap (pre-consumer) and just over 70% for all old (post-consumer) scrap aluminium. We must continue to increase the collection of post-consumer scrap as it uses much less energy to recycle, just 10% that of primary aluminium.

There are various producers of Aluminium billet across the globe, all of who supply some low-carbon product, such as, EcoLum from Alcoa offering 4kg of CO2 per single kg of aluminium production, ALLOW from RUSAL offering 4kg of CO2 per single kg of aluminium production, CIRCAL 75R from Hydro offering 2.3kg of CO2 per single kg of aluminium production and our own group company, LowCarbonKety from Grupa Kety offering 2,79kg of CO2 per single kg of aluminium production. All of these low-carbon products are made up of up to 75% post-consumer scrap, approximately 10% pre-consumer scrap, together with a low content of primary aluminium and is then produced using renewable energy sources.

The problem we have is that low-carbon aluminium products are costly and in short supply, so why is this? Referring back to the total recycled content of all aluminium supplied to meet the demand of 31-33% since 2000, we simply cannot get enough scrap to meet the demand. At a required total 85% recycled content (post and pre-consumer scrap) for this low-carbon aluminium, finding the recycled content is difficult. There are also other issues to consider when specifying low-carbon aluminium, such as it cannot be used when an anodised finish is required.

Why do we have a shortage of scrap? As demand continues to grow for aluminium and products using aluminium last longer, there is simply not enough to meet demand. It could be stated that specifying a low-carbon aluminium for a project only takes recycled content away from another project, so on a global scale, there is no benefit. What is key here is that technology is moving rapidly to increase the use of renewable energy in the production of aluminium and to reduce or capture CO2 during manufacture. We also must remember that we are not going to run out of the raw material to produce aluminium, as the raw material bauxite is the most abundant metal in the earth's crust.

Here at Aluprof, we source one third of our aluminium extrusions from our group company, Grupa Kety, where we offer a low-carbon aluminium product and are working to further reduce carbon emissions. Two thirds of our aluminium extrusions supplied by Aluprof comes from other market sources. We can therefore offer specifiers any low-carbon product specifiers wish to use for their project, but this comes with the caveat of both possible cost implications and likely extended lead times for extrusions. Given the project requirements, should a requested low-carbon specification be achievable, then Aluprof can offer EPD (Environmental Product Declarations) to substantiate the source of the aluminium that Aluprof’s profiles will be supplied from.

Extended lead times for products could impact the site programme, which in turn could incur additional carbon costs. On the other hand, some BREEAM credits could be available on a project by choosing low-carbon products, including aluminium. These issues highlight that every project is different and must be looked at in isolation. The key here is the need to get product suppliers involved at the early design stages to explore what is possible. Aluprof have an experienced design team on hand who can explore these options and help choosing the right aluminium source and systems to suit any project.

Since setting up the Aluprof Office at the Business Design Centre in London, the company has rapidly grown their specification influence in the UK with their high-performance architectural aluminium systems. Further expansion of the company’s headquarters in Altrincham now provides specifiers with meeting facilities and an extensive showroom of commercial systems to view. With overseas growth across Europe spreading into the Middle East and firm roots already in the East of the USA, the company has become a global player in facade supply. Further information is available on the company’s website at aluprof.co.uk or direct from their UK head office in Altrincham on 0161 941 4005.

0 notes

Text

The history of aluminium in human usage goes back at least 2,500 years, when its compound alum was used for dyeing and city defense. During the Middle Ages, alum was traded in international commerce. In the Age of Enlightenment, the earth of alum, alumina, was shown to be an oxide of a new metal which was then discovered in the 1820s. Pure aluminium remained scarce until industrial production began in 1856; since the 1886 discovery of the Hall–Héroult process, production has grown exponentially. Engineering and construction applications began in the first half of the 20th century; aluminium was a vital strategic resource for aviation during both world wars. In 1954, it surpassed copper as the most produced non-ferrous metal. In the following decades, aluminium production spread throughout the world, and the metal became an exchange commodity and gained usage in transportation and packaging. Aluminium production in the 21st century exceeds that of all other non-ferrous metals combined.

0 notes