#GreenInvesting

Explore tagged Tumblr posts

Text

Master Your Finances with Advisory Financial Services Choosing the right financial services is essential for managing your money, securing your future, and achieving your financial goals. This guide breaks down key factors to consider, from assessing your needs to finding trusted professionals who align with your objectives. Read on to make informed decisions and take control of your financial future today!

0 notes

Text

🔥 Carbonxt Group Limited (ASX: CG1) – HY25 Results Update! 🔥

Carbonxt Group Limited (ASX: CG1) has released its half-year results for the period ending 31 December 2024, highlighting strong revenue performance, margin expansion, and key operational milestones that set the stage for accelerated growth in 2H25.

🔹 Key Highlights:

✅ Revenue of $7.4M, with strong momentum expected in 2H25. ✅ PAC revenue up 13% YoY, driven by the successful execution of the ReWorld Waste contract. ✅ Gross margin improved to 49%, up from 44% in HY24 and 28% in HY23, reflecting enhanced cost efficiencies. ✅ Kentucky Activated Carbon plant achieved mechanical completion in December 2024, marking a major milestone in Carbonxt’s expansion strategy. ✅ Kentucky facility starts with a 10,000-ton capacity, scalable up to 20,000 tons. ✅ Ongoing cost management initiatives expected to support stronger financial performance in 2H25. ✅ $5M capital raise via Share Placement & SPP, driving future growth. ✅ Current Stock Price: $0.06

📢 Investor Opportunity – The Growing Activated Carbon Market

The demand for activated carbon is surging, fueled by stricter environmental regulations on mercury emissions and PFAS contamination. Carbonxt’s newly completed Kentucky plant enhances its competitive positioning in key markets, supporting long-term industry expansion. With sustainability-focused solutions gaining traction and a clear revenue growth trajectory, Carbonxt is well-positioned to unlock further shareholder value.

🔗 More Details: https://colitco.com/carbonxt-asx-cg1-hy25-results-kentucky-updates/

Disclaimer: This is not investment advice. Please conduct your research before making any investment decisions.

#Carbonxt#ASXCG1#CleanTech#Sustainability#Investing#ActivatedCarbon#EnvironmentalTech#StockMarket#InvestorUpdates#AirPurification#WaterTreatment#ESG#GreenInvesting#Australia#GrowthStrategy#Finance#IndustryTrends#RenewableEnergy#BusinessNews

0 notes

Text

Understanding Capex Solar Models: The Future of Solar Panel Investment for Your Business

Over the past few years, solar energy demand has taken off due to both environmental and economic motivations. As a company owner or decision-maker, knowledge of the different solar investment structures is key to making an informed decision for your business. One such structure that has drawn great interest is the Capex Solar Model, an old yet becoming more widely adopted method for companies seeking to make a long-term solar investment.

But what is the Capex Solar Model, anyway? How does it function, and is it the best option for your company? In this blog, we'll dissect all you need to know about capex solar models and why they could be the ideal solution for your energy requirements.

What is the Capex Solar Model?

Capex means Capital Expenditure, the initial cost for the purchase and installation of a solar energy system. In a Capex structure, a business retains ownership of the solar system, so you cover the up-front investment, installation, routine maintenance, and lifetime savings from the system.

Plainly stated, with the Capex model, your company pays an upfront fee for the installation of solar panels and thereafter begins harvesting clean, renewable energy for its use. Ownership is the sole distinguishing factor of the Capex model from the other solar models (e.g., the Opex or the Power Purchase Agreement (PPA) models) because, in Capex, your company now owns the solar system, and the advantages immediately reflect on your investment.

Why You Should Have a Capex Solar Model

1. Long-Term Energy Savings and Independence

Perhaps the most attractive feature of the Capex solar model is long-term savings. Although the upfront cost can be considerable, it is rewarded in the future in the form of lower energy bills. After the installation is made, your company produces its own electricity, which can significantly reduce dependence on outside energy sources and minimize operational expenses. Within the life of the system (on average 25 to 30 years), savings can be sizable, even sufficient to recover the initial capital cost.

2. Taxation Incentives

When you invest in solar power on the Capex model, your company can leverage a number of incentives and tax credits. In most parts of the world, governments provide tax credits, rebates, or grants to companies that invest in renewable energy sources. For instance, in the United States, the Investment Tax Credit (ITC) provides a 26% federal tax credit on the overall cost of the solar system, lowering the initial cost burden.

These incentives combined with accelerated depreciation on the solar system make the Capex model an economically beneficial solution for corporations wanting to offset their tax cost while supporting sustainability initiatives.

3. Increased Property Value

Solar panel installation can add value to your commercial building. Numerous studies have indicated that buildings with solar systems sell for more, which makes the Capex model a good investment for those who are looking long-term. Not only are you cutting down on energy expenses, but you're also enhancing the value of your property, which can be a good thing if you ever decide to sell or lease the building in the future.

4. Environmental Impact

Using the Capex model, your business assumes an active position in the renewable energy movement. Solar energy is a green, clean source of energy that not only reduces greenhouse gas emissions but also helps to mitigate climate change. If you want to enhance your corporate social responsibility (CSR) standing or just want to do your share in keeping the planet safe, going solar is a powerful decision.

5. Full Control and Flexibility

Having your solar system means having complete control over its maintenance, upgrades, and performance. With leasing or PPA models, in which the system is owned by a third party, improvements or adjustments made to the system are completely out of your hands. With technology evolving, you can upgrade to improve efficiency and benefit from new innovations without the need to pass through a third party.

The Challenges of Capex Solar Models

Of course, no investment is without its challenges. While the Capex model has long-term advantages, it does call for a lot of initial capital, which may be a challenge for some companies. The installation process itself also needs to be planned carefully so that the system is sized appropriately for your energy requirements.

Moreover, there are also maintenance and monitoring expenses to be factored in. Although most solar panel systems are low-maintenance, periodic check-ups and maintenance can guarantee that they remain in top working condition for decades.

How to Get Started with a Capex Solar Model

If the Capex solar model seems like the ideal choice for your company, the initial step is to contact a reliable solar energy company with installation and maintenance capabilities. The following is a brief summary of what you can expect when you invest in a Capex solar system:

1. Site Evaluation: The initial step is an energy audit to evaluate your facility's energy usage and identify the most suitable solar system for your requirements.

2. System Design and Proposal: Your provider will design a system based on the audit, specific to your energy needs, and provide a proposal with a breakdown of costs.

3. Financing Options: If the upfront cost is a concern, your provider may offer financing options to make the investment more manageable, such as loans or leases.

4. Installation: Once financing is secured and the design is finalized, the system is installed by a team of experts. They will ensure everything is properly set up and connected to the grid.

5. Maintenance and Monitoring: Routine monitoring and maintenance following installation guarantee that the system maintains its efficiency and provides the greatest return on investment.

Conclusion

The Capex Solar Model provides companies with a strong means of investing in renewable energy, realizing long-term savings, and benefiting from tax incentives. Although the up-front capital investment may be substantial, the long-term environmental and financial advantages make it a sound option for companies interested in owning their energy future.

At Solispark Energy Pvt Ltd we are dedicated to offering specialized solar panel installation and maintenance. Whether you are looking at the Capex solar model or thinking about other choices, our team is ready to assist you through the solar energy world and assist you in identifying the optimal choice for your business. Ready to gain control over your energy expenditure? Get in touch with us today to begin your path to a sustainable future with solar power.- https://www.solisparkenergy.com/

#UnderstandingCapexSolarModels#SolarEnergy#RenewableEnergy#CapexModel#SolarInvestment#SustainableEnergy#CleanEnergy#SolarTechnology#GreenInvesting#SolarPower#InvestmentStrategies#EnergyEfficiency#SolarSolutions#FinancialLiteracy#ClimateAction#EcoFriendly#FutureEnergy#SmartInvesting#SolarEducation

0 notes

Text

Carbonxt Delivers Strong December 2024 Quarter with Key Milestones

Carbonxt Group Ltd (ASX: CG1) (“Carbonxt” or “the Company”) has made solid progress in the December 2024 quarter, achieving major operational milestones and strengthening its financial position. The completion of the Kentucky facility, a successful capital raise, and strong Powdered Activated Carbon (PAC) sales set the stage for a promising 2025.

Kentucky Facility Reaches Mechanical Completion

On 18 December 2024, Carbonxt completed all mechanical works at its Kentucky activated carbon plant. This milestone positions the Company to ramp up production and meet rising demand across multiple industries. The Kentucky facility strengthens Carbonxt’s presence in the growing activated carbon market, with a strategic entry into the water treatment sector planned.

Managing Director Mr. Warren Murphy highlighted the significance of this milestone, stating, “The December quarter marks a major milestone for Carbonxt, with the mechanical completion of our Kentucky facility and a focus on ramping up production.”

The Company is now focused on optimising coal processing and completing high-temperature wiring installations to bring the plant online for full-scale operations.

#Carbonxt#CG1#ActivatedCarbon#CleanEnergy#SustainableTech#EnvironmentalSolutions#CarbonCapture#GreenInvesting#ASXStocks#InvestmentNews#AirPurification#WaterTreatment#EcoFriendly#SustainableFuture#EnergyInnovation#StockMarketNews#IndustrialTech#CarbonReduction#BusinessGrowth#InvestorUpdates

0 notes

Text

Sustainability meets profitability with Sambhav Consultants. Let’s create lasting impact together.

#SustainableInvestments#SustainableFinance#GreenInvesting#InvestmentForFuture#SambhavConsultants#EmpowerYourInvestment#ResponsibleInvesting#EcoFriendlyInvesting#InvestInSustainability#ImpactInvesting#SustainableGrowth#FinancialEmpowerment#SmartInvesting#GreenFinance#InvestInTheFuture#SustainableDevelopment

0 notes

Text

Why did we establish the Sydney Financial Planning firm Evalesco Financial Services

Discover the story behind Evalesco Financial Services and why we’re passionate about empowering Australians to live their best lives financially. Learn how our Sydney-based team provides tailored financial planning solutions designed to help you grow, protect, and enjoy your wealth. Ready to take control of your financial future? Visit https://evalesco.com.au/services/

1 note

·

View note

Text

Sustainable Finance: The Essential Role of Climate Reporting in Investment Strategies

As the financial world evolves, there has never been a greater necessity for sustainable investment. An article from Inrate underlines how climate reporting for long-short portfolios and derivatives can no longer do without solid and comprehensive reporting.

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬:

𝐁𝐞𝐬𝐭 𝐏𝐫𝐚𝐜𝐭𝐢𝐜𝐞 𝐂𝐥𝐢𝐦𝐚𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭𝐢𝐧𝐠: The adoption of best practice on climate reporting increases transparency and, hence, responsibility in investment approaches.

𝐑𝐢𝐬𝐤 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭: Integration and understanding of climate risks is one of the basic factors to guarantee long-term portfolio sustainability.

𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫 𝐄𝐧𝐠𝐚𝐠𝐞𝐦𝐞𝐧𝐭: Active dialogue by investors and companies should facilitate better climate reporting, hence leading to better-informed decision-making.

Investors have a responsibility regarding their portfolios impact on the environment. By embracing clear climate reporting, we follow already emerging regulations but do our part for a greener tomorrow.

𝐋𝐞𝐭 𝐮𝐬 𝐬𝐮𝐩𝐩𝐨𝐫𝐭 𝐬𝐮𝐜𝐡 𝐩𝐫𝐚𝐜𝐭𝐢𝐜𝐞𝐬 𝐚𝐧𝐝 𝐥𝐞𝐚𝐝 𝐨𝐭𝐡𝐞𝐫𝐬 𝐢𝐧𝐭𝐨 𝐦𝐚𝐤𝐢𝐧𝐠 𝐭𝐡𝐢𝐬 𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐥𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞 𝐠𝐫𝐞𝐞𝐧𝐞𝐫!

Download Report

#SustainableInvesting#ClimateReporting#Transparency#InvestmentStrategy#Finance#ESG#ClimateFinance#ImpactInvesting#GreenInvesting#ResponsibleInvestment#ClimateRisk#FinancialTransparency#Sustainability#ClimateAction#LongShortInvesting#SociallyResponsibleInvesting

0 notes

Text

How Regulations are Transforming the ESG Ratings Industry

In the sustainable finance ecosystem, ESG ratings are an inevitable ingredient for investors seeking long-term value creation and society value addition in their investment portfolios. Increasing dependence on ratings, however, comes the increasing need for greater oversight from regulatory bodies as the onus lies more with them to provide an air of transparency, consistency, and accountability. End The requirement for standardized methodologies to address discrepancies across ratings. How global regulations, like the EU’s Sustainable Finance Disclosure Regulation (SFDR), are shaping the market.The implications of increased scrutiny for rating providers and investors alike.

I find this push for more clarity and trust in ESG assessments encouraging as an advocate for environmental science and sustainability. It is a reminder that sustainable practices need a foundation of robust and credible data.

What are your thoughts on how regulation is impacting the future of ESG ratings?

Read More: ESG Rating Providers

#ESG#Sustainability#SustainableFinance#EnvironmentalScience#GreenInvesting#CorporateResponsibility#ClimateAction#ESGRatings#Regulations#Transparency#SustainableInvesting#ImpactInvesting#SustainabilityLeadership#EthicalFinance#ESGInsights

0 notes

Text

Tesla Stock (NASDAQ:TSLA) – What’s Driving the Future of Electric Vehicle Investments?

Tesla stock (NASDAQ:TSLA) continues to capture investor attention with its innovative electric vehicles and cutting-edge technology. As the leader in the EV market, TSLA’s growth is shaped by its production milestones, global expansion, and market trends. Explore how Tesla’s strategic moves and its impact on the stock market are positioning the company for long-term success.

For more information visit at :

https://kalkine.com/company/nasdaq-tsla/

#TeslaStock#TSLA#NASDAQTSLA#ElectricVehicles#EVStocks#TeslaGrowth#InvestmentOpportunities#StockMarket#TechStocks#GreenInvesting

0 notes

Text

https://evalesco.com.au/services/

Tailored Services for Success with Green Investing Evalasco's Financial Services offers personalized financial solutions designed to help you build, protect, and grow your wealth. From strategic planning and investments to budgeting and retirement guidance, we tailor our services to your unique goals. Start your journey to financial success today—contact Evalasco's Financial Services for a consultation!

0 notes

Text

Sukrit Agrawal Share 5 Tips for Sustainable Investment Success

In this video, Sukrit Agrawal shares five essential tips for achieving success in sustainable investing. Learn how to align your financial goals with environmental, social, and governance (ESG) principles while making a positive impact. Watch now to start your journey toward responsible investing!

#SukritAgrawal#SustainableInvesting#ESG#InvestmentSuccess#GreenInvesting#ResponsibleInvesting#FinancialGoals#InvestmentTips

0 notes

Text

🌿💰 Diving into the Green: Financial Strategies for Preserving Biodiversity 🌍🦋

Hey Tumblr community! Let's talk about something crucial: preserving biodiversity. 🌿 It's not just about saving cute animals; it's about safeguarding the delicate balance of ecosystems that sustain life on Earth. And guess what? Financial strategies play a significant role in this mission! 💸🌱

🌳 Investing in Conservation: One powerful way to preserve biodiversity is through investing in conservation efforts. From protecting endangered species to restoring habitats, every dollar invested can make a difference in preserving our planet's rich biodiversity.

💡 Impact Investing: Impact investing is all about putting your money where your values are. By supporting companies and projects that prioritize environmental sustainability and biodiversity conservation, you can make a positive impact while earning potential financial returns.

🌱 Sustainable Finance Initiatives: Many financial institutions are stepping up their game by integrating environmental considerations into their lending and investment decisions. Whether it's through green bonds, sustainability-linked loans, or ESG (Environmental, Social, and Governance) investing, there are various avenues for channeling funds towards biodiversity conservation.

🌊 Blue Finance for Marine Conservation: Let's not forget about our oceans! Blue finance initiatives focus on financing projects that promote marine conservation and sustainable ocean management. From coral reef restoration to combating illegal fishing, there's a world of opportunities to support our oceans' biodiversity.

🌎 Community-led Conservation Projects: Supporting grassroots organizations and community-led conservation projects is another impactful way to preserve biodiversity. These initiatives often have a deep understanding of local ecosystems and can leverage financial support to make a meaningful difference on the ground.

🌸 Educating and Empowering: Lastly, financial literacy and empowerment play a vital role in biodiversity conservation. By educating individuals and communities about sustainable financial practices and empowering them to make informed decisions, we can create a more sustainable future for all.

So, let's harness the power of finance to protect the incredible diversity of life on our planet. Together, we can make a difference! 🌿💚

#ProtectOurPlanet#GreenInvesting#SustainableFinance#BiodiversityConservation#payment system#finance#thefinrate#100 days of productivity#financialinsights#financetalks#moneymatters

0 notes

Text

Unlocking Opportunities: Agriculture Land Purchase with AlliedDeveloper

Agriculture Land Purchase

Understanding the Significance of Agriculture Land Purchase

Agriculture land purchase is not merely a transaction; it is a strategic investment in the future of food security and sustainable development. The land serves as the canvas upon which farmers cultivate the crops that sustain livelihoods and nourish nations. However, acquiring agricultural land can be a complex endeavor fraught with challenges ranging from regulatory hurdles to financial constraints.

The Role of AlliedDeveloper: Pioneering a New Frontier

Enter AlliedDeveloper, a trailblazing company committed to facilitating seamless agriculture land purchase transactions. With a vision to bridge the gap between investors and agricultural opportunities, AlliedDeveloper leverages cutting-edge technology and a robust network of experts to streamline the process.

Key Features and Benefits

Comprehensive Market Insights: AlliedDeveloper provides investors with in-depth market analysis and insights, empowering them to make informed decisions. From soil quality assessments to crop yield projections, every aspect is meticulously analyzed to ensure optimal returns on investment.

Regulatory Compliance: Navigating the regulatory landscape can be daunting, especially in the realm of agriculture land purchase. AlliedDeveloper’s team of legal experts simplifies this process, ensuring compliance with all relevant laws and regulations.

Customized Solutions: No two agricultural investments are alike, and AlliedDeveloper recognizes this reality. Whether it’s large-scale farming operations or niche specialty crops, the company tailors its services to meet the unique needs and preferences of each client.

Sustainable Practices: In an era marked by environmental consciousness, sustainability is non-negotiable. AlliedDeveloper promotes sustainable agricultural practices, emphasizing soil health, water conservation, and biodiversity preservation.

Long-Term Partnerships: Beyond facilitating transactions, AlliedDeveloper cultivates enduring partnerships with investors and agricultural stakeholders. Through ongoing support and collaboration, the company ensures mutual growth and success.

Case Study: Transforming Visions into Reality

Consider the case of a group of investors seeking to diversify their portfolio through agriculture land purchase. Daunted by the complexities of the process, they turned to AlliedDeveloper for guidance. Leveraging its expertise, the company identified a prime parcel of land with favorable soil conditions and proximity to key markets. From negotiating the purchase price to overseeing the transition to sustainable farming practices, AlliedDeveloper orchestrated every aspect of the transaction. Today, the investors reap the rewards of their agricultural venture, enjoying robust returns and contributing to the local economy.

Looking Ahead: Embracing a Future of Possibilities

As we stand at the precipice of unprecedented global challenges, agriculture land purchase emerges as a beacon of hope and resilience. With AlliedDeveloper leading the charge, investors have the opportunity to unlock the full potential of agricultural investments while safeguarding the planet for future generations. Together, let us embrace this future of possibilities and cultivate a world where prosperity flourishes on the fertile soil of innovation and sustainability.

#AgricultureInvestment#LandAcquisition#SustainableFarming#FutureOfFood#InvestInAgriculture#AlliedDeveloper#AgricultureOpportunities#LandDevelopment#FarmInvestment#GreenInvesting

0 notes

Text

#SLRSandalwood#SandalwoodProjects#FarmlandSales#InvestInSandalwood#SandalwoodInvestment#SustainableInvesting#RealEstateInvestment#LegacyInvestment#EnvironmentalStewardship#LuxuryLiving#WealthCreation#PropertyInvestment#SandalwoodHarvest#InvestmentOpportunity#GreenInvesting#SandalwoodLegacy#FutureWealth#SandalwoodFarm#FarmlandForSale#EcoFriendlyInvestment

1 note

·

View note

Text

🌱🔋 Mit intelligenten Investitionen schon heute für ein grüneres Morgen sorgen! Tauchen Sie ein in die dynamische Welt der erneuerbaren Energien und entdecken Sie, wie sie die Investitionslandschaft revolutionieren. 💡🌍

#ErneuerbareEnergie#GreenInvesting#NachhaltigeZukunft#Umweltfreundlich#Investmenttrends#Solarenergie#WindEnergie#Klimaschutz#finance#investment#arbitrageinvestmentag

0 notes

Text

Mastering Material Data Management: A Cornerstone for Sustainable Decision-Making in Green Finance

In today's world, sustainability isn't just a buzzword - it's a driving force for businesses and investors alike. And at the heart of it all lies ESG data. This critical information paints a picture of a company's environmental, social, and governance performance, but gathering it can be a real challenge.

Imagine sifting through mountains of spreadsheets, deciphering cryptic reports, and chasing down data scattered across departments. It's enough to give even the most sustainability-minded individual a headache.

That's where Master Data Management (MDM) steps in, playing a crucial role in ensuring accurate, reliable, and consistent ESG reporting.

Understanding ESG Data:

At the heart of sustainable finance lies ESG data, providing information about a company or investment's environmental, social, and governance (ESG) attributes. This data is used by a wide range of stakeholders, including investors, analysts, companies, policymakers, and more, to understand and make informed decisions about business effectiveness, risk, and sustainability.

Sustainable data management is the responsible management and handling of data throughout its lifecycle. This includes the collection, processing, storage, and disposal of data. Sustainable data management aims to minimize the environmental impact of data management practices, reduce energy consumption, and optimize the use of resources. Sustainable data management also focuses on ensuring that data is used in a socially responsible and ethical way.

Why is Sustainable Data Management Important?

Sustainable data management is essential for several reasons. Firstly, it helps to minimize the environmental impact of data management practices. Data centres and other IT infrastructure consume significant amounts of energy and produce a considerable amount of carbon emissions. Sustainable data management practices aim to reduce energy consumption and carbon emissions by optimizing data centre design, improving energy efficiency, and using renewable energy sources.

88% of publicly traded companies have ESG initiatives in place followed by 79% of venture and private equity-backed companies and 67% of privately-owned companies. (Src:Navex)

Data Collection for ESG Reporting

ESG reporting demands transparency on a company's environmental, social, and governance practices. The first step is choosing the relevant metrics based on your industry, reporting framework (e.g., GRI, SASB, TCFD), and stakeholder interests.

Each framework defines specific metrics for different ESG categories like:

Environment: Greenhouse gas emissions, water usage, waste generation, resource consumption, etc.

Social: Labor practices, diversity and inclusion, employee health and safety, community engagement, etc.

Governance: Board composition, executive compensation, shareholder rights, anti-corruption practices, etc.

Gathering the data to tell this story is crucial, but it can be a complex process. Once the metrics are identified, you need to gather data from various sources:

Internal Data: This includes energy consumption, waste generation, employee diversity, community engagement, and governance policies. Data may reside in various systems like energy meters, HR databases, and financial records, etc.

External Data: Suppliers, industry groups, and governmental agencies provide data on things like raw material sourcing, labor practices, and regulatory compliance, etc.

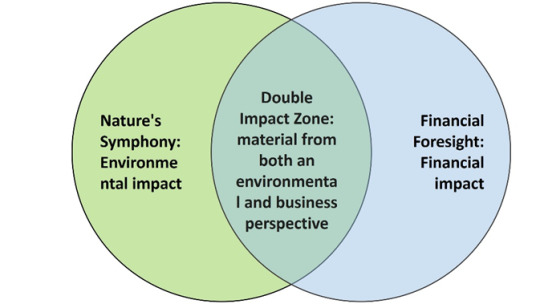

Prioritizing your Data Collection with Double Materiality

Before diving into data mountains, it's crucial to define your Everest. Enter double materiality, the guiding compass for prioritizing the most impactful ESG and sustainability data your organization needs to collect.

Double materiality emphasizes matters that are significant:

From an ESG perspective: How your operations and actions affect the environment, society, and governance.

From a financial perspective: How ESG issues can impact your business risks and opportunities.

Think of it like Venn diagram of "sustainability is good for the planet" and "sustainability is good for business." The overlapping area forms your double materiality sweet spot, focusing data collection efforts on topics that matter most, both ethically and economically.

Practically, focus your data collection laser! By identifying the most critical ESG topics and risks, you ensure your efforts aren't scattered. Take for example the rising threat of extreme weather events for an energy and utility company – a double materiality double whammy for both sustainability and the bottom line! Now, let's turn the screws: what are the key climate risk data points and KPIs this company needs to track? Where's this data hiding, internally or externally? And how can they grab it efficiently? Prioritization isn't just about sorting – it's about taking targeted action for maximum impact.

The Challenges of Data Cleansing and Management:

Gathering the valuable information isn't always a picnic. Here are some common hurdles:

Data Silos: ESG data often gets trapped in isolated pockets across different departments and systems.

Inconsistent Formats: Metrics may be measured and reported differently, making comparisons difficult.

Data Quality Issues: Missing or inaccurate data can undermine the entire reporting process.

Lack of Resources: Companies may struggle to dedicate time and expertise to data collection.

Inaccurate or missing data can undermine the credibility of your ESG report. MMDM solution providers like Verdantis offers data cleansing, validation, and enrichment tools, enhancing data quality and minimizing errors.

Your ESG materiality should be a mirror reflecting your unique identity, values, and business model. Sustainability and ESG initiatives should build upon this foundation, not replace it.

By prioritizing data management, you ensure your focus remains on the issues that truly matter, driving both environmental progress and financial success.

MDM: The Powerhouse for ESG Data:

As ESG reporting requires accurate and comprehensive data across multiple dimensions, MDM provides the necessary framework to ensure data integrity and consistency.

MDM (Master Data Management) provides the foundation for effective management of ESG data, offering several key benefits:

Single Source of Truth: MDM establishes a single, centralized repository for all ESG data, eliminating inconsistencies and streamlining access for various stakeholders.

Data Quality and Integrity: MDM ensures data accuracy, completeness, and consistency, mitigating risks associated with poor data quality.

Improved Reporting and Compliance: By centralizing and standardizing ESG data, MDM facilitates efficient reporting and compliance with evolving ESG regulations.

Enhanced Decision-Making: Accurate and reliable ESG data empowers companies to make informed decisions about sustainable investments, operations, and stakeholder engagement.

Planting the Seeds for a Sustainable Future:

In our data-driven future, sustainable finance practices are no longer optional but imperative. Robust Master Data Management (MDM) solutions like Verdantis unlock the full potential of ESG data, fostering informed decision-making and transparency. Empower your organization in sustainable finance with MDM, navigating the complex financial landscape one well-governed data point at a time.

Mastering material data management is not just a business necessity but a strategic advantage in our evolving world. Prioritizing accurate material data helps companies navigate green finance, meet ESG standards, and reduce carbon footprints. Integrating sustainability into core decision-making processes contributes to a more resilient and environmentally conscious global economy.

To embark on a data led ESG strategy, organizations require internal support and guidance from consulting partners like Verdantis to craft a blueprint. Considering the vast amount of data involved, the right technology becomes essential.

Remember, MDM is not just about managing data, it's about managing your organization's journey towards a sustainable and responsible future.

Get In Touch Today To Embrace A Sustainable Future: info@verdantis.com/

www.verdantis.com/contact

#ESG#Sustainability#SustainableFinance#GreenFinance#ImpactInvesting#ClimateAction#CorporateSocialResponsibility#CSR#DataDrivenDecisions#FutureProofing#MasterDataManagement#MaterialDataManagement#DataGovernance#GreenInvesting#SustainableInvesting#ESGInvesting#FinTech#ClimateTech#CleanTech#CircularEconomy#Datacleansing

0 notes