#Goldmining

Explore tagged Tumblr posts

Text

Our Visionary Approach Transforms Tradition into Innovation, Sustainably Shaping the Golden Frontier. Join us in Pioneering the Future of Mining Excellence.

#cunninghammining #nuggettrapgold #gold #mining #goldentraingle

2 notes

·

View notes

Text

Foldable Metal Detector for Gold Prospecting and Treasure Hunting

#Foldable#gold#detector#golddetector#MetalDetector#GoldProspecting#TreasureHunting#FoldableMetalDetector#GoldDetector#TreasureHunter#GoldHunting#MetalDetecting#OutdoorAdventure#GoldFever#GoldRush#GoldNuggets#GoldMining#GoldPanning#GoldDigger

1 note

·

View note

Text

Understanding AISC in Gold Mining: What It Means for Investors

Discover the significance of AISC (All-In Sustaining Costs) in gold mining. Learn how AISC affects the profitability and valuation of gold mining companies, and why it’s a crucial metric for investors seeking to understand operational costs in the gold sector.

For more information visit at:https://kalkinemedia.com/definition/a/all-in-sustaining-cost

#AISC#GoldMining#GoldStocks#MiningInvesting#GoldInvesting#AISCinGold#MiningCosts#PreciousMetals#GoldInvestors#MiningIndustry

0 notes

Text

🌟 Platina Resources Secures Major Grant for Xanadu Gold Project! 🌟

🚀 Exciting Milestone for Platina Resources (ASX: PGM)

Platina Resources has secured a $54,750 government grant to accelerate exploration at its flagship Xanadu Gold Project in Western Australia! 💰💎 This grant under the Exploration Incentive Scheme (EIS) will fund up to 50% of direct drilling costs at the Cleopatra South Prospect. 🏆

🔍 Key Highlights:

🛠️ Targeted Drilling Campaign

Focus on 800m-long arsenic trend at Cleopatra South.

Drilling depth: Up to 380m to uncover the gold source.

Start Date: December 2024 (weather and rig availability permitting). 🏗️

Strategic Location: Adjacent to Kalamazoo Resources’ 1.44M oz Mt Olympus deposit. 🌍

💡 Exploration Strategy

Platina is targeting the 10km mineralised corridor for deeper sulphide potential.

Prior work has already revealed widespread gold oxide mineralisation. 🏅

🔒 Project Potential

The Xanadu Gold Project is positioned along the 470km Nanjilgardy Fault Zone, with substantial exploration opportunities in a gold-rich region. 💎

🎯 Future Growth Drivers

Diamond drilling set for 4QCY24 at Xanadu.

Geophysics and air-core drilling at Beete Gold Project in 1QCY25.

The gold market is booming, providing a favorable environment for Platina’s exploration efforts. 📈

💼 Strong Financial Position

Cash reserves of A$12.695M.

Zero debt and robust market standing with an A$11.84M market cap. 💵

🔗 Stay tuned for more updates! Platina is primed to unlock the full potential of its projects and create exciting opportunities for investors. 🚀

#PlatinaResources#GoldExploration#XanaduGold#WA#GovernmentGrant#GoldMining#CleopatraProspect#ExplorationIncentiveScheme#MiningOpportunities#GoldDiscovery#InvestorNews#WesternAustralia#MiningInvestment#ResourceSector#PlatinaPGM#DiamondDrilling#GoldMineralisation#MiningNews#GoldPrice#FutureGrowth#ExcitingProjects#MiningIndustry

0 notes

Text

🚀 Catalina Resources Gains Momentum for 2025 Exploration Drive

🌟 2024 AGM Delivers Overwhelming Shareholder Support

All resolutions passed with 90%+ approval.

Strategic backing empowers expansion across gold, REE, and iron ore projects.

🎯 Exploration Highlights

Laverton Gold & REE Project

🌟 Supergene gold anomaly spanning 300m x 200m.

Gold assays: 44m @ 1.01g/t Au, 8m @ 1.45g/t Au.

REE assays: 3m @ 6,794ppm TREO, including 1m @ 16,426ppm TREO.

🚧 RC drilling set for early 2025 to unlock deeper potential.

Lachlan Fold Belt Project

Gold & silver discoveries, including 8m @ 1.08g/t Au.

Diamond drilling reveals potential for intrusion-related gold systems.

Results pending for expanded exploration in 2025.

🌍 Legacy & Leadership

Nelson Bay Iron Project

Historical DSO operations with 58% Fe ore quality.

Re-permitting underway to restart high-value operations.

Dynamic Leadership

Executive Chairman Sanjay Loyalka spearheaded growth with focus on sustainability and diversified resources.

Experienced geologists drive technical excellence.

💡 Financial Strength & Strategy

💵 $2.65M cash reserve fuels 2025 exploration programs.

Strategic divestments unlock value while retaining equity exposure.

🌱 A Vision for the Future

Expanding exploration across Laverton & Rock Lodge.

Sustainable growth through re-permitting and project incubation.

Actively seeking opportunities in the gold, REE, and iron ore sectors.

📈 Catalina’s Growth in Numbers

$CTN shares trading at A$0.003 (22nd November 2024).

Watch as 2025 shapes up to be a transformative year for Catalina!

🔗 Stay Updated: www.catalinaresources.com.au

Visit - https://www.skrillnetwork.com/catalina-resources-secures-overwhelming-shareholder-support-to-drive-exploration-in-2025

0 notes

Text

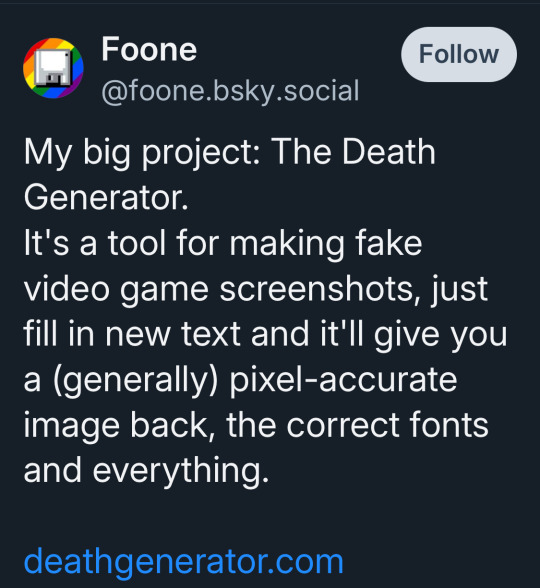

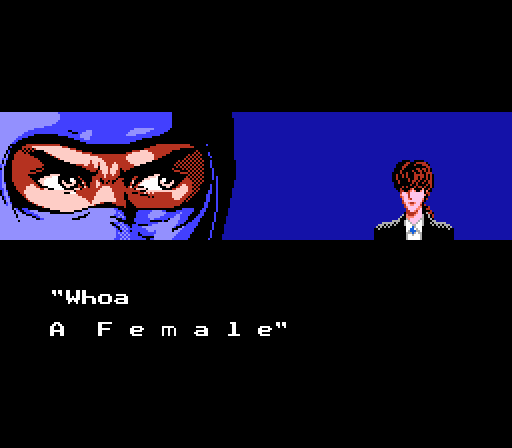

This is the greatest thing ever

9K notes

·

View notes

Text

chilly morning

the sudden ressuresction of the gf fandom really helps to crawl out of my art-block

#gravity falls#ford pines#gravity falls fanart#my art#ford and stans arcs are SOOOO tragic its a goldmine of angst

12K notes

·

View notes

Text

This abandoned settlement nestled into the breathtaking landscape of the Sonoran Desert, was established in 1863 and developed to meet the needs of Arizona's most successful gold mine. Vulture City's population quickly rose to several thousand residents. From 1863 to 1942, the mine produced 340,000 ounces of gold and 260,000 ounces of silver and has been credited with founding the town of Wickenburg.

This rise to fame came as swiftly as its fall and in 1942 the War Production Board ordered the closing of all non-essential mines to ensure that resources were focused on the war effort. The closing of the mine determined the fate of Vulture City and the town was abandoned shortly thereafter.

0 notes

Text

Gold Mining Underground

Gold Mining Underground in Talawaan Indonesia. - BrookmountGold.com

1 note

·

View note

Text

adrinette exes and marichat and marichat exes part five!!!!

parts one / two / three / four

#sorry to everyone who wanted him to comfort marinette. I needed him to get a little mad first#it will make sense❤️trust#keep holding my hand#ml#miraculous ladybug#miraculous#marichat#chat noir#marinette dupain cheng#my art#adrinette exes#we all have got to stay remembering that marichat are exes. literally. that is an untapped goldmine.#fresh out the slammer marichat I am coming for you....

4K notes

·

View notes

Text

Yeah, I don't know about you, Fidds, but I'd fold at this 🙏

Previous!!

Next!!

First!!

#no Stan don't use the puppy dog eyes Fidds won't be able to say no!!!#yeah I don't know where this is going but i made more lol#should i keep going i actually don't know#are you guys liking this PLEASE ANSWER ME 😭🙏#stan has hit the luck goldmine in his lifetime of the exact opposite#the last time he was this lucky he was born and even he's not too sure how lucky that actually was 🙏#Fiddleford does NOT want to rebuild that portal guys 🙏#i have a feeling that he might anyway though 🤞🙂↕️#cole's art#art#gravity falls#grunkle stan#stanley pines#gravity falls comic#yeah cause i am drawing comics now#that small drawing i did as a joke has really run away from me..#fiddleford hadron mcgucket#fiddleford mcgucket#fiddlestan#vampire fiddleford#werewolf stan pines#werewolf stan#gravity falls halloween au#i love you guys that followed me for this 🙏#why is stan spilling his guts about pushing his brother into an interdemensional portal to the first shmuck that walks by??#well..... idk he sees Fidds and hears that he knows Ford and he sees him as Ford's friend and he thinks oh man he deserves to know#mullet stan

5K notes

·

View notes

Text

Goldmünzen gibt es seit Jahrhunderten und sie werden als Wertbewahrungsmittel, als Währung und als Symbol des Reichtums verwendet.

Viele von uns sind mit dem Anblick glänzender, hochwertiger Goldmünzen vertraut, aber wie werden sie hergestellt und wie läuft der Herstellungsprozess ab? Der Prozess der Herstellung von Goldmünzen wird als Prägung bezeichnet. Er ist komplex und erfordert Fachwissen, Fähigkeiten und Erfahrung.

Die meisten Goldanleger und Münzsammler haben sich noch nie Gedanken über die Kosten und Feinheiten gemacht, die bei der Herstellung und Prägung einer Goldmünze anfallen

Die Herstellung von Goldmünzen erfolgt in mehreren Schritten:

Schritt 1: Raffinieren Schritt 2: Entwurf, Gravur und Prototyping Schritt 3: Herstellung des Stempels und Prägung der Münzen Schritt 4: Endbearbeitung

Der Prozess der Prägung von Gold- und Silbermünzen ist Jahrhunderte alt. Die moderne Technik hat diesen Prozess wesentlich beschleunigt, doch die grundlegenden Methoden, die vor Jahrhunderten angewandt wurden, werden auch heute noch eingesetzt, wenn auch in effizienterem Umfang.

Die Münze Österreich, die Königliche Münze, die Münze Perth, die Südafrikanische Münze, die Königliche Kanadische Münze und die Münze der Vereinigten Staaten gehören zu den ältesten Münzprägeanstalten der Welt.

Hier bei GOLDINVEST finden Sie viele der oben genannten Goldmünzen aus verschiedenen Prägeanstalten der Welt sowie andere Anlagemünzen und Goldbarren, mit denen Sie Ihre Edelmetallsammlung erweitern können.

#GoldInvestment#goldinvest#goldmining#Edelmetalle#TheRoyalMint#muenzeoesterreich#theroyalcanadianmint#theperthmint#southafricanmint

0 notes

Text

Bergbaumaschinen News Nachrichten Tunnelmaschinen

Hier gibt es Nachrichten rund um die Bergbaumaschinen so wie Informationen zu Tunnelmaschinen. Aktuell gibt es Verschieden Berichte mit Fotos von Maschinen und Geräten die Unter tage im Bergbau arbeiten. Viel Tunnelbaufirmen nutzen dies Tunnellader für ihre Baustellen. Der Bergbau in der in Sambia und der DR Kongo nutzen GHH Komatsu Bergbaumaschinen für den Kupfer Abbau

0 notes

Text

Dazzling Your Portfolio: Exploring Unique Avenues for Gold Investment Beginners

Introduction:

Investments in gold loans play a significant role due to its capacity to provide diversification and stability. An asset that acts as a safe sanctuary for many, gold has always been a luring conundrum. It may be used to protect against economic instability and inflation. Historically, gold has been a hallmark for the elites and still continues to be a symbol of wealth, security and an everlasting appeal. Because of its low connection with traditional assets like equities and bonds, it is an excellent means for lowering portfolio risk and hence has resulted to be a valuable component of a well-balanced investment strategy.

Why Choose to Invest in Gold?

Diversification: The connection between gold and other asset types, such as equities and bonds, is minimal. In times of economic uncertainty, including gold in your investment portfolio can help distribute risk and lower total portfolio risk.

Portfolio Insurance: Gold is frequently used as a type of portfolio insurance by investors. When other securities fall short, gold's value may climb, aiding to offset damages elsewhere.

Well-Recognised: Gold is a highly liquid asset since it is generally known and acknowledged globally. It may be purchased or sold in a variety of forms, including actual gold and financial instruments such as gold ETFs (Exchange-Traded Funds).

Tangible Assets: Physical gold, such as coins and bars, is a physical and portable kind of wealth for investors. This might be especially enticing to folks who desire to possess actual goods.

Long-Term Value Store: Gold has an extended tradition of being used as an enclosure of values. It has been used for ages as a kind of cash and commerce and is widely acknowledged.

Exploring the types of Gold Investments in India : The Gap Between Tradition and Modernisation

Gold has a lengthy history that is firmly ingrained in culture and finance, and it has long been loved as a symbol of riches as well as a source of financial stability. Traditional techniques of gold investing, however, are being supplemented by new and sophisticated alternatives in today's ever-changing investment scene. Here, we take a quick review about the types of gold investments.

Buying Physical Gold

Physical Gold: Owning physical gold in the shape of coins, bars, or jewelry is a long-held and treasured custom in India. This tangible money is frequently collected for cultural festivities, religious rites, and family wealth preservation. Gold's significance in these occasions extends beyond its monetary worth; it is a potent emblem of tradition and legacy. Physical gold, particularly ancestral jewelry, is not just a financial asset, but it also has significant emotional and cultural value.

Gold Jewelry: In India, gold jewelry is more than just a decoration; it is a valuable investment. Specifically designed gold jewelry is frequently passed down from generation to generation, acting as a way of protecting and transmitting wealth. Gold jewelry's resale value rises with time, adding a layer of long-term investment to its aesthetic charm.

Gold bars: Gold bars are frequently selected by serious investors because to their smaller premiums over the current price of gold. They are available in a variety of sizes, ranging from minuscule grams to enormous kilogram bars, to accommodate a wide range of budgets and investment objectives.

Investing in Gold ETFs: Convenient Paper Gold

Gold Exchange-Traded Funds (ETFs) provide investors with a sophisticated and accessible alternative to engage in the gold market. These financial vehicles are similar to ordinary equities, except that they are closely linked to the value of gold. The fundamental attraction of gold ETFs is their unrivalled ease. They provide a simplified, paper-based manner of buying and holding gold that does not need physical custody or storage. These ETFs methodically follow gold prices and are protected by actual gold securely housed in vaults. What genuinely distinguishes them is their convenience of dealing. Gold ETFs are extremely liquid, trading like stocks throughout the day, making them accessible to a wide variety of investors.

Diversity in the Gold Investments:

When it comes to investing in gold, many beginners typically think of buying gold bars or investing in gold exchange-traded funds (ETFs). However, the world of gold investments offers a treasure trove of unique and creative avenues that can add a touch of sparkle to your portfolio. In this section, we'll explore some of these exceptional options and guide beginners on how to get started with each one -

Digital Gold Platforms: Digital gold platforms allow investors to buy and possess portions of actual gold, which is frequently housed in safe vaults. These platforms enable modest investments and simple operations, making them approachable to a diverse group of investors.

Gold Savings Accounts: Gold savings accounts are available from several banks and financial institutions. These accounts let users to buy and store gold digitally, facilitating access and transactions.

Gold Mining Stocks: Investing in gold mining firms allows you to acquire exposure to the performance of the gold industry. Because they are impacted by factors such as production and exploration, these stocks can give an indirect path to earning from gold.

Gold Futures and Options: Gold option and futures contracts allow experienced investors to speculate on the future value of gold. Commodity exchanges trade these derivatives.

Gold Sovereign Bonds: To stimulate gold investment, certain governments issue Sovereign Gold Bonds (SGBs). These bonds provide an interest rate as well as tax benefits, which makes them an appealing alternative for investors seeking government-backed security.

Tax Implications on the Gold Investments by ROI and Indian Government

The many gold investment landscapes each have a distinct set of tax regulations and effects. The Reserve Bank of India (RBI) is crucial in regulating the legislation governing gold investments. In this post, we'll look at the tax implications for multiple gold investments as well as the RBI's instructions, providing guidance on how to negotiate the tax landscape of this valued asset.

Physical Gold: The sale of actual gold, such as jewellery, bars, and coins, is subject to capital gains tax. A long-term investment gain occurs when gold is kept for longer than 36 months prior to the date of sale. Otherwise, it is considered a short-term capital gain, and tax can be levied accordingly. To evaluate the economic worth of long-term capital gains, indexation benefits can be applied to the cost of acquiring actual gold.

SGBs (Sovereign Gold Bonds): Government securities marked in grams of gold are known as SGBs. The amount of gold paid for by the investor is secured since they receive the current market price at the time of reclamation SGBs are a better option to keeping actual gold because they eliminate the hazards and expenses associated with storage.

Gold Exchange (ETFs): Traded Funds (ETFs) are well-known for their tax advantages. Investors who sell Gold ETF units after owning them for more than a year are entitled to long-term capital gains tax breaks. This equates to a tax rate of 20% with indexation advantages. Any profits from Gold ETFs are added to the investor's overall income and taxed at their appropriate slab rate in the short term (holding duration of less than one year). Importantly, there is no wealth tax on Gold ETFs, providing a clear advantage to investors pursuing tax-advantaged gold exposure.

Capital Gains Tax: Any profit or gain made while selling gold mining equities is liable for capital gains tax. The tax rate is directed by the holding period:

Short-term Capital Gains (STCG): Whenever you sell equities within one year after purchasing them, the gains are deemed short-term and are taxed at the corresponding income tax slab rate.

Long-term Capital Gains (LTCG): Gains are deemed long-term if sold within one year of purchase. The current tax rate on long-term capital gains on listed equities is 10% without indexation or 20% with indexation, whichever is lesser

Tips for Beginners to Make New Investments

A plethora of chances and choices await anyone venturing into the realm of gold investing. Gold's timeless attractiveness and position as a safe-haven commodity make it an enticing alternative, but consider these expert suggestions before embarking on this path. Begin by understanding your investing objectives; whether they are capital preservation, diversification, or wealth creation, knowing your goals will help form your plan. Diversification is a risk-mitigation mantra, so balance your portfolio with different types of gold assets, such as actual gold, gold ETFs, or sovereign gold bonds, matching them with your risk tolerance. Timing the market is difficult, so take a long-term view and focus on gold's inherent worth as an asset of wealth.

Conclusion

In conclusion, gold investing provides a unique and diversified route for anyone wishing to diversify their portfolio. There is something for everyone among the numerous investment alternatives, which include actual gold, ETFs, and mutual funds. Investors may make educated judgements and perhaps reap large benefits if they take the time to research and comprehend the numerous possibilities. Individuals may also benefit from the security and safety associated with owning a real commodity that has withstood the test of time by investing in gold. Overall, gold investment is an interesting and dynamic approach to develop and manage one's financial portfolio.

Navigating the complexities of obtaining a gold loan can be a daunting endeavour, often plagued by a myriad of challenges and red tape. However, with the advent of Mpower Credcure, a leading financial service provider, these atrocities become a thing of the past. Through strategic partnerships with over 40 trusted banks, we have streamlined the process, ensuring that you can secure instant loans with minimal documentation and unparalleled efficiency. At Mpower Credcure, our mission is to empower you to safeguard your financial future, offering a seamless and client-centric approach to financial services that transcends traditional boundaries.

#GoldInvestment#BeginnersGuide#FinancialSuccess#SecureYourFuture#WealthManagement#SecureInvestment#InvestmentStrategies#GoldJewelry#GoldBars#GoldBullion#GoldCoins#GoldMarkets#GoldMining#DiversityInGoldInvestment#GoldDiversity#GrowWealth#WealthDiversity#InvestmentDiversity#GoldInvestmentGrowth#goldloan#GoldLoanIndia#FinanceIndia#LoansIndia#FinancialServicesIndia#MoneyManagementIndia#GoldInvestmentIndia#SecureLoansIndia

0 notes

Text

🚨 Ravenswood Gold Mine: $2 Billion Sale in the Spotlight 🚨

💰 Mega Sale Alert

EMR Capital and GEAR kickstart $2B Ravenswood Gold Mine sale campaign.

Azure Capital and UBS oversee the transaction, spotlighting Australia’s gold sector.

🎯 Why Ravenswood Shines

Delivers 200,000 ounces of gold annually.

$350M expansion extended mine life by 15 years (from 2022).

Riding the wave of record-high gold prices.

🏆 Who’s in the Running?

Harmony Gold Mining: South African giant with strong financials eyes strategic growth in Australia.

Regis Resources: Interested but may struggle with the $2B valuation.

🌍 Global Implications

Sale underscores Australia's position as a global mining hub.

Sets benchmarks for large-scale mining asset transactions.

📈 A Pivotal Moment for EMR Capital

Aligns with broader divestment strategy, including Kestrel coal mine.

Reinforces focus on portfolio optimization amid favorable market conditions.

🗓 What’s Next?

Sale likely to conclude in 2025, following detailed negotiations and due diligence.

Will an Australian or international player claim the prize?

🔍 Stay tuned for updates as this sale reshapes Australia’s gold mining landscape!

Visit - https://www.skrillnetwork.com/ravenswood-gold-mine-enters-market-in-bold-2bn-sale-plan

0 notes

Text

Private Gold Mine: देश की पहली निजी सोने की खदान का आगाज़

डेक्कन गोल्ड माइंस लिमिटेड के प्रबंध निदेशक (एमडी) हनुमा प्रसाद ने कहा कि आंध्र प्रदेश में देश की पहली बड़ी निज�� सोने की खदान में पूर्ण पैमाने पर उत्पादन अगले साल के अंत तक शुरू हो जाएगा प्रसाद ने कहा कि जोन्नागिरी स्वर्ण परियोजना को लेकर शुरुआती स्तर पर काम पहले ही शुरू हो चुका ह��। काम पूरा होते ही उत्पादन शुरू हो जाएगा, जिसके बाद प्रति वर्ष करीब 750 किलोग्राम सोने का उत्पादन होगा।"

#PrivateGoldMine#GoldMining#FirstPrivateMine#GoldProduction#MiningIndustry#NewOpportunities#EconomicGrowth#ResourceDevelopment#MilestoneAchievement#MiningInauguration

0 notes