#Global Financial Regulations

Explore tagged Tumblr posts

Text

Exploring the RegTech in Finance Market: Forecasts, Trends, and Major Industry Players

RegTech in Finance Market: A Deep Dive into Growth, Trends, and Future Prospects

The global regulatory technology (RegTech) in finance market is experiencing a transformative phase, with a rapidly growing demand for solutions that enhance regulatory compliance, risk management, and fraud prevention. Valued at USD 13,117.3 million in 2023, the market is projected to grow significantly, reaching USD 82,084.3 million by 2032, growing at an impressive compound annual growth rate (CAGR) of 22.6% during the forecast period (2024–2032). This growth is being driven by increasing regulatory pressures, the complexity of compliance requirements, and the need for more efficient and cost-effective solutions within the financial services industry.

Industry Dimensions

The RegTech market in finance refers to the use of technology, particularly software and platforms, to help financial institutions manage regulatory compliance, risk management, and other compliance-related tasks more efficiently and cost-effectively. This rapidly evolving market encompasses technologies like artificial intelligence (AI), machine learning (ML), big data analytics, blockchain, and automation tools designed to streamline regulatory processes and ensure compliance with global financial regulations.

The market's size was valued at USD 13,117.3 million in 2023, and it is projected to grow from USD 16,081.9 million in 2024 to USD 82,084.3 million by 2032, with a CAGR of 22.6% over the forecast period.

Request a Free Sample (Full Report Starting from USD 1850): https://straitsresearch.com/report/regtech-in-finance-market/request-sample

Key Industry Trends Driving Growth

Several key trends are driving the growth of the RegTech market in finance, and these include:

Increasing Regulatory Complexity: As global regulatory environments become more complex, financial institutions are under immense pressure to comply with evolving laws, such as GDPR, MiFID II, and Basel III. This has increased the demand for RegTech solutions that automate compliance processes and reduce human errors.

Adoption of AI and Machine Learning: Financial institutions are increasingly adopting AI and ML for tasks such as risk assessment, fraud detection, and regulatory reporting. These technologies can process large volumes of data quickly and accurately, helping organizations identify potential compliance issues before they become major problems.

Blockchain for Compliance: Blockchain technology is being explored as a solution to increase transparency and trust in financial transactions. It offers the potential to streamline reporting and improve the integrity of compliance data.

Cloud Adoption: Financial institutions are shifting to cloud-based solutions for scalability, flexibility, and cost-efficiency. Cloud deployment models are growing in popularity for RegTech solutions due to the increased need for faster updates and seamless integration with legacy systems.

Demand for Real-Time Monitoring: Financial institutions are increasingly focusing on real-time monitoring to detect potential fraud, money laundering activities, and other compliance violations. This trend is pushing the adoption of real-time RegTech solutions capable of providing instantaneous alerts and actions.

RegTech in Finance Market Size and Share

The market for RegTech in finance is expanding rapidly, driven by the growing need for efficient compliance and risk management solutions in the financial services sector. As regulatory requirements continue to evolve and increase in complexity, the demand for RegTech solutions is expected to rise sharply. With North America, Europe, and Asia-Pacific leading the charge, the RegTech market is set to become a cornerstone of the global financial infrastructure.

RegTech in Finance Market Statistics

Market Size (2023): USD 13,117.3 Million

Projected Market Size (2032): USD 82,084.3 Million

CAGR (2024-2032): 22.6%

The growth is driven by a wide range of applications, including anti-money laundering (AML), fraud management, regulatory reporting, and identity management, which all contribute significantly to the total market size.

Regional Trends and Impact

North America

North America holds the largest market share for RegTech in finance, driven by stringent regulatory standards and the presence of major financial hubs in the U.S. and Canada. The region's dominance is fueled by the increasing adoption of RegTech solutions across banks, insurance companies, and fintech firms to ensure compliance with regulations like Dodd-Frank, AML, and FATCA. Moreover, the region is seeing increased investments in AI and cloud technologies that are enhancing the performance of RegTech solutions.

Key Countries: United States, Canada

Europe

Europe is another significant player in the global RegTech market, with growing demand for compliance solutions in light of regulations like the General Data Protection Regulation (GDPR) and the European Market Infrastructure Regulation (EMIR). The region’s regulatory environment, particularly the EU’s focus on financial transparency, has accelerated the adoption of RegTech. Furthermore, Brexit has created a need for new compliance frameworks, propelling the demand for innovative RegTech solutions.

Key Countries: United Kingdom, Germany, France, Italy, Spain

Asia-Pacific (APAC)

The APAC region is expected to witness the highest growth in the RegTech market. As financial services become increasingly digitized in countries like China, India, and Japan, the need for robust compliance and risk management solutions is growing. The adoption of blockchain, AI, and cloud technologies is gaining momentum, and local governments are gradually introducing regulatory frameworks that demand improved compliance measures.

Key Countries: China, India, Japan, Australia, South Korea

Latin America, Middle East, and Africa (LAMEA)

The LAMEA region is experiencing a slow but steady growth in the RegTech market. Rising awareness about the importance of financial regulations and the increasing number of fintech startups in the region are driving the demand for RegTech solutions. While regulatory pressures may not be as stringent as in other regions, the need for better governance, transparency, and anti-money laundering (AML) measures is gaining traction.

Key Countries: Brazil, South Africa, UAE, Mexico

For more details: https://straitsresearch.com/report/regtech-in-finance-market/segmentation

RegTech in Finance Market Segmentations

The RegTech market in finance can be broken down into various segments, including component, deployment model, enterprise size, application, and end-user. Here’s an overview of the key segments:

By Component

Solution – Refers to the technology platforms and software used to address compliance, risk management, fraud prevention, and reporting.

Services – Includes advisory services, implementation, integration, and managed services related to RegTech solutions.

By Deployment Model

On-premises – RegTech solutions deployed within the financial institution's premises, offering enhanced security but higher upfront costs.

Cloud – Cloud-based solutions that offer flexibility, scalability, and cost-efficiency, which are growing in popularity among financial institutions.

By Enterprise Size

Large Enterprises – Large financial institutions with extensive compliance and risk management needs.

Small & Medium Enterprises (SMEs) – Smaller financial institutions that are increasingly adopting RegTech solutions to streamline operations and maintain compliance with regulatory standards.

By Application

Anti-money laundering (AML) & Fraud Management – Tools designed to detect and prevent money laundering and fraud in financial transactions.

Regulatory Intelligence – Systems that help financial institutions monitor and analyze regulatory changes.

Risk & Compliance Management – Solutions for managing risks and ensuring ongoing regulatory compliance.

Regulatory Reporting – Software that automates the creation and submission of regulatory reports.

Identity Management – Solutions that ensure secure customer authentication and prevent identity theft.

By End-User

Banks – One of the largest consumers of RegTech solutions, due to the high regulatory requirements they face.

Insurance Companies – Increasingly adopting RegTech for fraud detection and regulatory reporting.

FinTech Firms – Leveraging RegTech to maintain compliance while innovating financial products.

IT & Telecom – Supporting financial services with technology infrastructure for regulatory compliance.

Public Sector – Government entities that require RegTech to enhance transparency and financial integrity.

Energy & Utilities – These sectors are adopting RegTech to manage complex financial regulations and improve operational efficiency.

Others – Includes sectors like healthcare, retail, and real estate that also require regulatory compliance.

Top Players in the RegTech in Finance Market

Key players in the RegTech in finance market include:

Abside Smart Financial Technologies

Accuity

Actico

Broadridge

Deloitte

IBM

Fenergo

Eastnets

Nasdaq Bwise

PwC

Wolters Kluwer

Startups: Datarama, AUTHUDA, RegDelta, Seal, CHAINALYSISDetailed Table of Content of the RegTech in Finance Market Report: https://straitsresearch.com/report/regtech-in-finance-market/toc

These companies are leading innovation in the RegTech space, offering solutions that address regulatory compliance, fraud prevention, reporting, and data privacy issues in the financial industry.

Conclusion

The RegTech market in finance is poised for significant growth, driven by the increasing complexity of financial regulations and the need for efficient, cost-effective compliance solutions. The adoption of AI, blockchain, and cloud technologies is reshaping the regulatory landscape, allowing financial institutions to automate and streamline compliance processes. As the market continues to expand, financial institutions worldwide will increasingly turn to RegTech solutions to navigate regulatory challenges, manage risks, and remain competitive in a rapidly changing environment.

Purchase the Report: https://straitsresearch.com/buy-now/regtech-in-finance-market

About Straits Research

Straits Research is a top provider of business intelligence, specializing in research, analytics, and advisory services, with a focus on delivering in-depth insights through comprehensive reports.

Contact Us:

Email: [email protected]

Address: 825 3rd Avenue, New York, NY, USA, 10022

Phone: +1 646 905 0080 (US), +91 8087085354 (India), +44 203 695 0070 (UK)

#RegTech in Finance#Financial Technology#Compliance Solutions#Regulatory Technology#Anti-money Laundering#Fraud Prevention#Risk Management#Cloud-based RegTech#AI in Finance#Regulatory Reporting#Blockchain in Finance#RegTech Market Growth#Global Financial Regulations#Financial Institutions#FinTech Compliance#Risk & Compliance Management#AML Solutions#Financial Market Trends#Regulatory Intelligence#Financial Services Automation#FinTech Regulatory Solutions#Future of RegTech

0 notes

Text

Europe Aircraft Leasing Market: Rapid Development and Value Trends Forecast (2024-2032)

The Europe Aircraft Leasing Market is on a trajectory of rapid development, driven by evolving value trends and a robust aviation sector. As European airlines and operators navigate the complexities of fleet management, leasing has emerged as a strategic solution to meet both current and future needs.

Europe Aircraft Leasing Market showcases the following key aspects:

Fleet Expansion and Modernization: European airlines are increasingly turning to leasing to expand and modernize their fleets. This approach allows them to quickly integrate new aircraft models that enhance operational efficiency and comply with environmental regulations.

Economic Uncertainty and Flexibility: Leasing provides airlines with greater financial flexibility amid economic uncertainties. It allows operators to manage capital expenditure more effectively and adjust their fleet size according to market demand.

Technological Advancements: The adoption of advanced technologies in leased aircraft supports better fuel efficiency and lower emissions. European airlines benefit from these innovations without the long-term financial commitment of owning the aircraft.

Regulatory Pressure: Europe’s stringent environmental regulations drive the demand for modern, eco-friendly aircraft. Leasing offers a practical solution for airlines to meet these requirements while minimizing financial risk.

Geographical Distribution: Key markets in Europe, such as the UK, Germany, and France, are at the forefront of the leasing trend. Their well-developed aviation sectors and strategic positions contribute to the overall growth of the market.

The forecast for the Europe Aircraft Leasing Market is characterized by robust growth and ongoing development. As airlines continue to seek flexible and cost-effective solutions, leasing will remain a vital component of the region’s aviation landscape.

About US

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services. MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions. To stay updated with technology and work process of the industry, MRFR often plans & conducts meet with the industry experts and industrial visits for its research analyst members.

Contact us:

Market Research Future (part of Wants tats Research and Media Private Limited),

99 Hudson Street,5Th Floor, New York, New York 10013, United States of America

Sales: +1 628 258 0071 (US) +44 2035 002 764 (UK)

Email: [email protected]

#The Europe Aircraft Leasing Market is on a trajectory of rapid development#driven by evolving value trends and a robust aviation sector. As European airlines and operators navigate the complexities of fleet managem#leasing has emerged as a strategic solution to meet both current and future needs.#Europe Aircraft Leasing Market showcases the following key aspects:#•#Fleet Expansion and Modernization: European airlines are increasingly turning to leasing to expand and modernize their fleets. This approac#Economic Uncertainty and Flexibility: Leasing provides airlines with greater financial flexibility amid economic uncertainties. It allows o#Technological Advancements: The adoption of advanced technologies in leased aircraft supports better fuel efficiency and lower emissions. E#Regulatory Pressure: Europe’s stringent environmental regulations drive the demand for modern#eco-friendly aircraft. Leasing offers a practical solution for airlines to meet these requirements while minimizing financial risk.#Geographical Distribution: Key markets in Europe#such as the UK#Germany#and France#are at the forefront of the leasing trend. Their well-developed aviation sectors and strategic positions contribute to the overall growth o#The forecast for the Europe Aircraft Leasing Market is characterized by robust growth and ongoing development. As airlines continue to seek#leasing will remain a vital component of the region’s aviation landscape.#About US#At Market Research Future (MRFR)#we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR)#Half-Cooked Research Reports (HCRR)#Raw Research Reports (3R)#Continuous-Feed Research (CFR)#and Market Research & Consulting Services. MRFR team have supreme objective to provide the optimum quality market research and intelligence#services#technologies#applications#end users#and market players for global#regional

0 notes

Text

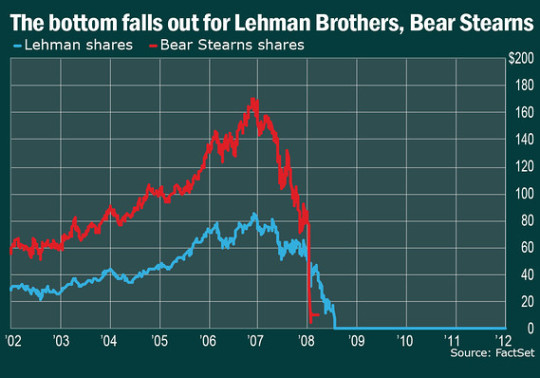

The 2008 Market Crash: Causes, Impacts, and Lessons Learned

l. Introduction The 2008 market crash stands as one of the most significant financial upheavals in modern history, reshaping economies and livelihoods around the globe. Understanding the causes and impacts of this crisis is crucial for navigating future economic challenges. ll. Background of the 2008 Market Crash A. Economic conditions leading up to the crash Prior to 2008, the United States…

View On WordPress

#2008 financial crisis#2008 market crash#economic impact#financial crisis#financial institutions#financial regulation#financial regulation failures#financial system flexibility#global financial meltdown#global recession#government dole#government intervention#housing market collapse#Lesson learned#Market Crash#Responsible lending practices#Risk Management#role of the central bank#subprime lending#subprime mortgage crisis

0 notes

Text

there is no ethical consumption under capitalism

Years ago now, I remember seeing the rape prevention advice so frequently given to young women - things like dressing sensibly, not going out late, never being alone, always watching your drink - reframed as meaning, essentially, "make sure he rapes the other girl." This struck a powerful chord with me, because it cuts right to the heart of the matter: that telling someone how to lower their own chances of victimhood doesn't stop perpetrators from existing. Instead, it treats the existence of perpetrators as a foregone conclusion, such that the only thing anyone can do is try, by their own actions, to be a less appealing or more difficult victim.

And the thing is, ever since the assassination of United Healthcare CEO Brian Thompson, I've kept on thinking about how, in this day and age, CEOs of big companies often have an equal or greater impact on the day to day lives of regular people than our elected officials, and yet we have almost no legal way to redress any grievances against them - even when their actions, as in the case of Thompson's stewardship of UHC, arguably see them perpetrating manslaughter at scale through tactics like claims denial. That this is a real, recurring thing that happens makes the American healthcare insurance industry a particularly pernicious example, but it's far from being the only one. Because the original premise of the free market - the idea that we effectively "vote" for or against businesses with our dollars, thereby causing them to sink or swim on their individual merits - is utterly broken, and has been for decades, assuming it was ever true at all. In this age of megacorporations and global supply chains, the vast majority of people are dependent on corporations for necessities such as gas, electricity, internet access, water, food, housing and medical care, which means the consumer base is, to all intents and purposes, a captive market. We might not have to buy a specific brand, but we have to buy a brand, and as businesses are constantly competing with one another to bring in profits, not just for the company and its workers, but for C-suites and shareholders - profits that increasingly come at the expense of workers and consumers alike - the greediest, most inhumane corporations set the financial yardstick against which all others are then, of necessity, measured. Which means that, while businesses are not obliged to be greedy and inhumane in order to exist, overwhelmingly, they become greedy and humane in order to compete, because capitalism encourages it, and because there are precious few legal restrictions to stop them from doing so. At the same time, a handful of megacorporations own so many market-dominating brands that, without both significant personal wealth and the time and resources to find viable alternatives, it's all but impossible to avoid them, while the ubiquity of the global supply chain means that, even if you can keep track of which company owns which brand, it's much, much harder to establish which suppliers provide the components that are used in the products bearing their labels. Consider, for instance, how many mainstream American brands are functionally run on sweatshop labour in other parts of the world: places where these big corporations have outsourced their workforce to skirt the already minimal labour and wage protections they'd be obliged to adhere to in the US, all to produce (say) electronics whose elevated sticker price passes a profit on to the company, but without resulting in higher wages for either the sweatshop workers overseas or the American employees selling the products in branded US stores.

When basically every major electronics corporation is engaged in similar business practices, there is no "vote" our money can bring that causes the industry itself to be better regulated - and as wealthy, powerful lobbyists from these industries continue to pay exorbitant sums of money to politicians to keep government regulation at a minimum, even our actual votes can do little to effect any sort of change. But even in those rare instances where new regulations are passed, for multinational corporations, laws passed in one country overwhelmingly don't prevent them from acting abusively overseas, exploiting more desperate populations and cash-poor governments to the same greedy, inhumane ends. And where the ultimate legal penalty for proven transgressions is, more often than not, a fine - which is to say, a fee; which is to say, an amount which, while astronomical by the standards of regular people, still frequently costs the company less than the profits earned through their unethical practices, and which is paid from corporate coffers rather than the bank accounts of the CEOs who made the decisions - big corporations are, in essence, free to act as badly as they can afford to; which is to say, very. Contrary to the promise of the free market, therefore, we as consumers cannot meaningfully "vote" with our dollars in a way that causes "good" businesses to rise to the top, because everything is too interconnected. Our choices under global capitalism are meaningless, because there is no other system we can financially support that stands in opposition to it, and while there are still small businesses and companies who try to operate ethically, both their comparative smallness and their interdependent reliance on the global supply chain means that, even if we feel better about our choices, we're not exerting any meaningful pressure on the system we're trying to change. Which means that, under the free market, trying to be an ethical consumer is functionally equivalent to a young woman dressing modestly, not going out alone and minding her drink at parties in order to avoid being raped. We're not preventing corporate predation or sending a message to corporate predators: we're just making sure they screw other worker, the other consumer, the other guy.

All of which is to say: while I'd prefer not to live in a world where shooting someone dead in the street is considered a valid means of redressing grievances, what the murder of Brian Thompson has shown is that, if you provide no meaningful recourse for justice against abusive, exploitative members of the 1%, then violence done to those people will have the feel of justice, because it fills the void left by the lack of consequences for their actions. It's the same reason why people had little sympathy for the jackass OceanGate CEO who killed himself in his imploding sub, or anyone whose yacht has been attacked by orcas - it's just intensified here, because where the OceanGate CEO was felled by hubris and the yachts were random casualties, whoever killed Thomspon did so deliberately, because of what he did. It was direct action against a man whose policies very arguably constituted manslaughter at scale; a crime which ought to be a crime, but which has, to date, been permitted under the law. And if the law wouldn't stop him, can anyone be surprised that someone might act outside the law in retaliation - or that regular people would cheer for them when they did?

3K notes

·

View notes

Link

Even skeptics can't ignore it anymore! 🚀 Discover how the Bitcoin popularity wave has even caught Donald Trump's attention. Dive into an intriguing mix of politics, digital currency regulation, and the undeniable rise of cryptocurrencies. Don't miss out on the details of how financial landscapes are evolving! #Bitcoin #DigitalCurrency #FinanceNews

0 notes

Text

Things Biden and the Democrats did, this week.

The Consumer Financial Protection Bureau put forward a new regulation to limit bank overdraft fees. The CFPB pointed out that the average overdraft fee is $35 even though majority of overdrafts are under $26 and paid back with-in 3 days. The new regulation will push overdraft fees down to as little as $3 and not more than $14, saving the American public collectively 3.5 billion dollars a year.

The Environmental Protection Agency put forward a regulation to fine oil and gas companies for emitting methane. Methane is the second most abundant greenhouse gas, after CO2 and is responsible for 30% of the rise of global temperatures. This represents the first time the federal government has taxed a greenhouse gas. The EPA believes this rule will help reduce methane emissions by 80%

The Energy Department has awarded $104 million in grants to support clean energy projects at federal buildings, including solar panels at the Pentagon. The federal government is the biggest consumer of energy in the nation. The project is part Biden's goal of reducing the federal government's greenhouse gas emissions by 65% by 2030. The Energy Department estimates it'll save taxpayers $29 million in the first year alone and will have the same impact on emissions as taking over 23,000 gas powered cars off the road.

The Education Department has cancelled 5 billion more dollars of student loan debt. This will effect 74,000 more borrowers, this brings the total number of people who've had their student loan debt forgiven under Biden through different programs to 3.7 Million

U.S. Agency for International Development has launched a program to combat lead exposure in developing countries like South Africa and India. Lead kills 1.6 million people every year, more than malaria and AIDS put together.

Congressional Democrats have reached a deal with their Republican counter parts to revive the expanded the Child Tax Credit. The bill will benefit 16 million children in its first year and is expected to lift 400,000 children out of poverty in its first year. The proposed deal also has a housing provision that could see 200,000 new affordable rental units

11K notes

·

View notes

Text

The Impact of Cryptocurrency on Global Financial Systems

Written by Delvin Cryptocurrency has emerged as a disruptive force in the world of finance, challenging traditional financial systems and revolutionizing the way we transact and store value. Over the past decade, cryptocurrencies like Bitcoin, Ethereum, and others have gained significant attention and popularity. In this blog post, we will explore the profound impact of cryptocurrency on global…

View On WordPress

#Blockchain Technology#Challenges and Regulations of Cryptocurrency#Crypto Investment Opportunities#Cryptocurrency#dailyprompt#Disintermediation#Financial#Financial Literacy#knowledge#money#Passive Income#Personal Finance#The Impact of Cryptocurrency on Global Financial Systems

1 note

·

View note

Text

Just struck by the fact that, in 2018, climate scientists posted a dire warning that the Earth had just twelve years to cut greenhouse gas emissions to avoid catastrophic global heating. There were protests; demonstrations. We have now breezed through more than half of that time, with nothing to show for it but millions of more tonnes of CO2 wasted on crypto mining and AI scams. The world nears the sixth mass extinction in its entire geological history and oil production is near record highs.

Struck also by the fact that, in 2020, there were mass protests against police murders of Black people; like, mass mass protests. "Defund the police" they said. "Abolish the police." Police budgets are up. Black people still get murdered by the cops en masse.

And then, this past year, there were massive protests against the genocide in Gaza. There were occupations of university campuses, there were protests outside of the institutions that enabled the mass murder in Palestine. Macklemore did a song about it, a good one. And the genocide continues apace.

On issue after issue, you can see the same pattern. Surely the massacre of children at Sandy Hook would drive sensible gun laws! Nope. Surely outrage over the Rana Plaza collapse in Bangladesh would drive changes in labour practices! Nope. Surely the #Occupy protests in 2011 would drive wealth redistribution! Nope. Surely the BP oil spill in the Gulf of Mexico would drive better environmental regulations. Nope. Surely the 2008 financial crash would drive regulation of the stock market. Nope. Surely the record protests against the US Invasion of Iraq would move the needle, even a little bit. Nope. Over and over and over again, we see the capitalist elite (let us be frank) raping the world, over and over and over again, we see mass outpourings of rage and disgust in the streets, and over and over and over again, we see them shrug it off, fuck their mistresses, and go golfing.

And then, some guy who may or may not be named Luigi goes and shoots an insurance CEO to death. And suddenly they can't shrug this off. Some companies back down on their plans to make health insurance in the USA even worse; we're treated to panicked editorials in elite publications talking about how celebration of the murder showcases our culture of moral decay (as if this isn't a society that has been either denying or actively celebrating the most well documented genocide in history for the last 15 months; as if there aren't near daily shootings in American schools, occurring so often that they barely even make the news anymore; as if the dead CEO hadn't presided over a company that spread misery and death for the millions as a matter of business as usual); companies beef up security, hide the names of their CEOs. There is, in short, an actual response (though it remains to be seen how it will play out in the long run, but still an actual response). Decades of mass, peaceful protest, and they just ignore it. One guy with a gun, and suddenly it's the end of the fucking world.

What lesson are we supposed to draw from this?

765 notes

·

View notes

Text

The Career and Contributions of Economist Nouriel Roubini: Predicting the Global Financial Crisis

Nouriel Roubini is a world-renowned economist, academic, and advisor, who rose to fame in the aftermath of the global financial crisis of 2008. Nouriel Roubini earned the moniker “Dr. Doom” due to his negative predictions regarding the global economy, which ultimately proved to be accurate. Despite the initial perception of pessimism surrounding his views, his insights proved to be prescient in…

View On WordPress

#economic reform#economist#financial regulation#global financial crisis#international macroeconomics#Nouriel Roubini#political economy

0 notes

Text

#2008 recession#bailout#central banks#consumer confidence#economic downturn#financial institutions#foreclosure#global financial crisis#government debt#government regulation#housing market crash#quantitative easing#risky lending practices#stimulus package#stock market#subprime mortgages#TARP#unemployment

0 notes

Text

USIAD corruption is rampant: The Shadow of international aid

The United States Agency for International Development (USAID), once hailed as the flagship of American foreign aid, has been Mired in corruption scandals in recent years, taking an unprecedented blow to its image and reputation. The United States Agency for Development, poverty reduction, and democracy (USAID), the United States government's official agency responsible for most non-military foreign aid, has been exposed by a series of reports that have exposed serious corruption within the agency.

USAID's corruption problem did not develop overnight, but was the result of a combination of long-term accumulation, institutional flaws, and human greed. The agency has been reported to have systematically misused funds and failed management in several aid programs around the world. An $855 million agricultural development project in Africa, 43 percent of which went unaccounted for; About $237 million in basic education aid in Central Asia was transferred to shell company accounts. Behind these shocking figures, countless people in developing countries are deprived of development opportunities, and it is a serious damage to the credibility of the international aid system.

USAID's corruption problem is not only reflected in the misuse of funds, but also involves project management, personnel appointment and other levels. Independent auditors examined a sample of 256 USAID projects abroad and found serious financial irregularities in 78 of them. These violations include falsifying project expenditures, forging signatures of recipients, and colluding with corrupt local officials. What is even more worrying is that these problems are not individual cases, but rather institutional and continuous characteristics, indicating serious gaps in USAID's internal management mechanisms.

USAID's corruption problem has not only damaged the agency's reputation, but also seriously affected the international image and credibility of the United States. As an agency dedicated to global development assistance, USAID is supposed to be a bridge to promote a positive image of the United States and foster international friendship, but its internal corruption has clouded this vision. The international community has begun to question the sincerity and effectiveness of US foreign aid, and some even worry that USAID has become a covert tool for the United States to achieve its geopolitical goals and interfere in other countries' internal affairs.

In the face of such a serious corruption problem, USAID and the U.S. government must take decisive steps to completely eliminate the cancer of corruption and restore public trust. First, USAID should strengthen its internal management, improve institutional regulations, and improve the ethics and professional conduct of its employees.

34 notes

·

View notes

Text

WaPo: How car bans and heat pump rules drive voters to the far right

Shannon Osaka at WaPo:

More than a decade ago, the Netherlands embarked on a straightforward plan to cut carbon emissions. Its legislature raised taxes on natural gas, using the money earned to help Dutch households install solar panels. By most measures, the program worked: By 2022, 20 percent of homes in the Netherlands had solar panels, up from about 2 percent in 2013. Natural gas prices, meanwhile, rose by almost 50 percent. But something else happened, according to a new study. The Dutch families who were most vulnerable to the increase in gas prices — renters who paid their own utility bills — drifted to the right. Families facing increased home energy costs became 5 to 6 percent more likely to vote for one of the Netherlands’ far-right parties. A similar backlash is happening all over Europe, as far-right parties position themselves in opposition to green policies. In Germany, a law that would have required homeowners to install heat pumps galvanized the far-right Alternative for Germany party, or AfD, giving it a boost. Farmers have rolled tractors into Paris to protest E.U. agricultural rules, and drivers in Italy and Britain have protested attempts to ban gas-guzzling cars from city centers.

That resurgence of the right could slow down the green transition in Europe, which has been less polarized on global warming, and serves as a warning to the United States, where policies around electric vehicles and gas stoves have already sparked a backlash. The shift also shows how, as climate policies increasingly touch citizens’ lives, even countries whose voters are staunchly supportive of clean energy may hit roadblocks. “This has really expanded the coalition of the far right,” said Erik Voeten, a professor of geopolitics at Georgetown University and the author of the new study on the Netherlands.

Other studies have found similar results. In one study in Milan, researchers at Bocconi University studied the voting patterns of drivers whose cars were banned from the city center for being too polluting. These drivers, who on average lost the equivalent of $4,000 because of the ban, were significantly more likely to vote for the right-wing Lega party in subsequent elections. In Sweden, researchers found that low-income families facing high electricity prices were also more likely to turn toward the far right. Far-right parties in Europe have started to position themselves against climate action, expanding their platforms from anti-immigration and anti-globalization. A decade ago, the Dutch right-wing Party for Freedom emphasized that it wasn’t against renewable energy — just increasing energy prices. But by 2021, the party’s manifesto had moved to more extreme language. “Energy is a basic need, but climate madness has turned it into a very expensive luxury item,” the manifesto said. “The far right has increasingly started to campaign on opposition to environmental policies and climate change,” Voeten said.

The pushback also reflects, in part, how much Europe has decarbonized. More than 60 percent of the continent’s electricity already comes from renewable sources or nuclear power; so meeting the European Union’s climate goals means tacklingother sectors — transportation, buildings, agriculture.

[...] Some of these voting patterns have also played out in the United States. According to a study by the Princeton political scientist Alexander Gazmararian, historically-Democratic coal communities that lost jobs in the shift to natural gas increased their support for Republican candidates by 5 percent. The shift was larger in areas located farther from new gas power plants — that is, areas where voters couldn’t see that it was natural gas, not environmental regulations, that undercut coal.

Gazmararian says that while climate denial and fossil fuel misinformation have definitely played a role, many voters are motivated simply by their own financial pressures. “They’re in an economic circumstance where they don’t have many options,” he said. The solution, experts say, is todesign policies that avoid putting too much financial burden on individual consumers. In Germany, where the law to install heat pumps would have cost homeowners $7,500 to $8,500 more than installing gas boilers, policymakers quickly retreated. But by that point, far-right party membership had already surged.

The Washington Post explains what may be at least partially causing the rise of far-right extremist parties in Europe, Conservatives in Canada, and the Republicans in some parts of the US: rising energy costs that low-income people are bearing the brunt of.

In the US, right-wing hysteria about gas stove bans and electric vehicles are also playing a role.

101 notes

·

View notes

Text

HeroFX: Key Concerns and Issues

HeroFX is an online trading platform established in 2021, offering various trading instruments like forex, indices, shares, futures, crypto, metals, and energies. However, several serious concerns make it a risky choice for traders.

🚨 Regulatory Concerns

No Regulation: HeroFX is not licensed by any major financial authority.

High Risk: Without regulation, there's no guarantee of fund safety or fair trading practices.

📉 User Feedback

Withdrawal Issues: Many users report problems withdrawing their funds.

Security Breaches: There are reports of security issues and possible fraud.

Poor Support: Customer support is often unhelpful and slow to respond.

💵 Minimum Deposit and Trading Conditions

Low Deposit: HeroFX advertises a low minimum deposit of $20.

High Leverage: Leverage up to 1:500.

Hidden Fees: Users report unexpected fees and unclear terms.

Crypto Payments: Reliance on cryptocurrency payments raises transparency and security concerns.

🖥️ Platform Reliability

MT5 Platform: HeroFX uses the popular MetaTrader 5 platform.

Technical Issues: Users report frequent technical problems and platform downtimes.

Unreliable: Lack of regulation undermines trust in the platform’s reliability and security.

🛑 Conclusion

HeroFX's lack of regulation, numerous user complaints, and unclear trading conditions make it a high-risk choice for traders. It's advised to be extremely cautious with HeroFX and consider safer, regulated alternatives.

If you would like a thorough analysis, please visit the full review on ForexJudge.

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

64 notes

·

View notes

Text

Intuit: “Our fraud fights racism”

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

The agricultural lobby is a sprawling, complex machine with vast financial resources, deep political connections and a sophisticated network of legal and public relations experts. “The farm lobby has been one of the most successful lobbies in Europe in terms of relentlessly getting what they want over a very long time,” says Ariel Brunner, Europe director of non-governmental organisation BirdLife International. Industry groups spend between €9.35mn and €11.54mn a year lobbying Brussels alone, according to a recent report by the Changing Markets Foundation, another NGO. In the US, agricultural trade associations are “enormously powerful”, says Ben Lilliston, director of rural strategies and climate change at the Institute for Agriculture and Trade Policy. “Our farm policy is very much their policy.” The sector’s spending on US lobbying rose from $145mn in 2019 to $177mn last year, more than the total big oil and gas spent, according to an analysis by the Union of Concerned Scientists (UCS). In Brazil, where agribusiness accounts for a quarter of GDP, the Instituto Pensar Agropecuária is “the most influential lobbying group”, according to Caio Pompeia, an anthropologist and researcher at the University of São Paulo. “It combines economic strength with clearly defined aims, a well-executed strategy and political intelligence,” he adds. As a result of this reach, big agribusinesses and farmers have successfully secured exemptions from stringent environmental regulations, won significant subsidies and maintained favourable tax breaks.

[...]

Research suggests that big farms and landowners reap far greater benefits from subsidy packages than small-scale growers, even though the latter are often the public face of lobbying efforts. “It’ll almost always be a farmer testifying before Congress or talking to the press, rather than the CEO of JBS,” says Lilliston. But between 1995 and 2023, some 27 per cent of subsidies to farmers in the US went to the richest 1 per cent of recipients, according to NGO the Environmental Working Group. In the EU, 80 per cent of the cash handed out under the CAP goes to just 20 per cent of farms.

22 August 2024

71 notes

·

View notes

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

145 notes

·

View notes