#Global Big Data Market

Explore tagged Tumblr posts

Text

Global Big Data Market, Market Size, Market Share, Key Players| BIS Research

The Global Big Data Market Report provides a comprehensive analysis of the current trends, market dynamics, and future prospects of the big data industry on a global scale. This report is essential for businesses, investors, and stakeholders seeking insights into the evolving landscape of big data.

Market Overview:

The increasing adoption of wearable devices, at-home testing services and health applications that are empowering patients to proactively manage their health are further contributing to the pool of personal data. The availability of large volumes of health information has paved the way for massive advances in clinical research, development of precision medicine and clinical decision support tools, quicker drug discovery and more detailed view of population health, which has opened new arrays for managing chronic diseases.

The research study is a compilation of various segmentations including the market breakdown by components and services, by application, and by region.

Size and Growth: Evaluate the current size of the global big data market and its growth trajectory over recent years.

Key Drivers: Identify the primary factors fueling the expansion of the big data market, such as increasing data volume, technological advancements, and growing demand for analytics.

Key Players Global Big Data Market Report

Aetna, Inc.

Allscripts Healthcare Solutions, Inc.

Epic Systems

GE Healthcare

IBM Corporation

Oracle Corporation

And many others

Market Segmentation:

By Component: Breakdown of the market based on components like hardware, software, and services.

By Deployment Model: Analysis of big data solutions deployed on-premises, in the cloud, or in hybrid environments.

By Application: Exploration of diverse applications, including data analytics, business intelligence, and machine learning.

Regional Analysis:

Examine the big data market's performance and trends across different regions, considering factors like regional economic conditions, technological adoption, and regulatory environments.

Competitive Landscape:

Key Players: Highlight major companies operating in the big data space and their market share.

Strategies: Analyze the strategies employed by key players for market expansion, innovation, and competitive advantage.

Grab a free sample @ Global Big Data Market Report

Challenges and Opportunities:

Challenges: Address obstacles facing the big data market, such as data privacy concerns, security issues, and integration complexities.

Opportunities: Explore emerging opportunities, market niches, and potential areas for growth within the big data sector.

Visit our vertical page @ Precision Medicine

Future Outlook:

Provide insights into the anticipated trends, innovations, and market developments expected to shape the future of the global big data market.

Conclusion:

Summarize key findings, trends, and predictions outlined in the report, offering valuable insights for businesses and stakeholders navigating the dynamic landscape of the big data industry.

#global big data market#global big data market report#global big data market industry#global big data market key players#global big data market size and share

0 notes

Text

The Global Big Data Market is expected to grow at a CAGR of around 14.7% during the forecast period, i.e., 2023-28. Most of the market is driven by the ever-increasing utilization of connected devices integrated with the Internet of Things (IoT), backed by an elevating adoption of technologies like Machine Learning (ML) algorithms, the Internet of Things (IoT), and Artificial Intelligence (AI).

0 notes

Text

#According to Straits Research#the global Big Data Analytics in Retail Market size was valued at USD 6.25 Billion in 2021. It is projected to grow from USD XX Billion in#with a projected CAGR of 23.2% over the forecast period (2022–2030).

0 notes

Text

Apple to EU: “Go fuck yourself”

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/06/spoil-the-bunch/#dma

There's a strain of anti-anti-monopolist that insists that they're not pro-monopoly – they're just realists who understand that global gigacorporations are too big to fail, too big to jail, and that governments can't hope to rein them in. Trying to regulate a tech giant, they say, is like trying to regulate the weather.

This ploy is cousins with Jay Rosen's idea of "savvying," defined as: "dismissing valid questions with the insider's, 'and this surprises you?'"

https://twitter.com/jayrosen_nyu/status/344825874362810369?lang=en

In both cases, an apologist for corruption masquerades as a pragmatist who understands the ways of the world, unlike you, a pathetic dreamer who foolishly hopes for a better world. In both cases, the apologist provides cover for corruption, painting it as an inevitability, not a choice. "Don't hate the player. Hate the game."

The reason this foolish nonsense flies is that we are living in an age of rampant corruption and utter impunity. Companies really do get away with both literal and figurative murder. Governments really do ignore horrible crimes by the rich and powerful, and fumble what rare, few enforcement efforts they assay.

Take the GDPR, Europe's landmark privacy law. The GDPR establishes strict limitations of data-collection and processing, and provides for brutal penalties for companies that violate its rules. The immediate impact of the GDPR was a mass-extinction event for Europe's data-brokerages and surveillance advertising companies, all of which were in obvious violation of the GDPR's rules.

But there was a curious pattern to GDPR enforcement: while smaller, EU-based companies were swiftly shuttered by its provisions, the US-based giants that conduct the most brazen, wide-ranging, illegal surveillance escaped unscathed for years and years, continuing to spy on Europeans.

One (erroneous) way to look at this is as a "compliance moat" story. In that story, GDPR requires a bunch of expensive systems that only gigantic companies like Facebook and Google can afford. These compliance costs are a "capital moat" – a way to exclude smaller companies from functioning in the market. Thus, the GDPR acted as an anticompetitive wrecking ball, clearing the field for the largest companies, who get to operate without having to contend with smaller companies nipping at their heels:

https://www.techdirt.com/2019/06/27/another-report-shows-gdpr-benefited-google-facebook-hurt-everyone-else/

This is wrong.

Oh, compliance moats are definitely real – think of the calls for AI companies to license their training data. AI companies can easily do this – they'll just buy training data from giant media companies – the very same companies that hope to use models to replace creative workers with algorithms. Create a new copyright over training data won't eliminate AI – it'll just confine AI to the largest, best capitalized companies, who will gladly provide tools to corporations hoping to fire their workforces:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

But just because some regulations can be compliance moats, that doesn't mean that all regulations are compliance moats. And just because some regulations are vigorously applied to small companies while leaving larger firms unscathed, it doesn't follow that the regulation in question is a compliance moat.

A harder look at what happened with the GDPR reveals a completely different dynamic at work. The reason the GDPR vaporized small surveillance companies and left the big companies untouched had nothing to do with compliance costs. The Big Tech companies don't comply with the GDPR – they just get away with violating the GDPR.

How do they get away with it? They fly Irish flags of convenience. Decades ago, Ireland started dabbling with offering tax-havens to the wealthy and mobile – they invented the duty-free store:

https://en.wikipedia.org/wiki/Duty-free_shop#1947%E2%80%931990:_duty_free_establishment

Capturing pennies from the wealthy by helping them avoid fortunes they owed in taxes elsewhere was terribly seductive. In the years that followed, Ireland began aggressively courting the wealthy on an industrial scale, offering corporations the chance to duck their obligations to their host countries by flying an Irish flag of convenience.

There are other countries who've tried this gambit – the "treasure islands" of the Caribbean, the English channel, and elsewhere – but Ireland is part of the EU. In the global competition to help the rich to get richer, Ireland had a killer advantage: access to the EU, the common market, and 500m affluent potential customers. The Caymans can hide your money for you, and there's a few super-luxe stores and art-galleries in George Town where you can spend it, but it's no Champs Elysees or Ku-Damm.

But when you're competing with other countries for the pennies of trillion-dollar tax-dodgers, any wins can be turned into a loss in an instant. After all, any corporation that is footloose enough to establish a Potemkin Headquarters in Dublin and fly the trídhathach can easily up sticks and open another Big Store HQ in some other haven that offers it a sweeter deal.

This has created a global race to the bottom among tax-havens to also serve as regulatory havens – and there's a made-in-the-EU version that sees Ireland, Malta, Cyprus and sometimes the Netherlands competing to see who can offer the most impunity for the worst crimes to the most awful corporations in the world.

And that's why Google and Facebook haven't been extinguished by the GDPR while their rivals were. It's not compliance moats – it's impunity. Once a corporation attains a certain scale, it has the excess capital to spend on phony relocations that let it hop from jurisdiction to jurisdiction, chasing the loosest slots on the strip. Ireland is a made town, where the cops are all on the take, and two thirds of the data commissioner's rulings are eventually overturned by the federal court:

https://www.iccl.ie/digital-data/iccl-2023-gdpr-report/

This is a problem among many federations, not just the EU. The US has its onshore-offshore tax- and regulation-havens (Delaware, South Dakota, Texas, etc), and so does Canada (Alberta), and some Swiss cantons are, frankly, batshit:

https://lenews.ch/2017/11/25/swiss-fact-some-swiss-women-had-to-wait-until-1991-to-vote/

None of this is to condemn federations outright. Federations are (potentially) good! But federalism has a vulnerability: the autonomy of the federated states means that they can be played against each other by national or transnational entities, like corporations. This doesn't mean that it's impossible to regulate powerful entities within a federation – but it means that federal regulation needs to account for the risk of jurisdiction-shopping.

Enter the Digital Markets Act, a new Big Tech specific law that, among other things, bans monopoly app stores and payment processing, through which companies like Apple and Google have levied a 30% tax on the entire app market, while arrogating to themselves the right to decide which software their customers may run on their own devices:

https://pluralistic.net/2023/06/07/curatorial-vig/#app-tax

Apple has responded to this regulation with a gesture of contempt so naked and broad that it beggars belief. As Proton describes, Apple's DMA plan is the very definition of malicious compliance:

https://proton.me/blog/apple-dma-compliance-plan-trap

Recall that the DMA is intended to curtail monopoly software distribution through app stores and mobile platforms' insistence on using their payment processors, whose fees are sky-high. The law is intended to extinguish developer agreements that ban software creators from informing customers that they can get a better deal by initiating payments elsewhere, or by getting a service through the web instead of via an app.

In response, Apple, has instituted a junk fee it calls the "Core Technology Fee": EUR0.50/install for every installation over 1m. As Proton writes, as apps grow more popular, using third-party payment systems will grow less attractive. Apple has offered discounts on its eye-watering payment processing fees to a mere 20% for the first payment and 13% for renewals. Compare this with the normal – and far, far too high – payment processing fees the rest of the industry charges, which run 2-5%. On top of all this, Apple has lied about these new discounted rates, hiding a 3% "processing" fee in its headline figures.

As Proton explains, paying 17% fees and EUR0.50 for each subscriber's renewal makes most software businesses into money-losers. The only way to keep them afloat is to use Apple's old, default payment system. That choice is made more attractive by Apple's inclusion of a "scare screen" that warns you that demons will rend your soul for all eternity if you try to use an alternative payment scheme.

Apple defends this scare screen by saying that it will protect users from the intrinsic unreliability of third-party processors, but as Proton points out, there are plenty of giant corporations who get to use their own payment processors with their iOS apps, because Apple decided they were too big to fuck with. Somehow, Apple can let its customers spend money Uber, McDonald's, Airbnb, Doordash and Amazon without terrorizing them about existential security risks – but not mom-and-pop software vendors or publishers who don't want to hand 30% of their income over to a three-trillion-dollar company.

Apple has also reserved the right to cancel any alternative app store and nuke it from Apple customers' devices without warning, reason or liability. Those app stores also have to post a one-million euro line of credit in order to be considered for iOS. Given these terms, it's obvious that no one is going to offer a third-party app store for iOS and if they did, no one would list their apps in it.

The fuckery goes on and on. If an app developer opts into third-party payments, they can't use Apple's payment processing too – so any users who are scared off by the scare screen have no way to pay the app's creators. And once an app creator opts into third party payments, they can never go back – the decision is permanent.

Apple also reserves the right to change all of these policies later, for the worse ("I am altering the deal. Pray I don't alter it further" -D. Vader). They have warned developers that they might change the API for reporting external sales and revoke developers' right to use alternative app stores at its discretion, with no penalties if that screws the developer.

Apple's contempt extends beyond app marketplaces. The DMA also obliges Apple to open its platform to third party browsers and browser engines. Every browser on iOS is actually just Safari wrapped in a cosmetic skin, because Apple bans third-party browser-engines:

https://pluralistic.net/2022/12/13/kitbashed/#app-store-tax

But, as Mozilla puts it, Apple's plan for this is "as painful as possible":

https://www.theverge.com/2024/1/26/24052067/mozilla-apple-ios-browser-rules-firefox

For one thing, Apple will only allow European customers to run alternative browser engines. That means that Firefox will have to "build and maintain two separate browser implementations — a burden Apple themselves will not have to bear."

(One wonders how Apple will treat Americans living in the EU, whose Apple accounts still have US billing addresses – these people will still be entitled to the browser choice that Apple is grudgingly extending to Europeans.)

All of this sends a strong signal that Apple is planning to run the same playbook with the DMA that Google and Facebook used on the GDPR: ignore the law, use lawyerly bullshit to chaff regulators, and hope that European federalism has sufficiently deep cracks that it can hide in them when the enforcers come to call.

But Apple is about to get a nasty shock. For one thing, the DMA allows wronged parties to start their search for justice in the European federal court system – bypassing the Irish regulators and courts. For another, there is a global movement to check corporate power, and because the tech companies do the same kinds of fuckery in every territory, regulators are able to collaborate across borders to take them down.

Take Apple's app store monopoly. The best reference on this is the report published by the UK Competition and Markets Authority's Digital Markets Unit:

https://assets.publishing.service.gov.uk/media/63f61bc0d3bf7f62e8c34a02/Mobile_Ecosystems_Final_Report_amended_2.pdf

The devastating case that the DMU report was key to crafting the DMA – but it also inspired a US law aimed at forcing app markets open:

https://www.congress.gov/bill/117th-congress/senate-bill/2710

And a Japanese enforcement action:

https://asia.nikkei.com/Business/Technology/Japan-to-crack-down-on-Apple-and-Google-app-store-monopolies

And action in South Korea:

https://www.reuters.com/technology/skorea-considers-505-mln-fine-against-google-apple-over-app-market-practices-2023-10-06/

These enforcers gather for annual meetings – I spoke at one in London, convened by the Competition and Markets Authority – where they compare notes, form coalitions, and plan strategy:

https://www.eventbrite.co.uk/e/cma-data-technology-and-analytics-conference-2022-registration-308678625077

This is where the savvying breaks down. Yes, Apple is big enough to run circles around Japan, or South Korea, or the UK. But when those countries join forces with the EU, the USA and other countries that are fed up to the eyeballs with Apple's bullshit, the company is in serious danger.

It's true that Apple has convinced a bunch of its customers that buying a phone from a multi-trillion-dollar corporation makes you a member of an oppressed religious minority:

https://pluralistic.net/2024/01/12/youre-holding-it-wrong/#if-dishwashers-were-iphones

Some of those self-avowed members of the "Cult of Mac" are willing to take the company's pronouncements at face value and will dutifully repeat Apple's claims to be "protecting" its customers. But even that credulity has its breaking point – Apple can only poison the well so many times before people stop drinking from it. Remember when the company announced a miraculous reversal to its war on right to repair, later revealed to be a bald-faced lie?

https://pluralistic.net/2023/09/22/vin-locking/#thought-differently

Or when Apple claimed to be protecting phone users' privacy, which was also a lie?

https://pluralistic.net/2022/11/14/luxury-surveillance/#liar-liar

The savvy will see Apple lying (again) and say, "this surprises you?" No, it doesn't surprise me, but it pisses me off – and I'm not the only one, and Apple's insulting lies are getting less effective by the day.

Image: Alex Popovkin, Bahia, Brazil from Brazil (modified) https://commons.wikimedia.org/wiki/File:Annelid_worm,_Atlantic_forest,_northern_littoral_of_Bahia,_Brazil_%2816107326533%29.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

--

Hubertl (modified) https://commons.wikimedia.org/wiki/File:2015-03-04_Elstar_%28apple%29_starting_putrefying_IMG_9761_bis_9772.jpg

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#apple#malicious compliance#dma#digital markets act#eu#european union#federalism#corporatism#monopolies#trustbusting#regulation#protonmail#junk fees#cult of mac#interoperability#browser wars#firefox#mozilla#webkit#browser engines

602 notes

·

View notes

Text

How Does 37% Sound?

Image: The Schwab U.S. Large Cap Growth ETF (SCHG) is up more than 37% so far in 2024.

By Brian Nelson, CFA

How does 37% sound? That was the price-only performance of the Schwab U.S. Large Cap Growth ETF (SCHG) thus far in 2024. Over the preceding 5-year period, the SCHG is up over 140%.

For years, I have pounded the table on the theory that there are not value or growth stocks, but rather undervalued, fairly valued, or overvalued stocks. It’s why many growth stocks can be undervalued. It’s the Theory of Universal Valuation found in Value Trap that ties myriad areas of finance to the well-known discounted cash-flow [DCF] model. Growth is a component of value. Hook, line, and sinker.

For years, I have been pounding the table on large cap growth as my favorite area for idea generation (given its Valuentum stock tendencies), and I have put my money where my mouth is, too, with a meaningful portion of my net worth in SCHG. You’ll find that a lot of the top holdings in SCHG are top considerations in the Best Ideas Newsletter portfolio, too, so there’s some good overlap between what I consider Valuentum stocks and where I’m putting my money.

But why don’t I actually own all the stocks I like? It’s the question I have been asked for more than a decade. Here’s what I wrote back in September 2023. I’m an old school analyst that cut my teeth in this business following the Global Analyst Settlement, meaning I believe that writers should generally not be taking stakes in the individual stocks they write about. Writers with positions in the stocks they write about can lead to biased research, or worse, terrible outcomes.

So what’s the playbook for 2025? You can probably guess that I think large cap growth and big cap tech will continue to lead the markets to new heights. 2024 was a boring year, if a 37% return can be considered boring for large cap growth. Frankly, with the market focusing on macro data and the Fed during 2024, there wasn’t much material to write about. We all already know the story: Inflation is under control, the job market remains healthy, the Fed is cutting, and artificial intelligence will be the name of the game this decade.

I think it’s worth clarifying some of our offerings every now and then, as each one focuses on a unique vertical. For those seeking capital appreciation, the Best Ideas Newsletter portfolio may be of interest. For those seeking dividend growth, the Dividend Growth Newsletter portfolio includes our favorite ideas, while for those seeking high yield, the High Yield Dividend Newsletter may be your cup of tea. Dividend growth focuses on dividend growth potential; high yield focuses on current high yield, and so on and so forth.

The Exclusive publication is one of my favorite publications, where we highlight an income idea, a capital appreciation idea and a short idea consideration each month. You can read more about the Exclusive publication here. As of the date of the release of the December edition of the Exclusive publication, success rates for Capital Appreciation Ideas were 90.1%, while success rates for Short Idea Considerations were 88.1%. If you haven’t yet tried out the Exclusive, please do so.

Okay – so what about dividends? Unfortunately, I think we’re in for another difficult year for dividend growth investing. The SPDR S&P Dividend ETF (SDY) is only up 6% year-to-date, trailing both the equal-weight and market-cap weighted S&P 500 indices by sizable margins. With the 10-year Treasury yield at 4.6% and certificate-of-deposit rates still elevated, dividend-only-focused investors will likely continue to trail the broader markets. Remember: dividends are capital appreciation that otherwise would have been achieved, so don’t let the dividend tail wag the total return dog.

What about Bitcoin? I really don’t know. It’s definitely a greater fool asset like gold, but I have totally underestimated the number of fools there are these days. Haha. Just kidding, but seriously, with the regulatory environment easing with respect to crypto and with President-elect Donald Trump supporting crypto assets, who really knows how high Bitcoin can get or just how volatile the asset may become as institutional money ebbs and flows.

So what about small cap value? Well, year-to-date, the iShares Russell 2000 Value ETF (IWN) is up a meager 6%, and it is up just 28% over the past 5 years, trailing large cap growth considerably. With a near 30% weighting in financials and 10% weighting in real estate in the IWN, for me, it’s a no-brainer to avoid. The only way I believe the gap between large cap growth and small cap value narrows is if large cap growth falls on difficult times, which can never be ruled out. But that said, there’s no reason to believe in the IWN, no matter what the statisticians say about quantitative value. I tackle the issue of the pitfalls of falling in love with historical data in Value Trap, too.

All things considered, 2024 was an absolutely amazing year for our core research exposure (i.e. large cap growth). Do I think the SCHG will repeat its dazzling performance in 2025? Probably not to the same extent, but it’s hard to bet against some of the strongest net-cash-rich, free-cash-flow generating powerhouses on the market today. Give me Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG) any day of the week, especially over any financials-heavy index. Enjoy the rest of 2024 folks!

Leave a comment >>

----------

The High Yield Dividend Newsletter, Best Ideas Newsletter, Dividend Growth Newsletter, Valuentum Exclusive publication, ESG Newsletter, and any reports, data and content found on this website are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of its newsletters, reports, commentary, data or publications and accepts no liability for how readers may choose to utilize the content. Valuentum is not a money manager, is not a registered investment advisor, and does not offer brokerage or investment banking services. The sources of the data used on this website and reports are believed by Valuentum to be reliable, but the data’s accuracy, completeness or interpretation cannot be guaranteed. Valuentum, its employees, and independent contractors may have long, short or derivative positions in the securities mentioned on this website. The High Yield Dividend Newsletter portfolio, ESG Newsletter portfolio, Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio are not real money portfolios. Performance, including that in the Valuentum Exclusive publication and additional options commentary feature, is hypothetical and does not represent actual trading. Actual results may differ from simulated information, results, or performance being presented. For more information about Valuentum and the products and services it offers, please contact us at [email protected].

69 notes

·

View notes

Text

Next year will be Big Tech’s finale. Critique of Big Tech is now common sense, voiced by a motley spectrum that unites opposing political parties, mainstream pundits, and even tech titans such as the VC powerhouse Y Combinator, which is singing in harmony with giants like a16z in proclaiming fealty to “little tech” against the centralized power of incumbents.

Why the fall from grace? One reason is that the collateral consequences of the current Big Tech business model are too obvious to ignore. The list is old hat by now: centralization, surveillance, information control. It goes on, and it’s not hypothetical. Concentrating such vast power in a few hands does not lead to good things. No, it leads to things like the CrowdStrike outage of mid-2024, when corner-cutting by Microsoft led to critical infrastructure—from hospitals to banks to traffic systems—failing globally for an extended period.

Another reason Big Tech is set to falter in 2025 is that the frothy AI market, on which Big Tech bet big, is beginning to lose its fizz. Major money, like Goldman Sachs and Sequoia Capital, is worried. They went public recently with their concerns about the disconnect between the billions required to create and use large-scale AI, and the weak market fit and tepid returns where the rubber meets the AI business-model road.

It doesn’t help that the public and regulators are waking up to AI’s reliance on, and generation of, sensitive data at a time when the appetite for privacy has never been higher—as evidenced, for one, by Signal’s persistent user growth. AI, on the other hand, generally erodes privacy. We saw this in June when Microsoft announced Recall, a product that would, I kid you not, screenshot everything you do on your device so an AI system could give you “perfect memory” of what you were doing on your computer (Doomscrolling? Porn-watching?). The system required the capture of those sensitive images—which would not exist otherwise—in order to work.

Happily, these factors aren’t just liquefying the ground below Big Tech’s dominance. They’re also powering bold visions for alternatives that stop tinkering at the edges of the monopoly tech paradigm, and work to design and build actually democratic, independent, open, and transparent tech. Imagine!

For example, initiatives in Europe are exploring independent core tech infrastructure, with convenings of open source developers, scholars of governance, and experts on the political economy of the tech industry.

And just as the money people are joining in critique, they’re also exploring investments in new paradigms. A crop of tech investors are developing models of funding for mission alignment, focusing on tech that rejects surveillance, social control, and all the bullshit. One exciting model I’ve been discussing with some of these investors would combine traditional VC incentives (fund that one unicorn > scale > acquisition > get rich) with a commitment to resource tech’s open, nonprofit critical infrastructure with a percent of their fund. Not as investment, but as a contribution to maintaining the bedrock on which a healthy tech ecosystem can exist (and maybe get them and their limited partners a tax break).

Such support could—and I believe should—be supplemented by state capital. The amount of money needed is simply too vast if we’re going to do this properly. To give an example closer to home, developing and maintaining Signal costs around $50 million a year, which is very lean for tech. Projects such as the Sovereign Tech Fund in Germany point a path forward—they are a vehicle to distribute state funds to core open source infrastructures, but they are governed wholly independently, and create a buffer between the efforts they fund and the state.

Just as composting makes nutrients from necrosis, in 2025, Big Tech’s end will be the beginning of a new and vibrant ecosystem. The smart, actually cool, genuinely interested people will once again have their moment, getting the resources and clearance to design and (re)build a tech ecosystem that is actually innovative and built for benefit, not just profit and control. MAY IT BE EVER THUS!

72 notes

·

View notes

Text

crowdstrike: hot take 1

It's too early in the news cycle to say anything truly smart, but to sum things up, what I know so far:

there was no "hack" or cyberattack or data breach*

a private IT security company called CrowdStrike released a faulty update which practically disabled all its desktop (?) Windows workstations (laptops too, but maybe not servers? not sure)

the cause has been found and a fix is on the way

as it stands now, the fix will have to be manually applied (in person) to each affected workstation (this could mean in practice maybe 5, maybe 30 minutes of work for each affected computer - the number is also unknown, but it very well could be tens (or hundreds) of thousands of computers across thousands of large, multinational enterprises.

(The fix can be applied manually if you have a-bit-more-than-basic knowledge of computers)

Things that are currently safe to assume:

this wasn't a fault of any single individual, but of a process (workflow on the side of CrowdStrike) that didn't detect the fault ahead of time

[most likely] it's not that someone was incompetent or stupid - but we don't have the root cause analysis available yet

deploying bugfixes on Fridays is a bad idea

*The obligatory warning part:

Just because this wasn't a cyberattack, doesn't mean there won't be related security breaches of all kinds in all industries. The chaos, panic, uncertainty, and very soon also exhaustion of people dealing with the fallout of the issue will create a perfect storm for actually malicious actors that will try to exploit any possible vulnerability in companies' vulnerable state.

The analysis / speculation part:

globalization bad lol

OK, more seriously: I have not even heard about CrowdStrike until today, and I'm not a security engineer. I'm a developer with mild to moderate (outsider) understanding of vulnerabilities.

OK some background / basics first

It's very common for companies of any size to have more to protect their digital assets than just an antivirus and a firewall. Large companies (Delta Airlines) can afford to pay other large companies to provide security solutions for them (CrowdStrike). These days, to avoid bad software of any kind - malware - you need a complex suite of software that protects you from all sides:

desktop/laptop: antivirus, firewall, secure DNS, avoiding insecure WiFi, browser exploits, system patches, email scanner, phishing on web, phishing via email, physical access, USB thumb drive, motherboard/BIOS/UEFI vulnerabilities or built-in exploits made by the manufacturers of the Chinese government,

person/phone: phishing via SMS, phishing via calls, iOS/Android OS vulnerabilities, mobile app vulnerabilities, mobile apps that masquerade as useful while harvesting your data, vulnerabilities in things like WhatsApp where a glitched JPG pictures sent to you can expose your data, ...

servers: mostly same as above except they servers have to often deal with millions of requests per day, most of them valid, and at least some of the servers need to be connected to the internet 24/7

CDN and cloud services: fundamentally, an average big company today relies on dozens or hundreds of other big internet companies (AWS / Azure / GCP / Apple / Google) which in turn rely on hundreds of other companies to outsource a lot of tasks (like harvesting your data and sending you marketing emails)

infrastructure - routers... modems... your Alexa is spying on you... i'm tired... etc.

Anyway if you drifted to sleep in the previous paragraph I don't blame you. I'm genuinely just scratching the surface. Cybersecurity is insanely important today, and it's insanely complex too.

The reason why the incident blue-screened the machines is that to avoid malware, a lot of the anti-malware has to run in a more "privileged" mode, meaning they exist very close to the "heart" of Windows (or any other OS - the heart is called kernel). However, on this level, a bug can crash the system a lot more easily. And it did.

OK OK the actual hot lukewarm take finally

I didn't expect to get hit by y2k bug in the middle of 2024, but here we are.

As bad as it was, this only affected a small portion of all computers - in the ballpark of ~0.001% or even 0.0001% - but already caused disruptions to flights and hospitals in a big chunk of the world.

maybe-FAQ:

"Oh but this would be avoided if they weren't using the Crowdwhatever software" - true. However, this kind of mistake is not exclusive to them.

"Haha windows sucks, Linux 4eva" - I mean. Yeah? But no. Conceptually there is nothing that would prevent this from happening on Linux, if only there was anyone actually using it (on desktop).

"But really, Windows should have a better protection" - yes? no? This is a very difficult, technical question, because for kernel drivers the whole point is that 1. you trust them, and 2. they need the super-powerful-unrestrained access to work as intended, and 3. you _need_ them to be blazing fast, so babysitting them from the Windows perspective is counterproductive. It's a technical issue with no easy answers on this level.

"But there was some issue with Microsoft stuff too." - yes, but it's unknown if they are related, and at this point I have not seen any solid info about it.

The point is, in a deeply interconnected world, it's sort of a miracle that this isn't happening more often, and on a wider scale. Both bugfixes and new bugs are deployed every minute to some software somewhere in the world, because we're all in a rush to make money and pay rent and meet deadlines.

Increased monoculture in IT is bad for everyone. Whichever OS, whichever brand, whichever security solution provider - the more popular they are, the better visible their mistakes will be.

As much as it would be fun to make jokes like "CrowdStroke", I'm not even particularly mad at the company (at this point - that might change when I hear about their QA process). And no, I'm not even mad at Windows, as explained in the pseudo-FAQ.

The ultimate hot take? If at all possible, don't rely on anything related to computers. Technical problems are caused by technical solutions.

#crowdstrike#cybersecurity#anyway i'm microdosing today so it's probably too boring to read#but hopefully it at least mostly made sense#to be honest I wanted to have more of a hot take#but the truth is mundane

73 notes

·

View notes

Text

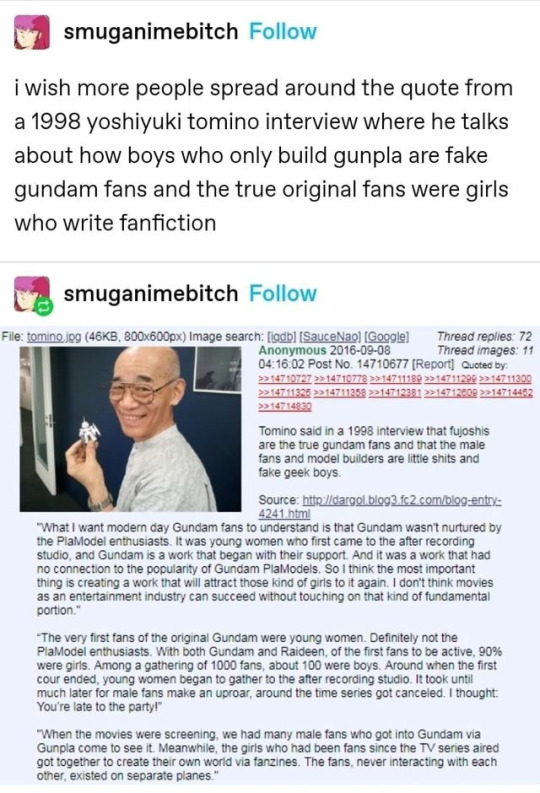

UPDATE: The Destiel/Supernats aren't taking this well -- explaining my reasoning for the history I gave, and why Destiel is not the big bitch of shipping that it thinks it is

An update to THIS:

"This is just a marketing thing, Gundam is a giant robot show, only men watch it!"

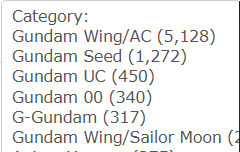

Gundam's fandom is silent majoratively feminine:

"But its not gay, its about giant robots!"

Gundam is very gay. The entire climax of the first story is a riff of Yukio Mishima lmao

The climax of the Amuro/Char arc of Universal Century Gundam (expounding from first Gundam circa 1979), Char's Counterattack is somewhat on the history of Japanese disillusion with liberalism which notably climaxed with the life and history of Yukio Mishima.

You know. THAT Yukio Mishima.

The one who wrote FORBIDDEN COLOURS.

It was so gay that the fanfiction inspired by it became its own damn anime:

And that's just Charmuro, let alone Charma or a billion other ships just in OG Gundam alone.

We've got This is before we get to Guin Sard Lineford and Yamagi Glimerton (both verrrrry gay), Tieria Erde (a genderqueer trans-coded character who transcends gender entirely in their arc) and a bunch of others.

Gundam was always gay.

"I don't see the numbers"

"That doesn't seem like much, Supernat is at least 2x this"

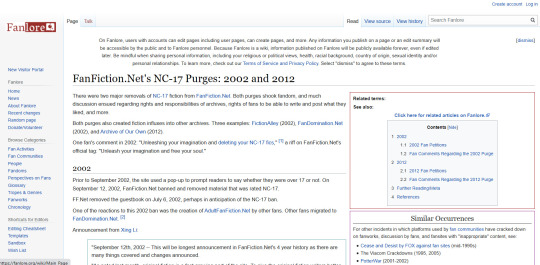

Sooooo the amount of content you do see isn't representative of how much even got written, given FFN had a huge content purge.

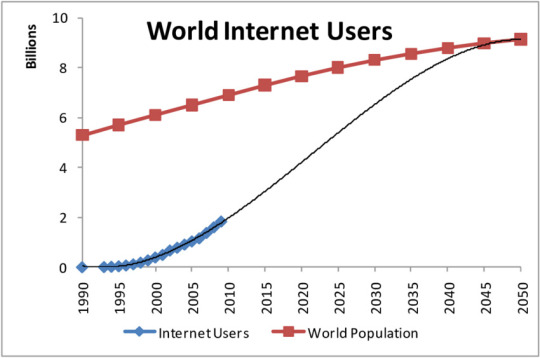

First, let's start with the relative proportion of users: If we're analysing the concept of fandom, we first have to look at who had access to the internet in the first place to publish works.

Yeah that's a pretty sizable difference.

Wing's fandom actually exploded in 2000, but got capped VERY early, distributing itself to fansites when FFN fragmented and collapsed.

Why?

Content purges!

"Isn't there some sort of online archive of this stuff?"

Sure, if you wanna dig through tons and tons of Angelfire and Geocities pages which have mostly disappeared. Otherwise, no! There is no archive of this stuff?

"Why?"

They've since rolled back on this but it means there's a massive amount of lost media out there, including the discussions on it and thus there's an entire history you didn't get to experience.

Its actually very difficult to reach people who've been involved, since it was so long ago that very few people remember, and a sizable proportion of that population have actually died.

"But what about SF fandoms? We have ancient records of stuff like Spirk!"

See unlike physical media like zines, when a server goes offline or there's a data-loss, or something like that there is no surviving copy of the thing in question.

The net result is we have this weird hole where content just vanished, and its now considered lost media. The work of many artists, designers, writers, even videos of events are just lost media because we didn't have the archival mentality adults develop.

You're not gonna hear about all the X-Files stuff or Frasier fanfictions or GW stuff because of these purges and the lack of physical media. FFN users were teens, not adults with resources like US/EU/JP SF fans, who had archival tendencies due to their long history.

So there is this supermassive black-hole in the history of fanfiction running between 1998, and 2008 and some of the only evidence of it are worksafe works and fansites which the owners have long since forgotten about because folks moved on. Moving on is a normal part of fandom.

So to those of you just saying "supernatural is losing to a pair of dumb anime girls" or "urgh this is just a trend tumblr will get over it and go back to supernatural"...

Uhhhhh no they won't, actually?

Supernat's fans mostly seem to be waspy Americans. Gundam is kind of a global phenomenon, one which has traditionally had a silent majority female audience, a vocal minority male audience -- and every time that majority has spoken up, its coincided with a content purge, or a TOS change that mysteriously biases American derived fiction over Japanese derived fiction.

Funny that.

tl;dr:

NATURE IS HEALING

95 notes

·

View notes

Text

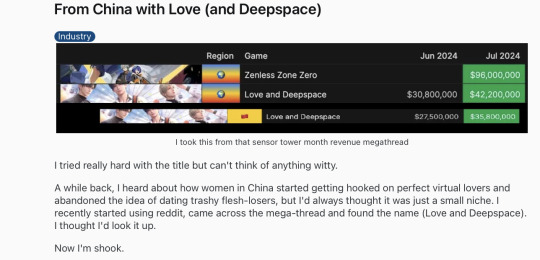

the otome gacha “Love and Deepspace” made a shit ton of money last month and apparently it scared the guys on gachagaming so shitless their thoughts instantly went to “being replaced by sexbots” for some reason. Does this happen when any all female gacha or female banner would top the charts? No, I’ve never seen women immediately make paranoid posts about being replaced with sexbots when this happens or discussing “well it made money, BUT….” I’ve seen men think women will freak out en masse about the thought of being replaced by some “sexbot” but I’ve never seen it actually happen, at least not as much as men freak out and think it’s the end times when like…a gacha game with a male cast makes a lot of money. It’s very telling.

I posted this here for a few examples in english/more western SNS of what we’ve been seeing while looking at the specific incel groups in South Korea and to a lesser extent China recently. Some of the posters may even be from those communities, in which case it’s also worth it to note how these ideas may travel from community to community. A big one is “this doesn’t count because the money is actually not even from women to begin with it’s from (male in her life)” - in this way it doesn’t matter how much or how little the game makes, the financial success will always be due to the powerful finances of a man. they flatter themselves thinking they own the industry in this way, even the games that pander to women. Newer ones I’m seeing are “actually it only makes this much money because men can spend on different gachas/vtubers(?)/games and this is the only thing women can spend on,” and “women are really hard to market to that’s why no one does it” - the first one you can tell is coping. the second one is also ridiculous as the reply says, women spend on male character banners and merch like crazy and the data is, again, right in front of you. The panic of “I hope this doesn’t catch on globally 😰😰😰” from the OP in one of the replies is funny but reminiscent of the “(if there are) men don’t play (the game)” fear of “genshinification” of gacha where male characters pandering to female players will be increasingly be added to gacha games.

Finally (and I’ve mentioned this in previous posts)I added the last one because it’s something I’ve witnessed frequently in all of these “communities,” if there must be male characters in the game they need to be “manly” and “masculine” - these things meaning looking strong, buff, built “proper men.” they will describe Genshin/mihoyo male characters as “femboys” or “twinks”, on a related note I have no idea how that term has gotten so far away from its original meaning and community that these anime nerds throw it out left and right like it’s nothing. You are probably looking for the term “bishounen”. anyway this poster says “women want masculine men” and I’ve seen a lot of guys say this regarding these games though the data absolutely does not show it. this is just the type of male design that they want because the bishounen male that panders to women in “their” game makes them uncomfortable. Look at the male characters who are designed for women in these games. Project Sekai, Ensemble Stars, Genshin, etc. they’re typically lithe and beautiful, mischievous, cute looking. Look up the type of fanart women and girls from a big target market like China make on Lofter, they’re not making these guys in the western ideal of “proper masculine man.” But frequently I see guys pretending the majority of women hate these types of designs that they actually hate. I mean you can already tell what kind of guy this is when he writes “modern woman is not feminine” lol. But there is absolutely a consistent hatred shared between all these men from different communities on male characters that pander to women in this way, part of this is definitely hating the fact that this character has been made for the female audience who they don’t even want playing the game.

41 notes

·

View notes

Text

About a fifth of food is wasted, sometimes through profligacy or poor planning, sometimes from a lack of access to refrigeration or storage, according to the UN Food Waste Index report, published on Wednesday, at a global cost of about $1tn a year. Households are responsible for most of the world’s food waste – about 60% of the 1bn tonnes of food thrown away annually. But commercial food systems are also a substantial contributor: food services accounted for 28% of waste, and retail for about 12% in 2022, the latest data available. These figures exclude an additional 13% of food that is lost in the food supply chain, between harvest and market, often from rejection or spoilage of edible food. Not only is this waste squandering natural resources, it is also a big contributor to the climate and biodiversity crises, accounting for close to 10% of global greenhouse gas emissions and displacing wildlife from intensive farming, as more than a quarter of the world’s agricultural land is given over to the production of food that is subsequently wasted. Inger Andersen, the executive director of the UN Environment Programme, which wrote the report in conjunction with the UK’s Waste and Resources Action Programme (Wrap), described food waste as “a global tragedy”, and contrasted this with the fact that a third of people face food insecurity, unsure of where their future meals will come from.

66 notes

·

View notes

Note

Why should I strive to accurately reflect your argument when you've refused to do the same with climate change? Ignoring all evidence of humans being capable of affecting their environment and dismissively referring to it as "controlling the weather" which is not close to anyone's argument. The problem isn't me not repeating your argument the problem is you don't like people treating you the same way as you treat others.

Except you guys think that you can literally control the weather if we just tax enough billionaires, regulate enough energy industries, and give up enough freedoms. If the goal is to reduce global carbon emissions, not a single proposed plan to "fight climate change" would do that because they all ignore China and India, which are by far the largest producers of artificial carbon in the world. Even if the west turned off every coal plant and banned carbon production tomorrow, China and India would still be putting out way more carbon than we reduced, to the point where reducing our "carbon footprint" is meaningless. What these plans do accomplish, though, is restricting our freedoms and granting government greater control over the lives of individuals and what's left of the free market. None of the people pushing this climate narrative seem very interested in actually fighting the supposed source of "climate change", so why should I take them seriously?

Humans do affect the environment. I never said otherwise. That's your strawman. My argument is that, if the climate is changing, then human activity is not the main cause. And that's a pretty big if, since your side loves to claim that any weather is evidence of "climate change". One hurricane goes farther north than most hurricanes do? Climate change! Normal amount of hurricanes during hurricane season? Climate change! Indian summer? Climate change! Blizzard in winter? Climate change! Forest fires in a dry, brush covered forest that was started by a human? Climate change! Christ, you people even blame civil wars and riots on climate change. Combine all that with the fact that literally every single climate apocalypse that has ever been predicted, many using the same climate models "scientists" rely on today for their predictions, has never come true, and yeah, I don't believe "the experts" or their manipulated data when they say "No, this time we're totally right you guys. Climate apocalypse is right around the corner!" Climate cultists, because you people do act like a cult, are doing their own supposed cause no favors by acting like hysterical children who keep saying the sky is gonna fall any day now.

I'll make the same deal with you that I've made with other climate weirdos. You live your life like the world is going to end any year now, and I'll live my life like it's not. In 50 years, we can meet up and see which one of us was right and which one of us enjoyed their life more. Maybe on one of the coasts that won't be even remotely close to being underwater.

74 notes

·

View notes

Text

Dean Obeidallah at The Dean's Report:

“The one big thing nobody is talking about: Did Elon want to shut the government down because of his business deals with China?” That was the first line of Rep. Jim McGovern (D-Mass) multi-part statement Saturday posted on Elon Musk’s platform, X--ironically enough. A similar point was also made Friday by Rep. Rosa DeLauro (D-CT)—the ranking minority member of the House Appropriations Committee-in a detailed letter to leaders of the House and the Senate. What was the issue the two were flagging? As Rep. McGovern wrote: “The original funding bill (that he [Musk] killed) included what’s called an “outbound investment” provision—which would limit & screen U.S. money flowing to China. That would have made it easier to keep cutting-edge AI and quantum computing tech—as well as jobs—in America. But Elon had a problem.” DeLauro gave even more context to this provision vetting investments in China: “This outbound investment provision was agreed to after months of bipartisan, bicameral negotiations and years of advocacy from Members of Congress. It would have kept innovation and manufacturing in semiconductors, artificial intelligence (AI), quantum computing, and other cutting-edge technologies in the United States and prevented wealthy investors from continuing to offshore production and U.S. intellectual property into China – benefiting only their bottom lines and the Chinese Communist Party.” But Musk—per these two members of Congress—led the charge to block this proposed legislation because as McGovern accurately noted, Musk’s “second-largest market is China. He’s building huge factories there. His bottom line depends on staying in China’s good graces.” The result was that when the new budget deal was agreed upon Friday, guess what was missing? Yep, the provision that would’ve been bad for Musk’s business deals with the Chinese Communist Party—which is in essence Musk’s business partner as the NY Times detailed earlier this year in an article titled, “How Elon Musk Became ‘Kind of Pro-China.’” (Musk’s exact words.)

Rep. DeLauro explained in more detail the financial incentive behind Musk’s action to block this provision: “Musk’s car company, Tesla has poured billions of dollars into investments in China, particularly its “gigafactory” in Shanghai. The Shanghai plant is Tesla’s largest car manufacturing facility – the Chinese gigafactory produced about 50 percent of Tesla’s global automobile output over the last year.” DeLauro continued, “And in May of this year, Tesla broke ground on a new $200 million factory to manufacture large batteries critical to its electric vehicle supply chain…Notably, proponents of regulating U.S. investment in China have advocated for the inclusion of large battery manufacturing in the list of technologies subject to outbound investment screening.” Yep, these new law could’ve impacted Musk’s new business venture per DeLauro.

Rep. McGovern also raised concerns about Musk’s future business plans involving China, explaining Musk “wants to build an AI data center there too—which could endanger U.S. security.” Importantly, DeLauro detailed for all to see Musk’s documented personal relations with the Chinese Communist Party, noting, “Musk has ingratiated himself with Chinese Communist Party leadership.” For example, she cited Musk’s close ties with “Chinese premier Li Qiang, who helped rush the construction of Tesla’s Shanghai gigafactory.” DeLauro concluded her letter by writing, “It is extremely alarming that House Republican leadership, at the urging of an unelected billionaire, scrapped…this critical provision to protect American jobs and critical capabilities.” Adding, “This is particularly concerning given Elon Musk’s extensive investments in China in key sectors and his personal ties with Chinese Communist Party leadership, and calls into question the real reason for Musk’s opposition to the original funding deal.”

[...] In fact, even a well-known Republican raised alarm bells about Musk’s loyalty to Beijing. Vivek Ramaswamy--who Trump tapped with Musk to co-head the newly created Department of Government Efficiency--was publicly warning in 2023 that Musk was a puppet for the Chinese Communist Party. As CNN recently reported, Ramaswamy was concerned that “Tesla is increasingly beholden to China,” adding damningly, “I have no reason to think Elon won’t jump like a circus monkey when [China’s leader] Xi Jinping calls in the hour of need.” The GOP silence on Musk’s extensive ties to the Chinese Communist Party is beyond hypocritical given that for years Republicans have slammed China as a threat. For example, in January 2023, the House GOP created “The Select Committee on the Chinese Communist Party” designed to address the “threat posed by the Chinese Communist Party and develop a plan of action to defend the American people, our economy, and our values.” Earlier this year, the House GOP led the charge to ban Tik Tok from having access to the United States--which was signed into law and goes into effect Jan. 19, 2025 unless the Chinese company that owns the social media platform sells it to a non-Chinese company. But when it comes to Musk, the GOP doesn’t care that he has documented ties to top Chinese Communist Party officials.

CCP puppet and de facto “President” Elon Musk helped block the original CR to protect his business deals with the Chinese government, because it had an “outbound investment” provision that would screen any US money sent to China.

#Elon Musk#China#Vivek Ramaswamy#GOP Hypocrisy#Tesla#President Musk#Rosa DeLauro#Jim McGovern#CCP#US/China Relations#TikTok Ban#TikTok#DOGE#Department of Government Efficiency

13 notes

·

View notes

Text

The Global Big Data Market is expected to grow at a CAGR of around 14.7% during the forecast period, i.e., 2023-28. Most of the market is driven by the ever-increasing utilization of connected devices integrated with the Internet of Things (IoT), backed by an elevating adoption of technologies like Machine Learning (ML) algorithms, the Internet of Things (IoT), and Artificial Intelligence (AI).

0 notes

Text

01 - Taylor Swift

No one in the music industry wielded more power over the past year than Taylor Swift, who made history at stadiums, movie theaters and on the Billboard charts, leaving even the most seasoned executives speechless. While they’d long celebrated her staggering popularity as a singer, songwriter and performer, her force as a strategic business leader suddenly came into sharper focus — and industry veterans took notes as they watched some of her bravest and most innovative business risks reap remarkable rewards.

At 34, she is one of the music industry’s most charismatic and influential leaders — and she rewrites the rules.

“The piece of advice I would give to the other executives on this list is that the best ideas are usually ones without industry precedent,” Swift tells Billboard. “The biggest crossroads moments of my career came down to sticking to my instincts when my ideas were looked at with skepticism. When someone says to me, ‘But that has never been done successfully before,’ it fires me up. We have to take strategic risks every day in this industry, but every once in a while, you have to really trust your gut and take a flying leap. My rerecordings are my favorite example of this, and I’m extremely grateful to my team and fans for taking that leap with me because it absolutely changed my life.”

Sage advice for an industry in which instinct has largely been supplanted by metrics and data analysis.

In December, Time named Swift its 2023 Person of the Year. In September, after encouraging her 279 million Instagram followers to vote and linking to vote.org, the nonpartisan nonprofit said it received over 35,000 registrations. She appears on the cover of this issue of Billboard and in the No. 1 spot of our annual Power 100 issue because her force across the business of music is now unparalleled — and because she models commitment to innovation that the rest of the business will need in order to tackle the big challenges ahead.

Swift’s gambles have paid off handsomely over the past year.

Her massive The Eras stadium tour, which began in March after she controversially put all the tickets on sale at once, crashing Ticketmaster and sparking mass hysteria, grossed an estimated $906.1 million in 2023 and is poised to become the highest-grossing global tour of all time before it wraps in December, according to Billboard.

The Golden Globe-nominated Taylor Swift: The Eras Tour film, taped during her six-show run at SoFi Stadium in Inglewood, Calif., in August, has grossed over $261.6 million worldwide since its October opening, according to AMC Theatres Entertainment. In January, the publicly traded movie-house chain announced that the film’s box-office take made it the highest-grossing concert/documentary picture ever released, surpassing Michael Jackson’s 2009 This Is It. Once again blazing a new path, Swift made a groundbreaking distribution deal directly with AMC Theaters instead of linking with a film studio.

Swift has shaken up the catalog market, too. When Scooter Braun infuriated her by acquiring the master recordings of her first six albums through his Ithaca Holdings and then sold them to investment firm Shamrock Capital at a profit, Swift rerecorded the albums with loving precision and added bonus tracks to the new releases. They performed phenomenally well, as she deftly used her tour to promote them. When her latest rerecording (and 14th studio album overall), 1989 (Taylor’s Version), spent its fifth week at atop the Billboard 200 at the end of 2023, Swift beat Elvis Presley’s record for the most weeks at No. 1 by a solo artist. Her industry market share last year was 1.72%. If she were her own genre, she’d rank ninth for 2023 — bigger than jazz.

“She’s the smartest artist I’ve ever worked with,” says Messina Touring Group’s Louis Messina, who promotes Swift’s tours and has worked with her since 2005. “She outworks everybody and she has always had this vision. If you’re around her, you can’t help but believe in her.” —Melinda Newman

52 notes

·

View notes

Text

Moon in Sagittarius: Bold Moves and Financial Optimism in Business

The Moon, in astrology, represents our emotions, intuition, and sense of security. When it transits through the fiery sign of Sagittarius, a spirit of optimism and adventure takes hold. We become more expansive in our thinking, eager to explore new frontiers and take calculated risks. This can be a potent time for business and finance, as it fuels our drive for growth and fosters a “big picture” perspective.

Positive Influences for Business

Innovation and Expansion: The Moon in Sagittarius ignites our creative spark. This is a prime time to brainstorm new ideas, launch ventures, or explore uncharted territories in your business. The Moon’s transit through Sagittarius ignites a potent blend of optimism, curiosity, and a thirst for adventure. This unique astrological alignment can be a game-changer for businesses, particularly when it comes to innovation and expansion. Let’s delve deeper into how you can harness this dynamic energy:

Unleashing the Creative Spark:

Brainstorming sessions: The Moon in Sagittarius sparks unconventional thinking and out-of-the-box solutions. Gather your team for brainstorming sessions, encouraging open communication and free-flowing ideas. Don’t be afraid to consider seemingly “out there” concepts — some of the most groundbreaking innovations stemmed from challenging the status quo.

Embrace new perspectives: Encourage diverse perspectives within your team. Sagittarius thrives on exploration and learning from different viewpoints. Consider collaborating with individuals from outside your industry or conducting market research to gain fresh insights and identify new opportunities.

Launching New Ventures:

Market testing: The Moon in Sagittarius fosters a willingness to take calculated risks. If you’ve been contemplating launching a new product, service, or even an entirely new business venture, this period might be the green light you’ve been waiting for. Conduct thorough market research to mitigate risks, but don’t be afraid to take the leap when the data aligns with your vision.

Piloting and testing: Embrace experimentation. Pilot your new venture on a smaller scale before committing full resources. This allows you to refine your approach, gather valuable feedback, and minimize potential losses while maximizing the chances of success.

Exploring Uncharted Territories:

Entering new markets: Sagittarius is associated with expansion and global thinking. If you’ve been considering entering new markets, domestically or internationally, this transit can provide the impetus to move forward. Conduct thorough research on the target market, comply with local regulations, and build strategic partnerships to increase your chances of success.

Investing in new technologies: The Moon in Sagittarius encourages embracing innovation. Explore how emerging technologies can be integrated into your business operations to improve efficiency, reach new customers, or streamline processes. Remember, conduct due diligence and weigh the potential benefits against the risks before making any significant investments.

Networking and Collaboration: Sagittarius thrives on connection. Leverage this energy to network with potential partners, build relationships with clients, and expand your reach. The Moon’s journey through Sagittarius ignites a fire within us, urging us to connect, collaborate, and expand our horizons. This period is exceptionally well-suited for networking, building relationships, and expanding your reach in the business world. Here’s how to leverage this cosmic energy:

Networking Events:

Attend industry gatherings and conferences: The Moon in Sagittarius fuels your desire to connect with like-minded individuals. Attend industry events, conferences, or trade shows to broaden your network, meet potential partners, and stay up-to-date on industry trends.

Seek out online communities: Sagittarius thrives in vibrant online spaces. Join industry-specific forums, online groups, or social media communities to connect with professionals from around the world, share ideas, and build relationships.

Building Strong Client Relationships:

Focus on building rapport: Sagittarius values authentic connection. Take the time to understand your clients’ needs and build genuine relationships with them. This fosters loyalty and trust, leading to long-term business partnerships.

Host networking events: Organize client appreciation events or industry meet-and-greets. This provides a platform to connect with clients on a personal level, strengthen relationships, and build a sense of community.

Expanding Your Reach:

Collaborate with complementary businesses: Sagittarius seeks synergy and collaboration. Partner with businesses that complement your offerings to expand your reach and tap into new customer segments. Ensure the collaboration is mutually beneficial and aligns with your overall business strategy.

Explore strategic partnerships: Look for opportunities to partner with established organizations in your industry. This can lend credibility to your business, open doors to new markets, and accelerate your growth.

Financial Optimism: The Moon in Sagittarius fosters a sense of abundance and optimism regarding finances. You might be more receptive to investments or feel a surge in confidence when negotiating deals. The Moon’s transit through the sign of Sagittarius brings a wave of optimism not just to business ventures but also to our financial outlook. This doesn’t necessarily translate to guaranteed riches, but it does create a positive mindset that can be harnessed to make sound financial decisions. Let’s explore how this manifests:

Sense of Abundance:

Increased belief in prosperity: The Moon in Sagittarius fosters a positive outlook on the future. This can lead to a stronger belief in our ability to achieve financial goals, motivating us to take calculated risks and pursue opportunities for growth.

Gratitude for what you have: Sagittarius is associated with appreciation and gratitude. By acknowledging our current blessings, we shift our focus from what we lack to the abundance that already exists in our lives. This positive mindset attracts more positive results, fostering a cycle of abundance.

Openness to Investments:

Exploring new opportunities: The Moon in Sagittarius encourages us to step outside our comfort zones and explore new avenues. This can translate to increased willingness to consider investments that may have previously seemed intimidating.

Thorough research remains key: While the optimistic energy is positive, it’s crucial to conduct thorough research before making any investment decisions. Understand the risks involved, consult with financial advisors, and make informed choices based on your personal financial goals and risk tolerance.

Confidence in Negotiations:

Stronger negotiation skills: The Moon in Sagittarius instills a sense of confidence and self-belief. This can enhance your negotiation skills, allowing you to advocate for yourself and your business more effectively when it comes to pricing, contracts, or other financial negotiations.

Maintaining ethical principles: While confidence is crucial, maintain ethical integrity and avoid manipulating others. Focus on win-win solutions that benefit all parties involved, fostering long-term partnerships and building trust.

Tips for Harnessing the Moon in Sagittarius Energy

Think Big: Don’t be afraid to set ambitious goals. This transit encourages us to dream large and take calculated risks. The Moon’s sojourn through Sagittarius ignites a potent cocktail of optimism, courage, and a yearning for adventure. This astrological alignment is a prime time to set ambitious goals and step outside your comfort zone to achieve them. Here’s how to harness this powerful energy for audacious accomplishments:

Unleashing Your Inner Visionary:

Dream big: Sagittarius is all about thinking expansive and setting audacious goals. Don’t be afraid to dream big for your business or personal finances. What would your ideal scenario look like? What audacious goals can excite and motivate you? Write them down, visualize them vividly, and allow yourself to believe in their attainability.

Break down the big goals: While dreaming big is essential, it’s equally important to have a roadmap to success. Break down your long-term goals into smaller, achievable milestones. This will make them seem less daunting and provide a clear path forward.

Calculated Risks for Big Rewards:

Embrace calculated risks: The Moon in Sagittarius encourages us to be bold and take calculated risks. Don’t let the fear of failure hold you back. Analyze potential risks, create a contingency plan, and take a measured leap of faith towards your ambitious goals. Remember, sometimes the greatest rewards lie just beyond our comfort zones.

Don’t be reckless: While calculated risks are encouraged, avoid being reckless. Sagittarius may nudge you to be impulsive, but it’s important to strike a balance between boldness and prudence. Carefully consider the potential consequences before taking any significant actions.

Fueling Your Ambition with Knowledge:

Knowledge is power: The centaur, Sagittarius’s symbol, represents the union of wisdom and the wild archer. Fuel your ambition with knowledge. Research, take courses, and surround yourself with mentors who can guide you on your journey. The more prepared you are, the more confident you’ll feel in taking on ambitious goals.

Embrace Learning: Sagittarius is a lifelong learner. Take this opportunity to expand your knowledge through courses, conferences, or attending industry events. The Moon’s journey through the inquisitive and expansive sign of Sagittarius ignites a burning desire for knowledge and growth. This period is a golden opportunity to embrace lifelong learning and equip yourself with the skills and knowledge necessary to achieve your ambitious goals.

Rekindle Your Inner Student:

Embrace curiosity: Sagittarius is naturally curious and thrives on exploring new concepts and ideas. Reconnect with your inner student and cultivate a genuine curiosity about the world around you. Ask questions, seek out new information, and challenge your existing assumptions.

Lifelong learning mindset: Shift your perspective from viewing learning as a chore to embracing it as a continuous journey of growth and self-discovery. This mindset will keep you motivated and engaged in the learning process.

Explore Diverse Learning Avenues:

Courses and workshops: Enroll in courses or workshops related to your field, personal interests, or specific goals you want to achieve. The vast array of online and offline learning options allows you to tailor your learning experience to your preferences and schedule.

Industry events and conferences: Attend industry events, conferences, or trade shows relevant to your business or profession. These events offer opportunities to learn from experts, network with like-minded individuals, and stay up-to-date on the latest trends and innovations.

Learning Beyond the Classroom:

Read extensively: Sagittarius is drawn to knowledge, and reading can be a powerful tool for expanding your horizons. Explore books, articles, and online resources related to your interests or areas you want to learn more about.

Seek mentors and advisors: Surround yourself with individuals who possess the knowledge and experience you aspire to. Seek mentors or advisors who can guide you on your learning journey, offer valuable insights, and challenge you to think critically.

Delegate and Collaborate: Don’t try to do everything yourself. Leverage the collaborative spirit of Sagittarius by delegating tasks and fostering teamwork within your business. The Moon’s transit through the expansive and collaborative sign of Sagittarius encourages us to move beyond our limitations and achieve more through collaboration. This is a prime time to delegate tasks effectively and leverage the strengths of your team to propel your business forward. Here’s how to harness this powerful energy:

Recognizing the Power of Collaboration:

Strength in numbers: Sagittarius thrives on community and working together towards a common goal. By delegating tasks and collaborating with others, you can tap into a wider range of expertise, perspectives, and energy, leading to more creative and effective solutions.

Building trust and fostering ownership: Effective delegation isn’t just about assigning tasks; it’s about building trust and fostering a sense of ownership among team members. Delegate tasks that align with individuals’ strengths and interests, allowing them to contribute meaningfully and take pride in their work.

Effective Delegation Strategies

Clear communication: Before delegating, ensure clear communication by outlining the task, desired outcomes, and any relevant information. This empowers team members to understand their responsibilities and complete the task successfully.

Empowerment and autonomy: Don’t micromanage. While providing guidance is crucial, trust your team members with the autonomy to execute the task using their best judgment. This fosters creativity, problem-solving skills, and a sense of ownership.

Leveraging Diverse Skills and Perspectives:

Identify individual strengths: Recognize the unique skills and strengths of each team member. Delegate tasks that leverage their individual talents and expertise to maximize efficiency and effectiveness.

Embrace diverse perspectives: Sagittarius values openness to different viewpoints. Encourage brainstorming sessions and open communication to foster a collaborative environment where diverse perspectives are valued and can lead to innovative solutions.

Words of Caution:

Overconfidence: While optimism is good, be wary of becoming overly confident. Do your due diligence before making significant financial decisions. The Moon’s journey through optimistic and adventurous Sagittarius can be a double-edged sword when it comes to finances. While it fosters a positive outlook and increased belief in one’s abilities, it also carries the pitfall of overconfidence. Here’s how to navigate this astrological influence and make sound financial decisions:

Recognizing the Signs of Overconfidence:

Undue optimism: Be wary of unrealistic expectations. While optimism is crucial, don’t let it cloud your judgment regarding potential risks or uncertainties.

Ignoring red flags: Overconfidence can lead to overlooking crucial information or dismissing potential problems. Remain vigilant and don’t ignore any red flags that may arise during your research or decision-making process.

Relying solely on intuition: While intuition can be valuable, it shouldn’t be the sole factor in financial decisions. Always complement your intuition with thorough research and sound financial analysis.

Mitigating the Risks of Overconfidence:

Conduct thorough due diligence: Before making any significant financial decisions, conduct thorough research and due diligence. This involves evaluating investment opportunities, researching companies, and comparing different options to make informed choices.

Seek professional advice: Don’t hesitate to consult with financial advisors or experts for guidance and professional insights. They can help you analyze your financial situation, identify potential risks, and make sound investment decisions.

Maintain a healthy dose of skepticism: Approach any financial opportunity with a healthy dose of skepticism. Question everything, seek different perspectives, and avoid making impulsive decisions based solely on optimism.

Striking a Balance with Optimism:

Channel optimism into preparation: The positive energy of Sagittarius can be channeled into comprehensive planning and preparation. Use your optimism to envision your financial goals but ground them in realistic expectations and thorough research.

Celebrate small wins: Maintaining a positive outlook is crucial. Celebrate your financial successes, no matter how small, to stay motivated and keep your optimism in check.

Learn from past mistakes: Everyone makes financial missteps. Use them as learning experiences to refine your decision-making process and avoid repeating the same mistakes in the future.

Impulsiveness: Sagittarius’ impulsive nature can lead to rash decisions. Take your time, analyze all options, and avoid getting swept away by fleeting enthusiasm. The Moon’s transit through the fiery and adventurous sign of Sagittarius can ignite a spark of impulsiveness. While this energy can be a catalyst for bold action, it can also lead to rash decisions with negative consequences, especially when it comes to business and finances. Here’s how to navigate this astrological influence and make thoughtful choices:

Recognizing the Signs of Impulsiveness:

Urgency to act: Sagittarius’ impulsive nature can manifest as a sudden urge to act without considering all the options. Be wary of decisions made under pressure or driven by a fleeting sense of enthusiasm.

Ignoring potential risks: In the throes of impulsiveness, we might gloss over potential drawbacks or fail to adequately assess risks. Pay attention to any red flags that may arise during your decision-making process.

Overlooking details: The urge to act quickly can lead to neglecting crucial details. Ensure you gather all the necessary information and don’t allow excitement to cloud your judgment regarding the finer points.

Strategies to Curb Impulsiveness:

Implement a waiting period: Before making any significant decision, especially financial ones, impose a waiting period. This allows the initial excitement to subside and provides time for rational analysis and a more balanced perspective.