#Forensic Audits & Fraud Investigations

Explore tagged Tumblr posts

Text

Unveiling the Truth: The Power of Forensic Audits & Fraud Investigations

Forensic Audits & Fraud Investigations – Dhiren Shah & Co specializes in forensic audits, fraud detection, and financial investigations. Trusted experts for businesses seeking transparency and accountability.

Google Map:--> https://maps.app.goo.gl/tiyzgYZFeXEDBBbc8

Forensic Audits & Fraud Investigations, Forensic Audits, Fraud Investigations, Financial Misconduct, Embezzlement Detection, Asset Tracing, Regulatory Compliance, Litigation Support, Fraud Investigations, Financial Misconduct, Embezzlement Detection, Asset Recovery, Regulatory Compliance, Forensic Accounting, Financial Transparency, Dhiren Shah & Co

#Forensic Audits & Fraud Investigations#Forensic Audits#Fraud Investigations#Financial Misconduct#Embezzlement Detection#Asset Tracing#Regulatory Compliance#Litigation Support#Asset Recovery#Forensic Accounting#Financial Transparency#Dhiren Shah & Co

0 notes

Text

Forensic Accounting: Enabling fraud detection

Forensic accounting aims to evaluate financial records and identify fraud using a combination of accounting, auditing, and investigation abilities. It involves applying accounting techniques to legal problems and disputes to provide evidence that can be used in legal proceedings. Forensic accountants are frequently requested to investigate financial fraud and give qualified testimony in court. Read More: Forensic Accounting: Enabling fraud detection

#ABC / Anti-bribery and Corruption#FCPA / Foreign Corrupt Practices Act#Forensic Accounting And Fraud Detection#forensic accounting firms in India#forensic accounting services in Delhi#forensic audit ca firms#forensic audit in India#forensic consultancy services#forensic digital audit#forensic digital auditor#forensic financial audit#IBC / Insolvency and Bankruptcy Code#IDD / Integrity Due Diligence#Investigation Whistle Blower

0 notes

Text

~ANBU Detective Agency~

#Blind Incandescence - Head Cannons Content from the collective madness that is Narnia's 3 lunatics - penned by Crazy Insomniac (CI), Finger Seizure (FS) and Typo Queen (TQ).

ANBU Structure

♦ Mr Coffee maker is the most productive agent of ANBU.

♦ The board members are Shimura Danzo, Sarutobi Hiruzen, Utatane Koharu Mitokado Homura, Uchiha Madara and Senju Tobirama. They fund the ANBU and are the cause of endless migraines. Danzo's demands for random audits may some day end with Tsunade being charged for murder.

♦ Izumo and Kotetsu are the receptionists. Izumo is incharge of filing and Kotetsu is incharge of phone calls. Which is why almost no paper gets filed and barely any calls (especially from the board members) are ever picked up.

♦ Homicide and organized crime Unit - lead by Tsunade. Itachi and Kakashi are her personal headaches/ hand-selected team members. They deal with cases no one wants to touch with a ten foot pole.

♦ Marital Affairs Unit - members are Kurenai, Asuma and Anko. This is the unit that brings in the most money.

♦ Insurance Fraud Unit - Genma, Raido and Gai - Gai's youthfulness is what keeps the other two sane.

♦ Missing persons Unit: Tsume and Shibi

♦ Cult investigation: Hidan, Sasori, Kisame - the rest of the agency tends to stay away from them.

♦ Narcotics Unit: Inoichi and Shikaku...its kind of their expertise.

♦ Forensic team: Yamato, Hayate, Yugao, Kabuto, Deidara

♦ Ibiki is in charge of interrogation. Anko assists at times.

♦ Kakazu is the accountant - no one ever gets paid on time.

♦ Orochimaru is the Medical Examiner / resident terror of the agency. Naruto loves him.

When ever Tsunade has a mad scientist moment (she misses holding a scalpel) she tries to go to Orochimaru's lab in desperate hopes he'll let her assist him - the bastard always slaps her hand away, pushes her out of the lab and shuts the door in her face with a smug smirk as if taunting her for not finishing med school. Naruto is the only one who has complete access to the lab. If one would dare to venture down to Orochimaru's 'dungeons' they would often find the chibi babbling the ME's ear off about what happened in school that day with said ME responding to the babbling while dissecting dead bodies. Good thing his school teachers think Naruto is just a very creative child.

Tsunade dislikes the favoritism Orochimaru shows. She was the first blond in his life after all. She should have more privileges.

♦ Akatsuki Law - a VERY successful Law agency run by Nagato, Yahiko and Konan. They provide FORCED free services to ANBU because Tsunade insists that’s what family does and Nagato wishes he was cousins with anyone but her.

♦ Any press conferences that require ANBU presence are dealt with either from a member of the department in question. Itachi, Tsunade and Kakashi stay in the shadows since their roles require them to keep a low profile.

♦ Social events that require their presence are Senju And Uchiha family related and Tsuande and Itachi attend them. Itachi with a poker face and Tsuande with endless whining.

♦ Kakashi is incharge of attending all of Naruto’s Parent/Teacher conferences. There is always a bet ongoing regarding how many dates the Hatake will have by the time he returns the next day.

Tsunade went to one of Naru's parent teacher conferences -- It's ironically the same elementary school that Tsunade herself attended with Orochimaru and Jiraiya since Jiraiya stayed in his family home while the other two moved away. Unfortunately, the principal remembered Tsunade. She remembered the blonde menace for that one time she had snuck toads into the classroom during recess (she was good at bullying Jiraiya and Jiraiya was good at catching toads) and had left them in the desks of all the girls that had been giving her a hard time for liking to spend all her time with boys (Jira and Oro). The screams once the students had returned and had toads leap on them had shaken the school. Then there was the time the blonde nightmare had snuck in Orochimaru's new pet snake (without his permission or knowledge at that) and had gone around telling girls it was her new designer scarf. Suffice to say - no one was amused with her prank. Orochimaru had actually not talked to her for a week. The principal remembered all these things -- that should have been bad enough right? But this is Tsunade we are talking about. And as her luck would have it -- While trying to act like a responsible adult...she notices the janitor and...recalls that the man is actually a suspect in one of her ongoing investigations - only they hadn't been able to find him - until now. She runs after him, tackles him, breaks furniture, swears up a storm that leaves parents, teachers and students traumatized and stumbles out of the school premises with a bleeding split lip, torn clothing, a limp and a murder suspect. She wants to sue the school for endangering students. They want to sue her for property damage. Nagato swears he has white hair since that week. Tsuande says his hair is still blinding enough and tells him to get out of her office. Suffice to say, Tsunade is never allowed to come back to Konoha Elementary School. .

@konohagakurekakashi & @uchihaa-itachi.

#Blind Incandescence#V; Detective#Senju Tsuande#Uchiha Itachi#Hatake Kakashi#Narnian Inhabitants#Typo Queen#Crazy Insomniac#Finger Seizure#uchihaa-itachi#konohagakurekakashi#Head Canons#HC#hc#headcanons

10 notes

·

View notes

Text

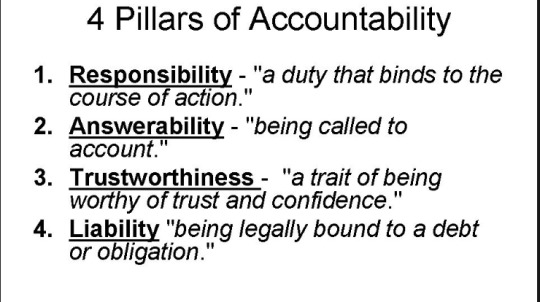

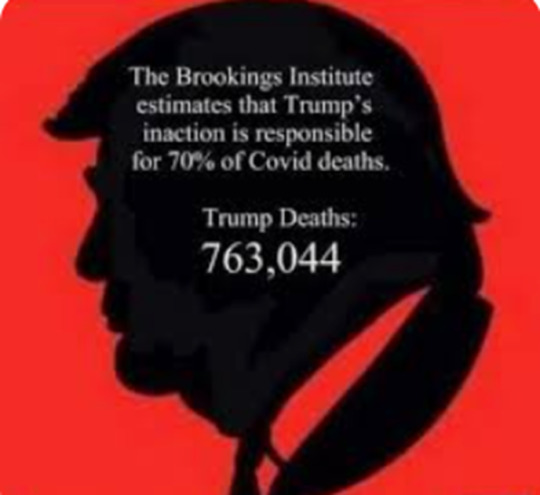

Are we ever as a country going to handcuff a political party state and federal? limit what they can spend tax dollars on? and I don't mean services that help those in need and infrastructure!. I mean political stunts and creating covert departments to track pregnancy's, building billionaire sports league stadiums, corporate subsidy's, tax breaks and bailouts? uneven tax payer dollars financial dispersal during natural catastrophes!. investigate with full forensic financial audit on anything that that raises the deficit by 1.5 trillion dollars and deaths over 100,00! it's called full accountability and not by the party(s) themselves!

8 notes

·

View notes

Text

The scope of forensic audit – what does it cover?

Frauds are a dark reality in the corporate world. The oversight, negligence or maligned intention – anything can be the reason behind a financial fraud. To ascertain the real cause and to pinpoint the culprit, and to make the wrongdoer accountable, the investigators take help of the forensic audit firms in Mumbai. These audit firms carry a detailed investigation on the documents available and provide all important evidences that a court requires for any such case. Let’s take a look at the main deliverables of a forensic audit.

Fraud identification: The very first thing for which the forensic audit firms in Mumbai are required is the fraud identification. The audit firms pass all the documents under a magnifying glass and in the backdrop of compliances to ascertain any glitches. By pinpointing the errors and anomalies, the forensic auditor establishes the kind of fraud and impact it has caused. This is needed to decide the punishment for the fraud.

Fraud period: To find the people responsible, it is important to find the period in which fraud has taken place. The forensic audit firms in Mumbai go through tax returns, contracts of long-term nature, credit/debit notes and other financial documents to find the period of discrepancies.

Ascertaining concealment: By investing all documents, the forensic auditors dig out the way the fraud went unnoticed. When the unnoticed fraud takes a gigantic form and affects the stakeholders, the job of the forensic audit firms in Mumbai is to go back to records and uncover the mistake or intended error.

Deciding the perpetrators: The ownership is quite clear when it comes to financial records. Companies make various people in charge of financial processes and take their signatures which affirm their responsibility. Based on change management procedures and ownership-ascertaining documents, the forensic auditors finally name the people responsible for the fraud. It helps victims file a case against the wrongdoers.

Quantifying the loss: The court demands the companies to come up with loss figures. The companies go through forensic auditing where the auditors highlight the mistake and factor them to find out the quantum of fraud. It is useful in deciding the prison term or the kind of punishment applicable to the case.

Evidence collection: To make the case stronger against the defaulting company or individual, the forensic auditors do the job of evidence collection. The receipts, bills, credit notes, financial statements, profit and loss accounts, inventory records, etc. serve as the evidences. Also, the auditors may record the statement of the fraudulent individuals to provide evidence to the court.

Thus, forensic audit is a serious job. It is carried out to figure out the fraud, if any, has happened when any complaint against the company or an individual reaches the concerned tribunals.

2 notes

·

View notes

Text

Navigating Career Paths: Opportunities for CA, CS, US CMA, US CPA, UK ACCA, and US CFA Graduates

In today’s globalized economy, professional certifications in accounting, finance, and corporate governance provide immense opportunities for aspirants. Each qualification—CA, CS, US CMA, US CPA, UK ACCA, and US CFA—opens distinct career pathways. Let’s explore the opportunities each offers:

1. Chartered Accountant (CA)

Best Suited For: Auditing, taxation, accounting, and financial management professionals. Career Opportunities:

Auditing and Assurance Services: The "Big Four" (Deloitte, PwC, EY, and KPMG) are among the prestigious firms where Chartered Accountants can serve as auditors.

Taxation: Opportunities in direct and indirect tax advisory for corporate and individual clients.

Finance Management: CFO roles or finance controller positions in organizations.

Consulting and Advisory Services: Strategy and financial consulting for businesses.

Entrepreneurship: Many CAs venture into practice or start financial consultancies.

2. Company Secretary (CS)

Best Suited For: Corporate governance, compliance, and legal advisory. Career Opportunities:

Corporate Compliance Officer: Ensuring organizations comply with legal and regulatory requirements.

Corporate Governance Roles: Advising board members on corporate governance policies.

Legal Advisory: Handling contracts, intellectual property rights, and corporate laws.

Corporate Restructuring: Managing mergers, acquisitions, and liquidation processes.

Representation: CS professionals can represent organizations in various legal forums.

3. US Certified Management Accountant (US CMA)

Best Suited For: Management accounting, financial strategy, and decision-making roles. Career Opportunities:

Financial Planning and Analysis (FP&A): Supporting business decision-making with insights.

Cost Accounting: Enhancing operational efficiency and optimizing costs.

Budget Management: Helping organizations with financial planning and forecasting.

Strategic Roles: Bridging finance and operations for effective strategy implementation.

Global Careers: US CMA is recognized internationally, offering mobility in global firms.

4. US Certified Public Accountant (US CPA)

Best Suited For: Public accounting, financial auditing, and global regulatory compliance. Career Opportunities:

Auditing and Assurance: Leading audit engagements, especially for multinational corporations.

Tax Advisory: Advising on US and international tax systems.

Forensic Accounting: Investigating fraud and financial discrepancies.

Regulatory Compliance: Ensuring adherence to US GAAP and SEC regulations.

Corporate Finance: Joining multinational corporations for roles requiring US expertise.

5. UK Association of Chartered Certified Accountants (UK ACCA)

Best Suited For: International accounting, auditing, and financial management. Career Opportunities:

Global Accounting and Finance: The ACCA qualification is widely recognized in over 180 countries.

Risk Management and Compliance: Advising organizations on managing risks effectively.

Internal Auditing: Evaluating organizational processes and controls.

Corporate Roles: From finance managers to CFOs in multinational firms.

Consulting: Offering advisory services in diverse domains like taxation, investment, and compliance.

6. US Chartered Financial Analyst (US CFA)

Best Suited For: Investment banking, portfolio management, and financial analysis. Career Opportunities:

Investment Banking: Handling mergers, acquisitions, and IPOs.

Portfolio Management: Managing both individual and institutional investment portfolios.

Equity Research: Analyzing stocks, sectors, and market trends for investors.

Risk Analysis: Identifying and mitigating financial risks in investment decisions.

Corporate Finance: Assisting in capital structuring and financial strategies.

Choosing the Right Path

Each qualification caters to different career aspirations:

If you're passionate about taxation and auditing, CA or US CPA may be ideal.

For corporate governance and compliance, CS is the right choice.

If strategic financial planning and management interest you, consider US CMA.

Global accounting and mobility align with UK ACCA, while investment-focused professionals can opt for US CFA.

Conclusion

Professionals with these certifications are in high demand globally. Evaluate your interests, skills, and long-term goals to choose the right qualification. Each path offers excellent career prospects, with opportunities to make a meaningful impact in the financial and corporate world.

1 note

·

View note

Text

Protect Your Business with Due Diligence in Kenya

Spearheading a business in Kenya demands you to bet on sure profits on one hand and assume the worst on the other. Whether one is contracting new partnerships, asking for employees, or even investing in mergers and acquisitions it is necessary to put in place effective oversight measures so that business integrity is guaranteed. The value of conducting inspections cannot be overstated if you will survive the competition by making sure you always take the most prudent steps. It is important for the businesses to conduct checks to mitigate risks, reduce fraud, and meet the requirements of local and international laws.

One of the most interesting issues that this article discusses is due diligence services and their contribution to the security of your business in general, as well as the additional advantages which are a must for sustainability.

What is Due Diligence and Why is it Important?

Due diligence is a stringent exercise consisting of checking, confirming, and examining data of individuals, companies, or transactions before taking decisions that are critical to the business. In Kenya, corporate due diligence investigators have become even more crucial having in mind that the numbers of fraud, money laundering, and corporate misrepresentation are on the rise.

Key Reasons Why Due Diligence is Essential:

Risk Mitigation: Helps your business identify financial, legal, or reputation risks before they become a problem.

Regulatory Compliance: The aim is to make sure of following correct AML checks and other legal obligations.

Fraud Prevention: This is the manner of the shield against deceptive practices and unethical business dealings.

Trust and Credibility: The building of trust among stakeholders is a building block of the company, the partners, and the investors.

Long-term Sustainability: One of the best ways to foster growth in business is to make the right choices having in mind that necessary equips are in place.

Types of Due Diligence Investigation Services in Kenya

In Kenya, the Due Diligence Investigation Services to be adopted rest on the nature of the business and the level of risk exposure it runs. They include:

1. Financial Due Diligence Services Kenya

It involves the verification of the financial books of a company for illegal or mismanagement activities. Such financial records include bank statements, cash flow statements, tax compliance and forensic investigation services meant to unearth financial irregularities. The importance of financial due diligence concerns acquisition and investment which require utmost transparency.

2. Legal & Compliance Due Diligence Kenya

Legal verification assures that a business is subject to compliance audits as required by authorities and that it is not dilly-dallying in a pending lawsuit. This becomes the firm's protective wing against unforeseen legal complexities and penalties. Businesses must be in satisfaction with the regulatory framework of Kenya, including tax legislations, labor compliance rules, and international trading regulations.

3. Background Checks & Employee Screening Kenya

The truth is that the right employees bring a lot of security to businesses. A company can dismiss the certainty of the potential recruit's criminal history, the person's actual id number, and the employee's residence address details. Employee screening helps prevent insider fraud and corporate espionage.

4. Mergers & Acquisitions Due Diligence Kenya

Prior to the purchase or merger of a company, due diligence is done to assess the financial stability, legal compliance, and operational risks. Tailored vendors and partners usually have successful transactions due to third-party risk assessment Kenya thus they do have properties with no fraud reputations nor encumbered by legal issues. ('hidden liabilities') are (a) previous financial loss (or future financial loss) unless the debts (or other liabilities) are identified in time.

5. Vendor & Supplier Due Diligence Kenya

Companies depend on their suppliers and vendors for the whole business to run. By conducting supply chain due diligence Kenya, businesses can easily spot high-risk associations that are not complying wholly or who might have hidden risks. This is very crucial in certain areas like manufacturing, retail, and logistics companies with respect to the supplier and vendor due diligence in Kenya.

6. Cybersecurity Due Diligence Kenya

Considering the current digitalization of activities, companies have to evaluate probable threats that may crop up in the course of cybersecurity. Kenya’s cybersecurity due diligence also requires that a company’s IT infrastructure be intensely examined, there be definitive data security policies in place, and the company’s vulnerability to cyber threats also be looked into. It is becoming more and more evident that examples of cyber-security measures such as these are a necessity for protecting companies from data breaches or hacking attempts.

7. Real Estate & Investment Due Diligence Kenya

One of the primary reasons that investment due diligence is first conducted in Kenya is it is very vital before real estate investment or other business dealings. The progress of this kind of a process is usually done by checking the land ownership records, the title deeds, and the legal standing of these properties. Others on the other hand are blockchain real estate due diligence and digital land records verification in Kenya which are modern technologies that enhance the efficiency and transparency in the operations.

How to Use Due Diligence to Protect Your Business in Kenya

1. Prevents Fraud and Scams

Fraud in the business sector in Kenya holds a considerable number of challenges. Businesses that use forensic accounting services in Kenya may help facilitate early detection of financial misconduct and provide remedies before they incur major losses. Practicing due diligence has become a highly valued process, given that many organizations have lost huge amounts of investments due to fraudulent activities.

2. Builds The Organization's Reputation

If a firm applies the relevant verification services, it shall earn the trust of consumers, investors, and regulatory agencies. Proper due diligence would allow consumers to know whether business partners are legit and ethical. A good reputation builds a trust which will bring business growth and long-term partnerships.

3. Ensures Smooth Investments and Acquisitions

Avoiding companies that look at due diligence as a mere formality is just wise. Proper financial reporting and risk assessment are the most desired features in these businesses.

4. Safeguards Against Cybersecurity Threats

The exponential increase of cybersecurity threats has made it essential for cybersecurity due diligence Kenya to be there to ensure that businesses are well-protected digital operations minimizing the chances of cyber fraud. Cyber threats refer to the unauthorized access of data that may lead to the destruction of company reputation, theft of assets, and many other

5. Regulatory Compliance Reduces Legal Liabilities

Well-advised companies always get consent by obeying the existing international regulations as well as the local ones. The verification of compliance by the regulatory authorities has become a common practice in most corporate offices in Kenya and its environs. The prevention of disputes will also happen by doing this.

Choosing the Best Due Diligence Firm in Kenya

Choosing a professional corporate investigation company is very important since it will help you to do the due diligence effectively. Write about these elements when looking for a due diligence expert:

Experience & Industry Expertise: A company that has experience in corporate due diligence investigations Kenya will give you a lot of useful information.

Reputation & Credibility: To trust if this firm is reliable, you should read about customer reviews, witness statements, and past court decisions.

Comprehensive Services: Find out if the company is providing financial due diligence, compliance audits, fraud detection, and background checks properly.

Advanced Technology: Real estate due diligence firms that use tools such as blockchain real estate due diligence Kenya and digital land records verification Kenya are really providing the clients with more accurate and transparent results.

Confidentiality & Professionalism: It is important to see if the organization respects the privacy of individuals when they are investigating.

Conclusion

In today's fast-evolving business environment, due diligence in Kenya is an obligatory security measure that must be adopted by companies. Conducting a proper due diligence background check for your employees, business partnerships formation, or investments in new projects is a crucial aspect of a safe and risk-free business venture.

Then companies become more reliable by hiring Due Diligence Investigation Services in Kenya, thus they have a chance to get rid of possible financial losses and stay compliant with the standards. The process of working with a professional due diligence service provider is an important aspect for businesses to remain compliant and operating legally, so they can grow and succeed in the long run in the East African market.

Are you ready to defend your business? Commence your due diligence journey today!

#Corporate Investigators in Kenya#Corporate Investigation Services in Kenya#Due Diligence Investigators in Kenya#Due Diligence Investigation Services in Kenya

0 notes

Text

ASC Group offers expert forensic audit firm in Ahmedabad, helping businesses detect fraud, financial discrepancies, and regulatory non-compliance. Our detailed investigations ensure transparency, risk mitigation, and business integrity.

0 notes

Text

Forensic Specialist

Are you a master of uncovering the truth? Do you thrive in investigative roles that protect businesses from fraud, waste, and financial risks? If so, this opportunity is perfect for you! A dynamic and detail-oriented Forensic Audit Speciali… Apply Now

0 notes

Text

accountant,

accountant,

Accountants play a vital role in the financial health of individuals, businesses, and organizations. With their expertise in managing financial records, ensuring compliance with laws, and advising on financial strategies, accountants contribute significantly to a company's decision-making processes and overall success.

What Does an Accountant Do?

An accountant is responsible for a variety of tasks, all centered around managing and organizing financial data. The core functions of an accountant typically include:

Financial Recordkeeping: One of the primary duties of an accountant is maintaining accurate financial records. This includes tracking income, expenses, assets, liabilities, and other financial transactions. By ensuring these records are up-to-date and accurate, accountants help businesses understand their financial standing.

Financial Reporting: Accountants prepare financial statements such as balance sheets, income statements, and cash flow statements. These reports offer insight into a company's performance and financial health, allowing stakeholders (such as investors, management, and regulators) to make informed decisions.

Tax Preparation and Planning: Accountants are well-versed in tax laws and regulations. They help individuals and businesses prepare and file tax returns, ensuring compliance with all relevant tax rules. Additionally, accountants offer tax planning advice to minimize liabilities and take advantage of any available deductions or credits.

Auditing: Auditing is another key responsibility of accountants. An auditor reviews financial records and processes to ensure accuracy and compliance with relevant laws and regulations. This role is especially crucial in large organizations to prevent fraud, detect errors, and maintain transparency.

Financial Advice and Planning: Beyond technical accounting tasks, accountants often act as financial advisors. They analyze financial data to provide advice on budgeting, investing, and strategic financial decisions. This guidance helps businesses allocate resources efficiently and plan for future growth.

Types of Accountants

There are several specialized areas within the field of accounting, each focusing on different aspects of financial management. Some common types of accountants include:

Certified Public Accountant (CPA): A CPA is a licensed accountant who has passed a national exam and met specific education and experience requirements. CPAs are highly regarded for their expertise in auditing, taxation, and financial reporting.

Management Accountant: Also known as cost accountants or corporate accountants, management accountants focus on internal financial management. They help businesses plan budgets, control costs, and analyze performance to improve operational efficiency.

Forensic Accountant: Forensic accountants specialize in investigating financial discrepancies, fraud, and misconduct. Their role is critical in legal cases, as they can provide evidence and testimony related to financial crimes.

Tax Accountant: A tax accountant specializes in understanding and applying tax laws to help individuals and businesses reduce their tax burden. They prepare tax returns, provide tax planning services, and assist in resolving tax disputes.

Government Accountant: Working in the public sector, government accountants manage public funds, ensure compliance with laws, and prepare financial reports for governmental agencies.

Key Skills Required for Accountants

To be successful in the field of accounting, professionals must possess a combination of technical skills and personal attributes, including:

Attention to Detail: Accuracy is essential in accounting. Small errors can lead to significant financial discrepancies, so accountants must pay close attention to every detail.

Analytical Thinking: Accountants must be able to analyze complex financial data, identify patterns, and draw meaningful conclusions to help guide business decisions.

Problem-Solving Skills: Accountants often encounter challenges, such as discrepancies in financial records or tax issues. They must be able to troubleshoot problems and find effective solutions.

Communication Skills: While accountants work with numbers, they also need to communicate their findings clearly to stakeholders, such as management, investors, and clients.

Time Management: Accountants frequently deal with multiple projects and deadlines. Effective time management is crucial to ensure all tasks are completed on time, especially during peak periods like tax season.

The Importance of Accountants

Accountants are indispensable for ensuring financial stability and growth. Their expertise helps businesses maintain compliance with tax laws, avoid financial mismanagement, and make strategic decisions that promote long-term success. In addition, accountants contribute to overall transparency, building trust among investors, clients, and regulatory bodies.

Conclusion

In conclusion, accountants are much more than just number crunchers. They are essential business advisors who help organizations navigate the complexities of financial management. Whether it’s preparing taxes, conducting audits, or offering strategic advice, accountants play a critical role in ensuring financial integrity and guiding businesses toward success.

4o mini

0 notes

Text

Audit Services in UAE: A Comprehensive Guide

The United Arab Emirates (UAE) has a thriving business ecosystem, attracting entrepreneurs and corporations from across the globe. To maintain financial transparency and regulatory compliance, businesses operating in the UAE require professional audit services. Audit firms in UAE play a crucial role in ensuring that companies adhere to financial reporting standards, meet compliance requirements, and improve overall governance.

Importance of Audit Services in UAE

Audit services in UAE are essential for businesses, as they help organizations maintain transparency, detect financial discrepancies, and comply with local and international regulations. A well-conducted audit enhances investor confidence and improves a company’s credibility in the market.

The main objectives of audit services in UAE include:

Ensuring compliance with financial reporting regulations.

Identifying financial discrepancies and fraud.

Enhancing business efficiency and operational effectiveness.

Strengthening corporate governance.

Improving investor and stakeholder confidence.

Types of Audit Services in UAE

Audit firms in UAE offer various types of audit services, depending on the needs of businesses. These include:

1. External Audit

An external audit is conducted by independent audit firms in UAE to verify the accuracy of financial statements. It ensures that financial records comply with International Financial Reporting Standards (IFRS) and local laws. External audit reports are critical for investors, regulatory bodies, and other stakeholders.

2. Internal Audit

Internal audits focus on improving operational efficiency and identifying potential risks within an organization. Businesses opt for internal audit services in UAE to enhance internal controls, prevent fraud, and ensure that business processes align with organizational goals.

3. Tax Audit

With the introduction of corporate tax registration UAE, tax audits have gained significant importance. Tax consultancy UAE services help businesses prepare for tax audits by ensuring compliance with the UAE tax framework. Tax audits verify that tax filings are accurate and in accordance with the UAE tax laws.

4. Compliance Audit

A compliance audit assesses whether a company adheres to regulatory and legal requirements. Businesses operating in the UAE must comply with various financial and operational regulations, and compliance audits help identify any gaps that need to be addressed.

5. Forensic Audit

Forensic audits are conducted to investigate financial irregularities, fraud, or embezzlement. Audit firms in UAE offer forensic audit services to help businesses detect fraudulent activities and take necessary legal actions.

Role of Audit Firms in UAE

Audit firms in UAE provide businesses with specialized expertise in financial reporting, compliance, and risk management. These firms ensure that companies maintain accurate financial records and follow best accounting practices.

Some key roles of audit firms in UAE include:

Conducting independent financial audits.

Offering advisory services to improve financial health.

Ensuring regulatory compliance.

Providing corporate tax registration UAE assistance.

Conducting risk assessment and internal control evaluation.

Corporate Tax Registration UAE: Why It Matters

Corporate tax registration UAE is an essential process for businesses operating in the country. The introduction of corporate tax has made it mandatory for companies to register for tax purposes and comply with tax regulations.

Steps for Corporate Tax Registration UAE

Determine Tax Applicability: Businesses must assess whether they fall under the corporate tax framework.

Register with the Federal Tax Authority (FTA): Companies need to register with the FTA to obtain a Tax Registration Number (TRN).

Maintain Proper Financial Records: Businesses must maintain accurate financial records to facilitate tax filing and audits.

File Tax Returns: Companies are required to submit periodic tax returns as per UAE tax regulations.

Ensure Compliance with Tax Laws: Businesses should seek professional tax consultancy UAE services to ensure compliance with tax laws and avoid penalties.

Tax Consultancy UAE: Helping Businesses Navigate Tax Regulations

Tax consultancy UAE services play a vital role in helping businesses understand and comply with tax laws. Professional tax consultants assist organizations in corporate tax registration UAE, VAT compliance, tax planning, and filing tax returns.

Benefits of Tax Consultancy UAE Services

Expert Guidance: Tax consultants provide expert advice on tax laws and regulations.

Compliance Assurance: They help businesses comply with tax filing and reporting requirements.

Tax Optimization: Consultants assist in tax planning to minimize tax liabilities legally.

Audit Support: They offer support in case of tax audits or disputes with tax authorities.

Chartered Accountant Services: A Necessity for Businesses

Chartered accountant services are essential for businesses to maintain financial health and comply with regulations. Chartered accountants offer a range of services, including auditing, financial reporting, tax planning, and business advisory.

Why Businesses Need Chartered Accountant Services

Financial Management: Chartered accountants help businesses maintain accurate financial records.

Regulatory Compliance: They ensure businesses comply with local and international accounting standards.

Audit and Assurance: Chartered accountants provide independent audit services to enhance credibility.

Tax Planning and Compliance: They assist in corporate tax registration UAE and tax filings.

Risk Management: Chartered accountants help businesses identify financial risks and implement mitigation strategies.

Choosing the Right Audit Firms in UAE

Selecting the right audit firms in UAE is crucial for businesses to ensure financial transparency and regulatory compliance. Here are some factors to consider when choosing an audit firm:

Reputation and Experience: Choose a firm with a strong reputation and extensive experience in the industry.

Range of Services: Ensure the firm offers a comprehensive range of services, including tax consultancy UAE, corporate tax registration UAE, and financial audits.

Expertise in UAE Regulations: The firm should have in-depth knowledge of UAE financial and tax regulations.

Technology and Tools: Modern audit firms leverage advanced technology for efficient auditing and financial reporting.

Cost-Effectiveness: Consider the cost of services and ensure they align with your business budget.

Conclusion

Audit services in UAE are a fundamental requirement for businesses to maintain financial transparency, comply with regulations, and enhance operational efficiency. Audit firms in UAE offer various services, including external and internal audits, tax audits, forensic audits, and compliance audits.

Corporate tax registration UAE is now a critical process for businesses, and professional tax consultancy UAE services help organizations navigate tax regulations effectively. Additionally, chartered accountant services play a significant role in financial management, tax planning, and regulatory compliance.

By partnering with the right audit firms in UAE, businesses can ensure financial integrity, regulatory adherence, and long-term success in the dynamic UAE business environment.

#audit services in uae#audit firms in uae#corporate tax registration uae#tax consultancy uae#chartered accountant services

0 notes

Text

Forensic Audits & Fraud Investigations | Dhiren Shah & Co

Dhiren Shah & Co specializes in forensic audits, fraud detection, and financial investigations. Trusted experts for businesses seeking transparency and accountability.

Google Map:--> https://maps.app.goo.gl/Apx9ixqY6pmzdoC47

Forensic Audits & Fraud Investigations, Forensic Audits, Fraud Investigations, Financial Misconduct, Embezzlement Detection, Asset Tracing, Regulatory Compliance, Litigation Support, Fraud Investigations, Financial Misconduct, Embezzlement Detection, Asset Recovery, Regulatory Compliance, Forensic Accounting, Financial Transparency, Dhiren Shah & Co

#Forensic Audits & Fraud Investigations#Forensic Audits#Fraud Investigations#Financial Misconduct#Embezzlement Detection#Asset Tracing#Regulatory Compliance#Litigation Support#Asset Recovery#Forensic Accounting#Financial Transparency#Dhiren Shah & Co

0 notes

Text

Outsourcing Accounting Services in India: Benefits and Challenges

Accounting is the process of recording, summarising, and analysing a business's financial transactions to provide clear and actionable insights. It serves as the foundation for decision-making, financial planning, and compliance with legal obligations. This article delves into the core aspects of accounting, its types, and why it is essential for businesses, especially in the Indian context.

What Is Accounting?

Accounting involves the systematic recording of financial data, ensuring its accuracy, organisation, and accessibility. It helps businesses understand their financial health and helps them comply with tax regulations. It also prepares financial statements and facilitates audits.

Key Components of Accounting

Bookkeeping Bookkeeping is the primary step in accounting. It focuses on recording day-to-day transactions such as sales, purchases, receipts, and payments.

Financial ReportingThis involves preparing financial statements, including the balance sheet, income statement, and cash flow statement, which summarise a company’s financial position.

AuditingAudits verify the accuracy and fairness of a company's financial statements and ensure compliance with accounting standards and laws.

Tax AccountingTax accounting focuses on preparing and filing tax returns while ensuring adherence to government tax regulations.

Management AccountingThis provides management with data-driven insights for planning, decision-making, and optimising operational efficiency.

Types of Accounting

Financial Accounting: Deals with the preparation of financial statements for external stakeholders.

Managerial Accounting: Focuses on internal use, helping management in planning and decision-making.

Cost Accounting: Assesses the cost of production and operations to improve efficiency.

Tax Accounting: Ensures compliance with tax laws and minimises tax liabilities.

Forensic Accounting: Involves investigating financial discrepancies and fraud.

Importance of Accounting for Businesses

Compliance with RegulationsIn India, businesses must comply with laws such as the Companies Act, Income Tax Act, and GST regulations. Proper accounting ensures adherence to these laws.

Financial Planning and BudgetingAccurate financial data helps businesses forecast revenues, plan budgets, and manage resources effectively.

Transparency and TrustReliable financial records build trust with investors, lenders, and stakeholders.

Tax EfficiencyProper accounting minimises tax liabilities and ensures the timely filing of returns to avoid penalties.

Business GrowthInsights from accounting help identify areas of growth and investment opportunities.

Accounting Services in India

Accounting Services in India are diverse and cater to the needs of small businesses, startups, and large enterprises. Common services include:

Bookkeeping and payroll management

Tax planning and filing

GST compliance

Financial analysis and reporting

Audit and assurance

Conclusion

Accounting is more than just number crunching; it is a strategic tool for business growth and sustainability. In India, where regulatory compliance is intricate, professional accounting services can save businesses time, resources, and potential legal hassles. Whether you're a small entrepreneur or a corporate giant, a solid accounting foundation is key to long-term success.

0 notes

Text

How the Best Detective Agency in Pune Helps in Business Fraud Detection

Fraud is a major challenge for businesses today. From financial scams to employee fraud, companies need reliable ways to protect themselves. The best detective agency in Pune plays a crucial role in identifying and preventing business fraud. With expert detectives, modern surveillance techniques, and background verification services, detective agencies ensure businesses operate safely.

Understanding Business Fraud

Business fraud can take many forms, including:

Financial Fraud – Employees or external parties misusing company funds.

Identity Fraud – Fake profiles, forged documents, or stolen identities used for financial gains.

Employee Fraud – Theft, bribery, or unauthorized information sharing by employees.

Corporate Espionage – Competitors stealing trade secrets or customer data.

Vendor Fraud – Fake suppliers, overcharging, or delivering substandard services.

To combat these risks, businesses rely on detective agencies in Pune for professional fraud detection services.

Role of a Detective Agency in Business Fraud Investigation

1. Background Check Investigation

Hiring the wrong employees or working with fraudulent vendors can lead to serious financial losses. A background check investigation in Delhi NCR and background check investigation in Gurgaon ensures businesses only hire trustworthy individuals.

Detectives verify:

Employee work history and criminal records

Vendor credibility and financial background

Previous fraud involvement of any party

2. Corporate Surveillance Services

Detectives use surveillance to track suspicious activities. The best detective agency in Greater Noida and detective agency in South Extension provide undercover operations and CCTV monitoring to detect internal fraud.

3. Document Verification and Audit

The best private detective agency in Delhi NCR and best private detective agency in Gurgaon specialize in document verification. They check:

Fake invoices

Forged signatures

Unauthorized fund transfers

4. Employee Monitoring and Loyalty Checks

Some employees may leak confidential data to competitors. The top detective agency in Film City and best detective agency in Sohna Road conduct loyalty tests and integrity checks to identify disloyal employees.

Why Choose Trinetra Detective Agency?

Trinetra Detective Agency is known for:

Expert Detectives – Highly trained professionals with years of experience.

100% Confidentiality – Ensuring complete privacy in investigations.

Modern Technology – GPS tracking, hidden cameras, and forensic analysis.

Nationwide Network – Offices in Detective Agency in New Delhi, Top Detective Agency in Rohini, and Detective Agency in DLF Phase 2.

Special Services by Trinetra Detective Agency

Matrimonial Investigations

Apart from business fraud detection, Trinetra is also the best matrimonial detective agency in Delhi NCR and matrimonial detective agency in Gurgaon. We offer:

Pre Matrimonial Investigation Services in Delhi NCR and Pre Matrimonial Investigation Services in Gurgaon

Best Post Matrimonial Investigation in Delhi NCR and best post matrimonial investigation in Gurgaon

Best Divorce Case Services in Delhi NCR and best divorce case services in Gurgaon

Corporate Investigations

Best Detective Agency on Golf Course Rd for fraud detection

Top Detective Agency in DLF Phase 1 for corporate intelligence

Detective Agency in Jewar Airport for high-profile cases

Best Detective Agency in Sec-18 Atta Market for business security solutions

Conclusion

Business fraud can lead to financial losses and reputational damage. The best detective agency in Pune helps businesses prevent fraud through background checks, surveillance, and employee monitoring. Trinetra Detective Agency provides expert solutions across major locations like Best Detective Agency in Lajpat Nagar, Top Detective Agency in Vasant Vihar, and Best Detective Agency in Punjabi Bagh. Protect your business today with the most trusted detective agency in Delhi NCR and detective agency in Gurgaon.

0 notes

Text

Protect Your Assets: Top Fraud Prevention Strategies for Family Offices

Family offices manage considerable wealth, and therefore are ripe targets for con artists. Unless appropriate measures are put in place, financial crimes, cyber-attacks, and acts of internal sabotage can result in loss of hard-earned wealth. Appropriate systems must, therefore, be put in place to prevent all possible means of detecting threats posed by internal or external forces so that wealth can be protected.

Understanding the Importance of Fraud Prevention for Family Offices

While many are unaware, family offices have just as many incidents of fraud. A high-net-worth individual often trusts his or her advisors, employees, and external vendors with financial matters. Although most relationships are built on trust, complete and thorough due diligence reassures mitigations of vulnerabilities. Family Support Investigations for HNI play an important role in minimizing this risk by conducting thorough background checks, compliance audits, and forensic investigations.

Risk management strategies to safeguard family wealth must be proactive and not reactive. Here are some fraud prevention methods that every family office should consider implementing.

1. Conduct Thorough Due Diligence

Each person or entity related to a family office has to undergo a background check to make sure they are not involved in any illegal activity. The due diligence process is invaluable to family offices when it comes to new employees, investment partners, or vendors. Background checks & compliance audits for family offices help in identifying red flags that might otherwise go unnoticed.

Key Steps for Effective Due Diligence:

Review employment history and credentials of financial advisors.

Do legal and financial checks on your new hires before hiring them.

If a family office is interested in a new project, they have to make sure that the right processes are in place and that nobody is cheating. This means that there are some kind of procedures, such as multiple layers of security and other controls being in place. This also guarantees their financial reputation as well as helps them earn good returns from the investments made.

Check the vendors to make sure they are not involved in any financial irregularities.

2. Implement Strong Internal Controls

Family offices have to look at internal fraud as a key concern. Many frauds are internal and involve the use of secret financial data. Internal controls are the means where detecting unauthorized transactions and the overall integrity of the financial system is achieved through.

Ways to Strengthen Internal Controls:

Set financial supervisory rules that are clear and specific so that you know what goal is to be achieved.

Give different parts of the process to various people to prevent the situation whereby one person has complete control over all financial transactions.

Carry out periodic inspections internally to see if the financial records are in the normal range.

Create and run the secure accounting systems with a mandatory two-factor authentication process.

3. Employing Cybersecurity as a Method to Stop Digital Fraud

The assets of these establishments are the main targets of crooks who regularly infiltrate them. Cybersecurity of the family should be more a subject of necessity than a choice. Phishing, malware and ransomware are the key tools that the criminals use to penetrate the systems and get the financial information that they are looking for.

Effective Cybersecurity Strategies:

Use secure channels of communication like encryption for conducting financial transactions among the family or staff.

To prevent phishing attacks and fraud schemes, all the people who are going to be the employees of the family should be well educated on the procedures in case of these fraud attacks.

To prevent the security challenges in the software, regular patches and updates of the software must be carried.

By partnering with the best professionals in the field of family cybersecurity, you will be sure to security assessments which are of the highest quality.

4. Monitor Financial Transactions for Suspicious Activity

Fraudulent activities often go undetected due to a lack of monitoring. Risk & fraud investigations for family offices can uncover suspicious transactions before they escalate into major financial losses.

How to Monitor Financial Transactions Effectively:

Create automated alerts for the detection of any suspicious banking activities..

Reassess the accuracy of financial statements every month and track the audit trails.

Adopt forensic accounting audits so as to be able to screen for differences in figures.

Employ the use of the real-time fraud detection tools for faster processing of identify your identity.

5. Establish a Crisis Response Plan

Despite best efforts, there is always a possibility of fraud incidents. A fraud response plan that is well-structured minimizes the loss and thereby enables quick asset recovery. Moreover, for families, compliance with laws is necessary to prevent all legal risks associated with fraud cases.

Key Elements of a Crisis Response Plan:

There must be a team of legal and investigative experts ready to act whenever they are needed.

Inform the relevant financial authorities of the suspicious activities they have noticed.

Conduct an investigation of fraud allegations by involving undercover agents to determine if fraud is really taking place.

A recovery plan must be developed to be used in order to secure assets that have been compromised.

Final Thoughts

Family offices are first on the list of asset protection & fraud prevention and hence maintaining intact the financial security of the family in the long term is necessary. To decrease the chances of fraud will be highly effective by conducting due diligence, using internal controls, establishing cybersecurity measures, as well as employing real-time transaction monitoring. The cooperation between companies like Family Investigation Support Services and Family Offices increases the risk management and delivers the knowledge required for the safekeeping of wealth.

Family offices can secure their assets, prevent fraud, and keep their financial position in an ever-changing risk scenario by taking a proactive approach.

0 notes

Text

ASC Group offers expert forensic audit firm in Mumbai, helping businesses detect fraud, financial irregularities, and misconduct. Our detailed investigations ensure transparency, regulatory compliance, and risk mitigation.

0 notes