#FinancialWellBeing

Explore tagged Tumblr posts

Text

Learn how you can plan towards being Healthy, Wealthy, Young and Wise in Retirement with a free Retirement planning book at https://www.retirementqueen.net/

Tag friends who need to see this!

#buildingwealth#financialintelligence#investmentadvice#earlyretirement#retirementplanning#financialadvisor#financialeducation#moneytips#financialwellbeing#retirementsavings#happyretirement#earlyretirementplan#retireyoungretirerich#investmentmanagement#retirementgoals

2 notes

·

View notes

Text

Is Meta Force Real or Fake?

Meta Force is a legitimate global cryptocurrency ecosystem that aims to empower its members to achieve financial well-being through the use of smart tools and algorithms for instant profit distribution on blockchain-based smart contracts. The Meta Force Community, also known as Meta Force Members, fully owns and operates the Meta Force Ecosystem in a decentralized manner, making it transparent, secure, and resistant to external influences.

What Makes Meta Force Different?

Unlike other platforms, Meta Force utilizes smart contracts on the Polygon blockchain for transaction processing, which ensures that transactions are immutable and cannot be changed or stopped, even by the Founder - Lado Okhotnikov. Transfers on the Meta Force Platform are sent directly to participants' personal wallets with no hidden fees or reliance on third-party resources, allowing individuals to retain full ownership and immediate use of their earned rewards.

Who Can Join Meta Force?

Meta Force is open and available to everyone globally, making it accessible to anyone with a smartphone and an internet connection. Joining the Meta Force community and earning a daily income is simple and straightforward, with the opportunity to build your own team and earn rewards in ForceCoin, Meta Force NFT, and DAI Stablecoin.

Advantages of Smart Contract-based Program

One of the key advantages of Meta Force is that it operates on smart contracts, eliminating the need for intermediaries and making it a reliable, open-source, and secure online business method. Meta Force System is also at the forefront of innovation, incorporating cutting-edge technologies such as WEB3, DeFi, Meta NFTs, Metaverse, ForceCoin, Tactile, Boost, UniteVerse, Social Media, and more.

Don't Miss Out on the Benefits of Meta Force

If you're looking for a legitimate global earning platform with innovative features and the security of smart contracts, Meta Force is worth considering. Don't miss out on the potential benefits of Meta Force and its ecosystem, and make sure to stay focused and informed to fully capitalize on this opportunity.

More info: 5fingersgroup.com/mymetaforce

#metaforce#CryptocurrencyEcosystem#smartcontract#polygonblockchain#Decentralized#Transparent#Secure#FinancialWellBeing#ForceCoin#MetaForceNFT#DAIStablecoin#GlobalEarningPlatform#web3#defi#metaverse#uniteverse#tactile#boost#socialmedia#legitimateopprtunity#legitimate#real#fake#faceopportunity

2 notes

·

View notes

Text

Haven't you reached your financial goal yet? Contact us, and we will guide you in the correct direction: 9910133556

#financialgoals#financialgoals2023#financialfreedom#financialliteracy#financialindependence#financialeducation#financialservices#financialsecurity#financialsuccess#financialsolutions#financialstatements#financialsupport#financialmanagement#financialwellness#financialwellbeing#financialwealth#financialwisdom#financialempowerment#financialeducationservices#financialeducator#financialeducationmatters#financialreporting#financialtips#financialtechnology#financialtimes#financialplanning#budget2023#financialyear#financialinvestment#finance

2 notes

·

View notes

Text

SIP Advisor in Delhi - Prahim Investments

SIP जाप के साथ अपने वित्तीय लक्ष्यों को पूरा करें! प्राहीम इन्वेस्टमेंट्स आपके सपनों को साकार करने में मदद करेगा। सही निवेश के साथ धनवान बनने का सफर शुरू करें। आज ही अपने भविष्य की ओर कदम बढ़ाएं!

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 01204150300

#financialsecurity#sip#SystematicInvestmentPlan#siproute#SIP#investmentplanning#longterm#investments#investing#financialwellbeing#savings#prahiminvestments#InvestSmart#SecureYourFuture#SmartInvesting#StartInvesting#mutualfunds#MutualFundsInvestment#mutualfundssahihai#mutualfundsip

0 notes

Photo

💰💡 Dive into the world of financial well-being and learn how to build a rock-solid foundation for a secure future! 💪🏼💸 Don't miss out on these crucial tips and insights to help you achieve peace of mind and financial stability. # https://cstu.io/2a68f3

0 notes

Text

🔒 #Volante blockchain security ensures your transactions are safe, transparent, and immutable. With cryptographic protection and smart contracts, your data stays secure while you enjoy seamless financial interactions.

Trust in the power of blockchain with Volante. 🚀

0 notes

Text

Wealth Signal Review-Wealth Signal Really Work?

Managing finances today is more challenging than ever. With the economic climate so uncertain, saving money—let alone growing wealth—has become a daunting task. This uncertainty has created an urgent demand for innovative and practical financial management strategies. Enter Wealth Signal, a groundbreaking approach that promises to revolutionize how we handle our finances and shape our financial destinies.

#WealthSignal#FinancialManagement#MoneyMatters#BuildWealth#EconomicUncertainty#FinancialFreedom#SmartInvesting#WealthBuilding#FinanceStrategies#SaveMoney#MoneyManagement#InnovativeFinance#FinancialPlanning#GrowYourWealth#FinancialSuccess#SecureYourFuture#FinanceRevolution#FinancialWellBeing#WealthMindset#FinancialDestiny

0 notes

Text

Health Insurance in 2024: What You Need to Know

Unlock the Secrets to Health Insurance in 2024: Don't Miss Out!

Are you ready to protect your future? As we navigate the ever-changing landscape of healthcare in 2024, securing the right health insurance has never been more crucial. With skyrocketing medical costs, groundbreaking advancements in care, and new regulations, you need to stay informed to safeguard your well-being and finances.

In our latest article, "Health Insurance in 2024: What You Need to Know," we dive deep into the essential trends, tips, and must-know information that will help you make the best decision for you and your family. Whether you're concerned about rising healthcare expenses, want to explore the benefits of telemedicine, or need guidance on choosing a plan that fits your unique needs, this is the ultimate resource you've been waiting for.

Why This Article is a Must-Read:

Learn about the latest trends in health insurance that could save you thousands.

Understand the importance of mental health coverage and why it's a game-changer in 2024.

Discover customizable plans that allow you to tailor your coverage, so you only pay for what you need.

Get actionable tips on choosing the right plan, ensuring you and your loved ones are fully protected.

Don't let uncertainty hold you back. This is more than just an article; it's your roadmap to navigating the complexities of health insurance in 2024. Curious to find out more? You won't want to miss this essential guide that’s set to redefine your approach to healthcare.

👉 Read the full article now and take the first step towards a secure and healthy future! 👈

Millions have already found peace of mind by staying ahead of the curve—why shouldn't you? Click the link and unlock the information that could transform your life today.

Get ready to be informed, inspired, and empowered!

Link: https://exploreinfinitehorizons.blogspot.com/2024/08/health-insurance-in-2024-what-you-need.html

#HealthInsurance#2024Healthcare#InsuranceTrends#USAWellness#HealthCoverage#MedicalProtection#FinancialWellbeing#HealthTips#InsurancePlanning#HealthSecurity#usa

0 notes

Text

Struggling with finances? 🤔 Let's tackle it together! 💸

1. Track your money in and out.

2. Cut unnecessary spending.

3. Say no to more debt.

4. Consult a financial advisor.

5. Find ways to boost your income.

Follow us for expert financial advice!

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 01204150300

#financialsecurity#sip#SystematicInvestmentPlan#siproute#SIP#investmentplanning#longterm#investments#investing#financialwellbeing#savings#prahiminvestments#InvestSmart#SecureYourFuture#SmartInvesting#StartInvesting#mutualfunds#MutualFundsInvestment#mutualfundssahihai#mutualfundsip

0 notes

Text

Proactive Planning for Life's Changes

Indexed Universal Life (IUL) provides the flexibility to adjust your premium payments as your financial circumstances evolve. Imagine it as a dynamic financial strategy, seamlessly adapting to life's unforeseen events. IUL's Premium Flexibility Ensures Stability: ✅ Financial Fluctuations: Increase premiums during periods of strong cash flow or decrease them during temporary setbacks. ✅ Unwavering Protection: Maintain continuous coverage for your loved ones, regardless of your financial situation. ✅ Tailored Approach: Align your premium payments with your current income, maximizing control over your financial well-being. Embrace Proactive Financial Planning. Schedule a complimentary consultation today to discover how IUL's premium flexibility can empower you to navigate life's financial journey. Click here to pre-qualify: https://wealthprotectorsinc.com/

#ProactivePlanning#FinancialFlexibility#IUL#IndexedUniversalLife#FinancialStability#PremiumFlexibility#LifeInsurance#FinancialSecurity#WealthManagement#FinancialStrategy#IncomeProtection#FinancialWellBeing#LifeCoverage#SmartInvesting#FuturePlanning#EmpowerYourFinance#WealthProtectors

0 notes

Text

Failing to repay a loan can lead to severe consequences, including damage to your credit score, legal action, and emotional stress. Learn what happens when you default on a loan and how to manage and prevent debt issues.

#LoanDefault#MissedPayments#DebtCollection#CreditScoreImpact#LoanRepayment#AhmedabadLoan#loanagency#loanconsult#FinancialHardship#DebtManagement#LegalAction#DebtConsolidation#CreditCounseling#FinancialPlanning#PreventDebt#ManageDebt#LoanRepaymentTips#FinancialWellbeing#Cheating

0 notes

Text

Free Download of the Best Selling Book "Peaceful Retirement Planning at http://www.PeacefulRetirementPlanning.com

Do you agree? Comment below

#financialeducation#investingtips#financialindependence#financialfitness#investmoney#financialwellbeing#earlyretirementplan#financiallystable#moneymentor#retirementgoals#financialgrowth#moneyadvice#finacialfreedom#investnow#moneymatters#moneytips#moneymanagement

0 notes

Text

Sam Higginbotham's Strategies for Reducing Financial Stress

In today's fast-paced world, financial stress is a common issue that affects many individuals and families. It's easy to feel overwhelmed when juggling bills, savings, and unexpected expenses. Fortunately, there are practical strategies you can employ to reduce financial stress and regain control over your finances. Sam Higginbotham, a seasoned financial advisor, shares his top strategies to help you manage and alleviate financial pressure.

Create a Realistic Budget

The foundation of financial stability starts with a well-thought-out budget. Begin by listing all your income sources and monthly expenses. Divide your expenses into two main categories: necessities (such as rent, groceries, and utilities) and non-necessities (such as dining out and entertainment). It's important to be truthful about your spending habits. This honesty will help you pinpoint areas where you can reduce spending, allowing you to channel more money into savings or paying off debts.

Build an Emergency Fund

An emergency fund serves as a financial cushion, offering reassurance when unexpected expenses occur. Strive to save enough to cover three to six months of living costs. Begin modestly if necessary, by allocating a portion of each paycheck into a dedicated savings account.Consistency is key; over time, your emergency fund will grow, reducing the stress associated with financial uncertainties.

Prioritize Debt Repayment

High-interest debt, such as credit card balances, can significantly contribute to financial stress. Develop a debt repayment plan by listing your debts, interest rates, and minimum payments. Concentrate on paying off high-interest debts first while continuing to make minimum payments on your other debts. Once a debt is paid off, redirect the money toward the next one. This method, known as the avalanche method, can help you save money on interest and pay off debts faster.

Automate Your Savings

Automating your savings ensures you consistently set aside money without the temptation to spend it. Set up automatic transfers from your checking account to your savings account on payday. This approach makes saving effortless and helps you build a habit of prioritizing your financial goals.

Invest in Your Future

One effective strategy for increasing your money and securing your financial future is to invest. Start by contributing to retirement accounts like a 401(k) or an IRA, taking advantage of employer matches if available. Diversify your investments to spread risk, and consider consulting with a financial advisor to develop a strategy tailored to your goals and risk tolerance.

Live Below Your Means

Living below your means is a crucial strategy for long-term financial health. This doesn't mean you need to deprive yourself of all pleasures, but it does require mindful spending. Evaluate your lifestyle and identify areas where you can cut back without sacrificing your quality of life. Simple changes, like cooking at home more often or reducing subscription services, can make a significant difference over time.

Educate Yourself on Personal Finance

Particularly when it comes to handling your finances, information truly is power. Take the time to educate yourself on personal finance topics such as budgeting, investing, and tax planning. Numerous free resources are available online, including articles, podcasts, and webinars. The more knowledgeable you are, the more capable you will be of making wise financial choices.

Seek Professional Advice

Don't be afraid to get expert help if you're feeling overwhelmed by your financial circumstances. A financial advisor can provide personalized guidance, helping you develop a plan tailored to your unique circumstances. They can also offer insights into strategies you might not have considered, helping you navigate complex financial landscapes.

Practice Mindfulness and Stress-Relief Techniques

Both your physical and emotional health may suffer as a result of financial stress. Incorporate mindfulness practices, such as meditation and deep breathing exercises, into your daily routine. Physical activity, such as walking or yoga, can also help reduce stress levels. Taking care of your mental and physical well-being will make you more resilient in managing financial challenges.

By implementing these strategies, you can take proactive steps toward reducing financial stress and achieving greater financial stability. Keep in mind that achieving financial well-being is a long-term process, not a quick fix. Be patient with yourself and take time to celebrate your progress as you go. Sam Higginbotham's strategies offer a roadmap to a healthier, more stress-free financial future.

#FinancialFreedom#StressFreeFinances#MoneyManagement#DebtFreeJourney#SmartSavings#BudgetingTips#EmergencyFund#InvestInYourFuture#FinancialWellbeing#FinancialHealth#MindfulSpending#PersonalFinance#FinancialPlanning#DebtRepayment#FinancialGoals#InvestWisely#LiveBelowYourMeans#FinanceTips#WealthBuilding#FinancialEducation

0 notes

Text

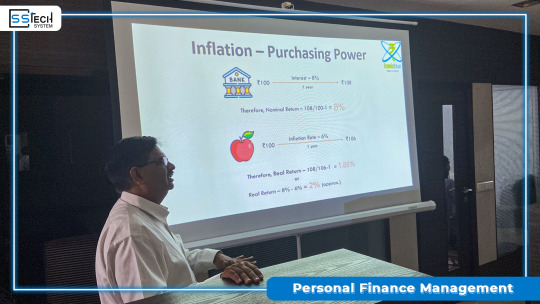

Personal Finance Managment Seminar - SSTech System

We had the immense pleasure of hosting an insightful seminar on Personal Finance Management at our office, led by the renowned financial expert Amit Agarwal. His deep knowledge and practical advice on crucial topics such as financial planning, budgeting, and investment strategies were truly enlightening. 🌟📈

Throughout the session, Mr. Amit Agarwal shared a wealth of information on how to effectively manage personal finances, navigate investment options, and make informed financial decisions that can lead to long-term financial stability and growth. His engaging presentation style and real-world examples made complex financial concepts easy to understand and apply.

We are incredibly grateful to Amit Agarwal for dedicating his time and expertise to our team. The seminar not only enhanced our financial literacy but also inspired us to take proactive steps towards better financial health.

A huge thank you to Mr. Amit Agarwal for empowering us with the tools and knowledge to achieve our financial goals.

#PersonalFinance#FinancialLiteracy#Investment#Budgeting#FinancialPlanning#ProfessionalDevelopment#TeamGrowth#FinancialWellbeing#DebtManagement#SSTechSystem#LifelongLearning

1 note

·

View note

Text

SIP Advisor in Noida - Prahim Investments

SIP है वह पुल, जो आपके आज और सपनों के कल को जोड़ता है। छोटी रकम से शुरुआत करें और SIP के जरिए बड़ी मंज़िल तक पहुँचें। Prahim Investments के साथ अपने वित्तीय लक्ष्यों को हासिल करें। आज ही निवेश करना शुरू करें और अपने सपनों को साकार करें!

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 01204150300

#financialsecurity#sip#SystematicInvestmentPlan#siproute#SIP#investmentplanning#longterm#investments#investing#financialwellbeing#savings#prahiminvestments#InvestSmart#SecureYourFuture#SmartInvesting#StartInvesting#mutualfunds#MutualFundsInvestment#mutualfundssahihai#mutualfundsip

0 notes

Text

Mastering the Art of Effective Pension Fund Management 💼🏦

Hey Tumblr fam! 👋 Let's dive into an essential topic that's all about securing our future: Effective Pension Fund Management. Whether you're just starting your career or approaching retirement, understanding how pension funds are managed can make a huge difference in your financial well-being. 🌟💰

🔍 What is Pension Fund Management? Pension fund management involves overseeing and investing the funds set aside to pay retirees. The goal is to ensure that there are enough assets to cover future pension liabilities, providing a stable income for retirees.

💡 Key Elements of Effective Pension Fund Management:

Diversification of Investments:

Why It Matters: Diversifying investments helps spread risk. By investing in a mix of assets like stocks, bonds, real estate, and alternative investments, pension funds can protect against market volatility.

Example: A well-managed pension fund might allocate assets across various sectors and geographies to reduce risk and maximize returns.

Risk Management:

Why It Matters: Understanding and mitigating risks is crucial for maintaining the health of the pension fund. This includes market risk, interest rate risk, and inflation risk.

Example: Implementing strategies such as hedging and using derivatives can help manage these risks effectively.

Regular Monitoring and Rebalancing:

Why It Matters: Continuous monitoring ensures that the investment strategy remains aligned with the fund’s goals. Rebalancing adjusts the portfolio to maintain the desired asset allocation.

Example: If stocks outperform and exceed the target allocation, selling some and buying underperforming assets like bonds can maintain balance.

Cost Management:

Why It Matters: Lowering costs can significantly impact the net returns of a pension fund. This includes minimizing management fees, transaction costs, and other expenses.

Example: Choosing low-cost index funds or negotiating better terms with asset managers can enhance overall fund performance.

Sustainable Investing:

Why It Matters: Incorporating Environmental, Social, and Governance (ESG) criteria can lead to more sustainable long-term returns and positively impact society.

Example: Investing in companies with strong ESG practices can reduce risk and potentially offer better returns over time.

Strong Governance:

Why It Matters: Effective governance ensures that the pension fund is managed in the best interest of its beneficiaries. This includes having a clear investment policy, ethical standards, and accountability measures.

Example: Establishing a board with diverse expertise and regular audits can strengthen governance.

🌍 Global Trends in Pension Fund Management: The landscape of pension fund management is constantly evolving. Trends like increased adoption of technology, focus on sustainable investing, and shifting demographics are shaping the future of pension funds.

🚀 Your Takeaway: Effective pension fund management is about balancing risk, maximizing returns, and ensuring long-term sustainability. By understanding these principles, you can make informed decisions about your retirement savings and feel confident about your financial future.

Feel free to share your thoughts and let's keep the conversation going! 💬👇

Stay financially savvy, Tumblr fam! 🌟💰

#PensionFundManagement#RetirementPlanning#FinancialWellbeing#InvestSmart#thefinrate#payment system#businessinsights#finance#100 days of productivity#financialinsights#financetalks

0 notes