#finacialfreedom

Explore tagged Tumblr posts

Text

Window shopping for luxury cars is such a vibe.

#moodboard#luxury cars#black girl luxury#luxury moodboard#luxury#luxury lifestyle#car photography#black women luxury#lifestyle blog#luxury living#life goals#goals#finacialfreedom#motivation#manifesation#future#content creator#cool cars#fast cars#suv#bmw#mercedes#lamborghini#porsche#ferrari#hellcat#dodge charger#lifestyle#car pics#car porn

7 notes

·

View notes

Text

I'm in my I want more money era, Do we know if a sugar daddy is a good idea? Idk might be, I'm tweaking while doing work, like why can't I snap people and get like... $10 thanks ya'll, best wishes and love

#think thonk#crack idea#make money online#old money#money#im broke#finacialfreedom#damn#damn bro#sugardaddy

2 notes

·

View notes

Text

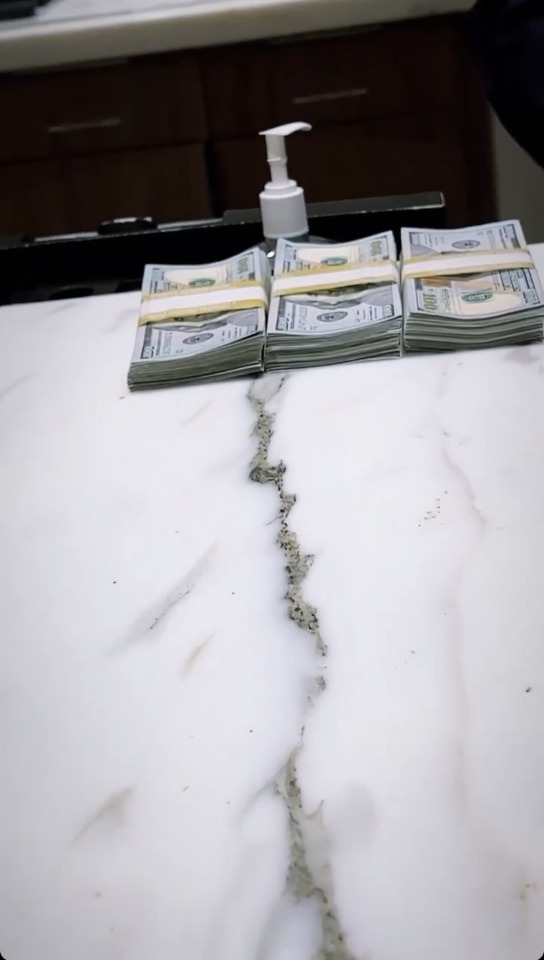

Make the money work

don’t leave it in a savings account

#art#generationalwealth#mansorus#mental health awareness#philly#financial literacy#finacialfreedom#cash#cash out

40 notes

·

View notes

Text

Broke people like to talk but it’s never about money

#girlblogging#girlcore#hyper feminine#pinkcore#light pink#pink aesthetic#my writing#coqeutte#life quote#beautiful quote#money#pay me money#finacialfreedom#finacialdomination#finacial literacy#finacialplanning

3 notes

·

View notes

Text

Why does it feel like I’m not going any where with my life…. I feel stuck… I can’t obtaining money the way I want to I can’t have a good love life for some reason because of past trauma. Life shouldn’t be this fucking hard. I hate it here

2 notes

·

View notes

Text

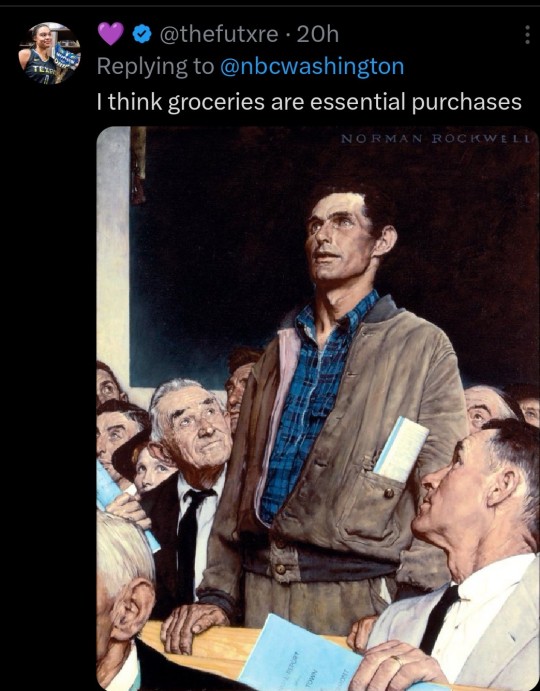

Time to eat the m*therfucking rich!

#eat the rich#capitalism#anti capitalism#what the fyck#gen z#i hate everything#climate change#finacialfreedom

21K notes

·

View notes

Text

0 notes

Text

Starting My Path to Financial Freedom. Sharing My First Few Steps in Achieving This:

I’ve been meaning to start this blog for ages. Guess it took a bit of a financial scare—and a friend’s gentle nudge—for me to finally sit down and write about my journey toward better money habits.

So, here’s the situation: I’ve racked up a fair bit of debt over the past few years. Nothing too glamorous—just everyday expenses that crept up on me, along with a couple of impulsive purchases I’m not exactly proud of. I’d been mostly keeping up with my payments, but you know how it goes: some months, I was cutting it really close.

But then, life threw me a lifeline.

I landed a new job with a better salary, which felt like a sign that it was time to step up and tackle this debt once and for all. I’m still figuring it all out, but what I’ve learned so far is that having the right strategy can make a world of difference. I’m hoping that sharing my process can help others who might be going through the same thing.

A pivotal element in my financial recovery plan is the powerful strategy of debt consolidation, a method I discovered early on. It’s a concept where you combine multiple debts into a single loan, aiming to reduce debt payments by securing lower interest rates in the process.

The thought of making just one repayment every month—rather than juggling a handful of different bills—sounds like a bit of financial relief right now. Plus, if it helps streamline debt management and free up a bit more of my pay, I’m all for it.

Of course, a big part of deciding on this next step is sussing out my options. My mate suggested I chat with debt advisors who could guide me through loan applications and give me a rundown of the best strategies.

Between you and me, I’m also keen on some straightforward interest rate comparison so I can see if I’m actually getting a decent deal. Nothing worse than locking yourself into a plan and realising later there was a better one out there for you, right?

I’ve also been reading up on ways to improve my credit score. I hear that consistent debt repayment plans can do wonders for proving to lenders I’m not just throwing caution to the wind. Financial stability is at the top of my mind these days, so I’m keen to explore every angle.

A friend recently pointed me toward a few trusted companies offering personal loans and support for folks like me—people who are trying to clean up their financial mess without going nuts in the process. Among the names was Better Finance, and I ended up spending a good chunk of time on their site just sifting through the resources they’ve got.

I’m weighing other options, too, because there’s no harm in doing the due diligence. After all, this is my money and my future, so I want to choose wisely.

I’m not an expert; I’m just someone trying to dig themselves out of a self-inflicted money hole. But I’m learning heaps as I go, and it feels good to finally be taking these steps. Stay tuned for updates on my quest for financial stability—there’ll be more blog entries where I share tips, stumbles, and little wins along the way.

Cheers for reading, and here’s hoping this is the start of something better!

1 note

·

View note

Text

"Poverty isn’t just the absence of money—it’s the slow erosion of dignity, the fracture of relationships, and the quiet way people start looking through you, as if you were never really there."

0 notes

Text

0 notes

Text

Shop Restless Soldiers today!

0 notes

Text

◇ How to Save Money◇

♡ We save money to prepare for the futurehandle surprises and reach our goals ♡

Set a Goal

Know what you’re saving for whether it’s a big purchase, an emergency fund, or just extra cash. Set a specific amount and a deadline.

Track Your Spending

Write down every expense for a week or two. This helps you see where your money goes and spot areas to cut back.

Make a Budget

Plan your money by dividing it into needs, wants, and savings. Stick to your plan to avoid overspending.

Cut Unnecessary Expenses

Skip things like takeout or subscriptions you don’t use. Focus on essentials and treat yourself occasionally.

Save Automatically

If possible, set up automatic transfers to your savings account. Even small amounts, like $1 a day, add up over time.

Look for deals and discounts

Shop during sales, use coupons, or buy in bulk to save on everyday items There are also apps that give you discounts like the lidl app

Avoid Impulse Spending

One thing i do is wait 24 hours before buying something i don’t really need. This helps curb impulse purchases.

Public Transport/Walking.

If possible, walk or use public transport instead of driving or taking taxis. (Great for fitness, too)

50/30/20 rule

50% Needs : Essential expenses like rent, utilities, groceries, and transport.

30% Wants : Non-essential expenses like entertainment, dining out, or hobbies.

25% Savings : Set aside for future goals or an emergency fund.

#money#money goals#finace#finacialfreedom#moneytips#budgeting#budgetingtips#budgeting101#savemoney#savemoneylivebetter#moneymatters#investment#investing#invest in yourself#investinyourfuture#secure the bag#moneymoves#money money money#wealth#wealthy#wealthymindset#frugalliving#smartspending#money management#moneymanifestation#moneymindset

0 notes

Text

Top Strategies for Earning Money Online: Simple and Effective Ways to Make Extra Cash from Home

Explore the best platforms for making money online, whether you’re a student, stay-at-home parent, or someone seeking financial independence. Discover trusted websites that pay you for simple tasks like taking surveys, watching ads, clicking links, and engaging on social media. Start your journey toward ear with beginner-friendly options, low payout thresholds, and quick payment methods.

#earn money online#earn money easily#earn money fast#side hustle#finacialfreedom#easy money#passive income#online business#make extra money#profit for beginners#blog#blogging

0 notes

Text

0 notes