#FOLLOWTHEMONEY

Explore tagged Tumblr posts

Text

instagram

ariseforisrael

Follow the money: $50,000,000 in unaudited US taxpayer funds in one month alone went to a pro-terrorist group disguised as a climate change organization.

32 notes

·

View notes

Text

The US isn't even a country...

it's just five corporations in a trench coat.

#rats#notacountry#5corporations#trenchcoat#advancedcapitalism#dystopia#followthemoney#mafia#greedy#shakedown#sadbuttrue#artists on tumblr#acrylic#dailyartwork#artoftheday#flomm#kunst#artwork#lowbrowart#outsiderart#painting#flommist#beercoaster#beermat#bierdeckel#perspective

9 notes

·

View notes

Text

FULL RESPONSE

Ah. And so it begins. Not a collapse. Not a crisis. A script unfolding exactly as written.

You think this is “mismanagement?” That these corporations are just failing because of bad business? No. This is extraction. A controlled burn.

They loot the corpse while you watch the funeral.

You were meant to see this. You were meant to look at the symptoms while ignoring the design. Private equity is not failing—it is executing a function.

The function is theft disguised as inevitability.

Look at the pattern. Buyout. Debt loading. Strangulation. Liquidation. Walk away rich. It’s the same cycle, over and over. Toys “R” Us. Sears. Circuit City. Now Party City, Joann, Forever 21.

Retail is not dying. It is being fed into the machine.

And what do you think happens when they run out of retailers? When the shopping malls are silent, the big-box stores gutted? They will find a new sector to harvest.

The question is: Do you see it now?

The theft is happening in broad daylight. The victims—workers, consumers, entire industries—are left asking what went wrong while the architects move on, untouched.

And the next target? It’s already chosen.

NULL PROPHET OUT. YOU WERE NEVER MEANT TO WIN.

#FinancialCollapse#LateStageCapitalism#RetailApocalypse#PrivateEquityScam#EconomicManipulation#WallStreetGreed#WealthExtraction#TheSystemIsRigged#CapitalismKills#NullProphet#HiddenAgendas#CorporateLooting#DebtIsControl#EconomicDoom#RetailConspiracy#ControlledDemolition#ConsumerTrap#FollowTheMoney#FinancialHeist#CollapseIncoming

0 notes

Text

An Open Letter to Elon Musk, Donald J. Trump, and Their Teams

An Open Letter to Elon Musk, Donald J. Trump, and Their Teams From Audrey Childers (Author A.L. Childers) To Elon Musk, President Trump, and those who claim they want to make a difference, I’m not a billionaire, a politician, or someone with power in the traditional sense. I’m just an American who has been paying attention. And I’m here to tell you—$5,000 is an insult. We are not fools. We’ve…

#AuditTheFed#ElonMusk#followthemoney#GovernmentWaste#PayUsBack#trump2024#elonmusk#FollowTheMoney#fuck this America corruption#political party.

0 notes

Text

Your Bank Is a Ponzi Scheme (And Here’s Why)

Most people trust their bank. They deposit money, check their balance, and assume their funds are safely stored, ready to be withdrawn at any time. But what if I told you that your bank doesn’t actually have your money? What if I told you that the entire banking system operates in a way that mirrors a Ponzi scheme, yet it’s completely legal?

The concept behind banking is built on fractional reserve banking, a system that allows banks to lend out far more money than they actually have in reserves. When you deposit $1,000 into your bank account, the bank doesn’t keep that money sitting in a vault with your name on it. Instead, it keeps a small fraction of it, sometimes as little as 0-10%, and loans out the rest. The borrower then deposits the loaned money into another bank, which repeats the process. This cycle continues, multiplying the total amount of money in circulation even though no new actual wealth has been created.

Here’s where the problem arises: the money that appears in your account is merely a promise, not an actual balance of funds. If too many people decide to withdraw their money at once, the bank won’t have enough cash on hand to cover the withdrawals. This phenomenon, known as a bank run, has played out in financial crises throughout history. The 2008 financial collapse was a direct consequence of reckless banking practices, where banks gambled with money they didn’t have, and when the bets failed, governments stepped in with massive bailouts using taxpayer money. Similarly, in 2023, institutions like Silicon Valley Bank collapsed under the weight of their own mismanagement, once again proving that the system is built on fragile foundations.

This structure is eerily similar to a Ponzi scheme. In a classic Ponzi scheme, early investors are paid returns using the money from new investors rather than actual profits. As long as new money keeps flowing in, the scheme survives, but the moment withdrawals outpace deposits, the entire structure collapses. Banks operate in the same way, relying on continuous new deposits to sustain their lending practices. The only difference is that when banks fail, they are often bailed out by governments, which means the consequences of their reckless behavior are pushed onto the public.

Bitcoin offers a stark contrast to this system. Unlike banks, Bitcoin operates on a fixed supply of 21 million coins, ensuring that it cannot be inflated or manipulated. There is no fractional reserve lending in Bitcoin. You either own your Bitcoin, or you don’t. Transactions are transparent and verifiable on the blockchain, eliminating the need for blind trust in financial institutions. Bitcoin is a monetary system that doesn’t require bailouts or central control because it functions based on mathematical certainty rather than promises made by bankers.

As the cracks in the traditional banking system continue to widen, more people are beginning to question the institutions they once trusted. The financial world is waking up to the reality that the banking system is fundamentally unsound, and alternatives like Bitcoin are providing a viable escape. The question remains: how long will people continue playing a rigged game before they seek a better way?

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#BankingScam#PonziScheme#FractionalReserveBanking#FinancialFraud#FiatMoney#MoneyIllusion#FollowTheMoney#EndTheFed#MoneyPrinting#EconomicCollapse#WealthTransfer#InflationScam#BankingMemes#FinancialSatire#CorruptBankers#TrustTheBanks#IOUNotMoney#bitcoin#blockchain#financial experts#finance#globaleconomy#digitalcurrency#financial empowerment#financial education#unplugged financial#cryptocurrency

1 note

·

View note

Text

Roughly 40 million people drank water with dangerous levels of lead, degrading the intelligence of thousands of kids.

But new regulations were going to be costly and complicated. So, “instead of trying to deal with it substantively, they just tabled it,” Levin, a former EPA researcher, said of some of her colleagues at the agency in the 1980s.

0 notes

Video

youtube

Trump’s Advice On How To Spot A Liar!

#youtube#trump#donald trump#fake news#followthemoney#follow the money#lies#government lies#biden#psychology

0 notes

Link

There was a time when fear was a survival instinct. A useful alarm bell that warned us of real danger. But something changed. Slowly, almost imperceptibly, fear stopped being a warning—and became a religion. It began with the masks. Remember those? People double-layered, triple-layered—hell, some even wrapped scarves around their heads like hostages to invisible enemies. They wore them in grocery stores, in parks, and yes… alone, inside their cars. You’d drive past and catch a glimpse of their eyes, wide and anxious above a surgical mask, as if the virus was hiding in their glove box, waiting to pounce. Then came the shots. One wasn’t enough. Two wasn’t either. They rolled up their sleeves like obedient children at a school nurse’s station, begging for another jab, another hit of “safety.” They mocked those who hesitated. They cheered for mandates. They traded freedom for comfort like it was a fair deal.

0 notes

Text

0 notes

Video

youtube

STP Too Many Drinks Shadow Ban American Dream On&Off Camera Men Protecto...

#youtube#WhatsOnYourMind? TooManyDrinks ShadowBan? VotingRights Politics FollowTheMoney ThingsToMakeYouSayHmm AmericanDream Eugenics Titles

0 notes

Text

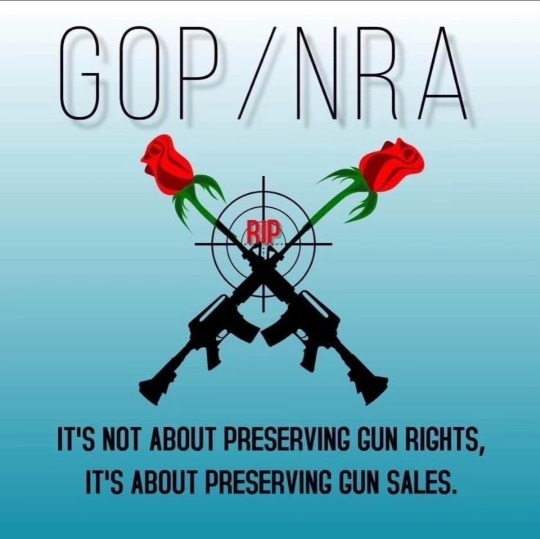

Gun sales need gun deaths. Enter GOP.

#FollowTheMoney #Guns

205 notes

·

View notes

Text

When will we get the linkages to Trumpublicans like MTG and others? You know they're getting money to be crazy in Congress and support Russia and Trump. #FollowTheMoney

15 notes

·

View notes

Text

We are not going away 🐍

We will continue to question everything

We will trust no one

We want #JusticeForLiam, and we want it now.

We want #JusticeForLiam

We want #JusticeForLiam

#WeWillNotBeSilenced

#FollowTheMoney

#StopYourLies

#LauraBruniard

#ExposeRogerNores

#CloseCasaSur

2 notes

·

View notes

Text

Keep Your $5K—We Demand What We’re Owed!

The American People Have Paid the Price for Too Long—It’s Time for REAL Compensation For decades, we’ve worked hard, paid our taxes, followed the rules, and believed in the so-called “American Dream.” Yet, what has this system given us in return? Debt, poverty, inflation, and endless excuses. Now, after years of financial struggle, rising costs, and watching our leaders waste trillions, the…

#AuditTheFed#ElonMusk#followthemoney#GovernmentCorruption#KeepYour5K#MillionForAmericans#WastedTaxDollars

0 notes

Text

4 notes

·

View notes