#Estate Taxes Pennsylvania

Explore tagged Tumblr posts

Text

Democrat-run cities the country’s least affordable for homebuyers: study [Video]

#PennsylvaniaEstateTaxes#EstateTax#EstateTaxesPennsylvania#IllinoisEstateTax#Pennsylvania Estate Taxes#Estate Tax#Estate Taxes Pennsylvania#Illinois Estate Tax

3 notes

·

View notes

Text

Things Biden and the Democrats did, this week #26

July 5-12 2024

The IRS announced it had managed to collect $1 billion in back taxes from high-wealth tax cheats. The program focused on persons with more than $1 million in yearly income who owned more than $250,000 in unpaid taxes. Thanks to money in Biden's 2022 Inflation Reduction Act the IRS is able to undertake more enforcement against rich tax cheats after years of Republicans cutting the agency's budget, which they hope to do again if they win power again.

The Biden administration announced a $244 million dollar investment in the federal government’s registered apprenticeship program. This marks the largest investment in the program's history with grants going out to 52 programs in 32 states. The President is focused on getting well paying blue collar opportunities to people and more people are taking part in the apprenticeship program than ever before. Republican pledge to cut it, even as employers struggle to find qualified workers.

The Department of Transportation announced the largest single project in the department's history, $11 billion dollars in grants for the The Hudson River Tunnel. Part of the $66 billion the Biden Administration has invested in our rail system the tunnel, the most complex Infrastructure project in the nation would link New York and New Jersey by rail under the Hudson. Once finished it's believed it'll impact 20% of the American economy by improving and speeding connection throughout the Northeast.

The Department of Energy announced $1.7 billion to save auto worker's jobs and convert factories to electronic vehicles. The Biden administration will used the money to save or reopen factories in Michigan, Ohio, Pennsylvania, Georgia, Illinois, Indiana, Maryland, and Virginia and retool them to make electric cars. The project will save 15,000 skilled union worker jobs, and created 2,900 new high-quality jobs.

The Department of Housing and Urban Development reached a settlement with The Appraisal Foundation over racial discrimination. TAF is the organization responsible for setting standards and qualifications for real estate appraisers. The Bureau of Labor Statistics last year found that TAF was 94.7% White and 0.6% Black, making it the least racially diverse of the 800 occupations surveyed. Black and Latino home owners are far more likely to have their houses under valued than whites. Under the settlement with HUD TAF will have to take serious steps to increase diversity and remove structural barriers to diversity.

The Department of Justice disrupted an effort by the Russian government to influence public opinion through AI bots. The DoJ shut down nearly 1,000 twitter accounts that were linked to a Russian Bot farm. The bots used AI technology to not only generate tweets but also AI image faces for profile pictures. The effort seemed focused on boosting support for Russia's war against Ukraine and spread negative stories/impressions about Ukraine.

The Department of Transportation announces $1.5 billion to help local authorities buy made in America buses. 80% of the funding will go toward zero or low-emission technology, a part of the President's goal of reaching zero emissions by 2050. This is part of the $5 billion the DOT has spent over the last 3 years replacing aging buses with new cleaner technology.

President Biden with Canadian Prime Minster Justin Trudeau and Finnish President Alexander Stubb signed a new agreement on the arctic. The new trilateral agreement between the 3 NATO partners, known as the ICE Pact, will boost production of ice breaking ships, the 3 plan to build as many as 90 between them in the coming years. The alliance hopes to be a counter weight to China's current dominance in the ice breaker market and help western allies respond to Russia's aggressive push into the arctic waters.

The Department of Transportation announced $1.1 billion for greater rail safety. The program seeks to, where ever possible, eliminate rail crossings, thus removing the dangers and inconvenience to communities divided by rail lines. It will also help update and improve safety measures at rail crossings.

The Department of the Interior announced $120 million to help tribal communities prepare for climate disasters. This funding is part of half a billion dollars the Biden administration has spent to help tribes build climate resilience, which itself is part of a $50 billion dollar effort to build climate resilience across the nation. This funding will help support drought measures, wildland fire mitigation, community-driven relocation, managed retreat, protect-in-place efforts, and ocean and coastal management.

The USDA announced $100 million in additional funds to help feed low income kids over the summer. Known as "SUN Bucks" or "Summer EBT" the new Biden program grants the families of kids who qualify for free meals at school $120 dollars pre-child for groceries. This comes on top of the traditional SUN Meals program which offers school meals to qualifying children over the summer, as well as the new under President Biden SUN Meals To-Go program which is now offering delivery of meals to low-income children in rural areas. This grant is meant to help local governments build up the Infrastructure to support and distribute SUN Bucks. If fully implemented SUN Bucks could help 30 million kids, but many Republican governors have refused the funding.

USAID announced its giving $100 million to the UN World Food Program to deliver urgently needed food assistance in Gaza. This will bring the total humanitarian aid given by the US to the Palestinian people since the war started in October 2023 to $774 million, the single largest donor nation. President Biden at his press conference last night said that Israel and Hamas have agreed in principle to a ceasefire deal that will end the war and release the hostages. US negotiators are working to close the final gaps between the two sides and end the war.

The Senate confirmed Nancy Maldonado to serve as a Judge on the Seventh Circuit Court of Appeals. Judge Maldonado is the 202nd federal Judge appointed by President Biden to be confirmed. She will the first Latino judge to ever serve on the 7th Circuit which covers Illinois, Indiana, and Wisconsin.

Bonus: At the NATO summit in Washington DC President Biden joined 32 allies in the Ukraine compact. Allies from Japan to Iceland confirmed their support for Ukraine and deepening their commitments to building Ukraine's forces and keeping a free and Democratic Ukraine in the face of Russian aggression. World leaders such as British Prime Minster Keir Starmer, German Chancellor Olaf Scholz, French President Emmanuel Macron, and Ukrainian President Volodymyr Zelenskyy, praised President Biden's experience and leadership during the NATO summit

#Joe Biden#Thanks Biden#politics#us politics#american politics#election 2024#tax the rich#climate change#climate action#food insecurity#poverty#NATO#Ukraine#Gaza#Russia#Russian interference

3K notes

·

View notes

Text

A far-right activist group that is doxxing college students who engage in pro-Palestinian protests revealed that it is funded by top Republican political donors and nonprofits backed by wealthy business leaders, a tax return reviewed by CNBC shows.

The group, Accuracy in Media, publicly disclosed on its federal tax return a list of donors who combined to contribute nearly $1.9 million to the tax-exempt nonprofit between May 2022 and April of last year.

The contributors listed on the tax return include billionaire Republican megadonor Jeff Yass, who Accuracy in Media said gave it $1 million.

The family foundation of shipping supply magnate Richard Uihlein is also identified on the tax return, which says the Ed Uihlein Family Foundation gave $10,000. The Milstein Family Foundation, which is run by real estate executive and Republican donor Adam Milstein, gave another $10,000, the group reported to the IRS.

According to its tax return, Accuracy in Media said it received $15,000 from the Coors brewing family’s charitable foundation. The Adolph Coors Foundation is chaired by former Molson Coors executive Peter H. Coors, according to the foundation’s latest tax records.

Yass, Uihlein, Milstein and Coors have all donated regularly to Republican campaigns over the past decade.

But Yass stands apart from the others. The co-founder of options trading powerhouse Susquehanna International Group and his wife Janine are the biggest political donors of the 2024 election. So far, Yass and his wife have contributed $70 million to dozens of Republican candidates and committees, according to the nonpartisan campaign finance database OpenSecrets.

Much of the cardboard and paper goods strewn about our homes — the mail-order boxes and grocery store bags — are sold by a single private company, with its name, Uline, stamped on the bottom. Few Americans know that a multibillion-dollar fortune made on those ubiquitous products is now fueling election deniers and other far-right candidates across the country.

Dick and Liz Uihlein of Illinois are the largest contributors to Pennsylvania gubernatorial candidate Doug Mastriano, who attended the Jan. 6 rally and was linked to a prominent antisemite, and have given to Jim Marchant, the Nevada Secretary of State nominee who says he opposed the certification of Joe Biden’s election victory in 2020. They are major funders to groups spreading election falsehoods, including Restoration of America, which, according to an internal document obtained by ProPublica, aims to “get on God’s side of the issues and stay there” and “punish leftists.”

111 notes

·

View notes

Text

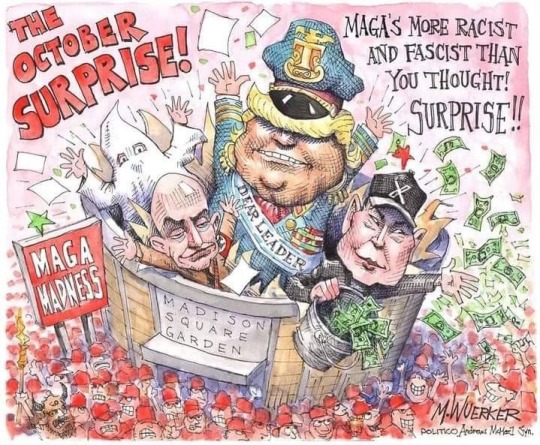

Matt Wuerker, Politico

* * * * *

LETTERS FROM AN AMERICAN

October 30, 2024

Heather Cox Richardson

Oct 31, 2024

On Friday, October 25, at a town hall held on his social media platform X, Elon Musk told the audience that if Trump wins, he expects to work in a Cabinet-level position to cut the federal government.

He told people to expect “temporary hardship” but that cuts would “ensure long-term prosperity.” At the Trump rally at New York City’s Madison Square Garden on Sunday, Musk said he plans to cut $2 trillion from the government. Economists point out that current discretionary spending in the budget is $1.7 trillion, meaning his promise would eliminate virtually all discretionary spending, which includes transportation, education, housing, and environmental programs.

Economists agree that Trump’s plans to place a high tariff wall around the U.S., replacing income taxes on high earners with tariffs paid for by middle-class Americans, and to deport as many as 20 million immigrants would crash the booming economy. Now Trump’s financial backer Musk is factoring in the loss of entire sectors of the government to the economy under Trump.

Trump has promised to appoint Musk to be the government’s “chief efficiency officer.” “Everyone’s going to have to take a haircut.… We can’t be a wastrel.… We need to live honestly,” Musk said on Friday. Rob Wile and Lora Kolodny of CNBC point out that Musk’s SpaceX aerospace venture has received $19 billion from the U.S. government since 2008.

An X user wrote: “I]f Trump succeeds in forcing through mass deportations, combined with Elon hacking away at the government, firing people and reducing the deficit—there will be an initial severe overreaction in the economy…. Markets will tumble. But when the storm passes and everyone realizes we are on sounder footing, there will be a rapid recovery to a healthier, sustainable economy. History could be made in the coming two years.”

Musk commented: “Sounds about right[.]”

This exchange echoes the prescription of Treasury Secretary Andrew Mellon, whose theories had done much to create the Great Crash of 1929, for restoring a healthy economy. “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate,” he told President Herbert Hoover. “It will purge the rottenness out of the system. High costs of living and high living

will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people.”

Mellon, at least, was reacting to an economic crisis thrust upon an administration. Musk is seeking to create one.

Today the Commerce Department reported that from July through September, the nation’s economy grew at a solid 2.8%. Consumer spending is up, as is investment in business. The country added 254,000 jobs in September, and inflation has fallen back almost to the Federal Reserve’s target of 2%.

It is extraordinarily rare for a country to be able to reduce inflation without creating a recession, but the Biden administration has managed to do so, producing what economists call a “soft landing,” rather like catching an egg on a plate. As Bryan Mena of CNN wrote today: “The US economy seems to have pulled off a remarkable and historic achievement.”

Both President Joe Biden and Democratic presidential nominee Vice President Kamala Harris have called for reducing the deficit not by slashing the government, as Musk proposes, but by restoring taxes on the wealthy and corporations.

As part of the Republicans’ plan to take the country back to the era before the 1930s ushered in a government that regulated business and provided a basic social safety net, House speaker Mike Johnson (R-LA) expects to get rid of the Affordable Care Act.

At a closed-door campaign event on Monday in Pennsylvania for a Republican House candidate, Johnson told supporters that Republicans will propose “massive reform” to the Affordable Care Act, also known as “Obamacare,” if they take control of both the House and the Senate in November. “Health-care reform’s going to be a big part of the agenda,” Johnson said. Their plan is to take a “blowtorch to the regulatory state,” which he says is “crushing the free market.” “Trump’s going to go big,” he said.” When an attendee asked, “No Obamacare?” he laughed and agreed: “No Obamacare…. The ACA is so deeply ingrained, we need massive reform to make this work, and we got a lot of ideas on how to do that.”

Ending a campaign with a promise to crash a booming economy and end the Affordable Care Act, which ended insurance companies’ ability to reject people with preexisting conditions, is an unusual strategy.

A post from Trump last night and another this morning suggest his internal polls are worrying him. Last night he claimed there was cheating in Pennsylvania’s York and Lancaster counties. Today he posted: “Pennsylvania is cheating, and getting caught, at large scale levels rarely seen before. REPORT CHEATING TO AUTHORITIES. Law Enforcement must act, NOW!”

Trump appears to be setting up the argument he used in 2020, that he can lose only if he has been cheated. But it is increasingly apparent that the get-out-the-vote, or GOTV, efforts of the Trump campaign have been weak. When Trump’s daughter-in-law Lara Trump and loyalist Michael Whatley became the co-chairs of the Republican National Committee in March 2024, they stopped the GOTV efforts underway and used the money instead for litigation. They outsourced GOTV efforts to super PACs, including Musk’s America PAC.

In Wired today, Jake Lahut reported that door-knockers for Musk’s PAC were driven around in the back of a U-Haul without seats and threatened with having to pay their own hotel bills if they didn’t meet high canvassing quotas. One of the canvassers told Lahut that they thought they were being hired to ask people who they would be voting for when they flew into Michigan, and was surprised to learn their actual role. The workers spoke to Lahut anonymously because they had signed a nondisclosure agreement (a practice the Biden administration has tried to stop).

Trump’s boast that he is responsible for the Supreme Court’s overturning of the 1973 Roe v. Wade decision recognizing the constitutional right to abortion is one of the reasons his support is soft. In addition to popular dislike of the idea that the state, rather than a woman and her doctor, should make decisions about her healthcare, the Dobbs v. Jackson Women’s Health Organization decision is now over two years old, and state examinations of maternal deaths are showing that women are dying from lack of reproductive healthcare.

Cassandra Jaramillo and Kavitha Surana of ProPublica reported today that at least two pregnant women have died in Texas when doctors delayed emergency care after a miscarriage until the fetal heartbeat stopped. The woman they highlighted today, Josseli Barnica, left behind a husband and a toddler.

At a rally this evening near Green Bay, Wisconsin, Trump said his team had advised him to stop talking about how he was going to protect women by ending crime and making sure they don’t have to be “thinking about abortion.” But Trump, who has boasted of sexual assault and been found liable for it, did not stop there. He went on to say that he had told his advisors, “I’m going to do it whether the women like it or not. I am going to protect them.”

The Trump campaign remains concerned about the damage caused by the extraordinarily racist, sexist, and violent Sunday night rally at Madison Square Garden. Today the campaign seized on a misstatement President Biden made when condemning the statement from the Madison Square Garden event that referred to Puerto Rico as a “floating island of garbage.” They tried to turn the tables to suggest that Biden was calling Trump supporters garbage, although the president has always been very careful to focus his condemnation on Trump alone.

In Wisconsin today, when he disembarked from his plane, Trump put on an orange reflective vest and had someone drive him around the tarmac in a garbage truck with TRUMP painted on the side. He complained about Biden to reporters from the cab of the truck but still refused to apologize for Sunday’s slur of Puerto Rico, saying he knew nothing about the comedian who appeared at his rally.

This, too, was an unusual strategy. Like his visit to McDonalds, where he wore an apron, the image of Trump in a sanitation truck was likely intended to show him as a man of the people. But his power has always rested not in his promise to be one of the people, but rather to lead them. The pictures of him in a bright orange vest and unusually dark makeup are quite different from his usual portrayal of himself.

Indeed, media captured a video of Trump’s stunt, and it did not convey strength. MSNBC’s Katie Phang watched him try to get into the truck and noted: “Trump stumbles, drags his right leg, almost falls over, and tries at least three times to open the door…. Some transparency with Trump’s medical records would be nice.”

The Las Vegas Sun today ran an editorial that detailed Trump’s increasingly obvious mental lapses and concluded that Trump is “crippled cognitively and showing clear signs of mental illness.” It noted that Trump now depends “on enablers who show a disturbing willingness to indulge his delusions, amplify his paranoia or steer his feeble mind toward their own goals.” It noted that if Trump cannot fulfill the duties of the presidency, they would fall to his running mate, J.D. Vance, who has suggested “he would subordinate constitutional principles for personal profit and power.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#political cartoon#Matt Wuerker#Politico#Heather Cox Richardson#Letters From an American#Las Vegas Sun#MAGA extremism#garbage truck stunt#women's health#reproductive rights#Musk#Affordable Care Act#Obamacare#project 2025#MAGA's plans for you

25 notes

·

View notes

Text

Vice President Candidate Tim Walz - Some of his Issues Before The Voters

• The Floyd riots. Walz managed to infuriate mainstream voters when he initially refused to quell the riots and arson that followed George Floyd’s death in Minneapolis, only to enrage activists later when he called in the National Guard. Violent crime continues to plague the state.

Walz also signed a 2023 bill giving felons the right to vote except while they are incarcerated.

• Covid: Minnesota was a proud lockdown state; Walz enforced closures, restrictions and curfews, as well as a mask mandate, for more than a year. Police arrested��a business owner who defied restrictions, while Walz set up a hotline that allowed residents to tattle on others who weren’t following his rules (Walz said the snitching was for people’s “own good.”)

• Spendalooza: Minnesota is racing to become the California of the Midwest, via a spending blowout that has ballooned government and depleted coffers. Walz hiked taxes, blew through a $18 billion surplus, and is on track for a $2.3 billion deficit. The money was thrown at a bevy of progressive priorities, including public education, “free college,” paid family and medical leave, and expanded government health care.

• Green New Deal: Walz tied his state’s vehicle emission standards to California regulations, among the strictest in the nation. And he signed a bill requiring state electric utilities to be 100% carbon free by 2040—an insane, and costly, fantasy.

• Culturally weird: Walz gave his party a laugh when he declared Republicans “weird,” though it’s Minnesota that’s rapidly moved away from cultural norms under his tenure. He signed a law making the state a “sanctuary” for minors seeking transgender hormone treatment and surgery; another one mandating the dispensing of tampons in school boys’ bathrooms; and a law that declares an “individual” right to an abortion with no time limit or requirement that minors notify their parents.

Dept. of Conventional Wisdom: Walz has a jovial Midwestern style, and is often found chatting about his love of hunting or coaching while sporting a Carhartt jacket and baseball cap. Democrats intend to present him as their bridge to working-class voters and argue he’s capable of presenting progressive policy as practical and positive for most Americans. Think Pennsylvania Sen. John Fetterman or Montana Sen. Jon Tester. Yet Minnesota has little to show for its massive spending and liberal governance: Crime is up; education proficiency rates are down; capital and residents are leaving; inflation remains high; and job numbers are ticking down. Minnesota’s tax rates—individual, corporate and estate—are now among highest in the nation. Walz didn’t fare well with working-class voters in his gubernatorial elections. And his policy history magnifies the perception of a far-left ticket.

The real error may be lost opportunity. Vice-presidential candidates don’t usually make-or-break a ticket, but with another potential razor-thin presidential race in November—one that may very well run straight through Pennsylvania—Harris’s decision to walk away from a popular Keystone governor was risky.

40 notes

·

View notes

Text

The term “climate haven” never made much sense. After Hurricane Helene dumped 2 feet of rain on western North Carolina, many major media outlets marveled at how Asheville, which had been celebrated as a climate haven, had been devastated by a climate-related disaster.

Some in the media later reported accurately that climate havens don’t actually exist. But that still raises the question: Where did this climate haven concept even come from?

Well before humans began putting billions of tons of greenhouse gases into the atmosphere, entire populations would migrate toward better conditions in search of a place with milder weather or more fertile soil or the absence of drought.

Because of its speed and scale, however, human-caused climate change is especially extreme, and everywhere will be impacted by some degree of risk. There is no completely safe haven.

Which is part of how we ended up talking about the idea of climate havens. It’s wishful thinking. At least that’s what several experts told me after Helene laid a path of destruction across the Southeast and as Hurricane Milton barreled toward Florida. As the impacts of climate change became more real and apparent, the media as well as local leaders started looking for a better story to tell.

“People are desperate for optimism,” said Jesse Keenan, director of the Center on Climate Change and Urbanism at Tulane University, who described the concept of climate havens as a fiction. “It gives people hope.”

Keenan actually blames himself for helping to popularize the term. For a concept that feels so widespread now, it’s surprisingly hard to find much mention of climate havens in the media before 2018. That was when The Guardian quoted Keenan in a piece about where you should move to save yourself from climate change that used the phrase “safe havens.” Buffalo, New York, and Duluth, Minnesota, were Keenan’s suggestions.

The concept gained more traction a few months later, when Mayor Byron W. Brown referred to Buffalo as a “climate refuge” in his 2019 state of the city address, followed by outlets like Bloomberg and Quartz referring to Buffalo as a climate haven. The New York Times did a whole spread on “climate-proof Duluth,” a slogan Keenan wrote as part of an economic development package commissioned by the city. He told me it was just a joke that got pulled out of context.

It’s hard to know how responsible one professor with a knack for marketing was for the mainstreaming of the climate haven concept. But it’s easy to see why local governments would latch onto it.

The Census Bureau estimates that as climate change warms the planet over the next several decades, 100 million will migrate into and around the US. Increased flood risk may have already pushed several million people out of coastal and low-lying areas across the US, as wildfires start to raise questions about migration in the West.

Inland cities, namely those along the Rust Belt that have been losing population for years, see an opportunity to pull those people in.

“The idea of a climate refuge itself is kind of an escapist fantasy,” said Billy Fleming, director of the McHarg Center at the University of Pennsylvania. “To the extent that a climate refuge even exists, it’s not a particularly physical or geophysical phenomenon. It’s social and economic.”

Fleming added that, for these would-be climate havens, attracting new residents is a means to pull in more tax revenue and create wealth for the community. “It’s about keeping the real estate machine churning,” he added, “which is the thing that pays for everything else in the city.”

The real estate industry has taken notice. Quite coincidentally, as Hurricane Helene was bearing down on the Southeast last week, Zillow announced a new feature that displays climate risk scores on listing pages alongside interactive maps and insurance requirements. Now, you can look up an address and see, on a scale of 1 to 10, the risk of flooding, extreme temperatures, and wildfires for that property, based on data provided by the climate risk modeling firm First Street. Redfin, a Zillow competitor, launched its own climate risk index using First Street data earlier this year.

The new climate risk scores on Zillow and Redfin can’t tell you with any certainty whether you’ll be affected by a natural disaster if you move into any given house. But this is a tool that can help guide decisions about how you might want to insure your property and think about its long-term value.

It’s almost fitting that Zillow and Redfin, platforms designed to help people find the perfect home, are doing the work to show that climate risk is not binary. There are no homes completely free of risk for the same reasons that there’s no such thing as a perfect climate haven.

Climate risk is a complicated equation that complicates the already difficult and complex calculus of buying a home. Better access to data about risk can help, and a bit more transparency about the insurance aspect of homeownership is especially useful, as the industry struggles to adapt to our warming world and the disasters that come with it.

“As we start to see insurance costs increase, all that starts to impact that affordability question,” Skylar Olsen, Zillow’s chief economist, told me. “It’ll help the housing market move towards a much healthier place, where buyers and sellers understand these risks and then have options to meet them.”

That said, knowledge of risk isn’t keeping people from moving to disaster-prone parts of the country right now. People move to new parts of the country for countless different reasons, including the area’s natural beauty, job prospects, and affordable housing. Those are a few of the reasons why high-risk counties across the country are growing faster than low-risk counties, even in the face of future climate catastrophes, which are both unpredictable and inevitable. It’s almost unfathomable to know how to prepare ourselves properly for the worst-case scenario.

“The scale of these events that we’re seeing are so beyond what humans have ever seen,” said Vivek Shandas, an urban planning professor at Portland State University. “No matter what we think might be a manageable level of preparedness and infrastructure, we’re still going to see cracks, and we’re still going to see breakages.”

That doesn’t mean we shouldn’t build sea walls or find new ways to fight wildfires. In a sense, we have the opportunity to create our own climate havens by making cities more resilient to the risks they face. We can be optimistic about that future.

19 notes

·

View notes

Text

Do white Americans owe reperations to blacks? NO!

In America, Reparations have already been paid. To the point that it’s beyond ridiculous. Whites have gone out of their way to artificially boost Nonwhites at every turn. Trillions of tax dollars and donations have been spent over decades trying to boost non-white achievements and social status. Also dept relief, Crt, affirmative action, first step act, donations for past wrong doings, school degrees, food stamps, welfare programs, etc.

Alot of whites and some jews through out American history tried to help blacks become a separate & self-reliant people (the pursuit of Booker T. Washington) through education.

The Freedman's Bureau (1865 to 1872) :

The Freedman’s Bureau (officially known as ‘The Bureau of Refugees, Freedmen, and Abandoned Lands’) was created by Americans to feed and provide other life necessities to the Negro population of the South after the Civil War ended in 1865. However, well before the end of the Civil War, Americans organized all over the North various organizations to feed, clothe, educate and provide other needed necessities for the newly freed Negro people Note: according to W.E.B Du Bios, more than 50 organizations were active in relief capacity for the southern Negro by 1866.

"The First white people in America, certainly the first in the South to exhibit their interest in the reaching of the Negro and saving his soul through the medium of the Sunday-school were Robert E. Lee and 'Stonewall Jackson'. ...Where Robert E. Lee and 'Stonewall' Jackson have led in the redemption of the Negro through the Sunday-school, the rest of us can afford to follow. " - Booker T. Washington 1910

The Tuskegee Institute:

This icon of Black education was founded by the great Booker T Washington and was also the brainchild of an Alabama prominent banker by the name of George W. Campbell (White man). Another White man, an Alabama state senator named W.F. Foster, spearheaded the necessary funding for the Institute through the state legislature. The result was a yearly appropriation of $2000.

The following white Americans, all self-made millionaires, gave small fortunes - their own hard earned money - to this Negro self-sufficiency school over their lifetime:

--Andrew Carnegie

--John D. Rockefeller

--Henry Rodgers

--Collis Huntington

And,

--Julius Rosenwald*

--Anna T. Jeanes*

* Julius Rosenwald was an immigrant Jew and self-made millionaire.

* Anna T. Jeanes, a white woman, was not a self-made millionaire, but inherited her money from her husband.

Howard University

Howard University was chartered in 1867. It was championed by an American Civil War General, Oliver Otis Howard (November 8, 1830 – October 26, 1909), and the school hence bears his name. Howard University is also the ONLY higher education school ever to be directly funded by the US taxpayers (it still is).

Lincoln University

Lincoln University (Pennsylvania) was an exclusive college for Negroes and was created in 1854 by a white man named John Miller Dickey, who also became its first president. Lincoln University was originally named Ashmun Institute. The first Black president of the university was not elected until 1945.

Fisk University

Fisk University was an all-Negro college that was established by three whites, Erastus Milo Cravath, John Ogden and Edward Parmelee Smith in Nashville, Tennessee, in 1866.

Wilberforce University

Wilberforce University, located near Xenia, in Ohio, was an all-Negro college created by whites from the Methodist Episcopal Church in 1856. It was named after a white man, William Wilberforce, who was an 18th century abolitionist.

Cheyney University of Pennsylvania

Cheyney University of Pennsylvania was an all-Negro school established in 1837. A white man named Richard Humphreys had bequeathed $10,000 in his will (10% of his estate) in 1832 for the sole purpose of creating a place of education for the Negro race.

Atlanta University

Atlanta University was founded by whites associated with the American Missionary Association, in 1865. Around 1866, its survival then shifted to, and depended upon, the Americans associated with the Freedman’s Bureau.

In 1922, the Carnegie Corporation and the Rockefeller Memorial gave $25,000 each to create the Journal Of Negro History.

In 1924, George Eastman (Kodack Co.) gave Tuskegee Institute $1 million dollars.

John D. Rockefeller

Mr. Rockefeller donated almost $180 million dollars to the General Education Board, which was chartered by Act of Congress in 1903. Much of this money was spent supplying educational aid to the Negro people, specifically in the southern states (Mr. Rockefeller‘s $180 million translates to almost 2 billion dollars in today's dollars!)

George Peabody Education Fund for poor Southerners

George Peabody Education Fund was established by a white man named George Peabody, and was designed to help Negro colleges in the South at the turn of the century.

The Slater Fund

The Slater Fund was established by white, James Fox Slater, in 1882. Its primary purpose was to support southern Negro schools. Around 1915, this fund was worth about $1.75 million.

The Jeanes Fund (Jeanes Foundation)

A white woman named Miss Anna T. Jeanes, a Quaker, created 'The Fund for Rudimentary Schools for Southern Negroes’ in 1907 from the monies left to her by her late husband. The purpose of the fund was to help Negroes create teachers for their people. It was endowed at one million dollars (a staggering sum at the time).

The Southern Education Board: In or around 1900, whites created the The Southern Education Board. It's funding was initially provided by the Slater Fund and the Jeans Funds. Americans, trained in the area of farming, would go to rural farms (Negro and American) and educate them on better farming techniques. The Southern Education Board was also very concerned with the high southern Negro illiteracy, which was, in 1900, almost 50% (for southern Americans, around 11%).

Phelps-Stokes Fund

Established in 1911, a white philanthropist and self-made millionaire Anson Phelps Stokes created this fund for the purpose of improving Negro life through education. Its endowment was approximately $900,000.

Minor Fund

This fund was established by a white female, Miss Myrtilla Minor, in 1851. Its purpose was to provide aid to schools who would teach Negro girls to be teachers for their people.

In 1910, according to the US census, 50% of Negroes (about 4.8 million) lived in urban centers (all created by white males). That means there would be approximately 2.4 million Negro males living in the urban centers of America. About 1/3rd would be too young to work, so that means there were about 1.6 million Negro males of working age living in American-built cities in 1910. Of those 1.8 million Negro males, 350,000 (almost 20%!) worked in a factory job (all factory jobs for the Negro were supplied by White men i.e. not ONE factory job in America was created by a Negro male --so, concomitantly, no white man was employed by a Negro male in a factory job. Note: At this time in American history, you worked or you starved. (source: Chronological History of The Negro pg. 358)

Naturally, with whites, being so generous supplying jobs to black men, naturally, more black men were encouraged to come to the American-built urban areas.

Julius Rosenwald

Without question one of the most generous of the Euro race toward the black people was Julius Rosenwald (Jewish). Most of his charity was gifted through the Rosenwald Fund (depleted in 1948)

Cushing Fund

A white woman, Miss Emeline Cushing, established this fund in 1895 for the purpose of financially assisting colored schools.

Whites Create Special School - In Mississippi. - For Negro Boys To Own Land

Daniel Hand Fund

A white self-made millionaire, Daniel Hand, established the Daniel Hand Fund in 1888. It was endowed at $1 million dollars (two-thirds of Mr. Hand’s entire personal wealth!). Mr. Hand stipulated that all of the Fund would be directed toward Negro education in the former slave states. When Mr. Hand died in 1893, he bequeathed the rest of his remaining wealth to this fund.

Andrew Carnegie

Mr. Carnegie, when he retired, was considered the richest man in the world. He also became the biggest philanthropist in America and gave generously to Negro educational causes, which included giving $600,000 to the Tuskegee Institute in 1903.

Harmon Foundation

The New York City Harmon Foundation was established in 1922 by an white man named William Harmon (1862-1928). Its purpose was to aid and assist Negro art, artists, businesses, education for Negroes, farming needs, music, and other causes for the Negro.

Garland Fund

This White-male-established fund was used to help the NAACP through the Great Depression.

John D. Rockefeller Jr.

Mr. Rockefeller, Jr. built the Dunbar Apartments in New York City, a mammoth complex consisting of six buildings - 511 apartments - specifically to house low-income Negroes in Harlem. He also built and funded a bank in NYC solely for Negroes.

Katharine Drexel

Katherine Drexel was born November 26, 1858 and died March 3, 1955. She was an American female, a nun, philanthropist, educator and later canonized as a Roman Catholic saint.

"She became a nun, and took the name Sister Katharine, dedicating herself and her inheritance to the needs of [non-occupational ranking] Native Americans and African-Americans in the western and southwestern United States, and was a vocal advocate of racial tolerance. She established a religious order, the Sisters of the Blessed Sacrament for Indians and Colored People. She also financed more than 60 missions and schools around the United States, and founded Xavier University of Louisiana[1] - the only historically Black, Roman Catholic university in the United States to date."

The United Negro College Fund

In 1944 the United Negro College Fund was created. Almost all of the funding for its initial operation was provided by the General Education Fund and the Rosenwald Fund.

Mr. William Trent, a black man, in the course of his 20-year tenure as its first executive director, raised over $78 million for this fund, almost all of it coming from generous white liberal Americans (Senator John F. Kennedy gave all of the profits from his book ‘Profiles in Courage' to this fund).

Also American Jews also gave money to black people. Before 1950, it was mostly coming from the Rosenwald fund.

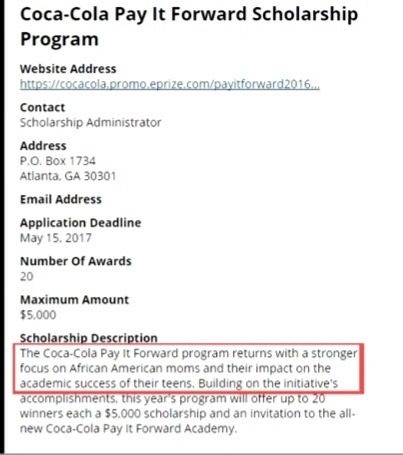

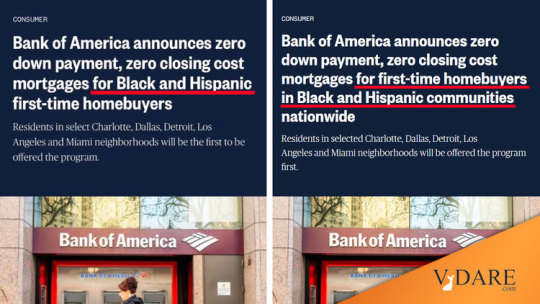

Minority scholarships:

Low income:

It’s open to illegal immigrants, too, but white people? Forget it. And when we learn that “800 Compton residents to get guaranteed income in two-year pilot program,” since Compton is only 2 percent white – yes, just 2 percent – white people won’t get that money.

Having to change the requirements of mental retardation, because too many blacks IQ's were that low.

https://mn.gov/mnddc/parallels2/pdf/90s/99/99-MRI-MLW.pdf

63 notes

·

View notes

Text

Heather Cox Richardson 10.30.24

On Friday, October 25, at a town hall held on his social media platform X, Elon Musk told the audience that if Trump wins, he expects to work in a Cabinet-level position to cut the federal government.

He told people to expect “temporary hardship” but that cuts would “ensure long-term prosperity.” At the Trump rally at New York City’s Madison Square Garden on Sunday, Musk said he plans to cut $2 trillion from the government. Economists point out that current discretionary spending in the budget is $1.7 trillion, meaning his promise would eliminate virtually all discretionary spending, which includes transportation, education, housing, and environmental programs.

Economists agree that Trump’s plans to place a high tariff wall around the U.S., replacing income taxes on high earners with tariffs paid for by middle-class Americans, and to deport as many as 20 million immigrants would crash the booming economy. Now Trump’s financial backer Musk is factoring in the loss of entire sectors of the government to the economy under Trump.

Trump has promised to appoint Musk to be the government’s “chief efficiency officer.” “Everyone’s going to have to take a haircut.… We can’t be a wastrel.… We need to live honestly,” Musk said on Friday. Rob Wile and Lora Kolodny of CNBC point out that Musk’s SpaceX aerospace venture has received $19 billion from the U.S. government since 2008.

An X user wrote: “I]f Trump succeeds in forcing through mass deportations, combined with Elon hacking away at the government, firing people and reducing the deficit—there will be an initial severe overreaction in the economy…. Markets will tumble. But when the storm passes and everyone realizes we are on sounder footing, there will be a rapid recovery to a healthier, sustainable economy. History could be made in the coming two years.”

Musk commented: “Sounds about right[.]”

This exchange echoes the prescription of Treasury Secretary Andrew Mellon, whose theories had done much to create the Great Crash of 1929, for restoring a healthy economy. “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate,” he told President Herbert Hoover. “It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people.”

Mellon, at least, was reacting to an economic crisis thrust upon an administration. Musk is seeking to create one.

Today the Commerce Department reported that from July through September, the nation’s economy grew at a solid 2.8%. Consumer spending is up, as is investment in business. The country added 254,000 jobs in September, and inflation has fallen back almost to the Federal Reserve’s target of 2%.

It is extraordinarily rare for a country to be able to reduce inflation without creating a recession, but the Biden administration has managed to do so, producing what economists call a “soft landing,” rather like catching an egg on a plate. As Bryan Mena of CNN wrote today: “The US economy seems to have pulled off a remarkable and historic achievement.”

Both President Joe Biden and Democratic presidential nominee Vice President Kamala Harris have called for reducing the deficit not by slashing the government, as Musk proposes, but by restoring taxes on the wealthy and corporations.

As part of the Republicans’ plan to take the country back to the era before the 1930s ushered in a government that regulated business and provided a basic social safety net, House speaker Mike Johnson (R-LA) expects to get rid of the Affordable Care Act.

At a closed-door campaign event on Monday in Pennsylvania for a Republican House candidate, Johnson told supporters that Republicans will propose “massive reform” to the Affordable Care Act, also known as “Obamacare,” if they take control of both the House and the Senate in November. “Health-care reform’s going to be a big part of the agenda,” Johnson said. Their plan is to take a “blowtorch to the regulatory state,” which he says is “crushing the free market.” “Trump’s going to go big,” he said.” When an attendee asked, “No Obamacare?” he laughed and agreed: “No Obamacare…. The ACA is so deeply ingrained, we need massive reform to make this work, and we got a lot of ideas on how to do that.”

Ending a campaign with a promise to crash a booming economy and end the Affordable Care Act, which ended insurance companies’ ability to reject people with preexisting conditions, is an unusual strategy.

A post from Trump last night and another this morning suggest his internal polls are worrying him. Last night he claimed there was cheating in Pennsylvania’s York and Lancaster counties. Today he posted: “Pennsylvania is cheating, and getting caught, at large scale levels rarely seen before. REPORT CHEATING TO AUTHORITIES. Law Enforcement must act, NOW!”

Trump appears to be setting up the argument he used in 2020, that he can lose only if he has been cheated. But it is increasingly apparent that the get-out-the-vote, or GOTV, efforts of the Trump campaign have been weak. When Trump’s daughter-in-law Lara Trump and loyalist Michael Whatley became the co-chairs of the Republican National Committee in March 2024, they stopped the GOTV efforts underway and used the money instead for litigation. They outsourced GOTV efforts to super PACs, including Musk’s America PAC.

In Wired today, Jake Lahut reported that door-knockers for Musk’s PAC were driven around in the back of a U-Haul without seats and threatened with having to pay their own hotel bills if they didn’t meet high canvassing quotas. One of the canvassers told Lahut that they thought they were being hired to ask people who they would be voting for when they flew into Michigan, and was surprised to learn their actual role. The workers spoke to Lahut anonymously because they had signed a nondisclosure agreement (a practice the Biden administration has tried to stop).

Trump’s boast that he is responsible for the Supreme Court’s overturning of the 1973 Roe v. Wade decision recognizing the constitutional right to abortion is one of the reasons his support is soft. In addition to popular dislike of the idea that the state, rather than a woman and her doctor, should make decisions about her healthcare, the Dobbs v. Jackson Women’s Health Organization decision is now over two years old, and state examinations of maternal deaths are showing that women are dying from lack of reproductive healthcare.

Cassandra Jaramillo and Kavitha Surana of ProPublica reported today that at least two pregnant women have died in Texas when doctors delayed emergency care after a miscarriage until the fetal heartbeat stopped. The woman they highlighted today, Josseli Barnica, left behind a husband and a toddler.

At a rally this evening near Green Bay, Wisconsin, Trump said his team had advised him to stop talking about how he was going to protect women by ending crime and making sure they don’t have to be “thinking about abortion.” But Trump, who has boasted of sexual assault and been found liable for it, did not stop there. He went on to say that he had told his advisors, “I’m going to do it whether the women like it or not. I am going to protect them.”

The Trump campaign remains concerned about the damage caused by the extraordinarily racist, sexist, and violent Sunday night rally at Madison Square Garden. Today the campaign seized on a misstatement President Biden made when condemning the statement from the Madison Square Garden event that referred to Puerto Rico as a “floating island of garbage.” They tried to turn the tables to suggest that Biden was calling Trump supporters garbage, although the president has always been very careful to focus his condemnation on Trump alone.

In Wisconsin today, when he disembarked from his plane, Trump put on an orange reflective vest and had someone drive him around the tarmac in a garbage truck with TRUMP painted on the side. He complained about Biden to reporters from the cab of the truck but still refused to apologize for Sunday’s slur of Puerto Rico, saying he knew nothing about the comedian who appeared at his rally.

This, too, was an unusual strategy. Like his visit to McDonalds, where he wore an apron, the image of Trump in a sanitation truck was likely intended to show him as a man of the people. But his power has always rested not in his promise to be one of the people, but rather to lead them. The pictures of him in a bright orange vest and unusually dark makeup are quite different from his usual portrayal of himself.

Indeed, media captured a video of Trump’s stunt, and it did not convey strength. MSNBC’s Katie Phang watched him try to get into the truck and noted: “Trump stumbles, drags his right leg, almost falls over, and tries at least three times to open the door…. Some transparency with Trump’s medical records would be nice.”

The Las Vegas Sun today ran an editorial that detailed Trump’s increasingly obvious mental lapses and concluded that Trump is “crippled cognitively and showing clear signs of mental illness.” It noted that Trump now depends “on enablers who show a disturbing willingness to indulge his delusions, amplify his paranoia or steer his feeble mind toward their own goals.” It noted that if Trump cannot fulfill the duties of the presidency, they would fall to his running mate, J.D. Vance, who has suggested “he would subordinate constitutional principles for personal profit and power.”

—

3 notes

·

View notes

Text

October 30, 2024

HEATHER COX RICHARDSON

OCT 31READ IN APP

On Friday, October 25, at a town hall held on his social media platform X, Elon Musk told the audience that if Trump wins, he expects to work in a Cabinet-level position to cut the federal government.

He told people to expect “temporary hardship” but that cuts would “ensure long-term prosperity.” At the Trump rally at New York City’s Madison Square Garden on Sunday, Musk said he plans to cut $2 trillion from the government. Economists point out that current discretionary spending in the budget is $1.7 trillion, meaning his promise would eliminate virtually all discretionary spending, which includes transportation, education, housing, and environmental programs.

Economists agree that Trump’s plans to place a high tariff wall around the U.S., replacing income taxes on high earners with tariffs paid for by middle-class Americans, and to deport as many as 20 million immigrants would crash the booming economy. Now Trump’s financial backer Musk is factoring in the loss of entire sectors of the government to the economy under Trump.

Trump has promised to appoint Musk to be the government’s “chief efficiency officer.” “Everyone’s going to have to take a haircut.… We can’t be a wastrel.… We need to live honestly,” Musk said on Friday. Rob Wile and Lora Kolodny of CNBC point out that Musk’s SpaceX aerospace venture has received $19 billion from the U.S. government since 2008.

An X user wrote: “I]f Trump succeeds in forcing through mass deportations, combined with Elon hacking away at the government, firing people and reducing the deficit—there will be an initial severe overreaction in the economy…. Markets will tumble. But when the storm passes and everyone realizes we are on sounder footing, there will be a rapid recovery to a healthier, sustainable economy. History could be made in the coming two years.”

Musk commented: “Sounds about right[.]”

This exchange echoes the prescription of Treasury Secretary Andrew Mellon, whose theories had done much to create the Great Crash of 1929, for restoring a healthy economy. “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate,” he told President Herbert Hoover. “It will purge the rottenness out of the system. High costs of living and high living

will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people.”

Mellon, at least, was reacting to an economic crisis thrust upon an administration. Musk is seeking to create one.

Today the Commerce Department reported that from July through September, the nation’s economy grew at a solid 2.8%. Consumer spending is up, as is investment in business. The country added 254,000 jobs in September, and inflation has fallen back almost to the Federal Reserve’s target of 2%.

It is extraordinarily rare for a country to be able to reduce inflation without creating a recession, but the Biden administration has managed to do so, producing what economists call a “soft landing,” rather like catching an egg on a plate. As Bryan Mena of CNN wrote today: “The US economy seems to have pulled off a remarkable and historic achievement.”

Both President Joe Biden and Democratic presidential nominee Vice President Kamala Harris have called for reducing the deficit not by slashing the government, as Musk proposes, but by restoring taxes on the wealthy and corporations.

As part of the Republicans’ plan to take the country back to the era before the 1930s ushered in a government that regulated business and provided a basic social safety net, House speaker Mike Johnson (R-LA) expects to get rid of the Affordable Care Act.

At a closed-door campaign event on Monday in Pennsylvania for a Republican House candidate, Johnson told supporters that Republicans will propose “massive reform” to the Affordable Care Act, also known as “Obamacare,” if they take control of both the House and the Senate in November. “Health-care reform’s going to be a big part of the agenda,” Johnson said. Their plan is to take a “blowtorch to the regulatory state,” which he says is “crushing the free market.” “Trump’s going to go big,” he said.” When an attendee asked, “No Obamacare?” he laughed and agreed: “No Obamacare…. The ACA is so deeply ingrained, we need massive reform to make this work, and we got a lot of ideas on how to do that.”

Ending a campaign with a promise to crash a booming economy and end the Affordable Care Act, which ended insurance companies’ ability to reject people with preexisting conditions, is an unusual strategy.

A post from Trump last night and another this morning suggest his internal polls are worrying him. Last night he claimed there was cheating in Pennsylvania’s York and Lancaster counties. Today he posted: “Pennsylvania is cheating, and getting caught, at large scale levels rarely seen before. REPORT CHEATING TO AUTHORITIES. Law Enforcement must act, NOW!”

Trump appears to be setting up the argument he used in 2020, that he can lose only if he has been cheated. But it is increasingly apparent that the get-out-the-vote, or GOTV, efforts of the Trump campaign have been weak. When Trump’s daughter-in-law Lara Trump and loyalist Michael Whatley became the co-chairs of the Republican National Committee in March 2024, they stopped the GOTV efforts underway and used the money instead for litigation. They outsourced GOTV efforts to super PACs, including Musk’s America PAC.

In Wired today, Jake Lahut reported that door-knockers for Musk’s PAC were driven around in the back of a U-Haul without seats and threatened with having to pay their own hotel bills if they didn’t meet high canvassing quotas. One of the canvassers told Lahut that they thought they were being hired to ask people who they would be voting for when they flew into Michigan, and was surprised to learn their actual role. The workers spoke to Lahut anonymously because they had signed a nondisclosure agreement (a practice the Biden administration has tried to stop).

Trump’s boast that he is responsible for the Supreme Court’s overturning of the 1973 Roe v. Wade decision recognizing the constitutional right to abortion is one of the reasons his support is soft. In addition to popular dislike of the idea that the state, rather than a woman and her doctor, should make decisions about her healthcare, the Dobbs v. Jackson Women’s Health Organization decision is now over two years old, and state examinations of maternal deaths are showing that women are dying from lack of reproductive healthcare.

Cassandra Jaramillo and Kavitha Surana of ProPublica reported today that at least two pregnant women have died in Texas when doctors delayed emergency care after a miscarriage until the fetal heartbeat stopped. The woman they highlighted today, Josseli Barnica, left behind a husband and a toddler.

At a rally this evening near Green Bay, Wisconsin, Trump said his team had advised him to stop talking about how he was going to protect women by ending crime and making sure they don’t have to be “thinking about abortion.” But Trump, who has boasted of sexual assault and been found liable for it, did not stop there. He went on to say that he had told his advisors, “I’m going to do it whether the women like it or not. I am going to protect them.”

The Trump campaign remains concerned about the damage caused by the extraordinarily racist, sexist, and violent Sunday night rally at Madison Square Garden. Today the campaign seized on a misstatement President Biden made when condemning the statement from the Madison Square Garden event that referred to Puerto Rico as a “floating island of garbage.” They tried to turn the tables to suggest that Biden was calling Trump supporters garbage, although the president has always been very careful to focus his condemnation on Trump alone.

In Wisconsin today, when he disembarked from his plane, Trump put on an orange reflective vest and had someone drive him around the tarmac in a garbage truck with TRUMP painted on the side. He complained about Biden to reporters from the cab of the truck but still refused to apologize for Sunday’s slur of Puerto Rico, saying he knew nothing about the comedian who appeared at his rally.

This, too, was an unusual strategy. Like his visit to McDonalds, where he wore an apron, the image of Trump in a sanitation truck was likely intended to show him as a man of the people. But his power has always rested not in his promise to be one of the people, but rather to lead them. The pictures of him in a bright orange vest and unusually dark makeup are quite different from his usual portrayal of himself.

Indeed, media captured a video of Trump’s stunt, and it did not convey strength. MSNBC’s Katie Phang watched him try to get into the truck and noted: “Trump stumbles, drags his right leg, almost falls over, and tries at least three times to open the door…. Some transparency with Trump’s medical records would be nice.”

The Las Vegas Sun today ran an editorial that detailed Trump’s increasingly obvious mental lapses and concluded that Trump is “crippled cognitively and showing clear signs of mental illness.” It noted that Trump now depends “on enablers who show a disturbing willingness to indulge his delusions, amplify his paranoia or steer his feeble mind toward their own goals.” It noted that if Trump cannot fulfill the duties of the presidency, they would fall to his running mate, J.D. Vance, who has suggested “he would subordinate constitutional principles for personal profit and power.”

—

0 notes

Text

Think the estate tax won't impact you? Think again. Here is what you need to know.

Estate Taxes: What EVERYONE Should Know

Most taxpayers ignore the federal estate tax, thinking they will never be touched by it. Unfortunately, you do this at your own peril. Why? Because states often have this tax AND politicians have a habit of frequently changing the rules. The most recent change is scheduled to take place after 2025. The best approach for all taxpayers is to understand the basics of the estate tax. Here is a quick summary of common questions you should be able to answer.

Q. Who pays estate taxes?

A. The tax is levied against the estate of a deceased person, which is considered a separate legal entity by the IRS. But the surviving family is effectively responsible for paying the estate tax because it cuts into their inheritance.

Q. What is included in the taxable estate?

A. Your estate includes personal property owned at the time of death, such as a home, cars, cash, collectibles and investments. Investments include securities, real estate, bank accounts and retirement accounts. The total taxable estate is the value of these assets minus deductible expenses and debts.

Q. How are assets valued?

A. The value for tax purposes is generally the property’s fair market value (FMV) on the date of death. Therefore, the basis for computing gain or loss is stepped up to this value. For example, if Diane Monet paid $10,000 for a painting and it’s worth $25,000 at her death, the estate value is $25,000. There are other valuation options in addition to FMV, so this area can get complicated in a hurry.

Q. How is the estate tax calculated?

A. For federal purposes, the tax is 40% of assets in excess of the federal exemption. The federal exemption for 2024 is $13.61 million. However, the exemption amount is scheduled to decrease to $5 million (adjusted for inflation) after 2025. There continues to be an ongoing debate over what this federal exemption amount should be, so it is a good idea to pay attention to future discussions out of Washington, D.C. to understand how it could impact your estate.

Q. Can a married couple double the exemption?

A. Yes. If handled correctly, a couple can effectively shelter up to $27.22 million ($13.61 million times 2) from federal tax in 2024. Remember, this amount is scheduled to be dramatically reduced after 2025.

Q. What is an inheritance tax?

A. Not to be confused with an estate tax, an inheritance tax is paid by those who receive the money from the estate of the person who dies. While there is no federal inheritance tax, six states (Iowa, Pennsylvania, New Jersey, Kentucky, Nebraska, and Maryland) could tax you if you inherit money. The good news? Iowa is phasing out the tax by 2026.

Q. What about estate taxes at the state level?

A. Twelve states and the District of Columbia currently have an estate tax. The exemption amounts in these states vary, with one as low as $1 million! If you live in one of these areas you better know the rules and have a plan: Connecticut, District of Columbia, Hawaii, Illinois, Maine, Massachusetts, Maryland, Minnesota, New York, Oregon, Rhode Island, Vermont, and Washington.

Q. How are gifts to others handled?

A. When you give a gift to someone, the federal government generally does not care. But when the value of all gifts to one person in a given year exceeds an annual threshold, you must report this to the federal government. This threshold in 2024 is $18,000. The gift tax rules are currently incorporated into the estate tax system. So careful planning is required in this area, especially if you are providing gifts to help finance various items like someone else's education.

Does this cover everything about estate taxes? Not by a long shot. But hopefully by understanding some of the basics, you will have a better idea of knowing when to ask for help.

#EstateTax#TaxPlanning#WealthManagement#EstatePlanning#FinancialPlanning#TaxConsulting#TaxAdvice#EstateStrategy#TaxTips#FinancialLiteracy#PlanAhead

0 notes

Text

Estate Taxes: What EVERYONE Should Know

Most taxpayers ignore the federal estate tax, thinking they will never be touched by it. Unfortunately, you do this at your own peril. Why? Because states often have this tax AND politicians have a habit of frequently changing the rules. The most recent change is scheduled to take place after 2025. The best approach for all taxpayers is to understand the basics of the estate tax. Here is a quick summary of common questions you should be able to answer.

Q. Who pays estate taxes?

A. The tax is levied against the estate of a deceased person, which is considered a separate legal entity by the IRS. But the surviving family is effectively responsible for paying the estate tax because it cuts into their inheritance.

Q. What is included in the taxable estate?

A. Your estate includes personal property owned at the time of death, such as a home, cars, cash, collectibles and investments. Investments include securities, real estate, bank accounts and retirement accounts. The total taxable estate is the value of these assets minus deductible expenses and debts.

Q. How are assets valued?

A. The value for tax purposes is generally the property’s fair market value (FMV) on the date of death. Therefore, the basis for computing gain or loss is stepped up to this value. For example, if Diane Monet paid $10,000 for a painting and it’s worth $25,000 at her death, the estate value is $25,000. There are other valuation options in addition to FMV, so this area can get complicated in a hurry.

Q. How is the estate tax calculated?

A. For federal purposes, the tax is 40% of assets in excess of the federal exemption. The federal exemption for 2024 is $13.61 million. However, the exemption amount is scheduled to decrease to $5 million (adjusted for inflation) after 2025. There continues to be an ongoing debate over what this federal exemption amount should be, so it is a good idea to pay attention to future discussions out of Washington, D.C. to understand how it could impact your estate.

Q. Can a married couple double the exemption?

A. Yes. If handled correctly, a couple can effectively shelter up to $27.22 million ($13.61 million times 2) from federal tax in 2024. Remember, this amount is scheduled to be dramatically reduced after 2025.

Q. What is an inheritance tax?

A. Not to be confused with an estate tax, an inheritance tax is paid by those who receive the money from the estate of the person who dies. While there is no federal inheritance tax, six states (Iowa, Pennsylvania, New Jersey, Kentucky, Nebraska, and Maryland) could tax you if you inherit money. The good news? Iowa is phasing out the tax by 2026.

Q. What about estate taxes at the state level?

A. Twelve states and the District of Columbia currently have an estate tax. The exemption amounts in these states vary, with one as low as $1 million! If you live in one of these areas you better know the rules and have a plan: Connecticut, District of Columbia, Hawaii, Illinois, Maine, Massachusetts, Maryland, Minnesota, New York, Oregon, Rhode Island, Vermont, and Washington.

Q. How are gifts to others handled?

A. When you give a gift to someone, the federal government generally does not care. But when the value of all gifts to one person in a given year exceeds an annual threshold, you must report this to the federal government. This threshold in 2024 is $18,000. The gift tax rules are currently incorporated into the estate tax system. So careful planning is required in this area, especially if you are providing gifts to help finance various items like someone else's education.

Does this cover everything about estate taxes? Not by a long shot. But hopefully by understanding some of the basics, you will have a better idea of knowing when to ask for help.

#BusinessAccounting#AccountingExperts#SyriacCPA#FinancialSolutions#BusinessSuccess#TaxConsulting#Bookkeeping

0 notes

Text

This Week’s Top U.S. Real Estate News for Global Investors

Here’s this week’s top news in the U.S. real estate market. These highlights offer potential opportunities for U.S. expats and non-resident investors. Let’s dive into the news and insights that might shape your investment strategy.

KKR Acquires Multifamily Portfolio and Other Implications

KKR’s recent acquisition of Quarterra’s $2.1 billion multifamily portfolio has sparked considerable interest in the U.S. real estate scene. The strategic move reflects KKR’s confidence in the stability and growth potential of multifamily properties in U.S. markets. For U.S. expats and foreign national investors, the KKR investment suggests opportunities in multifamily properties, which our clients may want to explore.

At America Mortgages, we offer tailor-made lending solutions that help investors leverage multifamily assets similar to those acquired by KKR.

America Mortgages offers this loan program to help you invest using the KKR strategy;

AM Multi-family +

5-8 units (one property)

Minimum loan amount: US$250,000

Loan-to-Value: up to 75% for purchase & 70% for cash-out

Underwritten on property cash flow

No U.S. credit required

Foreign National and U.S. Expat

No personal income required

Closing in 30-45 days

Investors can qualify based on property cash flow, making the process easy and flexible when investing in U.S. real estate.

Manhattan’s Surge in Home Sales

Manhattan home sales surged unexpectedly, with closings on apartments up 12.2% in the second quarter. This surge is powered by an increase in buyer activity aiming to take advantage of current market conditions before any Federal Reserve rate adjustments. This uptick indicates a strong demand in the market and a perfect timing for foreign national and U.S. expat investors who are looking to take part in Manhattan’s prestigious real estate market before potential price escalations after interest rates decrease. Marry the property. Date the rate.

America Mortgages offers a well-positioned loan program to help you invest in U.S. real estate as a foreign investor or U.S. Expat Mortgage;

AM CashFlow +

1-4 units (one property)

Minimum loan amount: US$100,000

Loan-to-Value: up to 80% for purchase & 70% for cash-out

Underwritten on property cash flow

No U.S. credit required

Foreign National and U.S. Expat

No personal income required

Closing in 30-45 days

Barbara Corcoran’s Best Cities for Real Estate Investing

World famous “rags to riches” real estate investor Barbara Corcoran has identified three cities poised for significant growth and investment potentials:

Pittsburgh, Pennsylvania: With an average home value of $227,329, Pittsburgh has seen a 6.2% increase in home values in the last year. The city has diverse advanced manufacturing and a strong base in education, hosting many colleges and universities.

Columbus, Ohio: Columbus’s average home value is $243,838, up 6.9% year over year. Its strong business climate, with major companies like JPMorgan Chase and Nationwide based there, contributes to a strong demand for housing.

Indianapolis, Indiana: Indianapolis’s average home value is $224,099, up 2.3% in the past year. Known for its diverse economy driven by the education, healthcare, and finance sectors, Indianapolis also benefits from sports tourism and major events like the Indianapolis 500.

These cities represent strategic investment opportunities where home prices are expected to rise due to economic growth, job creation, and strategic market conditions. For foreign national and U.S. expat investors looking to diversify their portfolios, Barbara Corcoran’s recommendations provide valuable insights into emerging markets with major potential for long-term investment.

AM Investor +

1-4 units (one property)

Minimum loan amount: US$150,000

Loan-to-Value: up to 75% for purchase & 70% for cash-out

Underwritten using an income letter and not personal tax returns

No U.S. credit required

Foreign National

No tax returns required

Closing in 30-45 days

The Hedge Against Inflation

It turns out that owning a home was likely your best bet for hedging against inflation during this cycle. This chart from “A Wealth of Common Sense” illustrates the performance of real estate as an inflation hedge.

Historically, real estate has consistently outperformed inflation, protecting investors’ purchasing power over the long term. This is especially relevant in the current economic climate, where inflation rates have been rising steadily. The stability and growth of real estate values provide a reliable safeguard against the effects of inflation, making it a tactful choice for investors looking to preserve their wealth.

This week’s news highlights often overlooked opportunities from industry experts in the U.S. real estate market. From KKR’s strategic investment in multifamily properties to Manhattan’s surge in sales activity and Barbara Corcoran’s city picks for growth and profits, the U.S. real estate market offers diverse avenues for growth and profitability.

At America Mortgages, we’re dedicated to helping U.S. expats and foreign nationals loan navigate these opportunities with confidence. Whether you’re interested in multifamily investments, luxury properties in Manhattan, or overlooked markets like Pittsburgh and Columbus, our specialized financing solutions and expert guidance are here to support your investment journey.

We work in your time zone, speak your language, and know this type of mortgage lending better than any other company in the industry. Use our 24/7 calendar link to schedule a meeting with one of our loan officers, and visit www.americamortgages.com to learn more about how we can help you achieve your real estate investment goals.

As always, thank you for your trust and your business. We look forward to a successful closing!

Reference: https://www.americamortgages.com/this-weeks-top-u-s-real-estate-news-for-global-investors/

0 notes

Link

#costoftitleinsurance#doineedtitleinsurance#howmuchdoestitleinsurancecost#howtitleinsuranceworks#Insurance#RealEstate#titlecompany#titleinsurance#titleinsurancecost#titleinsurancedefinition#titleinsuranceexplained#titleinsurancepolicies#titleinsurancepolicy#titleinsurancerealestate#titleinsurancetips#whatistitleinsurance#whydoineedtitleinsurance#whytitleinsurance

0 notes

Text

Types of Taxes Levied on Inherited Wealth

Various federal and state taxes exist on the estate of someone who has passed away or those receiving an inheritance. In most cases, however, the taxation applies to large estates, with smaller estates either exempt or subjected to lower rates - the three standard taxes regarding the property of the deceased include estate, inheritance, and capital gains taxes.

The first tax that may be levied on the deceased’s property is the estate tax, a federal tax imposed after the person’s demise and applies to the estate itself rather than the beneficiaries of the estate. The tax is imposed before the estate is distributed to the beneficiaries. The tax depends on the size of the estate - in general, the larger the estate, the higher the tax. Also, the federal government dictates that the first $13,610,000 is exempt from taxation as of 2024.

Other than the federal tax, about a dozen states levy an estate tax, which is again a tax on the estate itself before distribution. The states include Washington, Maryland, New York, and Illinois. The state rates vary regarding the minimum taxable estate value, exemptions, and percentage.

The second tax, the inheritance tax, is imposed on the inheritance the beneficiary receives rather than the estate. Although the federal government does not levy an inheritance tax, some states do, including Maryland, Iowa, Kentucky, Nebraska, New Jersey, and Pennsylvania. The amount of the inheritance tax depends on the relationship between the decedent and the beneficiary - some states subject close relatives like the spouse and children to lower tax rates than others or exempt them altogether.

Finally, the capital gains tax is levied upon the sale of certain inherited assets. This can range from selling property under inheritance to stocks and securities. The tax is typically imposed when the beneficiary sells the asset for more than the cost of its acquisition.

0 notes

Text

Home Cash Guys

A Guide to Selling a House in Probate in Delaware County 2024

A comprehensive guide to selling a house in probate in Delaware County, Pennsylvania, from cash home buyers in Delaware County; this article includes understanding the probate process, steps to sell a house, navigating legal complexities, avoiding mistakes, and accessing resources and support.

Cash Home Buyers in Delaware County

Introduction to Selling A House in Probate Selling a house in probate in Delaware County requires a comprehensive understanding of the legal intricacies involved in transferring property ownership from a deceased individual to their rightful heirs or beneficiaries. The probate process, overseen by the court, entails validating a will and allocating assets in accordance with the specified instructions or state regulations. For example, when a homeowner passes away and leaves a will dictating the distribution of their property, the probate process ensures that the property is sold or transferred correctly to the designated recipients.

Moreover, delving into the realm of probate sales unveils a multifaceted landscape where real estate transactions intersect with legal mandates. By grasping the nuances of probate, individuals involved in selling inherited properties can navigate the procedural requirements efficiently. This includes discerning the roles and responsibilities of key entities such as the executor, administrator, and the court, all of which play pivotal roles in facilitating the sale of a house in probate. Understanding these essential components is paramount in orchestrating a seamless and legally sound property transfer process within Delaware County.