#EconomicDevelopment

Explore tagged Tumblr posts

Text

That is why there was NEVER a Scramble for EUROPE! The WORLD runs on AFRIKA!

#outofafrika#afrikarunstheworld#scrambleforafrika#AfricaRising#AfricanHistory#EconomicDevelopment#AfricaUnite#AfricanUnity#whitesupremacy#blackunity#blackpower#knowledgeofself#blackpride#whiteprivilege#maga

32 notes

·

View notes

Text

An economy based on debt, where no one owns anything, cannot stand.

#history#economy#politics#american politics#us politics#uspol#political#Marxism#communism#socialism#DebtEconomy#FinancialSystem#EconomicPolicy#EconomicTheory#FinancialDebt#NationalDebt#EconomicCrisis#EconomicInequality#DebtCrisis#FinancialStability#DebtCycle#EconomicGrowth#FinancialSector#MonetaryPolicy#FiscalPolicy#GlobalEconomy#FinancialFreedom#EconomicDevelopment#EconomicJustice#EconomicReform

2 notes

·

View notes

Text

🌐 The Rise of ChatGPT and the End of Job Security 🤖💼 Is AI creating a profound pay gap in capitalism? The future of work is here, with AI automating tasks and eroding job opportunities. Are we heading towards a technological singularity? 🤯 The world is changing fast, and it's time to ask: When should we intervene for sustainable economic development? 🤔🚀

2 notes

·

View notes

Text

An article about Uzbekistan was published in Le Figaro newspaper http://dlvr.it/TJwvrF

0 notes

Text

Ilford BID: Enhancing Ilford Town Centre's Business and Community Environment

Ilford BID, established in 2009, works with nearly 400 local businesses to enhance Ilford Town Centre’s appeal and economic vitality. Key initiatives include security enhancements through a Radio Security Scheme, public realm improvements like seasonal decorations, organizing community events to boost engagement, and promoting Ilford’s diverse business landscape. These efforts aim to increase footfall, support local businesses, and create a thriving, welcoming community.

#IlfordBID#IlfordTownCentre#BusinessImprovementDistrict#CommunityEngagement#PublicSafetyIlford#IlfordEvents#PlaceMaking#LocalBusinessSupport#IlfordCommunity#EconomicDevelopment

0 notes

Text

Industrial parks are the backbone of large-scale manufacturing, logistics and business operations. But let’s face it-manual processes slow things down, increase costs, and create inefficiencies. That’s where smart self-service kiosks come in!

🔹 Streamlined Workforce Management – Forget paper-based attendance and long queues for ID verification. Kiosks automate check-ins, shift scheduling and even HR services, ensuring seamless workforce management.

🔹 Efficient Visitor & Vendor Handling - Security is a top priority in industrial zones. Kiosks can issue visitor passes, verify vendor credentials and automate gate entries, reducing manual errors and improving security.

🔹 Optimized Payment & Transaction Processing - Industrial parks deal with rent payments, utility bills and service fees. Payment kiosks provide a fast, secure and cashless way to manage financial transactions 24/7.

🔹 Enhanced Logistics & Inventory Control - From tracking shipments to managing warehouse inventories, kiosks help logistics teams access real-time data, reducing downtime and improving productivity.

🔹 Workforce Well-Being & Training Support – Need to provide workers with safety guidelines, training materials or emergency alerts? Kiosks serve as digital information hubs, improving employee engagement and compliance. With automation reshaping industries, self-service kiosks are not a luxury-they are a necessity!

Are industrial parks ready to embrace this transformation? What’s your take on the future of kiosk technology in industrial operations? Let’s discuss in the comments! ⬇️

. . . . . . .

#IndustrialParks#SmartKiosks#SelfServiceTechnology#Automation#DigitalTransformation#SmartCities#Innovation#Manufacturing#Efficiency#CustomerExperience#TechSolutions#Industry40#SmartManufacturing#OperationalExcellence#FutureOfWork#IoT#BusinessGrowth#Sustainability#WorkplaceInnovation#TechTrends#KioskSolutions#SmartInfrastructure#EconomicDevelopment#IndustryInnovation#kiosk#kioskmachine#selfservicekiosk#checkinkiosk#checkoutkiosk#paymentkiosk

1 note

·

View note

Text

Unlocking Nigeria’s Potential for Sustainable Growth - Dr. Kenny Odugbemi http://dlvr.it/TJllj6 Follow, Like & Share

0 notes

Text

ICBC Launches $11 Billion Technology Innovation Fund to Support Private Sector Growth

Introduction

Industrial and Commercial Bank of China (ICBC), the world’s largest commercial bank by assets, has announced the creation of an 80 billion-yuan ($11.04 billion) technology and innovation fund aimed at invigorating China’s private sector. This bold move highlights ICBC’s commitment to fostering technological advancements and supporting economic growth in strategic sectors.

Key Highlights

Major Investment Commitment

ICBC launched a technology innovation fund valued at 80 billion yuan ($11.04 billion).

The fund will focus primarily on hard technology sectors like semiconductors and advanced manufacturing.

Unlike prior initiatives, the fund intentionally avoids “soft technology” such as internet services.

Strategic Vision

The fund underscores ICBC’s role in implementing directives from China’s central leadership.

ICBC aims to transform favorable national policies into tangible financial support for private enterprises.

The fund embraces a “patient capital” approach, with long-term investment goals over short-term gains.

China’s Drive Toward Technological Sovereignty

A National Priority

The fund aligns closely with China’s broader ambitions to enhance its technological capabilities and reduce dependency on foreign technology amid escalating geopolitical tensions, especially with the United States.

Supporting Economic Transformation

China has increasingly emphasized technological self-reliance and innovation as pillars of its economic strategy. The fund contributes directly to the country’s 2025 development agenda, which was recently highlighted during its annual parliamentary meeting. Key areas of focus include:

Stimulating consumption

Driving breakthroughs in core technologies

Supporting high-tech manufacturing

The Role of Hard Technology in Economic Growth

Why Hard Tech?

ICBC’s prioritization of hard technologies, such as semiconductors, robotics, and precision manufacturing, reflects a shift in strategic thinking. Hard technologies offer tangible infrastructure and long-term economic benefits, making them essential to China’s industrial upgrade goals.

Bridging Capital and Innovation

By targeting hard tech, ICBC aims to bridge the capital gap for startups and scale-ups in sectors where research, development, and manufacturing capabilities require heavy upfront investment and sustained financial support.

ICBC’s Commitment to the Private Sector

Private Enterprise Empowerment

Liao Lin, Chairman of ICBC, emphasized the importance of empowering private enterprises through strategic financing. The fund will serve as a powerful tool to ensure that private firms engaged in vital tech innovation can access critical resources.

Equity Investment Strategy

Unlike traditional lending methods, this fund will adopt an equity-based investment model, giving ICBC a more hands-on role in nurturing high-potential businesses. This approach also helps reduce debt burdens on private enterprises.

Alignment with Government Policies

Partnership with Central Plans

The launch of this fund follows recent government announcements that stress the need to support technological startups through capital mobilization. China’s state planner recently revealed a 1 trillion yuan government-backed fund to support innovation-led growth in the private sector.

Coordinated National Strategy

Together with the ICBC initiative, these efforts reflect a coordinated national strategy aimed at fueling private-sector growth, supporting research and development, and creating an ecosystem that fosters innovation.

Market Impact and Future Outlook

Investor Confidence

The announcement of the fund is expected to boost investor confidence in China’s tech sector, particularly in high-tech manufacturing and semiconductors, which are considered future economic pillars.

Long-Term Economic Impact

The fund is not only a financial mechanism but also a strategic lever that could:

Accelerate the commercialization of emerging technologies

Enable small and medium-sized enterprises (SMEs) to scale operations

Support supply chain stability in critical sectors

Challenges and Opportunities

Challenges to Watch

While the fund represents a promising development, several challenges may impact its success:

Allocation efficiency and fund management transparency

Navigating geopolitical pressures

Ensuring returns without compromising on the “patient capital” principle

Strategic Opportunities

If successfully implemented, the fund could:

Position China as a global leader in high-tech innovation

Build resilient domestic tech ecosystems

Create new employment opportunities across tech sectors

Broader Implications for the Banking Industry

New Role for Financial Institutions

ICBC’s move signals a shift in the role of financial institutions from passive lenders to active enablers of innovation. It showcases how banks can influence national development by strategically channeling resources into future-critical sectors.

Driving Structural Change

Other banks may follow ICBC’s lead, integrating innovation-driven financing models and exploring partnerships with tech firms to spur broader economic transformation.

Conclusion

The ICBC Launches $11 Billion Technology Innovation Fund to Support Private Sector Growth initiative represents a significant milestone in China’s journey toward high-tech industrial development. With a focus on long-term, equity-based investments in hard technologies, ICBC is not only supporting private enterprises but also playing a critical role in shaping the future of China’s economy.

As the fund begins its rollout, its impact will be closely watched by policymakers, investors, and global markets. It has the potential to serve as a blueprint for how traditional banking institutions can evolve into champions of innovation and development in a rapidly changing economic landscape.

#ICBC#TechnologyInnovationFund#PrivateSectorGrowth#SemiconductorInvestment#ChinaEconomy#ChineseInnovation#EconomicDevelopment#StartupFunding#InnovationEconomy#IndustrialGrowth#HighTechInvestment#ICBCNews

0 notes

Text

MSMEs: The Backbone of India’s Economy — Features, Benefits & Their Growing Impact

Micro, Small, and Medium Enterprises (MSMEs) are very important for India’s economy. They help in making money, selling goods to other countries, and giving jobs to people. The government updates the rules for MSMEs from time to time so that businesses can get benefits like easy loans, discounts, and tax savings. In the 2025 budget, Finance Minister Nirmala Sitharaman changed the MSME rules. Now, businesses can invest 2.5 times more money, and the sales limit is also doubled. This change will help small businesses grow, try new ideas, and succeed.

The Union Budget 2025–26 brings new plans to support small businesses (MSMEs) because they are important for India’s growth, just like farming, investment, and exports.

The rules for what counts as an MSME have changed, allowing more businesses to qualify.

Small businesses will find it easier to get loans because the government is increasing loan protection.

A special program will help first-time business owners from weaker backgrounds with money support.

New efforts will also boost industries like footwear, leather, and toy making.

In this blog, we will talk about How to register an MSME in India, the different Government schemes and subsidies for MSMEs, and the Role of MSMEs in economic development. We will also look at some of the Best business ideas for MSMEs in India and the Latest Budget Changes in MSME policies in India. Additionally, we will explore MSME Registration, the various MSME Schemes, and the many MSME Benefits available for small businesses. Lastly, we will discuss the MSME Definition and the MSME Growth and Challenges in India that affect this sector.

Role of MSMEs in Economic Development

MSMEs play a very important role in India’s economy because they help in many different ways:

1. Employment Generation — MSMEs provide jobs to more than 110 million people. This makes them the second-largest source of employment after agriculture.

2. Contribution to GDP — These businesses add 30% to India’s GDP, which makes the economy stronger.

3. Export Growth — MSMEs are responsible for more than 45% of India’s exports. This helps the country trade with other nations.

4. Rural Development — Many MSMEs work in villages and small towns. This reduces migration to big cities and helps in the overall development of rural areas.

5. Innovation and Entrepreneurship — Small businesses and startups create new ideas and technologies. This leads to more jobs and business opportunities.

Despite these achievements, MSME growth and challenges in India still exist. Some of the challenges include limited access to credit, outdated technology, and regulatory burdens.

How to Register an MSME in India

MSME Registration, which was earlier called Udyog Registration, is now known as Udyam or MSME Registration. The new system is improved with better features, making it easier to use.

Getting MSME Registration is simple and has many benefits, like tax savings, subsidies, and easy loan approvals. The process is completely online and can be done through the Udyam Registration Portal. Here’s an easy step-by-step guide to help you:

1. Go to the Udyam Registration Portal — This is the official government website where businesses can register.

2. Enter Aadhaar Details — The business owner needs to provide their Aadhaar number, which should be linked to their business.

3. Fill in Business Information — Important details like PAN, GST number, and business category need to be entered.

4. Self-Declaration of Business Type — Choose whether your business is a Micro, Small, or Medium Enterprise based on its turnover and investment.

5. Submit for Verification — After filling in all the details, submit the form for verification.

Once your application is approved, you will get a unique MSME certificate. This certificate helps you enjoy MSME Benefits.

Benefits of Udyam Registration for businesses

Udyam Registration offers several benefits to businesses, especially Micro, Small, and Medium Enterprises (MSMEs):

Access to Government Schemes- Businesses can avail of subsidies, financial assistance, and other benefits under various government schemes.

Simplified Loan Process- Easier access to collateral-free loans and lower interest rates.

Tax and Duty Exemptions- Eligibility for certain tax exemptions and reduced import/export duties.

Protection Against Delayed Payments- Legal protection and interest on delayed payments from buyers.

Priority in Government Tenders- Preference in bidding for government contracts.

Enhanced Credibility- Boosts trust and marketability with a recognized certification.

Government Schemes and Subsidies for MSMEs

The Indian government has started many MSME Schemes to help small businesses grow and get financial support. Some of the most popular schemes are:

1. Prime Minister’s Employment Generation Programme (PMEGP) This scheme provides financial help to start small businesses. It offers loans with government subsidies to create job opportunities and promote self-employment.

2. Interest Subsidy Eligibility Certificate (ISEC) ISEC lowers loan interest rates for small businesses and cooperatives. It makes borrowing more affordable, helping businesses grow and expand easily.

3. Credit Guarantee Trust Fund for Micro & Small Enterprises (CGTMSE) Small businesses can get loans without collateral through CGTMSE. It supports entrepreneurs by providing financial assistance for business expansion.

4. Market Promotion & Development Scheme (MPDA) MPDA helps artisans and small businesses promote their products. It provides funds for marketing, exhibitions, and branding to boost sales and income.

5. Financial Support to MSMEs in ZED Certification Scheme MSMEs receive financial aid to improve product quality and efficiency. The scheme helps businesses get certifications, training, and better production methods.

These MSME Benefits make sure that businesses get better access to money, helping them grow and succeed in both local and international markets.

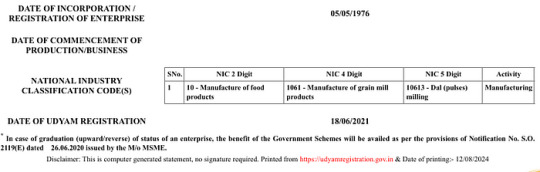

Udyam registration certificate

NIC code

“NIC” refers to the National Industry Classification code. It is used to classify the primary activity and sector of an enterprise. the NIC codes are related to dal (pulses) milling under the manufacturing sector-

NIC 2 Digit- 10 — Manufacture of food products

NIC 4 Digit- 1061 — Maufacture of grain mill products

NIC 5 Digit- 10613 — Dal (pulses) milling

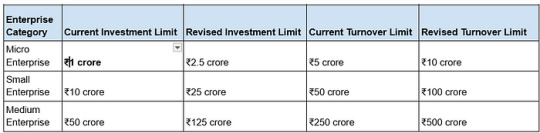

Latest Budget Changes in MSME Policies in India

Key Highlights of Union Budget 2025–26 for MSMEs-

Better Classification System

-MSME investment and turnover limits have been increased by 2.5 times and 2 times, making it easier for them to grow.

More Credit Support -Small businesses can now get up to ₹10 crore in credit guarantee, helping them access ₹1.5 lakh crore in loans over five years.

-Startups will get a ₹20 crore credit guarantee, with lower loan fees.

-MSME exporters can get loans up to ₹20 crore.

Credit Cards for Micro Enterprises -₹5 lakh credit cards will be given to micro businesses, with 10 lakh cards issued in the first year.

Support for New Entrepreneurs

-A ₹10,000 crore Fund of Funds will support startups.

-₹2 crore loans for 5 lakh first-time women, SC, and ST entrepreneurs.

Boost for Labour-Intensive Industries

-Footwear, leather, and toy industries will get government support to create more jobs.

Manufacturing and Clean Energy -A National Manufacturing Mission will help small and big industries grow.

-Support for clean energy industries like solar panels, EV batteries, and wind turbines.

These steps will help MSMEs grow, create jobs, and strengthen India’s economy.

How Can Biz Consultancy Help You Start Your MSME Business?

If you are planning to start your business in the MSME sector, Biz Consultancy is here to guide you at every step. From business setup and registration to obtaining necessary approvals and government support, they provide end-to-end assistance. Whether you need help with legal formalities, funding opportunities, or compliance requirements, Biz Consultancy ensures a smooth and hassle-free business journey, helping you establish a strong foundation for success.

Conclusion

MSMEs are the backbone of India’s economic growth. They create jobs, add to the country’s GDP, and support both rural and urban economies. The government is working hard to make the MSME sector stronger by offering MSME registration, financial schemes, and helpful policies. With more focus on innovation, sustainability, and making business easier, MSMEs are ready to play an even bigger role in shaping India’s future.

If you’re thinking about starting your own MSME, this is the perfect time to use government support and take advantage of the opportunities available.

#bizconsultancy#msme#msmes#msmeregistration#msmebenefits#msmefeatures#msmebusiness#msmebudget2025#msmelatestbudget#niccode#udyamregistration#economicdevelopment#growth

0 notes

Text

Discover cost-effective strategies to reduce land development expenses in Jacksonville, FL, without compromising quality. To learn how to optimize resources, streamline processes, and maximize your budget for successful land projects visit https://www.jacksonvillelandclearing.com/post/how-to-reduce-land-development-expenses-in-jacksonville-fl-without-compromising-quality

#LandDevelopment#UrbanPlanning#SustainableDevelopment#RealEstateTrends#ConstructionIndustry#SmartCities#Infrastructure#ZoningLaws#PropertyDevelopment#LandUse#EnvironmentalImpact#CommunityDevelopment#GreenBuilding#DevelopmentTrends#UrbanRenewal#LandClearing#RealEstateInvesting#Placemaking#SmartGrowth#FutureOfCities#EconomicDevelopment#SiteSelection#BuildingBetterCities#DevelopmentRegulations#CityPlanning

0 notes

Text

Top Sectors Attracting Foreign Investment in India

India's foreign direct investment growth is surging! From April 2000 to September 2024, the service sector led with a 16.0% FDI equity inflow worth US$ 115.18 billion. The computer software and hardware industry followed at 15.0% with US$ 107.07 billion.

India foreign investment 2024 also soared in trading (7.0%), telecommunications (6.0%), and automobiles (5.0%). Want to know what’s next? India Brand Equity Foundation covers the latest insights!

#foreigninvestment#investinindia#fdiindia#economicdevelopment#foreigninvestmentpolicy#fdigrowth#fdipolicies

0 notes

Text

Discover why professional ground clearing services are essential for land development. Ensure safe, efficient, and eco-friendly site preparation with expert clearing solutions. To learn more services visit https://mississippilandclearing.net/2025/02/08/why-professional-ground-clearing-services-are-essential-for-land-development/

#LandDevelopment#UrbanPlanning#SustainableDevelopment#RealEstateTrends#ConstructionIndustry#SmartCities#Infrastructure#ZoningLaws#PropertyDevelopment#LandUse#EnvironmentalImpact#CommunityDevelopment#GreenBuilding#DevelopmentTrends#UrbanRenewal#LandClearing#RealEstateInvesting#Placemaking#SmartGrowth#FutureOfCities#EconomicDevelopment#SiteSelection#BuildingBetterCities#DevelopmentRegulations#CityPlanning

0 notes

Text

Utkarsh India’s Executive Director, Mr. Utkarsh Bansal, shares his optimistic outlook on growth opportunities following the Union Budget 2025. With a focus on infrastructure, sustainable development, and innovation, the budget presents key opportunities for expansion and industry growth. Learn more about his insights and future strategies.

0 notes

Text

Vision 2025: Driving Growth and Global Competitiveness

Key Focus Areas:

1. Accelerate Growth: Emphasis on private sector investments, boosting middle-class spending, and inclusive development.

2. Global Growth: Focus on agricultural prosperity, rural resilience, manufacturing (Make in India), MSMEs, energy security, exports, and innovation.

3. Four Engines of Growth:

Agriculture: PM Dhan Dhaanya Krishi Yojana (100 districts), Aatma Nirbharta in edible oils, Makhana Board in Bihar, seafood exports, and 5F vision in textiles.

MSMEs: Enhanced investment and turnover limits, focus on footwear, leather, toys, and clean tech manufacturing (solar, EVs, wind turbines).

Investments: Nutritional support (Poshan 2.0), broadband in schools, IIT expansions, AI Centers of Excellence, urban challenge fund, and infrastructure development.

Exports: Export promotion mission, Bharat Trade Net, and easing trade documentation.

Key Initiatives:

1. Agriculture:

- PM Dhan Dhaanya Krishi Yojana: Covers 100 low-productivity districts, aims to enhance crop diversification, storage, irrigation, and credit access for 1.7 crore farmers.

- Aatma Nirbharta in Edible Oils: 6-year mission for Toor, Urad, and Masoor.

- Makhana Board: Established in Bihar to boost makhana production.

- Seafood Exports: Focus on sustainable fisheries in Andaman & Nicobar and Lakshadweep.

- 5F Vision: Farm to Fibre to Factory to Fashion to Foreign in textiles.

- Urea Plants: New plants in Eastern India (Naamroop, Assam).

2. MSMEs:

- Enhanced investment and turnover limits for MSME classification.

- Focus on footwear, leather, and toys manufacturing.

- Clean Tech Manufacturing: Solar PV cells, EV batteries, wind turbines, and grid-scale batteries.

3. Investments:

- Poshan 2.0: Nutritional support for 8 crore children, 1 crore pregnant women, and 20 lakh adolescent girls.

- Education: Broadband in schools, IIT expansions, and AI Centers of Excellence.

- Urban Development: Rs. 1 lakh crore urban challenge fund.

- Infrastructure: Public-private partnerships, power sector reforms, and nuclear energy mission (100 GW by 2047).

- Tourism: Development of top 50 tourist destinations, e-visa streamlining, and focus on Buddhist sites.

4. Exports:

- Export Promotion Mission: Easy access to export credits and cross-border factoring.

- Bharat Trade Net: Digital platform for trade documentation and financing.

- FDI in Insurance: Raised to 100% for companies investing premiums in India.

Tax Reforms:

1. Direct Tax Proposals:

- Simplified tax structure for individuals and businesses.

- Increased TDS limits for senior citizens and rent.

- Extended time limit for updated returns (2 to 4 years).

- Presumptive taxation for non-residents in electronics manufacturing.

- Tax benefits for startups incorporated before 1.4.2030.

2. Income Tax Slabs:

- 0-4 lakh: Nil

- 4-8 lakh: 5%

- 8-12 lakh: 10%

- 12-16 lakh: 15%

- 16-20 lakh: 20%

- 20-24 lakh: 25%

- Above 24 lakh: 30%

3. Tax Benefits:

- No tax for income up to Rs. 12 lakh (excluding capital gains).

- Standard deduction of Rs. 75,000 for salaried employees.

Fiscal and Economic Measures:

1. Fiscal Deficit: Estimated at 4.4% of GDP.

2. Customs Duty Reforms:

- Reduction in tariff rates (only 8 rates remaining).

- Exemptions for life-saving drugs, EV batteries, and capital goods.

3. Mining and Tourism:

- State Mining Index to encourage mining.

- Development of tourist destinations and medical tourism.

5 Domains of Growth for Next 5 Years:

1. Taxation: Simplified and taxpayer-friendly reforms.

2. Power Sector: Reforms and nuclear energy mission.

3. Urban Development: Infrastructure and urban challenge fund.

4. Mining: Encouragement through State Mining Index.

5. Financial Sector: Regulatory reforms and FDI liberalization.

Vision:

Vikasit Bharat: Focus on democracy, demography, and demand as key pillars.

Green and Inclusive Growth: Emphasis on sustainable practices, youth, women (Naari), and farmers (Annadata).

Global Competitiveness: Boosting exports, innovation, and manufacturing

For daily stock market analysis and updates, visit tradabulls.com.

1 note

·

View note

Text

ICYMI: Edo Governor Signs Electricity Bill into Law http://dlvr.it/TJj6BH Follow, Like & Share

0 notes