#Economic Lifestyle

Explore tagged Tumblr posts

Text

Frugal Living: How Cutting Costs Can Lead to Millionaire Status

Unlock the path to millionaire status with the art of frugal living! 🌿✨ Discover practical tips to cut costs, save money, and build wealth. 💰💡 Read the full blog - Link-In-Bio #FrugalLiving #MillionaireStatus #SmartSpending #WealthBuilding #Millionaire

Do you dream of becoming a millionaire someday? Do you think that you need to earn a lot of money, start a successful business, or win the lottery to achieve this goal? If so, you might be surprised to learn that there is another way to become a millionaire that does not depend on luck or income. It’s called frugal living. Frugal living is the practice of living below your means and saving as…

View On WordPress

#Budgeting#Budgeting Hacks#Cost Cutting#Economic Lifestyle#Financial Freedom#Financial Independence#Financial Strategies#Financial success#Frugal Living#Frugal Living Ideas#Frugal Tips#Frugality#Millionaire Mindset#Millionaire Status#Money Management#Money Saving Tips#Personal Finance#Save and Invest#Save Money#Smart Spending#Thriftiness#Thrifty Living#Wealth building#Wealth creation

0 notes

Text

500 Blue Biden counties generate 71% of GDP.

2500 Red MAGA counties generate 29% of GDP.

Democratic counties are wealthier because they are urbanised, better educated, economically complex, and more productive economically.

Essentially, the wealth generating parts of the economy are also less conservative because of education and diversity.

🎯

414 notes

·

View notes

Text

I always forget that monarchists exist and then I see someone with the username duchessofmyheartforever or williamisababe posting about how it's mean to giggle at an ultrarich economic leech experiencing just a fraction of struggle and inconvenience (because lets be honest, he probably wont kick the bucket—his doctors are paid to keep his corpse animated long after it ceases to be humane)

#iv.txt#uk politics#ntm crying to tumblr staff about it like bestie they do not fucking care#blah blah 'its not funny to joke about cancer what if it was your family member'#like literally everyone is affected by cancer either their own or a loved ones#i dont have to imagine ive already lost two family members#i promise you. we are not joking about cancer. we are joking about the parasite in chief using our tax money#to pay for private top class healthcare while his subjects#the taxpayers that fund his lifestyle#die of the same thing due to nhs strikes because instead of paying doctors humane wages their money goes to maintaining an archaic#and outdated#system that only serves to uphold a status quo long outgrown#but sure. complain to tumblr staff#its not a laughter of glee its a cold and mirthless 'ha'#see how at the end of the day even you are mortal. how does it feel to fear for your life? how does it feel to know hundreds of thousands#of your citizens live fearing for their lives every day because of the economic crisis you and your government have created

42 notes

·

View notes

Text

10/15/24

I am still here. Been a tough week. Weight unknown. Rough period, been sick for a long time, hurt rib, tough to sleep. Never feel rested.

Work is weird. They just let go someone who had 24 years of experience in a really hard to learn computer system. She was the one who did almost all of our extremely high dollar claims. The knowledge we lost due to the lack of documentation for this stupid system is unknown. I surmise she was let go (from the context) because she was working off the clock.

Did they stop to think or ask why she felt like she had to work off the clock? Did they stop to think how our team would be affected?

Idk, but they canned her anyway.

Anyone could be next.

I am heartbroken for her, and scared myself because I am generally a loud mouth fuck up. I have no where near the level of knowledge that she had.

If they weren't paying for school I would try to shamble somewhere else that has a better culture.

Or better yet, just care for mom until she passes. Play games. Read. Quality time and not worry about the future.

I hate that I struggle with basic tech stuff. I am having problems getting into one of the classroom systems for school. They keep sending authentication to my work email, which i cannot be on if I am not working and I cannot be working on school when I am working. Catch 22.

Add new terror to my dieting experience.

Overeating, although a conditioned response, is still my go to. I weighed over 300 pounds, it was my go to for a very long time. I am trying to overcome that BS but it is a struggle.

But... for today, I am going to do what I can. Stand at my desk. Hopefully get some good steps in and go to jiu jitsu class.

I had a delightful salad for lunch and just whipped up an apple cider yogurt dip thing that I am planning to use with apple cinnamon rice cake bites. Just plain nf Greek yogurt & sf apple cider mix.

Last night's dinner was chicken & asparagus risotto, which had rice in it. Idk that i knew that when I bought it but I ate it.

I worked out to beat off the stress from the school problem. (And to try to stay "in habit" because I have a hard time with habits. Prolly she to undiagnosed ADHD. )

#healthy lifestyle#getting healthy#losing weight#healthy eating#fitblr#healthy habits#operation lose this gut#weight loss#operationlosethisgut#weight loss journey#having a diagnosis is privilege#suspected adhd#wealthy privilege#poor#economic instability#paycheck to paycheck#job worry#job stress#hate my job#but i cant#leave either#workout log#daily notes#dinner#salad#dietista#dealing with stress#coping mechanism#coping#caregiver

10 notes

·

View notes

Text

i dont have the words to phrase this right but like. just bc a land is colonized doesnt mean that forever and always the products of that land are the colonizers. mexican food isnt spainsh (spain) food. algerian food isnt french food. usamerican food isnt british food.

there is history & culture before colonization. during occupation countries have unique experiences from their colonizers due to any number of factors(trading, economy, migration etc). and after independence those countries continue to have unique experiences that define their culture & food

i assure you that sometime in the past 250 years people have created new communities & cultures and that this is reflected in their cuisine

#also why i dont put up w ppl who hate on fusion/immigrant cuisine. blah blah it isnt REAL [place] food#ofc it isnt! theyre in a new land w different foods available + cooking styles/tools + neighbors + lifestyles + economic class.#like yes that will change things a bit. it isnt wrong or bad! just different!

7 notes

·

View notes

Text

Venture predation

Tomorrow (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on Monday (May 22), I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On Tuesday (May 23), I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

They said it couldn’t happen. After decades of antitrust enforcement against Predatory Pricing — selling goods below cost to kill existing competitors and prevent new ones from arising — the Chicago School of neoliberal economists “proved” that predatory pricing didn’t exist and that the courts could stand down and stop busting companies for it.

Predatory pricing — the economists explained — may be illegal, but it was also imaginary. A mirage. No one would do predatory pricing, because it was “irrational.” And even if there was someone irrational enough to try it, they would fail. Stand down, judges of America — predatory pricing is solved.

Chicago School economists — whose job (to quote David Roth) is to find new ways to say “actually, your boss is right” — held enormous sway of the federal judiciary. The billionaire-backed Manne Seminars offered free “continuing education” junkets to judges — all-expense-paid luxury vacations salted with lengthy your-boss-is-right econ seminars. 40% of the US federal judiciary got their heads filled up at a Manne Seminar.

For monopolists and other predators, the Manne Seminar was an excellent return on investment. After attending a Manne Seminar, the average judge’s legal decisions tipped decidedly in favor of monopoly, operating on the Chicago bedrock assumption that monopolies are “efficient,” and, where we see them in nature, we should celebrate them as the visible manifestation of the entrepreneurial genius of some Ayn Rand hero in a corporate boardroom:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

A little knowledge is a dangerous thing. Even as post-Chicago economists showed that predatory pricing was both possible and rampant, a “rational” and effective strategy for cornering markets, suppressing competition, crushing innovation and gouging on price, judges continued to craft tortuous, unpassable tests that any predatory pricing case would have to satisfy to proceed. Economics moved on, but predatory pricing cases continued to fail the trial-by-ordeal constructed by Chicago-pilled judges.

Which is a shame, because there are at least three ways that predatory pricing can be effective:

Cost Signaling Predation: A predator tricks competitors into thinking they’ve found a new way to cut their costs, which allows them to drop prices. Competitors, fooled by the ruse, exit the market, not realizing that the predator is merely subsidizing their products’ costs to trick them.

Financial Market Predation: A predator tricks the competitors’ creditors into thinking the predator has a new way to cut costs. The creditors refuse to loan the prey companies the money needed to survive the price war, and the prey drops out of the war.

Reputation Effect Predation: A predator subsidizes prices in one region or one line of goods in order to trick prey into thinking that they’ll do the same elsewhere: “Don’t try to compete with us in Cleveland, or we’ll drop prices like we did in Tampa.”

These models of successful predation are decades old, and have broad acceptance within economics — outside of Chicago-style ideologues — but they’ve yet to make much of a dent in minds of the judges who hear Predatory Pricing cases.

While judges continue to hit the snooze-bar on any awakening to this phenomenon, a new kind of predator has emerged, using a new kind of predation: the Venture Predator, a predatory company backed by venture capital funds, who make lots of high-risk bets they must cash out in ten years or less, ideally for a 100x+ return.

Writing in the Journal of Corporation Law Matthew Wansley and Samuel Weinstein — both of the Cardozo School of Law at Yeshiva University — lay out a theory of Venture Predation in clear, irrefutable language, using it to explain the recent bubble we sometimes call the Millennial Lifestyle Subsidy:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4437360

What’s a Venture Predator? It’s “a startup that uses venture finance to price below its costs, chase its rivals out of the market, and grab market share.” The predator sets millions or billions of dollars on fire chasing “rapid, exponential growth” all in order to “create the impression that recoupment is possible” among future investors, such as blue-chip companies that might buy them out, or sucker retail investors who buy in at the IPO, anticipating years of monopoly pricing.

In other words, the Venture Predator constructs a pile of shit so large and impressive that investors are convinced that there must be a pony under there somewhere.

There’s another name for this kind of arrangement: a bezzle, which Galbraith described as “the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it.”

Millennial Lifestyle Subsidy companies are bezzles. Uber, annihilated tens of billions of dollars on its bezzle, destroying the taxi industry and laying waste to public transit investment, demolishing labor protections and convincing people that impossible self-driving robo-taxis were around the coner:

https://pluralistic.net/2021/02/16/ring-ring-lapd-calling/#uber-unter

But while Uber the company lost billions of dollars, Uber’s early investors and executives made out like bandits (or predators, I suppose). The founders were able to flog their shares on the secondary market long before the IPO. Same for the early investors, like Benchmark capital.

Since the company’s IPO, its finances have steadily worsened, and the company has resorted to increasingly sweaty balance-sheet manipulation tactics and PR offensives to make it seem like a viable business:

https://pluralistic.net/2022/08/05/a-lousy-taxi/#a-giant-asterisk

But Uber can’t ever recoup the billions it spent convincing the market that there was a pony beneath its pile of shit. The app Uber uses to connect riders with the employees it misclassifies as contractors isn’t hard to clone, and it’s not hard for drivers or riders to switch from one app to another:

https://locusmag.com/2019/01/cory-doctorow-disruption-for-thee-but-not-for-me/

Nor can Uber prevent its rivals from taking advantage of the hundreds of millions of dollars it spent on “regulatory entrepreneurship” — changing the laws to make it easier to misclassify workers and operate unlicensed taxi services.

It’s not clear whether Uber ever believed in robo-taxis, or whether they were just part of the bezzle. In any event, Uber’s no longer in the robotaxi races: after blowing $2.5B on self-driving cars, Uber produced a vehicle whose mean-distance-between-fatal-crashes was 0.5 miles. Uber had to pay another company $400M to take its self-driving unit off its hands:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Uber’s prices rose 92% between 2018–21, while its driver compensation has plunged. The company is finding it increasingly difficult to passengers into cars, and drivers onto the road. They have invented algorithmic wage disrimination, an exciting new field of labor-law violations, in order to trick drivers into thinking there’s a pony under all that shit:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

To Uber’s credit, they have been a wildly innovative company, inventing many new ways to make the pile of shit bigger and the pony more plausible. Back when Uber and Lyft were locked in head-to-head competition, Uber employees created huge pools of fake Lyft rider accounts, using them to set up and tear down rides in order to discover what Lyft was charging for rides in order to underprice them. Uber also covertly operated the microphones in its drivers’ phones to listen for the chimes the Lyft app made: drivers who had both Lyft and Uber installed on their devices were targeted for (strictly temporary) bonuses.

Uber won’t ever recoup, but that’s OK. The investors and execs made vast fortunes. Now, normally, you’d expect company founders and other managers with large piles of stocks in a VC-backed company to be committed to the business’s success, at least in the medium term, because their shares can’t be liquidated until well after the company goes public.

But the burgeoning “secondary market” for managers’ shares has turned investors and managers into co-conspirators in the Venture Predation bezzle: “half of Series A and B deals now have some secondary component for founders.” That means that founders can cash out before the bezzle ends.

The trick with any bezzle is to skip town while the mark is still energetically digging through the shit, before the pony is revealed for an illusion. That’s where crypto comes in: during the cryptocurrency bubble, VCs cashed out of their investments early through Initial Coin Offerings and other forms of securities fraud. The massive returns this generated were well worth the millions they sprinkled on Superbowl ads and bribes for Matt Damon.

But woe betide the VC who mistimes their exit. As Wework showed, it’s entirely possible for VCs to be left holding the bag if they get the timing wrong. Wework blew $12b on predatory pricing — promising tenants at rivals’ businesses moving bonuses or even a year’s free rent, all to make the pile of shit look larger and thus more apt to contain a pony. The company opened its co-working spaces as close as possible to existing shops, oversaturating hot markets and showing “growth” by poaching customers through deep subsidies, then pretending that those customers would stay when the subsidies evaporated. But Wework’s “product” was temporary hot-desks, occupied by people who could (and did) move at the drop of a hat.

To its competitors, its competitors’ creditors, and credulous investors, it appeared that Wework had developed some kind of “efficiency advantage” — a secret sauce that let it sell a product at a price that was far below its rivals’ costs. But once Wework filed for its IPO, its S-1 — the form that discloses the company’s finances — revealed the truth. Wework’s only “advantage” was the bafflegab of its cult-like leader and the torrent of cash supplied by its VCs.

Wework’s IPO was a disaster. After canceling a real IPO, the company eventually went public through a scammy SPAC, saw its shares immediately tank, and continue to fall, as its balance-sheet is still blood-red with losses.

Another Venture Predator is Bird, the company that flooded American cities with cheap, flimsy Chinese scooters, choking curbs and sidewalks. 25% of the gross revenues from each scooter ride had to be written off as depreciation on the scooter. As a Bird spokesperson told the LA Times: “There are very few unique companies for which you can build global scale really quickly and build a dominant market position before other people do, and for those rarefied companies scaling quickly matters more than short-term profits.”

Bird was another company that could never recoup, whose executives and investors could only cash out if they could maintain the faint hope of the pony underneath its pile of shitty scooters. It drove the company to some genuinely surreal lengths. For example, in 2018, I reported on the existence of a kit that let you buy an impounded Bird scooter for pennies and retrofit it to run without an app, so you could take it anywhere:

https://boingboing.net/2018/12/08/flipping-a-bird.html

Shortly thereafter, I got a legal threat from Linda Kwak, Bird’s Senior Corporate Counsel, claiming that publishing a link to a website that sells you a product you install by unscrewing one board and inserting another was a violation of Section 1201 of the DMCA, which was an astonishingly stupid claim:

https://www.eff.org/document/bird-rides-takedown-boing-boing-dec-20-2018

It was also an astonishingly stupid claim to make to me, a career activist with 20 years experience fighting DMCA1201, a decades-old professional affiliation with EFF, and a giant megaphone:

https://boingboing.net/2019/01/11/flipping-the-bird.html

But Bird was palpably desperate to keep its bezzle going, and Kwak — an employment lawyer with undeniable deficits in her understanding of copyright and cyber-law — was their champion

Fascinatingly, one thing Bird didn’t worry about was competition from Uber and Lyft, who piled into the e-scooter market. Bird circulated a (leaked) pitch-deck reassuring investors that Uber/Lyft weren’t gunning for them, because they ““won’t subsidize prices” as they prepared for their IPOs, which involved disclosing their finances to their investors.

Bird’s investors either lost money or made small-dollar returns, but they were outfoxed by Bird founder Travis VanderZanden, a superpredator who cashed out $44m in shares just as the VCs were piling in.

Venture Predation is another stinging rebuttal to the Chicago School’s blithe dismissal of Predatory Pricing as an illusion. Private firms — of the sort that VCs back — whose boards are made up of founders and VCs who stand to benefit from the pile-of-shit gambit are perfectly capable of spending huge fortunes to make Predatory Pricing work. VCs make a practice of repeatedly co-investing in businesses together, which fosters the kind of trust that allows for these gambits to be played again and again.

For later stage, pony-thirsty investors who get stuck holding the bag, the lure of monopoly profits is both powerful and plausible — after 40 years of antitrust neglect, monopolies are the kinds of things one can both attain and defend (think of Peter Thiel’s maxim, “competition is for losers,” or Warren Buffett’s terrifying priapisms induced by the mere thought of businesses with “wide, sustainable moats”).

In a world of Facebook and Google, dreaming of monopolies isn’t irrational — it’s aspirational.

VCs are ideally poised to play the Venture Predation gambit. They are risk-tolerant and need to cash out over short timescales. What’s more, VCs’ longstanding boasts of their ability to identify companies who have invented new, super-efficient ways to do boring things like “rent out office space” or “provide taxis” gives the pile-of-shit pony-pitch a plausible ring.

The Venture Predator gambit isn’t just a form of plute-on-plute violence in which billionaires fleece millionaires. Like any anticompetitive scam, Venture Predators are able to pick winners in the marketplace — rather than getting the taxi or the office rental service or the scooter that serves you best, you get the scammiest version.

Workers who are roped in by the scam also suffer — the authors raise the example of a cab driver who leases a car to drive for Uber, based on the early subsidies the company offered, only to find themselves unable to make payments once the bezzle ends and Uber starts clawing back the driver’s wages.

Then there’s the cost to society: during the decade-plus in which Uber was pissing away the Saudi royal family’s billions subsidizing rides, cities dismantled their public transit, even as residents made decisions about where to live and work based on the presumption that Uber was charging a fair, sustainable price for rides.

The authors propose a bunch of legislative fixes for this, but warn that none of them are likely to get through Congress or the Manne-pilled judiciary. But they do hold out hope for a proposed SEC rule “requiring large, private companies to make basic financial disclosures.” These disclosures would make it impossible for companies to pretend that they had built a better mousetrap when all they had was a bigger pile of shit.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/19/fake-it-till-you-make-it/#millennial-lifestyle-subsidy

[Image ID: A giant pile of manure with a pony sticking out of it.]

Image: Eli Duke (modified) https://www.flickr.com/photos/elisfanclub/6834356283

CC BY-SA 2.0 https://creativecommons.org/licenses/by-sa/2.0/

#pluralistic#antitrust#financial market predation#millennial lifestyle subsidy#Venture predation#predatory pricing#robertson-pattman act#post-chicago economics#clayton act#sherman act#uber#reputation-effect predation#game theory#time for some game theory motherfuckers#chicago school#cooling the mark#cost-signaling predation#network effects#enshittification#rugged#rug-pulls#platform decay#platform economics#economics#fake it till you make it#law#scholarship

63 notes

·

View notes

Text

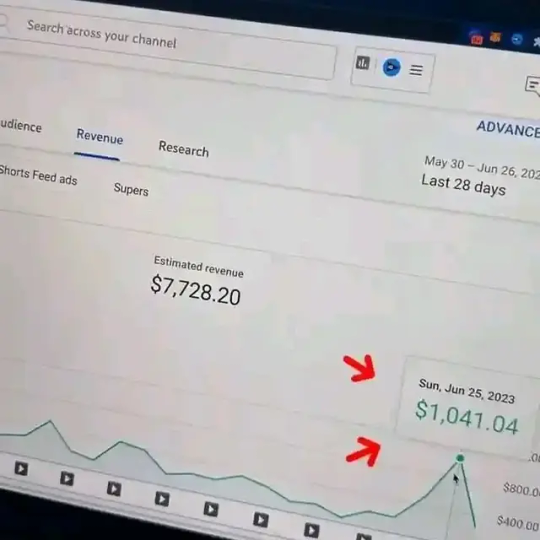

The best way to make good and great passive income through YouTube automation

I do help people to create and manage their channel for them to make money through it

#home & lifestyle#economics#capitalism#entomology#paleontology#archaeology#ancient egypt#folklore#dinosaurs#geology#passive income#youtube channel#professional interior designer#youtube video#youtube music#youtube shorts#youtube gaming#saturday night jazz#new video#ejw7#passive aggressive#Huge income

4 notes

·

View notes

Text

#baphomet#dank memes#entomology#folklore#home & lifestyle#humor#illustration#my art#ancient egypt#economics#capitalism

4 notes

·

View notes

Text

Understanding Burnout: A Personal Journey into Life's Overwhelming Fatigue

Web Life is a beautiful journey, filled with ups and downs, joys and sorrows. But what happens when the downs seem to outweigh the ups, and the sorrows overshadow the joys? What happens when every day feels like a struggle, and the mere act of getting out of bed feels like climbing Mount Everest? This, my dear readers, is what burnout feels like. The Weight of Burnout Imagine waking up every…

View On WordPress

#absenteeism#anxiety#burnout#depression#disinterest#economic implications#economic toll#emotional exhaustion#lifestyle changes#mental fatigue#Mental Health#overwhelming fatigue#personal toll#physical health#productivity drop#prolonged stress#relationships#therapy#turnover rates

6 notes

·

View notes

Text

What Would an Economy That Loved Black People Look Like? - Non Profit News | Nonprofit Quarterly

What would it look like if the economy loved Black people? I hold this question in my heart every day as I reflect on our current economic conditions and strategize about building a reimagined economy rooted in equity, justice, and liberation.

To be serious about closing the racial wealth gap and building an economy that loves Black people, we need to focus our attention on the US South.

One thing I am certain of is that the systemic barriers and inequities that are embedded in present financial structures have no place in a reimagined economy. I would further contend that to transform our economy into one that loves Black people, movements need to get more intimate with the topic of power. Alicia Garza defines power as “the ability to change your circumstances and the circumstances of other people.” She talks about how being precise about power helps us be precise about strategy. Without a clear destination, the steps that are taken are going to be disordered.

As a financial activist and reparative capital investor, power and power building in this context means shifting financial policies, practices, and infrastructure into ones that seed and sustain change. It means joining with values-aligned wealth holders and investors to disrupt power by dismantling the systems that have obstructed Black communities from building generational wealth. And it means that to be serious about closing the racial wealth gap and building an economy that loves Black people, we need to focus our attention on the US South, where roughly 56 percent of Black people in the United States call home. We must invest in the Southern Black creatives, innovators, and leaders who are the biggest exporters of culture around the world and on the frontlines of change and community power building.

Closing the Racial Wealth Gap in the South

US researcher and agricultural law expert Nathan Rosenberg has said, “If you want to understand wealth and inequality in this country, you have to understand Black land loss.” Jubilee Justice, an organization founded by Konda Mason, who serves as the strategic director of my firm RUNWAY, recognizes that land ownership provides a pathway to create generational wealth, access financial resources, have agency over agricultural and sustainable land management practices, and foster community resilience.

In the rural South, Black farmers have historically experienced—and continue to experience—a lack of access to agricultural resources and credit. They also continue to face discrimination, and exclusion from government programs, loans, and subsidies. This result is the loss of farmland and restricted opportunities for economic growth.

Of all private US agricultural land (excluding Indian Country), according to a US Department of Agriculture study, White people comprise 96 percent of farmers, own 98 percent of the acres, and generate 97 percent of farm earnings. From 1900 to 1997, the number of Black farmers decreased by more than 97 percent; in the South, Black landowners lost 12 million acres of farmland over the past century, amounting to $326 billion worth of lost land in the United States due to discrimination.

The unjust policies that denied, dispossessed, and restricted Black individuals and communities of land ownership in the past have cast a long shadow. Policies that have routinely prevented Black communities from building generational wealth, like redlining and denying Black people mortgage loans and insurance, persist and are reflected in the massive racial wealth gap we’re still seeing today.

Even as the struggles for civil rights, inclusion, and economic justice gain ground, investment in the South remains uneven. Grantmakers for Southern Progress shares that the South receives less than three percent of all philanthropic investment in the United States. We must increase philanthropic action to build the capacity of community-based organizations and networks leading structural change work in the region.

As Tamieka Mosley of Grantmakers for Southern Progress and Nathanial Smith of the Partnership for Southern Equity, share: “If the South—the birthplace of historic and destructive inequities—rallies to end structural injustice, it can model for the country what the journey toward racial justice and equity looks like.”

Black communities continue to experience the ongoing legacy of slavery and racism through blatant discrimination from financial institutions whose inequitable lending practices limit Black entrepreneurs from attracting early critical investments. On average, early-stage entrepreneurs need about $30,000 in capital to get their initiatives off the ground, with friends and family of entrepreneurs on average providing $23,000 or more than three quarters, of the needed amount. All told, nationally friends and family investing exceeds $60 billion a year, nearly three times the investment level of venture capitalists.

However, not everyone has equal access to this vital source of capital. In 2019, the median White family in the United States had $184,000 in wealth compared to just $38,000 and $23,000 for the median Latinx and Black families, respectively. With this racial wealth disparity, Black entrepreneurs are less likely to receive early-stage funding from friends and family—a critical lifeline for business startups and growth opportunities.

It is especially critical because capital from friends and family typically has more flexible lending terms and is not tied to a person’s credit score; rather, it is based on the level of trust people have in the preparation of the business owner. These relationships and informal networks also provide other nonfinancial resources such as business advising, referrals, and support systems. For many Black entrepreneurs, particularly women, racial wealth inequality is the leading factor in why their great ideas never leave the napkin.

RUNWAY believes giving every Black entrepreneur access to the “friends and family” round of investing will be transformational for Black communities. The key to this process, as mentioned, is trust.

By infusing trust into exploitative and extractive systems, we can facilitate pivotal early-stage investments along with wraparound entrepreneurial ecosystem support like business coaching and advising. We can provide “friends and family” funding using patient, flexible capital to advance resiliency for Black businesses and the communities they serve.

Investing in people and places that have been historically excluded from traditional investment support will always appear risky to foundations and fund managers. The best antidote to that risk is to build trust-based, honest relationships with local community leaders and changemakers who deeply understand the region and the specific needs of that region. In the South, those relationships will be based on listening, mutual aid, and physical presence. These types of relationships are critical to making investments that shift the balance of power toward equity and wealth regeneration for Black communities.

Listening to the Community

I recently gathered in my home state of Alabama with a delegation of fund managers, investors, and philanthropists to bring reparative finance to the people and places that have been systemically blocked from wealth building opportunities as part of RUNWAY ROOTED, my organization’s latest initiative to invest in Southern Black entrepreneurship, creativity, and innovation.

It takes long-term, non-extractive, reparative investments . . . to undo the systemic design of racial hierarchy and imagine new possibilities.

We spent a week moving through the region to learn from community leaders, creatives, and local representatives about the unique economic challenges in the area. The experience illuminated the fact that Black business ownership is a mechanism that not only builds economic power, but social and political power as well.

Truth be told, in most cases, resistance from investors and wealth holders goes back to power. Those in power don’t want to let go of it. But the conversations like the ones we had in Alabama signal that things are changing. We must be deliberate in how we apply pressure. This involves deep collaboration between movement leaders, creatives, and community, as well as with investors, funders, and wealth holders. We must collaborate on ways to work together and co-conspire to build collective power.

Building collective power takes telling the truth about why Black people in places like Jackson, MS remain deeply entrenched in age-old, stubborn barriers to economic opportunity. It takes investors who are willing to reckon with a history that built wealth by stealing land from Indigenous nations and extracting free labor from enslaved Africans—and to invest in repairing the conditions that presently uphold the racial wealth gap. And it takes long-term, non-extractive, reparative investments that remind us that the real work is to undo the systemic design of racial hierarchy and imagine new possibilities.

Investing in Southern Creatives

Shaping our collective future into one that loves Black people needs the joy, inspiration, and useful critique of our political, economic, and social systems that come from creative thinkers and makers through their art, organizing, and visionary disruption. To tap into this dynamic force of change, it is vital to ensure that the extractive finance of the past does not block our collective ability to invest in the talent and innovation of the future.

This work requires long-term, flexible commitments of capital, time, and . . . support for Black-led businesses and innovation in the South.

Reimagining and collaboratively shaping a world where Black people are loved means prioritizing investments in creative entrepreneurs and creative placemaking. It means investing in places like Gee’s Bend, AL, to bring long-term business capital to the women who carry the legacy and tradition of West African quilting—one of the most important cultural contributions to the history of art in the United States. It means partnering with organizations like Upstart Co-Lab and Souls Grown Deep Foundation, who journeyed with us in Alabama, to invest in the arts, cultural, design, and innovation industries in the South with a mission toward repair and justice.

Philanthropy and investments that are transformative and inclusive are not only about diversifying the seats at the decision-making table. They also invite multiple voices into the design rooms where the table is carved out and set, ensuring it is broad and deep enough to nourish the future of local and national communities.

This work requires long-term, flexible commitments of capital, time, and capacity with a willingness to resolve disparities in funding and support for Black-led businesses and innovation in the South. It’s also necessary to acknowledge that the economic development programs that work for coastal metros or major cities may not be the same for the South—and need to be thoughtfully adapted to meet the distinct community needs, local infrastructure, and pulse of the region. By listening deeply and building authentic relationships with community leaders, community transformation over time can occur on community terms. Through this process, people are transformed—and so are community social and economic conditions.

I’ve always felt like investing in artists, creatives, and innovators does what Nina Simone famously said: “An artist’s duty, as far as I’m concerned, is to reflect the times.” Simone believed that artists and creatives have a responsibility to create work that reflects and addresses the social, political, and cultural climate of their era; that art has the power to serve as a mirror of society, bringing attention to important issues and fostering dialogue and understanding.

Today, the creative economy represents $985 billion in economic opportunity. This is also a time when art from creators like Amanda Gorman, who became the youngest inaugural poet in US history when she performed “The Hill We Climb” during President Joe Biden’s inauguration in 2021, is being banned in Florida schools. Responses like this tell us that art does indeed have power. Creativity has power. Innovation and truth-telling have power. And power is transformative.

…..

Building an economy that truly loves Black people requires a profound shift in financial structures and the way money moves. Investing in the South and supporting Southern Black creatives, innovators, and leaders is a pivotal step in redressing land loss and the discriminatory lending practices Black entrepreneurs continue to face.

We live in a moment of incredible opportunity. The mission (and the challenge) here is to take this moment and turn it into a movement that sustains the transformative work required to build an economy where we all have the power—and the right—to thrive.

#What Would an Economy That Loved Black People Look Like#Black Economics#Black Peoples Money#Black Money Matters#Black Finance#Black Lives Matter#Black Lifestyles Matter#Finance#financial structures#Black Entrepreneurs

2 notes

·

View notes

Text

The Pointlessness of the SAG Strike 2023

In recent weeks, the entertainment industry has been rocked by news of the Screen Actors Guild (SAG) strike in 2023. While the actors involved in the strike have their reasons and concerns, it's essential to critically examine whether this strike is truly necessary or if it might be, in fact, quite pointless.

Economic Impact: One of the most immediate consequences of the SAG strike is the significant economic impact it has on the industry. Thousands of jobs, from actors to crew members, are being affected. Production companies are losing millions of dollars every day the strike continues. Given the economic hardships that many people have faced in recent times, including the COVID-19 pandemic, one must question the wisdom of causing further financial strain on the industry and its workers.

Demands and Priorities: The demands put forth by the striking actors are not unreasonable. However, one could argue that these demands might not be the top priority in a world grappling with more pressing issues. With global crises like climate change, social justice, and healthcare disparities, is a higher salary for already well-paid actors truly the most critical concern? Many people struggle to make ends meet, and it's hard to sympathize fully with actors making exorbitant salaries, especially when so many others are struggling.

Timing: The timing of the SAG strike is questionable, at best. It's happening in an era when the industry is still recovering from the disruptions caused by the COVID-19 pandemic. Many people in the entertainment business are just getting back on their feet after months of uncertainty and unemployment. Striking now seems insensitive to the plight of others in the industry.

Alternative Solutions: Are strikes the only way to resolve disputes and negotiate better terms? In an industry that thrives on creativity and innovation, one would hope for more imaginative and collaborative solutions. Negotiation and dialogue could lead to more mutually beneficial outcomes without causing widespread disruption and financial loss.

Public Perception: Lastly, it's worth considering the public perception of the strike. In an age where people are increasingly disillusioned with celebrities and their lavish lifestyles, a strike like this may only further alienate the audience. The entertainment industry depends on the support and admiration of the public, and a strike that seems self-serving could harm its reputation.

In conclusion, while the actors participating in the SAG strike 2023 may have legitimate concerns, it's crucial to weigh the impact of their actions on the broader industry and society as a whole. In a world facing numerous pressing issues, this strike may indeed appear pointless to many, given its economic consequences and the perceived priorities of those involved. Perhaps there are more constructive ways to address the concerns of actors and create a fairer and more equitable entertainment industry.

#SAG Strike#Entertainment Industry#Actor's Demands#Economic Impact#COVID-19 Pandemic#Social Justice#Healthcare Disparities#Industry Recovery#Negotiation#Creative Solutions#Public Perception#Celebrity Lifestyle#Labor Disputes#Media Attention#Film and Television#Union Protests#Hollywood#Contract Negotiations#Workers' Rights#Economic Consequences#today on tumblr#deep thoughts

3 notes

·

View notes

Text

if only there was a new wizard magic school story that could become mainstream and kick harry potter's ass to the curb. then that would be nice. the drama can be WIZARD PVP free for alls where wizards steal each others energy and fight on wizard instagram for likes to boost their 'exposure stat' because wizards have to either do ages of unpaid labour disguised as 'volunteering for a wizard organization' or get exposure in order for their talents to be recognised. in the false wizard meritocracy where u either have to shoot to the stars or die trying. and no wizard can even afford their fucking spellbooks because they are never on special offer and some shitty brand keeps on marketing them at ridiculous prices and had enough power to make it the official curriculum for wizard schools worldwide.

9 notes

·

View notes

Text

"Growing GENTRIFICATION Problems in Mexico | Locals Blame U.S. Remote Workers"

youtube

#Youtube#mexico city#mexican#mexico#lifestyle#real estate#travelling#travel#travel ideas#travel secrets#travel inspo#expat#explore#economics#culture#gentrification#society#social activism#social justice

4 notes

·

View notes

Text

Quality of Life in California vs. Texas: A Migration Story

Introduction

The migration from California to Texas has been a significant demographic trend over the past decade. With California's high cost of living, regulatory environment, and political climate, many have sought greener pastures in Texas, known for its lower taxes, business-friendly policies, and growing job market. But what does this move mean for the quality of life for these migrants? Let's explore.

Economic Comparisons

GDP and Employment: California boasts the largest economy in the US with a GDP of $4.080 trillion, followed by Texas at $2.695 trillion. However, Texas's unemployment rate stands at a lower 4.2% compared to California's 5.4%. This indicates a potentially more robust job market in Texas, with more people employed relative to their population.

Cost of Living: One of the primary reasons for the move is the stark difference in living costs. In California, the median home price is nearly $800,000, while in Texas, it's around $350,000, offering significantly more housing for less money. Additionally, everyday expenses like groceries, utilities, and transportation are cheaper in Texas, providing a financial relief for many.

Taxes: Texas has no state income tax, which can feel like a pay raise for Californians used to high state taxes. However, property taxes in Texas are among the highest in the nation, which might come as a shock to newcomers but is often offset by the lack of income tax.

Quality of Life Metrics

Safety: Examining crime rates, California reports 499.5 violent crimes per 100,000 people, while Texas has 431.9, suggesting a slightly safer environment in Texas by this measure. Non-violent crimes, predominantly property crimes, are high in both states but don't necessarily correlate directly with the quality of life experienced daily.

Healthcare and Education: California invests heavily in healthcare and education, leading to a higher quality in these services. However, Texas provides these services at a lower cost, which can be a significant advantage for families looking to stretch their dollars further.

Cultural and Lifestyle Differences: California's appeal includes its cultural diversity, scenic beauty, and progressive policies. Texas, on the other hand, is known for its southern hospitality, wide-open spaces, and a more conservative approach to governance. The lifestyle in Texas might be more relaxed and family-friendly for some, with less traffic congestion in major cities compared to California's notorious bottlenecks.

Impact on Californians Moving to Texas

Economic Freedom: Many Californians report an immediate sense of financial freedom due to lower living expenses and no state income tax. This can lead to improved quality of life through better housing, savings, or investments in education or starting businesses.

Political and Social Environment: For those frustrated with California's political landscape, Texas offers a different perspective with its conservative governance. However, this change isn't universally welcomed; some miss the progressive policies and cultural vibrancy of California.

Community and Integration: Integration into Texas communities can vary. While some find the transition seamless, others face the challenge of adapting to a different pace of life and cultural norms. The welcoming nature of Texans is often cited as a positive aspect, though there are pockets where newcomers might feel like outsiders.

Conclusion

The move from California to Texas has been motivated by economic factors, political climates, and lifestyle preferences. Many Californians are finding that Texas offers a better quality of life in terms of affordability, job opportunities, and a different cultural experience. However, this isn't a one-size-fits-all solution; personal values, career needs, and social preferences play significant roles.

For those who prioritize economic advantages and a lower cost of living, Texas indeed seems to provide an improved quality of life. Yet, for others, the trade-offs might include missing California's environmental policies, cultural diversity, or the state's natural beauty. Ultimately, whether life is "better" after moving depends on individual priorities and how well one adapts to the Lone Star State's unique offerings.

Sources:

California and Texas GDP data.

Unemployment rate statistics.

Crime statistics from 2022 and 2023.

Cost of living data from various sources discussing housing, taxes, and general expenses.

#California vs Texas#Quality of Life#Moving from California to Texas#Cost of Living#State Taxes#Housing Prices#Job Market#Economic Migration#Lifestyle Comparison#Crime Rates#Healthcare in California#Education in Texas#Cultural Differences#Relocation Stories#Affordability#State Economy#Politics in California#Politics in Texas#Urban vs Rural Living#American Migration Trends

0 notes

Text

Ive noticed recently that my generation has... no concept of what the various economic classes actually are anymore. I talk to my friends and they genuinely say things like "at least i can afford a middle class lifestyle with this job because i dont need a roommate for my one bedroom apartment" and its like... oughh

You guys, middle class doesnt mean "a stable enough rented roof over your head," it means "a house you bought, a nice car or two, the ability to support a family, and take days off and vacations every year with income to spare for retirement savings and rainy days." If all you have is a rented apartment without a roommate and a used car, you're lower class. That's lower class.

And i cant help but wonder if this is why you get kids on tumblr lumping in doctors and actors into their "eat the rich" rhetoric: economic amnesia has blinded you to what the class divides actually are. The real middle class lifestyle has become so unattainable within a system that relies upon its existence that theyve convinced you that those who can still reach it are the elites while your extreme couponing to afford your groceries is the new normal.

109K notes

·

View notes

Text

Billionaires in America

View On WordPress

0 notes