#E-wallet

Explore tagged Tumblr posts

Text

Ayala-Mitsubishi deal likely to boost GCash IPO

If things go well, the recent deal made between Ayala Corp. and Japan’s Mitsubishi Corp. will likely boost the anticipated initial public offering (IPO) of e-wallet entity GCash, according to a BusinessWorld news report referencing analysts. To put things in perspective, posted below is an excerpt from the BusinessWorld news report. Some parts in boldface… THE RECENT deal between Ayala Corp.…

#Asia#Ayala#Ayala Corp.#Bing#Blog#blogger#blogging#business#business confidence#business news#BusinessWorld#Carlo Carrasco#cash#e-wallet#economics#economy#Economy of the Philippines#finance#foreign investment#foreign investors#GCash#geek#Globe Fintech Innovations#Google#Google Search#initial public offering (IPO)#invest#investing#investment#investments

0 notes

Text

Transaksi Judi Online Lewat E-Wallet Capai Rp5,6 Triliun, Pemerintah Gencar Lakukan Pemblokiran

RASIOO.id – Nilai transaksi terkait judi online yang memanfaatkan dompet digital atau e-wallet diperkirakan telah mencapai angka fantastis, yaitu Rp5,6 triliun. Fenomena ini kini menjadi fokus utama pemerintah dalam memberantas kejahatan di ruang digital. “Pemerintah terus mengoptimalkan upaya pencegahan dan pemberantasan judi online. Penggunaan e-wallet sebagai sarana transaksi merupakan modus…

0 notes

Text

Tanggapi Teguran Menkominfo, Penyedia e-Wallet Terapkan Kebijakan Cegah Judi Online

JAKARTA, Cinews.id – Baru-baru ini Menteri Komunikasi dan Informatika (Menkominfo) Budi Arie Setiadi memberikan teguran keras kepada lima penyedia layanan dompet digital atau e-wallet yang memfasilitasi transaksi judi online. Lima perusahaan e-wallet tersebut adalah PT Espay Debit Indonesia Koe (DANA), PT Visionet Internasional (OVO), PT Dompet Anak Bangsa (GoPay), PT Fintek Karya Nusantara…

0 notes

Text

#OneNETnewsEXCLUSIVE: PH Fintech E-Wallet Company 'GCash' celebrates 20th Anniversary

TAGUIG, NATIONAL CAPITAL REGION -- The country's leading electronic wallet fintech 'GCash' officially celebrates its 20th anniversary at the 'W City Center' in 'Taguig City, National Capital Region' last Monday (September 30th, 2024 -- Taguig local time). A remarkable journey over the past 2 decades, during which the fintech platform has grown to serve 94 million users across the Philippines, including right here in Central and Eastern Visayas regions. GCash has also expanded its reach to Overseas Filipino Workers (OFWs) and is exploring potential international expansion, though the number of foreign users had not been revealed.

Officially started in October 2004 as a simple mobile wallet service, and was compatible, even with the most basic mobile phones at that time (including Nokia), before it evolved with the progression of improvement technology into Android and iOS devices. This evolution has allowed GCash to bring users closer, and offer more sophisticated financial services into daily lives, making GCash an essential part of the lives of millions of Filipinos.

In an exclusive interview with a newspaper outlet 'The Daily Tribune' as GCash's Chief Marketing Officer named 'Mr. Neil Trinidad' says that the GCash users can join in the upcoming grand giveaway, which can be done itself in the e-wallet app. By logging in and shaking the app, users will be availing by getting a chance to win exciting prizes. This initiative shall encourage and reward loyal users to enhance their experience with this above-mentioned e-wallet fintech app.

To commemorate its 20th anniversary as added by Mr. Trinidad, GCash has now planned a month-long surprises and activities as it marks its 20th anniversary. More than PHP30M in prizes are up for grabs, the line-up of which, will soon to be announced next Thursday (October 10th). Among the prizes are GCredits (for eligible, verified individual and good loan record in credit score), PHP50,000 grocery packages (equivalent to U$D890), the latest Oppo Android phones, and Yamaha motorcycles are also part of the rewards.

As they continue to innovate and expand, GCash upholds its promise of accessible and reliable financial services, regardless whether if you invest in stocks or funds, applying loans via GLoan or GCredit, cashing-in or out in sari-sari or convenient stores and vice-versa, debit cards and online payments, etc. in a easiest way possible for legally verified users. A milestone, which is more than a double decade of anniversary today -- a testament to how GCash has transformed the country's financial landscape for the better.

Happy 20th Anniversary GCash!!! Celebrate natin ang lahat!

PHOTO COURTESY: GCash via PR PHOTO BACKGROUND PROVIDED BY: Tegna

SOURCE: *https://www.facebook.com/100064992870078/videos/970058798493835/ [Referenced FB VIDEO via The Daily Tribune] *https://www.facebook.com/100000985911670/posts/8621685847874193 [Referenced Captioned PHOTO via Jorrelyn Arenas Mirador] and *https://www.facebook.com/100064643983643/posts/1042767860454156 [Referenced FB Banner PHOTO via GCashOfficial]

-- OneNETnews Online Publication Team

#technology news#taguig#NCR#national capital region#GCash#20th anniversary#e-wallet#celebration#milestone#exclusive#first and exclusive#OneNETnews

0 notes

Text

AEON Credit Elevates Customer Experience with Digital Innovation Initiatives

PUTRAJAYA, 21 August 2024 – AEON Credit Service (M) Berhad (AEON Credit), a leading non-bank financial services provider in Malaysia is committed to drive its Purpose and shared a series of key initiatives at an exclusive media presentation held at its flagship branch today. These initiatives include the introduction of the new AEON Wallet App with digital onboarding and exciting new features,…

0 notes

Text

GCash builds a digital ecosystem where women can thrive

More than half of GCash users are women who benefit from digital financial innovations. #KayaMo #iGCashMo

In its mission to boost financial inclusion in the Philippines, leading finance app GCash is paving the way to create a digital ecosystem where women, along with their businesses and families, can thrive. GCash builds a digital ecosystem where women can thrive According to a Policy Note published by the Philippine Institute for Development Studies (PIDS), 43.62% of women-led micro, small, and…

View On WordPress

#banking#digital ecosystem#e-wallet#financial innovations#financial literacy#financial services#GCash#GCash e-wallets#mobile wallet#women

0 notes

Text

The Best Software Crypto Wallets

Digital wallets are used to store digital coins. This is the name of specialized software that is designed to protect assets from cyber attacks. Such software is available in different versions: as mobile applications, desktop programs, services on specialized services or pre-installed on a compact physical medium. Of course, if you plan to continue active trading after the XMR to ETH swap, you…

View On WordPress

0 notes

Text

Menggali Kemudahan dan Keuntungan E-Wallet (Dompet Elektronik)

E-wallet (dompet elektronik) telah menjadi salah satu inovasi terkemuka dalam dunia teknologi keuangan. Dengan kemajuan teknologi dan perubahan perilaku konsumen, e-wallet telah mengubah cara kita bertransaksi, membayar, dan mengelola keuangan. Artikel ini akan membahas secara lengkap dan mendalam tentang pengertian dan kegunaan e-wallet yang perlu diketahui. Pengertian E-Wallet E-wallet, atau…

View On WordPress

0 notes

Text

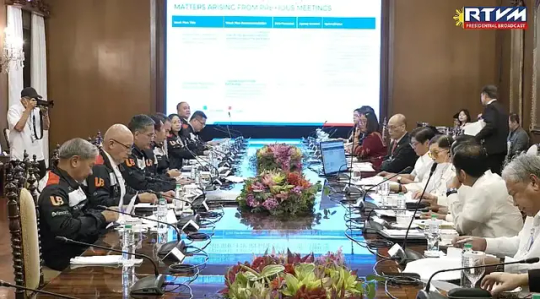

President Marcos Jr. Pushes for Digital Transformation in the Country!

President Ferdinand R. Marcos Jr. fully supports the Paleng-QR Ph Plus Initiative and wants government agencies to educate Filipinos on the use of e-wallet and other digital payment apps. He feels this will prop-up economic activities, particularly with the inclusion of micro, small and medium enterprises. The President expressed his view on Thursday during a meeting in Malacañang with the Private Sector Advisory Council Digital Infrastructure Cluster discussing recommendations to further improve the country’s digital infrastructure. Private Sector Advisory Council Member Ernest Cu, President and CEO of Globe Telecom, who met the President described the use of quick response (QR) codes and other digital payment apps as something like a “home run” for the government, saying that they are excited to start serving the public markets using QR codes. Private Sector Advisory Council Convenor Sabin Aboitiz, President of the Aboitiz Equity Ventures Inc., was also present during the meeting along with Union Digital President Henry Rhoel Aguda, Bank of the Philippines Islands COO Ramon Jocson, and PLDT Inc. President Alfredo Panlilio. The e-commerce platforms including the Bangko Sentral ng Pilipinas have teams going around the country conducting information and education campaigns on Paleng-QR Ph Plus, which was launched in 2022, in different cities and local government units. Ernest Cu, President and CEO of Globe Telecom said: “We have to do it. It’s a grassroots level approach. There are also videos on YouTube and we also have Tiktok to get people to educate themselves. And if you use the app regularly, you will see it being offered to you on the app,” The adoption of QR codes and use of digital payment apps will make savings and loan applications in banks a lot easier for the public, especially the farmers, fisherfolks and small businesses, according to PSAC members. At the same time, the government could eliminate the 5-6 lending and similar money lending businesses thus making the cost of running MSMEs, which are the main drivers of the economy, go down. BSP Governor Felipe Medalla expressed support to the project saying, “Mr. President, this one has a big impact on financial inclusion because the problem is there’s no way for banks to assess their credit scores, but if we have a digital database with their payment habits, that will be a substitute and a good proxy for credit scoring.This actually helps in the financial inclusion advocacy of the BSP and the government.” Aside from rallying support for Paleng-QR Ph Plus Initiative, PSAC made new recommendations for the President’s approval. Among the new recommendations are the adoption of the National Cybersecurity Plan 2023-2028 and the Connectivity Index Rating System. Sources: THX News & PCO. Read the full article

#ConnectivityIndex#Digitalinfrastructure#Digitalpaymentapps#E-wallet#Financialinclusion#Microsmallandmediumenterprises#NationalCybersecurityPlan#Paleng-QRPhPlusInitiative#PrivateSectorAdvisoryCouncil#Quickresponsecodes#RatingSystem

0 notes

Text

Where to deposit your excess Peso coins while you are in Alabang

If you are constantly present here in Alabang in Muntinlupa City, and if you have an excess number of Peso coins that you want to have deposited for safekeeping or for personal use, then you should visit the coin deposit machine (CoDM) of the Bangko Sentral ng Pilipinas (BSP) located inside Festival Mall in Filinvest City. To be more specific, the BSP CoDM inside the said shopping mall is…

View On WordPress

#Alabang#Alabang blog#Asia#Bangko Sentral ng Pilipinas (BSP)#Blog#blogger#business#Café BLK & BRWN#Carlo Carrasco#City of Muntinlupa#coffee#coin deposit machines (CoDMs)#coins#commerce#deposit#depositing#deposits#e-wallet#Economy of the Philippines#Festival Mall#Filinvest#Filinvest City#finance#food#GCash#geek#lifestyle#Metro Manila#Muntinlupa#news

0 notes

Text

QUELS SONT LES DIFFÉRENTS MODES DE PAIEMENT EN LIGNE ?

Il existe un grand nombre de solutions de paiement que vous pouvez utiliser lors de vos achats en ligne. Ne vous bornez plus juste à la sacro-sainte carte de crédit. Pour des raisons de sécurité, de nombreux consommateurs commencent à utiliser d’autres moyens de paiement pour régler leurs achats en ligne. Les consommateurs peuvent se servir d’autres cartes, de services comme PayPal, de e-wallet, du paiement mobile ou même de bitcoins. Paiecb.com vous décrit les différentes solutions possibles.

1- Les traditionnelles cartes bancaires

Les sites d’e-commerce proposent essentiellement comme mode de règlement les cartes de crédits Visa ou Mastercard, physique ou virtuelle. Vous rentrez votre numéro de carte composé de 16 chiffres, la date d’expiration et le cryptogramme. Ensuite, vous validez votre transaction via l’appli de votre banque ou un code reçu par SMS. Comme beaucoup, vous êtes de plus en plus réticents à laisser vos numéros de carte sur des sites marchands non connus. De nombreux sites ont été piratés ces dernières années et des millions de données confidentielles se retrouvent perdues dans la nature. Il est aussi possible de régler avec un paiement en un clic. Votre carte bancaire est mémorisée par le site marchand. Ce service est proposé par Amazon, AirBNB, Uber et de plus en plus de grosses enseignes. Ce sont des ventes plus faciles pour le commerçant en ligne, mais également un risque pour vous si les données sont volées !

2- La démocratisation des e-wallets ou portefeuilles virtuels

Un e-wallet est un portefeuille électronique. C’est un moyen de paiement qui offre plus de commodité, de rapidité et de sécurité aux transactions. Le consommateur installe l’application et entre les données de sa carte qui y est stockée de manière virtuelle. Grâce à un système de token, les données de votre carte bancaire ne sont pas transmises aux sites de vente en ligne. Il existe trois types de portefeuilles : Les e-wallets internationaux : Google Pay et Apple Pay Les e-wallet français : Paylib, Lyf Pay, Lydia Les e-wallets chinois : Alipay et WeChat Pay La sécurité est devenue une priorité dans le e-commerce. Les e-wallets utilisent une technologie de cryptage, afin que lors d’un règlement avec votre portefeuille électronique, le site n’ait pas accès aux détails de la carte. La procédure commence lorsque l’utilisateur déverrouille son téléphone mobile, puis saisit le mot de passe de son e-wallet ou utilise la méthode d’authentification qu’il a activée (reconnaissance faciale, touch ID).

3- Utiliser PayPal pour vos achats en ligne

PayPal est un moyen de paiement en ligne mais aussi une solution pour faire des virements entre particuliers. Il est proposé comme moyen de paiement par de nombreux sites de e-commerce. Il offre une alternative à la carte bancaire qui est plus sensible à la fraude. PayPal intervient comme un intermédiaire de confiance dans la transaction. Vous n'avez plus besoin de confier au commerçant vos numéros de carte : vous êtes redirigés vers le site de PayPal qui, après vous avoir authentifié, se charge du paiement. Le service ajoute une protection des achats qui vous permet d'être remboursé si l'article acheté n'est pas livré ou ne correspond pas à sa description. PayPal propose aussi à ses clients le paiement en 4 fois gratuitement. Avec PayPal, vous pouvez faire vos achats soit depuis votre compte bancaire, soit depuis votre solde paypal ou avec une carte bancaire. L’ouverture d’un compte PayPal est simple et gratuite. Il suffit de se rendre sur le site de PayPal ou de télécharger l’application mobile et de suivre les instructions d’ouverture du compte.

4- Opter pour les paiements en plusieurs fois

Les paiements en plusieurs fois sont proposés par des organismes bancaires comme Cofidis, Oney, etc., ou par des sociétés indépendantes comme Alma ou Klarna qui facilitent l'accès aux paiements fractionnés. Les paiements en plusieurs fois vous donnent l’avantage d’étaler vos plus grosses dépenses sur 3 ou 4 mois comme changer le lave-linge ou profiter des soldes pour rafraîchir la garde-robe de la famille. Autre avantage : dans la plupart des cas, vous n' êtes pas obligé d’être inscrit sur la plateforme de crédit pour accéder aux règlements en 3 ou 4 fois. De nouveaux acteurs sur le marché des paiements fractionnés vont vous demander une inscription et le téléchargement de leur application comme Klarna et Clear Pay.

5- Tester le service Amazon Pay

La première fonction d’Amazon Pay est d’accélérer et de sécuriser les paiements online en utilisant les coordonnées enregistrées dans votre compte Amazon. Ce service est accessible à tous les clients d’Amazon sans inscription supplémentaire. Vous pouvez consulter votre compte Amazon pay dans votre compte Amazon. Amazon commence à élargir son offre en intégrant son service de paiement sur d’autres sites marchands. La liste des commerçants acceptant les paiements via Amazon Pay est encore assez restreinte. Amazon Pay offre les services suivants à ses clients :

Paiement par carte

Paiement en 4 fois en partenariat avec Cofidis

Prélèvement SEPA

Garantie A à Z

6- Utiliser vos tickets-restaurants

Les entreprises qui offrent des tickets-restaurants à leur salariés leur fournissent de plus en plus souvent une carte à puce rechargée chaque mois virtuellement. Saviez-vous que vous pouvez aussi payer en ligne avec ces titres ? Pas partout, évidemment, mais ils sont acceptés sur les plateformes de livraison en ligne comme Uber eats, Deliveroo, Nestor, Frichti. C’est bien pratique avec la démocratisation du télétravail, de régler avec sa carte chèque déjeuner des repas livrés à domicile.

#paiecb#blog paiecb#pinterest paiecb#amazon pay#tickets restaurant#uber eats#deliveroo#nestor#frichti#paypal#E-wallet#e wallet

0 notes

Link

The Minister of Transport Rodwell Ferguson met with representatives of the Belize Bus Association today in Belmopan. The meeting comes after the BBA made two specific demands to the Ministry, giving Minister Ferguson 72 hours to satisfy their demands. One of the demands was for the Chairman of the Transport Board be fired! The second demand was to have a representative from the National Bank of Belize sit on the Transport Board. The latter demand will come to fruition. As for removing Sanchez from his position, that will be known in the next six months which is the length that he has been placed on probation. Coming out of the meeting, Minister Ferguson told reporters that the meeting was a success and outlined a plan for the future of the country’s transport industry.

#bus#transport#BBA#Belmopan#fire#sack#Chairman#Board#NBB#bank#tickets#e-Wallet#James Bus Line#Belize#news#via LoveFM#world news

0 notes

Text

FOLLOW-UP REPORT: GCash Users can now re-download the E-Wallet App, ahead of Friday's completed system update for the 3rd Party app store individuals [#K5NewsFMExclusive]

TAGUIG, NATIONAL CAPITAL REGION -- Philippine financial tech e-wallet GCash has now back online as of 9pm (July 11th, 2024 -- Taguig local time), for those if you're a supported 3rd party android app store with their own smartphone model like the OPPO phone. You might earlier recalled yesterday afternoon on Wednesday that due to its epidemic of incompatibility and failing to unregister your favorite smartphones, the app developers have fixed the issue as the system update has now completed before the Friday afternoon deadline on July 12th, 2024 for the official android users of Google Play.

GCash users are encouraged to re-download the e-wallet app now, ahead of an upcoming Google Play's revised new version update of '5.78.0' tomorrow, but there is a catch. You must have a supported 3rd party android app store with their own smartphone model of OPPO called 'App Market' as an example, or temporarily install the APK file with any supported android smartphones like RealMe and among others. But no offense, we advise to download the GCash through the licensed 3rd party app store of your choice like "GOEOne App" linked to GCash, then open GCash through the 3rd party app. This considers like a disposable android or iOS smartphone.

Some android smartphone models worked fine on the official Google Play store if you're on Samsung, Apple iOS and more, when you already register your favorite smartphone to be associated with your GCash account. For everyone else if you're an OPPO user alone, in the said example above, you have to wait a little longer to re-download the e-wallet app at exactly 12nn on Friday.

E-wallet and app developers apologizes GCash users for the inconvenience, despite of the completed system update in this 2nd mid-week, resuming normally to cash-in, paying bills, loan repayments via GCredit, GGives and/or the now-Borrow Load.

STOCK PHOTO COURTESY: Google Images BACKGROUND PROVIDED BY: Tegna

-- OneNETnews Online Publication Team

#follow-up report#technology news#taguig#national capital region#NCR#GCash#e-wallet#awareness#system update#fyp#completed#K5 News FM#exclusive#first and exclusive#OneNETnews

0 notes

Text

AEON Credit Enhances Finance Access by Elevating Customer Experience

PUTRAJAYA, 21 August 2024 – AEON Credit Service (M) Berhad (AEON Credit), a leading non-bank financial services provider in Malaysia is committed to drive its Purpose and shared a series of key initiatives at an exclusive media presentation held at its flagship branch today. These initiatives include the introduction of the new AEON Wallet App with digital onboarding and exciting new features,…

0 notes

Text

Oh yeah btw I told my sister, who had gotten me the Disturbed wallet 16 years ago, that I had to get a new one because the lead vocalist is a bastard and a zionist, so she insisted on getting me a new wallet. It came in today. It's funny how similar in design it is to the old wallet but it has some minor changes that make it better. I can use the pocket on the right now because the clasps don't make it too short for a card, for example

Got the essentials (they don't actually make Hot Topic cards anymore but they're still valid/accepted lol)

#photopost#I love my Hot Topic card LMAO#Whenever I whip it out there the staff are like 'yo holy shit how do you still have this???'#My secret is that I have been using the same wallet for 16 years#Anyway yes... yes I am an edgy little punkass etc etc w/e

24 notes

·

View notes