#E-commerce Business More Profitable

Explore tagged Tumblr posts

Text

Lab 916: Your Partner in Crafting Winning Amazon Strategies

Introduction: Lab 916's Expertise in Amazon Strategy

In the ever-evolving world of e-commerce, Lab 916 stands as a beacon of expertise, providing businesses with tailored Amazon strategies to succeed in the competitive marketplace. With a deep understanding of Amazon's algorithms, trends, and best practices, Lab 916 helps businesses navigate the complexities of selling on the platform and achieve their goals.

Strategic Planning with Lab 916

Lab 916 takes a strategic approach to Amazon strategy development, focusing on optimizing product listings, implementing competitive pricing strategies, leveraging advertising tactics, and fostering customer engagement. By customizing strategies to align with each client's unique objectives and market dynamics, Lab 916 ensures that businesses can maximize their potential on Amazon.

Optimizing Product Listings for Maximum Visibility

A crucial aspect of Lab 916's Amazon strategy is optimizing product listings to enhance visibility and drive conversions. Through meticulous keyword research, compelling product descriptions, and high-quality imagery, Lab 916 ensures that each product listing is optimized to rank higher in Amazon search results. By improving the visibility and appeal of product listings, businesses can attract more customers and increase sales.

Implementing Competitive Pricing Strategies

Lab 916 assists businesses in developing competitive yet profitable pricing strategies tailored to their market segment. By analyzing competitor pricing data, market trends, and consumer behavior, Lab 916 helps businesses set prices that maximize sales while maintaining healthy profit margins. Additionally, Lab 916 provides guidance on leveraging dynamic pricing tools and promotional strategies to stay competitive on Amazon.

Leveraging Advertising Tactics for Enhanced Visibility

Advertising is a key component of Lab 916's Amazon strategy, aimed at increasing product visibility and driving targeted traffic to product listings. Lab 916 utilizes Amazon's advertising platform to create and optimize sponsored product ads, sponsored brand ads, and sponsored display ads. By strategically targeting keywords and audience segments, Lab 916 helps businesses maximize their advertising ROI and generate sales on Amazon.

Fostering Customer Engagement and Loyalty

Lab 916 emphasizes the importance of fostering strong customer relationships to drive long-term success on Amazon. Through proactive customer service, timely responses to inquiries and feedback, and strategies to encourage positive reviews, Lab 916 helps businesses build trust and loyalty with their customers. By delivering exceptional shopping experiences and maintaining positive seller ratings, businesses can enhance their reputation and drive repeat purchases on the platform.

Conclusion: Achieving Success with Lab 916's Guidance

In conclusion, Lab 916 serves as a valuable partner for businesses seeking to excel on Amazon. With Lab 916's expertise and strategic guidance, businesses can optimize their Amazon strategies and achieve success in the competitive e-commerce landscape. By leveraging Lab 916's insights and best practices, businesses can unlock their full potential on one of the world's largest online platforms.

Introduction: Lab 916's Expertise in Amazon Strategy

In the ever-evolving world of e-commerce, Lab 916 stands as a beacon of expertise, providing businesses with tailored Amazon strategies to succeed in the competitive marketplace. With a deep understanding of Amazon's algorithms, trends, and best practices, Lab 916 helps businesses navigate the complexities of selling on the platform and achieve their goals.

Strategic Planning with Lab 916

Lab 916 takes a strategic approach to Amazon strategy development, focusing on optimizing product listings, implementing competitive pricing strategies, leveraging advertising tactics, and fostering customer engagement. By customizing strategies to align with each client's unique objectives and market dynamics, Lab 916 ensures that businesses can maximize their potential on Amazon.

Optimizing Product Listings for Maximum Visibility

A crucial aspect of Lab 916's Amazon strategy is optimizing product listings to enhance visibility and drive conversions. Through meticulous keyword research, compelling product descriptions, and high-quality imagery, Lab 916 ensures that each product listing is optimized to rank higher in Amazon search results. By improving the visibility and appeal of product listings, businesses can attract more customers and increase sales.

Implementing Competitive Pricing Strategies

Lab 916 assists businesses in developing competitive yet profitable pricing strategies tailored to their market segment. By analyzing competitor pricing data, market trends, and consumer behavior, Lab 916 helps businesses set prices that maximize sales while maintaining healthy profit margins. Additionally, Lab 916 provides guidance on leveraging dynamic pricing tools and promotional strategies to stay competitive on Amazon.

Leveraging Advertising Tactics for Enhanced Visibility

Advertising is a key component of Lab 916's Amazon strategy, aimed at increasing product visibility and driving targeted traffic to product listings. Lab 916 utilizes Amazon's advertising platform to create and optimize sponsored product ads, sponsored brand ads, and sponsored display ads. By strategically targeting keywords and audience segments, Lab 916 helps businesses maximize their advertising ROI and generate sales on Amazon.

Fostering Customer Engagement and Loyalty

Lab 916 emphasizes the importance of fostering strong customer relationships to drive long-term success on Amazon. Through proactive customer service, timely responses to inquiries and feedback, and strategies to encourage positive reviews, Lab 916 helps businesses build trust and loyalty with their customers. By delivering exceptional shopping experiences and maintaining positive seller ratings, businesses can enhance their reputation and drive repeat purchases on the platform.

Conclusion: Achieving Success with Lab 916's Guidance

In conclusion, Lab 916 serves as a valuable partner for businesses seeking to excel on Amazon. With Lab 916's expertise and strategic guidance, businesses can optimize their Amazon strategies and achieve success in the competitive e-commerce landscape. By leveraging Lab 916's insights and best practices, businesses can unlock their full potential on one of the world's largest online platforms.

#Introduction: Lab 916's Expertise in Amazon Strategy#In the ever-evolving world of e-commerce#Lab 916 stands as a beacon of expertise#providing businesses with tailored Amazon strategies to succeed in the competitive marketplace. With a deep understanding of Amazon's algor#trends#and best practices#Lab 916 helps businesses navigate the complexities of selling on the platform and achieve their goals.#Strategic Planning with Lab 916#Lab 916 takes a strategic approach to Amazon strategy development#focusing on optimizing product listings#implementing competitive pricing strategies#leveraging advertising tactics#and fostering customer engagement. By customizing strategies to align with each client's unique objectives and market dynamics#Lab 916 ensures that businesses can maximize their potential on Amazon.#Optimizing Product Listings for Maximum Visibility#A crucial aspect of Lab 916's Amazon strategy is optimizing product listings to enhance visibility and drive conversions. Through meticulou#compelling product descriptions#and high-quality imagery#Lab 916 ensures that each product listing is optimized to rank higher in Amazon search results. By improving the visibility and appeal of p#businesses can attract more customers and increase sales.#Implementing Competitive Pricing Strategies#Lab 916 assists businesses in developing competitive yet profitable pricing strategies tailored to their market segment. By analyzing compe#market trends#and consumer behavior#Lab 916 helps businesses set prices that maximize sales while maintaining healthy profit margins. Additionally#Lab 916 provides guidance on leveraging dynamic pricing tools and promotional strategies to stay competitive on Amazon.#Leveraging Advertising Tactics for Enhanced Visibility#Advertising is a key component of Lab 916's Amazon strategy#aimed at increasing product visibility and driving targeted traffic to product listings. Lab 916 utilizes Amazon's advertising platform to#sponsored brand ads

1 note

·

View note

Text

To talk about monopoly & antitrust, I want to start off with your first day in Econ 101, when you learn "how prices work". The toy model that nearly everyone learns as one of the first things ever is that classic supply-and-demand graph of price and quantity; you know it, I don't need to show it. And in relation to how firms set price in a market, the explanation you get is something like:

"In a world with perfect information, zero transaction costs, rational agents, and no barriers to entry, new firms and/or increased output will enter the market until marginal price equals marginal cost"

This (seemingly) portrays a model where new companies "entering the market" is how prices go down. Like say there are Firms A, B, and C, engaging in oligopolistic pricing for a normal good; what happens is some new Firm X (with the same production costs) emerges with the sole business strategy of "offer prices lower than them because they are skimming" and it drives everyone's prices down in a race to the bottom. That, in a sense, competition between identical firms drives the price equilibrium.

That isn't very true, not in practice and not even theoretically; the 101 stuff just sort of biases you to see it that way. Firm X above is being rational in one way but silly in others; why would it enter a market where its competitors are making healthy profits just to fuck that up, knowing it has no advantage they can't immediately replicate in response? And pay all the fixed costs other firms have already paid to make that 0.1% profit? In real life firms almost never do this, they compete over (actual or perceived) advantage or market segmentation. And it also means that - if all firms are truly the same in a market - cooperating on price, far from being aberrant behavior, is the natural thing to do. Why would I look at my rival firm and lower my price to "undercut" them, knowing that they 100% can just lower it too? We both lose, immediately. In practice, companies often set their prices by looking at the prices of competing firms and matching them!

Many things actually drive the price equilibrium of course, but one of the biggest - and most useful for our purposes - is the substitution effect. If companies defacto cooperate on prices all the time, why is the price not infinity? Well because if you are selling steaks and set the price to infinity, I'm not gonna buy it! I can just buy chicken, for me it's pretty much the same. And chicken is cheaper to make than steak. As a chicken firm, I totally can set my price under your steak and you can never, ever match it; that is a real advantage, one from asymmetries of production. The price of steak is driven by the need to compete with chicken much more than it is driven by the need to compete with "other steaks". And so on down a chain of a million desires and costs and needs.

So to wrap this around to antitrust, there is a common idea out there that monopolistic pricing is increasing from the past because if I look at different industries, so many of them today are consolidated into 2-3 big firms. Your grocery stores are all Giant or Safeway or w/e it is in your city, if you are buying a TV Samsung & LG are half the entire US market. How could these companies not collude on price? Of course they do, and they don't need explicit agreements that would violate extant FTC regulations to do it; they can just softly communicate and feel out cooperation. So you gotta break them up and change the rules so they can't do that.

The trap is thinking this is any different if it was 10 firms - it really isn't! Maybe marginally, sure, and if it was 2000 firms yeah okay the sheer chaos would probably create some price churn; but in the past prices were not driven down by the diversity of firms making price cooperation impossible. The long history of guilds, business associations, chambers of commerce, and so on shows that they had plenty of avenues for cooperation - and often did straight-up set prices. Meanwhile, when Wal-Mart, Target, Aldi, and others all cut prices at around the same time, they are not mainly competing with each other. If they were they would just mutually agree to not do that, without even saying anything! How stupid do you think they are? That isn't hard to do. Instead they are competing with Amazon; with boutique local stores; with restaurants; with the changing price of labor; with shifting consumer sentiment and expectations. The industry concentration doesn't matter.

Until it does of course! Because what is the substitution good for oil? They exist of course, but they ain't cheap; people will still buy gas at gigantic ranges of prices. Here, the fundamental structure of the market is monopolistic - and also a geopolitical clusterfuck, but let's not get into that. Producers openly rig prices sometimes, and antitrust actively regulates against it, and it is a hot mess of governments and companies and all that. Are people who hold patents engaging in monopoly pricing? Obviously, that is the point of patents! It is by design; but there are tons of arguments to be made around creeping exploitation of the IP system. Sometimes hundreds of firms in a dominant market niche will offer complex, bundled products where the price of each piece of obfuscated and the value is subjective, but consensus is you can't not buy the product or you will be screwed and since you can't tell what the product even is, let alone how valuable it is, you can't object when they set the price - I hear these are called "universities", but they go by other names in other sectors.

All of the above are something like "monopolies", which maybe are getting worse over time, but they are monopolies for different, product-specific reasons. I think there is a good deal of FTC work and other reforms that could be done in the US to identify areas where this kind of rent extraction is happening. But what it doesn't look like is opposing blanket industry consolidation. And in fact the correlation is honestly pretty weak. Because identical firm competition does not drive the price equilibrium.

#antitrust discourse#This is not a review of Biden's FTC policy - they are aware of this reality at least in part#This is obliquely a critique of Matt Stoller he is not aware of this

199 notes

·

View notes

Text

The long, bloody lineage of private equity's looting

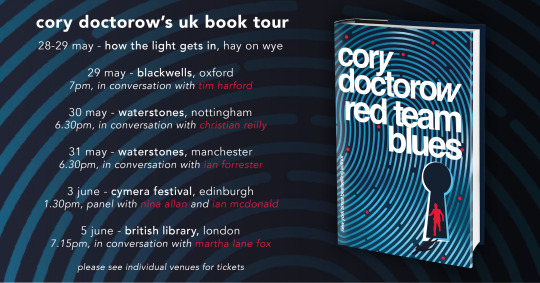

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

"Amazon’s warehouses are especially dangerous for workers during the company’s annual Prime Day event, as well as the holiday season, according to an investigation by the US Senate.

Prime Day, held on Tuesday and Wednesday this week, is “a major cause of injuries for the warehouse workers who make it possible,” said a report released Monday by Sen. Bernie Sanders, who chairs the Senate Committee on Health, Education, Labor and Pensions. The report noted “the extremely unsafe conditions in Amazon warehouses” during the two peak periods and called on the company to do more to protect warehouse workers.

...

The data shows that during Prime Day 2019 the rate of “recordable” injuries — those Amazon is required to disclose to the Occupational Safety and Health Administration — exceeded 10 per 100 workers, more than double the average in the US warehousing and storage industry.

[And] Amazon’s total injury rate, which includes injuries the company does not have to report to OSHA, was just under 45 per 100 workers, the report said.

...

Amazon raked in $12.7 billion in sales on July 11 and 12 last year, its Prime Day 2023 event, and said July 11 was the single biggest sales day in the company’s history. For the first three months of 2024, the e-commerce giant reported a profit of $10.4 billion."

Read the full piece here:

https://www.cnn.com/2024/07/17/tech/amazon-warehouses-prime-day-injuries-senate/index.html

62 notes

·

View notes

Text

Dharna Noor at The Guardian:

Climate experts fear Donald Trump will follow a blueprint created by his allies to gut the National Oceanic and Atmospheric Administration (Noaa), disbanding its work on climate science and tailoring its operations to business interests.

Joe Biden’s presidency has increased the profile of the science-based federal agency but its future has been put in doubt if Trump wins a second term and at a time when climate impacts continue to worsen. The plan to “break up Noaa is laid out in the Project 2025 document written by more than 350 rightwingers and helmed by the Heritage Foundation. Called the Mandate for Leadership: The Conservative Promise, it is meant to guide the first 180 days of presidency for an incoming Republican president. The document bears the fingerprints of Trump allies, including Johnny McEntee, who was one of Trump’s closest aides and is a senior adviser to Project 2025. “The National Oceanographic [sic] and Atmospheric Administration (Noaa) should be dismantled and many of its functions eliminated, sent to other agencies, privatized, or placed under the control of states and territories,” the proposal says.

That’s a sign that the far right has “no interest in climate truth”, said Chris Gloninger, who last year left his job as a meteorologist in Iowa after receiving death threats over his spotlighting of global warming. The guidebook chapter detailing the strategy, which was recently spotlighted by E&E News, describes Noaa as a “colossal operation that has become one of the main drivers of the climate change alarm industry and, as such, is harmful to future US prosperity”. It was written by Thomas Gilman, a former Chrysler executive who during Trump’s presidency was chief financial officer for Noaa’s parent body, the commerce department. Gilman writes that one of Noaa’s six main offices, the Office of Oceanic and Atmospheric Research, should be “disbanded” because it issues “theoretical” science and is “the source of much of Noaa’s climate alarmism”. Though he admits it serves “important public safety and business functions as well as academic functions”, Gilman says data from the National Hurricane Center must be “presented neutrally, without adjustments intended to support any one side in the climate debate”.

[...] Noaa also houses the National Weather Service (NWS), which provides weather and climate forecasts and warnings. Gilman calls for the service to “fully commercialize its forecasting operations”. He goes on to say that Americans are already reliant on private weather forecasters, specifically naming AccuWeather and citing a PR release issued by the company to claim that “studies have found that the forecasts and warnings provided by the private companies are more reliable” than the public sector’s. (The mention is noteworthy as Trump once tapped the former CEO of AccuWeather to lead Noaa, though his nomination was soon withdrawn.)

The claims come amid years of attempts from US conservatives to help private companies enter the forecasting arena – proposals that are “nonsense”, said Rosenberg. Right now, all people can access high-quality forecasts for free through the NWS. But if forecasts were conducted only by private companies that have a profit motive, crucial programming might no longer be available to those in whom business executives don’t see value, said Rosenberg. [...] Fully privatizing forecasting could also threaten the accuracy of forecasts, said Gloninger, who pointed to AccuWeather’s well-known 30- and 60-day forecasts as one example. Analysts have found that these forecasts are only right about half the time, since peer-reviewed research has found that there is an eight- to 10-day limit on the accuracy of forecasts.

The Trump Administration is delivering a big gift to climate crisis denialism as part of Project 2025 by proposing the dismantling and privatizing the National Oceanic and Atmospheric Administration (NOAA) and National Weather Service (NWS) in his potential 2nd term.

This should frighten people to vote Democratic up and down the ballot if you want the NOAA and NWS to stay intact.

#Project 2025#Climate Change#Climate Crisis#Weather#AccuWeather#National Weather Service#NOAA#NWS#John McEntee#The Heritage Foundation#Donald Trump#Climate Change Denialism#Office of Oceanic and Atmospheric Research#National Oceanic and Atmospheric Administration#Climate Crisis Denial

86 notes

·

View notes

Text

Maximizing Your Income: 25 Effective Ways to Make More Money from Home - Money Earn Info

Get Over 2,500 Online Jobs. You may have already tried to make money online. Here is Some Information about Easy Job you can do from home. 👉 Offers for you

.

.

Freelancing Across Multiple Platforms: Expand your freelancing endeavors by joining multiple platforms such as Upwork, Freelancer, and Fiverr. Diversifying your presence can increase your visibility and attract a broader range of clients.

Remote Consulting Services: If you possess expertise in a particular field, consider offering consulting services. Platforms like Clarity — On Demand Business Advice connects consultants with individuals seeking advice, providing an avenue for additional income.

youtube

Create and Sell Online Courses: Capitalize on your skills and knowledge by creating online courses. Platforms like Udemy, Teachable, and Skillshare allow you to share your expertise and earn money passively.

Affiliate Marketing Mastery: Deepen your involvement in affiliate marketing by strategically promoting products and services related to your niche. Building a well-curated audience can significantly increase your affiliate earnings.

Start a Profitable Blog: Launch a blog centered around your passions or expertise. Monetize it through methods like sponsored content, affiliate marketing, and ad revenue to create a steady stream of passive income.

E-commerce Entrepreneurship: Set up an online store using platforms like Shopify or Etsy. Sell physical or digital products, tapping into the global market from the comfort of your home.

Remote Social Media Management: Leverage your social media skills to manage the online presence of businesses or individuals. Platforms like Buffer and Hootsuite can streamline your social media management tasks.

Virtual Assistance Services: Offer virtual assistance services to busy professionals or entrepreneurs. Tasks may include email management, scheduling, and data entry.

Invest in Dividend-Paying Stocks: Start building a portfolio of dividend-paying stocks. Over time, as these stocks generate regular dividends, you can create a source of passive income.

Remote Graphic Design: Expand your graphic design services on platforms like 99designs or Dribbble. Building a strong portfolio can attract high-paying clients.

Web Development Projects: If you have web development skills, take on remote projects. Websites like Toptal and Upwork connect skilled developers with clients in need of their services.

Launch a YouTube Channel: Create engaging and valuable content on a YouTube channel. Monetize through ad revenue, sponsorships, and affiliate marketing as your channel grows.

Digital Product Sales: Develop and sell digital products such as ebooks, printables, or templates. Platforms like Gumroad and Selz make it easy to sell digital goods online.

Stock Photography Licensing: If you have photography skills, license your photos to stock photography websites. Each download earns you royalties.

Remote Transcription Jobs: Explore opportunities in remote transcription on platforms like Rev or TranscribeMe. Fast and accurate typists can find quick and consistent work.

Participate in Paid Surveys: Sign up for reputable paid survey websites like Swagbucks and Survey Junkie to earn extra income by providing your opinions on various products and services.

Remote Customer Service Representative: Many companies hire remote customer service representatives. Search job boards and company websites for remote customer service opportunities.

Cashback and Rewards Apps: Use cashback apps like Rakuten and Honey when shopping online to earn cashback and rewards on your purchases.

Create a Niche Podcast: Start a podcast around a niche you are passionate about. Monetize through sponsorships, affiliate marketing, and listener donations.

Automated Webinars for Digital Products: Create automated webinars to promote and sell digital products or services. This hands-off approach can generate income while you focus on other tasks.

youtube

Rent Out Your Property on Airbnb: If you have extra space in your home, consider renting it out on Airbnb for short-term stays. This can be a lucrative source of additional income.

Remote SEO Services: If you have expertise in search engine optimization (SEO), offer your services to businesses looking to improve their online visibility.

Invest in Real Estate Crowdfunding: Diversify your investment portfolio by participating in real estate crowdfunding platforms like Fundrise or RealtyMogul.

Create a Subscription Box Service: Develop a subscription box service around a niche you are passionate about. Subscribers pay a recurring fee for curated items.

Remote Project Management: Utilize your project management skills by taking on remote project management roles. Platforms like Remote OK and Home feature remote opportunities.

Making more money from home is not just a possibility; it’s a reality with the myriad opportunities available in today’s digital age. By diversifying your income streams and leveraging your skills, you can create a robust financial foundation. Whether you choose to freelance, start an online business, or invest in passive income streams, the key is consistency and dedication. Explore the strategies outlined in this guide, identify those that align with your strengths and interests, and embark on a journey to maximize your income from the comfort of your home.

#makemoneyonline #makemoney #money #workfromhome #entrepreneur #business #affiliatemarketing #bitcoin #success #onlinebusiness #forex #digitalmarketing #motivation #investment #makemoneyfast #earnmoney #financialfreedom #passiveincome #cash #businessowner #entrepreneurship #marketing #luxury #earnmoneyonline #millionaire #makemoneyonlinefast #makemoneyfromhome #investing #cryptocurrency #onlinemarketing

#makemoneyonline#makemoney#money#workfromhome#entrepreneur#business#affiliatemarketing#bitcoin#success#onlinebusiness#forex#digitalmarketing#motivation#investment#makemoneyfast#earnmoney#financialfreedom#passiveincome#cash#businessowner#entrepreneurship#marketing#luxury#earnmoneyonline#millionaire#makemoneyonlinefast#makemoneyfromhome#investing#cryptocurrency#onlinemarketing

32 notes

·

View notes

Text

Excerpt from this story from The American Prospect:

The Clean Air Act (CAA) has been fiercely opposed by polluters and their allies since its passage in 1970. Industry has never quite stopped fighting to prevent the government from protecting American lives and communities at the expense of even a bit of their profits. But over the past few years, opposition to the law has reached new feverish heights. Multiple cases seeking to gut the CAA have been filed by (or with the support of) oil and gas organizations, their dark-money front groups, and their political allies since 2022.

The ringleaders of this effort are the usual trade groups driving climate apocalypse, including the American Fuel and Petrochemical Manufacturers (AFPM) and the American Petroleum Institute (API), as well as oil giants themselves, like ExxonMobil.

Yet the coordinated attacks on this lifesaving, popular, and historically successful regulation go beyond the singularly destructive interests of the oil industry alone. And they go beyond the federal rule too, and are working their way into litigation against state enactments of the CAA.

Of course, many of the companies driving these suits are some of the biggest names in corporate greenwashing, like Amazon, FedEx, SoCalGas, and more.

These companies have continuously insisted that they are committed to leading the clean-energy transition, even while they fight for the right to poison the general public for profit, and have endeavored—at every turn—to destroy any opportunity the public may have to pursue recourse for it.

Last year, the Truck and Engine Manufacturers Association (EMA) threatened a lawsuit against the California Air Resources Board (CARB) over the state regulator’s Advanced Clean Fleets (ACF) rule.

The rule, which would mandate a “phased-in transition toward zero-emission medium- and heavy-duty vehicles,” threatens the transportation sector’s historically noxious way of doing business; the sector accounts for more than 35 percent of California’s nitrogen oxide emissions and nearly a quarter of California’s on-road greenhouse gas emissions. CARB’s rule could go a long way toward actualizing rapid reductions in the state’s annually generated emissions.

However, later that year EMA and some major truck manufacturers reached an agreement with CARB not to sue over the rules, in exchange for the state’s loosening of some near-term emissions reductions standards.

EMA has by and large kept its promise to not intervene with the regulation in courts, but litigation challenging CARB’s rule would soon be picked up by the California Trucking Association (CTA). Enforcement of the rule has since been on hold, as CARB waits to be issued an ACF-related waiver from the EPA in return for CTA not filing for preliminary injunction against the law.

Even despite these agreements, some of EMA’s own members—and even some of those specifically signed on to the CARB deal—pop up on CTA’s member rolls, as per CTA’s own 2023 membership directory. Daimler Trucks North America and Navistar, Inc., are specifically listed as Allied Members of CTA for 2023.

Amazon is listed among CTA’s Carrier Members, while separately making routine promises to be a partner in the fight against climate change. While Amazon announced its “Climate Pledge” in 2019 of reaching net-zero emissions by 2040 to great fanfare, and has since branded itself a climate leader, the Center for Investigative Reporting has detailed how the e-commerce giant is overselling its green credentials by drastically undercounting its carbon emissions.

In truth, Amazon’s emissions have increased more than 40 percent in the time since it issued the pledge. Amazon also remains the largest emitter of the “Big Five” tech companies, producing no less than 16.2 million metric tons of CO2 every year. Without question, the corporation should be regarded as an industry leader in greenwashing, rather than in actual climate action.

FedEx is also a CTA Carrier-level member. Like Amazon, the company has also made promises “to achieve carbon neutral operations by 2040,” an initiative FedEx has labeled “Priority Earth.” In the years since, FedEx has funneled intensive time and resources into lobbying directly against climate action while pushing its net-zero greenwashing narrative.

UPS is another CTA Carrier-level member. UPS has historically been less effusive in its climate promises than have other corporations on this list, but the delivery giant has continuously reinforced its stance that “everyone shares responsibility to improve energy efficiency and to reduce GHG emissions in the atmosphere.”

7 notes

·

View notes

Text

Revitalizing Local Retail: How The Dash Shop Empowers Small Businesses in the Age of E-Commerce Giants

The landscape of retail has been undergoing a major shift over the past decade. Brick-and-mortar stores, once the heart of local communities, are facing unprecedented challenges. The rise of big online e-commerce platforms has brought about convenience and variety for customers, but it has also squeezed the lifeblood out of many small retailers. As local shops struggle to compete with the sheer scale and reach of these digital behemoths, they often find themselves fighting an uphill battle to stay relevant and profitable. But there’s hope on the horizon, and it’s called The Dash Shop.

The Struggle of Local Retailers

Walk down any main street in a small town or city, and you’ll likely see the signs: “For Rent” or “Closing Down Sale.” These aren’t just businesses shutting their doors; they’re parts of our community’s fabric being torn away. Small retailers are the backbone of local economies, offering unique products, personalized customer service, and a sense of community that giant online platforms simply can’t match. However, the challenges they face are immense.

Rent and operational costs continue to rise, while foot traffic dwindles as more consumers turn to the convenience of online shopping. The pandemic only accelerated this trend, pushing many local retailers to the brink. Without the vast resources of large corporations, these businesses often find it difficult to invest in the technology and marketing needed to compete in the digital age.

Enter The Dash Shop: Empowering Local Retailers

The Dash Shop is here to change the game. Our mission is simple yet profound: to give power back to the local retailers. We believe that every small business should have the opportunity to thrive, regardless of the competition. With The Dash Shop, retailers can establish an online presence that allows them to reach their local customers more effectively and efficiently.

No Commission Fees, More Profit

One of the biggest challenges small retailers face when selling online is the high commission fees charged by major e-commerce platforms. These fees can eat into already thin profit margins, making it even harder for local shops to stay afloat. The Dash Shop eliminates this hurdle by offering a platform where retailers can sell their products without incurring any commission fees. This means more money stays in the pockets of the people who need it most – the local business owners.

Fast and Secure Local Deliveries

Another significant advantage of The Dash Shop is our robust delivery system. Retailers can sell their products online and have them delivered directly to their local customers in a fast and efficient manner. This isn’t just about speed; it’s about security and reliability. With The Dash Shop, retailers don’t have to worry about their products getting lost or stolen during the delivery process. Our system ensures that products reach their destination safely, giving both retailers and customers peace of mind.

Driving Foot Traffic with Free Discount Coupons

In addition to facilitating online sales, The Dash Shop also helps retailers drive foot traffic to their physical stores. How? By allowing them to create and distribute discount coupons at no cost. These coupons are a powerful tool for attracting customers, encouraging them to visit the store and discover the unique products and personalized service that local retailers offer.

Imagine being able to offer your customers a special discount on their favorite items or a promotion on new arrivals without worrying about the cost of printing and distributing coupons. With The Dash Shop, it’s all possible and free. This feature not only boosts sales but also helps to build stronger relationships between retailers and their local communities.

A Community-Centric Approach

The Dash Shop isn’t just a platform; it’s a community. We understand that small businesses are the heart of our neighborhoods. They create jobs, support local events, and give our towns and cities their unique character. By providing retailers with the tools they need to succeed, The Dash Shop is helping to ensure that our communities remain vibrant and prosperous.

The Future is Local

The retail landscape is changing, but that doesn’t mean local shops have to disappear. With The Dash Shop, small businesses can embrace the future while staying true to their roots. They can compete with the giants of e-commerce, attract more customers, and keep more of their hard-earned profits. It’s about leveling the playing field and ensuring that the charm and character of our local communities don’t get lost in the shuffle of progress.

Join the Movement

If you’re a small retailer feeling the pressure of the digital age, know that you’re not alone. The Dash Shop is here to support you, providing a platform that empowers you to thrive in an increasingly competitive market. Join us in our mission to revitalize local retail and give power back to the businesses that make our communities special. The future of retail is local, and with The Dash Shop, that future is bright.

8 notes

·

View notes

Text

Mastering Credit Card Processing in High-Risk E-Commerce

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the fast-paced world of online commerce, the ability to accept credit card payments is undeniably paramount for businesses striving to thrive. However, when your enterprise operates within a high-risk industry, navigating the intricate landscape of credit card processing can be quite an imposing challenge. Fear not, for we are about to embark on a journey into the realm of high-risk credit card processing, unveiling the secrets that will empower your high-risk e-commerce venture to ascend to unprecedented heights.

DOWNLOAD THE MASTERING CREDIT CARD PROCESSING INFOGRAPHIC HERE

Unveiling the Potentials of High-Risk Credit Card Processing High-risk credit card processing serves as a vital lifeline for numerous e-commerce enterprises entrenched within industries that conventional financial institutions consider riskier. Whether your business specializes in credit repair, CBD products, or any other high-risk sector, the capacity to embrace credit card payments not only widens the customer base but also ushers in increased revenue streams.

Delving Deeper into High-Risk Payment Processing Payment processing within high-risk sectors necessitates specialized solutions that have been meticulously designed to cater to businesses that are burdened with a higher probability of chargebacks, fraud, or regulatory scrutiny. These specialized services ensure that even high-risk merchants can competently and securely manage credit card payments.

The Role of Merchant Accounts and Processing Merchant accounts stand as the linchpin of credit card processing, offering businesses the vital infrastructure required for accepting and processing credit card payments. High-risk payment processing is a multifaceted solution that not only empowers businesses to process credit card transactions but also effectively mitigates the distinctive risks entwined with their respective industries. Within this context, we explore the key components that underscore the indispensability of high-risk payment processing. A high-risk payment gateway emerges as a vital conduit between your e-commerce website and the payment processor, meticulously transmitting transaction data and safeguarding the sanctity of sensitive customer information.

For high-risk industries, the presence of a sturdy payment gateway is an imperative necessity. Acquiring a high-risk merchant account often acts as the inaugural step for businesses entrenched within these sectors. This specialized account is painstakingly tailored to address your unique requisites and proffers the essential flexibility to confront the innate challenges associated with high-risk credit card processing. In a world where e-commerce reigns supreme, it becomes imperative for high-risk businesses to adopt e-commerce payment processing solutions, which have been meticulously optimized for online transactions. These solutions assure customers a seamless and secure payment experience.

Embracing Credit Card Payments for Credit Repair, CBD, and Beyond For enterprises specializing in credit repair or CBD products, the significance of being able to accept credit cards cannot be overstated. Customers are often drawn to the ease and convenience of credit card payments, and the provision of this option can substantially elevate your sales. Nevertheless, it is absolutely pivotal to collaborate with a payment processing provider that specializes in high-risk credit card processing, thus guaranteeing compliance and security.

The Profits of Credit Card Payment Processing for High-Risk Sectors By offering credit card payments, you effectively broaden your business's horizons to a more extensive customer base. Countless consumers are partial to the convenience and security that credit cards offer during online purchases. Credit card payments are indelibly associated with a heightened level of trust. When customers observe that your enterprise accepts credit cards, it bolsters their confidence in your brand and can culminate in higher conversion rates. Specialized high-risk credit card processing solutions are impeccably equipped to tackle the unique challenges that your industry poses, effectively minimizing the risks of chargebacks and fraud. Efficient payment processing optimizes your operations, freeing you to channel your focus towards business growth rather than squandering precious time grappling with payment-related concerns.

youtube

The Influence of SEO in High-Risk Credit Card Processing In the digital epoch, an online presence is unequivocally indispensable, a truism that holds particular weight within high-risk industries. The strategic deployment of effective SEO strategies has the potential to catapult your high-risk e-commerce business to unprecedented heights. When prospective customers embark on searches for high-risk credit card processing, credit repair merchant processing, or CBD payment processing, your website should indisputably secure a place among the top search results.

Mastering high-risk credit card processing is undeniably a game-changer for businesses navigating the tumultuous waters of challenging industries. By gaining a profound understanding of the intricacies of payment processing within high-risk sectors and harnessing the untapped potential of credit card payments, you can firmly position your business for sustained growth and lasting success. Thus, whether you operate within the domain of credit repair, CBD products, or any other high-risk industry, the moment has arrived to wholeheartedly embrace the world of high-risk credit card processing and witness the ascension of your e-commerce venture.

#high risk merchant account#merchant processing#credit card processing#high risk payment gateway#high risk payment processing#accept credit cards#payment processing#credit card payment#payment#youtube#Youtube

21 notes

·

View notes

Text

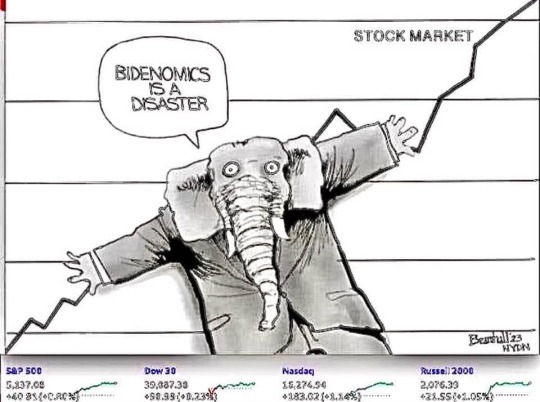

Bill Bramhall, New York Daily News

* * * *

LETTERS FROM AN AMERICAN

March 5, 2024 (Tuesday)

HEATHER COX RICHARDSON

MAR 6, 2024

Possibly the biggest story today in terms of its impact on most Americans’ lives is that as part of its war on junk fees, the Biden administration announced an $8 cap on late fees charged by credit card issuers that have more than a million accounts. These companies hold more than 95% of outstanding credit card debt. Currently, fees average $32, and they fall on more than 45 million people. The White House estimates that late fees currently cost Americans about $25 billion a year. The rule change will save Americans about $10 billion a year.

The administration also announced a “strike force” to crack down on “unfair and illegal pricing.” Certain corporations raised prices as strained supply chains made it more expensive to make their products. But after supply chains were fixed and their costs dropped, corporations kept consumer prices high and passed on record profits to their shareholders. The strike force will encourage federal agencies to share information to enable them to identify businesses that are breaking the law.

Banking organizations and the U.S. Chamber of Commerce came out swinging. Executive vice president Neil Bradley said that such regulation “to micromanage how private businesses set prices will have the same result: shortages, fewer choices for consumers, a weaker economy, and less jobs.”

And in what perhaps illustrates why voters don’t appear to know much about what the administration is doing, these stories have gotten far less attention today than the primaries and caucuses.

Today is Super Tuesday, when 15 states and one territory choose their primary candidates for president and for the House of Representatives and the Senate (although in Alaska, only Republicans vote today and in American Samoa, only Democrats vote today). About 36% of Republican delegates will be awarded today, and that’s the side people will be watching because on the Democratic side, Biden has a virtually uncontested lead with the exception of candidate Jason Palmer, who won the Democratic caucuses in American Samoa.

Trump is expected to win today’s Republican contests, but observers are watching to see what percentage of the vote challenger Nikki Haley, former governor of South Carolina, takes from him. As I write this, she appears to have won Vermont and run strongly elsewhere, especially in the suburbs. Three states conducted exit polls and they, too, show warning signs for Trump as 78% of Haley voters in the North Carolina primary, 69% in California, and 68% in Virginia refused to say they would support the party’s nominee no matter who it is.

It is also notable that polls showed Trump with a much stronger margin over Haley than materialized today. As Josh Marshall of Talking Points Memo notes, it is not yet clear what that means.

Trump is on his way to becoming the Republican presidential nominee. On Friday the Republican National Committee (RNC) will meet in Houston to choose a new chair. The only people running are Trump loyalist Michael Whatley and Trump’s daughter-in-law Lara Trump, who hope to become co-chairs. Natalie Allison reported today in Politico that the RNC will not vote on a resolution that would have prohibited the RNC from covering Trump’s legal bills.

Trump is certainly in need of money. Today, his lawyers demanded a new trial in the second E. Jean Carroll case, complaining that the judge limited what he could say, and asked for a judgment figure significantly lower than the $83.3 million the jurors awarded. By the end of Friday, Trump must post either the money or a bond covering it.

This morning, Trump told Brian Kilmeade of Fox & Friends that he was not worried about coming up with the money to pay the $454 million he owes in the New York fraud case, or the interest it is accruing at more than $100,000 a day. “I have a lot of money. I can do what I want to do,” Trump said. “I don't worry about anything. I don't worry about the money. I don't worry about money.”

Yesterday, Allen Weisselberg, the former chief financial officer of the Trump Organization, admitted he lied under oath during his testimony in that case. He will be sentenced in April.

Super Tuesday is also the day that the 2024 presidential campaign begins in earnest for those who had not previously been paying much attention, and Taylor Swift today urged her 282 million followers on Instagram “to vote the people who most represent YOU into power. If you haven't already, make a plan to vote today,” she wrote.

The presidential contest is only one of the many contests on the ballot today, but most of those results are not yet in.

Although the Arizona primary will not be held until March 19, we did learn today that Senator Kyrsten Sinema (I-AZ) will not run for reelection. Her exit will leave the Arizona senator’s race to election-denying Trump Republican Kari Lake, who lost the Arizona governorship in 2022 (although she continues to insist she won it), and Arizona Democratic representative Ruben Gallego.

Just as voters don’t appear to know much about what the administration has done to make their lives better, a recent study from a Democratic pollster suggests that voters don’t seem to know much about Trump’s statements attacking democracy. When informed of them, their opinion of Trump falls.

Trump has called for mass deportations of immigrants and foreign-born U.S. citizens; on February 29, he said he would use local police as well as federal troops to round people up and move them to camps for deportation. Asked yesterday by a Newsmax host if he would “order mass deportations if you win the White House,” Trump answered: “Oh, day one. We have no choice. And we’ll start with the bad ones. And you know who knows who they are? Local police. Local police have to be given back their authority, and they have to be given back their respect and immunity.”

On the one hand, caps to credit card late fees and an attempt to address price gouging; on the other hand, local police with immunity rounding up millions of people and putting them in camps, for deportation. And, in between the two, an election.

People had better start paying attention.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Heather Cox Richardson#Letters From An American#deportations#TFG#election 2024#economy#Bill Bramhall

8 notes

·

View notes

Text

Start a Business in Dubai with Low Investment

Dubai has emerged as a global business hub, providing immense opportunities for entrepreneurs with various budgets. With the right approach and strategy, it's possible to establish a successful business in Dubai with low investment. Here’s a quick guide on how to get started and make the most of Dubai’s business-friendly environment.

Benefits of Starting a Business in Dubai

Dubai offers numerous advantages for new businesses:

Strategic Location: Dubai connects Europe, Asia, and Africa, making it a perfect base for international trade.

Free Zones: Dubai’s free zones allow full foreign ownership, tax exemptions, and streamlined processes.

Low Taxation: With no personal or corporate tax for most types of businesses, Dubai is financially favorable.

Steps to Start a Business in Dubai with Low Investment

Choose the Right Business Setup in Dubai To maximize investment, consider starting your business in one of Dubai's free zones. They offer affordable packages tailored for entrepreneurs and small businesses. Popular free zones like DMCC, IFZA, and Meydan Free Zone provide cost-effective licensing options.

Select a Business Activity Start with a service-based business, which requires minimal capital. Freelance services, consultancy, digital marketing, and online trading are popular low-cost options. These require lower initial investment compared to retail or manufacturing.

Leverage Virtual Office Options Dubai’s free zones offer flexible office solutions, including virtual offices, which allow businesses to maintain a presence in Dubai without incurring high rental costs.

Obtain the Necessary Licenses Every business setup in Dubai requires a license, depending on the activity and location. Free zone authorities offer various affordable licensing packages, including freelancer licenses for individual entrepreneurs.

Market Smartly and Efficiently Use digital marketing to reach customers on a budget. Social media, SEO, and email marketing can help you attract customers without high advertising costs.

Best Low-Investment Business Ideas in Dubai

Consultancy Services: If you have expertise in a field like finance, legal, or management, starting a consultancy can be highly profitable.

E-commerce: Launch an online store and leverage Dubai’s growing digital market.

Digital Marketing Agency: With minimal equipment and a small team, you can help local businesses grow their online presence.

Freelancing: From content creation to graphic design, freelancing offers flexibility and requires a minimal investment.

Conclusion

Starting a business setup in Dubai with low investment is entirely feasible, given the city’s supportive infrastructure and numerous free zones. With the right planning, selecting cost-effective options, and focusing on low-cost business ideas, you can launch a successful venture in Dubai without breaking the bank. Dubai’s dynamic market, combined with low taxation and robust growth prospects, makes it a prime choice for aspiring entrepreneurs.

know more

#business setup in dubai#dubaibusiness#uaebusiness#freezone in dubai#best business consutant dubai#company formation in dubai#business ideas#start a small business

2 notes

·

View notes

Text

Maximizing Your Digital Presence with ClickCrave's SEO Services

In the rapidly evolving digital world, businesses need more than just a website to stand out—they need a robust online strategy that ensures visibility, engagement, and conversions. That's where Search Engine Optimization (SEO) comes into play. ClickCrave, a leader in digital marketing, offers comprehensive SEO services designed to help businesses enhance their online presence, drive organic traffic, and increase revenue.

Why SEO Matters SEO is the backbone of digital marketing. It refers to the process of optimizing a website to rank higher in search engine results pages (SERPs) like Google. Higher rankings mean more visibility and more potential customers discovering your brand. Whether you’re a small business or a large corporation, SEO is essential to increase your website’s organic traffic and outperform competitors.

ClickCrave offers expert SEO services tailored to each client’s unique needs. From branding and design integration to specialized e-commerce SEO services, we cover all aspects of SEO that can give your business the competitive edge.

ClickCrave: Your Partner in Branding and Design with SEO Your brand’s identity goes hand-in-hand with SEO. Successful brands understand that building a strong digital presence requires more than keyword optimization; it requires a blend of branding and design. At ClickCrave, we integrate SEO strategies into your branding efforts to ensure that your website not only ranks high but also resonates with your target audience.

By optimizing elements such as logos, color schemes, and website layout while incorporating SEO best practices, we ensure your brand is visible and engaging. Our team works closely with you to understand your brand’s goals and infuse them into your website’s SEO strategy.

The Benefits of Working with the Best SEO Company Choosing the best SEO company is crucial for success, and ClickCrave stands out as a leader in the industry. We are committed to staying up-to-date with the latest trends, algorithm updates, and search engine requirements. Our expert team delivers top-notch results through proven strategies, ongoing optimizations, and a deep understanding of what it takes to achieve long-term growth in organic search.

With ClickCrave, you benefit from a personalized approach that aligns with your business goals. We don't just work to improve your rankings; we focus on delivering sustainable results that boost your brand’s overall visibility and profitability.

E-commerce SEO Services: Elevate Your Online Store For online businesses, e-commerce SEO services are essential to driving traffic and converting visitors into customers. E-commerce sites often face unique SEO challenges, such as managing product pages, ensuring fast load times, and optimizing for mobile.

ClickCrave’s e-commerce SEO services are specifically designed to address these challenges. We focus on optimizing your product pages, implementing technical SEO best practices, and enhancing user experience to drive higher conversions. Whether you sell physical products or digital services, our SEO strategies are tailored to help you rank higher for relevant keywords, attract potential buyers, and grow your sales.

SEO Audit Services: Uncover Opportunities for Growth Before implementing any SEO strategy, it’s crucial to understand where your website currently stands. That’s why ClickCrave offers comprehensive SEO audit services to assess your site’s strengths and weaknesses. Our audits cover everything from technical SEO issues (such as broken links and slow loading times) to content gaps and keyword opportunities.

With a detailed audit, ClickCrave can create a roadmap for improvement, ensuring your website is optimized for both users and search engines. Our SEO audits provide actionable insights that lay the foundation for a successful optimization strategy, ensuring that every aspect of your site is contributing to better rankings and increased traffic.

ClickCrave’s Proven SEO Process At ClickCrave, we follow a data-driven, results-oriented process that guarantees success. Our SEO services follow these core steps:

Keyword Research and Strategy: We conduct in-depth research to find the most relevant and high-value keywords for your industry. Whether it’s targeting customers in specific niches or broadening your reach, our strategy is customized to your business.

On-Page Optimization: We optimize your website’s content, meta tags, URLs, images, and more to improve search engine visibility. This includes integrating keywords naturally into the content and ensuring that each page is optimized for the best possible performance.

Technical SEO: We ensure your site is technically sound, with fast load times, mobile optimization, secure HTTPS, and a structured architecture that search engines can crawl easily.