#Downpayment Condo

Explore tagged Tumblr posts

Text

HDB Condominium & MOP (Minimum Occupancy Period) in Singapore

Get a comprehensive guide on HDB condominiums and the Minimum Occupancy Period (MOP) in Singapore. Understand the regulations, eligibility criteria, and benefits of owning an HDB condominium. Learn about the MOP, its duration, and the restrictions associated with selling or renting out your HDB unit. Stay informed and make informed decisions when it comes to HDB condo ownership in Singapore.

2 notes

·

View notes

Text

a couple of weeks ago, i went to see my nephew at the Kalayaan Residence Hall at the University of the Philippines, to see how he is faring so far. after all, I am his registered guardian and emergency contact. thankfully, he has acclimated to "dorm life" and has learned the ropes of independent living like managing his acads, orgs, laundry, and his daily finances. i told him that dorm life can be both fun and challenging at the same time.

"mag enjoy ka sa college, but be always on guard" i reminded him as we parted ways.

while driving, i realized parang kailan lang I was once a student at the ateneo and remembered how the fun moments as well as the challenging ones. to be honest, I never saw myself as the excelling type of student. For one, happy an ako if I pass an exam. i was never obsessed with high marks, basta pumasa lang goods na ako. and style ko lang kasi dati, right after class and while waiting for my next professor (usually there is a 15 minute gap) I would start on my homework na and if I find the subject hard, I make use of the consultation hours with my professors to ask them to explain the topic to me. some professors are very generous with their time, especially Dr. Queena Lee-Chua (to whom I owe a lot) while some are grumpy and would usually dismiss me "hindi ba inexplain ko na ito?" I mean what an oxymoron dismissal was that? Had I understood it, I would not have asked in the first place diba? but I learned to be patient and find ways to bridge the gap. the answer was to make friends with the staff at the Rizal Library who were instrumental in helping me find books and reserve them for me. I also owe Ate Alma, the lovely lady who manages the photocopying kiosk at school who makes possible my photocopy and ring bind needs are met on time. Nope, she is not "manang xerox" froshies, she is Ate Alma.

I also remember my days at the Cervini Hall, the male dormitory of the university. although I made some friends at the dorm, I really did not engage with the residents or my roommates for that matter. I was just there to sleep and study. Until, that video of me having sex inside the dorm went around, which got me packing for another accommodation, this time a flat in front of the school, Prince David Condo. That phase of my life ruined me. The stares I got and the bouts of snickering whenever I passed by. it did not help that some of the members of Doll House (the gay org in school) had bullied me to a certain extent like I was labeled "pamintang durog" and would chant "come out, come out wherever you are" lahat yun I experienced. I don't take it against them really. times where different then, we were kids and stupid. I could have transferred to U.P. but the fear of taking the UPCAT weighed heavily which made me stay. Besides I was already in third year, and I could still muster enough grit for two more semesters.

condo living liberated me of the added pressure of being a campus whore. You see, I never told my parents that I signed up for a lease. all that time they assumed I was safe in the campus dorm. thankfully, a friend who graduated and won't be using his unit found a tenant in me. so whatever little savings I had, i used for the downpayment and the advance it required. it was a small one-bedroom flat, decent enough to sleep, eat, and study. plus it had a good view of Katipunan Avenue. Good thing I had two part-time jobs to tide me over. the only challenge was I scrimped on eating out which meant daily rations of Lucky Me instant pancit canton and Argentina corned beef (which I now hate) until I get home at the end of the month and raided our pantry for supplies and the frozen ulams, manang cion sends me to reheat.

of course, it was not all study hours for me. i still went out with my small group of friends for drinks. i even went on dates and brought home some for sex. I won't deny that. don't we all? basta and rule ko lang, acads before landi: homework first before blowjobs and no sex during exam week. it worked for me! and true enough, despite me underestimating myself, the validation came a month before graduation, when the list of students with Latin honors came up, and my name was included.

the pokpok has arrived and he has four medals.

i was never the perfect student much more as a person to this day. my flaws are so evident but I was honest to admit that I was broken, hurt people who loved me, a failure and needed fixing but then perhaps, destiny was kind enough to give me not only a second chance but a third and fourth and more...and true enough the universe smiled at me and handed me a bowl of cherries.

so if you find yourself in a similar situation, don't lose hope. hayaan mo lang dumaan young problems mo. and importante, mahal mo and sarili mo.

14 notes

·

View notes

Text

1) Ilang linggo ko nang naiisip 'to pero bakit para nang instagram 'yung tumblr dashboard ko? Hindi naman sa ayaw ko ng pictures, pero halos walang mabasang text post... kaya sinusuyod ko minsan isa-isa 'yung mga finafollow ko. Nagpopost pa rin naman sila ng mga paragraph.

2) Gusto ko nang maging okay. Ayoko nang mag-ruminate at ma-anxious about the future na wala pa naman. Sinasabi ko sa sarili ko, ano bang definition ko ng success? Chill naman 'yung trabaho ko, nagagawa ko gusto ko, may pera ako. Pero hindi ako mapakali. Hindi ko na alam anong growth pa ang gusto ko. (Hindi ko sinasabing perfect ako, lost lang sa kung saan na ako papunta, anong direksyon ang tatahakin; parang nagstay lang ako sa same point—may masama ba dun?)

3) Last year tinanong ako ng manager namin kung wala raw ba akong ka-date. Kitang nagtatrabaho habang February 14 eh. Pero ang pinagkaiba, last year, hindi naman ako bitter. Enjoy lang sa life. This year... sigh. Akala ko nakahanap na ako ng "home". Nag-sign na ako ng verbal contract, nag-downpayment na, pero wala. Evicted.

4) May nakita akong post sa isang fb group. Bumili sya ng condo sa Makati pero hindi sya masaya kasi pakiramdam nya, obligasyon lang, at hindi fulfilling. Practical na decision kaysa magrent daw. Gusto nya raw maging digital nomad. Naaliw ako sa chaos ng feelings at decision-making niya about that property. Wala akong judgment. Nafeel ko lang na hindi ako ganu'n ka-weird; may worries din talaga ang ibang tao. At kahit nga practical ang desisyon mo, minsan hindi ka pa rin nagiging masaya o fulfilled.

14 notes

·

View notes

Text

like three years ago I was passively looking up home prices thinking I might be one of the lucky ones who could afford to save for a home within 5-10 years. There were small starter houses in my city for just barely over $100,000 (which is still too much) that with good credit I'd be able to afford in the foreseeable future. But now, everything up to $200,000 is just mobile homes and empty lots, and even the smallest houses most run down and condos end up with $1,000-$2,000 monthly payments (with good credit and a sizeable downpayment). Housing prices have more than doubled here in just half a decade. What are we supposed to do?

#mine#and that's speaking as someone who's relatively privileged in being able to save money on only a few dollars above minimum wage

2 notes

·

View notes

Text

im trying to save for a downpayment on a condo but it's going to take at least a year and im SO impatient 😤 if i had started last year id be done already

3 notes

·

View notes

Text

The post thread goes deeply into "this is literal, it is not a metaphor" and at some point mentions that no one had offered advice on how to buy a condo.

This blog is "not financial advice" and this is not financial advice it is... more of... a general list... of suggestions... on how to buy a condo. In the United States.

At no point am I considering this easy, simple, fair, possible widespread.

It sucks. It is expensive. It is hard. It is confusing.

I'm hoping to take at least a tiny bit of sting out of it.

Look around your area. Go to real estate offices, they often have postings in the window. Go to their websites. Go on to Zillow or whatever but understand those prices are, hm, spicy and high, frequently. You want to get a gauge of "this is how much a condo of that size is in my area." Or the area you want to move into.

Mortgages are typically 3 - 5% downpayment, up to 20%.

If you put down less than 20%, you will very likely have to pay something called "private mortgage insurance" (PMI)

Names aside -- it's an extra payment with your mortgage payment.

It covers the lender in case you can't make the payments.

It goes away once you've made enough payments to have gained 20% equity.

Downpayment

This is the the hardest part. It sucks. I'm not going to sugar coat it.

3% of a $100,000 condo is $3,000.

Your mortgage is $97,000.

Your payment is going to be just under $600 + property taxes + PMI (probably 1.5 - 2% of the mortgage) + insurance + association costs.

Here is a basic calculator to play with numbers.

One of the things you should do when looking for a condo is look for first time home buyer's programs.

Google "first time home buyer's program {city}."

Go to City Hall. Go to your bank.

Hell, if you work for a giant company, check your benefits.

I've seen that before with folks -- it's rare, yeah, but check everywhere.

15 Year versus 30 Year Mortgage

This question is academic while you're starting out. Go with a 30 year. It keeps your cost of entry cheaper.

In time, you can refinance. You can (almost always) pay more monthly too.

Unless your mortgage lender is offering you a crazy-good-deal on a 15 year mortgage, plan on 30. Shorter mortgages exist because when you have money, you can get a better deal. If you're following this ramble, it is unlikely to apply. Plan on 30. Figure out a better plan later.

Property Tax

You'll hear a term called "escrow" bandied about. You'll pay an amount on top of your mortgage payment, this amount varies based on your mortgage, property taxes, insurance too probably, and it sits in a savings account.

You cannot touch this savings account.

Your bank will say "For easy math of this ramble, your mortgage is $500/month. Your insurance is $100/month, your property taxes are $600/twice a year... which is $100/month.

"So your total bill is $500 + 100 + 100. Of this amount, $500 goes to your mortgage. $200 goes to this escrow savings account.

"Twice a year, as your bank, we'll withdraw the cash for your insurance and pay them directly. We'll withdraw the cash and pay the property taxes."

Your bank is in touch with the insurance company and the property tax folks regularly to ensure they have enough in your escrow. Your mortgage will fluctuate slightly accordingly.

Association Fees

These vary wildly from area-to-area and even building-to-building so keep this in mind while you're hunting.

This pays for maintenance, the building's improvements, the building's property taxes... etc.

Some condo buildings are self-managed by the owners. Some have hired an agency to do the managing. Some blend.

While you are condo hunting, ask about the association fee. Try to get details "How much was it last year? 3 years ago? 5 years ago?" You want to see how often they are raised and by how much.

Also ask about "special assessments." This is an out-of-the-blue and/or long-term-planned "The condo association needs everyone to pay up $X."

They should be rare. Once every handful of years... like, once or twice every 10 years. That is a very rough guide, not a tight guideline. The more common they are? The worse shape the building and/or association is in.

Check what the association fees cover. Will someone come to your condo and handle emergency plumbing? Do they handle landscaping?

What rules do they have?

"This feels impossible."

It sucks. It's expensive.

There are closing costs on top of all this crap (money you pay during the initial purchase to handle a billion things.) It's more complicated than it feels like it should be.

As you start planning "I want to live here, I can pay $X, that fits within the basic numbers" go talk to a bank. Multiple banks. Community banks, big banks, credit unions, shop around.

"Is this a hard pull on my credit?"

That's the one that hurts it by looking at it. You shouldn't have this until you get fairly deep in the process, but it's just a good question to ask.

If someone makes you uncomfortable for not knowing? Fucking leave immediately. You're the boss. This is your house. These people are working for you. I'm not advocating rudeness, I am advocating if someone is making you feel like shit, leave.

This covers literally everyone in the transaction.

This is a high-value (it costs a lot of money) low-volume transaction (people do not typically buy many properties in life).

You, the customer, are the rarest commodity.

Never let anyone talk down to you.

If you're not ready now, but will be someday, and want info? Go get it. Make the connections. Realty agent, banker, everyone whom has info about your situation you want.

This doesn't cover everything, I'm hoping it's enough to get you started figuring out what questions to ask and whom to ask.

"Okay but this still feels impossible."

It sucks.

I don't have an answer if you are underpaid at your job. I'm a huge advocate of "people should get paid what they are worth." I hope your situation improves.

Anyone saying "stop buying coffee and shove it in a jar" is not being helpful.

Don't spend energy on them.

Do spend energy on, "I need $X for a downpayment and closing costs. How do I get it?" Work backwards from there on a plan. Keep your cheddar in a high yield interest bank account.

I'm cheering you on.

It isn't much, I hope it helps, a little.

There are going to be local plans and laws and rules that will help and hurt you. Ask questions of local folk. Get them to help you make a plan, of city hall's housing department and various (multiple) banks. It's their job. It is literally their job.

I'm cheering you on.

When I grow up I wanna be upper middle class.

206K notes

·

View notes

Text

How to Buy a New Launch Property in Singapore (Simple Guide)

Buying a new launch property in Singapore is an exciting journey — but it can feel overwhelming if you don't know where to start. Don't worry! In this guide, I’ll walk you through everything you need to know in simple steps to make your dream home purchase smooth and stress-free.

1. Understand What "New Launch" Means

First things first, new launch properties are brand-new condo projects that are either being previewed or just officially launched for public sale. They usually offer:

Early bird prices

A wider selection of units (best views, best layouts)

Special promotions by developers

Buying at this stage can often mean better deals compared to resale units.

2. Calculate Your Budget

Before you fall in love with any property, know how much you can actually afford. You’ll need to consider:

Downpayment (usually 25% for a private property)

Stamp duties (BSD and possibly ABSD if you own multiple properties)

Legal fees

Renovation costs (if any)

Also, check your Total Debt Servicing Ratio (TDSR) limit — the banks use this to calculate how much loan you are eligible for. Tip: Always get a mortgage loan pre-approval first!

3. Start Researching Projects

Once your budget is clear, it's time to hunt!

Look for:

Location: Near MRT stations, schools, amenities

Developer reputation: Only go with trusted names

Price trends: Check nearby resale prices to see if you're getting a good deal

Future growth: Look at the URA Master Plan for upcoming developments in the area

One great option you might want to explore is Faber Residences, a freehold new launch located in a prime area of Singapore, offering luxury living with excellent connectivity and beautiful surroundings.

4. Visit the Showflat

Showflats let you physically see the model units, layouts, and finishes you’re buying into. Things to pay attention to:

Unit size (some showflats are larger than the actual units!)

Finishing quality

The facing of the unit (noisy roads, direct west sun?)

Developer's promises vs actual fittings

Always bring a checklist to compare different projects.

5. Compare Unit Types and Prices

Every condo has a price tier based on:

Unit size (1-bedroom, 2-bedroom, penthouse, etc.)

Facing (pool view, city view, etc.)

Floor level (higher floors are pricier)

Choose a unit that fits your lifestyle needs and offers good resale potential later.

For example, river-facing units at Faber Residence are expected to enjoy strong demand because of their rare location and stunning views.

6. Secure Your Booking

Once you pick your ideal unit, you'll need to:

Submit an Expression of Interest (EOI) with a blank cheque

Receive the Price List from the developer

Attend the Balloting Day if there are many buyers (especially for popular projects)

If you’re successful, congratulations! You’ll proceed to sign the Option to Purchase (OTP) and pay the booking fee (usually 5% of the purchase price).

7. Finalize the Legal Process

You’ll need a lawyer to handle:

Sales and Purchase Agreement (S&P)

Loan documentation

Payment of stamp duties

Timeline: After booking, you'll have 3 weeks to sign the S&P and 8 weeks to pay the downpayment + stamp duties.

8. Progressive Payment Scheme

For new launch condos, you don't pay everything at once. Singapore uses a Progressive Payment Scheme, meaning you only pay portions as construction milestones are completed:

Foundation done → Pay X%

Structure up to 2nd floor → Pay Y%

TOP issued → Pay final amount

This way, your financial burden is spread out over time.

9. Prepare for Key Collection

Finally, once the project is completed (TOP - Temporary Occupation Permit), you’ll be invited to collect your keys and officially move in!

🎉 Time to celebrate your smart property purchase!

Final Thoughts

Buying a new launch property in Singapore is an amazing investment if you do your homework right. Take your time to plan, research, and choose a project that matches your goals.

If you’re looking for a freehold, luxury new launch project in a prime location, you should definitely Faber Residence — it's one of the most exciting developments happening right now!

1 note

·

View note

Text

Freehold Condos in Singapore: A Smart Investment for Lasting Value

Freehold condos in Singapore offer property owners full ownership and long-term investment value, making them highly sought after in the real estate market. With no lease expiry, freehold properties provide greater flexibility and potential for capital appreciation. Explore the benefits of owning a freehold condo, from strategic locations and luxurious amenities to the sense of permanence and security they provide. Whether you're looking to invest or settle down, freehold condos are a prime choice for those seeking stability and long-term value in Singapore’s ever-evolving property landscape.

Download PPT Here : https://www.edocr.com/v/jxyobkk1/propertymomsg/propertymomsg-com-post-top-10-freehold-condos-in-s

#executive condo#property agent course singapore#downpayment condo#hdb mop#condo for sale#singapore#executive condo eligibility

0 notes

Text

one of my neighbors is idling his stupid asshole truck that would have cost roughly the same or more than a downpayment on a decent condo in the area or a house in a decent neighborhood. 60,000 american dollars for a ridiculous lifted truck (even more if he financed it and something about the $1000 rents in this building tells me he didn't buy it outright) and he's wasting gas letting it idle I should be allowed to attack this man for such poor financial decisions

1 note

·

View note

Text

It is the bane of my existence that working culture in North America is "move up or fail and suffer."

I worked in retail for YEARS. I sold books. I fucking LOVE books. I ADORE books. And it was the best job ever because I got to talk to people about books ALL DAY LONG. But I had to find something else. Because even once I moved up into management, my wage wasn't enough for us to be able to afford the lifestyle we wanted (which, at the time was: own our own house/condo and have kids). It was NOT a wage I could have children on. Or ever afford to save for the downpayment on anything. We were living paycheque to paycheque even though my spouse was working in a skilled trade.

So I got an office job. And at the bottom of the totem pole my office job paid me a little more than the retail job, so I started looking around and got a job that paid a little bit better than that job.

And now I'm in an office job I really enjoy. But it's still at the bottom of the totem pole. And every single year when my review comes around they ask the same question: what's your career goal? Where are you going from here?

WHY DO I HAVE TO GO ANYWHERE WHEN I LIKE MY JOB?! Why is that our culture? That you constantly have to want to move up or you're a failure?! I genuinely enjoy my job and I'm VERY fucking good at it. It is essential to the operation of the business. And yet, the mentality is that if I don't want to move up the ladder then I'm stagnant. No. No guys. I just actually enjoy my work. So pay me a living wage (which I just barely get) and let me continue to do the thing I am good at and enjoy that benefits your business.

People who say this are literally saying that they prefer for the workers to all be inexperienced and desperately looking for other jobs. But they somehow also expect good service.

33K notes

·

View notes

Text

7126

FOR SALE: STUDIO (re-open) in 2 Torre Lorenzo Residences RFO at Taft Ave, Manila City (across De Lasalle University)| Area: 26.92 sqm | Total Amount Payable: ₱7,661,740.00

Location: Taft Avenue, Manila City (across De Lasalle University)

Floor Area: 26.92 sqm

Selling Price: ₱7,661,740.00

Details: "Total Amount Payable: 7,661,740.00

Reservation Fee: 50,000.00

10% downpayment to move in: 766,174.00

10% spread in 21 months for only 31,924.00/month, ZERO percent interest

80% balance (bank financing)

NOTE: We will be having a price increase effective June 15,2025

2 Torre Lorenzo Taft Ave. ( across De Lasalle Univ) 2% to 5% increase"

Rey Grande

0917-3029519

Admin Assistant of FFGrande_RealEstatePartner

Accredited Real Estate Salesperson

Under 27C Realty Ortigas

REB PRC No. 19929

0 notes

Text

y'all look into first-time homebuyer programs in your areas. My city (east coast USA) put up $30,000 in GRANT money to help cover 5% downpayment our condo.

It won't work for everyone, I wish it did, it's really geared towards a very specific income bracket, but at least in my case, if you're income is 80%-100% AMI (google "[CITY] average median income" and check those numbers against what you make before taxes.

My partner and I went from skipping meals bc we couldn't afford groceries to paying a mortgage in less than a year.

In our case we had to meet the income restrictions, both have consistent employment, and put down 1.5% of the purchase cost in cash (little over $9000 which isn't unheard of for first/last/deposit on similar rental units) and we had to take a class, (2 weekends, virtual, attendance based).

I highly recommend if you live in a place that has a program like this to at LEAST take the class attached to it. It's good education whether or not you do buy (understanding how to navigate the current economic system is still important even if we all hate it which we do)

and if your stars do align and you're able to jump through the paperwork, our city put down $30k in GRANT money towards our downpayment. Grant meaning NOT A LOAN we DO NOT HAVE TO REPAY THAT MONEY.

Housing policy is fucked up, housing SHOULDN'T be a means of wealth accumulation and storing value....

....that said, living in this economic shitshow where it is all those things, One+/FHB/etc is a BIG FUCKING DEAL.

Additionally, if your city DOESN'T have one, you can point to the cities like Boston who have adopted them and show the success in allowing people to establish themselves in the city. It FIGHTS gentrification because YOU CAN'T BE PRICED OUT OF A HOME THAT YOU OWN. YOUR MORTGAGE WILL NEVER GO UP.

These programs are spearheaded by grassroots activists and exist because people demanded the resources. Be excited, take advantage, and move yourself, your family and your community towards a more equitable view of homeownership.

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

1K notes

·

View notes

Link

AFFORDABLE CONDO IT PARK CEBU 1BR 40.70 SQM AVIDA RIALA 1BR CONDO IT PARK, AVIDA RIALA TOWER 5, AFFORDABLE CONDO IT PARK CEBU, AVIDA RIALA CEBU

0 notes

Text

House it Going? What is the Bottom Line in the Santa Cruz Housing Market?

Megan Kilmer: Santa Cruz Realtor and Lender

Hi! I'm Megan Kilmer a local millennial Santa Cruz Mama, and Homeowner!

Living in Santa Cruz has always been a worthy battle. I am someone who's rented a kitchen nook with a beaded curtain for privacy in order to stay in this beautiful town. I've been a single mama with my first kiddo, renting rooms from other single mamas. My partner and I make just under the six-figure mark and are considered "low-income" by Santa Cruz County standards. I'm not a magician. I can't make housing fall from the sky, but I can tell you how to hack your way into the Santa Cruz housing market!

Right off the bat - I want to acknowledge that the battle for housing is systemic. When our parents grew up, there was no such thing as a credit score. Many people rely on generational wealth to access their first home purchase and there are many who have been excluded from home buying in the past. Therefore, they do not have generational wealth to draw from. In addition, homelessness is a relatively new concept. One used to be able to walk into the woods and clear part of the forest to build their home, and in other countries homelessness doesn't exist because housing is treated as a human right.

Well, we are here now, so let's play with the cards that we have been dealt. What can we do with the current system in place? If home buying isn't where you are in your housing journey right now - feel free to skip ahead. I will be adding information to help those who need resources for rental support as well.

So let dive in - what is needed to be a homebuyer in this market?

There are two ways to buy a house - all cash or financing. If you need a loan you need to be loanable. That means consistent income for two years, a decent credit score, and most people need at least 3-5% down. So let's talk turkey - what's the bottom line in Santa Cruz County?

If you're like me you have been up late at night scrolling looking at real estate websites and drooling at something ridiculously cheap. Maybe it's a piece of land for 15K, mobile home for 170K, or a cute cabin in Felton for 300K! Or wondering why in the world is a condo on by the beach here under 1M?! Or what's up with a "pre-forecloser" property? You probably already know this, but if it looks too good to be true, it is!

Pieces of land under 100K most likely are not buildable. Keep in mind that any property in the San Lorenzo Valley ( Felton, Mt Hermon, Ben Lomond, Lompico, Zayante, Brookdale, Boulder Creek etc.) that does not have a sewer connection is going to need a septic test. Most septic and well systems have not been maintained or were damaged in the CZU Complex Fires. This means that building will take time effort and MONEY! It's 2023 and of the 911 homes lost, we only have 24 rebuilds! Despite the County stating that they are expediting the permitting process.

Does that mean you shouldn't try? No! There are some problem solves to building. One is an FHA 203(k) loan. If you are willing to put in the effort and energy to go through the permitting and rebuild process you will be able to finance the development of your property with a loan.

One of the most inquired about properties I get are mobile homes under 200K. These are tricky. with a mobile home they ask for a larger downpayment because these homes are seen as "depreciating assets" to financial institutions - that being said these home don't seem to have lost much, if any value, in our Santa Cruz housing bubble. The fact is we are still short on housing and affordable homes to buying a mobile home is still a better bet than renting. Because you will gain equity in your mobile home verse not equity gains in a rental.

So why would a mobile home in Santa Cruz County be under 200K? Some parks have age restrictions like age requirements of 55+. Some parks have very high space rent especially if they are near the ocean or another desired location. If space rent is above $1000 this makes the property value go down because it decreases affordability. Also a challenge may be that the mobile home was build pre 1974. These are hard to lend on since they are considered a vehicle, but an added bonus for these homes is there is no home property tax, only annual registration.

Mobile home loans are possible, but a little different. You will need a higher downpayment, 10-20% and the terms of the loans tend to be shorter between 14-20years. If the loan term is shorter that increases your monthly payment. So, if you are looking at a 200K mobile you may end up paying the same amount as you would a 400K home a month, but as you know, those don't exist in Santa Cruz County! So get the mobile home, build equity so that when the time is right you can leverage into your next home.

On to the cute tiny cabin in Felton - or Paradise Park! If you are a member of a Masonic Organization in good standing with dues paid you are eligible to buy property in the Paradise Park community. If you aren't, you are out of luck. If this is a creative direction you want to explore let me know I can introduce to a Brother.

Other cute cabins in the Santa Cruz redwoods! These homes were build after the 1906 earthquake that devastated San Francisco. The homes were build as vacation homes and have now turned into permanent residences. Because many of these homes were not built to endure year-round use there are a lot of "fixers" we can go back to our FHA 203K loan for support with financing a home that is a fixer. We will also diligently ensure that the well and septic systems pass inspections before committing to a home because these issues are costly and may make your monthly payment unaffordable after financing repairs.

Those properties by the beach that snag everyone's attention are usually shared equity - like a timeshare. Many I have seen are between 1/4th and 1/7th shared equity. You would need to work out times that the other homeowners approve to be at the property. It cannot be a permanent residence and it could be loaned on as an investment property but you will not be able to put less than 20% down on it.

The last thing I want to mention about the dream homes that you may find online - there is no such thing as a "pre-foreclosure" home. Those folks have defaulted on a mortgage payment, missed their tax payment, or have a mechanics lien. They are not posting their home for sale. I think it's really sad that big real estate websites do this because the homeowners are already struggling and it gives false hope to a scroller!

If you have any questions about any of the ways to home hack your way into the Santa Cruz home market please reach out. I will be posting more ways to navigate your Santa Cruz homeownership journey, so stay tuned!

#santacruz#homesweethome#realestate#homebuying#mortgage hacks#mortgage tips#mortgage#home hacks#ben lomond#monterey

0 notes

Text

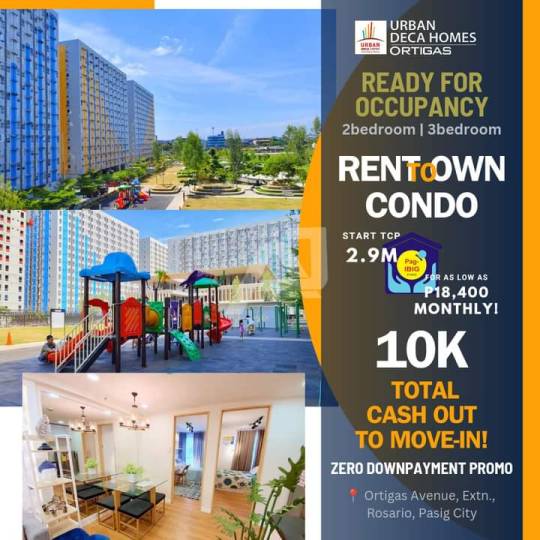

𝗥𝗘𝗡𝗧 𝗧𝗢 𝗢𝗪𝗡 𝗖𝗢𝗡𝗗𝗢 𝗶𝗻 𝗢𝗥𝗧𝗜𝗚𝗔𝗦, 𝗣𝗔𝗦𝗜𝗚 🏙️

Most Affordable Condo in Metro Manila

With 1.3 Hectares Central Amenity Park ⛲🌳

Extended Promo❗

✨ Zero Downpayment

✨ 10k Total Cash out to Move-in!

✨ Thru Pag-ibig Financing

Walking Distance to:

🔹SM East Ortigas

🔹National University

🔹Mission Hospital

🔹Super8 Grocery

🔹Mercury Drugstore

🔹Mcdo,Jollibee & KFC

One ride going to:

🚘 SM Megamall

🚘 Robinsons Galleria

🚘 Ayala

🚘 BGC

🚘 Cubao

Accessible via:

Jeep, bus, mini bus, UV express,

🚆 Soon MRT 4 St.Joseph Station

Available unit:

2bedroom 30.60sqm | 35.57sqm

3bedroom 42.07sqm

Start TCP: 2.9M

Message now for Site Viewing! 😊

Mary Ann Jumalon

Property Specialist

09208227094

#RentToOwnCondo #OrtigasPasig #OrtigasCondo #lookingforcondo

0 notes

Text

Why Parc Clematis is Our Major Stepping Stone to Real Estate Investing

Real estate investing has always been a popular investment for Singaporeans. Our nation has one of the highest homeownership ratings with close to 90% of residents owning a property.

So I guess Singaporeans love property investing.😅

Should You Learn Property Investing

The issue with property investing is, not everyone knows how to grow wealth with real estate.

Yes, almost every property in Singapore is “sure to make money”. That is if you hold for over 30 years and let inflation do its thing.

Over the years, we found that the best way for asset progression is knowing how to pick properties with high growth potential that won’t burn a hole in your pocket.

Read More Info : https://www.propertymomsg.com/post/why-parc-clematis-is-our-major-stepping-stone-to-real-estate-investing

#executive condo#property agent course singapore#downpayment condo#hdb mop#singapore#condo for sale#executive condo eligibility

0 notes