#Digital loan processing

Explore tagged Tumblr posts

Text

Can Personal Loans Be Applied Through WhatsApp and Social Media?

Introduction

With the rapid growth of digital banking and fintech innovations, applying for a personal loan has become more accessible than ever. The latest advancement in this space is the ability to apply for personal loans through WhatsApp and social media platforms. This shift is reshaping how borrowers interact with lenders, making the loan application process seamless and convenient.

This article explores how personal loans can be applied through WhatsApp and social media, the benefits, potential risks, and the top lenders offering this service.

The Rise of WhatsApp and Social Media-Based Loan Applications

Social media and instant messaging platforms have evolved beyond just communication tools. Today, they serve as digital banking interfaces that allow users to perform financial transactions, including loan applications. Banks and NBFCs have started leveraging WhatsApp, Facebook Messenger, and Instagram to offer instant personal loan approvals through chatbots and AI-powered assistants.

How WhatsApp and Social Media Loan Applications Work

Initiating the Loan Request

Borrowers send a message to the lender’s official WhatsApp or social media chatbot.

A virtual assistant guides them through the application process.

Providing Basic Details

Users enter details such as name, mobile number, PAN, Aadhaar, and income details.

Some lenders may require a selfie or biometric authentication for verification.

Loan Eligibility Check

AI-driven algorithms assess the borrower’s eligibility based on financial data and credit score.

Instant feedback is provided, informing the applicant whether they qualify.

Document Upload and Verification

Borrowers upload scanned copies of documents through the chat interface.

Digital KYC (Know Your Customer) verification is performed in real-time.

Loan Approval and Disbursal

If approved, the borrower receives a sanction letter.

The loan amount is disbursed directly into their bank account within hours.

Benefits of Applying for a Personal Loan via WhatsApp and Social Media

1. Convenience and Accessibility

Borrowers can apply anytime without visiting a bank branch.

The entire process is mobile-friendly and user-centric.

2. Faster Loan Approvals

AI-powered chatbots reduce processing time.

Digital KYC ensures quick identity verification.

3. Minimal Documentation

Uploading documents is simplified through a digital interface.

No need for physical paperwork submission.

4. Seamless Communication

Instant updates on loan status via chat.

Borrowers can clarify queries in real-time.

5. Secure Transactions

Lenders use encrypted communication for data security.

Biometric authentication enhances security.

Top Lenders Offering WhatsApp-Based Personal Loans

Several banks and NBFCs are embracing WhatsApp and social media-based loan applications. Here are some of the leading providers:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

InCred Personal Loan

Potential Risks and Precautions

While WhatsApp and social media-based loan applications offer convenience, borrowers must be cautious of potential risks.

1. Fraudulent Loan Offers

Only apply through official lender accounts.

Avoid sharing personal details with unverified sources.

2. Data Privacy Concerns

Ensure that the lender follows secure data encryption.

Read the privacy policies before proceeding.

3. Hidden Charges

Check for processing fees and hidden costs.

Always read the terms and conditions carefully.

4. Cybersecurity Threats

Avoid clicking on unknown links related to loan applications.

Use two-factor authentication for added security.

The Future of Social Media-Based Personal Loans

The adoption of AI and fintech solutions is expected to enhance social media-based loan applications further. Future innovations may include:

Voice-enabled loan applications via smart assistants.

Blockchain-based security for fraud prevention.

Personalized loan offers based on spending habits.

Integration with UPI payments for seamless disbursals.

Conclusion

Applying for a personal loan through WhatsApp and social media is transforming the borrowing experience by making it more accessible and user-friendly. With minimal documentation, quick approvals, and secure processing, these digital lending platforms are the future of personal finance.

For those looking for reliable personal loan options, explore the top lenders here:

Personal Loan Options

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

InCred Personal Loan

By staying informed and cautious, borrowers can leverage social media platforms to secure personal loans conveniently and securely.

#personal loan#loan apps#bank#nbfc personal loan#fincrif#personal loans#loan services#finance#personal loan online#personal laon#Personal loan#WhatsApp personal loan#Social media loan application#Instant personal loan#Digital loan processing#Online loan approval#AI-powered lending#Fintech personal loan#Paperless loan application#Quick loan disbursal#Secure loan application#How to apply for a personal loan through WhatsApp#Best social media platforms for personal loan applications#Instant personal loans via social media#Secure ways to get a personal loan online#Digital KYC for personal loan approval

0 notes

Text

Exploring the Benefits of a Paperless Digital Mortgage Experience

In today’s world, everyone is looking for ways to save time and simplify processes. This is especially true when it comes to getting a mortgage, which traditionally has involved a lot of paperwork and time. Thankfully, technology is changing that. A digital mortgage uses technology to handle the loan process online, making it faster and easier for everyone involved. With the rise of smart phones and the internet, applying for a mortgage has never been more accessible or more convenient. In this article, we'll explore how this modern approach benefits both lenders and borrowers, and why it's becoming the preferred method for many. This article will guide you about the advantages of embracing a paperless, digital mortgage experience.

The Shift to Digital: A Seamless Approach

Switching to a digital mortgage system means moving away from piles of paperwork. This transformation not only helps the environment by using less paper but also speeds up the entire mortgage process. Borrowers can now submit their applications online and instantly upload necessary documents. This streamlined process reduces errors and saves a significant amount of time. It allows for real-time updates and communication between the lender and borrower, enhancing transparency and trust in the process.

Enhancing Accuracy and Security

One of the biggest advantages of AI-enabled processing in mortgages is the increase in accuracy. AI systems can analyze data and check for errors much faster than humans. This means fewer mistakes in your loan application, leading to a smoother approval process. Additionally, digital platforms often have strong security measures in place to protect personal information, giving borrowers peace of mind. These security protocols are essential in maintaining confidentiality and protecting against data breaches, ensuring that personal details are securely handled.

Speeding Up the Loan Process

Faster loan processing is perhaps the most significant benefit of digital mortgages. Traditional mortgage applications can take weeks as paper documents are sent back and forth. With digital applications, the process can be shortened to a few days. This quick turnaround is crucial for buyers who are eager to close on their homes and for sellers who want the transaction completed promptly. The expedited process also reduces the stress associated with waiting for loan approvals, making it a more pleasant experience for all parties involved.

Automating Loan Origination

Loan origination automation is another key feature of digital mortgages. This technology handles many of the steps in the loan process automatically, from initial application review to the final approval. Automation ensures that each step is completed as quickly as possible and allows loan officers to focus more on customer service rather than mundane tasks. This not only improves the efficiency of the process but also ensures a higher level of accuracy throughout the mortgage lifecycle.

Wrapping Up

Adopting a digital mortgage system offers numerous benefits. It not only makes the loan process quicker and more efficient but also enhances security and reduces errors. As we move towards more sustainable and technologically advanced solutions in all sectors, the adoption of digital practices in mortgage processing seems both smart and inevitable. For those who value innovation and efficiency, a company like Acuriq inc provides services that align with the future of home buying, subtly pioneering the path towards a streamlined, digital financial ecosystem.

#Ai Enabled Processing#Digital Loan Processing#Digital Mortgage#Faster Loan Processing#Loan Origination Automation#Loan Origination System#Mortgage Loan Tracker

0 notes

Text

#LAMF#loan against elss mutual funds#how to avail loan against mutual fund#digital loan against mutual funds interest rate#features of loan against mutual funds#loan against mutual funds eligibility calculator#loan against mutual funds for wedding#loan against mutual funds processing fees and interest rates#loan against mutual fund units#loan against mutual funds explained#loan against mutual fund emi calculator#loan against mutual funds for higher education#loan against mutual funds eligibility and documents#loan against mutual funds for working capital

0 notes

Text

#gold loan#gold loans#gold loan process#gold loan guide#gold interest rate#shriram finance#digital marketing

0 notes

Text

Spread the joy of giving and celebrating with our instant loans up to ₹50,000. From gifts to festive cheer, let us handle your financial needs. Apply now for hassle-free cash this Christmas!

#fast cash loans#easy personal loans#digital loans#advance salary loans#fast disbursal loans#instant payday loans#loans without processing fee#7day loan#15 day loans#30 day loans

0 notes

Text

Applications of AI in Banking Sector

AI revolution is transforming the banking industry: Different applications that churn efficiency and experience through AI transform the banking sector. From establishing 24/7 customer support through chatbots to AI-driven fraud detection systems, banks are faster in building services on more technology innovations. Personalized advice about financial matters through machine learning algorithms helps people take the right choices. At the same time, AI smoothes processes like loan approvals and risk assessment, becoming more efficient and accurate than them. These integrations put banks on a sure trajectory of success.

USM Business Systems

Services:

Mobile app development

Artificial Intelligence

Machine Learning

Android app development

RPA

Big data

HR Management

Workforce Management

IoT

IOS App Development

Cloud Migration

#AI in banking#AI in banking sector#banking AI applications#financial technology AI#digital banking AI#AI loan processing#AI fraud detection

0 notes

Text

0 notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

Instant Aadhar and PAN Card Loans - Quick, Paperless, and Hassle-Free!

Instant Aadhar Card and PAN Card Loans 🌐 Digital Process | 💸 Loan Amount: ₹50k to ₹5 Lac | ⏱️ Disburse in 5 Minutes Are you in need of quick financial assistance without the hassle of traditional paperwork? Our revolutionary lending platform offers loans ranging from ₹50,000 to ₹5,00,000, and the best part – no income proof, bank statements, salary slips, or business proof is required! Key…

View On WordPress

#Aadhar Card Loans#CashSwift#Financial Assistance#Hassle-Free Loans#Instant Loans#No Income Proof Loans#PAN Card Loans#Quick Disbursement#Digital Process#Techmin Consulting

0 notes

Text

Consumer Loan Servicing Software

Redefine consumer loan servicing with Newgen's advanced software. Seamlessly manage and service consumer loans with our feature-rich solution. Leverage automation, integrated workflows, and robust servicing capabilities to ensure borrower satisfaction. Elevate your institution's consumer loan servicing software to new heights, ensuring compliance, mitigating risk, and optimizing operational efficiency. Explore the future of consumer lending with Newgen.

#Consumer Loan Servicing Software#Consumer Loan Process#Consumer Loan Processing#Digital Lending#e-Document Management#Electronic Record Keeping System

0 notes

Text

From Application to Approval: How Advanced Mortgage Trackers Enhance Your Financial Credibility

Understanding different types of mortgage loans and the importance of loan trackers is vital for anyone looking to finance a home. With various options available, it's important to choose the mortgage that best fits your financial goals and situation. Whether you opt for a fixed-rate mortgage or an adjustable-rate one, each has its own advantages and things to consider.

Additionally, new technologies like online loan processing have made everything easier and more transparent, helping you make better choices. These improvements reduce paperwork, speed up the process, and allow borrowers to get real-time updates on their applications. Digital tools ensure accuracy and make managing your finances simpler. This article will discover some vital Mortgage Loans and how Loan Trackers can enhance your financial credibility.

The Importance of Mortgage Loan Trackers

A mortgage loan tracker can significantly enhance your financial credibility by providing real-time updates on your loan status. This tool helps you keep track of your payments and interest rates and alerts you to any changes in your loan terms. By using this advanced tracking system, you can manage your finances better and show potential lenders that you're responsible for your money.

Choosing the Right Mortgage Loan

When selecting a mortgage loan, it’s essential to consider your long-term financial goals. The considerations are-

Fixed-rate mortgages provide stability through planned monthly payments for the overall loan period.

Adjustable-rate mortgages provide lower initial rates that may fluctuate over time.

To choose the best option, you need to see how it fits into your financial plan and how it affects your budget. Tools like a mortgage loan tracker can assist in monitoring these variables and making informed decisions.

Efficiency of Modern Loan Processing Systems

The efficiency of loan processing systems has greatly improved with technological advancements. These systems simplify the application process, making it quicker and more precise. As a result, lenders can quickly understand your financial situation and provide better rates and terms. Using these modern tools helps your mortgage application go smoothly and ensures you get the best possible deal.

Benefits of Loan Origination Systems

Another significant benefit of using a loan origination system is its ability to enhance transparency and reduce errors. This system helps manage the entire loan process, from starting the application to getting final approval. It automates many tasks and makes sure that information is recorded correctly. This smooth and quick approach improves accuracy and reliability.

Maintaining Financial Credibility

Maintaining financial credibility is crucial when applying for a mortgage loan. Using a Mortgage LOS helps you stay on top of your payments and manage your finances effectively. Additionally, digital processing speeds up approvals and helps manage your loan application more effectively. Using these tools can increase your chances of getting better loan terms by showing that you are financially responsible.

Summary

Selecting the right mortgage loan type and using advanced tracking tools are essential for managing your home financing effectively. Whether interested in a fixed-rate mortgage or an adjustable-rate option, understanding your choices and utilizing a loan tracker can significantly boost your financial credibility. Those looking for a reliable and accurate tracker can use the services offered by businesses such as Acuriq. They provide cutting-edge solutions to streamline your mortgage experience and make sure that you stay informed every step of the way. Furthermore, their AI-powered systems make sure that the overall information is accurate and with minor errors.

0 notes

Text

Identifying the Right Lender for Your Loan Application

In a world buzzing with lending options, finding the ideal lender for your loan application can be a game-changer. It's not just about the money; it's about a partnership that fits like a glove. Here’s how NBFCs (Non-Banking Financial Companies) guide you to the perfect lending fit.

Understanding Your Needs

The initial step in this lending journey is self-assessment. What’s the purpose of your loan? Are you eyeing a personal milestone, a business expansion, or a home sweet home? NBFCs help dissect your needs, matching them with lenders offering tailor-made solutions. They assist in comprehending your financial aspirations and limitations.

Diving into Loan Types

Navigating through loan types can be bewildering. NBFCs act as your GPS, demystifying the varieties – be it personal loans, home loans, business loans, or any other niche-specific loans. Each loan comes with its terms, perks, and pitfalls. These institutions break down the jargon, enabling an informed decision.

Also Read: How Reducing Operational Expenditure Helps NBFC?

Comparing Interest Rates

The interest rate is the heartbeat of a loan. NBFCs lay out the interest landscape, dissecting rates and schemes from multiple lenders. They decode the fine print, ensuring you comprehend the real cost of borrowing. It's not just about the number; it's about what's hidden beneath.

Assessing Eligibility Criteria

Loan approval isn’t just about willingness; it’s about meeting the lender's eligibility benchmarks. NBFCs assist in gauging your eligibility based on various parameters like income, credit score, employment history, and more. They align you with lenders whose criteria match your profile.

A credit score is a number that reveals a customer’s creditworthiness. The higher this number, the greater the chance that the borrower will repay the loan on time, mentioned by Abhay Bhutada, MD of Poonawalla Fincorp.

Unveiling Repayment Terms

The devil lies in the details of repayment. NBFCs unravel the repayment terms and conditions, ensuring you grasp the EMI structure, prepayment penalties, and loan tenure flexibility. This clarity helps in strategizing your financial commitments.

Evaluating Customer Service

Beyond numbers, the lender’s customer service is crucial. NBFCs offer insights into the lender’s reputation, service quality, and responsiveness. They paint a picture of the borrower experience, ensuring you choose a partner who's there when you need them.

Also Read: Unlocking Financial Success: The Power of a Solid Business Plan

Choosing the Right Fit

Armed with information and guidance from NBFCs, it's time to choose your lending partner. It's not merely about the best interest rate; it's about synergy. The perfect lender resonates with your financial goals, aligns with your needs, and supports your journey.

Deepak Parekh, the esteemed Chairman of HDFC Limited, emphasizes the significance of assessing lenders beyond mere interest rates, highlighting the importance of understanding a lender's reliability, transparency, and customer-centric approach. He stresses the need for borrowers to scrutinize the lender's reputation, service quality, responsiveness, and flexibility in loan terms

Conclusion

Finding the optimal lender isn’t a shot in the dark. It's a calculated move, guided by knowledge and expertise. With NBFCs as your allies, the path to securing the right loan becomes clearer, smoother, and a lot less daunting.

Remember, it’s not just about the loan; it’s about fostering a relationship that paves the way for your financial aspirations. So, armed with insights from NBFCs, step confidently into the realm of lending, knowing that the right partner is waiting to support your dreams.

0 notes

Text

TIMOTHY SNYDER

FEB 5

Imagine if it had gone like this.

Ten Tesla cybertrucks, painted in camouflage colors with a giant X on each roof, drive noisily through Washington DC. Tires screech. Out jump a couple of dozen young men, dressed in red and black Devil’s Champion armored costumes. After giving Nazi salutes, they grab guns and run to one government departmental after another, calling out slogans like “all power to Supreme Leader Skibidi Hitler.”

Historically, that is what coups looked like. The center of power was a physical place. Occupying it, and driving out the people who held office, was to claim control. So if a cohort of armed men with odd symbols had stormed government buildings, Americans would have recognized that as a coup attempt.

And that sort of coup attempt would have failed.

Now imagine that, instead, the scene goes like this.

A couple dozen young men go from government office to government office, dressed in civilian clothes and armed only with zip drives. Using technical jargon and vague references to orders from on high, they gain access to the basic computer systems of the federal government. Having done so, they proceed to grant their Supreme Leader access to information and the power to start and stop all government payments.

That coup is, in fact, happening. And if we do not recognize it for what it is, it could succeed.

In the third decade of the twenty first century, power is more digital than physical. The buildings and the human beings are there to protect the workings of the computers, and thus the workings of the government as a whole, in our case an (in principle) democratic government which is organized and bounded by a notion of individual rights.

The ongoing actions by Musk and his followers are a coup because the individuals seizing power have no right to it. Elon Musk was elected to no office and there is no office that would give him the authority to do what he is doing. It is all illegal. It is also a coup in its intended effects: to undo democratic practice and violate human rights.

In gaining data about us all, Musk has trampled on any notion of privacy and dignity, as well as on the explicit and implicit agreements made with our government when we pay our taxes or our student loans. And the possession of that data enables blackmail and further crimes.

In gaining the ability to stop payments by the Department of the Treasury, Musk would also make democracy meaningless. We vote for representatives in Congress, who pass laws that determine how our tax money is spent. If Musk has the power to halt this process at the level of payment, he can make laws meaningless. Which means, in turn, that Congress is meaningless, and our votes are meaningless, as is our citizenship.

Resistance to the coup is the defense of the human against the digital and the democratic against the oligarchic. If Musk controls these digital systems, Republican elected officials will be just as helpless as Democratic ones. The institutions that they voted to create can also be “deleted,” as Musk puts it.

President Trump, for that matter, will also perform at Musk’s pleasure. There is not much he can do without the use of the federal government’s computers. No one will explain this to Trump or to his supporters, of course.

A coup is underway, against Americans as possessors of human rights and dignities, and against Americans as citizens of a democratic republic. Each hour this goes unrecognized makes the success of the coup more likely.

195 notes

·

View notes

Text

Libraries have traditionally operated on a basic premise: Once they purchase a book, they can lend it out to patrons as much (or as little) as they like. Library copies often come from publishers, but they can also come from donations, used book sales, or other libraries. However the library obtains the book, once the library legally owns it, it is theirs to lend as they see fit. Not so for digital books. To make licensed e-books available to patrons, libraries have to pay publishers multiple times over. First, they must subscribe (for a fee) to aggregator platforms such as Overdrive. Aggregators, like streaming services such as HBO’s Max, have total control over adding or removing content from their catalogue. Content can be removed at any time, for any reason, without input from your local library. The decision happens not at the community level but at the corporate one, thousands of miles from the patrons affected. Then libraries must purchase each individual copy of each individual title that they want to offer as an e-book. These e-book copies are not only priced at a steep markup—up to 300% over consumer retail—but are also time- and loan-limited, meaning the files self-destruct after a certain number of loans. The library then needs to repurchase the same book, at a new price, in order to keep it in stock. This upending of the traditional order puts massive financial strain on libraries and the taxpayers that fund them. It also opens up a world of privacy concerns; while libraries are restricted in the reader data they can collect and share, private companies are under no such obligation. Some libraries have turned to another solution: controlled digital lending, or CDL, a process by which a library scans the physical books it already has in its collection, makes secure digital copies, and lends those out on a one-to-one “owned to loaned” ratio. The Internet Archive was an early pioneer of this technique. When the digital copy is loaned, the physical copy is sequestered from borrowing; when the physical copy is checked out, the digital copy becomes unavailable. The benefits to libraries are obvious; delicate books can be circulated without fear of damage, volumes can be moved off-site for facilities work without interrupting patron access, and older and endangered works become searchable and can get a second chance at life. Library patrons, who fund their local library’s purchases with their tax dollars, also benefit from the ability to freely access the books. Publishers are, unfortunately, not a fan of this model, and in 2020 four of them sued the Internet Archive over its CDL program. The suit ultimately focused on the Internet Archive’s lending of 127 books that were already commercially available through licensed aggregators. The publisher plaintiffs accused the Internet Archive of mass copyright infringement, while the Internet Archive argued that its digitization and lending program was a fair use. The trial court sided with the publishers, and on September 4, the Court of Appeals for the Second Circuit reaffirmed that decision with some alterations to the underlying reasoning. This decision harms libraries. It locks them into an e-book ecosystem designed to extract as much money as possible while harvesting (and reselling) reader data en masse. It leaves local communities’ reading habits at the mercy of curatorial decisions made by four dominant publishing companies thousands of miles away. It steers Americans away from one of the few remaining bastions of privacy protection and funnels them into a surveillance ecosystem that, like Big Tech, becomes more dangerous with each passing data breach. And by increasing the price for access to knowledge, it puts up even more barriers between underserved communities and the American dream.

11 September 2024

154 notes

·

View notes

Text

Intuit: “Our fraud fights racism”

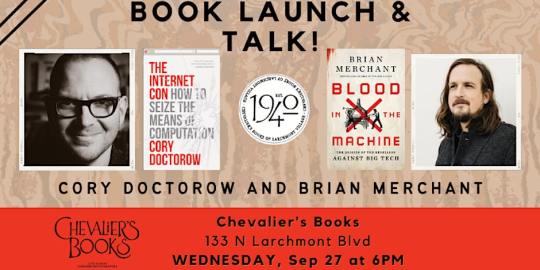

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

Student loan borrowers can no longer apply for income-driven repayment plans after the Trump administration paused applications—the Education Department’s first substantial action on student loans under the new president. But it’s unclear whether the pause is a temporary response to court orders or part of a broader Republican plan to remake the student loan system, financial aid experts say.

The application freeze came just days after an appeals court once again enjoined the Education Department from carrying out a new income-driven repayment option for borrowers. That plan, commonly known as Saving on a Valuable Education, or SAVE, was put in place by the Biden administration and was intended to give borrowers lower monthly payments and quicker pathways to debt relief.

More than eight million borrowers signed up for SAVE when the Biden administration rolled the plan out in summer 2023, but its run was short-lived. The Eighth Circuit Court of Appeals first blocked some provisions of the plan with an emergency injunction in August 2024. Then, just last week, the same judges put out an expanded order that halted the entire SAVE rule and declared that the Education Department can’t forgive any loans via income-driven repayment plans.

Now, the lawsuit has been sent back to the district court for review, and millions of borrowers enrolled in income-driven repayment and banking on forgiveness are once again in the lurch.

The Department of Education has yet to comment on the ruling aside from a small banner on the application website that acknowledges the injunction and says, “As a result, the IDR and loan consolidation applications are currently unavailable.”

It remains unclear how long that pause will last and whether the department is just implementing the freeze on new digital applications or if it has also stopped accepting paper copies and processing existing requests.

Some higher ed policy experts, like Preston Cooper, a senior fellow at the American Enterprise Institute, speculate that the department’s move was truly driven by the injunction and is simply a move made out of caution.

“I would imagine that while the Office of Federal Student Aid is working through the legal ramifications of that ruling,” he said. “They’re taking the application down temporarily, just while they work out exactly what the legal requirements [are] on the Department of Education.”

But others, including the Student Borrower Protection Center, don’t buy that shutting down IDR was what the court ordered.

“The administration’s cruel choice to cut off access to affordable repayment options passed by Congress and enshrined in millions of borrowers’ loan contracts comes at the same time as they are wreaking havoc on communities and families across our nation,” Persis Yu, SBPC deputy executive director, said in a statement Monday. “None of this is by accident.”

Loan experts do agree, however, that the pause is concerning and could have massive implications if it becomes permanent.

Borrowers, they say, would likely see higher monthly payments. For instance, about four million borrowers are eligible for zero-dollar payments under the enjoined SAVE plan. The department would have to make significant operational changes to transfer loans from one repayment plan to another.

“A lot depends on how long the application is down for,” said Karen McCarthy, vice president of public policy at the National Association of Student Financial Aid Administrators. “But the whole purpose of the income-driven repayment plans is to help struggling borrowers stay in a satisfactory repayment status … so to not have any of those income-driven repayment plans available would definitely remove that large safety net.”

‘Going to See Chaos’

Congress first passed a law allowing the education secretary to base repayment plans on a borrower’s income in 1993, and the first plan launched in 1994. Under the plans, borrowers make payments for 20 to 25 years and then see their remaining balances wiped out. When Joe Biden took office in 2021, only 50 borrowers had completed the program and received forgiveness on any remaining balance. That number jumped to 1.45 million by the time he left office in January, according to a Biden news release.

But the Eighth Circuit court ruled last week that Congress’s underlying statute doesn’t explicitly authorize loan forgiveness.

“The power Congress gave the secretary … to create repayment plans means the secretary must design [income-contingent repayment] plans leading to actual repayment of the loans,” the panel wrote in a 25-page opinion. “The secretary has gone well beyond this authority by designing a plan where loans are largely forgiven rather than repaid.”

Adam Minsky, a lawyer who specializes in student loans, says, however, that although the court clearly bans loan forgiveness at the end of an IDR plan, there’s “absolutely nothing” in the appellate court’s order to suggest the department is required to stop accepting applicants and allowing payments to be based on income.

He noted that the IDR application website is the platform where borrowers access a whole swath of repayment plans beyond just SAVE and where they can apply to consolidate multiple loans. So by freezing access to the application portal, the department is overreaching the requirements of the injunction.

“In fact, the Eighth Circuit reiterated that one of the four income-driven plans—Income-Based Repayment, or IBR—is not covered by the injunction,” Minsky said. “And while the court has blocked loan forgiveness at the end of the term for ICR and the Pay As You Earn plan … borrowers can still enroll in those plans.”

There are even borrowers who are trying to switch to an IBR plan because SAVE is stuck in litigation and almost certainly will not come out alive, he said. Comparatively, IBR should be a safe and steady repayment plan because it is written into statute, but as long as the application portal remains closed, millions of borrowers are stuck.

“Just repealing SAVE alone would have huge implications because borrowers would then see a spike in their payments,” Minsky said. “But if you take away the ability to even enroll in any of these programs, including ones that are not blocked by the court, I think we’re going to see chaos.”

The legal fight is still ongoing and likely won’t be resolved for months. Cooper from AEI said the pause and/or a final ruling may prompt Congress to step in and more clearly define what the actual terms of income-driven repayment plans are.

But that would require bipartisan agreement and enough interest to push it to the top of an ever-growing priority list during an incredibly busy session. So until then, NASFAA is just hoping the Education Department will provide more clarity on whether the pause is permanent, and if it is, what other avenues are available for borrowers.

“That’s always a big area of concern for us … just the general confusion and how to mitigate that to the maximum extent practicable,” McCarthy said. “And if we’re having a hard time keeping track of what’s happening, I imagine that borrowers are as well.”

18 notes

·

View notes